Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Innovar

Print version ISSN 0121-5051

Innovar vol.24 no.53 Bogotá July/Sept. 2014

https://doi.org/10.15446/innovar.v24n53.43909

http://dx.doi.org/10.15446/innovar.v24n53.43909

Corporate risk in family businesses under economic crisis

Riesgo corporativo en empresas familiares bajo la crisis económica

Le risque corporatif dans les entreprises familiales dans la crise économique

Risco corporativo em empresas familiares sob a crise econômica

Elisabete S. Vieira

Coordinator Professor. GOVCOPP Unit Research, ISCA Department, University of Aveiro. Aveiro (Portugal). E-mail: elisabete.vieira@ua.pt.

Correspondencia: Universidade de Aveiro, apartado 58. 3811-953. Aveiro (Portugal).

Citación: Vieira, E. (2014). Corporate Risk in Family Businesses Under Economic Crisis. Innovar, 24(53), 61-73.

Clasificación JEL: G01, G39, C23.

Recibido: Junio 2013; aprobado: Noviembre 2013.

Abstract:

This paper analyses corporate risk in family businesses in conjunction with generalized economic adversity. Using data from Portuguese family-controlled firms for the period of time between 1999 and 2010, we focus on the possibility of asymmetrical corporate risk effects between periods of stability and economic adversity. Overall, the results suggest that the evidence concerning the family firms' risk is Sensitive to the different types of risk considered. Comparing family businesses with their counterparts, we find evidence that the former have lower levels of operational risk and are more indebted. The results indicate that the systematic risk is negatively related to age and positively related to size, the former relationship being stronger for family firms and the latter for non-family firms than for their counterparts. The evidence supports the hypothesis that risk for family controlled firms is less positively related to the proportion of independent directors on the board than non-family controlled firms, suggesting that founders are concerned about the survival of their firms. Finally, the results show that crises affect the operational risk in family businesses, suggesting that family firm managers are more reluctant to assume risk in periods of crisis. This paper offers some insights on the literature concerning family firms. To our knowledge, this is the first study to analyse corporate risk in the context of family firms. In addition, it examines corporate risk in combination with generalized economic adversity.

Keywords: Corporate risk, Family Firms, Crisis, Panel data.

Resumen:

Este artículo analiza el riesgo corporativo en empresas familiares en yuxtaposición con la adversidad económica generalizada. Usando información de empresas familiares de Portugal para el período entre 1999 y 2010, nos enfocamos en la posibilidad de efectos asimétricos de riesgo corporativo entre períodos de estabilidad y de adversidad económica. En general, los resultados sugieren que la evidencia concerniente al riesgo de las empresas familiares es sensible a los diferentes tipos de riesgos que se consideren. Al comparar las empresas familiares con sus contrapartes, encontramos evidencia de que las primeras tienen niveles menores de riesgo operativo y tienen mayores deudas. Los resultados indican que el riesgo sistemático está negativamente relacionado con la edad y positivamente relacionado con el tamaño; la primera relación es más fuerte para las empresas familiares y la segunda para las no familiares que para sus contrapartes. La evidencia apoya la hipótesis de que el riesgo empresarial de las empresas controladas por una familia está menos relacionado positivamente con la proporción de directores independientes en la junta que las empresas no familiares, lo que sugiere que a los fundadores les preocupa la supervivencia de su empresa. Finalmente, los resultados muestran que la crisis afecta el riesgo operativo en empresas familiares, lo que sugiere que los gerentes de las empresas familiares son más reacios a tomar riesgos en períodos de crisis. Este artículo ofrece algunas nociones presentes en la literatura sobre empresas familiares. Hasta donde sabemos, este es el primer estudio en analizar el riesgo corporativo en el contexto de empresas familiares. Adicionalmente, examina el riesgo corporativo en combinación con la adversidad económica generalizada.

Palabras clave: Riesgo corporativo, empresas familiares, crisis, datos de panel.

Résumé:

Cet article analyse le risque corporatif dans les entreprises familiales en juxtaposition avec l'adversité économique généralisée. Utilisant l'information d'entreprises familiales du Portugal pour la période 1999- 2010, nous nous concentrons sur la possibilité d'effets asymétriques de risque corporatif entre les périodes de stabilité et d'adversité économique. En général, les résultats suggèrent que le risque des entreprises familiales est fonction des types de risque considérés. Une comparaison des entreprises familiales avec leurs interlocuteurs montre que les premières ont un moindre niveau de risque opératoire et davantage de dettes. Les résultats indiquent que le risque systématique est négativement lié à l'âge et positivement en relation avec la taille; la première relation est plus forte pour les entreprises familiales et la seconde plus forte pour les non-familiales que pour les interlocuteurs. L'évidence appuie l'hypothèse que le risque entrepreneurial des entreprises contrôlées par une famille est moins lié positivement avec la proportion de directeurs indépendants dans le conseil d'administration que les entreprises non familiales, ce qui laisse penser que les fondateurs sont préoccupés par la survie de leur entreprise. Enfin, les résultats montrent que la crise affecte le risque opératoire des entreprises familiales, ce qui suggère que les gérants des entreprises familiales sont plus réticents à prendre des risques en période de crise. Cet article apporte quelques notions présentes dans les publications sur les entreprises familiales. Mais, autant que l'on sache, c'est la première étude qui analyse le risque corporatif dans le contexte des entreprises familiales. En outre, elle considère le risque corporatif en liaison avec l'adversité économique généralisée.

Mots-clés: Risque corporatif; entreprises familiales; crise; données de panel.

Resumo:

Este artigo analisa o risco corporativo em empresas familiares em justaposição com a adversidade econômica generalizada. Usando informação de empresas familiares de Portugal para o período entre 1999 e 2010, nos centramos na possibilidade de efeitos assimétricos de risco corporativo entre períodos de estabilidade e de adversidade econômica. Em geral, os resultados sugerem que a evidência concernente ao risco das empresas familiares é Sensível aos diferentes tipos de riscos que forem considerados. Ao comparar as empresas familiares com as suas congêneres, encontramos evidência de que as primeiras têm menores níveis de risco operativo e têm mais dívidas. Os resultados indicam que o risco sistemático está negativamente relacionado com a idade e positivamente relacionado com o tamanho; a primeira relação é mais forte para as empresas familiares e a segunda para as não familiares, do que para as suas congêneres. A evidência apoia a hipótese de que o risco empresarial das empresas controladas por uma família está menos relacionado positivamente com a proporção de diretores independentes na diretoria do que as empresas não familiares, o que sugere que os fundadores se preocupam com a sobrevivência da sua empresa. Finalmente, os resultados mostram que a crise afeta o risco operativo em empresas familiares, o que sugere que os gerentes das empresas familiares são mais relutantes a tomarem riscos em períodos de crise. Este artigo oferece algumas noções presentes na literatura sobre empresas familiares. Até onde sabemos, este é o primeiro estudo que analisa o risco corporativo no contexto de empresas familiares. Adicionalmente, examina o risco corporativo em combinação com a adversidade econômica generalizada.

Palavras-chave: risco corporativo, empresas familiares, crise, dados de painel.

Introduction

Existing literature suggests that family shareholders, with large equity stakes and executive representation, are common to public traded firms worldwide. La Porta, Lopez-de-Silanes, and Shleifer (1999) analyzed a sample of 27 countries, finding evidence that about 50% of firms were family controlled firms. Faccio and Lang (2002) found that more than 60% of listed firms in France, Italy, and Germany were family businesses. Sraer and Thesmar (2007) analyzed the listed French firms, concluding that more than 60% of the firms were managed by founding families. Although Usbased studies document relatively lower percentage values for family businesses, Anderson and Reeb (2003) and Villalonga and Amit (2006) found a percentage of 35 and 37, respectively.

Regardless of recent research on corporate finance in the context of family firms (dividends, debt and board structure, etc.), much research is still required. In addition, there is a gap in the research concerning corporate risk in the perspective of family businesses.

In this context, we investigated corporate risk and its relationship with firm specific variables in the context of family firms, exploring also the firms' risk under steady and adverse economic conditions, using a sample of 58 Portuguese listed firms on Euronext Lisbon for the 1999-2010 period. Thirty-five firms were family-controlled (about 60% of the firms) and the remaining 23 were non-family controlled firms.

This study contributes to the literature on family business in three main ways. The first is by exploring corporate risk in the context of family businesses. To our knowledge, this is the first study to analyze corporate risk in the context of family firms. This study offers an empirical attempt to isolate variables of potential significance in this regard. Previous studies focused only on financial risk related to the capital financing structure (Anderson, Mansi, & Reeb, 2003; Romano, Tanewski, & Smyrnios, 2000) or on entrepreneurial risk (Zahra, 2005), ignoring other types of risk.

The second contribution is exploring the firms' risk under both steady and adverse economic conditions, in order to test whether family controlled firms are Sensitive to economic crises. Finally, this is the first study to analyze the risk of family-controlled firms in Portugal. We believe the Portuguese example is of interest for two main reasons. Smith (2008) argued that there may be differences between family and non-family firms because of their corporate environment and this country tends to exhibit concentrated ownership and family control. Faccio and Lang (2002) found evidence that family firms constitute 60.34% of firms sampled in Portugal and that in about 50% of the family-controlled firms, the controlling owner is in management. Moreover, Portugal is a continental European country, of which the history, capital market, and firm characteristics largely differ from English-speaking countries, where most studies on family firms have been conducted. The results obtained in the USA may not apply to companies from other countries whose goals and strategies are different (Zahra, 2005).

Overall, the results indicate that the family firms' risk is Sensitive to the different types of risk considered. We found evidence that family firms have lower levels of operational risk and are more indebted than non-family firms. In addition, their managers are more reluctant to assume risk in periods of crisis.

The remainder of this paper is organized as follows. Section 1 reviews the related literature and presents the formulated hypotheses. Section 2 describes the methodology and data. Section 3 presents the empirical results. Finally, section 4 concludes the paper.

Literature Review and Hypotheses

Meyer and Zucker (1989) argued that family firms suffer from strategic inertia and become risk averse.

Usually, families wish to pass the firm on to subsequent generations, favoring their own children and other family members (Zahra, 2005). Consequently, they place more value on the survival of the firm than wealth maximization that other firms would seek (James, 1999). Once survival becomes a priority, taking on excessive risk should not be one of the family's objectives. Indeed, Storey (1994) stated that family businesses tend to be averse to risk. Anderson et al. (2003) and Schmid, Ampenberger, Kaserer, and Achleitner (2008) argued that family firms hold poorly diversified portfolios, having strong incentives to reduce firm risk and cash flow variability. Naldi, Nordqvist, Sjöberg, and Wiklund (2007) draw a sample of Swedish firms, finding that even if family firms do take risks while engaged in entrepreneurial activities, they take risk to a lesser extent than non-family firms. This provides empirical support to the assumption that family firms tend to be more conservative and risk averse in their strategy making (Carney, 2005; Schulze, Lubatkin, & Dino, 2002).

These observations suggest the following hypothesis:

H1: Family controlled firms present lower levels of risk than non-family controlled firms.

However, Maug (1998) emphasized that founding families often have highly undiversified investment, which may be affected adversely by the firm's idiosyncratic risk, leading a family firm to take excessive risks. Indeed, Khaemasunun (2004) found that family firms are riskier beta, indicating the non-diversifiable nature of their assets.

Gómez-Mejía, Haynes, Núñez-Nickel, Jacobson, and Moyano-Fuentes (2007) analyzed the Spanish market for the period between 1944 and 1998, concluding that family firms may be risk willing and risk averse at the same time. According the authors, non-family firms performing below target engage in projects with greater outcome variance (venturing risk) to avoid continued financial losses, and family firms might be willing to accept below-target performance and a higher probability of failure (a performance hazard) to avoid socio emotional losses. This contrasts earlier literature, which has proposed that as a result of highly concentrated undiversified assets, family firms are more risk averse (Anderson et al., 2003; Schmid et al., 2008).

Masulis (1988) suggested that managers prefer to have less leverage than their counterparts in order to reduce the risk of their undiversified investment in the company. Mishra and McConaughy (1999) concluded that the founding family's aversion to the risk of a loss of control motivates the use of less debt.

The risk adverse characteristics of family firms may imply less leverage (Zhou, 2012). Family firms have incentives to reduce risk, and higher levels of debt increase financial risk. Consequently, the risk of bankruptcy and loss of control also increase. Then, comparing family controlled firms with non-family firms, the former are less likely to have higher levels of debt (Mishra & McConaughy, 1999; storey, 1994), which leads to the second testable hypothesis:

H2: Family controlled firms present lower debt levels than non-family controlled firms.

The empirical results are not consensual.

According to Xin-Ping, Zhen-song, and Ming-Gui (2006), the desire to retain control and reduce risk has opposing effects on leverage decisions. On the one hand, the desire to concentrate voting power motivates families to use more debt. On the other, the desire to reduce risk motivates families to use less debt financing. González, Guzmán, Pombo, and Trujillo (2011) analyzed a sample of 523 Colombian firms for the 1996-2006 period, concluding that risk aversion pushes firms toward lower debt levels, but the need to finance growth and the risk of losing control make family firms prefer higher debt levels and a higher risk aversion for family directors, because blockholders' risk aversion implies less indebtedness for the firm.

Sonnenfeld and Spence (1989), Gallo and Vilaseca (1996) and Mishra and McConaughy (1999) found that family controlled firms use less debt. Gallo and Vilaseca (1996) interpret this result as proof for controlled risk aversion in family firms. Anderson et al. (2003) show that American family firms tend to have lower debt cost, because of the long-term horizon typical of this type of business and management's concern for reputation.

However, Wiwattanakantang (1999), based on a Thai sample, showed that family firms have significantly more debt than non-family firms, arguing that family ownership helps to reduce the agency cost of debt.

Pindado and Torre (2008) analyzed a sample of Spanish listed firms for the period between 1990 and 1999, finding that family firms are less concerned with financial risk, but more concerned with maintaining their control over the firm than their counterparts. In addition, Setia-atmaja, Tanewski, and Skully (2009) and Setia-Atmaja (2010) found evidence that family controlled firms employ higher debt levels, compared to non-family firms, concluding that family firms use debt as a substitute for independent directors. The authors suggest that family firms do not expropriate minority or outside shareholders, but might adopt higher debt levels in order to improve monitoring. Céspedes, González, and Molina (2010) and González et al. (2011) stated that firms tend to prefer debt to equity when losing control is an issue.

According to the finance assumption that profitability and risk are positively associated, we expect a positive relationship between performance and risk. Indeed, the positive risk/return relation is a fundamental concept in finance theory.

Conventional decision theory is considered to be a tradeoff between risk and the expected return (e.g., Lintner, 1965; Mmossin, 1966; Sharpe, 1964), as defined in the Capital asset Pricing model (CAPM). However, some existing literature (e.g., Chen, Hexter, & Hu, 1993; Gallo, Tapies & Cappuyns, 2004) reported diverging findings on the financial performance of family businesses. Thus, the performance differences between family and nonfamily firms need to be interpreted carefully.

Considering the family controlled firms risk aversion (Storey, 1994), we expect that the risk and, consequently, the profitability of family firms to be lower than the one of non-family firms. This leads to the following hypothesis:

H3: Family controlled firms' risk is less positively related to profitability than non-family controlled firms.

However, Wiseman and Catanach (1997) find arguments and results of positive and negative associations between risk taking and performance in the literature. In their study, they found that risk taking has positive and negative effects on performance, depending on the contexts. The alignment of interest between the firm and the family should encourage the exploration of innovative ideas that stimulates growth and improves performance (Zahra, 2005).

Although Rauch, Wiklund, Lumpkin, and Frese (2009) and Sraer and Thesmar (2007) found that the risk-taking dimension is positively related to performance, findings by Naldi et al. (2007) and Nunes, Viveiros, and Serrasqueiro (2012) suggest that risk taking in family firms is negatively related to perceived performance. However, Naldi et al. (2007) do not consider systematic risk.

The number of years a firm operates in the market is a sign of its survival (Rodríguez-Rodríguez, 2006). Analyzing a sample of Portuguese SMES, Nunes et al. (2012) concluded that age negatively influences the firms' business risk.

We expect that firm age is associated with firm risk, with younger companies presenting higher levels of risk. On this basis, and based on the assumption that family firms are more adverse to risk, we formulated hypothesis four:

H4: Family controlled firms' risk is more negatively related to age than non-family controlled firms.

Family firms are likely to handle risk differently than other types of firms, partly because management and ownership are not separated (e.g., Fama & Jensen, 1983) and partly because of the family nature of ownership and management (e.g., Zahra, 2005).

Several authors stated that firm size is essential to increase firms' levels of profitability (Gschwandtner, 2005; Hardwick, 1997; Wyn, 1998). According to the risk/return relationship, we expect that the higher the firms' profitability, the higher the systematic risk. The pecking order approach (Myers, 1984; Myers & Majluf, 1984) argues that companies follow a hierarchical sequence in the selection of their funding sources in order to minimize the costs of financing. According to Rajan and Zingales (1995), companies with high levels of earnings have low levels of debt capital be-cause they are able to use internal financing, not needing to rely on external resources. Considering the family controlled firms risk aversion, we expect the size of family firms to be less (more) relevant for increasing (decreasing) risk, compared to the case of non-family firms. In this context, it is expected that the larger the firms, the lower the need for external borrowing, reducing the financial risk.

In this context, we formulate two related hypotheses:

H5a: Family controlled firms' systematic risk is less positively related to size than non-family controlled firms.

H5b: Family controlled firms' financial risk is more negatively related to size than non-family controlled firms.

Beatty and Zajac (1994) and Denis, Denis, and sarin (1997) suggested that managers become risk averse as their ownership in the firm increases, so, there are reasons to believe that risk avoidance is stronger in family firms than in non-family firms.

Villalonga and Amit (2006), Adams, Almeida, and Ferreira (2009) and Zhou (2012) find a positive relationship between the presence of the founder as Ceo of the family business or as the Chairman of the board and the firms' profitability. Insofar as corporate risk, founders are often concerned about the survival of their firms and protecting their legacy for future generations (Zahra, 2005). This idea suggests that the higher the independent directors, the higher the risk level assumed. Given the expectation that family firms tend to have lower levels of risk than nonfamily controlled firms, we formulate the sixth hypothesis:

H6: Family controlled firms' risk is less positively related to the proportion of independent directors on the board than non-family controlled firms.

However, Fama and Jensen (1983) and Jensen and Meckling (1976) suggested that as ownership increases, a greater alignment between the owner and the firm is achieved, which may encourage the exploration of innovative ideas that stimulate growth and improve performance, leading to higher levels of risk.

In periods of recession, the volatility of share prices is higher (Veronesi, 1999). Moreover, investors tend to be irrational and to overreact to bad market conditions (Glode, Hollifield, Kacperczyk, & Kogan, 2010). In the context of the agency theory, it is well known that managers have the incentive to take excessive risky projects when their firm is close to bankruptcy because they lose nothing from the downside failure and get the upside gain of the excess risk. Non-family firm managers are myopic and have more incentive to take on risky projects to boost current earnings (Anderson & Reeb, 2003). According to Zhou (2012), in times of crisis, this situation is highly likely to happen.

In this context, it is expected that family businesses are not as affected by this attitude as their counterpart firms. Based on the arguments above, we formulate the last hypothesis:

H7: Family controlled firms' risk is less positively related to crisis than non-family controlled firms.

Methodology and data

Methodology

To apply our methodology, we need to distinguish between family firms (FF) and non-family firms (NFF).

Because of the significant number of distinct definitions for FF in the literature (e.g., Litz, 1995; Chua, Chrisman, & Sharma, 1999; Sharma, Chrisman & Chua, 1997), there is a lack of a widely accepted definition of FF (Bennedsen & Nielsen, 2010). In addition, some researchers concluded that the evidence concerning FF is Sensitive to their different definitions (Allouche, Amann, Jaussaud, & Kurashina, 2008; Maury 2006; Miller, le Breton-Miller, Lester, & Cannella, 2007; Westhead & Cowling, 1998).

We follow la Porta, Lopez-de-Silanes, Shleifer, and Vishny (2000) and Setia-Atmaja et al. (2009), defining FF as those firms in which the founding family or family member control 20% or more equity, and are involved in the top management of the firm. The classification of FF and NFF was corroborated in the firm's annual report.

Because we wanted to examine the risk of FF, our dependent variable is risk (Risk). We consider three kinds of Risk: systematic, operational and financial.

To analyze systematic risk, we considered the beta measure (Beta), obtained though the CAPM:

Ri,t - Rf,t = αi + βi (Rm,t - Rf,t) + εi,t (1)

where:

Ri,t = return on share i in period t;

Ri,t = risk free return in period t;

αi = abnormal return from CAPM model;

βi = systematic risk (beta);

Rmt = market return in period t;

εi,t = error term.

To analyze operational risk, we consider the standard deviation (calculated over the past three years) of operating in-come before depreciation to annual sales (OIDBS) (Mishra & McConaughy, 1999).

Finally, financial risk is measured by the level of financial leverage (lFl), calculated as the operating income scaled by the income before taxes.

In which concerns the independent variables, we considered the firms' debt (DEBT), operational performance (OROA), age (AGE), size (FS), the board independence (BOARD) and the market crisis (CRISIS).

The debt is the ratio of debt to total assets. A positive relationship was expected between debt and financial risk.

As in Zhou (2012), we measured performance as the operating return on assets (OROA), calculated as the operating earnings divided by total assets. We used oRoa because it is unaffected by the changes in capital structure, not including firms' financial earnings, which determines the corporate tax base. Usually, profitability is related with firms' economic risk (Rodríguez-Rodríguez, 2006). According to financial assumptions, we expected a positive relationship between performance and risk.

The number of years a firm operates in the market is a sign of its survival. We expected the firms' age to be associated with firms' risk, with younger companies presenting more risk. Thus, we expect a negative sign for this coefficient. AGE was measured as the natural logarithm of the difference between incorporation year and a fiscal year.

Following Anderson et al. (2003), we measured Fs as the natural logarithm of the book value of total assets of a firm. We expected a positive (negative) relationship between Fs and systematic (financial) risk.

We analyzed the effect of board independence on the risk. According to Anderson and Reeb (2004) and Setia-Atmaja (2010), independent directors are the individuals whose only business relationship to the firm is their directorship, identified in firms' annual reports. BOARD was measured as the proportion of independent directors on the board. There should be a positive relationship between Board and Risk.

We considered a dummy variable in order to identify the market crisis, which is one if a fiscal year is considering a year of financial recession, and zero otherwise. Considering distinctly the periods of financial boom and years of recession allowed us to analyze whether the family firms' risk differs according to the market conditions. The variable Crisis took the value one for the 2008, 2009 and 2010 years, and zero otherwise.

As control variables, we considered the cost of debt (Costd) and the weight of fixed operating costs (FOC). Costd was calculated as the interest expenses scaled by debt. We expected a positive relationship between Costd and firms' financial risk. Anderson et al. (2003) results indicate that FF experience a lower cost of debt financing. The FOC was calculated as the weight of fixed operating costs to the total of operating costs. We expected a positive relationship between the FOC and the firms' operational risk.

To analyze the relationship between RisK and the independent variables, we employed the following regression model:

RISKi,t = α + β1DEBTi,t + β2OROAi,t + β3AGEi,t + β4FSi,t + β5BOARDi,t + β6CRISISi,t + β7COSTDi,t + β8FOCi,t + β9INDUSTRYi,t + β10YEARi,t + εi,t (2)

The suffix i,t indicates that variables were considered for firm i during year t. ei,t is the error term.

The dependent variable assumed the different kinds of risk (systematic, operational and financial), of which the variables were already explained above.

We included industry dummy variables in order to consider any variation in the dependent variable due to industry differences. Anderson and Reeb (2003), Villalonga and amit (2006) and Zhou (2012) show that FF are not symmetrically distributed in every industry. Finally, we considered year dummy variables to remove any secular effects among the independent variable.

We employed a panel data methodology, since the combination of a time series with a cross-section of n firms requires this methodology in order to adequately express the non-observable heterogeneity of the individuals (Baltagi, 1995). We used the pooled ordinary least squares (OLS), the fixed effects model (Fem), with all regressors uncorrelated with individual effects, and the random effects model (Rem), with all regressors correlated with individual effects. Subsequently, we used the F-statistic and the Hausman (1978) test to choose the most appropriate model. We present the standard errors corrected for heteroscedasticity and covariance (White, 1980).

Data

The sample consisted of an unbalanced panel data, corresponding to Portuguese non-financial listed FF and NFF on the euronext Lisbon, covering the period from 1999 to 2010. Data were obtained from SABI, a private database provided by Bureau van Dijk, and complemented with some additional information collected on the firms' annual reports.

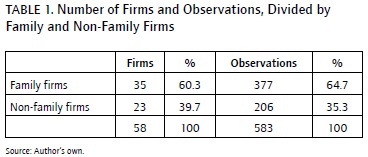

Table 1 reports the number of firms and observations related to FF and NFF samples.

The sample is constituted by 58 firms, corresponding to 583 observations. We classified 35 firms as FF, corresponding to 377 observations and 23 firms as NFF (206 observations). FF constituted about 60% of the global sample, consistent with the percentage found by Faccio and Lang (2002) for Portugal (60.34%). The evidence that almost 65% of the observations are related to FF is consistent with the evidence that family shareholders are common in public traded firms' worldwide (Anderson & Reeb, 2003; Claessens, Djankov, & Lang, 2000; Faccio & Lang, 2002; Holderness, 2009; Villalonga & Amit, 2006).

Results

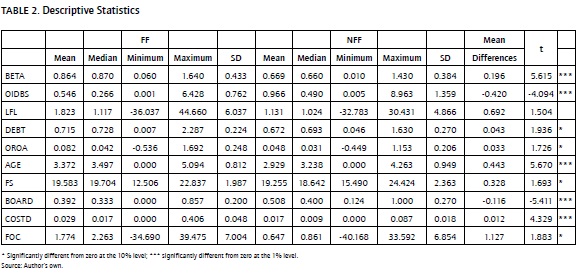

Table 2 presents the descriptive statistics for the study's variables, including the mean, median, standard deviation, and maximum and minimum values, as well as the differences in mean variables between FF and NFF.

In what concerns the firms' risk, we can see that FF are distinct from NFF in terms of the systematic and the operational risk. Although FF present higher levels of systematic risk, they have lower levels of operational risk.

The evidence that FF present higher levels of systematic risk (a mean beta of 0.864) than NFF (mean of 0.669) is in accordance with the results of Maug (1998) and Khaemasunun (2004), who found that family firms are riskier beta, suggesting the non-diversifiable of the asset.

The lower levels of FF operational risk (a mean of 0.546 against 0.966 for NFF) is consistent with prior theoretical studies (Meyer & Zucker, 1989; Storey, 1994) as well as the empirical evidence that family businesses tend to be averse to risk (Anderson et al., 2003; Carney, 2005; Naldi et al., 2007; Schulze et al., 2002; Schmid et al., 2008).

Given the risk results, we found evidence for the hypothesis that FF present lower levels of risk than NFF (H1), but only for the operational risk. In addition, our results suggest that the evidence concerning the family firms' risk is Sensitive to the different types of risk considered.

Insofar as independent variables, FF differ from NFF in several firm characteristics. FF are more indebted, presenting a higher cost of debt, and more fixed operating costs, are older and larger, have a lower proportion of independent directors on the board, and present higher levels of profitability.

Contrary to the expected, FF USE more debt than NFF (a mean of 71.5% and 67.2%, respectively). Thus, the second hypothesis is not supported (H2). Although this result is contrary to the assumptions of Storey (1994) and Mishra and McConaughy (1999), and the evidence provided by Allouche et al. (2008) and Zhou (2012), it is consistent with the evidence of Khaemasunun (2004), Xin-Ping et al. (2006), Pindado and Torre (2008), Setia-Atmaja et al. (2009) and Setia-Atmaja (2010). Maybe the evidence that FF are more dependent on lenders than NFF might be explained by the use of debt to improve monitoring. In addition, older business owners tend to present lower levels of preference for equity (Romano et al., 2000), and, in our sample, FF are indeed older. Alternatively, as FF are bigger, they can more easily obtain debt. It can also suggest that family firms are less concerned with financial risk, since their cost of debt is higher, but more concerned with maintaining their control over the firm than their counterparts (Pindado & Torre, 2008). Finally, FF might use debt as a substitute for independent directors (Setia-Atmaja et al., 2009; Setia-Atmaja, 2010).

Higher levels of debt result in higher financing costs,, which can explain the fact that FF have a higher value for the cost of capital (a mean of 2.9% and 1.7%, respectively). This should lead to higher levels of financial risk. Indeed, FF present a higher value for the financial risk variable. However, the difference is not statistically significant.

Curiously, the evidence that FF present more fixed operating costs is not consistent with the evidence that FF present lower levels of operational risk. However, the mean difference is only statistically significant at 10%.

In contrast with the results of Schmid et al. (2008), FF are both older and larger.

In what concerns the oRoa measure, our results are in line with other studies that found evidence that FF outperform NFF (Allouche et al., 2008; Andersen & Reeb, 2003; Gnan & Montemerlo, 2001; Poutziouris, Sitorus, & Chittenden, 2002; Scholes, Wilson, Wright, & Noke, 2012; Sraer & Thesmar, 2007). One possible reason for this may be the greater alignment between the owner and the firm as ownership increases, which may, in turn, improve performance (Fama & Jensen, 1983; Jensen & Meckling, 1976).

The mean proportion of independent directors is significantly lower for FF (39.2%) than for NFF (50.8%), and this result is consistent with the perspective that family members dominate the board of directors (Anderson & Reeb, 2004; Setiaatmaja, 2010) and that family shareholders are common in public traded firms (Claessens et al., 2000; Faccio & Lang, 2002; Holderness, 2009; Villalonga & Amit, 2006;).

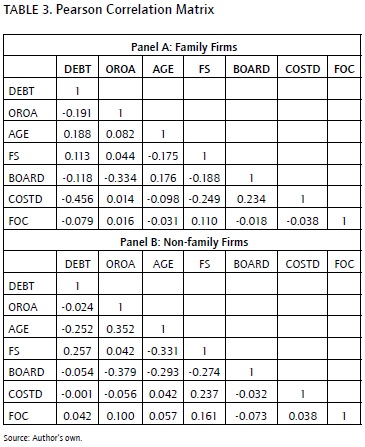

Table 3 reports the Pearson correlations among the independent variables for FF (Panel a) and NFF (Panel B).

For FF, the higher level of correlation (in absolute terms) is between COSTD and DEBT (-0.456), showing that the higher the debt, the lower the cost of debt. This in an indication that FF have financing capability, obtaining debt with low costs, suggesting no risk of distress.

For NFF, the higher correlation coefficients are between Fs and DEBT (0.257) and between Board and Oroa (-0.379). The correlation between Fs and DEBT suggests that large NFF tend to have higher debt ratios, which is in accordance with the results of Rajan and Zingales (1995). This result is consistent with the trade-off theory, which notes that large companies are less exposed to costs of financial distress and would expect to borrow more. Finally, NFF with higher levels of independent directors on the board tend to have lower levels of profitability.

Overall, all the coefficients are low (below 0.46). Consequently, it does not appear to be sufficiently large to cause concern about multicollinearity problems.

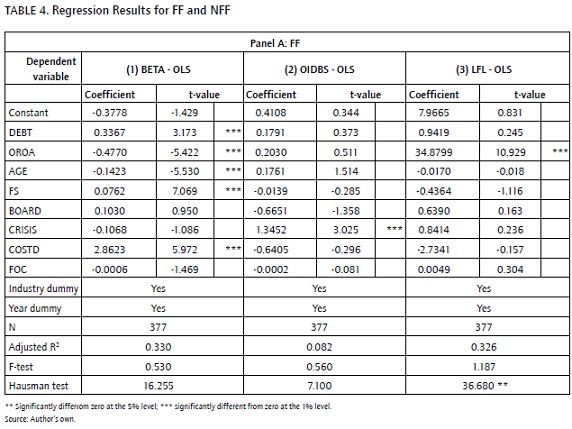

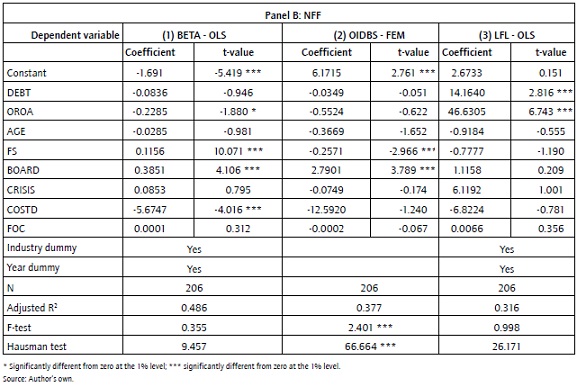

Table 4 reports the regression (2) results for FF (Panel a) and NFF (Panel B), considering the three measures of risk (Beta, OIDBS and LFL). We present the best model results for each of the regressions1.

We start with the analysis of the FF results (Panel a). Considering the Beta dependent variable (model 1), we can see that the variables that explain the systematic risk are the DEBT, OROA, AGE, FS and COSTD, all of them statistically significant at 1% level.

As expected, the leverage is positively related to firms' systematic risk. Contrary to the expected, the results show a negative relationship between OROA and β, suggesting that the better the performance, the lower the risk, which is consistent with the results of Nunes et al. (2012) and somewhat in accordance with the ones of Naldi et al. (2007), who found that family firms take on risks, but with negative implications for their performance. This evidence suggests that FF expect the firm to stay within the family over generations (James, 1999) and let key business decisions be influenced by the family (Chua et al., 1999). According to the expected relationship, the results indicate that the younger and the larger the FF, the higher the β. The results on AGE suggest that older companies are often unwilling to change (Sathe, 2003). The positive relationship between systematic risk and size is consistent with the association predicted in hypothesis H5a. Finally, the evidence shows that the higher the Costd, the higher the systematic risk.

Considering model (2), the results show that the operational risk is influenced only by CRISIS. In periods of crisis, this type of risk is higher, as expected, suggesting higher levels of earnings volatility.

Finally, model (3) suggests that financial risk is positively related to OROA.

Overall, the regression model fits better for the NFF sample (Panel B). With the exception of model (3), the R2 are higher for NFF models.

Considering model (1), we found a positive relationship between Fs and Board and the systematic risk, and a negative relationship between Oroa and Costd and the systematic risk, which suggest that the larger the FF and the higher the proportion of independent directors on the board, the higher the Beta. However, the higher the profitability and the cost of debt, the lower the systematic risk. The statistical significant coefficients present the same sign as in the FF sample, with the exception of the Costd. The positive relationship between systematic risk and Fs is consistent with the association predicted in hypothesis H5a (model 1) and the assumption that firm size is important to increase the profitability of firms (Gschwandtner, 2005; Hardwick, 1997; Wyn, 1998).

Insofar as model (2), the coefficient on Fs is statistically significant and negative and the coefficient on BOARD is positive and statistically significant. The coefficient on Fs suggests that larger companies might resist change and innovation (Sathe, 2003). The positive signal on Board is as expected, being in line with the assumption that founders are concerned with the survival of their firms and protecting their legacy for future generations (James, 1999; Zahra, 2005).

Model (3) results, as expected, suggest that the higher the debt ratio and the profitability, the higher the financial risk. The first relation is consistent with corporate finance theory assumptions (e.g., Myers, 1984) and the second one with the relationship between risk and performance (Lintner, 1965; Mossin, 1966; Sharpe, 1964).

Finally, we compared the FF (Panel a) with the NFF (Panel B) regression results.

For both the FF and NFF samples, the best model is the one where the dependent variables are the systematic risk (model 1). In this model, we found some evidence of industry effect.

We found no evidence that FF risk is less positively related to profitability than NFF, finding no support for H3. In what concerns the Beta, the results indicate that FF risk is more negatively related to age than NFF. Consequently, we found evidence for H4, with respect to systematic risk. We found evidence that FF systematic risk is less positively related to size than NFF. However, the results do not indicate that FF financial risk is more negatively related to size than NFF. Consequently, our results support H5a, but do not support H5B. For models (1) and (2), FF risk appears to be less positively related to the proportion of independent directors on the board than NFF, which is consistent with H6. This evidence suggests that risk avoidance is stronger for FF than for NFF (Beatty & Zajac, 1994; Denis, Denis, & Sarin, 1997). Finally, we found no evidence supporting the hypothesis that FF risk is less positively related to crisis than NFF (H7).

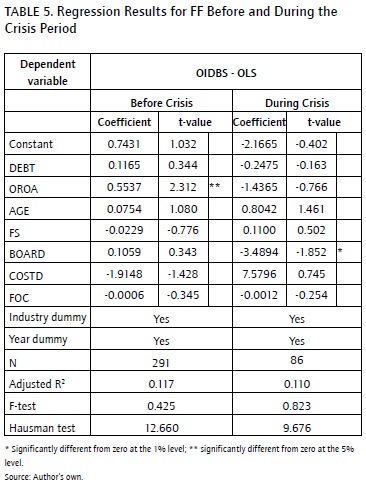

The evidence obtained in table 4 (Panel a) shows that Crisis affects the operational risk in FF. In this context, and for robustness reasons, we decided to split the sample of FF in two sub-periods: before the crisis (1999-2007) and during the crisis (2008-2010), in order to analyze whether the independent variables in operational risk differ between expansion and recession periods.

Table 5 shows the results of the regression (2), without considering the Crisis dummy variable and considering the Oidbs measure of risk for the two distinct periods.

Before the crisis, the operational risk is positively influenced by profitability, which is in accordance with the financial assumptions, as well as the results of Sraer and Thesmar (2007) and Rauch et al. (2009). It suggests that in expansion periods, FF are more likely to assume risk with perspectives of higher returns. During crisis, the results show that the higher the independent directors the lower the risk, suggesting that managers are more reluctant to assume risk in periods of crisis.

Conclusion

This paper investigates firm risk in the context of Portuguese listed family-controlled firms, using an unbalanced panel data for the 1999-2010 period and focusing on the possibility of asymmetrical corporate risk effects between periods of stability and economic adversity.

The results suggest that the evidence concerning the family firms' risk is Sensitive to the different types of risk considered.

Overall, we found evidence that family firms have lower levels of operational risk than non-family firms. In addition, the results suggest that managers of family firms are more reluctant to assume risk in periods of crisis. This evidence suggests that family firms tend to be more conservative and risk averse than non-family firms, and that risk avoidance is stronger for crisis periods. Therefore it may have real consequences for the allocation of corporate investment capital between family and non-family firms, according to the risk aversion of investors.

The results indicate that the systematic risk is negatively related to age, suggesting that younger companies present higher risk, which is consistent with the life cycle of firms, the relationship being stronger for family firms than for their counterparts. Moreover, we found evidence that family firms' systematic risk is positively related to size, the relationship being stronger for non-family firms than for the family businesses.

Finally, the evidence supports the hypothesis that the higher the proportion of independent directors on the board, the higher the systematic and operational risks, the relationship being less positive in the family controlled firms. This evidence suggests that founders are more con-cerned about the survival of their firms than with the finance principle of shareholder wealth maximization, possibly because of families wish to pass the firm to subsequent generations. For policy makers, the finding that firm risk is significantly influenced by board independence in both family and non-family firms, could serve to justify a decision insofar as the proportion of independent directors on board.

Although studying a Portuguese sample aids the contribution made by our study, because it is a market that has not yet been explored in this context, it also represents a limitation of our work because of the small size of the sample, resulting from the small size of the Portuguese capital market.

The results suggest several avenues for future research. Given the verification that evidence concerning family firms' studies is Sensitive to the respective definition, there is a need to consider alternative definitions of family firms, analyzing whether the results differ according to the definition of family firm. The results suggest the need to explore the relationship between risk and profitability in family businesses. Finally, we would like to focus on behavioural finance theory in order to explain the determinants of corporate risk in the context of family-controlled firms.

Notes

1For simplicity reasons, we report only the results for the best model. However, the other outputs are available from authors upon request.

References

Adams, R., Almeida, H., & Ferreira, D. (2009). Understanding the relationship between founder-ceos and firm performance. Journal of Empirical Finance, 16(1), 136-50. [ Links ]

Allouche, J., Amann, B., Jaussaud, J., & Kurashina, T. (2008). The impact of family control on the performance and financial characteristics of family versus nonfamily businesses in Japan: a matched-pair investigation. Family Business Review, 21(4), 315-329. [ Links ]

Anderson, R. C., & Reeb, D. M. (2004). Board composition: balancing family influence in S & P 500 firms. Administrative Science Quarterly, 49, 1301-1328. [ Links ]

Anderson, R. C., & Reeb, D. M. (2003). Founding family ownership and firm performance: evidence from the s&P 500. Journal of Finance, 58(3), 1301-1328. [ Links ]

Anderson, R. C., Mansi, S. A., & Reeb, D. M. (2003). Founding family ownership and the agency cost of debt. Journal of Financial Economics, 68, 263-285. [ Links ]

Baltagi, B. (1995). Econometric Analysis of Panel Data. Chichester: John Wiley and Sons. [ Links ]

Beatty, R., & Zajac, E. (1994). Managerial incentives, monitoring, and risk bearing: a study of executive compensation, ownership, and board structure in initial public offerings. Administrative Science Quarterly, 39, 313-335. [ Links ]

Bennedsen, M., & Nielsen, K. (2010). Incentive and entrenchment effects in european ownership. Journal of Banking and Finance, 34, 2212-2229. [ Links ]

Carney, M. (2005). Corporate governance and competitive advantage in family-controlled firms. Entrepreneurship Theory & Practice, 29(3), 249-265. [ Links ]

Céspedes, J., González M., & Molina C. (2010). Ownership and capital structure in latin america. Journal of Business Research, 63(3), 248-254. [ Links ]

Chen, H., Hexter, L., & Hu, M. (1993). Management ownership and corporate value: some new evidence. Managerial and Decision Economics, 14(4), 335-346. [ Links ]

Chua, J. H., Chrisman, J. J., & Sharma, P. (1999). Defining the family business by behavior. Entrepreneurship Theory & Practice, 23(4), 19-39. [ Links ]

Claessens, S., Djankov, S., & Lang, L. (2000). The separation of ownership and control in east asian corporations. Journal of Financial Economics, 58, 81-112. [ Links ]

Denis, D., Denis, D., & Sarin, A. (1997). Agency problems, equity ownership, and corporate diversification. Journal of Finance, 52, 135-160. [ Links ]

Faccio, M., & Lang, L. (2002). The ultimate ownership of Western european Corporations. Journal of Financial Economics, 65, 365-395. [ Links ]

Fama, E. F., & Jensen, M. C. (1983). Separation of ownership and control. Journal of Law and Economics, 26, 301-325. [ Links ]

Gallo, M. A., & Vilaseca, A. (1996). Finance in family business. Family Business Review, 9(4), 387-401. [ Links ]

Gallo, M. A., Tapies, J., & Cappuyns, K. (2004). Comparison of family and nonfamily business: Financial logic and personal preferences, Family Business Review, 17(4), 303-318. [ Links ]

Glode, V., Hollifield, B., Kacperczyk, M., & Kogan, S. (2010). Is investor rationality time varying? evidence from the mutual fund industry. NBER Working Paper. Retrieved from http://www.nber.org/papers/w15038. [ Links ]

Gnan, L., Montemerlo, D. (2001). Structure and dynamics of ownership, governance and strategy: Role of family and impact on performance in italian SMES. In G. Corbetta, D. Montemerlo (eds.), The role of family in family business (pp. 224-244). Rome: FBn Research Forum Proceedings. [ Links ]

Gómez-Mejía, L., Haynes, K., Núñez-Nickel, M, Jacobson, K., & Moyano-Fuentes, J. (2007). Socioemotional wealth and business risks in family-controlled firms: evidence from spanish olive oil mills. Administrative Science Quarterly, 52, 106-137. [ Links ]

González, M., Guzmán, A., Pombo, C., & Trujillo, M. (2011). Family firms and debt: Risk aversion versus risk of losing control. Working Paper. Retrieved from http://ssrn.com/abstract=1639158. [ Links ]

Gschwandtner, A. (2005). Profit persistence in the 'very' long run: Evidence from survivors and exiters. Applied Economics, 37, 793-806. [ Links ]

Hardwick, P. (1997). Measuring cost inefficiency in the UK life insurance industry. Applied Financial Economics, 7, 37-44. [ Links ]

Hausman, J. A. (1978). Specification tests in econometrics. Econometrica, 46(6), 1251-1271. [ Links ]

Holderness, C. G. (2009). The myth of diffuse ownership in the United states. Review of Financial Studies, 22, 1377-1408. [ Links ]

James, H. S. (1999). Owner as manager, extended horizons and the family firm. International Journal of the Economics of Business, 6, 41-55. [ Links ]

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: managerial behaviour, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360. [ Links ]

Khaemasunun, K. (2004). Three essays on the profitability, risk, and viability of family firms in a developing economy, Phd thesis, West virginia University. [ Links ]

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. W. (2000). Agency problems and dividend policies around the world. Journal of Finance, 55(1), 1-33. [ Links ]

La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (1999). Corporate ownership around the world. Journal of Finance, LIV (2), 471-517. [ Links ]

Lintner, J. (1965). The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets. Review of Economics and Statistics, 47, 13-37. [ Links ]

Litz, R. A. (1995). The family business: toward definitional clarity. Family Business Review, 8(2), 71-81. [ Links ]

Masulis, R. W. (1988). Corporate investment and dividend decisions under differential personal taxation. Journal of Financial and Quantitative Analysis, 23(4), 369-385. [ Links ]

Maug, E. (1998). Large shareholders as monitors: is there a trade-off between liquidity and control? The Journal of Finance, 53, 65-98. [ Links ]

Maury, B. (2006). Family ownership and firm performance: empirical evidence from western european corporations. Journal of Corporate Finance, 12(2), 321-341. [ Links ]

Meyer, M. W., & Zucker, L. G. (1989). Permanently failing organizations. Newbury Park, C. A.: Sage Publications. [ Links ]

Miller, D., Le Breton-Miller, I., lester, R. H., & Cannella Jr., A. A. (2007). Are family firms really superior performers? Journal of Corporate Finance, 13(5), 829-858. [ Links ]

Mishra, C. S., & McConaughy, D. L. (1999). Founding family control and capital structure: the risk of loss of control and the aversion to debt. Entrepreneurship theory and practice, 53-64. [ Links ]

Mossin, J. (1966). Equilibrium in a capital asset market. Econometrica, 34, 768-783. [ Links ]

Myers, S. C. (1984). The capital structure puzzle. Journal of Finance, 39(3), 575-592. [ Links ]

Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investments decisions: When firms have information that inventors do not have. Journal of Financial Economics, 13, 187-221. [ Links ]

Naldi, L., Nordqvist, M., Sjöberg, K., & Wiklund, J. (2007). Entrepreneurial orientation, risk taking, and performance in family firms. Family Business Review, XX(1), 33-47. [ Links ]

Nunes, P. M., Viveiros, A, & Serrasqueiro, Z. (2012). Are the determinants of young sme profitability different? empirical evidence using dynamic estimators. Journal of Business Economics and Management, 13(3), 443-470. [ Links ]

Pindado, J., & Torre, C. (2008). Financial decisions as determinants of ownership structure: evidence from spanish family controlled firms. Managerial Finance, 34(12), 868-885. [ Links ]

Poutziouris, P., Sitorus, S., & Chittenden, F. (2002). The financial affairs of family companies. Manchester: Business school Press. [ Links ]

Rajan, R. G., & Zingales, L. (1995). What do we know about capital structure? some evidence from international data. Journal of Finance, 50, 1421-1460. [ Links ]

Rauch, A., Wiklund, J., Lumpkin, G. T., & Frese, M. (2009). Entrepreneurial orientation and business performance: an assessment of past research and suggestions for the future. Entrepreneurship Theory and Practice, 33, 761-787. [ Links ]

Rodríguez-Rodríguez, O. (2006). Trade credit in small and medium size firms: an application of the system estimator with panel data. Small Business Economics, 27, 103-126. [ Links ]

Romano, C. A., Tanewski, G. A., & Smyrnios, K. X. (2000). Capital structure decision making: a model for family business. Journal of Business Venturing, 16, 285-310. [ Links ]

Sathe, V. (2003). Corporate entrepreneurship: Top managers and new business creation. Cambridge, U. K.: Cambridge University Press. [ Links ]

Schmid, T., Ampenberger, M., Kaserer, C., & Achleitner, A. (2008). Family firms, agency costs and risk aversion - empirical evidence from diversification and hedging decisions. Working Paper. Retrieved from http://ssrn.com/abstract=1314823 or http://dx.doi.org/10.2139/ssrn.1314823. [ Links ]

Scholes, L., Wilson, N., Wright, M., & Noke, H. (2012). Listed family firms: industrial and geographical context, governance and performance. Working Paper. Retrieved from http://ssrn.com/abstract=2002906. [ Links ]

Schulze, W. S., Lubatkin, M. H., & Dino, R. N. (2002). Altruism, agency and the competitiveness of family firms. Managerial and Decision Economics, 23, 247-259. [ Links ]

Setia-Atmaja, L. S. (2010). Dividend and debt policies of family controlled firms: the impact of board independence. International Journal of Managerial Finance, 6(2), 128-142. [ Links ]

Setia-atmaja, L. S., Tanewski, G. A., & Skully, M. 2009. The role of dividends, debt and board structure in the governance of family-controlled firms. Journal of Business Finance & Accounting, 36(7/8), 863-898. [ Links ]

Sharma, P., Chrisman, J. J., & Chua, J. H. (1997). Strategic management of family business: Past research and future challenges. Family Business Review, 10(1), 1-35. [ Links ]

Sharpe, W. F. (1964). Capital asset prices: a theory of market equilibrium under conditions of risk. Journal of Finance, 19, 425-442. [ Links ]

Smith, M. (2008). Differences between family and non-family SMES, a comparative study of austria and Belgium. Journal of Management and Organization, 14, 40-58. [ Links ]

Sonnenfeld, J. A., & Spence, P. L. (1989). The parting patriarch of a family firm. Family Business Review, 2(4), 355-375. [ Links ]

Sraer, D., & Thesmar, D. (2007). Performance and behaviour of family firms: evidence from the French stock market. Journal of European Economic Association, 5(4), 709-751. [ Links ]

Storey, D. J. (1994). Understanding the Small Business Sector. london: Routledge. [ Links ]

Veronesi, P. (1999). Stock investors overreaction to bad news in good times: a rational expectation equilibrium model. Review of Financial Studies, 12(5), 975-1007. [ Links ]

Villalonga, B., Amit, R. (2006). How do family ownership, control, and management, affect firm value?. Journal of Financial Economics, 80(2), 385-417. [ Links ]

Westhead, P., & Cowling, M. (1998). Family firm research: the need for a methodological rethink. Entrepreneurial Theory & Practice, 23, 31-56. [ Links ]

White, H. (1980). A Heteroscedasticity-consistent covariance matrix estimator and a direct test for heteroscedasticity. Econometrica, 48(4), 149-170. [ Links ]

Wiseman, R. M., & Catanach, A. H. (1997). A longitudinal disaggregation of operational risk under changing regulatory conditions: evidence from the savings and loan industry. Academy of Management Journal, 40, 799-830. [ Links ]

Wiwattanakantang, Y. (1999). An empirical study on the determinants of the capital structure of thai firms. Pacific-Basic Finance Journal, 7(3-4), 371-403. [ Links ]

Wyn, J. (1998). The fourth wave. Best's Review, 99, 53-57. [ Links ]

Xin-Ping, X., Zhen-song, Z., & Ming-Gui, Z. Y. (2006). Voting power, bankruptcy risk and radical debt financing behavior of family firms: empirical evidences from China. Working Paper. Retrieved from http://ieeexplore.ieee.org/xpl/login.jsp?tp=&arnumber=4105121&url=http%3a%2F%2Fieeexplore.ieee.org%2Fxpls%2Fabs_all.jsp%3Farnumber%3d4105121. [ Links ]

Zahra, S. A. (2005). Entrepreneurial risk taking in family firms. Family Business Review, 18(1), 23-40. [ Links ]

Zhou, H. (2012). Are family firms better performers during financial crisis? Working Paper. Retrieved from http://ssrn.com/abstract=1990250. [ Links ]