Introduction

The growing tendency for markets' globalization modifies the way companies organize and act, inciting them to ponder the development of their activities in international trade. The internationalization process (IP), operationalized through the internationalization model (IM), adopted by a company is seen as part of its growth strategy (Roque et al., 2018a). This process is usually associated with the normal growth of companies and it is, therefore, a strategic option for those wishing to compete in the global market. Hence, in the context of the current economic crisis, internationalization is fundamental for economic development (Simões, 2011) and for the survival of companies, especially the most technologically developed, which would not be possible if they were limited to small countries (Roque et al, 2019a). This explains the great interest in the study of internationalization and its ways of operationalizing the process.

There are several models of internationalization and the adoption of a particular model depends on several variables (Roque et al., 2019a). In this process, it is fundamental that companies have structures that facilitate information analysis, control and planning as an essential input for decision-making (Dimitratos et al, 2003) and good performance.

The relationship between strategy and structure has long been addressed. Chandler (1962) studied us largest firms from 1909 to 1959 and found that change in corporate strategy came first and led to changes in an organization's structure. "A new strategy requires a new or at least refashioned structure if the enlarge enterprise was to be operated efficiently" (Chandler, 1962, p. 15). The Management Accounting and Control System (MACS) integrates the organizations' structure and can be defined as tools that managers use to maintain or change patterns in organizational activities and to implement new strategies (Anthony & Govindarajan, 2007; Roque et al, 2020).

Despite the growing interest in the MAcs-strategy relationship (Bisbe & Malagueño, 2012; Franco-Santos et al., 2012; García-Álvarez et al., 2019; Gimbert et al., 2010; Gomez-Conde & Lopez-Valeiras, 2018; Gomez-Conde et al, 2019; Lopez-Valeiras et al., 2015; Ramon-Jeronimo et al., 2019), the picture presented in the literature was found to be fragmented (Langfield-Smith, 1997) with an inconsistent conceptualization and operationalization (Otley, 2016; Tucker et al., 2009). Some authors consider that there is little knowledge about the effects of MACS in the strategy implementation (Coller et al., 2018; Frigotto et al., 2013; Skasrbask & Tryggestad, 2010).

On the other hand, very few authors have studied the uses of MACS in the internationalization process (Araujo et al., 2010, 2011; Gomez-Conde & Lopez-Valeiras, 2018; Florez et al., 2012; Vélez et al, 2008, 2014, 2015). According to Gomez-Conde and Lopez-Valeiras (2018), recent empirical research has narrowed the focus to demonstrate a direct and positive influence of MACS on internationalization. However, the role of MACS on internationalization remains to be fully developed (Gomez-Conde & Lopez-Valeiras, 2018). This paper addresses this gap by analyzing the impact of MACS on the Uppsala Internationalization Model (U-Model), one of the main existing models (Bartlett & Ghoshal, 1991; Oyson & Whittaker, 2010; Roque et al, 2019a). Additionally, to our knowledge, no empirical study based on this relationship has yet been developed.

Our paper contributes to the literature on the MACS-strategy relationship (Langfield-Smith, 2006) by proposing to examine the relationship between MACS and the U-Model and providing an inside-out perspective (Chenhall, 2005a).

Henri (2006), one of the authors who has studied MACS-strategy relationship, suggests two distinct research lines. A first line emphasizes the effects of the strategy in MACS. The authors who follow this line (Chapman, 1997, 1998; Dent, 1987) use a structural and static approach. Besides, they consider that the configuration of MACS results from the implementation of the strategy and represents the last step in the strategic management process. On the other hand, a second line of research emphasizes the effects of MACS in strategy. The studies that follow this line resort to a procedural and dynamic approach (Roque et al., 2020). Through this approach it is possible to recognize and study MACS role during the whole strategy implementation process. It is in this second line of research that the present study is inserted.

According to Dent (1990), just a few researchers have sought to extend previous research to embrace relation-ships between firms' strategies and the design of their MACS. Moreover, empirical studies aimed at understanding management control configurations are relatively scarce (Bedford & Sandelin, 2015). Some authors (Ismail, 2013; Roque et al., 2020) have drawn attention to the need for more studies that seek to recognize how MACS can help companies in the implementation of the strategy. Therefore, and using Henri (2006) procedural and dynamic approach, we intend to examine how internationalization, through the internationalization model adopted, is influenced by MACS as a company information system, since this relationship between a specific internationalization strategy (U-Model) and MACS has never been studied before.

Thus, the following questions arise: i) How does MACS eased up the implementation of the internationalization strategy; and ii) how does the internationalization strategy implied changes in MACS. And, if this is the case, what changes?

To answer these questions, an inside-out perspective based on a qualitative research approach is used, through the development of an exploratory case study (Yin, 2014) conducted in a Portuguese automobile sector company. Data about the IP and MACS were collected through three interviews, company visits and document analysis, over an interpolated period of 5 months. We conclude that MACS can facilitate IP implementation; however; this process involves adjustments in MACS.

The rest of this paper is organized as follows. The next section presents the literature review with an explanation of IP-related concepts, followed by a description of MACS and its role in organizations. The relationship between MACS and IM is also analyzed in this section. Thereafter, we will address the case study methodology. Afterward, empirical results will be presented and discussed. Finally, the paper ends with a conclusions section, which includes the study contributions and limitations and suggests some avenues for further research.

Theoretical background

The internationalization process

Due to the limitations of domestic markets, increasing globalization or the need to diversify risks (Araujo et al, 2011), internationalization is currently seen as a strategic option for companies that compete globally. This process is assumed to be an extension of strategies to other countries, replicating partially or even fully their operational chain. In this process, the level of activities outside the country of origin is increased (Meyer, 1996) and operations (strategy, structure, and resources) are adapted to international environments (Calof & Beamish, 1995).

The motivations for developing the IP can be very different and even vary in the course of the process. The literature highlights the need to obtain a greater availability of natural resources; the possibility of hiring cheaper labor; the increasing attractiveness of markets (Dunning & Lundan, 2008); the need to follow the internationalization of customers; the need to reduce the dependence on domestic market; the search for new opportunities; the strategy of attacking international competitors in the country of origin; the search for economies of scale; and also the core business maintenance (Raposo et al, 2007).

In the national context, Simões (2011) argues that the main reasons for the internationalization of Portuguese companies are associated with market share increases, their recognition in the international market and, lastly, with the need to seek new resources. The same factors presented in studies outside the national territory.

Singla et al. (2017) argue that both motivation and firm's capability to internationalize are required and significantly influenced by owners' motivation and ability to access resources. Therefore, a critical aspect of internationalization decisions is market entry mode, which typically entails considering the amount of resources to invest, the control level, and the risk that internationalization implies (Kraus et al, 2015). Companies that are internationalized often seek to minimize risks in international expansion by implementing tight control over foreign operations (Brouthers, 2013).

There are several alternatives for companies to develop their IP, such as exports, contractual forms (licensing, franchising, management contracts, turnkey contracts, sub-contracting, production sharing, and strategic alliances), and foreign direct investment (FDI) (Anderson & Gatignons, 1986; Hill et al., 1990). The first alternative, export, is today considered a pillar for the survival of many companies (Fink et al., 2008). Before the opening of branches, usually companies go through an export phase and, from there, they extended their activities. In other words, they proceed to the opening of a branch office or a subsidiary when there is already an historical work of conception, production, sales, and marketing at an international level. Usually, the international expansion is initially made for countries similar to the country of origin and is gradually expanded to others (Pogrebnyakov & Maitland, 2011). Hill et al. (1990) consider that whatever the model adopted for the IP, all of them have specific consequences for the company in terms of operations control, commitment of resources and risks dissemination.

Some authors (Oyson & Whittaker, 2010; Roque et al., 2020) suggest that the two dominant approaches about the configuration of the IP are: The U-Model developed in the 70s at Uppsala University (Johanson & Vahlne 1977; Johanson & Wiedersheim-Paul, 1975) and the I-Model (Bilkey & Tesar, 1977; Cavusgil, 1980), which sees internationalization as an innovation process.

However, there are other models that can be adopted by the company, namely the Born Globals model (Knight & Cavusgil, 1996), the Product's Life Cycle model (Vermon, 1966), the Non-Sequential model (Cuervo-Cazurra, 2011), the Pre-Export Activities model (Wiedersheim-Paul et al., 1978), the Integration model, and the Network Theory model (Sharma, 1993). In this study, the U-Model is used from the perspective of the establishment chain model (Four-Stage Model) proposed by Johanson and Wiedersheim-Paul (1975).

The choice of the U-Model comes from the fact that this is one of the most adopted models in the literature (Oyson & Whittaker, 2010), and because this is the model followed by the studied company, which allowed it over time a sustained, progressive, and incremental evolution of success in the international market. The U-Model explains the companies' IP through a gradual extension of operations (Johanson & Vahlne, 1977), following a progressive and incremental logic. Consequently, this model is composed by a sequence of four different stages (Johanson & Widershein-Paul, 1975). The first stage encompasses sporadic or intermittent export activities that allow the company a first contact without a commitment of resources, but with the disadvantage that the information received is reduced. The second stage encompasses direct exports performed by representatives or partners, allowing a greater knowl-edge of the market. However, it requires a greater commitment of resources. The third stage is based on the creation of a sales related subsidiary, which allows the company to control directly the information channel; however, it has the disadvantage of representing an increase in costs and risks. Finally, the last stage is based on the implementation of a production unit to increase the market share in the country where the company wishes to internationalize. This stage requires the highest level of commitment of resources.

Thus, the commitment of resources increases as the company moves from one stage to another. The company gradually increases its involvement, as its knowledge about the new markets in which it operates grows, especially that one that is acquired from the experience of sporadic exports (Penrose, 1959).

In an IP, there are surely some difficulties materialized by the differences between the company's country of origin and the destination country, namely language, culture, political systems, education systems, among others (Johanson & Wiedersheim-Paul, 1975). It is well known that firms tend primarily to establish relations with "psychologically" similar countries and gradually expand to psychologically and geographically distant regions as they gain experience. The incremental model of internationalization also explains that the managers' lack of knowledge about foreign markets and their aversion to risk restricts the selection of countries for the company's expansion (Hadjikhani & Johanson, 2002; Johanson & Vahlne, 1977).

Management accounting and control systems and their role in organizations

The structure of organizations involves all its hierarchical composition (top management and other elements), including how the company is organized (Wang & Ahmed, 2003). MACS are seen as integral elements of the organizational structure itself as they provide useful and essential information for the decision-making process (Anderson & Widener, 2007; Naranjo-Gil & Hartmann, 2006), thus, influencing the company's strategy (Roque et al., 2019b). Therefore, the control system is explicitly designed to support the organization's strategy (Dent, 1990; Simons, 1987, 1990), since its purpose is to provide useful and valid information for the decision-making process, planning and evaluation (Merchant & Otley, 2006).

The popularity of MACS tools to support strategy has grown in recent years, the interest emanates from the developments of methods such as budgeting, the balanced scorecard (Ferreira, 2017), or activity-based costing. Budgets have always been an integral part of the MACS and recent research shows that they can be used to stimulate creativity and change (Cools et al, 2017); the Balanced scorecard is a technique that started as a relatively straightforward call for greater levels of nonfinancial performance measurement (Saraiva & Alves, 2015); and activity-based costing provides benefits through improved information for strategic and operational decision making (Krumwiede & Charles, 2014).

However, it is not easy to find a consensual definition of management control systems (Fisher, 1998), management accounting systems or even organizational control in the literature (Roque et al., 2018c), since there are definitions where these terms are used as synonyms (Chenhall, 2003), and other definitions where they have different meanings, separating accounting from control (Abernethy & Chua, 1996; Anthony, 1965; Chenhall, 2003; Langfield-Smith, 1997, 2006; Malmi & Brown, 2008; Merchant & Vander-Stede, 2007; Ouchi, 1979; Simons, 1995; Strauss et al, 2013).

Throughout this work, the term MACS (management accounting and control systems) will be used in order to favor management control systems and, simultaneously, high-lighting the role of management accounting (Macintosh & Quattrone, 2010; Roque et al., 2020). It is assumed that MACS are structures that systematically use management accounting information to achieve pre-established objectives (Chenhall, 2003) and concurrently include a wide spectrum of control mechanisms, namely personal, top management, or organizational control (Malmi & Brown, 2008), whose design depends on the organizational structure (Gomes & Salas, 2001).

The design of MACS is critical to provide managers with information that allows them to evaluate the strategy's implementation and the necessary adjustments to achieve the organization's goals (Gomez-Conde et al., 2013; Roque et al., 2018c). These systems involve formal (written and standardized) procedures based on information, protocols and routines used by most companies in order to align their employees' behavior and decisions with the organization's strategic goals (Merchant & Vander-Stede, 2007). This drawing is helpful, as it helps managers to make decisions, to fulfil their responsibilities, and avoids losing control due to the lack of monitoring (Simons, 1987, 1994).

Inamdar (2012) supports that executives and managers of multi-business companies are increasingly using these systems in order to establish a corporate strategic alignment with the organizational structure and to create synergies through their business units. Hence, MACS emerge as information providers that help the IP. However, some authors who consider that MACS are static systems that only provide information to support strategies' formulation, not their implementation (Cadez & Guilding, 2008), dispute this opinion.

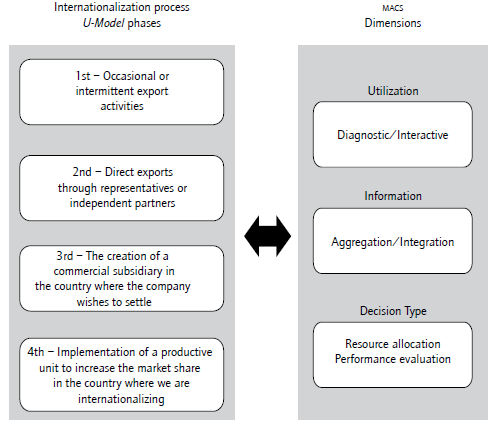

MACS characteristics may change over time and the importance of their dimensions may vary according to the specificities of the context of each organization (Bedford & Sandelin, 2015; Bouwens & Abemethy, 2000). Like in other studies (Roque et al, 2018b, 2019b, 2020; Novas et al., 2017; Simons, 1991), a comprehensive view of MACS is adopted. Accordingly, it is considered that MACS vary ac-cording to three dimensions (Roque et al., 2018c, 2020): i) the style of use of the information provided, which can be diagnostic or interactive; ii) the type of information provided, which can assume different levels of aggregation and integration, and, lastly; and iii) the type of decision supported, considering the existence of performance evaluation decisions and resources allocation decisions.

MACS design is considered as if they were non-typified instruments, that is, each system is composed of unique features according to the specific characteristics of its organization and according to the importance or role assigned to each of its dimensions (Roque et al., 2018b). Thus, the system is assumed as a prerequisite for decision-making, not only in relation to the resources allocation but as a means of performance evaluation (Novas et al, 2012, Roque et al., 2018c).

The relationship between the internationalization model and MACS

Some studies (Cumming et al, 2017; Puck & Filatotchev, 2020) have related the IP to the study of corporate finance and strategic management. Following this line of research, we relate the IP with the MACS, since accounting literature has given increased attention to the relationship between management accounting systems and strategy (Bedford et al, 2016; Bisbe & Malagueño, 2012; Davila et al, 2015; Franco-Santos et al, 2012; García-Álvarez et al, 2019; Gimbert et al., 2010; Gomez-Conde & Lopez-Valeiras, 2018; Gomez-Conde et al., 2019; Langfield-Smith, 2006; Lin et al., 2017; Lopez-Valeiras et al., 2015; Ramon-Jeronimo et al., 2019). This literature has focused on different strategic frameworks, such as strategy process (Mintzberg & Waters, 1985) and strategy typologies (Miles & Snow, 1978). As suggested by Frezatti et al. (2011), the main contribution to this literature is to show which management accounting attributes seem to be more adequate for different strategic planning profiles, and different IMS.

In this line of research, several studies (Dent, 1990; Simons, 1987, 1990) suggest that MACS should be explicitly adapted to support a strategy, achieve advantage, and improve performance. Thus, the role of MACS is recognized in strategy formulation, as well as during the development of the strategic management process (Henri, 2006), and focuses on issues such as dialogue and interaction (Chapman, 1997). Otley (2016) argues that MACS is continually changing and developing, which increases interest in research that study these changes over time and that explain the mechanisms for such implementation. Recently, Samagaio et al. (2017) studied the adoption of these systems by high-tech start-ups to evaluate the impact of internal and external contingency factors on MACS use. Environmental heterogeneity has been considered as an external factor, while business strategy and structure decentralization are seen as internal factors. Additionally, Samagaio et al. (2017) argue that these situational factors can have different effects on the use of MACS.

Conceptual structure - Relationship and implications IM-MACS

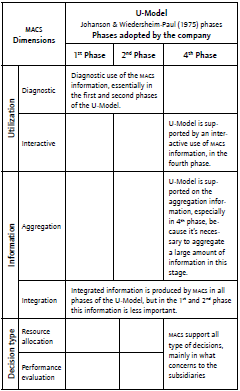

As we have seen, the U-Model is composed by a sequence of four phases and is supported by a diagnostic use of MACS, in the first and second phases, according to the establishment chain (Johanson & Wiedersheim-Paul, 1975); that is, in the phase of sporadic activities or intermittent export, and in the phase of direct exports, through representatives or independent partners. The top manager does not get directly involved in these phases, he rather chooses to delegate functions to lower level managers. When necessary, these lower level managers will alert the top manager about situations that require their attention. Diagnostic MACS correspond to formal systems that managers use to control outcomes, analyzing deviations from previously established performance goals and taking corrective actions. They are generally limited systems in the search for innovative solutions and the identification of opportunities, since attentions are essentially directed to the performance variables (Roque et al, 2018c, 2020).

Subsequently, in its third and fourth phases (Johanson & Wiedersheim-Paul, 1975), that is, at the stage of establishing a commercial branch and/or establishing a production unit to increase the market share in the country to where the firm is internationalizing, the U-Model IM is based on an interactive MACS. This system is the one the manager uses daily to provide the necessary information for decision-making and for providing information to his subordinates. The information that comes from the system is used in regular meetings with subordinates, in order to allow the results analysis and compliance with the plan of action (Simons, 1991).

Interactive systems foster innovation, learning and the search for new solutions, which trigger the emergence of new strategies as their participants interact and respond to the emerging opportunities and threats (Novas et al, 2012; Roque et al., 2018c). In this way, it is possible to use this type of systems in the phases of internationalization expansion through the creation of commercial or productive subsidiaries. The uses of interactive type systems allow for more informal, less restricted, and more superficial control, where communication and cooperation stand out (Roque et al., 2018c). Thus, the flow of information is largely stimulated through debates and dialogue, inspiring the creation and integration of knowledge (Agbejule, 2006).

Organizational performance (Abernethy & Brownell, 1999) improves when a diagnostic use is related to low levels of strategic change, which occurs in the 1st and 2nd phases of the establishment chain of the model (Johanson & Wiedersheim-Paul, 1975). On the other hand, an interactive style of utilization is related to high levels of strategic change. The pressures from external stakeholders influence interactive use (Osma et al, 2018), which occurs in the 3rd and 4th phases.

According to Novas et al. (2012), MACS have an impact on organizational performance. However, this relationship is approached under two different perspectives. In the first perspective, MACS (or certain dimensions) are considered to have a positive direct effect on organizational performance (e.g. Abernethy & Brownell, 1999; Cadez & Guilding, 2008; Chong & Chong, 1997; Jermias & Gani, 2004). The second perspective argues that MACS (or certain dimensions) exert a positive indirect effect on organizational performance through direct effects generated by certain variables (e.g. Bisbe & Otley, 2004). Thus, regardless of the perspective, the style of information utilization that comes from a given MACS influences the company's performance.

Moreover, any system of the diagnostic type can easily become interactive motivated by the action of management based on dialogue and learning spread throughout the organization (Simons, 1994). On the other hand, as Roque et al. (2018c) argue, it is necessary to understand that an interactive system in a company can be used in a non-interactive way, depending on contextual and circumstantial variables that are weighted (Simons, 1995). Therefore, the use given to the information is fundamental.

In this relation, we can verify that the U-Model looks for a diagnostic-type use of MACS in the first two stages of development, whereas it requires systems of the interactive-type in the last two stages of development, so we can confirm an adjustment between the IM and the information provided by MACS. Thus, a dynamic approach to the relationship between MACS and internationalization strategy is demonstrated as suggested by contingency theory (Grabner & Moers, 2013; Otley, 2016).

As far as the need of the nature of information concerns, the U-Model emerges as multi-faceted, since, according to the different phases of the life cycle, there are simultaneously different levels of integration and aggregation of information throughout the company's evolution. In the beginning of the business lifecycle, due to the available products and services' homogeneity and the markets in which the company operates, as well as due to the characteristics of structure (simple and centralized), information tends to take a simpler form (Roque et al., 2018c). As the company evolves, in terms of product/service diversity or conquering new markets, the information needs tend to be adapted and, thus, they modify and become tendentiously more aggregate and integrated, compared to their initial stage. The integration and aggregation characteristics of information are viewed in a contingent way, according to the life cycle.

Systems based on the integration of information are systems that, on one hand, make it possible to understand the cause-and-effect relationships between structure, strategy and goals. They allow a better visualization of the way the activities are related to the internationalization strategy. On the other hand, these systems include a measurement component associated with the provision of various measures that are related to financial aspects (Chenhall, 2005b, Roque et al, 2018c). These systems allow the integration of the operational and strategic side; integration that ac-counting systems generally do not allow. The integration dimension increases as the interdependence between organizations also increases, allowing a broad and complete view of the whole and means of coordination between the various organizational units (Roque et al, 2020). In turn, the aggregation of information allows a large amount of information to be processed over a given period of time (Bouwens & Abernethy, 2000; Roque et al., 2018c). Thus, it is understood that the U-Model is based on a MACS in which the information is aggregated in order to capture a high volume of information, but simultaneously a system in which the information is integrated in order to relate the operational activities to the strategy.

Regarding the decisions supported by MACS, the U-Model focuses on two types of decisions -resource allocation and performance evaluation (and control)- in the 3rd and 4th phases of the model, since its need arises after the creation of branches or productive units. Resource allocation decisions require the distribution of resources, whether monetary or non-monetary, among the different units of the organization in order to embed in managers' accountability for the tasks and activities to be performed (Naranjo-Gil & Hartmann, 2006; Roque et al., 2018c). This situation is necessary in the 3rd and 4th phases of the model, in which all the information is essential for an adequate distribution of resources, and in situations of uncertainty and instability, when the availability of better information will obviously result in better resources allocation decisions (Baines & Langfield-Smith, 2003, Roque et al, 2018c).

In turn, performance evaluation decisions are related with the monitoring and control of organizational goals and of the performance of managers in charge, and the organizational units they manage. Thus, the U-Model requires MACS that provides information to support decisions associated with resource allocation; that is, for planning decisions and coordination of activities arising in the 3rd and 4th phases of the model. It also requires MACS to provide information to assist performance evaluation process, when there are subsidiaries, since it is necessary to monitor and control the achievement of organizational goals. Figure 1 illustrates this relationship and its implications.

Methodology

In order to analyze the relationship between MACS and the IP, we developed a qualitative empirical study (Archer & Otley, 1991; Simons, 1990) in a Portuguese organization (Francisco & Alves, 2012). Similarly to other studies (Henri, 2006; Naranjo-Gil, 2006; Novas et al., 2012, Roque et al, 2020), three dimensions of MACS were examined -style of information use, nature of information, and type of decision- within the four phases of the U-Model model (figure 1), according to the Johanson and Wiedersheim-Paul's (1975) establishment chain, in order to understand the role of MACS in the internationalization implementation process. Following Henri (2006), a procedural and dynamic approach to the IP was used in order to verify if this implied (or not) changes in the MACS, and to analyze how the latter contributed to the strategy's success.

To understand how the company's U-Model is influenced by MACS, a qualitative research methodology was developed through a single case study (Yin, 2014). This type of research approach is useful if it can show and analyses intentions, discourse, actions and interactions of actors (Dana & Dumez, 2015). However, it should be noted that "the practice of doing qualitative field studies involves an ongoing reflection on data and its positioning against different theories such that the data can contribute to and develop further the chosen research questions" (Ahrens & Chapman, 2006, p. 820).

Data were collected through three semi-structured interviews with open and closed questions that were adapted from validated questionnaires and interview guides obtained from other studies (Burns et al., 2003; Novas et al., 2017). A documentary analysis to reports provided by the company was also performed, allowing us to improve the interpretation of results and triangulate the information, as well as improve the construct validity and the reliability of the research (Ahrens & Chapman, 2006). The critical incident technique (Flanagan, 1954; Hay, 2014; Hettlage & Steinlin, 2006) was used to collect subjective information, in a reflexive logic, that derived from situations and events lived and experienced by the interviewees (Chell, 2004). With this methodology, we followed Miles et al. (2014), who argue that instrumentation is a misnomer since most of the fieldwork in isolated case studies consists of taking notes and recording events (conversations, meetings, and documentary analysis).

The studied company is Portuguese and develops its activity in the automotive component industry (manufacturing control desks, micro switch and test pins). The company was selected because on March 2016 it was awarded the internationalization prize in the smes category at the Export and Internationalization Prize Contest, promoted by Novo Banco and Jornal de Negócios, since it has focused on internationalization through the adoption of a specific model as a driving force for performance improvement.

In this company, only the Executive Director was interviewed, because he simultaneously accumulated the functions of Commercial Director, Development and IT Manager. The choice for this key informant stems from the fact that he is the main person in charge of the ip, although there is currently a process of delegation of work, duties and responsibilities, that is, the responsibilities and roles are being gradually transferred to other internal staff to ensure a more detailed follow-up of the process in each branch. It was decided not to interview them, since the entire implementation of the ip, as well as the periodic account analysis, is carried out and performed by the Executive Director.

The interviews, as well as the collection of additional data (meetings and informal visits), took place between July and October 2016. All the responses were transcribed and all the informal conversations during the visit to the company's premises were recorded.

Empirical analysis

Company description and strategy

Dinefer - Engineering and Industrial Systems S.A. was founded in 1988 in Castelo Branco, Portugal. Initially, it was a small company contributing to the automotive industry with the manufacture of control desks. Over time, Dinefer began to grow and felt the need to start its ip, something that occurred in 2003. This interest arose for two reasons: the need for customer proximity and the conquest of market share. Today, Dinefer is present in four continents. In Europe, the firm is established in Portugal (headquarters), Slovakia (2004), and Romania (2012). In Africa, it is present in Morocco (2006). In America, it has settled in Brazil (2009), however, this branch closed in 2015. In the Asian continent, the company is present in India (2010). In India and Romania, the company has no legal entity, so it has developed its activity through another company in charge of providing technical support.

Currently, the company has 165 employees and is defined as a multinational corporation, solidly established in the world market with great expertise and a strong growth (36% in the last two years). Dinefer seeks to accompany the markets' evolution and recorded a business volume of around 9,2 million euros in 2015 with an export rate of over 95%. From the analysis of various internal reports (financial, efficiency, profitability and productivity ratios, balance sheets, income statements, among others), we can infer that the company has grown considerably and externally from 2002 to 2003. In 2001, the external market accounted for only 7% (EUR 226,344) of the turnover. In 2002, at the external level, the first million Euros was reached (EUR 1,392,660), that is, the external market represented 36% of the turnover. The year 2002 was of reflection and strategy planning, and in 2003 the first subsidiary was created in Tunisia. From then on, the external growth has been exponential, accompanied and supported by the opening of new subsidiaries.

From the profitability and productivity ratios analysis provided by the CEO, we can verify there was a sales' profitability evolution since Dinefer decided to open cross-border subsidiaries, that is, since 2003. The growth has been progressive, and by 2015 the highest value of productivity ratio, until then, was recorded. This improvement was due, in part, to the consolidation of the company's image of credibility at the international level. In that year, 70% of the turnover was directed to non-EU markets and 25% to the intra-EU market. The gross value added (CVA) analysis also registered a strong growth since the beginning of the ip, although with some fluctuations between 2011 and 2014 resulting from contingencies in the subsidiaries' host countries, namely Brazil (that suffered a political crisis in this period).

Results analysis and discussion

The company's internationalization strategy and the adopted model

Dinefer develops its activity in a very specific industrial sector: automotive components manufacturing. Consequently, at a very early stage the need to sell its products abroad emerged, since the national market was too limited. According to the literature, the primary motive is often the access to new markets and the sales potential offered by foreign markets (Morschett et al., 2009). As the Executive Director claimed: "the main reason for the internationalization was a question of survival, we didn't make the decision between supplying the national or the international market; we had to focus on the market, and it is almost entirely outside Portugal."

Then, in 1996, Dinefer started its first international sales through direct export. This IP has been growing over time, and it has been consolidated with the opening of subsidiaries. This process has been stimulated by a growing demand for new customers in the international context. This situation has brought a number of competitive advantages to the company, as the Executive Director states:

First, because we are closer to the clients and also because it allows us to obtain lower costs at the production level, not only for the labor, but also for the proximity of suppliers, which results simultaneously in lower production costs and more competitive prices.

The IP was an initiative of the company's CEO. He planned and designed a strategic enlargement of the company precisely in order to be closer to customers and, thus, even reducing costs (labor, logistics, etc.). The process currently has the involvement of all workers, being characterized as a "large and continuous process, (...) there is an involvement of the entire team, because the performance achieved by the company depends on this involvement." Hence, similar to what is suggested by literature, the process was developed fundamentally for two reasons: the need of customer proximity (Raposo et al., 2007) and a saturated local market (Morschett et al., 2009).

To Dinefer, as the Executive Director argues, "[...] it makes no sense for us to think about the national and international market. We think about Europe and outside Europe. We think of a global market with several regions, which have different specificities". The opening of subsidiaries started in Tunisia in 2003, where one of the company's largest customers is located. Subsequently, Slovakia followed in 2004, Morocco in 2006, and Brazil in 2009. This growth was conditioned "by contingency issues, namely the state of the economy, the legal framework (taxes) and the culture" of the host countries. The company is also present in India, since 2010, and in Romania, since 2012, in partnership with other companies that provide technical support. Through its subsidiaries, Dinefer currently operates in several continents, with emphasis on its European (Portugal, Slovakia, and Romania), African (Morocco), American (Brazil), and Asian (India) units. Overall, the company is also established in the markets of Spain, France, Tunisia, Czech Republic, Ukraine, Lithuania, Poland, Bulgaria, Turkey, Hungary, Mexico, and China, to which it exports directly. Thus, the company's growth connected to its IP is notorious (figure 2).

Traditionally, a development process such as internationalization is associated with a set of difficulties (Johanson & Wiedersheim-Paul, 1975). Therefore, the interviewee was questioned about the problems faced during the development of the process, being highlighted the linguistic and cultural challenges. Hence, in the opinion of the Executive Director:

[...] the multiculturalism is always a challenge and it is a difficulty for the process, which deserves special attention, it is not simple to deal with the host countries' culture, and multicultural management is not an easy task. Establishing a company's organizational culture [itself] is also hampered.

In parallel, the respondent also highlighted the difficulty in dealing with the legal and political aspects, referring, in particular, to the "lack of staff, the difficulty in hiring human resources with the required qualifications (training/ education) in the country of destination."

However, he added the organization never felt the need to resort to the mobility of specialized staff for the subsidiaries, except for Brazil, where a technician was transferred, who is simultaneously a company partner, fundamentally "for the sake of control and reporting information." That is, the figure of the expatriate is used to accelerate the ip"[...] hiring expatriates may facilitate an increase in the speed of internationalization owing to the knowledge they possess" (Dabic et al, 2015, p. 317). This demonstrates a new way of connecting MACS to strategy through the figure of the expatriate.

A further difficulty identified by the respondent is the intense competition in the sector, "we must be aware of the competitors' positioning in order not to saturate the market," he said.

As mentioned above, the company is present in some countries through technical support units. Thus, in India and Romania no subsidiary has yet been established. To better understand the process and its impact on the company's results, we questioned the respondent about the partner-ship that is established, to which he said:

The return is very positive, by the fact that we do not have a legal entity incorporated in this country, we do not have the traditional costs associated with the plants' operation. This question arises even more importantly in India, where our turnover assumes a particular relevance, around 15% in 2015. This partner is a former employee of our largest customer, Yazaki, so he knows the market very well.

In this process evaluation, the respondent also refers, as advantages: "the exchange of knowledge and collaboration, the increase of the information flow, the learning, the technological and market knowledge and the influence on suppliers and customers." Consequently, he characterizes the partnership process as "well structured, although with some growth difficulties, due to some contingencies."

The Executive Director was questioned about future perspectives, to which he replied:

At present, the opening of more branches in Europe is being studied, namely in Serbia, Romania and Bulgaria. However, other possibilities are being considered, such as the Chinese market where the existence of contingency restrictions (such as the great difficulty in hiring qualified human resources) has blocked the process, or the Mexican market (where there is a lot of competition), or even the Russian market (where political and economic aspects are not the most favorable).

At last, and given the fact that we intend to identify and characterize the IM followed by the company, the interviewee was questioned about the entry and establishment procedures used. He said that the IP started always as a:

Simple process of direct export, then, if a potential market is detected, through the export volume and customer positioning, the opening of a technical support unit is performed and, later, in the last stage, according to its evolution, the opening of an industrial subsidiary begins.

He also added that the most important criteria in choosing the market were the existing personal or commercial relationships and the fact that the company intends to follow "the customers and also to stand beside important competitors, in order to gain market share."

So, from this analysis, and according to the literature review, we can conclude that the adopted model by Dinefer is the U-Model. Dinefer initially starts to develop international sales, that is, exports, and only later it develops direct investments through the opening of industrial subsidiaries. This whole process happens in a progressive, gradual and incremental way (Johanson & Vahlne, 1977). However, contrary to what the literature defends (e.g. Pedersen, 2000), the market potential is not ignored, since it should be noted that Dinefer is developing its internationalization based on the follow-up of its clients, although it focuses on the market's specific knowledge (Clark et al., 1997); take for example the case of the partnerships' establishment.

According to the internationalization phases of the establishment chain proposed by Johanson and Wiedersheim-Paul (1975), Dinefer develops its internationalization route based mainly on the 1st, 2nd and 4th phases. The 3rd phase (the creation of a commercial branch) is suppressed. Given the company's sector of activity (automotive components industry), there is no need to establish the 3rd phase. International sales are carried out through the first and the second phases of the chain of establishment, i.e, through intermittent and direct exports or through the establishment of partnerships (such as Romania and India, where there is technical support units). Regarding the 4th phase, that is, the phase of direct deployment of industrial branches, the company has currently three units: Tunisia, Slovakia, and Morocco.

Dinefer's management accounting and control system

In order to describe the use and roles of MACS in Dinefer, we asked the Executive Director about the systems and techniques used in the company. The interviewee replied that "in addition to the requirements of financial accounting and also of the statutory auditor, which required that the subsidiaries accounts are certified, it is also our requirement that everything should be controlled." Thus, there is an integrated and proper information system that:

[...] allows controlling all the expenses, times, and consumptions in each branch. This system provides information about product configuration, order management, planning, and distribution requirements, in terms of quality management, inventory management, production/ manufacturing execution systems and global connection of the parent company with the subsidiaries.

On a regular basis:

Faceto-face meetings are held in the subsidiary's host countries to analyze the accounts and performance evolution. A quarterly analysis is also performed on the main financial statements, which are sent by the accounting offices of the subsidiary's host country, with which this commitment was established. These meetings are decisive for the subsidiaries future management.

The interviewee was also questioned about the usefulness of the information provided by the management accounting system implemented in the company. Hence, he said that "the implemented system provides useful information to support decisions, namely whether we should invest or not, to define our goals, our strategy, whether we should hire staff or not, whether our performance is achieved or not." It is also suited to:

[…] implement new ideas and ways to accomplish the tasks; to establish and negotiate medium/long-term goals and objectives; to debate hypotheses and plans of action, to achieve established plans and objectives, to align performance measures with strategic objectives, to allow a permanent coordination with subordinates, to assess and adequately control subordinates and still function as a continuous learning tool.

Thus, the information is provided with the purpose of performance evaluation and resource allocation (Novas et al., 2012, Roque et al, 2020).

In order to define Dinefer's MACS in terms of the nature of the information provided, we asked the interviewee to characterize it with regard to the available information flow. According to the interviewee, the company's MACS provides:

information on costs and other measures connected to the various units;

disaggregated information (e.g. fixed and variable costs);

sectoral information related to a particular department, section, cost center, etc.;

a precise definition of goals for each activity executed by different areas of the organizational structure, providing studies on the effect of certain events on concrete time periods (e.g. reports, trends, comparisons);

information prepared to allow the construction of scenarios, that is, statistics;

processed information to emphasize how different functions (e.g. production, marketing) are specifically affected by the occurrence of certain events (e.g., cultural events), to which he adds "this situation occur mainly in India, since it is a very marked by traditions country;"

information about the effect of a functional unit's decisions on the performance of other functional units. Here, "because there is a dependency between the subsidiaries, since there are components that are produced in Tunisia for a product that is being manufactured in Morocco;"information on the effect of decisions made on a given functional unit;and information in appropriate formats for the construction of indicators and decision models.

Then, the interviewee was asked to comment on decisions regarding financial and non-financial resources' distribution (e.g. materials, human resources, time), as well as decisions related to the monitoring and control of the implementation of goals and objectives by the units or services under its supervision (Roque et al., 2020). According to the interviewee, financial information is very important, as so it is the quantitative, non-financial information and the qualitative information he collects from the system.

The answers suggest that the type of information of Dinefer's MACS is directed not only to management, evaluation and resources control, but also to performance evaluation decisions. This situation is demonstrated through the employee performance reports and the performance evaluation reports that have been made available to us. Consequently, it is also a very complete system at a control level, either material or immaterial. The MACS structure analysis shows that it is a comprehensive system (Novas et al, 2012; Roque et al, 2020; Simons, 1991) in which information is used in a diagnostic or interactive manner, depending on the purpose and strategy. The integration dimension is particularly relevant as interdependencies increase, since integrated information provides a comprehensive view of the set and the means of coordination between organizational units (Novas et al, 2017, Roque et al, 2018c).

Relationship between MACS and the internationalization model

Dinefer strategic imperative is usually present, as the Executive Director claims:

No matter how well the organization of all the information systems is (accounting or operational). The most important is to understand the business and to manage it to attract and retain customers! However, the internationalization continuity depends a lot on the macs in the subsidiaries; there is a constant company adaptation which increases the degree of organization; it is fundamental to align the system with our strategy.1

Therefore, the strategy is modified and adapted according to the information that derives from the MACS. This conclusion supports our proposition, that MACS implies changes and conditions the IP.

The interviewee was then asked about changes in MACS' structure as the IP was developed and, if so, to identify those changes. The Executive Director argued that:

The process of change is inevitable with the internationalization, both in terms of control and accounting. Internationalization leads to a continuous improvement of the subsidiaries' MACS. There is a constant adaptation of the company, which increases its degree of organization. On the other hand, it is fundamental to align the system with our strategy. Hence, some authority has been delegated, especially in the subsidiaries. However, there are still some centralized activities. There is concern with the fact that the MACS presents not only financial but also non-financial data. This happens because the information grows over time and the information that derives from control and quality is more objective and more synthetic, allowing an easier reading and decision making.

So, there is effectively a strategic alignment between top hierarchy and operational managers, the information is more objective, synthetic and decision-oriented, there are more actions, less bureaucracy, and a greater focus in the future. Given this, we can conclude that the strategy implies changes in the MACS, namely with regard to the type of information.

When we study the relationship between MACS and the internationalization model, we can verify that Dinefer started its IP on the basis of sporadic and then direct exports, and, only later, it started to open subsidiaries abroad. After analyzing the evolution of the company and the development of its IP, we can conclude that the internationalization model adopted is the U-Model, clearly identifying the following phases: 1st, 2nd, and 4th. The third phase is non-existent because in the business sector this company belongs to (automotive components industry) there is no need to establish a commercial branch, as we could see in the section about the company's internationalization strategy and its adopted model.

The adopted model (U-Model) uses the information that derives from MACS in a diagnostic style, fundamentally in the first and second phases of the process (Johanson & Wiedersheim-Paul, 1975); that is, in the phase of sporadic or intermittent export activities (table 1) and in the direct exports phase, through representatives or independent partners. Therefore, MACS is used to monitor the results achieved and correct deviations from the previously established performance objectives. Thus, the system supports and sustains the IP in these phases.

Subsequently, the U-Model of internationalization is supported by an interactive use of MACS information in the fourth phase (Johanson & Wiedersheim-Paul, 1975), that is, during the industrial subsidiaries creation strategy, in order to increase the market share. The use of the system is reported to the whole team and the achieved performance depends on this involvement, as the interviewee suggests. For this purpose, according to the interviewee:

Face-to-face meetings are held in the subsidiary's host countries to analyze the accounts and performance evolution. A quarterly analysis is also performed on the main financial statements, which are sent by the accounting offices of the subsidiary's host country, with which this commitment was established. These meetings are decisive for the subsidiaries future management.

The information is used in an interactive manner, allowing its proper flow and fostering debate and dialogue within the organization itself, thus, constituting a fundamental mechanism for the knowledge creation and integration (Agbejule, 2006, Roque et al., 2020). This result is in line with what was argued by Osma et al. (2018, p.42), that is, the pressures from external stakeholders influence the interactive use:

[...] to implement new ideas and ways to accomplish the tasks; to establish and negotiate medium/long-term goals and objectives; to debate hypotheses and plans of action, to achieve established plans and objectives, to align performance measures with strategic objectives, to allow a permanent coordination with subordinates, to assess and adequately control subordinates and still function as a continuous learning tool.

Given the characteristics of this type of system, it is noticeable its use in the internationalization expansion phases by creating productive subsidiaries; 4th phase of the establishment chain (Novas et al, 2012, Roque et al, 2020).

Regarding the nature of the information, the U-Model is based on the MACS according to the different stages of the process and its strategic information needs. The system provides a wide range of useful information; for example, information that determines the execution of the different functions, such as production or marketing, which are specifically affected by the occurrence of cultural events, as the case of India, and require reflection in the decision-making process. It also provides integrated and aggregated information on the effect of the decisions of a functional unit on the performance of other functional units, since there is dependency among the subsidiaries.

It is clear that, in the early stages of the company's life, the information required in the IP tends to assume a simpler form (Roque et al, 2018c). However, as it develops, and it chooses to open subsidiaries, the information tends to be more aggregated, allowing to process a substantial amount of information in a certain period of time (Bouwens & Abemethy, 2000), connecting the operational and the strategic levels (Chenhall, 2005b), in comparison to the company's initial stage. Thus, the U-Model is based on a MACS in which the information is aggregated in order to capture a large volume of information and, at the same time, is a system in which the information is integrated, allowing a broader and more comprehensive vision of the set and means of coordination among the various subsidiaries (Chia, 1995).

Regarding the type of decision supported in the development of the ip, we can conclude that the company's MACS supports all decisions; namely, resource allocation, performance evaluation and control decisions, particularly in what concerns to the subsidiaries', as suggested by Novas et al. (2012). Thus, Dinefer's IM is supported by a MACS directed towards resource allocation decisions, essentially to plan and coordinate the subsidiaries' activities (Naranjo-Gil & Hartmann, 2006; Novas et al, 2012), that is, in the 4th phase of the establishment chain, where "the implemented system provides useful information to support decisions, namely whether we should invest or not, to define our goals, our strategy, whether we should hire staff or not, whether our performance is achieved or not," according to the interviewee.

On the other hand, it should be noted that the interviewee considered that the financial information from MACS is very important, although qualitative information is important as well "to allow a permanent coordination with subordinates, to assess and adequately control subordinates and still function as a continuous learning tool." The information is also directed towards performance evaluation decisions, that is, towards aspects related to the monitoring and control of the organizational goals, as well as the evaluation of the managers and the organizational units' performance: "[...] to establish and negotiate medium/ long-term goals and objectives; to debate hypotheses and plans of action, to achieve established plans and objectives, to align performance measures with strategic objectives […]."

Based on the analysis presented (table 1), we can conclude that MACS condition the development of the IP, in particular by the availability of the necessary information for decision-making. In turn, the latter is adjusted to the IP needs, experiencing some adjustments related to information requirements. Therefore, we suggest that MACS facilitate internationalization strategy implementation, which implies some changes in the system.

Conclusions

As observed in other studies, Dinefer has developed its IP incrementally. This was initiated through direct sales, that is, exports, and subsequently the process was developed through the opening of subsidiaries abroad. Through this process, the company was intended to follow the client and to survive.

The steps for the company's subsidiaries opening follow the assumption of the gradual and incremental model of Johanson and Vahlne (1977) and the Establishment Chain (Johanson & Wiedersheim-Paul, 1975), which allow concluding that the adopted model is the U-Model.

Once the relationship between MACS and the IM has been established, we can conclude that the system is used whenever the company feels the need to obtain information in order to support its strategy. The IP develops in phases, demanding as it evolves new information from the MACS, thus forcing it progressively to adapt (Roque et al, 2020). There are, therefore, changes in the design of the MACS, particularly in the characteristics of the information provided (passive role of the system) and in the way MACS information is used (active role of the system) during the IP. Thus, during this process, MACS information can be used in a diagnostic or interactive manner, the information can be aggregated or integrated, and the decisions can be resource allocation or performance evaluation.

This research brings scientific contributions in several ways. Firstly, we contribute to increase knowledge about the MACS-internationalization strategy relationship, since there are still few studies on this subject (Araujo et al, 2010, 2011; Florez et al., 2012; Gomez-Conde & Lopez-Valeiras, 2018; Vélez et al, 2008, 2014, 2015) and for the growing stream of accounting literature that examines the Levers of Control framework (Asiaei et al, 2018; Kruis et al, 2016). Secondly, this research is innovative, since, as far as we know, it is the first time the relationship between MACS and a specific internationalization model (U-Model) has been studied. We analyze how MACS are used, what are the characteristics of the information coming from MACS, and what kinds of decisions are supported by MACS in each phase of the U-Model development. Thirdly, this research introduces a dynamic and "inside-out" approach (Chenhall, 2005b) of the relationship studied, when most studies use a static and "outsider-in" approach. This new approach allowed us to examine the adjustment that occurred in MACS (in terms of information use, information needs, and decision supported) in each phase of the U-Model. In addition, this study confirms previous research findings (Coller et al, 2018; Naranjo-Gil, 2016) on the active and passive role of MACS. Finally, this research helps to increase knowledge in practice, as it helps companies to understand how they can adjust their MACS according to their U-Model development phase.

We can conclude, therefore, that a MACS adjusted to the information needs of the company can facilitate the IP implementation. However, as in other studies (Roque et al, 2020), this process implies an adjustment in MACS.

The study results also highlight the fact that MACS are used throughout the IM in a differentiated way, depending on the information needs, evidencing some aspects of the contingency theory (Grabner & Moers, 2013; Otley, 2016; Roque et al, 2020).

Aware of the limitations of this work, namely the fact that the analysis is limited to a single case study, it is unfeasible to make generalized conclusions. We need to recognize that the study of MACS does not always lead to establishing that what works in one organizational context will work in another (Saulpic & Zarlowski, 2014), since different configurations and uses of MACS will result in different reactions (Otley, 2016).

We suggest the replication of this study in other companies from different activity sectors, in order to study the impact of MACS over different internationalization models. Alternatively, the development of a quantitative study applied to Portuguese companies that allows analyzing the relation between the company's IM and the MACS characteristics could also be suggested.