Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Innovar

Print version ISSN 0121-5051

Innovar vol.25 no.56 Bogotá Apr./June 2015

https://doi.org/10.15446/innovar.v25n56.48994

DOI: http://dx.doi.org/10.15446/innovar.v25n56.48994

Motives for Financial Valuation of Intangibles and Business Performance in SMEs1

Motivos para la valoración financiera de intangibles y su relación con el desempeño empresarial de pequeñas y medianas empresas

Motifs de la valorisation financière des ressources immatérielles et leur relation avec la performance entrepreneuriale des petites et moyennes entreprises

Motivos financeiros para avaliação de intangíveis e desempenho dos negócios para as pequeñas e médias empresas (PMES)

Belén Vallejo-AlonsoI, José Domingo García-MerinoII, Gerardo Arregui-AyastuyIII

I Ph.D. En Ciencias Económicas y Empresariales Universidad del País Vasco (UPV/EHU)

Bilbao, España

Equipo de Investigación sobre Valoración Financiera de los Intangibles (VALINTE)

Correo electrónico: belen.vallejo@ehu.es

II Ph.D. En Ciencias Económicas y Empresariales Universidad del País Vasco (UPV/EHU)

Bilbao, España

Equipo de Investigación sobre Valoración Financiera de los Intangibles (VALINTE)

Correo electrónico: josedomingo.garcia@ehu.es

III Ph.D. En Ciencias Económicas y Empresariales Universidad del País Vasco (UPV/EHU)

Bilbao, España

Equipo de Investigación sobre Valoración Financiera de los Intangibles (VALINTE)

Correo electrónico: gerardo.arregui@ehu.es

Correspondencia: Belén Vallejo Alonso. F. de CC Económicas y Empresariales. Dto. Economía Financiera II. Avda. Lehendakari Aguirre 83. 48015 Bilbao (Vizcaya) España.

Citación: Vallejo-Alonso, B., García-Merino, J. D., & Arregui-Ayastuy, G. (2015). Motives for Financial Valuation of Intangibles and Business Performance in SMEs. Innovar, 25(56), 113-128. doi: 10.15446/inno-var.v25n56.48994. Enlace DOI: http://dx.doi.org/10.15446/innovar.v25n56.48994.

Clasificación JEL: M10, G39, L25.

Recibido: Octubre 2011, Aprobado: Junio 2013.

Abstract:

In line with the Resource-based view, intangibles have become the key resource for generating competitive advantages in a firm. This is particularly significant in the case of small and medium enterprises (SMEs) whose competitive advantage is frequently based on intangible resources. However, there has been little attempt to assess and measure the role of intangible resources in firms' performance, and the motives driving their valuation process. Besides, most of the studies have been carried out in large firms. This article, combining theoretical contributions and empirical evidence, aims to analyze the relationship between the motives, external or internal, driving the valuation process of intangibles and the performance obtained by SMEs. Considering the recognized hypotheses and based on a survey of a representative sample of 369 Spanish SMEs' managers, in addition to the financial data collected from these firms, we explore whether the different motives driving the companies to perform a financial valuation of their intangibles are reflected in the business performance, and conditioned by financial structure and the level of intangibles. Results indicate that SMEs consider important to report intangibles value to external stakeholders as they depict a higher level of borrowing, as well as a higher level of intangibles accounted in the balance sheet. Furthermore, SMEs that consider the financial valuation of their intangibles for internal reasons achieve better performance. The implications of these results and suggestions for future research are dicussed as well.

Key words: Intangibles, financial valuation of intangibles, small and medium enterprises (SMEs), managers' opinion, business performance.

Resumen:

En conjunto con el enfoque en recursos de una firma, los activos intangibles se han convertido en elemento clave para la generación de ventajas competitivas, especialmente, en pequeñas y medianas empresas (Pymes), cuya ventaja competitiva regularmente se centra en sus intangibles. A pesar de su importancia es poco lo que se ha hecho para evaluar y medir el papel de los recursos intangibles de las empresas, así como los motivos que impulsan su proceso de valoración financiera, teniendo en cuenta que la mayor parte de los estudios en este campo se han llevado a cabo en grandes empresas. Mediante el estudio de aportes teóricos y evidencia empírica, este artículo tiene como objetivo analizar la relación entre los motivos internos y externos que impulsan el proceso de valoración de intangibles, y el desempeño general de las Pymes analizadas. Partiendo de la información presentada en hipótesis reconocidas, y con base en una muestra representativa de 369 gerentes de Pymes en España, e información financiera de las firmas que representan, se examinó si los motivos que impulsan a las empresas a valorar económicamente sus intangibles se ven reflejados en el desempeño empresarial de la firma, y si estos se encuentran condicionados por su estructura financiera y el carácter mismo de sus intangibles. Los resultados indican que las Pymes consideran relevante presentar el valor de sus intangibles a terceros, ya que estos se ven representados en una capacidad de endeudamiento superior y un reporte de mayores activos en sus balances generales, a lo que se suma una mejoría en el desempeño financiero en general. Finalmente, se discuten las implicaciones de los resultados obtenidos por este estudio y se presentan ciertas recomendaciones para investigaciones futuras.

Palabras Clave: Intangibles, valoración financiera de intangibles, pequeñas y medianas empresas (Pymes), opinión de los directivos, desempeño de la firma.

Résumé:

Conjointement avec 1'approche fondée sur les ressources de l'entre-prise, les actifs intangibles (ou immatériels) sont devenus un élément clé pour la génération d'avantages concurrentiels, en particulier dans les petites et moyennes entreprises (PME), dont l'avantage concurrentiel réside habituellement en leurs ressources immatérielles. En dépit de l'importance de ce type de ressources, peu d'études ont cherché à évaluer et mesurer leur rôle et à préciser les motifs qui im-pulsent leur processus de valorisation financière, en outre, la plupart des études menées en ce domaine portent sur de grandes entreprises. À travers une étude des apports théoriques et des évidences empiriques, cet article se propose d'analyser la relation entre les motifs internes et externes qui impulsent le processus de valorisation des ressources immatérielles et la performance générale des PME étudiées À partir de l'information présentée en hypotheses reconnues et sur la base d'un échantillon représentatif de 369 dirigeants de PME espagnoles et de l'information financière des firmes qu'ils représentent, on examine si les motifs qui incitent les entreprises à valoriser financièrement leurs ressources immatérielles se reflètent dans la performance de la firme et s'ils sont conditionnés par la structure financière des entreprises et le caractère même de leurs ressources immatérielles. Les résul-tats montrent que les PME considèrent comme important de présenter aux tiers la valeur de leurs ressources immatérielles vu que celles-ci sont représentées dans les bilans généraux par une capacité d'endettement supérieure et un rapport de plus grands actifs, à quoi s'ajoute une amélioration de la performance financière en gé-néral. Enfin, l'article analyse les implications des résultats obtenus par cette étude et formule quelques recommandations pour de futures recherches en ce domaine.

Mots-clés: Ressources immatérielles, valorisation financière des ressources immatérielles, petites et moyennes entreprises (PME), opinion des dirigeants, performance de la firme.

Resumo:

Em linha com a Visão Baseada em Recursos (Resource-Based View – RBV), os intangíveis tornaram-se o principal recurso para gerar vantagens competitivas em uma empresa. Isso é particularmente importante no caso das Pequenas e Médias Empresas (PMEs), cuja vantagem competitiva é frequentemente baseada em recursos intangíveis. No entanto, tem havido pouco esforço para avaliar e medir o papel dos recursos intangíveis no desempenho das empresas e dos motivos de dirigir seu processo de avaliação. Além disso, a maioria dos estudos têm sido realizados em grandes empresas. Este artigo combina contribuições teóricas e dados empíricos, tem por objetivo analisar a relação entre os motivos, internos ou externos, a condução do processo de avaliação dos intangíveis e o desempenho obtido pelas pequeñas e médias empresas. Considerando-se as hipóteses reconhecidas e com base em uma pesquisa com uma amostra representativa de 369 gestores de PMEs espanholas, além dos dados financeiros obtidos a partir dessas empresas, exploramos se os diferentes motivos de condução das empresas para realizar uma avaliação financeira de seus ativos intangíveis, são refletidos no desempenho dos negócios, e condicionada pela estrutura financeira e o nível de intangíveis. Os resultados indicam que as PMEs consideram importante fazer relatório dos bens incorpóreos de valor para as partes interessadas externas porque estas mostram um maior nível de endividamento, bem como um maior nível de intangíveis contabilizados no balanço. Além disso, as PME consideram que conseguem um melhor desempenho da avaliação financeira de seus intangíveis por razões internas. As implicações desses resultados são discutidas, bem como são dadas sugestões para futuras pesquisas.

Palavras-chave: Intangíveis, avaliação financeira de bens incorpóreos, Pequenas e Médias Empresas (PMEs), Gestores de Opinião, desempenho dos negócios.

Introduction

Intangibles are the major drivers of company growth (Lev & Zambon, 2003). There are numerous studies that find evidence of the positive relationship of investing in intangibles and the value creation of the company (Firer & Williams, 2003; Riahi-Belkaoui, 2003; Sáenz, 2005; Prieto & Revilla, 2006; Tan et al., 2007).

Interest in intangibles is not limited to the academic field and has arisen as a growing concern also detected in the business world. Studies such as Hall (1992), Gray et al. (2004), Gallego and Rodríguez (2005), or Lonnqvist et al. (2008) show management conviction regarding the key role that intangibles play in the development of competitive advantages. This is particularly significant in the case of SMEs whose competitive advantage is frequently based on intangible resources, mainly those companies intensive in knowledge that represent one of the principal revitalizing elements of the economy. The importance of an adequate management of intangible resources is clear, and is especially relevant during economic crisis periods.

In order to adequately manage intangibles it is necessary to get information relating to them. The constraints of the information provided by the markets and accounting systems have fostered a research approach, which emerged in the 1990s, to identify and value the intangible resources of the companies. Nevertheless, the identification and valuation of intangibles is not exempt from difficulties: 1) it is necessary to acquire costs for obtaining the information; 2) in most cases there are no standardized processes to value them; 3) it results difficult to individually assess each intangible because of the existence of synergies; 4) managers are afraid of providing competitors with critical information.

What can lead the companies to incur in costs in order to value their intangibles? The motives that drive companies to value their intangibles can be internal -related to generating information for managers- or external -related to the report on intangibles to external stakeholders. Greater knowledge regarding intangibles and their value, among other benefits, allows an efficient allocation of the resources (Canibaño et al., 1999), reduces the risk of opportunist behavior by managers (Abbody & Lev, 2000) and reduces capital costs (Botosan, 1997; Lev, 2001). Independently of the motive that drives the valuation of intangibles, the generated information should contribute to a better management and thus improve results. Nevertheless, the motive that stands out in each case can determine both the results obtained, and the intensity of the obtained enhancement.

There is ample literature on the measurement and valuation of intangibles and their relationship with business performance (Bontis et al., 2000; Bontis & Fitz-Enz, 2002; Riahi-Belkaoui, 2003; Sáenz, 2005; Chen, 2005; Chen et al., 2005; Tan et al., 2007; Wang, 2008; Hang, 2009; Francisco et al., 2010; Garanina & Pavlova, 2011; Zerhri et al., 2012). However, very few authors analyze whether there is a relationship between the motives that may lead to a financial valuation process of the intangibles and business performance. Lonnqvist et al. (2008) find that companies pay greater attention to internal motives, rather than external, when they measure their intangibles.

It is noteworthy that most of the studies so far conducted focus on large companies, whereas SMEs are the mainstay of the European business structure, and that is particularly true in Spain (Eurostat, 2009). SMEs with fewer financial and tangible resources should support their competitive advantage in intangible resources.

In recent years, some works analyzing the importance of intangibles in SMEs and their influence in management have been published. Thornhill and Gellatly, (2005), Ya-suda (2005), Calvo (2006) and Nunes and Almeida (2009), establish a positive relationship between companies' investments in intangibles and their growth. Durst and Gueldenberg (2009) found that, in the case of external succession in SMEs, intangible assets have a remarkable influence decision-making on the external successor. Bakar and Ahmad (2010) suggest that intangibles are the main innovation drivers in Malaysian SMEs, and Pena (2002) concludes that intangibles in Spanish companies are associated with the survival and growth of startups.

Still, there are very few studies on the valuation of SMEs' intangibles, the possible motives behind this valuation and their effect on results. Salojarvi (2004) found that Finnish SMEs that implement active practices to manage their intangibles obtain better results in innovation and developing new products.

Because of this lack of empirical studies we analyze the relationship between the motives driving the valuation process and the results obtained by companies. The study shows that SMEs that consider the financial valuation of their intangibles to be important for internal reasons get a better performance, with a statistically significant growth in profits. On the other hand, SMEs that believe the financial valuation of their intangibles is important in order to facilitate information for external stakeholders are pressured to do so, because they have higher levels of leverage, and because of the load of the intangibles resources in relation to total resources with the weight of intangible resources is statistically significant.

The study is structured as follows. First, the role that SMEs intangibles play in determining business competitiveness is justified, using the Resource-based view. Subsequently, the advantages and difficulties generated by the financial valuation of intangibles are analyzed. The third section considers the hypothesis of this study, namely, whether the different motives driving companies to perform a financial valuation of their intangibles are reflected in business performance and conditioned by financial structure. In the following section, the methodology to test the proposed hypothesis is described. The results are then explained and the main conclusions presented.

Intangibles as Strategic Resources and the Reasons for their Financial Valuation

Intangible Resources as a Source of competitive Advantage

Bettis and Hitt (1995) state that the traditional limits of sectors have become blurred, and markets are intermingled and overlaid in highly volatile environments. It is therefore now more difficult and less evident to determine what constitutes a sector. Therefore, a strategy must be defined in terms of what the company is capable of doing, instead of using the customers and their needs as the benchmark (Quinn, 1992). Management strategy must consider the impact on the adjustment of the company's resources and capabilities to respond to the opportunities that emerge from its environment (Grant, 2002).

All the same, not all resources are equally important for business success. Barney (1991) argues that those resources that provide a competitive advantage, and therefore determine value creation in the firm, must be valuable, rare, inimitable and non-substitutable. A competitive advantage is sustainable when based on heterogeneous and imperfectly transferable resources (Lippman & Rumelt, 1982; Grant, 1991; Barney, 1991; Amit & Schoemaker, 1993). With rare exceptions, the resources that fulfil these criteria are usually intangibles (Itami & Roehl, 1987; Hall, 1992; Barney, 1991; Grant, 1991; Boisot, 1998; Kristandl & Bontis, 2007). Their specific characteristics provide them with substantial differentiating potential (Villalonga, 2004), that competitors find difficult to imitate (Kaplan & Norton, 2004; Rodríguez & Ordónez, 2003).

The Resource-based view has evolved in recent years and mainly focuses on three dimensions: the Knowledge-based approach, the Relational approach and the Intellectual-capital approach. The Intellectual-capital approach (Reed et al., 2006) involves the primacy of intangibles in achieving better and sustainable business performance. This pragmatic-theory approach represents a focalization or specialization of the Resource-based view on those intangibles or factors that may lead to business success. This trend, that emerged from professional practice, distinguishes different categories of intangibles: 1) human capital, or knowledge, skills, experiences and attitudes held by the members of an organization (Bueno, 2003; Subramaniam & Young, 2005); 2) structural capital, which includes the knowledge that provides coherence and a common thread to the whole organization (Edvinsson & Malone, 1997); and 3) relational capital, which emerges from the ability that the organization needs to have relationships with its external stakeholders (Bueno, 2003; Reed et al, 2006).

Reed et al. (2006) point out that the different types of intangibles are complementary resources, so that an allocation to one increases the allocation to the others, resulting in a new indivisible resource that directly affects the performance of the organization. This characteristic precisely increases the difficulty of valuing intangibles, as it is not easy to attribute performance to a specific intangible.

The Resource-based view approach gives a general explanation of business success, but does not establish differences between SMEs and large companies; their size is the only difference2. Deloof (2003), Rogers (2004) and Fong (2008) conclude that intangibles are a fundamental element for the survival and the growth of SMEs. The study by Hyvonen and Tuominen (2006) shows that innovation capability and relationships with customers and supply chain partners are the key determinants of competitive advantage and performance in SMEs.

Financial Valuation of Intangibles

The importance of intangibles as determining factors of competitive position come up against the difficulty involved in trying to quantify them (Guthrie et al., 2006). Nonetheless, in the last two decades the measurement and evaluation of intangibles have played a prominent role in academic research.

In regard to measurement, great progress was made in 1995, with the publication by Skandia of the first report on intellectual capital. Other pioneering studies were presented by Brooking (1996), Kaplan and Norton (1996), Edvinsson and Malone (1997), Sveiby (1997), Bueno (2003), and more recently López and Nevado (2008). Measurement basically consists of two tasks: on the one hand, identification and classification of intangibles; and on the other, a search for indicators that enable the intangibles to be measured, that is, to monitor their development and compare the situation of the company with other bench-marked firms.

Most of the models do not assign financial value to intellectual capital using financial indicators to measure it (Ciprian et al, 2012), so this measurement does not permit monetary valuation of intangibles, nor determine their potential to create value in the firm; thus managers must consider whether the decisions being adopted are increasing the value of the firm's intangibles and firm performance. Subsequently, attempts to measure the contribution to the value of the company of intangible resources in monetary terms have been made, receiving the name of "financial valuation". The main methods developed along this line can be grouped into:

- Those methods based on the efficiency of stock markets3;

- those based on cash flow discounting;

- and those supported by option theory.

They all have pros and cons4, and as a result, it is not an easy task to look for straightforward and accurate methods and models for the financial valuation of intangibles. According to Olivé Tomás (2008), there are no standardized procedures for the majority of intangibles, but rather each intangible has to be analyzed in depth considering it is context-specific. This makes it difficult to apply generally accepted models.

Most attempts at implementing intangible valuation models have involved large companies. Very little research has focused on valuation methods that might also be applicable to small and medium enterprises. SMEs have fewer resources to identify and manage intangibles and they usually have less developed information databases. Therefore, additional costs associated with gathering information are expected, making it particularly difficult to isolate the effects generated by each intangible, and thus requiring a frequently global valuation (Martin & Hartley, 2006).

As Johanson et al. (2001) point out, the lack of reliable financial information about intangibles is one of the main problems for their management. Ross and Ross (1997), and Liebowitz and Suen (2000) state that in order to better manage such resources, it is necessary to count on a method to measure them. Therefore, a valuation process for the intangible resources of a company will improve knowledge and management. In the same way, García-Merino et al. (2008) point out that managers of 75 percent of medium enterprises, and 73 percent of small enterprises, consider the financial valuation of intangibles to be highly important.

Motives for the Financial Valuation of Intangibles: External and Internal

The motives behind a company beginning a valuation process of intangibles are determining factors, both to establish the valuation methodology to be applied, and the expected results of this process. Specifically, Marr and Gray (2002) and Marr et al. (2003) put forward the following:

1. Strategy formulation. In order to formulate a strategy, it is fundamental to establish the available resources, the existing relations between the intangibles and other resources, and the connection between intangibles and the performance (Grant, 1991).

2. Strategy assessment and execution (Neely et al., 1996; Kaplan & Norton, 1996; Bassi & Van Buren, 1999). Intangibles are part of the inputs that a company has to use to develop a specific business strategy, but they are also outputs once the strategy is implemented.

3. Defining compensation systems. The majority of companies have realized that trusting only in financial measures may encourage operations to be seen from a short-term perspective (Johnson & Kaplan, 1987), particularly if the incentive systems are linked to them (Bushman et al., 1995). The incentive systems need to be established according to the way the company is managed with the purpose of increasing its capacity to generate value in the future, which is going to depend in great part on the development of its intangibles.

4. Strategic development, diversification and expansion (Teece, 1980). In order to better exploit their resources many companies plan to diversify, merge or join in partnership agreements with other companies. Lev (2001) suggests that the network economies and synergies associated to research and development (R&D) investments and other intangibles are very important. Morck and Yeung (2003) find that diversification generates value in the presence of intangibles such as R&D or advertising, but in turn destroys value in other cases.

5. Communicating the value of the company's resources to stakeholders. The lack of information on a firm's intangibles has a negative effect due to: (i) insider trading (Aboody & Lev, 2000); (ii) excessive volatility and undervaluing of firms; and (iii) an increase in the cost of capital (Leadbeater, 2000; Gu & Lev, 2001). In general, the dissemination of information about intangibles has a positive impact on the image of the company (Cani-bano et al, 2002).

Marr and Gray (2002) argue that the motives behind a valuation process are divided into external and internal. A financial valuation process could improve knowledge about a firm's intangibles towards two directions: internal and external agents. External motives are those related to the report on intangibles to external stakeholders: shareholders, borrowers, suppliers, possible partners and, in general, society. The fifth of the above motives and also the fourth, insofar as they refer to possible mergers, come under the external category. Internal motives are related to generating information for internal stakeholders, mainly managers. Lev (2001) considers that managers show a significant lack of information on firms' intangible resources. This internal category includes the first three motives set out above, and also the fourth with regard to internal growth strategies.

Methodology

Hypothesis

Valuing Intangibles for External Motives

As previously indicated, external motives are those relating to generating information for external stakeholders. In the greatest number of cases financial statements are their fundamental source of information, though many authors stress on the shortcomings of these, especially with respect to intangible valuation (Lev, 1989; Lev & Zarowin, 1998; Martínez Ochoa, 1999).

In this context, companies intending to reduce information asymmetry must disclose voluntary information about their intangibles. Following this approach, the RICARDIS Report considers that directives for publishing standardized reports on SMEs intangibles need to be developed (European Commission, 2006).

Even so, as Rylander et al. (2000) indicate, there are curbs on publishing this type of information: 1) managers are afraid of providing competitors with critical information, and 2) there are additional costs associated with gathering and disclosing the information. In the case of SMEs these difficulties are higher than in large companies, because SMEs have fewer resources (Blaug & Lekhi, 2009). Further, Ittner (2008) believes that more research about the effect of the valuation of intangibles on performance is required. We consider that SMEs that voluntarily disclose information about their intangibles must have concrete incentives to do so. Therefore, the following hypothesis is advanced:

H1,: SMEs that consider external motives as driving forces for a financial valuation of their intangibles have incentives to disclose the value of the intangibles to external stakeholders.

In order to test this hypothesis, it is necessary to set out the characteristics of the companies that can generate those incentives. A characteristic that is widely reported by the literature is the standard of leverage. Thus, according to agency theory, the higher the leverage in a company, the more likely are the conflicts between internal and external stakeholders, which imply greater agency costs (Kim & Sorensen, 1986; Brennan, 1995); the higher the debt, the greater the tendency of managers to disclose information on intangibles as they aim to reduce agency costs. Vicente (2001) found that highly specific and opaque resources (he analyzed internal investments in R&D and investment in specific human capital) limit the leverage capacity of the company.

In the case of SMEs, there is general consensus regarding the financial restrictions faced, taking into account that their fragile nature represents a highly perilous investment compared with large companies (Blaug & Lekhi, 2009). These difficulties have been a serious problem in SMEs during the current crisis, particularly in those whose majority of resources are intangibles, because they need to show more guarantees to obtain financing. Therefore, where there is higher leverage, the managers will be more likely to disclose information regarding intangible resources in order to reduce agency costs.

We now put forward the following secondary hypothesis:

H,1σ: SMEs that consider external motives as driving forces to develop a financial valuation of their intangibles have a higher level of leverage.

For an intangible asset to be accepted as collateral, this must be easily identifiable and preserve its value when disentangled from the firm (Guimón, 2005). Bezant and Punt (1997), and Blaug and Lekhi (2009) conclude that intangibles are accepted as guarantees on very few occasions; thus we can state that the value of intangibles tends to be context-specific. This situation causes a higher financial cost to firms. For the listed companies, Shi (1999) expresses that an increase in R&D expenses is associated with an increase in the cost of debt. Lev et al. (2000) conclude that the companies with a high rate of growth of investments in R&D are systematically undervalued, and this undervaluing implies a higher capital cost.

This fact is aggravated in the case of the SMEs that wish to finance projects linked to intangibles, such as innovation activities. The difficulties attached to quantifying intangible assets, information asymmetries and perceived risks weigh very negatively against these companies when looking for funding. This is even more pressing in the case of technology-based SMEs (Bank of England, 2001). The only way that they have to improve this situation and reduce their information asymmetries is to report information on all their resources, and particularly, on their intangibles. SMEs with higher level of intangibles will have more incentive to know the value of their intangibles.

Even though it is difficult to measure the magnitude of intangibles, one possibility might be to use the Market Value/Book Value ratio as proxy. However, this is only possible with listed companies, while the great majority of SMEs are not listed. As Spanish accounting legislation allows some intangibles to be included on the balance sheet, such as R&D expenditure, patents, licenses, brands, etc., we use the book value of these intangibles as a proxy (Intangible Assets). Thus, we suppose that SMEs with a higher proportion of intangibles accounted for in the balance sheet, have an incentive to disclose information about them. Therefore, we have formulated the following secondary hypothesis:

H1,b: SMEs that consider external motives as a driving force to develop a financial valuation of their intangibles have a higher level of accounted intangible assets.

One of the predictable consequences of disclosing information on the value of intangibles will be the reduction in the cost of financial resources that should lead to an increase in the return on equity (ROE). Therefore, the following hypothesis is advanced:

H2: SMEs that consider external motives as driving forces to develop a financial valuation of their intangibles obtain a higher ROE.

Valuation of Intangibles for Internal Motives

These motives prevail in companies which prioritize improving their management. Given the information shortcomings noted by Lev (2001) and the managers' need for this information, the development of a financial valuation process of the business intangibles should increase companies' profits. Efficient strategic management must be supported by quantitative and qualitative information regarding intangibles (Vitale et al., 1994).

Most of the literature finds a positive relationship between the development and formalization of the strategy and the performance of SMEs (Bracker & Pearson, 1986; Ran-gone, 1999; McKiernan & Morris, 2005). Implementing a process to financially value intangibles as the most important strategic resources, is an example of this strategic thinking process. Therefore, we believe that SMEs that consider knowledge of their intangibles to be important for an improvement in their management, should achieve better performance.

In that respect, it does not seem that one way of measuring performance is more appropriate than another, therefore the following hypothesis and sub-hypotheses considering different valuation measures are proposed5.

H3: SMEs that consider internal motives as driving forces to develop a financial valuation of their intangibles will obtain better performance:

H3a: SMEs that consider internal motives as driving forces to develop a financial valuation of their intangibles will obtain higher ROE.

H3b: SMEs that consider internal motives as driving forces to develop a financial valuation of their intangibles will obtain higher return on assets (ROA).

H3c:SMEs that consider internal motives as driving forces to develop a financial valuation of their intangibles will obtain greater growth in profits.

H3d: SMEs that consider internal motives as driving forces to develop a financial valuation of their intangibles will obtain greater growth in turnover or sales.

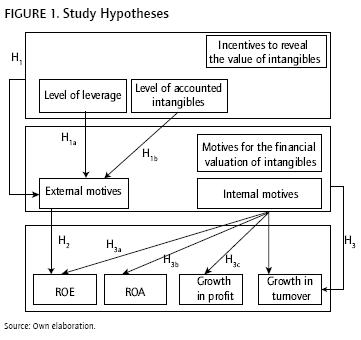

Figure 1 graphically represents all the hypotheses put forward.

Process for Obtaining the Data

Presentation of the Process

In order to obtain the necessary data to test the hypotheses, two types of information are necessary: on the one hand, the information relative to the importance assigned by the managers of the companies to the motives, internal or external, for the financial valuation of intangibles; and on the other, financial information about the results and the economic and financial structure of enquired SMEs.

Information about the motives to value the intangibles, was obtained by conducting a telephone survey with chief financial officers (CFOs)6 about aspects relating to business intangibles and their valuation, the degree of knowledge that they had about them and their motives for valuing them. To carry out the fieldwork we prepared the questionnaire, selected the population and obtained the sample.

With reference to the questionnaire, the research team prepared a preliminary proposal. Consequently, in order to be able to improve this scheme and check its validity, a pretest was carried out in conjunction with the members of the Basque Country Finance and Management Forum, consisting in semi-structured interviews7.

The study focused on companies of the Basque Country. As García et al. (2010) have justified, the relevance of this geographical area was based on several reasons relating to its differentiating characteristics:

- The Basque Country, located in the North of Spain, is an autonomous community with legislative capacity in certain areas and its own government.

- The three provinces in this region have tax autonomy as they collect all taxes, in addition to have the capacity to establish tax characteristics.

- The Basque Country, despite of its lack of natural resources, has been one of Spainsh regions with a strong business and industrial tradition. Given precisely this lack of natural resources, we estimate that Basque companies will give special value to their intangible resources.

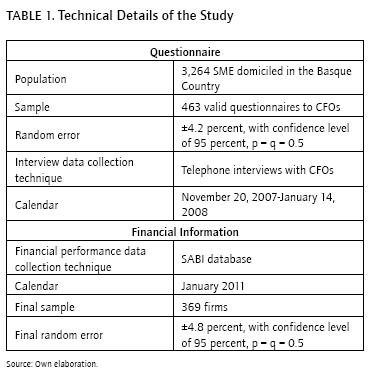

Information on the companies was obtained from the SABI (Sistema de Análisis de Balances Ibéricos) database, that gathers data on all the Spanish companies. Out of the initial population, consisting of 44,424 SMEs8, micro-companies (those with less than ten employees or annual turnover of less than two million euros) were excluded, obtaining a final population of 3,264 SMEs for the purpose of this research. We obtain a random sample of 463 firms which provided a level of confidence of 95 percent, and a maximum error rate of 4.2 percent. The fieldwork was carried out between November 20, 2007 and January 14, 2008.

The data about economic and financial results of the SMEs was obtained from available information in the SABI database in January 2011. On this date, for most of the companies, the last information available was from 2008. For this reason, the empirical study has been done with the available five year period, 2004-2008.

The companies whose data was not available for at least four years were excluded from the analysis. Very extreme cases, with more than five deviations from the mean, were likewise eliminated. The total number of companies to be analyzed was reduced to 369, which provided a maximum error level of ±4.8 percent, for a confidence level of 95 percent. The basic characteristics of the process are summarized in Table 1.

Information about the Importance of Internal and External Motivations

In order to determine the type of motives that can drive an SME to financially value its intangibles, was first necessary to know whether the CFO considered the valuation as an important matter. If the response was affirmative, we asked the CFO about the motives which drove them to value their intangibles.

Different motives were set to the managers in the questionnaire, to determine whether the financial valuation of the intangibles was important from an internal or external point of view. The quantification of the importance granted to motives by the managers, was carried out by calculating the average valuation obtained for the external and internal motivations, being understood that managers considered the internal (or external) motives to be important if the average value was, at least, of 4 (the importance is measured on a scale of 1 to 5, with 1 corresponding to "unimportant" and 5 corresponding to "very important").

Information about Business Performance

In order to check the H1a hypothesis, the level of leverage was measured using the liabilities to equity ratio. In order to check the H1b hypothesis, the level of intangibles was defined as the ratio of intangible assets to total assets. The operating profit was used to calculate the ROA and the growth in profits. In all cases, the mean value of the variables in the analysis period (2004-2008) was taken in order to test the hypothesis.

Statistical Analysis

First of all, a descriptive analysis was carried out to establish to what extent the data met the relationships specified by the hypotheses. Secondly, statistical hypothesis testing was performed.

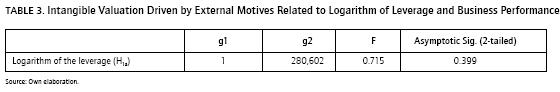

When checking H1a, the normality of "logarithm of leverage" variable was not rejected at a 5 percent level according to the Kolmogorov-Smirnov test. Once verified there is not homoscedasticity using the Levene statistics, the Welch test was performed to analyze the mean difference. With the other variables, the Mann-Whitney U test has been used because of the abnormal distribution of the variables. When the relationships proposed in each hypothesis were statistically significant, we proceeded to model such relationships in order to assess their magnitude.

Results

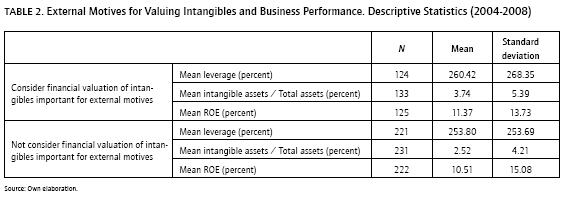

Regarding the first two hypotheses, H1 and H2, the descriptive analysis (Table 2) shows that companies considering external motives as important driving forces for a financial valuation process have greater incentives to initiate such a process. Their level of leverage and the weight of intangible assets to total assets are greater than in the case of the SMEs that consider the external motives less important. Further, such companies obtained an improvement on their financial performance.

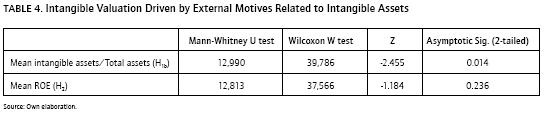

The statistical test of the hypothesis H1b (Table 4) shows that the difference in the accounted intangible assets level is significant at the 5 percent level. Nonetheless the difference in the logarithm of the leverage level is not significant (Table 3). Therefore the H1b hypothesis is accepted, but it is not possible to accept H1a hypothesis.

The propensity to disclose information about the company's intangibles is not transferred to the financial results. Even though the financial return is higher, the differences are not statistically significant (Table 4), thus the H2 hypothesis cannot be accepted.

A possible explanation may be that the SMEs with more leverage or that have greater value of intangibles in the balance sheet, start from a situation with high financial costs. Under these circumstances, the improvement in the financial cost, as a result of facilitating information about their intangibles, does not enable them to achieve better financing conditions than the SMEs with less leverage or less weight of intangible resources on their balance sheets.

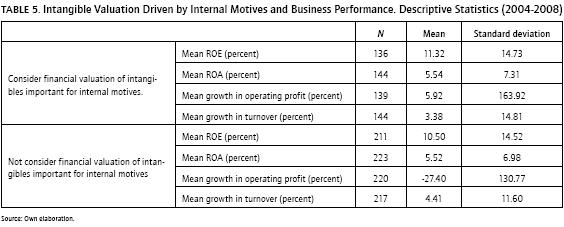

With regards to internal motives, the descriptive analysis shows that the performance obtained by the SMEs that consider these motives important to carry out a financial valuation process of intangibles is better than those who do not (Table 5).

However, only the differences of growth in operating profit are statistically significant, so we can only accept the H3c hypothesis. According to the Mann-Whitney U test (Table 6) the sub-hypotheses H3a, H3b, H3d cannot be accepted.

A possible explanation of these results is that firms can take decisions to strengthen their intangibles, which are detrimental to their more immediate performance. Many of the investments in intangibles are considered expenses. Training policies, advertising costs, etc., increase the value of the resources of the SMEs and its capacity to generate profits, in spite of affecting negatively the most immediate results. The positive impact on the performance is therefore tempered over the early years. The prudent approach of accounting methods when profits are measured tends particularly to undervalue the return on investment in intangibles (Vicente, 2001).

On the other hand, as argued by Rodríguez (2004), though the valuation of intangibles is considered fundamental, in many cases this option is not accompanied by an active management. The concern with valuing intangibles involves a change in the approach of the SMEs, but if it is not applied to specific practices, it will be difficult to obtain a notably better performance.

A third justification for the results is that carrying out a financial valuation process of intangibles presents theoretically internal and external advantages. However, the deployment of a valuation process can incur in a series of costs. Aside from the costs of identifying and collecting information, there are others related to the disclosure of that information. As far as intangible assets are strategic resources for the SMEs, the dissemination of information may lead to a loss of competitive advantage (Macagnan, 2005). This threat arises both from the risk of being imitated by competitors, and from the fact that the causal ambiguity is often the strength that converts intangibles into competitive advantages. As Gray et al. (2004) indicate, SMEs only collect information on their intangibles and therefore acquire expenditures, when they are forced to do so.

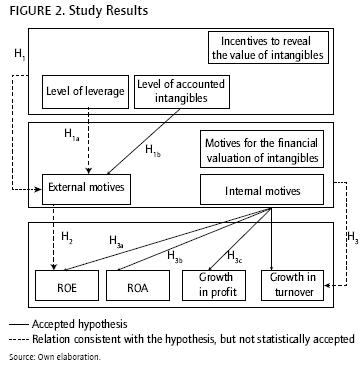

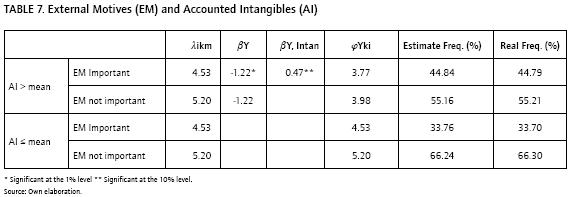

As seen in Figure 2 the univariate analysis shows that the Intangible assets/Total assets ratio, a proxy for the level of accounted for intangibles, is the only factor significantly related with external motives. We measured this relationship using a logistic regression, because the dependent variable is categorical.

Where,

Y is external motives (value = 1 if external motives are important; value = 2 if external motives are not important).

Z is level of accounted intangibles (value = 1 if Intangible assets/Total assets is greater than mean; value = 2 if In tangible assets/Total assets is not greater than mean). The results are presented in Table 7.

With a beta of 0.47, significant at the 10% level, the Odds ratio is e0.47 = 1.6; based on this numbers we can affirm that in the case when the accounted for intangibles level is greater than average, the probability that external motives are important is 1.6 times greater than the case when the level is below the average.

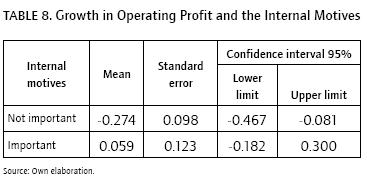

As seen in Figure 2, the relationship between internal motives and the growth in operating profit is statistically significant as well. Since the dependent variable, growth in operating profit, fulfills the hypothesis of homogeneity of variances, and the independent variable, the importance of internal motives, the Univariate General Linear Model can be applied. The results are as follows (Table 8):

Then, it can be stated that:

Growth in Operating Profit = -0.274 + 0.333 Internal Motives

Since the value of b is significant at the 95% level, we can affirm that when managers considered internal motives important, on average, growth in profit was 33,3% higher than when these motives are not regarded as essential.

Conclusions

Intangibles have become a fundamental element for competitiveness in SMEs. For their management, it is necessary to have the information on how these resources contribute to value creation. However, accounting information is increasingly less representative of company value and intangibles are invisible resources many times. The intangibles valuation could provide useful information for making decisions regarding the allocation of intangible resources and their management. Then, performance of firms that are interested in their valuation will prove better.

Difficulties for the valuation of intangibles are even more relevant in SMEs, as firms have fewer means to value them. This shows that valuation models should be adapted to the needs of these companies, assisting managers in the task of identifying and knowing the contribution of intangibles to the company value.

Motives that drive managers of SMEs to value their intangibles could be internal -related to generating information for managers- or external -related to reporting on intangibles to external stakeholders. Independently of the motive that led to the valuation of their intangibles, a process of financial valuation that improves knowledge of intangibles should help obtain a better performance. This study is an attempt to measure the existing relationship between the concern of SMEs to financially value their intangible resources, the reasons behind that valuation and firm's performance.

Accordingly, results show that SMEs' interest in providing information about intangibles is greater as the weight of the intangible assets increases and there is a higher leverage, although the second possible explanatory variable is not significant. The presentation of reports on intangibles generates advantages for the companies that do so. The report reduces information asymmetries and agency costs, which should result in an improved company image, in particular, for creditors. Providing information about intangibles to external stakeholders facilitates the attainment of financial resources. Going further, the improvements to the image of the SMEs are not only limited to those companies with high levels of leverage and significant intangible resources, but rather to every company. Therefore, reporting on the intangibles of the company should be a recommended widespread practice.

Those SMEs that consider important to value their intangibles and take into account the possibility of increasing their knowledge of these resources, should be able to better manage them and thereby obtain better results. Nonetheless, the analysis of the data in this study shows that only the improvements obtained in profits growth are momentous. Implementing a valuation process generates costs, reducing the potential positive impact of a better knowledge of intangibles. These costs depend on the complexity of the valuation methods applied, whose majority have been developed in large companies that own more resources. SMEs' information systems are less developed so is more expensive to obtain the information. We consider vital to develop methods for financial valuation of intangibles adapted to SMEs that enable an easy implementation taking into account the limitations of their information systems, at a reasonable cost. To the extent that the application of these methods will result in a better understanding of intangibles, their use will become widespread and consequently improve the competitiveness of SMEs.

This study only considers the effect that a greater interest in the financial valuation of intangibles has on the accounting results. The practical basis of accounting methods to measure profits tends particularly to undervalue the return on the investment of intangibles. It would also be of interest to consider subjective performance measurements in future studies.

We consider that further research is of a great interest in order to establish to what extent SMEs with greater concern in their intangibles perform better during the last economic crisis. The hypothesis should then be that a decline in performance of SMEs that consider important to carry out a financial valuation process of their intangibles, should be smaller.

Pie de página

1 This paper is part of the SAI12/161 S-PC12UN018 project, funded by the Basque Government and the University of the Basque Country, and the EHU11/37 project funded by the University of the Basque Country, and UFI (11/51).

2 Works as Bakar and Ahmad (2010), Aragón-Correa et al. (2008), Fong (2003) and Rangone (1999) consider this approach for SMEs.

3 In case of the SMEs most of them do not quote on stock markets, making it necessary to apply the analogical-stock exchange method (Caballer & Moya, 1997).

4 A review of the different methods for the financial valuation of intangibles can be consulted at Rodríguez-Castellanos et al. (2007).

5 These variables have been widely used in the literature to assess the performance of companies, e.g., Bontis et al. (2000), Chen et al. (2005), Maditinos et al. (2011) and Fathi et al. (2013).

6 The survey was focused on CFOs or the person that the company considered more suitable to answer it.

7 Any additional information relative to the study and the questionnaire can be requested to the authors.

8 In order to select the SMEs population we chose the first of the three criteria most often used (number of employees, turnover and total assets), as we consider this criterion is more stable over time and less subject to situational factors. Under this criterion a SME is a company with 249 employees or less.

References

Aboody, D., & Lev, B. (2000). Information Asymmetry, R&D and Insider Gains. Journal of Finance, 55(2), 747-766. [ Links ]

Amit, R., & Schoemaker, P. (1993). Strategic Assets and Organizational Rent. Strategic Management Journal, 14, 33-46. [ Links ]

Aragón-Correa, J.A., Hurtado-Torres, N.S., Sharma, S., & García-Morales, V.J. (2008). Environmental Strategy and Performance in Small Firms: A resource-Based Perspective. Journal of Environmental Management, 86(1), 88-103. [ Links ]

Bakar, L.J.A., & Ahmad, H. (2010). Assessing the Relationship between Firm Resources and Product Innovation Performance: a Resource Based View. Business Process Management Journal, ,6(3), 420-435. [ Links ]

Bank of England (2001). Financing of Technology-Based Small Firms. London, UK. Bank of England. [ Links ]

Barney, J.B. (1991). Firm Resources and Sustained Competitive Advantage. Journal of Management, 17(1), 99-120. [ Links ]

Bassi, L.J., & Van Buren, M.E. (1999). Valuing Investments in Intellectual Capital. International Journal of Technology Management, 18(5-8), 414-432. [ Links ]

Bettis, R.A., & Hitt, M.A. (1995). The New Competitive Landscape. Strategic Management Journal, 16, 7-19. [ Links ]

Bezant, M., & Punt, R. (1997). The Use of Intellectual Property as Security for Debt Transactions. London, UK: The Intellectual Property Institute. [ Links ]

Blaug, R., & Lekhi, R. (2009). Accounting for Intangibles: Financial Reporting and Value Creation in the Knowledge Economy. London, UK: The Work Foundation. Available at: http://www.thework-foundation.com/assets/docs/publications/223_intangibles_final.pdf. [ Links ]

Boisot, M.H. (1998). Knowledge assets: securing competitive advantage in the information economy. New York, USA: Oxford University Press. [ Links ]

Bontis, N., & Fitz-Enz, J. (2002). Intellectual Capital ROI: a Causal Map of Human Capital Antecedents and Consequents. Journal of Intellectual Capital, 3(3), 223-247. [ Links ]

Bontis, N., Keow, W.C., & Richardson, S. (2000). Intellectual Capital and Business Performance in Malaysian Industries. Journal of Intellectual Capital, 1 (1), 85-97. [ Links ]

Botosan, C.A. (1997). Disclosure Level and the Cost of Equity Capital. The Accounting Review, 72(3), 323-349. [ Links ]

Bracker, J.S., & Pearson, J.N. (1986). Planning and Financial Performance of Small Mature Firms. Strategic Management Journal, 7(6), 503-522. [ Links ]

Brennan, M. (1995). Corporate Finance over the Past 25 Years. Financial Management, 24(2), 9-22. [ Links ]

Brooking, A. (1996). Intellectual Capital. Core Assets for the Third Millenium Enterprise. London, UK: International Thomson Business Press. [ Links ]

Bueno, E. (Dir.) (2003). Model for the Measurement and Management of Intellectual Capital: Intellectus Model. Intellectus Documents, 5. Madrid: Knowledge Society Research Centre. [ Links ]

Bushman, R.M., Indjejikian, R.J., & Smith, A. (1995). Aggregate Performance Measures in Business Unit Manager Compensation: the Role of Intrafirm Interdependencies. Journal of Accounting Research, 33, 101-128. [ Links ]

Caballer, V., & Moya, I. (1997). Companies Valuation: an Analogical Stock Market Empirical Approach. In Topsacalian, P. (Ed). Contemporary Developments in Finance. Paris: Éditions ESKA. [ Links ]

Calvo, J. (2006). Testing Gibrat's Law for Small, Young and Innovating Firms. Small Business Economics, 26, 117-123. [ Links ]

Canibaño, L., García-Ayuso, M., & Sánchez P. (1999). La relevancia de los intangibles para la valoración y gestión de empresas: revisión de la literatura. Revista Espanola de Financiación y Contabilidad, 100, 17-88. [ Links ]

Canibaño, L., Sánchez, P., García-Ayuso, M., & Chaminade, C. (2002). MERITUM Project. Guidelines for Managing and Reporting on Intangibles (Intellectual Capital Report). Madrid: Vodafone Foundation. [ Links ]

Chen, M., Cheng, S., & Hwang, Y. (2005). An empirical Investigation of the Relationship between Intellectual Capital and Firm's Market Value and Financial Performance. Journal of Intellectual Capital 6(2), 159-176. [ Links ]

Chen, P. (2005). Intellectual Capital Performance of Commercial Banks in Malaysia. Journal of Intellectual Capital, 6(3), 385-396. [ Links ]

Ciprian, G.G., Valentin, R., Mãdãlina, G.I.A., & Lucia, V.V.M. (2012). From visible to hidden intangible assets. Procedia-Social and Behavioral Sciences, 62, 682-688. [ Links ]

Deloof, M. (2003). Does Working Capital Management Affect Profitability of Belgian Firms? Journal of Business Finance and Accounting, 30, 573-588. [ Links ]

Durst, S., & Gueldenberg, S. (2009). The Meaning of Intangible Assets: New Insights into External Company Succession in SMEs. Electronic Journal of Knowledge Management, 7(4), 437-446. Available at: www.ejkm.com. [ Links ]

Edvinsson, L., & Malone, M.S. (1997). Intellectual Capital: Realizing your Company's True Value by Finding Brainpower. New York, USA: Harper Business. [ Links ]

European Commission (2006). RICARDIS: Reporting Intellectual Capital to Augment Research, Development and Innovation in SMEs. Available at: www.pymesonline.com/formacion/index.php?action=download&id=475. [ Links ]

Eurostat (2009). European Business. Facts and Figures. Luxembourg: Office for Official Publications of the European Communities. [ Links ]

Fathi, S., Farahmand, S., & Khorasani, M. (2013). Impact of Intellectual Capital on Financial Performance. International Journal of Academic Research in Economics and Management Sciences, 2(1), 6-17. [ Links ]

Firer, S., & Williams, S.M. (2003). IC and Traditional Measures of Corporate Performance. Paper presented at 6th World Congress on Intellectual Capital. January 2003. Ontario, McMaster University. [ Links ]

Fong, C. (2003). Rol que juegan los activos intangibles en la construcción de ventaja competitiva sustentable en la Pyme. Un estudio de casos con empresas de Cataluna y de Jalisco, Ph.D. dissertation. Universidad Autónoma de Barcelona. [ Links ]

Fong, C. (2008). Role of Intangible Assets in the Success of Small and Medium-Sized Businesses. Global Journal of Business Research, 2(1), 53-68. [ Links ]

Francisco, J., Cruz, F.L., & Kimura, H. (2010). Intellectual Capital and Value Creation in the Machinery and Equipment Industry. In Rodrigues, S. (Ed.): Proceedings of the 2nd European Conference on Intellectual Capital. Reading (UK): Academic Publishing Limited, 10-20. [ Links ]

Gallego, I., & Rodriguez, L. (2005). Situation of Intangible Assets in Spanish Firms: an Empirical Analysis. Journal of Intellectual Capital, 6(1), 105-126. [ Links ]

Garanina, T., & Pavlova, Y. (2011). Intangible Assets and Value Creation of a Company: Russian and UK Evidence. In Turner, G. (Ed.): Proceedings of the 3nd European Conference on Intellectual Capital. Reading (UK): Academic Publishing Limited, 165-175. [ Links ]

García-Merino, J.D., Rodríguez-Castellanos, A., Vallejo-Alonso, B., & Arregui-Ayastuy, G. (2008). Importancia y valoración de los intangibles: la percepción de los Directivos. Estudios de Economia Aplicada, 26(3), 27-56. [ Links ]

García-Merino, J.D., Arregui-Ayastuy, G., Rodríguez-Castellanos, A., & García-Zambrano, L. (2010). The intangibles' mindset of CFOs' and corporate performance. Knowledge Management Research & Practice, 8, 340-350. [ Links ]

Grant, R.M. (1991). The Resource-Based Theory of Competitive Advantages: Implications for Strategy Formulation. California Management Review, 33(3), 114-135. [ Links ]

Grant, R.M. (2002). Contemporary Strategy Analysis: Concepts, Techniques, Applications. Oxford, UK: Blackwell Publishing. [ Links ]

Gray, D., Roos, G., & Rastas, T. (2004). What Intangible Resources do Companies Value, Measure, and Report? A Synthesis of UK and Finnish Research. International Journal of Learning and Intellectual Capital, 1(3), 242-261. [ Links ]

Gu, F., & Lev, B. (2001). Intangible assets: measurement, drivers, usefulness. Available at: http://pages.stern.nyu.edu/~blev/intangible-assets.doc. [ Links ]

Guimón, J. (2005). Intellectual Capital Reporting and Credit Risk Analysis. Journal of Intellectual Capital, 6(1), 28-42. [ Links ]

Guthrie, J., Petty, R., & Ricceri, F. (2006). The voluntary reporting of intellectual capital: comparing evidence from Hong Kong and Australia. Journal of Intellectual Capital, 7(2), 254-271. [ Links ]

Hall, R.H. (1992). The Strategic Analysis of Intangible Resources. Strategic Management Journal, 13(2), 135-144. [ Links ]

Hang, K. (2009). Impact of intellectual capital on organizational performance: an empirical study of companies in the Hang Seng Index. The Learning Organization, 16(1), 4-39. [ Links ]

Hyvonen, S., & Tuominen, M. (2006). Entrepreneurial Innovations, Market-driven Intangibles and Learning Orientation: Critical Indicators for Performance Advantages in SMEs. International Journal of Management & Decision Making, 7(6), 643-660. [ Links ]

Itami, H., & Roehl, T. (1987). Mobilizing Invisible Assets. Cambridge: Harvard University Press. [ Links ]

Ittner, C.D. (2008). Does Measuring Intangibles for Management Purposes Improve Performance? A Review of the Evidence. Accounting and Business Research, 38(3), 261-272. [ Links ]

Johanson, U., Martensson, M., & Skoog, M. (2001). Measuring to Understand Intangible Performance Drivers. The European Accounting Review, 10(3), 407-37. [ Links ]

Johnson, T.H., & Kaplan, R.S. (1987). Relevance Lost: The Rise and the Fall of Management Accounting. Boston USA: Harvard Business School Press. [ Links ]

Kaplan, R.S., & Norton, D.P. (1996). The Balanced Scorecard: Translating Strategy into Action. Boston: Harvard Business School. [ Links ]

Kaplan, R.S., & Norton, D.P. (2004). Measuring the Strategic Readiness of Intangible Assets. Harvard Business Review, 82(2), 52-63. [ Links ]

Kim, W.S., & Sorensen, E.H. (1986). Evidence on the Impact of the Agency Costs of Debt on Corporate Debt Policy. Journal of Financial and Quantitative Analysis, 21(2), 131-144. [ Links ]

Kristandl, G., & Bontis, N. (2007). Constructing a Definition for Intangibles Using the Resource Based View of the Firm. Journal of Management Decision, 45(9), 1510-1524. [ Links ]

Leadbeater, C. (2000). New Measures for the New Economy. London, UK: ICAEW. [ Links ]

Lev, B. (1989). On the Usefulness of Earnings and Earnings Research: Lessons and Directions from two Decades of Empirical Research. Journal of Accounting Research, 27(supplement), 153-192. [ Links ]

Lev, B. (2001). Intangibles: Management, Measurement and Reporting. Washington, USA: Brooking Institution Press. [ Links ]

Lev, B., Sarath, A., & Sougiannis, T. (2000). R&D reporting biases and their consequences. Working Paper. University Stern School of Business, New York. [ Links ]

Lev, B., & Zambon, S. (2003). Intangibles and Intellectual: Capital an Introduction to a Special Issue. European Accounting Review, 12(4), 597-603. [ Links ]

Lev, B., & Zarowin, P. (1998). The Boundaries of Financial Reporting and How to Extend them. Working Paper. University Stern School of Business, New York. [ Links ]

Liebowitz, J., & Suen, C.Y. (2000). Developing Knowledge Management Metrics for Measuring Intellectual Capital. Journal of Intellectual Capital, 1 (1), 54-67. [ Links ]

Lippman, S. A., & Rumelt, R. P. (1982). Uncertain imitability: An Analysis of Interfirm Differences in Efficiency under Competition. The Bell Journal of Economics, 13(2), 418-438. [ Links ]

Lonnqvist, A., Kujansivu, P., & Sillanpaa, V. (2008). Intellectual Capital Management Practices in Finnish Companies. International Journal of Innovation and Regional Development, 1 (2), 130-146. [ Links ]

López Ruiz, V.R., & Nevado Pena, D. (2008). Análisis Integral como sistema de medición y gestión de capitales intangibles en Organizaciones y Territorios. Estudios de Economia Aplicada, 26(2), 119-137. [ Links ]

Macagnan, C.B. (2005). Factores explicativos de la revelación de información de activos intangibles de empresas que cotizan en España. Ph.D. dissertation. Universidad Autónoma de Barcelona, Barcelona. [ Links ]

Marr, B., & Gray, D. (2002). Measuring Intellectual Capital - The Internal and External Drivers for Measuring and Reporting the Intangibles of an Organization. Paper presented at the Congress the Transparent Enterprise. The Value of Intangibles. Madrid, Spain. [ Links ]

Marr, B., Gray, D., & Neely, A. (2003). Why do Firms Measure their Intellectual Capital? Journal of Intellectual Capital, 4(4), 441-464. [ Links ]

Martin, C., & Hartley, J. (2006). Intangible Assets and SMEs, ACCA Research Report, 93. London: Association of Chartered Certified Accountants. [ Links ]

Martínez Ochoa, L. (1999). Relevancia de la información contable y activos intangibles. Paper presented at X Congress of the Asociación Espanola de Contabilidad y Administración de Empresas (AECA), Zaragoza, Spain. [ Links ]

Maditinos, D., Chatzoudes, D., Tsairidis, C., & Theriou, G. (2011). The impact of intellectual capital on firms' market value and financial performance. Journal of intellectual capital, 12(1), 132-151. [ Links ]

McKiernan, P., & Morris, C. (2005). Strategic Planning and Financial Performance in UK SMEs: Does Formality Matter? British Journal of Management, 5(s1), S31-S41. [ Links ]

Morck, R., & Yeung, B. (2003). Why Firms Diversify: Internalization vs Agency Behaviour. In Hand, J., & Lev, B. (Eds.). Intangible Assets: Values, Measures, and Risk. Oxford: Oxford University Press, 269-302. [ Links ]

Neely, A., Mills, J., Gregory, M., & Richards, H. (1996). Performance Measurement System Design: Should Process-Based Approaches be Adopted? International Journal of Production Economics, 4647, 423-431. [ Links ]

Nunes, P.M., & Almeida, A. (2009). The Quadratic Relationship between Intangible Assets and Growth in Portuguese SMEs. The Amfite-atru Economic Journal, 11(25), 151-158. [ Links ]

Olivé Tomás, A. (2008). Cómo Valorar una Empresa a partir de sus Activos Intangibles. Harvard Deusto, Finanzas & Contabilidad, 82, 42-56. [ Links ]

Pena, I. (2002). Intellectual Capital and Business Start-up Success. Journal of Intellectual Capital, 3(2), 180-198. [ Links ]

Prieto, I.M., & Revilla, E. (2006). Assessing the Impact of Learning Capability on Business Performance: Empirical Evidence from Spain. Management Learning, 37(4), 499-522. [ Links ]

Quinn, J.B. (1992). Intelligent enterprise: A Knowledge and Service Based Paradigm for Industry. New York, USA: The Free Press. [ Links ]

Rangone, A. (1999). A Resource-Based Approach to Strategy Analysis in Small-Medium Sized Enterprises. Small Business Economics, 12(3), 233-248. [ Links ]

Reed, K., Lubatkin, M., & Srinivasan, N. (2006). Proposing and Testing an Intellectual Capital-Based View of the Firm. Journal of Management Studies, 43, 867-893. [ Links ]

Riahi-Belkaoui, A. (2003). Intellectual Capital and Firm Performance of US Multinational Firms: A Study of the Resource-Based and Stakeholder Views. Journal of Intellectual Capital, 4(2), 215-226. [ Links ]

Rodríguez, J., & Ordonez, P. (2003). Knowledge Management and Organizational Competitiveness: a Framework for Human Capital Analysis. Journal of Knowledge Management, 7(3), 82-91. [ Links ]

Rodríguez, L. (2004). Valoración y gestión de activos intangibles: aproximación teórica y estudio empírico. Available at: http://ec.europa.eu/invest-in-research/pdf/download_en/2006-2977_web1.pdf. [ Links ]

Rodríguez-Castellanos, A., Arregui-Ayastuy, G., & Vallejo-Alonso, B. (2007). The Financial Valuation of Intangibles: A Method Grounded on an IC-Based Taxonomy. In Joia, L.A. (Ed). Strategies for Information Technology and Intellectual Capital: Challenges and Opportunities. London: Information Science Reference, 66-90. [ Links ]

Rogers, M. (2004). Networks, Firm Size and Innovation. Small Business Economics, 22, 141-153. [ Links ]

Ross, G., & Ross, J. (1997). Measuring your Company's Intellectual Performance. Long Range Planning, 30, 413-426. [ Links ]

Rylander, A., Jacobsen, K., & Roos, G. (2000). Towards Improved Information Disclosure on Intellectual Capital. International Journal of Technology Management, 20(5-8), 715-741. [ Links ]

Sáenz, J. (2005). Human Capital Indicators, Business Performance and Market-to-Book Ratio. Journal of Intellectual Capital, 6(3), 374-384. [ Links ]

Salojàrvi, S. (2004). The Role and Nature of Knowledge Management in Finnish SMEs. International Journal of Learning and Intellectual Capital, 1 (3), 334-357. [ Links ]

Shi, C. (1999). On the Trade-off between the Future Benefits and Riskiness of R&D: a Bondholders Perspective. Working Paper, Irvine, CA: University of California - Irvine School of Business. [ Links ]

Subramaniam, M., & Youndt, M. (2005). The Influence of Intellectual Capital on the Types of Innovative Capabilities. Academy of Management Journal, 48(3), 450-463. [ Links ]

Sveiby, K.E. (1997). The New Organizational Wealth: Managing & Measuring Knowledge-Based Assets. San Francisco, USA: Berrett-Koestler Publishers. [ Links ]

Tan, H.P., Plowman, D., & Hancock, P. (2007). Intellectual Capital and Financial Returns of Companies. Journal of Intellectual Capital, 8(1), 76-95. [ Links ]

Teece, D.J. (1980). Economies of Scope and the Scope of the Enterprise. Journal of Economic Behavior and Organization, 1, 223-33. [ Links ]

Thornhill, S., & Gellatly, G. (2005). Intangible Assets and Entrepreneurial Finance: The Role of Growth History and Growth Expectations. International Entrepreneurship and Management Journal, 1 , 135-148. [ Links ]

Vicente, J.D. (2001). Specifity and Opacity as Resource-Based Determinants of Capital Structure: Evidence for Spanish Manufacturing Firms. Strategic Management Journal, 22(1), 157-177. [ Links ]

Villalonga, B. (2004). Intangible Resources, Tobin's q, and Sustain-ability of Performance Differences. Journal of Economic Behavior & Organization, 54(2), 205-230. [ Links ]

Vitale, M., Mavrinac, S.C., & Hauser, M. (1994). New Process/Financial Scorecard: a Strategic Performance Measurement System. Planning Review, 22(4), 21-26. [ Links ]

Wang, J. (2008). Investigating market value and intellectual capital for S&P500. Journal of Intellectual Capital, 9(4), 546-563. [ Links ]

Yasuda, T. (2005). Firm Growth, Size, Age and Behavior in Japanese Manufacturing. Small Business Economics, 24(1), 1-15. [ Links ]

Zerhri, C., Abdelbaki, A., & Bouabdellah, N. (2012). How intellectual capital affects a firm's performance? Australian Journal of Business and Management Research, 2(8), 24-31. [ Links ]