Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Estudios Gerenciales

Print version ISSN 0123-5923

estud.gerenc. vol.26 no.117 Cali Oct./Dec. 2010

GOVERNANCE CODES: FACTS OR FICTIONS? A STUDY OF GOVERNANCE CODES IN COLOMBIA1,2

JULIÁN BENAVIDES FRANCO*1, SAMUEL MONGRUT MONTALVÁN2

1Ph. D. in Business, Tulane University, United States. Chief, Departamento de Contabilidad y Finanzas, Universidad Icesi, Colombia. Research Group "Inversión, Financiación y Control", affiliated to Universidad Icesi, Colciencias B classification. jbenavid@icesi.edu.co

2Ph.D. en Ciencias Económicas y Empresariales, Universidad de Barcelona, España. Professor, Escuela de Graduados en Administración, Tecnológico de Monterrey, Campus Querétaro, México. Centro de Investigación de la Universidad del Pacifico (CIUP), Peru. smongrut@itesm.mx

* Autor para correspondencia. Dirigir correspondencia a: Universidad Icesi, Calle 18 No. 122-135, Pance, Cali, Colombia.

Fecha de recepción: 03-09-2009 Fecha de corrección: 02-02-2010 Fecha de aceptación: 11-10-2010

ABSTRACT

This article studies the effects on accounting performance and financing decisions of Colombian firms after issuing a corporate governance code. We assemble a database of Colombian issuers and test the hypotheses of improved performance and higher leverage after issuing a code. The results show that the firms return on assets after the code introduction improves in excess of 1%; the effect is amplified by the code quality. Additionally, the firms leverage increased, in excess of 5%, when the code quality was factored into the analysis. These results suggest that controlling parties commitment to self restrain, by reducing their private benefits and/or the expropriation of non controlling parties, through the code introduction, is indeed an effective measure and that the financial markets agree, increasing the supply of funds to the firms.

KEYWORDS

Corporate governance, governance codes, agency theory, accounting performance, leverage.

JEL classification: G30, M48, K22

RESUMEN

Códigos de Gobierno en Colombia: ¿realidad o ficción?

Este artículo estudia los efectos sobre el desempeño contable y sobre las decisiones financieras de empresas colombianas después de implementar su código de gobierno. Los resultados muestran que el retorno sobre los activos de las empresas, luego de implementado el código, mejora en más de 1%; el efecto es amplificado por la calidad del código. Adicionalmente, se notó un incremento de más de un 5% en el apalancamiento de las empresas que habían incorporado un código. Estos resultados sugieren que el compromiso de las partes controladas para autorregularse, reduciendo sus beneficios privados y/o la expropiación de las partes no controladoras, a través de la introducción del código, es en realidad una medida efectiva y que los mercados financieros apoyan, incrementando el suministro de fondos a las firmas.

PALABRAS CLAVE

Gobierno corporativo, códigos de gobierno, teoría de agencia, desempeño contable, apalancamiento.

RESUMO

Códigos de Governança na Colômbia: fatos ou ficção?

Este artigo estuda os efeitos sobre o desempenho contabilístico e sobre as decisões financeiras de empresas colombianas depois que emitiram seu próprio código de governança. Os resultados mostram que o retorno sobre os ativos das empresas depois de emitido o código melhora em mais de 1%; o efeito é amplificado pela qualidade do código. Adicionalmente, após a introdução do código, a alavancagem das empresas se incrementa em mais de 5% quando a qualidade do código é incorporada na análise. Estes resultados sugerem que o compromisso das partes em controle para se auto regular, reduzindo seus benefícios privados e/ou a expropriação das partes não controladoras, através da introdução do código, é na realidade uma medida eficaz e que os mercados financeiros concordam, aumentando o fornecimento de fundos para empresas.

PALAVRAS CHAVE

Governo corporativo, códigos de governança, teoria de agência, desempenho contabilístico, alavancagem.

INTRODUCTION

Firm governance codes are devices pushed by regulators in order to induce good behavior by firm controlling parties: by committing to reduce their private benefits, or the expropriation of fund suppliers, the controlling parties create a trusty environment that eases outside financing, reducing the cost of capital and generating higher returns for all involved parties. The trend began with the Cadbury Report in 1992; their issuance followed a series of company failures in the U.K., likely by poor governance practices. The report was produced by an ad hoc committee chaired by Sir Adrian Cadbury, an influential executive in the UK; the result was governance guidelines for for-profit public firms. After this effort different countries and organizations have been following the trend, with exchanges and regulators around the world issuing analogous requirements or guidelines, product of the consensus of experts panels. By 2008 the European Corporate Governance Institute (ECGI) listed 234 different codes, guidelines and comparative studies from 63 countries and 6 multi-country organizations. After the Cadbury Report, Canada issued The Toronto Report and South Africa issued the King Report in 1994. In 1995 Australia disclosed the Bosch Report, France disclosed the Vienot Report, and the United Kingdom the Greenbury Report, this time on directors remuneration. The highest peak came in 2002, with 33 studies and recommendations.

Clearly the idea of self regulation has some appeal for the business community and regulators. Colombia is not different in this sense, and the association of Chambers of Commerce (Confecamaras) produced in 2001 the firs best practice code for public firms. The Colombian regulator, Superintendencia de Valores (today Superintendencia Financiera), with the resolution 275/2001 required that all firms with listed securities and that intended to receive funds from pension funds produced a Governance Code. By November of 2003, ninety one issuers had adopted governance codes. In 2005, the Congress enacted the Law of the Securities Market.3 which established board guidelines for public firms and the conditions to be met by independent board members. Finally, in 2007 the Superintendencia adopted a Country Governance Code, and demanded that issuers answered a Governance Survey about their compliance of the guidelines included in the Code. As many current requirements around the world, a particular firm should comply or explain why does not meet what the Code demands.

There is, however, little effort in these Guidelines or Codes to link theoretical justifications to actual recommendations. A broad picture of the reasons behind the Codes begins with the Agency Theory. Under the premises of this theory, opportunistic agents can take advantage of principals, if their behavior is not completely verifiable or their results are affected by uncertainty. Three different parties can be identified at the top of any organization: 1) management, who should act in behalf of all owners and respond to the board; but they can act opportunistically, expropriating shareholders; 2) large, sometimes controlling, shareholders, who should act in behalf of themselves, but can expropriate minority shareholders; and 3) minority shareholders. An additional party is the product of a key mechanism of governance: the board of directors; board members are agents who act in behalf of all owners, and whose job is almost exclusively to deal with management, but their function is affected by the relationship with management, their private interests, and time constrains. Considerable research has been carried out to find what characteristics make an efficient board. Under the premise that firm charters and the rule of law (legal system and judiciary) are not enough to avoid non optimal behavior by agents, business associations and regulators alike have encouraged the adoption of governance guidelines. In order to induce good behavior by agents (managers, board members, and controlling shareholders), contracts, implicit and explicit, should be well designed and controlled, especially because management can expropriate shareholders due to their advantage in information and their control of daily and major decisions. Fama and Jensen (1983) analyze the problem and posit that in complex organizations is optimal to allocate the different steps involved in decision making between management and the board of directors.

Management should be in charge of proposing and implementing decisions, while the board of directors should be in charge of the approval and monitoring of decisions. Boards effectiveness can suffer if management forces. Not surprisingly, all governance guidelines include rules related to the operation and structure of the board of directors.

The efficient operation of the board addresses the three agency conflicts mentioned above, but outsiders, funds providers, also might be hurt by informational disadvantages. To alleviate asymmetric information problems, the codes usually require enough disclosure of financial and operational data to give to stakeholders, and to the market in general, a precise idea of the current and prospective situation of the firm. Additionally, dealings and contracts involving senior management and directors regarding payment (at least the structure of the incentive packages), share purchases/sales, operations with the firm and other potential conflict of interests are commonly required to disclose. The self regulation of firms is based on the idea that transparent management and arms length relationships with controlling groups induce the trust of outside investors in the firm. As a consequence, outside investors, shareholders and creditors are willing to provide more funds at lower costs. Additionally, trust reduces monitoring costs making the firms operations more efficient. If the benefits of a larger size, lower cost of capital, better risk allocation and reduced monitoring outweighs the reduction in private benefits by the controlling parties, then governance codes are effective.

The tests in this research document an increase in accounting performance for the Colombian firms that issue a governance code, which also sheds light about the causality between governance and financial results. Given that a positive association between performance and governance levels, does not answer if good governance produces better results or if good results induce better governance; the approach we use permit us to tackle this important issue. The coefficients in our equations show that improvements in performance and increased leverage occur after an event associated to better practices. We document an increase of 1,53% in return on assets, after the firms issue their governance code and controlling per the countrys GDP. The effect is also associated to the code quality, firms issuing better written codes have higher increments in return on assets. Our results show that return on performance increases by 3,52% for firms with good codes. As stated before an additional positive consequence of the governance codes is debt access. After issuing a well written governance code a firm is able to increase its leverage; an increase of 7,03% in financial leverage is found for firms with good codes. The results seem to support the effectiveness of self regulation as a mean to induce optimal behavior by controlling parties. The outcome is, hopefully, an improved equilibrium where firms grow faster, because funds providers, perceiving less risk, are willing to reduce their required returns and/or increase their supply of funds to the firms.

The article is organized as follows: after this introductory section; section one surveys related papers; section two analyzes the structure of governance codes, following the guidelines developed by the OECD; section three presents the data and the relevant tests; and section four concludes.

1. LITERATURE REVIEW

A large body of research explores the links between governance and performance. Klapper and Love (2004) use a governance score for emerging markets firms and report that firms with higher scores have better operating performance and market valuation for the year 2002. Brown and Caylor (2004) built a governance index and find that in 2002 US firms with high scores were more profitable, more valuable and paid more dividends. Garay, González, González, and Hernández (2006) also built a governance index and find that Venezuelan firms with high scores were more valuable and paid more dividends in 2002. Gruszczynski (2006) reports that independent corporate ratings assigned by the Polish Corporate Governance Forum were associated with higher profit margins and lower debt levels for the largest listed Polish firms.

Padgett and Shabbir (2005) study the code compliance for U.K. firms in the FTSE 350 for the years 2002 and 2003, and find that Total Shareholder Return (capital gains and dividend yield) is associated with higher levels of compliance, additionally they report that causation runs from governance to performance, addressing the issue that corporate governance produces better firm results, which is similar to what we find in our tests; code compliance is based in reports that firms send to the regulator; in this mode, instead of firms writing their governance codes, the regulator defines what a standard governance code should include and firms report what recommendations they meet and what they don´t, explaining why they do not comply the standard.

In the Netherlands, a study by de Jong, DeJong, Mertens, and Wesley (2004) comparing firm measures pre and post Peters Report (Netherlands Governance Guidelines) found little evidence of a positive impact of the Peters Report in the performance of Dutch firms; however they found that limits on shareholder rights tend to produce lower Tobins q; and that the levels of Tobins q, and growth were statistically higher in the post-Peter era, at that time (circa 1997) there was not a comply or explain requirement. Price, Roman, and Rountree (2007) did not find effects of governance compliance for listed Mexican firms, following the enactment of the Voluntary Code in 2003, even after a period of increasing compliance.

Pombo and Gutierrez (2007) do not find significant determinants of governance quality, except for the code existence and the stock liquidity for Colombian firms for the period between 1998 and 2002. Using information from 2005, Langebaek and Ortiz (2007) built a governance index for Colombian listed firms but they did not find any association between this index and the firms Tobins q; however, given the low liquidity of most of Colombian shares, this lack of association is not surprising.

2. OECD GUIDELINES AND CODE QUALITY

The Organization for Economic Cooperation and Development (OECD) was one of the first institutions to issue governance guidelines and became an important reference for subsequent efforts. The guidelines cover the following topics: 1) Shareholders rights, 2) Equitable treatment of shareholders, 3) Stakeholders role, 4) Disclosure and transparency, and 5) Responsibilities of the board.

- Shareholders rights: according to the guidelines, the governance framework should protect the exercise of shareholders rights, providing mechanisms to facilitate informed participation and voting in all relevant company decisions for all shareholders. Transactions including changes in control will be completely disclosed, and fair priced, allowing for all sharehold-ers to express their concerns and those concerns should be properly addressed. At no time measures to shield management from accountability will be in place.

- Equitable treatment of sharehold- ers: specific rules for avoiding actions that expropriate specific groups of shareholders are also required by the guidelines, those rules include provisions to ease voting procedures, disclosure of any material interest by board members or management in any transaction that affect the firm, and effective means of redress by affected shareholders.

- The role of stakeholders: the rights of stakeholders recognized by law or through mutual agreements should be respected and recognized, promoting active cooperation among the stakeholders and the company to foster value creation, those stakeholders include, but are not limited to, employees and creditors.

- Disclosure and transparency: in terms of disclosure and transparency, the guidelines recommend that all material information regarding the firm must be timely and properly disclosed.

- The board of directors: responsibilities of the board include the strategic guidance of the firm, monitoring of management, the boards accountability to the company and shareholders, and ensuring a fair treatment of all shareholders when its decisions affect them differently. The board also selects top management, and defines their compensation, making sure that incentives are properly designed to align the interests of management and all shareholders.

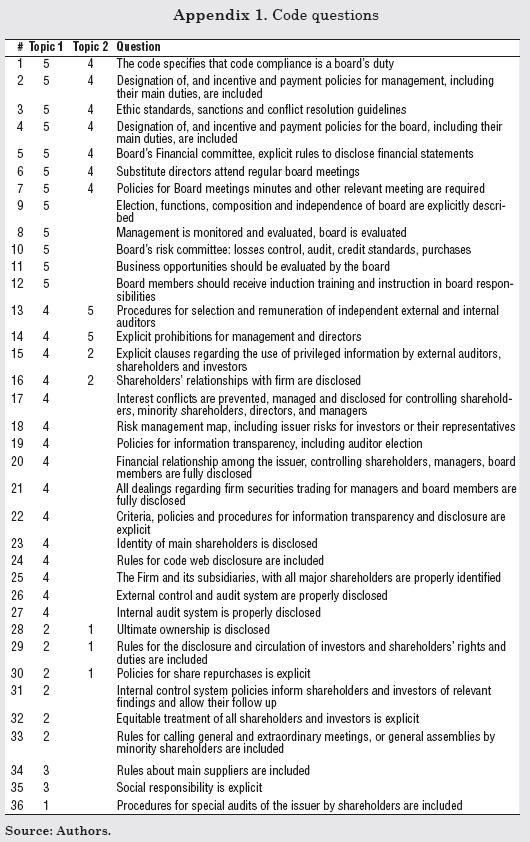

Studying the different codes issued by the Colombian firms we came up with a set of thirty six questions, related to the topics included in the guidelines and regarding if a particular code includes a section covering each questions specific issue. To rate the codes we award one point per each question the code includes and normalize the rating dividing by the total number of questions. In Appendix 1 we show the questions we study and to which topic are related.

3. DATA SET AND TESTS

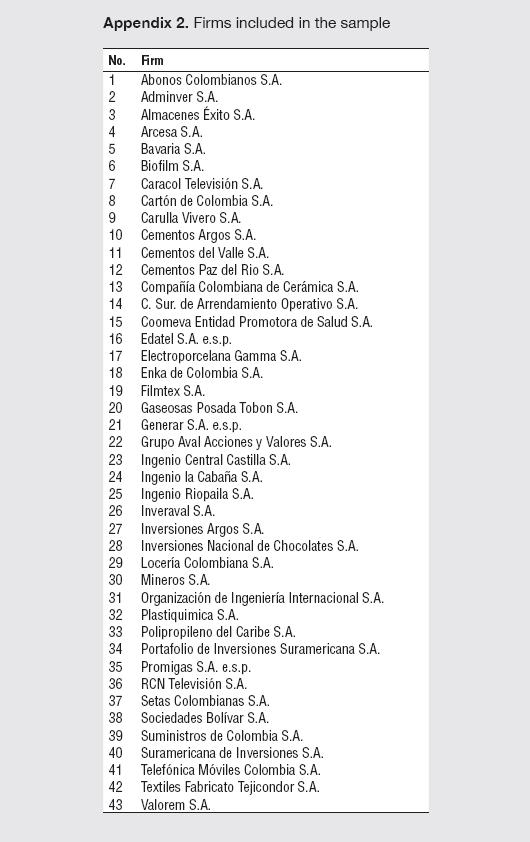

Our financial data is from firms who issues securities, bonds and shares, which are traded in the Colombian Exchange. Those firms report their financial information to the local regulator, Superintendencia Financiera, which makes that information available through its website. From that information we assemble an unbalanced panel of 299 firms with 1381 firm-year observations from 1997 to 2006, excluding financial firms, but keeping holding companies.4 The code requirement was introduced in 2001 for a firm with ten years of data, who introduced its code in 2001, we have five pre and post code years of financial information. From 2001 until the end of our study period, 101 firms, including financial firms, had issued their governance codes. Excluding financial firms and firms without enough financial information, we end up with 43 firms producing a Governance Code (Appendix 2) and 325 firm-year observations, which we analyze. The results of Hausman tests to choose between a random or fixed effects approach favors the random effect approach (see Table 3, panel A, regression 4; and Table 4, panel B, regression 2).

3.1. Variables

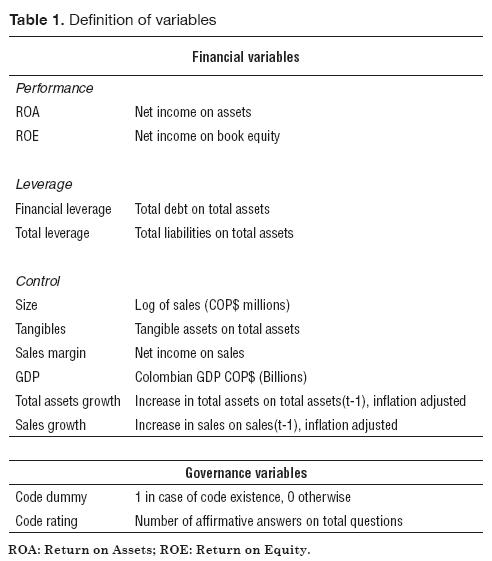

Table 1 shows our variables definition. The financial variables include: accounting performance, return on assets and return on equity; two alternative measures of leverage, total and financial leverage; and four control variables including proxies for size (the log of sales in Colombian pesos -COP$- millions), market power, assets tangibility, and the overall economic situation. The governance related variables include a dummy for the code existence, the code rating, and an interaction variable for both. The code dummy takes the value of one after the code is issued, zero otherwise.

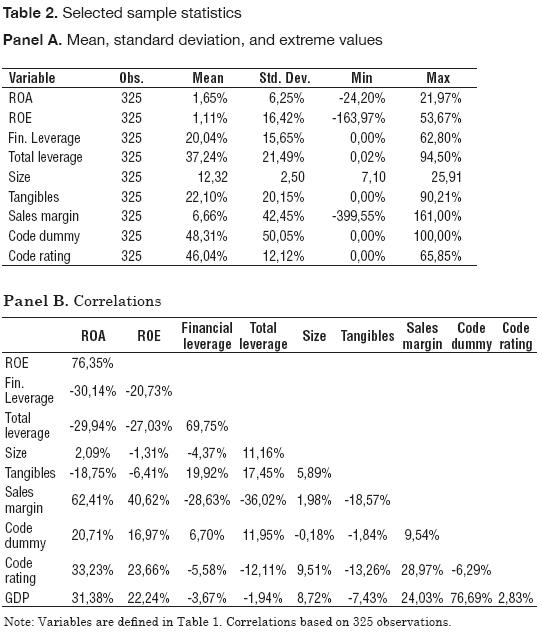

Table 2 reports the statistics of our data. The correlations among our measures of performance and the code rating are positive, similar to what happens with the GDP. Our regressions intend to uncover if the code rating has a positive impact on performance besides the GDP; the correlation between the code rating and the GDP is almost zero, as expected, which gives more support to our regressions.

3.2. Regressions

The structure of our tests sheds light on the relationship between governance codes and accounting performance. We also test if firms with governance codes have more access to external funds, particularly debt, after they issue a governance code. Our hypotheses are as follows.

H1. Performance improves after the issuance of a governance code.

Our rationale was explained previously. By a credible self committing of management and controlling shareholders to a non extracting behavior, fund providers are willing to reduce their expected return, lowering the firms cost of capital. As a consequence the firm becomes more profitable because more positive NPV projects are carried away. Additionally, monitoring costs are reduced, which also has a positive impact on profitability. We go further and posit that improvements in performance are associated with the code quality, and then we have a related hypothesis:

H1a. The increment in performance is associated with the code quality.

Our second group of hypotheses is related with the firms debt capacity. Given that the firms risk is reduced, creditors are willing to provide more funds to the firms. Then, after the code issuance the firm leverage will be higher:

H2. Leverage increases after the issuance of a governance code.

Similarly to our first hypothesis, we also posit that the increment in leverage will be higher for the firm with the better codes.

H2a. The increment in leverage is positively associated with the code quality.

3.3. Test of hypotheses H1 and H1a

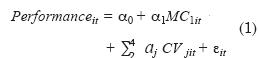

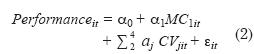

In accordance with our hypotheses we structure two set of equations. The first has accounting performance as the dependent variable, the second group has leverage. The equation for the first set is as follows:

The performance variables are ROA or ROE, while the control variables are tangibility of assets, leverage, size, and sales margin. All the control variables are known to have an impact on performance. Firms with high tangible assets tend to characterize mature industries with low returns, so we expect a negative relationship with performance. Size is also a signal of lower risk, less variability of income, thus the relationship with performance should be negative. Leverage and performance are negatively related according to the pecking order theory (Myers and Majluf, 1984), but according to the free cash flow argument by Jensen (1986), the relationship can be positive, with managers working harder to meet debt service. Sales margin is positively related with performance, given that market power produces higher returns. The last control variable is GDP, although the structure of our regressions measures the increase in performance after the code is introduced, is it possible that a spurious association appears if the sample years record better economic results. The control mechanisms we consider are the code dummy and the interaction between the code dummy and the code rating. We do not consider the code rating alone as mechanism of control, because our interest is, as said before, to assess if the code introduction and its quality have a positive impact on firms performance.

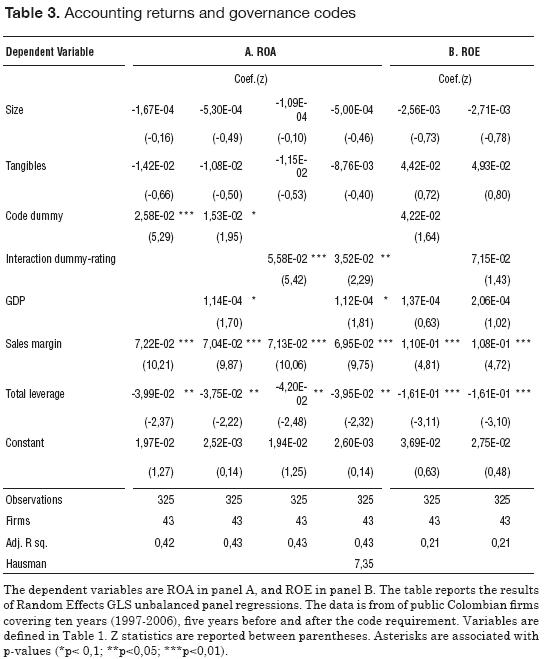

Our results are reported in Table 3. Panel A regressions have an explanatory power of 0,42 while panel B regressions have one of 0,21 which means that our stronger dependent variable will be ROA, the results that follow confirm it. The control variables have the hypothesized signs but just sales margin and leverage are statistically significant, with the leverage sign backing the pecking order explanation. The first two regressions of panel A, where ROA is the dependent variable, show that the code dummy is still statistically significant after controlling per GDP; however, the effect is diminished in size, by 1,05% and in statistical power to 10%. Nevertheless, the increase in ROA after the code is introduced is 1,53%, which is a substantial gain for any firm. When we switch to the interaction variable as control mechanism, in regressions 3 and 4 of panel A, we find a stronger picture. The effect of the interaction variable, after controlling per GDP, is statistically significant at 5% and the coefficient is 3,52%; for the average code this means an increase in ROA of 1,62% (3,52%*46,04%), and an increase of 2,32% (3,52%*65,85%) for the firm with the best code. When we compare the effect of the code issuance and their quality (regressions 2 and 4) the size is almost the same for the average code: while the size coefficient for the code issuance is 1,53%, the improvement for the average code is 1,62% (3,52%*46,04%). Taken together the results show an important and positive impact on ROA after the firms issue governance codes. The results do not translate to ROE, the results in Panel B show that neither the code dummy nor the interaction variable are statistically significant, which means that improvements in performance of assets also accrue to additional stakeholders, most likely creditors.

3.4. Test of hypotheses H2 and H2a

The second group of regressions tests the association between leverage and the introduction of a governance code. The equation is as follows:

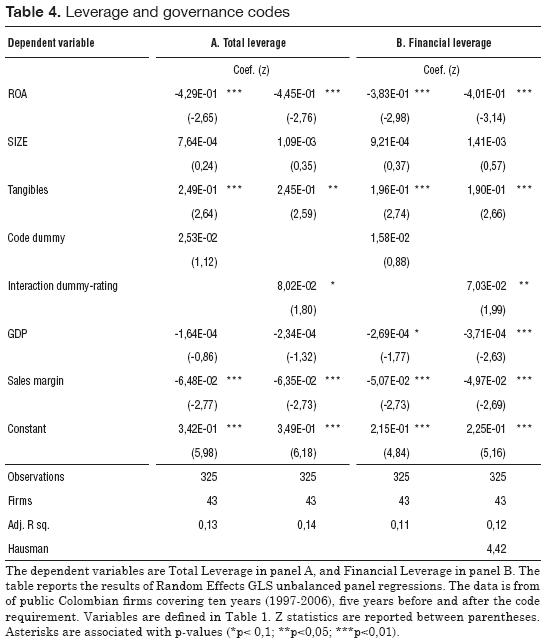

The control variables are size, tangible assets, GDP, sales margin, and performance. Size and the level of tangible assets should have a positive effect on leverage, reducing the risk for creditors by more stable cash flows and because tangible assets are used as collateral for debts, respectively. GDP, profitability, and sales margin should be negatively associated with leverage, because higher cash flows, whatever the cause, reduce the need of external funds. The mechanisms of control are still the code dummy and the interaction variable.

Our results are reported in Table 4. As robustness test we measure leverage in two ways, as total leverage and as financial leverage, the results are qualitatively similar with an explanatory power rounding the 12%. Again all the control variables have the hypothesized sign, with size lacking statistical significance in all specifications, while GDP lacks statistical significance in panel A specifications. The control mechanism effect on leverage is absent when the variable is just the code dummy; however, when combined with the code quality in the interaction variable, the expected result stands out. For total leverage the effect is statistically significant at 10% and the coefficient size is 8,02%, which means an increase in leverage of 3,69% (8,02%*46,04%) for the average code, while the improvement is 5,28% (8,02%*65,85%) for the firm with the best code. For financial leverage the coefficient is 7,03%, statistically significant at 5%, and the increase in leverage for the average code is 3,23% (7,03%*46,04%), while the improvement is 4,63% (7,03%*65,85%) for the firm with the best code. It is important to note that creditors seem to take into account the code quality when approve additional funds to firms. In a market with scarcity of funds this advantage can be crucial to exploit investment opportunities, securing the firms with good governance practices higher growth rates than its counterparties.

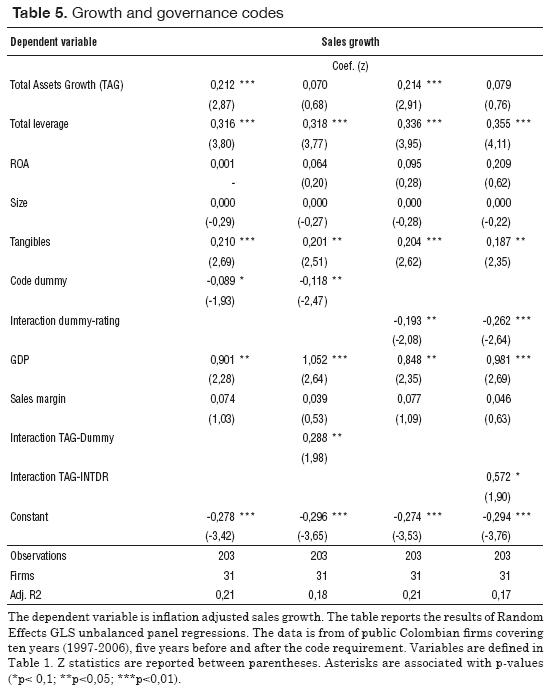

3.5. Mechanisms of improvement

It is also interesting to assess what is the operational influence in the introduction of a governance code. To study this issue we looked for relationships between sales growth and the governance code and its quality. Table 5 reports our findings. We find that sales growth is positively influenced by investments (assets growth), leverage5 and GDP, as reported in regressions 1 and 3.

However, the same regressions show a negative, and statistically significant impact of the presence of a governance code; the impact is magnified by the quality of the governance code. Firms reduce their sales growth in 9% after issuing a governance code, and the firm with the highest quality code reduces its sales growth in 12%. Our results point out that the improvements in performance prompted by the codes are the result of operational improvements, rather than changes in sales. Finally, regressions 2 and 4 in Table 5 introduce an interaction term between investments and the governance codes. The effect of this new variable is twofold; first, it reduces the statistical significance of investments, but, second, the new interaction term is positive and statistically significant. Our result can be interpreted as an additional positive effect of the codes; after the code introduction (also weighed by its quality) capital investments are more effectively channeled into sales growth.

4. CONCLUSIONS

Given the lack of liquidity of most of the shares of the stock issuers in our sample, we couldnt study the effect on the firms market value of the governance code issuance; we instead study the accounting performance. Accounting measures respond to fundamental changes in a slower pace than market measures, making difficult to disentangle the effect of external shocks or events. To the best of our knowledge we tried to include all the relevant control variables that can also affect performance, we were able to find a positive impact on return on assets and higher leverage.

A positive impact on ROA and the possibility of secure additional debt funds in a traditionally restricted market is not, by any means, a small byproduct of the issuance of a governance code with good quality. It shows that efforts to improve governance practices translate to the firm finances. Our article exploits a unique window of opportunity, when firms were free to structure their codes in any way they wanted; before the issuance of the country code and the requirement of adherence to the country code. Although good codes could be the result of hiring the right consultants, we think that our results show that a strong commitment to better levels of governance, produces better codes and, as our article documents, better economic results. We also show that the relationship between sales growth and investments is positively mediated by the presence of governance codes. Different articles have documented the positive association between governance levels and performance, some of them built their own performance measures, some use self declared code compliance, but most look for simultaneous associations; our approach is to rate the governance code at its inception and link it to improvements in performance after its introduction, solving the causality issue. Our article supports the argument that better government practices increase financial performance and that credible commitments are valued by fund providers. We leave to further research the impact of governance codes in the firm payout and its cost of capital, as additional positive consequences of better practices.

FOOTNOTE

1. The authors gratefully acknowledge the research assistant of Ewelina Makowska, Mauricio Arcos, Juan Manuel Chaves and Angela del Valle.

2. Este documento fue seleccionado en la convocatoria para enviar artículos, Call for Papers, realizada en el marco del Simposio "Análisis y propuestas creativas ante los retos del nuevo entorno empresarial", organizado en el marco de celebración de los 30 años de la Facultad de Ciencias Administrativas y Económicas de la Universidad Icesi y de los 25 años de su revista académica, Estudios Gerenciales, el 15 y 16 de octubre de 2009, en la ciudad de Cali (Colombia). El documento fue presentado en las sesiones simultáneas del área de "Organizaciones".

3. Ley 964 del Mercado de Valores (Congreso de la República de Colombia, 2005).

4. We run regressions for the whole group of firms, firms with and without a code. Not surprisingly the GDP control wipes away the code and interaction variable effect. Our results are available upon request.

5. Similar regressions using financial leverage, produces virtually the same results.

BIBLIOGRAPHIC REFERENCES

1. Brown, L. and Caylor, M. (2004). Corporate governance and firm performance (SSRN working paper). Retrieved from http://papers.ssrn.com/sol3/papers.cfm?abstract_id=586423 [ Links ]

2. Fama, E. and Jensen, M. (1983). Separation of ownership and control. Journal of Law and Economics, 26(2), 301-325. [ Links ]

3. Garay, U., González, G., González, M. and Hernandez, Y. (2006). Índice de buen gobierno corporativo y desempeño financiero en la Bolsa de Valores de Caracas. Estudio IESA, 24. [ Links ]

4. Gruszczynski, M. (2006). Corporate governance and financial performance of companies in Poland (working paper No. 2-05). Retrieved from http://papers.ssrn.com/sol3/papers.cfm?abstract_id=873887## [ Links ]

5. Jensen, M. (1986). Agency costs of free cash flow, corporate finance, and takeovers. American Economic Review, 76(2), 323-329. [ Links ]

6. Jong, A., DeJong, D., Mertens, G. and Wesley, C. (2004). The role of self-regulation in corporate governance: evidence and implications from The Netherlands (Simon School of Business Working Paper No. FR 00-20). Retrieved from http://papers.ssrn.com/sol3/papers.cfm?abstract_id=246952 [ Links ]

7. Klapper, L. and Love, I. (2004). Corporate governance, investor protection, and performance in emerging markets. Journal of Corporate Finance, 10(5), 703-728. [ Links ]

8. Langebaek, A. and Ortiz, J. (2007). Q de Tobin y gobierno corporativo de las empresas listadas en bolsa. Borradores de Economía, Banco de la República de Colombia, 447. [ Links ]

9. Ley 964 del Mercado de Valores. Congreso de la República de Colombia, 964, 2005. [ Links ]

10. Myers, S. and Majluf, N. (1984). Corporate financing and investment decisions. When firms have information that investors do not have. Journal of Financial Economics, 13(2), 187-221. [ Links ]

11. Padgett, C. and Shabbir, A. (2005). The UK code of corporate governance: Link between compliance and firm performance (ICMA Centre, University of Reading, discussion papers in finance DP2005-17). Retrieved from http://ideas.repec.org/p/rdg/icmadp/icma-dp2005-17.html [ Links ]

12. Pombo, C. and Gutierrez, L. (2007). Corporate governance and firm valuation in Colombia (RES working papers No. 4470). Retrieved from http://ideas.repec.org/p/idb/wpaper/4470.html [ Links ]

13. Price, R., Roman, F. and Rountree, B. (2007). Governance reform, share concentration and financial reporting transparency in Mexico (working paper). Retrieved from http://papers.ssrn.com/sol3/papers.cfm?abstract_id=897811 [ Links ]