Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Innovar

Print version ISSN 0121-5051

Innovar vol.21 no.42 Bogotá Oct./Dec. 2011

Clemente Forero-Pineda*, Daniella Laureiro-Martinez** & Alejandra Marín***

* Universidad de los Andes School of Management, Bogotá, Colombia E-mail address: cfp@adm.uniandes.edu.co

** Universidad de los Andes School of Management, Bogotá, Colombia E-mail address: dlaureiro@gmail.com

*** Universidad de los Andes School of Management, Bogotá, Colombia E-mail address: amm@adm.uniandes.edu.co

Submitted: March de 2011 Accepted: August 2011

Abstract :

Based on empirical results, this article reopens the discussion about the relationship between intellectual property and innovation in developing countries. Intellectual property grants a monopoly over the commercial exploitation of innovations. Ex ante, this monopoly may promote innovation but ex post it may become a disincentive to diffusion and subsequent innovation. After reviewing the terms of the debate in the classical and current literature, we address two empirical issues: What patterns of intellectual property behavior coexist among the small and medium enterprises (SMEs) of a developing country (Colombia) and how these patterns relate to the innovation performance of these firms.

Keywords:

Innovation patterns, intellectual property, SMEs, developing country.

Resumen:

Con fundamento en resultados empíricos, este artículo reabre la discusión acerca de la relación entre propiedad intelectual e innovación en países en desarrollo. La propiedad intelectual otorga un monopolio para la explotación comercial de una innovación. La expectativa de gozar de un monopolio puede promover la innovación; sin embargo, una vez establecido el monopolio, éste puede desincentivar la difusión de la idea y el desarrollo de innovaciones derivadas de ella. Después de revisar los términos del debate en las literaturas clásica y actual, enfocamos nuestra atención en dos cuestiones empíricas: (1) qué patrones de comportamiento frente a la propiedad intelectual coexisten entre las pequeñas y medianas empresas de un país en desarrollo como Colombia y (2) cómo se relacionan estos patrones con el desempeño innovador de las firmas.

Palabras clave:

patrones de innovación, propiedad intelectual, PYMES, desarrollo.

Résumé :

Sur base de résultats empiriques, cet article ouvre à nouveau la discussion sur la relation entre propriété intellectuelle et innovation dans les pays en développement. La propriété intellectuelle accorde le monopole pour l'exploitation commerciale d'une innovation. Le désir de détention d'un monopole peut promouvoir l'innovation; cependant, le monopole établi peut arriver à dissuader la diffusion de l'idée et le développement d'innovations dérivées de celle-ci.

Après avoir revu les termes du débat dans les publications classiques et actuelles, nous nous concentrons sur deux questions empiriques : (1) Quels sont les modèles de comportement en rapport avec la propriété intellectuelle qui coexistent dans les petites et moyennes entreprises d'un pays en développement comme la Colombie. (2) Quels sont les rapports de ces modèles avec le développement innovateur des entreprises.

Mots-clefs :

modèles d'innovation, propriété intellectuelle, petites et moyennes entreprises, développement.

Resumo:

Com fundamento em resultados empíricos, este artigo reabre a discussão sobre a relação entre propriedade intelectual e inovação em países em desenvolvimento. A propriedade intelectual outorga um monopólio para a exploração comercial de uma inovação. A expectativa de gozar de um monopólio pode promover a inovação; sem embargo, uma vez estabelecido o monopólio, este pode desestimular a difusão da idéia e o desenvolvimento de inovações delas derivadas. Depois de revisar os termos do debate na literatura clássica e atual, enfocamos nossa atenção em duas questões empíricas: (1) que padrões de comportamento frente à propriedade intelectual coexistem entre as pequenas e médias empresas de um país em desenvolvimento como a Colômbia e (2) como se relacionam estes padrões com o desempenho inovador das firmas.

Palavras chave:

padrões de inovação, propriedade intelectual, PME, desenvolvimento.

How do small and medium enterprises (SMEs) in a developing country innovate, and what is the role of intellectual property in the innovative behavior of these firms? This article addresses these two central questions, reporting the results of empirical research on patterns of intellectual property behavior and innovation effort and their impact on the innovative performance of Colombian SMEs.

The relationship between intellectual property rights (IPR) and innovative behavior has been a major focus of interest in innovation studies. Some researchers claim that IPR-enhancing policies promote innovation, while others reach the opposite conclusion. Most of the literature on the subject refers to industrialized countries, though a series of studies in the past two decades have addressed the policy dilemma faced by developing countries, both theoretically and in empirical analyses of specific sectors.

Structural and institutional contexts of innovation are different in industrialized and developing countries. Credit and human-capital restrictions, higher costs of innovating, lower enforcement of IPR, and the ensuing limited ability to appropriate innovations in developing economies are oft-cited characteristics that affect innovation processes. Indeed, the frequency of major innovations and of patenting among SMEs in developing countries is so low that conventional measures, such as patent statistics, fail to differentiate among substantially different innovation behaviors in SMEs. Nonetheless, patent ownership may play an important role as a determinant of the firm's innovative behavior.

We intend to clarify these relationships by presenting the results of empirical research on SMEs in Colombia. In the next section, we review the main contributions to the debate on patent monopoly and competition, and relate it to patent ownership. We then present the methodology of our survey and identify distinct innovation patterns, where patent ownership is a key variable. Finally, we summarize our findings about the relationship between the patterns of intellectual property behavior of SMEs and innovation performance.

The effect of patents on innovation has been the subject of a long debate in industrialized countries. Patents grant a monopoly over the commercial exploitation of innovations, which may promote innovation ex ante but can become a disincentive ex post to diffusion and, under certain conditions, to subsequent innovations. An analysis of the relationship between monopoly and innovation in general is a good starting point for understanding how intellectual property is related to innovation.

In 1942, Schumpeter studied a regime where a firm's innovation creates a competitive advantage that leads to develop the next innovation to maintain its monopoly. In previous work from 1912, he had analyzed a regime where a "step-by-step" process occurs: Entrants move up to the innovator's level and then face the same chances, and perhaps sharper incentives than the original firm, to innovate further[1].

Arrow (1962, p. 70) explored an effect that lowers the incentives of a monopolist to innovate. Since the new product competes with the firm's old product, "the incentive to invent is less under monopolistic than under competitive conditions, but even in the latter case it will be less than is socially desirable"[2].

Within this general framework, Nordhaus (1969, pp. 88-89) set the problem of designing an optimal intellectual property policy as a trade-off between the ex ante incentives for innovation associated with stronger IPR and the ex post incentives for the innovation's diffusion, associated with weaker IPR. For Nordhaus, "The patent system may give a level of research that is close to the optimum, but -as shown- only at the expense of higher prices, lower output, and the inefficiencies usually associated with monopoly".

In 1981, Mansfield et al. concluded that patent protection did not seem essential for the development and introduction of innovations. In 1986, Mansfield argued that the patent system -often viewed as having a global positive effect on innovation- has a small impact on the number of inventions in most industries. Levin et al. (1987) interpreted the results of the Yale survey, inferring that other means of appropriation were more important than the patent system in many industries.

For Bessen and Maskin (2000), "Imitation invariably inhibits innovation in a static world; in a dynamic world, imitators can provide benefit to both the original innovator and to society as a whole" (2000, p. 21).

The relationship between intellectual property, concentration and innovation has also been analyzed from an evolutionary perspective. Metcalfe and Ramlogan (2005, p. 215) conclude that "the most plausible competition policy is a pro-innovation policy in which markets are open to entry and enforce exit and in which abnormal profits and losses are the norm".

One of the neo-Schumpeterian strands of literature on the relationship between competition and innovation has obtained important results. Aghion et al. (1997) developed a model with step-by-step innovation, demonstrating that more intense product market competition and imitation promote growth and innovation.

Aghion and Griffith (2005) show a strong inverted-U relationship between innovation, as measured by the citationweighted patent count, and product market competition. These predictions have important policy implications for the design of competition policy. Nonetheless, these results are obtained with indicators not easily available in developing countries. In the case of India, Aghion and Griffith (2005) refer to the empirical work of Aghion et al. (2005), which shows differences in the growth-enhancing effects of market liberalization in different zones.

From a different theoretical perspective, Heller and Eisenberg (1998) draw on Harding's "tragedy of the commons", to argue that intellectual property may slow down innovation. For these authors, "a resource (in this case, knowledge) is prone to underuse in a 'tragedy of the anticommons' when multiple owners each have a right to exclude others from a scarce resource and no one has an effective privilege of use".

Several other studies have accompanied policy decisions on intellectual property, transfer of technology and innovation in developing countries in the past two decades.

In the 1990s, the debate evolved most interestingly toward considering the impact of stronger intellectual property rights in the context of North-South trade. Helpman (1993, pp. 1274-75) based his analysis on a two-region model by Krugman (1979): The North, where firms only innovate; and the South, where firms only imitate. Helpman's conclusion was that, with tighter IPR, "if anyone benefits, it is not the South... In the absence of foreign direct investment tighter IPRs move the terms of trade against the South and bring about a reallocation of manufacturing towards higher priced Northern products, which harms the South". In the presence of foreign direct investment, the South also loses while the effects on the North are not clear.

Yang and Maskus (2001, p. 171) responded to Helpman by arguing that, when licensing is accounted for, the North increases its innovation rates and the rate of licensing increases in the South. Nonetheless, both Helpman and Yang and Maskus rule out innovation in the South, eluding the discussion of the impact of IPRs on innovation dynamics in the South.

Summarizing one policy stance on this debate, Correa (2007) examines the role of IPRs in learning and knowledge accumulation in least developed countries (LDCs). He notes that the type and content of technology transfers improve with capabilities of domestic firms, but most LDCs are in an initiation phase. He claims that "the lack of IPR protection may be essential to allow learning through imitation at the initial levels of technological development [...] More generally, competition (as opposed to the monopolization entailed in some cases by IPRs) can be a powerful incentive to introduce product, process or organizational innovations" (Correa, 2007, p. 7). This statement should be qualified for certain sectors and countries. For instance, Dutta and Sharma (2008) found that Indian firms in more innovation-intense industries increased their R&D spending after the implementation of the TRIPs agreement, while Aboites and Cimoli (2001) obtained opposite evidence in their analysis of the pharmaceutical sector in Mexico.

Foray (2007, p. 13) observes that "the patent system excludes a certain type of competition which is the competition by copying (usually defined as a competition on prices) while not excluding another type of competition which is a competition by substitution (or innovation)". Foray observes that this relationship between imitation and research, development and design efforts should be taken into account for a proper design of innovation policies.

Although a vast amount of theoretical work illustrates the links between IPRs, innovation and technology transfer, how "it translates to strengthening innovation at the firmlevel behaviour and to what extent this relationship holds true in the case of least developed countries remains unanswered" (Sampath 2007, p. 3). Sampath (2007) conducted an in-depth investigation of the pharmaceutical, agro-processing and textiles and ready-made garments (RMG) sectors in Bangladesh, and concludes that "the presence of intellectual property rights in the local context does not play a role, either as a direct incentive for innovation or as an indirect incentive enabling knowledge spillovers" (Sampath, 2007, p. 5). A large number of local firms considered themselves to be involved in new product or process innovations, "but there was no observable positive impact of intellectual property rights on licensing, technology transfer, or technology sourcing through foreign subsidiaries [...] The only important sources of innovation at the firm level are the firms' own indigenous innovation efforts, and innovation through imitation/copying" (Sampath, 2007, p. 5).

These contrasting criteria have led some researchers to look for the optimal level of intellectual property rights protection, when facing a trade-off between encouraging domestic firms' imitation of foreign technology and the promotion of domestic R&D based inventions. Chen and Puttitanun (2005) analyze the case of China, and find that, depending on the level of economic development, the optimal level of protection exhibits a U-shape. Lin et al. (2010) present findings that complement the work of Chen and Puttitanun (2005). These authors present evidence that property rights (including intellectual property rights) protection promote R&D investments.

In reference to the context of Latin American and Caribbean countries (LAC), Alcorta and Peres (1998, p. 878) analyzed various country-specific empirical studies, concluding that "by and large, patenting [...] has been negligible" and that "the innovative performance of LAC's innovation systems, with the only exception perhaps of Mexico [...], is low in absolute terms and has lost relatively to many countries that started at similar levels twenty years ago". These authors relate this result with the issue of the technological content of Latin American exports, observing that "LAC exports are relatively less geared [...] [at the end of the nineties] to the most technologically advanced products than what they were in the mid-1970s".

The national context

The circumstances in which innovation takes place in developing countries and specifically in Colombia determined the definition of variables in our empirical exploration of the relationship between patenting and innovation behavior.

Colombia is an intermediate developing country that is neither among the newly industrialized nor among the least developed countries. According to Nelson (1968), Colombia's total factor productivity was similar to that of Japan in the 1960s. Today, it is remarkably lower. Ranked 101 among 232 countries in income per capita worldwide, and 69 among 177 countries in the Human Development Index for the year 2005 (United Nations, 2006), Colombia has relatively low technological development and its R&D expenditure as a percentage of national income was 0.37% in 2008 (Salazar, 2001). Our survey focused on SMEs, which account for 67.2% of employment in the country (Ayyagari et al., 2003) and where the issue of autonomous innovation vs. imitation is presumably most poignant.

In an early study of Colombian industry, Nelson (1968, p. 1243) pointed out that large Colombian industries operate in an environment similar to that of firms in industrialized countries: "Notice how much closer the large Colombian firms were to their U.S. counterparts in terms of value added per worker than were the small Colombian firms". Small firms were quite different. According to Nelson, "this group was composed of the traditional small craft firms using significantly less in the way of modern equipment, and quite different (and less related to formal education) skills, and creating a far lower added value per worker" (1968, p. 1239). A decade later, Ogliastri et al. (1977) analyzed the results of a survey with SMEs and found that low capital accumulation, limited technology absorption, and strong financial restrictions were the main obstacles to their innovation processes.

Little has changed since. Three decades later, Malaver and Vargas (2004) noted that the role of technology and innovation in Colombian industry is not strategic but functional and that innovation is concentrated in the entrepreneur. In an analysis of the innovation survey of 1996, Salazar (1998) found that innovation is a function relegated almost exclusively to the firm's management. Their attendance at fairs, trade shows and seminars contributes more frequently to innovation than formal R&D does.

In the present decade, following the 1994 GATT-WTO agreement on trade related aspects of intellectual property rights, and in prior fulfillment of conditions related to expectations of bilateral trade agreements, Colombia substantially raised the levels of protection and enforcement of intellectual property rights. The Government has implemented the TRIPs agreement; in the pharmaceutical sector, it has adopted the protection of clinical trial data for pharmaceuticals, and the Attorney General has opened a specialized division for the prosecution of IPR violations.

The research

A common feature of the literature on intellectual property, innovation and the sources of innovation is the recognition that reality is more complex than theoretical models can reflect. To shed light on this issue, we carried out an empirical exploration of the relationship between intellectual property, firm characteristics, and innovation. The focus here is on the patterns of research effort behavior, intellectual property, and innovation performance of SMEs.

The point of departure of our empirical exploration is that firms in developing countries innovate and imitate.

Consequently, we hypothesize that, when firms in developing countries innovate, they face a choice that is definitely more complex than either innovating or imitating foreign products and technology. Actually, it is observed that firms, both in industrialized and developing countries, combine innovation and imitation.

To recognize the diversity of innovation behaviors among Colombian SMEs, and to study the differential role of patent ownership and imitation in their innovation strategies, we look for clusters of innovation patterns, defined in terms of patent ownership, imitation and expenditure in research, design and development (RD&D).

For this study of innovation and intellectual property in Colombian SMEs, a relatively large group of 27 variables related to innovation, imitation, and intellectual property ownership was initially surveyed and analyzed. Seven are related to IP issues: patent ownership; imitation and adaptation of foreign models or designs; imitation and adaptation of models or designs found in national markets; reverse engineering; ideas of middle management and workers; the presence of foreign technical assistance; consulting. Three other variables were also included: the ratio of research, development and design expenditures to sales of the firm (RD&D); the educational level of the manager, and the use of knowledge derived from customer satisfaction studies.

Rather than aiming at the detection of a unique underlying pattern of innovation and intellectual property behavior, we searched for the coexistence of diverse patterns in the same economic space. This explains our choice of cluster analysis and the subsequent analysis of variance between clusters.

After a preliminary exploration of possible patterns, the analysis led us to select three of these variables, related to IP and innovation: patent ownership, imitation of foreign models and designs, and the magnitude of the effort in research, development and design (RD&D). These three variables are related to concepts that have been the object of a substantial amount of theoretical literature and seem appropriate for the analysis of the various forms of innovation in SMEs of a developing country.

The strategic choice made by an SME over these three dimensions describes what is hereby defined as a pattern of innovation and intellectual property behavior. SMEs in the sample were grouped in clusters, according to their combination of these three variables. Patent ownership was measured as a dummy variable indicating whether the SME declared to possess one or more patents. 7.72% of the SMEs in the sample declared to own patents (19 SMEs).

Imitation of foreign models and designs was measured with a multinomial scale that signaled the level of importance for the firm of the imitation of foreign products as one of the three main sources of innovation. 28.9% of the sample (71 firms of a total of 213 valid answers) recognized the imitation of foreign products as a source of innovation. The magnitude of the effort in research, development, and design (RD&D) was measured as the percent of research, development and design expenditures in proportion to the total sales of the firm.

Each of the patterns was then related to the innovation performance and organizational and structural variables of the SMEs studied. Innovation performance was measured in terms of new products or designs. This choice deserves some discussion. Geroski (1994) suggested measuring the output of innovation processes as the sum of major and minor innovations that directly impact on markets, instead of measuring it through R&D expenditure or patents granted, and innovative activity has indeed been measured as the percentage of sales that can be attributed to products newly developed in the preceding five years. This implies that both the number of new products and their success in the market are taken into consideration (Kraft, 1989).

Innovativeness is a multi-dimensional concept, but since product innovations are usually more frequent than process innovations in small firms (Utterback and Abernathy, 1975), a measure including only the firm's product innovations is preferred (Hadjimanolis, 2000).

To cope with the imperfection of any of these indicators, we adopted several measures of product innovation. Different definitions of "new products" were reviewed, including those in the Oslo Manual (OECD and Eurostat, 2005) and the Bogota Manual, as analyzed in Durán et al. (2000). In these studies, product innovation consists of the acquisition, assimilation, or imitation of new technologies to improve existing products or to fabricate new ones. In contrast with the Oslo Manual, we included product design innovations since these comprise most of the innovation activities of SMEs in developing countries.

Referring to an industrialized country, Landry and Amara (2002) object measuring innovation through new products, since this measure does not discriminate accurately between highly innovative manufacturing firms and those of only average innovativeness. However, we observed no radical innovators in our study and so adopted new product counts or a standardized transformation of this variable as an acceptable output measure.

Clustering variables

Ownership of patents

Many studies have used R&D expenditures or patent statistics as proxies for innovative activity, but as Cohen and Levin (1989, p. 1063) note, "There are significant problems with patent counts as a measure of innovation".

As Geroski (1994, p. 7) observes, "patents signal that there is appropriable innovative knowledge", but since patenting activity in Colombia is so uncommon, rather than considering patents as a measure of the output of innovation processes, in this research we used the ownership of patents (whether developed in-house or not) as a determinant of innovative behavior and a clustering variable. In the empirical analysis that follows, patent ownership was measured as a binary variable: The firm owns one or more patents or not.

Imitation of foreign models

Imitation has an aspect of knowledge diffusion that has long been ignored (Mukoyama, 2003). Though widespread in industrialized countries, imitation is vital in the analysis of developing countries (Alcorta and Peres, 1998; Helpman, 1993; Juma and Clark, 2002; Foray 2007; Correa 2007). Helpman (1993) argued that imitation is a major effort in less developed countries involving the development of absorptive capacity for advanced technology and particular efforts to assimilate and adopt foreign technologies. Analyzing the case of China, Siu et al. (2006, p. 329) reported that SMEs use two sources to generate new products: Attribute listing and copying. "The 'new products' are products with modified product attributes only, rather than 'state-of-the-art' new products". Pack and Westphal (1986, p. 105) consider that in imitation "effort is required in using technological information and accumulating technological knowledge to evaluate and choose technology; to acquire and operate processes and manufacture products; to manage changes in products, processes, procedures, and organizational arrangements; and to create new technology".

Imitation often relates to the concept of "catch-up". The literature views catch-up as a complex function going beyond the path of development followed earlier by industrialized countries. In this context, imitation is a critical stage in the process of learning to industrialize (Juma and Clark, 2002). Import substitution policies applied in Latin America in the 1950s and 1960s viewed imitation and adaptation as an important strategy for industrialization and catch-up. The rate at which a follower is able to undertake technological imitation is crucial in catch-up models. The rate of imitation is greatly influenced by existing technological capabilities, policies, and institutional arrangements. Different authors see catch-up through imitation as requiring conscious and policy-guided efforts on the part of governments (Helpman, 1993; Juma and Clark, 2002).

For these reasons, the imitation of foreign products was chosen as a key clustering variable. To obtain values for the variable "imitation of foreign models", we asked the firms surveyed to rank the three main sources of innovation, chosen from a menu of eight options. 28.9% of the firms included imitation and adaptation of foreign models in the ranking. In a multinomial scale from 0 to 3, where 0 means that the firm did not consider imitation of foreign models as one of the three most important sources and 3 means that the firm considers imitation the most important source of innovation, the average score was 0.54, with a standard deviation of 0.932.

The magnitude of RD&D effort

The expenditure in research and development (R&D) is one of the easiest to identify inputs of innovation (Freel, 2005), and an acceptable indicator of innovation effort. Innovation theory positively links innovativeness with the expenditure on R&D (Tidd et al., 2005; Acs and Audretsch, 2005). Nonetheless, many small firms simply have no formal R&D operation, and efforts devoted to technological innovation are typically an unmeasured fraction of the time worked by the firm's engineers and managers (Freel, 2005; Cohen and Levin, 1989; Hadjimanolis, 2000). In many cases, the formal concept of R&D does not exist at all in many SMEs (Adeboye, 1997).

In consequence, we adopted a broader definition of R&D, taking into account adaptation efforts, design (an activity that may be very substantial in these firms), and development activities. Following Rosenberg (1994, p. 126), we understood "development" (in R&D) as "a range of activities whose content differs widely from one industry to another. It generally includes designing of new products, testing and evaluating their performance (which in some industries may involve the building and testing of prototypes, or experimentation with pilot plants), and inventing and designing new and appropriate manufacturing processes". Mahemba and De Bruijn (2003, pp. 167-168) argue that because of the low technological level of developing countries, the objectives of R&D in SMEs are "focused on alteration and adoption of discoveries made elsewhere". Imitation generally requires an effort of adaptation and may be quite costly, as certain authors have stressed (Weiner, 1969; Mansfield et al., 1981; Mansfield, 1984; Helpman, 1993; Juma and Clark, 2002). The inclusion of imitation costs in R&D expenditures of SMEs in developing countries is also supported by Rubenstein (1980).

Roper (1999) affirms that there is considerable evidence of systematic under-reporting of R&D in small firms. Moreover, small firms "tend to undertake a significant amount of innovative activities in their design, production and sales departments rather than in their R&D departments (which often do not exist at all). The problem with the R&D figures provided by official surveys is that they do not include these informal R&D activities" (Santarelli and Sterlacchini, 1990 p. 223). Rosenberg (1994, p. 126) expresses it similarly, "[...] R&D is, in fact, overwhelmingly D. Yet, we know more about the 12 percent of R&D that constitutes basic research than about the 68% that constitutes development. While this may be understandable on the part of natural scientists, it is less so on the part of economists".

Macpherson (1997) takes into account internal and external research, development and design (RD&D). To emphasize the inclusion of design and other innovation-oriented expenses of SMEs, we adopted his denomination "RD&D". Macpherson found that "successful product innovation can flow from a variety of strategies, one of which involves almost zero spending on RD&D inputs -either internal or external. On balance, however, the probability of successful innovation is higher among SMEs that augment their in-house skills with outside assistance" (1997, p. 300). In terms of the Oslo and Frascati manuals (OECD and Eurostat 2005, p. 36) this encompassing definition of RD&D covers both "R&D" and "other innovative activity". It includes permanent research, development and design expenditure and occasional investment in these activities. In their study of innovation in Argentinean industry, Chudnovsky et al. (2006, p. 283) find that "firms consider R&D activities as part of their routines and a valuable asset to be preserved even in bad times".

Following Mansfield et al. (1981), we asked firms in our study to incorporate in R&D "all costs of developing and introducing the imitated product, including applied research, product specification, pilot plan or prototype construction, investment in plant and equipment, and manufacturing and marketing start up". RD&D was operationalized as a metric variable between zero and 1 representing the percentage of all RD&D expenses over total sales at the time of the survey.

The empirical analysis

The three variables just presented (ownership of patents, imitation of foreign models, and RD&D as a fraction of total sales) were used to obtain clusters exhibiting more homogeneous patterns of combination. The predictive power of this clustering compared to the value of other variables related to the innovation process and the role of intellectual property was then analyzed. This allowed interpretations of how innovation is determined in SMEs of a developing country, and what is the role of imitation and patent ownership in this process. The environment of these innovation efforts was then analyzed and some policy implications were extracted.

Statistical framework

Since a general listing of SMEs does not exist in Colombia, we aggregated information from different databases, compiled by governmental and non-governmental organizations: Proexport, Acopi-Antioquia and the Chambers of Commerce in the cities of Cali and Bucaramanga.

Eight manufacturing and one service ISIC sectors were included in the study. The criteria for their selection were the percentage contribution of SMEs to total production and their total exports (see Table 1). These shares indicate the extent of competition in local and foreign markets. In agreement with Williamson's suggestion (1965), we thought that the relationship between intellectual property and competition should be studied in sectors with a significant share of SMEs in total production; also, we concentrated on tradable-good sectors, in order to place the issue of intellectual property in an international context.

The eight manufacturing sectors chosen were: tanning and dressing of leather and manufacture of leather products, rubber and plastic products, apparel, food products and beverages, metal products and machinery[3], publishing, printing and reproduction of recorded media, wood and products of wood and cork, chemicals and chemical products. Although the shares of SMEs in production and exports were not available for the service sector, this sector contributes 67.7% to GNP and 11.3 % to total exports (WTO, 2005). Tradable services were thus included in the sample.

Two other restrictions limited the universe of the survey. Cities included in the study were the five largest in Colombia (Bogota, Medellin, Cali, Barranquilla and Bucaramanga), where approximately 83% of Colombian SMEs operate. Since the failure rate of newly created firms in developing countries is high (between 50% and 75% in the first three years, according to the Economic Commission for Latin America), firms in existence for less than three years were excluded, leaving 4,168 SMEs for potential inclusion in the survey.

Sample selection and cluster analysis

A stratified random procedure was applied to the 4,168 SMEs of these eight sectors in the five largest Colombian cities (Table 1). In each city, an unrestricted random sample was chosen. A priori sector stratification was applied only in Bogota, where 50% of SMEs in the country are located (Rodríguez, 2003). Data was collected between February and August 2004. Regional offices and universities were contacted to serve as intermediaries to reach the firms outside Bogota. Personal visits, email and direct mail were used to collect the information. The researchers visited at least one time the cities that participated in the study to have access to verify the information collected.

The response rate was 32.67%. There were 246 usable responses, with a margin of error of 6.04%.

Cluster analysis was applied to identify patterns of combined sources of innovation. To determine whether there are different innovation patterns among Colombian small firms, we applied two-step cluster analysis, which is particularly effective for differentiation when both scale variables and continuous clustering variables are combined[4] (SPSS, 2005). As expressed by de Jong and Marsili (2006, pp. 225-226), "Empirical taxonomies have proven to be a useful tool for understanding the diversity of innovative behavior that can be observed across firms". Actually, many categories may appear in the analysis. As these authors conclude, "The innovation patterns in small firms are more diverse than generally believed, more diverse than was suggested in Pavitt's taxonomy, in which they are represented mainly by two categories".

Description of the sample

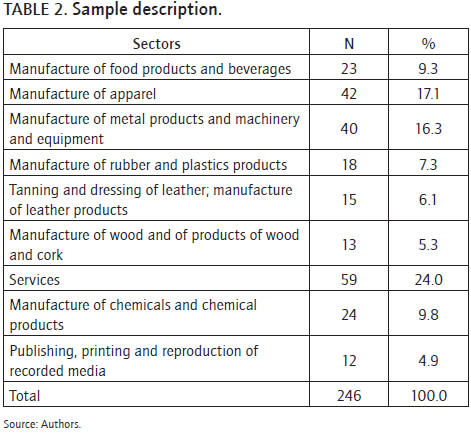

The sample reflected a geographical distribution similar to the universe pool: 58% of SMEs were located in Bogota, and the remaining 42% were located in the next four largest cities (Medellin 16%, Cali 13%, Barranquilla 7%, and Bucaramanga 6%). The average year the SMEs in the sample began operation is 1989; thus the average age of firms is 15 years at the time of the survey. In 2003, the average number of employees was 60, with a standard deviation (s.d.) of 166. Average sales were 1.07 million dollars (s.d. 2,90 million dollars) and average assets were 0.62 million dollars (s.d. 2.61 million dollars)[5]. The sector distribution of firms in the sample is presented in Table 2.

Nineteen companies in the sample (7.7%) own one or more patents. The average expenditure in RD&D as a percentage of total sales is 5.45%, with a standard deviation of 7.8%. This is not too far away from the 4 to 5% average reported by Durán et al. (1998) following the 1996 Colombian National Survey of Science and Technology.

Description of the clusters

Akaike's information criterion for conglomeration was used to determine the number of clusters. The two-step cluster analysis produces a sequence of partitions in one run. Partitions of up to 15 clusters were considered and the criterion was applied. The highest ratio of the measures of the distances was obtained for four clusters. Table 3 shows the distinct characteristics of the firms belonging to each of the four clusters, the distribution of the SMEs in the four clusters, the average values and variance analysis for each grouping variable. Clusters are statistically distinct in each of the clustering variables.

These clusters were then compared in terms of their innovation performance, measured by the number of new products and designs in 2003. Observation of the clusters and patterns of combination of the three innovation sources considered shows clearly distinct patterns of innovation. We labeled these four patterns of innovations (a) determined by patent ownership, (b) imitation and adaptationbased, (c) RD&D-based, and (d) classical innovation.

Of 246 firms, 19 firms belong to the first cluster. They own one or more patents and form a pattern determined by patent ownership. Their average expenditure in RD&D is 10%, while imitation of foreign models has an average of 0.26 (s.d. 0.65) in a multinomial scale from 0 to 3, where 3 represents the most important source of innovation for the firm. Firms in this cluster have the lowest innovation performance: The number of new products or designs in 2003 is 3.47.

66 firms form the imitation and adaptation-based pattern. They hold no patents. Their average expenditure in RD&D is 4% (s.d. 6%). The average score in imitation of foreign models was 1.91 (s.d. 0.70). They have the second highest innovation rate, 10.3 new products in 2003 and 3.29 new design or product lines.

43 firms form the RD&D pattern of innovation. They own no patents, and their average expenditure in RD&D is 15% (the highest among the four clusters). Imitation of foreign models has an average of 0.07 (s.d 0.34), the second lowest score in the four clusters. They have the highest rate of new products or designs in 2003 (an average of 24.28 new products or designs in 2003).

Of 246 firms, 118 belong to what we call the classical pattern[6] cluster. None of them owns patents. Their average expenditure in RD&D as a percentage of total sales is 2% (s. d. 2%). They do not report imitation or adaptation of foreign models. On the average, they bring 7.23 new products or designs to the market in 2003.

Several observations can be made concerning this classification. First, SMEs with the best innovation performance do not own patents; they spend a larger share of their income on RD&D, and display a low score of imitation of foreign models. This validates a common assumption in innovation studies that "R&D has the highest correlation with product innovation, suggesting that the main objective of R&D is to develop products" (Tang, 2006, p. 72). The results also confirm a hypothesis put forward by Weiner (1969), Mansfield et al. (1981), and others that imitation and adaptation require substantial RD&D efforts. SMEs in the imitation and adaptation-based cluster spend an average of 4% on RD&D. Though only 66 firms belong to this cluster, when imitation and adaptation of both national and foreign products and designs are observed, we find that 42.7 % of the firms in the sample of 246 engage in imitation and adaptation practices.

As expected, 100% of SMEs in this cluster imitate and adapt foreign or national products and designs. Paradoxically, the cluster of patent owners ranks second in percentage of firms engaging in imitation and adaptation of foreign or national products and designs (31.6%).

The positive relationship between imitation/adaptation and innovation performance is consistent with the competitive environment where these firms operate. Helpman (1993, p. 1275) states that "imitation is an economic activity much the same as innovation" Teubal (1996, p.449) argued that "successful penetration of research and development (R&D) in a newly industrialized country (NIC) context is a process involving extensive learning, including collective learning ('learning by others'); multidisciplinary learning (both techno-economic and managerial/organizational); and learning which is cumulative through time. This is especially so at an early ('infant') phase of diffusion of this process through the economy".

Our empirical findings are consistent with one of Helpman's conclusions (1993, p. 1276) that "in less developed countries imitation is a major effort that involves the development of absorptive capacity for advanced technologies on the one hand and particular efforts to assimilate and adopt foreign technologies on the other".

Firms owning patents have the lowest innovation performance. Even though their expenditures in RD&D are relatively high, the number of new products they take to the market is, on average, the lowest. This may be interpreted either as reflecting qualitative differences in these firms' new products or as a confirmation of the hypothesis, reviewed in the section Patent monopoly and competition, that the monopoly granted by a patent induces less innovative behavior. This may occur through Arrow's replacement effect, which states that an incumbent monopolist has weaker incentives than entrants do to innovate, because the new product must compete with the firm's old product (Aghion et al., 2001). This dilemma is dealt with in the following section.

Refined measures of innovation output

Bessen and Maskin (2000), Cohen and Levin (1989), and Tang (2006) argue that the output of innovation differs by sector, and a statistically significant relationship between sector and the number of new products developed is in fact observed. Accordingly, the z-score method was used to standardize the measure of innovation output: The mean of each sector was subtracted from the number of new products of each firm and the difference obtained was divided by the standard deviation of each sector. The main results do not change after this normalization. The RD&Dbased cluster still has the highest measure of standardized new products (0.639). The cluster determined by patent ownership still had the lowest value (-0.223); see Table 3.

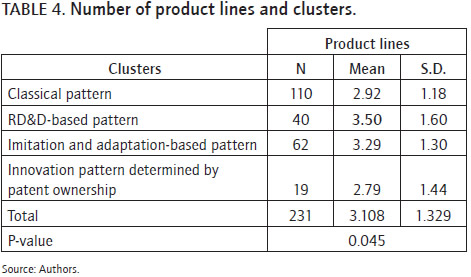

A third measure of innovation output is the average number of product lines that SMEs in each cluster report. A product line is a group of closely related products or services, usually sharing the same production techniques. Significant differences among the four clusters and comparable results were found in terms of this output indicator (p=0.045), with the RD&D-based pattern showing the highest average of product lines. The ranking of the four groups was the same, and patent owners showed the lowest innovation performance (see Table 4).

In the following sections, we test the differentiating power of the clustering of SMEs in terms of their innovation, imitation and RD&D investment. For that, we compare the four clusters obtained in terms of a few innovation related characteristics.

Internal and external innovation sources

Technical assistance and consulting are particularly appropriate for small firms, as reported by Macpherson (1991) for North America and Rothwell (1991) and Freel (2005) for Europe. Since these firms have inevitable internal constraints in resources for innovative activities, external sources of technology and knowledge such as innovation networks, innovation-related cooperation, and consulting activities are useful. As Freel (2000, p. 263) put it, "The evidence suggests that the most innovative firms are involved in extensive and diverse links with a variety of external sources of knowledge and expertise".

Foreign technical assistance appears to be particularly important for Colombian SMEs in the RD&D-based pattern of innovation; 39.4% ranked foreign technical assistance and consulting activities among their three most important sources of innovation. Firms in this cluster also show the highest percentage in mentioning consulting as a source of innovation (72.7%). Note that this is the cluster with the highest performance in terms of new products. One possible explanation is Freel's analysis (2005) of participation in innovation networks. When small firms have the opportunity to combine their internal sources with external sources, their innovative performance improves. In contrast, the cluster with the smallest percentage both in foreign technical assistance and consulting is the imitation and adaptation-based pattern with 15.15% and 25.76%, respectively.

In their research on SMEs in Tanzania, Mahemba and De Bruijn (2003) also found that the most innovating companies were likely to seek external technical support. Perhaps, as Nelson (1968) observed for large industries in Colombia in the 1960s, the most innovative groups among SMEs in developing countries also share a few similarities with those in industrialized countries.

Internal sources of ideas for innovation

Regarding the internal sources of innovation, although for most of the SMEs in the sample the manager's education is a very important source, the called classical pattern has the highest percentage (88.5%), followed by the RD&D-based pattern (84.8%). Ideas of middle management and workers appears to be particularly important for the innovation pattern determined by patent ownership (50%), followed by the RD&D-based pattern.

Patterns of innovation and ownership structure

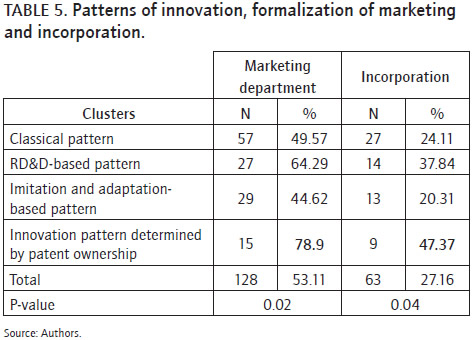

A significant difference is observed among the four clusters in terms of the incorporation of firms (p=0.04)[7]. Patent owners have the highest percentage of incorporation (47.37%) while firms in the imitation and adaptationbased pattern have the lowest (20.31%).

It is interesting to note that patent owners' efforts are aimed at marginal improvements of their patented products, and investing in the formalization of marketing activities is more frequent (see Table 5). It is possible to raise the hypothesis that patent ownership is an attractive characteristic and a signal for potential investors. Since patent-owning firms show lower performance in terms of different measures of new products and since these firms are often incorporated, one could question the economic value of this signal, except for the market monopoly it entails.

Analyzing innovation in British firms, Geroski (1994) obtained a result comparable to ours: "[...] small firms or fringe players have an incentive to use them [major innovations] to improve their market position, while large incumbent firms who enjoy rents on their existing activities have an incentive to resist their advance [...] Although large, monopolistic firms may have superior resources to generate new innovations and may be in a better position to exploit them than other firms, innovative activity is often rent-displacing and this dulls the incentives of such firms to innovate" (p. 149).

Common characteristics of clusters

Nonsignificant differences among the four clusters are found in terms of the following variables: Age of the firm (p= 0.46); size, measured in terms of number of employees, sales and assets (p= 0.40, 0.20 and 0.40, respectively); capital and non-capital cities (p= 0.48), and large and medium- sized cities (p= 0.56); efficiency ratios such as sales per employee (p= 0.24), and assets per employee (p= 0.90).

Firms in the sample are 15 years old on average, and all clusters had averages close to this value. Though there is considerable controversy in the literature about a positive or negative relationship between size and innovation (Acs and Audretsch, 2005; Damanpour, 1996; Vossen, 1998), the results obtained here do not support either hypothesis. Nor do the assets of a firm appear to be predetermining its innovation pattern. These results, which coincide with those of Hadjimanolis (2000) and Kannebley et al. (2005), support the hypothesis that size is not a barrier for innovation in small firms.

Service firms are present in similar proportions in the different clusters. The differences were not significant (p= 0.77). Neither service nor manufacture predominates in any cluster. This coincides with the results of Kannebley et al. (2005) and de Jong and Marsili (2006). The differences among clusters in terms of the percentage of exports over total sales for the firms in each cluster (p= 0.48) and the percentage of firms in each cluster that were regular exporters (those exporting continuously for 3 or more years) were also explored (p= 0.54). Neither of these two measures of internationalization showed significant differences among clusters.

Our empirical exploration of the relationship between the intellectual property assets and the innovation behavior of SMEs in a developing country yields one central result: The cluster of SMEs owning patents has a significantly lower rate of new products brought to the market per year than firms in the other clusters.

This implies that patent owning firms are less innovative in terms of new products, when compared to other SMEs. Their innovation efforts (as measured by RD&D) are also relatively low. This would support the hypothesis that, through the so-called "replacement effect" or other reasons mentioned earlier, patents exempt their owners from the necessity of pursuing a continuous process of innovation. As the average age of these firms is not significantly different from the average age of firms in other clusters, one could also infer that an innovative behavior is not required from them to survive over time. The protection of patents seems to be sufficient to guarantee their survival and appears to be related to less innovative behavior.

Patent owning firms operate in a market environment which is completely different from that of the other clusters identified in the analysis. Patent owners rely on the monopoly granted to them by the patent system while the three other clusters of SMEs identified in the analysis operate in an environment of competition. In the monopolistic environment of patent owners, innovation efforts are geared toward marginal improvements of their patented products, and investing in the formalization of marketing activities is more frequent (see Table 5). The significantly higher proportion of incorporated firms in this cluster suggests that patent ownership operates as an efficient signal to investors in the imperfect capital market of this developing country. This signal, together with a well organized, formal management of marketing, seems to provide them with a relatively easier access to capital resources.

In contrast, firms in the RD&D-based cluster do not own patents; they operate in markets where patents do not prevent direct competition and where the life cycle of new products is short or where product differentiation is high; these firms depend on an intense innovation activity and spend the highest share of their sales in research, development and design (RD&D); they are the most innovative in terms of new products, but do not patent or register their new products or designs. They have an intermediate propensity to imitate the innovations of other firms, and they rely on technical assistance and external consulting more often than firms in other clusters.

The third cluster found in the analysis relies primarily on imitation and adaptation, especially of foreign models, to innovate and survive in their markets. Their expenditures in RD&D are an important part of their total sales. This is consistent with the hypothesis, proven by different studies for industrialized countries, that engaging in imitation and adaptation demands an important fraction of what these firms would spend if they developed these products on their own.

In the competitive environment where the RD&D and imitation-based firms operate, either important investments in RD&D, high rates of innovation and imitation, or a formalization of design activities are required. Competitors are closely watched, and their products sometimes inspire each other's designs.

The fourth and largest cluster (more than half of the surveyed firms) is made of SMEs that follow what we have called the 'classical pattern of innovation'. Since their inception, they have survived depending on the ideas and education of the entrepreneur; they do not own patents or carry any formal process of research and development; they spend the lowest proportion of sales in RD&D, and do not report imitating national or foreign models.

This empirical result, obtained for a sample of SMEs in a specific developing country, is in line with the monopoly interpretation rather than with the incentive interpretation of the effects of the protection of intellectual property. The most innovative firms operate in a competitive environment, where markets are not protected. Firms enjoying the protection of patents have survived, apparently without as much pressure to introduce new products continuously into the market. One can conclude that, in the specific context of this study, where frontier technologies are not at issue, the ownership of intellectual property is not an incentive to innovation. Instead, firms owning patents exhibit a less intensive innovative activity. The effects of IP protection may allow the long-term survival of firms with relatively lower RD&D efforts and which put less new products or designs into the market.

An interesting aspect of the analysis is that differences in sector or regional composition of the four clusters are not significant. The size of the firm, its age or the percentage of its sales that is being exported are not significantly different among clusters.

What are the policy implications of these results? First, intellectual property protection should not be viewed as a panacea for improving the innovation performance of small and medium enterprises of all kinds. Rather than adopting international across-the-board intellectual property standards, developing-country governments interested in promoting innovation should design specific intellectual property policies that weigh the two-sided impact of patenting on innovation. For that, special efforts should be made by the authorities of these countries to raise more detailed statistics allowing to understand the various innovation processes taking place in SMEs. Also, since no single innovation policy would be optimal for all kinds on SMEs identified in this study, alternative schemes for the promotion of innovation should coexist to attract the attention of different kinds of SMEs to innovative activities.

The authors thank Paul A. David and Martin Bell for valuable guidance and comments. Luz Marina Ferro, Vicente Pinilla and José Miguel Ospina, members of the research team on Export Potential of Developing-Country SMEs, shared the SMEsurvey. Rafael Bautista and attendants at the UASM Faculty Seminar on Innovation and Intellectual Property made valuable comments. The authors acknowledge the financial support of Universidad de los Andes School of Management.

[1] See Schumpeter (1942) and Schumpeter (1912).

[2] This effect, later called "replacement effect" by Tirole (1988, p. 392), is related to Arrow's definition of a monopoly which does not include the case of innovations competing with old products of the same firm (1962, p. 619).}

[3] Manufacture of metal products and manufacture of machinery were integrated in one sector.

[4] To determine the number of clusters automatically, two-step cluster analysis works with the hierarchical clustering method. The first step calculates Bayesian (Schwartz) information criteria-BIC-for each number of clusters within a specified range and uses it to find the initial estimate for the number of clusters. The second step refines the initial estimate by finding the greatest change in distance between the two closest clusters in each hierarchical clustering stage.

[5] The exchange rate was 2 807.97 COP/USD, the average reported by the Colombian Central Bank for 2003.

[6] This model was called classical because the main source of innovation reported is the education and ideas of the entrepreneur or manager, as in the classical Schumpeterian theory. The quantitative result is presented in the following section.

[7] In Colombian law, societies with limited responsibility and equity shares are regulated by the authority and are called "anonymous societies". The law for these societies is similar to the law of incorporation in the Anglo-Saxon legislation.

Aboites, J. & Cimoli, M. (2001). Intellectual property rights and national innovation systems. Some lessons from the mexican experience. Conference paper, Druid - Danish Research Unit for Industrial Dynamics Conference, Denmark, June. http://www.business.auc.dk/druid/conferences/nw/conf-papers.html [ Links ]

Acs, Z. J. & Audretsch, D. B. (2005). Innovation and technological change. In Acs, Z. J. & Audretsch, D. B. (eds.), Handbook of entrepreneurship research: An interdisciplinary survey and introduction (pp. 55-80). New York: Springer. [ Links ]

Adeboye, T. (1997). Models of innovation and sub-Saharan Africa's development tragedy. Technology Analysis & Strategic Management, 9(2), 213-235. [ Links ]

Aghion, P., Harris, C. & Vickers, J. (1997). Competition and growth with step-by-step innovation: An example. European Economic Review, 41, 771-782. [ Links ]

Aghion, P., Harris, C., Howitt, P. & Vickers, J. (2001). Competition, imitation and growth with step-by-step innovation. Review of Economic Studies, 68(3), 467-492. [ Links ]

Aghion, P., Burgess, R., Redding, S. & Zilibotti, F. (2005). Entry liberalization and inequality in industrial performance. Journal of the European Economic Association, 3(2-3), 291-302. [ Links ]

Aghion, P. & Griffith, R. (2005). Competition and growth: Reconciling theory and evidence. Cambridge, MA: MIT Press. [ Links ]

Alcorta, L. & Peres, W. (1998). Innovation systems and technological specialization in Latin America and the Caribbean. Research Policy, 26, 857-881. [ Links ]

Arrow, K. J. (1962). Economic welfare and the allocation of resources for inventions. In Nelson, R., (ed.), The rate and direction of inventive activity (pp. 609-625). New Jersey: Princeton University Press. [ Links ]

Ayyagari, M., Thorsten, B. & Demirgüç-Kunt, A. (2003). Small and medium enterprises across the globe: A new database. World Bank Policy Research Working Paper 3127, 27-28. [ Links ]

Bessen, J. & Maskin, E. (2000). Sequential innovation, patents, and imitation. Massachusetts Institute of Technology, Working Paper Department of Economics 00-01, 1-35. [ Links ]

Chen, Y. & Puttitanun, T. (2005). Intellectual property rights and innovation in developing countries. Journal of Development Economics, 78, 474-493. [ Links ]

Chudnovsky, D., López, A. & Pupato, G. (2006). Innovation and productivity in developing countries: A study of Argentine manufacturing firms' behavior (1992-2001). Research Policy, 35, 266-288. [ Links ]

Cohen, W. & Levin, R. (1989). Empirical studies of innovation and market structure. In Schmalensee, R. W. (ed.), Handbook of industrial organization, 2 (pp. 1060-1107). North-Holland: Elsevier Science Publications. [ Links ]

Correa, C. (2007). Intellectual property in LDCs: Strategies for enhancing technology transfer and dissemination. University of Buenos Aires (Background Paper No. 4), 40 pages. [ Links ]

Damanpour, F. (1996). Organizational complexity and innovation: Developing and testing multiple contingency models. Management Science, 42(5), 693-716. [ Links ]

De Jong, J.P.J. & Marsili, O. (2006). The fruit flies of innovations: A taxonomy of innovative small firms. Research Policy, 35, 213-229. [ Links ]

Departamento Administrativo Nacional de Estadística, DANE. (2002). Encuesta Anual Manufacturera (Manufacturing Annual Survey). Retrieved from http://www.dane.gov.co. [ Links ]

Departamento Nacional de Planeación, DNP. (2003). Indicadores Industria, Microempresas y Empresariales (Industry, Micro-businesses and Business Indicators). Retrieved from http://www.dnp.gov.co. [ Links ]

Durán, X., Ibáñez, R., Salazar, M. & Vargas, M. (1998). La innovación tecnológica en Colombia: características por tamaño y tipo de empresa. Bogotá: Departamento Nacional de Planeación. [ Links ]

Durán, X., Ibáñez, R., Salazar, M. & Vargas, M. (2000). La innovación tecnológica en Colombia: características por sector industrial y región geográfica. Bogotá: Observatorio Colombiano de Ciencia y Tecnología. [ Links ]

Dutta, A. & Sharma, S. (2008). Intellectual property rights and innovation in developing countries: Evidence from India. Washington, D.C.: Georgetown University. [ Links ]

Foray, D. (2007). Knowledge, intellectual property and development in LDCs: Toward innovative policy initiatives. Ecole Polytechnique Fédérale de Lausanne (Background Paper No. 2), 68 pages. [ Links ]

Freel, M. S. (2000). External linkages and product innovation in small manufacturing firms. Entrepreneurship & Regional Development, 12, 245-266. [ Links ]

Freel, M. S. (2005). Patterns of innovation and skills in small firms. Technovation, 25, 123-134. [ Links ]

Geroski, P. A. (1994). Market structure, corporate performance and innovative activity. New York: Oxford University Press. [ Links ]

Hadjimanolis, A. (2000). An investigation of innovation antecedents in small firms in the context of a small developing country. R & D Management, 30(3), 235-245. [ Links ]

Heller, M. & Eisenberg, R. (1998). Can patents deter innovation? Science, 280(5364), 698-701. [ Links ]

Helpman, E. (1993). Innovation, imitation and intellectual property rights. Econometrica, 61(6), 1247-1280. [ Links ]

Juma, C. & Clark, N. (2002). Technological catch-up: Opportunities and challenges for developing countries. Scottish Universities Policy Research and Advice Network, SUPRA Working Series Papers 28, 1-24. [ Links ]

Kannebley Jr, S., Silveira Porto, G. & Toldo Pazello, E. (2005). Characteristics of Brazilian innovative firms: An empirical analysis based on PINTEC-industrial research on technological innovation. Research Policy, 34, 872-893. [ Links ]

Kraft, K. (1989). Market structure, firm characteristics and innovative activity. Journal of Industrial Economics, 37(3), 329-336. [ Links ]

Krugman, P. (1979). A model of innovation, technology transfer, and the world distribution of income. Journal of Political Economy, 87(2), 253-266. [ Links ]

Landry, R. & Amara, N. (2002). Effects of sources of information on novelty of innovation in Canadian manufacturing firms: Evidence from the 1999 Statistics Canada Innovation Survey. Study prepared for Industry Canada, Innovation Policy Branch, Québec. [ Links ]

Levin, R. C., Klevorick, A. K., Nelson, R., Winter, S. G., Gilbert, R. & Griliches, Z. (1987). Appropriating the returns from industrial research and development. Brooking Papers on Economic Activity, 3, 783-831. [ Links ]

Lin, C., Lin, P. & Song, F. (2010). Property rights protection and corporate R&D: Evidence from China. Journal of Development Economics, 93, 49-62. [ Links ]

Macpherson, A. D. (1991). New product development among small industrial firms: A comparative assessment of the role of technical service linkages in Toronto and Buffalo. Economic Geography, 67(2), 136-146. [ Links ]

Macpherson, A. D. (1997). A comparison of within-firm and external sources of product innovation. Growth and Change, 28, 289-308. [ Links ]

Mahemba, C. M. & De Bruijn, E. J. (2003). Innovation activities by small and medium-sized manufacturing enterprises in Tanzania. Creativity and Innovation Management, 12(3), 162-173. [ Links ]

Malaver, F. & Vargas, M. (2004). Hacia una caracterización de los procesos de innovación en la industria colombiana. Los resultados de un estudio de casos. Academia, 33, 5-33. [ Links ]

Mansfield, E. (1984). R&D and innovation: Some empirical findings. In Griliches, Z. (ed.), R&D, patents, and productivity (pp. 127-154). National Bureau of Economic Research. Chicago, IL: University of Chicago Press. [ Links ]

Mansfield, E. (1986). Patents and innovation: An empirical study. Management Science, 32(2), 173-181. [ Links ]

Mansfield, E., Schwartz, M. & Wagner, S. (1981). Imitation costs and patents: An empirical study. The Economic Journal, 91(364), 907-918. [ Links ]

Metcalfe, J. S. & Ramlogan, R. (2005). Competition and the regulation of economic development. Quarterly Review of Economics and Finance, 45, 215-235. [ Links ]

Mukoyama, T. (2003). Innovation, imitation, and growth with cumulative technology. Journal of Monetary Economics, 50(2), 361-380. [ Links ]

Nelson, R. (1968). A "diffusion" model of international productivity differences in manufacturing industry. American Economic Review, 58(5), 1219-1248. [ Links ]

Nordhaus, W. D. (1969). An economic theory of technological change. American Economic Review, Papers and Proceedings, 59(2), 18-28. [ Links ]

OECD & Eurostat (2005). Oslo manual. The measurement of scientific and technological activities. Guidelines for collecting and interpreting innovation data. Third ed. [ Links ]

Ogliastri, E., Sardi, A. & Azuero, E. (1977). La transferencia y desarrollo de la tecnología. New York: CAI. [ Links ]

Pack, H. & Westphal, L. E. (1986). Industrial strategy and technological change. Journal of Development Economics, 22, 87-128. [ Links ]

Rodríguez, A. (2003). La realidad de la PYME colombiana. Desafío para el desarrollo. Bogotá: Fundes. [ Links ]

Roper, S. (1999). Under-reporting of R&D in small firms: The impact on international R&D comparisons. Small Business Economics, 12, 131-135. [ Links ]

Rosenberg, N. (1994). Exploring the Black Box. Technology, economics and history. Cambridge: Cambridge University Press. [ Links ]

Rothwell, R. (1991). External networking and innovation in small and medium-sized manufacturing firms in Europe. Technovation, 11(2), 93-112. [ Links ]

Rubenstein, A. H. (1980). Research and development issues in developing countries. In Dean, B. V., Goldhar, J. L. (eds.), Management of research and innovation (pp. 253-283). New York: North-Holland Publishing. [ Links ]

Salazar, M. (1998). Panorama de la innovación tecnológica en la industria colombiana. Revista de la ANDI, 151, 66-74. [ Links ]

Salazar, M., Lucio, J., Rivera, S.C., Bernal, E., Ruiz, C., Usgame, D., Daza Caicedo, S., Lucio-Arias, D., Albis, N., Colorado, L., Guerrero, J., León, A., Usgame, G., Bueno, E., Perea, G.I., García, M., Guevara, A. & Pardo, M. (2011). Indicadores de ciencia y tecnología - Colombia 2010. Bogotá: OCYT (Observatorio Colombiano de Ciencia y Tecnología). [ Links ]

Sampath, P. G. (2007). Intellectual property and innovation in least developed countries: Pharmaceuticals, agro-processing and textiles and RMG in Bangladesh. United Nations University - MERIT (Background Paper No. 9), 58 pages. [ Links ]

Santarelli, E. & Sterlacchini, A. (1990). Innovation, formal vs. informal R&D, and firm size: Some evidence from Italian manufacturing firm. Small Business Economics, 2, 223-228. [ Links ]

Schumpeter, J. A. (1912). Theorie der wirtschaftlichen Entwicklung. First edition. München and Leipzig: Verlag von Duncker & Humblot. [ Links ]

Schumpeter, J. A. (1942). Capitalism, socialism, and democracy. New York: Harper and Brothers. [ Links ]

Siu, W., Lin, T., Fang, W. & Liu, S. (2006). An institutional analysis of the new product development process of small and medium enterprises (SMEs) in China, Hong Kong and Taiwan. Industrial Marketing Management, 35, 323-335. [ Links ]

SPSS (2005). The SPSS two step cluster component. A scalable component enabling more efficient customer segmentation. White Paper - technical report. www.spss.com/downloads on December 5, 2005. [ Links ]

Tang, J. (2006). Competition and innovation behavior. Research Policy, 35, 68-82. [ Links ]

Teubal, M. (1996). R&D and technology policy in NI CS as a learning processes. World Development, 24(3), 449-460. [ Links ]

Tidd, J., Bessant, J. & Pavitt, K. (2005). Managing innovation. Integrating technological, market and organizational change, 3rd ed. West Sussex: John Wiley & Sons, Ltd. [ Links ]

Tirole, J. (1988). The theory of industrial organization. Cambridge, MA: MIT Press. [ Links ]

United Nations (2006). Human development report, downloaded from http://hdr.undp.org/presskit/hdr2005/pdf/presskit/HDR05_PKE_HDI.pdf, on June 9, 2006. [ Links ]

Utterback, J. M. & Abernathy, W. J. (1975). A dynamic model of process and product innovation. Omega, 3(6), 639-656. [ Links ]

Vossen, R. W. (1998). Relative strengths and weaknesses of small firms in innovation (research note). International Small Business Journal, 16(3), 88-94. [ Links ]

Weiner, M. (1969). La modernización empresarial. México: Editorial Roble. [ Links ]

Williamson, O. E. (1965). Innovation and market structure. Journal of Political Economy, 73(1), 67-73. [ Links ]

WTO (2005). Trade by sector International Trade Statistics 2005. <http://www.wto.org/>. [ Links ]

Yang, G. & Maskus, K. E. (2001). Intellectual property rights, licensing, and innovation in an endogenous product-cycle model. Journal of International Economics, 53, 169-187. [ Links ]