Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Acessos

Acessos

Links relacionados

-

Citado por Google

Citado por Google -

Similares em

SciELO

Similares em

SciELO -

Similares em Google

Similares em Google

Compartilhar

Revista Facultad de Ciencias Económicas: Investigación y Reflexión

versão impressa ISSN 0121-6805

Rev.fac.cienc.econ. vol.22 no.1 Bogotá jan./un. 2014

ORGANIZATIONAL STRUCTURE FOR COAL MINE IN BOYACÁ*

ESTRUCTURA ORGANIZACIONAL PARA UNA MINA DE CARBÓN EN BOYACÁ

ESTRUTURA ORGANIZACIONAL PARA UMA MINA DE CARVÃO EM BOYACÁ

JOHN W. ROSSO MURILLO**

UNIVERSIDAD DE LOS ANDES (COLOMBIA)

* This is a reflection article as part of the research developed in the course 'Theory of the Firm', under the supervision of Dr. Juan Benavides, in the Doctorate of Management at Universidad de Los Andes.

** Estudiante de Doctorado de la Universidad de Los Andes. Master en Administración Económica y Financiera, Ingeniero Industrial, de la UTR Profesor de la Universidad Pedagógica y Tecnológica de Colombia -UPTC. Asistente Graduado Universidad de Los Andes. Correo electrónico: jw.rosso20@uniandes.edu.co, john.rosso@uptc.edu.co

Recibido/ Received/ Recebido: 09/09/2013 - Aceptado/ Accepted/ Aprovado: 19/03/2014

Abstract

This is a review article that analyze previous research results and contrasts them with the firm theory in order to propose an economic organization structure for Boyacá's mining sector. Results indicate that the present scheme of contracts between producers and intermediaries is inefficient and promotes inequality. The highest benefits proportion is in the intermediation side, despite the risk and effort falls mainly on the producer. Three different forms of sector's organization are presented, as well as pros and cons aspects from each side are analyzed, in the light of the theoretical framework proposed. Most region farmers are smallholders and they are characterized by a high heterogeneity, it is conclude that alliance scheme is more economic and socially efficient in the relationship between producer and market.

Keywords: Coal Production, Organizational design, Contract, Alliances.

Resumen

Este es un artículo de revisión que analiza los resultados de investigaciones previas y los contrasta con la teoría de la firma con el propósito de proponer una forma de organización económica para el sector minero de Boyacá. Los resultados señalan que el esquema actual de contratos entre productores e intermediarios es ineficiente y promueve la desigualdad. La mayor proporción de los beneficios queda en manos de los intermediarios, a pesar de que el riesgo y el esfuerzo recaen sobre el productor, principalmente. Se presentan tres diferentes formas de organización para el sector y se analizan los aspectos positivos y negativos de cada una de ellas a la luz del marco teórico propuesto. Como en su mayoría los productores de la región son pequeños y se caracterizan por una alta heterogeneidad, se concluye que el esquema de alianzas es más eficiente económica y socialmente en la relación entre productor y mercado.

Palabras clave: Producción de carbón, Diseño organizacional, Contratos, Alianzas.

Resumo

Este é um artigo de revisão que analisa os resultados de pesquisas prévias e os contrasta com a teoria da empresa com o propósito de propor uma forma de organização econômica para o setor mineiro de Boyacá. Os resultados assinalam que o esquema atual de contratos entre produtores e intermediários é ineficiente e promove a desigualdade. A maior proporção dos benefícios fica nas mãos dos intermediários, apesar de que o risco e o esforço recaem sobre o produtor, principalmente. Apresentam-se três diferentes formas de organização para o setor e se analisam os aspectos positivos e negativos de cada uma delas à luz do marco teórico proposto. Como em sua maioria os produtores da região são pequenos e se caracterizam por uma alta heterogeneidade, conclui-se que o esquema de alianças é mais eficiente econômica e socialmente na relação entre produtor e mercado.

Palavras chave: Produção de carvão, Desenho organizacional, Contratos, Alianças.

Rosso, J. (2014) Organizational Structure for Coal Mining in Boyacá. En: Revista de la Facultad de Ciencias Económicas de la Universidad Militar Nueva Granada. rev.fac.cienc.econ, XXII (1).

JEL: D24, D02, D86, D74.

1. Introduction

According to Warner & Sullivan (2004), extractive industries have raised importance in the worldwide economy, and especially, in developing and emerging economies, when measured by the flow of foreign direct investment (FDI). Due to the rapid growth of the industry, there are many challenges in managing, environmental, and particularly, in social issues to be faced by institutions in these countries. This article reflects on an economic and social problem of one of the coal producing regions in Colombia, as is Boyaca. The main objective is to analyze the secondary data from field-based research that were collected in year 2011 by Benavides et al. (2011), and to propose an efficient form of organization for the coal mining sector in this region. First, I propose three different alternatives of organization; second, I analyze the pros and cons of each organizational form; and third, I present the best organizational alternative under the paradigm of the theory of the firm.

Empirical evidence shows that the average producer in the region is small, lacks of technological development and her financial capacity is minimum. These features make the producer subject of high information asymmetry when engaged in an agreement (mostly informal) with the commercial intermediary. In this way, the current scheme of contracts between producers and commercial intermediaries is inefficient and promotes inequity. These results are in line with the findings of Krug & Mehta (2001), whose statement claims that "high transaction costs associated with uncertainty, together with resource constraints, are responsible for pushing entrepreneurs into these agreements" (Krug & Mehta, 2001, 3). In addition, cultural features of local producers like individualism, has made to fall the negotiation capacity of the producers, since they manage the intermediary in different ways, and this isolation is economically ineffective (Franks, Brereton, & Moran, 2010).

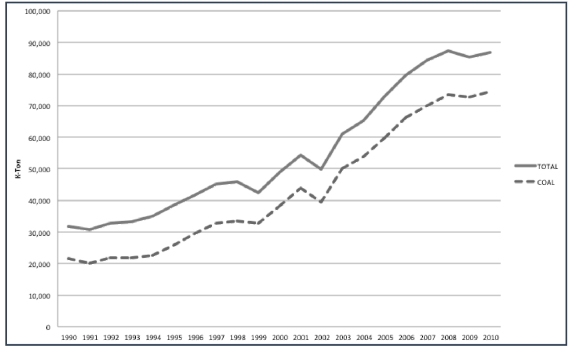

Figure 1. Colombia's total mineral production1

There is no doubt that as in the rest of developing economies and emerging markets, the extractive industry has became economically important, in Colombia it also has been as well. In Colombia, mining has increasing its total production during last 20 years (Figure 1). Total production, without emeralds, has become almost threefold; it was 31.750 K-ton in early 90's and has increased up to 86.750 K-ton in 2010. From such production, coal represented near 67% at the beginning of this period, and has reached 85% nowadays, approximately. Other minerals like Cooper or precious metals like Silver or Gold, have not significant weight over the total production.

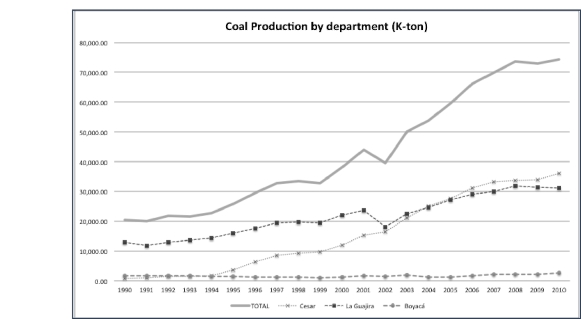

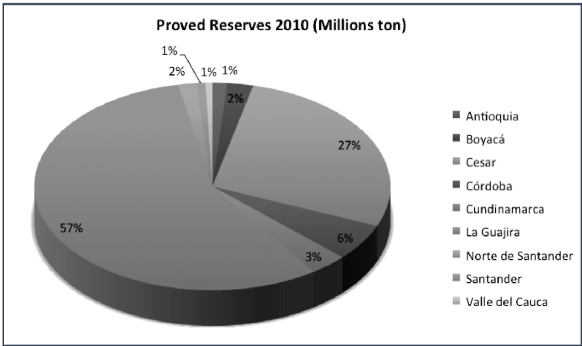

Since coal mining has reached an important role in the economy, it is important to see where the coal resources and the production are. In Colombia, La Guajira and Cesar departments have the biggest proportion (84%) of coal reserves (Figure 2).

Boyaca is considered one of the regions with smaller coal deposits (Jáhnig, 2007). As it is observed, Boyaca just have 2% of total coal reserves. However, as stated before, in the region this activity has a remarkable importance in the economy. Mining generates from 4.000 to 8.000 jobs (Benavides et al., 2011).

The role of the mining in the regional economy is important because in spite of representing just 2% of the regional GDP, its growth has rounded 20% in the last years2 (DANE, 2011). Production does not have grown as in the Caribbean region (See Figure 3), but its importance is due to the characteristics of regional economy. Moreover, the transferences from National Government corresponding to royalties for coal extraction were equivalent to the 0,82% of the total regional income budget in 20103. Therefore, it is necessary to have an optimal organizational structure to get better economically and socially efficient results.

Boyaca is considered one of the regions with smaller coal deposits (Jáhnig, 2007). As it is observed, Boyaca just have 2% of total coal reserves. However, as stated before, in the region this activity has a remarkable importance in the economy. Mining generates from 4.000 to 8.000 jobs (Benavides et al., 2011).

Figure 2. Colombia's total coal reserves4

The role of the mining in the regional economy is important because in spite of representing just 2% of the regional GDP its growth has rounded 20% in the last years6 (DANE, 2011). Production does not have grown as in the Caribbean region (Figure 3), but its importance is due to the characteristics of regional economy. Moreover, the transferences from National Government corresponding to royalties for coal extraction were equivalent to the 0,82% of the total regional income budget in 20107. Therefore, it is necessary to have an optimal organizational structure to get better economically and socially efficient results.

In Colombia, coal mining has not been planning as an institutional policy. Great deals of coal resources are mined in illegal way (it is known as 'fact mining'). The Government has promoted some laws (Law 141/1994, Law 685/2001 and Law 1382/2010), but they have not rendered the expected results mining coal (Güiza, 2010, 83).

1.1 Method

Data collection procedures: This study used secondary data from field-based research that were collected in year 2011 by Benavides et al. (2011). They were presented to the sponsor institution8 in 2011 to study the current characterization of the small-scale coal mining in the central region of Colombia. The list of sources includes 11 meetings between small-scale producers, 2 with regional associations and established firms, and 16 detailed interviews in 4 departments.

Authors apply a cluster analysis to classify the producers. All the clusters are characterized by using different variables. I review this information and define three different forms of organization. I compare each alternative under the theory of the firm (Spulber, 2009) paradigm. Then, analyze the pros and cons and recommend the best form of organization for coal mining sector in Boyaca.

Figure 3. Colombia's coal production8

2. Characterization of the mining sector in Colombia and Boyaca

The coal reserve areas of Boyacá go from the municipality of Jericó, in the north, to the border with the department of Cundinamarca; the main mining area is located between the municipalities of Sogamoso and Jericó, which has bituminous type coals (Mejía, 2005, 29).

Boyaca has established mining districts9 to improve the conditions of the miners and to control this activity. One of the most important of them, for coal mining, is the North Boyaca District, which includes 23 municipalities from 3 provinces10. There are 210 mining titles operating (Güiza, 2010, 176). By the Act 354/2009 from Ministerio de Minas y Energia (Energy and Mining Ministry), it was declared a special reserve of coal in Jerico municipality, given the poor conditions of the exploitation in that zone.

In Boyaca metallurgic coal is around 58% of the total coal production, while thermal coal is the complementary 42% over the total. The extraction of this mineral is characterized for being, between 70% or 80%, an illegal activity. In general, illegal mining is present in the 44% of the total municipalities in the country and it represents near 30% of the total mining exports (Güiza, 2010).

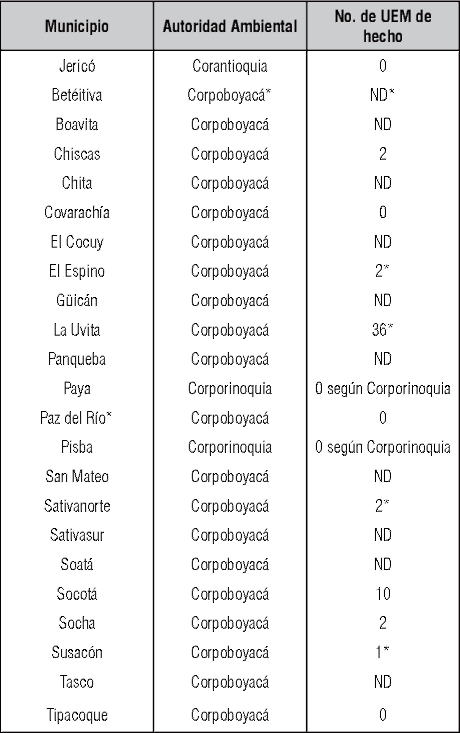

For example, in the mining district of North Boyaca, there are identified 55 units of illegal mining (Table 1), according with the Güiza (2010, 13) report11. This is in line with the findings of Lahiri-Dutt (2007) who points out that illegal mining prevails in the developing world. According to the author, immediate consequences of this kind of activity are greater inequality and poverty, and environmental problems. Nevertheless, it is important to notice that, in general, producers interviewed recognize the importance of being right with the authorities.

According to Benavides et al. (2011), mining activity is replacing the primary activities of the region: agriculture and livestock. However, it is estimated that 48% of the mining is artisanal, 38% small scale mining, and just 14% is medium or great scale mining. It implies a poor development of technology and a high dependence on human labor. Some characteristics of this type of mining are described as following (Table 1).

Table 1. Fact mining units in North Boyacá District of Mining12,13

The information collected directly from Tasco municipality, indicates that there are 32 illegal mining units in that zone. The consequences of the illegality are deeply considered in section three of this paper.

As observed in Benavides et al. (2011), other cultural and personal characteristics of the miners in this region involve that miner is strong and resilient, and dedicated to her work, but in most cases they represent the first generation of miners with little experience compared with miners from other regions. Because the proportion of small scale and artisanal mining, their start in the business is very rudimentary; the level of professionalism is very low, and most of them do not perceive growing as needed since they assume mining just as a livelihood not as a business. It is a region that prefers to work with miners from the region, living in their homes near the mine; only 20% to 30% come from other regions of the country (Benavides et al., 2011).

Related to the personality, they are people difficult to organize. The miners do not like to commit a schedule work; they just work according to the individual capacity. Additionally, they use to spent part of their money on consumption of liquor (mainly beer). These people are with little loyalty to the employer, move from the mines in the region looking for the highest payment. The owner of the mine feels very frustrated by the lack of miner's commitment (Table 2).

Table 2. Characteristics of mining activity14

2.1 Production

In the region there are problems related to climate, since the winter affects the productivity of the mines for several months. Furthermore, after the rainy season miners should carry out repairs which are costly. Additionally, environmental authority is not perceived as support but as prosecutor, so the miner perceives herself alone (Benavides et al., 2011).

Small-scale mining is generally characterized by production units with a minimum degree of organization, small-scale production and low level of technology. On the other hand the subsistence mining is comprised mostly of independent workers who combine this activity with other productive activities, especially agricultural, reason why mining becomes cyclical (Mesa Sectorial de Minería, 2003; UPME, 2004).

In her study, Betancurt (2002) found that the technology used for extraction of the mineral, at the small mining, is mainly underground of cavern. There are used two methods: extraction by room and pillars and the method of long wall; being the former the most used in Colombia. In spite of its popularity, this method causes that the amount of coal extracted be relatively low.

Artisanal miners do not have any mechanization process. Small miners sometimes use compressed air for the perforation and coal starting operations. They have electrical power and it allows for ventilation underground. Most of the mines have a low mechanization and are based on an intensive manual labor; this has as a consequence a little cost of capital but a little amount of clean coal (Betancurt, 2002, 216).

Studies have demonstrated that mining sector in Boyacá has a very low degree of R&d; it is possibly due to the poor education level of the miners (Benavides et al., 2011; Betancurt, 2002; Mesa Sectorial de Minería, 2003). Artisanal miner is an individual who only reaches a primary level of education. Still, Benavides et al. (2011) found that the bigger is the size of the activity, the greater is the level of education of the miners (or their staff, when apply).

2.2 Market and commercialization

Regarding the marketing activities, Boyacá has a high level of organizational complexity (Benavides et al., 2011). From the market perspective, the region is characterized by high industrial demand of coal, e.g. thermal industries, cement, paper and brick, the needs of power generation and exports of metallurgical coal. Additionally, this demand is highly stationary.

In another perspective are the distribution and marketing channels. According to Benavides et al. (2011) there is a high presence of arbitrageurs, which characterizes the market as one with multiple buyers and sellers, with a dominant position of the formers in price setting. The very small producers sell almost all their product to traders, excepting occasional sales to large consumers (due to some cases of very high quality). Small producers sell to medium and large regional customers (supply contracts) and some retailers. On the other hand, the medium producers buy from other producers; they have storage facilities and add value classifying the product and preparing mixtures adapted to the characteristics of consumers with quality control. Their customers are usually large consumers and sometimes they directly export.

In general, for the miners of the region, the sales abroad are of little interest given the characteristics of regional demand. For the small mining exports is too costly, because it requires a client, or customer pull, with a clear negotiation covenants. Additionally, it implies high requirements in terms of volume, transportation costs, taxes, permits; and low flexibility in payment, as well as fluctuations in international prices (Benavides et al., 2011). Betancurt (2002, 212) considers that the reason why the Boyaca's coal does not arrive at international markets is, mainly, due to the high transport costs from the center of the country to the coast, where ports are located. Actually, there is a road and rail infrastructure to supply the regional demand, only (Ponce, 2005).

3. Illegal mining consequences

There is evidence of the negative impact of illegal mining on the economic, social and environmental dimensions of any region (Aspinall, 2001; Dreschler, 2001; Hilson, 2009; Kitula, 2006). According to Barry (1995, 1): "although it provides an important source of income, artisanal mining engenders a host of problems: environmental, health, and safety concerns; labor and gender issues; and technical, financial, regulatory, and legal issues". The fact that illegal mining in Boyaca rounded the 80% over the total, have negative impacts as well.

In the World Bank conference (Barry, 1995) pointed out that from the financial and technical perspectives, there are some serious problems in this kind of mining. Firstly, this miner does not have enough financial resources to invest in technology (sometimes is not interested), and is not subject to any loan from the financial system. They have higher transaction cost related to de post exploitation activities (like production gathering and commercialization).

Related to the commercialization, there are problems in the relationship of illegal miners with established mining enterprises or traders, because the illegal status of the formers. It is evident the existence of constrains in establishing legal contracts between the parts. Benavides et al. (2011) found that most of the contracts are not signed but there is a personal compromise (gentlemen's agreement) between the parts. This imposes uncertainty over the long-term relationship and limits the investment decisions. This is in line with Das & Noushis's contention related with the propensity to opportunistic behavior between the parties when the length of the relationship is perceived just for a short-term (Das & Noushi, 2002).

That is the reason why small or artisanal miners have a real disadvantage in any contractual relationship, sometimes affecting their income and maintaining (or promoting) the illegal status quo. For Amaratunga & Kumar (1994, 15), under such scheme, the beneficiaries are the traders, buying below market price to make quick profits.

According to Hansmann & Kraakman (2000, 808), there are two ways of coordinate the economic activity of two parties: (i) by having direct contracts between each other, and (ii) Entering in a contract with a third party who coordinates the contractual relationship. In sum, an ex-ante mechanism for deterring opportunistic behavior is to write formal contracts, and an ex-post mechanism is monitoring (Das & Noushi, 2002, 97).

3.1 Constrains to legalization process

In an environment where legalization implies a big effort, there are not incentives to legalization. As a matter fact, legalization process in Colombia implies a legal process15, plenty of prerequisites and activities by who is interested in established that a great number of illegal miners have not interest in legalization (Benavides et al., 2011). Actually, most of them have decided to be illegal and assume the risk of their decision.

One of the biggest barriers related to this subject is the scanty capacity of small-scale miners to accomplish the technical and economical requirements imposed by laws, to operate a legal mine. Sometimes, this is due to the shortage of knowledge about these matters. On the other hand, the capacity of monitoring and control by government is not enough to cover all the illegal activities. In fact, one can find that public policy considers this level of control as good enough. The national Government judges that given the structure of the sector, where biggest enterprises own the 97% of the sector's assets and they generates the 98% of the profits, it is not necessary to have any small size detailed analysis (Ruiz, 2007, 9).

This is a fact that has been found in different studies around the world. For example, Chakravorty (2001) showed a difficulty to gather information about this type of mining; Dreschler (2001) found that the sector is extremely mobile and flexible, mining activities can appear and disappear overnight, which makes it very difficult to control, even for local authorities and NGOs working many years in the sector. In the case of sub Saharan Africa, for example, the approach taken to formalize and support this mining has resulted in the implementation of bureaucratic licensing schemes, and in the designing of ineffective and/or incompatible regulations (Hilson, 2009, 4).

Gathering producers would incentive the legalization; the group shares the process, not only in expenses, but also in the effort engaged. It should facilitate the relationship between authorities and miners for regulation and monitoring activities. On the other hand, the intervention of an intermediary could alleviate the costs of legalization by individuals. An intermediary provides economies of scale and minimizes the informational costs (Gehrig, 1993).

Though, financial matters are other kind of constrains because of the characteristics of the regional mining sector. Benavides et al. (2011) have found that traders are one of the most common financing resources. Traders have enough capital to provide the miner with cash flow resources in order to attend their daily operations. It could be considered a form of strategic loan, by means of which trader engage an underlying contract for buying coal.

3.1.1 Market failure

It is worth to evaluate this type of activity and to consider more detailed aspects, because it generates asymmetries and delivers the bargaining power to the buyer. This aspect is treated on Spulber (1996a), by using a model of the market with endogenous price setting by intermediaries. The author found that depending on the discount rate16, this could lead to an intermediary acting as a monopoly. Apreda (2001) considers the intermediary as a "broker of asymmetric information".

It is assumed that the loan has no interest rate charges; however, it is clear that the bargaining power of the lender allows her to set, in turn, the purchase price once the coal has been extracted. Murry & Zhu (2008) mention that this bargain power creates asymmetries favoring intermediaries. This is termed in the literature of transaction costs as "lock-in situation", which transform a bilateral exchange in to a command structure (Wathne & Heide, 2000).

On the other hand, since mining is a stationary and income variable activity, as was pointed out above, miner is not subject to credit for commercial banks. In fact, they do not have much interest in to access bank financing due to the existence of the alternative source from intermediaries.

It is clear that the common trader activity is an imperfect substitute for financial markets and leads to asymmetries between producers and consumers. In despite of being an apparent agreement without warranty, lender can take possession of the miner's assets, but borrower does not perceive the situation due to a lack of an explicit interest rate. In this situation, besides, producer reaches a comfort zone that let her to get daily operating resources and inhibits improvements in technology, knowledge and legal practices.

From these two conditions in the relationship between producers and commercial traders, it is clear that there is a problem of control rights allocation. These control rights are defined as "the right from one party to affect the course of action of the business in certain circumstances" (Tirole, 2010, 387). Since the intermediary have enough power on this relationship, the allocation of the control rights are not based on the willingness of the producer to transfer them to the counterparty, but in the impossibility to exert them.

3.2 Illegality and property rights

As was described before, asymmetries between producers and consumers make the parts to face problems regarding property rights. In spite of the miner being the owner of the resources, bargain structure imposes restrictions to her as a residual claimant. When buyers give financial resources to the producers, or provide services as transport of the final product, they gain a power on the contractual relationship that poses her as residual claimant. It causes a fall in private benefits for the producer (Hart & Holmstrom, 2010, 3).

While it could be thought that one solution to this problem is to write complete contracts, it is not a final solution17, especially when writing complete contracts at no cost is impossible (Hart, 1988). On the other hand, most of the contracts between illegal miners and buyers are just gentlemen's agreements. So, contracts enforcement is a constraint for symmetric relationships in this market because buyers face a moral hazard problem. Benavides et al. (2011) have identified that miners do not respect this kind of agreements and, sometimes, decide to sell the product to any consumer that is paying the better price.

This kind of behavior is correlated as much with the size if the trader. Traders as intermediaries have been identified in the market, mainly being of three types (Benavides et al., 2011):

• Intermediary traders: they benefit from producer's necessities of financing and other resources. Their payments are 30 to 90 days in average. As well, generate distortions on the market since they set the buying and selling price.

• Permanent traders: they pay in a short term, 8 days in average. The prices are ruled by the size of the producer (first degree price discrimination). They have storage facilities and add value by classifying coal.

• Temporary traders: they appear sporadically paying higher prices than the market. They do not require specific quantity or quality. Usually rent a space, but are not established in the area. They use to pay cash.

In this perspective, illegality promotes unfair competition between legal producers and generates price wars, which leads to price volatility Due to this situation, producers needs to engage in vertical integration with the trading activity (Hart & Holmstrom, 2010). As consequence medium scale producers are the biggest beneficiaries of prices throughout the chain. This appetite for high prices, lack of compliance with industry standards, the reluctance to submit to state control and disregard for processing and marketing the final product, promote operating practices without environmental control, quality of mining health and safety and a fail in the reputation of the business.

4. Organizational structure for the sector

The regional mining environment described shows that due to illegality, mainly, most of the transactions between producers and buyers are directly performed. Nevertheless, it is not necessarily the best form of organization to be more economically and socially efficient. In their study, Pooe & Mathu (2011) claim for a more collaborative supply chain to make the coal mining more competitive, in the South Africa's case.

On the other hand, for direct interchange, Spulber (2009, 4) highlights that the firm act as contracting hub and that they achieve more than would a complete set of contracts between the parties. In general, an intermediation function clears the market and facilitates the matching between sellers and buyers (Spulber, 1996b).

From this point of view I present three different alternatives to organize the mining sector in Boyacá in order to improve efficiency and benefits for all the actors of the chain. First of all, the firm as the corporation concept from the Spulber's perspective; second, an alliances structure; and finally, a cooperative scheme of organization.

4.1 A firm vs. individual interchange

Until here it is clear that small scale and artisanal miners have a very short vision of the mining business and they do not have any interest in association activities. However, a firm is an economic vehicle that enhances exchange, doing it more efficient than the direct exchange (Spulber, 2009, 11). Its role improves the information gathering and the matching process, decreasing transaction costs. Firms also alleviate financial constraints, and board monitoring by corporate owners (Allen & Phillips, 2000).

In this way, one of the more evident advantages of firm gathering producers of coal is the bargaining power. Given the opportunity to improve information systems and to subscribe multiple contracts, allows the firm to standardize the selling process. By offering standard contracts, producers can go to the market for generalized bid-ask prices, free of traders bargain power. In Spulber (2009) this bargain power is considered as an externality from which, in this case, buyers extract benefits. Moreover, when this market power is big enough, these firms can set the bid-ask prices and the market equilibrium is compared with a monopoly intermediation (Spulber, 1996a).

One argument against firm could be the fixed transaction costs. According with the theory, the benefit derived from the firm intermediation vs. direct interchange must be greater than the transaction costs (Spulber, 2009). But under the current scheme it has been noticed that the gap between market price and buyer price offered is great enough to cover those fixed costs and to give benefits to the firm. According with the costs analysis of Benavides et al. (2011), this activity has a utility margin different for each type of coal. For thermal coal, the utility margin is around 27% and for metallurgic coal is 76% in average. In Boyacá the thermal coal is around 42% of the total production and the metallurgic coal is 58% (Benavides et al, 2011, 41).

On the other hand the analysis of fixed cost must not be separated from the investments analysis. As was highlighted in former sections, one of the problems of the small-scale mining is the insignificant level of investment and a lack of interest for technology development. Since the firm realizes economies from specialization, it provides a better capacity to invest in equipment as in education for miners.

Added value is a consequence of this new investment capacity. A firm could engage projects for adding value to coal, as storage facilities, cleaning processes and transportation to consumer place. Current situation do not facilitates that the small producer controls any value added, since storage or transportation services are in charge of traders.

Because of the characteristics of labor market in mining sector in Boyacá hiring employees by verbal contracts and, sometimes, under illegal schemes18, there is a problem that could be solved. Firm has the capacity of hire employees under legal schemes and design incentive systems that promotes an adequate effort when compared to the compensation. Firm has to train the personnel with necessary skills to develop the work. This is a way to improve the education level of artisanal and small-scale mining, in which currently almost 40% of miners do not have any education and 30% just have reached the elementary education level (Benavides et al. 2011, 53). On the other hand, firm provides all the required elements of protection to ensure that the work done avoid any type of risk.

Reputation and construction of a brand name encourage firms to improve commercial relationships. By the way, it allows the contracts enforcement given that the firm operates under the institutional framework. It leads to benefits for partners, but most important, to consumers that will have a counterpart for claims and warranties.

It is evident that by this way, firm can overdue financial constrains like capital access from traditional financial sector. Benavides et al. (2011) have found that banks use to lend money to persons by their reputation and a long-term relationship. The financial sector in Boyaca does not consider the small-scale producer as a subject of credit. It is due to that this sector perceives the producers as persons with a minimum technical capacity, an absence of accountancy, a lack of accomplishment of contracts, a little association capacity and a scarce entrepreneurial capacity (Benavides et al., 2011, 129).

One possible barrier to this form of organization is related to the property rights. Not always there is a coincidence between the property of land, the mining official permission owner and, the person who is exploiting the resources. As Spulber (1989) point out, particularly, property rights may not be clearly defined for natural resources. Here achieving completeness and exclusivity is often incompatible with a system of private ownership (Spulber, 1989, 49). This situation generates social tensions and it is an evident obstacle for a firm scheme. It is not quite clear who must join the firm as partner because the problem needs to be solved before.

In this sense, it is absolutely necessary to have the State intervention through the public policy. Regulations, norms, monitoring activities, promotion and prevention, are some of the activities the Government is called to implement, far away from the merely energy consumption policy. There are many examples of successful public policy around the world; though, most of them refer to developed countries (Gordon, 1987).

However, as Benavides et al. (2011) remark in their work, that idiosyncratic aspects of the producers in Boyacá are clear barriers to implement a corporation scheme. One of the main problems is the separation of the property and control. Well-defined property rights are essential to the establishment of firms (Spulber, 2009, 66). By definition, "a firm is an organization whose objectives differ from those of its owners" (Spulber, 2009, 63). It has been identified a resilience and a lack of interest for associability.

Here one can find a barrier to establish a firm where producers are the partners. A firm is a scheme in which the benefits are perceived as shared. Given the regional miner's behavior, as individualists, it is very difficult for this producer to assume the partner condition. An incentive problem emerges when it is not possible to show a clear positive benefit-cost balance to the coal producers. Incentives for artisanal and small scale miners are just the subsistence Benavides et al. (2011), while a firm has to guarantee longevity.

Clear rules between partners would be a prerequisite for this organizational form. Then corporate governance is an alternative to introduce these rules, which implies a previous education process and an individual approaching to generate confidence between the partners. It has to be clear for them that profits are maximized when firm acts independent of the consumption objectives of its owners (Spulber, 2009, 147).

Nevertheless, what is proposed here does not imply the necessity of integration between producing and trading activities. Improvements in technical, marketing and financial aspects, allow the firm to subscribe contracts with intermediaries, as legally organized trader, or even with final consumers, in a more efficient way.

At the end, one of the key success factors is the willingness of the agents involved to make the firm a profitable business. Here one can find the major constraint to this proposal. First, as mentioned before, illiteracy plus the lack of interest for association are determinants for a low entrepreneurial capacity. This argument has been developed by Molefe & Ashworth (2004) in the development of Small Mining Enterprises in South Africa. Second, given the success rate between new firms in the region, which is 68% within the first five years (Wengel, Ferreira, Restrepo & Suárez, 2008), there is an important barrier to be solved before implementing a firm scheme model.

Moreover, it is important to notice that one of the key points of the Science and Technology prospective plan for Boyaca, is the education. Particularly, for mining and energy sectors, it appears as imperative to provide more entrepreneurial education to the population of these sectors in order to improve competitiveness and economic efficiency (Ruiz et al., 2012).

4.2 Alliances

An alliance is a flexible organization that allows firms to experiment with new technological, organizational, and marketing strategies. The principle goal of the alliance is to learn more about technical and market parameters. According to Ashoka (1993) a few successful alliances can trigger more widespread alliance formation. Then, it could be a middle term scheme of solution for illegality problem of mining in Boyacá.

Alliances have different dimensions to be considered. Some of them refers to the geographical origin of the partners, the intra or inter sector of them, for example (Vyas, Shelburn, & Rogers, 1995). However, the most important dimension to be considered in this case is the relationship to be established, this is, the motivation behind such alliance. The objective of any proposed alliance should be to improve the economical and social conditions of the mining sector in the region.

Artisanal and small-scale miners in Boyacá, given the characterization done before, could be considered behaving as early entrepreneurs. It is, they could be located in the first stage of entrepreneurial process, according to (Spulber, 2009, 153). As a matter of fact, in this stage the startup's objectives are not separated from the owners'. Although they do not accomplish the firm definition, their role in regional economy has been recognized before. Alliances between them could be a first step to find the financial resources to become firms. It could encourage the coal miners to legality.

In their book, Contractor & Lorange (2002) have established that one of the key factors for the success of a strategic alliance is if the parties are legally able to join the contractual terms of the alliance. Other authors highlight the importance of cultural aspects and behavioral norms between the parts (Artz & Brush, 2000, 338). In fact, it is considered very difficult to establish alliances between regions (or even micro-regions) where cultural differences are quite remarkable (Fothergill, 1994). Nevertheless, evidence of cross-country alliances shows important successes (Gillingham, 1995).

Cultural barriers are clearly defined in Benavides et al (2011). Mining activity for small-scale and artisanal miners is a short-term vision business. Illegality and power imbalances promote isolation between producers. Their propensity to opportunistic behavior makes the producer as a subject not willing to cooperate. While the vision of the business is just the short term, the alliance strategy will be not viewed as a beneficial alternative.

According with Kandemir et. al (2006), the alliance orientation will depend on the capabilities of participants for looking opportunities, coordinate the activities and managing effectively. However, it is not easy to start an alliance under the features described above. Alliances are the arena for multiple opportunistic behavior situations (Das & Noushi, 2002). Moreover, Buckling & Sengupta (1993) point out that the success will depend mainly on the resources that each participant provides to the alliance. Other authors consider that it depends on the voluntarily aligment of capabilities and contractual structure (Haeussler & Higgins, 2013, 28).

It is recognized that institutional framework plays an important role in alliances strategy (Das & Noushi, 2002; Tirole, 1994; Vyas et al., 1995). Benavides et al. (2011) found that institutional framework is perceived in a negative way in Boyaca. The Authorities in the field are perceived as prosecutors; legalization process as extremely complex, and other supporting and promoting governmental offices as unknown.

Provided that alliances have basically two basic factors as determinants, market and technology (Vyas et al., 1995, 49), it is important to have a clear vision of the benefits expected in the regional sector. Once alliances are established, they can encourage projects for assessing markets in a more efficient way. Value drivers for coal commercialization are the more important prospects. Technologies of better exploitation under the health and environment perspectives have to be in the agenda.

There are many risks that miners face in the underground mining. Coal bed methane could be mentioned as one of them. Mechanization and learning on the mining know how would offer an attractiveness to coal producers in the region. On the other hand, in spite of the lack of concern for their health, prevention and security program will improve the mining conditions in the region. In general, alliances moderate the knowledge flow along the coal cluster (Contractor & Lorange, 2002, 164).

Whit this organization, partners do not need to allocate common property. All the projects can be started under the shared risk model. In this way, transaction costs related to the projects are treated as shared and assumed by a third party. The role of the Government as facilitator ensures a more adequate allocation of rights. However, Krug & Metha (2001) consider that an effective alliance should overcome this role by an adequate set of sanctions and social punishment .

Market exploration and finding of new customers is one of the biggest tasks of the alliance. When a great number of producers engage in a wide bargain process there are many economic advantages and benefits (Pierson, 1950). In this form, producers achieve a bargain power derived from greater quantities to negotiate, prices standardization to customers, and possibility to sell abroad. This strategy breaks the current circle depicted by intermediaries due to its market power in price setting (Benavides et al. 2011, 205).

One of the problems identified when alliances operate is the weak incentive to avoid cheating or opportunistic behavior (Ashoka, 1993, p. 152). Thus they may be thought of as experimental organizations that trade off the acquisition of knowledge against potential tosses due to cheating and opportunism. Compared with the current framework, cheating is not a new practice. Due to illegality the hold-up is very common between producers and buyers in verbal contracts (gentlemen's agreements). As was mentioned before, it is impossible to appeal to complete contracts. As is said by Artz & Brush (2000, 338), "while relational contracts may mitigate some opportunistic behavior, significant residual opportunism may remain".

Another circumstance derived from this kind of association is the free riding problem. As Spulber (2009, 329) points out, members of the alliance could engage non-cooperative behavior. In this sense, alliance can experience a great transaction costs derived from this conduct. So, again, the incentives design to make attractive the tradeoff between joint projects against transaction costs, have to play an important role.

Assuming that it is a real risk to face by the alliance; parties have to make investments that permit them to develop competences in distinguishing high-risk partners from (preferred) low risk partners and reduce problems of adverse selection (Contractor & Lorange, 2002, 154). The definition of promotion strategies from Government institutions must be the key of the alliances.

4.3 Cooperatives

It is important to notice that a cooperative is not a firm. A cooperative seeks an increasing of the social welfare, while a firm seeks to increase the stockholders' welfare. In such way, the subjective interests of the members (owners) influence the cooperative's production decisions, provided that its interests are mainly social. Then, there is not separation of ownership and control (Spulber, 2009).

Koljatic & Silva (2011) find that cooperatives are a kind of organization in low-income sectors in Latin America. These authors point out that self-organized groups share risks and benefits and take advantage of some tax exemptions. According to Bonus (1986), one of the main advantages of this organization is that the members gain the benefits of collective organization and, on the other hand, they keep their independent operation. Undoubtedly, this is the center of the analysis in this case, and is how to reach the equilibrium between independency and social benefits for coal producers.

Multcher (1980) has studied coal cooperatives in US as a means of providing services and to improve their economic position in coal markets, and has demonstrated the potential benefit-cost for the participants. On the other hand, Rieber & Soo (1975) analyzed the feasibility of marketing/transportation cooperatives composed of small coalmines producers, primarily located in Alabama, Kentucky, Ohio, Western Pennsylvania, Tennessee, Virginia, and West Virginia.

There is no doubt that the cooperative form of organization has received attention and has supported many productive units. By this form, it is possible to undertake projects that can serve as support units for established producers. This has mainly been the spirit of producer cooperatives in different areas.

In Boyaca potato cluster has implement strategies of association, some like cooperatives, in order to provide benefits to the associates. For example, storage facilities have been one of those benefits. In the case of coffee grain industry in Colombia, cooperatives not just have supported the storage, but the marketing activity has been remarkable. Then, one of the alternatives for the cooperative is to improve the storage and classification conditions of the coal in the region.

There are experiences in this kind of organization of producers in Boyacá. Actually, Benavides et al. (2011) have identified at least seven experiences of cooperative organizations in Boyaca19. Nonetheless they pointed out that the experiences from miners have been not always positive and they perceive the costs of association but not the same way the benefits. In most of the cases, there are no major motivations to maintain the cooperative by members, beyond the right of exploitation (Benavides et al. 2011, 74).

Cooperatives, however, have received a hard criticism from different perspectives. According to Spulber (2009, 331) cooperatives experience several types of transaction costs that affect their efficiency in allocating resources. Given that the cooperative has an organization framework that is based in the democratic participation of the associates; participants face high cost of operating and monitoring. On the other hand, as was mentioned before, perceptions of the coal producers about their cooperative experiences indicate that they find the costs of operating quite expensive against the benefits derived from the organization. As well Spulber (2009) warns that the transaction costs for a cooperative increases with the number of participants (diseconomies of scale). As a matter of fact, Bonus (1986) affirms that the argument of having economies of scale is not strong enough to justify a cooperative.

The experiences identified by Benavides et al. (2001) show that there has been different projects developed that has not received the expected attention by the members of the cooperative. For example, in the case of CARBOPAZ, facilities for storage and classification are not employed by most of the members (Benavides et al. 2011, 74). It could be due to a poor managerial ability of the cooperative; or even, the lack of interest of the users.

On the other hand, results show that under the current operation scheme, the interest to be associated to the cooperative is minimum. Producers have to sale the entire production to the cooperative; at the same time, they must pay a fee directly related to their production level. However, the cooperative is not able to support the individual producer in financing with the financial sector (Benavides et al. 2011, 74).

The results obtained by Benavides et al. (2011) from the field, are important inputs in the analysis of the different alternatives drawn here. Each of them would have diverse impacts on the social and economical situation for mining in the region. Those impacts need to be considered in defining the future this sector in Boyacá. The following are the most important results under each alternative (Table 3).

Table 3. Analysis of the results under the proposed organization alternatives20

5. Conclusions and remarks

Davidson (1993) sustains that the small-scale and artisanal mining cannot be ignored or eliminated; he argues the necessity of Governments and private sectors intervention in legalizing it. The purpose of to evaluate three different alternatives of organization for this sector is to maximize its social and economical benefits.

It is necessary to encourage the artisanal and small-scale miners to find any organizational form that promotes the legalization and avoid asymmetries in their contractual relationships. At the same time, it is necessary to improve the social, economic, environmental and personal conditions, under those miners work. It is clear that they need formation in techniques of coal exploitation, as well in entrepreneurial abilities and knowledge. Some extent of collaboration between them also is necessary.

It has been depicted the idiosyncratic feature that could restrict the cooperation due to the remarkable individualism of the local miners. Allocation of rights, moral hazard, free riding and contracts enforcement are the main barriers to organize the producers, particularly, small-scale and artisanal miners.

From this point of view, and given the analysis of proposed alternatives, alliances are a well mechanism for organization of the mining sector in Boyaca. In the current situation, the legal processes for legalization are perceived as extremely complex (Benavides et al. 2011). Other organizative forms as firms or cooperatives that requires legal partners should fail in the middle term.

Opportunistic behavior is a real menace for the model. Nonetheless, more complete contracts and enforcement should reduce the negative impact of this menace. A third party monitoring is perceived as guarantor of efficiency in a long-term relationship. However, some authors consider that it is necessary to tolerate some level of opportunism (Wathne & Heide, 2000).

In the first steps, it is clear that the alliance strategy could be hard to implement, according with Inkpen & Ross (2001). Nonetheless, with the time social and political mechanisms of enforcement guarantee the persistence of the alliance. Moreover, the informal contracts are a significant support for formal contracts since they are based on trustiness and loyalty (Frankel, Whipple & Frayer, 1996)

The main contention is that changes are benefic not only for producers, but for the actors in the coal supply chain, as pointed out in previous studies (Pooe & Mathu, 2011). Small-scale miners could beneficiate more in cooperating with bigger firms; they can access more easily to financing, as proposed by Tirole (2010). Intermediaries involved will decrease their market power and this cleans the market and facilitates competence. Clients could obtain more quality and fair prices.

From the point of view of institutions, Government has a key role as facilitator. Allocation of rights and contract enforcement are main activities to develop. However, the extent of its participation overcomes the merely legal role. Promoting activities and education are part of a long-term strategy.

The scope of this work is not to propone a complete and definitively organizational form, but to put on the table the discussion from the point of view of the theory of the firm. It is necessary further research in fields like organizational behavior to guarantee the persistence of any organizational model.

There is no doubt that the theory of the firm indicates that actually there is an opportunity to make the Boyaca's coal industry more competitive and economically better efficient. Communities and society will be the beneficiaries. However, it is necessary the Government intervention through the public policy to reach the objective.

1 Source: Own elaboration. Data: INGEOMINAS.

2 Further information and detailed statistical information at www.dane.gov.co

3 Own calculation based on the information reported by UPME (2011) and Gobernación de Boyacá: http://www.boyaca.gov.co/gobernacion/presupuesto/25-gobernacion/presupuesto/265-presupuestos-2006-2007-2008-y-2010

4 Source: Own elaboration. Data: INGEOMINAS.

5 Further information and detailed statistical information at www.dane.gov.co

6 Own calculation based on the information reported by UPME (2011) and Gobernación de Boyacá: http://www.boyaca.gov.co/gobernacion/presupuesto/25-gobernacion/presupuesto/265-presupuestos-2006-2007-2008-y-2010

7 Centro de Investigación Económica y Social -FEDESARROLLO: http://www.fedesarrollo.org.co/

8 Source: Own elaboration. Data: INGEOMINAS.

9 This is a kind of administrative entity defined on a specific territory by the National Government (Mining Ministry), in association with the local Government. Its main characteristic is that the principal economic activity is mining. It is created with the purpose is to develop policies towards management and economic efficiency of mining activity (Fundacion para el Desarrollo del Quindío, 2008).

10 Boyaca has a sub-regional division called 'Provincias' (in English: provinces). This kind of territory is bigger than a municipality but smaller than a department. Each province has a number of municipalities and one recognized province's capital. There are 15 sub-regional divisions in total.

11 The report "Mineria de hecho en Colombia" (Fact mining in Colombia), by Güiza (2010) is part of a series of reports presented by the Defensor del Pueblo, in the developing of his functions in citizen rights defense.

12 Ardila (2010, 176). ND means Not Available.

13 Note for correction: When author of this table refers to Jericó, it is a municipality in Boyacá with the same name of another municipality in Antioquia, where environmental Authority is Corpoantioquia. However, concerning to Jericó (Boyacá) the environmental Authority is Corpoboyacá.

14 Source: translated from Benavides et al. (2011, 44).

15 This site is an official web site for a legalization process of any exploitation contract with the State: http://www.gobiernoenlinea.gov.co/web/guesVhome/-/government-services/4367/maximized

16 In his model, Spulber consider the time as a transaction cost (Spulber, 1996a, 560)

17 Tirole (2010) highlights that in spite of the existence of contracts, the final results could be different as written due to the role of Control Rights.

18 This type of contract is present in the Artisanal scale mining. The Small and Medium mining is more organized in this sense and have understand the importance to have formal contracts. However, contracts are subscribed just for short terms of three months to avoid continuity (Benavides et al. 2011, 43).

19 Some cooperatives are well recognized; as CARBOPAZ , which has been working for 19 years as producer cooperative. It has its own explotation title in Socotá and gathers more than 32 partners, and other partners working in other titles.

20 Source: own adaptation from Benavides et al. (2011, 203-207)

6. References

Act 354/2009 del Ministerio de Minas y Energía. Área de Reserva Especial en el Municipio de Jericó, Departamento de Boyacá, Resolución 354 (2009) Diario Oficial Año CXLIV. N. 47567, Diciembre. [ Links ]

Allen, J. W. & Phillips, G. M. (2000). "Corporate Equity Ownership, Strategic Alliances, and Product Market Relationships". En: The Journal of Finance, 55(6): 2791-2815. [ Links ]

Amaratunga, D. & Kumar, R. (1994). "Government policies towards small-scale mining". In: Resources Policy, 20(1): 15-22. [ Links ]

Apreda, R. (2001). "The Brokerage of Asymmetric Information" (CEMA Working Papers: Serie Documentos de Trabajo. No. 190). Universidad del CEMA. [ Links ]

Artz, K. & Brush, T. (2000). "Asset specificity, uncertainty and relational norms. In: Journal of Economic Behavior & Organization, 41(4): 337-362. [ Links ]

Ashoka, M. (1993). "Learning through alliances". In: Journal of Economic Behavior & Organization, 20(2): 151-170. [ Links ]

Aspinall, C. (2001). Small-scale mining in Indonesia. International Institute for Environment and Development, Mining Minerals and Sustainable Development Report, (79) 30. [ Links ]

Barry, M. (1995). Regularizing informal mining. Industry and Energy Department Ocasional Paper, World Bank Technical Papers Energy Series, 6). Presented at the A summary of the proceedings of the international round table on artisanal mining, Washington: World Bank. [ Links ]

Benavides, J., Cabrera, P., Salazar, N. & Zapata, J. (2011). Pequeña y mediana minería de carbón del interior del país: alternativa de comercialización y financiación a partir de la conformación de alianzas estratégicas. Informe Final, Bogotá, D.C.: Fedesarrollo [ Links ]

Betancurt, L. (2002). Sustainable indicators of the small coal mining in Colombia. Indicators of sustainability for the mineral extraction industries: 201-224. Brazil: CYTED-CETEM. [ Links ]

Bonus, H. (1986). "The cooperative association as a business enterprise: a study in the economics of transactions". In: Journal of Institutional and Theoretical Economics (JITE)/Zeitschrift Für Die Gesamte Staatswissenschaft: 310-339. [ Links ]

Bucklin, L. P & Sengupta, S. (1993). Organizing Successful Co-Marketing Alliances. The Journal of Marketing, 57(2), 32-46. [ Links ]

Chakravorty, S. (2001). "Artisanal and small-scale mining in India". In: Mining, Minerals and Sustainable Development, (78), 81. [ Links ]

Contractor, F J. & Lorange, P (2002). Cooperative strategies and alliances. USA: Emerald Group Publishing. [ Links ]

DANE (2011). Informe de coyuntura económica regional -ICER 2011. Bogotá: Banco de la República-DANE. [ Links ]

Das, T. K. & Noushi, R. (2002). "Opportunism dynamics in strategic alliances". In: Cooperative strategies and alliances (1 Edition) Elsevier Science Boston, MA. [ Links ]

Davidson, J. (1993). "The transformation and successful development of small-scale mining enterprises in developing countries". In: Natural Resources Forum, 17(4): 315-326. [ Links ]

Dreschler, B. (2001). 2Small-scale mining and sustainable development within the SADC region". Mining, Minerals and Sustainable Development, (84), 165. [ Links ]

Fothergill, S. (1994). "The Impact of Regional Alliances: the Case of the Eu Coalfields". In: European Urban and Regional Studies, 1(2): 177 -180. [ Links ]

Frankel, R., Whipple, J. S. & Frayer, D. J. (1996). "Formal versus informal contracts: achieving alliance success". In: International Journal of Physical Distribution & Logistics Management, 26(3): 47-63. [ Links ]

Franks, D. M., Brereton, D. & Moran, C. J. (2010). "Managing the cumulative impacts of coal mining on regional communities and environments in Australia". In: Impact Assessment and Project Appraisal, 28(4): 299-312. [ Links ]

Gehrig, T. (1993). "Intermediation in search markets". In: Journal of Economics & Management Strategy, 2(1): 97-120. [ Links ]

Gillingham, J. (1995). "The European coal and steel community: an object lesson?". In: Eichengreen (Ed.) B. Europe's post-war recovery. Great Britain: Cambridge University Press. [ Links ]

Gordon, R. L. (1987). World coal: economics, policies, and prospects. Great Britain: Cambridge University Press. [ Links ]

Güiza, L. (2010). La minería de hecho en Colombia. Bogotá: Defensoría del Pueblo. [ Links ]

Haeussler, C. & Higgins, M. J. (2013). "Strategic Alliances: Trading Ownership for Capabilities". Presented at the 35th DRUID Celebration Conference, Barcelona: ESADE Business School. Retrieved from http://www.wiwi.uni-passau.de/fileadmin/dokumente/lehrstuehle/haeussler/Publikationen/ Publications_in_Re-feered_Journals/Haeussler_Higgins_Trading_Ownership_for_Capabilities_JEMS.pdf [ Links ]

Hansmann, H. & Kraakman, R. (2000). "Organizational law as asset partitioning". In: European Economic Review, 44(4-6): 807-817. [ Links ]

Hart, O. D. (1988). "Incomplete Contracts and the Theory of the Firm". In: Journal of Law, Economics, & Organization, 4(1) 119-139. [ Links ]

Hart, O. & Holmstrom, B. (2010). "A theory of firm scope". In: The Quarterly Journal of Economics, 125(2): 483-513. [ Links ]

Hilson, G. (2009). "Small-scale mining, poverty and economic development in sub-Saharan Africa: An overview". In: Resources Policy, 34(1): 1-5. [ Links ]

Inkpen, A. C. & Ross, J. (2001). "Why do some strategic alliances persist beyond their useful life?" In: California Management Review, 44(1). [ Links ]

Jáhnig, A. (2007). Coal Deposits of Colombia. Master Thesis. Freiberg, Technische Universitat Bergakademie Freiberg. [ Links ]

Kandemir, D., Yaprak, A. & Cavusgil, S. T. (2006). Alliance orientation: conceptualization, measurement, and impact on market performance. In: Journal of the Academy of Marketing Science, 34(3): 324-340. [ Links ]

Kitula, A. G. N. (2006). "The environmental and socio-economic impacts of mining on local livelihoods in Tanzania: A case study of Geita District".In: Journal of Cleaner Production, 14(3-4): 405-414. [ Links ]

Koljatic, M. & Silva, M. (2011). "Alliances in SMEs and cooperatives involved in business with low income sectors in Latin America". In: Revista Innovar, 21(40). [ Links ]

Krug, B. & Mehta, J. (2001). Entrepreneurship by Alliance (Report series No. ERS-2001-85-ORG). Erasmus Universiteit Rotterdam: Erasmus Research Institute of Management (ERIM). [ Links ]

Lahiri-Dutt, K. (2007). "Illegal coal mining in eastern India: Rethinking legitimacy and limits of justice". In: Economic and Political Weekly: 57-66. [ Links ]

Law 141 (1994) Diario Oficial. Año CXXX. N. 41414. 30, Junio. Creación del Fondo Nacional de Regalías, la Comisión Nacional de Regalías, y regulación del derecho del Estado a percibir regalías por la explotación de recursos naturales no renovables. [ Links ]

Law 685 (2001) Diario Oficial. Año CXXXVII. N. 44545. 8, Septiembre. Código de Minas. [ Links ]

Law 1382 (2010) Diario Oficial. Año CXLIV. N. 47618. 9, Febrero. Modificación a la Ley 685, Código de Minas. [ Links ]

Mejía, T. S. (2005). La cadena del carbón. El carbón colombiano: fuente de energía para el mundo. Bogotá, D.C.: Ministerio de Minas y Energía-UPME. [ Links ]

Mesa Sectorial de Minería (2003). Caracterización ocupacionaldel sector minero (Estudio de caracterización). Sogamoso: SENA. [ Links ]

Molefe, N. & Ashworth, S. G. E. (2004). Transformation of the coal mining procurement supply chain. Retrieved from http://www.coaltech.co.za/chamber%20Databases%5Ccoaltech%5CCom_DocMan.nsf/0/ED183AAA1D7CBBE042257441002A58FA/$File/Task%203.8.3%20-%20SMME-BEE%20Procurement.pdf [ Links ]

Multcher, J. (1980). Coal-Cooperative Efficiency Program: small-mine operations. Berger Associates; Appalachian Regional Commission [ Links ]

Murry, D. & Zhu, Z. (2008). "Asymmetric price responses, market integration and market power: A study of the U.S. natural gas market". In: Energy Economics, 30(3): 748-765. [ Links ]

Pierson, F. C. (1950). Prospects for Industry-Wide Bargaining. In: Industrial and Labor Relations Review, 3(3): 341-361. [ Links ]

Ponce, A. (2005). Distritos mineros: exportaciones e infraestructura de transporte. Bogotá: Unidad de Planeación Minero Energética -UPME. [ Links ]

Pooe, D. & Mathu, K. (2011). "The South African coal mining industry: A need for a more efficient and collaborative supply chain". In: Journal of Transport and Supply Chain Management, 5(1): 316-336. [ Links ]

Rieber, M. & Soo, S. L. (1975). "Feasibility of coal mine cooperatives: a preliminary report and analysis". Urbana, Ill.: University of Illinois at Urbana-Champaign; Center for Advanced Computation [ Links ]

Ruiz, C. F., Henao, D., Lozano, M., Colorado, L. A., Mora, H., Velandia, J. & Salazar, M. (2012). Plan estratégico departamental de Ciencia, Tecnología e Innovación -PEDCTI. Departamento Administrativo de Ciencia y Tecnología -COLCIENCIAS. [ Links ]

Ruiz, H. (2007). Comportamiento del Sector Minero Colombiano 2004-2006. Bogotá: Superintendencia de Sociedades. [ Links ]

Spulber, D. F (1989). Regulation and markets. USA: MIT press. [ Links ]

Spulber, D. F (1996a). "Market Making by Price-Setting Firms". In: The Review of Economic Studies, 63(4): 559-580. [ Links ]

Spulber, D. F (1996b). "Market microstructure and intermediation". In: The Journal of Economic Perspectives, 10(3): 135-152. [ Links ]

Spulber, D. F. (2009). The theory of the firm: microeconomics with endogenous enterprises, firms, markets, and organizations. USA: Cambridge University Press. [ Links ]

Tirole, J. (1994). The theory of industrial organization. MIT press. [ Links ]

Tirole, J. (2010). The theory of corporate finance. Princeton University Press. [ Links ]

UPME. (2004). Plan de acción para la sostenibilidad y creación de centros ambientales mineros -CAM, cadenas productivas y plan padrinos. Bogotá: Ministerio de Minas y Energía-UPME. [ Links ]

Vyas, N. M., Shelburn, W. L. & Rogers, D. C. (1995). "An analysis of strategic alliances: forms, functions and framework". In: Journal of Business & Industrial Marketing, 10(3): 47-60. [ Links ]

Warner, M., & Sullivan, R. (2004). Putting partnerships to work: Strategic alliances for development between government, the private sector and civil society. Greenleaf Publishing. [ Links ]

Wathne, K. H. & Heide, J. B. (2000)."Opportunism in Interfirm Relationships: Forms, Outcomes, and Solutions". In: Journal of Marketing, 64(4): 36-51. [ Links ]

Wengel, J., Ferreira, G. B., Restrepo, S. & Suárez, L. M. (2008). "Trayectorias empresariales: destrucción creativa, economías de escala, exportaciones y empleo". In: Revista de La InformaciónBásica, 3(2). [ Links ]