Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Innovar

Print version ISSN 0121-5051

Innovar vol.24 no.54 Bogotá Oct./Dec. 2014

https://doi.org/10.15446/innovar.v24n54.46458

http://dx.doi.org/10.15446/innovar.v24n54.46458

Accrual Financial Reporting in the Public Sector: Is it a Reality?

Información financiera de devengo en el sector público: ¿es una realidad?

Rapport d'accroissement financier dans le secteur public: une réalité?

Informação financeira de acréscimo no setor público: É uma realidade?

Isabel Brusca AlijardeI, Vicente Montesinos JulveII

I Universidad de Zaragoza, Spain. Departamento de Contabilidad y Finanzas. Facultad de Ciências Económicas y Empresariales. Zaragoza, Spain. E-mail: ibrusca@unizar.es

II Universidad de Valencia, Spain. Departamento de Contabilidad. Facultad de Ciencias Económicas y Empresariales. Valencia, Spain. E-mail: Vicente.Montesinos@uv.es

Correspondencia Departamento de Contabilidad y Finanzas (At. Isabel Brusca). Facultad de Economía y Empresa. Gran Vía, 2-3a planta. 50005-Zaragoza.

Citación: Brusca Alijarde, I., & Montesinos Julve, V. (2014). Accrual Financial Reporting in the Public Sector: Is it a Reality? Innovar, 24(54), 107-120.

Clasificación JEL: M41.

Recibido: Febrero 2012; Aprobado: Septiembre 2013.

Abstract:

Although modernization of governmental accounting has led to the implementation of accrual financial reporting, budgets in most continental European countries, including Spain, continue to be based on cash or modified cash methods. Consequently, cash-based and accrual-based financial information coexist. This may create problems for the full implementation of accrual financial statements. This paper analyzes the differences in practice between the results disclosed in financial and budgetary statements under both bases of accounting in order to identify to what extent accrual accounting has been implemented and to verify whether budgetary and accrual-based financial figures are significantly different. The research findings show that there is a high correlation between the current budgetary result and the economic result and, therefore, that in practice the accrual principle has not been implemented effectively.

Keywords: Public sector accounting, accrual accounting, local government, financial reporting.

Resumen:

La modernización de la contabilidad pública ha llevado consigo la implantación de información financiera basada en el principio de devengo. No obstante, en algunos países europeos, como por ejemplo España, el presupuesto continúa elaborándose mediante el criterio de caja o caja modificada y por consiguiente ambos sistemas coexisten. Esto puede convertirse en un problema para la implantación real del principio de devengo. Este artículo analiza las diferencias que existen en la práctica entre el resultado presupuestario y el resultado económico, con el objetivo de evidenciar si realmente existen diferencias significativas entre uno y otro y poner así de manifiesto en qué medida la contabilidad de devengo ha sido implementada de forma real.

Palabras clave: contabilidad del sector público, contabilidad de devengo, gobierno local, reportes financieros.

Résumé:

La modernisation de la comptabilité publique a mené avec elle l'implantation d'information financière basée sur le principe d'exercice. Cependant, dans certains pays européens, comme l'Espagne, par exemple, le budget continue d'etre élaboré selon un critère de caisse ou de caisse modifiée et par conséquent les deux systèmes coexistent. Cela peut devenir un problème pour la mise en place réelle du principe d'exercice. Cet article analyse les différences qui existent dans la pratique entre le résultat budgétaire et le résultat économique, pour mettre en évidence s'il existe réellement des différences significatives entre l'un et l'autre et démontrer ainsi dans quelle mesure la comptabilité d'exercice a été mise en place de façon réelle.

Mots-clés: Comptabilité du secteur public, comptabilité d'exercice, gouvernement local, rapport financier.

Resumo:

A modernização da contabilidade pública tem levado consigo a implantação de informação financeira baseada no princípio da especialização dos exercícios. No entanto, em alguns países europeus, como a Espanha, por exemplo, o orçamento continua sendo elaborado mediante o critério de caixa ou caixa modificada e, em consequência, ambos os sistemas coexistem. Isto pode virar um problema para a implantação real do princípio da especialização dos exercícios. Este artigo analisa as diferenças que existem na prática entre o resultado orçamentário e o resultado económico, com o objetivo de evidenciar se realmente existem diferenças significativas entre um e outro e mostrar assim em que medida o regime contabilístico do acréscimo foi implementado de maneira real.

Palavras-chave: Contabilidade do setor público, regime contabilístico do acréscimo, governo local, relatórios financeiros.

Introduction

In recent years, most Organisation for Economic Cooperation and Development (OECD) countries have introduced important reforms into their public accounting systems following New Public Management (NPM) perspectives and principles. These reforms have a two-fold objective: To improve public service management and to increase the transparency and accountability of governments (Caperchione, 2006; Chan & Xiaoyue, 2002; Lapsley, 1999). Reforms of government accounting generally focus on implementing accrual-based information systems, conforming to generally accepted accounting principles (GAAP), and progressively bringing procedures inline with the business accounting model (Hood, 1995; Lüder & Jones, 2003; OECD, 2002). Australia, New Zealand and the UK are leaders in the initiative for the convergence of the two types of accounting systems (Barton, 2009; Broadbent & Guthrie, 2008; Ryan et al., 2007).

As Lapsley, Mussari and Paulsson (2009) point out, in the world of public sector accounting, the adoption of accrual accounting is self-evident and has been encouraged by the recommendations of international organizations such as the International Public Sector Accounting Standards Board (IPSASB) and the OECD. However, the literature shows that there are many differences between countries (Adam, Mussari & Jones, 2011; Pina, Torres & Yetano, 2009) and that, in the implementation of accrual accounting, many problems and ambiguities arise (Arnaboldi & Lapsley, 2009). This paper focuses on one of these ambiguities: The duality of financial and budgetary accounting systems, which is a barrier to implementing accrual accounting in practice.

In most continental European countries, budgets are based on cash or modified cash methods so that cash-based and accrual-based financial information coexist. This is the case, for example, in Italy, France, Portugal, Belgium and Spain. Even though a reconciliation of these two types of information is sometimes required by legal standards, the use of different recognition criteria for budgets and for financial statements can be confusing. This is why accrual statements have a secondary role in most countries where the two recognition bases coexist. Budgetary information drives the management of public entities because legal requirements refer only to this information.

Guthrie (1998) points out that this duality can cause confusion for managers because they receive conflicting signals from two parallel sets of accounting figures. On the other hand, Pina et al. (2009) maintain that the dual system implemented in continental European countries may be one reason for the dissemination of accrual accounting, because it does not require the introduction of deep organizational changes and answers citizens' democratic demands for higher responsiveness, transparency and accountability.

This paper aims to analyze the extent to which there has been a real implementation of accrual accounting in a dual system, taking into account the effect on the operating statement in Spanish local governments. In Spain, accrual-based financial statements have been prepared since 1992, but budgets are still based on the modified cash basis. As a consequence of this duality, even when public managers have to prepare both types of information-and they do-for management and legal purposes, priority is given to budgetary figures and reports (Brusca & Montesinos, 2011) because the parliamentary debate is based on these figures. In fact, accrual-based financial figures are only used for accountability purposes.

This study contributes to the extensive literature about implementing accrual accounting and the problems and ambiguities it causes. It aims to show, through an empirical study, that the implementation of accrual accounting has many problems in practice and that although entities always try to follow the accounting standards from a formal point of view, the implementation may not be effective. The paper offers a two-fold extension of previous accounting literature. First, it focuses on an ambiguity that has received little attention in the literature and, second, it offers an empirical perspective of the implementation and the problems that it can have in practice. It can be considered as a study of the outcomes of a reform process for Spanish local governments that has already taken nearly 20 years, and complements others papers that demonstrate problems of accrual accounting in other countries, such as those of Arnaboldi and Lapsley (2009) for the UK, or Anessi-Pessina and Steccolini (2007) for Italy.

The theoretical bases of this research-that is, the assumptions to be verified, the variables considered in the empirical analysis, and the design of the model which represents their functional relations-are built on the logic of the accounting model: How economic or accrual and budgetary results are determined, and the main items that constitute the differences between both results.

The theoretical background of accounting behavior in public organizations, especially agency and institutional theories, has been a useful tool for explaining and analyzing the variables and circumstances that boost the adoption of accrual accounting rules and practices in public entities.

Finally, in order to obtain useful research results, we have taken into consideration, for the period and variables of the study, existing previous analyses for other countries such as Italy. This enables an international comparison of the main findings of the paper.

The results show that the implementation of the accrual system in local entities has been more formal than real. The problems that remain unresolved are generally recognized, such as the treatment of asset depreciation. The paper enriches the literature about the problems of accrual accounting, showing that although entities may wish to comply with the standards, managers are not necessarily interested in the information obtained through the accrual method and such information is little used in practice.

The rest of the paper is organized into five sections. First we review the literature and the state of the art. We look at the use of accrual and cash bases in accounting and budgeting. What benefits and risks can the adoption of accrual imply, especially when it coexists with the cash basis? We go on to describe the situation of the Spanish local government system, referring particularly to the accrual-based statement of revenues and expenses, the statement of budget execution, and the conceptual differences between them. The fourth section provides a description of the empirical research: Objectives, sample and methodology. The results are presented in the fifth section. A final section draws some conclusions and discusses the implications for accounting practitioners and researchers.

Implementation of Accrual Accounting in Governments with a Dual System

Theoretical Framework

The modernization of governmental accounting reflects the common direction of reforms towards the implementation of accrual financial reporting in conformity with GAAP, using the business accounting model as a reference. The actions taken include accrual accounting reforms, in some cases accompanied by accrual budgeting, performance management systems, results-oriented and performance budgeting, and performance benchmarking.

Within accrual accounting, the main objectives of financial reporting are to provide information useful for accountability and decision-making purposes. From a theoretical perspective, some theories can be used in order to explain the introduction of accrual accounting and reporting in local government. For example, according to agency theory, local government information can be used for monitoring and linking managerial action with principals (citizens), and the information can be the main vehicle for accountability to external users. In the public sector, however, the relationships between principals and agents are complex and open-ended or not explicitly defined, and are thus not easily monitored (Broadbent & Laughlin, 2003). Each individual is presumed to be motivated by self-interest and will not use the information unless it somehow contributes to their own economic wellbeing. As a consequence, agents will need reasons to use the information. From the stakeholders' perspective, Zimmerman (1977) points out some problems that can arise in the control of the agent by the principal in this case. Because of the small probability of a voter influencing an election, each voter will incur a small expected cost.

According to institutional theory, local governments may introduce accrual accounting and reporting to meet external requirements and to provide an impression of rationality and efficiency, seeking legitimacy, but will not use the system to improve internal performance (Brignall & Modell, 2000; Modell, 2001, 2004; Scott, 1987). When the process of accrual basis adoption is assessed in the light of the institutional approach, a "decoupling" can be found, as accrual and cash-based information still co-exist in financial reporting by public entities (Archel, Husillos & Spence, 2011). As a result of this circumstance, an interesting discussion can be opened from a theoretical perspective, with the first question focused on identifying where the dominant discourse is now really located: Is it accruals, supported by academics, big firms and professional bodies, or is it cash-based reporting, supported by traditional behavior and practices?

Accrual accounting is an international tendency and most governments around the world see this as an objective for their accounting systems, although there are differences in the implementation process between countries (Adam et al., 2011; Lüder & Jones, 2003; Pina et al., 2009). Lapsley et al. (2009) argue that the adoption has been self-evident because of the pressures on governments to demonstrate their effectiveness and efficiency and to discharge their responsibilities, bearing in mind that accrual financial statements can be considered as a tool to this end. The International Public Sector Accounting Standards Board (IPSASB) has had an important role in these processes, especially in connection with the issue of the International Public Sector Accounting Standards (IPSASs) based on the accrual method.

However, there are some arguments in the literature that indicate the need to be careful when extending business accounting to public sector entities, to prevent it leading to 'perverse outcomes' (Broadbent & Guthrie, 2008; Christiaens & Rommel 2008; Ellwood, 2003; Ellwood &

Newberry 2007; Federation des Experts Comptables Euro-péens, 2003; Guthrie, 1998; Lapsley, 2009; Lapsley et al. 2009; Newberry, 2007). Another trend even questions the advisability of introducing accrual accounting in the public sector, arguing that the benefits claimed are not being verified in practice, while the costs of shifting to accrual accounting are accepted as being substantial (Wynne, 2008).

From a practical perspective, the implementation of accrual accounting systems overcomes many conflicts and ambiguities, as pointed out by Arnaboldi and Lapsley (2009). The authors highlighted the recognition and valuation of assets or the non-neutrality of accrual accounting as examples. Lapsley et al. (2009) identified similar problems relating to heritage assets, infrastructure assets, community assets, and capital maintenance and erosion.

Furthermore, many authors argue that the adoption of full accrual accounting has expanded the opportunities available to governments to utilize accounting measurement discretion for the purposes of managing reported financial results (Stalebrink, 2007). For example, Vinnari and

Nasi (2008) consider that the heterogeneity of accrual accounting applications may lead to creative accounting solutions, especially in the public sector context, with the consequence that accounting information is not sufficiently transparent, users may be misled, and accounting does not properly fulfill its accountability functions.

The literature shows that relevant questions still remain unanswered, such as the recognition and valuation of infrastructure and heritage assets (Adam et al., 2011; Chris-tiaens, 2004; Jorge, Carvalho & Fernandes, 2007), and the usefulness of accrual financial statements has not been fully demonstrated (Arnaboldi & Lapsley, 2009; Jones & Pendlebury, 2004; Pilcher & Dean, 2009).

One additional problem that persists in many European continental countries is the duality of budgetary and financial reporting systems, which can lead to a degree of ambivalence about implementing accrual accounting and also using accrual financial statements.

Coordination Between Accrual and Budgetary Systems: International Experiences

Australia, New Zealand and the UK use accrual accounting both for financial reporting and for budgets. In the Netherlands, local governments are also using the modified accrual basis to prepare their budgets (Van der Hock, 2005). The same situation can be found in most German local governments, where important innovations are being introduced with resource-based and output-oriented budgeting (Lüder, 2008; Ridder, Bruns & Spier, 2005), although at the moment caution prevails, especially in the Federal Government (Jones & Lüder, 2011). In Denmark, the introduction of accrual accounting in budgets was tried out in several municipalities in 2006-2007 and there is now a general process of change involving the adoption of the accrual basis in the budget. Similarly, in Finland, the municipal sector adopted the accrual accounting method for both budgeting and financial accounts at the end of the 1990s (Vinnari & Nasi, 2008).

On the other hand, most European countries continue preparing their budgets and budgetary reports according to the modified cash basis, focusing on cash and short-term claims and debts, especially in the continental area. As a consequence, important conflicts and implementation problems remain for adopting accrual accounting within the existing traditional environment of a cash-based budgetary culture and practice.

The reasons for continuing using the cash or modified cash basis in budgets are that these are the methods traditionally used, and, above all, appropriations, assignations and authorizations are based on that criterion in law. The cash basis reflects the traditional public sector concern with control, with guaranteeing the fulfillment of established limits, and with showing the short-term economic impact of fiscal policies.

As the budgetary and accounting systems are usually two subsystems of the general information system, it is necessary to establish some mechanisms for their coordination. The situation varies greatly if the accounting and budgetary bases are the same or if they are different. In the first case, a transaction should be recorded in the two systems equally and a single system can produce both kinds of documents: Budgetary and financial. When the budgetary basis differs from the accounting basis, in most cases there is integration of the budgetary and accounting systems through the use of budgetary procedures. Moreover, reconciliation between the two criteria is not always shown in the financial report, and this is the case in Spain.

Therefore, the duality of the system creates some problems for implementing the accrual basis, and reduces the usefulness of financial reporting. The traditional concept of governmental accounting persists, giving more importance to budgetary reporting for the accountability objective. Budgetary reporting is essential for the political process of discussing and approving local government expenditures. This implies that the budget is, in the end, the most important document, and the information system revolves around it. Pina et al. (2009) argue that these European continental countries are implementing the accrual basis, adapting it to their own organizational context and administrative culture, but the new requirements of accounting, accountability and auditing are viewed by public sector managers and civil servants with some suspicion.

This can explain why some authors consider that the new accounting information is little used, often due to its failure to replace traditional budgetary accounting as the entity's main accounting system (Anessi-Pessina & Steccolini, 2007; Anthony, 2000; Paulson, 2006). If cash remains the reference for appropriations, managers are not interested in accrual financial statements (Brusca & Montesinos, 2011).

In Portugal, integration between financial accounting and budgetary reporting has not diminished the role of budgeting in determining the development of accounting and reporting systems; financial and cost accounting systems are still basically guided by budgetary transactions (Jorge, 2007).

In Italy, although local governments should present a balance sheet and an operating statement, double entry bookkeeping is not mandatory; governments can derive these statements from budgetary reports through a complex system of year-end adjustments (Anessi-Pessina, Nasi & Steccolini, 2008). Criticisms have arisen with respect to the coordination between both systems, arguing that this procedure ignores the profound differences between cash-based budgets and accrual accounting in terms of goals and methods for forcing the two systems to coexist. This inevitably leads to upholding budgetary accounting as the main system and reducing accrual-based reporting to a meaningless formality (Anessi-Pessina & Steccolini, 2007; Caperchione, 2003).

The Greek reform initiative introduced a combined approach for accrual accounting and double entry cash accounting through two separate accounting systems that work in parallel, but each one retaining its autonomy (i.e. each system would have to comply with its own rules and principles). Thus, while the accrual accounting system would register transactions in a similar way to the private sector, the cash accounting system would track the implementation of the budget by monitoring expenditures and revenues through all the legitimate phases and procedures of municipalities (Cohen, Kaimenaki & Zorgois, 2007).

In Belgium, municipalities simply add accrual accounting separately so that most budgetary accounting principles have been maintained and even supersede the accrual accounting system. Municipal councils seem to ignore the reporting of the balance sheet and income statement; they are only interested in their budgets and budgetary reporting, and they consider that the link between budgetary accounting and accrual accounting is contradictory (Christiaens, 2003; Christiaens & Rommel, 2008).

Similarly, Paulson (2006, p. 58) maintains that accrual accounting is not used in public organizations, in particular in Swedish government: "both the survey and the interviews indicate that the use of accrual accounting information may be lower than it otherwise would be, due to the fact that the state budget in Sweden is still based upon a modified cash principle".

To summarize, the existence of a duality of criteria for accounting and budgeting can be a significant problem for accrual implementation, because it is difficult to understand the information obtained with heterogeneous principles. In practice, it is not clear that accrual accounting reporting is going to be used if budgetary reporting maintains the modified accrual basis.

However, and in spite of the theoretical and practical objections to the usefulness of accrual reporting in public entities, and the reservations about the convenience of preserving cash-based budgetary reports, international public sector accounting standards are designed on the basis of accruals, and a general agreement exists on the inevitable need to report true and fair information about the economic position of public entities, and not only their short-term financial flows, as budgetary reports present. All this highlights that the generally accepted view, both in academic and professional fields, is that accrual reporting is the first requirement for public sector accounting, not only for historical information, but also for economic and financial forecasts.

This paper presents empirical research on the links between the two types of reports, considering a sample of Spanish municipalities. As a result of this, we try to show how relevant the differences between both kinds of information are in practice.

Accounting and Budgetary Criteria in Spanish Local Governments

Moving From Cash to Accrual Accounting

In Spain, the government accounting system is based on the business accounting model, but includes particularities for public sector entities. The three levels of government (central, regional and local) use the accrual basis for the elaboration of financial statements. However, the predominance of the budget is maintained due to a legal and administrative culture unlike that of the Anglo-Saxon countries. Budgetary reporting is still based on the modified cash basis of accounting.

At local government level, the introduction of an accrual accounting system in 1992 was the first step in modernizing financial accounting. The Accounting Instruction for Local Government (ICAL) from 1992 requires the presentation of a balance sheet, an operating statement, and a statement of sources and applications of funds, using the accrual basis of accounting. Moreover, a cash flow statement and a budget execution statement are also produced. The ICAL contains a format for the presentation of these statements, as well as the accounting principles applicable and the criteria for the valuation of the elements of the statements. There is a simplified model for entities with fewer than 5,000 inhabitants, the main difference being the details of the financial statements, but the accounting principles and valuation criteria are the same as in the normal model.

The introduction of the new accounting system was an important change which presented difficulties for a traditional administration that had always used an accounting information system in which only the budget was disclosed using a modified cash basis. In the early years of applying accrual accounting, financial directors had some problems with asset valuation and especially with the introduction of estimates where there was no information. For example, although the standard states that properties and equipment should be valued at historical cost minus accumulated depreciation, there were no norms for the depreciation.

In 2004 this standard was amended (the new rules became effective in 2006), with the intention of adapting the model to a new general government accounting framework and simplifying the content of financial reports in the case of small municipalities. The new ICAL included more detailed criteria in areas such as depreciation, stating that property and equipment should be depreciated using the linear method. The Council has to approve the criteria of the entity for the application of the accounting principles and evaluation norms, such as the criteria for depreciation.

The Budgetary Tradition in a Dual Information System

However, there have been no changes either in the budgetary system, which maintains the modified cash basis of accounting, or in the procedures for coordinating the budgetary and accounting subsystems. There is a double entry system and a transaction is introduced simultaneously in the budgetary system and in the accounting system, with the corresponding codes and rules.

As a consequence, the system produces two kinds of information. There are two measures of results: accrual results and budgetary results. Moreover, there is no reconciliation between these results at the end of the period, which is compulsory in other European continental countries such as Italy. Under this dual system, with the presentation of the budgetary information in a single statement, from a theoretical point of view, the accounting criteria are not affected by the budgetary criteria, because only in the budgetary statements do the latter dominate, maintaining non-connected criteria and reporting systems.

The budgetary result obtained is the difference between budgetary revenues and expenses of the period. It indicates whether the budgetary expenditures are funded by budgetary resources. The budgetary statement reports current and capital operations separately, and the current budgetary result can also be calculated as the difference between current revenue and expenses using budgetary criteria. This will eliminate some of the differences between the cash-based budgetary statement and the accrual-based operating statement, taking into account that capital operations are not reflected in this operating statement, as they are neither accrual revenues nor accrual expenses.

The accrual-based operating statement shows the economic result or net income, which represents the change in net assets resulting from operations, both budgetary and non-budgetary. It is determined by the difference between the revenues and expenses of the period using the same methodology as in business entities.

There is some controversy about the usefulness of these measures, and especially about the economic result, because the objective of a local government is not to make a profit but to provide services. The budgetary result can be more suitable for local government activity because it provides a measure of the extent to which budgetary revenues were sufficient to meet budgetary expenditures, and because it determines the politico-economic decisions, since the budgetary result has always been, and still is, the principal concern of politicians and public sector managers.

According to the opinion of financial directors, the economic result has a limited usefulness (Brusca, 1997). The reasons given for this can be summarized as follows: it is not adapted to the activity of local governments; it does not have great significance in politico-economic decisions; some gaps exist in the application of accounting principles, such as the matching principle applied to capital grants and special taxes; it does not allow the entity's performance to be assessed, nor is it comparable from one entity to another; and it is affected by the valuation problems of assets in the areas of depreciation and allowances.

Differences Between Economic and Budgetary Results: The Accrual Principle

The differences between the economic and budgetary results are due to the criteria applicable in each area, especially to three accounting principles that are not applicable in the budget: accrual principle, matching concept, and conservatism or conservative principle.

If we take the current budgetary result, the differences between it and the economic result can be found in the following items:

- Depreciations and provisions are registered as expenses in the economic result because of the matching concept which is not applicable in the budgetary area.

- Work carried out on assets is capitalized in the balance sheet but shown as an expense in the budgetary area.

- Extraordinary gains and losses are included in the income statement but not in the current budgetary result. Acquisitions and disposals of assets, for example, will be registered in the capital section of the budget.

- Capital grants to be paid by the entity are registered in the capital section of the budget but recognized as expenses in the operating statement.

- Applying the accrual basis has an impact on current expenses and revenues. Revenues are recognized in budgets when collected or receivables are due, whereas expenses are registered when paid or due for payment.

Thus, the differences can be classified into four groups:

- extraordinary items due to profit and losses of assets,

- capital transfers,

- application of the matching and conservative principles, which covers depreciation and provisions, and

- timing of recognition of current revenues and expenses. We will differentiate between financial and non-financial expenses to show the effect of accrual in financial expenses.

An Empirical Analysis of Differences Between the Two Criteria in Practice

Objectives and Hypotheses

In order to test the implementation of accrual accounting in Spanish local governments (mandatory from 1992) and the differences between this information and budgetary reporting, we have designed an empirical study with the following objectives:

- to compare the accrual basis results with the current budgetary result in order to show how they behave, as well as the association between the two variables;

- to analyze what types of differences are more important and the particular items that have more weight;

- to analyze whether there are variations in the differences and association between the two variables over time;

- to test whether there are differences between entities according to their size; and

- to show whether there are differences between geographical areas that reflect cultural differences and traditions.

To accomplish these objectives, we have defined six hypotheses.

H1. Because of conceptual differences between the accrual and budgetary results, they behave differently. A low correlation can therefore be expected between them.

H2. The matching concept can have a relevant effect on the differences, taking into account that depreciation is one of the most important effects of the accrual criterion. At the same time, we are conscious that depreciation and provision expenses are not quantitatively important in local government.

H3. the effect of timing differences in recognition of expenses and revenues can also be important. This effect can be greater in expenses than in revenues. Because of the difficulties of registering revenues under the accrual criterion, governments could try to register revenues with the same criteria in the economic and budgetary subsystems.

H4. As governments gain more experience with accrual accounting, the differences between current budgetary results and economic results increase.

H5. the situation differs according to the size of the local government. Larger cities are supposed to have more sophisticated systems for accrual accounting and, as a consequence, the differences between accrual and budgetary results are greater than in small cities.

H6. there are differences between local entities depending on regions, reflecting the diversity of traditions and cultures.

There are not many empirical papers about the differences between accrual and cash and commitment information in practice, and only the paper of Anessi-Pessina and Stec-colini (2007) has similar objectives to our paper. they also studied the differences between budgetary and accrual-based results for Italian local governments, although they selected only 30 entities. our study tries to take a step forward by using a broader sample of spanish local authorities over an eight-year period, which still allows us to compare the results between the spanish and italian experiences. our paper is also related to accounting management literature (or earnings management in the case of the private sector), where not many studies have been carried out in the local government area. We can highlight Pilcher and Van der Zahn's (2010) study, for example, which analyzes the use of discretionary accrual (i.e., depreciation) to adjust the financial performance. Findings indicate a significant positive association between absolute unexpected depreciation and absolute local government income before capital contributions, and a significant positive association between absolute unexpected depreciation and capital contributions.

Sample and Data

The sample is made up of 1,488 local governments in two Spanish Autonomous Regions (Cataluña, 946, and Valencia, 542) for the period 1998-2005. the reason for choosing these entities was the availability of information. the data have been extracted from the financial statements published on the Internet by the Audit Offices of Cataluña and Valencia (http://www.sindicatura.org and http://www.sindicom.gva.es). We have focused on entities with more than 5,000 inhabitants, because entities with fewer inhabitants use a simplified accounting system and will have greater difficulty in applying the accrual criterion. Nevertheless, we sometimes refer to the group of smaller local governments in order to make comparisons.

The variables for the analysis are the current budgetary result (BR) and the economic result (ER), the difference between them, and the variables that cause those differences. Because of the great heterogeneity in the data we have considered it necessary to standardize them, dividing them by current revenues.

Methodology

To study the degree of association between the BR and ER, we have used the Pearson coefficient of correlation. In order to identify which variable has the greatest weight in the difference between BR and ER, we study the coefficient of correlation between each of the variables and the difference, as well as the dispersion plot. these analyses are complemented by a multiple regression analysis by steps. the dependent variable is the difference between BR and ER and the independent variables are the four groups of differences mentioned previously. In each step the variable with the greatest explanatory power is introduced and the increase in R2 shows the rise in the percentage of variability explained by the variable.

To check whether the difference between the two variables behaves differently over time, we use a simple regression. the dependent variable is the difference between BR and ER and the independent variable is the year. Furthermore, we analyze whether the linear association between BR and ER is statistically different over time, using a general regression model with dummy variables, taking 1998 as the base year.

To test whether there are differences according to population size, we classify local government into three groups and use the ANOVA test for independent samples if the hypotheses (normality and equality of variances) are satisfied, and the Kruskal Wallis test if not.

To analyze the behavior of the difference between BR and BE according to the geographical area, we use a test of differences of means (the t-student test or the non-parametric test of Mann Whitney).

Analysis of Results

Association Between Current Budgetary Result and Economic result

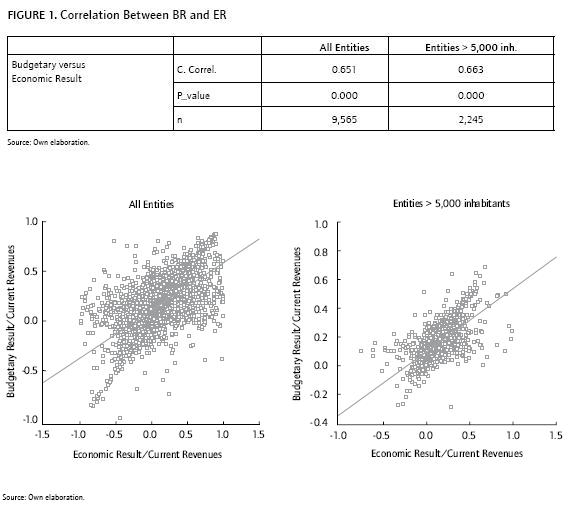

The results of the correlation test show that there is a high correlation between the two variables, and it is even higher if we consider only entities with more than 5,000 inhabitants. Moreover, we can see that the mean of difference is only 0.0408, that is 4.08 percent of current revenues, with a standard deviation of 0.1164. the dispersion plot also shows the high degree of association between the two types of results (Figure 1).

As a consequence, it appears that the theoretical differences between BR and ER are not reflected in practice, and a high association between the two variables shows that in the end the differences in the criteria for obtaining them has not been very relevant. this leads us to reject the first of our hypotheses, in which we propose that they behave differently. similar conclusions were obtained by Anessi-Pessina and steccolini (2007), with a correlation coefficient of 0.61 in 1998 and a smaller one in 2003.

Analysis of differences between budgetary Result and Economic Result

If we group the differences into four types, the coefficients of the Pearson correlation of each of the groups with the difference variable show that the group of variables that most affects the behavior of the difference is the extraordinary items, with a coefficient of 0.756 (strong relation), followed by the matching concept effect with a coefficient of 0.315 (slight relation) and the timing of recognition with a coefficient of 0.207 (very weak relation).

In fact, if we add the extraordinary items to the current budget result, the correlation coefficient with the economic result rises to 0.764 for the group of all municipalities and to 0.871 for municipalities with more than 5,000 inhabitants.

If we break down the analysis for each variable that causes differences, the variable that most affects the difference is the extraordinary items with a coefficient of 0.792, followed by depreciations and provisions with a coefficient of 0.351. this allows us to accept the second hypothesis about the effect of depreciation; although it is not quantitatively important, it causes relevant differences between BR and ER.

We can observe the low weight of the timing of recognition and, in particular, timing of recognition of financial expenses, revenues and capital transfers. As a consequence, we can conclude that there are no important differences between the expenses registered in the economic and budgetary statements. Governments use similar criteria for both statements, due in part to the difficulties of accrual implementation. this leads us to reject our third hypothesis about the effect of accrual in expenses.

Similar conclusions are obtained from the multiple regressions by steps, where we observe that the most influential variable is extraordinary items, which represents 62.7% of the variability. the second most important item is depreciations and provisions, which constitutes an additional 21.5%. Further steps add very little to the explanatory difference.

This analysis shows that the most relevant difference between BR and ER is extraordinary items, which is a logical difference given that the heading appears in the accrual statement only. Depreciation also causes differences between the two variables, although its statistical weight is slight. these results are very similar to those of Anessi-Pessina and Steccolini (2007), where the largest items explaining the differences between current surplus and net income were extraordinary gains, followed by depreciation.

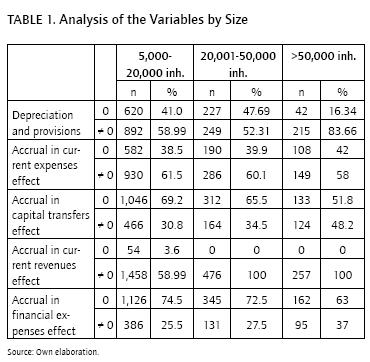

It is interesting to analyze the behavior of these variables by entity size, especially with respect to the null values of the variables. the accounts of 41.01% of entities with a population between 5,000 and 20,000 do not register depreciations or provisions, nor are depreciations registered by 47.69% of local governments with a population between 20,001 and 50,000. this falls to 16.34% for entities with more than 50,000 inhabitants. these results contrast with those of Stalebrink (2007), who concludes that Swedish municipalities use discretion associated with the accounting for write-off and depreciation expenses to manage reported financial performance. More specifically, the findings indicate that governments tend to increase these discretionary accruals if they can be absorbed by a surplus.

A similar situation is seen in the timing of recognition of current expenses, where results show no differences between budgetary and accrual expenses in 40% of cases. there is no difference in this respect between small and larger local governments. the percentage of correlation is even higher in the case of financial expenses, especially in entities with fewer than 50,000 inhabitants, where accrual and budget coincide in 74% of cases. the effect of accrual in capital transfers is null in a very high percentage of cases, too. Finally, the situation is a little different in the case of revenues where budget and accrual do not usually coincide. In most cases the difference is very small (mean of 0.0298, st. deviation of 0.0932). When the sign of this variable is positive it indicates that revenues are higher in budget accounts than in accrual accounts.

To a certain extent, this was stated by Anthony (2000, pp. 7-8) who proposed that at an aggregate level there is only a slight difference between obligations and expenses-the important ones occur in responsibility centers; budgeteers are accustomed to the obligation system. Some argue that expense accounting is easier to manipulate, but playing games with the budget will always be possible; not many people understand or care about the difference between expenses and obligations. From our results we can conclude that in fact the differences between obligations and expenses are slight and this could be because public accountants are not interested at all in expenses, so they register the same in the budget and in the operating statement. As funds continue to be appropriated on an obligation basis, managers will continue to base their decisions on information produced according to the obligation system. "Neither accountants nor managers will pay attention to the information in the expense-based accounts and, consequently, this system will simply atrophy" (Anthony, 2000, p. 8).

Analysis of the Evolution of Differences Between Budgetary Results and Economic Results Over Time

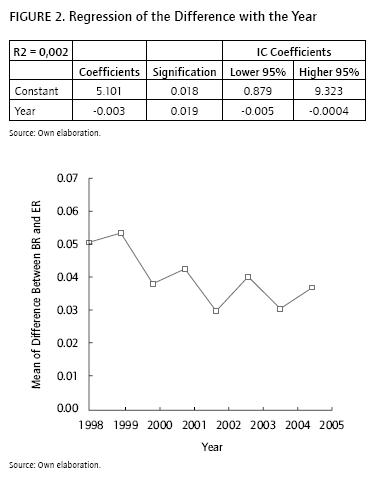

The results of the regression, to test whether the particular year influences the difference between the two variables, shows that the difference between BR and ER is significant and negative over time, 0.003 per year. Looking at Figure 2, however, we can conclude that this relation between BR and ER is very slight, as only 0.2% of the variability of the difference is explained by the year in question. Furthermore, in the plot we can see a great variability in the variable every year and there is no clear tendency.

In a similar way, the regression analysis with dummy variables shows that the correlation between BR and ER is significantly different in 2001 and 2004 compared with other years. In these two years the regression coefficients and the correlation coefficients indicate that the correlation is higher.

This leads us to reject the hypothesis that the length of experience of the entities in the use of accrual accounting increases differences over time. The variability changes greatly in different years and is even negative overall.

These results are a little different to those of Anessi-Pes-sina and Steccolini (2007), who confirmed that the correlation between accrual and budgetary results decreased as experience with the use of accrual accounting increased.

Characteristics of local government as explanatory Variables: size and Geographical Area

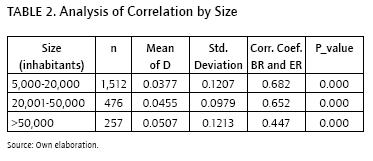

The correlation coefficients between BR and ER by size are shown in Table 2.

The p-value of the Kruskal Wallis test shows significant variations in the difference between BR and ER according to population size. We can see that in populations of between 5,000 and 20,000 inhabitants, the difference between the two variables is significantly lower than in populations of more than 50,000 inhabitants.

In the regressions with dummy variables, we observe that for populations of more than 50,000 inhabitants, the regression coefficient is lower. Therefore, the correlation between the two variables is also lower.

This leads us to accept the hypothesis that larger entities show bigger differences between BR and ER, because they apply the accrual system more effectively. For example, they register depreciation and provisions expenses to a greater extent, and the same is true of the effect of timing of recognition, with greater differences between expenses and revenues in the budget and in the operating statement. These results do not coincide with those of Anessi-Pessina and Steccolini (2007), where no differences in size were shown. This may be because they only included 30 municipalities in their study, classified into two groups (40,000-100,000; >=100,000).

To check whether there are differences by geographical area, we have compared the entities of the two autonomous regions in the study. The result of the Mann-Whitney test (p-value 0.000) indicates that there are significant variations in the differences between BR and ER depending on the region. In Cataluña, the average difference between the two variables is greater than in Valencia. The regression analysis with dummy variables shows that the regression coefficient is larger for Valencia. Therefore, the difference between variables is greater in Cataluña, indicating that to a certain extent its local governments apply the accrual system more strictly. This reflects traditional and cultural differences.

A similar result was found by Anessi-Pessina and Steccolini (2007), who identified differences in geographical areas, with some areas more likely to introduce depreciation. In fact, in a later paper (Anessi-Pessina et al, 2008) they show that the adoption of an integrated system of accruals and budgetary accounting is influenced by such "cultural" variables as the perceptions of Chief Financial Officers and geographical location.

Conclusions and Implications

The accrual system has been widely accepted from a theoretical point of view. In spite of the current debate about its problems and practical difficulties, most accounting frameworks for public entities recommend its application in public administration systems. It is, in fact, one of the main subjects of discussion within the NPM paradigm. Especially interesting is the debate about the conflicts, problems and ambiguities that accrual system implementation can cause (Arnaboldi & Lapsley, 2009; Lapsley, 2009; Lapsley et al., 2009).

One of these ambiguities is the duality of the system, because in most European countries accrual systems coexist with the modified cash basis in budgets, and a great deal of criticism arises due to the problems of coordinating the two systems. A very useful tool for assessing this duality can be the institutional theory, as coupling and decoupling processes appear with the co-existence of accrual and cash-based reports; this fact could be interpreted as an inconsistency or contradiction in the regulatory and reporting behavior of public entities (Archel et al, 2011).

The results of this study show that the differences between financial and budgetary reporting, with respect to the result of the accounting period, are more theoretical than practical. In fact, there is a high correlation between BR and ER. This is because the influence of the differences caused by the matching concept and the timing of recognition is very small. The main difference between BR and ER is extraordinary results. Moreover, many entities do not register depreciation and provisions while many others register the same revenue and expenses in the budget as in the operating statement. This is evidence that the implementation of the accrual system in local entities has been more nominal than real. Accrual statements are prepared but that accrual is not always used, due to the discretionary nature of the standards, as well as many problems of implementation. The problems that remain unresolved are generally recognized, such as the treatment of depreciation of assets. For example, it is difficult to recognize depreciation for entities that may not have an inventory of assets or may have many assets not recognized in the balance sheet.

Although entities may wish to comply with the standards, managers are not necessarily interested in the information obtained through the accrual method and such information is little used in practice. Priority is given to budgetary reporting in political discussion processes and entities consider this information much more important than accrual financial statements. For this reason they are not worried about solving the problems of implementation.

Our results are very similar to those of Anessi-Pessina and Steccolini (2007) for Italy, although the framework is very different because in Spain accrual accounting is mandatory for all local governments, while in Italy only accrual statements are mandatory and some entities derive their statements from budgetary reporting.

Furthermore, the passing of time does not seem to affect the situation. The length of experience of entities in applying the accrual system has not improved its level of use.

There are, however, differences between entities according to their size and cultural and geographical characteristics. Bigger entities show greater differences between BR and ER due to a stricter application of the accrual criterion.

Cultural differences show that in some regions there may be greater propensity to apply the accrual criterion, even though the legislation is applicable nationally.

The results of the study provide evidence that, in practice, the coexistence of the two criteria leads to the predominance of the budgetary criterion, both in budgetary and in financial accounting. Therefore, despite accounting standards regulations providing for the application of the accrual principle, Spanish local entities prepare accrual financial statements that do not in fact apply accrual in many items, such as depreciation. This is probably due to the ambiguities and problems that a dual system can cause, which reduce the interest of politicians and managers in accrual financial statements. The implementation of accrual financial statements in Spanish local governments is more a question of rhetoric than of reality, as previously pointed out by other authors (Guthrie, 1998).

In any case, the advantage of the accrual system with respect to asset and liability information is maintained because they are shown in the balance sheet, which would not be prepared under traditional budgetary reporting. If we really want to change the focus of managers and policy makers towards accrual-based information, the accrual criterion must be adopted for drawing up budgets. If accrual is used for budgets and for financial statements, there will be a single criterion and the problems of coordination will disappear. However, control may be more difficult to exercise in an accrual budget.

References

Adam, B., Mussari, R., & Jones, R. (2011). The diversity of accrual policies in local government financial reporting: An examination of infrastructure, art and heritage assets in Germany, Italy and the UK. Financial Accountability and Management, 27(2), 107-133. [ Links ]

Anessi-Pessina, E., & Steccolini, I. (2007). Effects of budgetary and accruals accounting coexistence: Evidence from Italian local governments. Financial Accountability & Management, 23(2), 113-31. [ Links ]

Anessi-Pessina, E., Nasi, G., & Steccolini, I. (2008). Accounting reforms: Determinants of local governments' choices. Financial Accountability & Management, 24(3), 321-342. [ Links ]

Anthony, R. N. (2000). The Fatal Defect in the Federal Accounting System. Public Budgeting & Finance, 20(4), 1-10. [ Links ]

Archel, P., Husillos, J., & Spence, C. (2011). The institutionalisation of un-accountability: Loading the dice of corporate social responsibility discourse. Accounting, Organisations and Society, 36, 327-343. [ Links ]

Arnaboldi, M., & Lapsley, I. (2009). On the implementation of accrual accounting: A study of conflict and ambiguity. European Accounting Review, 18(4), 809-836. [ Links ]

Barton, A. (2009). The use and abuse of accounting in the public sector financial management reform program in Australia. Abacus, 45(2), 221-248. [ Links ]

Brignall, S & Modell, S (2000). An institutional perspective on performance measurement and management in the new public sector. Management Accounting Research, 11 (3), 281-306. [ Links ]

Broadbent, J., & Guthrie, J. (2008). Public sector to public services: 20 years of contextual accounting research. Accounting, Auditing and Accountability Journal, 21(2), 129-169. [ Links ]

Broadbent, J., & Laughlin, R. (2003). Control and legitimation in government accountability processes: the Private Finance Initiative in the UK. Critical Perspectives on Accounting, 14(1-2), 23-48. [ Links ]

Brusca, I. (1997). The usefulness of local government financial reporting, Financial Accountability & Management, 13(1), 17-34. [ Links ]

Brusca, I., & Montesinos, V. (2011). The usefulness of performance and financial reporting in local government: The Spanish experience. Paper presented to the CIGAR Conference, Ghent, Belgium. [ Links ]

Caperchione, E. (2003). Local government accounting system reform in Italy: A critical analysis. Journal of Public Budgeting, Accounting and Financial Management, 15 (1), 110-145. [ Links ]

Caperchione, E. (2006). The new public management. A perspective for finance practitioners. Paris, France: Federation des Experts Comptables Européens, FEE. [ Links ]

Chan, J. L., & Xiaoyue, C. (2002). Models of Public Budgeting and Accounting Reform, OECD, Paris, France. [ Links ]

Christiaens, J. (2003). Accrual accounting reforms in Belgian local governments: A comparative examination. Journal of Public Budgeting, Accounting and Financial Management, 5(1), 92-109. [ Links ]

Christiaens, J. (2004). Capital assets in governmental accounting reforms: Comparing flemish technical issues with international standards. European Accounting Review, 13(4), 743-770. [ Links ]

Christiaens, J., & Rommel, J. (2008). Accrual accounting reforms: Only for businesslike (parts of) governments. Financial Accountability and Management, 24(1), 59-75. [ Links ]

Cohen, S., Kaimenaki, E., & Zorgios, Y. (2007). Assessing IT as a key success factor for accrual accounting implementation in Greek municipalities. Financial Accountability and Management, 23(1), 91-111. [ Links ]

Ellwood, S. (2003). Bridging the GAAP across the UK public sector. Accounting and Business Research, 33(2), 105-121. [ Links ]

Ellwood, S., & Newberry, S. (2007). Public sector accrual accounting: Institutionalising neo-liberal principles? Accounting, Auditing & Accountability Journal, 20(4), 549-573. [ Links ]

Federation des Experts Comptables Européens-FEE (2003). The adoption of accrual accounting and budgeting by governments (central, regional and local). Retrieved from http://www.fee.be. [ Links ]

Guthrie, J. (1998). Application of accrual accounting in the Australian public sector-rhetoric or reality? Financial Accountability and Management, 14(1), 1-18. [ Links ]

Hood, C. (1995). Emerging issues in public administration. Public Administration, 73(1), 165-183. [ Links ]

Jones, R., & Pendlebury, M. (2004). A theory of the published accounts of local authorities. Financial Accountability & Management, 20(3), 305-325. [ Links ]

Jones, R., & Lüder, K. (2011). The federal government of Germany's circumspection concerning accrual budgeting and accounting (with Klaus Lüder). Public Money and Management, 31(4), 265-227. [ Links ]

Jorge, S. (2007). A comparative-international theory for Portuguese local government accounting. Polytechnical Studies Review, IV(7), 211-234. [ Links ]

Jorge, S., Carvalho, J. B., & Fernandes, M. J. (2007). Governmental accounting in Portugal: Why accrual basis is a problem. Journal of Public Budgeting, Accounting and Financial Management, 19(4), 411-446. [ Links ]

Lapsley, I. (1999). Accounting and the new public management: Instruments of substantive efficiency or a rationalising modernity? Financial Accountability & Management, 15(3-4), 201-207. [ Links ]

Lapsley, I. (2009). New public management: The cruellest invention of human spirit? Abacus, 45(1), 1-17. [ Links ]

Lapsley, I., Mussari, R., & Paulsson, G. (2009). On the adoption of accrual accounting in the public sector: A self-evident and problematic reform. European Accounting Review, 18(4), 719-723. [ Links ]

Lüder, K. (2008). Accrual accounting in German governments. In R. C. W. Eken and P. M. van der Zanden (Eds.), Het Beroep Accountant Central (pp. 73-86). Tilburg: Universiteit van Tilburg. [ Links ]

Lüder, K., & Jones, R. (Eds.) (2003). The diffusion of accrual accounting and budgeting in european governments - A cross country analysis. In K. Lüder and R. Jones (Eds.), Reforming governmental accounting and budgeting in Europe (pp. 13-58). Frankfurt/Main: Fachverlag Moderne Wirtschaft. [ Links ]

Modell, S. (2001). Performance measurement and institutional processes: a study of managerial responses to public sector reform. Management Accounting Research, 12(4), 437-464. [ Links ]

Modell, S. (2004). Performance measurement myth in public sector. A research note. Financial Accountability and Management, 20(1), 39-55. [ Links ]

Newberry, S. (2007). Where to next with governmental financial reporting? National Accountant, 23(2), 18-20. [ Links ]

OECD. (2002). Accrual accounting and budgeting - Key issues and recent developments. Paris: OECD. [ Links ]

Paulson, G. (2006). Accrual accounting in the public sector: Experiences from the Central Government in Sweden. Financial Accountability and Management, 22(1), 47-62. [ Links ]

Pilcher, R., & Dean, G. (2009). Consequences and cost of financial reporting compliance for local government. European Accounting Review, 18(4), 725-744. [ Links ]

Pilcher, R., & Van der Zahn, M. (2010). Local governments, unexpected depreciation and financial performance adjustment. Financial Accountability and Management, 26(3), 299-324. [ Links ]

Pina, V., Torres, L., & Yetano, A. (2009). Accrual accounting in EU local governments: One method, several approaches. European Accounting Review, 18(4), 765-807. [ Links ]

Ridder, H. G., Bruns, H. J., & Spier, F. (2005). Analysis of public management change processes: The case of local government accounting reforms in Germany. Public Administration, 83(2), 443-447. [ Links ]

Ryan, C.M., Guthrie, J., & Day, R. (2007). Politics of financial reporting and the consequences for the public sector. Abacus, 43 (4), 474-487. [ Links ]

Stalebrink, O. (2007). An investigation of discretionary accruals and surplus-deficit management: Evidence from Swedish municipalities. Financial Accountability & Management, 23(4), 451-458. [ Links ]

Van der Hock, M. P. (2005). From cash to accrual budgeting and accounting in the public sector: The Dutch experience. Public Budgeting and Finance, 25(1), 32-45. [ Links ]

Vinnari, E. M., & Nasi, S. (2008). Creative accrual accounting in the public sector: 'Milking' water utilities to balance municipal budgets and accounts. Financial Accountability & Management, 24(2), 97-116. [ Links ]

Wynne, A. (2008). Accrual accounting for the public sector-A fad that has had its day? International Journal of Governmental Financial Management, 8(2),117-132. [ Links ]

Zimmerman, J. L. (1977). The municipal accounting maze: An analysis of political incentives. Journal of Accounting Research, 15, 107-144. [ Links ]