Introduction

This work presents research on the performance of innovation in the pharmaceutical industry in accordance with its characteristics and attributes. In Spain, innovation arises as part of expansion to create goods or services or to significantly improve those that already exist. The drugs manufactured by pharmaceutical companies have been related to the development of a community, being required for their contribution to health (Formichella, 2005; OECD & Eurostat, 2005).

The prominence of this industry has driven a review of public information of pharmaceutical companies established in Spanish territory affiliated with Farmaindustria and Plan Profarma (2010) during the period from 2009 to 2011 (Plan Profarma is a joint program of the Spanish Ministry of Industry, Energy and Tourism that aims to increase the competitiveness of the pharmaceutical industry in Spain). The above is motivated by the profound literary content through diverse sources of information that offer a compendium of figures about the pharmaceutical sector of a country, a group of countries, a continent or the pharmaceutical sector in general, which promotes the specific exploration of what happens in a country, together with the interaction that it sustains as part of the European Community.

Consequently, the information was introduced into a database created for the purpose of assessing the innovative profile of the pharmaceutical companies. Other studies conducted on the pharmaceutical sector in Spain have used the questionnaire as a research tool, achieving limited acceptance and in some cases, the results have revealed a low rate of response, for example, 4.23% (García, 1995; Piña, 2007).

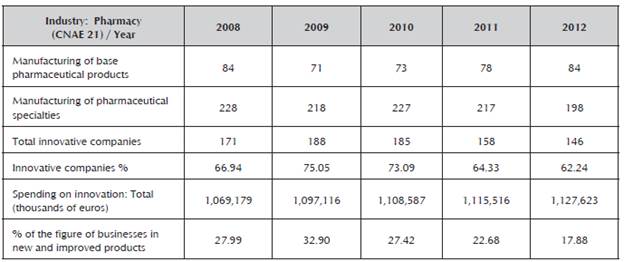

Firstly, the literature was used as an instrument to obtain information to assist the decision-making process (Ortíz, 2003; Zaintek, 2003). The data found were filtered by autonomous community, as well as by the sector of economic activity, number of employees and therapeutic areas, among others, in which characteristics of innovative behavior can be indicated during the period of study, as well as indications of opportunity and threat. In addition to this, the National Statistics Institute (INE, for the Spanish original) makes an annual publication of the most innovative sectors of Spain, which according to the 2008-2012 comparison, observes a decrease in the pharmaceutical industry in the number of innovative companies (see Table 1).

Table 1 Comparison of innovative companies in Spain by branch of activity: 2008, 2009, 2010, 2011 and 2012.

Source: National Statistics Institute (INE 2013a)

Table 1 presents figures of innovative companies that manufacture pharmaceutical specialties according to the National Classification of Economic Activities of Spain (CNAE, for the Spanish original, 21.2) (INE, 2013b), as an appropriate reference to assess the companies against. During the period of analysis, the country was in financial crisis, in which an increase in market power was reflected by the companies that continued to operate despite the reduction in numbers each year.

Pharmaceutical specialties refer to medication with the defined composition and information in pharmaceutical format and established dosage prepared for its immediate, available and conditional medicinal use and for its sale to the public with name, packaging, containing and labeling in line with sanitary authorization (INE, 2013b; Tait, 2001).

This work shows the advantages of the national pharmaceutical industry and the opportunities that can be detected with the help of available information about the study environment, like the possible contingencies for threats. These include the number of domestic and foreign companies and the annual sales figures. However, the pharmaceutical sector is classified as an innovative sector. Therefore, the characteristics that the companies habitually exhibit to define their innovative profile are explained (INE, 2013a).

Therefore, the selection of variables was based on obtaining information that would reflect the opportunities and threats of the pharmaceutical industry in Spain in the short and medium term (1-3 years) with an elemental perspective of a comparative static study.

The scope established in this analysis includes establishing relevant information that suggests indications of an event according to the performance shown by the Spanish pharmaceutical industry in a period of time.

Methodology

The pharmaceutical companies and laboratories in Spain are the main actors in this work, which is comprised of N = 200 national and international companies that represent 100% of the population. This percentage includes the companies that were affiliated with Farmaindustria and Plan Profarma in the period of analysis.

The companies that form the population have been estimated without restrictions regarding the size of the organization or type of economic activity that it carries out as a parent company or foreign subsidiary with the aim to issue an analytical argument that admits the greatest number of companies of the genre in the study.

The non-probability sampling for this work is intentional. This means that the elements are selected based on criteria or opinions pre-established by the researcher.

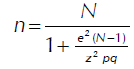

In this case, the type of sampling was selected according to the kind of comparative statistical analysis, obtaining the advantage of the finite, reduced-sized and known population. Therefore, the formula used to establish the sample when the population size is known is described below, according to Vallejo (2011).

n = Size of the sample we would like to know

N = Known population size

z = Value of z corresponding to the confidence level. A 95% confidence level (it is also expressed as follows: α= 0.05) corresponding to z = 1.96 sigmas or typical errors.

e = The margin of error and means possible deviation or error that is accepted and must not be higher than 0.05 (5%) so that the results are relatively informative and useful

pq = Population variance, as unknown, the highest variance possible is used assuming that half answers yes and the other half answers no = (0.50) (0.50) = 0.25 (a constant)

The necessary sample size to reliably estimate the measurement instrument in this analysis corresponds to n = 132 observations for a population N = 200 elements, thus maintaining a margin of error of 5% and confidence level of 95%. In this aspect, the population value validates the instrument to create the database of Spanish pharmaceutical companies.

Once the sampling was carried out, the companies that were the subject of the study were identified through the websites from which information was taken and stored in a database of Spanish pharmaceutical companies. In its contents, the database displays fields to document the characteristics and attributes of the selected variables according to the Oslo Manual (2005) and the Frascati Manual (2002). Finally, the Iberian Balance Sheet Analysis System (SABI, for the Spanish original) (2012) was used as a tool for inquiry about the annual accounting information that Spanish companies supply to the classified records according to the National Code of Economic Activities (CNAE, for the Spanish original).

Design

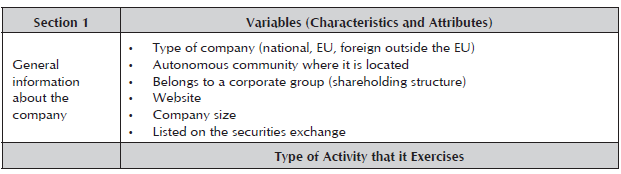

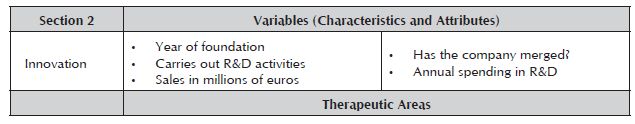

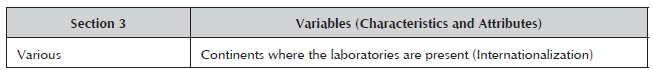

This work defined three sections considered for the qualitative and quantitative analysis of innovation in Spanish pharmaceutical companies. Each one contains variables selected with the aim to obtain useful information in a specific review of the studied sector in Spain with which an opinion can be issued based on prior and historical results (see Tables 2, 3 and 4).

Table 3 Indicator of innovation and the variables that will describe the innovation effort of the companies.

Table 4 The degree of internationalization of national and international pharmaceutical products is shown.

The section called General Information about the Company provides the set of characteristics and attributes of the pharmaceutical companies, as well as referring to some of their functions (see Table 2). Following a qualitative model, it describes: 1. Data and main sources of the information, 2. Transcription and structuring of information in a database, and 3. Coding of information in three categories (national companies, European companies and companies from the rest of the world). The quantitative model is static descriptive (Fernández, 2006).

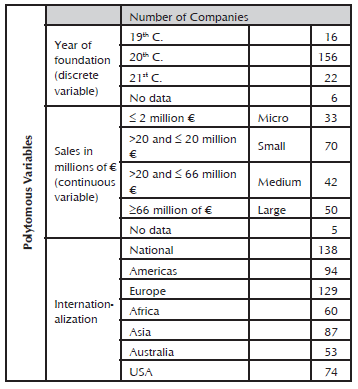

The type of variable used differs in each section and therefore, they were grouped according to their type. Regarding the measurement scale for the qualitative variables, the dichotomous and polytomous variables are "nominal or ordinal" like the quantitative variables, and the continuous variables are ordinal. In turn, they represent a set of independent variables grouped in each section.

Among the types of main products is parapharmacy (products that are not medication, but are similarly consumed or used by human beings to help take care of their health) (Portalfarma 2012).

The Innovation Section represents aspects that research part of the innovative activity of the pharmaceutical companies and identifies strong and weak aspects of it. Furthermore, it recognizes the main therapeutic areas in which the companies work. Therefore, the information obtained will serve to evaluate an aspect of the innovation efforts of the Spanish pharmaceutical companies.

As the last section, Various, refers to the operations sphere that identifies the geographical area of the destination of the products manufactured by the pharmaceutical firms.

Internationalization has covered the five continents (Europe, Africa, Asia, Oceania and the Americas), as well as Spain and the United States of America separately, because it is perceived that literature about the Americas could create confusion by being associated only with the United States of America or being considered as all the countries that are geographically located in the continent of the Americas from Greenland to Chile and Argentina.

Procedure

Firstly, the list of pharmaceutical companies associated with Plan Profarma (2009) and Farmaindustria (2010) in the period of time studied was obtained. According to the Oslo Manual (OECD & Eurostat, 2005) and the Frascati Manual (OECD, 2002), variables were selected that generated interest in the value content that they offer, because the information as a whole is useful for the decision-makers involved in the sector. Thirdly, a database was generated of pharmaceutical companies established in Spain. Once the database was documented, the data were treated using filters to obtain accurate quantitative data, which were translated into diagrams and maps.

The filtering consisted of eliminating the cases with lost values or assigning an estimated value and therefore, calculating and obtaining averages and percentages. In this way, the treatment contributed to the identification of companies that carry out R&D for example, because it has been established by institutions such as INE and Farmaindustria to be one of the indexes connected to a company's degree of innovation. For this reason, associations that carry out R&D constitute an essential factor in an economy's competitiveness and growth.

Results and Discussion

The results are displayed below in tables and figures where important values to consider in a decision-making process are highlighted.

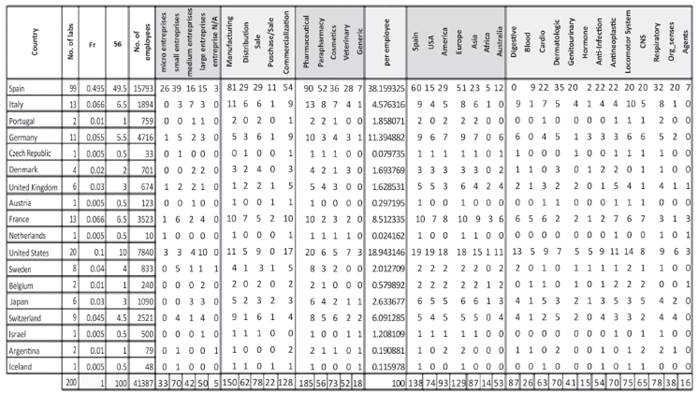

The following was found from the variables of the General Information Section.

The kind of company refers to the geographical origin. Regarding this characteristic, national companies were identified with n = 99 and international companies with n = 101. According to the data treatment, the international companies were classified according to the country of origin of the subsidiary, whether of the European Union (EU) or the rest of the world (RW).

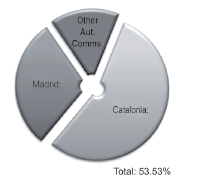

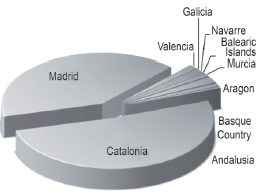

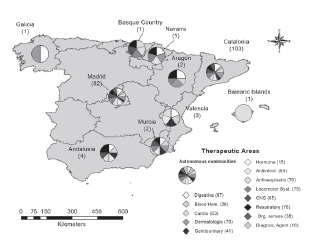

In Figure 1, the set of companies of the analysis are observed N = 200, as well as their location, out of which, the greatest proportion is found in the communities of Madrid and Catalonia.

Figure 1 Distribution of domestic and foreign pharmaceutical companies located in Spain by autonomous community.

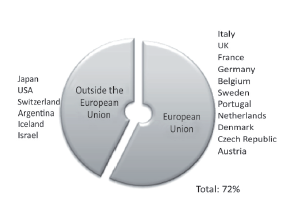

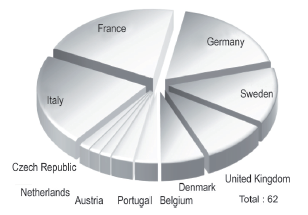

In the international part, in the EU, countries such as Italy, France, Germany, Sweden and the United Kingdom stand out with each country having more than five pharmaceutical companies. This group represents 31% of the analyzed population (see Figure 2).

Figure 2 Average of international pharmaceutical companies originating in countries of the European Union.

Meanwhile, the countries of the rest of the world (RW) have an influence in Spain in 19.5% of the analyzed population. In this group, there are powers of domination in the pharmaceutical industry comprised of the USA, Switzerland and Japan from three continents: the Americas, Europe and Asia (see Figure 3). Geographically, Switzerland is located in Central Europe, but it does not belong to the economic area of the euro and therefore, corresponds to the sector of countries of the RW for this work.

Figure 3 Average of international pharmaceutical companies originating in countries outside of the European Union (rest of the world).

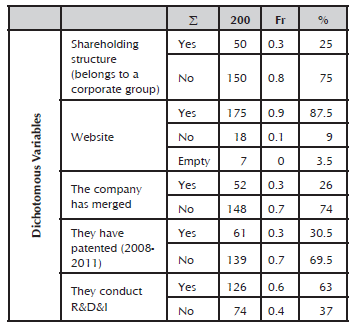

It was identified that 25% of the analyzed sample maintains a shareholding structure. That is, it belongs to a corporate group. In the case of national firms, the microenterprises and SMEs that form part of a corporate group share the same website. Only 9% of cases does not have public information, resorting to other available sources, such as the SABI database (2012), for inquiry.

The company size was considered based on the volume of annual sales and the number of employees.

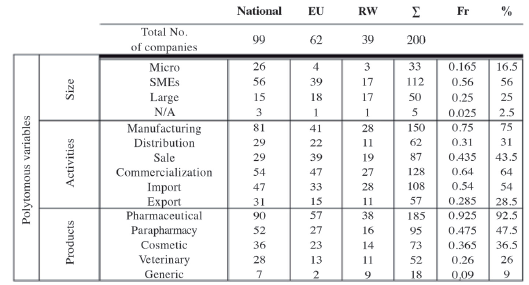

According to the results, during the period of time analyzed, national and international companies comprise almost the same number of companies in both categories. On the other hand, the Spanish pharmaceutical industry is comprised mainly of micro, small and medium enterprises. The large companies constitute an elevated percentage of foreign companies (see Table 6 and Table 7).

Table 6 Number of pharmaceutical companies by region and characteristics.

Units: Absolute values and percentages.

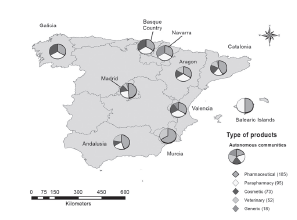

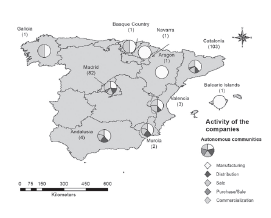

The sector of activity and the type of products that the Spanish pharmaceutical companies work on have national and international exposure (see Table 6 and Table 7). On the one hand, Table 6 indicates the kind of corresponding variable and on the other, Figures 4 and 5 are displayed on the map for better visual location.

The national companies and those of the RW have been more inclined toward import than export, such that they offer their countries a position of deficit.

Figure 4 Geographical distribution according to the kind of product that is produced in the Spanish pharmaceutical companies.

Figure 5 Geographical distribution according to the sector of economic activity in which the Spanish pharmaceutical companies operate.

However, this phenomenon occurs in other industrial sectors of the country and the contrary situation of surplus will be reflected in different investments of the organization, such as R&D, training, recruitment and others.

The number of companies listed on the securities exchange corresponds to 7.5% of the analyzed population.

The results of the second section refer to:

The sales figure in millions of euros. On the one hand, it can alert suppliers and distributors of the company's negotiating power. On the other hand, the company size can be classified by its revenue, which despite not being an indicator of innovation can be used to observe the characteristics of firms with an innovative profile.

The establishment of companies of the Spanish pharmaceutical sector had its peak in the 20th century. In this regard, it is worth mentioning that only 17% of the population indicated the year in which it started operations in Spain.

R&D activities refer to the work carried out by the pharmaceutical companies to obtain new innovative products. For example: targeting drugs (molecules that perform an essential function in a disease that are transformed into a new medication) (Amgen, 2013). With this rigor, 28 national companies were identified in Barcelona, 15 in Madrid and the remaining 8 in the other communities indicated above. The set of companies represents 25% of the analyzed population and 53.53% of the national firms that carry out R&D (see Figure 6). The national companies that recorded innovative activity have presence through their products in Europe, the Americas, Asia, Africa, USA and Australia, in this order.

Meanwhile, the international community of pharmaceutical firms that carries out R&D comprises 36% of the population, which amounts to 42 companies of the EU and 30 companies from the RW (see Figure 7).

The nature of the pharmaceutical sector and its relationship with innovation both maintain a strong influence in different countries, which is mainly due to the sector's impact, performance and capacity to resolve problems in the health sector. This is related to its capacity for innovation and its imitation strategy (Guzman, 2004).

Therefore, Spain is located within the moderate innovators group of countries. This is how it is classified by the Union Scoreboard of the European Union. This characterization perceives an imbalanced system of innovation in research according to the evaluation of the eight dimensions that constitute this body (Hollanders, & Es-Sadki, 2014).

Investment in R&D demonstrates the competitive and strategic importance of the companies, which is quantified in an annual average. However, this work is inaccurate considering that only 10% of the analyzed population reported its figures.

In this sense, the pharmaceutical industry maintains an elevated rate of investment in R&D regarding sales, which characterizes this industry by being one of the most intensive in scientific research and technological development, dedicating a fifth of all the industrial R&D of Europe. However, this investment is almost completely financed by private money.

In turn, Tsokanas and Fragouli (2012) explain that each new medication that enters the pharmaceutical market is the result of a long, risky and very costly R&D process (Badr, Madden & Wright, 2006).

At the end of the 20th century and noticeably from the year 2000, many mergers between companies were observed, where according to data collected, 26% of the population completed a merger, acquisition or joint venture commercial agreement because it was in its interest. The common reasons included achieving operating economies, product expansion, growth, and above all, having the strength of both companies. This kind of operation aims to position the company in new markets, such as the North American, Asian, Australian and African markets, despite knowing that resources are scarce in the last market.

Therefore, the way in which they affect these operations lies in increasing the number of foreign firms established in national territory when possibly aspiring to the growth of Spanish firms for development of both the sector and the country. Likewise, mergers are not considered to be a constant among Spanish firms.

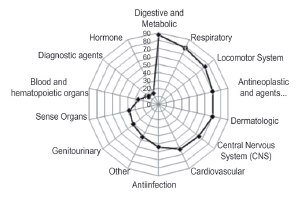

To sum up, 60% of the pharmaceutical companies produces drugs for the following therapeutic groups: Cardiovascular with 31%, followed by Antineoplastics (tumors) with 27.5% and the Respiratory System with 11.57%, recognized up to 2012 in accordance with INE (2010).

The degree of diversification is applied to different therapeutic groups in which the Spanish pharmaceutical companies work. In this case, areas of specialization can be identified just as the forgotten and less profitable ones can. The therapeutic areas with the greatest presence in pharmaceutical companies concern the central nervous system (CNS), cardiovascular, digestive-metabolic and respiratory systems, which comprise 67% of the total market in sold units (Farmaindustria, 2012).

From the geographical perspective, Figure 8 highlights the representative therapies given the presence in the pharmaceutical companies. For example, the firms located in Madrid or Catalonia comprise the whole range of analyzed therapies. However, this does not mean that every company manufactures drugs for all the mentioned therapies, but that for the production, distribution or sale of these therapies, they are produced in laboratories that are physically located in the indicated communities and on different scales (see Figure 9).

Figure 8 Therapeutic areas with greater and lower presence of production, distribution or sales in the Spanish pharmaceutical companies.

Note: The number in brackets includes the total companies in this community and the number in the table of contents indicates the amount of companies that produce drugs for this therapy. Source: Own preparation.

Figure 9 Geographical distribution of pharmaceutical firms that work in different therapeutic areas by autonomous community.

Based on the results obtained, it is emphasized that the International Federation of Pharmaceutical Manufacturers and Associations has stated that the main chronic diseases are: cardiovascular, cancer and respiratory diseases and diabetes, because every year, they cause the death of three out of five people in the world with 80% of deaths related to countries with low or medium income (IFPMA, 2013).

As the last section, Various refers to the sales operations environment of the pharmaceutical companies. Table 7 indicates the estimated geographical areas for the location of greatest impact, also called degree of internationalization, due to the presence of the pharmaceutical products in different countries of the world.

Another characteristic of the pharmaceutical industry is the elevated degree of internationalization that it has. The production facilities that are owned by the companies are not located exclusively in their countries of origin, they have extended abroad. This process has been essentially led by the multinational pharmaceutical companies that trade in the world. Although the reasons that lead the pharmaceutical companies to globalize their activities can be diverse, there are two kinds of motive. On the one hand, there are those that aim to establish their commercial presence in the highest number of foreign markets in an attempt to compensate for the production costs of drugs. On the other hand, the pharmaceutical companies always aim to obtain the resources that they need, taking their key services (R&D, production of active substances, dosage and packaging) to a global scale.

Internationalization evokes the number of companies that are present in each geographical area analyzed, which include the five continents and the two additional areas of the USA and Spain. The result shows that Spain, Europe and the Americas are the markets that incorporate a greater presence of drugs prepared by the different pharmaceutical companies into their portfolio. While the addition of the USA, Africa, Asia and Australia, is lower.

Conclusions

From the perspective that the field of innovation projects through literature and public information on the pharmaceutical companies, relevant information is recovered from the Spanish industrial sector. In this sense, it is possible to assume that regarding industry, the pharmacy genre is located within the country's range of innovative industries, despite not belonging to the most notable sectors, such as the automotive and aeronautical sectors (Farmaindustria, 2012). However, it enjoys a good position in the category of main investing sectors for innovation in R&D.

Based on the results obtained in this work, the following can be concluded:

The national pharmaceutical industry is showing a decrease in the number of associated companies and an increase in the number of foreign companies through the creation of subsidiaries. According to the observed trend, it has been explained that this industry assumes the progressive growth of large international firms and the decrease of national microenterprises and SMEs.

The poles of innovation are identified according to the geographical circumstances in the communities of Madrid and Catalonia (Barcelona).

The year of establishment of the companies falls between 1812 and 2009, and the majority of the companies are 21 to 50 years old. That is to say that they were founded between 1943 and 1973. These data do not offer valuable information to issue a qualitative judgment on the innovative profile, above all when there is not a relationship as it is not a variable dependent on innovation. However, it is a reference that can be applied to future studies.

Out of the national companies, 25% dedicates its efforts to R&D activities and indicates a low innovation index that may represent the pharmaceutical sector within the innovative industry system.

The Spanish pharmaceutical industry is comprised of micro, small and medium enterprises. The large pharmaceutical companies established in Spain are usually part of foreign companies. The most famous include those of North American, French, German, Italian and Swiss origin (Farmaindustria 2015). Therefore, the trend for medium and large companies to acquire the smaller companies creating mergers is still going strong. The advantages include the possible prevention of a company's dispossession, strengthening itself from said union.

Following codes of confidentiality in information, the pharmaceutical companies do not always disclose public information, but offer data through private paid portals. This situation is accessible for the most involved people, being classified in an elitist position for select people and organizations.

Drug manufacturing has been the main activity of the Spanish pharmaceutical companies and those from the rest of the world. While for those of European origin, sales have been the main activity. On the other hand, the relevant products continue to be the pharmaceuticals. However, the inclination toward parapharmacy, cosmetic and generic products is gradually becoming stronger to the extent that now exclusive establishments can be found in the case of parapharmacy.

The companies that are listed on the securities exchange comply with the requirements of the National Commission of the Securities Market for distributing their shares among the public, which increases the prestige of the company when it has to provide information about its status. The aim is to provide confidence to possible investors. One of the restrictive requirements is to include a minimum capital of 1.2 million euros and no partner can have more than 25% of the shares. The above means being a solvent company when doing business, as well as being recognized by suppliers, investors and clients (Comisión Nacional de Mercado de Valores, 2014; Sánchez and Borrel, 1996).

In accordance with the type of innovation (product and process) (OECD and Eurostat, 2005), it is assumed that the main distinctive characteristic of the pharmaceutical sector has been product innovation in already existing therapeutic areas. This is in accordance with the number of targeting drug projects authorized by the Food & Drug Administration (FDA) annually. This implies that the SMEs are creators of small changes, for example, with a new product presentation or the limited modification of the current products.

Therefore, radical innovations are aimed at the large firms that have the capacity to invest resources in R&D, for example. Essentially, these companies are usually foreign, so the Spanish pharmaceutical companies do not concern themselves with radical innovations. However, given the nature of this industry, the SMEs are those that constantly make small innovations to the drugs and that are in turn, the main engine for Spanish pharmaceutical innovation, even if they later have to resort to firms with a larger infrastructure to complement the pharmaceutical development.

In the associations of Farmaindustria and associates of Plan Profarma, the companies gradually change according to the plan they belong to. Therefore, each year, the amount of associated companies may show a slight modification to the extent that it shows growth or the opposite.

The results shown herein are part of a study carried out on the Spanish pharmaceutical sector. Consequently, with the innovative behavior observed and, from another less common perspective, by presenting information regarding therapies, products, services and so on, details were obtained that are not shown in the annual reports, including the description of the poles of innovation, geographical location by autonomous community, investor countries, therapies and participation in R&D.

A dilemma found was the absence of a homogeneous format that expresses the sales percentage, global invoicing and the figures achieved annually in millions of euros or U.S. dollars. The diversity lies in the fact that the information may be a consolidation of all corporate companies and not individual information.

The consequence of all of the above alludes to work on the same sector, with the aim to purchase characteristics and attributes in different years, without ignoring the limitations that occur, such as the absence of financial information, the restricted availability of public information or having to resort to payment portals to obtain information of interest, as well as the limited proximity of the pharmaceutical firms to conduct surveys on paper, online or in person.

Finally, the innovation trends that may affect the pharmaceutical sector in general mentioned by the National Intelligence Council include individual empowerment, demography, natural resources and environment, science and technology, the global economy and future conflicts (Tenet, 2000).

After 2009, with the drop of activity in Europe, economic evolution has been irregular (Farmaindustria, 2014). The economic crisis has shown that Spain needs to change its model of economic growth to ensure sustainable development in the 21st century. (Farmaindustria, 2009). This is an opportunity for the industry itself.

texto em

texto em