Introduction

From the moment the internet appeared, there have been changes in how companies operating in both the production sector and the service sector do business. The banking sector is one of the most important sectors among them, experiencing changes in the way they do business. Bogner and Barr (2000) state that with the spread of the internet in the twenty-first century, the business environment has become extremely competitive with the disappearance of borders in terms of globalization. Thanks to digital innovation and new product development technologies, companies achieve growth by improving their financial performance and capturing advantages. Digital innovation is a mandatory requirement for technology-oriented companies, and it is very difficult for technology-oriented companies that do not implement digital innovation to compete in their industries. According to Fitzgerald et al. (2014), it is stated that sectors that embrace digital innovation have the potential to achieve significant advancements such as digitalizing companies and enhancing customer experience through successful digitalization efforts. Commitment to digital innovation and technology enables companies to create new business models, otherwise, it becomes difficult for them to compete with their competitors. Mowery et al. (1998) stated companies must have technological competence to adopt digital innovations. In this case, it will not be possible for companies that cannot successfully implement digital innovations to achieve the desired level of performance output. Therefore, we can foresee that digital banking will continue to grow rapidly in the present and future worlds. To maximize the benefits for both customers and banks, it is essential that customers know and trust the features associated with digital innovations.

Safeena et al. (2012) stated mobile banking applications are as effective as traditional banking services and appeal to more customers. According to Shaikh (2013), the expanded uses of technology can increase the demand for mobile banking services, thus attracting the perceptions of mobile banking users in a positive direction. This positive change can be explained by activating many banks and financial institutions, expanding customer access with new products and applications, increasing customer retention, increasing operational efficiency and enabling companies to increase their market share. According to Illia et al. (2015), banks are turning to mobile and Internet banking by investing more in technology-based services in addition to their traditional branches. Klein and Mayer (2011) emphasize that mobile banking is very important among customers living in rural areas and receiving inadequate service from banking services.

According to the research of Shaikh and Karjaluoto (2015), it is explained that the digitalization of companies or focusing on other technological factors together with mobile banking applications positively affect consumer attitudes and perceptions. Considering the technological developments and the diversity offered in mobile banking, a literature search was conducted, taking into account the state of knowledge about mobile banking and its general adoption in research. Especially with the technological developments in the field of mobile devices and the revolutionizing of information technology in the banking sector, the competition is getting more and more complicated. With banks placing greater emphasis on digitalization, data were collected from expert-level administrative personnel working in the field of mobile banking/digital banking in banks to analyze their strategic situation and digital innovation. Analyses were conducted, and based on the results obtained, relevant information and suggestions were provided in the discussion and conclusion sections.

Literature

Strategic Vision on Digitalization

Digitalization in the financial sector is increasingly affecting business relations and information technologies between the customer and the company in today's world (Setia et al., 2013). According to Rai et al. (2012), digitalization helps to reduce costs and provide better customer service in the financial sector. At the same time, companies in this sector need to analyze their responses to customer demands when they focus on efficient transfer processes and cost strategies by adapting their services to digitalization (Tallon, 2010). As digitalization rapidly develops today, companies in the financial sector, particularly banks, are increasingly required to provide digitalized services to their customers (Nüesch et al., 2015). Therefore, banks need to promptly develop a strategic vision and business strategies for digitalization in order to offer new online services.

James and Lahti (2011) state that companies in the financial sector will ensure their possible future positions as they attach importance to digitalization strategically. Kraus et al. (2018) stated strategic planning is important for companies in digitalization and that companies need the cooperation of employees to be successful in planning. For this reason, as digitalization develops rapidly today, companies in the financial sector, especially banks, are required to increasingly provide digital services to their customers in order to stay competitive Banker et al. (2009), due to the cost of digitalization applications, and Holzinger et al. (2007) emphasize that banks should develop a clear vision for digitalization since new digital banking tools are not always adopted by customers. With employees who can use digitization appropriately, companies can better articulate the use of digital services to their customers.

Harmonizing the strategic perspective developed in the structure of the organization with the products/services is a determinant for maximizing the company's efforts and performance in marketing and staying in the market (Webster, 1992). Therefore, financial institutions should develop a strategic vision in the digital environment. Financial institutions that want to gain a competitive advantage should develop a strategic vision related to digitalization (Niemand et al., 2017). In this context, as a result of the literature research, the effects of strategic vision on digitalization on digital innovation and financial performance, innovation performance and digital natives PAI for banks are examined.

Digital Innovation

If companies start to grow and their systems, structures, cultures, processes, routines, and even capabilities start to slow down, they will have difficulty adapting to innovation processes and changes and may not be efficient. In this case, with the decrease in the efficiency of the company's capabilities, the skills no longer developed may become useless or even harmful. For example, a company can gain efficiency by having enterprise resource planning to standardize and institutionalize its operations and processes, but at the same time, it may be difficult for the company to compete as it will be difficult to adapt enterprise resource planning, operations, and standardized processes with digital innovation (Chan et al., 2019). Therefore, the desire of companies to try to reach their planned business goals makes digital technologies more and more important (Nylén & Holmström, 2015).

Digital innovation is defined as the creation of innovation in the changes that occur in the use of digital technologies (Hanelt et al., 2021). Nambisan et al. (2017) affirm digital innovation is the creation of business processes resulting in the correct use of digital technologies. Digital technologies are "a fundamental function for companies' systems in the field of technology" (Gawer, 2011). In companies that want to develop digital innovation, mostly service innovation or innovations in product/service systems are very important as the development of the features of products/services continues simultaneously (Matzner et al., 2018). With the continuous development of digital technologies, companies are moving towards higher production capacity and naturally lower and more efficient costs. In his research, Gibbard (2014) found that innovations in technology positively affect the rise of mobile technologies. As companies begin to develop products/services through digital innovation, they need more digital innovation (Svahn & Henfridsson, 2012). In other words, combinations of digital and physical components must be combined to innovate products/services (Yoo et al., 2010). As a result of the research in the literature, both the independent and mediator variable effects of digital innovation are analyzed.

Financial Performance

Ousama et al. (2019) stated financial performance is an essential factor for a company to remain successful in the market. Nufus et al. (2020) explain that excellent financial performance is the main goal of every company. Coombs and Bierly (2006) analyzed the efficiency effect of technological competence on financial investments. In this research, it is accepted that financial performance is one of the most determinant factors for a company's growth and sustainability. It is stated that to achieve good financial performance, companies must have technological capabilities so that they can gain a competitive advantage (Mbama et al., 2018). According to Rashid et al. (2020), companies that use the latest technologies and are advantageous in terms of technology should give importance to software to gain financial advantage. Companies that invest in software and technologies can achieve higher financial performance.

In particular, it has been stated that if banks with extensive digital services prioritize digital innovation, it may have a positive effect on their financial performance (Scott et al., 2017). Because the security of digital transactions in the financial sector can increase the number of transactions customers will make, ultimately resulting in the potential acquisition of more customers. In other words, improved financial performance can be achieved by considering the total return figures brought by shareholders, price increases, and dividends (Rhyne, 1986). Companies in the financial sector should act in line with the needs and wishes of their customers while developing their new products/services. The needs and wishes of customers are also important for effective resource management and successful technology development management and the adequacy of new technology (Park et al., 2021). According to Zhong et al. (2017), firms plan and implement financial inputs every year. Based on these plans, firms can achieve targeted financial performance. As a result of the literature research, the effects of strategic vision on digitalization and digital innovation on financial performance are examined.

Innovation Performance

Companies that adopt innovation focus on the development of new products and services with change (Kahn, 2018). Innovation requires having a different idea of culture and understanding together with employees who are open to vision, change, and development (Anzola-Román et al., 2018). However, in today's world where change is increasing day by day with competition, every company must innovate to survive in the long run. Innovation is now a necessary factor for a company's growth and sustainability (Schoemaker et al., 2018). If it is necessary to look at innovation from a different perspective; Companies that want to be a pioneer in a market can create their market with their innovative product or service. It can be said that what distinguishes innovative companies from other companies is to see the market that may occur in areas where there are no customers and to create a business model for this need by seizing the opportunity (Ni et al., 2021). For this reason, companies need to keep up with change to survive for many years and innovate to stay competitive and even to be superior in competition. To innovate, the organizational structure must be designed so that the employees are in an innovative organizational culture environment and the employees contribute to the production/service (Hughes et al., 2018).

Performance can be expressed as the percentage of success a company has achieved in a certain period (Raffoni et al., 2018). In other words, performance is a quantitative and qualitative description of how much an individual, a community or an organization can achieve their intended goals through their actions. In this direction, the concept of innovation performance can be expressed as the level of success or failure that companies have achieved in the market in their innovation studies in line with their strategies, the market they are in and their technological competencies (Hameed et al., 2021). Results for innovation performance are obtained as outcomes of product, process, innovation and development studies, considering various aspects of organizational innovation (Edquist et al., 2018). Innovation performance is related to both production, service-oriented and management and marketing-oriented functional processes such as innovation development, delivery and promotion processes. In this respect, it can be said that innovation performance is a process that includes innovation processes from beginning to end (Xie et al., 2018). As a result of the literature research in the literature, the effects of strategic vision on digitalization and digital innovation on innovation performance are examined.

Digital Natives' Perceptions of Artificial Intelligence

The term Artificial Intelligence (AI) was coined by John McCarthy in 1956. He defined AI as the science and engineering of producing intelligent machines. The scientific goal of AI is to understand intelligence by creating computer programs that exhibit intelligent behavior, using symbolic inference or reasoning inside the machine. AI has recently become a remarkable topic with its deep learning achievements (Gunning et al., 2019).

The business world is developing strategies to deal with this opportunity and challenge. Banks with mobile banking applications need to gain their customers' trust by providing practical solutions and advanced functions (for example, smart agent-based portfolio management and financial planning services) so that they can improve their competencies for problems that may arise from smartphone applications. Otherwise, there is a high probability of losing customers (Zhang et al., 2018). Sarlin and Björk (2017) state although there have been many limited machine-learning applications for years, machine learning and AI have recently become important factors in banking services.

According to Moro et al. (2015), in banking where high-level techniques are applied, especially credit evaluation, branch performance, e-banking, and customer segmentation and retention are important criteria in terms of sustainability. For this reason, the concept of AI becomes essential in mobile banking transactions and the acquisition of new customers. According to Mogaji et al. (2021), banking operations and processes are evolving as banks invest more in customer-facing AI. On the other hand, Baabdullah et al. (2019) stated research in the field of mobile technologies provides insight into a technology context and that previous experience with a brand conceptualized similar to brand attitude can affect the consumers' attitude towards using technologies. According to Farah et al. (2018), the perceived value for adult users and thus the benefit of innovation, followed by usage and risk, are the most important factors affecting mobile banking adoption. The decreasing cost of internet access combined with smartphones creates huge opportunities for organizations with diverse motivations to inform and influence large numbers of people. As a result, the strategic vision in digitalization and the effect of digital innovation on digital natives' perception of AI (DNPAI) are examined.

Relationships between Variables

Li et al. (2016) emphasize that under competitive pressure, SMES use digital platforms to make a profit. Companies, like individuals, manage their financial transactions by utilizing digital banking applications. According to Kazan et al. (2018), digital platforms represent an emerging field that can affect company performance. There will likely be positive developments in the performance of the banks as digital banking applications become widespread. According to Gu and Tayi (2016), they state that digitalization is important to retain customers and gain new customers. This explanation supports our hypothesis that digital innovation in the financial industry has a positive impact on DNPAI.

According to Floyd and Lane (2000), when companies develop a strategic vision in digi-talization, they can positively affect their financial performance by attracting new customers along with distinguishing themselves from other companies. These explanations support our hypothesis that the strategic vision in digitalization has a positive effect on financial performance. As digital technologies become pervasive and compatible with companies' systems, barriers to digital innovation disappear, thus enabling implemented strategies to produce, develop and finance new digital products and services (Nylén & Holmström, 2015). Technological innovation at any level can affect subsequent innovations at other levels. For example, the success of the global adoption of smartphones and mobile applications is helping to develop mobile financial services innovations such as mobile banking, mobile payments and money transfers (Liu et al. 2015).

Ai-based companies increase interaction with mobile banking customers by managing recurring payments, savings and investments in their financial planning (Lipton et al., 2016). Clemons and Row (1991) and Clemons (1986) state that digital innovation is crucial in terms of creating long-term profitability and sustainable competitive advantage. According to Valmohammadi (2017) and Ussahawanitchakit (2012), digital innovation is accepted as an important strategic tool for companies to improve themselves, gain competitive power and increase their performance. These studies support our hypotheses that digital innovation can positively affect both financial performance and innovation performance. The hypotheses tested as a result of the literature research are presented below.

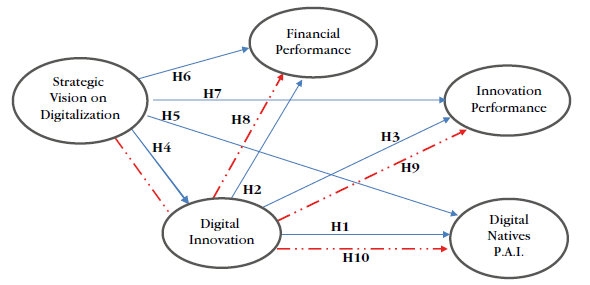

H1: Digital innovation of banks has a positive effect on DNPAI.

H2: Digital innovation of banks has a positive effect on financial performance.

H3: Digital innovation of banks has a positive effect on innovation performance.

H4: Strategic vision in the digitalization of banks has a positive effect on digital innovation.

H5: Strategic vision of banks in digitalization has a positive effect on digital natives PAI.

H6: In the digitalization of banks, the strategic vision has a positive effect on innovation performance.

H7: In the digitalization of banks, the strategic vision has a positive effect on financial performance.

H8: Digital innovation has a mediation variable effect between strategic vision and financial performance in digitalization in banks.

H9: Digital innovation has a mediation variable effect between strategic vision and innovation performance in digitalization in the banks.

H10: Digital innovation has a mediation variable effect between strategic vision and DNPAI in digitalization in the banks.

Methodology

As a result of the literature research, it was decided to test the model presented in Figure 1. Based on some relationships in the literature, direct and indirect effects between variables on the model were analyzed.

Structural equation models are often used to reveal multiple statistical relationships, visually demonstrate connections, and test an established model. The reason for using SEM models in the study is to explain these relationships and test the accuracy of the research model. With this modeling technique, it is possible to obtain both factor analysis results and regression analysis results. In the first stage, relations between the scale expressions and the variables were given with factor loads and weights, validity/reliability analyzes were made for the model; finally, the research model was tested. Hypotheses H1-H7 to prove the direct relationships (positive or negative) between the variables. The H8-H10 hypotheses were established to prove the mediator variable effects. In the H1-H7 hypotheses, the strategic vision on digitalization (SDV) variable, the path analysis for the effects of innovation performance (IP), digital innovation (DI), DNPAI, and financial performance (FP), the effects of digital innovation variable on innovation performance, digital natives perceptions of AI and financial performance results are given. Then, path analysis results were given for the mediation effect of the digital innovation variable on strategic vision on digitalization and other individual variables in the H9-H10 hypotheses.

Common Method Bias (CMB) problems may arise in the analysis due to reasons such as asking all the questions to the same participants during the answers, having a large number of questions, and reporting the questions by the participants themselves. This issue needs to be checked. For this, the result of Harmon's single-factor test can be looked at, as a result, if there is no dominant factor with more than 50 % variance, it can be said that there is no CMB problem. While preparing the scale, the number of questions was kept at a reasonable level so that the CMB problem would not arise, the respondents were not given more or less time than necessary, and anonymity was ensured in the survey. At the same time, a variable that is completely unrelated to the variables in the model was added to the model and the correlation coefficients were checked and the coefficient was obtained very low. Thus, it has been shown that the CMB is destroyed.

Sampling Method

A sample of 603 participants was taken to establish and test the model, and a scale consisting of expressions was presented to them. A five-point Likert scale was used in the study and the participants were asked to rate the scale statements between Strongly Agree = 5 and Strongly Disagree = 1. Data were collected through an online survey due to pandemic conditions. In this study, the banking sector was chosen as the population. The main reason for determining this population was the examination of digital innovation and DNPAI variables in the research. By using clustering and convenience sampling methods from the population, sampling was done in a hybrid way. In terms of the representation of every region of Turkey, the scale was sent to the cities of Istanbul, Ankara, Izmir and Bursa, where the density was high. The deadline for the data obtained was August 2021. The survey was terminated because a sufficient size was reached. For this reason, the study reflects the results up to this period and the perspectives of the participants during it. At the same time, there is a pandemic effect on data collection. The results obtained from the study may vary under different conditions.

Scales

The statements in the scale were taken from previous publications, where the reliability and validity tests were performed. The scales were compiled, and the scale form was created.

Strategic Vision on Digitalization (SDV) scale:Niemand et al. (2021) used the scale in their research.

Innovation Performance (IP) scale:Prajogo and Ahmed (2006) used the scale in their research.

Digital Innovation (DI) scale:Khin and Ho (2019) used the scale in their research.

Digital Natives' Perceptions of Artificial Intelligence (DNPAI) scale:Payne et al. (2018) used the scale in their research.

Financial Performance (FP) scale:Wang and Wang (2012) and Paladino (2007) used the scale in their research.

The scale form consisted of 2 groups of questions. In the first one, three demographic questions were asked: age, gender and province of activity. In the second group, the expressions obtained from the literature review for the five variables used were given with a five-point Likert scale. Participants were asked to rate these statements (5: Strongly Agree - 1: Strongly Disagree). With the scores, hypotheses were tested. The scale expressions used are given in Table 2.

Analysis

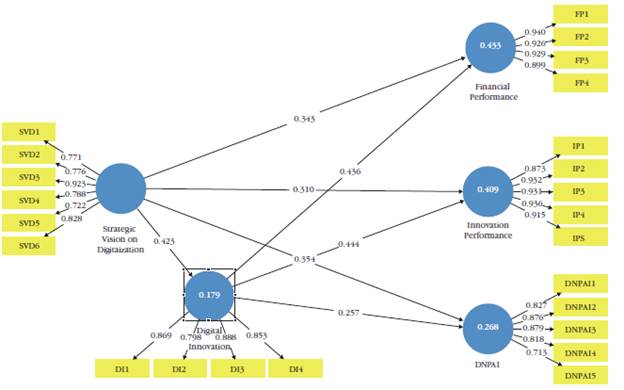

The conceptual model in Figure 1 was tested in the Smart PLS 3.3.3 program. The first processes were factor analysis and finding the reliability/validity values of the scale. If the data set does not have appropriate factor loadings and appropriate validity/reliability values, hypothesis tests cannot be performed. Once it has been established that the measurements are appropriate, path analysis can be initiated to test the hypotheses.

The reliability levels of all variables were calculated at the construct and item levels. Outer loading, outer weight, outer loadings, t-statistic and variance inflation factor (VIF) values and R square values obtained are presented in Table 2.

Table 2 Factor Analysis Results

| Outer Loadings | Outer Weights | Adj.R Square | Outer Loadings t-Stat. | Outer VIF | ||

|---|---|---|---|---|---|---|

| Digital Innovation (DI) | 1. The quality of our digital solutions in the organization I work for is superior to our competitors. | 0.869 | 0.403 | 0.170 | 40.877* | 1.896 |

| 2. At my company, the features of our digital solutions are superior to those of our competitors. | 0.798 | 0.244 | 15.308* | 1.934 | ||

| 3. The applications of our digital solutions in the organization I work for are completely different from our competitors. | 0.888 | 0.261 | 23.305* | 3.772 | ||

| 4. At the company I work for, our digital solutions are different from our competitors in terms of product/service platforms. | 0.853 | 0.262 | 20.184* | 3.155 | ||

| Digital Natives’ Perceptions of A.I (DNPAI) | 1. ai is used in the company where I work. | 0.827 | 0.234 | 0.253 | 14.649* | 4.041 |

| 2. Investments are made in ai in the company where I work. | 0.876 | 0.238 | 17.734* | 4.159 | ||

| 3. I think ai is necessary in the company where I work. | 0.879 | 0.246 | 26.723* | 2.915 | ||

| 4. I am sure I can use ai. | 0.818 | 0.280 | 16.229* | 2.044 | ||

| 5. In general, I adapt quickly to the use of ai. | 0.713 | 0.215 | 9.004* | 1.851 | ||

| Financial Performance (FP) | 1. The company I work for has a good return on investment compared to competitors. | 0.940 | 0.266 | 0.422 | 59.803* | 4.009 |

| 2. Sales growth is good in my company compared to competitors. | 0.926 | 0.273 | 48.904* | 4.220 | ||

| 3. In the company I work for, the return on assets is good compared to the competitors. | 0.929 | 0.288 | 79.225* | 4.002 | ||

| 4. In the company I work for, the costs are at the minimum level compared to the competitors. | 0.899 | 0.256 | 33.231* | 3.191 | ||

| Innovation Performance | 1. New innovations are constantly being implemented in the company where I work. | 0.873 | 0.214 | 32.454* | 3.368 | |

| 2. The latest technological innovations are used in our products/services at the company I work. | 0.932 | 0.216 | 54.896* | 3.267 | ||

| 3. The rate of new product/service development is high in the company where I work. | 0.931 | 0.212 | 0.397 | 56.303* | 3.115 | |

| 4. The technological competitiveness of the company I work for is in good condition. | 0.936 | 0.218 | 51.750* | 3.721 | ||

| 5. The speed of adopting the latest technological innovations in the processes of the company I work for is good. | 0.915 | 0.230 | 47.618* | 4.777 | ||

| Strategic Vision on Digitalization (SVD) | 1. The organization I work for has a clear vision of how it will remain competitive over the next 5-10 years regarding digital strategy. | 0.771 | 0.223 | 14.756* | 2.080 | |

| 2. The organization I work for has a clearly defined digital strategy. | 0.766 | 0.167 | 7.649* | 4.068 | ||

| 3. In my company, the digital strategy is implemented in all business units. | 0.923 | 0.257 | 50.522* | 3.141 | ||

| 4. In the company I work for, the digital strategy is constantly evaluated and implemented. | 0.788 | 0.247 | 15.144* | 2.031 | ||

| 5. In my company, new business models are created based on digital technologies. | 0.722 | 0.119 | 5.690* | 3.264 | ||

| 6. In the company where I work, R&D studies are carried out on digitalization from a strategic point of view for the future. | 0.828 | 0.221 | 15.877* | 3.259 | ||

*All p value < 0.05

When Table 2 is examined, it is evidenced all of the load values are above 0.70. Outer loading values should not contain negative values. Negative outer weights might be a result of high indicator collinearity (Ringle & Sarstedt, 2016). All weight values are positive, and all VIF values are less than 5, which shows there is no collinearity problem between expressions. T values indicate how well the expressions fit with the variables. It is sufficient for these values to be greater than 1.96. The compatibility of the expressions with the variables is satisfactory. R square value shows the extent to which factors (variables) explain each other. Above 0.26 is an acceptable value. All values are greater than 0.26 and variables that are sufficiently explanatory to each other are present in the model.

Cronbach Alpha, Composite Reliability (CR) and Average Variance Extracted (AVE) values are given in Table 3 to determine the reliability of the scale. At the same time, how many expressions are included in each variable is also available in this table. It is preferred that Croncach Alpha and CR values are 0.70 and AVE values above 0.50 (Nunnally, 1978; Hair et al., 2010; Chin, 2010; Çakir, 2019).

The values that enable examining the convergent and discriminant validity elements were obtained within the specified reference intervals. All Cronbach Alpha values were above 0.70 and rho_A values were calculated for each variable. This coefficient was suggested by Chin (1998) and suggests that acceptable scores should be higher than 0.70 (Çakir, 2019). Since the Rho coefficient is based on loads rather than observed correlations between variables, it is a better reliability measure than Cronbach's Alpha value in structural equation modeling (Demo et al., 2012). CR values above 0.70 and AVE values above 0.50 indicate convergent and discriminant validity. CR values of all variables are greater than their own AVE values. Maximum Shared Variance (MSV) Values are calculated over correlation values. MSV is calculated with the square of the largest correlation coefficient between a latent variable and other latent variables. Likewise, the ASV value is calculated over correlations. It is calculated by taking the average of the squares of the correlation coefficients between a latent variable and other latent variables. The correlation values used for these calculations are presented in Table 4. Discriminant validity is confirmed if the AVE is greater than MSV or ASV (Rebelo-Pinto et al., 2014).

There are other values that can be used to assess the discriminant validity of the scale. By examining the results of the Fornell-Larcker criterion and Heterotrait-Monotrait Ratio, it can be determined whether this measure of validity is provided or not. The values mentioned are presented in Table 3.

Table 4 consists of two parts. The first one shows the values and correlations obtained according to the Fornell-Larcker criteria: the values in bold and underlined are the criterion value obtained by a variable when compared with itself. This criterion value must be the largest in the row and column. The other values in the columns with bold and underlined numbers in the table are the correlation coefficients between the variables. There are positive significant correlations between the variables. Heterotrait-Monotrait ratios are given in the second part of the table. The fact that these values are less than 0.85 indicates the presence of discriminant validity.

The analyses conducted up to this point are related to the structural model. The consistency of the statements with the variables, as well as the reliability and validity measurements of the scale, are given. After proving that the data set is suitable, path analyses can be started to test the hypotheses.

The hypotheses given in Table 5 were tested. The hypotheses between H1 and H7 were set up to test the existence and compatibility of direct relationships. The column shown as the Original Sample gives the Path Coefficient values. The t-test is used to test the significance of the path coefficient values. If the obtained t-statistic value is greater than 1.96 or the P value is less than 0.05 for the 5 % significance level, it means that the paths are significant.

Table 5 Path Coefficient and Confidence Intervals Value

O: Original Sample, M: Sample Mean

Table 6 Mediation effect path results

O: Original Sample, M: Sample Mean

As a result of the path analysis, the presence of a mediation effect was revealed. To determine whether this mediation effect is full or partial, the significance of both direct and indirect effects was examined. If indirect and direct effects are significant on the same path, partial effects are mentioned (Cheung & Lau, 2008), and if one is significant and the other is not, a full effect is mentioned. As can be seen from the results of the analysis, since both indirect and direct effects are significant, the latent variable DI has a mediation effect in all relations.

Discussion

Advanced high-tech products/services create a competitive edge in the business world. This competition forces companies to contend with a dynamic and complex business environment. In it, companies must focus on their core competencies and keep up with innovations to maintain their market sustainability. The ability of a company to gain a competitive advantage over others depends on the strategic vision, as it enables the company to move towards its longterm plans and stay in the market (Chew & Chong, 1999). Gratton (1994) mentioned various human factors for the implementation of strategic vision by companies. This organizational culture includes systems such as senior management and human resources. That is, they remind us that the implementation of any strategic vision takes place with human-sourced assistance. Without human assistance, no strategic vision can be successfully implemented. In this case, the human resource factor should not be forgotten in the success of the strategic digital vision and digital innovation. In their research, Grandon and Pearson (2004) state that the costs and risks arising from the adoption and implementation of technology may be higher for small-sized companies due to limited resources and a lack of knowledge in technology management. However, large-scale companies, especially banks in the financial sector, must constantly invest in technology, so they need to take responsibility for these costs because, if they lag behind technology, especially in the financial sector, customers may show negative reactions.

Cohen and Levinthal (1990) state that when the technological capability of the company is weak, it will have problems in finding and catching new opportunities against developing technologies. For this reason, technological infrastructure digital investments should be appropriate and sustainable. Technological developments have accelerated the communication and transactions of companies in the financial sector with customers. The widespread use of mobile banking, especially due to the extensive use of the Internet and smartphones, increases the strategic and digital technology infrastructure investments of banks. According to Shi and Yan (2019), the integration of technological developments into industries accelerates the optimization and upgrading of the economic structure and has a profound effect on production and people's lifestyle. For example, with the increase in mobile banking applications together with the digital technology investments made in the banking sector, people's lifestyles are also positively affected by saving time and space and making their transactions. According to Bhatt and Bhatt (2016), people explain that thanks to mobile banking, people can perform their banking transactions by themselves and gain a competitive advantage in financial markets by accelerating these transactions most conveniently and cost-effectively. Therefore, it will be possible for companies to gain a competitive advantage by introducing new products and services to the market by developing talents related to innovation. Astuti et al. (2020) stated in their research that the adoption of digital technology for innovation positively affects company performance. On the other hand, Shin et al. (2017) explain that financial performance is a very important factor for a firm to develop and stay in the market. Hanelt et al. (2021) digital innovation has a positive effect on firm performance. When the research results were analyzed, it was possible to explain that strategic digitalization and digital innovation have positive effects on financial and innovation performance and DNPAI. The research and the results of the analysis show the hypotheses are correct and supported.

Conclusion

Competition in the banking sector has greatly affected the way banks provide services over time. While customers needed banks before, with the entry of many foreign and domestic banks into the sector in the 1990s, banks have become in need of customers. In this period when the customer portfolio has become important, banks have become competitive to meet their demands/needs. In the 2000s, the rapid developments in technology caused the banking sector to enter new competition in the technological field. This competition has provided banks with the opportunity to reach larger customer bases and to provide services faster and at a lower cost. Especially since the second half of the 2000s, with the integration of Internet use into smart devices, technological developments in the banking sector have accelerated and the concept of digital banking emerged. Defined as the use of technology to run banking services smoothly, digital banking aims to develop products/ services considering customers' requests/needs, unlike traditional banking. This sector has undergone a great digital transformation since the Cash Dispenser application, which is considered the first application of digital banking and allows customers to make transactions without going to the bank. ATM devices, debit cards, credit cards, telephone banking, internet banking, mobile banking applications, QR code usage, contactless transactions in payment systems using credit cards or mobile devices, cryptocurrencies coming with blockchain technology, open banking and digital checks are associated with this digital transformation. Thanks to the changes and developments in technology, banks have begun to attach importance to investments aimed at achieving innovation success in products and services to gain a competitive advantage by renewing their technological infrastructure. Holzinger et al. (2007) state digital innovation increases competitiveness. According to Yoo et al. (2010), digital innovation is accepted as a tool to benefit from digital technology. Companies in digital innovation transformation gain a competitive advantage over other companies and offer opportunities to expand their product and service portfolios into new areas.

However, companies that want to manage digital innovation need to understand the unique characteristics of digital innovation processes. Along with these studies, it can be argued that digitalization is very important for the banking sector, and positive results have been obtained in the performance of banks with digitalization. Considering the limitations of the research, data were collected from expert employees in strategic decision-making management in banks. In future studies, there is a need to compare the results to be obtained in companies in different sectors, considering the sample size. It is suggested that such investigations should be made more widespread, especially in companies that are responsible for implementing and implementing applications such as digitalization, innovation and artificial intelligence.