Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Innovar

Print version ISSN 0121-5051

Innovar vol.24 no.spe Bogotá Dec. 2014

https://doi.org/10.15446/innovar.v24n1spe.47563

http://dx.doi.org/10.15446/innovar.v24n1spe.47563

The Influence of Entrepreneurial Learning in New Firms' Performance: A Study in Costa Rica1

La influencia del aprendizaje empresarial en el desempeño de nuevas firmas: Un estudio en Costa Rica

L'influence de l'apprentissage entrepreneurial sur les résultats des nouvelles entreprises: Une étude au Costa Rica

Influência do aprendizado empresarial no desempenho das empresas emergentes: O caso da Costa Rica

Juan Carlos LeivaI, Ricardo MongeII, Joaquin AlegreIII

I Ph. D. Professor at Technological Institute of Costa Rica. Business School. Cartago, Costa Rica, Central America. E-mail: jleiva@itcr.ac.cr

II Ph. D. Professor at University of Valencia, Spain. Dept. of Management 'Juan Jose Renau Piqueras'. Valencia, Spain. E-mail: joaquin.alegre@uv.es

III Ph. D. Professor at Technological Institute of Costa Rica. Business School. Cartago, Costa Rica, Central America. E-mail: rmonge@caatec.org

Correspondencia: Joaquin Alegre. University of Valencia, Spain. Department of Management 'Juan Jose Renau Piqueras'. Avda. de los Naranjos, s/n, 46022 Valencia, Spain.

Citación: Leiva, J. C., Alegre, J., & Monge, R. (2014). The Influence of Entrepreneurial Learning in New Firms' Performance: A Study in Costa Rica. Innovar, vol. 24, Edición Especial 2014, 129-140.

Clasificación JEL: M13, L26.

Recibido: Mayo de 2012, Aprobado: Enero de 2014.

Abstract:

The creation of new firms is important for the economy, and entrepreneurial learning is essential for the performance of new firms. We contribute to existing knowledge by combining these two topics and considering a third one: The role of multinational companies (MNCs) as a source of learning for the entrepreneur. This approach has rarely been taken in the literature. We investigated the performance of a group of young companies created by former employees of MNCs and their relationship with entrepreneurial learning in such companies. The study was based on a sample of 175 former employees of MNCs in Costa Rica, who founded their own firm between 2001 and 2007. The control group was formed in the same sectors and over the same time period, but contained people who were not former employees of MNCs. We found a positive linear relationship between post-start-up entrepreneurial learning and performance. No relationship was found between pre-start-up entrepreneurial learning and performance. We did not find significant differences in entrepreneurs with work experience in MNCs. This poses interesting questions for future work.

Key words: Entrepreneurial learning, entrepreneurial performance, knowledge relatedness, business plans, start-ups.

Resumen:

La creación de nuevas firmas es importante para la economía. El aprendizaje emprendedor es fundamental para el desempeño de las nuevas firmas. Este artículo contribuye al conocimiento combinando los dos temas anteriores y considerando el papel que cumplen las empresas multinacionales (EIVIN) como fuentes de aprendizaje emprendedor. Este enfoque ha sido poco abordado en la literatura. El trabajo investigó el desempeño de un grupo de empresas de reciente creación, formadas por exempleados de EMN y su relación con el aprendizaje emprendedor en dichas empresas. El estudio se basó en una muestra de 175 exempleados de EMN en Costa Rica, que dejaron sus puestos de trabajo y formaron sus propias empresas entre los años 2001-2007. Se trabajó con un grupo de control de firmas formadas en los mismos sectores y lapsos pero por personas que no fueron empleadas de EIVVN. Hallamos una correlación positiva entre el aprendizaje emprendedor posterior a la creación de la empresa y el desempeño. No asi entre el aprendizaje emprendedor previo y el desempeño. No hallamos diferencias significativas entre emprendedores por haber tenido experiencia en EIVVN. Esto deja planteadas preguntas interesantes para futuros trabajos.

Palabras clave: aprendizaje emprendedor, desempeño emprendedor, relación de conocimiento, planes de negocios, creación de empresas.

Résumé:

La création de nouvelles entreprises est importante pour l'eco-nomie. L'apprentissage entrepreneurial est fondamental pour le résultat des nouvelles entreprises. Cet article contribue à la connaissance en com-binant les deux thèmes precedents et en considérant le rôle que jouent les entreprises multinationales (EIVVN) comme sources d'apprentissage entrepreneurial. Cette approche a été peu abordée dans les publications. Le travail a étudié le résultat d'un groupe d'entreprises de création récente, constituées par d'anciens employes d'EVVN et leur relation avec l'apprentissage entrepreneurial dans ces entreprises. L'etude se base sur un échan-tillon de 175 ex employes d'EVVN au Costa Rica qui ont laissé leurs emplois et créé leurs propres entreprises dans les années 2001-2007. Le travail s'est fait avec un groupe de controle d'entreprises formées dans les mêmes secteurs et à la même époque mais par des personnes qui n'avaient pas été employees par des EIVVN. Nous trouvons une relation positive entre l'apprentissage entrepreneurial prealable à la creation de l'entreprise et le resultat. Il n'en va pas de même lorsque l'apprentissage entrepreneurial est posterieur. Nous ne trouvons pas de differences notables chez les entrepreneurs qui ont eu une experience dans des EIvVN. Cela pose d'interessantes questions pour de futurs travaux.

Mots-clés: Apprentissage entrepreneurial, performance entrepreneu-riale, relation de connaissance, plans d'affaires, creation d'entreprises.

Resumo:

A criação de novas empresas e importante para a economia. O aprendizado empresarial e fundamental para o desempenho das novas empresas. Este artigo contribui para o conhecimento, combinando os dois temas anteriores e considerando o papel das empresas multinacionais (EIVVN) como fontes de aprendizado empresarial. Esta visão não tem sido muito abordada na literatura. O trabalho estudou o desempenho de um grupo de empresas criadas recentemente, formadas por antigos empregados de EIVVN e a sua relação com o aprendizado empresarial nessas empresas. O estudo se baseou em uma amostra de 175 antigos empregados de EIvVN na Costa Rica, que deixaram os seus empregos e conformaram as suas próprias empresas entre os anos 2001 e 2007. O trabalho foi realizado com um grupo de controle de empresas conformadas nos mesmos setores e tempos, mas por pessoas que não foram empregados de EIVVN. Encontramos uma correlação positiva entre o aprendizado empresarial anterior à criação da empresa e o desempenho. Não entre o aprendizado empresarial posterior e o desempenho. Não encontramos diferenças significativas entre empreendedores por ter tido experiência em EIVVN. Isto deixa algumas perguntas interessantes para futuros trabalhos.

Palavras-chave: Aprendizado empresarial, desempenho empresarial, relação de conhecimento, planos de negócios, criação de empresas.

Introduction

This paper seeks to contribute to understanding of the relationship between entrepreneurial learning and the performance of young firms, from the theoretical perspective of the knowledge-based view, and in the context of multinational companies (MNCs) as a source of resources and capabilities for the entrepreneur. This approach has rarely been taken in the literature.

The topic is important for a number of reasons. First, firm creation is very important for economic growth (Audretsch & Keilbach, 2004). Second, when a firm is young it depends heavily on the founder's knowledge. Therefore, the concept of entrepreneurial learning becomes fundamental to the performance of these companies (De Clercq & Arenius, 2006; Dencker, Gruber & Shah, 2009; Voudouris, Dimitratos & Salavou, 2010). Third, MNCs are today a key player for the global economy and one of the most important aspects of this is the impact that those MNCs can have on their hosts' local business (Spencer, 2008).

Little is known about the triangulation of topics proposed here. A paper by Gõrg and Strobl (2004) found higher productivity in a group of companies in Ghana that were created by former employees of MNCs. In Latin America, Vera and Dutrenit (2007) associated a further development of technological and managerial capabilities with entrepreneurs' prior work experience, in this case in MNCs installed in Mexico. As we can see, these are specific features relating to productivity and capabilities.

When we look at the three topics separately, there is more that can be said. In relation to firm creation, the Global Entrepreneurship Monitor (GEM, 2008) provides useful information about the process of startups, the people involved in them, and the contexts where new firms are created. In the case of Latin America, there are various papers on this topic (Amorós, 2011). In addition, there are several works sponsored by the Inter-American Development Bank (IADB) that also describe the entrepreneurial process in Latin America (Kantis, Moori & Angelelli, 2004).

As for entrepreneurial learning, there are several scholars that address the issue from a theoretical perspective (Minniti & Bygrave, 2001; Politis, 2005; Rae, 2006), while others address the issue empirically (De Clercq & Arenius, 2006; Dencker et al., 2009; Voudouris, et al., 2010). Often there is no link between approaches. It is also noteworthy that evidence of the relationship between entrepreneurial learning and the performance of young companies is contradictory (Brinckmann, Grichnik & Kapsa, 2010; Dencker et al., 2009; Sapienza, Parhankangas & Autio, 2004). We did not find papers that address this issue in Latin America.

On the topic of MNCs, their impact has been studied from various perspectives (Di Guardo & Valentini, 2007). In our field of interest-the impact of MNCs on local businesses via knowledge spillovers-there are few papers. As previously noted, Gõrg and Strobl (2004) addressed it from the perspective of productivity, and Vera and Dutrenit (2007) from technological and managerial capabilities.

Thus, we intend to contribute to the study of the relationship between the performance of young companies created by former employees of MNCs based in Costa Rica, and the entrepreneurial learning of entrepreneurs who were MNC employees. We also contrast this with a control group consisting of identical enterprises (in terms of commercial sector and time of founding), but founded by entrepreneurs who never worked in MNCs.

In this study, the concept of entrepreneurial learning was operationalized by three variables: Having a business plan; pre-start-up training that proved useful to the entrepreneur in setting up his or her firm; and knowledge relat-edness (Davidsson & Honig, 2003; Dencker et al., 2009; Sapienza et al., 2004; West & Noel, 2009). In all three variables, the relationship with firm performance is contradictory (Bhide, 2000; Dencker et al., 2009; Liao & Gartner, 2006; Sapienza et al., 2004; West & Noel, 2009; Wiklund & Shepherd, 2003).

In the following sections, this paper continues with the theoretical framework, methodology, results, discussion, and conclusions.

Theory

Entrepreneurial Learning

We understand entrepreneurial learning as "the process by which people acquire, assimilate, and organize newly formed knowledge with preexisting structures-and how learning affects entrepreneurial action" (Holcomb, Ireland, Holmes & Hitt, 2009). Notice that the concept involves three actions: Acquiring, assimilating and organizing.

Entrepreneurial learning can be acquired in three ways: Experientially, vicariously, or through formal, explicit, and codified acquisition (Holcomb et al., 2009). Experiential acquisition occurs when entrepreneurs learn from experience and accumulate new knowledge in their memories. Experience is represented figuratively and is then transformed into new knowledge. Vicarious acquisition occurs through the observation of other people's behaviors or actions, and their results in terms of social reward or censure. Formal, explicit, and codified acquisition takes place when the entrepreneur consults formal sources such as books and articles, or undergoes training.

Assimilation refers to how people process and interpret the new information they have acquired, from which their memories derive meanings and associations (Mandler, 1967). Assimilation can take place in two ways: By extension and by intension. In the case of the former, people assimilate through the active application of their ideas or concepts in the real world, whereas in the latter, internal reflection predominates (Corbett, 2005).

Organization reflects the mental structures and connections that people's memories make with the assimilated information; in other words, the way new acquired and assimilated knowledge is structured or linked together with previous existing knowledge and later used in entrepreneurial activity (Holcomb et al., 2009). This capacity varies from one person to another and can be defined as an incremental process of adaptation (Levinthal & March, 1993).

Entrepreneurial learning has been associated with a concept of learning history, in other words, all the accumulated knowledge that a person has generated (consciously or otherwise) throughout his or her life, and that may be useful in setting up a new venture (Minniti & Bygrave, 2001). This accumulated knowledge will also condition the learning that takes place during the entrepreneurial process. The accumulation of knowledge may also be conceptualized as part of the entrepreneurial learning process itself (Cope, 2005). Consequently, two stages of learning can be referred to: Pre-start-up learning and post-start-up learning (Cope, 2005).

Entrepreneurial learning is therefore decisive in the performance of young firms (De Clercq & Arenius, 2006; Dencker et al., 2009, Harrison & Leitch, 2005; Ravasi & Turati, 2005; Voudouris et al,, 2010).

Knowledge Spillovers: MNCs as a Source of Learning

The study of MNCs and their effects on host economies has generated contradictory results. One set of studies has found positive results, such as demonstrated effects on local firms, some informal interactions (with clients, suppliers, allies, etc.), formal alliances, and labor mobility (transfer of qualified employees to local firms for example). In contrast, other research has revealed negative effects such as the displacement of local firms, and increased cost of production factors as a result of the competitive effects generated in, for example, the employment and financial markets (Burke, Gorg & Hanley, 2008; Javorcik, 2004; Spencer, 2008).

When analyzed with a specific focus on learning, one of the most relevant factors is that of knowledge spillover effects. Knowledge spillover is understood as the use a local firm makes of knowledge created by an MNC, without any recompense by the local firm to the MNC for this knowledge (Javorcik, 2004). Spencer (2008) proposed that firms founded by higher level former MNC employees (spinoffs) would be the best channel for the diffusion of knowledge from MNCs to the local business community as a whole. However, little research attention has been given to this proposition (Gõrg & Strobl, 2004; Vera & Dutrénit, 2007).

Entrepreneurial Learning and Performance

The knowledge-based view proposes that the basic function of all companies is to create and apply knowledge (Grant, 1996; Nonaka, 1994). Within this framework, knowledge has become the most relevant resource a company can possess to generate competitive advantage and superior sustainable performance (Grant, 1996). Organizational knowledge is embedded both in its employees and in the firm's organizational culture, routines, policies, systems, and procedures (Alavi & Leidner, 2001; Alegre, Sengupta & Lapiedra, 2012).

Young firms are therefore more dependent on knowledge generated by its founding entrepreneurs, at least while the organization matures, and creates and applies its own organizational learning processes. Therefore, we can say that entrepreneurial learning is decisive in the performance of young firms (Dencker et al., 2009; Voudouris et al., 2010; Zhang, Soh & Wong, 2010).

The concept of entrepreneurial learning has been opera-tionalized and described in various ways. We selected three: Drafting business plans, pre-start-up training, and knowledge relatedness (Dencker et al., 2009; Liao & Gartner 2006; Sapienza et al, 2004; West & Noel, 2009). The first two describe the pre-start-up entrepreneurial learning and the third the post-start-up entrepreneurial learning.

The use of business plans has been extensively explored. The relationship between business plan and performance is not clear-cut and is the subject of academic debate. Some studies have associated drafting a business plan with better prospects of survival for young firms (Brinckmann et al., 2010; Delmar & Shane, 2004; Gruber, 2007; Liao & Gartner, 2006), while others have found no link between the two (Bhide, 2000; Dencker et al, 2009). In our case, we were guided by the findings of a recent paper that associated it with better performance using meta-analysis (Brinckmann et al, 2010).

Pre-start-up training refers to training received on a voluntary basis in the workplace or outside the formal education system (Davidsson & Honig, 2003). Results tend to have a positive link with entrepreneurial activity, particularly when the person's industry and gender are controlled for (Gimeno, Folta, Cooper & Woo, 1997; Robinson & Sexton, 1994).

Knowledge relatedness is understood as the degree of similarity between a firm's knowledge and that of its parent (the company the entrepreneur leaves to set up his or her own firm). Two positions exist with regard to knowledge relatedness. The first is that of scholars who find a positive linear association between knowledge relatedness and enhanced business performance (West & Noel, 2009). The second position is taken by those who propose a curvilinear relationship (in the shape of an inverted U) between knowledge and new venture performance (Sapienza et al, 2004). In our case, we have followed the first position.

The concept of firm performance is by no means easy to determine, even more so in the case of young firms (Delmar & Shane, 2004). It is therefore important to consider performance from the perspective of constructing competitive advantages that are sustainable over time. Since this research deals with young firms and focuses on knowledge, the most suitable measures to evaluate performance are general (sales and financial) and innovation results (Gruber, 2007; West & Noel, 2009).

In the case of general performance (sales and financial), the literature offers various measurement methods: Profitability, sales, financial results, employees, and competitive position, among others (West & Noel, 2009). We selected sales and financial results in order to balance two complementary perspectives.

In light of these arguments we propose the two first hypotheses of the study:

H1a: Pre-start-up entrepreneurial learning has a positive impact on firm performance

H1b: Post-start-up entrepreneurial learning has a positive impact on firm performance

Innovation is similarly difficult to evaluate (Flor & Oltra, 2004), although it has recently gained importance within the resources and capabilities approach. This is because it is associated with superior performance and with the construction of dynamic capabilities that at the same time lead to greater sustainable competitive advantages (Akgun, Keskin, Byrne & Aren, 2007).

We understand innovative performance as the competitive position that the company achieves as a result of its management of new products and services in the market (Akgun et al, 2007).

We did not find papers relating innovative performance to entrepreneurial learning using the same terms as our approach, but there were studies that analyzed sales and financial performance (Akgun et al, 2007) as well as knowledge management (Alegre & Lapiedra, 2005).

From this another two hypotheses arise:

H2a: Pre-start-up entrepreneurial learning has a positive impact on innovative performance

H2b: Post-start-up entrepreneurial learning has a positive impact on innovative performance

Method

Sample

In Costa Rica, 46,864 MNC employees left their jobs between 2001 and 2007 (Monge, Mata & Vargas, 2008). Of this total, 11,120 withdrew from the labor market altogether. One may assume that they no longer worked in Costa Rica, they retired, they devoted their time to personal matters, or they set up their own companies. This latter group was the focus of our sample: Former employees of MNCs in Costa Rica who left their jobs and set up their own companies.

The simple random sampling technique was applied. A total of 175 questionnaires were gathered from the target group, with a margin of error of 7% and a confidence level of 95%. The questionnaires were completed over the telephone between June and September 2010. A control group was formed (n 181) including companies created in the same sectors and over the same period, but by people who had never been employed by MNCs.

The method allows inferences to the entire population, which helps prevent methodological problems (i.e. Low response rates) (Dean, Shook & Payne, 2007; Mullen, Budeva & Doney, 2009). The fieldwork was performed by Unimer Research International by telephone between June and September, 2010.

Dependent Variables

The first dependent variable was firm performance. Specifically, we used sales growth and financial return (West & Noel, 2009) from start-up to the time of the study. To this end, we used two questions from West and Noel (2009), asking the entrepreneurs' opinions (on a Likert scale) about the sales growth and financial return of their firms vis-à-vis their competitive environment. The questions were translated from the original English into Spanish. We decided to use a subjective measurement of performance, because figures for sales and profits are difficult to obtain in this type of company (Gruber, 2007).

The second dependent variable was innovative performance. In this study we applied a subjective measure used by Akgun et al. (2007), consisting of four questions (on a Likert scale) relating the firm's competitive environment with the following elements: The time taken to introduce new products; the perception of these products as innovative in the market; the competitive position; and total introduction of new innovative products and/or services in a given time period. The questions were translated from the original English into Spanish.

Independent Variables

The first independent variable was pre-start-up entrepreneurial learning. It was operationalized through two components: The use of a business plan, and training that proved useful in setting up the new venture.

A simple yes or no question was used to ask entrepreneurs whether or not they had used a business plan, translated from the original in English (Liao & Gartner, 2006) to Spanish. In this sense our argument is that, in the business plan, entrepreneurs displayed their knowledge and experience (Liao & Gartner, 2006), much of which will be a result of their experience in MNCs (Spencer, 2008).

They were also asked a similar question about whether they had received training in their former MNC job, and whether it had been useful in setting up their own venture. Although one would expect a MNC to provide training for employees to improve their performance, knowledge spillovers may also occur. This would be that such training is applied to the new company founded by the entrepreneur when he or she leaves the MNC. Ergo, the training not only improves the performance of the person in the MNC, also its future performance, for example as an entrepreneur.

The second independent variable was post-start-up entrepreneurial learning. This variable was operationalized through the concept of knowledge relatedness (Sapienza et al, 2004; West & Noel, 2009). Specifically, knowledge relatedness was considered as a positive, linear indicator of entrepreneurial learning (West & Noel, 2009). We applied the same question used by West and Noel (2009), but followed Sapienza et al. (2004), to include three areas: Strategy, operations, and marketing activities. The three questions were translated from the original English into Spanish.

Control Variables

The control variables used were as follows: The entrepreneur's age at new venture start-up; the presence of founding partners; the entrepreneur's academic training; type of experience in previous job; and type of company (target group versus control group). Various studies have found that the age variable can have a differentiating effect in new venture start-up processes (GEM, 2008). We requested information on the number of partners involved in setting up the new venture, since the presence of founding partners is a component of social capital that plays an important role in firms' initial learning and development processes (Davidsson & Honig, 2003). Academic training is also a relevant human capital component with a notable influence on the entrepreneurial process, as reported in numerous studies (Weisz, Vassolo & Cooper, 2004). The type of work experience (managerial and in the same sector as the new venture, as opposed to others) has also been shown to have an important influence on new venture start-up processes (Dencker et al, 2009). Finally, the entrepreneur's previous employment in an MNC (target group) as opposed to another type of company was also included as a control variable.

Analyses

Two regressions were used, each of which associated entrepreneurial learning (before and after start-up) with firm performance (sales and financial returns) and innovative performance. The use of regressions is a robust technique and is accepted in the studies of entrepreneurship (Dean et al, 2007; Mullen et al, 2009).

Specifically, the regressions used were as follows:

P = α1 Pre + ß1 Post + λ1 control

where "P" represents firm performance, "Pre" is pre-start-up entrepreneurial learning, and "Post" is post-start-up learning.

Similarly, innovative performance (I) was correlated in the following regression:

I = α1 Pre + ß1 Post + λ1 control

where "I" is innovative performance, "Pre" is pre-start-up entrepreneurial learning, and "Post" is post-start-up learning.

The model variables were constructed as follows. In the case of firm performance (P) the responses to the original questions (on a 5-point Likert scale) were added together, and an indicator labeled "firm performance" was then created that therefore had a maximum value of 10 and a minimum value of 2. Finally, this was divided by 10 to give a range of 0 to 1. This index creation procedure has been used in other studies, and is a good proxy for objective performance indicators (Akgun et al., 2007; Gruber, 2007; Lumpkin & Dess, 1995).

As in the previous case, an indicator was also created for innovative performance (I), labeled "innovative performance", by adding together the four responses to the relevant questions. A maximum value of 40 and a minimum value of 4 was therefore obtained. This was divided by 40 to give a range of 0 to 1 (Gruber, 2007; Lumpkin & Dess, 1995).

In the case of pre-start-up entrepreneurial learning (Pre), the related questions were re-codified; a value of 1 represents having a business plan and having received training useful for new venture start-up, and a value of zero represents a negative response. The two responses were then added together to construct an index of pre-start-up entrepreneurial learning, which could take a maximum value of 2 and a minimum of 0. This was then divided by 2 to give a value of 0 to 1 (Gruber, 2007; Lumpkin & Dess, 1995).

An index for post-start-up learning (Post) was also created by summing the three responses to related questions, labeled 'knowledge relatedness', which could reach a maximum value of 30 and a minimum of 3. As in the previous cases, it was divided by the magnitude of the range, in this case 30, to give a value of 0 to 1 (Gruber, 2007; Lumpkin & Dess, 1995).

The procedure for the control variables was as follows. Ages of 36 years and over were given a value of (1), and younger than 36 (0), 36 being the average age of Costa Rican entrepreneurs (Leiva, 2009). The absence of founding partners was given a value of (1), whereas the presence of partners was (0), since 53% of Costa Rican entrepreneurs start up their firms on their own (Leiva, 2009). The academic training of the founding partner interviewed was classified as either university (1) or non-university (0). Previous employment experience was classified as managerial or supervisory positions (1) or other positions (0). These last two variables reflect the difference in human capital deriving from university education and managerial experience in the new venture start-up process (Davidsson & Honig, 2003). Type of company was the target group (1) or the control group (0).

Finally, the statistical regression model was estimated following the stepwise method using the SPSS software package (version 17).

Results

Sample Composition

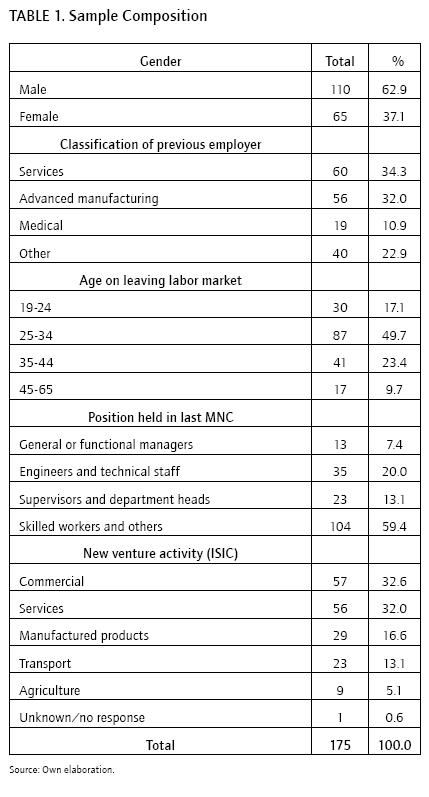

The composition of the sample (Table 1) shows a predomination of men aged between 25 and 34, with previous work experience as operatives in service or advanced manufacturing MNCs.

Entrepreneurial Learning Process

With regard to pre-start-up entrepreneurial learning, 56% of the entrepreneurs reported having prepared a business plan before start-up. The result for the control group was slightly lower, but not significantly different (49.2%). There was also no difference with other Costa Rican entrepreneurs (Leiva, 2008, 2009) or similar international contexts (GEM, 2008; Kantis et al, 2004).

In terms of training received in the MNC useful for setting up a new venture, 27.4% reported having received no training, and 22.9% had received training but did not consider it beneficial to starting up their business. Among those who had received useful training for starting up their firm, the most frequently mentioned areas of training were customer service (11.4%), human resources (8%), and marketing (4%). In total, 44% (excluding those who did not answer) had received training useful for setting up a new venture. In the control group this result was 19%. This reflects a difference between training that MNCs provide compared to local companies.

The post-start-up entrepreneurial learning process was analyzed from three perspectives: Strategy, operations, and marketing. Similarity of strategy gave an average result of 2.64 (on a 10-point Likert scale), placing the classification very close to "totally different". In other words, former MNC employees who went on to set up their own firms generally followed completely different business strategies from those of their previous employers. In contrast, the average for the control group was 5.43 and the difference between means was significant. A similar trend emerged in the results for operations. The target group average was 2.59, tending towards "very different", whereas the value for the control group was 5.43, with a significant difference between the two. The results for marketing were similar: A mean of 2.6 for the target group, compared to 5.8 for the control group. In all cases the differences with the control group were significant.

Performance and Entrepreneurial Learning

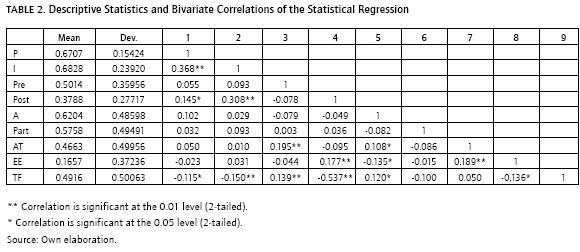

Table 2 presents the descriptive statistics and correlations of the variables included in the regression. All the variables were included: Firm performance (P), Innovative performance (I), Pre-start-up Entrepreneurial Learning (Pre), Post-start-up Entrepreneurial Learning (Post), Age (A), Presence of Partners (Part), Academic Training (AT), Employment Experience (EE), and Type of Firm (TF).

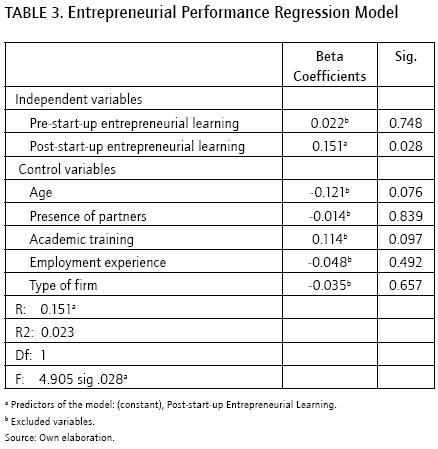

Our first two hypotheses predicted a positive association between both pre- and post-start-up entrepreneurial learning and young firm performance. The results of the regression (Table 3) do not show a significant relationship in the case of pre-start-up entrepreneurial learning (sig 0.748), though there is such a relationship for post-startup entrepreneurial learning (sig 0.028). These results lead us to reject hypothesis H1a and accept H1b. Hence, we cannot claim that pre-start-up entrepreneurial learning has a positive impact on firm performance, although this is the case for post-start-up entrepreneurial learning.

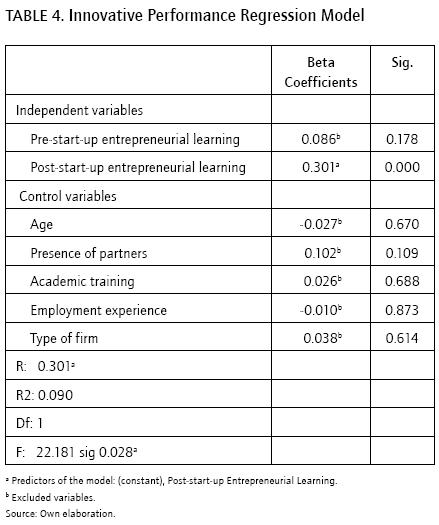

With regard to entrepreneurial learning and innovative performance, hypotheses H2a and H2b predicted a positive relationship between both pre-start-up and post-startup entrepreneurial learning and innovative performance. The results, as shown in Table 4, are similar to those for hypotheses H1a and H1b There was no significant relationship in pre-start-up entrepreneurial learning (sig 0.178); however, there was a significant relationship in post-startup entrepreneurial learning (sig 0.000). Based on these results, we reject hypothesis H2a and accept hypothesis H2b. In other words, pre-start-up entrepreneurial learning cannot be said to have a positive impact on innovative performance, whereas the opposite is true in the case of post-start-up entrepreneurial learning.

The control variables did not alter these results (Tables 3 and 4). It was consistently shown that post-start-up entrepreneurial learning is positively related to the performance of the company, regardless of the presence of founding partners, the entrepreneur's academic training, type of experience in previous jobs, or type of company (target group versus control group). This last point is worth mentioning, as it implies that, seen from the knowledge perspective, the implementation of strategies similar to those observed in the MNC where the entrepreneurs previously worked does not lead to marked differences in performance.

Discussion

This paper seeks to further understanding of the relationship between young firms and entrepreneurial learning from the theoretical perspective of the knowledge-based view, and in the context of MNCs as a source of resources and capabilities for the entrepreneur. Accordingly, we described the entrepreneurial learning of a group of entrepreneurs that were previously employees of MNCs in Costa Rica and also sought to determine the relationship between entrepreneurial learning and performance of the entrepreneurs' start-up firms.

In the description of entrepreneurial learning, most entrepreneurs claimed to have drawn up a business plan before launching their own firm, and reported not having received training in their previous MNC jobs that proved useful in setting up their new ventures. After launching their firms, these entrepreneurs used general business, operations, and marketing strategies that differed markedly from those followed by their former MNC employers. This last point shows a significant difference from the control group, in which knowledge relatedness was higher. One possible explanation could be that MNCs have more structure and specialization of functions, which causes employees to be less exposed to the company as a whole, and the markets.

Our study hypothesized that pre-start-up and post-startup entrepreneurial learning would have a positive and direct influence on firm performance and innovative performance. However, the results do not support this hypothesis with regard to pre-start-up entrepreneurial learning. This finding can be added to the long list of divergent opinions on the benefits of drawing up a business plan and undergoing training for starting up a new firm (Bhide, 2000).

It is important to remember that there are a number of authors who seriously question the benefits of writing a business plan and advocate a more pragmatic approach in the creation of companies (Bhide, 2000). Our results, overall, appear to support the general idea that writing a business plan does not result in better performance. We explored this question further through a series of ad hoc tests, which did not reveal different results when some social and human capital variables were considered as control variables (Dencker et al, 2009).

One possible explanation for our results may lie in associating the benefits of a business plan with the specific dynamism of the business sector the entrepreneur has chosen to enter (Gruber, 2007). In the present case, the relative absence of positive impacts on firm performance in firms that had a business plan before start-up may be attributed to a specific contextual situation, as Gruber (2007) posits.

This author found that the benefits of having a business plan are more pronounced in highly dynamic, competitive contexts.

With regard to training, it should be remembered that our study focuses on training received while the entrepreneur was employed by an MNC prior to starting up his or her own firm. It is logical to expect that such training would address the immediate functions and responsibilities of employees in their present positions; MNCs would be unlikely to design training courses to effectively help their employees start up their own businesses. Clearly, the effects of training would be collateral or secondary, but this aspect was included in our study because we were particularly interested in the role of MNCs as providers of resources for starting up firms.

As our study shows, only a minority of respondents reported having had training in their previous MNC positions that proved beneficial when they were starting up their own new ventures. As part of the entrepreneurial learning process, this training experience was not significantly associated with enhanced performance. Our finding coincides with Davidsson and Honig (2003), who associated human capital with the identification of business opportunities, but not with their successful exploitation. In this regard, the interesting thing is that the training received by entrepreneurs in companies where they previously worked had no impact on the performance of their companies, regardless of them receiving this training in an MNC.

Our results revealed a link between post-start-up entrepreneurial learning and performance. Specifically, a positive linear relationship was found between knowledge relatedness and improved firm performance, as demonstrated by West and Noel (2009) and in contrast to Sa -pienza et al. (2004), who advocated a balance between generating and adopting new knowledge. Overall, our results show that the greater the relatedness or similarity between the business strategy, operations, and marketing applied in the new ventures, and those the entrepreneurs were familiar with in their previous MNC positions, the higher the sales, and financial and innovative performance they achieved. However, this was not different in the control group.

Conclusions

Our investigation examined a thematic triangulation that so far has been little examined: The relationship between entrepreneurial learning and the creation of companies, within the framework of MNCs as a source of learning for entrepreneurs.

The main conclusion was that post-start-up entrepreneurial learning, in our case knowledge relatedness, had a positive and linear influence on general and innovative performance. This reinforces the idea that for start-ups, the entrepreneurial learning of its founders is fundamental. A very important source of such learning is the type of prior work experience that the entrepreneur has.

The literature does not delve deeply into the type of learning or experience, it only points out that it is important for it to exist (West & Noel, 2009). We say that a very important experience for an entrepreneur is one that allows him or her to view business strategies. Not just any previous experience generates relevant entrepreneurial learning processes. Another relevant conclusion of our work is our finding that MNCs, as a source of entrepreneurial learning, have not produced a significant difference.

This could have several explanations. One would think that, somehow, the MNCs are not the "best entrepreneur schools" for local businesses. This is perhaps because of the greater structure and specialization of functions that might exist in MNCs. Another explanation could be that the entrepreneur, because of the different nature of his or her own company and the MNC where he or she worked, cannot apply similar strategies. If this is the case, it raises a very interesting question regarding the absorption capacity and the conditions of the local business environment.

The findings have various economic implications. For the policy makers, this research provides information that will improve the process of decision-making for developing new entrepreneurs as well as attracting foreign direct investment. For practitioners, it provides information that can assist in making the process of planning and launching new companies more effective. For academics, the findings offer greater knowledge of a phenomenon little explored, as has been mentioned, and at the same time they propose new lines of research.

Some limitations of the research should be taken into account. First, performance was evaluated on the basis of the entrepreneurs' own perceptions, not by real sales figures, financial results, or other firm data, which entails certain limitations. The same can be said for innovative performance. The advantage of asking entrepreneurs about their own perceptions are that a certain type of information is gathered which is often missed by other-especially secondary-sources; however, it involves the risk that the entrepreneur may overrate their firms' performance, or that a certain type of subjective bias may be present.

A second limitation is that all the MNCs where the entrepreneurs had previously worked were attracted to Costa Rica by the Foreign Trade Council over a limited period of time, and focused on certain sectors of production, which may lead to some bias. In addition, it should be taken into account that the control sample was created in an ad hoc manner, based on records of the institutions involved in the study.

A third limitation is the difficulty of operationalizing the entrepreneurial learning concept. We used the preparation of business plans, training received, and knowledge relatedness in an attempt to balance tacit and explicit knowledge, from a range of sources and time periods. However, the measurement may have omitted relevant examples of entrepreneurial learning reported in the literature, such as networking.

Various future research lines emerge from the present study. One line may be to further explore whether MNCs are potentially better "entrepreneur schools" than local firms. Although the MNCs are close to the "state of the art" in their areas of expertise (Spencer, 2008), one can question whether these companies offer their employees more meaningful learning experiences than a local company, from the point of view of entrepreneurial learning. This because the local company is perhaps more rooted in a given business context (Kantis et al., 2004).

The relationship between entrepreneurial learning and firm performance is also a field ripe for study (Dencker et al., 2009; West & Noel, 2009). Further contributions would be welcome in the debate on how entrepreneurial learning among founder entrepreneurs affects the performance of young firms.

Our review of the literature revealed two blocks of research on entrepreneurial learning: The first was predominantly theoretical and attempted to define the concept (Holcomb et al, 2009; Minniti & Bygrave, 2001; Politis, 2005; Rae, 2006), while the second attempted to empirically quantify different aspects of entrepreneurial learning and its influences (De Clercq & Arenius, 2006; Dencker et al., 2009; Sapienza et al., 2004; Voudouris et al., 2010; Zhang et al., 2010), frequently at a distance from the above-mentioned theoretical research. Future research should introduce other statistical analyses and use other indicators of entrepreneurial learning, or construct new ones. Our study used three of the indicators most frequently cited in the literature, but as mentioned earlier, learning is a continual process, and its development can be influenced by many idiosyncratic factors.

Pie de página

1Acknowledgements: This work was supported by the Inter-American Development Bank (IADB), the High Technology Advisory Committee of Costa Rica (CAATEC), and Vice-Rector for Research, Technological Institute of Costa Rica. We appreciate the information provided by the Investment Promotion Agency of Costa Rica (CINDE), Social Security Fund of Costa Rica (CCSS), and Foreign Trade Council of Costa Rica (PRO-COMER). We also thank Unimer Research International Co for collecting data. Finally, the authors would like to thank the Spanish Ministry of Economy and Competitiveness (ECO2011-29863) for its financial support of this research.

References

Audretsch, D. B., & Keilbach, M. (2004). Does entrepreneurship capital matter? Entrepreneurship: Theory & Practice, 28(5), 419-429. [ Links ]

Akgun, A. E., Keskin, H., Byrne., J. C., & Aren, S. (2007). Emotional and learning capability and their impact on product innovativeness and firm performance. Technovation, 27, 501-513. [ Links ]

Alavi, M., & Leidner, D. E. (2001). Review: Knowledge management and knowledge management systems: Conceptual foundations and research issues. MIS Quarterly, 25, 107-133. [ Links ]

Alegre. J., & Lapiedra, R. (2005). Gestión del conocimiento y desempeño innovador: un estudio empírico del papel mediador del repertorio de competencias distintivas. Cuadernos de Economía y Dirección de Empresas, 23, 117-138. [ Links ]

Alegre, J., Sengupta. K., & Lapiedra, R. (2012). Knowledge management and the innovation performance in a High-Tech SMEs industry. International Small Business Journal. In press. [ Links ]

Amorós, J. E. (2011). El Proyecto Global Entrepreneurship Monitor (GEM): una aproximación desde el contexto latinoamericano. Academia, Revista Latinoamericana de Administración, 46, 1-15. [ Links ]

Bhide, A. (2000). The origin and evolution of new businesses. Oxford University Press: New York. [ Links ]

Brinckmann, J., Grichnik, D., & Kapsa, D. (2010). Should entrepreneurs plan or just storm the castle? A meta-analysis on contextual factors impacting the business planning-performance relationship in small firms. Journal of Business Venturing, 25(1), 24-40. [ Links ]

Burke, A., Gorg, H., & Hanley, A. (2008). The impact of foreign direct investment on new firm survival in the UK: Evidence for static versus dynamic industries. Small Business Economics, 31, 395-407. [ Links ]

Cope, J. (2005). Toward a dynamic learning perspective of entrepreneurship. Entrepreneurship: Theory & Practice, 29(4), 373-397. [ Links ]

Corbett, A. C. (2005). Experiential learning within the process of opportunity identification and exploitation. Entrepreneurship Theory and Practice, 29(4), 473-491. [ Links ]

Davidsson, P., & Honig, B. (2003). The role of social and human capital among nascent entrepreneurs. Journal of Business Venturing, 18(3), 301-330. [ Links ]

Dean, M. A., Shook, C. L., & Payne, G. (2007). The past, present, and future of entrepreneurship research: Data analytic trends and training. Entrepreneurship: Theory & Practice, 31(4), 601-618. [ Links ]

De Backer, K., & Sleuwaegen, L. (2003). Does foreign direct investment crowd out domestic entrepreneurship? Review of Industrial Organization, 22(1), 67-84. [ Links ]

De Clercq, D., & Arenius, P. (2006). The role of knowledge in business start-up activity. International Small Business Journal, 24(4), 339-358. [ Links ]

Delmar, F., & Shane, S. (2004). Legitimating first: Organizing activities and the persistence of new ventures. Journal of Business Venturing, 19, 385-410. [ Links ]

Dencker, J., Gruber, M., & Shah, S. (2009). Pre-entry knowledge, learning, and the survival of new firms. Organization Science, 20(3), 516-537. [ Links ]

Di Guardo, C., & Valentini, G. (2007). Taking actively advantage of MNCs' presence. Small Business Economics, 28, 55-68. [ Links ]

Flor, M.L., & Oltra, M. J. (2004). Identification of innovating firms through technological innovation indicators: an application to the Spanish ceramic tile industry. Research Policy, 33, 323-336. [ Links ]

GEM. (2008). Global Entrepreneurship Monitor, Report 2008. http://www.gemconsortium.org. [ Links ]

Gimeno, J., Folta, T., Cooper, A., & Woo, C. (1997). Survival of the fittest? Entrepreneurial human capital and the persistence of underper-forming firms. Administrative Science Quarterly, 42(4), 750-783. [ Links ]

Gõrg, H., & Strobl, E. (2004). Spillovers from foreign firms through worker mobility: An empirical investigation (Discussion Paper 463). DIW Berlin German Institute for Economic Research. [ Links ]

Grant, R. M. (1996). Toward a knowledge-based theory of the firm. Strategic Management Journal, 17(winter special issue), 109-122. [ Links ]

Gruber, M. (2007). Uncovering the value of planning in new venture creation: A process and contingency perspective. Journal of Business Venturing, 22(6), 782-807. [ Links ]

Harrison, R. T., & Leitch, C. M. (2005). Learning: researching the interface between learning and the entrepreneurial context. Entrepreneurship Theory and Practice, 29(4), 351-371. [ Links ]

Holcomb, T.R., Ireland, R.D, Holmes Jr., R.M., and Hitt, M.A. (2009). Architecture of Entrepreneurial Learning: Exploring the Link Among Heuristics, Knowledge, and Action. Entrepreneurship: Theory & Practice, 33(1), 167-192. [ Links ]

Javorcik, B. S. (2004). Does foreign direct investment increase the productivity of domestic firms? In search of spillovers through backward linkages. American Economic Review, 94(3), 605-627. [ Links ]

Kantis, H., Moori, V., & Angelelli, P. (2004). Desarrollo emprendedor: América Latinay la experiencia internacional. Washington: Banco Interamericano de Desarrollo. [ Links ]

Leiva, J. C. (2008). ¿Nacen empresas de las actividades de fomento al espíritu emprendedor? Un vistazo a empresas surgidas del Concurso Nacional de Emprendedores y el Programa de Formación en Espíritu Emprendedor del TEC. Revista Tec Empresarial, 2(1), 16-24. [ Links ]

Leiva, J. C. (2009). El origen de la empresa. In L. Brenes & V. Govaere (Comps.). El estado nacional de las Mipymes costarricenses formales. San Jose: editorial UNED Costa Rica. [ Links ]

Levinthal, D. A., & March, J. G. (1993). The myopia of learning. Strategic Management Journal, 14(2), 95-112. [ Links ]

Liao, J., & Gartner, W. B. (2006). The effects of pre-venture plan timing and perceived environmental uncertainty on the persistence of emerging firms. Small Business Economics, 27, 23-40. [ Links ]

Lumpkin, G. T., & Dess, G. G. (1995). Simplicity as a strategy-making process: The effects of stage of organizational development and environment on performance. Academy of Management Journal, 38(5), 1386-1407. [ Links ]

Mandler, G. (1967). Organization and memory. The Psychology of Learning and Motivation, 1, 327-372. [ Links ]

Minniti, M., & Bygrave, W. (2001). A dynamic model of entrepreneurial learning. Entrepreneurship Theory and Practice, 25(3), 5-16. [ Links ]

Monge, R., Mata, A., & Vargas, J. (2008). CINDEy el desarrollo reciente de Costa Rica. San Jose: Fundación CAATEC. [ Links ]

Mullen, M. R., Budeva, D. G., & Doney, P. M. (2009). Research methods in the leading small business-entrepreneurship journals: A critical review with recommendations for future research. Journal of Small Business Management, 47(3), 287-307. [ Links ]

Nonaka, I. (1994). A dynamic theory of organizational knowledge creation. Organization Science, 5(1), 14-37. [ Links ]

Politis, D. (2005). The process of entrepreneurial learning: A conceptual framework. Entrepreneurship Theory and Practice, 29(4), 399-424. [ Links ]

Rae, D. (2006). Entrepreneurial Learning: A Conceptual Framework for Technology based Enterprise. Technology Analysis & Strategic Management, 18(1), 39-56. [ Links ]

Ravasi, D., & Turati, D. (2005). Exploring entrepreneurial learning: A comparative study of technology development projects. Journal of Business Venturing, 20(1), 137-164. [ Links ]

Robinson, P., & Sexton, E. (1994). The effect of education and experience on self-employment success. Journal of Business Venturing, 9(2), 141-156. [ Links ]

Sapienza, H. J., Parhankangas, A., & Autio, E. (2004). Knowledge relatedness and post-spin-off growth. Journal of Business Venturing, 19(6), 809-829. [ Links ]

Spencer, J. W. (2008). The impact of multinational enterprise strategy on indigenous enterprises: Horizontal spill overs and crowding out in developing countries. Academy of Management Review, 33(2), 341-361. [ Links ]

Spender, J. C. (1996). Making knowledge the basis of a dynamic theory of the firm. Strategic Management Journal, 17 (winter special issue), 45-62. [ Links ]

Vera, A. O., & Dutrenit, G. (2007). Derramas de las MNCs a traves de la movilidad de los trabajadores: evidencia de pymes de maquinados en Ciudad Juárez. Ide@s CONCYTEG, 2(19), 30-49. [ Links ]

Voudouris, I., Dimitratos, P., & Salavou, H. (2010). Entrepreneurial learning in the international new high-technology venture. International Small Business Journal, 29(3), 238-258. [ Links ]

Walter, A., Auer, M., & Ritter, T. (2006). The impact of network capabilities and entrepreneurial orientation on university spin-off performance Journal of Business Venturing, 21, 541-567. [ Links ]

Weisz, N., Vassolo, R., & Cooper, A. C. (2004). A theoretical and empirical assessment of the social capital of nascent entrepreneurial teams. Academy of Management Best Conference Paper, ENT: K1. [ Links ]

West III, G. P., & Noel, T. W. (2009). The impact of knowledge resources on new venture performance. Journal of Small Business Management, 47(1), 1-22. [ Links ]

Wiklund, J., & Shepherd, D. A. (2003). Knowledge-based resources, entrepreneurial orientation, and the performance of small and medium-sized businesses. Strategic Management Journal, 24(13), 1307-1314. [ Links ]

Zhang, J., Soh, P. H., & Wong, P. K. (2010). Direct ties, prior knowledge, and entrepreneurial resource acquisitions in China and Singapore. International Small Business Journal, 29(2), 170-189. [ Links ]