Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Historia Caribe

Print version ISSN 0122-8803

Hist. Caribe vol.8 no.23 Barranquilla July/Dec. 2013

Artículo de investigación científica

Trading development or developing trade? The Dominican Republic's trade, policies, and effects in historical perspective*

¿Desarrollo o Comercio? Comercio exterior, políticas y sus efectos en la República Dominicana en perspectiva histórica

Desenvolvimento comercial ou desenvolvimento do comércio? O comércio da república Dominicana, políticas e efeitos na perspectiva histórica

«Trading development or developing trade?» Le commerce de la République Dominicaine, les politiques et les effets dès une perspective historique

Leticia Arroyo Abad1, Amelia U. Santos-Paulino2

1 Profesora asistente del Department of Economics and in the International Politics & Economics, Middlebury College (EEUU). Correo electrónico: larroyoabad@middlebury.edu. La autora es Licenciada en Economía de la Universidad Católica Argentina. Magister en estudios latinoamericanos de la University Of Kansas (EEUU). Doctora en economía con especialización en historia económica latinoamericana de la University of California, Davis (EEUU). Entre sus publicaciones tenemos: "Persistent Inequality? Trade, Factor Endowments, and Inequality in Republican Latin America"Journal of Economic History 73-1 (2012); y "Between Conquest and Independence: Living Standards in Spanish Latin America", Explorations in Economic History, 49-2 (2012). Entre sus intereses se encuentran los temas de historia económica latinoamericana, los estudios sobre los estándares de vida, desigualdad e instituciones.

2 Afiliada institucionalmente a la United Nations Conference on Trade and Development (Suiza). Correo electrónico: Amelia.Santos-Paulino@unctad.org. La autora es Licenciada en Economía de la Pontificia Universidad Católica Madre y Maestra (República Dominicana) y Doctora en Economía de la University of Kent (Reino Unido). Tenemos entre sus publicaciones recientes: "Can Free Trade Agreements Reduce Economic Vulnerability?," South African Journal of Economics Vol. 74, 4 (2011) y "The Dominican Republic Trade Policy Review 2008," The World Economy Vol. 33,11 (2010). Sus líneas de investigación son: comercio exterior y desarrollo económico.

* El presente artículo es resultado del proyecto de investigación "Long-term economic growth and development"; financiada por la Foundation and the American Philosophical Society, (EEUU).

Para citar este artículo: Leticia Arroyo Abad y Amelia U. Santos-Paulino, "Trading development or developing trade? The Dominican Republic's trade, policies, and effects in historical perspective", Historia Caribe 23 (Julio-Diciembre): Vol. VIII N° 23, págs. 209-239.

Esta publicación está bajo una licencia Creative Commons Reconocimiento-Compartir Igual 3.0

Recibido: 30 de noviembre de 2012 Aprobado: 03 de abril de 2013 Modificado: 15 de mayo de 2013

Abstract

The Dominican Republic's partaking in the global economy has fluctuated significantly since post-colonial times. This paper follows this country's journey in and out of the world markets since 1880s by analysing the role of the export sector within the economy and the impact on development. We are interested in whether the DR developed due to the expansion of trade or if actually trade hampered development. We find that the integration to the world economy has been costly, as the volatility of the terms of trade and capital flows increased the country's vulnerability. The implemented governmental policies introduced distortions to the economy and achieved few gains in terms of economic development. Export diversification arrived relatively late to the DR, and the effects on development have been divergent, as far as improving trade balance, promoting diversification, building human capital, and creating employment.

Key words: trade, economic development.

Resumen

La integración de la Republica Dominicana en la economía global ha fluctuado considerablemente desde la época colonial. Este artículo explora el viaje de este país en relación a los mercados internacionales mediante el análisis del sector exportador y su impacto en la economía local y en el desarrollo económico en general. Nuestro interés radica en evaluar el rol de comercio internacional en el desarrollo de la República Dominicana utilizando una perspectiva de largo plazo.

Palabras claves: comercio exterior, desarrollo económico.

Resumo

A integração da República Dominicana na economia global tem flutuado consideravelmente desde a época colonial. Este artigo explora a viagem deste país em relação aos mercados internacionais, analisando o setor de exportação e seu impacto sobre a economia local e no desenvolvimento econômico em geral. O nosso interesse radica em avaliar o papel do comércio internacional no desenvolvimento da República Dominicana usando uma perspectiva de longo prazo.

Palavras-chave: comércio exterior, desenvolvimento econômico.

Résumé

L'intégration de la République Dominicaine dans l'économie globale a considérablement fluctué depuis l'époque coloniale. Cet article explore le parcours de ce pays en ce qui concerne son insertion dans les marchés internationaux, par le biais de l'analyse du secteur exportateur et son impact dans l'économie locale et dans le développement économique en général. Nous tenons à évaluer le rôle du commerce international dans le développement de la République Dominicaine en utilisant une perspective à long terme.

Mots-clés: commerce extérieur, développement économique.

1. Introduction

The Dominican Republic's partaking in the global economy has fluctuated significantly since post-colonial times. This paper follows this country's journey in and out of the world markets since 1880s by analysing the role of the export sector within the economy, the policies implemented, and the impact on development. We are interested in the role that trade had in promoting or hampering development in the Dominican Republic. The role of trade in fostering economic development has been contested in economics. The range of ideas and policies recommended to promote economic development by opening the economy has changed significantly throughout history.1 From free trade lovers to export pessimists, we have seen a number of studies advocating for or against trade as an engine of economic development. The link between trade and development is particularly relevant for developing countries, as many scholars have highlighted that an economy guided by comparative advantage can achieve higher growth and welfare2.

Nowadays, policy makers and international institutions, such as the International Monetary Fund and the World Bank, have also advocated for integration as a means to achieve higher economic growth. Some think-tanks claim that protectionist countries grow less than those open to trade3; however, others state that developing countries engage in an unequal exchange and do not reap the full benefits of trade4. The most recent scholarship has resorted to looking at the contemporary experience of a large set of developing countries, to disentangle the effects of trade on economic development. Research shows that trade and financial flows have increased dramatically in recent decades, and that integration and liberalization have been crucial for achieving sustained growth in developing countries. Additionally, the international mobility and division of labour is expected to generate important distributional changes, hence developing gains within countries5. Despite notable socioeconomic improvements over the last decade, such as better income distribution, poverty reduction, and overall advancement towards inclusive and sustained growth, the mechanisms that make trade a development tool are still contentious. Some of the theoretical and empirical issues include the impact of the secular deterioration on developing countries' terms of trade, the insidious implications of specialization into low value-added activities, or the skill differential between rich and poor countries. Particularly, the expansion of trade and diversification away from commodities and traditional exports, and its relationship with development are also crucial.

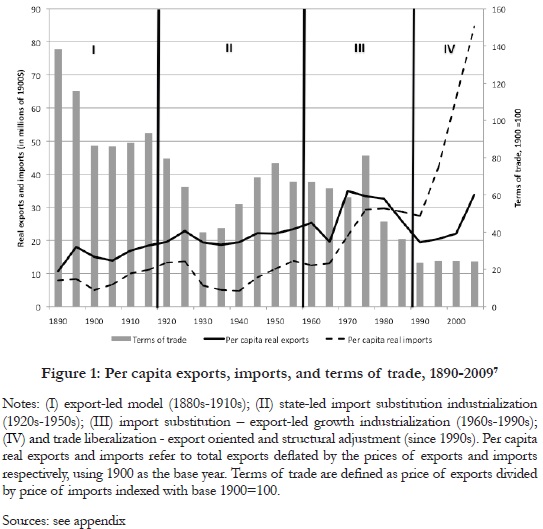

Our paper takes a different approach by looking at trade and development in one small economy throughout a period over 100 years. Our analysis starts in the late 19th century, then explores the main stages of economic development of the Dominican Republic coinciding with the traditional economic history division of Latin American history: export-led model (1880s-1910s), state-led import substitution industrialization (1920s-1950s), import substitution - export-led growth industrialization (1960s-1990s), and trade liberalization - export oriented and structural adjustment (since 1990s) (see Figure 1). In each of these periods, we identify the role of the export sector, the policies adopted, and the effects on development.

By taking a long-run view, this study examines the ebb and flow of the external sector in relation to the overall economy, while assessing the links to and effects on development. Being a tropical island, international commerce (particularly commodities trade) has special significance for the DR. As such, commercial links to other economies have a magnified impact. By looking at the past, we can better assess the choices and constraints that this economy faced, along with the effects on the evolution and development of different sectors. To assess the long-term evolution of this economy, we have compiled different measures of economic development (such as real wages) and estimated indicators of trade (e.g. real exports, real imports, and terms of trade).6 As such, this paper's contribution includes not only these new indicators, but also over a century-long analysis of this country's trajectory from the perspective of trade and and development.

Similar to Latin America, the DR adopted an export-led model during the first globalisation wave (1870-1913). This strategy was based on the production of the so-called tropical products (tobacco, and later the development of extensive production of sugar, cacao, and coffee). This resulted in an export boom between 1880s-1910s; however, it was short-lived. The DR was not alien to the events in the global economy which had signifi cantly arrested the impact of trade on development. The demand for DR’s exports was greatly affected by the World Wars and the Great Depression. The collapse of world commodity prices shook the pillars of the export-led growth model, leading to foreign exchange crises. The country looked for domestic sources of growth by promoting import-substituting industries.

This strategy, driven by debt crises and commodity prices slump, culminated in the volatile decade of the 1980s. Since then, the country returned to participating in the world economy. The DR's success in the recent periods has resulted from the implementation of a three-pronged development strategy consisting on diversifying production, developing special economic zones, and maintaining ample economic and social engagement with the rest of the world.

In this long-run analysis of the Dominican Republic, we find that the traditional export sectors, such as tropical commodities, played a prominent role in the destiny of this country until the last thirty years. Whether the country opted for free trade or protectionism, the export mix changed little for almost a century. While the importance of the export sector is undeniable, its dynamism waned during the import-industrialization years. It was not until this second globalization wave that real exports per capita achieved the same levels as the turn of the 20th century. The combination of large swings in commodity prices and the experience with industrialization during the wars prompted the country to diversify the sources of production and trade from commodities to manufactures. This process was intensified during the trade liberalization extending to tourism; but, the strategy was limited, as the expected diversification was not realised, at least within manufactures. In terms of development, our findings indicate that the adopted strategies failed to provide sustainable development in the long run. During the first globalization and the ISI periods, welfare did not improve significantly. Moreover, while the reintegration to the world markets in the 1980s improved real wages, it was plagued by macroeconomic instability. The widespread reforms in the 1990s facilitated the Dominican Republic's continuous involvement in the global economy, as demonstrated by the evolution of trade in goods and services and capital flows. Nevertheless, the dual nature of the country's industrial sectors - whereby Free trade exports processing zones coexist with a laggard agricultural sector - may ignite the growth and development prospects. Moreover, the reliance on tourism as a key income-generating sector poses significant constrains to the sustainability of the growth and development model going forward.

2. Export-led model (1880s-1914)

From 1870 to 1914, the world experienced an unprecedented increase in international trade. Known as the first globalization, this period of time was characterized by global integration as newly independent Latin America soon joined the globalizing wave. It benefited from the abundant capital flows from Europe and the sustained demand of raw materials. For some countries, this phenomenon intensified the colonial export structure, but for others, it created a dynamic export sector8. In any case, Latin America integrated into the world economy mostly as a supplier of commodities. In the case of the Dominican Republic, once the dust settled after the independence wars, the country also turned to the international markets for economic growth. Integration to the world markets was the chosen path to modernization.

The government was instrumental in promoting the export sector. The measures aimed at expanding and improving the productivity. In 1876, a law enabled the transfer of public lands to private hands when used for export production. Three years later, to increase efficiency, subsidies and tax incentives were offered for the cultivation of sugarcane, cacao, coffee, tobacco, cotton, and banana with imported machinery9. This transition was marked by the increase of productivity in the agricultural export sector aided by the expansion of transportation network.

The expansion was not without challenges. In the late 19th century the sugar industry faced intense competition with European newly manufactured beet sugar, prompting a deep restructure of the sector. As a result, the industry became much more concentrated as bigger refineries acquired the troubled firms. The response was to reduce the export tax on sugar to compensate for the low prices in 1884. The fiscal pressure led to its reinstatement a year later. In 1891, the industry found some respite with the McKinley agreement with the US that slashed tariffs to selected commodities under a reciprocity clause.

As many of the nascent Latin American nations, this country concentrated in exporting a handful of commodities while importing manufactures and capital goods. The export-led growth model was based on the principle of comparative advantage. In particular, sugar, tobacco, coffee, and cacao represented the bulk of the export basket.

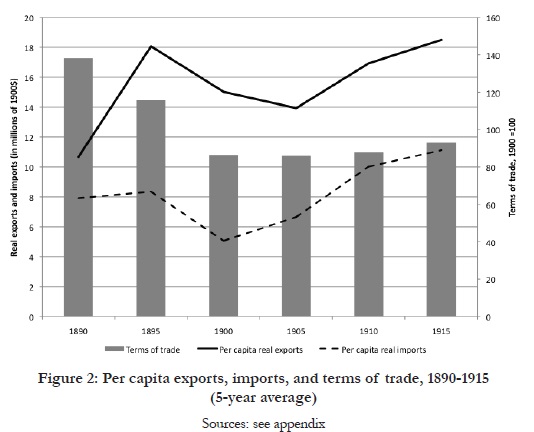

Overall, both exports and imports experienced remarkable growth. From 1894 to 1914, exports increased 150%, doubling the performance of the imports. In per-capita terms, the evolution of trade was also favourable with over 50% growth from 1894 to 1915. This development is even more exceptional considering the economy faced unfavourable terms of trade throughout this period. Exports prices fell by 25% while import prices increased, resulting in a net loss of almost 23% (see Figure 2).

Of these four commodities, sugar captured over half of the total exports. Its expansion relied on foreign human and physical capital. It was not until the decline of the Cuban sugar export sector that the Dominican Republic achieved some participation in the world markets. The independence wars in Cuba marred the sugar-exporting sector to undermine Spanish colonial control. Consequently, Cuban capitalists and technical staff, attracted by high quality and inexpensive land, fled to the Dominican Republic. It was then that this economy transitioned from an artisan sugar mill to the mechanized sugar refinery, drawing investors from other countries as well10.

Despite the importance of the US as a market, the Dominican Republic was too small to exert influence in the world sugar market. Its total production only amounted for, at most, 5% of the US total imports.11 However, it was short-lived: after three years, the US charged a 40% tariff on all imported sugar. At the end of the period, 62% of the area cultivated belonged to the foreign capital12.

Of the other commodities, cacao experienced the most significant growth. In 1860, it could barely meet the domestic demand as it was not cultivated as a crop. While it also attracted foreign capital, the cultivation extended over the entire territory, promoting artisan chocolate production as well. By the early 20th century, it became the most valuable export commodity to the American market. Despite its promise, by the end of this period, cacao expansion halted due to droughts and price decline. Coffee cultivation, despite it being the fourth most important export commodity, faced competition for labour from the sugar industry. Tobacco cultivation had the longest tradition in the island. The indigenous plant remained of domestic importance throughout colonial times; yet, it failed to fl ourish like the other commodities due to its unreliable quality and the increasing participation of the US as a main trading partner13.

The expansion of the export sector boosted imports as well. The dynamic sugar industry needed machinery and other basic inputs from abroad. Rice, timber, leather, textiles, and shoes made up for the rest of the imports during this period. The US supplied the lion’s share (around 60% of total imports), followed by Germany, the UK, and France.

The modernization of the Dominican economy brought about significant changes in the country's economic and social development. The expansion of the export sector, in particular sugar, made the under population of the island more evident. In 1887, the population only amounted to 382,000 people, growing at 2.5% rate per year in the next thirty years. Indeed, the population did not reach a million by the time of the first census14 (Gobierno Provisional 1975). The need of workers for sugar harvesting promoted domestic and regional migration. In the first phase of the industry expansion, the rural population migrated to the sugar-producing areas. In 1883, more than 90% of the labour force in the sugar industry was domestic, but it soon proved to be insufficient prompting seasonal migration from nearby islands. During his annual address to the Congress, President Heureaux justified the need for foreign labour to improve the competitiveness of the sugar industry.

Known as braceros, these workers from the Caribbean became indispensable for the sugar industry. The 1912 Law on Immigration challenged this free movement of labour to the Dominican Republic, establishing a priority to Caucasian immigration that limited the influx of braceros. This law intended to protect the domestic economy. In particular, the inflow of copious labour from abroad depressed real wages and contributed little to the domestic economy. Given the seasonal nature of the foreign labour, their income did not stimulate the Dominican economy15.

The demand for labour also shaped the concentration of population in the country. Aided by the spread of roads and railroads, workers and their families moved towards the producing centres. This marked a strong change with respect to colonial times. Up until the modernization period, the bulk of the population practiced subsistence agriculture. The early post-independent accounts carefully noted the lack of large landowners in the country, as such sugar was produced with artisan methods not involving large sugarcane plantations. The concentration of land ownership picked up steam in the later part of the 19th century. From 1882 to 1896, the sugar cultivating area quadrupled. With this increasing annexation of land for production, the economy began the transition from communal landownership to private property16.

Overall, the process of modernization of the Dominican economy brought about profound winds of change. The remarkable expansion of the agricultural production for export was achieved, despite unfavourable terms of trade and mostly absence of advantageous commercial position with the Dominican Republic's main trading partner, the US. In addition, this expansion, in particular sugar, triggered a significant mobilization of the workforce. Domestically, the population migrated towards the areas of active economic activity while a rising influx of immigrants aided the labour needed for the progress of agriculture. While the influx of foreign capital, technology, and labour propelled this post-colonial economy, the development costs were not negligible. The exodus of the labour from traditional agriculture led to an increase in the cost of living. In addition, immigration depressed domestic wages while the export sector commenced its concentration of capital and land.

3. State-led import substitution industrialization (1915-1950s)

World War I (WWI) changed the configuration of the existing world order. In the next thirty years, the world experienced a major financial and economic crisis, known as the Great Crisis, and another World War. One of the consequences was the increased vulnerability of peripheral nations that had to adapt to the new power model. Latin America, given its role in the world system, underwent major adjustments and changed its development strategy considerably. Between the 1930s to 1970s, this region opted for a different development approach, concentrating on the domestic market as a source for economic growth. This inward looking development strategy not only permeated the political, economic and social levels of debate in Latin America, but it also remained the main paradigm in economic policy for the next fifty years. The adoption of this strategy involved an important shift in the economic structure, the medium- and long-term perspectives, and the integration of Latin America with the rest of the world.

The transition to inward-looking development strategy in the Dominican Republic was adopted after the economic and political crisis in the early 1920s. Politically, after serious turmoil in the early 1910s, the US took over and remained in power until 1924.17 During WWI, the economy enjoyed prosperity based on the high demand of commodities, particularly sugar. The war also rerouted most of the Dominican exports to the US, reaching 87% in 1920. Known as the "dance of the millions", these bonanza years were characterised by a significant rise in imports and exports. The new American military government set in motion an array of reforms during the occupation. The expansion in public works was financed by the creation of new taxes on Dominican alcohol and property. The result was the development of extensive railroad and highway systems, together with the proliferation of publicly funded schools.

This boom came to a painful halt in 1921. The European economies managed to rebuild beet sugar production, driving prices to pre-war levels. The drop was dramatic: from $26 per short ton the price of sugar collapsed to less than $7 in 1921 and $4 a year later. With this crisis, the political standing of the government deteriorated, leading to the end of the occupation in 1924.

The origins of protectionism in the Dominican Republic date back to the Trujillo years. Trujillo began his reign by establishing governmental monopolies in salt, meat, and rice protected from foreign competition. While fostering domestic production, these measures were just means to increase his personal wealth as he controlled or owned those industries. In addition, he promoted domestic and agricultural activities. As soon as the country recovered from the effects of the Great Depression's commodity price collapse, he resumed the investment in public works projects including highways, railroads, and canals. To promote agricultural production, he transferred thousands of hectares of public land as part of his colonization plans. As a consequence of the 1929 worldwide crisis, the country experienced a severe scarcity of imports and Trujillo recognized the importance of a growing industrial sector. In his quest to promote manufacturing activities, he changed the Constitution to allow him to grant incentives a tax credit to the sector.

The evolution of Trujillo's own power went hand in hand with the overall growth in the economy. The period between 1938 and 1960 is notable in terms of domestic growth based on industrialization. However, the expansion was Trujillo-centric: by 1961, 80% of industrial production was under his ownership, employing over 45% of the domestic labour force.

During the export-led growth period, a share of the agricultural sector became modernized; however, most of the rural population continued traditional practices of subsistence agriculture. In line with Trujillo's goals of economic development, he turned to the countryside. He identified the unexploited resources and embarked in a widespread agrarian reform that changed the Dominican agricultural landscape. The reform included land redistribution and a wide array of subsidies and incentives.

Starting in 1934, the government transferred thousands of hectares to private ownership. The first main vehicle of redistribution was through the dismantlement of communal lands. This initiative was followed by privatization of public lands and appropriation of privately owned lands in exchange for public irrigation. Infrastructure was a crucial part of the agrarian plan: by 1955, the Dominican Republic became one of the countries with highest share of irrigated lands. While gaining popular rural support, the regime placed strong incentives to use labour and land. With strict vagrancy laws and extensive incentives, the regime succeeded in expanding the cultivated area together with domestic production. However, there were limits to these winds of change, specifically with respect to the sugar industry. In the Eastern provinces, foreign interests remained a powerful force. Even though the land redistribution did not quite materialize in this region, Trujillo opted for increased taxation to the sugar industry18.

The first obstacle was the 1919 tariff. This treaty greatly affected the infant industrial sector as American manufacturers enjoyed Duty-free status. While a revision was justified in order to protect the industry and increase tax collection, the government faced a binding agreement that prevented the change without US authorization. To bypass this constraint, the government passed the Law 190, creating a series of consumption taxes on imported manufactured goods in 1925. Despite the protests from the US government, the effective rate of protection climbed to 85% by the mid-1930s. Notwithstanding this level of protection, the main limiting factor for imports was the drastic collapse of commodities prices during the 1920s, dramatically reducing the export revenue and the import capacity.

Intentional industrialization also dates back to the Trujillo regime. His zeal for political and economic power geographically relocated the industrial centre of the country to Santo Domingo. After monopolizing the food supply, the ruler extended his infl uence to other industrial endeavours that would complement his own. In 1934, the Law 672 formally established incentives to new agricultural-based industries. The benefi ts included tax exemptions for technology imports and consumption tax rebates for selected exporting industries. The success of these policies was limited. By 1941, only 28% of the 37,000 workers in manufacturing were employed in non-sugar industries. As such, the average size of an industrial fi rm was 16 workers.

A new industrial policy was drafted after the Trujillo-Hull Treaty in 1940, when the Dominican Republic finally regained autonomy in terms of tariff policy. A new Constitution in 1942 named the Congress as the organ in charge of drafting tax exemptions and incentives. These policies came into play exactly when the economy was suffering from the effects of WWII isolation. In line with this situation, the government banned the exports of domestically manufactured goods and other essential goods. Trujillo's wealth expanded with the increasing regulation of domestic production. He took advantage of the external context to charge monopoly prices on essential goods and collect sizable fees for import licences.

As in most of Latin America, the development of the industrial sector was a product of international context and domestic policies. The isolation of the WWI planted the seeds of unintended industrialization. Simple artisan shops emerged to solve the unavailability of foreign manufactured imports. Then, the sector expanded in the subsequent decades with the aid of favourable governmental policies.

Industrial promotion was successful in this new stage. While small firms expanded production by attracting more workers, the wealthier business class fully appropriated the stipulations of the new legislation. Requesting a wide array of special concessions, the Congress granted contracts to selected industrial interests. The first successful attempt was to found a textile firm based on Dominican production of cotton. This initiative received full exemption of all taxes for five years including tariffs on machinery and raw material imports. This contract became the blueprint for other import-substituting projects presented to the government. The import-substituting initiatives did not stop in the private sector. The state stepped in sectors of national interest such as alcohol distilling and chocolate production by providing funding and other favourable incentives. The industrialization promotion terms were very advantageous that even foreign investors jumped on the bandwagon. In the 1950s, Trujillo approved the extension of benefits to foreign capital leading to the creation of industrial free zones in 195519.

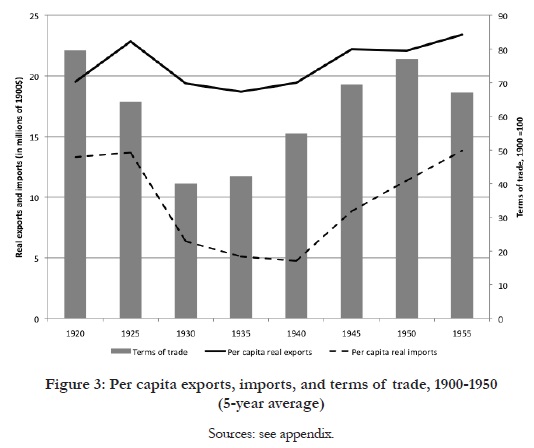

While successful at expanding the local industry, the industrialization programmes did not foster trade. As Figure 3 shows, both real imports and real exports per capita declined during the bulk of the period. Real imports per capita reached less than 40% of the level achieved by the end of the first globalization wave. Per capita real exports lost some ground during the 1930s and 1940s as well.

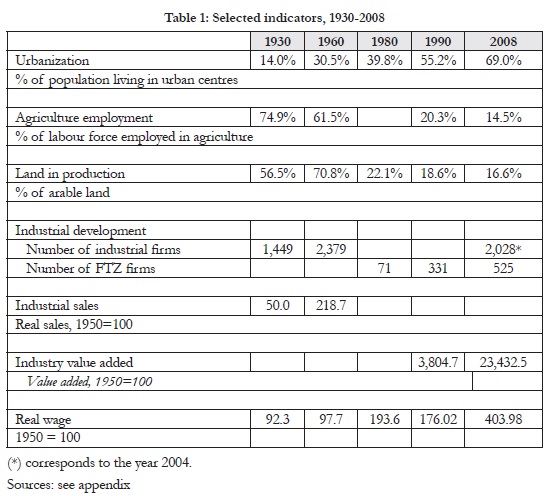

As shown in Table 1, profound changes pervaded the Dominican economy during this period. The urban centres, this time, attracted rural population: while urbanization doubled, the population employed in agriculture declined almost 15 percentage points to reach around 60% at the end of the period. Despite the migration to the cities, the agricultural sector increased substantially the area cultivated, reaching 70% of the total arable land by 1960. A clear pattern arises: the cities, where industrialization was seated, pulled more and more population from the countryside. As manufacturing firms expanded in number and production, the gains for the labour force were scant. In fact, the real industrial wage only climbed 6% in these three decades.

The growth of the Dominican economy during this period of unintended and intentional industrialization is undeniable. Excluding the sugar industry, the industrial sector tripled its size to employ almost 30,000 workers in 2,400 firms by 1963 (Oficina Nacional de Estadística). Despite this progress, the sugar industry still contributed as much revenue as all the other sectors combined while employing three times the labour force in manufacturing. Moreover, the intentional stage of import-substituting industrialization failed to adopt a uniform strategy. As in many other Latin American countries, the policies did not obey efficiency or developmental considerations. In addition, the expansion of the industrial sector channelled funds to the regime creating an increasingly distorted economy. From a development perspective, the agrarian reform benefitted the landless class by providing secure property rights; however, this reform also followed the capricious direction of Trujillo's leadership. While formal employment opportunities improved, the increasing cost of living stemming from the consumption taxes and substitution initiatives resulted in meagre gains for the labourer class.

4. Import substitution - export-led growth industrialization, 1960s-1990s

After decades of import-substitution industrialization, Latin America geared its efforts toward export promotion one more time over half a century after the first globalisation wave. The fruits of the famous industrial policies did not materialise for all the countries. The region once again faced a strategy dilemma while suffering from the consequences of macroeconomic mismanagement and a different international environment. One by one, the countries adopted trade liberalization policies that prompted an increase in exports and imports throughout the region. The new orthodoxy was solidified in the 1990s with the seal of approval from multilateral organizations. The impact of these policies varied considerably by country but in all cases there was acceleration in export growth from the 1990s onwards.

For the Dominican Republic, this renewed integration to world markets brought instability of export earnings and the increasing vulnerability to external shocks. The Dominican government then initiated a programme to restructure the real economy, aimed at diversifying its production and trade structures away from primary commodities. The government, assuming a more active role, embarked on protectionist ISI strategies, similar to programmes implemented in the rest of Latin America. Protectionist policies included imposing quantitative and administrative restrictions on imports, maintaining overvalued exchange rates and directing government investment in key industries.

The first and most significant programme involved the promotion of specialized manufacturing while protecting domestic producers from foreign competition. The Industrial Incentive Law (Law 299) of 1968 alongside the establishment of the Industrial Development Board, focused on developing the sectors of mining, construction and tourism. Trade policy was also legislated, involving the institution of a complex tariff code, additional duties, contingents, licenses, prohibitions, exemptions, and concessions to specific industries20. The variety of restrictions was paired with a multiple exchange rate system.

The Dominican Republic experienced a period of sustained growth following the restoration of democracy in the early 1960s, mostly due to favourable external conditions. From 1966 through the 1970s, GDP growth averaged 8% per annum, one of the highest growth rates in the world at the time. As in the previous decades, production and exports were highly concentrated in primary commodities, and at the beginning of the 1970s relatively few commodities accounted over 70 % of total export earnings: cacao, coffee, sugar and tobacco. Figure 4 shows that per capita real exports expanded during the period, leading to a positive trade balance.

But large fluctuations in revenues characterised the industries linked to world commodity markets. The terms of trade have been clearly unstable, due to the change in the price of oil (the country's main import) and the international prices of commodity exports (e.g. sugar and mining). During the current globalization wave, terms of trade instability are more evident. The favourable external conditions to commodity exports were visible in the mid 1970s, but the strike of luck followed by a sharp deterioration in relative prices during the next decades.

While industrial policy created the base for promoting and establishing a virtually inexistent industrial sector, inefficient policies, alongside other market imperfections, limited the outward orientation and success of the domestic industries. After a manifested effort to promote industrial development and diversification of trade, commercial policy turned inefficient because it relied on the use of complex instruments, mostly in the form of tariffs and non-tariff barriers and direct subsidies to specific industries. The restrictions and selective application of classical industrial policy instruments lingered to the following decades.

World events such as the increases in oil prices, the international debt crisis and the global recession that demarked the 1980s, contributed to the poor performance and brought to surface the inadequacies of the system for promoting sustained growth and development. The Dominican Republic was further disadvantaged by the decline in world sugar prices and the tightening of US sugar import quotas. The external shocks and unprecedented high interest rates on foreign loans pushed the economy into a cycle of current account deficits and growing external debt, and to the basis for a fi rst-generation exchange rate crisis.

Table 1 shows the marked structural changes following the import substitution – export led growth industrialization heterodoxy. The urban centres continued to draw rural population; however, the population employed in agriculture declined by almost half, relative to the 1930s. This also translated in a dramatic reduction of agricultural production according to the lower percentage of arable land.

The road towards industrial development was apparent in the increase in the value added of manufactures and the real wages with reference to the 1950s.

However, the number of plants declined, at the same time that the emerging FTZ sector was expanding. Real wages, as the overall economic conditions deteriorated, were also affected by the macroeconomic crises of the 1980s. It became evident these policies were not conducive to sustained growth. In tackling the late 1980s crisis, a new stabilization and structural adjustment reform package was implemented in the early 1990s. The program and its implications are discussed in the following section.

5. Trade liberalization - export oriented and structural adjustment since the 1990s

Following the 'lost decade', Latin America and other developing countries launched an extensive programme of macroeconomic reforms aimed at improving national policies and economic performance.

The Dominican Republic started fundamental economic reforms and trade policy adjustments in the early 1990s. The programme focused mostly on fiscal and trade policy reforms, and the main targets were increasing the efficiency of the existing tariff and tax structures, eliminating price distortions, reducing asymmetries in the incentives provided to specific industries and sectors, and maintaining fiscal equilibrium.

As far as trade and development, addressing the anti-export bias manifested by the unbalanced incentive structures and the exchange rate regimes were the most urgent tasks in order to increase exports' competitiveness and to achieve a better allocation of resources with a higher participation of the private sector in productive activities21. That is, trade policy reform, not industrial policy, was the tool to influence sectorial development and, thus, national industry portfolio.

At the onset of the structural reforms, the trade regime was complex and subject to discretion. Trade policy was typified by the use of import substitution strategy based on tariffs and non-tariff measures, exemptions and concessions to specific industries, and a multiple exchange rate system with various rates applied to different transactions. Before the reform, imports were ruled by over 27 laws, and 140 different taxes and duties, and were subject to three different types of exchange rates.22 The 1990 tariff reform addressed these issues.23 The domestic taxes applied to imports were also reformed, particularly the value added tax.

The exchange rate for different imports was unified, and the system of custom administration was improved reducing inefficiencies and corruption. In 1995 Congress approved a new foreign direct investment (FDI) law, which eliminated restrictions on foreign companies investing in selected economic sectors, and allowed the repatriation of profits and the access to long-term loans. Once macroeconomic stability was achieved in 1991, the Dominican Republic entered a new period of remarkable economic growth ruled by an open economic system.

In December of 2000, The Congress approved a programme of trade and tax policy reforms, the Tariff Reform and Fiscal Compensation Program. The new program further reduced tariffs and trade duties, the value added tax, and the tax on selective consumption. Overall, the reforms rendered the trade policy regime compliant with the multilateral rules governed by the General Agreement on Tariff and Taxes and the World Trade Organization (GATT/WTO).24

Notwithstanding ongoing trade liberalization, the incentive framework continues to be characterized by significant bias in favour of selected productive sectors. Most exporters of goods are exempt from the general trade and fiscal schemes in an attempt to counteract the anti-export bias of these regimes. The strategy, in tandem to persistent inefficiencies in infrastructure, notably in electricity supply, are significant obstacles for sustained improvements productivity, and hence development.

The manufacturing sector is divided in a set of firms that supplies the domestic market and the firms producing under the Free Trade Zones (FTZ) which operates under the incentives regime. FTZ production accounts for most of the Dominican Republic's merchandise exports, but its main industry, textiles and clothing, has been recently affected by the pressures of a more competitive global environment. In addition to export promotion programmes, new fiscal incentives schemes have been introduced to promote the competitiveness of the domestic industry and to reduce the gap resulting from incentives granted under the export-promotion regimes. But the concerns about distortions and allocation of resources remain25.

In contrast to manufacturing, agriculture production continues to be supported through incentives, including higher-than-average applied tariffs, direct payments, quotas, and marketing and price control programmes. Despite the significance of manufacturing and agriculture, it is the services sector that dominates the Dominican economy, mainly via tourism related activities. The contribution of tourism to the Dominican economy is crucial, and the sector has recovered from its depression in the early 2000s. There are no restrictions to foreign investment in the sector, and investors in certain tourism projects are granted incentives akin to the FTZ, including import and income tax exemptions.26 The telecommunications sector is one of the most dynamic in the Dominican economy, and has benefited from large flows of foreign investment following privatization in the mid-1990s. Conflicting with previous periods, trade policy measures continue to be used as short-term instruments for counteracting macroeconomic crises and business cycle fluctuations.

During the trade and liberalization driven development spell, the Dominican Republic managed to achieve a certain degree of structural transformation, insofar as achieving a relative shift from the commodities dependence that characterised earlier periods. Despite the advancements from the 1990s, the country requires further institutional and political changes to maintain sustainble growth and to generate the expected development gains. Per capita real imports still surpass per capita real exports, which is symptomatic of the productivity constrains and the limited factor endowments. In line with other studies27, we show that the country's advancements, in terms of development, steams mostly from the diversification of production and the development of special (free processing) economic zones and the country's participation in global trade and finance.

The recent performance of the Dominican Republic, as evidenced by high output growth and large productivity gains, is nonetheless divergent, due to the concentration of economic activities in narrow sectors such as manufacturing, telecommunications, and financial services. In terms of development, this implies limited impact on, for instance, employment generation. Moreover, the employment generated tends to be of low quality and real wages have remained stagnant28 .

Concluding remarks

Trade has brought about benefits for the Dominican economy; it allowed the country to integrate to the world markets allowing access to imports and capital. But these benefits entail unavoidable challenges. Throughout its history, the performance of the tropical commodity export sector deeply influenced economic development. The vulnerability to economic and environmental shocks is latent for small - tropical islands. Despite the significant openness to international trade, the low diversification in production and exports further exposes the country's vulnerability to adverse fluctuations and shocks in world markets and limits export earnings potential. This is evident in the historically unstable terms of trade and the volatile economic performance, mostly following the global commodity crises. To cope with the volatile global market conditions, this country attempted to diversify the productive base resulting in a series of distortions and biases.

Interventions by developing countries' include imposing tariffs, subsidies and tax breaks that imply distortions beyond those related with optimal taxes or revenue constraints. The question is, if these interventions are justified, do they necessarily lead to growth and development? The evidence further shows that trade and FDI policies are able to generate welfare gains when associated with increasing exposure to trade (i.e. export promotion leads to more welfare enhancement than import substitution). In developing countries in general, trade (and FDI influx) has led to higher and more sustained economic growth in the periods where there has been a clear export promotion strategy29. Industrial policy through FDI promotion may be more effective than intervention in trade, in part because FDI-promotion policies focus on new activities rather than on protecting (possibly unsuccessful) industries and sectors. Yet, there is a danger for the FDI-led export models to remain technologically stagnant, leaving developing countries unable to progress beyond the assembly of imported components30.

We show that the Dominican Republic has experimented with different policies to promote exports and the development of the domestic economy. At the whim of international forces, the export sector in the first globalisation failed to be a sustainable source of economic growth. Moreover, the relative insulation provided the World Wars allowed the government to adopt protectionist policies. The consequences of ISI were dire in terms of distortions and biases in the productive system contributing to profound economic crises.

In recent decades, the Dominican Republic has made significant progress towards a more open trade regime, particularly through the elimination of non-tariff barriers, by simplifying its tariff structure, and by reducing the rates of duties. The structure of the trade policy required important unilateral adjustments in response to the multilateral agenda, particularly with reference to the instruments that affect the productive sectors and the export strategies of the country. As a result, the Dominican Republic experienced remarkable growth rates in recent decades, which outpaced the performance of other countries in Latin America and the Caribbean.

Despite this recent success, eliminating the sources of distortions created by incentives to specific industries, continue to be a major challenge for the Dominican Republic. It is well known that agriculture is supported by measures like higher-than-average applied tariffs, direct payments, and marketing and price control programmes. These policies create deep distortions that impact mostly the consumers. But what is more critical is overcoming basic infrastructure constraints that reduce productivity by increasing costs. For the Dominican Republic, as other middle-income countries in Latin America and elsewhere, further diversifying production and trade is an enduring battle. This mostly implies evolving from labour-intensive, low-skill production perpetuated by the assembling FTZ model to higher value added and more skill technology-intensive activities.31 Investments in human capital, alongside with improving policies and infrastructure, will encourage such transformation, and will facilitate nurturing the creation of high quality employment.

Notes

7 A traditional indicator to measure the degree of openness is exports and imports as a share of the Gross Domestic Product (GDP). Unfortunately, GDP data are not available until mid-20th century. In the absence of GDP figures, other economic historians scale exports and imports scaled by total population to portray the degree of openness (see for example Bulmer-Thomas 2003).8 L. Arroyo Abad, and A.U. Santos-Paulino,"Trading Inequality? Assessing the Impact of Factor Endowments and International Trade on Inequality". UNU-WIDER Research Papers No. 2009/44 (2009).

9 Frank Moya Pons, "Import-Substitution Industrialization Policies in the Dominican Republic, 1925-61". The Hispanic American Historical Review70(4) (1990): 539-577.

10 Franklin J Franco, Historia económica y financiera de la República Dominicana, (Santo Domingo: Editora Universitaria), 1999.

11 Data from FAO (1960). The Dominican Republic exported 80% of the sugar production.

12 José Del Castillo,. La inmigración de braceros azucareros en la República Dominicana, 1900-1930, (Santo Domingo: Cuadernos del CENDIA), 1978. Humberto García Muñíz, "La plantación que no se repite: las historias azucareras de la República Dominicana y Puerto Rico, 1870-1930", Revista de Indias, 15(233), (2005).

14 Gobierno Provisional de la República Dominicana. Primer Censo Nacional de la República Dominicana, (Santo Domingo: Editora de la Universidad Autónoma de Santo Domingo), 1975.

15 José Del Castillo, La inmigración de braceros azucareros en la República Dominicana, 1900-1930, (Santo Domingo: Cuadernos del CENDIA), 1978.

16 Guillermo Moreno, "De la Propiedad comunera a la Propiedad Privada Moderna 1844-1924". Eme Eme Estudios Dominicanos, 9(51) (1980).

17 American intervention in Latin America was widespread and frequent during this period. For example the US established fiscal receiverships in eight countries in the region from 1904 to 1930 (see Arroyo Abad and Maurer 2013).

18 Richard Lee Turits, Foundations of Despotism: Peasants, the Trujillo Regime, and Modernity in Dominican History. Stanford: Stanford University Press, 2003.

19 Frank Moya Pons, Breve Historia Contemporánea de la República Dominicana, (México: Fondo de Cultura Económica), 1999.

20 Amelia U. Santos-Paulino, "Trade liberalisation and trade performance in the DominicanRepublic".Journal of International Development,18 (2006): 925-944.

21 Andrés Dauhajre Hijo, Sesgo Anti-exportador y Promoción de Exportaciones en la República Dominicana, (Santo Domingo: Banco Central de la República Dominicana), 1994.

22 Import prohibitions included textiles, food and electronic products, shoes, cars and luxury items. These prohibitions were supposed to encourage national production and to achieve a balanced trade account.

23 A new tariff code based on the 'Harmonised System of Goods Codification' was introduced. Although tariff rates were significantly reduced, temporary tariff surcharges remained in place until 1995 to counteract the impact liberalization on the protective structure of 'sensitive' sectors and to allow them to adapt gradually to foreign competition.

24 During the Uruguay Round of multilateral trade negotiations (1986-1994), a protection schedule and a tariff of 40% was consolidated for selected agricultural products (beans, corn, chicken, milk, rice and sugar). In 1998, the government established the quotas (approved by the WTO in February 1999) and tariffs on imports in excess of the quotas. The Dominican Republic further the reforms to include streamlining customs procedures, reducing tariffs, eliminating import surcharges and export taxes, and improving the legal framework akin to international standards. Since 2002, new laws have been adopted to improve the protection and enforcement of intellectual property rights, mostly reflecting the entry into force of the free trade agreement with the USA and Central America (DR-CAFTA).In some cases, the domestic regulations go beyond the standards established by the Trade Related Intellectual Property Rights (TRIPS) Agreement. Santos-Paulino (2010) documents the range of legislature reforms governing transparency and international trade.

25 Other programmes have been also fostered to aid small and medium-sized enterprises, technological innovation and regional development, mainly consisting of tax incentives, financing on preferential terms, technical assistance and support for research and development, World Trade Organization. "The Dominican Republic Trade Policy Review".Secretariat Report (2008).

26 Such incentives are conditional on employing Dominican professionals.

27 Susan Pozo, José R. Sánchez-Fung, and Amelia U. Santos-Paulino."Economic strategies in the Dominican Republic".Working Paper No. 2010/115 (2010).

28 A. Abdullaev, and M. Estevão."Growth and Employment in the Dominican Republic: Options for a Job-Rich Growth".IMF Working PaperWP/13/40 (2013).

29 Balasubramanyam, V., Mohamed Salisuand David Sapsford. "Foreign Direct Investment in EP and IS countries". Economic Journal, 106 (1996): 92-105.

30 Vandana Chandra, and Sashi Kolavalli."Technology, Adaptation,and Exports: How Some Countries Got it Right". In Technology,Adaptation and Exportsedited by Vandana Chandra, Chapter 1, World Bank Publications, 2006.

31 See, for instance, Hausmann et al. (2007) for a cross section analysis of export specialization and development.

References

Abdullaev, A. and M. Estevão. "Growth and Employment in the Dominican Republic: Options for a Job-Rich Growth". IMF Working Paper WP/13/40 (2013). [ Links ]

Arroyo Abad, Leticia and Noel Maurer. "Fiscal Receiverships and Charter Cities: Lessons from the U.S. to Latin America".1904-29, mimeo, (2013). [ Links ]

ArroyoAbad, L. and A.U. Santos-Paulino,"Trading Inequality? Assessing the Impact of Factor Endowments and International Trade on Inequality". UNU-WIDER Research Papers No. 2009/44 (2009). [ Links ]

Balasubramanyam, V., Mohamed Salisuand David Sapsford. "Foreign Direct Investment in EP and IS countries". Economic Journal, 106 (1996): 92-105. [ Links ]

Bulmer-Thomas, Victor. The Economic History of Latin America since Independence. Cambridge: Cambridge University Press, 2003. [ Links ]

Chandra, Vandana and Sashi Kolavalli. "Technology, Adaptation,and Exports: How Some Countries Got it Right". In Technology, Adaptation and Exportsedited by Vandana Chandra, Chapter 1, World Bank Publications, 2006. [ Links ]

Dauhajre Hijo, Andrés. Sesgo Anti-exportador y Promoción de Exportaciones en la República Dominicana. Santo Domingo: Banco Central de la República Dominicana, 1994. [ Links ]

Del Castillo, José. La inmigración de braceros azucareros en la República Dominicana, 1900-1930. Santo Domingo: Cuadernos del CENDIA, 1978. [ Links ]

Del Castillo, José. "La formación de la industria azucarera dominicana entre el 1872 y 1930".Clío, 74(169) (2005). [ Links ]

Food and Agriculture Organization. The World Sugar Economy in Figures, 1880-1959. Rome: FAO, 1960. [ Links ]

Franco, Franklin J.Historia económica y financiera de la República Dominicana. Santo Domingo: Editora Universitaria, 1999. [ Links ]

Froning, D. H. The benefitsof free trade: A guide for policymakers. The Heritage Foundation Backgrounder, 2000. [ Links ]

García Muñíz, Humberto. "La plantación que no se repite: las historias azucareras de la República Dominicana y Puerto Rico, 1870-1930".Revista de Indias, 15(233), (2005). [ Links ]

Gobierno Provisional de la República Dominicana. Primer Censo Nacional de la República Dominicana. Santo Domingo: Editora de la Universidad Autónoma de Santo Domingo, 1975. [ Links ]

Goldberg, P. K. and N. Pavcnik. "Distributional Effects of Globalization in Developing Countries".Journal of Economic Literature, 45(1) (2007): 39-82. [ Links ]

Hausmann, R., J. Hwang and D. Rodrik,'What you Export Matters',Journal of Economic Growth, 12: 1-25, 2007. [ Links ]

Krueger, Anne."Trade Policy and Economic Development: How We Learn".American Economic Review, 87(1) (1997): 1-22. [ Links ]

Lluberes, Antonio. "La economía del tabaco en el Cibao en la segunda mitad del siglo XIX". Eme Eme Estudios Dominicanos, 1(4)(1973). [ Links ]

Moreno, Guillermo, "De la Propiedad comunera a la Propiedad Privada Moderna 1844-1924". Eme Eme Estudios Dominicanos, 9(51) (1980). [ Links ]

Moya Pons, Frank. "Import-Substitution Industrialization Policies in the Dominican Republic, 1925-61". The Hispanic American Historical Review70(4) (1990): 539-577. [ Links ]

Moya Pons, Frank. Breve Historia Contemporánea de la República Dominicana. México: Fondo de Cultura Económica, 1999. [ Links ]

Mutto, Paul. "La economía de exportación de la República Dominicana". Eme Eme Estudios Dominicanos, 3(15)(1974). [ Links ]

Mutto, Paul. "Las importaciones y el impacto del cambio económico en la República Dominicana, 1900-1930". Eme Eme Estudios Dominicanos, 4(20) (1975). [ Links ]

Oficina Nacional de Estadística.Anuario estadístico de la República Dominicana. Ciudad Trujillo: Dirección General de Estadística, various years. [ Links ]

Panagariya, Arvind. "Miracles and debacles: Do free-trade skeptics have a case?." Economics Working Paper Archive, Washington University in St. Louis, International Trade Series 0308013 (2003). [ Links ]

Pozo, Susan, José R. Sánchez-Fung, and Amelia U. Santos-Paulino. "A note on modelling economic growth determinants in the Dominican Republic". Macroeconomics and Finance in Emerging Market Economies, 4 (1) (2011):35-41. [ Links ]

Pozo, Susan, José R. Sánchez-Fung, and Amelia U. Santos-Paulino."Economic strategies in the Dominican Republic". Working Paper No. 2010/115 (2010). [ Links ]

Prebisch, Raúl. El desarrollo de la América Latina y algunos de sus principales problemas. Santiago de Chile: Comisión Económica para América Latina (CEPAL), 1949. [ Links ]

Ricardo, David. Principles of Political Economy, with Some of Their Applications to Social Philosophy. London: Parker, 1848. [ Links ]

Sachs, Jeffrey and Andrew Warner. "Economic Reform and the Process of Global Integration". Brookings Papers on Economic Activity, (1) (1995): 1-118. [ Links ]

Santos-Paulino, Amelia U., "Trade liberalisation and trade performance in the Dominican Republic". Journal of International Development,18 (2006): 925-944. [ Links ]

Santos-Paulino, Amelia U., "The Dominican Republic Trade Policy Review". World Economy, 33 (11) (2010): 1414-1429. [ Links ]

Tupy, M. L. Free trade benefits all. Washington Times (January 6)(2006). [ Links ]

Turits, Richard Lee.Foundations of Despotism: Peasants, the Trujillo Regime, and Modernity in Dominican History. Stanford: Stanford University Press, 2003. [ Links ]

Williamson, J.G. Globalization and the Poor Periphery before 1950.Cambridge: MIT Press, 2006. [ Links ]

Winters, A.L., N. McCulloch, and A. McKay (2004). "Trade liberalization and poverty: The evidence so far". Journal of Economic Literature, 42 (2004): 72-115. [ Links ]

World Trade Organization. "The Dominican Republic Trade Policy Review". Secretariat Report(2008). [ Links ]

Appendix

- Trade data

- Total flows, composition, destination, and origin

1890-1906: Handbook of the American Republics, 1890-1910

1906-1930: Informe de Receptoría de Aduanas Dominicanas, 1907-1930.

1931-1939: Dominican Republic Statistical Office, 21 años de estadísticas dominicanas, 1936-1956, Ciudad Trujillo: Era de Trujillo, 1957.

1940-2010: Oficina Nacional de Estadística. - Terms of trade

- Export prices:

1890-1906:

Tobacco: From Olmstead, Alan L., and Paul W. Rhode, "Cotton, cottonseed, shorn wool, and tobacco - acreage, production, price, and cotton stocks: 1790-1999 [Annual]." Table Da755-765 in Historical Statistics of the United States, Earliest Times to the Present: Millennial Edition, edited by Susan B. Carter, Scott Sigmund Gartner, Michael R. Haines, Alan L. Olmstead, Richard Sutch, and Gavin Wright. New York: Cambridge University Press, 2006.

Sugar and Cacao: Haines, Michael R., " Wholesale prices of selected commodities: 1784-1998." Table Cc205-266 in Historical Statistics of the United States, Earliest Times to the Present: Millennial Edition, edited by Susan B. Carter, Scott Sigmund Gartner, Michael R. Haines, Alan L. Olmstead, Richard Sutch, and Gavin Wright. New York: Cambridge University Press, 2006.

Coffee: Sauerbeck, Augustus, Prices of Commodities and the Precious Metals, Journal of the Statistical Society of London 49(3), 1886.

Sauerbeck, Augustus, Prices of Commodities During the Last Seven Years, Journal of the Royal Statistical Society, 56(2), 1893.

1907-1935: Informe de Receptoría de Aduanas Dominicanas, 1907-1930.

1935-1947: Dominican Republic Statistical Office, 21 años de estadísticas dominicanas, 1936-1956, Ciudad Trujillo: Era de Trujillo, 1957.

1948-1979: IFC

1980-2010: UNCTAD - Import prices:

Until 1940s, most of the imports were textiles, machinery, and building materials from the US. In the absence of Dominican prices, we opted for American wholesale prices as detailed below.

1890-1946: based on the imports composition, we used the price evolution of textiles, metals and metal products, building materials, and chemicals from Hanes, Christopher, "Wholesale price indexes, by commodity group: 1890-1951 [Bureau of Labor Statistics]." Table Cc84-95 in Historical Statistics of the United States, Earliest Times to the Present: Millennial Edition, edited by Susan B. Carter, Scott Sigmund Gartner, Michael R. Haines, Alan L. Olmstead, Richard Sutch, and Gavin Wright. New York: Cambridge University Press, 2006.

1947-1979: Martí Gutiérrez, Adolfo, Instrumental para el Estudio de la Economía Dominicana, 1945-1995, Santo Domingo: Editora Búho, 1997.

1980-2010: UNCTAD

Export and import weights

Based on export and import composition in 1880s-1910s. - Population

- Dirección General de Estadística, Población del República Dominicana, Ciudad Trujillo: Dirección General de Estadistica, 1947.

- Industrial statistics

- Oficina Nacional de Estadística, Anuario estadístico de la República Dominicana, Ciudad Trujillo, Dirección General de Estadística, various years.

- Central Bank of the Dominican Republic

- Consejo Nacional de Zonas Francas, Informe Estadístico

- See for example Krueger (1997) and Panagariya (2003).

- David Ricardo, Principles of Political Economy, with Some of Their Applications to Social Philosophy (London: Parker, 1848). Jeffrey Sachs and Warner Andrew. Economic Reform and the Process of Global Integration. Brookings Papers on Economic Activity (1995), 1-118.

- D. H. Froning, The benefitsof free trade: A guide for policymakers. (The Heritage Foundation Backgrounder, 2000). M. L Tupy, "Free trade benefits all", Washington Times, January 6th, 2006.

- Raúl Prebisch, El desarrollo de la América Latina y algunos de sus principales problemas. (Santiago de Chile: Comisión Económica para América Latina [CEPAL]), 1949. J.G.Williamson, Globalization and the Poor Periphery before 1950, (Cambridge: MIT Press), 2006.

- A.L.Winters, N. McCulloch and A. McKay (2004). "Trade liberalization and poverty: The evidence so far".Journal of Economic Literature, 42 (2004): 72-115. P. K. Goldberg and N. Pavcnik. "Distributional Effects of Globalization in Developing Countries". Journal of Economic Literature, 45(1) (2007): 39-82.

- Given the long-run approach of this paper, it is sometimes difficult to find data for long-run series for development outcomes over time. While we present consistent series for trade over this long period of time, we offer selected indicators on economic development in the different sections based on availability.