1. Introduction

The importance of Corporate Governance (CG) for corporate longevity is well-established in contemporary literature (Basterretxea, Cornforth, & Heras-Saizarbitoria, 2020). Since the 2000s, studies of CG have been made as part of a business strategy and concerns about best governance practices, and the influence of CG in the management systems of organizations has intensified (Al-Bassam, Ntim, Opong, & Downs, 2018; Maia & Di Serio, 2017; Vilela, Carvalho Neto, Bernardes, & Cardoso, 2015).

Academic research and the interest of management professionals takes place mainly in traditional capitalist companies whose raison d'être is to maximize shareholder wealth (Vilela, Carvalho Neto, Bernardes, & Cardoso, 2015; Denis, 2016; Basterretxea, Cornforth, & Heras-Saizarbitoria, 2020). This situation arises, fundamentally, from the conflicts among stakeholders and between shareholders and agents, which increase as economic size and share capital dispersion are enhanced (Kreuzberg & Vicente, 2019).

Despite the development of CG in the last 20 years, its applications to other organizational formats such as co-operatives are still poorly developed in terms of models, practices, and results (Siqueira & Bialoskorski Neto, 2014; Basterretxea, Cornforth, & Heras-Saizarbitoria, 2020).

The evolution of the cooperative ethos in the modern economic context has depended on a management form that reconciles the multiple interests of the members as a collective with the development of the joint itself (Carpes & Cunha, 2018). So that accountability and transparency among members and other stakeholders are strengthened (Rebelo, Leal, & Teixeira, 2017).

The tendency has been for cooperatives to reorganize strategically and become more market-oriented, thus creating mechanisms that align the interests of the board and management with a focus on organizational performance. This is associated with an efficient and transparent management process that instill confidence in the cooperative as a whole (Bijman, Hendrikse, & Oijen, 2013; Liu & Li, 2020).

In this scenario, cooperative governance is a management structure based on cooperative principles and values, which aims to achieve social objectives and the sustainable performance of organizations considering the interests of the associates, and is based on ethics and transparency (OCB, 2016). This definition stems from the understanding of CG as the way in which firms are directed, monitored, and encouraged, including the relationship of all those interested and involved in the company (Denis, 2016).

In multiple contexts, cooperatives operate in a competitive environment; therefore, they need business structures that allow them to increase competitiveness (Catapan & Colauto, 2014). In Brazil, agricultural co-operatives contribute significantly to agribusiness and, consequently, to the Brazilian economy (OCB, 2019). The country has 6,887 cooperatives (2018), out of which 1,618 are characterized as agribusiness and export 48% of the volume of produced Brazilian food. This country is the second food export in the world (OCB, 2019).

Thus, the longevity and prosperity of agricultural co-operatives in Brazil is a decisive factor in food security and the sustainability of farming activities. Its effects reach more than 10% of the global population that consumes products from cooperative Brazilian producers directly or indirectly.

Brazilian agricultural production is concentrated in the Southeast, South, and Center-West regions. It is characterized by the country's agribusiness as "Center-South" (Neves, Castro, & Freitas, 2019). This region is responsible for – of Brazil's food production, so the concentration of sampled cooperatives here reveals the correspondence between agricultural cooperatives and rural production (Neves, Castro, & Freitas, 2019; Oliveira Júnior & Wander, 2020).

Notwithstanding the economic and social importance of these enterprises for Brazilian agribusiness, it still receives little attention from researchers, and the extension of organizational models is limited (Carpes & Cunha, 2018). For this reason, the current study focuses on a theoretical-practical gap involving the need to propose a performance model for agricultural cooperatives based on principles and practices of corporate governance.

To best structure this research, the text was organized, in addition to the introduction, into four other sections. The second section presents the literature review with theoretical principles for empirical study. The third section shows the methodology and highlights the sources of information and analytical techniques employed. The fourth section displays the results and discusses the study. The fifth section provides closing remarks.

2. Literature Review

The discussions on governance structures in cooperative organizations started due to the growth in cooperative activities and, consequently, the demand for improvements in their management processes (Carpes & Cunha, 2018; Teixeira, Caleman, & Américo, 2020). The topic is relatively new and related studies are in the initial phase (Hannachi, Fares, Coleno, & Assens, 2020; Maciel, Seibert, Silva, Wbatuba, & Salla, 2018).

Governance - specifically for agricultural cooperatives - is an alternative to improve processes and relationships with associates, employees, and the community (Al-Bassam, Ntim, Opong, & Downs, 2018). Good cooperative governance practices increase the administration's transparency, facilitate development and competitiveness, stimulate the participation of cooperative members in decisions, and lead to better economic and financial results, thus creating value for cooperative organizations (Basterretxea, Cornforth, & Heras-Saizarbitoria, 2020).

Five (5) principles guide cooperative governance: i) self-management; ii) a sense of justice; iii) transparency; iv) education; and v) sustainability (OCB, 2016).

Adhering to good governance practices is relevant to encourage the sustainable development of cooperative organizations, to strengthen them in the market, and to reduce conflicts of interest (Marcis, Bortoluzzi, Lima, & Costa, 2018). The literature has consolidated agency problems as the leading cause of conflicts (Jensen & Meckling, 1976). The theme is widely debated in traditional capitalist companies in which the separation of ownership and management provides vast informational asymmetries (Teixeira, Caleman, & Américo, 2020; Arévalo-Alegría, Acuña-Duarte, & King-Domínguez, 2020). However, this approach cannot be extrapolated in an identical way to traditional companies without considering the distinctive features of a cooperative (Costa & Melo, 2017).

These organizations operate the concept of co-operative system for a social purpose. They were based on the development of man and society through cooperation and experiences based on collective work (Fernández, Fernández, Rivera, & Calero, 2016).

In this organizational model, people unite with the same objective, willing to face different situations and to solve problems that benefit economic and social aspects. The co-operative system has always been present throughout the development of our civilization (Hannachi, Fares, Coleno, & Assens, 2020)

The cooperative is seen as a viable alternative to the traditional capitalist business model. It combines peculiar characteristics of the co-operative system (e.g., social purpose and collective work) with the positive features of the capitalist system (e.g., value creation, business models). It can also be considered a hybrid organization that mixes companies and third sector organizations (Bijman, Hendrikse, & Oijen, 2013).

Moreover, as hybrid structures, cooperatives have increased governance demands considering that the management, leadership, and business development requires differentiated practices of transparency, participation, engagement, and reliability. Thus, these organizations need specific models of governance (Carpes & Cunha, 2018; Costa & Melo, 2017).

Nevertheless, administrative science has developed and still focuses on traditional organizations; the training of managers and leaders for cooperatives and other collective organizations is restricted, and sometimes their specific problems are solved empirically (Oliveira Júnior & Wander, 2020).

It is important to emphasize that cooperatives are present in almost every country and are responsible for the economic development of some regions, including Brazil (Bis, et al., 2020).

Among the branches of the co-operative system, agricultural is the most representative in Brazil (OCB, 2019). However, even though it was not the precursor, it was the one that developed the most (Carpes & Cunha, 2018) due to the economic policy adopted by Brazilian rulers after the world financial crisis in the late 1920s. At the time, they were considered an alternative to minimize some difficulties arising from the situation and problems related to the supply of foodstuffs to urban centers, being necessary to make national production diverse and varied - coffee was the main product. It was also necessary to enable the small producer to associate and become an active member of a cooperative so that the domestic market could develop (Costa, Amorim Jr, & Silva, 2015).

Cooperatives have become a critical organizational instrument to market members' production and to take actions that contribute to production efficiency and good financial results (Hannachi, Fares, Coleno, & Assens, 2020). The agricultural cooperative-rural producer relationship structure directly influences the production and marketing of products delivered by members, so that, the involvement and relations profiles of cooperative impact potential in the production yield, and agrarian income (Ma, Renwick, Yuan, & Ratna, 2018).

Table 1 presents the objectives and actions of agricultural cooperatives, which, as well as commercial organizations, need to conduct some activities effectively so that cooperative members continue to be part of the agreed business; value it as a collaborative model that transforms their daily lives based on solidarity, responsibility, democracy, and equality; and are sustainable and at the same time competitive (Figueiredo & Franco, 2018).

Table 1 Objectives and actions of agricultural cooperatives.

| Roles | Actions | Authors |

|---|---|---|

| Market / Commercialization | i) Development of new markets; ii) brand development; iii) price formation; iv) product standardization; v) coordination of product dissemination; others. | (Abate, 2018; Bijman & Iliopoulos, 2014; Verhofstadt & Maertens, 2015) |

| Financial | i) Partnerships with financial institutions and/or credit unions; ii) financing of inputs to members; iii) support in establishing future contracts; iv) remunerate the cooperative financially or with material benefits based on synergy gains from sales and/or logistical/operational processes. | (Verhofstadt & Maertens, 2015) |

| Logistics and Operations | i) Negotiation of aggregate purchase of inputs; ii) negotiation for better conditions to acquire technology, machinery, and equipment; iii) sale of inputs to members; iv) registration of inputand service suppliers; v) technical advice for producers; vi) creation of laboratories. | (Abate, 2018) |

| Administrative and Institutional | i) Legal support for contracts; ii) establishment of agreements to benefit members (health plans, social security, pharmacies, others); iii) organization of working groups for the development of the cooperative; iv) hiring consulting and advisory companies; v) promotion and dissemination of new regulations, innovations, and good practices; vi) representation of the interests of cooperative members with other renowned entities, economic groups, executive, legislative and judiciary powers; among others. | (OCB, 2019) |

| Information Technology | i) field-oriented technology; ii) software for tracking products; iii) task automation. | (Bijman & Iliopoulos, 2014) |

Source: own elaboration.

The governance structure proposed for cooperatives is composed of several bodies, named by the OCB as "governance agents" (OCB, 2016). Governance is essential for influencing cooperative economic, financial, and social performance (Maciel, Seibert, Silva, Wbatuba, & Salla, 2018). The basic structure of cooperative governance in Brazil is defined in Federal Law No. 5,764 that presents the rules and guidelines for the General Meeting, Administrative Board/Executive Board, Fiscal Council, or Audit Committee (BRASIL, 1971). The governance structure suggested by the support and regulatory bodies comprises Cooperatives represented by the General Assembly, Administrative Board/Executive Board, Fiscal Council, Advisory Council, Technical Committee, Social Committee, and Executive Management (OCB, 2016).

Implementing good governance practices is relevant to encourage the sustainable development of cooperative organizations, strengthening them against the market, reducing conflicts of interest (Maciel, Seibert, Silva, Wbatuba, & Salla, 2018); and also to attract investments by reducing exposure to risk (Bijman & Iliopoulos, 2014). The scandals that have already occurred in Brazilian and international companies have made good governance practices paramount even for cooperative organizations (Teixeira, Caleman, & Américo, 2020).

Table 2 presents a comparison of the governance structures proposed for organizations with public company profiles and cooperative organizations as an alternative to improve the transparency and security of information, and the relationship between members; to improve management processes; and to obtain better economic-financial results (IBGC, 2015; OCB, 2016).

Table 2 Comparison between corporate and cooperative governance structure.

| Bodies / Agents | Corporate Governance | Cooperative Governance |

|---|---|---|

| General Assembly | Sovereign body responsible for decision making. | Sovereign body responsible for decision making. |

| Administrative Board | It is subordinated to the General Assembly responsible for making strategic decisions. | Subordinate to the General Assembly responsible for making strategic decisions, it can also be called the board. |

| Audit Committee | Subordinated to the General Assembly. | Subordinated to the General Assembly. |

| Governance Secretariat | Exclusivity of Corporate Governance, support to the Board of Directors in its activities. | It is not part of the Cooperative Governance structure. |

| Consulting Board | It is not part of the Corporate Governance structure. | Exclusivity of Cooperative Governance. |

| Chief Executive Officer (CEO) | Responsible for strategic management of the organization. | Exclusivity of Corporate Governance. |

| Executive Management | Responsible for managing specific areas (ex. Financial, Marketing, Operation). | It has a similarity to the Chief Executive Officer. |

| Committees | Subordinated to the CEO | Reported to the Administrative Board. |

| Audit | Reported to the Audit Committee. | Reported to the Administrative Board. |

Source: own elaboration.

The cooperative governance model must be adapted to the reality of each organization. Although there are regulated structures in Brazil and other countries, there is no empirical evidence of a model that presents management strategies and tools that allow the Cooperative Governance model to be robust and will enable the organization to demonstrate economic, environmental, and social performance adherent to its purpose (Araújo, Magalhães, & Gomes, 2016; Pokharel, Regmi, Featherstone, & Archer, 2019). This study is focused and research was conducted on this theoretical-empirical space. Analyzing cooperative organizations using financial performance tools is necessary to demonstrate the viability of the business and that it is attractive to the cooperative (Giacomin, Boetler, Fiabani, & Sandri, 2018; Rebelo, Leal, & Teixeira, 2017).

Studies on financial performance in agricultural cooperatives show that it is possible to adapt economic indicators such as working capital requirements, cash flow, and liquidity to verify performance (Lauermann, Souza, Moreira, & Souza, 2016; Sathapatyanon, et al., 2018).

The economic-financial analysis of agricultural cooperatives must differ from conventional analyzes be-cause they have principles and values that guide their activities that are different from capitalist companies (Pokharel, Regmi, Featherstone, & Archer, 2019; Marcis, Lima, & Costa, 2018)

The performance evaluation of agricultural cooperatives is carried out using methods and variable indicators based on information from the balance sheet and other accounting statements, thus allowing financial analysis similar to that carried out by any type of organization, but with some caveats (Martins & Lucato, 2018).

Assessing performance from social and environmental indicators has also become frequent in organizations, although some managers are still resistant to these issues even though they have gained meaning (Araújo, Magalhães, & Gomes, 2016; Carneiro, Arruda, & Leite, 2018).

The study conducted by Marcis et al. (2018) identified, through a systematic literature review, that there are no instruments, techniques, and performance indicators in sustainability to evaluate agricultural activities. It reveals the importance of new empirical studies that enable expanding the analysis of performance of cooperatives regarding economic and financial aspects. These indicators demonstrate the social and environmental impact in a structure that values governance (Kreuzberg & Vicente, 2019).

3. Methodological procedures

3.1 Materials

The most recent data - from 2018 - indicate the existence of 1,618 agricultural cooperatives in Brazil (OCB, 2019). We identified 770 Brazilian cooperatives through the public databases and sent a questionnaire via e-mail. The identification of cooperatives, verification of their existence, contact forms, sending the questionnaire, and receiving the answers took place in the first half of 2019.

The questionnaires combine questions developed by Francisco, Amaral and Castro (2013) that had already been tested in other contexts, and are associated with the articles of Santos (2015) and Marcis, Lima, and Costa (2018). Some questions were adapted and others were expanded or modified for this research. The 60-item questionnaire was prepared and divided into five sections: 1) Respondent characterization; 2) Cooperative context; 3) Cooperative management structure; 4) Indicators of the cooperative's financial performance; and 5) Social and environmental indicators.

Research ethics respecting confidentiality of the information provided were followed according to the requirements of the research institution to which the first author is associated. A total of 48 questionnaires were considered appropriate and complete, with a return rate close to 6%. This situation may be one of the reasons why most empirical articles on agricultural cooperatives are case studies (Araújo, Magalhães, & Gomes, 2016; Bis, et al., 2020; Giacomin, Boetler, Fiabani, & Sandri, 2018). Although the absolute number is limited, it is noteworthy that studies - through a survey of the Brazilian reality and for this particular audience - present a low rate of respondents; however, the amount obtained in this research is superior to other studies (Londero & Figari, 2018). The quality of the completed forms was preserved, and that significant number would allow a quantitative analysis within the limits of the adjustment parameters, thus expanding conventional results on this topic from case studies (Teixeira, Caleman, & Américo, 2020).

The quality of the answers was verified by Cronbach's alpha for sections 3, 4, and 5 because the questions in this section that address the research scope (management structure, financial, environmental, and social performance) require answers in a Likert ordinary scale of 5 points (from 1 to 5. Being 1 not very important, and 5 very important); procedure similar to the studies that served as base to this questionnaire.

The reliability of results for the three sections were respectively: 0.83, 0.95, and 0.90. These results demonstrate that the answers to the questions are consistent with the proposed scale and that used in the methods (Christmann & Aelst, 2006).

3.2 Methods

Factor and discriminant analysis were used to obtain quantified results from the structured questionnaires. The fit of models following the Kaiser-Meyer-Olkin (KMO) and Bartlett sphericity tests were used for exploratory factor analysis (Hair Jr., Black, Babin, & Anderson, 2014). F statistic for the Wilks’ Lambda test was used to assay discriminant variables (Hair Jr., Black, Babin, & Anderson, 2014). Statistical tests were run on DMS/SPSS version 22.0.

Exploratory factor analysis was chosen because it summarizes the variables in the questionnaire, thus allowing us to generate categories or respondent profiles based on the combination of variables with associations between them (Hair Jr., Black, Babin, & Anderson, 2014). For this questionnaire-derived answer options related to the level of agreement in respondents, questions were separated into three categories: i) cooperative governance variables; ii) economic-financial performance variables; and iii) social and environmental variables.

As the sample size was limited to 48 respondents, the recommendations of Winter, Dodou, and Wirienga (2009) that the specification of the exploratory factor analysis model and the reliability of the information do not limit by size sample were considered. For these authors, it is possible to obtain reliable factor loadings with samples smaller than ten respondents. As shown, the model specification should be a function of variables such as sample size, number of variables, factor loading, commonality, explained variance, and the use of Barlett's sphericity test (Winter, Dodou, & Wirienga, 2009). Thus, following the recommendations of the study by Winter, Dodou and Wirienga (2009, pp. 154-156), in Table 2 only factor loadings greater than 0.6 were considered, thus limiting it to two latent variables (factors) and a maximum of twelve exploratory variables per model (Co-operative management structure, cooperative financial performance, and social and environmental results).

Discriminant analysis was used for the variables listed in the questionnaire, which had simple yes/no answer options. For qualitative analysis, the variables were separated into two categories: i) Group 1, where the variables used could discriminate among agricultural cooperatives using best CG practices, and ii) Group 0, where the variables used were of limited value among the CG practices. Thus, it was possible to assess which of the exploratory variables would distinguish cooperatives with the best management practices according to the questionnaire.

4. Results and discussion

This section presents the results obtained from the research and discusses them. Initially, basic descriptive data show the sample profile, and after the exploratory factor and discriminant analyses, it offers foundations to propose a performance model based on cooperative governance.

4.1 Sample profile

Table 3 provides demographic information on the sampled agricultural cooperatives and shows their social, economic, and productive characteristics and geographical position.

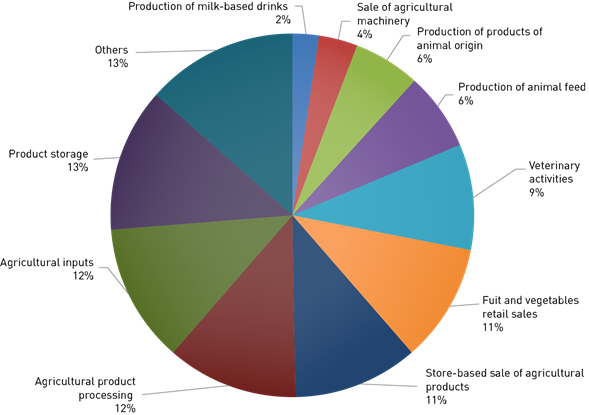

The relationship between agricultural production and cooperatives in Brazil has been reported in the literature (Neves, Castro, & Freitas, 2019; Oliveira Júnior & Wander, 2020). Studies have considered the importance of cooperatives to support rural producer activities via credit, technical assistance, coordination of product comercialization efforts, and input acquisition, among others (Bis, et al., 2020). The range of services provided by the sapled cooperatives is shown in Figure 1. Each responding cooperative offers, on average, between 3 and 4 services to cooperative members, some offer up to 11 services.

The importance of cooperatives to rural production is also seen in the development of new markets (Hannachi, Fares, Coleno, & Assens, 2020). Table 3 shows that more than 45% of the assessed cooperatives operate in the national or international market, which is higher than Brazilian companies where less than 10% do so (Neves, Castro, & Freitas, 2019).

Cooperatives from the Northeast region have a greater participation in the international market compared to the Midwest, which is the largest grain-producing region in Brazil. Agricultural production in the Midwest is characterized by markedly larger properties (mean >200 ha), and the production and commercialization profile focus mainly on trading companies (Oliveira Júnior & Wander, 2020). Therefore, cooperatives are not common in this region (Neves, Castro, & Freitas, 2019).

In contrast, agricultural production in the Northeast occurs, on average, in smaller properties (mean <100 ha), and specific local productive arrangements, such as fruits and cotton, have taken advantage of cooperative mechanisms to leverage their sales for international trade (Oliveira & Pereira, 2019). The Northeast has the lowest level of human development in the country, and agricultural cooperatives have contributed to the improvement of producer living standards and incomes in the region (Neves, Castro, & Freitas, 2019).

For the cooperatives, the average time since foundation (Table 3) indicates that organizations already consolidated in their activities, especially those in the South and Southeast regions. This result was expected since the cooperative movement in Brazil had its historical genesis there. It was more evident in places where the strong influence from European and Asian immigrants contributed to the country-wide development of cooperatives in the first half of the 20th century (Neves, Castro, & Freitas, 2019; Bis, et al., 2020).

Source: own elaboration from survey data.

Figure 1 Products and services offered by the surveyed cooperatives (Total of 171 answers.)

Table 3 Profile of the surveyed agricultural cooperatives by region.

| Region | Distribution by region | Share of the national or international market | Average time since founding (years) | Number of members | Number of cooperatives |

|---|---|---|---|---|---|

| Southeast | 37.5% | 19% | 30 | 138 | 1,176 |

| South | 20.8% | 12% | 55 | 296 | 2,204 |

| Central west | 18.7% | 4% | 15 | 195 | 84 |

| North | 12.5% | 2% | 8 | 41 | 111 |

| North-east | 10.4% | 8% | 12 | 16 | 59 |

| Total | 100.0% | 45% | 28 | 686 | 3,634 |

Source: own elaboration from survey data.

The numbers of people directly employed by or linked to cooperatives demonstrate their importance for society in terms of income generation and employment. Together, the 48 cooperatives analyzed here had 44.9 thousand members and 7.5 thousand employees. The results also indicated the heterogeneity of the sample, i.e., the number of members, ranged between 9 and 5,900. The diversity of cooperative structures in Brazil has already been reported in other studies (Neves, Castro, & Freitas, 2019) and it is also a feature in other countries (Pokharel, Archer, y Featherstone, 2020).

They are, therefore, complex organizations with a significant impact on society and production chains. Under such circumstances, there is a clear need for ad-ministrative structures that support the management systems of these organizations and allow goals to be achieved in a sustainable manner (Maciel, Seibert, Silva, Wbatuba, & Salla, 2018). This finding has been reported in various empirical studies, not only in Brazil (Maciel, Seibert, Silva, Wbatuba, & Salla, 2018), but in many other countries (Paniagua, Rivelles, & Sapena, 2018).

4.2. Formation of Performance and Governance Dimensions

Initially, the variables were organized into three categories: 1) Cooperative management structure; indicators of the cooperative's financial performance; and social and environmental indicators. The variables of each category were subjected to factor analysis to identify clusters of representative characteristics from the samples. Table 4 shows the factorial results for the cooperative management variables.

Table 4 Descriptive results and factor analysis of cooperative management variables.

| Variables | Basic Statistics | Factors | ||

|---|---|---|---|---|

| Mean | Standard deviation | 1 | 2 | |

| Administrative board meets regularly | 4.52 | 0.77 | 0.78 | |

| Executive board meets regularly | 4.40 | 0.84 | 0.78 | |

| Activities of the executive officers accountable to the administrative board | 4.56 | 0.82 | 0.77 | |

| Regular meetings of the executive board, managers, and employees | 4.15 | 0.94 | 0.74 | |

| Periodic assessment of members of the administrative board, executive board, and audit committee | 3.98 | 1.14 | 0.67 | |

| Financial statements available to all members | 4.33 | 0.95 | 0.65 | |

| Audit committee meets regularly | 4.35 | 0.86 | 0.60 | |

| Unrestricted access by members of the administrative board and audit committee to all documents, information, and records of the cooperative | 4.52 | 0.92 | 0,67 | |

| Discuss external audit opinion and/or audit committee opinions at the general assembly | 4.15 | 1,30 | 0,63 | |

| Technical training for members of the administrative board, audit committee, and executive board | 4.42 | 0.79 | 0,57 | |

| Regular monitoring of economic and financial indicators by the administrative board Ω | 4.52 | 0.71 | - | - |

| Use of accounting tools in decision-making processes Ω | 4.75 | 0.44 | - | - |

Note 1: Kaiser-Meyer-Olkin test of sampling adequacy: 0.772; 2. Bartlett's sphericity test: χ²: 212.876 and p-value: 0.000. Note 2. Ω - loading factor below |0.6|.

Source: own elaboration from survey data.

The basic statistics results reveal a high level of importance of the management variables for cooperatives considering that the answers were reported on a 5-point Likert scale (1-5). Thus, the practices appear relevant to this socio-economic sector, confirming the need to expand the discussions to create cooperative management structures (Maciel, Seibert, Silva, Wbatuba, & Salla, 2018).

The factor analysis grouped the twelve variables into two factors that explain approximately 50% of the total variance among the cooperative management variables assessed with the scale. The KMO and Barlett’s Sphericity tests adjustment indicators guarantee that the factor analysis fits adequately (Hair Jr., Black, Babin, & Anderson, 2014).The two factors were given specific titles for this study based on their characteristics. These were: F1) Reliability and F2) Transparency.

Reliability grouped those variables related to the importance of management agents and the regular meeting of employees, which allows better control, monitoring, and inspection of internal processes; strategies defined by each management agent, quality and reliability of reports issued by cooperatives, which target auditing or expertise. This is implicit in the best management practices because it includes a third party to evaluate the reports of the entities involved (Maciel, Seibert, Silva, Wbatuba, & Salla, 2018). This area includes accounting and financial statements. In the current study, a notable concern was expressed regarding the level of discussion of such reports at the general assembly.

Thus, reliability becomes a dynamic process led by the feedback of evaluation results and consideration of conditions external to the cooperative (Maciel, Seibert, Silva, Wbatuba, & Salla, 2018).

Systematized meetings are the prerogative of co-operative management in the OCB (2016) manual of good practices. These actions improve communication, minimize confusion, and strengthen relationships and integration between workers and management (Maciel, Seibert, Silva, Wbatuba, & Salla, 2018).

Transparency, the second factor, grouped three variables related to the access and availability of the co-operative information to the financial and administration board members, and the technical qualification of newly added members.

This group demonstrates concerns about an im-personal, impartial, and professional approach, which is key to the transparency of the cooperative's activities and decision-making processes (Maciel, Seibert, Silva, Wbatuba, & Salla, 2018).

Moreover, these results show that cooperatives need to train their advisory team and to have strategies to replace them. They should prepare new leaders and train members of the cooperative who can assist the board and committees with opinions, reports, and analysis of documents (Bis, et al., 2020). The board assumes the role of mediator between the cooperative members and executive management and is the central element in the cooperative governance structure (Buang & Samah, 2020).

The difficulty in managing possible asymmetries and conflicts of interest when multiple positions are occupied by the same person, as well as the historical process of cooperatives in Brazil, may have influenced the segregation of this single variable and, indeed, have highlighted its relevance and importance (Maciel, Seibert, Silva, Wbatuba, & Salla, 2018).

Table 5 shows the descriptive and factorial results for the importance of participating cooperatives' financial performance variables. Responses were reported on a 5-point Likert scale (1-5).

Table 5 Descriptive results and factor analysis of financial performance variables.

| Variables | Descriptor | Factors | ||

|---|---|---|---|---|

| Mean | Standard Deviation | 1 | 2 | |

| The assessment of working capital | 4.27 | 0.98 | 0.88 | |

| Relationship between debt and the cooperative's cash reserves | 4.35 | 1.00 | 0.87 | |

| Current liquidity | 4.25 | 0.91 | 0.81 | |

| Interest payment capability | 4.31 | 0.90 | 0.77 | |

| Share of short-term debt in total debt | 4.19 | 1.02 | 0.75 | |

| Level of indebtedness | 4.38 | 0.96 | 0.74 | |

| Cooperative budget accuracy | 4.27 | 0.92 | 0.74 | |

| Economic value of the cooperative | 4.13 | 0.98 | 0.73 | |

| Degree of financial leverage | 4.25 | 1.02 | 0.69 | |

| Variation in the distribution of profits to members | 4.19 | 1.00 | 0.62 | |

| Gross margin | 3.96 | 1.15 | 0.91 | |

| Operational margin | 4.10 | 0.99 | 0.81 | |

| Return on Investment | 4.19 | 1.00 | 0.80 | |

| Net margin | 4.33 | 0.93 | 0.77 | |

| Variation in investments in cooperative assets | 3.94 | 1.019 | 0.74 | |

| Variation in surplus/deficit | 4.21 | .922 | 0.73 |

Notes: 1. Kaiser-Meyer-Olkin measure of sampling adequacy 0.869; 2. Bartlett's sphericity test: Approx. χ² : 811,47; p-value: 0.000.

Source: own elaboration from survey data.

The averages of the performance variables were between 3.94 and 4.38, with standard deviations varying between 0.903 and 1.148. This shows a relative homogeneity in the importance given to financial performance indicators. Factorial analysis summarizes these variables in three factors, which explained more than 80% of the variance. KMO tests and Bartlett's sphericity values validate the robustness of the model.

The factor analysis grouped the twelve variables into two factors, which explain approximately 73% of the total variance. The KMO and Barletts Sphericity tests guarantee that the factor analysis fits adequately (Hair Jr., Black, Babin, & Anderson, 2014). All the variables found significant loading factors to the two factors like require Winter, Dodou, and Wieringa (2009) for this size sample.The two factors generated for the financial performance variables were F1) financial control, and F2) profitability.

The first one combined all variables related to the management of the cooperative's sources of capital and short-term solvency related to liquidity indicators, working capital management, and budget control. The term was given because of the importance of financial management and its impact on short-term solvency (Pokharel, Regmi, Featherstone, & Archer, 2019).

It was the factor with the highest loading, so great attention is paid to the ability of cooperatives to meet their operational and financial obligations, which parallels the concerns regarding the impacts that indebtedness can have on them (Guindani & Pinto, 2016; Pokharel, Regmi, Featherstone, & Archer, 2019). This condition is especially notable in Brazil, where the credit market has high asymmetry and there have been three decades of double-digit nominal interest rates. It has hampered the profitability of cooperatives and has been one of the reasons of bankruptcies (Rodrigues, Lauermann, Moreira, Ferrares, & Souza, 2018).

The second factor brought together all variables involved in future and current profitability, as well as the indicators of changes in investments and profits. Grouping these variables confirms the importance of cooperative's financial performance (Pokharel, Archer, & Featherstone, 2020).

The members of a cooperative expect good results from it; therefore, the executives must pay close attention to appropriate financial indicators (Giacomin, Boetler, Fiabani, & Sandri, 2018). These results demonstrate that, although cooperatives do not have profit as an end, they have economic goals; to reach them, this factor should be monitored (Pokharel, Archer, & Featherstone, 2020).

Table 6 shows the descriptive and factorial results for the social and environmental variables, which, in contrast to the financial indicator variables, showed more significant levels of dispersion between the means and standard deviations. Responses were reported on a 5-point Likert scale (1-5). These descriptive results suggest that, unlike financial ones, cooperatives do not share a general outlook on the importance of environmental and social outcomes.

Table 6 Descriptive results and factor analysis of social and environmental variables.

| Variables | Descriptors | Factor | |

|---|---|---|---|

| Mean | Standard Deviation | 1 | |

| Social projects, cultural and sporting activities for members | 3.13 | 1.33 | 0.88 |

| Spending on social, cultural, and educational actions | 3.31 | 1.24 | 0.85 |

| Incentives and awards for employees | 3.33 | 1.48 | 0.87 |

| Participation of family members in activities developed by the cooperative | 3.63 | 1.25 | 0.83 |

| Training or qualification events offered to cooperative members | 4.06 | 1.06 | 0.78 |

| Life insurance, medical assistance, and private pension for cooperative members | 2.96 | 1.429 | 0.77 |

| Variation in the number of cooperative members | 3.46 | 1.32 | 0.70 |

| Certifications obtained by the cooperative | 3.56 | 1.367 | 0.67 |

| Environmental conservation actions | 4.27 | 1.026 | 0.63 |

| Tracking the production of cooperative members Ω | 3.96 | 1.237 | - |

Notes 1. Kaiser-Meyer-Olkin measure of sampling adequacy 0.872; 2. Bartlett's sphericity test: χ²: 337.32; p-value: 0.000. Note 2: Ω loading factor below |0.6|.

Source: own elaboration from survey data.

This factor accumulated 62% of the total variance, and the KMO and Barlett's sphericity results confirm the model's fit.

The social and environmental variable can be understood as sustainability and demonstrates the need for a holistic assessment of these actions, including the importance of cooperative efforts regarding its members. They will validate external actions when they perceive that they are part of the sustainability strategies and notice their impact.

The relationship and well-being of the cooperative members are considered important to encourage the active participation of them and their families in the discussions, including women and young people. Such aspects are directly interconnected with good governance practices and, within the governance structure, are represented by social committees (Nájera-Vázquez & Martínez-Romero, 2019) (Maciel, Seibert, Silva, Wbatuba, & Salla, 2018).

The latter are governance agents composed of members and their families, organized into homogeneous groups classified by aspects such as gender, age group, or agricultural product (OCB, 2016). Such forms of organization facilitate communication within the cooperative and lead to greater engagement by the cooperative members as a whole (Macedo, Sousa, & Amodeo, 2014). This form of socialization encourages the formation of new leaders who participate in representative bodies (OCB, 2019).

The sustainability factor also demonstrates the importance of new requirements for increased transparency, reliability of production processes, and enhanced interest in how the production process works for the consumer market (e.g., organic, free-range, among others). Hence, the importance of certifications (Rauta, Paetzold, & Winck, 2017). The consumer market, especially the external one, is increasingly demanding. It now places importance not only on product presentation but on such aspects as nutritional and health issues. Nowadays, it is necessary to prove pro-duct quality and growth method to guarantee consumer safety (Rauta, Paetzold, & Winck, 2017).

In response, to reach new markets and better prices for their products, cooperatives have invested in the appropriate certifications (Araújo, Magalhães, & Gomes, 2016). This opportunity is closely related to good governance practices, as it favors development and competitiveness (OCB, 2016). It is worth mentioning that the requirements for certification are often close to the cooperative ideals (Araújo, Magalhães, & Gomes, 2016).

Education, training, and information disclosure are key elements for cooperatives being directly related to their development and the principles of cooperative governance (Maciel, Seibert, Silva, Wbatuba, & Salla, 2018; Bis, et al., 2020).

Agricultural cooperatives adopt sustainable practices when required by the legislation to commercialize their products, they also adopt other practices linked to preservation and conservation of the environment based on cooperative principles, primarily based on respect for the community (Carneiro, Arruda, & Leite, 2018) and responsible behavior (Hale, Legun, Campbell, & Carolan, 2019).

4.3. Discriminant Characteristics of Cooperatives Regarding Governance

In addition to understanding the profile of agricultural cooperatives in terms of their governance practices and performance analysis described by exploratory factor analysis, the study explored which of the variables were most effective to distinguish the cooperatives with the best governance practices, as indicated in the questionnaire.

Table 7 lists the variables used and the criteria established to distinguish agricultural cooperatives with the best management practices (Group 1) from those in which they were limited or unwanted (Group 0).

Table 7 Variables and criteria used to distinguish agricultural cooperatives.

| Variable | Criterion | Group 0 | Group 1 |

|---|---|---|---|

| Cooperative Market | Cooperatives that operate at the local and/or regional market and cooperatives involved in national and/or international markets. | 26 | 22 |

| Chairman nominations | Cooperatives whose statutes do no limit the number of chairman reappointments and those where one to three reappointments are allowed. | 35 | 13 |

| External Audits | Cooperatives that contract external audits and those that do not. | 23 | 25 |

| Communication Channels | Cooperatives with communication channels for different audiences and cooperatives without such audience-specific communication channels. | 13 | 35 |

| Education for Cooperative Members | Cooperatives that have education programs and those that do not. | 35 | 13 |

| Manager Remuneration | Cooperatives that remunerate their managers and cooperatives that do not. | 13 | 35 |

Source: own elaboration from survey data.

Table 8 shows the result of the discriminant analysis for cooperative operational variables. Cooperatives were separated into two groups, those that operate within the local and/or regional market (group 0) and another group that, in addition to operating within local markets, performs at the national and/or international level (group 1). The former group was identified as the one that does not favor good governance and performance practices, while the latter contributes to the good governance of cooperatives and better performance.

Table 8 Discriminant variables between Groups 0 and 1: Market.

| Discriminant Variables | Coefficient function | Wilks Lambda | |||

|---|---|---|---|---|---|

| Group 0 | Group 1 | Stat. | F Stat. | df1 | |

| Tracking members production | 1.347 | 2.092 | .907 | 4.704 | 1 |

| Gross margin | -4.666 | -6.931 | .776 | 6.487 | 2 |

| Level of indebtedness | 6.482 | 8.088 | .688 | 6.655 | 3 |

| Regular executive board meetings | 8.248 | 9.473 | .623 | 6.507 | 4 |

| Tracking members production | 1.347 | 2.092 | .907 | 4.704 | 1 |

| Gross margin | -4.666 | -6.931 | .776 | 6.487 | 2 |

Notes: 1. Stepwise method; 2. The maximum number of steps is 78; 3. The minimum insertable partial F is 3.84; 4. The maximum removable partial F is 2.71; 5. Constant value for Group 0: -25.21; 6. Constant value for Group 1: -31.71.

Source: own elaboration from survey data.

The highest coefficients found for the variables in Group 1 were related to the periodicity of board executive meetings and tracking board member production, which indicates that concerns regarding governance are more significant in this group. For financial indicators, indebtedness was more critical for Group 1 and the gross margin for Group 0. Therefore, cooperatives that operate within the national and/or international markets believe that frequent meetings with the executive board are essential. They admit production tracking and monitoring of the level of indebtedness.

Table 9 shows the discriminant analysis results for the reappointment variable. It is separated into two groups; in one, chairman reappointment is not deter-mined in the cooperative's statutes. In the other, one to three renewals are permitted, after which members of the representative body must assume the role. Group 0 is the one with undetermined renewals, which is not a good practice. Group 1 consists of those where the number of renewals is limited, an approach indicative of good governance.

Table 9 Discriminant variables between Groups 0 and 1: Chairman reappointment.

| Discriminant Variables | Coefficient function | Wilks Lambda | |||||

|---|---|---|---|---|---|---|---|

| Group 0 | Group 1 | Stat. | F Stat. | df1 | df2 | Sig. | |

| Cooperative budget occurrence | 5.212 | 5.944 | .920 | 4.012 | 1 | 46 | .051 |

Notes: 1. Stepwise method; 2. The maximum number of steps is 78; 3. The minimum insertable partial F is 3.84; 4. The maximum removable partial F is 2.71; 5. Constant value for Group 0: -11.42; 6. Constant value for Group 1: -14.64.

Source: own elaboration from survey data.

The explanatory variable for the groups (0 and 1) is unique, the cooperative's budgetary realization. For this, Group 1 had the highest coefficient, which indicates a more significant concern for performance-related issues.

Given the theoretical importance of limiting the chairman reappointment, it was expected that several variables could discriminate this management practice (IBGC, 2015). However, this single variable can help explain the lack of representativeness of such practice. In approximately 73% of the surveyed cooperatives, there is no time limit for chairman reappointment; the cooperative statutes do not establish a maximum period for an individual to be chairman.

Budget is a key tool for managing any cooperative (Guindani & Pinto, 2016). Consequently, being concerned about budgeting may indicate that the cooperatives that limit the reappointment of administrative officers also pay greater attention to it, both in planning and in terms of controlling expenses appropriately and effectively.

Table 10 shows the results of discriminant analysis for the variable external audit. This practice was separated into two groups; Group 1, cooperatives that contract an external audit - which is considered a characteristic of good governance -, and Group 0, composed of cooperatives that do not hire an external audit - which is not considered in line with good governance.

Table 10 Discriminant variables between Groups 0 and 1: External audit.

| Discriminant Variables | Coefficient function | Wilks Lambda | |||||

|---|---|---|---|---|---|---|---|

| Group 0 | Group1 | Stat. | F Stat. | df1 | df2 | Sig. | |

| At the general assembly, they discuss external audit opinion and/or the opinion of the audit committee. | 1.319 | 2.129 | .865 | 7.152 | 1 | 46 | .010 |

| The executive board meets regularly. | 6.489 | 5.435 | .749 | 7.535 | 2 | 45 | .002 |

Notes: 1. Stepwise method; 2. The maximum number of steps is 78; 3. The minimum partial F to be inserted is 3.84; 4. The maximum partial F to be removed is 2.71; 5. Constant value for Group 0: -18.20; 6. Constant value for Group 1: -16.90

Source: own elaboration from survey data.

The two discriminant variables related to whether external auditors are hired indicate that the cooperatives that adopt this practice place great value on the opinions of the audit committee and the assembly. They also require fewer meetings for these topics to be concluded satisfactorily. As a result, the external audit plays an essential role in informing the discussions and decisions of the administrative bodies.

The external audit is a necessary inspection and control tool for good governance. It creates value for the business (Maciel, Seibert, Silva, Wbatuba, & Salla, 2018), its role in the cooperative is related to analyzing the fiscal accounts and assessing their veracity (IBGC, 2015). Of the cooperatives participating in the survey, 52% hire an external audit to examine and oversee their financial statements.

Table 11 shows the result of the discriminant analysis for the variable communication channels and includes the means used to inform members about collective decisions. The variable was divided into two groups; the first one consisted of cooperatives with communication channels for different audiences; the second consisted of communication channels limited to the audience of agricultural cooperatives. Communication channel diversity is characteristic of good governance and performance, while limitation of such media is considered a negative characteristic.

Table 11 Discriminant variables between Groups 0 and 1: Communication Channels.

| Discriminant Variables | Coefficient function | Wilks Lambda | |||||

|---|---|---|---|---|---|---|---|

| Group 0 | Group 1 | Stat. | F Stat. | df1 | df2 | Sig. | |

| Social/Environmental Indicators | -2.806 | -0.474 | .894 | 5.429 | 1 | 46 | .024 |

| Financial statements available to all members | 5.031 | 3.868 | .812 | 5.200 | 2 | 45 | .009 |

| Environmental conservation actions | 1.326 | 2.339 | .740 | 5.159 | 3 | 44 | .004 |

| Control of size of working capital | 4.708 | 3.756 | .663 | 5.469 | 4 | 43 | .001 |

Notes: 1. Stepwise method; 2. The maximum number of steps is 78; 3. The minimum inserted partial F is 3.84; 4. The maximum removed partial F is 2.71; 5. Constant value for Group 0: -25.94; 6. Constant value for Group 1: -21.56.

Source: own elaboration from survey data.

The two most significant coefficients were in Group 0, indicating greater concern about performance and governance, namely, making financial statements available to all members and showing how capital is used. However, the channels for making public the decisions of the cooperative may not reach all members. Group 1 had the high coefficients for the same indicators as Group 0 but with a reduced degree of importance. Social/environmental indicators and environmental conservation actions had lower weights for both groups.

The effective communication between agents and members of the cooperative forms a necessary aspect of good governance, so that, the importance to assess communications channels. This practice is achieved by providing transparent information, cooperative education, and other elements. The cooperative members feel they belong to the collective and feel valued and respected (OCB, 2016; Liu & Li, 2020).

Table 12 shows the results of the discriminant ana-lysis for the variable cooperative education programs for members. This variable is divided into two groups: cooperatives with education programs and cooperatives without. Only the first is considered a requirement for good governance and performance.

Table 12 Discriminant variables between Groups 0 and 1: Cooperative Education.

| Discriminant Variables | Coefficient function | Wilks Lambda | |||||

|---|---|---|---|---|---|---|---|

| Group 0 | Group 1 | Stat. | F Stat. | df1 | df2 | Sig. | |

| Social/Environmental Indicators | 4.449 | 8.034 | .810 | 10.787 | 1 | 46 | .002 |

| The executive board meets regularly | 6.083 | 7.671 | .715 | 8.984 | 2 | 45 | .001 |

| Environmental conservation actions | 2.233 | 1.357 | .650 | 7.895 | 3 | 44 | .000 |

Notes: 1. Stepwise method; 2. The maximum number of steps is 78; 3. The minimum inserted partial F is 3.84; 4. The maximum removed partial F is 2.71; 5. Constant value for Group 0: -19.21; 6. Constant value for Group 1: -24.55.

Source: own elaboration from survey data.

Three indicators distinguish these two groups. Group 1 has the highest coefficients in social/environmental indicators and periodic meetings of the executive board. In Group 0, environmental conservation actions are rated high, even though such cooperatives do not give great value to cooperative education. Thus, cooperatives that placed greater importance on it also considered social/environmental issues important and often met with the executive board.

Investment in cooperative education is important for good governance (OCB, 2016), but only 26% of the participating cooperatives had this program.

Table 13 shows the discriminant analysis for the variable manager remuneration, separated into two groups; the cooperatives that remunerate their managers and the cooperatives that do not.

Table 13 Discriminant variables between Groups 0 and 1: Manager remuneration.

| Discriminant Variables | Coefficient function | Wilks Lambda | |||||

|---|---|---|---|---|---|---|---|

| Group 0 | Group 1 | Stat | F Stat | df1 | df2 | Sig. | |

| Degree of financial leverage | 5.902 | 4.688 | .795 | 11.837 | 1 | 46 | .001 |

Notes: 1. Stepwise method; 2. The maximum number of steps is 78; 3. The minimum inserted partial F is 3.84; 4. The maximum removed partial F is 2.71; 5. Constant value for Group 0: -15.45; 6. Constant value for Group 1: -10.

Source: own elaboration from survey data.

The variable manager remuneration is best explained by only one variable: degree of financial leverage. This variable has the highest coefficient in Group 0; thus, cooperatives that do not pay their managers consider the performance variable Degree of financial leverage more critical.

The survey showed that approximately 73% of the cooperatives pay their managers. To avoid conflicts of interest between managers and cooperative members, management remuneration must be adequate, both for directors/officers and executives (IBGC, 2015). The re-presentative body/position must have obligations and responsibilities that should be recognized by all (OCB, 2016). The amounts to be paid must be approved at the general assembly (OCB, 2016).

Based on the conducted factor analysis, via the indebtedness factor, the degree of financial leverage determines the positioning of the cooperative within the grouping. The cooperative can use third-party resources to increase the income of its members. That is what financial leverage measures in the context of funding for long-term payment and the ability to meet short-term obligations (Santos, 2015). As a result, cooperatives may choose not to pay their managers, so this disbursement does not impact the degree of financial leverage. Such a decision must be taken at a general meeting.

4.4. Management Implications

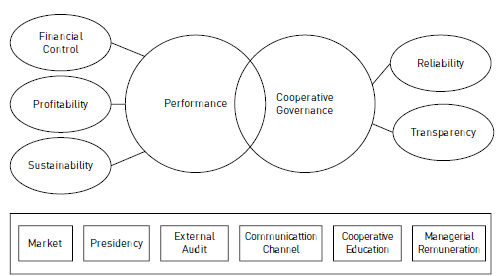

The central objective this study is to offer a performance model based on the principles and practices of corporate governance applied to agricultural cooperatives. This appears in Figure 2 and shows that performance is composed of factors that add economic and sustainability variables. This condition is key to co-operative longevity and touches on structural variables of the cooperative itself related to its commitment to both its members and the broader society.

For this form of management structure to be consolidated, it is necessary to have fundamentals of governance in place. These were grouped into reliability and transparency. In the performance dimension, it was found that the focus should be on liquidity, profitability, and sustainability. This model was based on important principles when discriminating between cooperatives with the best governance practices, namely: i) the market in which they operate; ii) chairman reappointments; iii) external audits; iv) communication channel forms; v) education within the cooperative; vi) managerial remuneration.

The model proposed as a result of the current study may be helpful for agricultural cooperatives, contributions are directed to the board of director, fiscal council, and executives of the cooperative organization responsible for managing the business.

In terms of discriminant variables and in the context of the market in which they operate, managers must pay attention to the opportunities for insertion in new markets, considering that they offer a quality product that meets the needs of an increasingly demanding consumer. All results should aim to improve many of the cooperative’s members and benefit society in general.

Chairman reappointment needs to be further dis-cussed within many of the analyzed cooperatives, so that the capacity for indefinite reappointments is removed from the statutes and new members can lead. General assemblies, administrative board meetings, audit committees, and executive boards are all appropriate for this. Such changes in representation potentially enable new proposals and visions along with new business models.

Hiring external audits is a critical element for achieving good governance in cooperatives. It is necessary to consider the adoption of this practice, as it allows information to be presented transparently and securely. Cooperatives need to improve the dissemination of information and management decisions to members so that everyone involved in the business is aware of the current situation under which they are operating.

There is a variety of communication channels and they should be used in ways that guarantee that information reaches its destination, thus ensuring that all members are aware of what is going on since a cooperative member is a joint owner of the business.

Education is one of the most important ways for cooperatives to achieve effective governance. For most of the surveyed cooperatives, this aspect needs to be improved to stimulate integration. Offering training courses to cooperative members and programs would raise awareness about the implementation of most sustainable business practices. This should be accompanied by promoting events that involve family members, such as women and young people.

Both the members and the board of executives of cooperatives that do not pay their managers should reconsider it, as remuneration encourages an excellent performance of managerial activities.

The proposed model should be included in agricultural cooperatives' strategic planning, as they need to better explore the performance issue. Using the methodology outlined above would enable them to take on new markets, improve positioning, and seek better results, thus contributing to the increasing success of the agribusiness in question.

Implement this model or any governance structure can be a challenge because it involves changes in all levels and areas of the cooperative and in the very relationship with the cooperative members. Therefore, the professionalization of management and/or hiring consultants or experienced professionals in this area is fundamental to define a process of change and organizational development, so that the implementation can be viable.

5. Conclusions

Cooperatives operate in a competitive environment because they are purely mercantile companies. They need structures to increase their competitiveness, seek alternatives that improve performance, and present better results to cooperative members. The capacity to do this is closely related to monitoring their financial health, for which it is crucial to know the level of financial control and profitability. The extent to which members of the cooperative feel integrated, the possibility of certification of what is produced, and the presence of environmental preservation practices all enhance the values of the cooperative and help making it more sustainable.

The proposed model gathers the performance and governance variables that compose the ultimate structure of an agricultural cooperative to create added value for the business. Such developments need to be encouraged by the OCB. This representative body has taken actions that stimulate more and better governance and performance practices in cooperatives so that each business is further strengthened.

The current study indicates that managers and stakeholders should have a broad view of the cooperative, one that relies on the integration of all agents, so that they assist each other in developing their general activities for the greater good of the cooperative. In addition, an integrated information system that reaches all areas and assist decision-making is required.

Although they are much smaller in number than in success, it is important to analyze cases of failure when diagnosing the aspects that need to be improved. One that relates to the lack of training, whether of cooperative or hired professionals, which directly affects the lives of members who, in many cases, depend on the cooperative profits to make a living.

However, the results of the study were built from empirical research with a limited and not probabilistic sample. All statistical procedures for data processing were followed, however, reaching a wider sample may provide new insights.

Future studies may replicate the proposed model in other geographic contexts or even for cooperatives dedicated to other economic activities. Applied studies can also be addressed to assess the implementation process and impact of governance models in agricultural cooperatives. Another opportunity for future studies is to assess the relationship between sustainability and cooperatives, especially those operating in the international market facing the growing demands and attention to environmental and social impacts in food production.