Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Estudios Gerenciales

Print version ISSN 0123-5923

estud.gerenc. vol.26 no.117 Cali Oct./Dec. 2010

STOCK MARKET WEALTH-EFFECTS DURING PRIVATIZATION INITIAL PUBLIC OFFERS IN CHILE (1984-1989)1

ROBERTO J. SANTILLÁN SALGADO*

Ph.D. in Business Administration ITESM -University of Texas, Mexico – United States. Full Professor of Finance, Graduate School of Business Administration, ITESM Monterrey Campus, Mexico. roberto.santillan@itesm.mx

* Dirigir correspondencia a: Av. Rufino Tamayo y Av. Fundadores, Valle Oriente, Garza García, Nuevo León, México, C.P. 66269.

Fecha de recepción: 15-06-2009 Fecha de corrección: 15-07-2010 Fecha de aceptación: 11-10-2010

ABSTRACT

The aftermarket performance of eleven privatization Initial Public Offers (IPOs) in Chile during 1984-1989 is studied in this document, and a detailed description of the economic and political conditions that prevailed is provided. In particular, we discuss the operational details of the stock issuing mechanism, complemented with a statistical study on the IPOs Market Adjusted Returns. While the sample size is limited and does not support a significant external validity, the analysis confirms the presence of aftermarket performance patterns that are very similar to those observed in private and privatization IPOs reported elsewhere (Aggarwal, Leal and Hernández, 1993; Dewenter and Malatesta, 1997; Loughran, Ritter and Rydqvist, 1994; Perotti and Guney, 1993).

KEYWORDS

Privatization, IPOs short-run underpricing, IPOs long-run under-performance.

JEL classification: G100, G140, G180

RESUMEN

Efecto-riqueza durante las Colocaciones Públicas Iniciales Privatizadoras en Chile (1984-1989)

Se estudia el desempeño posterior a la colocación de once Ofertas Públicas Iniciales (OPIs) en Chile, durante 1984-1989 y se proporciona una descripción detallada de las condiciones económicas y políticas prevalecientes. En particular, se presentan los detalles operativos del mecanismo de emisión de acciones, complementado con un estudio estadístico de los Rendimientos Ajustados por el Mercado de las OPIs. Aunque el tamaño de la muestra es limitado y no permite alcanzar una validez externa, el análisis confirma la presencia de patrones de desempeño muy similares a los observados en OPIs tanto privadas como privatizadoras, de acuerdo con otros estudios relacionados (Aggarwal, Leal y Hernández, 1993; Dewenter y Malatesta, 1997; Loughran, Ritter y Rydqvist, 1994; Perotti y Guney, 1993).

PALABRAS CLAVE

Privatización, subvaluación de OPIs, desempeño subnormal de largo plazo de OPIs.

RESUMO

Efeitos de riqueza durante as Colocações Públicas Iniciais de Privatização no Chile (1984-1989)

Estudamos o desempenho posterior a colocação de Ofertas Públicas Iniciais (OPIs) no Chile durante 1984-1989 e fornecemos uma descrição detalhada das condições econômicas e políticas prevalecentes. Em particular, apresentamos os detalhes operacionais do mecanismo de emissão de ações, complementado por um estudo estatístico dos Rendimentos Ajustados pelo Mercado das OPIs. Embora o tamanho da demonstração seja limitado e não permita alcançar uma validade externa, a análise confirma a presença de padrões de desempenho muito semelhantes aos observados em OPIs tanto privadas como privatizadas, de acordo com outros estudos relacionados (Aggarwal, Leal e Hernández, 1993; Dewenter e Malatesta, 1997; Loughran, Ritter e Rydqvist, 1994; Perotti e Guney, 1993).

PALAVRAS CHAVE

Privatização, subvalorização de OPIs, desempenho subnormal a longo prazo de OPIs.

INTRODUCTION

Privatization of State Owned Enterprises (SOEs) acquired great relevance during the 1980s and 1990s in both, developed and emerging countries. The fact that numerous governments engaged in vast privatization programs was a tacit recognition that the private sector is better prepared to run productive activities.2

Under some extreme circumstances, privatization decisions are associated to a survival strategy. For example, in the case of SOEs immersed in changing environmental conditions3 that demand dynamic investment efforts and are, at the same time, subject to limited public budgets. In many instances, the only sound strategic choice for handicapped SOEs is, in effect, privatization.

A number of works have documented how SOEs are frequently at a disadvantage when compared with private firms in terms of different performance measures (ROA, ROE, productivity, etc.), giving additional support to privatization programs.

Post-privatization performance also supports privatization programs and has been extensively documented (Boardman and Vining, 1989; Boubakri and Cosset, 1998; Boycko, Shleifer, and Vishny, 1995; Galal, Jones, Tandon and Vogelsang, 1994; Megginson, Nash and Van Randenborgh, 1994).

Among other beneficial consequences, different authors find that privatization reduces government intervention in the economy, along with public sector spending when subsidies to frequently inefficient operations are eliminated (e.g., Galal et al., 1994; Hachette and Lüders, 1994; Indacochea, 1993).

Another collection of studies has focused on the price performance of privatization IPOs shares and their long-run aftermarket performance for both emerging and developed markets. Most of those studies report significant short-run positive returns but disappointing long-term performance (Affleck-Graves, Hedge and Miller, 1996; Aggarwal, Leal and Hernandez, 1993; Benveniste and Wilhelm, 1997; Dewenter and Malatesta, 1997; Loughran, Ritter and Rydqvist, 1994; Perotti and Guney, 1993). This articles contribution to the privatization IPOs literature consists of the detailed analysis of a sample of Chilean privatization IPOs during a period that goes from 1985 to 1989. While the size of the sample is limited4 and does not support more general conclusions, the inclusion of institutional and economic context information provides additional elements to interpret the observed short-run underpricing and long-run underperformance of Chilean privatized companies shares.5

This article is organized as follows: section one reviews existing theories on IPOs short-run underpricing and long-run underperformance. Section two discusses empirical research work on private and privatization IPOs in Latin America and other countries. Section three narrates the privatization process in Chile from an institutional and historical perspective, emphasizing the economic and political implications of using public offerings to the general public as a mechanism for privatization. Section four discusses gradualism on the Chilean privatization. Section five presents a statistical analysis on the performance of Chilean IPOs shares from 1985 through 1989 and, finally, section six concludes offering additional insights on the use of IPOs as part of the Chilean privatization program.

1. TRADITIONAL THEORIES ON THE SHORT-RUN UNDERPRICING AND LONGRUN UNDERPERFORMANCE OF IPOs

1.1. Short run underpricing of IPOs

Short-run abnormal returns observed on IPOs shares have been an extensively studied subject. A number of studies have documented that shortrun underpricing is not unique to a country, and report evidence of its international presence (e.g., Celis and Maturana, 1998; Dewenter and Malatesta, 1997; Loughran et al., 1994).

Underpricing represents a puzzle for financial economists because, according to the Weak Form of the Efficient Markets Hypothesis (EMH for their abbreviations), observed market prices already contain all relevant historical information and, for that reason, no trading strategy based on historical information can yield abnormal returns. From that perspective, recurrent IPOs short run positive abnormal returns are inconsistent with the EMH.

To an investor, IPOs underpricing represent an opportunity to earn extraordinary short-run returns, while to the issuer it means leaving money on the table. Arbitrage arguments suggest that, if IPOs are more likely to offer extraordinary returns compared to other investment alternatives, all investors should demand them. However, an increased demand would result in issuers placing their IPOs at higher prices, thus reducing positive abnormal returns until they are totally eliminated. On the supply side, similar arguments suggest that IPOs issuance prices should converge to their economic value, eliminating short run underpricing.

The relative abundance of evidence on IPOs short run underpricing does not necessarily represent a contradiction of the EMH, but shows the need to develop a sensible explanation. In that sense, different attempts to give account of IPOs underpricing have been proposed. For example, Tinic (1988) explained IPOs underpricing in the United States emphasizing the role of legal risk. His argument is that underwriters take an insurance against potential legal liabilities by offering unseasoned stock issues at a price below their economic value.6

IPOs underpricing has also been associated with issuing firms signaling their quality (e.g., Allen and Faulhaber, 1989; Grinblatt and Yang, 1989; Welch, 1992). First time issuers who are conscious of the high quality of their issue underprice IPOs because that enables them to charge higher prices in subsequent stock offers.

Information asymmetry theories explain IPOs underpricing in terms of the existence of differential information between market participants. Baron (1982) presents a theory of the demand for advising and distribution services based on the existence of an asymmetry of information between the issuer and the investment banker. The value to the issuer of the bankers advising and distribution efforts is an increasing function of the issuers uncertainty. Greater uncertainty increases the demand for the services of the banker. Since the investment banker generates demand that may not otherwise exist by implicitly certifying the quality of the issue, the issuer lets the investment banker to underprice in compensation.

A different approach to information asymmetry was developed by Rock (1986), and suggests that there are two kinds of investors: informed and uniformed. Informed investors subscribe to IPOs only when they expect the after-market price to exceed the offering price, while uninformed investors subscribe to every IPO indiscriminately. In order to keep uninformed investors in the IPO market, investment bankers need to offer all IPOs at a discount from their expected after-market price.

1.2. Long-run underperformance of IPOs

A second extensively documented empirical regularity observed in IPOs aftermarket performance is their long-run overpricing. At first sight this is again a violation of the EMH because, if IPOs yield less than average long-run returns, investors will discriminate against them putting downward pressure on their placement prices until equilibrium risk-adjusted long-run returns prevail. Empirical evidence seems to contradict that expectation and leaves open a question about the completeness of the arbitrage arguments that support the EMH.

While no formal theory that explains long-run underperformance predominates over others, different authors agree that what appears to be IPO underpricing in the short-run results, in effect, to be long-run overpricing. Ritter (1991) studied the performance of 1.526 IPOs in the United States during a period that goes from 1975 to 1984. He found that his sample substantially underperformed a sample of firms matched by size and industry. Calculated from the closing prices on the first day of public trading to their three-year anniversaries, average holding period returns for the IPOs sample was 34,47%. However, a control sample of 1.526 listed stocks, matched by industry and market value, produced an average total return of 61,86% over the same period. Clearly, in the long run, IPOs underperformed.7

2. SHORT-RUN UNDERPRICING AND LONGRUN UNDERPERFORMANCE OF PRIVATE AND PRIVATIZATION IPOs IN LATIN AMERICA

The short-run underpricing and longrun underperformance evidence has also been documented by international studies (e.g., Aggarwal et al., 1993; Dewenter and Malatesta, 1997; Perotti and Guney, 1993).

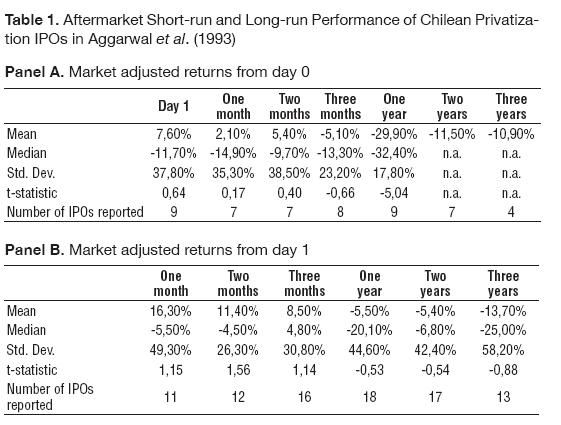

Aggarwal et al. (1993) studied Latin American IPOs during the 1980-1990 period8 and measured the aftermarket performance of Brazilian (62), Chilean (36) and Mexican (44) IPOs. A relevant feature of these authors sample was that important privatization programs in which capital markets played a significant role were included. However, while they report the short-run and long-run performance of their IPOs sample for each country, only in the Chilean sample do they discriminate private versus privatization IPOs.

According to Aggarwal et al. (1993), in Panel A of Table 1, day 1 Market Adjusted Returns were on average 7,60% for nine observations. While considerably above mean daily returns, that value was non-significant because of a very large standard deviation. However, using the median value to eliminate the effect of extreme observations, the average return for one day was -11,70%, suggesting that the method of public placements used in Chile reduced very short term underpricing, when compared to other countries in the same study.

When measured from the closing price on the first trading day, mean market-adjusted returns of 16,30%, 11,40% and 8,50%, after one, two and three months were reported. Also, in the long-run mean market adjusted returns calculated with reference to the issue price were -29,90%, -11,50% and -10,90% for one, two and three years, respectively; calculated from the closing price on day 1, the corresponding returns were -5,50%, -5,40% and -13,70%. Except for the one year mean market adjusted return, none of these values was statistically different from zero at conventional significance levels, due to large standard deviations.

Perotti and Guney (1993) report international evidence on privatization IPOs performance for France, the U.K., Spain, Chile, Nigeria, Turkey, Malaysia, Poland, Hungary, and Czechoslovakia. However, only in the case of the U.K., France, Turkey, and Malaysia, do they explicitly report an initial underpricing measurement.

Based on the analysis of the aftermarket performance of the U.K.s privatization IPOs, Perotti and Guney (1993) document a very interesting finding: in almost all cases where the initial offering price of privatization IPOs did not rise to a premium, governments sold the stock through an auction offer without a fixed price (tender sale). When the government chose some type of fixed-price offering, a large excess demand, as measured by the ratio of demand to supply at the offer price, and significant levels of underpricing were observed. In Chile, an auction mechanism was used to issue new stock during the 1980s, and privatization IPOs were not an exception.

The findings of Perotti and Guney (1993) are consistent with the results reported by the Aggarwal et al. (1993) study for Chilean privatization IPOs and suggest that, when IPOs are placed through an auction mechanism, the market determined price eliminates any excess demand. Perotti and Guney also identify an increasing volume of privatization shares sales, which they associate with a model of reputation building. They report the tendency of governments to only partly privatize individual companies and retain large stakes in them for a few years. Both of these tendencies are observed in the Chilean privatization program described below.

Dewenter and Malatesta (1997) made an in-depth analysis of 109 privatization IPOs price performance and compared them to private IPOs. Their sample included IPOs from Canada (13), France (10), Hungary (10), Japan (3), Malaysia (12), Poland (19), Thailand (4), and the United Kingdom (38), selected among fixedprice privatization IPOs.

The authors report both raw and market adjusted returns for different holding periods following the offer date in calendar day intervals (not trading days). While a direct comparison between the short run performance results reported by Perotti and Guney (1993) with the findings of this paper (where an auction mechanism with no fixed prices was used) is not possible, long run comparisons are still valid. Average raw returns for the whole sample for 1, 7, and 30 days periods were 25,60%, 25,20% and 25,70%. Average market adjusted returns for equivalent periods were 23,70%, 23,10%, and 22,80%.9

Tests for the statistical significance of differences between Mean Initial Returns for Privatization IPOs and private companies IPOs for Canada, France, Hungary, Japan, Malaysia, Thailand, and the U.K., show that, while significant differences for the aggregate sample are non-existent, individual country results tell a different story. Statistically significant positive differences suggest that British privatization IPOs were underpriced more than private IPOs. On the contrary, results for Canada and Malaysia indicate significant negative differences. If there is a tendency for government officials to underprice IPOs to a greater extent than private issuers, no conclusive evidence was obtained from this study.

3. PRIVATIZATION IN CHILE

While Chile was a pioneer of the privatization efforts initiating a comprehensive process during the 1970s,10 during the following two decades many other Latin American countries followed the same path;11 but, even today, the process is yet far from complete. Privatization is still taking place on a large scale in Latin America, Eastern Europe and several other regions of the world. For that reason, the insights obtained from a detailed analysis of historical privatization experiences can contribute to an improvement in the design of future privatization plans.

Among the antecedents of the Chilean military governments privatization program (1973-1990) were vast expropriation activities of previous governments. The Agricultural Reform Legislation passed during the Alessandri regime (1958-1964), established a framework for the transference of privately owned assets to the state. That piece of legislation was an important component of the political agenda of Frei (1964 -1970) and reached its maximum expression during the socialist government of Allende (1970 -1973), along with his plans to establish a centrally planned economy in Chile (Mandakovic and Lima, 1990).

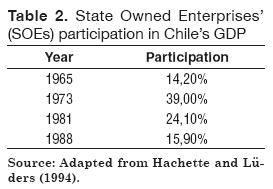

The military took-over political power in September 1973, and initiated a wide ranging privatization program which consistently reduced the public sector participation in GNP (Gross National Product), except for a brief interlude associated with the financial crisis of 1982-1983. Table 2 presents the increasing participation of SOEs in Chiles GDP from 1965 to 1973 and, after the military government took over, a profound reversal.

The privatization program is commonly divided in two rounds, clearly related with different stages in the evolution of the Chilean economic model. The first round started almost simultaneously with a period of severe economic crisis (1975) and finished with still another crisis (1982-1983).

During the First Round, privatization mechanisms favored the concentration of ownership in the hands of a few influential economic groups. Some of the mechanisms that favored concentration of ownership were, for example, the use of intra-group loans and access to generous credit lines from the Corporación Industrial de Fomento12 (Corfo), paying in cash only a small portion of the privatized firms prices.

During the early 1980s Chiles economy faced a drastic deterioration of its international terms of trade as a consequence of sensible reductions of its main exports prices and significant increases of international interest rates. After several years with a fixed exchange rate, in spite of significant inflation differentials with respect to its main commercial partners, the economy collapsed and a significant devaluation was unavoidable. The foreign debt crisis of 1982 further complicated domestic problems, eliminating the possibility to obtain any fresh external funds. The GNP decreased by 14,10% in 1982 and 0,70% during the following year. Unemployment rates reached levels of 22,10% and 22,20%; and inflation stabilized at 20,70% in 1982 and 23,10% in 1983.

Economic trouble seriously affected debtors of the financial system, and due to the high interdependence between industrial companies and financial entities, the latter were particularly vulnerable to the adverse environmental circumstances. With reduced cash flows and the free-fall in the value of assets in guarantee, many highly leveraged firms and individuals declared payments suspension and insolvency.

Bad loans increased from 2,30% to 4,10% of total loans between 1981 and 1982, reaching 8,40% at the end of 1983. Unproductive loans represented 15,10% of the financial system net worth in 1981, 45,70% in 1982, and a staggering 109,60% in 1983. As debtors could not pay their loans and many banks were leveraged in dollars, the threat of a bank run became imminent. Finally, government authorities decided to bail-out illiquid banks to protect depositors and external creditors (Alé, Larraín, Mallat, Ortuzar and Videla, 1990).

Paradoxically, the conditions created by the privatization strategy of the First Round were such that the government was forced to take control of numerous banks once again and, indirectly, of all non-banking firms controlled by the banks. Almost fifty recently privatized companies returned to the hands of the State during 1982-1983.

However, all firms that fell under the governments control as a consequence of the crisis were sold-back to the private sector during the following years in what was dubbed the second round of privatizations (1984-89).

During that period, besides privatizing again firms that had already been privatized during the First Round, but had fallen back under governmental control as a consequence of the crisis, several large public utilities originally created by the state like Chiles national airline, the telephone and electric companies and some mining companies, were also privatized.

Also, ownership transference mechanisms were diversified and new rules enforced to avoid the problems of the 1970s privatization experience. Among the innovative features of the Second Round was that the income maximization objective no longer remained as the governments single priority. Alternative objectives like the promotion of the local capital market and the wider distribution of stock ownership among the population were also included. According to Hachette and Lüders (1994), the Chilean government had learned that privatizations can be reversed and was ready to pay a price to minimize that probability.

Controlling packages of equity were privatized in closed bidding auctions, similar to the First Round. However, an important difference was that this time no government subsidized credit lines were available, and buyers were required to demonstrate their solvency.

As a consequence of the 1981-1982 crisis, local private investors were undercapitalized. However, there was a growing interest among foreign investors to participate in the rapidly modernizing Chilean economy and the government, recognizing the implications of a thin capital market for the success of its privatization program, deliberately included foreign investors in privatization auctions. Foreign participation in privatized companies took place mainly through joint-venture arrangements.

One last highly significant difference between the First and the Second Round was the fact that local capital markets development was considerably more advanced due to the significant impulse received since 198113 from an intense financial liberalization process14 and the introduction of privately managed retirement funds, named Administradoras de Fondos de Pensiones (AFPs for their abbreviation in Spanish).15

4. GRADUALISM IN THE CHILEAN PRIVATIZATION PROCESS

Privatization of SOEs effectively limits government intervention in managerial and strategic decisions. However, once privatized, firms are still exposed to adverse policy changes.

In view that privatization proceeds to the government are lowered when companies might be subject to undesired political actions, selling governments frequently structure privatization programs as to gradually build up policy credibility (Perotti, 1991; Perotti and Guney, 1993).

One way in which governments signal their commitment to market oriented policies is by retaining a non-controlling stock participation in privatized firms for long periods of time. While government officials are not direct owners of stock and for that reason do not have a personal interest in maximizing the income obtained through privatized firms selling auctions, state ownership implies political accountability. In general, politicians will avoid governmental actions that will have adverse effects on semi-privatized firms, or else face recrimination from political opposition, which can eventually produce unfavorable elections results.

Combined with the transference of managerial control to private investors, a government keeping symbolic ownership participation signals its willingness to bear at least part of the potential costs of an eventual policy change. After some time, if there are no policy reversals, investors confidence improves, facilitating subsequent privatization prices convergence to their expected economic value. This is in agreement with Perotti (1991) who provides a rationale for treating with special care the sales of policy-sensitive state-owned enterprises and justifies that a committed government will choose a gradual privatization instead of an immediate privatization.

While the military government in Chile did not depend on the results of periodic elections to remain in power, the privatization program had become one of the central issues of the military governments economic policy, and officials must have been very careful to manage it properly. Observed gradualism in the 1984-1989 privatization programs is clearly consistent with the argument of credibility building.

After the 1981-1982 financial crisis and economic recession, once the economy was stabilized, the privatization program was reinitiated in 1984. The originally stated objective for the Second Round was to reach a maximum private participation in controlled-by-Corfo firms of 30% in nineteen cases and 49% in two others. Four years later the original targets had been broadly exceeded. By March 1989 eighteen firms had been 100% privatized and eight more were programmed to reach that objective.

The strategy that was followed denotes a careful observation of local capital markets conditions, adjusting the issues program whenever conditions changes justified such adjustments. General conditions for privatization public offers of stock improved considerably after 1985, when AFPs were authorized to buy stock for their investments portfolio.16

While privatization programs gradualism in emerging countries probably reflects local capital markets limited absorption capacity privatization IPOs represented a very small proportion of the privatized firms total equity (most of the time, below 2%), and subsequent privatization issues were not very important in absolute value, but were indeed very numerous and received a significant followup by the local press.

The constant adjustment to the original privatization targets was explained by Corfo (Hachette and Lüders, 1994), in terms of the small size of the Chilean capital market and of the Bolsa de Santiago in particular, arguing that such a strategy allowed a sustained increase in the price obtained for SOEs stock. By contrast, Hachette and Lüders, commenting on the original privatization targets adjustments suggest that an announcement of the intention to privatize 100% of the ownership could have allowed the expected favorable effect since the beginning.

A political argument, however, also offers a sensible explanation of the adjustments. In face of the uncertainty that existed at the beginning of the Second Round, after the bitter experience of the previous round, the Chilean government may have decided that the impact of announcing a partial privatization would create a favorable environment and allow further increases to the privatization targets once satisfactory results of initial privatizations became evident. That strategy would minimize the political cost of a "once and for all" announcement.

The implementation of the program consisted in first, making very small IPOs of selected companies stock to create a presence in the market. As confidence was built, incremental private ownership levels were authorized, and additional issues followed to meet more ambitious targets.

Chilean SOEs privatization IPOs and Seasoned Public Issues (SPIs) followed a process that started with an Agreement of Corfos Board of Administration authorizing the Executive Vice-president to sell SOEs stock to private investors.17 Resolutions indicating specific details, like the choice of a specific broker and the price and number of shares to be sold in order to materialize the stated objectives of the agreements, followed.18

5. STATISTICAL ANALYSIS

While the size of the sample used is small to derive externally valid statistical conclusions, limited data availability was difficult to overcome. However, a statistical analysis of the short-run and long-run returns of Chilean privatization IPOs offers interesting insights.

Based on a comprehensive review of the most important local daily newspapers and a careful revision of Corfos historical files,19 eleven IPOs dates were identified for the period of reference.

The auction mechanism resulted in many different IPOs prices. As a matter of fact, each transaction during the auction period could potentially have taken place at a unique price. As mentioned before, making the identification of exact issue prices more difficult, issuers were not obliged to report IPOs prices to any government authorities. Not even the Superintendencia de Valores, the Chilean stock market official supervisory agency, kept records of that periods privatization IPOs prices.

Time series data for closing prices on the eleven identified privatized firms stock were obtained from the Bolsa de Comercio de Santiago for a period that goes from 1984 through 1989. Supplemental published information for all companies traded in the Bolsa de Comercio de Santiago was used to adjust for recorded market price variations not due to market forces.20

The first day of trading closing price was chosen as the first observation for each series based on several considerations. In the first place, as mentioned above, the auctions initial prices were not recorded in any publicly available file. Besides, participants in auction sessions were in many cases institutional investors21 who entered into long positions to re-sell them in the aftermarket. For that reason, as suggested by Aggarwal et al. (1993), new issues must be examined from the viewpoint of the investor who purchases the stock in the aftermarket. In Chile a vast majority of individual investors who purchased privatized companies stock paid an aftermarket price different from the initial price negotiated by large intermediaries during the auction transactions. For that reason first-day of trading closing prices might be considered more representative of the price paid by typical investors.22

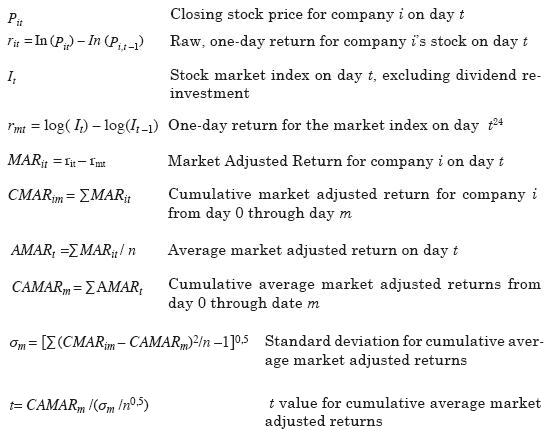

To measure the performance of privatization IPOs, daily Market Adjusted Returns (MARs) were calculated for each firm. MARs for the eleven IPOs were combined in portfolios to obtain Average Market Adjusted Returns (AMARs),23 and the null hypothesis that AMARs were not statistically different from zero was tested.

Raw and market-adjusted returns calculations were performed as follows:

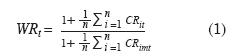

Wealth relatives were calculated as in Ritter (1991) and Aggarwal et al. (1993):

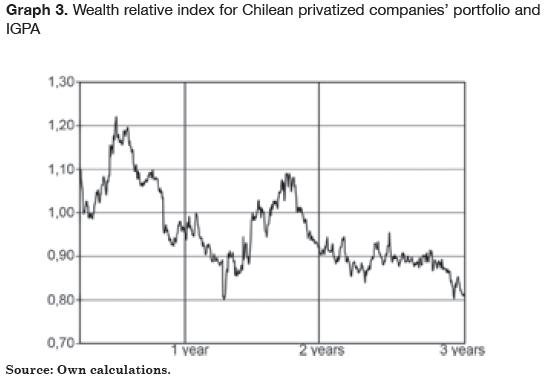

WRt is the wealth relative on day t; CRit is the cumulative (buy and hold) return of stock i from closing price on day 0 through day t, CRimt is the cumulative (buy and hold) market return, during the same period. The total number of IPOs in the sample (11) is represented by n. A wealth relative above one implies that IPOs outperformed the market, and viceversa, a wealth relative below one indicates underperformance.

Evidence on Chilean privatization IPOs short run underpricing was, in general terms, consistent with IPO performance evaluation results reported elsewhere.25

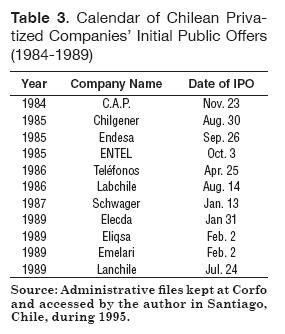

IPOs in Chile during 1985 and 1989 were more numerous than the rest of the period, as shown in Table 3.

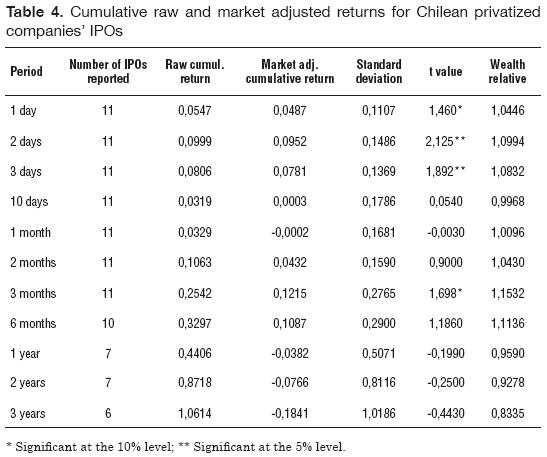

The number of observations for each period varies, as some companies had a longer post-IPO history than others, as reported in Table 4.

Cumulative Average Market Adjusted Returns (CAMARs) went from

t value for cumulative average market adjusted returns

14,87% during the first day of trading after the initial closing price, to 9,52% in day two and 7,81% in day 3, as reported in Table 4. After the first few days high returns there was a mean-reversion, probably due to an initial over-reaction. However, by the end of the first month CAMARs had recovered and consistently increased, reaching a ceiling after a little more than three months. The fact that investors who participated in privatization IPOs buying stock at day one closing prices obtained a CAMAR of approximately 20% during that period suggests that initial offer prices were probably underpriced.

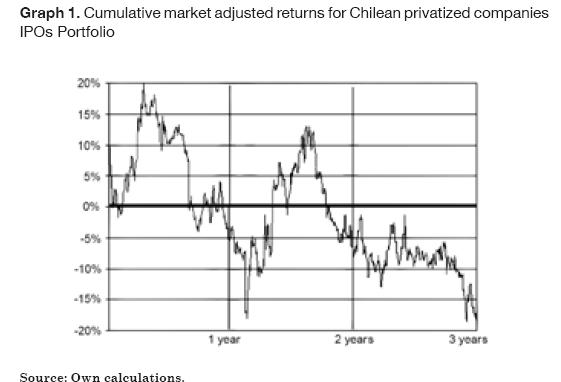

Mid-term and long-term CAMARs in the sample had a deceiving evolution becoming negative eight months after the IPOs date.

During year 2, and after reaching -18%, CAMARs recovered (reaching +12%), but then declined again, became negative, and did not recover for the rest of the three year period, as can be observed in Graph 1.

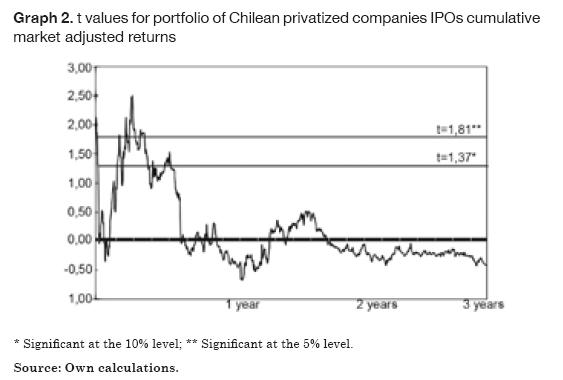

CAMARs were statistically significant different from zero during the first three days26 after the IPO (see Table 4). Again, after two months, CAMARs became statistically significant during a period that goes until the end of the fifth month.27 However, from that moment and until the end of the three-year window, no statistically significant different from zero values were found (see Graph 2).

Wealth Relative Index values reach a maximum value of 1,22 after three and a half months and then decreases (except for a short recovery) below 1,00 after 20 months, reaching a minimum level of 0,80 at the end of the period, as observed in Graph 3.

Evidence presented in Table 4 is consistent with previous studies on privatization IPOs aftermarket performance (e.g., Aggarwal et al., 1993; Loughran et al., 1994; Perotti and Guney, 1993). Short-run larger than expected28 returns and long run low profile performance indicate that the Chilean privatization process followed other documented international regularities.

6. DISCUSSION

In the context of the historical and institutional peculiarities of the Chilean capital market during the period that privatization IPOs took place, it is difficult to support the validity of generally accepted IPOs underpricing explanations, most of which have usually been developed to explain underpricing of IPOs in more mature and developed markets.

For example, the legal liability implications of inadequate due diligence as an explanation for the underpricing of IPOs were quite different in Chile, when compared to the United States. Claims for compensation against investment bankers were much more difficult to carry out, making Tinics (1988) theory a relatively weak explanation of Chilean privatization IPOs underpricing. More so, considering that the issuer was the Chilean state itself.

Information Asymmetry, another one of the most frequently cited theories to explain IPOs underpricing, reaches critical levels in emerging markets because issuing firms have fewer opportunities to obtain current information on similar firms issues and pricing decisions, and there is less competition among underwriting agents. In consequence, one would expect to see a more significant level of IPO underpricing than in more developed markets.29 However, given the characteristics of the auction-like process, similar to block-trades, used for privatization IPO placements in Chile (Aggarwal et al., 1993) and Loughran et al. (1994) investment bankers did not really perform as underwriters. In that sense, Barons model is neither adequate to explain Chilean privatization IPOs underpricing (Baron, 1982).

Regarding the theories that explain underpricing as a consequence of the issuing firms being little known, in this case most were highly visible in Chile before IPOs took place, suggesting that Rocks (1986) approach cannot offer a reasonable explanation of short run underpricing. While in more developed markets IPOs usually correspond to new fast-growth companies, Chilean privatization IPOs during the 1980s corresponded to usually larger and older companies (e.g., Aggarwal et al., 1993; Perotti and Guney, 1993).

Given the limited applicability of popular IPO underpricing theories, a different explanation supported by the economic and political context of Chilean privatization IPOs during 1984-1989 represents an original contribution to the understanding of that process.

Lower than economically justifiable proceeds on Chilean privatization IPOs can be attributed to the governments confidence-building strategy. Underpricing of early privatization stock sales, should have stimulated market participants to absorb a larger volume of privatized firms stock during the early stages of the program and it must also have been interpreted as additional evidence of the governments willingness to transfer management control to the new owners. In the long-run, subsequent privatization IPOs and Secondary Equity Offers (SEOs) would be made in a more confident environment and would eventually result in higher privatization proceeds.

While privatization IPO underpricing did not maximize government proceeds in the short-run, attractive returns obtained by investors increased subsequent privatization issues demand. Increased demand resulted in easier placements and in prices converging to their true economic value in a natural way.

The above arguments are consistent with a signaling approach to explain IPOs underpricing. Most of the literature on Signaling Theory has referred to underpricing as a means to suggest quality of assets (see, for example, Allen and Faulhaber, 1989), and signaling commitment to privatization policies by underpricing SOEs has also been discussed in privatization studies,30 but not explicitly discussed in the context of privatization IPO underpricing.

An explanation of signaling by underpricing to build confidence is further supported with the gradualism followed by the Chilean government in the issue of privatized firms stock. Gradualism can be interpreted as a signaling device that conveyed the message that the government was willing to share the risks implicit in potential shifts of policy by keeping a symbolic participation in privatized firms (even after corporate control had already been transferred to the private sector).

Gradual sales with frequent fine tuning of privatization targets suggest that the government had superior information over the value of the privatized firms assets and needed to transfer that information to the market. However, if private investors were better informed, a singleauction sale should have maximized privatization proceeds. In contrast, the process of carefully scheduled gradual sales together with a high level of discounts suggests that, for one reason or another maybe of a political nature, the government needed to convey some strong signal to the market.

Additional evidence supporting a confidence building by underpricing hypothesis is the faster growth rate experienced by the market absorption capacity for privatization issues than what domestic saving rates would have granted, and the fact that larger privatization issues became more frequent.

The Chilean experience through privatization IPOs offers valuable insights about gradualism and underpricing as useful tactics to achieve ambitious targets in an emerging and relatively small capital market. Policy designers responsible for implementing privatization plans in the future can benefit from the historical background of privatization experiences in that country.

Previous studies have focused on the Chilean privatization IPOs performance as part of a larger sample of IPOs. For example, the study of Aggarwal et al. (1993) develops a comprehensive study for Latin American IPOs, including both privatization and normal IPOs. However, in their study, they do not describe the way in which privatization issues offer prices were determined nor do they tell how they selected the data to make their privatization IPOs performance analysis.

The main findings of this study, as explained above, are that Chilean privatization IPOs were implemented through a large number of small block trades, under a public auction mechanism, that resulted in many different prices for successive transactions during the placement process, thus invalidating many of the common theoretical explanations of IPOs underpricing, and demanding a careful identification of the true initial quotes for the issues.

FOOTNOTE

1. Financial support was provided by the "Fondo para Promover la Actividad de Investigación", of the Facultad de Ciencias Económicas y Administrativas, Universidad Católica de Chile. The field research for this study was done when the author was a visiting professor at the Escuela de Administración de la Facultad de Ciencias Económicas y Administrativas of Universidad Católica de Chile (1995-1997). Since 1997 Dr. Santillán is a faculty member of EGADE-Tec de Monterrey, México.

2. Perotti (1991), for example, discusses that under public ownership governments retain unconditional control over the use of assets. That discretionary power is costly because it encourages rent-seeking behavior by firm insiders, who represent a more coordinated interest group than dispersed taxpayers. In contrast, private owners have both, the incentive and the ability to commit their efforts in pursue of efficient management.

3. These include an increasingly fast globalization of industries and the growing liberalization of national economies.

4. The number of Chilean SOEs for which privatization IPOs during the 1984-1989 period could be adequately documented was of only eleven: C.A.P., Chilgener, Endesa, Entel, Teléfonos, Labchile, Schwager, Elecda, Eliqsa, Emelari, and Lanchile.

5. While the performance of Chilean privatization IPOs was studied by Aggarwal et al. (1993), as part of an international study, this article analyzes a different sample of privatization IPOs, discusses several institutional aspects that differentiate the Chilean case from other similar processes, and attempts an explanation of the reported short-run underpricing and long-run overpricing of Chilean privatization IPOs during the 1985-1989 period.

6. In discussing Tinics work, Drake and Vetsuypens (1993) found that IPOs related litigation appears to be driven by large subsequent price declines long after the IPO, and not by whether the IPO was initially underpriced. However, if investment bankers underprice to avoid legal responsibility in case an underwritten issues performance results unsatisfactory, we would expect to see fewer short run cases of that nature.

7. Stoll and Curley (1970) focused on 205 small offers, and found that in the short run, the stocks in the sample showed remarkable price appreciation; Ibbotson (1975) used one offering per month for the ten year period 1960-1969, and computed excess returns on IPOs with an offer price of at least USD$3 per share. He concluded that results generally confirm there are no departures from market efficiency in the aftermarket. However, he did find evidence of positive performance in the first year, negative performance the next three years, and generally positive performance the fifth year, although the standard errors of his estimates are high enough to make it difficult to reject market efficiency.

8. The Aggarwal et al. (1993) study covers different subperiods for the three countries they survey (Brazil, Chile, and Mexico).

9. A detailed account of country-by-country raw and Market Adjusted Returns for equivalent periods is contained in Dewenter and Malatesta (1997, Table I, p.1666, op.cit.).

10. The first privatization actions took place short after the military government was installed, in 1973.

11. Notably, Argentina, Brazil, Colombia, México, Perú, and Venezuela.

12. The "Corporación Industrial de Fomento" is a Chilean government sponsored industrial development agency that performed the function of holding company for most nationalized companies and also managed the privatization process through an area called "Gerencia de Normalización".

13. Only attenuated by the financial crisis of 1982-1983.

14. Which begun in the late 1970s, but intensified during 1980 and 1981.

15. Accumulated financial resources managed by AFPs in December 1985, when they were authorized to buy stock for their investment portfolios, represented 11% of GNP. AFPs have the responsibility to manage large and constantly growing amounts of financial resources originated in workers and employees contributions to their individual retirement accounts. Until 1996, when AFPs were finally allowed to invest overseas all pension funds had to be invested in the domestic market.

16. It seems obvious that authorizing AFPs to invest part of their funds in stock was at least partially inspired by the intention to create favorable conditions for privatization issues.

17. In June 30, 1983, the Board authorized Corfos Vice-president to privatize up to 30% of the stock in each one of its subsidiaries. However, privatization targets were subject to constant changes. According to Hachette and Lüders (1994, p. 39), "out of 33 companies in the privatization process, 20 suffered one change in their annual target percentages of equity privatization, 3 suffered 3 changes and 1 suffered 4 changes".

18. The process of placing privatization IPOs in Chile during 1985-1989 was special in several respects:

- During the mid-eighties the use of equity financing through public issues was not common in Chile. Several structural changes had to take place, including new capital markets regulations and the authorization for institutional investors, such as pension funds (Administradoras de Fondos de Pensiones or AFPs in Spanish) and foreign investment funds participation, to create favorable conditions for privatization IPOs (Celis and Maturana, 1998).

- The Chilean IPOs market during the period of analysis used a public auction procedure.

- Issuers did not have the responsibility to report recorded issue prices.

- IPOs were not underwritten; instead, brokers/investment bankers offered them directly to investors during public auction sessions and on a commission basis (i.e., similar to block trades).

- Privatization IPOs consisted of very small blocks of stock and often lasted for several days (or even weeks).

- Since there were no underwriters, there was no firm commitment. Market forces determined different prices at subsequent stages of a privatization IPOs auction.

- In contrast with typical United States IPOs of small growth-companies, several privatized companies were long established and fairly large utilities; others were well known mining companies.

19. Access to Corfos historical archives was facilitated by Mr. Eduardo Bitrán, General Manager, at the time this study was developed, during the second semester of 1996.

20. Basically, splits. Prices were not adjusted for dividend payments because the benchmark portfolio used both for the market adjusted model used to measure abnormal returns. The Indice General de Precios Accionarios de la Bolsa de Santiago, IGPA, (Stock Market Price Index for the Santiago Stock Exchange) is not adjusted for dividend payments.

21. Stock brokers, Pension funds, Mutual funds, etc.

22. Excess returns in this study assume purchase of the issues at the closing price of the first day of trading.

23. IPOs dates were synchronized to make MARs comparable.

25. See, for example, Aggarwal et al. (1993) for an extensive survey of studies that document short run performance of IPOs.

26. t values for 10 degrees of freedom were significant at the 10% level for day one and at the 5% level for days 2 and 3.

27. Periods refer to approximate calendar days.

28. According to the assets systematic risk, under the assumptions of the Capital Asset Pricing Model (CAPM).

29. In emerging markets, underwriters should have the market power to condition large discounts on high quality firms to provide a firm commitment arrangement.

30. See, for example, Hachette and Lüders (1994) and Alé et al. (1990).

BIBLIOGRAPHIC REFERENCES

1. Affleck-Graves, J., Hedge, S. and Miller, R.E. (1996). Conditional price trends in the aftermarket for initial public offerings. Financial Management, 25(4), 25-40. [ Links ]

2. Aggarwal, R., Leal, R. and Hernández, L. (1993). The aftermarket performance of initial public offerings in Latin America. Financial Management, 22(1), 42-53. [ Links ]

3. Aggarwal, R. and Rivoli, P. (1990). Fads in the initial public offering market? Financial Management, 19(4), 45-57. [ Links ]

4. Alé, J., Larraín, L., Mallat, G., Ortuzar, M. and Videla, M. (1990). Estado Empresario y Privatización en Chile. Cuadernos Universitarios, Serie Investigaciones No. 2. [ Links ]

5. Allen, F. and Faulhaber, G.R. (1989). Signalling by Underpricing in the IPO Market. Journal of Financial Economics, 23(2), 303-323. [ Links ]

6. Baron, D.P. (1982). A model of the demand for investment banking advising and distribution services for new issues. The Journal of Finance, 37(4), 955-976. [ Links ]

7. Baron, D.P. and Holmstrom, B. (1980). The investment banking contract for new issues under asymmetric information: delegation and the incentive problem. The Journal of Finance, 35(5), 1115-1138. [ Links ]

8. Beatty, R.P. and Ritter, J.R. (1986). Investment banking, reputation, and the underpricing of initial public offerings. Journal of Financial Economics, 15(1-2), 213-232. [ Links ]

9. Benveniste, L.M. and Spindt, PA. (1989). How investment bankers determine the offer price and allocation of new issues. Journal of Financial Economics, 24(2), 343-361. [ Links ]

10. Benveniste, L.M. and Wilhelm, W.J. (1990). A comparative analysis of IPO proceeds under alternative regulatory environments. Journal of Financial Economics, 28(1-2), 173-207. [ Links ]

11. Benveniste, L.M. and Wilhelm, W.J. (1997). Initial public offerings: going by the book. Journal of Applied Corporate Finance, 10(1), 98-108. [ Links ]

12. Boardman, A. and Vining, A.R. (1989). Ownership and performance in competitive environments: A comparison of the performance of private, mixed, and state-owned enterprises. Journal of Law and Economics, 32(1), 1-33. [ Links ]

13. Boubakri, N. and Cosset, J.C. (1998). The Financial and Operating Performance of Newly Privatized Firms: Evidence from Developing Countries. Journal of Finance, 53(3), 1081-1110. [ Links ]

14. Boycko, M., Shleifer, A. and Vishny, R. (1995). Privatizing Russia. Cambridge, MA: MIT University Press. [ Links ]

15. Carter, R. and Manaster, S. (1990). Initial public offerings and underwriter reputation. The Journal of Finance, 45(4), 1045-1067. [ Links ]

16. Celis, C. and Maturana, G. (1998). Initial Public Offerings in Chile. Chile: Universidad Católica de Chile, Mimeo. [ Links ]

17. Dewenter, K. and Malatesta, P.H. (1997). Public offerings of state-owned and privately-owned enterprises: an international comparison. The Journal of Finance, 52(4), 1659-1679. [ Links ]

18. Drake, P.D. and Vetsuypens, M.R. (1993). IPO Underpricing and Insurance against Legal Liability. Financial Management, 22(1), 64-73. [ Links ]

19. Galal, A., Jones, L., Tandon, P. and Vogelsang, I. (1994). Welfare Consequences of Selling Public Enterprises: an empirical analysis. Washington, DC: The World Bank. [ Links ]

20. Grinblatt, M. and Yang, H.C. (1989). Signaling and the pricing of new issues. The Journal of Finance, 44 (2), 393-421. [ Links ]

21. Hachette, D. and Lüders, R. (1994). Privatization in Chile: an economic appraisal. San Francisco, CA: ICS (International Center for Economic Growth). [ Links ]

22. Hensler, D.A., Rutherford, R.C. and Springer, T.M. (1997). The survival of initial public offerings in the aftermarket. The Journal of Financial Research, 20(1), 93-110. [ Links ]

23. Hunt-McCool, J., Koh, S.C. and Francis, B. (1996). Testing for deliberate underpricing in the IPO premarket: A stochastic frontier approach. The Review of Financial Studies, 9(4), 1251-1269. [ Links ]

24. Ibbotson, R.G. (1975). Price performance of common stock new issues. Journal of Financial Economics, 2(3), 235-272. [ Links ]

25. Ibbotson, R.G., Sindelar, J.L. and Ritter, J.R. (1988). Initial public offerings. Journal of Applied Corporate Finance, 1(2), 37-45. [ Links ]

26. Ibbotson, R.G., Sindelar, J.L. and Ritter, J.R. (1994). The market problems with the pricing of initial public offerings. Journal of Applied Corporate Finance, 7(2), 66-74. [ Links ]

27. Indacochea, A. (1993). Privatizar la privatización, y reflexiones sobre el nuevo orden económico mundial. Lima, Peru: ESAN/IDE. [ Links ]

28. Keloharju, M. (1993). The winners curse, legal liability, and the long-run price performance of initial public offerings in Finland. Journal of Financial Economics, 34(2), 251-277. [ Links ]

29. Kunz, R.M. and Aggarwal, R. (1994). Why initial public offerings are underpriced: evidence from Switzerland. Journal of Banking and Finance, 18(4), 705-723. [ Links ]

30. Larraín, C.F. (1997). El proceso de apertura en bolsa. Riesgos y Oportunidades en la Gestión Financiera, ICARE, 83-94. [ Links ]

31. Loughran, T. and Ritter, J.R. (1995). The New issues puzzle. The Journal of Finance, 50(1), 23-51. [ Links ]

32. Loughran, T., Ritter, J.R. and Rydqvist, K. (1994). Initial Public Offerings: International insights. Pacific Basin Journal, 2(2-3), 165-199. [ Links ]

33. Mandakovic, T. and Lima, M. (1990). Privatization in Chile: Management Effectiveness Analysis. In D.J. Gale and J.N. Goodrich (Eds.), Privatization and Deregulation in Global Perspective (pp. 394-412). London: Pinter. [ Links ]

34. Megginson, W.L., Nash, R.C and Van Randenborgh, M. (1994). The Financial and Operating Performance of Newly Privatized Firms: An International Empirical Analysis. Journal of Finance, 46(2),403-452. [ Links ]

35. Perotti, E. (1991). Credible Privatization (Working Paper No. 91-12). Boston University. [ Links ]

36. Perotti, E. and Guney, S.E. (1993). The Structure of Privatization Plans. Financial Management, 22(1), 84-98. [ Links ]

37. Rajan, R. and Servaes, H. (1997). Analyst following of initial public offerings. The Journal of Finance, 52(2), 507-529. [ Links ]

38. Ritter, J.R. (1984). The hot issue market of 1980. Journal of Business, 57(2), 215-240. [ Links ]

39. Ritter, J.R. (1987). The cost of going public. Journal of Financial Economics, 19, 269-281. [ Links ]

40. Ritter, J.R. (1991). The long-run performance of initial public offerings. The Journal of Finance, 46(1), 3-27. [ Links ]

41. Rock, K. (1986). Why new issues are underpriced? Journal of Financial Economics, 15(1-2), 187-212. [ Links ]

42. Ruud, J. (1993). Underwriter price support and the IPO pricing puzzle. Journal of Financial Economics, 34(2), 135-151. [ Links ]

43. Saunders, A. (1990). Why are so many new stock issues underpriced? Federal Reserve Bank of Philadelphia, Business Review, March/April, 3-12. [ Links ]

44. Stoll, H.R. and Curley A.J. (1970). Small Businesses and the New Issues Market for Equities. The Journal of Financial and Quantitative Analysis, 5(3), 309-322. [ Links ]

45. Tinic, S.M. (1988). Anatomy of initial public offerings of common stock. The Journal of Finance, 43(4), 789-822. [ Links ]

46. Weiss, K. and Wilhelm, W.J. (1995). Evidence on the strategic allocation of initial public offerings. Journal of Financial Economics, 37(2), 239-257. [ Links ]

47. Welch, I. (1992). Sequential sales, learning, and cascades. The Journal of Finance, 47(2), 695-732. [ Links ]

48. Yarur, E.D. (1997). Impacto en la actividad bursátil – Nuevos desarrollos y desafíos. En ICARE (Eds.), Riesgos y Oportunidades en la Gestión Financiera (pp. 39-51). Santiago de Chile: ICARE. [ Links ]