1. Introduction

The COVID-19 pandemic is one of the most serious challenges humankind is facing, not only due to its effects on health, but also to the economic and social breakdown that comes with it. This pandemic caused an economic shutdown in many countries. Initially and mostly, it affected the agriculture and food sectors-closed restaurants and schools- thus leading to a rise in unemployment and reductions in the demand of certain commodities (Laure, 2020). Nevertheless, global food consumption has not been considerably affected due to the demand inelasticity of most agricultural products and the short duration of the strongest part of the shock (Elleby, Pérez, Adenauer, and Genovese, 2020) despite income losses and local supply chain disruptions associated with the pandemic (Arellana, Márquez and Cantillo, 2020).

In Latin America, production and investment shrank 7% and 20% in 2020, respectively (CEPAL, 2021), and the unemployment rate is expected to increase to 13.5% (Bárcena and Cimoli, 2020). This would lead to an increase of 28 million people living in poverty (CEPAL, 2020), thus reversing global poverty reduction efforts (The Economist, 2020). However, this contrasts with the stable or increasing demand for labor in some essential emergency response sectors such as health, agriculture, food supply chain, pharmaceuticals, and energy supply (CEPAL-OIT, 2020).

In Colombia, the economic activity dropped 6.8% in 2020, monetary poverty grew 6.8 percentage points to 42.5%, and income inequality increased as well. Nevertheless, rural poverty decreased 4.6 percentage points to 42.9%. Provided the lockdown restrictions, Bonet, Ricciulli-Marín, Pérez-Valbuena, Galvis-Aponte, Haddad, Araújo, and Perobelli (2020) estimate that the economic losses would have ranged between USD $1.2 billion and USD $16 billion per month1 with differentiated regional impacts since some regions are more vulnerable than others.

By sectors- although the short-term decline was evident, e.g., in services and mining- the initial expectation for the agricultural sector was less clear. ANIF (2020) forecasted a growth of 2.5% in this sector due to the household prioritization of these goods during the crisis, while Botero and Montañez (2020) foresaw a decrease of 5% during 2020. The agricultural sector in Colombia grew 2.8% during 2020. However, several farmers, particularly small ones, were severely hit by the lockdown. The closure of commercial establishments, hotels, and educational institutions, and the drop in household income caused a decrease in the domestic demand for some agricultural products. For example, according to FEDEPAPA,2 the closure of hotels and restaurants caused a 30% drop in the demand for potatoes. Therefore, there was a decrease in prices and production of some agricultural products because of excess supply in local markets.

The medium and long-term effects of the COVID-19 pandemic are still not clear, and much less is known about the post-pandemic economic and social recovery options. Among them, some authors see agriculture as a promising sector, considering not only its demand for labor but also because of food security (IDN, 2020; LOOP, 2020; Okonji, 2020). To tackle the economic effects of the pandemic in countries’ food production and distribution chain, governments worldwide have implemented different policies. These include more cooperation between customs and border control authorities, suspension of tariff payments, and other protectionist policies; support for small farmers in financial, technical, and sanitary issues; as well as logistical challenges such as the use of non-invasive monitoring mechanisms to speed up the clearance of goods (Aday and Aday, 2020; Bochtis, Benos, Lampridi, Marinoudi, Pearson, and Sørensen, 2020; Giordano and Ortiz, 2020; Escobar, Penagos, Albacete and García, 2020).

In Colombia, within the framework of the declaration of the State of Economic, Social, and Ecological Emergency (SESEE), the national government arranged several incentives to support households and provide incentives to employers to prevent layoffs and encourage production. In general, almost half of the 112 measures introduced by the Colombian government to deal with this pandemic were economic policies (Marriner and Becerra, 2020). For instance, unconditional cash transfer for emergency assistance to poor households had a positive effect on their well-being (Londoño-Vélez and Querubín, 2021). Some of these incentives were aimed at the agricultural sector. In regard to this set of policies, Marrine and Becerra (2020) highlight that access to credit benefited large companies the most, i.e., 94% of the loans were granted to large agricultural firms.

Previous literature has extensively discussed the economic effects of the Covid-19 lockdown on agricultural markets (e.g., Elleby et al., 2020), and described different policies proposed to mitigate these effects (e.g., Adeeth Cariapa, Kumar Acharya, Ashok Adhav, Sendhil and Ramasundaram, 2021; Pan, Yang, Zhou, and Kong, 2020). However, the analysis of their social and economic impacts has received less attention. Only one study that examined the impact of assistance measures on India’s farming was found (Varshney, Kumar, Mishra, Rashid, and Joshie, 2021). In this paper, we aim to evaluate the general economic impact of the government's economic policies in the framework of the SESEE, focusing on the agricultural sector. This will allow us to know whether and how government policies can mitigate the negative impact of the pandemic on it.

We are interested in measuring the impact of economic policies aimed at the agricultural sector’s recovery on the Colombian economy and the distributional effects between rural and urban areas. Among these policies there are economic incentives for agricultural sector workers and aid for social benefit payments, a program to support the transport of perishable agricultural and livestock products, and a zero tariff for corn imports. We analyze the effects of this set of policies considering some options for financing them. The objective of this analysis is to contrast the impacts of the different financing sources on the economy to identify the one with less negative effects on the economic performance and on the distribution of income between rural and urban households.

The remainder of the paper is organized as follows: Sections 2 and 3 present some background and the methodology, respectively. Then, in Section 4, we present the main results and in Section 5 the discussion and policy implications of these results. Section 6 provides the conclusions.

2. Background

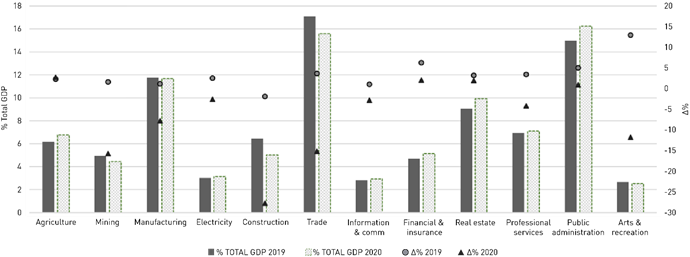

To control the pandemic, restaurants, hotels, educational institutions, and commerce in general have been closed. More than a year after the first strict confinement was decreed, several restrictions remain. Therefore, the total GDP fell by 6.8% in 2020. The most affected economic sectors were construction; mining and quarrying; trade; and artistic, entertainment, and recreational activities with decreases in production of 27.7%, 15.7%, 15.1%, and 11.7%, respectively. In contrast, the financial sector grew 2.1% and the agricultural sector grew 2.8% (see Figure 1).

Financial entities had profits of USD $3,9 billion in 2020 (Superintendencia Financiera de Colombia, 2020). The financial sector’s huge profits during the pandemic can be partly explained by some of the benefits obtained by companies in 2020. Despite an income tax surcharge on the financial sector of 4% in 2020 and 3% for 2021 and 2022, they also benefited with an income tax reduction that went from 33% in 2019 to 30% in 2022 (Congreso de la República, 2019). Likewise, the Central Bank of Colombia reduced banks’ reserve requirements by USD $2.5 million, and the government requested those financial entities to invest that money in Internal Public Debt Securities, which would give them a profit of USD $135 million (Gómez, 2020).

In the agricultural sector in 2020, fishing and aquaculture, crops, cattle, and forestry presented growth rates of 22.1%, 4.8%, 1.7%, and 1.6%, respectively, while coffee production fell 10.5%. Regarding other representative crops in Colombia, there was a decrease in corn production of 7.8% (Fenalce, 2021), and potatoes of 5.1% (Fedepapa, 2021). Finally, rice (Fedearroz, 2021) and cassava (Ministerio de Agricultura, 2021) production grew 14.7% and 1.5%, respectively.

On the other hand, because of the pandemic, there has been a significant decrease in the internal demand of agricultural commodities. For example, the hospitality and food service sector - one of the main consumers of agricultural commodities - decreased its output by 36.8%. Additionally, although the demand for food is inelastic, the loss of household income has also caused a significant reduction in their demand for food. It is estimated that between March and October 2020, the household income fell by USD $7.6 million (ANDI, 2020). Consequently, by March 2021, only 68.8% of households consumed three meals per day, compared to 90.4% of households in the same month in 2020 (DANE, 2021a).

Consequently, there was an excess supply of some crops such as cassava, rice, corn, and potatoes, which are consumed domestically, causing a drop in their price. In the case of coffee, despite a drop in its production, exports grew by 5.5%, and coffee growers obtained significant returns because of the rise in the price of coffee on the world market and the devaluation of the Colombian peso. Overall, 352,000 jobs were lost in rural areas (DANE, 2020); therefore, a drastic decrease in rural household income and an increase in poverty could be expected. However, in rural areas, the percentage of people living in monetary poverty decreased, going from 47.5% in 2019 to 42.9% in 2020 (DANE, 2021b).3 According to DANE, this is attributed to the mitigation effects of social programs and monetary aid implemented due to the pandemic, which was greater in rural areas (El Tiempo, 2021).

The policies designed to mitigate the negative impacts of the pandemic in the rural sector in Colombia were the following:

• Subsidy for peasant labor (Decree 486 of 2020). In total, about COP $40 billion (USD $10.8 million) were given to peasants over 70 years old who are not covered by any other government benefits; around 500,000 peasants received this subsidy. It is aimed to supplement the income necessary for the subsistence of workers and agricultural producers in compulsory isolation.

• Subsidy for farmers for service premium payments (Decree 803 of 2020). The government should pay 50% of the service premium to formal peasant workers who earn a minimum wage. The subsidy benefits around 4.2 million peasant laborers with an investment close to COP $924 billion (USD $250 million). With this policy, the national government assumes part of the labor obligations in charge of employers to protect and maintain formal employment.

Subsidy to cover the interest rate and financial costs and expenses associated with agricultural credit operations (Decree 486 of 2020). This subsidy is in-tended to ease liquidity constraints in rural areas, which would allow small and medium producers to recover from the effects of lockdown. Especially, the policy considered (i) the commissions of the Agricultural Guarantee Fund estimated at a value of COP $24,326 billion (USD $6.6 million); and (ii) the percentage of financial commissions for access to the Special Lines of Credit, estimated at COP $285 million (USD $77,173).

Subsidy to small farmers for the transport of perishable agricultural and livestock products (Decree 131 of 2020). The program has a budget of COP $33.5 billion (USD $9 million) to support 50% of the average cost of transportation of products such as potatoes, cassava, livestock, and fish produced by small farmers. The objective of this policy is to contribute to the supply of agricultural products in the centers of national consumption, and consequently to protect the income of agricultural producers.

Economic Reactivation Plan for the Agricultural Sector (Decree 168 of 2020). With a budget of COP $32.6 billion (USD $8.8 million), the plan focuses on small agricultural producers and includes the purchase or rental of machinery and equipment to facilitate harvesting, post-harvesting, and storage of agricultural products. It also includes help for repairs and basic related adjustments to small productive infrastructure. This plan aims to contribute to the general economic reactivation of the agricultural sector and to guarantee food security and supply of agricultural products and inputs.

Subsidy for small potato farmers (Decree 263 of 2020). The fall in the demand for potatoes genera-ted a drop in its average price, which caused losses in profitability for small producers. The program has a budget of COP $30 billion (USD $8 million) to support the commercialization of potatoes produced by small farmers. The program aims to mitigate the negative effects on the income of small potato producers.

Productive Alliances for Life. This program seeks to connect small rural producers with a formal commercial ally who buys part of or all the production and participates in the entire process. With a budget of COP $41 billion (USD $11 million), the national government expects to ensure the commercialization and income of small rural producers.

Tariff elimination for the import of some agricultural raw materials (Decree 523 of 2020). During the first months of the pandemic, it was difficult to import some raw materials such as corn, sorghum, and soybeans; thus generating a deficit in the domestic market and negatively impacting the production costs of some goods in the basic family basket. The temporary elimination of tariff for corn and other raw material imports aims to guarantee an adequate functioning of the supply system and food safety.

3. Methodology

A Social Accounting Matrix (SAM) of 2014 was built with information from the Integrated Economic Accounts (IEA) and the Supply and Use Tables (SUT) (DANE, 2014a, 2014b). Together, the IEA and the SUT provided information on production, added value, intermediate consumption, income, exports, imports, taxes, and government consumption. In the second stage, using data from the 2014 national agricultural census (DANE, 2016), the SAM was expanded to focus on the rural sector. The SAM with agricultural sector disaggregation allowed us to focus on the effects of the policy on four crops-corn, cassava, rice, and potatoes-and cattle, based on the share of each crop in the total crop output.

Additionally, a national household survey was used to single out two representative households, one rural and one urban. To split agricultural activities into small, medium, and large production units, we used information from INCORA4 (1996) and IGAC5 (2012). Hence, the information on agricultural activities was classified according to the size of the agricultural production units as large, medium, and small. Provided that cost structures differ across the different production technologies (small, medium, large), we used the RAS method (Trinh and Viet, 2013) to balance the SAM applying two constraints: (a) known totals from the supply and use tables (i.e., total intermediate input and factor demand by aggregated activities), and (b) the output value by firm size.

Finally, we used information from the national household survey and income and the expenditure survey to divide the labor factor in the SAM into skilled and unskilled labor, and each of these divisions into either rural or urban households. According to the demographic census of 2018, 23% of households are rural and 77% live in urban areas. The gross exploitation surplus of the original SAM was divided into capital, land, and natural resources used in livestock, fishing, and forestry by using information derived from the Global Trade Analysis Project (GTAP) database. For the division of the gross operating surplus into skilled and unskilled labor, capital, and land, we also turn to the Colombian SAM built by GTAP. In this database, there is no crop-level information; therefore, the same labor-capital ratio is present in all crops.

With this SAM, we simulated the effects of the COVID-19 pandemic and the policies already described in section 2 by using a single-country static Computable General Equilibrium (CGE) model. This tool is widely used to understand the welfare effects of economic policy, since by describing the behavior of producers and consumers and the links between them, it allows determining the distributional effects of an external shock. Recently, it has become an important instrument for different research on Covid-19, the agricultural sector, and food security (Beckman and Countryman, 2021; Laborde, Martin and Vos 2021; Beckman, Baquedano, and Countryman 2021; Swinnen, and Vos, 2021; Zidouemba, Kinda and Ouedraogo, 2020).

CGE models adopt a Walrasian equilibrium with perfect competition in all markets and the economic agents are rational. Firms produce goods and services and demand factors of production. Households earn their income from the sale of labor and capital and spend it on goods and services, pay taxes, and save. The State collects taxes to finance its spending and investment. Finally, goods and services are exchanged with the rest of the world. We adapted the CGE model developed by Decaluwé, Lemelin, Maisonnave, and Robichaud (2013) by focusing on the crop sector - considering large, medium, and small farms - and incorporating other extensions that allow us to understand the behavior of the Colombian economy. These extensions are described in Jiménez, Saldarriaga-Isaza, and Cicowiez (2021) .

The model includes the following three options for capital and land:

Capital and land are fixed and specific for each sector (K-fix).

Capital and land are mobile between sectors (K-mob).6

Land is mobile between sectors and capital has a horizontal supply curve (infinite supply) (K-sup).

The shocks introduced in the models are the following:

Total factor productivity: We model the subsidy to cover the interest rate and financial costs and expenses associated with agricultural credit operations as an increase in total factor productivity (Echavarría, Villamizar-Villegas, Restrepo-Tamayo, and Hernández-Leal, 2018). According to our calculations, this policy would have an impact of 6% on the total factor productivity.

Subsidy for labor: Subsidies for peasant labor and subsidies for farmers for service premium payments are considered as a labor subsidy. These subsidies create an increase in the demand for labor, especially unskilled. According to our calculations, subsidies for peasant labor generate a positive impact on the demand for labor of 0.187%, and the subsidy for service premium payments has an impact of 2.618%.

Subsidy for production: We model the subsidy for small farmers for the transport of perishable agricultural and livestock products, productive alliances for life, and the subsidy for small potato farmers as a reduction on the tax rate on production since these policies reduce production costs and, therefore, should increase production. We estimate that the transport subsidy for small farmers leads to a reduction of 0.19% on the tax rate, productive alliances for life leads to a reduction of 0.61%, and the subsidy for small potato farmers leads to a reduction of 3.9%.

Subsidy for capital: The economic reactivation program for the agricultural sector is modeled as a subsidy for capital, since this program includes the purchase of machinery and aid to improve the productive infrastructure in small and medium production units in the agricultural sector. According to our calculations, the policy would generate a reduction in the agricultural sector’s capital tax rate of 1.0065%.

Tariff reduction: Zero tariff for corn imports: The implementation of policies aimed at the agricultural sec-tor creates an increase of 1% in the public spending. The effects of the set of policies are measured by first considering the scenario of the negative shock of the pandemic in the agricultural sector (Covid scenario) according to the shocks already shown in section 2.

We analyze the effects of the set of policies considering two financing sources: direct taxes on households (tax-house) and taxes on the financial sector (tax-fin). The objective of this analysis is to contrast the impacts on the economy of the different financing sources to identify the source with less negative effects on economic performance and on the distribution of income between rural and urban households. Both types of taxes have been in the national policy discussion on progressive tax reforms. Specific tax collection from the financial sector is politically feasible due to the reasons mentioned in section 2. Indirect taxes on commodities are not analyzed because they are considered regressive (Decoster, Loughrey, O'Donoghue and Verwerft, 2010).

4. Results

Table 1 shows the effects of different financing sources on some macroeconomic indicators for three capital options. When the capital is fixed (K-fix), tax-house and tax-fin have a positive impact on rural and urban consumption. Likewise, there is a positive impact on household disposable income, especially for rural households. Finally, there is also a growth in the GDP. Regarding the other two options (K-mob and K-sup), tax-house and tax-fin yield results similar to those found in the fixed capital option; they are higher due to greater flexibility, especially in the K-sup scenario.

Table 1 Macroeconomic indicators for two different public spending financing sources.

| Tax-house | Tax-fin | |||||

|---|---|---|---|---|---|---|

| Variable | K-fix* | K-mob* | K-sup* | K-fix* | K-mob* | K-sup* |

| Urban-Household consumption | 8.11 | 8.32 | 12.81 | 8.05 | 8.24 | 14.47 |

| Rural-Household consumption | 3.96 | 5.16 | 8.17 | 4.09 | 5.33 | 7.3 |

| Urban disposable income | 2.19 | 3.53 | 6.18 | 2.18 | 3.52 | 6.81 |

| Rural disposable income | 6.23 | 10.43 | 17.35 | 6.64 | 10.97 | 13.92 |

| GDP at market prices | 6.16 | 6.88 | 9.26 | 5.88 | 6.24 | 9.83 |

| * % change w.r.t. Covid scenario K-fix, K-mob, and K-sup denote capital and land are fixed, capital and land are mobile, and land mobile and horizontal supply curve for capital, respectively. |

Source: own elaboration.

Crops such as cassava, corn, potatoes and rice, and cattle benefit from some subsidies aimed at small agricultural producers. In the K-fix scenario, tax-house and tax-fin make the output of all crops and cattle growth (see Table 2). The elimination of tariffs causes an increase in corn imports (see Table 3). Despite this, the policy makes corn output to increase as well. However, the greater domestic supply of these commodities would cause a fall in their domestic price, since a significant percentage of their output is destined for the domestic market. One of the sectors that benefits the most from the drop in prices is hospitality and food services, as they are some of the main consumers of these commodities. Finally, this sector has grown significantly may be due to the post-pandemic economic reactivation (see Table 2).

Table 2 Change in the aggregate output of crops of some commodities for two different public spending financing sources.

| Product | Tax-house | Tax-fin | ||||

|---|---|---|---|---|---|---|

| K-fix* | K-mob* | K-sup* | K-fix* | K-mob* | K-sup* | |

| Cassava-small | 12.7 | 11.1 | 13.9 | 12.7 | 11.1 | 14.6 |

| Potato - small | 17.6 | 16.5 | 19.6 | 17.6 | 16.5 | 20.2 |

| Corn | 11.1 | 9.5 | 12.5 | 11.1 | 9.5 | 13.1 |

| Rice | 10.9 | 9.1 | 12.0 | 10.9 | 9.0 | 12.7 |

| Other crops | 11.4 | 9.8 | 12.7 | 11.4 | 9.8 | 13.3 |

| Cattle | 9.8 | 9.5 | 12.6 | 9.8 | 9.5 | 13.2 |

| Hospitality and food | 33.2 | 30.7 | 35.2 | 33.2 | 30.7 | 36.4 |

| * % change w.r.t. Covid scenario K-fix, K-mob and K-sup denote fixed capital and land, mobile capital and land, and land mobile and horizontal supply curve for capital, respectively |

Source: own elaboration.

Table 3 Change in the quantity of imported corn (%)

| Scenario | Direct | Finance |

|---|---|---|

| K-fix | 5.63 | 5.64 |

| K-mob | 8.28 | 8.31 |

| K-sup | 12.50 | 13.07 |

Source: own elaboration.

In the K-mob scenario, tax-house and tax-fin positively impact output but less than when capital is fixed. Although this option assumes that the land can be used for different crops, each one requires special natural conditions. This intrinsic characteristic of the crops is considered in our SAM when we analyze their regional distribution. In the K-sup, due to the assumption of greater flexibility, there is a slightly higher growth than in the K-fix and K-mob scenarios in the output of crops and in the hospitality and food services sector (see Table 2).

On the other hand, cassava, corn, potato, and rice crops have a high demand for unskilled labor. Therefore, the increase in production must be accompanied by an increase in the demand for unskilled labor in both urban and rural areas. K-fix, tax-house, and tax-fin causes an increase in the demand for unskilled labor in these crops in both rural and urban areas. The demand for skilled labor also increases in both rural and urban areas; however, this increase in demand is lower than that of unskilled labor (see Tables 4 and 5). Regarding cattle, there is also an increase in the demand for skilled and unskilled labor, but lower compared to crops, because cattle raising is intensive on land.

Table 4 Changes in urban and rural labor demand (%) financing through tax-house.

| K-fix* | K-mob* | K-sup* | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Skilled labor | Unskilled labor | Skilled labor | Unskilled labor | Skilled labor | Unskilled labor | |||||||

| Urb | Rur | Urb | Rur | Urb | Rur | Urb | Rur | Urb | Rur | Urb | Rur | |

| Cassava | 8.6 | 8.5 | 9.3 | 7.0 | 8.2 | 8.4 | 8.0 | 5.1 | 11.3 | 11.7 | 11.0 | 7.6 |

| Potato | 14.5 | 14.5 | 15.3 | 12.8 | 13.7 | 14.0 | 13.5 | 10.5 | 17.0 | 17.4 | 16.6 | 13.1 |

| Cattle | 5.1 | 5.1 | 5.8 | 3.6 | 5.6 | 5.9 | 5.5 | 2.7 | 9.1 | 9.5 | 8.8 | 5.5 |

| Other crops | 7.1 | 7.1 | 7.8 | 5.6 | 7.0 | 7.3 | 6.8 | 4.0 | 10.2 | 10.6 | 9.9 | 6.5 |

| Rice | 8.7 | 8.6 | 9.4 | 7.1 | 7.8 | 8.1 | 7.7 | 4.8 | 11.0 | 11.3 | 10.6 | 7.3 |

| Corn | 6.8 | 6.7 | 7.5 | 5.2 | 6.7 | 7.0 | 6.6 | 3.7 | 9.9 | 10.3 | 9.6 | 6.3 |

| * % change w.r.t. Covid scenario K-fix, K-mob, and K-sup denote fixed capital and land, mobile capital and land, and land mobile and horizontal supply curve for capital, respectively. |

Source: own elaboration.

Table 5 Changes in urban and rural labor demand (%) financing through tax-fin.

| Product | K-fix* | K-mob* | K-sup* | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Skilled labor | Unskilled labor | Skilled labor | Unskilled labor | Skilled labor | Unskilled labor | |||||||

| Urb | Rur | Urb | Rur | Urb | Rur | Urb | Rur | Urb | Rur | Urb | Rur | |

| Cassava | 8.6 | 8.5 | 9.3 | 7.0 | 8.2 | 8.4 | 8.0 | 5.1 | 11.8 | 12.5 | 11.4 | 8.3 |

| Potato | 14.5 | 14.5 | 15.3 | 12.8 | 13.7 | 14.0 | 13.5 | 10.5 | 17.5 | 18.2 | 17.1 | 13.7 |

| Cattle | 5.1 | 5.1 | 5.8 | 3.6 | 5.6 | 5.9 | 5.5 | 2.6 | 9.7 | 10.4 | 9.3 | 6.2 |

| Other crops | 7.2 | 7.1 | 7.9 | 5.6 | 7.0 | 7.2 | 6.8 | 4.0 | 10.7 | 11.4 | 10.3 | 7.2 |

| Coffee | 14.2 | 14.1 | 14.9 | 12.5 | 83.6 | 84.0 | 83.4 | 78.4 | 73.3 | 74.4 | 72.7 | 67.8 |

| Rice | 8.7 | 8.6 | 9.4 | 7.1 | 7.8 | 8.1 | 7.7 | 4.8 | 11.5 | 12.2 | 11.1 | 8.0 |

| Corn | 6.8 | 6.7 | 7.5 | 5.2 | 6.7 | 7.0 | 6.6 | 3.7 | 10.4 | 11.1 | 10.0 | 6.9 |

| * % change w.r.t. Covid scenario K-fix, K-mob, and K-sup denote fixed capital and land, mobile capital and land, and land mobile and horizontal supply curve for capital, respectively. |

Source: own elaboration.

With both financing options in K-mob, the demand for unskilled and skilled labor increased in both urban and rural areas. In this case, the growth in the demand for labor is lower compared to the case when capital is fixed, which is a consequence of the lower increase in crops and cattle output. Finally, in the K-sup scenario with respect to K-fix and K-mob, the demand for unskilled and skilled labor increased in both urban and rural areas because of the output increase in this scenario.

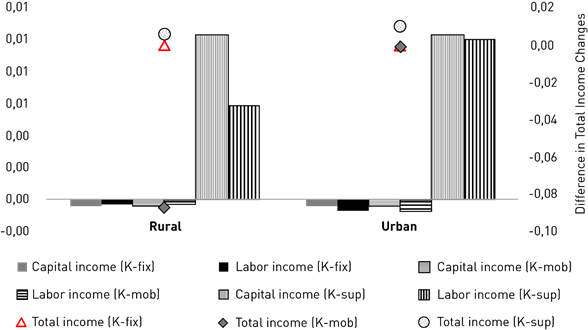

Finally, Figure 2 shows the impact of policies on the diverse sources of household income for the two financing options. When capital is fixed, both labor and capital income show positive but relatively small growth. For rural households, regarding both financing options, their total income grows by 0.07%, while urban ones grow only 0.01%. Nevertheless, total household income recovers to pre-covid levels.

Source: own elaboration.

Figure 2 Change (%) in household income financing through tax-house (a), and tax-fin (b)

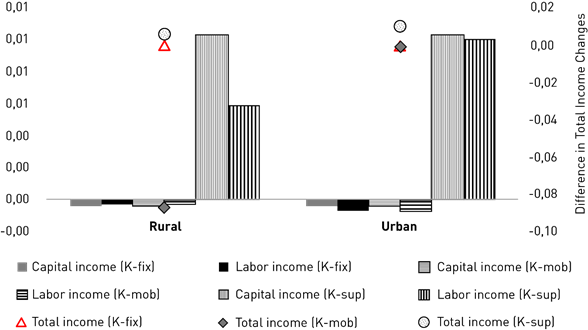

On the other hand, when capital is mobile, the impact is a little higher with tax-house, although not very significant, with an increase of 0.11% in total rural household income and 0.02% for urban households. Moreover, with tax-fin both rural and urban household income grows by only 0.02%. In general, the growth in total income would depend on the financing option, especially in rural households (see Figure 3).

5. Discussion

The outbreak of COVID-19 affected the global economy, particularly the agriculture and food sectors in many countries. To tackle these effects, governments in different countries have implemented several agricultural and food policies. Gruère and Brooks (2021) analyzed the measures taken by fifty-four countries during the first months of the pandemic, thus finding significant differences among the emphasis, scope, and regional diversity of policies between emerging and OECD member countries. Emerging countries focused their attention on trade and product flows, coordination, and food assistance, and more particularly on measures that were urgent and necessary to safeguard workers and ensure the minimum functioning of the agriculture value chains. By contrast, OECD countries relied more on support measures, either as agriculture and food sector support, sector-wide and institutional measures, or labor measures. However, the literature on the economic and social impact of these policies is scarce. To the best of our knowledge, this study is the first to evaluate the general economic effects of the government policy response to this pandemic. There is only one study that analyzes the impact of the assistance package in the agricultural sector in India (Varshney et al., 2021). Therefore, it is important to determine if these policies could have the desired effects and their extent - questions that we try to answer in this article.

As shown in Section 4, the set of policies that the Colombian government issued to mitigate the impacts of the pandemic on the agricultural sector may have some positive effects on employment, the disposable income, and consumption of rural households. The set of policies analyzed in this paper lead to an increase in the production of the main agricultural products well above 10% after the shock produced by the COVID-19 pandemic. Especially, the policy focused on small potato farmers can help restore the life quality of peasants severely affected by it. On average, these small farmers may increase their production by 17% after the event.

In general, total production would increase by 4.41% and the GDP would increase by more than 5%. The labor demand also increases, especially in the rural sector, which benefits the most from these policies. In particular, their implementation increases the demand for unskilled labor in rural areas. These changes in labor demand cause an increase in households’ disposable income, especially rural, which in turn increases consumption. Both are recovering to pre-covid levels.

It is possible to think that each policy may have either an effect lower than that expected or no effect at all. Nevertheless, instead of analyzing each policy, we analyzed them simultaneously since we see them as a package of complementary plans and programs whose aim is to support the recovery of the agricultural sector during and after the pandemic. Moreover, in view of the results of the different scenarios of capital mobility considered in our simulations, the effects of the policy would hold not only in the short-term, but also in a post-covid long-term scenario where all the capital needs are met.

Any policy that the government implements has a cost which must be financed with taxes at some point in time; thus, its budget deficit and the real investment demand can be kept. Among the options to finance this increase in the public expenditures are direct taxes to either households or specific economic sectors, or indirect taxes on commodities. The latter is considered regressive as it could reduce the consumption, specially of lower income classes. The former type of taxes, on the other hand, can be progressive and has been part of recent tax reforms. For instance, the one passed by the congress in 2019 already had established an income tax surcharge on the financial sector. From our results, under both financing options considered and for the policies analyzed, the growth in total income is higher for rural households regarding the considered financing options, which allows to reduce the income gap between rural and urban areas. However, this effect is a little higher when the set of policies is financed with a tax increase in the financial sector.

6. Conclusions

In this research we examined the set of policies that the Colombian government issued to mitigate the economic impacts of the COVID-19 pandemic on the agricultural sector. In general, we find that, as expected, these policies have positive effects on employment, particularly unskilled labor, the disposable income, and consumption of rural households, which recover to pre-covid levels. However, the changes in production of agricultural commodities make their prices fall. This variation in prices benefit consumers and some sectors such as hospitality and food services, but also offset the effect on rural households’ income.

Moreover, the results would hold both in the short-term and the long-term. Nevertheless, considering the time by which the policies were implemented, these results entail a combination of both the policies and the end of the strong phase of the lockdown. This is also true conditional on the two financing options considered here. For instance, the growth in total income for rural households is higher only with one of the financing options. Others such as indirect taxes on commodities might have different effects on welfare. Provided that poverty is more pronounced in rural areas, rural households’ welfare might fall should the agricultural policies be financed through this type of tax.