1. Introduction

Firms operating in developed and emerging markets face the reality of corruption (Misangyi, Weaver, & Elms, 2008; Ionescu, 2013). Corruption occurs in all countries, but it presents special challenges to firms in emerging market countries (Transparency International, 2016; Bohn, 2013). Complicating the issue is corruption’s influence that weakens already weak public institutions (Morris, 2009). Despite efforts in many emerging market countries to reform governments and strengthen institutions, corruption remains high in most of them (Transparency International, 2016). For example, in several Latin American countries, reforms have strengthened many public institutions, but rankings and scores on the Corruption Perception Index have not improved and many have worsened (Transparency International, 2016).

Corruption presents challenges to firms operating in emerging market countries, most of which prefer to engage in fair competition rather than corruption (Ciravegna, Lopez & Kundu, 2016). Firms in emerging markets generally prefer to avoid engaging in corruption, knowing that if they act corruptly, they damage their brand, alienate customers, and lose the support of their local communities (Schaefer & Schaefer, 2008). Emerging market firms instead want to achieve competitive advantages by building resources and capabilities, such as competitive pricing, innovation, distribution expertise, and by creating loyal, trusting, and trustworthy staff (Brenes, Haar, & Requena, 2009; Haar & Price, 2008). We argue that this last resource, the level of trust in the firm held by its staff, is a valuable capability. Furthermore, in highly corrupt countries, firm-level trust by employees engages them in ways that counter the external pressure placed on firms by public level corruption.

We ask the question, “How does firm-level trust by employees help emerging market firms mitigate the challenge of public level corruption?” The idea may seem counterintuitive: corruption is a dishonest and immoral behavior, while trust evokes honesty and a high level of morality. We argue that as firms that operate in corrupt environments build resources and capabilities to compete amid the uncertainty that corruption brings, firm-level trust is a very important resource. When employees trust the firm’s priorities, and see that achieving those priorities leads to individual and team goals, the firm is better aligned to succeed (Brenes, Mena, & Molina, 2008).

This research on firm-level trust deepens understanding about the institutional strength - corruption relationship in emerging markets. We hypothesize that firm-level trust is a key variable that moderates the relationship between institutional strength and perceived corruption, such that when people have a high level of trust in the companies they work for, they will find corruption to be less strongly associated with weak public institutions. Conversely, when people have low trust in the companies they work for, corruption will be more strongly associated with weak institutions. While past studies have examined the effect of public sector trust, or generalized trust, on corruption (Li & Wu, 2010; Uslaner, 2013), which is generally negative, our study is unique because it examines how firm-level trust, or particularized trust (Uslaner, 2004), may influence people’s perceptions of their public institutions and corruption.

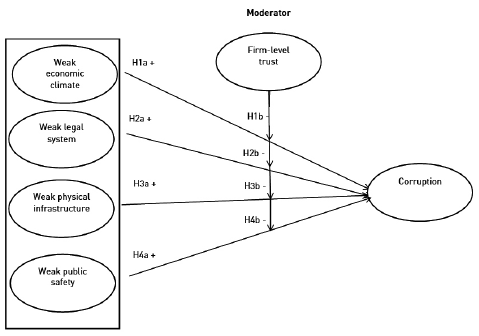

This underexplored area of study makes three contributions to the corruption literature. First, our conceptual model expands existing research on corruption, suggesting that firm-level trust moderates the long held and oft-replicated relationship between weak public institutions and perceived corruption. We surveyed employees of firms in Mexico and Peru, measuring perceptions of corruption, trust, and institutional strength. Using confirmatory factor analysis and linear regression, we test these main effects, and we broaden our scope to test how employee’s firm level trust moderates that relationship.

Second, we draw from the resource-based view of the firm (Barney, Ketchen, & Wright, 2011; Liu, 2012) to posit that firm-level trust is a resource and capability that increases employees’ positive engagement in the firm’s agenda, particularly in uncertain, corrupt institutional environments. Our contribution lies in empirically demonstrating that employees’ trust in the firm, a valuable resource, moderates the weak institution - perceived corruption relationship.

Third, to our knowledge, no studies have examined the firm-level trust - corruption relationship, although some have explored the relationship between people’s trust in their public institutions and perceptions of corruption. Our study does this, by examining this particularized level of trust that individuals in emerging market countries have in the firms they work for and its influence on their perceptions of corruption. By adding this important social variable, firm-level trust, to the study of perceived corruption, we begin to fill the gap that some scholars have recently called for (Bjornskov, 2011; Husted, 2002; Peña López & Santos, 2014). Together with work focusing on corruption in emerging economies, this study provides local and multinational corporation managers with new knowledge on how firm-level trust might help firms perform effectively and successfully in situations of high perceived corruption.

This paper is structured as follows: section 2 provides the theoretical framework and hypotheses; section 3 explains the methods used to analyze empirically the weak institution - perceived corruption relationship and the moderating effects of firm-level trust; section 4 discusses the results; and finally, section 5 offers conclusions, recommendations for practice and research, and limitations.

2. Theoretical framework

2.1. Corruption

“Corruption is the abuse of public power for private gain” (Lambsdorff, 2007, p.1). It occurs when people with discretionary power over public resources intentionally misdirect those resources or pervert organizational routines to their benefit (Jain, 2001; Lange, 2008). Corruption is that exercised by people in governmental institutions, because they have the power to arrest, imprison, charge, collect taxes from, and levy official power against, citizens and private firms in a way that non-governmental actors do not.

Corruption occurs to some degree in every country, per the corruption perception indices tracked by Transparency International (2016) and the World Bank (2016). Predictably, corruption generally has a negative effect. Corruption may lower national productivity (Lambsdorff, 2003); discourage investment by foreign and domestic firms (Habib & Zurawicki, 2002; Rose-Ackerman, 2002; Zhao, Kim, & Du, 2003); reduce confidence in public institutions (Berrios, 2010; Mocan, 2008); limit the development of small and medium-sized enterprises, weaken systems of public financial management, and undermine investments in health and education (Rose-Ackerman, 2002). Emerging market countries moving toward a free-market economy (Kvint, 2009) are particularly vulnerable to corruption, because their public institutions are often weaker (O’Higgins, 2006) and more corrupt (Arvate, Curi, Rocha, & Miessi Sanches, 2010; Mocan, 2008; Morris, 2009; Park, 2003; Venard, 2009; Morris & Klesner, 2010). Corruption feeds a vicious circle of negative outcomes where increased corruption produces less confidence in institutions, which in turn reduces private investment, slows economic growth, increases government outlays that favor the rich and well-connected, then leads to poor public infrastructure, and limits the ability of people and business to build sustainable incomes (O’Higgins, 2006).

2.2. Institutions and corruption

One theory of corruption suggests that individual attributes, such as a lack of integrity, moral identity, self-control, empathy, or psychopathology (Ashforth, Gioia, Robinson, & Trevino, 2008; Klitgaard, 1988) drive corrupt behavior. Corruption, then, is controlled by weeding out people with low moral character and discouraging them from acting on that character.

However, we argue in this paper that corruption is also institutional. Weak public institutions create a fertile environment for corruption (Morris, 2009; Schaefer & Schaefer, 2008), and in emerging market economies, forces larger than individual greed can drive corruption. Weak institutions result in a lack of transparency, lack of oversight, and uneven enforcement of policies, and these too are linked to higher incidences of corruption (Blake & Morris, 2009; Venard, 2009). Much of this research affirms the positive relationship between corruption and these weak institutions: namely, economic climate (Ahlin & Pang, 2008; Altunbas & Thornton, 2012; Fisman & Gatti, 2002; Rose-Ackermann, 2002), legal system (Rodriguez & Ehrichs, 2007), physical infrastructure (Huff & Kelley, 2005), and public safety (Lambsdorff, 2007; Price, 2008).

2.3. Firm-level trust

Trust is the “mutual confidence that no party to an exchange will exploit another’s vulnerabilities” (Sabel, 1993, p.1133). Trust mitigates risk between one person and another: suggesting that I am vulnerable, you know that I am vulnerable, but I trust that you will not act upon that vulnerability. Put another way, trust is “the willingness of a party to be vulnerable to the actions of another…based on the expectation that the other will [act]… irrespective of the ability to monitor or control [them]” (Mayer, Davis, & Schoorman, 1995, p.712).

“Trust helps people believe that other people are still part of their moral community” (Fukuyama, 1995, p. 153), making it easier to deal with them. Trust is built by past cultural and educational experiences, which influence how we trust other people and organizations. For example, when people trust those who are similar to themselves, it is because they think they know others in their group, such as people belonging to a religion (Parboteeah, Hoegl & Cullen, 2008), family, or workplace. This trust can translate to firms creating reliance and voluntary duty accepted by those engaged in the firm (Hosmer, 1995), and may help build intra-firm innovation and entrepreneurship (Childers & Offstein, 2007).

Firm-level trust, then, is a resource that can contribute to a firm’s competitive advantage. The resource-based view (RBV) suggests that a firm’s resources and capabilities, obtained by either buying or building them, are a source of competitive advantage (Barney et al., 2011; Lin & Wu, 2014). Capabilities that are valuable, rare, costly to imitate, and non-substitutable can create superior performance and competitive advantage (Barney et al., 2011). Capabilities are combinations of financial, physical, human, and organizational resources. Interestingly, the more intangible those resources are, the harder it is for competitors to acquire or imitate them, and the more likely the firm will sustain its competitive advantage.

Firm-level trust is an intangible resource that builds employee engagement (Hough, Green, & Plumlee, 2015; Malinen, Wright, & Cammock, 2013), employee commitment (Baek & Jung, 2015), and helps employees confidently transfer knowledge to their colleagues (Droege, Anderson, & Bowler, 2003; Yli-Renko, Autio, & Sapiencza, 2001). Those attributes are capabilities that could be a source of competitive advantage because they are hard to imitate, hard to substitute, and differentiate firms from their competitors (Barney et al., 2011). Firms that generate the dynamic capability of firm-level trust may deal better with environmental uncertainty (Teece, Pisano, & Shuen, 1997; Kanter, 1988), such as that found in emerging markets with weak institutions. Firms operating in countries with weak institutions must use creativity, flexibility, and constant adjustment to survive, and firm-level trust may be a resource that builds the capabilities to accomplish this.

For example, employees who trust their firms will focus on the productive tasks needed to add value to the firm (Mayer & Gavin, 2005), rather than be concerned about how weak institutions and corruption might threaten their work. Employees become engaged, and will spend time and energy on value-producing activities, taking innovative, calculated risks, instead of worrying about what the firm might do that could adversely affect them. In this way, an employee who trusts the firm and its management may take risks and be willing to admit to a mistake if it happens, helping to mitigate damage and conserve resources. When trust is high, employees spend less time in self-protection and devote more cognitive resources to valuable, productive work (Mayer & Gavin, 2005) and to the other people they work with (Vanhala, Puumalainen, & Blomqvist, 2011). Thus, firm-level trust is a resource that can build valuable, rare, inimitable, and non-substitutable capabilities (Malinen et al., 2013).

2.4. Economic climate, corruption, and firm-level trust

Recent studies on corruption reveal that a country’s economic climate, including its macro-economic policies such as inflation, exchange rates, and taxation (Altunbas & Thornton, 2012), is related to corruption. Countries with strong economic growth and prosperity have open markets, strong monetary policies, and rigorous financial oversight, which contribute to strong financial institutions and lower corruption (Rivera-Batiz, 2001; Venard, 2009; Wurgler, 2000). Conversely, a weak economic climate is associated with high levels of corruption because it creates uncertainty for foreign investors, which reduces foreign direct investment (Treisman, 2007), discourages capital flow, and impedes economic growth (World Bank, 2016). Thus, many studies suggest a positive relationship between a weak economic climate and high perceived corruption (Ahlin & Pang, 2008; Altunbas & Thornton, 2012; Fisman & Gatti, 2002; Rose-Ackermann, 2002).

Yet, in an environment where the economic climate is weak and perceived corruption is high, employees who have high levels of trust in the firms they work for will see the economic climate - corruption relationship as weaker, compared with employees with low firm-level trust. This is because high firm-level trust prevents employees from yielding to the challenges of the weak economy that their firm operates in. Indeed, employees with high firm-level trust believe that trust helps protect them from the negative impacts of a weak economic climate on the firm. Employees with high firm-level trust are likely to observe little corruption and internal strife within their firms, and therefore they find corruption to be less closely coupled with the weak economic climate that exists outside the firm.

Conversely, if employees have low trust in their firms, they may think there is little difference between the environment in their company and the environment of public institutions (Bailey & Paras, 2006). Their firms may seem just as uncertain as external public institutions, and they are more likely to think that corruption, which they see both inside and outside of their firms, is a function of the weak economic climate that surrounds them. Following these two arguments, we propose:

2.5. Legal system, corruption, and firm-level trust

A country’s legal system is also related to corruption, beginning with a strong legal system contributing positively to the reliability of the business environment (Scott, 1995). Countries with strong laws protect contractual interests and private property, limit state interference in private sector affairs, and have courts that rule efficiently on those laws (Cuervo-Cazurra, 2006; Lehnert, Benmamoun, & Zhao, 2013; North, 1991; Zhao et al., 2003). Kimbro (2002) found the stronger the legal systems, the less the perceived corruption in 61 countries. Conversely, weak legal systems beget weak administrative processes that encourage corruption. For example, civil servants may use their positions to extract bribes from companies in exchange for services. Due to weak legal recourse, this corrupt behavior may go unpunished, fostering more corruption (Rodriguez & Ehrichs, 2007).

In countries where the legal system is weak, employees who have high firm-level trust will find the legal system - corruption relationship to be weaker, compared with people who have low firm-level trust. In organizations where firm-level trust is high, people may be assured that the policies and procedures that they experience internally extend to how the firm behaves, even in a weak legal environment. Employees will trust that their firms are not above the law, and that firms will comport themselves in ways that are honest, legal, and moral, remaining separate from the threats and distractions of a challenging legal environment. Employees with high firm-level trust are likely to observe honest and legal behavior from managers and subordinates in the firm, concluding that corruption, while it exists outside the firm, is not closely coupled with a weak legal system. However, employees who have low trust in their firms may experience dishonest behavior in the firm, and conclude there is little difference between the corruption they see inside and outside their firms (Hatak, Fink, & Frank, 2015). Low trust may convince them that their firms and public institutions are equally corrupt, thereby associating corruption with the weak legal and moral behavior that surrounds them. Based on these two arguments, we pose:

2.6. Physical infrastructure, corruption, and firm-level trust

Physical infrastructure, such as highways, roads, bridges, sanitation, airports, and schools, represents an important public institutional force that is associated with corruption. A robust physical infrastructure signals a government’s vitality and investment priorities. The stronger the public infrastructure, the more attractive a community is to people and firms; likewise, a weak physical infrastructure discourages foreign investment and diminishes social and economic activity (Porter, 1990).

Infrastructure has a direct impact on people’s lives. A new school in an area that had none, or expanding a bus system, gives people access to education and saves them time. Therefore, weak physical infrastructure is a failure of the government to meet people’s needs. If infrastructure is weak, it suggests that public officials ignore public interest goals, perhaps to favor self-interest and personal financial incentives, such as kickbacks, and people associate it with corruption.

Yet trust can change that association. Where perceived corruption is high and physical infrastructure is weak, people who have high levels of trust in the firms they work for will perceive the physical infrastructure - corruption relationship to be weaker. Employees who have high firm-level trust are likely to think that physical and other conditions in which they work are positive, surmising that the firm takes care of them in a way that prevents them from being distracted by weak physical infrastructure outside the firm. People who have high firm-level trust think their firms have found ways to overcome the problems that result in poor or unattended infrastructure, because those kinds of conditions do not exist in their firms. In fact, high firm-level trust suggests there is limited or no corruption in the firm, so people believe corruption is not as strongly associated with the country’s weak physical infrastructure.

On the other hand, if employees have low trust in their firms, they may find conditions such as the physical underpinnings of their firm to be less favorable. They may believe there is little difference between the weak infrastructure they see both outside and inside their firms (Huff & Kelley, 2005). As such, they may find their firms are as inept and corrupt as those public institutions that failed to make the needed improvements on public infrastructure, and conclude that corruption is related to weak physical infrastructure. Based on these arguments, we pose two related hypotheses:

2.7. Public safety, corruption, and firm-level trust

Public safety is strong when law enforcement officials apply laws fairly and equitably (Davis, 2006). Public law enforcement, through robust public safety systems create stronger and more reliable environments and that help business growth by deterring crime, discouraging bribes, punishing impunity, and enforcing laws impartially. It follows, then, that strong public safety institutions reduce the opportunity and motive for corruption (Davis, 2006). Indeed, studies have shown that corruption is more prevalent in places where the application of law is weak (Lambsdorff, 2007; North, 1991) and where those who enforce public safety rules are compromised (Herzfeld & Weiss, 2003; Price, 2008).

In places where public safety is weak, corruption is perceived to be high; however, if employees have high levels of trust in the firms they work for, they will perceive the public safety - corruption relationship to be weaker, when compared with those who have low firm-level trust. Employees who have high firm-level trust are more likely to believe that the firms they work for will protect them from the threats and distractions of corrupt public safety officials, despite the fact that their firms operate within that context of public safety corruption. High firm-level trust may allow employees to believe that they are protected from many possible instances of impunity or overt abuse of law enforcement power that could occur, because the firm itself is trustworthy, even if that impunity is rampant outside the firm. High firm-level trust suggests that employees probably experience little or no abuse of power by authorities within the firm, and that trust may suggest that the corruption that exists in the broader, institutional environment is not as strongly connected with weakness in the public safety authority. However, if employees experience low trust in the firms they work for, they may find abuses of power within their firms, and find little difference between abuses in their companies and impunity demonstrated by public safety institutions (Peña López & Santos, 2014). Because they see corruption and abuse in their firms, they are more likely to expect corruption to be associated with abuse and poor public safety enforcement. For these reasons, we pose these hypotheses:

H4a: weak public safety is positively related to perceived corruption.

H4b: firm-level trust moderates the positive relationship between weak public safety and perceived corruption.

Figure 1 offers a graphic representation of the conceptual model and the related hypotheses discussed above. It also shows the hypothesized directions of the relationships that we later test.

3. Methodology

3.1. Data collection and sample

To test our hypotheses, we first measured the main effects of the four institutional variables - economic climate, legal system, physical infrastructure, and public safety - on perceived corruption. Then, we test the moderating effects of firm-level trust on the relationship between the four institutional variables and perceived corruption, similar to Tan and Lim’s (2009) test of the mediating effect of firm-level trust on the coworker trust and organizational commitment and performance relationship. We used confirmatory factor analysis and linear regression for our tests, and we describe our methods in detail below. Our methodology is unique because it captures the relationships among individuals’ perceptions of corruption, institutional weakness, and trust, which is different from the analysis of country-level data derived from publicly available data sets (Li & Wu, 2010). Accordingly, the level of analysis is the individual and their perceptions of public sector corruption, the strength of public institutions, and firm-level trust.

We administered surveys to approximately 550 managerial level, working professionals enrolled in graduate and executive business education studies at universities in Mexico and Peru in late 2012. We selected Mexico and Peru because both countries are emerging markets that in the last two decades, underwent significant institutional reforms to make them more stable and economically viable (Ciravegna et al., 2016). In addition, and despite these reforms, both countries continue to experience significant, increasing levels of corruption. According to Transparency International (2016), the latest available at this writing, Mexico’s ranking on the Corruption Perceptions Index (CPI) worsened, moving from 89 in 2009, to 123 in 2016, suggesting corruption has increased in recent years. Peru’s CPI suggests it has experienced a similar increase in corruption over time, as its ranking moved from 75 in 2009, to 101 in 2016. Table 1 illustrates this and other related indices as a point of reference.

Table 1 Corruption perceptions indices, rankings, and scores of Mexico and Peru

| Year | Mexico | Peru | |

|---|---|---|---|

| Score | 2012 | 34 | 38 |

| (Higher score = less corruption) | 2015 | 35 | 36 |

| 2016 | 30 | 35 | |

| Ranking | 2009 | 89 | 75 |

| (Closer to 1 = less corruption) | 2012 | 105 | 83 |

| 2016 | 123 | 101 |

Source: Transparency International (2016).

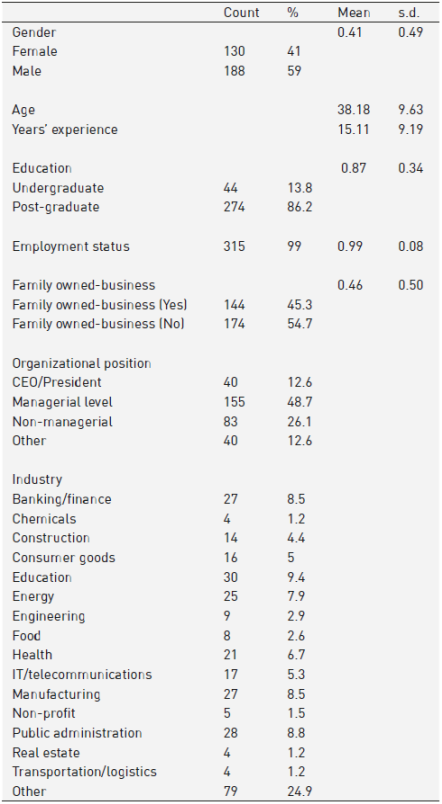

Recognizing that this was a convenient sample, a descriptive analysis indicates that the sample is representative of a broad based industry and employment level. The sample of individuals we surveyed included owners, CEOs, presidents, general managers, directors, supervisors and employees. It reflects a population of active and engaged business professionals, and is stratified enough to present an array of individual-level perceptions about corruption, public institutional strength, and firm-level trust. We received 548 responses and due to missing data, 318 were usable: 93 of the subjects were from Mexico, and 225 were from Peru. The average age was 38, with 41% female and 59% male. We controlled for education, with 14% of the respondents having an undergraduate degree and 86% holding a post-bachelor degree. Nearly 45% of respondents were associated with a family-owned business. We also controlled for position within the firm and industry. Finally, we measured firm size by the number of employees (avg. = 4622.59, s.d., 28260.54). As a result, we believe this sample adequately represents a cross section of business and managerial participants. Table 2 highlights the independent and dependent variables descriptive statistics and correlations. Table 3 highlights the control variables’ descriptive information, including percentages.

Table 2 Descriptive statistics and correlations - independent/dependent variables

| Variable | Mean | s.d. | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

|---|---|---|---|---|---|---|---|---|---|

| 1. Corruption | 4.86 | 2.01 | 1.000 | -0.086 | -0.097* | -0.001 | 0.030 | 0.289** | 0.159** |

| 2. Firm-level trust | 3.30 | 1.08 | 1.000 | -0.157*** | -0.259*** | -0.123** | -0.170*** | ||

| 3. Weak economic climate | 3.88 | 1.84 | 1.000 | 0.094** | 0.515** | 0.673** | |||

| 4. Weak legal system | 2.61 | 1.16 | 1.000 | 0.108* | 0.123* | ||||

| 5. Weak physical infrastructure | 3.30 | 1.66 | 1.000 | 0.595** | |||||

| 6. Weak public safety | 2.77 | 1.70 | 1.00 |

*** Correlation is significant at the 0.01 level (2-tailed).

** Correlation is significant at the 0.05 level (2-tailed).

* Correlation is significant at the 0.10 level (2-tailed).

Model control dummy variables include: age, gender, education, employment status, family owned business, years’ experience, managerial position, size of firm, industry.

Source: own elaboration.

3.2. Measures, scale development and reliability

Most studies of corruption do not measure actual corruption (Cuervo-Cazurra, 2016), because corruption is difficult to measure, illegal, and a socially unacceptable behavior. Therefore, researchers often use a proxy variable “perception of corruption” (e.g., Transparency International, 2016), measuring instead multiple dimensions of respondents’ experience with corruption. Similarly, we asked respondents for their perceptions about corruption experiences their firms, and firms like theirs, face.

Using a seven-point Likert scale, respondents answered 42 questions comprising eight subscales: corruption, economic climate, legal system, physical infrastructure, public safety, and firm-level trust. We adapted our questions about institutions and corruption from Venard (2009). Questions about corruption include “Firms like mine must make extra, unofficial payments to public officials to obtain licenses and permits”; and “Firms like mine must make extra, unofficial payments to public officials when dealing with courts”. Questions for institutions include “Infrastructure (telephone, electricity, water, roads, land) is problematic for the operation and growth of firms like mine” for physical infrastructure; and “Inflation is problematic for the operation and growth of firms like mine” for economic climate. We adapted firm-level trust questions from Gillespie (2003) and Mayer and Davis (1999). Questions measuring trust include “There is a very high level of trust throughout my firm”, and “I am willing to depend on my firm to back me up in difficult situations”. Control variables were age, gender, education, employment status, family own a business, years’ experience, managerial position, size of firm, and industry, and descriptions, shown on table 3. With the exception of age and years’ experience, each control was a categorical variable where subjects would select one of the control options. For example, responses in the “other” category reflected small numbers of non-supervisory employees for the organizational position variable, and fewer than four responses in other industry segments for the industry variable. We then applied these as dummy control variables within the regression.

Native Spanish speakers translated and back translated the surveys. Common methods variance that is a result of the measurement rather than the construct they measure, is a potential problem (Chang, Van Witteloostuijn, & Eden, 2010; Podsakoff, MacKenzie, Lee & Podsakoff, 2003). To mitigate common methods variance, verify our constructs, and verify cross-cultural invariance between the two-country sample, we followed Steenkamp and Baumgartner (1998). Cross-cultural invariance was achieved by constraining no less than two items between the two samples. This produced a non-significant comparison between nested models (Chi-square difference = 20.72, df = 13; p > 0.05), allowing us to combine the samples. The final constrained nested model still shows adequate fit (RMSEA = 0.05; CFI = 0.90).

We ran tests of convergent and discriminant validity utilizing Fornell and Larcker’s (1981) average variance extracted and composite reliability measures. Composite reliability is an alternative and stronger form of reliability than Chronbach alpha using the average variance extracted (AVE) compared to measurement error within the model. Utilizing confirmatory factor analysis, we verified all constructs. Convergent validity of all items loading on each construct was above recommended levels for scalar reliability. All scales showed sufficient reliability with loadings greater than the recommended 0.6 (Fornell & Larcker, 1981). These results confirm both discriminant and convergent validity of the scale measures, and reliability within each measure.

Following Hair, Black, Babin, Anderson, and Tatham (2006), we used linear regression analysis to test the hypotheses. Analysis on the variance of inflations (VIF) indicate that multicollinearity is not an issue, as all non-interactive term values are below 5 as recommended by Neter, Wasserman, and Kutner (1985).

4. Results

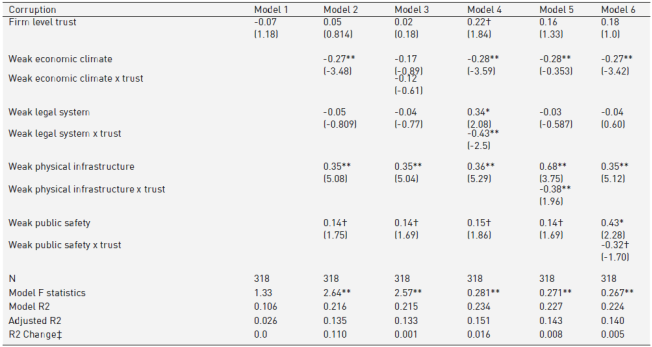

We used stepwise linear regressions to test our hypotheses. Table 4 tests the first hypothesis relating to corruption. For each model, we controlled for age, gender, education, employment status, family owned business, years’ experience, managerial position, size of firm, and industry; however, due to space considerations we only present the independent and dependent variables. Model 1 on table 4 shows the effects of firm-level trust on corruption (β=-0.07, p = 0.24), reflecting the argument that the trust - corruption relationship is more complex than the simple direct effect. Subsequent models build upon the direct effect, highlighting each institutional variable relationship to corruption, followed by the interactive effect of that institutional construct with firm-level trust.

Table 4 Institutional - corruption relationship and moderating effects of trust

** p<0.01, * p<0.05, † p<0.08

Numbers in parenthesis represent t-statistic.

‡R2 Change reflects change from model 1 and preceding model.

Model control dummy variables include: age, gender, education, employment status, family owned business, years’ experience, managerial position, size of firm, industry.

Source: own elaboration.

Model 2 shows the results of the main effects of all four institutional pillars - economic climate, legal system, physical infrastructure, and public crime - on corruption. While the Beta (βWeak Institutional Climate=-0.27, p < 0.01) is significant, the negative sign does not support H1a, which states a weak economic climate is positively related to corruption. There was no significant direct effect of weak legal systems, (βWeak Legal System=-0.05, p = 0.72), thereby providing no support for H2a. Regarding the relationship between weak physical infrastructure and corruption, we find a strong positive effect (βWeak Physical Infrastructure=0.35, p < 0.00) that supports H3a. This implies that the weaker the physical infrastructure, the greater the perception of corruption. Results slightly support H4a because weak public safety is positively related to corruption (βWeak Public Safety=0.14, p < 0.08). As people perceive weakness in their country’s public safety, they perceive greater corruption. We offer a robust analysis of these results in the conclusion section that follows.

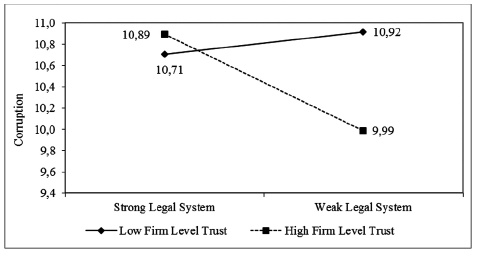

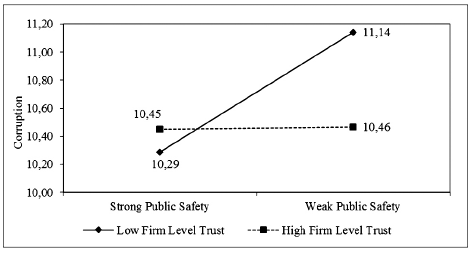

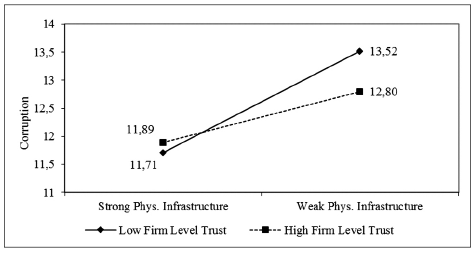

We then modeled each hypothesis separately, highlighting the interactive effect alongside our main effects. Model 3 shows that the interaction between the weak economic climate and firm-level trust is not significant (βWeak Institutional Climate x Trust = -0.12, p = 0.54), thereby not supporting H1b. Model 4 indicates there is a significant interaction between weak legal systems and firm-level trust (βWeak Legal Systems x Trust = -0.43, p < 0.01) providing support for H2b. Graphing this interaction indicates that as firm-level trust increases, weak legal systems have less of an effect upon corruption. Model 5 also demonstrates a significant interaction between weak physical infrastructure and corruption (βWeak Physical Infrastructure x Trust = -0.38, p < 0.01), providing support for H3b. Graphing this interaction highlights a similar effect as with the weak legal systems. Trust serves as a suppressing component, where higher levels of trust accentuate the effect of weak physical infrastructure on corruption. Model 6 shows a slightly significant interaction between weak public safety and firm-level trust (β = -0.32, p < 0.09), providing some support for H4b. Graphing this interaction indicates that as firm-level trust increases, the relationship between weak public safety and corruption is less positive. The graphs in figures 2, 3, and 4 illustrate these moderating relationships. In the following section, we expand upon these results, and offer explanations for them.

Source: own elaboration

Figure 3 Moderating effect of firm-level trust x weak physical infrastructure.

5. Conclusions

The results of our study partially confirm prior results that a weak public institutional environment is positively related to perceived corruption. We found that the relationship between two of the four institutional variables and corruption is positive: both weak physical infrastructure and weak public safety are associated with greater perceived corruption. More interestingly, however, firm-level trust moderates three of the four relationships. The higher the trust in the firms individuals work for, the less positively they perceive the relationship between corruption and a weak legal system (H2b), weak physical infrastructure (H3b), and weak public safety (H4b). While a weak legal system shows no significant relationship to corruption, as firm-level trust increases, weakness in the legal system is significantly less related to perceived corruption.

Results also indicated interactions between trust and legal systems, trust and physical infrastructure, and to a lesser extent trust and public safety, such that the more people trust in the firms they work for, the less strongly they perceived weaknesses in legal systems, infrastructure, and safety to be associated with corruption. One might think that people who have high firm-level trust would attribute weakness in their public institutions to corruption, but this was not the case. So, why did this trust, which suggests a lesser degree of corruption in the firms people work for, reduce the positive relationship between weak public institutions and perceptions of corruption?

As we proposed, firm-level trust acts as a strategic capability that instills employee confidence in managers and managerial decision-making. Corruption is a challenge to firms in any country, and studies confirm that most firms prefer to engage in fair competition rather than corruption (Ciravegna et al., 2016). Leaders of firms seem to understand that if they yield to corruption, they risk damaging their brand, alienating their customers, and losing support of the communities that support them (Schaefer & Schaefer, 2008). Firms prefer to operate by leveraging their competitive advantages that may include the valuable resource of a loyal, trusting, and trustworthy staff (Brenes et al., 2009; Haar & Price, 2008). High firm-level trust among employees is one mechanism that encourages employees to engage with the firm that counters the external pressure placed on firms by weak public institutions and corruption.

Trust implies that parties to an exchange will not exploit the other’s vulnerabilities (Sabel, 1993), suggesting that trust is the absence of corruption. While public sector corruption may be significant, firm-level trust permits employees to believe that the firm and its leaders serve as a buffer from the negative effects of corruption. Trust enables employees to work effectively, despite the chaos external corruption may present. In uncertain environments where corruption is high, firms need additional creativity and flexibility to be successful and firm-level trust may encourage that kind of behavior from employees.

It is important to highlight that people who have high firm-level trust still understand that public, institutional corruption exists. The difference is that they associate weakness in public institutions significantly less to that of corruption. These findings suggest that high firm-level trust shields them from the threats of a weak external environment, and that corruption, found outside of their trusted, inner circle, will not cause the firms they work for to collapse under the pressures of hostile strangers (Uslaner, 2004; 2013) found in weak public institutions.

Indeed, this does not mean that high firm-level trust begets employees with false expectations about corruption outside the firm: these employees are not unaware. They know their public institutions are weak, and that corruption exists (Bohn, 2013). By building employees’ particularized trust in the firm, managers do not lull them into believing that the firm is immune or insulated from corruption. Rather, the trust helps employees realize the limits of their public institutions and strategically rely on the resources of their particularized, in-group institutions to be more effective (Uslaner, 2013). Note that trust did not significantly moderate the economic climate-corruption relationship. Perhaps people feel the effects of a weak economic climate more directly, such that the high firm-level trust they experience in their organizations fails to protect them from its negative effects.

Our study revealed that firm-level trust may serve as a powerful resource. Future research might replicate our study in other countries, examine cross-national differences, and collect longitudinal data to examine possible causal relationships among the variables. Studies using data from more persons in the firm and over several points in time, might test the effect of firm-level trust on public policy, and examine possible spillover effects of micro- or firm-level trust on macro- or public institutional trust. Another research avenue might examine if the national business environment affects strategic interventions at firm level by testing how the strength, or weakness, of the four national institutional pillars affects the relationship between organizational structure and firm-level trust in firms.

Our study has a few limitations. First, this is a two-country sample, and while there may be similar relationships between institutions and corruption elsewhere, these results may not extend to situations in other countries. Future research might test the hypotheses in advanced or industrialized countries, to determine if there are differences compared with those of emerging markets. Second, we studied correlations among the institutional variables, corruption, and firm-level trust, but we do not claim causal effects. Our dataset is cross-sectional, and a longitudinal analysis is required to extract any causality among the strength of the institutional variables, trust and the perception of corruption. Data from a larger number of individuals in each firm would also provide a more generalized basis of analysis. Third, given the risk of common methods biases (Podsakoff et al., 2003), there are challenges resulting from construct creation and sample selection. However, we mitigated these biases by conducting convergent and discriminant validity testing across sample populations, and by using multiple sample populations in different countries (Lindell & Whitney, 2001; Conway & Lance, 2010).

In conclusion, practicing managers may find these results valuable. Business transactions require trust (Jarrat & Ceric, 2015), or a “fidelity with regard to promises” (Hume, 1978 /1739, p. 546). The business environment comprises a range of institutions that may raise, or raze, trust among those who play within it. While people hope that public institutions, such as courts and law enforcement, are not corrupt, they often are. So other institutions that do build trust, such as civic groups, trade associations and private-sector firms, help market transactions succeed by creating trustworthy relationships, spreading information about those with poor reputations, and sometimes blacklisting corrupt actors. McMillan (2002) notes that trustworthy firms complement weak institutional systems by compelling people to keep their word. The resource-based view suggests that managers of firms, including those operating in uncertain and corrupt environments, might use firm-level trust to develop a unique capability (Galunic & Rodan, 1998). When firm-level trust is high, so is employees’ ability to focus attention on the strategic and tactical work to be done. Managers who create high firm-level trust among employees, particularly in situations of uncertainty, may find that trust increases employees’ engagement in the firm (Malinen et al., 2013). Since trust is critical for enhancing the relationships inside and outside the firm, and for coordinating complex activities across the firm, the firm may leverage this internal trust to achieve its strategic goals. When employees trust the firm, they trust management will make decisions that are good for the firm and its stakeholders. This moderating effect of trust does not create complacent employees: employees are well aware that external institutional corruption exists. Trust may, however, allow employees to concentrate on their tasks and challenges at work (Mayer & Gavin, 2005), not be distracted by external institutional weaknesses, and to feel confident that larger, firm-wide strategic challenges, which may include threats of corruption, are being managed competently.