Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Innovar

Print version ISSN 0121-5051

Innovar vol.24 no.53 Bogotá July/Sept. 2014

https://doi.org/10.15446/innovar.v24n53.43914

http://dx.doi.org/10.15446/innovar.v24n53.43914

Corporate governance and performance in the largest european listed banks during the financial crisis

Gobernanza corporativa y desempeño de los bancos cotizados de mayor tamaño de Europa durante la crisis económica

Governança corporativa e desempenho dos bancos de maior tamanho da Europa que vão a público durante a crise econômica

Gouvernance corporative et rendement des banques d'Europe cotées d'une taille importante pendant la crise économique

J. Augusto FelícioI; Irina IvashkovskayaII; Ricardo RodriguesIII; Anastasia StepanovaIIII

I School of economics and management, University of Lisbon, Portugal

II Corporate Finance Center, Higher School of Economics, Russia

III Center for Management Studies, School of Economics and Management, Portugal

IIII Corporate Finance Center, Higher School of Economics, Russia

Corresponding author: Rua Miguel Lúpi, N.º 20, 1200-725 Lisboa - Portugal; jaufeli@iseg.utl.pt.

Citación: Felício, J., Ivashkovskaya, I., Rodrigues, R., & Stepanova, A. (2014). Corporate Governance and Performance in the largest european listed Banks during the Financial Crisis. Innovar, 24(53), 83-98.

Clasificación JEL: G34.

Recibido: Junio 2013; aprobado: Noviembre 2013.

Abstract:

This research focuses on the relationship between corporate governance and performance in the largest european listed banks, which have been studied to a lesser extent within this field. The study is based on agency theory and we use a sample of 404 observations referring to 97 banks selected from the annual ranking of the 2,000 biggest companies in the world prepared by Forbes. The paper covers the period from 2006 to 2010, thus, examining the changes in the performance drivers in the recent financial crisis. On the basis of the panel data analysis, we confirm that the variety of governance factors including board size, insider appointed, directors' age, board meetings and affiliated committees influence the performance of the banks. This paper contributes to a better understanding of the effect of corporate governance on the financial performance of the financial companies in times of high capital market volatility.

Keywords: Corporate governance; bank performance; agency theory; financial crisis.

Resumen:

Esta investigación se enfoca en la relación entre la gobernanza corporativa y el desempeño de los bancos cotizados en la bolsa y de mayor tamaño de europa, que es un tema menos estudiado dentro de este campo. El estudio se basa en la teoría de agencia, y usamos una muestra de 404 observaciones, que se refieren a 97 bancos seleccionados del ranking anual de Forbes de las 2000 compañías mundiales de mayor tamaño. El artículo cubre el período de 2006 a 2010, y por lo tanto examina los cambios en los indicadores de rendimiento dentro de la reciente crisis económica. Con base en el análisis de datos de panel confirmamos que la variedad de factores de gobernanza, incluyendo el tamaño de la junta, el nombramiento interno, la edad de los directores, las reuniones de la junta y los comités afiliados, inciden sobre el rendimiento de los bancos. Este artículo contribuye a una mejor comprensión del efecto de la gobernanza corporativa sobre el rendimiento económico de compañías financieras en tiempos de alta volatilidad del mercado de capitales.

Palabras clave: gobernanza corporativa; rendimiento de los bancos; teoría de agencia; crisis económica.

Resumo:

Este artigo se centra na relação entre a governança corporativa e o desempenho dos bancos de maior tamanho da europa que vão a público na bolsa, que é um tema menos estudado nos artigos sobre rendimento. O estudo se baseia na teoria de agência e usamos uma amostra de 404 observações que se referem a 97 bancos selecionados do ranking anual de Forbes dentre as 2000 companhias mundiais de maior tamanho. Cobre o período de 2006 a 2010 e, portanto, examina as mudanças nos indicadores de rendimento dentro da recente crise econômica. Com base na análise de dados de painel, confirmamos que a variedade de fatores de governança, incluindo o tamanho da diretoria, a nomeação interna, a idade dos diretores, as reuniões da diretoria e os comitês afiliados, incidem sobre o rendimento dos bancos. Este artigo contribui para uma melhor compreensão do efeito da governança corporativa sobre o rendimento econômico de companhias financeiras em tempos de alta volatilidade do mercado de capitais.

Palavras-chave: governança corporativa; rendimento dos bancos; teoria de agência; crise econômica.

Résumé:

Cet article est centré sur la relation entre la gouvernance corporative et le rendement des banques cotées en bourse et de grande taille d'Europe, ce qui est un sujet moins étudié dans les articles sur le rendement. L'étude se base sur la théorie d'agence et nous utilisons un échantillon de 404 observations qui se réfèrent à 97 banques choisies d'après le ranking annuel de Forbes des 2000 compagnies mondiales de plus grande taille. Elle couvre la période de 2006 à 2010, et examine les changements dans les indicateurs de rendement au cours de la récente crise économique. Sur la base de l'analyse de données du panel, nous confirmons que la variété des facteurs de gouvernance, incluant la taille du conseil d'entreprise, la nomination interne, l'âge des directeurs, les réunions du conseil d'entreprise et les comités affiliés ont une incidence sur le rendement des banques. Cet article contribue à une meilleure compréhension de l'effet de la gouvernance corporative sur le rendement économique de compagnies financières en des périodes de haute volatilité du marché des capitaux.

Mots-clés: gouvernance corporative; rendement des banques; théorie d'agence; crise économique.

Introduction

Larcker, Richardson and tuna (2007) argue that the lack of consistent empirical results on the influence of corporate governance on performance is due to the difficulty in adequately measuring corporate governance and, in that context, identify fourteen corporate governance factors. Based on these factors and on agency theory, Grove, Patelli, Victoravich and Xu (2011) study the influence of corporate governance on the performance of U.S. Banks.

The study of commercial banks and financial institutions is particularly relevant given the importance of the financial sector in the modern economy, thus, requiring specific regulations and supervision by market authorities. This importance became very clear during the recent international crisis since the banks were subject to specific interventions from central banks and governments (Friedman, 2011) aiming to maintain confidence in the markets (Zingales, 2008).

The importance of this work is justified by the focus on the period of the recent financial crisis and the small number of research studies that focus on the strategic perspective of the boards (Adams & Mehran, 2003; Kim, Burns & PreScott, 2009). Furthermore, it allows the identification of differences between North American and European banks, although we did not fully follow the factors proposed by Grove et al. (2011) as we gave preference to the ones proposed by Larcker et al. (2007). In this regard, Klein, Shapiro and young (2005) state that there is no clear evidence that better corporate governance leads to better performance of the companies in different markets.

The focus of this work is to understand the relationship between corporate governance mechanisms adopted by the major European listed banks and their performance. We verify the pattern in these relations in the time period under analysis. This paper contributes to a better understanding of the effect of corporate governance on the financial performance of the financial companies, especially the type of mechanisms and the relationship with performance variables. Besides the evident negative influence of the debt ratios on bank performance in times of financial crisis, we were able to find significant bank performance drivers among corporate governance indicators. The results demonstrate the significant positive influence of board meeting frequency and directors' experience measured with the director's age on the bank performance. The results did not provide the evidence to support the performance effect of block ownership, anti-takeover provisions, Ceo duality, busy boards, compensation mix and insider power that demonstrate a significant performance effect in a stable economic situation according to previous research. The bank size and the headquarters location (the Eurozone and countries' GDP per capita) also influence the performance of European banks.

The article is structured as follows. We present the literature review and the hypotheses in the section 1. Section 2 provides the conceptual model, the variables and empirical agenda. The results and discussion are given in the section 3. Finally, we summarize conclusions and recommendations for future research in the section 4.

Literature review and hypotheses

Corporate governance regards control mechanisms and the management of relationships between the various actors with effects on company performance. In this context, the board of directors, large shareholders and the market for corporate control stand out. Classic research studies the effect or the limitation of the behavior of executives and their action on performance (Core, Holthausen & Larcker, 1999; Klein, 2002). Black, Jang, Kim and Mark (2002) observed that companies with better corporate governance have better financial performance, which is supported by Jensen and Meckling (1976) and Fama and Jensen (1983). Good corporate governance helps the owner to exert control over the company's business. In turn, the governance mechanisms confer the owners a command position to manage the directors.

Traditionally, good corporate governance is associated with dispersed ownership, middle-sized independent board of directors and other mechanisms mitigating the agency costs. But the question of what good corporate governance is; is still open. How is it possible to quantify the quality of corporate governance? there are a large number of different approaches from using a large set of governance coefficients to developing the original research corporate governance ratings (e.g. Gompers, Ishii & Metrick, 2003). In this study, we use the methodology by Larcker et al. (2007) to evaluate the influence of corporate governance mechanisms on the bank performance described in methodological section of the paper. Below, we present a number of hypotheses concerning different dimensions of corporate governance.

Grossman and Hart (1988) highlight the conflict between minority and majority shareholders, as these are encouraged to maximize corporate performance and discriminate the minority, which leads to increased agency costs (Barclay & Holderness, 1989). Burkart, Gromb and Panunzi (1997) observe that the higher shareholder concentration leads to excessive control and the limitation of executives' initiative.

Iannotta, Nocera and Sironi (2007); Bektas and Kaymak (2009) report that, in banks, the effect of shareholder concentration on performance is different. Sarkar and Sarkar (2000); Gorton and Schmid (2000) observe that block ownership is positively related to performance, leading to higher market-to book ratios and return on assets. Shleifer and Vishny (1986) support that the concentrated ownership improves performance through the increase in control, but Demsetz and Villalonga (2001) state that the influence is negative. The non-linear impact of ownership on firm performance is highlighted by Prowse (1990); Holderness, Kroszner and Sheehan (1999).

Akhigbe and Madura (1996) consider that in companies with a high level of insider holdings and a low level of institutional holdings the adoption of anti-takeover provisions has negative effects on long-term performance. Accordingly, Larcker et al. (2007) found a negative association between anti-takeover provisions and performance and Agrawal and Knoeber (1996) found that the higher control of the company via takeovers has a negative effect on performance. Other results suggest that anti-takeover provisions have a positive influence on operating performance (Beiner, Drobetz, Schmid & Zimmerman, 2006; Seppo, Puttonen & Ratilainen, 2011). Similarly, Bauer et al. (2004) found a positive relationship between operating performance and the quality of external corporate governance.

Larcker et al. (2007) consider that the presence of debt is negatively associated with operating performance. However, debt generates external monitoring and influences the controlling shareholders to improve company performance. Debt is based on the perspective of creditors acting as a mechanism of corporate governance encompassing the natural adjustment of the market with positive effects on performance (Klock et al., 2005; Mansi, Maxwell & Miller, 2004). For denis (2001) and McColgan (2001) these governance mechanisms are effective and positive through the reduction of agency costs and the increase in performance. We suppose the debt level may have both a negative and a positive influence on bank performance depending on the sector and the business environment. As this study is devoted to crisis environment we suppose the negative performance effect of debt.

Consequently, the following hypotheses were formulated:

Hypothesis 1: Block ownership has a negative influence on bank performance.

Hypothesis 2: anti-takeover provisions have a negative influence on bank performance.

Hypothesis 3: debt level has a negative influence on bank performance.

According to Dalton, Daily, Johnson and Ellstrand (1999) larger boards accumulate more resources, expertise and negotiating power resulting from agency conflict (Jensen, 1993), but the larger size affects the decision-making process, making it more difficult and time consuming. Adams and Mehran (2003) observe that banks with larger boards have a complex organizational structure and require more committees (e.g., lending and credit risk committees). However, the smallest dimension of the board gives the Ceo more power (Yermack, 1996). De Andres and Valle-lado (2008); Grove et al. (2011) observed nonlinear relationships between the board size and bank performance, and the reasoning is that smaller boards make decisions faster, but large boards have greater experience, which is in accordance with Bennedsen, Kongsted and Nielson (2008) who argue that there is an ideal board size beyond which the company's performance is impaired. Adams and Mehran (2005) find a positive effect of board size on performance. This is because larger boards have more information (Coles, Daniel & Naveen, 2008; Dalton et al., 2005). Walsh and Seward (1990); Daily and Dalton (1993) reported that larger boards contributed to better financial performance. In the opposite direction, Eisenberg, Sundgren and Wells (1998) showed that companies with smaller boards had higher Roa. Given such diversity, Beiner et al. (2006) affirm that these results are inconsistent. In this study, we work with the largest European banks. This leads us to the idea that the nonlinear relationship will result in a negative influence on bank performance for the sample banks.

The insider board members are an important source of specific information but can be influenced by the CEO's lack of independence or by the distortion of objectives (Raheja, 2005). In view of the conflict between owners and managers, the managers that increase their ownership power tend to choose a board that is unlikely to be controlled by other shareholders (lasfer, 2006). Thus, companies that have high managerial ownership are less likely to have a high proportion of non-executives on the board and to appoint a non-executive chairman. Helland and sykuta (2005) consider that in firms that are more geared towards performance control, when the conflict centers on the relationship between majority and minority shareholders, the shareholders resort to more insiders on the board to in-crease the control.

The concentration of power is a key feature of insider power indicating weak corporate governance. It's assumed that the Ceo duality reduces the independence of the board (Larcker et al., 2007; Yermack, 1996). This supports the findings by Pi and timme (1993) indicating that in companies in the financial sector, the concentration of power has negative effects on Roa. However, the duality may bring about benefits, including the reduction of information asymmetry, reducing agency costs and improves the operating performance of the company (Belkhir, 2004; Bhagat & Bolton, 2008). yet some studies find no significant relationship between duality and firm performance (Coles, McWilliams & Sen, 2001; Rechner & Dalton, 1991). Thus, the following hypotheses were expressed:

Hypothesis 4: Board size has a negative influence on bank performance.

Hypothesis 5: insider representation has a negative influence on bank performance.

Hypothesis 6: Ceo duality has a negative influence on bank performance.

Serfling (2012) argues that the age of the Ceo has a major effect on business performance and contributes to the existence of agency costs. An older Ceo may turn the knowledge, skills and competencies that are obsolete and induce organizational decline (Agarwal & Gort, 2002). But for Jain and Kini (1994); Fama and French (2004) age does not explain the decrease in performance.

Harris and Shimizu (2004) found that busy directors are important sources of knowledge and improve the performance. However, companies that resort to busy directors (serving on three or more boards) have lower Market-Tobook ratios and weaker operating profitability (Ferris, Jagannathan & Pritchard, 2003; Fich & Shivadasani, 2004).

Vafeas (1999) indicates that the frequency of board meetings is negatively related to performance. For other authors the highest frequency of board meetings results in higher quality of monitoring of management actions and reinforces bonds of cohesion between directors with positive impact on corporate performance (Lipton & Lorsch, 1992; Mangena & Tauringana, 2008; Ntim, 2009). The hypotheses are as follows:

Hypothesis 7: Directors' age influence bank performance.

Hypothesis 8: Busy directors have a negative influence on bank performance.

Hypothesis 9: meeting frequency influences bank performance positively.

Baysinger and Butler (1985) found that firms that perform better include more outsiders on the board. In turn, Klein (2002) verified the presence of lower abnormal accruals when the board has a majority of outside directors. Given the large size of the boards in banks, Adams and Mehran (2003) refer to the need to pressure the boards to achieve greater efficiency in order to meet operational objectives. According to Boone, Field, Karpoff and Raheja (2007) and Linck, Netter and Yang (2008) in companies with larger boards there is a propensity for a progressive degeneration of corporate governance quality and higher Ceo compensation. A larger percentage of affiliated or inside directors in the audit committee is associated with lower efficacy of the committee and a lower quality of earnings in terms of more discretionary accruals (Klein, 2002; Vafeas, 2005).

Traditional opinion points to executive stock options having positive effects on firm performance, aligning the interest of executives with the interests of the shareholders (e.g. Hanlon, Rajgopal & Shevlin, 2003). The stock options lead the executives to focus on the short-term stock price to obtain better compensation when this is how they are remunerated (Peng & Roell, 2008). According to Chen, Firth, Gao and Rui (2006) the executive compensation through stock options is more prevalent in banks than other industries and this leads to high-risk taking in the banking industry. Ang, Cole and lin (2000) found that bank Ceos receive more and have greater incentives resulting from their compensation structure than Ceos of non-banking companies. However, Core et al. (1999); Brick, Palmon and Wald (2006) report that excessive Ceo compensation has a negative impact on the operating performance of companies. Newman and Mozes (1999) found that Ceos receive preferential treatment, at the expense of shareholders, when insiders are members of the compensation committee. However, some studies demonstrate no link between stock compensation plans and performance (e.g. Vafeas, 1999). In consequence, the hypotheses are the following:

Hypothesis 10: affiliated committees have a negative influence on bank performance.

Hypothesis 11: the compensation mix has a positive influence on bank performance.

The impact of board size on performance depends on the characteristics of the company and the country where it operates because the role and function of the board varies between countries. The performance of the large companies will depend on the specific functions and effectiveness of boards and this will differ according to the institutional and legal environment (e.g., Guest, 2008). For Klapper and love (2004), a firm-level corporate governance is highly correlated with better operating performance measured by Roa. Kiel and Nicholson (2003) found positive correlation between firm size and performance. It's assumed that the development of the countries where banks undertake their banking business affects their performance. Likewise, the location of the headquarters in the eurozone has effects on financing options and performance. The following hypotheses were formulated:

Hypothesis 12: Bank size influences the bank performance.

Hypothesis 13: the bank headquarters location (eurozone and countries' GDP per capita) influences bank performance.

Conceptual model, Variables and empirical agenda

The conceptual model

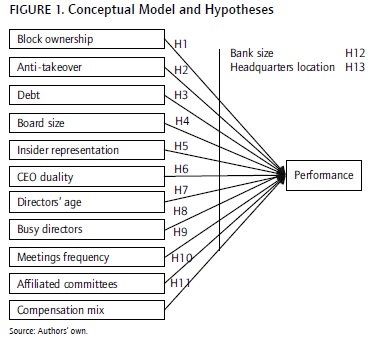

The model relates the corporate governance factors with the bank performance variables (Figure 1). The size of the banks and the banks' headquarters location are considered as control variables.

Factors and Variables

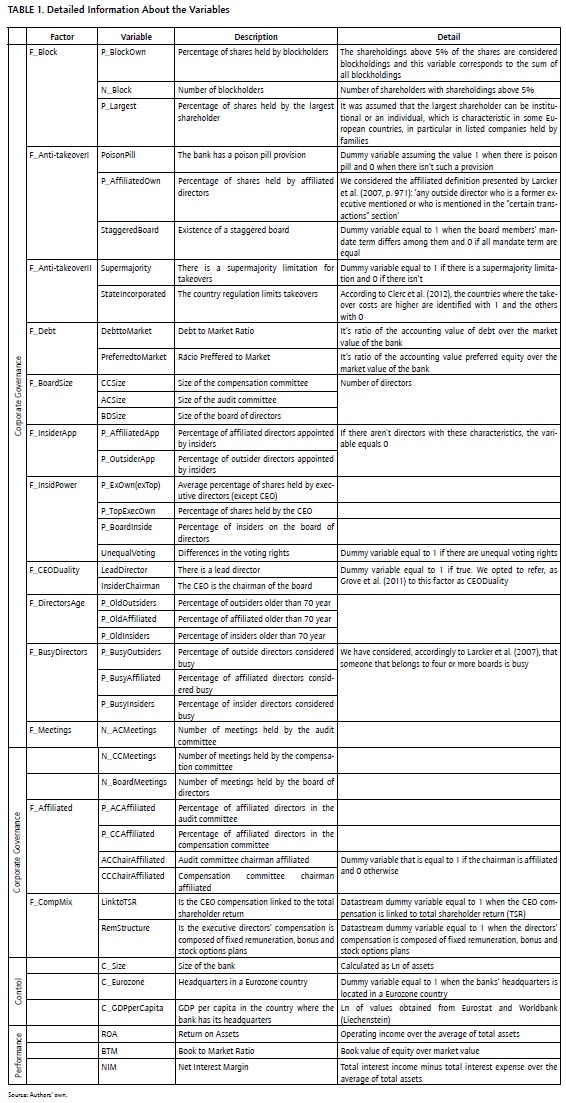

In this study, based on Larcker et al. (2007), we used a total of 36 corporate governance variables that resulted in 13 factors (Table 1). We didn't replicate the factor Active that included three variables related to the activism of institutional investors. In the case of remuneration, it wasn't possible to replicate the original variables that were replaced by two others focusing on the alignment of interests between ownership and management.

The performance variables are the return on assets (Roa), expressing performance in the accounting perspective, the book to market ratio (BTM), which reflects the market valuation, and the net interest margin (NIM), which evaluates the specific performance arising from banking activity. The control variables are the size of the bank (C_size), the bank's headquarters in a Eurozone country (C_Eurozone), and GDP per capita (C_GDPperCapita), to reflect the different levels of economic development of each country.

Sample and data collection

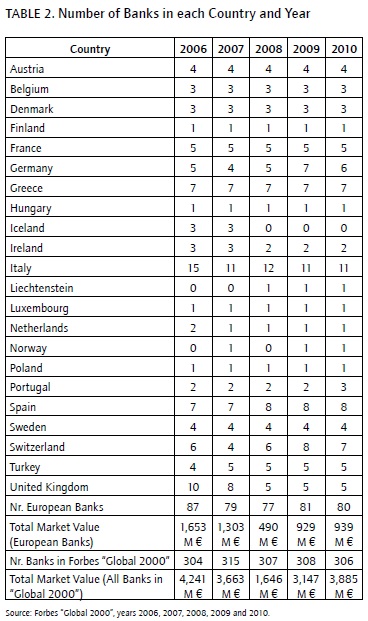

For the present study, we selected banks with headquarters in European countries that are part of the list of the 2,000 largest listed companies "Global 2000" published by Forbes. We considered the years 2006 to 2010. According to the methodology (Forbes, 2011), the classification of companies in the "Global 2000" list was based on sales, profits, assets and stock market valuation collected through the databases interactive data, Thomson Reuters Fundamentals and Worldscope. The sample consists of 404 observations of 97 different banks. From these banks, 70 appear in the ranking in each year, four banks appear only in four years, three banks appear in three years, nine banks in two years and, finally, 11 banks only have one presence in the ranking. Detailed information on the distribution by year and country is presented in table 2.

Governance variables were mostly hand-collected from the banks' annual reports -obtained on their websites- and the variables of a financial nature and remuneration were obtained through the datastream database.

Statistical instruments

In this research, we followed the approach of Larcker et al. (2007) and Grove et al. (2011) (that focused on north American banks), consisting in the creation of governance factors from the original variables. We standardized the 36 governance variables and, based on the average of the standardized variables, the governance index scores were computed. The procedure was adjusted to reflect the substitutability of variables, such as Larcker et al. (2007), in the factors anti-takeover i, compensation mix and Ceo duality. Using this methodology, we computed 13 governance factors.

The panel data analysis method was considered suitable to study the temporal structure of the data (e.g., Mangena, Tauringana & Chamisa, 2012). Since some of the banks do not appear on the list every year, we have an unbalanced panel whose technical details are presented by Wooldridge (2002). The random effects model is:

Yit = βXit + α + uit + εit [1]

where uit is the between entity error and εit is the within entity error.

To interpret the results, we took into consideration the value of R2 (coefficient of determination) for prediction accuracy, this case presented for overall, between and within. To assess the significance of each regression, we considered the value of the Wald Χ2, testing whether the regression coefficients are nonzero. In the analysis of individual coefficients, we refer to the p-value. The coefficients simultaneously include the within and between effects, representing the average of the independent variable effect on the dependent variable when the dependent variable varies one temporal unit and between banks.

Analysis and Results

Descriptive Analysis

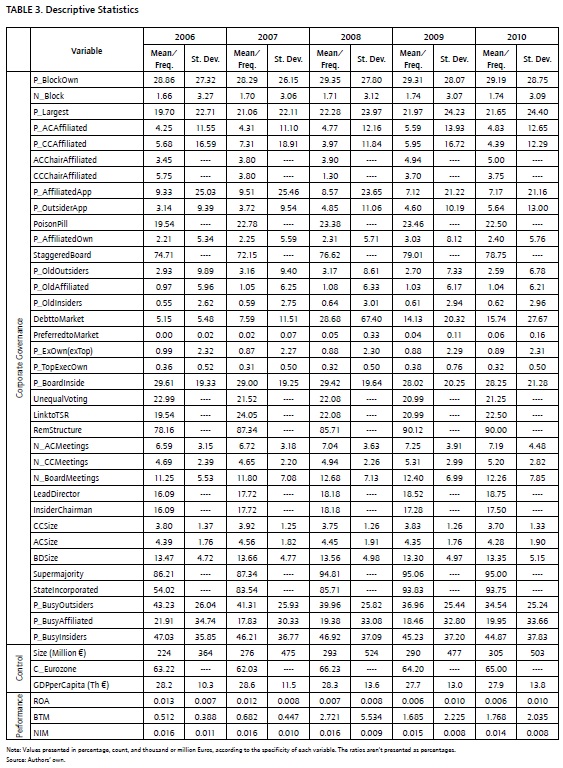

The average values and standard deviations of the variables in each year and the evolution of European banks in the 5-year period are presented in table 3.

An important feature distinguishing the European and U.S. banks is the level of shareholder dispersion (although the sample includes the largest UK banks that are more similar to their U.S. counterparts). Analyzing the percentage held by the main shareholder, slightly above 20%, it can be assumed that it allows the effective control of the bank, which is also supported by the average number of blockholders close to 1.7 and the accumulated percentage held by them is slightly below 30%. The existence of more than 20% of banks with unequal voting rights accentuates the power of dominant shareholders. In this context, we recognize the importance of the problem of expropriation of minority shareholders, accordingly to the agency theory. Referring to 2005, Grove et al. (2011) show that the percentage held by the largest shareholder is only 11%, and blockholders only own 17% of the shares. The Ceo has a higher percentage of shares than the average executive but it remains below 1%, which is significantly lower than the value of 3.3% presented by Larcker et al. (2007).

Referring to the board of directors organization, on average, the board has more than 13 members, while the compensation committee consists of less than 4 members and the audit committee has more than 4 members. The boards meet on a monthly basis, but there is an increase in frequency over the 5-year period. Although meeting less frequently, audit and compensation committees show greater activity in the post-crisis period. The board is made up of about 30% insiders (Grove et al. refer 16% in 2011) that is quite stable across the period. Besides, the number of banks with an insider chairman and a lead director is increasing in times of crisis providing us with the evidence of the growing level of Ceo duality.

In the crisis period, we find the substantial decrease in the percentage of busy managers, specially the outsiders, which is important when undertaking monitoring activities. The percentage of companies that pay executives using various components (distinct deadlines and dependent on the evolution of the company) increased from 78.16% to 90% from pre-crisis 2006 to post-crisis 2010. The percentage of banks that index the Ceo compensation to total shareholder return also increased and fixed at 22.5% in 2010.

The anti-takeover defense poison pill is adopted in more than 20% of the banks and the supermajority requirements in about 95% of the banks, and both increased in the crisis period. The progressive adoption in different countries of the eU regulation on takeovers, as pointed by Clerc, Demarigny, Valiante and Aremendía (2012), led to an increase in the takeover costs.

Through the years, there was an increase in the average size of banks. Nevertheless the crisis resulted in the strong devaluation of banks in the markets (reported in table 2) with obvious impact on debt-to-Market and preferred-ToMarket ratios.

The data highlights the importance of GDP per capita to reflect the different levels of development of the european countries. The average, weighted by the number of banks in each country, is €28,000/year and decreasing in recent years, ranging from € 6,300 or € 8,000 in turkey or Poland and € 52,000 in Norway or even higher in Liechtenstein.

There is a decrease in the performance of European banks, with Roa falling by half in three years, lower than that Grove et al. (2011) obtained for banks in Usa. The book-toMarket ratio is also affected by the sharp decline of stock market valuation. The smallest difference between the beginning and end of the period corresponds to the variable NIM that reduces from 0.016 in 2006 to 0.014 in 2010.

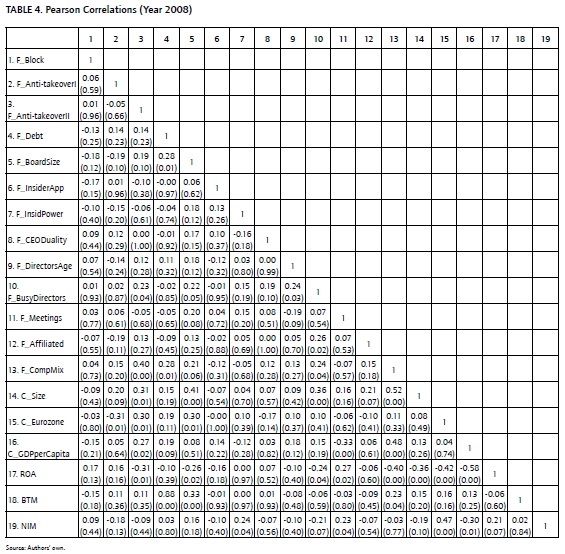

The Pearson correlations (table 4), for the year 2008, display positive correlations between F_debt and F_Compmix, between F_debt and F_Boardsize and between F_Compmix and F_anti-takeoverii. The F_Busydirectors factor is positively correlated with factors F_affiliated, F_directorsage, F_Compmix, F_Boardsize and F_anti-takeoverii.

The control variable C_size is positively correlated with F_Compmix, F_Boardsize, F_anti-takeoverii and F_Busydirectors. The control variable C_eurozone shows positive correlation with F_anti-takeoveri, F_Boardsize and F_antitakeoverii. The control variable C_GDPperCapita is positively correlated with F_Compmix and F_anti-takeoverii and negatively correlated with F_meetings.

The performance variable Roa shows a positive correlation with F_meetings and negative with F_Compmix, F_Boardsize, F_anti-takeoverii, F_Busydirectors, C_size, C_eurozone and C_GDPperCapita. It appears that smaller banks with their headquarters outside the eurozone and in less developed countries have better return on assets. Different governance problems are more relevant in different contexts, influenced by the lower maturity of financial markets, lower shareholder protection and differences in the legal framework that increases the risk associated with investments.

The crisis particularly affects the performance variable BTM that is positively correlated with F_debt, F_Compmix and F_Boardsize. The performance variable NIM is positively correlated with F_insidPower, F_meetings and C_eurozone and negatively correlated with C_GDPperCapita.

Multivariate analysis

The panel data summary for each variable over the period, based on standard deviations, shows that the variation between banks (between) is stronger than the variation within the banks (within). The variable BTM is the only one whereby the within standard deviation exceeds the between standard deviation.

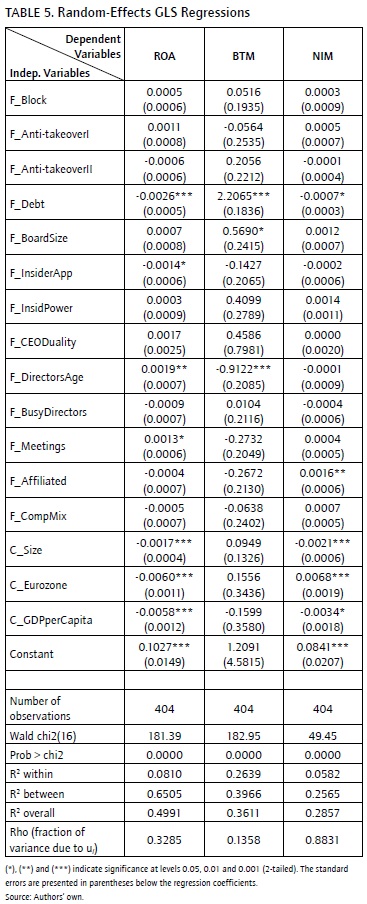

The random effects model is significant, despite fluctuations in the explained variability (between) of the variables Roa (R2 = 0.651), BTM (R2 = 0.397) and NIM (R2 = 0.257) (table 5). The Wald statistics is quite high in all the specifications.

The factor F_Block, referring to blockholdings, shows no significant relationship with the performance, although it could be expected that greater shareholder concentration would imply better performance through the reduction of the collective action problem, thus not confirming hypothesis 1. Although the literature presents anti-takeover mea-sures as an indicator of bad governance, this study did not find statistical evidence of this relationship; therefore, hypothesis 2 isn't supported.

The F_debt factor influences the performance with statistically significant relationships with the dependent variables, supporting hypothesis 3. The variable F_debt presents a negative relationship with ROA and NIM and positive relationship with BTM. The higher debt contributes to lower the banks' return on assets (ROA), lower profitability margins (NIM) and lower valuation of banks in the market, leading to a higher ratio BTM.

The factor concerning board and committee size (F_Boardsize), positively influences BTM, supporting the arguments that highlight that the excessive board size reduces its capacity to act, confirming hypothesis 4.

Only one of the factors relating to insider representation presents statistically significant results, with F_insiderapp negatively influencing the return on assets (Roa), supporting hypothesis 5. Factor F_insidPower emphasizes the gap in the relationship between ownership and management through the entrenchment of executives, but the results do not support the influence of this factor on performance.

Still within the framework of the constitution and functioning of the board, there is a statistically significant effect of the age of the directors (F_directorsage) in the performance of banks, confirming hypothesis 7. It appears that the higher age of directors, leveraging their knowledge and experience, positively influences banks' profitability (Roa) and market valuation (negative relationship with the variable BTM).

There are no statistically significant relationships of the duality of the Ceo (F_Ceoduality) and busy directors (F_ Busydirectors) with performance, thus hypotheses 6 and 8 aren't confirmed.

The increased frequency of the board and its committee meetings presents statistically significant and positive influence on ROA, confirming hypothesis 9.

The preponderance of affiliated members on the board committees and chairs reduces the monitoring capacity of those committees. It would be expected or the F_affiliated factor to contribute negatively to performance. However, the results show a positive and statistically significant influence on NIM indicating that the greater presence of affiliated members helps to increase the interest rate differential on assets ratio (hypothesis 10).

Although in the year 2008 the data reveals correlation between compensation mix and performance variables, none of the regressions confirm the existence of such influence relationship, giving no support for hypothesis 11.

Bank size (C_Size), the context in which the banks' headquarters are located (C_eurozone), and the GDP per capita of the countries (C_GDPperCapita) show a statistically significant relationship with performance measured by Roa and nim, confirming hypotheses 12 and 13. Bank size negatively influences Roa and NIM. The location in the euro zone contributes to a decrease in Roa but increases the business margins referred to the NIM. The higher development of the countries where the banks have headquarters, measured by GDP per capita, negatively influences the performance measured by Roa and NIM.

Discussion

The higher shareholder concentration observed in european banks supports further studies on its impact on the functioning of the banks, particularly given the potential effect of expropriation of minority shareholders. The results obtained do not support the existence of a linear relationship of shareholder concentration with performance or linear correlation with any other variable in the model. These results are coherent with the diversity of effects observed by iannotta et al. (2007); Kaymak and Bektas (2009), as in this case there is no significant relationship.

A number of papers emphasized the importance of nonexecutive and independent directors as an indication of good corporate governance. However, we should also take into consideration the specific knowledge that insiders or affiliated directors have on the business or the company, contributing to higher business performance, which is supported in this study. In this vein of experience and knowledge appreciation, we highlight the positive contribution of the old and affiliated directors on the performance of European banks. In this study, we do not demonstrate that the adoption of anti-takeover provisions is reflected in the performance of organizations, which contradicts the negative influence according to Beiner et al. (2006); Seppo et al. (2011).

Financing the activities through the market (F_debt) leads banks to greater recognition in the market, thus, facilitating access to the market. However, this affects bank profitability (Roa) and consequently the profitability margin (NIM) due to the need to offer the banks' clients better conditions to attract more unfavorable capital to the bank, according to the literature (Mansi et al. 2004; Klock, Mansi & Maxwell, 2005). To our mind, it is worth mentioning that the financial leverage negatively influences not only the market performance of the bank measured with book-to-Market ratio, but also the operational performance measures like the profitability margin. The key logic here concerns the crisis period. A number of papers describe the results demonstrating the negative influence of financial leverage on the performance of the companies in times of crisis (see e.g. Davydov & Vähämaa, 2013), while during the stable financial periods, the market usually estimates the growing level of debt positively be-cause of the increasing debt tax shield.

The larger boards (F_Boardsize) leverage the greater knowledge and experience of its members and the action of independent members but, in our sample, this contributes to depreciation on the stock market (BTM). Although the literature observes inconsistent results (e.g., Beiner et al., 2003), this study confirms the negative effect of the size of the board on the market valuation of bank assets that is traditionally supported with long and inefficient decision-making processes involving extremely large boards.

The existence of a larger number of members appointed by insiders (F_Insiderapp) has a negative effect on ROA. The older managers contribute positively to Roa and have a negative effect on BTM, reflecting the recognition and appreciation of the bank in the market, accordingly to Serfling (2012) that observes the important effect of age on the performance of managers. These results demonstrate the important role of the experience of managers in achieving results.

The board and the frequency of its committee meetings to analyze transactions and prepare the decision-making process, positively influences Roa and, in the analysis period, the increase in the frequency of meetings is noticeable. These results confirm many authors (Lipton & Lorsch, 1992; Mangena & Tauringana, 2008; Ntim, 2009) and contradict Vafeas (1999). In turn, the affiliated committees influence an increase in the banks' business margins (NIM). Authors such as Klein (2002) and Vafeas (2005) show divergent results, suggesting the need for further studies.

The research model assumes that the influence of the control variables is directly reflected in the performance of banks and advances the existence of other control variables to be included in further research. It was found that the larger banks with headquarters located in the eurozone or countries with higher GDP per capita are likely to obtain lower Roa. Likewise, the larger banks located in countries with higher GDP per capita obtain lower margins in their banking business (NIM), but if they are located in the eurozone, NIM improves. Previous literature (e.g., Kiel & Nicholson, 2003) supports that the size of banks positively influences performance, which is contrary to the results of this study. The empirical observation shows different results depending on the context.

As in previous studies (Iannotta et al., 2007; Bektas & Kaymak, 2009), we too failed to find any evidence of the influence of blockholders participation (F_Block) on performance that is in line with the inconclusive results in literature.

The same occurs with antitakeover measures (F_anti-takeoveri and F_antitakeoverii), that several authors consider positive (Beiner et al., 2006; seppo et al., 2011), F_insider-Power, that according to Raheja (2005) distort the objectives due to the conflict of interests, F_Ceoduality that several authors (Pi & Timme, 1993; Larcker et al., 2007) believe to reduce the independence leading to decreased performance, F_Busydirectors, leading to weaker profitability (Ferris et al., 2003; Shivadasani & Fich, 2004), and F_Compmix that several authors (Hanlon et al., 2003, Peng and Roell, 2008) consider positive but others consider negative (Brick et al., 2006) or not related (Vafeas, 1999).

Conclusions

The results obtained show that in a crisis period, bank profitability is affected by greater use of debt and insiders' participation on the board. However, the results of the bank benefit from the higher age of managers and frequency of meetings. We can also conclude that the value of banks on the stock market is hampered by the size of the board and the bank indebtedness. However, older managers take actions that are beneficial. Resorting to debt affects the margins of the banking activity but these margins benefit from the presence of affiliated members on the board committees.

Another important conclusion is that size of the banks and the location of the headquarters in developed countries have a negative influence on the banks' business margins and consequently on profitability. But the location of the same banks in the Eurozone leads to better margins, thus contributing to prevent lower profitability.

Although this wasn't the focus of the study, the shareholder concentration levels raise the question of whether the expropriation of minority shareholders is more relevant than the collective action problems that characterize the economies in which widely dispersed shareholding prevail such as, for example, the U.S.

This study presents very important contributions to help understand the influence of governance mechanisms on the performance of banks in periods of crisis. Additionally it contributes to understanding the influence of the countries development on the banks performance. We also highlight the influence of different financing options on the banks' market value or business profitability. The results allow us to formulate a number of practical implications. First, we would like to attract the attention of the bankers to the crucial influence of high debt ratios on the bank performance in times of crisis. In the period with high volatility of the market capitalization, it is important to realize that the debt-to-equity ratio will be volatile itself and may increase suddenly (what we observed in 2008). That leads us to an idea that it could be useful for a bank to constrain the financial leverage increase when the capital market volatility is growing. Second, we conclude that old directors on the board create value, so, it is important to have a number of experienced directors on the board in times of crisis. In our opinion, in times of crisis, the board faces the non-standard situations that need the understanding of potential crisis outcome scenarios. In such a situation, it is extremely important that the director has previous experience of the different types of financial crises and the changes of long-term business cycles. Finally, the evidence demonstrates that the higher frequency of board and committee meetings, although expensive, could be very profitable for a bank.

Recommendations for future research

First of all, it is worth mentioning the sample limitation of the study. In this research, we used the data on corporate governance collected by hand from the annual reports of the banks that could drive the heterogeneity of the data, second, our study was limited to a time period with extremely high volatility in the capital markets that may affect the forecast performance of the model when applying to the time periods with low capital market volatility.

The assumptions about the composition of the governance factors, based on the works of Larcker et al. (2007) and Grove et al. (2011), should be subject to separate analysis and aggregation of variables. In question are important differences between governance models and the research model that should also be applied to other activity sectors. The literature confirms the existence of nonlinear relationships between corporate governance and performance, which should be developed in future work. It is also relevant to study the role of family holdings in the corporate governance model in different contexts.

Recent research also demonstrates alleviation for the assumptions of exogenous character of a number of corporate governance factors, especially those working with ownership concentration. In this research, we used the classical assumption of the exogenous character of all these factors. Is that an issue? is it a reliable assumption? First, to our mind, it would be interesting to introduce some ownership factors into the model as endogenous ones. But we should realize that the interpretation of the results would not be that clear in this case. Second, as a key instrument we use panel regression analysis taking into account the time structure of data that alleviates the potential problems of endogeneity. Nevertheless, we still consider the analysis of endogeneity as a potential direction for future research.

References

Adams, R., & Mehran, H. (2003). Is corporate governance different for bank holding Companies? Economic Policy Review, 9(1), 123-142. [ Links ]

Adams, R., & Mehran, H. (2005). Corporate performance, board structure and its determinants in the banking industry. Federal Reserve Bank of New York Staff Reports, 330, 1-49. [ Links ]

Agarwal, R., & Gort, M. (2002). Firm and product life cycles and firm survival. The American Economic Review, 92(2), 184-190. [ Links ]

Agrawal, A., & Knoeber, C.R. (1996). Firm performance and mechanisms to control agency problems between managers and shareholders. Journal of Financial and Quantitative Analysis, 31(3), 377-397. [ Links ]

Akhigbe, A., & Madura, J. (1996). Dividend policy and corporate performance. Journal of Business Finance and Accounting, 23, 1267-1287. [ Links ]

Ang, J., Cole, R., & Lin, J. (2000). Agency costs and ownership structure. The Journal of Finance, 55(1), 81-106. [ Links ]

Barclay, M.J., & Holderness, G.H. (1989). Private benefits from control of public corporations. Journal of Financial Economics, 25, 371-95. [ Links ]

Bauer, R., Guenster, N., & Otten, R. (2004). Empirical evidence on corporate governance in europe: the effect on stock returns, firm value and performance. Journal of Asset Management, 5(2), 91-104. [ Links ]

Baysinger, B. D., & Butler, H. D. (1985). Corporate governance and the board of directors: performance effects of changes in board composition. Journal of Law, Economics and Organization, 1, 101-124. [ Links ]

Beiner, S., Drobetz, W., Schmid, M., & Zimmerman, H. (2006). An integrated framework of corporate covernance and firm valuation. European Financial Management, 12(2), 249-283. [ Links ]

Bektas, E., & Kaymak, T. (2009). Governance mechanisms and ownership in an emerging market: the case of turkish banks. Emerging markets Finance & Trade, 45(6), 20-32. [ Links ]

Belkhir, M. (2004). Board structure, ownership structure, and firm performance: evidence from banking. Applied Financial Economics, 19(19), 1581-1593. [ Links ]

Bennedsen, M., Kongsted, H. C., & Nielson, K. M. (2008). The causal effect of board size and the performance of small and medium size firms. Journal of Banking and Finance, 32, 1098-1109. [ Links ]

Bhagat, S., & Bolton, B. (2008). Corporate governance and firm performance. Journal of Corporate Finance, 14(3), 257-273. [ Links ]

Black, B., Jang, H., Kim, W., & Mark, J. (2002). Does corporate governance affect firm value? Evidence from Korea. Working Paper, Stanford Law School. [ Links ]

Boone, A.L., Field, L.C., Karpoff, J.M., & Raheja, C.G. (2007). The determinants of corporate board size and composition: an empirical analysis. Journal of Financial Economics, 85, 66-101. [ Links ]

Brick, I.E., Palmon, O., & Wald, J.K. (2006). Ceo compensation, director compensation, and firm performance: evidence of cronyism? Journal of Corporate Finance, 12(3), 403-423. [ Links ]

Burkart, M., Gromb, D., & Panunzi, F. (1997). Large shareholders, monitoring, and the value of the firm. Quarterly. Journal Economics, 112, 693-728. [ Links ]

Chen, G., Firth, M., Gao, D.N., & Rui, O.M. (2006). Ownership structure, corporate governance, and fraud: evidence from China. Journal of Corporate Finance, 12, 424-448. [ Links ]

Clerc, C., Demarigny, F., Valiante, D., & Aremendía, M. M. (2012). A legal and economic assessment of European takeover regulation. Paris, France: marccus Partnes and Centre for european Policy studies. [ Links ]

Coles, J., Daniel, N., & Naveen, L. (2008). Boards: does one size fit all? Journal of Financial Economics, 87, 329-356. [ Links ]

Coles, J., McWilliams, V., & Sen, N. (2001). An examination of the relationship of governance mechanisms to performance. Journal of Management, 27(1), 23-55. [ Links ]

Core, J.E., Holthausen, R.W., & Larcker, D.F. (1999). Corporate governance, chief executive officer Compensation and firm performance. Journal of Financial Economics, 51(3), 371-406. [ Links ]

Daily, C.M., & Dalton, D.R. (1993). Board of directors leadership and structure: Control and performance implications. Entrepreneurship Theory and Practice, 17, 65-81. [ Links ]

Dalton, D.R., Daily, C.M., Johnson, J.L., & Ellstrand, A.E. (1999). Number of directors and financial performance: a meta-analysis. Academy of Management Journal, 42, 674-86. [ Links ]

Dalton, C. M., & Dalton, D. R. (2005). Boards of directors: utilizing empirical evidence in developing practical prescriptions. British Journal of Management, 16:91-97. [ Links ]

Davydov, D., & Vahamaa, S. (2013). Debt source choices and stock market performance of Russian firms during the financial crisis. Emerging markets Review, 15, 148-159, [ Links ]

De Andres, P., & Vallelado, E. (2008). Corporate governance in banking: the role of the board of directors. Journal of Banking & Finance, 32, 2570-2580. [ Links ]

Demsetz, H., & Villalonga, B. (2001). Ownership structure and corporate performance. Journal of Corporate Finance, 7, 209-233. [ Links ]

Denis, D. (2001). Twenty-five years of corporate governance research... and counting. Review of Financial Economics, 10, 191-212. [ Links ]

Eisenberg, T., Sundgren, S., & Wells, M. (1998). Larger board size and decreasing firm value in small firms. Journal of Financial Economics, 48, 35-54. [ Links ]

Fama E.F., & Jensen, M.C. (1983). Separation of ownership and control. Journal of Law and Economics, 26, 301-325. [ Links ]

Fama, E.F., & French, K.R. (2004). The capital asset pricing model: theory and evidence. Journal of Economic Perspectives, 18, 25-40. [ Links ]

Ferris, S.P., Jagannathan, M., & Pritchard, A.C. (2003). Too busy to mind the business. Monitoring by directors with multiple board appointments. Journal of Finance, 58 (3), 1087-1112. [ Links ]

Fich, E., & Shivdasani, A. (2004). The impact of stock-option compensation for outside directors on firm value. Journal of Business, 78(6), 2229-2254. [ Links ]

Forbes (2011). Special Report: Global 2000 methodology. Retrieved march 22, 2012, from http://www.forbes.com/2011/04/20/global2000-11-methodology.html. [ Links ]

Friedman, B. M. (2011). Learning from the crisis: what can central banks do? in Challenges to Central Banking in the Context of Financial Crisis, subir Gokarn. New Delhi: Academic Foundation. [ Links ]

Gompers, P., Ishii, J., & Metrick, A. (2003). Corporate governance and equity prices. Quarterly Journal of Economics, 118(1), 107-155. [ Links ]

Gorton, G., & Schmid, F.A. (2000). Universal banking and the performance of German firms. Journal of Financial Economics, 58, 29-80. [ Links ]

Grossman, S., & Hart, O. (1988). One share-one vote and the market for corporate control. Journal of Financial Economics, 20, 175-202. [ Links ]

Grove, H., Patelli, L., Victoravich, L. M., & Xu, P. (2011). Corporate governance and performance in the wake of the financial crisis: evidence from Us commercial banks. Corporate Governance: An International Review, 19(5), 418-436. [ Links ]

Guest, P.M. (2008). The determinants of board size and composition: evidence from the UK. Journal of Corporate Finance, 14, 51-72. [ Links ]

Hanlon, M., Rajgopal, S., & Shevlin, T. (2003). Are executive stock options associated with future earnings. Journal of Accounting and Economics, 36(1-3), 3-43. [ Links ]

Harris, I.C. & Shimizu, K. (2004). Too busy to serve? an examination of the influence of overboarded directors. Journal of Management Studies, 41(5), 775-798. [ Links ]

Helland, E., & Sykuta, M. (2005). Who's monitoring the monitor? Do outside directors protect shareholders' interests? The Financial Review, 40(2), 155-172. [ Links ]

Holderness, C., Kroszner, R., & Sheehan, D. (1999). Were the good old days that good? Changes in managerial stock ownership since the great depression. Journal of Finance, 54(2), 435-470. [ Links ]

Iannotta, G., Nocera, G., & Sironi, A. (2007). Ownership structure, risk and performance in the european banking industry. Journal of Banking Finance, 31, 2127-2149. [ Links ]

Jain, B.A., & Kini, O. (1994). The post-issue operating performance of iPo firms. Journal of Finance, 49, 1699-1726. [ Links ]

Jensen, J.C. (1993). The modern industrial revolution, exit, and the failure of internal control systems. Journal of Finance, 48, 1-80. [ Links ]

Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3, 305-360. [ Links ]

Kiel, G., & Nicholson, G. (2003). Board composition and corporate performance: how the australian experience informs contrasting theories of corporate governance. Corporate Governance: An International Review, 11(3), 189-205. [ Links ]

Kim, B., Burns, M.L., & PreScott, J.E. (2009). The strategic role of the board: the impact of board structure on top management team strategic action capability. Corporate Governance: An International Review, 17(6), 728-743. [ Links ]

Klapper, L.F., & Love, I. (2004). Corporate governance, investor protection, and performance in emerging markets. Journal of Corporate Finance, 10(5), 703-728. [ Links ]

Klein, A. (2002). Audit committee, board of director characteristics, and earnings management. Journal of Accounting and Economics, 33, 375-400. [ Links ]

Klein, P., Shapiro, D., & Young, J. (2005). Corporate governance, family ownership and firm value: the Canadian evidence. Corporate Governance: An International Review, 13(6), 769-784. [ Links ]

Klock, M.S., Mansi, S.A., & Maxwell W.F. (2005). Does corporate governance matter to bondholders?. Journal of Financial and Quantitative Analysis, 40, 693-719. [ Links ]

Larcker, D. F., Richardson, S. A., & Tuna, I. (2007). Corporate governance, accounting outcomes, and organizational performance. The Accounting Review, 82(4), 963-1008. [ Links ]

Lasfer, M.A. (2006). The interrelationship between managerial ownership and board structure. Journal of Business Finance and Accounting, 33(7/8), 1006-1033. [ Links ]

Linck, J., Netter, J., & Yang, T. (2008). The determinants of board structure. Journal of Financial Economics, 87, 308-328. [ Links ]

Lipton, M., & Lorsch, J. (1992). A modest proposal for improved corporate governance. Business Lawyer, 48(1), 59-77. [ Links ]

Mangena, M., & Tauringana, V. (2008). A study of the relationship between audit committee factors and voluntary external auditor involvement in UK interim reporting. International Journal of Auditing, 12(1), 43-63. [ Links ]

Mangena, M., Tauringana, V., & Chamisa, E. (2012). Corporate boards, ownership structure and firm performance in an environment of severe political and economic crisis. British Journal of Management, 23, s23-s41. [ Links ]

Mansi, S.A., Maxwell, W.F., & Miller, D.P. (2004). Does auditor quality and tenure matter to investors? Journal of Accounting Research, 42, 755-793. [ Links ]

McColgan. P. (2001). Agency theory and corporate governance: a review of the literature from a UK perspective. Working Paper, 06/0203, department of accounting and Finance, University of Strathclyde, UK. [ Links ]

Newman, H., & Mozes, H. (1999). Does composition of the compensation committee influence Ceo compensation practices. Financial Management, 28, 41-53. [ Links ]

Ntim, C.G. (2009). Internal corporate governance and firm financial performance evidence from South African listed firms. Unpublished doctoral dissertation, University of Glasgow. [ Links ]

Peng, L., & Röell, A. (2008). Manipulation and equity-based compensation. American Economic Review, 98(2), 285-290. [ Links ]

Pi, L., & timme, S. (1993). Corporate control and bank efficiency. Journal of Banking and Finance, 17, 515-530. [ Links ]

Prowse, S.D. (1990). Institutional investment patterns and corporate financial behavior in the United states and Japan. Journal of Financial Economics, 27(1), 43-66. [ Links ]

Raheja, C.G. (2005). Determinants of board size and composition: a theory of corporate boards. Journal Financial Quantitative Analysis, 40(2), 307-329. [ Links ]

Rechner, P.l., & Dalton, D.R. (1991). CEO duality and organizational performance: a longitudinal analysis. Strategic Management Journal, 12, 155-161. [ Links ]

Sarkar, J., & Sarkar, S. (2000). Large shareholder activism in corporate governance in developing countries: evidence from india. International Review of Finance, 1, 161-194. [ Links ]

Seppo, I., Puttonen, V., & Ratilainen, T. (2011). External corporate governance and performance: evidence from the nordic countries. The European Journal of Finance, 17(5-6), 427-450. [ Links ]

Serfling, M.A. (2012). CEO age, underinvestment, and agency costs. Working paper. Eller College of management, University of Arizona. [ Links ]

Shleifer, A., & Vishny, R.W. (1986). Large shareholders and corporate control. Journal of Political Economy, 94(3), 461-488. [ Links ]

Vafeas, N. (1999). Board meeting frequency and firm performance. Journal of Financial Economics, 53(1), 113-142. [ Links ]

Vafeas, N. (2005). Audit committees, boards and the quality of reported earnings. Contemporary Accounting Research, 22, 1093-1122. [ Links ]

Walsh, J.P., & Seward, J.K. (1990). On the efficiency of internal and external corporate control mechanisms. Academy of Management Review, 15(3), 421-458. [ Links ]

Wooldridge, J. M. (2002). Econometric analysis of cross section and panel data. Cambridge, Massachussets: Mit Press. [ Links ]

Yermack, D. (1996). Higher market valuation of companies with a small board of directors. Journal of Financial Economics, 40, 185-211. [ Links ]

Zingales, L. (2008). Plan B. The Economist's Voice, 5(6), 4. [ Links ]