Introduction

International Financial Reporting Standards (IFRS) 16 Leases began implementation on January 1, 2019, introducing significant changes to the financial statements of the adopting companies. The measurement and analysis of the effects of the adoption of new standards has generated growing interest for regulators in adopting countries (Molina and Mora, 2015). Along this path of analysis, academic research has a fundamental role that can help those in charge of establishing accounting standards and policies understand the effects of the standards on entities (Trombetta et al, 2012).

A new standard can have microeconomic and macroeconomic effects. The variations seen after the implementation of the standard must be analyzed to identify the actual effects of the standard and to evaluate to what extent the standard has met the objectives set by the standardization board. To do so, one must understand that the standards can produce different variations in different groups (EFRAG, 2011). In this regard, Haller et al. (2012) show that the effects associated with a new standard may differ based on geographic region or industrial sector. Therefore, it is essential to identify the possible effects of IFRS 16 on leases in Latin American adopters, since there are no known previous studies that investigate the possible impacts on these entities, and it is essential to establish if the effects given in the literature in external contexts are replicated in this case in Colombian entities listed on the Stock Exchange.

In addition, the implementation of IFRS 16 entails the elimination of differences in the revenue recognition between financial and operating leases, which creates a single recognition model under the lessee category. Therefore, all leases are incorporated into the financial statement, which increases the assets and liabilities of the entity (Molina and Mora, 2015). These changes also generate substantial variations in the income statement, statement of changes in equity, and cash flow statement, as the effect on liabilities depends on the maturity date and the recognition of existing commitments. This situation ultimately impacts the key financial ratios of the entities, especially those related to the leverage and debt of the adopting companies, and it affects the capital structure, debt commitments, profit sharing, stakeholder returns, and the real returns of the companies, since the equity of the entities is negatively impacted (Fitó et al, 2013; Rivada et al, 2014).

Furthermore, the disclosure characteristics that must be met are important to consider. This topic has been addressed by Arimany et al. (2018), who identify non-compliance with disclosures required by the leasing standard. As a result, it is necessary to identify the variations in the disclosure characteristics that adopting companies must follow, as well as whether the disclosures required under the new standard are being made, identifying if there are improvements in the information available to users.

As previously noted, the effects of the implementation of the new standards must be studied before the standard is applied and after it is adopted, and the lack of research that addresses this issue in Latin America reinforces the need to analyze the effects of the implementation of IFRS 16 Leases. Therefore, this study seeks to identify the effects of the implementation of IFRS 16 Leases on the financial statements and notes to the financial statements of the 67 companies listed on the Colombian Stock Exchange (BVC). The methodological development of the study includes the application of Gray's conservatism index and the application of the content analysis technique, to identify the qualitative variables of the study. This research also contributes to identifying how the practices of the institutions change in real contexts, intending to have a lesser impact on the financial statements of the adopting entities. To this end, the methodology used to analyze the data is first presented. Then, the results are explained in detail. Finally, the conclusions of the study are presented.

Literature review

IFRS is continually updated due to various regulatory issues that are of public interest. A discussion of an issue related to leases resulted in the subsequent publication of IFRS 16. The discussion of the publication of the new standard, which modified the conditions in IFRIC4, SIC 15, SIC 27, and IAS 17, in effect since 2001, began in March 2009 with the publication of the discussion document; in August 2010, the first project of the standard was issued. Then, in May 2013, the second amendment project was issued, and in January 2016, the new IFRS 16 was issued, with an implementation date of January 1, 2019 (International Accounting Standards Board IASB, 2016).

The IFRS 16 amendment process described above is the result of a joint project initiated by the International Accounting Standards Board (IASB) and the U.S. Financial Accounting Standards Board (FASB). Its ultimate objective was to eliminate the differences between the us GAAP (the United States Generally Accepted Accounting Principles) and the IFRS and to resolve the informational limitations faced by users due to operating leases and the risk exposure of the entities caused by this type of contract. However, the final results of the convergence process were not the same for the two regulators, since the FASB decided to continue with a dual model for the lessee, in which a distinction must be made between operating and capital leases; therefore, the accounting of the two differs (Deloitte, 2016).

Regarding the objectives achieved by the IASB, the standard introduced significant changes in terms of the recognition, measurement, and disclosure of leases. Thus, IFRS 16 (2016) establishes that a lease is one that "conveys the right to use an asset for a while in exchange for consideration" (p. 8). Additionally, the standard clearly shows the factors that distinguish between leases of an identified asset and service contracts.

The new standard substantially modifies the accounting of the lessee, a situation that differs from the objectives achieved by the FASB, since operating leases that were not being recorded in the financial statement are now included through a model that uses control recognition to identify the leases. Thus, the classification test that made it possible to differentiate between financial and operating leases has been eliminated. Consequently, a single recognition model has been created, which leads to the recognition of higher assets and liabilities in the statement of financial position. Similarly, the standard establishes the recognition of contingent rents or variable payments in the measurement of lease assets and liabilities when they depend on an index or a rate or when fixed payments are considered (PWC, 2018). In contrast, the revenue recognition of the lessor does not change, as it will continue to recognize operating and financial leases separately. However, IFRS 16 does establish some increases in the disclosures provided by lessors depending on risk exposure and, specifically, residual value risk exposure.

The changes presented above may affect the adopting companies. The term effects, as established by EFRAG (2011, p. 8), are "consequences that flow, or are likely to flow, from an accounting standard". The effects of a standard can be micro-economic, since dividends, share prices, and agreements between institutions may be affected, which makes a necessary comparison with the objectives pursued by the standard (Laughlin and Puxty, 1983). The effects can also be macroeconomic since there are changes in aspects such as the efficient allocation of resources and the remuneration effects of society (Haller et al, 2012).

Studying the effects associated with the implementation of a new standard helps legislators and regulators of standards had better understand the possible effects of accounting standards on organizations and their environment (Trombetta et al., 2012). In this regard, academic research has a fundamental role since it incorporates factors from previous experience that trigger analytical processes, which include the analysis of the ex-ante effects and ex-post effects of the application of the standard.

Adopters of a new norm are concerned about the contents of the standard from the issuance of discussion drafts. Specifically, for IFRS 16, the regulator entity received and analyzed more than 1700 comments before the final release of the standard (Deloitte, 2016). This early approach to the criteria of the standard and t the impacts on the adopting companies were analyzed by Mellado and Parte (2016), who identified the characteristics associated with the generation of lobbying groups in favor of modifying the aspects issued in the discussion papers of the IFRS 16 Leases standard. The authors classified the lobbying activity into three intensity categories and established that it is associated with the characteristics of the firm. Thus, larger and more profitable companies lobby more intensively. Similarly, companies that are involved with leases and that are directly affected by the proposal, dedicate more resources to lobbying since the accounting approach is considered decisive due to its ability to affect the future of the leasing industry.

Molina and Mora (2015), also studied the positioning of pressure groups and who analyzed the comments sent before IFRS 16 was released. The results show that the stakeholders involved in the process utilize the conceptual framework of the IFRS to present their arguments and make the task of lobbying against standard setting bodies more effective.

However, the studies that analyze the probable effects of the adoption of the standard focus on Europe. For example, Giner et al. (2018) simulated the effects of the application of IFRS 16 in companies listed in the STOXX All Europe 100 index using the Monte Carlo method. The results of this research show that aspects such as liquidity and return on assets would decrease, while leverage and return on equity would increase. In addition, the results show that certain strategies can be applied to soften the impact of IFRS 16 (e.g., reducing the lease term). Similarly, Morales-Díaz and Zamora-Ramírez (2018) analyzed 646 European companies listed on the stock market and found that, after adopting the IFRS 16, the key financial balance ratios of the companies are significantly impacted, especially in terms of leverage.

On the other hand, researchers in Europe have studied topics other than the impact of IFRS 16 on financial statements. For example, Arimany et al. (2018) analyzed the level and evolution of the criteria of the breakdown of information associated with operating leases. The study sample included Spanish and British companies between 2005 and 2011. The results of a profit model for panel data show that England organizations have higher levels of disclosure than Spanish companies, and the determinants are associated with media coverage and the company's sector.

Rivada et al. (2014) also cover "Spanish and British companies but focus on the effects of the standard on listed companies". The results show that the impact is significant, with decreased ROA (return on assets) and increased debt ratio. The authors identify that the company's sector is more representative than its country of operation. Additionally, the study suggests that due to the implementation of IFRS 16, companies may choose to modify their financing policies to mitigate the effect of the standard.

Fitó et al. (2013) analyzed 52 Spanish companies for the period between 2008 and 2010, and they assessed the potential impact of the standard using the constructive capitalization method and compared it with the factor method. The results show that the impact is significant for the leverage ratios, which may be an important economic consequence since it would affect the capital structure, debt commitments, and relative position of the organization in the market. The study also shows that the most affected companies are those in the retail and energy sectors.

In Spain, Giner and Pardo (2018) analyzed "whether the capitalized operating leases presented in the footnotes of financial statements by the Spanish companies listed in the stock exchange for the period from 2010 to 2013 are valued by users when setting market prices". Similarly, the research identifies the effect of including operating leases using the constructive capitalization method; the results suggest that the change will not have a significant impact on stock market users but that variations in the debt commitments of the adopting companies are expected.

Furthermore, Pardo and Giner (2018) study the nonfinancial entities in Spain listed in the IBEX 35 and identify the consequences of a change in accounting standards on operating leases in companies and financial information users. The constructive capitalization method is used, and nonparametric tests are used to estimate the effect on the key ratios of the companies. The results show that the impact on the ratios of the entities is significant, and it is more representative of larger companies with higher market value. The study also identifies that companies in the retail sector show a greater increase in EBITDA (earnings before interest, tax, depreciation, and amortization).

As for other geographical areas, Chatfield et al. (2017) carried out a study of hotel companies in the United States. The study shows that hotel companies make extensive use of operating leases. Consequently, the implementation of the standard unfavorably impacts debt ratios and leasehold interest coverage. In addition, it was found that the implementation can take time and money for companies in the sector. In addition, Alabood et al. (2019) analyze the impact of IFRS 16 on three airlines that operate in the Middle East and demonstrate that the recognition of operating leases in the financial statement creates great challenges for these entities, including the market response to radical changes in the key ratios of the companies.

Another study that analyzes the impact of IFRS 16 Leases was carried out by Nurkasheva et al. (2018), who showed that the financial indicators, capital leverage, and EBITDA of Kazakhstan companies are significantly impacted and that the impact was greatest for retail and airline companies. The study also suggests that the new standard may influence the special terms of loan contracts, credit ratings, loan costs, and stakeholder perception of the company. In Colombia, the study conducted by Moreno and Díaz (2019) analyzes the possible effects of IFRS 16 on leasing agreements for companies in the aeronautical sector, identifying that with the entry into force of the standard, there may be changes in the recognition of leasing contracts that were previously recognized as operating and that with IFRS 16 will be recognized in the financial statement.

Similarly, research conducted in Mexico by Lambreton and Rivas (2017) shows that after the incorporation of the standard, changes in the financial statements associated with increases in assets, current liabilities, and long-term liabilities are expected. On the other hand, decreases in equity are expected because of the standard on retained earnings from capitalization. In Brazil, the study conducted by Barboza and Katsumi (2018) identifies that the implementation of the standard will produce variations in key indicators such as ROA, ROE and, EBTDA, this study also shows that because of the adoption of the standard, an increase in the use of professional judgment in the recognition of economic operations in the financial statements is expected. This partially coincides with the research conducted by Suzuki, Viera and Willrich (2021) which shows variations in the indicators of leverage, capital structure, and profitability of the organizations.

Studies following the adoption of the standard in Latin America focus on Brazil. Rodrigues et al. (2022) analyzed the impacts reflected in the economic and financial indicators after the adaptation to IFRS 16 using the consolidated financial statements of 2018 and 2019, evidencing that, in the components of total assets, fixed assets, non-current liabilities and net income a positive variation is presented concerning the previous year and only current liabilities decreased; in the indicators of liquidity, ROA and capital structure refer to the composition of long-term debt and the equity participation of third parties, a reduction was presented. In this same line, Vitor Seidler and Fagundes (2020), show how the adoption of IFRS impacts the equity structure of companies and produces changes in the explanatory notes accompanying the financial statements.

On the other hand, De Sousa Silva, Gonzales, and de Almeida Santos (2022) analyze the level of compliance with the accounting disclosure requirements required by IFRS 16, finding that most companies have not yet adapted to the level of the disclosure, outlined in the new technical standard, since they disclose a little more than half of the items set forth.

The studies presented in the prior literature above show the importance of analyzing the impact of IFRS 16 on organizations. Some previous studies have revealed the potential effects of the standard in Latin America and other countries, but no known study has analyzed the effects of the standard in the post-adoption period in Colombia. Therefore, this study is an important tool that can be used to understand the effects of the leasing standard in Colombian companies, identifying useful aspects of the new regulatory framework

Methodology

The methodology used to develop this research is a mix of qualitxative and quantitative approaches. First, a quantitative analysis is performed to identify the potential impacts of the standard. In this case, Bolsa de Valores de Colombia. (2019) states that "the financial statements and notes are studied for 100 % of the entities listed on the Colombian Stock Exchange, which amount to 681 Colombian entities with active marketability as of December 2019". These reports, which serve as the primary source of information, are taken from the data published by the Super Intendencia Financiera de Colombia.

In the first application of IFRS 16, the potential effects of the application of the standard were established to identify whether the entity presented a variation due to reclassification or equity impact, whether it did not present a material impact or whether information on the impact and/or implementation of the standard was not provided. The financial statements of entities that presented equity impacts were analyzed using the Gray Conservatism Index. The conservatism index has its origin in the cultural influence theory of accounting (Gray, 1988). The elimination of conservatism can alter managerial behavior by imposing significant costs on investors.

The Gray Conservatism Index is used to measure the impact of IFRS 16 on the financial statements of the companies studied. This index has been previously used in studies conducted by Weetman and Gray (1990, 1991), Adams et al. (1993), Cooke (1993), Hellman (1993), Norton (1995), Jiménez et al. (2015a), Ali et al. (2016) Pelucio et al. (2019) and Karatzimas and Zounta (2011). Gray (1980) developed the measurement index in 1980, and it was subsequently modified by Weetman et al. (1998). This index allows the convergence process between accounting standards to be measured through empirical research and identifies the impact on the financial information presented (Jiménez et al., 2015b). Consequently, the measurement index enables the differences seen in the financial statements due to the implementation of the new standard to be calculated.

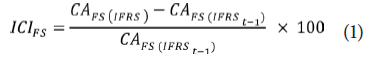

On this basis, and considering the needs of the research presented in this case, the variable used is represented by

Where:

CA FS (IFRS) = Component of the financial statement presented according to International Financial Reporting Standards (ifrs 16).

CA FS (IFRS t-1) = Component of the financial statement presented according to the International Financial Reporting Standards before ifrs 16 went into effect.

ICI FS = Individual comparability index for each component of the financial statements analyzed

Additionally, the literature review identified the key financial indicators that are potentially affected by the adoption of the standard, for which an ex-ante and ex-post analysis of the application of the standard is carried out.

Subsequently, the content analysis method is applied to the disclosures made by companies that adopted the standard is analyzed. Content analysis, as described by:

Chavez (2002), is any technique, method, or procedure that seeks to identify certain elements in documents, whether written, drawn, or recorded. In other words, content analysis involves the interpretation of texts from a compilation of information through systematic reading; here in, the disclosures of the financial statements of the companies listed in the bvc are considered

The content analysis is performed for 32 categories that correspond to the disclosures that both lessee and lessors must present, 20 of which correspond to the information of the lessee, and 12 correspond to that of the lessor. On this basis, a score of 0 or 1 is assigned; a value of 1 indicates that the entity must apply the standard as a lessee and/or lessor, and 0 is assigned otherwise. Once it is established that the entity must apply the section of the standard, whether the entity has disclosed the required regulatory aspects is analyzed. A value of 1 is assigned if the disclosure complies, and otherwise, a value of 0 is assigned. Thus, a total of 2176 analyzed data were obtained. Additionally, since it is the first annual report under IFRS 16, an analysis is carried out to identify which initial implementation solutions were used for the lessors according to Appendix C, subparagraph 10 of IFRS 16.

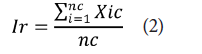

The disclosure index based on the IFRS 16 criteria is obtained by calculating the sum of the scores achieved by the company and then dividing by the maximum number of possible points, as follows:

Where:

Ir = Disclosure index by company.

nc = Number of categories evaluated. 1 if the entity being studied has the characteristic.

0 if the entity being studied does not have the characteristic.

Such that 0 < ir < 1

Considering the above literature, Giner et al. (2018); Morales-Díaz and Zamora-Ramírez (2018), Nurkasheva et al. (2018), and Fitó et al. (2013) it is evident that the indicators that may have the greatest impact are ROE, debt, and leverage; these indicators were calculated following the provisions in Table 1, shown below.

Table 1 Financial indicators

| Indicator | Calculation variables |

|---|---|

| ROE | Net income divided by equity |

| Debt | Total Liabilities divided by Total Assets |

| Leverage | Total Liabilities divided by Total Equity |

Source: Elaboration by authors

To analyze the impact of the standard on these three indicators, we simulated in 2019, what would be the result of the main components of the financial statement. For this purpose, the notes to the financial statements were analyzed and the accounting entries associated with the impact of the standard were reversed. In this way, the data without the effect of IFRS 16, were obtained.

To identify if the variation in the equity of the companies after the adoption of IFRS16 is significant, the Wilcoxon test is performed. This test allows us to identify the significant differences in two related samples (Wilcoxon, 1945). In this context, we construct the following research hypothesis:

The equity of Colombian entities after the adoption of IFRS 16 differs significantly from the equity of these entities as the effects of adoption are not included.

Results and discussions

The analysis of the impact of the first adoption of IFRS 16 on the entities listed in the BVC shows in Table 2 that 50.00 % of the entities present variations due to reclassification in the statement of financial position, which is the highest percentage for the companies observed. Similarly, 17.65 % of the entities show equity variation, as detailed in Table 3, and 14.71 % do not show material impacts, as specifically reflected in the financial statements. Furthermore, 8.82 % do not relay information associated with the impact of the implementation of IFRS 16 but did modify their policies to adapt them to the criteria of the standard. The opposite occurs in 8.82 % of the companies that neither disclose any information related to IFRS 16 nor update their leasing policy with the criteria of the standard. This factor draws attention to compliance with international standards and the transparency of the information reported by these entities.

Table 2 Impact of the application of IFRS 16 on entities

| Variable | Percentage |

|---|---|

| Reclassification Variation | 50.00 % |

| Equity impact | 17.65 % |

| No material impact | 14.71 % |

| No information was associated with the impact of ifrs 16 implementation | 8.82 % |

| No reference is made to the implementation of ifrs 16 | 8.82 % |

| TOTAL | 100 % |

Source: Elaboration by authors based on data from financial statements of entities listed in the Bvc as of December 31, 2019

The equity impact has been taken from the statement of changes in equity, together with the notes to the financial statements, which specifically disclose the impact of the first-time application of the standard. Table 3 details the equity impacts of the adoption of the standard.

Table 3 Equity impacts of adopting the standard

| Variable | Minimum | Maximum | Mean | Median | Std. Deviation | |

|---|---|---|---|---|---|---|

| ABS ICI EF | 0.00005 | 0.05539 | 0.00692 | 0.00087 | 0.01557 | |

| ICI EF | - 0.05539 | 0.00815 | - 0.00344 | 0.00024 | 0.01679 | |

| Variables analyzed* | ||||||

| X** | - 495,229 | 26,986 | - 48,857 | 4,224 | 151,038 | |

| abs(x) | 4 | 495,229 | 63,868 | 11,516 | 144,799 | |

| Equity | 84,088 | 26,883,919 | 9,890,288 | 6,743,451 | 10,138,111 | |

| 3 entities with negative variation 25% | 25% | |||||

| 9 entities with positive variation | 75% | |||||

Source: Elaboration by authors based on the data from the financial statements of the entities listed in the Bvc as of December 31, 2019.

* Expressed in millions of Colombian pesos **Equity impact value.

The 16.18 % of entities with equity impacts correspond to 12 entities, of which one belongs to the commercial sector, five to the financial sector, five to the industrial sector, and one to the service sector. As the Table above shows, there is a 5.53 % impact on equity due to the adoption of the standard in absolute terms, in one of these entities, without considering negative and positive effects. The mean impact on the companies was 0.692 %. If the negative and positive variations are considered, then there is a negative impact on equity of 5.53 % in one of the entities studied which corresponds to the commercial sector. The greatest positive impact is 0.815 %, which corresponds to a banking institution. The mean that considers negative and positive differences is 0.344 %. As previously stated in total, of the 68 entities, 12 presented patrimonial impacts, 25 % showed negative variations and 75 % of the entities analyzed showed positive variations.

As shown above, the mean impact on the equity of the companies studied belonging to the industrial, financial, and service sectors is less than 1 %.

Only one of the entities from the retail sector has a negative equity impact of 5.53 %, which is associated with the recognition of the right-of-use assets, lease liability, and the effect of the regulation on the equity of investments that are accounted for using the equity method. Therefore, it is observed that in 11 of the 12 companies analyzed, the level of conservatism is maintained. These results partially agree with the research developed by Pelucio et al. (2019).

The application of the Wilcoxon test evidenced a rejection of the null hypothesis, so the research hypothesis is accepted. Therefore, there is a significant variation between the equity of the entities before including the effects of IFRS 16 and after the effects of IFRS 16, with a significance level of 5 % and a p-value of 0.013.

The equity variations produced in the financial statements of the companies studied affect the key performance indicators (i.e., ROE (return on equity), debt and leverage). The following Table 4 shows the effects seen in 17.65 % of the companies that presented a change in equity because of adopting the standard compared to 2018 which is the period immediately preceding the adoption.

Table 4 Variation in the key indicators of the companies listed in the Bvc

| Indicators with the application of ifrs 16 | Indicators without application of ifrs 16 | Difference in Mean | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Variable | 2019 | 2018 | |||||||||

| Mínimum | Maximum | Mean | Median | Standard Desviation | Mínimum | Maximum | Mean | Median | Standard Desviation | ||

| ROE | 0,0161 | 0,2231 | 0,0994 | 0,1104 | 0,0650 | 0,0161 | 0,2247 | 0,1013 | 0,1074 | 0,0671 | - 0,0019 |

| Debt | 0,0557 | 0,8965 | 0,5044 | 0,5097 | 0,3114 | 0,0556 | 0,8884 | 0,4906 | 0,4886 | 0,3107 | 0,0138 |

| Leverage | 0,0590 | 8,6611 | 2,6118 | 1,0467 | 3,2140 | 0,0589 | 9,6014 | 2,6970 | 1,0019 | 3,4443 | - 0,0852 |

Source: Elaboration by authors using data from the financial statements of entities listed in the Bvc as of December 31, 2019.

The key indicators of the studied entities show some variations, the highest difference in the mean is seen in the leverage indicator, which has a variation of -8.52 %. Previous studies carried out by Rivada et al. (2014), Fitó et al. (2013), Giner et al. (2018), Morales-Díaz and Zamora Ramírez (2018) and Nurkasheva et al. (2018), whose studies show that the adoption of the standard could potentially affect the leverage indicator. Similarly, ROE decreased by 0.19 %. This information is contrary to the research carried out by Giner et al. (2018). On the other hand, indicators such as debt showed an increase in the average of the factors analyzed of 1.38 %. This information is consistent with the studies conducted by Giner and Pardo (2018); Rivada et al. (2014) and Fitó et al. (2013). These results show how accounting standards affect the earnings of companies. Therefore, entities in the periods before to the adoption of the standard should study the possible effects and prepare in advance for the adoption of the standard.

These variations in equity and the key performance indicators of the companies studied must be analyzed along with the compliance with the disclosures required by the standard, as stated by EFRAG (2011), it is important to identify if the standard has met the objectives set by the regulatory organization. To do so, the content analysis technique is applied to the qualitative variables that must be disclosed by the entities in their financial statements and footnotes. The following Table 5 summarizes the 32 categories analyzed for the 68 entities listed in the BVC based on the IFRS 16 paragraph that explicitly requires disclosure.

Table 5 Qualitative analysis of factors to be disclosed by the entities studied

| IFRS 16 paragraph with explicit disclosure criteria | Number of entities that meet this category | Number of entities that disclose | Percentage of compliance |

|---|---|---|---|

| 47 (a) | 58 | 42 | 72 % |

| 47 (b) | 58 | 48 | 83 % |

| 49 | 58 | 14 | 24 % |

| 50 (a) | 58 | 37 | 64 % |

| 50 (c) | 52 | 6 | 12 % |

| 52 | 58 | 41 | 71 % |

| 53 (a) | 58 | 36 | 62 % |

| 53 (b) | 58 | 46 | 79 % |

| 53 (c) | 55 | 40 | 73 % |

| 53 (d) | 53 | 38 | 72 % |

| 53 (e) | 8 | 6 | 75 % |

| 53 (f) | 7 | 6 | 86 % |

| 53 (g) | 58 | 20 | 34 % |

| 53 (h) | 54 | 35 | 65 % |

| 53 (i) | 4 | 4 | 100 % |

| 53 (j) | 58 | 47 | 82 % |

| 58 | 58 | 35 | 60 % |

| 59 (a) | 24 | 15 | 63 % |

| 59 (b) | 18 | 10 | 56 % |

| 59 (c) | 17 | 13 | 76 % |

| 90 (ai) | 9 | 3 | 33 % |

| 90 (aii) | 15 | 12 | 80 % |

| 90 (aiii) | 10 | 7 | 70 % |

| 90 (b) | 14 | 7 | 50 % |

| 92 (a) | 14 | 7 | 50 % |

| 92 (b) | 14 | 11 | 79 % |

| 93 | 15 | 7 | 47 % |

| 94 | 15 | 7 | 47 % |

| 95 | 32 | 16 | 50 % |

| 97 | 36 | 9 | 25 % |

| IFRS 16 General information on whether there are operating leases (Lessor category) | 36 | 22 | 61 % |

| IFRS 16 General information on whether there are finance leases(Lessor category) | 15 | 7 | 47 % |

| Analyzed categories total | 32 |

Source: Elaboration by authors using data from the financial statements of entities listed in the bvc as of December 31, 2019.

Qualitative analysis of the disclosures of the lessee

From the companies listed in the BVC, 85 % (58 companies) are lessees who must recognize a right-of use asset and a lease liability; 41 of these companies disclose information on such leases in a single footnote or separate section of the financial statements, which results in 71 % compliance. Of these companies, 17 should disclose the lease restrictions and/or agreements, but only 13 do so, even though such information is relevant for the users of the financial statements. Similarly, while 24 companies would have to disclose the nature of the activities under which they use the lease, only 15 (65 %) do so.

From the 58 companies under the lessee category, 42 disclose information on right-of-use assets separately from other assets, and 16 show it under Plant and Equipment Property and/or under Investment Property. Only 36 companies provide information on the depreciation charge of these assets either through a Table, as suggested by the standard, or another expression of depreciation. In addition, 72 % of the companies disclose right-of-use assets separately, and 60 % show the values corresponding to the depreciation of those assets. Furthermore, 81 % of the lessees disclose the book value of the right of use assets at the end of the period. Finally, 54 of the lessee companies show an increase in right of use assets, for which the asset incorporation disclosure applies, and only 65 % (35 companies) disclose the values and concepts of such incorporation.

For the disclosure of right-of-use liabilities, of the 58 companies that should include this information in the footnotes, 48 disclose it separately, while the remaining companies disclose it with other obligations, specifying that the line item include values for leasing liabilities. Regarding to right of use liability, only 14 companies (24 %) disclose interest expenses in their Income Statement for the Period and Other Comprehensive Income; the others do not detail it in that statement. For the maturities of these liabilities, 35 companies (60 %) disclose an analysis of these maturities separately from the other liabilities, as suggested by the standard.

Entities that have leases under the lessee category must show the expenses and income associated with this activity in the Income Statement and disclose them in their footnotes. In this regard, of the 58 lessee companies for which this concept applies, 55 meet the criteria due to expenses incurred for short-term leases, 53 for leasing low-value assets, and eight for expenses in variable leases not included in the measurement of liabilities. Regarding disclosures, of the 55 companies that meet the short-term expenses criteria, 40 (73 %) disclose such information, of the 53 that apply low value assets expense, 38 comply with the disclosure, and of the eight companies that have variable lease expenses, 75 % (six companies) show it in the footnotes.

Regarding income, seven of the 58 companies have income from subleases, and only six disclose the concepts and their values. For-profits or losses from sale transactions with subsequent leasing, four entities qualify and 100 % disclose that they carried out the operation and the corresponding value of the result. It should be noted that some entities did not qualify for this operation but did disclose this activity in their footnotes, i.e., they specified that they did not obtain gains or losses.

Regarding the disclosures that lessees must make in the cash flow statement, of the 58 entities that apply this concept, 64 % show cash payments of the principal of the liability in financing activities and only 34 % disclose total cash outflows from leases. Furthermore, 52 companies qualify for disclosing payments for short-term leases, low-value assets, and variable leases not included in the measurement of the liability; only six of these companies comply with the disclosure for such concepts, within the operating activities in the financial statement mentioned, which confirms the noncompliance with this disclosure.

Qualitative analysis of the disclosures of the lessor

Considering that IFRS 16 does change the accounting that must be carried out under the lessor category, the financial statements of lessors do not change. However, lessors must provide information associated with the operations, where on average it is evident that 64 % disclose both qualitative and quantitative information about the activities and their nature, as well as the risk management strategy for underlying assets. For companies that operate as lessors, there are 51 contracts, 15 of which correspond to financial leases, i.e., ownership of the underlying asset is transferred to the lessee at the end of the lease term. Either the lessee can buy the underlying asset or the lease term covers most of the economic life of the asset (IASB (International Accounting Standards Board), 2016). The remaining 36 companies have operating leases; it should be noted that lessors do not provide much clarity regarding the type of lease contract.

Regarding financial leases, only seven entities disclose information, i.e., only 47 % comply with the disclosure regarding the ownership of assets under lease with a qualitative and quantitative explanation of their net investment and the maturities of accounts receivable from leasing; 53 % do not disclose any type of information about their financial lease contracts. Regarding operating lease contracts, while 61 % of the entities disclose information in their financial statements, only 25% disclose an analysis of the maturities to be received in the first five years and the total for the remaining years.

On average, lessor participation in disclosures is 53 % positive; in contrast, for lessee companies, participation is above 65 %, which demonstrates that there is more information and compliance with the standard due to information related to operations being provided.

Table 6.

| Total analyzed categories | The number of companies analyzed | Minimum | Maximum | Mean | Median | Std. Deviation |

|---|---|---|---|---|---|---|

| 32 | 68 | 0.11538 | 1.00000 | 0.61365 | 0.63475 | 0.20082 |

Source: Elaboration by authors using data from the financial statements of entities listed in the Bvc as of December 31, 2019.

Of the companies listed in the bvc that act as lessees and/or lessors, 61 % disclose contact information by the criteria of the standard, which reveals a lack of compliance with the disclosures or the presentation of information regarding their contracts, as indicated by ifrs 16.

Regarding the initial implementation and the options in paragraph C10 of ifrs 16, the companies listed in the bvc used the exceptions detailed in the following Table 7.

Table 7 Practical options in the initial implementation of ifrs 16

| IFRS 16 paragraph | Practical options in the initial implementation | Entities that use this option | Percentage of practical option use |

|---|---|---|---|

| C10 (a) | The entity applied a single discount rate to a portfolio of leases with reasonably similar characteristics. | 12 | 17.65 % |

| C10 (b) | 12 17.65% C10 (b): On the date of initial implementation, the entity adjusted the right of use asset for the amount of any provision for onerous contracts recognized in the statement of financial position immediately prior to the date of initial implementation. | 1 | 1.47 % |

| C10 (c) | The entity acting as the lessee may elect to account for operating leases with a remaining lease term of less than 12 months from the date of initial implementation, as a short-term lease. | 50 | 73.53 % |

| C10 (d) | A lessee may exclude initial direct costs from the measurement of the right-of-use asset on the date of initial implementation. | 14 | 20.59 % |

| C10 (e) | A lessee can use a retrospective approach, such as when determining the lease term, if the contract includes options to extend or terminate the lease. | 39 | 57.35 % |

Source: Elaboration by authors using the footnotes from the financial statements of the entities listed in the bvc as of December 31, 2019

Appendix C of IFRS 16, section 10, provides lessees who had operating leases classified under IAS 17 the option to select one or more solutions to support the adoption of IFRS 16. Some of these practical options used by the entities allowed operating leases to be counted as short-term leases, which occurred in 73.53 % of the entities analyzed. This alternative allows companies to lessen the impact of the standard, a strategy planned by Giner et al. (2018) in a study carried out on the companies in the stoxx All Europe 100 index.

Similarly, 57.5 % of the entities use a retrospective approach, and these companies do not modify the information predating IFRS 16. Thus, 20.59 % of the companies choose to exclude the initial direct costs of the measurement of the right-of-use asset on the date of initial implementation, and 17.65 % apply a single discount rate to the lease portfolio with similar characteristics. Only one entity (1.47 %) adjusts the right-of-use asset on the date of initial implementation by the amount corresponding to onerous contracts recognized in the statement of the financial position immediately before the date of initial implementation. Finally, it is found that most solutions recognize expenses due to short-term contracts and use information retrospectively, showing an improvement in the disclosure of information regarding leases, despite not reaching 100 % of the disclosure objectives required by the standard. This allows users to access more complete and clearer information

Conclusions

The objective of this research is to identify the impacts produced by the adoption of IFRS 16 on the entities listed in the BVC in Colombia. This is the first known study that analyzes the impacts of the standard in Latin American countries. This study shows that, after IFRS 16 was adopted by the entities listed in the BVC, the greatest impact was associated with variations due to reclassification (50.00 % of entities), followed by the equity impact experienced by the companies studied (17.65 %).

In 25 % of entities with an equity impact, the variation was negative, and in 75 %, there was a positive variation due to the implementation of the standard. Similarly, it is important to consider the inferior disclosure characteristics shown by 8.82 % of the entities. Despite being required to incorporate the principles of IFRS 16, these entities did not change their leasing policy and did not report the potential impacts of the standard, which contradicts the qualitative characteristics of financial information established by the IFRS.

The analysis carried out with the key indicators of the company shows that leverage was the most affected indicator after adopting the standard, which is consistent with previous research.

On the other hand, the ROE decreased, while debt increased as predicted in previous research. However, the effects of a standard cannot be generalized and deserve to be studied in a particular way in each geographical context. Additionally, regarding the practical options used in the initial implementation of the standard, 73.53 % of the entities opted to account for operating leases with a term of 12 months or less as short term leases, a strategy that mitigates the impacts of adopting the standard. This aspect also shows how entities modify their operating practices according to the effects that may occur with the application of a new standard.

Regarding the qualitative aspects to be reported by the companies studied, it is observed that, on average, the entities using the lessor category comply with 53 % of disclosures; however, for lessee companies, 65 % of disclosures fit the IFRS 16 criteria, which reflects increased information and compliance with the standard. This result is mainly due to the change that occurred under IFRS 16 for the lessee category.

The analysis of the impact of the adoption of the standard shows that, despite presenting an increase in disclosures, none of the companies reaches 100 % of the required disclosures in aspects that apply to the entity. Therefore, the objectives proposed by the standardization organism would be partially achieved. Therefore, this study can help entities identify the aspects that must be disclosed so that the practices carried out by the companies that must apply IFRS 16 are optimized. In addition, the disclosure study could be replicated in other contexts to analyze if the objectives pursued by the standard in terms of disclosure are achievable by the adopting entities, especially if it is considered a variable that has been little studied in previous research since only one of them analyzes the variations that the standard produces in terms of disclosure. Future studies could perform a long-term analysis of the effect of the lease standard on the entity's financial results.