Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Innovar

Print version ISSN 0121-5051

Innovar vol.22 no.44 Bogotá Apr. 2012

Javier Pantoja-Robayo

PhD in Management. Option finance. HEC University - EAFIT University. Assistant Professor in Business School, Eafit University Colombia. E-mail: jpantoja@eafit.edu.co

Recibido: septiembre de 2011 Aceptado: febrero de 2012.

Abstract:

This paper presents a study of the Forward Risk Premia (FRP) in Wholesale Electric Power Market in Colombia (WPMC) showing how the FRP varies throughout the day and how its properties are explained by risk factors. It also shows that expected forward risk premia depends on factors such as variations in expected spot prices, due to the climatic conditions generated by the Oceanic Niño Index (ONI) and its impact on the available quantity of water to generate electric power. This document provides a quantitative assessment of the Colombian electricity forward price premium as defined as the discrepancy between spot and forward prices in the Colombian market. The study applies appropriate methodologies including linear regression and GARCH modeling of time series to investigate the issue under concern. It delivers empirical results which, to the best of our knowledge, are new in the market context of Colombia. In particular, the relation between a weather-linked phenomenon such as El Niño effect and electric forward price premia is quantified.

Key words:

Forward Risk Premia, Electric Power Markets, Oceanic Niño Index (ONI).

Resumen:

Este artículo, en primer lugar presenta un estudio de las primas de riesgo forward (FRP) en el Mercado Mayorista de Energía Eléctrica en Colombia (WPMC) que muestra cómo el FRP varía a lo largo del día y de cómo sus propiedades se explican por los factores de riesgo. En segundo lugar, muestra que las primas de riesgo forward esperadas dependen de factores tales como las variaciones en los precios al contado, debido a las condiciones climáticas generadas por el Índice Oceánico El Niño (ONI) y su impacto en la cantidad disponible de agua para generar energía eléctrica. Este documento proporciona una evaluación cuantitativa del precio de la prima de riesgo de la electricidad en Colombia definiéndola como la discrepancia entre los precios spot y forward en el mercado colombiano. En este estudio se aplican metodologías apropiadas, incluyendo regresión lineal y modelos GARCH de series de tiempo para investigar el tema planteado. Ofrece resultados empíricos que, según nuestro conocimiento, son nuevos en el contexto del mercado colombiano. En particular, cuantificar la relación entre un fenómeno climático como El Niño y el efecto sobre las primas de riesgo en energía eléctrica.

Palabras clave:

prima de riesgo forward, mercado de energía eléctrica, Oceanic Niño Index (ONI).

Résumé:

Cet article présente tout d'abord une étude des primes de risque forward (FRP) sur le Marché de gros d'Énergie Électrique en Colombie démontrant comment le risque forward (FRP) varie durant la journée et comment ses propriétés sont expliquées par les facteurs de risque. D'autre part il est démontré que les expectatives de primes de risque forward dépendent de facteurs tels que les variations de prix au comptant, en raison des conditions climatiques engendrées par l'indice Oceanic Niño Index (ONI) et son impact sur la quantité d'eau disponible pour produire l'énergie électrique. Ce document fournit une évaluation quantitative du prix de la prime de risque de l'électricité en Colombie, celle-ci étant définie comme la différence entre les prix spot et forward sur le marché colombien. Cette étude utilise des méthodologies appropriées, incluant la régression linéaire et les modèles GARCH de séries de temps pour effectuer la recherche sur le thème proposé. Des résultats empiriques sont transmis et, à notre connaissance, ils sont nouveaux dans le contexte du marché colombien, s'agissant, en particulier, de quantifier la relation entre un phénomène climatique tel que el Niño, et son effet sur les primes de risque en énergie électrique.

Mots-Clefs :

Prime de risque Forward, marché d'énergie électrique, Oceanic Niño Index (ONI).

Resumo:

Este artigo, em primeiro lugar apresenta um estudo dos prêmios de risco forward (FRP) no Mercado Atacadista de Energia Elétrica na Colômbia (WPMC) que mostra como o FRP varia ao longo do dia e de como suas propriedades são explicadas pelos fatores de risco. Em segundo lugar, mostra que os prêmios de risco forward esperados dependem de fatores reais, tais como as variações nos precios al contado, devido às condições climáticas geradas pelo Índice Oceânico El Niño (ONI) e seu impacto na quantidade disponível de água para gerar energia elétrica. Este documento proporciona uma avaliação quantitativa do preço do prêmio de risco da eletricidade na Colômbia, definindo-a como a discrepância entre os preços spot e forward no mercado colombiano. Neste estudo aplicam-se metodologias apropriadas, incluindo regressão linear e modelos GARCH de séries de tempo para investigar o tema estabelecido. Oferece resultados empíricos que, conforme nosso entendimento, são novos no contexto do mercado colombiano. Em particular, quantificar a relação entre um fenômeno climático como El Niño e o efeito sobre os prêmios de risco de energia elétrica.

Palavras chave :

Prêmio de Risco Forward, Mercado de Energia Elétrica, Oceanic Niño Index (ONI).

The transaction of a commodity, which relates physical production to financial transactions through contracts, presents peculiar characteristics. First of all it has the singularity of requiring balance between the offer and the demand in real time and the possession of geographical limitations; and second, the impossibility of generating inventory that mitigates the price fluctuation, taking into account that those prices present numerous peaks, jumps and fat tails. In addition, the question that has to be asked is if electric forward prices reflect economic fundamentals or if the traders can manipulate those prices; moreover, the answers become extremely relevant in the market due to regulatory issues and the expectations of rational agents.

This paper provides a quantitative assessment of the Colombian electricity forward price premium, which is defined as the discrepancy between spot and forward prices in the Colombian market. The study applies econometric methodologies including Vector Auto-regression VAR, linear regression and GARCH modeling of time series to investigate the issue under concern. These results, that are new in the Colombian market context, show the relationship between a weather-linked phenomenon such as El Niño effect and the quantified electric forward price premia.

Empirical studies about electric power markets from several authors show that there are two basic approaches to define Risk Premia; first, the standard no-arbitrage or cost-of-carry (Brennan, 1958), and second, the equilibrium model (Hicks, 1939; Cootner, 1960; Bessembinder and Lemmon, 2002; Longstaff and Wang, 2004). If storability of electric power was not a concrete issue, no inventories could be held, allowing the capacity of response to cover the short position in forward contracts traded in this market; therefore, the first basic approach cannot be applied. Thus, the second basic approach is suitable, taking into account the conditions of the market. Geman and Eydeland (1999) agree with the fact that the no-arbitrage approach does not apply to electric power and noticed that there were differences between forward prices and expected spot prices, which implied the presence of the Forward Premia, suggesting that the Forward Premia represents compensation for bearing risk. A similar approach to the one of Bessembinder and Lemmon (2002) and Longstaff and Wang (2004) is used in this paper.

Several El Niño studies (e.g., Barnston and Glantz, 1999; Barnston and Chelliah, 1997; Barnston and Ropelewski, 1992) have shown significant effects on a number of economically critical climate variables in North and South America with climatic effects producing drought periods and rainfall along the Pacific and Atlantic coasts. The correlation between the volatility of prices and the ONI is explained by the fact that tropical countries such as Colombia have coastal areas on at least one of these oceans and the electric power production system is water dependent. The hourly pattern shows differences throughout the day between the expected spot price and the forward prices. Moreover, expected spot prices are higher than forward prices, which are consistent with classical literature (e.g., Hicks, 1939; Cootner, 1960) and more recent studies by Bessembinder and Lemmon (2002), and Longstaff and Wang (2004).

Particular features about forward premia in the WPMC were found, which are also consistent with the classical literature. For instance, in this study, expected forward premia of unregulated markets show 21 significant values. Values also vary throughout the day from a minimum of -9.97% early in the morning to a maximum of 26.77% in the evening. Positive forward premia reach high values between 2.36% and the maximum percentage, which means that the expected spot prices are greater than the forward prices. On average, forward premia across the day are 2.13%.

Nonetheless, electric power prices show a particular behaviour. Both mean and median spot prices are calculated for a 24 hour period except from 18:00 to 21:00, when they are lower than the mean of forward prices. The relationship between spot and forward price behaviour shows that the spot price in a daily pattern is volatile and the forward price is smooth. Thus, it could be hypothesized that agents try to determine forward prices rationally as a riskaverse action. Then, forward premia represents compensation by bearing risk due to electric power prices, which are subject to sudden sharp upward jumps because of several conditions. Longstaff and Wang (2002) and Bessembinder and Lemmon (2002) reached the same conclusions about Forward Premia; on the wholesale electric power market of Pennsylvania, New Jersey, and Maryland "PJM".

Longstaff and Wang (2004) found that there are significant risk premia in electric power forward prices and suggest that risk-averse economic agents determine forward prices rationally. Bessembinder and Lemmon (2002) present an equilibrium model of electric power spot and forward prices. Other papers focusing on energy contracts include Routledge, Seppi, and Spatt (2000), Geman and Eydeland (1999), Pirrong and Jermakyan (1999), Kellerhals (2001), and Lucia and Schwartz (2002). This paper shows that, in emerging markets as well as in WPMC, Forward Premia for electric power prices have peculiar conditions related to their own characteristics.

We have found that expected Forward Risk Premia depends on factors such as variations in expected spot prices, due to the climatic conditions generated by the Oceanic Niño Index (ONI), and implications by variations in demanded electricity. The case study is the Colombian market as an example of emerging markets.

This paper is organized as follows, Section 1 introduces the reader into the main subject; Section 2 describes the wholesale electric power market in Colombia and the interaction between physical production of electricity and the financial contracts to trade it; Section 3 presents the data used in the empirical work; Section 4 discusses the empirical work and section 5 concludes.

The wholesale electric power market started in Colombia in the late nineteenth century and its development was the result of a private investment initiative that aimed at the generation, distribution, and commercialization of electric power. In the mid twentieth century this scheme started changing and the privately owned companies were nationalized.

In the 1990s, the electric power sector was in bankruptcy due to poor operational and financial management, which resulted in national electric energy rationing from 1991 to 1992. Since the approval of the new Colombian Constitution in 1991, new regulations have been established for the entry of private investors to the electric generation business and the government was authorized to make decisions related to the construction of new electric generation plants and their guarantees. Thus, the government authorized the involvement of governmental agencies to sign buying and selling contracts of electricity in the long term with the companies selected for that aim.

The Regulatory Commission for Gas and Energy (RCGE)2 was created by statutes, and its function is to regulate the entrepreneurial, commercial, technical, and operational aspects of this new structure of the electric power sector. This includes the generation, transmission, and distribution/commercialization of electric power. Regulations in the WPMC also created the figure of the "pure marketer", which is an intermediary agent whose purpose is to make competition dynamic and to provide the final customers with different ways to access competitive prices in the electric market of wholesalers. This is the typical case of an energy retailer procuring power from the wholesale market at the standing spot price and reselling it to industrial consumers exhibiting variable demand figures.

Regulations in Colombian market allows these agents to sell electric power to their customers through contracts that have no "steady electric power to endorse", that is, that endorsed by the electric generators to guarantee supply to these users. Moreover, these agents can take endless risks and, in the case of bankruptcy, they do not have assets to lose.

Electric power generators have warned of the risk that the existence of certain agents, who have agreed on long-term contracts without a real electric endorsement and used the electric financial market as an instrument to comply with their contractual obligations, could have on the future feasibility of the electric wholesale market. In times of low prices, the "pure marketers" have probably not had any difficulty to comply with their obligations with the electric financial market and signed contracts. But in times of high prices caused by phenomena such as El Niño or a poor equilibrium between supply and demand, these agents would be surely facing financial difficulties due to their losses and would opt out of businesses regardless of the purchases already made to the wholesale market and their customer supply. In 2008 the installed capacity of electric power generation in Colombia (13.4 GW) was 67% hydro (including small hydro), 27% natural gas, 5% coal, and 0.3% wind and cogeneration.

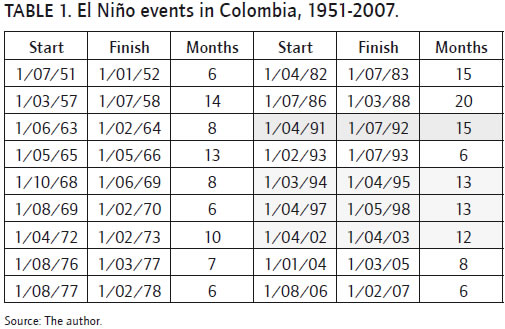

Colombia's electricity supply system is severely affected by adverse weather systems. Drought periods due to El Niño events can last for many months. El Niño periods between 1951 and 2007 are shown in Table 1, with the most severe periods of the last 20 years highlighted in blue. The effect of these droughts on water availability for electric power generation is demonstrated in Figure 1 for the 2002-2003 events, when water levels in hydroelectricity dams fell much more than the normal seasonal fluctuation.

In the Colombian system, the electric power generators would be obliged to supply electric power by the regulatory institution even if they were impaired by agents who did not comply with the secondary markets. These generators cannot assume this additional risk, because it is not part of their activity. If this situation were to occur, it would not only impair them financially, but it would also make them turn to the Justice system to determine who must as-sume liability for the resulting impairments. Hence, one of the authority's demands for electric generators is that they must insure themselves against price volatility risks. This opens up the opportunity of using derivative instruments in the Colombian electric sector in the foreseen future.

By Decree 055/2005, CREG had promoted the project to create a futures and options market. In 2007, the clearing house was created and started functioning in September 2008 in cooperation with the Colombian Stock Market to offer Treasury Bonds for future contracts. In October 2010, the first future contracts of electric energy were offered. This is the beginning of this kind of contract arrangement and it will reinforce the need to create a system of margin risk analysis, which basically depends on the forward prices of electricity, volatility, and interest rates, among other factors. Thus, it is necessary to determine which volatility model adjusts best to the characteristics of electric prices throughout time for the Colombian electric market.

The main data for this study consists of the hourly spot and forward non-delivery contracts from an unregulated market segment in the WPMC from January 1, 2000 to December 31, 2008. The sample has 24 series from a total of 3287 days. The series included the daily spot price and settlement forward prices determined for one year, in which the delivery has to be made one year forward. Figure 2 shows the characteristics of non-constant volatility and prices with jumps on the average daily spot price, the sample in this plot consists of daily observation for each the twenty-four hourly spot prices and the correspondent volatility, from January 01, 2000 to December 31, 2008.

In the case of electric power, the volatility presents excess of kurtosis, which in most cases reflects the length of tail distribution, that is, the longer the tail, the greater the probability of obtaining prices is extremely high or low. it also shows how discontinuous price jumps take place and there is evidence of volatility patterns, which are periods of high or low volatility followed by behaviours that are more moderate. Finally, there is evidence of convergence that is contrary to what happens to the underlying prices that move freely in any direction, implying that an underlying asset tends to present average long-term volatility.

Diverse explanations have been given to the fact that these series, based upon their behaviour, escape the normal assumption. Figure 3 shows movements of traded prices. Sharp peaks can be observed during some periods due to macroclimatic effects such as drought periods (El Niño phenomenon). The histogram shows the pattern prices and sharp peaks, these patterns cannot be associated with any specific distribution. Often, the volatility of the electric power market follows a mean-reversion process: the underlying asset tends to have an average volatility or longterm average, known as convergence.

Those series of data offer an almost ideal way to study the properties of electric power prices. In order to examine whether the mean-reverting and serial correlation conditions are present in the series on study, the unit-root tests3 (Appendix 1), and portmanteau test "RW1" were applied. These tests essentially determine whether the predictability condition is presented in the explicative variables. Results showed that series are stationary and autocorrelation should be zero (Appendix 2).

Particularly, economic effects that are not visible with daily and monthly-level data could be identified studied at an hourly level. In addition, the data included the first data set of the ONI series from January 2000 to December 2008 in a monthly pattern from the US National Oceanic & Atmospheric Administration. Thus, there is a significant correlation between the climatic variable and the volatility of electric power prices. Figure 4 shows the relationship between the logarithmic average of daily electric power prices and the El Niño phenomenon.

The ONI is based on Sea Surface Temperature (SST) departures from an average in the Niño 3.4 region, where the principal measure for monitoring, assessing, and predicting is El Niño phenomenon. Three-month running-mean SST departures in the Niño 3.4 region are defined and departures are based on a set of improved homogeneous historical SST analyses (Extended Reconstructed SST. v2)4. Appendix 3 shows i) El Niño and La Niña phenomena presented in the average surface temperature shown in the ONI, ii) the climatic effects on spot price due to El Niño behaviour, and iii) the climatic effects on spot prices due to La Niña behaviour.

The results of this study show that the mean of electric power spot prices varies throughout the day; the lowest price is $56.43 COP/KWh obtained in the morning (04:00) and $87.05 COP/KWh is the highest price in the evening (20:00).

Appendix 4 shows the pattern of hourly spot series for the most representative hours, particularly during peak demand hours, for instance from 19:00 to 22:00. The statistics summary and figure shown in Appendix 4 demonstrate that there are time series variation in the spot price for the peak hours, and the distribution of electric power spot prices is highly right-skewed5. For instance, the maximum spot price during peak hours is around $440 COP/KWh and the standard deviation for the spot prices for the same hours exceeds $34 COP/KWh, which is nearly 50% of the mean value.

Appendix 5 shows a summary of the statistics for the electric power forward prices, which are expressed in COP/KWh in the same units as spot prices. The forward prices patterns exhibit smoothness which is also supported by the fact that the average forward prices are comparable in magnitude to the average spot prices. The standard deviations of the forward prices are uniformly lower than the corresponding standard deviation for the spot prices, which are volatile. The average skewness of the forward prices shows that there is no presence of the extreme variations or peaks, such as spot prices that show right skewness, and that spot prices tend to display greater prices than forward prices.

A less volatile pattern can be observed in forward prices, whereas spot prices show erratic behaviour, which is verifiable with the standard deviation pattern. On the other hand, maximum forward prices are lower than the maximum spot prices. In addition to the basic data, the data on electric power load, spot price and the weather variable (dam level variation) were included and used to construct a set of explanatory variables in order to forecast the changes in the expected spot price and the changes in the expected load, throughout Vector Auto-Regression (VAR).

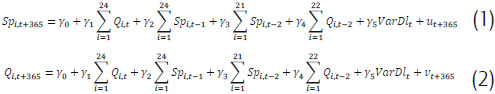

Data used to estimate VAR's system are the spot prices and quantities for each hour during the day from XM Colombian system. We also included weather-related variables, given the importance of the climatic conditions in order to capture volumetric risk effects, VAR's system are estimated separately for each twenty-four hours. VARs system for spot price Spi,t+365and quantity Qi,t+365include lagged variables over price, quantity and climatic variables represented by dam variations VarDlt, (equations 1 and 2). Table 2 reports the R2 from the VAR model used to forecast the hourly spot electric power prices and load quantities. The VARs forecast t+365 for spot price and quantity includes the spot and quantity at time t and their lags, and the weather variable that represents hydrology of the market on study, called dam variations.

In order to measure the risk of unexpected price and load quantity changes, the VAR framework (Sims, 1980), combined with the Garch Model (Engle, 1982) were adopted and followed. First, the set of explanatory variables including the spot price, load quantities and the Dam levels for the wholesale power market in Colombia were used. Second, VAR provides forecast price change in the spot price from day t to t+365 using information available on day t. Conditional volatility of unexpected spot price chan-ges was estimated using the Garch (1, 1) model (Bollerslev, 1986). Third, the VAR framework to forecast the expected load quantity from day t to t+365 was used again to obtain a measure of volumetric risk, taking into account information available on day t from the Neon system of the wholesale electric power market in Colombia. Subsequently, a Garch (1, 1) model was fitted to obtain the innovations of unexpected changes in load. Fourth, the dummy variable was also included to capture the climatic impact during the drought periods due to El Niño phenomenon, which are highly related to the dam levels. Finally, Garch variables and the dummy ONI variable were used to capture the impact on unexpected quantity and price changes. The constructed set of forecast series was used to predict the Forward Risk Premia throughout Ordinary Least Square Model.

Taking certain factors into account, the topology of bilateral contracts in the unregulated market segment was examined. Factors as the one-year forward non-delivery contracts and the relationship between forward prices, and the expected spot prices one year forward, obtained throughout the Vector Auto Regression Model (VAR). The economic theory establishes that this relationship, defined as Forward Risk Premia (FRP), should show the agent's expectations at the time of bearing risk.

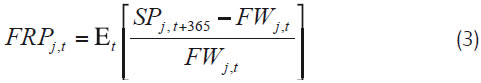

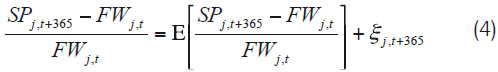

Following the general approach used in the literature in which the model of forward prices is based on equilibrium (e.g., Hicks, 1939; Cootner, 1960; Bessembinder and Lemmon, 2002; Longstaff and Wang, 2004), this paper is focused on the existence of FRP, or the difference between forward prices and expected spot prices. The Forward Risk Premia could be seen such as a ratio or percentage forward premia (French, 1986; Fama and French, 1987; Longstaff, and Wang, 2004). From this work it is evident that market behaviour depends on whether FRP is positive or negative. Positive premia is referred to as a normal backwardation; negative premia is referred to as contango. Throughout this paper, FRPj,t will represent the FRP obtained in the hour "j" of the day "t". SPj,t+365, will denote the expected spot price for day t+365; therefore, FWj,t, will stand for the forward price in the hour j of day t, for delivery during day t+365. Therefore, the FRP is defined by:

In order to construct an empirical analysis, the FRP was studied to determine their existence, and to examine the kind of characteristics they could take at an unconditional level of economic risk in the electric power market. The analysis of the expected FRP at conditional level is presented, and the effect of drought periods due to ONI as a quantity risk measure is explored.

In order to verify if FRP are zero on average, the mean of the FRP was calculated hour by hour. It was found that 2.14% forward premia is positive per 24-hours period. This result is consistent with the classical literature that expected spot prices should be higher than forward prices, and is consistent with Longstaff and Wang's (2004) results. Thus, FRP varies throughout the day with significant behaviour related to hourly demand. Equation (3) shows that the forward risk premia can be expressed as a conditional form (Longstaff and Wang 2004), which includes the unexpected component of the realized FRP presented in Equation (4) and denoted by ξj,t+365.

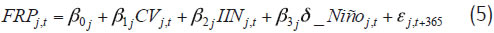

Based on equation (4), the regression model to estimate the forward risk premia for the t+365 period could be established hour-by-hour as well as ex-post occurrence of Conditional Forward premia in electric power markets. This estimate of forward risk premia depends on risk measures that capture unexpected changes on prices, demands and risk preferences.

Using the time series from WPMC, registered hour by hour, the spot prices and settlement forward prices of bilateral contracts on day t to be delivered on day t+365 at the same hour; three variables were included: the conditional volatility of expected changes on the spot prices, expressed by CVj,t or conditional volatility in the hour j of the day t; the innovations of expected changes in load quantities, expressed by IINj,t or innovations in the hour j of the day t; the dummy ONI variable which is denoted by δ_Niñoj,t. The ONI variable was used as a dummy variable that takes a value of one for drought periods and zero in all other cases. The first and second variables were obtained using the Garch (1,1) model to estimate expected spot prices according to volatility and expected changes in load. The third variable, due to technical conditions of electric power markets, is strongly related to climatic effects on load, which implies effects on prices. These explanatory variables permit forecasting of forward risk premia (FRP), using the Ordinary Least Square OLS regression model. Appendix 6 presents statistics for three statistically significant risk factors.

Table 3 shows the average of expected forward risk premia hour by hour, we can show that FRP are different to zero on average, Table 3 also shows the corresponding t-statistics and the summarized statistics of the FRP, including the Breusch-Pagan and Cook-Weisberg test for Heteroskedasticity. In the Colombian Wholesale Electric Power Market, the volatility also varies directly with FRP every hour throughout the day, except for a few hours early in the morning. In addition, the risk premia is positive from 9:00 to 22:00, which are the hours with medium or high demand, and strongly positive from 19.00 to 21.00, which are the hours with high demand. Therefore, when peak demand increases at those hours, long positions on forward markets obtain higher premia but the sensitivity of volatility in those hours is negative. Figure 5 shows the expected FRP hour by hour estimated from significant risk factors, (equation 5).

This paper presents new evidence about Forward Premia and includes new significant conditions that are relevant in wholesale electric power markets (WPMC). These results are perceptible in electric power spot prices and derivative prices for markets in tropical countries, where there are no seasons but climatic conditions such as El Niño phenomenon. Using the hourly spot and forward non-delivery contracts data set, it could be verified that the FRP takes place and has the characteristics of an economic risk measure of the market agents.

This paper focused on the percentage FRP as shown by French (1986), Fama and French (1987), Bessembinder and Lemmon (2002), and Longstaff and Wang (2004).

According to empirical results, the average expected forward risk premia can have positive behaviour in seventeen out of twenty-four hours, with a 2.14% average over all the hours in a range from -9.97% to 26.77%. These results represent the equilibrium compensation for bearing the price risk of the electric power for one year. The median or typical forward premia is positive and very near to the average forward premia (2.12%) this is an opposite result to that of Longstaff and Wang (2004) who found that median is negative. Our results suggest that the forward premia represents compensation for bearing the risk in the Colombian case.

In the Colombian electric power market the risk taker is the marketer, particularly in the unregulated market segment, because they are assuming the price risk in the long-term negotiations. The marketer represented by this demand tries to insure its future revenues and sacrifice its premia. It is relevant for further studies to evaluate the efficiency of this market, and the characteristics which determine why the marketer is willing to pay FRP and why the generator is in a better position to receive this bonus.

From the above, it applies that sellers assume the FRP for unregulated markets and so they have to pay for long-term contracts in order to guarantee future sales. For the unregulated market segment, the natural sellers are the marketers who pay the premia and assume the risk as well. The WPMC shows normal backwardation behaviour, probably due to the large opportunity cost related to electric power markets, which are characterized by high hydraulic dependence.

It was examined whether the FRP reflects compensation for risk taking by market agents through several risk mea-sures. One way to obtain these measures is suggested by Longstaff and Wang (2004) and Bessembinder and Lemmon (2002). These include volatilities of unexpected spot changes, volatilities of unexpected load changes and the weather variable, to capture price uncertainty, quantity uncertainty and climatic effects. Such variables play a significant role in explaining the FRP in the Colombian Market.

1 Acknowledgements: Discussions with the participants to the XM seminar on November 13, 2009 in Bogota (Colombia), and the 17th Global Finance Conference on June 27-30, 2010 in Poznan (Poland), are gratefully acknowledged.

2 In Spanish: Comisión Reguladora de Energía y Gas (CREG).

3 Augmented Dickey-Fuller, Phillips- Perron and Kwiatkowski-PhillipsSchmidt-Shin tests statistic.

4 The methodology is described by Smith and Reynolds (2003).

5 This dominant feature of electric power spot prices was established by Routledge, Seppi and Spatt (2001) and Longstaff and Wang (2004).

Barnston, A. G. & Ropelewski, C.F. (1992). Prediction of ENSO episodes using canonical correlation analysis. J. Climate, 5, 1316-1345. [ Links ]

Barnston, A. G., Chelliah, M. & Goldenberg, S. B. (1997). Documentation of a highly ENSO-related SST region in the equatorial Pacific. Atmosphere-Ocean, 35, 367-383. [ Links ]

Barnston, A. G., Glantz, M. H. & He, Y. (1999). Predictive skill of statistical and dynamical climate models in SST forecasts during the 1997-98 El Niño episode and the 1998 La Nina onset. Bull. Am. Met. Soc., 80, 217-243. [ Links ]

Bessembinder, H. & Lemmon, M. (June, 2002). Equilibrium Pricing and Optimal Hedging in Electricity Forward Markets. Journal of Finance, 57. [ Links ]

Brennan, M. J. (March, 1958). The Supply of Storage. American Economic Review, 48, 50-72. [ Links ]

Bollerslev, T. (1986). Generalized Autoregressive Conditional Heteroskedasticity. Journal of Econometrics, 31, 307-328. [ Links ]

Cootner, P. H. (August, 1960). Returns to Speculators: Telser vs. Keynes. Journal of Political Economy, 68, 396-404. [ Links ]

Dickey, D. & Fuller, W. (1982). Distribution of the estimates for autoregressive time series with unit root. Journal of American Statistical Association, 74, 427-431. [ Links ]

Engle, R. F. (1982). Autoregressive Conditional Heteroskedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica, 50, 987-1007. [ Links ]

Fama, E. F. & French, K. R. (January, 1987). Commodity Future Prices: Some Evidence on Forecast Power, Premias, and the Theory of Storage. Journal of Business, 60, 55-73. [ Links ]

French, K. R. (April, 1986). Detecting Spot Price Forecasts in Future Prices. Journal of Business, 59, S39-54. [ Links ]

Geman, H. & Eydeland, A. (1999). Fundamentals of Electricity Derivatives. Energy Modelling and the Management of Uncertainty, Risk Books, pp. 35-43. [ Links ]

Halpert, M. S. & Ropelewski, C. F. (1992). Surface temperature patterns associated with the Southern Oscillation J. Climate, 5, 577-593. [ Links ]

Hicks, J. (1939). Value and capital. Oxford University Press. [ Links ]

Higgins, R.W., Zhou, Y. & Kim, H.-K. (2001). Relationships between El Niño- Southern Oscillation and the Arctic Oscillation: A Climate-Weather Link. NCEP/Climate Prediction Center ATLAS 8. [ Links ]

Higgins, R. W., Kousky, V. E., Kim, H.-K., Shi, W. & Unger, D. (2002). High frequency and trend adjusted composites of United States temperature and precipitation by ENSO phase. NCEP/Climate Prediction Center ATLAS, 10, 22. [ Links ]

Hoerling, M. P. & Kumar, A. (May, 1997). Why do North American cli-mate anomalies differ from one El Niño event to another? Geophysical Research Letters, 24(1), 1059-1062. [ Links ]

Hoerling, M. P. & Kumar, A. (1997). Origins of extreme climate states during the 1982-83 ENSO winter.J. Climate, 10, 2859-2870. [ Links ]

Hemler, M. L. & Longstaff, F. A. (September, 1991). General Equilibrium Stock Index Futures Prices: Theory and Empirical Evidence. Journal of Financial and Quantitative Analysis, 26, 287-308. [ Links ]

Kellerhals, B. (2001). Pricing Electricity Forwards under Stochastic Volatility. Tubingen: Eberhard-Karl-University, Working paper. [ Links ]

Kwiatkowski, D., Phillips, P., Schimidt, P. & Shin, Y. (1992). Testing the Null Hypothesis of Stationary against the Alternative of a Unit Root. Journal of Econometrics, 54, 159-178. [ Links ]

Longstaff, F. & Wang, A. (2004), Electricity forward prices: a high-frequency empirical analysis. University of California. Paper 10_02. [ Links ]

Lucia, J. & Schwartz, E. S. (2002). Electricity Prices and Power Derivatives: Evidence from the Nordic Power Exchange. Review of Derivatives Research, 5, 1. [ Links ]

Phillips, P. & Perron, P. (1988). Testing for a unit roots in time series regression. Journal of Econometrics, 33, 335-346. [ Links ]

Pirrong, C. & Jermakyan, M. (1999). Valuing Power and Weather Derivatives on a Mesh. Using Finite Difference Methods. Energy Modelling and the Management of Uncertainty, Risk publications. [ Links ]

Routledge, B. R., Seppi, D. J. & Spatt, C. S. (June, 2000). Equilibrium Forward Curves for Commodities. Journal of Finance, 55, 1297-1338. [ Links ]

Sims, C. A. (1980). Macroeconometrícs and Reality. Econometrica, 48(90), 1-48. [ Links ]

Smith, T. M. & Reynolds, R. W. (2003). Extended Reconstruction of Global Sea Surface Temperatures based on COADS data (19841997). J. Climate, 16, 1495-1510. [ Links ]