Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Citado por Google

Citado por Google -

Similares en

SciELO

Similares en

SciELO -

Similares en Google

Similares en Google

Compartir

Innovar

versión impresa ISSN 0121-5051

Innovar vol.25 no.55 Bogotá ene./mar. 2015

https://doi.org/10.15446/innovar.v25n55.47226

http://dx.doi.org/10.15446/innovar.v25n55.47226

Do Innovation and Cooperation Influence SMEs' Competitiveness? Evidence From the Andalusian Metal-Mechanic Sector

¿Influye la innovación y la cooperación en la competitividad de las pymes? evidencia en el sector metalmecánico Andaluz

L'innovation et la cooperation influent-elles sur la compétitivité des pme? exemple dans le secteur andalou de la métallurgie mécanique

Tem influência a inovação e a cooperação na competitividade das pmes? evidência no setor metal-mecánico Andaluz

Juan A. TamayoI, José E. RomeroII, Javier GameroIII, Juan A. Martínez-RománIIII

I Ph.D., is an Associate Professor in the Department of Business Administration and Marketing at the University of Seville. He currently teaches in the School of Computer Engineering and the Tourism and Finance School of the University of Seville. Spain.

Country: Spain.

E-mail: jtamayo@us.es

II Is an Associate Professor in the Department of Applied Economics - Quantitative Methods - at the University of Seville. He currently teaches in the School of Business and Economics and the Tourism and Finance School of the University of Seville. Spain.

Country: Spain.

E-mail: romerogje@us.es

III Ph.D., is an Associate Professor in the Department of Applied Economics - Quantitative Methods - at the University of Seville. He currently teaches in the School of Business and Economics and the Tourism and Finance School of the University of Seville. Spain.

Country: Spain.

E-mail: jgam@us.es

IIII Ph.D., is an Associate Professor in the Department of Applied Economics at the University of Seville. He currently teaches in the School of Business and Economics, the Tourism and Finance School, the Law School and the International Postgraduate Centre of the University of Seville. Spain.

Country: Spain.

E-mail: jamroman@us.es

Correspondencia: Departamento de Economía Aplicada I. Facultad de Ciencias Económicas y Empresariales. Universidad de Sevilla. Avda. Ramón y Cajal, n° 1. C.P. 41018. Sevilla. Spain.

Citación: Tamayo, J. A., Romero, J. E., Gamero, J., & Martínez-Román, J. (2015). Do Innovation and Cooperation Influence SMEs' Competitiveness? Evidence From the Andalusian Metal-Mechanic Sector. Innovar, 25(55), 101-115. doi: 10.15446/innovar.v25n55.47226.

Clasificación JEL: M10, O32, C81.

Recibido: Junio de 2012, Aprobado: Abril de 2014.

Abstract:

This study's main objective is to determine the influence of innovation and cooperation on the competitiveness of SMEs in the metal-mechanic sector of Andalusia (Spain). Using information obtained by interviewing managers of a sample of 80 firms, we proposed a model of structural equations based on the Partial Least Squares (PLS) technique. This model, which explained 37% of the variability of competitiveness, also allowed us to test hypotheses about the positive influence of quality management, knowledge, financial resources and cooperation on innovative outcomes. Along with the contrasted hypotheses, the most noteworthy finding was that cooperation does not significantly influence the innovative outcomes of firms in this sector.

Key words: Competitiveness, innovation, cooperation, quality management, knowledge, SMEs, Andalusia (Spain).

Resumen:

El principal objetivo de este artículo es determinar la influencia de la innovación y la cooperación sobre la competitividad de las pymes en el sector metalmecánico de Andalucía (España). Con la información obtenida en entrevistas a los directivos de una muestra de 80 empresas, se ha propuesto un modelo usando ecuaciones estructurales basadas en la técnica Partial Least squares (PLs). este modelo, que explica el 37% de la variabilidad de la competitividad, también nos ha permitido testear hipótesis sobre la influencia positiva de la gestión de la calidad, conocimiento, recursos financieros y cooperación sobre los resultados innovadores. Junto a las hipótesis contrastadas, la conclusión más destacada fue que la cooperación no influye de manera significativa en los resultados innovadores de las empresas en este sector.

Palabras clave: Competitividad, innovación, cooperación, gestión de la calidad, conocimiento, pymes, Andalucía (España).

Résumé:

Le principal objectif de cet article consiste à déterminer l'influence de l'innovation et de la coopération sur la compétitivité des pme dans le secteur de la métallurgie mécanique d'Andalousie (Espagne). Avec reformation obtenue lors d'entretiens avec les directeurs d'un échantillon de 80 entreprises, a été proposé un modèle en utilisant des équations structurelles basées sur la technique Partial Least squares (PLs). Ce mo-dèle, qui explique 37 % de la variabilité de la compétitivité nous a éga-lement permis de tester l'hypothése sur l'influence positive de la gestion de la qualité, de la connaissance, des ressources financières et de la coopération sur les résultats innovateurs. Ces hypothèses s'étant vérifiées, la conclusion la plus remarquable est que la coopération n'influe pas significativement sur les résultats innovateurs des entreprises de ce secteur.

Mots-clés: Compétitivité, innovation, coopération, gestion de la qualité, connaissance, pme, Andalousie (Espagne).

Resumo:

O principal objetivo deste artigo é determinar a influência da inovação e a cooperação sobre a competitividade das PMEs no setor metal-mecânico da Andaluzia (Espanha). Com a informação obtida em entrevistas aos diretores, de una amostra de 80 empresas, foi proposto um modelo utilizando equações estruturais baseadas na técnica Partial Least squares (PLs). Este modelo, que explica 37% da variabilidade da competitividade, também nos permitiu testar hipóteses sobre a influência positiva da gestão da qualidade, conhecimento, recursos financeiros e cooperação sobre os resultados inovadores. Junto com as hipóteses contrastadas, a conclusão mais destacada é que a cooperação não tem influência, de maneira significativa, nos resultados inovadores das empresas neste setor.

Palavras-chave: Competitividade, inovação, cooperação, gestão da qualidade, conhecimento, PMEs, Andaluzia (Espanha).

Introduction

Since the European Union adopted the strategic goal of becoming the world's most competitive and dynamic knowledge-based economy with the capacity to grow economically and create more and better jobs (European Council, 2000), interest in competitiveness has increased. Following the 2005 assessment, which affirmed that the European economy had not reached the goals set (European Commission, 2005), the so-called Competitiveness and Innovation Framework Program for the period of 2007-2013 was developed, proposing a coherent framework for improving competitiveness and innovative potential within the European Union.

The current economic crisis has had a strong impact on unemployment in countries such as Spain. As competitiveness is a key factor in the recovery of employment (European Commission, 2010), it is logical that peripheral regions of the European Union have begun to formulate strategies for promoting competitiveness. As part of this effort, the scientific community can contribute to increasing knowledge of the factors that positively influence competitiveness. This knowledge may be useful in helping those in charge of economic policy to implement more effective measures.

This paper studies competitiveness at the micro-level: The units of analysis are firms in the Andalusian metal-mechanic sector. This approach complements others that have determined the level of competitiveness of a sector as a whole, and that have produced aggregate indices of competitiveness. Our empirical research evaluated how competitiveness is influenced by two of the most important variables: innovative outcomes (as a measure of innovation), and cooperation.

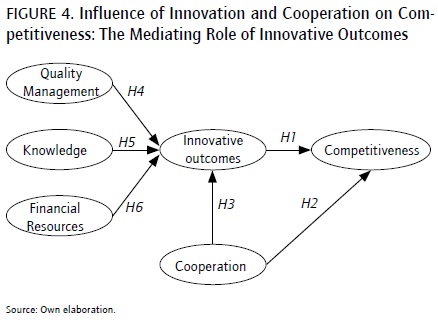

Accordingly, we first answered two specific questions in relation to this industrial sector: Does innovation influence competitiveness in a meaningful way? And does cooperation influence competitiveness? Thus, a primary objective of the work was to determine the direct influence of innovative outcomes and cooperation on firm competitiveness. The secondary objective consisted in determining the influence exerted by cooperation, quality management, knowledge, and financial resources on innovation.

In order to achieve these objectives, we proposed a new model and formulated research hypotheses. A Structural Equations Model (SEM) based on the PLS technique was used for the contrast of the hypotheses. This model allowed us to contrast the existence of relationships in a rigorous manner, in addition to offering an informative view of causal relationships. For the empirical validation of the model, we used data from personal interviews with managers, guided by a survey. The sample included 80 firms in the metal-mechanic sector, all located in provinces of Andalusia, as well as information from the Trade Register referring fundamentally to firm profitability.

In the second section of this paper we describe and justify the model by proposing a conceptual model and its hypotheses. We reflect on the concept of competitiveness and on the variables and potential relationships included in the model. The third section indicates the fundamental characteristics of the empirical study, and the fourth section presents and discusses the empirical results. Finally, the fifth section offers the main conclusions of the work.

Theoretical Framework and Hypotheses

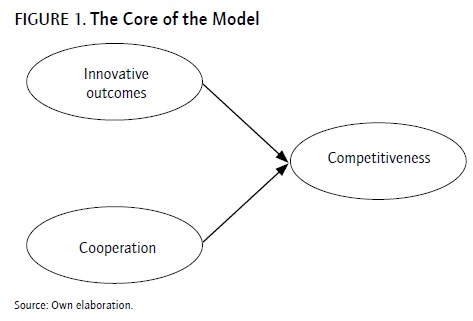

This work attributes special importance to the potential influence of the variables of innovative outcomes and cooperation on competitiveness (Figure 1). The relationships of these two variables with competitiveness constitute the nucleus of the model to be developed. Hence, we dedicate this section to justifying the theoretical basis of the relationships between the variables and explain what each of these constructs constitutes.

The next subsection deals with the concept of competitiveness-an elusive concept at different levels of analysis-and discusses how it can be evaluated through variables such as firm performance or profitability, market extension, size and age. We also describe the concept of competitiveness employed in the empirical study. Subsequently, we argue for the inclusion of innovative outcomes in the model, and after the justifying the importance of cooperation for competitiveness, we proceed to explain the variables for the rest of the model. In Figure 4, all variables and relationships are summarized.

The Elusive Concept of Competitiveness

Competitiveness is a very relevant concept for firm survival, the development of an industry, and the prosperity of a territory. Its importance is unquestionable within economics and management, and thus it has naturally been used in much of the specialized literature. However, the variety of uses of the concept and the lack of consensus surrounding it in the scientific community could lead us to wonder whether the term has any specific meaning (Connor, 2003).

It seems obvious that competitiveness is the ability to compete. Firm competitiveness is defined as the ability of a firm to successfully compete in its environment (Mesquita, Lazzarini & Cronin, 2007). The practical problem consists in pinpointing the concept so that it may be measured and made operative in empirical studies. The conceptual problem varies depending on the level of analysis to which the concept refers. In general terms, a greater conceptual clarity appears to exist on the meaning of the term when it refers to the firm itself rather than to the industry or the territory (Aiginger, 2006). It has even been proposed that the term competitiveness could be a dangerous, meaningless, and elusive obsession (Krugman, 1996, 1994a, 1994b). The appropriateness of the definition of competitiveness at the firm level is also debatable; there are authors who think that on a firm level, the definition of competitiveness is vague and problematic, though advances have been made (Ali, 2000).

In a certain sense, the concept of competitiveness seems to be better defined for other specialties than that of the scholar, in such a way that from the perspective of economic theory with a macroeconomic focus, the concept of competitiveness on a firm level could seem more precise, whereas for experts in the fields of organization and business economics, the aggregate-level view is more acceptable. Perhaps part of the problem lies in the lack of connection between the lines of investigation with different levels of aggregation (Chikan, 2008). The connection between the macro level, or that of the region, and the micro level, or that of the firm, can be found in the approach taken by Porter (1990), who offers a framework for analysis on the industrial level, valid for the study of competitiveness at both the territorial and the firm level (Chikan, 2008). In his model, generally referred to as Porter's diamond, this author establishes the foundations that allow for an understanding of how macro-level factors become micro-level factors that directly affect firms' capabilities.

It is normally thought that competitive firms must have a high level of profitability (Caridi, 1997). In small and medium firms, profitability and competitiveness are related (Chew, Yan & Cheah, 2008; Oksanen & Rilla, 2009). However, profitability in itself does not guarantee the competitiveness of a firm. At times a speculative nearsighted-ness can occur and future profitability can be sacrificed for short-term benefits (Blaine, 1993). These present benefits, deceptively high, are not necessarily a sign of competitive strength. On the other hand, many real business opportunities imply sacrificing part of present and future benefits (Tangen, 2003). Given the limitations of financial performance (Tangen, 2003), more variables should be considered in defining competitiveness.

Competitive firms increase their market share or access new markets (Oksanen & Rilla, 2009). Openness to international markets offers firms opportunities to maintain competitiveness (Hitt, Keats & DeMarie, 1998; Loyka & Powers, 2003). Growth in sales is one of the variables that serves to measure competitiveness in small and medium firms (Chew et al., 2008). This aspect of competitiveness can constitute a type of counterweight in the absence of profitability. Competitive firms will normally obtain benefits and grow at the same time. However, they may sacrifice part of their profitability in pursuit of growth, or, alternately, they may forego market extension, focusing on a niche or restricted market, in order to increase benefits.

Firms that try to widen their market also tend to increase in size. In this sense, competitiveness can be used to denote a firm's ability to grow and thrive alongside other firms in the market (Han, Chen & Ebrahimpour, 2007). Growth has been considered a fundamental business objective that contributes to competitiveness (Correa, Acosta, González & Medina, 2003). Business strategy seeks to simultaneously achieve both competitiveness and growth (Pehrsson, 2007). When measuring the growth of a firm, the number of workers has frequently been used, as this is an uncon-troversial and easily obtainable measurement (Dobbs & Hamilton, 2007). However, since we can logically assume a link between market extension and increase in firm size, we omitted this variable from the definition of the construct of competitiveness in our study. This decision was made for a number of reasons. The contribution of increase in size (measured by number of employees) to competitiveness is not always so direct, as it depends on other factors such as productivity per worker. Moreover, firms in this sector are SMEs, meaning that the effect of size on productivity is more limited. Finally, it is preferable to adopt the most simple and parsimonious definition possible for competitiveness.

It also seems natural that competitive firms show an ability to survive, and therefore it is not too far-fetched to assume that competitive firms tend to be more long-lived. Although this is not always the case, the fact they remain in the market for a longer period of time is an indicator that these firms have been profitable and have provided their customers with valuable products and services. In addition, older firms tend to be larger and to have access to more financial resources (Levinthal, 1991). Thus, it is not unusual that a certain relationship exists between a firm's size and its performance (Birley & Westhead, 1990). In this study, however, we opted not to include firm age in the construct of competitiveness. Although it is true that by demanding more age or survival of a firm, we ensure that they have a track record of profitability, we chose to eliminate the age factor on the assumption that, implicitly, some of the nuances that it would provide to the definition of competitiveness are adequately explained by profitability.

Concept of Competitiveness

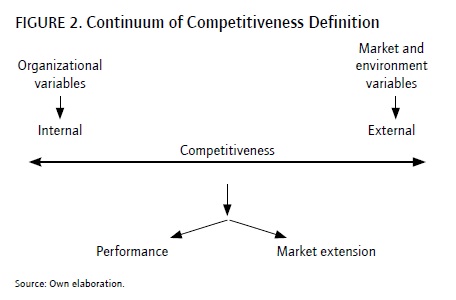

There are two alternatives for defining firm competitiveness: to focus on the internal aspects of the organization that make it competitive; or to focus on variables directly related to the market or the environment of an organization. The first option, fundamentally of an internal nature and centered on organizational variables, would be directly consistent with the Resource-Based View (RBV). This perspective is important for analyzing the resources and capabilities contributing to firms' ongoing competitive advantage (Barney, 1991). The second way of defining competitiveness attributes a crucial role to the market and, thus, to clients and the organization's interactions with other organizations within the environment. These alternatives are complementary, as it is possible to describe competitiveness with variables of an internal and external nature simultaneously.

To define competitiveness, we chose an intermediate option in the continuum between the organization and the market (Figure 2). The variables of market extension and performance reflect, respectively, the external and internal aspects of competitiveness. The most competitive organizations are in a better position to reach wider markets. Similarly, an organization's performance indicates its competitive strength: Profitability is a guarantee of competitiveness, meaning that more-profitable firms tend to be more competitive and vice-versa.

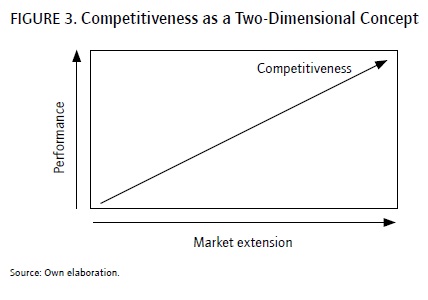

It is probably true that the definition of a term such as competitiveness is never right or wrong in an absolute sense and must be adjusted to each research or policy problem that arises (Ketels, 2006). Financial performance and market share are vital to the existence of a firm (Li, 2000). In this study, we will designate a firm as competitive if it grows and expands from national to international markets and also obtains benefits. Accordingly, as shown in Figure 3, in the model developed, competitiveness is a construct formed by two variables: market extension, measured by level of internationalization, and firm performance. This last variable was assigned a value on an ordinal scale according to profitability.

Innovative outcomes

This paper gages innovation through innovative outcomes, that is to say, through innovations in products. To define innovative outcomes, two respective indicators were used. The first refers to the level of product innovation and the second to the level of product innovation foreseen in the future. Innovation is viewed as a source of competitive advantage for internationalized firms (McAdam, Moffett, Ha-zlett & Shevlin, 2010). The direct link between innovation and firm competitiveness has frequently been highlighted (Guan & Ma, 2003; Hernández-Espallardo, Malmberg & Power, 2005; Sánchez-Pérez & Segovia-López, 2011; Yam, Lo, Tang & Lau, 2011).

However, although innovation contributes to competitiveness, especially in small firms, we must understand the factors that restrict innovation (Hewitt-Dundas & Roper, 2011). In our case, the relationship between innovation and competitiveness can be understood in light of the variables that form competitiveness. Many studies in the literature have suggested that innovation has a meaningful impact on organizational variables such as profitability (Li, 2000).

For these reasons, we proposed the following hypothesis:

Hypothesis 1: Innovative outcomes exert a positive influence on competitiveness.

Cooperation

We considered three variables in describing cooperation between organizations in this sector: distributor collaboration, national networks, and international networks. Cooperation with distributors is focused on the relationships that an organization establishes with firms situated downstream in the value system. Connections with national networks and international networks refer to the relationships established between firms and other national and international firms, respectively.

Cooperation can boost competitiveness (Enright & Roberts, 2001). It is a source of competitive strength (Jarillo, 1988), which contributes to success in the global network (Thoumrungroje & Tansuhaj, 2004). In fact, international competition is increasingly seen as occurring at the level of the organizational network more than at that of the individual organization (Soeters, 1993). Inter-firm cooperation is an efficient way to improve firms' competitiveness (Chen & Karami, 2010). Cooperation can be considered a contributing factor in the success of SMEs (Chittithaworn, Islam, Keawchana & Yusuf, 2011).

For these reasons, we proposed the following hypothesis:

Hypothesis 2: Cooperation exerts a positive influence on firm competitiveness.

The rest of the Model: some Factors that influence innovation

The rest of the model aims to analyze the influence of cooperation, quality management, knowledge, and financing on innovative outcomes. To justify this part of the model, we used Table 1, which summarizes the contributions in the literature that justify the relevance of these variables to innovation. Following the table, the last four hypotheses of the model are explained and argued, specifically those related to cooperation, quality management, knowledge, and funding.

Cooperation

Networks of cooperation can contribute to different types of innovation (Chen, 2008), and international networks contribute to the spread of innovation. More specifically, relationships established between organizations along the supply chain, such as intermediaries and consumers, can contribute to the rapid spread of innovation after overcoming any obstacles related to cultural differences between countries and conflicting goals (Steward & Conway, 2000).

In general, cooperation with other levels of the value system-suppliers, distributors, and customers-can be the key to innovation. A close relationship with distributors and customers provides firms with a vital source of innovation (von Hippel, 1986). This commonly accepted idea explains that in order to promote innovation, firms often look to stimulate cooperation (Falck, Heblich & Kipar, 2010). Cooperation appears to have a positive effect on the development of new products (Enright & Roberts, 2001).

Enough theoretical reasons exist to propose the following hypothesis:

Hypothesis 3: Cooperation exerts a positive influence on innovative outcomes.

Quality management

We included two variables in the quality management construct: certified systems of quality management and teams.

There are many reasons to analyze the relationship between innovative outcomes and quality management. It is an important factor that can help foster firms' innovative capability (Perdomo-Ortiz, González-Benito & Galende, 2006). Quality standards, which imply certified systems, have demonstrated a significant positive correlation with success in introducing new products to the market (Cho & Pucik, 2005; Cooper & Kleinschmidt, 1987; Martínez-Román et al, 2011). The product innovation process can be improved by applying the principles of quality management (Gobeli & Brown, 1993).

Besides quality management standards and principles, human resources are also very important. Therefore, it is appropriate to include quality management practices such as leadership and human resources management in this construct. They have a positive impact on the firm's inno-vativeness (Dinh, Igel & Laosirihongthong, 2006). Because of the complex problems that firms currently face, teams have become one of the key elements in today's quality management systems (Mehra, Hoffman & Sirias, 2001). It is thus logical that the existence of these teams is considered more and more frequently a prerequisite for work in organizations that seek to implement quality control systems (Irani, Choudrie, Love & Gunasekaran, 2002; Mehra et al, 2001).

Incremental innovation is reinforced by quality management, and the ongoing improvement which characterizes quality management is also key in the culture of innovative firms and contributes to the development of new products (McAdam, Armstrong & Kelly, 1998). Quality management seems in general to have a strong impact on innovative outcomes (Martínez-Román et al, 2011; Satish & Sriniv-asan, 2010). Hence, we proposed the following hypothesis:

Hypothesis 4: Quality management exerts a positive influence on innovative outcomes.

Knowledge

In this study, the knowledge construct included the variables Internal R&D, R&D collaboration, and technological acquisition, all of these being potentially relevant factors in the development of innovation.

R&D is a source of internal knowledge that exerts a clear influence on innovative outcomes. R&D can help measure internal efforts made by the firm in order to develop technological knowledge (Bertrand, 2009; Hull & Covin, 2010; Quintana & Benavides, 2008; Romijn & Albaladejo, 2002; Subramaniam & Youndt, 2005).

Likewise, R&D collaboration and technology acquisition are mainly related to external knowledge sourcing (Kang & Kang, 2009). Collaboration with other institutions takes on greater importance for innovation when the firm lacks the resources to rely on internal R&D (Chen, 2008; Lin, 2003). For this reason we included R&D collaboration in this construct. It may be a natural complement to R&D in small- to medium-size organizations that lack resources for internal R&D. Cooperation with partners who have complementary knowledge bases increases learning capacity, development and the implementation of innovation (Hitt et al., 1998). R&D collaboration and technology acquisition influence perceived number of product innovations (Kang & Kang, 2009).

In a generic sense, it is logical to propose the following hypothesis:

Hypothesis 5: Knowledge exerts a positive influence on innovative outcomes.

Financial resources

The financial resources construct is composed by the variables of external funding and internal funding. The specialized literature indicates that financial resources are important to innovative activity in firms (Furman et al., 2002). Several research studies have indicated that a positive correlation exists between internal funding and innovation (Kamien & Schwartz, 1978). The results have not been as conclusive with regards to how factors such as type of innovation (Galende & De la Fuente, 2003), characteristics of the credit market, and firm life cycle (Giudici & Paleari, 2000) affect this relationship.

But while internal resources clearly assist the innovative efforts of firms, the influence of external funding is more complex to evaluate in general terms. Wang and Thorn-hill (2010) highlighted the non-linear behavior of external funding in relation to innovative effort in large firms, in contrast to the linear and positive effect that internal resources have on innovation in these corporations. The research of Gundry and Welsch (2001) demonstrated the importance of diversification of funding sources, including several equity and debt sources, in processes of commercial expansion, start-up, and early growth of SMEs. However, the role of external funding does not reduce the importance of internal resources in the development of these types of firms (Gundry & Welsch, 2001) and, especially, the contribution of internal capital in the first stages of the new firm (Elston & Audretsch, 2011). We must also consider the inherent difficulties a small firm faces in efforts to access external funding. In fact, small and young firms tend to face greater obstacles to receiving bank loans in a context free of credit restrictions (Levenson & Willard, 2000).

Without doubt, well-founded reasons exist for investigating the relationship between financial resources and innovative outcomes. Thus, we proposed the following hypothesis:

Hypothesis 6: Financial resources exert a positive influence on innovative outcomes.

Complete model

The conceptual model in Figure 4 shows the constructs and the relationships proposed in the six previous hypotheses. Hypotheses 1 and 2 formulate the main questions of the work, related to the potential influence of cooperation and innovation on competitiveness. In addition, the influence of cooperation, quality management, knowledge and financial resources on innovative outcomes is also studied. As can be observed, innovative outcomes play a fundamental role in the model by focalizing most of the relationships.

Methodology of the Empirical Research

This section addresses several aspects related to the sample, the methodology, and the variables used for the empirical research.

Sample

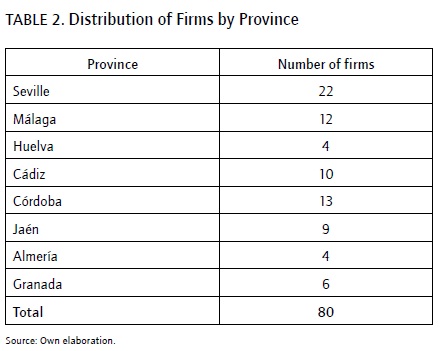

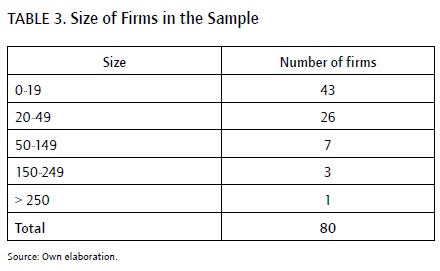

Our study centered on the Andalusian metal-mechanic sector. The sample size was 80 firms, which were selected by experts from the Andalusian Institute of Technology (IAT). The selection process sought to include the organizations most representative of their sector in the entire Andalusian territory (see Table 2). The average size of firms, measured by number of employees, was 36.8. Table 3 shows the distribution of firms in intervals based on size. As a whole, the sample describes the makeup of SMEs in Andalusia.

The data for the study were obtained through two alternative means: 1) from personal interviews in which a questionnaire was applied to owners and CEOs in the firms selected; and 2) from the Trade Register, which includes items of profitability used in the model. In the selection of sample elements, we sought to put data quality first with regards to both the business entities studied, and the method used for gathering information. For this reason, we decided that the most appropriate system for collecting information was the personal interview with managers or business owners guided by a questionnaire.

In general, to determine the minimum sample size in a PLS model, one must select the greater of the following two possibilities (Barclay, Higgins & Thompson, 1995; Chin, Marcolin & Newsted, 2003): 1) the number of indicators in the most complex formative construct; or 2) the greatest number of constructs that precede an endogenous construct. In our case, that number is 4. The sample size of 80 firms is thus sufficient for the analysis to be carried out.

Methodology and Variables

To formulate the model that proposes the set of hypotheses, we used SEM. This statistical method includes multiple regressions between visible and latent variables. Among the different techniques available, we opted for Partial Least Square (PLS) since the model features a construct with formative indicators (Henseler, Ringle & Sinkovics, 2009; Ringle, Gòtz, Wetzels & Wilson, 2009) and, moreover, the sample size is reduced (Reinartz, Haenlein & Henseler, 2009). The treatment of data was carried out with the pro- Results gram PLS Graph (Version 3, Build 1130).

Table 4 shows the observed variables that were included in the model long with their scales.

Results

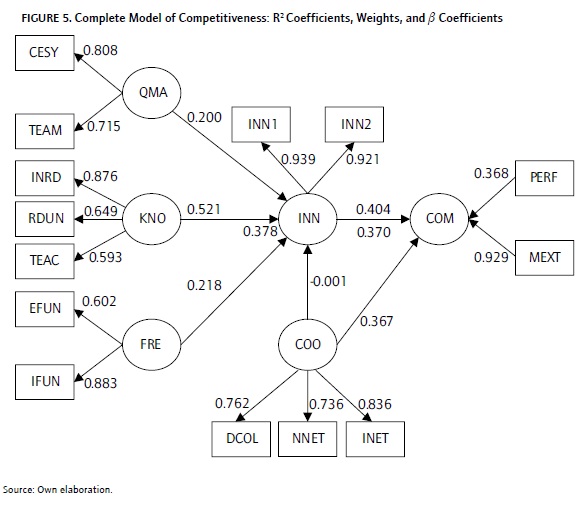

The PLS model that we proposed can be seen in Figure 5. It was tested in two stages (Barclay et al., 1995). Firstly, the measurement model was evaluated for validity and reliability. At this stage, it was necessary to evaluate the reflective and formative constructs that appear in the model in a differentiated manner. Secondly, the structural model was assessed as a whole.

Evaluating the measurement model for constructs with Reflective indicators

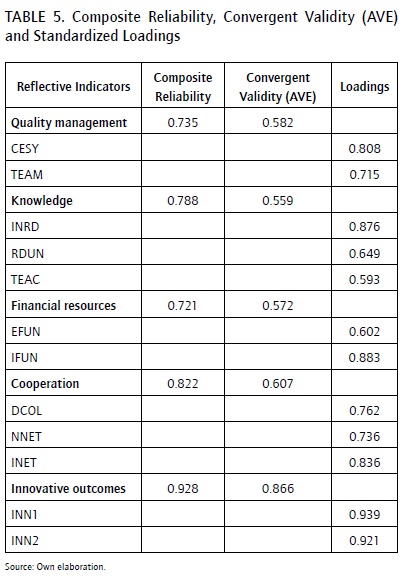

To test the validity of the constructs with reflective indicators, we analyzed the individual reliability of each indicator, composite reliability, the convergent validity, and the discriminant validity.

The individual reliability of each item was evaluated by examining the standardized loadings (λ). Although values over 0.7 are recommended, lower values such as 0.6, 0.5 or 0.4 can also be acceptable (Chin, 1998; Hair, Ringle & Sarstedt, 2011). We evaluated each construct's global reliability or composite reliability using the construct's composite reliability (Fornell & Larcker, 1981). For a scale to be considered reliable, it is suggested that the values obtained with composite reliability exceed the threshold of 0.7. Convergent validity was evaluated by means of the so-called Average Variance Extracted (AVE), developed by Fornell and Larcker (1981). For this indicator, values equal to or greater than 0.5 are recommended. As can be observed in Table 5, all of these conditions were met in the model developed.

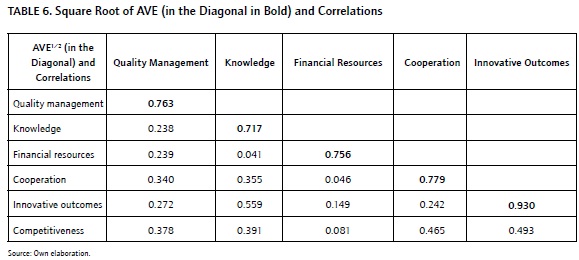

To study discriminant validity, it is preferable for the square root of AVE for each construct with reflective indicators to be greater than the correlation with any other construct. In our case, this condition was also met. Table 6 offers the square root of AVE in the diagonal in bold, and the correlations between constructs in the lower half of the matrix.

Evaluating the measurement model for constructs with Formative indicators

It is crucial that the formative construct possesses the meaning it is expected to possess from a theoretical point of view, meaning that the theoretical foundations and experts' opinion are fundamental aspects. Moreover, it is necessary to verify that high multicollinearity does not exist between formative indicators of the same construct. Given that competitiveness is formed by only two indicators, we only need to ensure that they are not collinear. In our case, this condition is met because the correlation between performance and market extension is only 0.002.

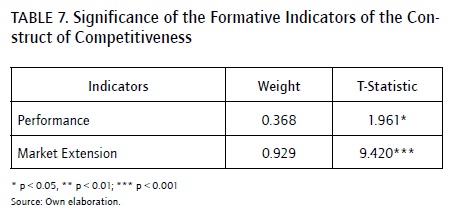

To test the significance of the coefficients of the formative indicators, we used bootstrapping with 500 subsamples. With significance levels of 5%, 1% and 0.1%, and relying on the one-tailed test for t(499), the following critical t values were obtained: t(0.05;499) = 1.6479, t(0.01;499) = 2.3338 and t(0.001;499) = 3.1066. In our case, there was only one construct with formative indicators, that of competitiveness. As shown in Table 7, the coefficients of its indicators (performance and market extension) were significant.

To determine the discriminant validity of the formative construct, the correlations between the formative construct and the rest of the constructs must be less than 0.7 (Urbach & Ahlemann, 2010). This restriction is also fulfilled in the model proposed, as can be observed in the last row of Table 6.

Evaluating the structural model

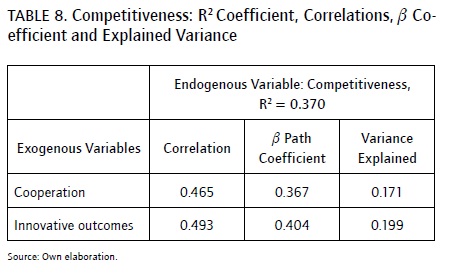

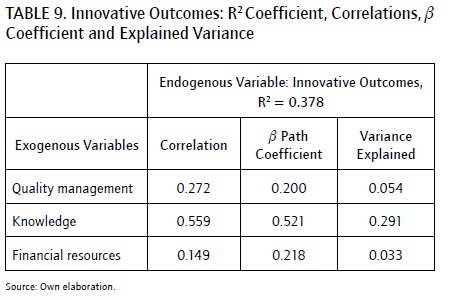

To evaluate the structural model, we used the R2 coefficients, the correlations between endogenous and exogenous constructs, and the standard path coefficients. In terms of competitiveness, 37% of variance was explained by the proposed model (17% due to cooperation and 20% to innovative outcomes). With respect to the construct of innovative outcomes, 37.8% of its variability was explained (29.1 % due to knowledge, 5.4% to quality management systems, and 3.3% to financial resources) (Tables 8 and 9).

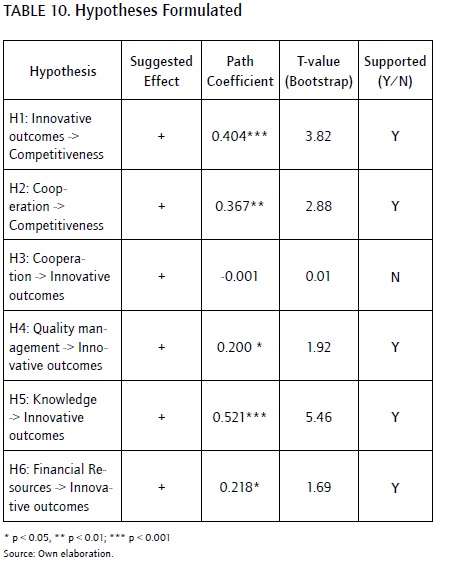

A bootstrap of 500 subsamples was used to test the model's hypotheses. With the significance levels and critical t values previously indicated, a proposed hypothesis was not rejected when the "experimental t value" was greater than the "critical t value". Table 10 shows the values

TABLE 8. competitiveness: R2 coefficient, correlations, b coefficient and Explained Variance corresponding to the hypotheses formulated. Thus, the only hypothesis rejected was hypothesis 3.

Evaluating Results

The model of structural equations proposed is valid as a whole and exceeds the usual tests related to the measurement model. In addition, the model shows predictive capacity, as the results of the Stone-Geisser test suggest. The Q2 values obtained with this test for the constructs of competitiveness and innovative outcomes are 0.116 and 0.099 respectively.

By analyzing the model, we may interpret the competitiveness of firms in this sector as a weighted average of performance and market extension where the weighting of the latter almost triples that of the former. The two dimensions selected are independent, though not equally relevant. If we opted to simplify the model even further, it could be shown that SMEs become more competitive as they extend their markets.

Competitiveness is explained by both innovative outcomes and cooperation. A high percentage of the variance of competitiveness is explained by the model. In understanding innovative outcomes, we must focus on knowledge, even though the influence of quality management and financial resources is also significant.

Among the hypotheses proposed, the hypothesis that cooperation exerts a positive influence on innovative outcomes was refuted. From a theoretical point of view, this result is not easily justifiable. But although it seems unusual, the finding is not entirely strange in Andalusia. In another study carried out in Seville (Spain), it was observed that cooperation could harm levels of innovation in small-and medium-sized firms (Martínez-Román et al, 2011). Perhaps the lack of a relationship between these two variables is an indication of organizational managers' low level of trust when establishing relationships with partners. This particular characteristic of a cultural nature will likely require more in-depth analysis in future studies.

The lack of a direct relationship between cooperation and innovation is not just unusual from a theoretical point of view. Understanding why this occurs is practically useful on a firm level as well as for economic policy. If cooperation is not directed toward the goal of innovative outcomes, it is predictable that the level of competitiveness will diminish. In order to improve this situation, it seems logical to reward behaviors that reduce opportunistic behavior by organizations. The objective would be to protect the interests of the collaborators, reducing opportunistic behavior with swift arbitration systems that would help to solve disputes between parties at the lowest cost possible. It also seems reasonable to encourage organizations' access to national and international networks of cooperation with a potential for developing innovations.

Conclusions

In this research paper we formulated a model of business competitiveness which proves that cooperation and innovative outcomes exert a real influence on competitiveness in firms belonging to the Andalusian metal-mechanic sector. Cooperation and innovative outcomes explain 37% of the variation in competitiveness. This result is interesting because it could encourage a concentrated effort both on an organizational management level and in the design of public policies. Thus, firm competiveness can be encouraged by fostering innovation in products and establishing the necessary conditions for increased cooperation with distributors and the development of more closely knit collaborative networks.

Describing competitiveness as a bidimensional construct allows us to focus efforts for promoting competitiveness. Moreover, the fact that the indicator of market extension has a greater weight than that of profitability can guide the search for competitiveness in this sector even more: Competitiveness can be attained fundamentally by the broadening of markets and internationalization.

The model also shows the significant influence exerted on innovative outcomes by quality management, knowledge and financial resources. Thus, the main contributions of this work are related to the hypotheses proposed in the research. However, the fact that cooperation does not contribute in a meaningful way to innovative outcomes is, in our opinion, as interesting as the hypotheses contrasted. This counterintuitive result also contradicts the majority of studies on innovation, although it does not appear strange in this business context. The finding may be attributable to peculiar characteristics of the cultural setting, which create the existing mistrust among organizational managers with regards to sharing knowledge. In any case, this lack of a relationship requires greater attention. We therefore suggest that the potential effect of cooperation on innovative outcomes could be taken on in future research, extending the model to new relationships of cooperation.

The negative influence of external funding on innovation may also be unusual. Easy access to bank funding seems to harm innovative outcomes. While this anomaly appears to result from various causes, the simplest explanation can be summarized as follows: Financial entities are not normally willing to assume the risk of funding innovations. This supposition is especially plausible in these times of credit restrictions and economic crisis in which firms lacking outside funding have to rely exclusively on their own funds in order to innovate.

As shown in our research, we have answered some questions while also identifying new areas of inquiry to be analyzed in future studies. In light of this work, the most obvious questions center on the lack of a positive influence of cooperation and easily accessible external funding on innovative outcomes. Additionally, as we have focused on a specific sector and region, it may be of interest to broaden the study to more sectors and make interregional comparisons allowing the results to be generalized, and to shed even more light on the factors that determine firm competitiveness.

References

Aiginger, K. (2006). Revisiting an evasive concept: Introduction to the special issue on competitiveness. Journal of Industry, Competition and Trade, 6(2), 115-136. [ Links ]

Ali, A. J. (2000). Rethinking competitiveness. Advances in Competitiveness Research, 8(1), 1-3. [ Links ]

Amara, N., Landry, R., Becheikh, N., & Ouimet, M. (2008). Learning and novelty of innovation in established manufacturing SMEs. Technovation, 28(7), 450-463. [ Links ]

Audretsch, D. B., & Lehmann, E. E. (2005). Does the knowledge spillover theory of entrepreneurship hold for regions? Research Policy, 34(8), 1191-1202. [ Links ]

Barclay, D., Higgins, C., & Thompson, R. (1995). The Partial Least Squares (PLS) approach to causal modeling: Personal computer adoption and use as an illustration (with commentaries). Technology Studies, 2(2), 285-323. [ Links ]

Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120. [ Links ]

Beneito, P. (2003). Choosing among alternative technological strategies: An empirical analysis of formal sources of innovation. Research Policy, 32(4), 693-713. [ Links ]

Bertrand, O. (2009). Effects of foreign acquisitions on R&D activity: Evidence from firm-level data for France. Research Policy, 38(6), 1021-1031. [ Links ]

Birley, S., & Westhead, P. (1990). Growth and performance contrasts between 'types' of small firms. Strategic Management Journal, 11 (7), 535-557. [ Links ]

Blaine, M. (1993). Profitability and competitiveness: Lessons from Japanese and American firms in the 1980s. California Management Review, 36(1), 48-48. [ Links ]

Brockman, B. K., & Morgan, R. M. (2003). Role of existing knowledge in new product innovativeness and performance. Decision Sciences, 34(2), 385-419. [ Links ]

Caloghirou, Y., Kastelli, I., & Tsakanikas, A. (2004). Internal capabilities and external knowledge sources: Complements or substitutes for innovative performance? Technovation, 24(1), 29-39. [ Links ]

Caridi, A. (1997). Profile analysis in automotive component industry: A new methodology to analyze a firm's competitiveness. Advances in Competitiveness Research, 5(1), 4-31. [ Links ]

Chen, C. (2008). Causal modeling of knowledge-based economy. Management Decision, 46(3), 501-514. [ Links ]

Chen, D., & Karami, A. (2010). Critical success factors for inter-firm technological cooperation: An empirical study of high-tech SMEs in China. International Journal of Technology Management, 51(2- 4), 282-299. [ Links ]

Chen, M. H., & Yang, Y. J. (2009). Typology and performance of new ventures in Taiwan. A model based on opportunity recognition and entrepreneurial creativity. International Journal of Entrepreneurial Behaviour & Research, 15(5), 398-414. [ Links ]

Chew, D. A. S., Yan, S., & Cheah, C. Y. J. (2008). Core capability and competitive strategy for construction SMEs in China. Chinese Management Studies, 2(3), 203-214. [ Links ]

Chikan, A. (2008). National and firm competitiveness: A general research model. Competitiveness Review, 18(1/2), 20-28. [ Links ]

Chin, W. W. (1998). The partial least squares approach for structural equation modeling, in G. A. Marcoulides (Ed.), Modern methods for business research (pp. 295-336). Mahwah, NJ: Lawrence Erl-baum Associates, Publisher. [ Links ]

Chin, W. W., Marcolin, B. L., & Newsted, P. R. (2003). A partial least squares latent variable modeling approach for measuring interaction effects: Results from a Monte Carlo simulation study and an electronic-mail emotion/adoption study. Information Systems Research, 14(2), 189-217. [ Links ]

Chittithaworn, C., Islam, M. A., Keawchana, T., & Yusuf, D. H. M. (2011). Factors affecting business success of small & medium enterprises (SMEs) in Thailand. Asian Social Science, 7(5), 180-190. [ Links ]

Cho, H., & Pucik, V. (2005). Relationship between innovativeness, quality, growth, profitability, and market value. Strategic Management Journal, 26(6), 555-575. [ Links ]

Connor, T. (2003). Managing for competitiveness: S proposed model for managerial focus. Strategic Change, 12(4), 195-207. [ Links ]

Cooper, R. G., & Kleinschmidt, E. J. (1987). New products: What separates winners from losers? Journal of Product Innovation Management, 4(3), 169-184. [ Links ]

Correa, A., Acosta, M., González, A. L., & Medina, U. (2003). Size, age and activity sector on the growth of the small and medium firm size. Small Business Economics, 21(3), 289-307. [ Links ]

Damanpour, F. (1991). Organizational innovation: A meta-analysis of effects of determinants and moderators. Academy of Management Journal, 34(3), 555-590. [ Links ]

Dinh, T. H., Igel, B., & Laosirihongthong, T. (2006). The impact of total quality management on innovation findings from a developing country. International Journal of Quality & Reliability Management, 23(9), 1092-1117. [ Links ]

Dobbs, M., & Hamilton, R. T. (2007). Small business growth: Recent evidence and new directions. International Journal of Entrepreneurial Behaviour & Research, 13(5), 296-296. [ Links ]

Elston, J. A., & Audretsch, D. B. (2011). Financing the entrepreneurial decision: An empirical approach using experimental data on risk attitudes. Small Business Economics, 36(2), 209-222. [ Links ]

Enright, M. J., & Roberts, B. H. (2001). Regional clustering in Australia. Australian Journal of Management, 26(1 Suppl), 65-85. [ Links ]

European Commission (2010). Europe 2020: A strategy for smart, sustainable and inclusive growth, COM/2010/2020 final, Brussels. [ Links ]

European Commission (2005). Communication to the Spring European Council - Working together for growth and jobs - A new start for the Lisbon Strategy, Communication from President Barroso in agreement with Vice-President Verheugen, COM/2005/24 final, Brussels. [ Links ]

European Council (2000). Presidency conclusions of the Extraordinary Lisbon European Council of 23-24 March, SN 100/1/00, Brussels. [ Links ]

Falck, O., Heblich, S., & Kipar, S. (2010). Industrial innovation direct evidence from a cluster-oriented policy. Regional Science and Urban Economics, 40(6), 574-582. [ Links ]

Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39-50. [ Links ]

Forsman, H. (2011). Innovation capacity and innovation development in small enterprises. A comparison between the manufacturing and service sectors. Research Policy, 40(5), 739-750. [ Links ]

Freel, M. (2003). Sectoral patterns of small firm innovation, networking and proximity. Research Policy, 32(5), 751-770. [ Links ]

Fukugawa, N. (2005). Characteristics of knowledge interactions between universities and small firms in Japan. International Small Business Journal, 23(4), 379-401. [ Links ]

Furman, J. L., Porter, M. E., & Stern, S. (2002). The determinants of national innovative capacity. Research Policy, 31 (6), 899-933. [ Links ]

Galende, J., & De la Fuente, J. M. (2003). Internal factors determining a firm's innovative behavior. Research Policy, 32(5), 715-736. [ Links ]

Giudici, G., & Paleari, S. (2000). The provision of finance to innovation: A survey conducted among Italian technology-based small firms. Small Business Economics, 14(1), 37-53. [ Links ]

Gobeli, D. H., & Brown, D. J. (1993). Improving the process of product innovation. Research Technology Management, 32(2), 38-38. [ Links ]

Guan, J., & Ma, N. (2003). Innovative capability and export performance of Chinese firms. Technovation, 23(9), 737-747. [ Links ]

Gundry, L. K., & Welsch, H. P. (2001). The ambitious entrepreneur: High growth strategies of women-owned enterprises. Journal of Business Venturing, 16(5), 453-470. [ Links ]

Hair, J. F., Ringle, C. M., & Sarstedt, M. (2011). PLS-SEM: Indeed a Silver Bullet. Journal of Marketing Theory and Practice, 19(2), 139-151. [ Links ]

Han, S. B., Chen, S. K., & Ebrahimpour, M. (2007). The Impact of ISO 9000 on TQM and business performance. Journal of Business and Economic Studies, 13(2), 1-23. [ Links ]

Henseler, J., Ringle, C. M., & Sinkovics, R. R. (2009). The use of partial least squares path modeling in international marketing, in R. R. Sinkovics & P. N. Ghauri (Eds.), New challenges to international marketing (Advances in International Marketing, Vol. 20, pp. 277319). Bingley, UK: Emerald. [ Links ]

Hernández-Espallardo, M., Sánchez-Pérez, M., & Segovia-López, C. (2011). Exploitation- and exploration-based innovations: The role of knowledge in inter-firm relationships with distributors. Technovation, 31(5-6), 203-215. [ Links ]

Hewitt-Dundas, N., & Roper, S. (2011). Creating advantage in peripheral regions: The role of publicly funded R&D centres. Research Policy, 40(6), 832-841. [ Links ]

Hitt, M. A., Keats, B. W., & DeMarie, S. M. (1998). Navigating in the new competitive landscape: Building strategic flexibility and competitive advantage in the 21st century. Academy of Management Executive, 12(4), 22-42. [ Links ]

Hull, C. E., & Covin, J. G. (2010). Learning capability, technological parity and innovation mode use. Journal of Product Innovation Management, 27(1), 97-114. [ Links ]

Hung, R. Y., Lien, B. Y., Yang, B., Wu, C. M., & Kuo, Y. M. (2011). Impact of TQM and organizational learning on innovation performance in the high-tech industry. International Business Review, 20(2), 213-225. [ Links ]

Hurley, R. F., & Hult, G. T. (1998). Innovation, market orientation, and organizational learning: An integration and empirical examination. Journal of Marketing, 62(3), 42-54. [ Links ]

Irani, Z., Choudrie, J, Love, P. E. D., & Gunasekaran, A. (2002). Sustaining TQM through self-directed work teams. The International Journal of Quality & Reliability Management, 19(5), 596-596. [ Links ]

Jarillo, C. J. (1988). On strategic networks. Strategic Management Journal, 9(1), 31-41. [ Links ]

Jiménez-Jiménez, D., & Sanz-Valle, R. (2011). Innovation, organizational learning, and performance. Journal of Business Research, 64(4), 408-417. [ Links ]

Kamien, M., & Schwartz, N. (1978). Self-financing of an R&D project. American Economic Review, 68(3), 252-261. [ Links ]

Kang, K. H., & Kang, J. (2009). How do firms source external knowledge for innovation? Analysing effects of different knowledge sourcing methods. International Journal of Innovation Management, 13(1), 1-17. [ Links ]

Kaufmann, A., & Tòdtling, F. (2002). How effective is innovation support for SMEs? An analysis of the region of Upper Austria. Technovation, 22(3), 147-159. [ Links ]

Kaufmann, A., & Tòdtling, F. (2001). Science-industry interaction in the process of innovation: The importance of boundary-crossing between systems. Research Policy, 30(5), 791-804. [ Links ]

Keizer, J. A., Dijkstra, L., & Halman, J. I. (2002). Explaining innovative efforts of SMEs. An exploratory survey among SMEs in the mechanical and electrical engineering sector in the Netherlands. Technovation, 22(1), 1-13. [ Links ]

Ketels, C. H. M. (2006). Michael Porter's competitiveness framework-recent learnings and new research priorities. Journal of Industry, Competition and Trade, 6(2), 63-66. [ Links ]

Kroll, H., & Schiller, D. (2010). Establishing an interface between public sector applied research and the Chinese enterprise sector: Preparing for 2020. Technovation, 30(2), 117-129. [ Links ]

Krugman, P. R. (1996). Making sense of the competitiveness debate. Oxford Review of Economic Policy, 12(3), 17-25. [ Links ]

Krugman, P. R. (1994a). Competitiveness: A dangerous obsession. Foreign Affairs, 73(2), 28-44. [ Links ]

Krugman, P. R. (1994b). The fight over competitiveness: A zero sum debate: Response: Proving my point. Foreign Affairs, 73(4), 186-201. [ Links ]

Levenson, A. R., & Willard, K. L. (2000). Do firms get the financing they want? Measuring credit rationing experienced by small businesses in the US. Small Business Economics, 14(2), 83-94. [ Links ]

Levinthal, D. A. (1991). Random walks and organizational mortality. Administrative Science Quarterly, 36(3), 397-420. [ Links ]

Li, J., & Kozhikode, R. K. (2009). Developing new innovation models: Shifts in the innovation landscapes in emerging economies and implications for global R&D management. Journal of International Management, 15(3), 328-339. [ Links ]

Li, L. X. (2000). An analysis of sources of competitiveness and performance of Chinese manufacturers. International Journal of Operations & Production Management, 20(3), 299-315. [ Links ]

Lin, B. W. (2003). Technology transfer as technological learning: A source of competitive advantage of firms with limited R&D resources. R&D Management, 33(3), 327-341. [ Links ]

Loyka, J. J., & Powers, T. L. (2003). A model of factors that influence global product standardization. Journal of Leadership & Organizational Studies, 10(2), 64-72. [ Links ]

Malmberg, A., & Power, D. (2005). (How) do (firms in) clusters create knowledge? Industry and Innovation, 12(4), 409-431. [ Links ]

Martínez-Román, J. A., Gamero, J., & Tamayo, J.A. (2011). Analysis of innovation in SMEs using an innovative capability-based non-linear model: A study in the province of Seville (Spain). Technovation, 31 (9), 459-475. [ Links ]

McAdam, R., Armstrong, G., & Kelly, B. (1998). Investigation of the relationship between total quality and innovation: A research study involving small organisations. European Journal of Innovation Management, 1(3), 139-147. [ Links ]

McAdam, R., Moffett, S., Hazlett, S. A., & Shevlin, M. (2010). Developing a model of innovation implementation for UK SMEs: A path analysis and explanatory case analysis. International Small Business Journal, 28(3), 195-214. [ Links ]

Mehra, S., Hoffman, J. M., & Sirias, D. (2001). TQM as a management strategy for the next millennia. International Journal of Operations & Production Management, 21 (5), 855-876. [ Links ]

Mesquita, L. F., Lazzarini, S. G., & Cronin, P. (2007). Determinants of firm competitiveness in Latinamerican emerging economies. International Journal of Operations & Production Management, 27(5), 501-523. [ Links ]

Oksanen, J., & Rilla, N. (2009). Innovation and entrepreneurship: New innovations as source for competitiveness in Finnish SMEs. International Journal of Entrepreneurship, 13(1), 35-48. [ Links ]

Pehrsson, A. (2007). The strategic states model: Strategies for business growth. Business Strategy Series, 8(1), 58-63. [ Links ]

Perdomo-Ortiz, J., González-Benito, J., & Galende, J. (2006). Total quality management as a forerunner of business innovation capability. Technovation, 26(10), 1170-1185. [ Links ]

Porter, M. E. (1990). The competitive advantage of nations. New York, N.Y.: Free Press. [ Links ]

Quintana, C., & Benavides, C. (2008). Innovative competence, exploration and exploitation: The influence of technological diversification. Research Policy, 37(3), 492-507. [ Links ]

Reinartz, W. J., Haenlein, M., & Henseler, J. (2009). An empirical comparison of the efficacy of covariance-based and variance-based SEM. International Journal of Market Research, 26(4), 332-344. [ Links ]

Ringle, C. M., Gòtz, O., Wetzels, M., & Wilson, B. (2009). On the use of formative measurement specifications in structural equation modeling: A Monte Carlo simulation study to compare covari-ance-based and partial least squares model estimation methodologies. Research Memoranda (METEOR), RM/09/014, Maastricht University. [ Links ]

Romijn, H., & Albaladejo, M. (2002). Determinants of innovation capability in small electronics and software firms in Southeast England. Research Policy, 31(7), 1053-1067. [ Links ]

Rondé, P., & Hussler, C. (2005). Innovation in regions: What does really matter? Research Policy 34(8), 1150-1172. [ Links ]

Satish, K. P., & Srinivasan, R. (2010). Total quality management and innovation performance: An empirical study on the interrelationships and effects. South Asian Journal of Management, 17(3), 8-22. [ Links ]

Soeters, J. (1993). Managing Euregional networks. Organization Studies, 14(5), 639-656. [ Links ]

Steward, F., & Conway, S. (2000). Building networks for innovation diffusion in Europe: Learning from the SPRINT programme. Enterprise & Innovation Management Studies, 1 (3), 281-301. [ Links ]

Subramaniam, M., & Youndt, M. A. (2005). The Influence of intellectual capital on the types of innovative capabilities. Academy of Management Journal, 48(3), 450-463. [ Links ]

Tangen, S. (2003). An overview of frequently used performance measures. International Journal of Productivity and Performance Management, 52(6), 347-354. [ Links ]

Thoumrungroje, A., & Tansuhaj, P. (2004). Globalization effects, co-marketing alliances, and performance. Journal of American Academy of Business, 5(1), 495-502. [ Links ]

Urbach, N., & Ahlemann, F. (2010). Structural Equation Modeling in Information Systems Research Using Partial Least Squares. Journal of Information Technology Theory and Application, 11(2), 5-40. [ Links ]

Vega-Jurado, J., Gutiérrez-Gracia, A., & Fernández-de-Lucio, I. (2009). Does external knowledge sourcing matter for innovation? Evidence from the spanish manufacturing industry. Industrial and Corporate Change, 18(4), 637-670. [ Links ]

Vega-Jurado, J., Gutiérrez-Gracia, A., Fernández-de-Lucio, I., & Manjarrés-Henríquez, L. (2008). The effect of external and internal factors on firms' product innovation. Research Policy, 37(4), 616-632. [ Links ]

Von Hippel, E. (1986). Lead Users: A Source of Novel Product Concepts. Management Science, 32(7), 791-805. [ Links ]

Wang, T. Y., & Thornhill, S. (2010). R&D investment and financing choices: a comprehensive perspective. Research Policy, 39(9), 1148-1159. [ Links ]

Yam, R. C. M., Lo, W., Tang, E. P. Y., & Lau, A. K. W. (2011). Analysis of sources of innovation, technological innovation capabilities, and performance: An empirical study of Hong Kong manufacturing industries. Research Policy 40(3), 391-402. [ Links ]