Introduction

The Guadalajara Metropolitan Area (GMA) has been called the "Mexican Silicon Valley" due to the high concentration of subsidiaries of multinational corporations (MNCS) from the electronics sector that have established operations in the region over the past couple of decades. Despite this large growth, there has been limited development of electronic design capabilities in the region (Gallagher & Zarsky, 2007). In contrast to the limited creation of electronic design competencies in the GMA, some companies have been able to develop such competencies success-fully. Understanding how these companies have been able to succeed is critical in expanding this industry.

Bell and Pavitt (1995) define the concept of technological capabilities as the skills required to generate and manage technological knowledge by applying it to production with the support of specialized resources. Furthermore, considering the importance of this concept, Kim (2001) improves this definition adding an economic component, not only as a way of applying knowledge but also as a way of being competitive in terms of price and quality. To these concepts, Ariffin and Figueiredo (2004) added an organizational element as they studied the development of technological capabilities in developing countries. They described technological capabilities as the resources required to develop and manage innovation, including the organization and the infrastructure involved. These authors also considered that such capabilities occur at the individual level (skills, knowledge, and experience) within the organization.

Evidence tends to confirm the hypothesis that attributes the possibility of international convergence of per-capita income to a sustained effort in each country to strengthen its technological capabilities (Cimoli, 2005). It was observed that the growth rate of each country in the period 1990-2003 (in a sample that included 60 countries) was positively related to technological capabilities and to the diversification of exports by dynamic sectors. Rasiah, Mohamad, and Sanjivee (2011) examine the impact of proximate domestic sourcing on productivity, exports, and technological upgrading in small and medium businesses (SMBS) in electric-electronics industries in Malaysia. Their econometric results show that technological intensity is positively correlated with productivity and export orientation and that governments should be encouraged to examine the nexus between suppliers, buyers, and economic performance in order to stimulate national inter-firm production synergies to increase competitiveness in domestic firms.

Paus and Gallagher (2008) identify two main reasons for the missing links between high-tech foreign direct investment (FDI) and the development of indigenous knowledge-based assets in Mexico. First, the government did not have a coherent strategy regarding the government policies needed to advance national capabilities, overcome market failures, and support the integration of national producers into MNCS' Global Value Chains (GVC). Second, there were limitations on the spillover potential from FDI. In Mexico, technology or scale requirements for inputs made it difficult for large MNCS to source domestically beyond simple inputs like packaging materials. Besides, fundamental changes in the organization of GVC in the computer industry led MNCS to rely on their global contract manufacturers rather than working with potential Mexican suppliers.

Mexico's industrialization strategy has focused on targeting foreign direct investment (FDI), primarily in the electronics industry, through friendly policies and tax exemptions aimed at obtaining technology. In terms of public policy, Iammarino, Padilla-Pérez, and Von-Tunzelmann (2008) show that FDI should be seen as a complement and not a substitute for local efforts to develop technological capabilities. The attraction of FDI in high-technology industries is not a sufficient condition to develop advanced regional technological capabilities. On the one hand, the presence of MNC subsidiaries does not guarantee technology transfer, and, on the other hand, the absorption and assimilation of imported technology is not considered a passive activity; rather, it demands extensive, continuous, and concerted efforts from all components of the system. Rivera (2010) found that the electronics cluster in Jalisco entailed the displacement of domestic firms and, despite Mexican FDI policy, there has been very limited technology transfer in Guadalajara. Furthermore, the existing technology transfer is concentrated in the absorption of operative capabilities. This situation has locked the region into a vicious circle. However, the creation of small indigenous software firms, the establishment of design houses, the increase in investments for research and design, and the promotion of technological learning processes among small indigenous software firms suggest that the electronics cluster in Jalisco may be heading to-wards a virtuous circle of sustainable development.

Concerning alternatives in financial incentives, the Mexican government has included mechanisms to provide some level of financial support for companies seeking to develop technological capabilities; however, these financial programs lack long-term support. Furthermore, as stated previously, it is clear the electronics "maquila"1 industry has undergone significant growth; though, the same cannot be said of the SMBS with electronic design capabilities.

Although some SMBS with electronic design capabilities have been established in the region, their success has not been multiplied. This problem is what triggered this research study to increase the level of understanding of the promotors and inhibitors of the development of SMBS with these type of technological capacities (Guillemin, 2014). The aim was to detect the enablers and inhibitors that trigger or hinder the creation and development of electronic design capabilities within the SMBS in the GMA and to determine the role human contacts played in accomplishing this objective.

In this paper, we begin with an overview of the electronic industry in the GMA, followed by a brief review of the Regional Innovation Systems (RIS), social capital and core competencies. Finally, the research methodology is reviewed, findings are discussed, and several recommendations are proposed.

The Electronics Industry and the Lack of Electronic Design Capabilities in the GMA

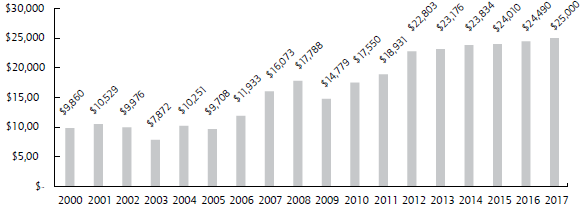

The electronics industry in the GMA has acquired significant relevance in the economic development of this region. Although the electronics sector has experienced rapid growth, the development of electronic design capabilities lags significantly in terms of economic growth and the number of human resources employed, compared with the "maquila" operations carried out by multinational companies and their assembly plants located in low-wage regions. According to the Mexican Electronics Chamber (Cámara Nacional de la Industria Electrónica de Telecomunicaciones y Tecnologías de la Información, CANIETI), the electronics industry represented 4.6% of Mexico's international exports in 2017 (CANIETI, 2019). Additionally, it has been accompanied by a large amount of FDI, which according to the Economic Commission for Latin America and the Caribbean (ECLAC) amounted to $20 billion dollars between 1999 and 2017 (ECLAC, 2018). Looking at the industry exports (figure 1), it is evident that the economic growth driven by the electronics sector exports in Jalisco has been a key component of the economic growth in the state and a significant employment generator.

Figure 1 Economic growth of the electronics industry in Jalisco in million US dollars (2000-2017). Source: CADELEC (2008, 2017).

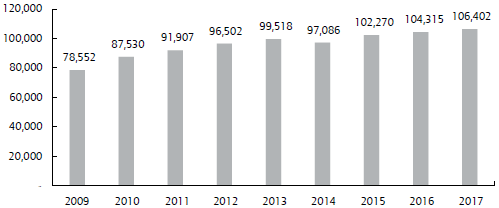

Another way to measure the importance of an industry in a region is by analyzing the number of employees that work in the sector. In this case, according to CADELEC (2008), the number of jobs related to this industry was estimated at approximately 26,000 in 1996, and for 2016 the estimate was 104,000 (CADELEC, 2017) (figure 2). In another measure, Jalisco's FDI between 1996 and 2007 was estimated at more than 4 billion dollars, and ProMéxico (2013) calculated 2 billion dollars of FDI for the period 2002-2012, out of a total of 9,791 billion dollars for the country. In addition to profits from electronics industry exports, another important factor that must be considered is the capacity of skilled workers in the industry. All these figures provide a good picture not only of the size and growth that this sector has achieved in the region in the last couple of decades, but also of its huge potential.

Figure 2 Employment generated by the electronics industry in Jalisco (2009-2016). Source: CADELEC (2017).

The development of the Mexican Silicon Valley can be appreciated by the growth of its exports and local job creation. In Jalisco, the regional electronics industry has maintained its growth levels. In 2011, exports from this industry were worth 18 billion dollars and generated more than 90,000 jobs associated with the sector (Suárez, 2011), and by 2017 it reached more than 24 billion dollars and provided employment to more than 100,000 people (CADELEC, 2017). More recently, CANIETI published that in 2018 this industry employed 103,844 people, without considering the number of contractors (CANIETI, 2019).

This impressive growth and evolution of the electronic industry in the region started back in the 60s when the first MNCS set up operations. By the end of the 80s, the GMA was called the "Mexican Silicon Valley" due to the number of MNCS established in the region. Although this development started three decades ago, it had its fastest growth after the North American Free Trade Agreement (NAFTA) between the United States, Canada and Mexico, which was signed in January 1994. It is important to highlight, however, that although the size and growth of this industry has been significant, the sector has increased volatility when labor cost is the only competitive advantage. This volatility was observed in 2001, when a high number of firms moved some of the work to China when they entered the World Trade Organization (WTO). In addition, the victory of Trump as the new president the United States, signals changes in the trading policies of this country, making the development of regional technological capabilities a more important task. As Gereffi, Humphrey, and Sturgeon (2005) highlighted, the strategy of industrialization of developing countries must extend to activities that have more value added, such as R&D, marketing and logistics, not only to manufacturing, so creating jobs such as electronic design and developing a strong local industry will ensure that the economic benefits are sustainable in the long run.

Sturgeon and Kawakami (2011) identify some of the persistent limits to upgrading experienced by even the most successful firms in the developing world. Four models used by developing country firms to overcome these limitations are presented: i) global expansion through the acquisition of declining brands (emerging multinationals); ii) separation of branded product divisions from contract manufacturing (original design manufacturing [ODM] spinoffs); iii) successful mixing of contract manufacturing and branded products (platform brands) for contractors with customers not in the electronic hardware business; and iv) the founding of factory-less product firms that rely on GVC for a range of inputs, including production (emerging factory-less start-ups).

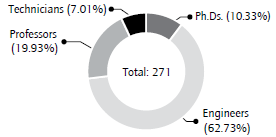

In contrast with the growth and the size of this sector, in 2008 only 271 people were working on electronic design in SMBS, with fewer than 100 employees in the GMA, according to CADELEC (figure 3). There is a more recent figure from CADELEC (2011) that showed 878 people working on electronic design activities, but it included the MNCS. These numbers contrast with the 90,000 jobs created by the electronics industry in the region (Suárez, 2011). The number of electronic design specialists in SMBS is also small when compared to the size of the SMB sector in Mexico, which generates 31.4% of all the jobs in the country (INEGI, 2014).

Figure 3 People working on electronic design activities in SMBS in the GMA (2008). Source: CADELEC, (2008).

By 2013, also according to CADELEC (2013), the number of people working on electronic design in SMBS was only 177, but, on the positive side, the overall number including those working in MNCS increased to 1700 employees. This more recent data shows that despite the availability of capable designers in the region (Rivera, Chapman, Sánchez, & Polanco, 2014), as MNCS growth suggests, this potential has not triggered a similar increase in the regional SMBS. No further census has been done in the region to understand if there has been a change. However, looking at the directory of SMBS in the region, no significant change has been observed, although it would be ideal to perform a new census of engineers doing design in SMBS in the GMA.

It is important to mention that the growth generated by the MNCS established in the GMA gave rise to the expectation of a technological transfer and the development of regional electronic design capabilities with much more added value. This expectation was based on the fact that MNCS possess high-tech knowledge capabilities and they also play an important role in international technology transfer (Carrillo & Partida, 2004). These technology transfers to the regions are aimed at contributing to innovation and the design of new products.

Nevertheless, even though the role of the electronic industry in the state of Jalisco is very important, the technology transfer is not obvious and requires further analysis. Dussel (1999) confirms this in a paper about the electronics industry in Jalisco written for the Latin American and the Caribbean Economic Commission (CEPAL) and mentions that it is still not possible to compare the development achieved by the region of Jalisco with the dynamic innovation of the original Silicon Valley. This was exemplified by considering the minimal integration of the SMBS into the electronics sector as well as the limited amount of design and the fact that most of the manufacturing is done with imported components, thus, overall results cannot be attributed to local vendors or developers. Furthermore, the low level of technological transfer between the electronic MNCS and the SMBS in the region persists, as suggested by Palacios (2008), nine years after the work by Dussel, where this author reports few links between MNCS and the local industry, few technology transfer activities, and an insignificant increase in local integration. The Foro Consultivo Científico Tecnológico (FCCT, 2006) reached a similar conclusion, pointing out that electronic goods produced by the multinational industry cannot be interpreted as technological added value created locally and, thus, the development of technological design capabilities cannot be asserted.

The analysis of Rivera et al. (2014), concerning the spatial dynamics of GMA taken an alternative theoretical basis related to knowledge network framework as productive ecosystem, shows that the territorial restructuring activities that began to be experienced in the 1980s accelerated in the 2000s. The presence of subsidiaries of global product design and testing companies, which tend to act as the axis of the emerging business network, has been decisive, linking to obtain qualified personnel (knowledge workers) with the higher education centers. Gradually after 2006, when the results of the restructuring began to be evident, GMA acquired signs, although weak, of a technopolis. Despite the role that the supply of knowledge workers began to play, maquila assembly has continued to represent the bulk of exports, mainly in telecommunications equipment, under a process controlled by the Contract Manufacturers (CM). The central role taken by global firm subsidiaries was pivotal to a new mode of interrelationship between the various stakeholders in the region.

Regional Innovation Systems (RIS), Social Capital, and Core Competencies

Regional innovation systems (RIS) are defined as a "constellation of industrial clusters surrounded by innovation sup-porting organizations" (Asheim & Coenen, 2005 p. 1173). RIS approaches emphasize the systemic dimensions of the innovation process, i.e., the dynamic interaction between the different components of the system: individuals, organizations, and institutions. However, RIS in developing countries depend on weak indigenous institutions catching up as opposed to being first movers; they also often rely on outside capital and knowledge. This lack of local knowledge resources forces local firms to be dependent on MNCS as providers of knowledge and capital.

RIS possess technological capabilities, understood as "knowledge and skills embedded in individuals, organizations and institutions located in a geographically-bounded area and conducive to innovative activity" (Padilla-Perez, 2006, p. 69). Well-functioning RIS are commonly characterized by a high level of technological capabilities in the organizations within the system as well as by intense, dense, broad outward flows to the rest of the world. Within this idea, technological capabilities are framed as a set of multidisciplinary skills encompassing all levels: companies, regions, and country.

In RIS, the interactions and linkages among the elements depend on "social capital." Healy and Côté (2001) defined social capital as "networks together with shared norms, values and understandings that facilitate co-operation within or among groups" (p. 41). While multiple definitions describe the concept from different perspectives, they present a common thread: "it is the interactions between members of networks that make possible the production and maintenance of this social asset" (Andriani & Christoforou, 2016, p. 5). Weiler and Hinz (2018) emphasize that social networks and trust play a crucial role in understanding the concept of social capital. The scope of the interactions is strongly influenced by the institutional framework (the rules, norms, and values). Authors such as Healy and Côté (2001) and Gausdal (2008) highlight the importance of social capital, since new industries and innovation development depend on collaboration, trust, partnerships, and knowledge networks.

Coleman (1988) identifies three forms of social capital. The first is the set of norms and obligations where trust is built within the social environment; the second, the ability to exchange information; and finally, the presence of sanctions when the norms are broken.

Adler and Kwon (2002) provide a different interpretation, saying that social capital is the goodwill that others have toward us and the value that this has, i.e., the influence it has on resource exchange, business creation, the exchange of intellectual capital, the strengthening of relationships between customers and suppliers, the creation of production networks, and inter-organizational learning.

Abba, Kabir, and Abubakar (2018) remark the importance of social capital as a condition for business success in developing countries, while Laursen, Masciarelli, and Prencipe (2012) underscore the role it plays in acquiring and using knowledge and fomenting a higher propensity to innovate. It also has an impact on transaction cost reduction, allowing companies to focus on developing technological capabilities (Landry, Amara, & Lamari, 2002). Healy and Côté (2001) also distinguish between different levels of social capital: one with family and close friends, another between unrelated individuals, and the last one between institutions both public and private. In addition to a solid social capital, having clear core competencies is also key. On this regard, Hamel and Prahalad (1990) define three characteristics of core competencies: they enable companies to deliver hard-to-copy differentiation to the market; they represent a significant benefit to the customer; and they can be extended to other products or markets, enabling companies to sustain growth.

A technology itself is not a core competency. What would fall under that heading is how that technology is integrated by those enterprises, along with the processes implemented to make use of it and add value. Companies need to be able to identify and develop these competencies in order create a competitive advantage in the marketplace. In the case of companies working on electronic design activities, many of their core competencies rely on technological capabilities that they need to develop.

In summary, to develop technological capabilities it is important to have a RIS, and for this RIS to function properly, having social capital between the players is key. Additionally, companies need to select and develop their core competencies supported by several technological capabilities that will give them necessary differentiation.

Research Methodology

For the purposes of this paper, the holistic, empirical, interpretative, and empathic aspects of the qualitative approach are those that make this methodology adequate (Rodríguez, Gil, & García, 1999). Within the qualitative approach, Leedy (1997) mentions three types of qualitative research design: Case Study, Ethnography and Grounded Theory. The first of these, i.e. case study, served as a guide for the present work, given that it explores an entity or phenomenon (the case) limited in time and within an activity (a program, event, process, institution or social group) that gathers detailed information through the use of various procedures during a period of time. The recommended protocol within the case study (Zucker, 2009) contains the following steps:

Description of the purpose of the case study (importance and questions to be answered).

Design of the unit of analysis.

Data collection and management.

Description of the case.

Analysis and its relationship with the unit of analysis.

Presentation and review of what was found, including narratives, references, and bibliography.

Demonstrate the rigor followed, which allows credibility, but also ability to confirm what was found.

To identify the external and internal factors within the SMBS that enable or inhibit the development of electronic design technological capabilities in the GMA, a multiple-case qualitative research methodology was used (Yin, 2008). A multiple case study was selected because it seeks to build an illustrative picture of the different characteristics and trajectories that SMES in this industry may have. This also allows comparing the different findings that help to make predictions from what has been found (Zucker, 2009).

For the analysis of the data obtained, two procedures were used. The first was the study of the trajectories of each case through the analysis of the development of their skills over time, which allowed key factors to be identified. That is to say, the important elements present in the narratives collected from the series of chronological events through which the companies had passed on their way in the development of design capabilities were identified, and which in some cases were common among the cases under study. The second procedure was that proposed by McQuarrie (1993), commonly used in market studies carried out by multinationals; this process of analysis is based on the capacity of the human brain to identify common patterns.

Yin (2008), in describing the different alternatives for the case study, proposes five possible analysis techniques:

The first by pattern search. This was searched by using the two procedures described above.

The second by searching for causal relationships that allow an explanation to be developed. This was done by studying case trajectories.

The study of events in time. This has also been applied when reviewing company trajectories.

Logic models that provide an explanation to the series of evidences.

And finally, cross-comparisons when you have several cases. This has also been done by contrasting the different companies studied.

The seven companies that were selected (table 1) had different levels of maturity and were involved in the production of different types of products within the electronics industry. All of them were located in the GMA. In-depth interviews with top-ranked personnel were conducted and all companies were visited (except for ATR).

Table 1 Electronics sector companies included in the study.

| Company | Main Activities | Person interviewed |

|---|---|---|

| Intel de México (Guadalajara design center) | Designs and tests microprocessor boards | The general manager, who was the founder of a startup acquired by Intel |

| BEA (also known as Idear Electrónica) | Designs products and solutions for public bus transportation systems | The R&D Director |

| Mixbaal | Designs and manufactures telecommunication products | The founder, owner and general manager |

| Bunker | Designs and manufactures high-power audio equipment | One of the founding partners and general manager |

| ATR | Designs and manufactures audio jukeboxes | The senior architect, who was part of the founding team |

| ASCI | Contracts electronics design and testing services | The cofounder and general manager |

| DSP Projects | Designs electronic digital signal processing | The owner and general manager |

Source: authors.

In addition to the seven companies, three top-ranked public officials were interviewed: the former Secretary of Economy under President Vicente Fox, who was part of the state government during one of the expansion periods of the electronics sector; the former director of the local public semiconductor research center (Centro de Tecnología de Semiconductores, CTS); and the former director of the Regional Electronics Chamber (Cámara Nacional de la Industria Electrónica de Telecomunicaciones y Tecnologías de la Información, CANIETI).

Two methods were used for data analysis. The first was a case trajectory analysis over time to identify key factors that were present in the companies during the development of their capabilities. The data was collected from the interview narratives about the history of each enterprise. As for the second method, an analysis matrix was constructed and, in the columns, the data was organized according to each case and the actor who was interviewed (table 2). In the rows within the matrix, the phrases collected were organized into two mayor categories: enablers and inhibitors. Then, each of these two categories was further organized into sub-categories, based on the theoretical framework that was considered relevant for this analysis: Regional Innovation Systems (RIS), core capabilities and social capital. Entrepreneurship was also evaluated as a sine qua non element. With these categories, the extracted quotes were grouped, as well as some of the observations made during the visits.

Table 2 Analysis matrix.

| Companies and Actors | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Categories | Subcategories | Intel | BEA | ATR | Bunker | Mixbaal | DSP projects | CANIETI former director | CTS director | Former Secretary of Economy |

| Enablers | RIS | |||||||||

| Social Capital | ||||||||||

| Core competencies | ||||||||||

| Entrepreneurship | ||||||||||

| Other Elements | ||||||||||

| Inhibitors | RIS | |||||||||

| Social Capital | ||||||||||

| Core competencies | ||||||||||

| Entrepreneurship | ||||||||||

| Other Elements | ||||||||||

Source: authors.

Findings

While it is true that electronic design technological capabilities have not grown as much as was expected, especially when compared to the economic growth and size of the regional electronics industry as a whole, there are some examples showing the potential, opportunities and enablers that are available regionally to support the development of SMBS with these types of competencies. It is within these cases that at the same time, the inhibitors and promotors were identified.

During this research, three key challenges were identified: first, the strengthening of the RIS, and within the RIS, finding better financial support mechanisms to support these types of companies (Guillemin & Pedroza, 2017); second, the development of knowledge, collaboration, and commercial relationship networks (social capital) within and outside the region; finally, the ability to detect the future key core competencies that need to be created and developed to create a competitive advantage in the market place, and the role the RIS played in the construction of these core competencies. The last two elements are the ones being discussed in the current paper.

Social Capital Impacts on Development Trajectories

In analyzing the cases, two significant challenges were key to their success. The first one was finding "what to do that the market needs", and second, "who will be my customer, how can I find them". In resolving these two challenges, the first element that played a key role was the social capital that the founders of these companies had.

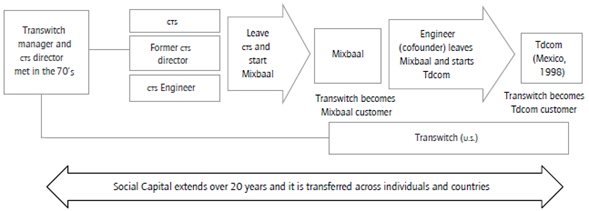

The first case that showed not only the importance of social capital but also its longevity was Tdcom, later acquired by Intel. A former CTS director and another engineer founded a company named Mixbaal, and one of their first customers was an engineering manager working in a company named Transwitch, which gave them one of the first design contracts. This individual had worked in Mexico City in the 70s, when he met the later CTS director. Later, when the engineer that cofounded Mixbaal left to start Tdcom, he was able to continue the relationship with this manager at Transwitch, which also gave the new company one of its first work assignments in 1998 (figure 4).

Figure 4 Social capital, longevity, transferability between individuals and impact across geographies. Source: authors.

This case not only shows how these personal relations were key to finding customers, but also how the relationship was extended from one individual to another, and its longevity extended over more than 20 years. This demonstrates that social capital can be transferred and accumulated over long periods of time, that it can expand across geographies, and that it is key to reaching the market.

Two additional cases (Gausdal, 2008; Jasso, 2004) exemplify how trust across individuals accelerates collaboration processes and is key to transferring knowledge. BEA founder wanted to develop a low-cost technological solution for public transportation systems in Mexico, but he lacked the technical expertise. Through the personal relationship he had with the director of the CTS, they established a cost-attractive collaboration agreement that not only allowed him to develop the first concept but also gave him access to qualified experts that helped develop the necessary technological capabilities. One example of this was that one Ph.D. from CTS spent his sabbatical year at BEA, helping them develop and grow their design team.

A third example was ASCI, which established a personal working relationship with a u.s. Hewlett Packard R&D manager who worked for some time in Guadalajara, where they met. Upon his return to the U.S., ASCI founder was able to sell engineering services to Hewlett Packard in Boise, Idaho (U.S.), through the extended contacts that he developed, making ASCI one example of the talent available in the region, as reported by Fortune magazine (October 29, 2001).

These cases illustrate the importance of "know-who" to gain access to the market (Lundvall, 1998), as well as the need to have access to knowledge (Lundvall, 2002), and the role that social capital plays in both cases. What was surprising was that in the cases of Tdcom and ASCI, social capital was transferred and extended among individuals, and that in all three cases, it had an impact over a long period of time that extended over a decade, and it crossed cultures and geographies.

Core Competency Development in the GMA

Another element identified as a key enabler in the success of these cases as they developed their technological capabilities was how they were able to select the right competencies to build, ones that over time would be required.

In the case of Tdcom, the existence of the CTS in the region was key, since they played an important role in enabling Tdcom to focus on one area of technology that at the time was developing, because the CTS had experts familiar with that technology. Specifically, the CTS had a lot of know-how around telecommunications and circuit design. For Tdcom founder, focusing on how to use this knowledge in the growing opportunity of the nascent internet was a natural decision based on his knowledge. He could recognize Internet's need to move large amounts of information using the telecom infrastructure and figured that technological capabilities would be required to design the equipment to enable that. Later, Intel acquired Tdcom, as the latter had developed intellectual property that was strategic for them as they were looking to enable solutions with newer communication networking capabilities. Intel grew to more than 1,000 design engineers in the GMA, because Tdcom selected the right core competencies that the future would need.

In the case of BEA, the founder had a solid knowledge of the market's needs and opportunities, as he had previous experience working in public transportation in Mexico City subway system, and he used the CTS as the first step in developing the right technical design capabilities. He had a vision of providing low-cost technological solutions for Mexican public bus transportation systems. At the time, the solutions available were from multinational companies, tailored for high-end subway systems; they were too expensive and not designed for the public bus transportation systems in developing countries. With this goal and collaborating with the CTS, he was able to develop the right core competencies based on market needs and technology.

The case of ATR is even more impressive, since they were able to generate intellectual property that was leading-edge at the time, even visionary. The technical cofounder succeeded in connecting the dots: before the iPod or iTunes existed, he projected that music was going to be commercialized, transmitted, and used over nonphysical media, at the time on the nascent internet. In 1999 he submitted a U.S. patent (5,959,945) titled: "System for selectively distributing music to a plurality of jukeboxes". It is important to note that the iPod was not introduced until 2001. The first claim of this patent is: "A music distribution system for local digital electronic jukeboxes". He determined that he needed to develop the necessary core competencies to be able to design a jukebox system that could play, distribute, and store music, maintain statistics, and optimize music transmission. In parallel he developed the legal framework. This is how ATR was born, based on a clear set of technical capabilities that needed to be developed. How he was able to "connect the dots" probably had something to do with the fact that he had worked as a senior R&D engineer in Hewlett Packard local R&D center at the GMA. This was an example of talent spillover from the multinational companies.

Bunker is a company that develops audio equipment; the founder worked as an electronic designer at Sony, specifically on their TV R&D team. After acquiring a set of design capabilities there, he decided to launch his own startup with a clear set of competencies in mind: the design of audio systems and solutions.

Prahalad (1993) highlights the importance of "core competencies" as a key element that determines future growth in companies. Having those capabilities is thus critical, but an underlying question is how they can be identified, selected, and developed. Ernst (2010) highlights two elements that need to be present: the first is some level of internal R&D effort that is a prerequisite for absorptive capacity; the second is the presence of an existing knowledge base, generated by universities, government laboratories or spillovers from competitors' innovation.

Discussion

Having social capital that helped to access the market, obtain resources, transfer knowledge and contact vendors, on the one hand, and determining which competencies to develop, on the other, were two key enablers in the development of electronic design technological capabilities within SMBS in the GMA.

Based on the cases analyzed and looking at their case trajectories, two questions arise related to these two enablers:

How was the social capital developed in the studied cases and what actions can be proactively taken to promote it?

What were the elements that influenced the selection of the core competencies, and can they be reutilized?

Three key elements can be identified in bringing some understanding to the first question. The first is the case of professionals studying abroad, specifically doing postgraduate degrees in technical areas and building professional contacts, who later migrated to different companies and became part of an international network that in the case of Tdcom enabled the company to access the market. The role that governments play in providing scholarships can be a trigger in developing international long-term social capital that is key in technology industries.

The second element consists of taking advantage of the networks that MNCS already have within themselves. Utilizing existing MNCS in the GMA to gain access to that market can be a path to enlarging social capital, as described in the ASCI case. Here the local chamber of the electronics industry plays a key role by serving as a conduit between companies in the region.

Third, the rotation of professionals within companies provides a natural path to enlarge the existing social capital, as it is transferred between individuals. This is exemplified also by Tdcom, where one of their first customers was an acquaintance of the founder of Mixbaal, another local company, where the Tdcom founder had worked and been partner; this allowed him to meet this customer. Here there is not much that can be done proactively.

The second question, related to the selection of core competencies, raises a more strategic issue. In the cases studied, two enablers were found that influenced these decisions.

The first was the presence of the CTS, which has a concentration of Ph.Ds. and researchers in close contact with leading-edge knowledge and technology trends. Tdcom founder had worked there before launching his own startup, and BEA founder partnered with the CTS in developing his first prototype. Later, a couple of experts from CTS helped him build his company's nascent technological capabilities. Increasing CTS'S engagement and collaboration with local SMBS, startups and local industry would be a possible path for detecting and constructing core competencies. This finding partly confirms the idea that innovation is the result of a group of actors and participants, which Padilla-Perez, Vang, and Chaminade (2009) associated with RIS in developing countries, commonly considered to be emerging or incomplete systems. In this case, RIS included the presence of a research center funded by the government and supported by one of the largest universities in the country (Instituto Politécnico Nacional, IPN).

Secondly, knowledge derived from a local industry spillover contributed to the creation of Bunker and had an indirect influence on ATR, since one of its founders had previous experience in the local Hewlett Packard R&D group. The impact of the spillover from MNCS has been studied before (Ariffin & Figueiredo, 2004; Padilla-Perez, 2008): it can be a source of knowledge and resource transfer, but at the same time it has been noted that, given the size of the electronics industry in the GMA, the knowledge transfer from those MNCS has not had the impact that one might expect (Palacios, 2008). How to take advantage of the knowledge within these MNCS and increase the spillover to the local SMBS in the region is still a question that needs to be resolved. One possibility to do so is through the local electronics chamber (CANIETI).

Conclusions

All countries are interested in owning businesses with competitive advantage of a technological nature; in other words, know how to do "something" much better than international competitors so they can swim in the northern seas. According to authors such as Prochnik (2010), the great challenge for Latin America regarding electronics is how to take a productive leap, the incorporation of the production of components, increase their production scales as well as participate and take advantage of the opportunities generated by existing or emerging Global Value Chains and to overcome the barriers to innovation and the development of SMES in developing countries (Garrido, 2015; Sturgeon & Kawakami, 2011).

The objective of this research was to find enablers and inhibitors to increase the number of SMBS in the GMA involved in electronic design, as this is a higher-value activity. The region has a high level of multinationals from the electronics sector, which contrasts with the low number of SMBS engaged in electronic design tasks. Although no recent census for design engineers working in SMBS has been performed since 2013, the numbers of SMBS doing design in the region has not changed significantly, which makes us believe that our results have not changed, although it would be desirable to have at hand updated census information.

During this research, three key enablers were identified. Two of them are discussed in this article. On the one hand, the social capital that companies develop and its impact on getting customers, transferring knowledge, and accessing resources. And, on the other, the ability to identify the core competencies that need to be developed. The third one has been discussed previously in a separate paper: the financial support mechanism and the role that government financial incentives play as an enabler (Guillemin & Pedroza, 2017).

The ability to develop these enablers is part of the activities that need to be promoted within the RIS, but that also need to be encouraged by the government through scholarships abroad, funding for research centers, and financial support. The active participation of the chambers is also important to increase the spillover from local MNCS, universities and the CTS, in order to influence the trajectories of the SMBS so that they focus on developing the right core competencies.

In spite that RIS in developing economies are characterized as immature (Rodríguez, Navarro-Chávez, & Gómez, 2014) and that their low degree of integration and interaction against their counterparts in developed countries, acknowledging their more unstable or weaker nature and that typically have "weak indigenous formal institutions" (Padilla-Pérez, Vang, & Chaminade, 2009, p. 143).

Our results support the opinion of Asheim, Isaksen, and Trippl (2019) in the sense that that an approach to RIS still a viable theoretical perspective and relevant policy instrument that requires a more proactive role by governments to not only increase the rate of economic growth but also create a type of growth characterized for being smart, inclusive, and sustainable. This implies that governments and policy makers should identify and articulate new mission-oriented innovation policies (Mazzucato, 2017) that rely on both public and private investments.

Having technological design capabilities is one of the elements with a direct impact on the creation of wealth by nations (Lundvall, 2002). Understanding how to accelerate the development of SMBS with such capabilities will contribute to the economic development of regions. Leveraging the existing strong high-tech presence, strengthening the RIS, expanding the social capital outside the region, and identifying core competences and future technologies will be key to triggering the development of more SMBS doing electronic design in the GMA.