Introduction

The COVID-19 pandemic has ravaged many countries and economies and has become a global public health emergency. Containment and mitigation measures have been implemented as the virus tends to be easily transmitted. These measures are intended to stop the spread of the virus and save lives (Hsiang et al., 2020). However, the economic costs involved in this process have been very high. Developing countries may have less money, shallower financial markets, limited fiscal capacity, and weaker institutional management of their health systems, thus feeling the impact more acutely.

When governments carry out cash transfer programs, they maintain consumption levels (World Bank, 2020). A World Bank report mentions that the size of fiscal incentive programs has changed considerably from one country to another over the years (World Bank, 2020). In Brazil, Chile, and Peru, the government hands out money to help people who have trouble paying their bills with a size close to 7 % of GDP.

Ecuador, for its part, has been one of the worst affected countries, with one of the ten highest mortality rates in the world per million inhabitants. As a result, mitigation and prevention procedures have been implemented, including mobility restrictions, meetings, curfews, and the suspension of non-essential activities. These policies have led to a drastic decline in economic activity, which has decreased by 30 % through May, according to the Economic Monitoring Indicator of the National Statistics Institute (INEC)1. Employment has also been affected by these regulations. According to the same institution, the unemployment rate increased to 13 % in May 2020 from 4 % in the same period of 2019, which may have a detrimental effect on Ecuador's demonstrable success in reducing poverty over the last three decades (Ocampo & Sabogal, 2018).

Similarly, the informal labor market could be impacted. By 2020, about 1.9 million workers were classified as informal, representing one-third of the labor force. The prominence of the informal sector requires an examination of its evolution and determinants during the coronavirus era. Understanding this characteristic is fundamental to developing public policies to mitigate this problem. Therefore, the purpose of this study is to analyze the evolution of informality in Ecuador and its income fluctuations between January and May 2020. A contribution to the literature is made by examining the pandemic informal labor market, a relatively new topic that has received little attention in Latin American countries, particularly Ecuador.

The paper is organized as follows. The second section, referring to the literature review, presents the different theories on how informal activities are clustered. The papers in the third section address the study of labor informality in Ecuador and how it affects the country's inhabitants, followed by a list of Ecuador's economic policies to curb informality. The fifth part emphasizes the research process; it is divided into a presentation of the model used and the sources of the research. To conclude, the results of the quantitative tests and their respective conclusions are shown.

Literature Review

Informality is associated with unstable jobs, little human capital, small or sole proprietorships, labor instability, no social security affiliation, and inadequate physical conditions of workplaces (Uribe, 2006).

The expression "informal sector" was used in 1972 in an International Labor Organization (ILO) report on Kenya (inspired by an article by Hart, 1970). Its conceptual contribution was to establish that the problem of employment in less developed countries was not unemployment, but the low wages of salaried workers who were forced to work on their account or in small commercial and service enterprises, many of which were unregistered, unprotected, and unregulated. The Kenyan research identified an irregular labor market, pragmatically referred to as the "informal sector" (Tokman, 1987).

In Latin America, the term "informal sector" was coined and promoted by the Regional Employment Program for Latin America and the Caribbean (PREALC, for its acronym in Spanish). It defines informality as easily accessible activities based on own resources, family businesses, small scale of operation, labor-intensive technology, skills acquired outside the formal education system, and unregulated markets that welcome people who cannot enter the formal sector due to their little or no specialization.

The preceding is consistent with ECLAC's structuralist perspective. It considers informality as a social phenomenon resulting from the structural heterogeneity of less developed economies, where high productivity sectors coexist with low productivity sectors, giving rise to the occupational structure of these countries (Allen et al., 2018). Therefore, structuralist analysis sees labor informality as a scarce development of the economic sector that prevents workforce from being fully covered, forcing the surplus population, whether skilled or unskilled labor, to work illegally, earn low wages, or, worse, lose their jobs. It is referred to in contemporary literature as the exclusion dimension of informality (Perry, 2008); in this structuralist framework, several works by Lewis (1954) or Hart (1970) stand out.

The structuralist view presents economic dualism (Doeringer & Piore, 1971). The modern sector encompasses activities with economies of scale in human capital and physical capital; the traditional or informal sector is that of low physical capital and less demanding labor training requirements. The informal sector tends to occur in small units with low productivity since it usually exceeds the equilibrium with the entry of workers. This situation does not allow achieving a level of efficiency in labor terms, creating a significant inequality gap between those who manage to enter the formal sector and those who are unable to do so regarding employment and per capita income.

According to the structuralist approach, informal jobs are the result of a lack of symmetry between demand and supply, both qualitative and quantitative, impacting the economic structure directly related to the labor market. The informal market receives surplus or unemployed labor from the formal market, allowing subsistence for the worker but eliminating the privileges of those who work formally (Arango & Hamann, 2013). The structuralist theory analyzes the existing gaps that keep labor demand lagging and explain the excess labor supply (Harris & Todaro, 1970). Table 1 presents the factors that show the behavior of demand and supply in the structuralist approach:

Table 1 Factors affecting the informal market according to the structuralist approach.

| Demand | Supply |

|---|---|

| Poor structural development of the economy (low economic diversification) | The demographic transition in its second stage. When the mortality rate has already decreased, but the birth rate is still high |

| Use of capital-intensive technologies | Urban migration flows |

| The policy of reducing the size of the State, whose workers are formal | Greater participation of family members other than the head of household, especially women |

Source: Rodríguez and James (2017)

Formal sector workers tend to improve their income over time, thanks to a more significant accumulation of human capital and work experience. This allows for companies' greater productivity, increasing economies of scale.

In this theory, a branch contributes its view of labor markets, called the creation of internal labor markets (ILB) in the modern sector, regulating aspects such as hiring, promotions, and wage increases, through associations or unions that represent workers and speak to companies. "The internal labor market consists of a set of employment relationships structured within the company, incorporating a set of formal (as in unionized companies) and informal rules, which govern all their jobs and interrelationships" (Taubman & Wachter, 1986, p. 1526).

With the above, we could think of creating some rules of the game between employees and employers to seek mutual benefit. Employees expect greater stability with a long-term wage increase, while the company gets better performance, workers' commitment, lower hiring and training costs, and a better working environment. All the above takes a toll on the supply, building a segmentation between the formal and informal market. For the secondary sector, the panorama is more difficult from a ILB point of view because workers' salary depends on their competitiveness-which decreases their income-, a lack of social and health benefits, and non-compliance with legal and labor regulations. The informal sector does not have a share in the ILB due to its scarce income and inadequate training of its workers, causing a low accumulation of human capital.

The institutionalist theory argues that informality is due to the high costs of establishing, managing, legalizing, and acting as an enterprise in a system of institutional legality, facing risks and situations that make the process of promoting formality and decent working conditions even more difficult. People working for the government or other groups covering taxes, labor, utility payments for economic activity, the environment, among others, establish this type of framework. Since agents can make their own decisions, they may opt for informality rather than dealing with all the costs and government corruption involved in setting up a legally incorporated business (Uribe, 2006).

The ILO, at the Fifteenth International Conference of Labor Statisticians in 1993, specified that informal sector enterprises are those unregistered or having a small number of workers, such as fewer than five, as they are unincorporated businesses that manufacture goods or services for sale or trade (Ortiz et al., 2007). The term "enterprise" refers to companies that hire workers and individuals who work for themselves or other companies.

The OECD, for its part, refers to the "shadow economy" as those activities that are legal but hidden from the authorities to evade tax and social security payments, as well as administrative procedures, minimum wage, and safety standards, among others (García et al., 2008).

The high cost of financing or the restrictive credit market also hinder the formalization of businesses, as documented in many developing countries (Botello, 2014), limiting the borrowing capacity by raising interest rates. Deficient or non-legalized economic units cannot borrow money to expand, invest, or undertake. Agents make cost-benefit decisions, and their choices are either formal or informal. The institutionalist theory results from a voluntary decision, where high transaction costs in the formal sector make entering the informal sector more attractive and valuable.

For Amin et al. (2019), one of the causes of informality are taxes and regulations by the government that hinder the creation of formal business. Formality is unattractive to those agents who are free in their decision-making and who, despite the benefits that the formal sector grants under legality, are not inclined to work in it. Kelmanson et al. (2019) and Mejía and Posada (2007) list the costs of formality and informality presented in the literature.

a) Formality costs: The costs associated with the official registration of the firm in government systems.

Cost of access: Legalization and registration procedures, bribery, financial costs

Permanence costs: Taxes, utility fees, labor benefits, and bureaucratic requirements

b) Costs of informality: By being outside the formal economic system, they are marginalized from bidding processes or financing facilities

Inability to access public goods provided by the government (legal, judicial, and police system)

Insecurity of property rights over capital and products

Contracts cannot be judicially guaranteed, devaluing them

Monitoring and transaction costs increase because contracts cannot be judicially backed

Access to credit is more costly because equity cannot be used as collateral for credit

Coase (1960, p. 121) refers to the fact that transaction costs can be, in certain situations, barriers between agents, reducing market efficiency. Some of these could cause certain transactions not to be achieved, promoting the informal sector. Other authors such as Hamann-Salcedo et al. (2012) and Rodríguez and James (2017) have noted the adverse impact of transaction costs on the labor market.

Public policy must consider the fiscal burden and the effects of institution degradation. For good decision-making, it is necessary to know the existing cost systems-social, tangible, intangible- and legislative regulation that reduces the negative externalities caused in a social environment (Rodríguez-Soto & Dussán-Pulecio, 2018). An institutional failure such as corruption directly influences the increase in informality. The institutionalist vision advocates laissez-faire in markets and asserts that state intervention in the economy to obtain liberation in labor markets is not advisable since it increases transaction costs.

Intellectuals become entrepreneurs and choose informality as a welfare option and not out of obligation. On the contrary, according to the structuralist view, informal workers are poor people forced to enter this sector (Rodríguez-Soto & Dussán-Pulecio, 2018).

In the end, labor informality is due to the lack of formal jobs and the market's inability to create jobs that make people happier. The modern private and public sectors cannot provide enough formal jobs, so the urban informal sector has become a way to obtain income to subsist precariously.

Ecuador's informal labor market

From a general point of view, the causes of labor informality are structural to Latin American economies (Arango & Posada, 2001; Sandoval, 2014). Since 1999, one out of three people willing to work formally cannot find a job. This level of informality makes Latin America one of the regions with the highest levels of informal workers compared to other similar regions (García & Cruz, 2017). This problem awakes the interest in investigating it in the country and its relationship with other relevant variables of economic development.

Albornoz and Ricaurte (2011) and the World Bank (2012) explored informality from 2000 to 2009, following up on different INEC methodologies. They argue an improvement in informality indicators based on government public policies supported by oil royalties. Along the same lines, Maurizio and Vázquez (2015) find that the intense formalization process has positively affected wage distribution, reducing inequality between groups. All the previous works highlight the need to reinforce the policies that have promoted formalization, especially facilitating the process of registering a new company in the public registry, reducing the tax burden on small businesses, improving access to credit, and making labor regulations more flexible.

In the case of the Latin American and Caribbean region, ECLAC (2020) estimates that a contraction of -1.8 % of GDP could increase the unemployment rate by ten percentage points, rising the number of poor people in the region from 185 to 220 million, while extreme poverty would increase from 67.4 to 90 million people. Because of this, multilateral cooperation is recommended, as it will be essential to overcome the effects of the pandemic.

As far as Ecuador is concerned, Acevedo et al. (2021) an inverse relationship is observed between GDP per capita and informality rates by country around 2018 and 2019 for population aged 15 years and older in the labor market before the pandemic. Ecuador is within the ten countries in the region with informality rates above 50 % and lower GDP, explicitly reporting a rate of over 60 % with a GDP of $10,000-$15,000.

In Ecuador, the employment rate for people over 15 years of age is above 60 %, with a marked labor gap for men, and the population between 15 and 19 years of age has the highest share in the rate. Concerning the population employed in the informal sector, the informality rate as a percentage of total employment is above 60 %, with a greater propensity to informality registered in rural areas and among the young population between 15 and 24 years of age. There are also differences in the percentage of people working in companies with 1 to 5 workers, which represent, in an extreme case, 83 % of total employment in Ecuador. For their part, it is young people between 15 and 24 years old who are at the top of Ecuador's inactivity and unemployment rates.

Among the main changes between 2016 and 2019 observed in Ecuador, there is a slight decrease (0.2 pp) in the percentage of unemployed working age population (WAP) and a much more notable decrease (10.5 pp) in informal WAP.

Regarding the Ecuadorian labor market's dynamics during 2020, the inactive WAP increased to 46 % for the second quarter, while the WAP with a formal job decreased to 15.3 % and the WAP with an informal job decreased to 33.9 %. These results are consistent with the ILO study (2020), which argues that changes in the labor market during the pandemic are not reflected in an increased unemployment rate; rather, due to mobility restrictions and lockdown measures, a large proportion of the employed population exited (at least temporarily) the labor force, increasing the percentage of inactivity. However, for the year's third quarter, a significant decrease in the inactive WAP (37.7 %) was observed, together with an increase in the percentage of WAP with informal jobs. The WAP employed in formal jobs maintained a downward trend for the third quarter of the year.

From the processing of household and employment surveys, we also found that, during the months of lockdown in 2020, women, people with fewer years of schooling, and the cohort aged 15 to 24 years register the highest rate of transition from informality to inactivity in all countries.

Ruesga et al. (2020) seek to determine the causes that generate greater informality in Ecuador with the econometric estimation methodology of logit and panel models. For this, they use data from the National Survey on Employment, Unemployment, and Underemployment (ENEMDU, for its acronym in Spanish), defining as dependent variable the probability of belonging to the informal sector and as explanatory variables rural or urban area, educational level, income, agricultural economic sector, sex, age, and role in the household.

As a result of the estimates made, it was found that informality is more prevalent in rural areas than in urban areas and that wages in the informal sector are lower than those in the formal sector. Likewise, it the representation of the male gender is more significant in the formal labor market than in the informal one, unlike women, most of whom belong to the informal sector. In general, and based on the different models estimated, it was deduced that the study could focus on variables related to the area of residence, educational level, productive sector, income range, and sex to explain labor informality. Consequently, the authors conclude that there is a greater probability of belonging to the informal labor market if the individual is a woman, works in the agricultural sector, resides in a rural area, has primary education, and earns less than the minimum wage.

In other nations, this issue has significantly impacted the labor market. Coibion et al. (2020) and Lemieux et al. (2020) have been able to study this in the United States of America and Canada. They have demonstrated a considerable decline in employment (20 million), which is much more than the total number of jobs lost during the Great Recession, a substantial decrease in the ability of workers to look for a new job, and a wage discrepancy between men and women. However, companies are rapidly implementing flextime policies. In addition, a considerable segment of the population has become economically inactive. Many parents must now assume primary responsibility for childcare.

This literature review only covers labor markets diametrically different from the Ecuadorian one. To contribute to this literature in Latin America and Ecuador, the methodological design with which this research aims to explore informality amidst the COVID-19 pandemic is shown below.

COVID-19 public policies in Ecuador

The Ecuadorian government has developed many policies. The first of these decrees restricted the mobility of people, especially children, adolescents, the elderly, people with disabilities and diseases, who needed specialized workers. It also ordered quarantines of non-essential activities.

As a result, the economy has suffered. In May 2020, the overall index of registered activities fell by 28 %. However, last year it was 8 %. The main economic sectors have been affected differently. For example, agricultural production fell by 11 % year on year, but industry and commerce plummeted by about 36 % annually.

The government has adopted several measures to solve these problems. Table 2 lists the economic decrees, especially those affecting the labor market. In summary, Ecuadorian legislation encourages teleworking and allows a 50 % reduction in working hours. Unlike other countries, the Ecuadorian labor market is unique. The administration has not allowed bonuses or suspension of vacations.

Table 2 COVID-19-era policies that affected the labor market in Ecuador

| Area | Policy | Start Date |

|---|---|---|

| Teleworking | All public and private companies must implement policies for teleworking during the health emergency. The suspension of normal working hours/conditions is extended for all workers until April 5. | 2020-03-21 |

| Teleworking | The suspension of normal working hours/conditions is extended for all workers until April 12. Starting April 13, a traffic light system will be implemented with different restrictions, depending on the province: red, orange, and green. | 2020-04-02 |

| Other labor protection policies | There are currently no policies in place for paid sick leave, unemployment insurance, and discrimination prevention in the context of COVID-19. | 2020-03-12 |

| Reduction of working hours | Reduction of working hours in the public sector to six hours, except in the health sector, armed forces, and police. The reduction for educators will be only one hour. This measure is expected to allow the public sector to save salaries of $980. | 2020-05-19 |

| Reduction of working hours | The Humanitarian Support Act will be in effect until 60 days after the end of the State of Emergency. Regarding working hours and salaries, the law establishes that private companies may reduce working hours by up to 50 % and salaries by 45 %. | 2020-06-22 |

Source: ECLAC (2020). COVID-2019 Observatory for Latin America and the Caribbean.

Among the consequences of not reducing labor costs, layoffs can cause rigidities in the formal labor market (Mondragón et al., 2012). Some economists have also noted why tax refunds and higher public spending would cause higher indebtedness, leading to a crowding-out effect (World Bank, 2020).

Materials and methods

Regarding the methodology used in the research, first, we analyzed the data on unemployment, informality, and inactivity of the EAP in Ecuador to determine the trends and origins of their variation. Next, a parametric model is used to determine the possible variations in the income of the informal population caused by COVID-19.

Measurement of labor informality in Ecuador

INEC classifies informal workers into two groups. The first comprises employed persons who work in companies that do not have a Single Taxpayer Registry (Registro Único de Contribuyentes-RUC, in Spanish). The second are employed persons who earn less than the minimum wage or work fewer hours than the legal working day during the reference week.2

The above coincides with the structuralist view, where social exclusion develops a pattern related to the informal economy. A worker's employment circumstances depend on his or her income, productivity, and education.

The primary data source used in this paper is the microdata from the Employment Survey, which considers probability sampling from the national and provincial levels. Due to the COVID-19 health emergency, the survey frequency was reduced in 2020. It was only conducted in May-June by telephone call3.

Model

This study aims to find out whether the wage distribution within the informal labor market changed significantly between 2019 and 2020, the years of the epidemic. Therefore, economists divide the wage gap into two parts: one explained by standard personal and occupational variables (such as age), and the other unexplained (Goraus & Tyrowicz, 2014).

Blinder (1973) decomposes the Mincerian equation parametrically. For example, he considers employee endowment characteristics, such as education and experience, and the imputed residual of control variables, such as nationality, gender, and race. To determine whether the wage distribution changed between May 2019 and May 2020, one must look at the wage distribution in May, before and during the pandemic.

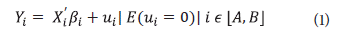

The procedure is as follows: First, select a continuous dependent variable (Y) and a set of categorical or continuous predictors (X). The Mincer equation is the basic equation (1974). Regarding the establishment of control groups, the treatment variable is the period covered by the survey, where zero weighting will be given if the survey was not conducted in May 2020. These factors are summarized in the equation below.

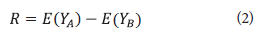

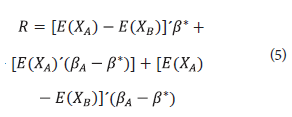

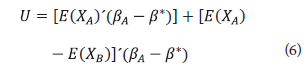

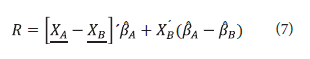

A and B are the groups to be controlled. The difference is within the expected wage value. The difference is found within the expected wage value.

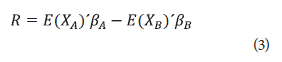

If we replace 1 in 2 and assume, E(u¡ = 0) we have:

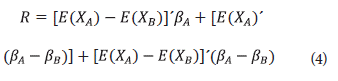

The algebraic decomposition presented by Daymont and Andrisani (1984) can be performed to understand all the effects that can be extracted from the above equation:

These three terms represent the various interactions between the coefficients, variables, and expected income values. Equation (5) represents a triple decomposition. The first term refers to endowment impacts, such as human capital, experience, and firm characteristics. The second measures coefficients based on comparison groupings. In general, the control characteristic is the temporal change between 2019 and 2020. The last one is based on the interactions of the two terms.

The predicted values of labor income are estimated independently using ordinary least squares. The predicted value for each group is then determined.

It should be mentioned that, within the economically active population, labor share may have changed due to the pandemic. Heras (2020) and Coibion et al. (2020) support this evidence. Consequently, a correction to the sample selection should be made. Their approach uses the two-stage sample selection correction procedure based on Heckman (1979), where a probabilistic equation is calculated on the individual's labor share based on his or her socioeconomic characteristics, which motivate this decision. We included in this work the number of children, the household's location, and whether the individual is married, assuming the existence of a set of coefficients that are not discriminatory, but are crucial to finding differences in the predictors. Suppose that is a hypothetical coefficient that can be replaced in Equation (5), as follows:

From Equation (6), two effects can be extracted; the first part is the inequality that is explained by the differences in the predictors. The second effect is the union of the last two terms:

These components are attributed to the part not explained by the predictors and to discrimination. However, it considers the effect of unspecified variables within the model. The procedure for this second decomposition tends to be more complex since the hypothetical beta must be calculated.

Oaxaca (1973), for example, assumes that β A = β* and β B = β*. The groups are interleaved, with Group A being the treatment group and Group B the base group. Another assumption derived from Oaxaca (1973) is one-way discrimination. Concerning Equation (7):

Results and discussion

Table 3 shows the variability of the period studied, reflecting how unemployment has increased for all rural and urban areas. The national total has tripled from 366 thousand people to one million. In relative terms, unemployment has climbed from as high as 13 % in June 2020 compared to 4.45 % in the same period of the previous year. Urban areas have higher unemployment (16.8 %) while it has not exceeded 6 % in rural areas.

Table 3 Number of people in the labor market in Ecuador. June 2019 vs 2020

| Category | Total | Urban | Rural | |||

|---|---|---|---|---|---|---|

| Jun-19 | Jun-20 | Jun-19 | Jun-20 | Jun-19 | Jun-20 | |

| Working Age Population (WAP) | 12,316 | 12,491 | 8,573 | 3,743 | 8,705 | 3,786 |

| Employed | 7,866 | 6,596 | 5,125 | 2,741 | 4,279 | 2,317 |

| Unemployed | 366 | 1,010 | 303 | 64 | 865 | 144 |

| Economically Inactive Population | 4,084 | 4,885 | 3,146 | 939 | 3,561 | 1,325 |

Source: Authors' calculations based on INEC data.

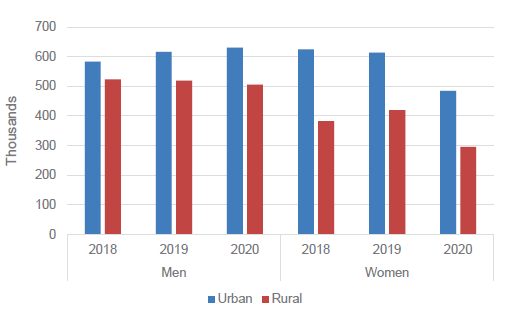

According to the non-full employment criterion for the informal population 1.9 million workers were counted under this identification in May 2020. The preceding represented a drop of 11 % compared to one year ago. This trend is distributed as follows by area: in the rural sector, there was a reduction of 139 thousand people (-11 %) compared to the urban area with 114 thousand (-9 %); by gender, a total of 1.1 million male workers were reported compared to 781 thousand female workers.

This variation in the informal population was due to the significant reduction of women.

Figure 1 shows how in the urban sector the decrease was 129 thousand and 123 thousand in the rural sector. The informal male population remained as of May 2020 at the same levels as in 2019 and 2018. This permanence of the phenomenon of informality can be supported by the statements of Sandoval (2014), given the structural weakness of the Latin American productive apparatus.

Source: Authors' calculations based on INEC data.

Figure 1 Number of informal workers by gender and area. May of each year.

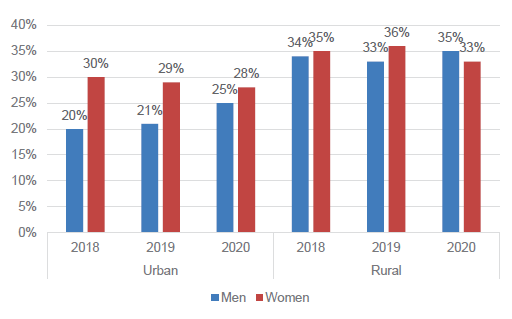

Figure 2 presents the trends of informality by gender in Ecuador in relative terms. In May 2020, 29 % of Ecuadorian workers were informal, representing a slight increase of 2 % compared to the same period in 2019. Figure 2 details the rate of those employed in the informal sector by gender and area in May 2018, 2019, and 2020. The two results show a higher rate for women (28 %) versus men (25 %). However, the employed male population had a significant increase since 2019. The rates have remained constant in the rural area, averaging 34 %.

Source: Authors' calculations based on INEC data.

Figure 2 Informality rate by gender and area. May of each year.

As in the case of the formal population, the hours worked have been significantly reduced for the informally employed population. Table 4 shows an average decrease of 20 % for all types of occupations.

Table 4 Weekly hours worked by gender. May of each year.

| Occupation category | Men | Women | ||

|---|---|---|---|---|

| 2019 | 2020 | 2019 | 2020 | |

| Private employee | 42.33 | 38.43 | 41.11 | 36.71 |

| Self-employed | 38.84 | 29.46 | 35.12 | 27.78 |

| Laborer or day laborer | 39.12 | 30.91 | 35.58 | 28.89 |

| Total | 39.55 | 31.45 | 36.79 | 30.86 |

Source: Authors' calculations based on INEC data.

Nevertheless, these differences in informality and unemployment rates are contextualized by the variations of the economically active (EAP) and inactive (EIP) population. From Table 3, it can be inferred that between June 2019 and 2020, the EAP decreased by 7.6 %, and the EIP increased 19 %. The former decreased by 626 thousand people, and the latter increased by 800 thousand. The total WAP did not change significantly overall (+1.4 percent or 174 thousand individuals), indicating that a more significant proportion of the economically active population became part of the inactive population because of the pandemic. This would have resulted in an unemployment rate of 17 percent instead of the current 13 percent.

According to microdata from the INEC Household Survey shown in Table 5, most of the active population turned to home occupations with an increase of 299 thousand people (19 %) and studying with 249 thousand (17 %).

Table 5 WAP activities. May of each year.

| Activity | 2018 | 2019 | 2020 | Abs. Var. | Var. % |

|---|---|---|---|---|---|

| Working | 7,648,773 | 7,865,786 | 6,595,606 | -1,270,180 | -16.1 |

| Looking for a job | 330,097 | 366,163 | 1,009,583 | 643,420 | 175.7 |

| Retired pensioner | 365,532 | 424,450 | 651,162 | 226,711 | 53.4 |

| Student | 1,433,910 | 1,423,473 | 1,673,033 | 249,560 | 17.5 |

| Household occupations | 1,613,341 | 1,555,750 | 1,855,230 | 299,480 | 19.2 |

| Disabled | 445,656 | 470,519 | 594,744 | 124,225 | 26.4 |

| Other | 186,538 | 210,052 | 111,217 | -98,836 | -47.1 |

| Total | 12,023,846 | 12,316,194 | 12,490,574 | 174,380 | 1.4 |

Source: 'Authors' calculations based on INEC data.

Variations in the tasks performed by workers during the pandemic, on the other hand, varied dramatically by the gender of workers. The employed female population decreased by 690 thousand, or 20 percent, between May 2019 and May 2020, according to Table 6. The employed male population decreased by 12 percent, or 579 thousand, between May 2019 and May 2020. Females gained ground in home occupations (+293 thousand). The number of male job seekers rose 202 percent between 2019 and 2020, from 173 thousand to 347 thousand unemployed men.

Table 6 WAP activities by gender. May of each year.

| Men | Women | |||||

|---|---|---|---|---|---|---|

| Activity | 2019 | 2020 | Variation | 2019 | 2020 | Variation |

| Working | 4,563,264 | 3,983,753 | -579,510 | 3,302,522 | 2,611,852 | -690,670 |

| Looking for a job | 173,489 | 524,625 | 351,136 | 192,674 | 484,958 | 292,284 |

| Retired pensioner | 214,399 | 347,612 | 133,213 | 210,051 | 303,549 | 93,498 |

| Student | 690,038 | 821,642 | 131,604 | 733,435 | 851,391 | 117,956 |

| Household occupations | 11,820 | 17,910 | 6,090 | 1,543,930 | 1,837,320 | 293,390 |

| Disabled | 258,599 | 349,796 | 91,197 | 211,920 | 244,948 | 33,028 |

| Other | 112,449 | 63,800 | -48,649 | 97,603 | 47,417 | -50,186 |

Source: Authors' calculations based on INEC data.

The results obtained at this level are consistent with those obtained by Coibion et al. (2020) and Lemieux et al. (2020) in North America and Canada and other researchers. In summary, there has been a significant increase in unemployment, mitigated to some extent by a shift from active to inactive population over the past few years and decreased informality.

Income

The Oaxaca-Blinder model estimated the wage change between May 2019 and May 2020. It uses the hourly labor income of informal workers as the dependent; the decomposition results are shown in Table 7.

Table 7 Wage decomposition by year.

| Differential | Coef. | Std. Err. | z | P>|z| |

|---|---|---|---|---|

| Log (Ing_hora)2020 | 1.23 | 0.02 | 62.88 | 0.00 |

| Log (Ing_hora)2019 | 1.51 | 0.01 | 170.68 | 0.00 |

| Diff. | -0.29 | 0.02 | -13.41 | 0.00 |

| Descom. | ||||

| Explained | 0.0030 | 0.0076 | 0.3900 | 0.6930 |

| Unexplained | -0.2904 | 0.0206 | -14.1200 | 0.0000 |

Source: Authors' calculations based on INEC data.

Between 2019 and 2020, hourly labor earnings of informal wage earners are projected to decline by 29 percent. Because the null hypothesis that the coefficient associated with variation equals zero is rejected at a rate of 1 percent, this difference is statistically significant. Since the explained component of the decomposition is not statistically significant, the discrepancy can be explained by the effect of the unexplained part of the decomposition.

Most of the difference is due to the variables not included, such as those related to time variation (-60 %). The variables incorporated into the model produce a positive variance of 31 percent of the unexplained portion, a significant variation. Aspects such as age, location, and type of activities performed are the most positive contributors. These factors should be considered for future formalization processes. According to Maurizio and Vázquez (2015), such processes are necessary to improve the wage inequality structure within countries.

These results seem to identify the time difference between estimates as the cause of informal workers' drop in hourly earnings. Coronavirus mitigation may have reduced the wages of informal workers by as much as 31 %, given the reduced job possibilities.

Conclusions

The COVID-19 pandemic has seriously affected Latin American economies. In August 2020, Ecuador counted nearly 110,000 infected and 6,500 dead. The government has undertaken several restrictions on mobility and economic activity in response. These measures have weakened the economy and significantly impacted the labor market.

About whether there have been significant changes in wage distribution within the informal labor market in 2019-2020, the year of the pandemic in Ecuador, we observed a 2 % increase in the informality rate, which in May 2020 stood at 29 %.

In absolute terms, this represents a population of 1.9 million informal workers, an annual reduction of 20 %. These results were due to the drop in the number of employed workers who are part of the EAP and have migrated to the inactive population. In another scenario, the unemployment rate would not have been 13 % but 17 %. The transition from work to inactivity has been very different for men and women. The former devoted themselves to job search, while the latter took on household chores. These conclusions are like those drawn by Acevedo et al. (2021) on the weakness of the Ecuadorian labor market and the transition of specific populations within the economically active population.

Regarding wages, the empirical results coincide with the predictions of the Mincerian model and the structuralist scenarios of informality. The empirical data are consistent with the model, which predicts a decrease in wages as the labor market adjusts to changes in labor supply and demand. Similarly, Ruesga et al.'s (2020) results on the determinants of informality are consistent with the variables that contribute to explaining wage variability in the model.

Continuing with the results, the hourly wage of the informal population fell on average by 29 %. Supply and demand shocks by the pandemic triggered this movement, while workers' endowments mitigated its consequences. As defined in Gamero and Pérez (2020), these shocks pose a challenge for governments, given that it cannot be anticipated whether they are transitory in structure or will remain, thus causing changes in the wage structure of Ecuador's employees. In the United States, the COVID-19 effects have been noted in a massive resignation of workers while finding bottlenecks in the labor supply in some sectors (Coombs, 2020).

While addressing health challenges, policymakers will need to carefully consider the efficacy and socioeconomic effects of containment and mitigation programs. Mass detection and control should also be used to restrict the spread of the virus. Ecuador has responded by restricting mobility. Public policy should respond by making direct and significant payments to the most vulnerable to reduce the impact on consumption.

However, in many developing countries, fiscal space and multipliers are limited and monetary transmission is inadequate. Macroeconomic policy in developing countries should avoid procyclicality, maintain public services, and help those in need. The global nature of COVID-19 requires international coordination regarding economic policy, health care, science, containment, and mitigation. Government action and public service delivery must be well designed.