Introduction

The knowledge generated by universities and research institutes should be incorporated by society in order to generate wealth. This means that these institutions further contribute to society by promoting economic development, in addition to the traditional teaching and research activities (Torkomian, 2011).

Universities and research institutes represent one part of a system composed of a set of interrelated elements that work motivated by the same goal. Each system is made up of components, relationships, and attributes.

Relationships between these components in a National Innovation System collaborate so that the transfer of technology may occur in some way (Carlsson, Jacobsson, Holmén, & Rickne, 2002).

In a National Innovation System, knowledge is a fundamental resource for the economy, in which learning becomes a basic process. The fact that knowledge differs in relation to other resources causes some traditional aspects of the economy to become less relevant. A second premise is that learning is a predominantly interactive process. Thus, a socially incorporated process cannot be understood without being analyzed within an institutional and cultural context. Therefore, a National Innovation System is a social and dynamic system in which the central activity is interactive learning (Lundvall, 1992).

Innovation is the result of interactive processes between actors who possess different types of skills and knowledge, and gather and exchange information for the purpose of solving technical, organizational, commercial or intellectual problems. In exchange, the interactions can be organized in different ways. When knowledge is coded, this becomes available almost instantly to businesses, regardless their location. However, when knowledge is diffuse and tacit, interactions depend on the spatial proximity between the actors involved in the same local environment and repeatedly gathered for the exchange of information (Bathelt, Malmberg, & Maskell, 2004).

Universities develop new knowledge through continuous interaction between individuals, in which tacit and explicit knowledge are transformed, leading to the creation of new ideas and concepts in a dynamic way (Grant, 1996; Nonaka, 1994). This created knowledge needs to overflow into society. In dynamic and turbulent environments, in which technological change is rapid and systemic, companies are increasingly dependent on external expertise to promote innovation, improve performance and achieve competitive advantage. Absorptive capacity (ACAP) corresponds to one of the key learning processes of organizations and indicates that knowledge must be acquired, assimilated, transformed, and exploited, in order to influence companies to build other dynamic organizational capacities. Dynamic capabilities are formed by a set of routines that create organizational changes, and routines can be considered behavior patterns or rules. Companies that conduct R&D activities internally tend to be more skilled in using external information, since absorptive capacity recommends that prior knowledge facilitates the use of new knowledge.

Some companies are more efficient at acquiring and assimilating knowledge while having more difficulty at leveraging the transformation and exploitation of knowledge, resulting in greater difficulties in improving performance. Knowledge can emerge from a variety of sources. Thus, the results of academic research reach society through numerous forms of technology transfer to companies, such as joint research, consulting, technical meetings, technology licensing, creation of new enterprises (spin-offs), service provision, training programs, and other means (Cohen & Levinthal, 1990; Grant, 1996; Nelson & Winter, 1982; Rogers, Takegami & Yin, 2001; Zahra & George, 2002).

In order to encourage scientists toward greater interaction with companies, many universities have established intermediary institutions -Technology Transfer Offices (TTOS)-which play a role in facilitating the process of technology commercialization, an activity not often emphasized in academia.

Thus, some elements about TTOS need to be well thought of: What is the proper balance between centralization and decentralization of TTOS within the academy? What structures encourage research groups? Is there implementation of adequate processes for decision-making and monitoring within the TTO?

TTOS can be a channel for developed knowledge flowing out of research institutions. The endogenously created knowledge results in opportunities that can be identified and expanded to the business sector. In this context, the research developed by Acs, Audrestsch, Braunerhjelm, & Carlsson (2005) has shown that knowledge is related to economic growth and that entrepreneurship is identified as knowledge spillover. In addition, innovative activities are geographically concentrated, since firms located in high-R&D regions are more likely to become innovators than companies located in isolated areas not beneficiaries of such knowledge overflow. Likewise, companies that depend on tacit knowledge are often grouped spatially. In this environment, the existence of structures to connect universities to the market can be very beneficial (Breschi & Lissoni, 2001).

Notwithstanding the numerous ways TTOS perform their role, this article will emphasize the new enterprises created in order to explore the knowledge generated in the academic environment. This is because although they are relevant to economic development, a number of difficulties still have to be overcome to put these companies into effect: the difficulties of researchers in acknowledging the benefits of marketing their research results; the difficulty in judging the commercial potential of an invention; the lack of knowledge about market dynamics; and the lack of bargaining power (O'Gorman, Byrne, & Pandya, 2008).

However, although it plays an important role, TTO is not a separate element. It should be performed under an entrepreneurial ecosystem, striving to stimulate the creation of businesses. There are other elements, also relevant, that constitute this ecosystem, such as policies, culture, markets, human capital and financial resources, among others (Isenberg, 2011). The presence of a single element in an ecosystem acting by itself barely contributes to stimulate business creation.

Thereby, the TTO needs to contain a balance between centralization and decentralization within the university, a design of appropriate structures for academic research groups' incentives, and implemeting appropriate processes for decision making and performance monitoring. Thus, there is a need for multiple elements that complement each other and interact to bring dynamism and new business possibilities.

Therefore, this paper studies the creation and performance of spin-offs within the entrepreneurial ecosystem, observing the cases of American and European universities and, particularly, evaluating actions by the TTO and other elements in order to stimulate the creation of academic spin-offs, since an articulated ecosystem is usually responsible for high rates of business creation.

Academic Spin-offs and the Influence of an Entrepreneurial Ecosystem

This section presents the characteristics of academic spin-offs and the initiatives ensuing from their success. The objective of exploring an entrepreneurial ecosystem is to understand which combined elements result in an environment that is more conducive to business creation.

Academic Spin-offs

Universities and research institutions can be innovation sources by means of incorporating inventions generated by companies. Academic spin-offs could play an important role in this process. Universities and research institutes are part of a larger system, a National Innovation System, composed of a set of elements and relationships that interact in the production, diffusion and use of knowledge, with the common objective of promoting the development of innovation capacity and learning from a country. The basic premise of a National Innovation System is that performance depends on a set of interacting policies, institutions and actors, making innovation a systemic and interactive phenomenon. As a consequence, the purpose of spin-offs is to make use of the opportunities identified in academic environments, generally consisting of faculty, staff or undergraduate and graduate students, and individuals from the "parent organization" (Cassiolato & Lastres, 2005; Lundvall, 1992; Torkomian, 2011; ZEW, 2002). This definition focuses on the involvement of people from the academic environment to the new business that is created. However, there are definitions for this type of business, such as that of O'Shea et al. (2007), that present a spin-off technology to be transferred as a central issue, without focusing on the entrepreneur or team that will start the new business but rather the result that will be transferred -the technology itself. In such cases, there is no direct involvement of the university staff in the management of the new enterprise.

For spin-offs there is no universal and unique concept. According to Wright, Clarysse, Lockett, & Knockaert (2008) and Zahra, Van-De-Velde, & Larraneta (2007), spin-offs are new ventures dependent upon the licensing or the institution's ownership transfer of intellectual property, therefore originating from formal agreements of a newly created company with an academic institution. This definition only considers a spin-off as the company that maintains an agreement or contract with the original institution. However, there are studies that consider a spin-off as any company resulting from the development that took place in academia and which resulted in a new business, with no official link.

Based on the different definitions of academic spin-offs, it is perceived that these companies are created to explore new knowledge developed at the university -tacit knowledge transformed into explicit knowledge- (Nonaka, 1994); they may (or may not) involve formal technology transfer via licensing; may be owned by the university, the inventors or third parties; may (or may not) involve the partial or full transfer of researchers; and may (or may not) be stimulated by the university.

Vohora, Wright, & Lockett (2004) found that these companies' success is influenced by the support of the parent organization, i.e. the university or research institute, in the process of guiding, training and having access to qualified skills. Lockett, Siegel, Wright, & Ensley (2005) found that the number of companies increases with university's increased spending on R&D, in addition to the skills of the technology transfer office staff to guide marketing. Bigliardi, Galati, & Verbano (2013) showed four factors that affect the performance of these companies: the characteristics of the university, the founder, the environment, and the characteristics of the technology. That said, there is a notorious need for a set of support structures in an environment able to stimulate both the creation process of these companies as well as their development process.

The Entrepreneurial Ecosystem

An aspect that contributes to the creation of companies is the environment, which should also be favorable to the emergence of new ideas, since new businesses emerge from them. This environment needs to provide the necessary requirements.

The business ecosystem can also be used to analyze situations of university-emerging entrepreneurship, as this ecosystem is formed by a set of internal and external attributes of the institution, which serves as a support infrastructure for the creation of new businesses. Companies that emerge within the university environment, as well as other companies, need certain conditions to survive, and is within this entrepreneurial ecosystem that they find the basic structures for that purpose (Lemos, 2011).

The Babson Entrepreneurship Ecosystem Project, at the Babson College, is an example of an entrepreneurial ecosystem. This project unfolded as a model that demonstrates that in order to foster entrepreneurship an environment may not be formed only by one element, but by a group of structures that strengthen the ecosystem by working together. According to this model, six major elements influence the development of entrepreneurship in a given region: policies, human capital, support institutions, culture, markets and financial resources. Public policies represent the responsibilities of government agencies and the support to entrepreneurship for implementing incentives and reducing bureaucratic barriers. Financial capital can be represented by the institutions responsible for financing entrepreneurship, angel investors, venture capital funds, seed capital and other financing arrangements. Culture includes the characteristics of a society; how people relate to each other, the factors that bring recognition, and other components. Fear of failure can be an element that inhibits entrepreneurship and is strongly related to the culture of a given region. Support institutions boost entrepreneurship, such as incubators, technology transfer offices, mentoring and other organizations, providing the necessary support. Human resources represents the people that work in the new business and who need to be trained for this purpose.

Finally, we have the markets, which correspond to the consumers who are ready to absorb these new products and disseminate them (Isenberg, 2011).

The experience of the Babson College showed that building an entrepreneurial ecosystem depends on a set of structures and actors mobilizing towards this purpose. Although it is not simple, it is a tendency for those universities that want to bring gains for the local community. To reach this level, it was necessary to build a culture based on actions of stimulus to the entrepreneurship, with change in the physical and teaching structures of the institution, constructed during 30 years. The curriculum of undergraduate and postgraduate students was reformulated, aiming the development of entrepreneurial skills through practical activities, immersion in projects, interdisciplinarity and case studies (Fetters, Greene, Rice, & Butler, 2010).

In each of the structures a critical mass consisting of different public and private actors, members of the academy, local companies, multinational companies, governmental entities, venture capital companies, among others, was created, forming a complex and integrated institutional framework (Bessant & Tidd, 2009).

The analysis of publications on this subject indicated that elements found in an ecosystem do not usually vary between different locations and studies. Although they are basically made up of similar elements, it is a mistake to replicate successful experiences in different contexts. What can be done is to stimulate the creation of these elements, keeping the characteristics of the region so that they motivate and assist in the business creation process.

Methodology

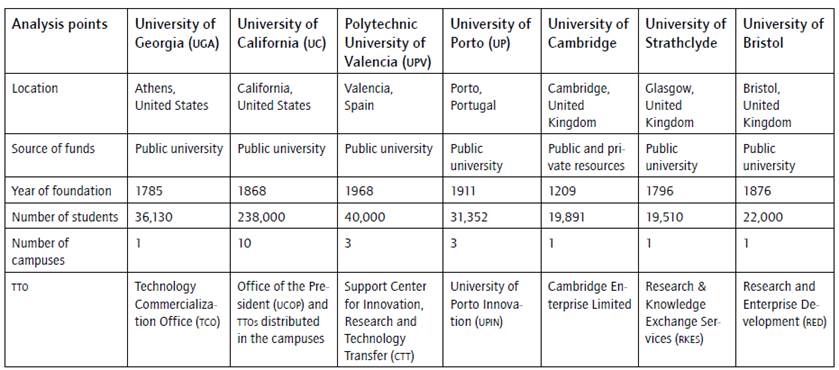

This research identified practices that stimulate spin-offs through case studies. The cases were analyzed from the point of view of technology transfer offices in a group of universities. Therefore, we selected two U.S. universities known for their high rates in creating this type of companies -the University of California (UC) and the University of Georgia (UCA) (O'Shea et al., 2007)-, and five European universities -Polytechnic University of Valencia (UPV), the University of Porto (UP), the University of Cambridge, the University of Strathclyde and the University of Bristol-, selected from The World University Rankings 2011-2012 (Thomson Reuters, 2013).

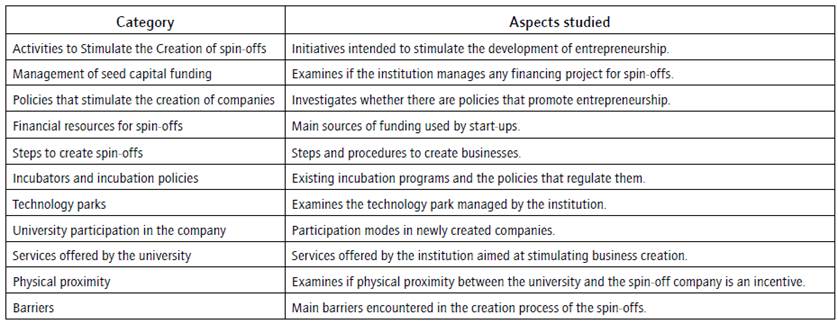

Afterwards, a research roadmap was prepared to help understand these institutions and see how they stimulate entrepreneurship, as shown in table 1. Data collection used semi-structured interviews, observations and document analysis.

Interviews, observations and document analysis were conducted from January 2014 to January 2015 in the seven institutions. At the University of Georgia we interviewed TTO Senior Technology Manager, collecting information on technology management, licensing activities in general, and valuation practices, and the Associate Director at the Georgia BioBusiness Center, who was asked about startups and spin-offs, business incubation process and development economic. At the University of California, interviews were conducted with the Executive Director, who works in Alliances and Services for Innovation at the Office of The President (UCOP), the Manager of the Skydeck business incubator, regarding the spin-off process and the training provided to entrepreneurs, and the Associate Director at QB3, an incubator dedicated to health, molecular biology and biotechnology.

At the Polytechnic University of Valencia, TTO Deputy Director was interviewed about the work carried out by this office, the focus on knowledge transfer, and also about the Polytechnic City of Innovation (Technology Park) and the process of creation and development of spin-offs. At the University of Porto we interviewed the Director of University of Porto Innovation (UPIN), who explained procedures for technology transfer and the incentive to entrepreneurship and generation of spin-offs. At the University of Strathclyde were interviewed the Director of Research and Knowledge Exchange Services, who introduced the institution and the services developed by the technology transfer office; the Commercial Manager, who explained the process of prospecting and transfer of technology; and the Director of the Center for Entrepreneurship, who explained activities to support entrepreneurship, from activities to seek venture capital to foster technology transfer activities and market analyzes for the commercialization of technologies. At the University of Bristol, the Director of Research and Enterprise Development (RED) addressed the role of TTO in the process for stimulating the impact of technologies and their transfer process (valuation, search of partners, licensing, etc.); the Operations Manager, who presented information on the process of creating spin-offs; and the management of the incubator. At the University of Cambridge, the interview was conducted with the Head of Consultancy Services Technology Associate, dealing with issues of office operation, technology transfer, encouragement for spin-offs, technology valuation and market research.

A semi-structured research questionnaire was used for conducting interviews. After the data collection phase an individual assessment was developed for each case, showing the results of each point investigated and a cross reference of the cases, in order to highlight the key factors that led to the creation of the academic spin-offs, as shown in the following section.

Results

This section characterizes the studied universities and presents the results of the case studies.

Presentation of Universities

Table 2 shows the characterization of the institutions that comprise the multiple case study.

As for location, two universities are situated in the United States, three in the United Kingdom, one in Spain and one in Portugal. All are public universities, except for the University of Cambridge, which has public and private funding.

Another point to emphasize is that only the Polytechnic University of Valencia is under 100 years, while the others are older universities and the University of Cambridge was founded more than 800 years ago (University of Cambridge, 2015).

In most of these universities the number of students varies between 19,000 and 40,000, except for the University of California, which has 238,000 students spread across 10 campuses.

There are technology transfer offices in all institutions. Although these structures are not the only ones responsible for the development of entrepreneurship in these universities, they represent an important support structure in the entrepreneurial ecosystem.

Analysis of Case Studies

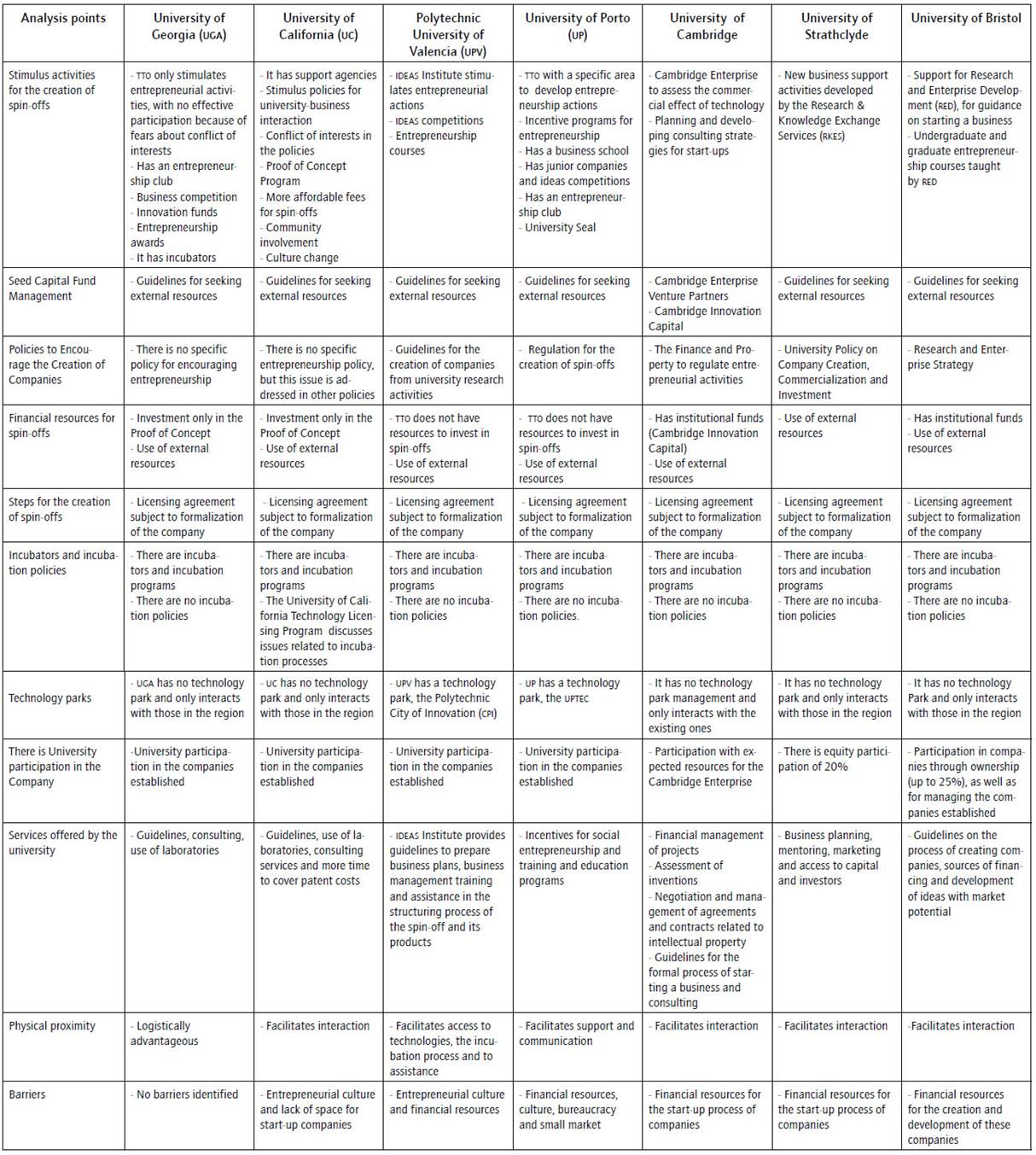

Table 3 shows the points studied in each institution and discussed in this section. Regarding the stimulus to create spin-offs in the selected universities, different support structures to provide guidelines in the various business phases and in the search for financial resources are observed. They all have business incubators and conduct business competitions. UC and UPV have entrepreneurship centers that are usually responsible for practical and informal entrepreneurial education. A distancing of the TTO in stimulating activities for the creation of business is only perceived at UCA, while in the other universities it is a strong intermediary between entrepreneurs and the institution.

Most institutions do not conduct management of seed capital funding, except for the Universities of Cambridge and Bristol, which have the following funds: the Cambridge Enterprise Venture Partners and the Cambridge Innovation Capital, and the University of Bristol Enterprise Fund. Since funds were raised the number of spin-offs has increased, demonstrating its importance for the community.

Specific stimulus policies for entrepreneurship are found at UPV (Regulations on Business Creation at the Polytechnic University of Valencia - University Research Activity), UP (Regulation for the Creation of Spin-offs), and at the University of Strathclyde (University Policy on Company Creation, Commercialization and Investment). UPV normative determines the role of IDEAS Institute to promote business creation, the seal of the institution and university shareholder participation. UP has the description of the rights and obligations of these spin-offs. Besides, there is no specific policy on entrepreneurship at UCA, UC has the University of California Technology Licensing Program, the University of Cambridge counts on the Finance and Property, and the University of Bristol has the Research and Enterprise Strategy, which are policies that address en-trepreneurship as a specific policy; albeit not as a central issue.

Regarding the financial resources for spin-offs, UC and UCA only invest in Proof of Concept, although the investment is not exactly for the spin-off company but to technology development. UP, UPV and the University of Strathclyde do not have their own spin-off investment means. The financial resources for these companies come from the resources of entrepreneurs, bank loans, financing, venture capital, and public and private funds. On the other hand, both the University of Cambridge and the University of Bristol have their own funds, such as the Cambridge Enterprise Venture Partners, the Cambridge Innovation Capital and the University of Bristol Enterprise Fund.

All the institutions have a business incubation process, which, in addition to physical space to the companies created, offer various support services to assist the company's opening process, idea validation, planning and other activities. However, most universities do not have incubation policies, except for the UC and its University of California Technology Licensing Program, which is not a specific incubation policy, although it addresses issues related to the incubation process of spin-offs.

Only UPV and up carry out the management of technology parks, while rest of the universities only interact with regional parks.

As for the steps to create the spin-offs, it should be noted that all of them need technology licensing agreements or other agreements to formalizing the company.

In addition, university's shareholding participation in spin-offs occurs in all institutions, which results from technology negotiations or the participation in programs such as the Proof of Concepts Program2.

As for the services offered by universities, each one of them has its own incentive system. UCA usually offers reduced costs during the technology negotiation process. UC offers laboratories, consulting, different terms and prices for the spin-offs and "quick licenses" for staff. UPV offers assistance in business modeling, entrepreneurial training and search for funding sources. UP has training programs and services for businesses in the incubator. The University of Cambridge has assessment services for inventions, negotiation and management of agreements and guidelines to formalize the company. The University of Strathclyde has assessment services for business planning and access to capital and investors. The University of Bristol offers guidelines for the development of ideas with market potential and funding sources. Companies emerging from these institutions are supported by the technology transfer office, incubators, entrepreneurship centers, and other structures (University of Bristol, 2015).

All institutions regard the physical proximity to the university as an advantage because of the logistics, access to information and direct interaction.

In terms of barriers, none were observed at UGA regarding business creation process, since TTO'S role is to stimulate; therefore, this aspect is under the responsibility of other departments in the institution. UC reported an entrepreneurial culture and lack of physical space for creating enterprises in the region. The barrier seen at UPV is the lack of entrepreneurial culture and financial resources, while up reported financial resources, bureaucracy and a restricted market as barriers. The universities of Cambridge, Strathclyde and Bristol presented financial resources as barriers in the process for the creation of new businesses.

Technology Transfer Office at UGA has limited initiatives to create spin-off activities, justified by the fear of potential conflict of interests. Entrepreneurship stimulation actions are promoted by the institution itself and its incubator by means of encouraging entrepreneurship programs. The biggest concern has to do with developing technology so that it becomes attractive to the market.

At UCG, UC and UPV conflict of interests were solved by the creation of regulations that determine that activities with potential conflict of interests must always be investigated. Therefore, there is a Committee that evaluates each case and formulates guidelines.

UC has a structure that differs from the others: it has a central office, an Office of the President (UCOP) and technology transfer offices in the different campuses (University of California, 2014). Each office has decision-making autonomy for hiring professionals, allocation of financial resources and decision-making in issues related with agreements. They have guidelines for licensing, rights and obligations associated with the research results, programs and support entrepreneurship policies, generally created together with UCOP. The Proof of Concept Programme, the "quick licenses" for employees and incentives for the licensing of spin-offs are key support elements and stimulus to the entrepreneurial culture. In addition, what strengthens the large number of companies created is the entrepreneurial ecosystem, formed by various structures that enable the creation and development of companies. This ecosystem consists of incubators, entrepreneurship centers, business school, teachers involved with the theme, entrepreneurs club, mentoring program, and other aspects that set it apart from ecosystems consisting of universities, government agencies, companies, entrepreneurs, venture capital investors, research institutes, incubators and business accelerators, the media, and members of the local community. Other remarkable points of UCOP and the technology transfer offices in its campuses are the speed to conclude contracts (speed in the process) and the constant strengthening of the brand through coordinated marketing endeavors in the academic community for society and, especially, for the companies.

Something outstanding at upv are well-defined regulations and policies, such as the "Business Creation Regulations at the Polytechnic University of Valencia based on the University Research Activity", which ensure these activities are firmly based on previously defined procedures and directed by the institution, securing that potential entrepreneurs know their rights and duties with the university. Moreover, these regulations set the limits of other issues that contribute to the performance of the institution, addressing the issue of staff participation in research projects, management of contracts and grants, protection and transfer of intellectual and industrial property rights, scientific integrity, research best practices, and codes for managing conflict of interests in research. This institution also has a Dean's Office exclusively dedicated to entre-preneurship implementation, as well as active innovation managers in major laboratories/institutes who are responsible for attracting new projects, detecting results subject to protection, assessment and guidance on financing routes, and setting out criteria for commercializing research results. Other important offices at UPV are the two bodies dedicated to stimulating entrepreneurship: IDEAS Institute and the Polytechnic City of Innovation (CPI), which foster project development initiatives for the creation of new businesses and the mobilization of financial resources (Instituto IDEAS UPV, 2014).

The major strengths observed at up were: the existence of a well-articulated entrepreneurial ecosystem, which includes UPIN, the Science and Technology Park of the University of Porto (UPTEC), the Porto Business School, the Entrepreneur-ship Club, and research funding from the European Community (Parque de Ciência e Tecnologia da Universidade do Porto UPTEC, 2014; Universidade do Porto, 2014). However, the structuring of this ecosystem is still quite new and subject to the articulation process. Another important factor is the Regulation of Spin-off Companies of the University of Porto, which is intended to stimulate and support innovative businesses, giving them the approval seal to be associated with up. Another intervention consists of the methodology defined to support entrepreneurs, intended to systematize the creation process and provide a range of services to promote the development of technology-based business projects; the Business Ignition Programme, aimed at empowering entrepreneurs in innovation management and business entrepreneurship; and iUP25k -Business Ideas Competition of the University of Porto-, a tool to raise awareness about entrepreneurship and the creation of new companies based on the exploration of knowledge and innovation processes. This program gives awards for financial resources, international trips and participation in business events, ensuring student participation interest and using the awards for the companies.

The University of Cambridge has a distinctive feature in the performance of its TTO, which invests in seed capital. There are currently two funds: the Cambridge Enterprise Venture Partners and the Cambridge Innovation Capital. The university has invested in seed capital since 1995, obtaining good results from this. The institution also has a network, the Enterprise and Innovation Network, which provides information to those intending to participate and to the participants of the incubators, TTO and other agencies. The network shares information about events, news and research in the area and interesting subjects, keeping close ties with potential entrepreneurs. The goal is to bring people with common interests together. Another interesting point in Cambridge is the continuous training for the TTO team, due to the proximity to the PraxisUnico, an association that supports innovation, helps develop important skills for technology transfer through training, and promotes interactive networking among the actors of this sector (PraxisUnico, 2016). An aspect that differentiates University of Cambridge TTO from others are the services rendered to the community and other TTOS. There is an emphasis on training and consulting to external bodies. However, this behavior is opposite from what takes place at UC, where any activity that is not technology transfer is believed not to contribute to achieve institutional goals, denying consulting or training services to other institutions.

The University of Strathclyde plays an important role in stimulating entrepreneurship, which includes receiving awards in this regard: University of the Year 2012, 2013, 2014 and Entrepreneurial University of 2013 by the Times Higher Education, demonstrating its integration in the entrepreneurial culture throughout the organization (University of Strathclyde, 2015). The stimulus to the development of spin-offs is a key assignment of the technology transfer office. University's TTO has a specific team to deal with the creation of new companies based on the technology of the institutions.

TTO at the University of Bristol has an active entrepreneurial identity, disseminating several actions among students as potential entrepreneurs. One of the programs for beginners is the Basecamp Master-classes, a set of workshops to stimulate and promote the generation of ideas and the inclusion of an entrepreneurial culture. There is a society directed at uniting young entrepreneurs in social events, discussions and dissemination of good practices, the Join Inc. There is also an internship program in the companies of the institution, the UoB, which enables practical work in real situations. These actions are relevant for preparing entrepreneurs, theme diffusion and for strengthening an entrepreneurial culture.

It is observed that the development of entrepreneurship in the institutions depends on a set of connected actors and shared actions in order to create the conditions for the emergence of new enterprises. In addition, stimulating entrepreneurship is strongly related to the development of an entrepreneurial ecosystem, in which innovation environments have a key role, but which depend on the creation of support policies, an attractive and receptive consumer market, and other aspects. Joint actions develop entre-preneurship in research institutions, but they rely on coordinated actions by the government, universities and companies.

Conclusions

This research identified stimulus actions for the creation of spin-offs in seven universities. At the University of Georgia, the TTO has lower performance in creating spin-offs for fear of conflict of interests. The institution has stimulus actions for entrepreneurship in partnership with the company-based incubator. The focus of the technology transfer office is to find ways to develop technologies that are attractive to the market, making use of the Proof of Concept Program.

The University of California has a technology transfer office at each campus, with decision-making autonomy and a central office that sets goals, guidelines and budgets for each individual office. Their work is focused on technology transfer activities, without diverging to activities such as consultancy or rendering services, since they believe that the role of this office is to transfer the results to society. The central office, UCOP, determines the guidelines for licensing technology, which are embodied in the policies and programs. They also have a strong ecosystem made up of incubators, entrepreneurship centers, business schools, teachers involved with the theme, entrepreneur clubs and other structures that influence entrepreneurship. What is clearly seen is that the joint action of all elements in the ecosystem reinforces the creation of new companies. The need to develop an entrepreneurial ecosystem produced by a set of well-articulated elements was strongly emphasized by Isenberg (2011).

The Polytechnic University of Valencia has well-defined entrepreneurship regulations and policies, as well as two bodies devoted to stimulating the creation of spin-offs, IDEAS Institute and the Polytechnic City of Innovation, which ensure institutional resources and the development of projects. This appears to follow the recommendation that policies that address entrepreneurship in its early stages should consider critical factors such as motivation, ability and opportunity, and also strive to ensure these and other important aspects are present in their academic community (Lundström & Stevenson, 2005).

The University of Porto has a well-articulated entrepreneurial ecosystem that includes UPIN, the UPTEC, the Porto Business School, the Entrepreneurship Club and research funding from the European Community. In addition, this institution created regulations on entrepreneurial activities, determining standards for companies that wish to receive a seal of approval and be considered as spin-offs of the up. In addition, there are various competitions of business ideas and entrepreneurial training programs developed by the area and dedicated to new TTO businesses. Another interesting feature is that the companies created by the institution are born with the idea of reaching the global market, due to the fact that Portugal is a small country and, therefore, has a limited market.

The Universities of Strathclyde and Bristol have a similar approach, identifying and driving opportunities, notwithstanding any form of protection or no protection. That is, they identify general opportunities, even if they are not protected by the institution. Furthermore, the University of Strathclyde has received entrepreneurial university awards, demonstrating the commitment of the entire organization to implement an entrepreneurial culture. These actions are aligned with the argument made by Saffu (2003), who shows the importance of the inclusion of an entrepreneurial culture as an element that generates a significant impact on the development of entrepreneurship.

University of Cambridge TTO differs for having a structure similar to a private company, focusing on providing services to the community and influence new businesses. The TTO provides services to the entire community.

Our case studies enabled to understand how each university operates in stimulating entrepreneurship. Actions, programs and policies they have developed can be used as incentives to other institutions that intend to strengthen their entrepreneurship stimulus.

Another point that could be perceived through the analysis of cases is that technological entrepreneurship does not arise spontaneously or automatically. Universities and research institutions that became a reference in the process of creating new businesses were aware it was necessary in order to change the approach followed by the body of the institution, doing so by training teachers, researchers and employees to act as transmitters of entrepreneurship. This also required a change of curriculum and student behavior, with a greater emphasis on practical activities.

Having policies to regulate permits and prohibitions regarding the transfer of technology and entrepreneurship within an academic environment brings a sense of security among participants. Creating an environment with business schools, entrepreneurship centers, incubators, TTOS and other structures can stimulate entrepreneurship. However, the most important factor is the presence of different actors belonging to academia, the business community and government representatives, interacting and articulating so that knowledge in fact materializes in new businesses.