Introduction

Innovation is a key element in defining strategies that increase productivity and a valid instrument that allows the product's differentiation and increased market share (Andreoni, 2014). From the perspective of macroeconomics, economic growth is related to innovations and technological progress, and from this perspective, the productivity increases result from the implementation of more sophisticated technology in production processes (Romer, 1990). Therefore, historically efforts have been made to identify the determining factors of business innovations. However, despite the growing interest in this topic, the efforts made to identify the determining factors of a firm's innovations do not seem sufficient. Also, there is a gap in the literature related to how the different sources of innovations may cause heterogeneity in a firm's outcome.

There is some consensus about innovation as a key to economic success in certain industries and, consequently, a crucial element for countries' economic growth. The literature provides evidence regarding the magnitude of these effects (Lambardi & Mora, 2014), there is also unanimity among authors that confirms that investment in research and development is fundamental for the growth of the productive sectors of a country, given that it allows the development of innovations that in the future will reduce the demands of capital and operating costs while increasing the generation of innovative products according to market needs (Becker & Dietz, 2004; Cooper & Helpman, 2004; Love & Roper, 1999; Raymond & St-Pierre, 2010; Shefer & Frenkel, 2005; Simonen & McCann, 2008; Torres-Barreto et al., 2016).

From a neoclassical perspective, economies grow as workers have more capital to work (Solow, 1956). For Schultz (1961), economic growth is the result of having a population with higher education levels; in this sense, current-day economies produce more than in the past because they have more qualified workers on their staff. On the other hand, Grossman & Helpman (1991) consider that the technological change is the force driving investment, in such a way that part of the growth attributed to the accumulation of capital comes from innovation, this being one of the topics of greater relevance in economic life (Kraemer-Mbula & Wamae, 2010); given that it has facilitated the progress of worldwide society in terms of the creation of material wealth, and even the increase in individual and social well-being (Palma et al., 2015). Additionally, incremental innovations, that is, small changes or improvements made to an invention to improve its efficiency, are essential for an economy's progress (Schumpeter, 1942). Therefore, this research aims to delve into the factors that influence the generation of business innovations in the industrial sector. Specifically, it seeks to deepen the effect of public aid invested in Science Technology and Innovation Activities (STIA) on acquiring innovative results of industrial companies in Colombia. Additionally, the moderating effect of qualified human capital and companies' ability to relate to their surrounding environment are analyzed. These variables are analyzed using a logistic regression model to estimate how companies must obtain innovative results. This is intended to strengthen the current knowledge of this area and provide a reference for future studies that seek to clarify what actions facilitate the development of new or improved products in the industrial sector.

The article begins with the theoretical framework and the formulation of research hypotheses. Subsequently, we present the methodology used, which is quantitative; since we used a numeric database and statistical analysis to define some relationships between variables, we then present the results obtained, and finally, the conclusions of the investigation are shown.

Review of the literature and hypothesis

Innovation

According to the Oslo Manual, innovation is understood as the development of new products, services or processes, or implementation of significant changes in products, processes, marketing methods, or in the organizational structure of a company to improve its results (Echeverría, 2008; Organisation for Economic Co-operation and Development [OECD] & Eurostat, 2007). Innovation occurs when a new or significantly improved good or service is provided, in terms of its technical characteristics, its use, or other functionalities (OECD & Eurostat, 2007), and is important in order to increase productivity and competitiveness of companies; for this particular reason, it is one of the most mentioned elements in contemporary business strategies, especially in the industrial sectors and those who heavily rely on technology usage, performance and effectiveness (Christensen, 1997; Kumbhakar et al., 2012; Liao & Greenfield, 2000).

Therefore, and bearing in mind that innovation is one of the key elements of economic growth, we must consider that the Colombian industrial sector has been growing at a moderate rate. This behavior could be partially attributed to the low number of companies that innovate. The number of innovations that are finally achieved, since more than 60% of industrial companies in the country is non-innovative (Colombian National Department of Statistics [DANE], 2020), generates a loss of competitiveness in the industry.

Given the relevance of innovation and the complexity of the mechanisms needed to develop it, several scholars have tried to research its determining factors, including financial and organizational ones, such as collaboration between companies, skilled labor, spending in R & D, size of the company, structure of the market and profitability (Benito-Hernández et al., 2012; Bhattacharya & Bloch, 2004; Buesa et al., 2002; Love & Roper, 1999; Mohr, 1969). Likewise, there is strong evidence in the literature of a relationship between innovation and access to technological knowledge with large R & D sections in the company; which requires various elements such as a sufficient size for its financing, the possibilities of cooperation, the expected return, the ability to take risks and the human factor (Díaz, 1996). However, the literature is sparse regarding the effect of public aid on innovation and the variables that moderate this relationship.

Financial resources and public intervention in R&D

Some authors argue that private companies finance R&D activities to generate innovations and then protect them with patents, which will provide said companies with monopoly benefits, encouraging them to make new investments. It is also stated that, although investment in R&D is less than that made in physical capital, its execution generates better returns (Cooper & Helpman, 2004; Romer, 1990). Countries such as Finland, Japan, and Sweden have sponsored the increase of technological progress through Public investment in R&D. In contrast, in Latin America, the participation of the government in the promotion of scientific and technological activities is almost inexistent, this being a trend for the past several decades (Rivas-Aceves & Venegas-Martínez, 2010).

On the other hand, Public intervention in private R&D activities is based on market failures (Arrow, 1972) since the implementation of R&D activities generates knowledge that can be accessible and reproducible by other companies, discouraging any private investment. For this reason, the government intervenes through subsidies and special conditions credits to re-incentivize research activities, this time with public co-financing mechanisms (Ebersberger, 2005; Holmstrom & Myerson, 1983). Therefore, it would be expected that those companies that receive Public support for R&D activities achieve better results in terms of innovation than those that do not have this support.

Resources and capabilities

The Theory of Resources and Capabilities, or so-called Research Based View of the firm (RBV), studies the internal sources of superior performance that organizations possess and tries to explain the heterogeneity among the organizations in the matter of resource distribution and allocation, development of capabilities and superior performances (Barney, 1991; Peteraf, 1993; Teece, 1982; Wernerfelt, 1984). This theory explains that discrepancies between companies' innovative results can come from differences in their physical, technological, financial, human, administrative, knowledgebase, and experience resources (Helfat & Peteraf, 2009), as well as their capabilities (Barney, 1991; Grant, 1991).

Therefore, resources and capabilities are considered key elements of innovation when they are exclusive to the company, without the possibility of purchasing and consequent replication by competitors (Rumelt, 1984; Wernerfelt, 1984). In a particular way, capabilities play an important role since they allow companies to use their innovation supplies and materials in different manners. In some sense, more efficiently than their competitors (Torres-Barreto et al, 2016), for example, when firms develop a capability to create strong and perdurable relationships with innovation services or research centers, it is more probable to obtain innovations that reach the market (Alvarez-Melgarejo & Torres-Barreto, 2018). It is expected an innovative environment to proliferate among them.

Capabilities can be operative or dynamic; the former involves routines, and the latter involves adaptation to the constant changes in the environment (Eisenhardt & Martin, 2000; Hoopes et al., 2003; Teece et al., 1997; Teece & Pisano, 1994). Also conceived as complex, unique, rare, based on intangible assets, difficult to imitate and substitute, capabilities help boost revenue generation (Sánchez & Herrera, 2016). It is worth mentioning here, for example, special capability firms develop to absorb information from the environment, which according to some authors, depends jointly on investments that are made in the human and scientific capital as well as in their productive structures (Cohen & Levinthal, 1989, 1990; Fagerberg, 1987).

On the other hand, a firm's resources also play an important role in developing innovations. For example, the human resource that sometimes retains the explicit and tacit knowledge within companies is part of a set of complex constructions and evolves towards business skills associated with this resource, resulting in valuable, rare, and difficult to imitate (Brito & Oliveira, 2016). Depending on the companies' size, there are developed structures around their human capital and training, education, and specialization. In this sense, larger companies are prone to have highly developed and more efficient structures; therefore, it is expected that these companies can easily develop and gather knowledge (Palma et al., 2015). On the other hand, small and medium companies are more dynamic in comparison with large-size ones, which influences the generation and consolidation of knowledge. Undoubtedly in both types of companies, the characteristics associated with the qualifications and knowledge gathered through their human capital are especially relevant.

Another important set of skills linked to individuals is inter-organizational relationships capabilities since they are the ones who ease the process of development and acquisition of knowledge (Torres-Barreto et al., 2020; Lund, 2006) and the access to a better-quality information flow (Alvarez-Melgarejo & Torres-Barreto, 2018; Hervas-Oliver & Albors-Garrigos, 2009), allowing firms to generate more innovations. This leads to the following hypothesis:

𝑯 𝟐 : Companies that receive public funding for research and development activities increase their probability of obtaining innovative results depending on their human capital qualifications.

𝑯 𝟑 : Companies that receive public funding for research and development activities increase their probability of obtaining innovative results depending on their relationships with their environment's different institutions.

Methodology

Data Collection

This research utilized the Colombian Survey of Development and Technological Innovation (EDIT-VII). A robust database guarantees the data's internal consistency through established control and coverage procedures applied by DANE. This survey covers responses of companies with 10 or more employees, is conducted biannually, is of a census type, and contains statistical information about the technological dynamics and trends related to investment in research, development, and innovation activities.

Variable Selection

A detailed analysis of the variables from the “EDIT” survey was carried out, identifying those candidates for proxies of innovative results, public funding, human resource qualifications, and a firm's relationship with the surroundings. After a review process, those variables with little significant contributions to the research were refined, and it was determined that work would be done transversally, using data of 2014 and a reduced base of 42 variables with 1,989 companies finally treated.

Dependent Variable

The absence of general measures representing the different innovation dimensions led to constructing a proxy variable as Innovative Results (IR). To measure it, new or significantly improved products measure were used (see Figure 1), according to the Oslo Manual (Young, 1996). The results of business patents were excluded because not all innovations are patentable, nor are all innovations patented (Griliches, 1990). Following Romer (1990), although private companies try to protect their innovations through patents, not all knowledge ends up becoming a product protected by a patent or other protection mechanism for intellectual property.

The dependent variable was then built up by aggregating four variables in EDIT, which indicate the generation of new or improved goods or services by firms' side. This dependent variable is dichotomous and assumes the value = 1 when the company has registered at least one innovative result in the study period and zero otherwise.

Independent Variables

In this research, the authors worked with three independent variables:

Public Funding for R&D (PF). This variable is identified in the "EDIT" as the money from public institutions used by companies to make investments in scientific, technological, and innovation activities. This independent variable was transformed into a natural logarithm in order to correct the overdispersion.

Human Resource Qualification. This variable is identified in the “EDIT” as the qualified personnel that works in the company; according to their academic level, they are identified as Postgraduate, Tertiary, P & S, or None. This, considering that the level of education of employees involved in scientific, technological, and innovation activities may moderate the relationship between public funding and innovative results, from the perspective of human capital proposed by Schultz (1960).

Relationships with the surroundings. Considering that companies' relationships with their environment can affect their innovative results, this research constructed a categorical variable of four levels representing the company's capability to relate to its environment. This variable was built up from the possible relationship firms may have with 19 entities belonging to the National Science, Technology, and Innovation Department. If a company does not relate to any of these entities, its relation is null (Rnull). If it does it with 1 to 6 entities, its relationship is low (Rlow), in the case of relating to 7 to 13 entities, it is considered that it has an average relationship (Raverage), and, when it happens with more than 13 entities it is considered that its relationship with the surroundings is high (Rhigh). This variable is adopted based on the approaches of academics such as, Gómez (2009), Norman & Verganti (2014), and Verganti (2008), who emphasize the importance of companies interacting with the different actors in their environment.

Control Variables

This research used the company's size (ttemployees) and the total investment logarithm in scientific, technological, and innovation activities (Invtt) as control variables. We used the log transformation to normalize the data. The log-transformation is widely used in economic and psychosocial research to deal with skewed data. This log transformation intends to decrease data variability and make data conform more closely to the normal distribution.

Results

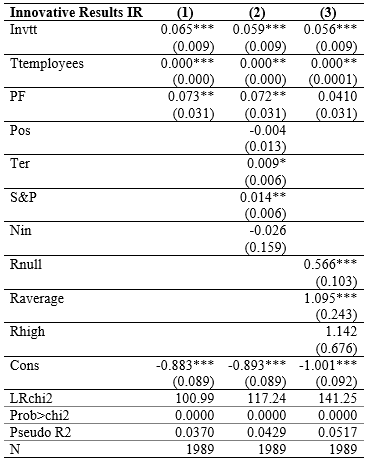

To contrast the hypotheses, the software STATA was used. Since this research's purpose relies on the probability of obtaining innovative results, a regression model of qualitative response, "logit," was tested, considering it allows to determine the probability of occurrence of an event with two possible outcomes (Gujarati, 2011). The results of this model are presented in Table 1. Column 1 presents the results obtained from the direct relationship between public funding investment and the innovative results obtained by firms. Column 2 shows the moderating effect of human capital qualification on the relationship between public funding and companies' acquirement of innovative results. Column 3 shows the moderating effect of the ability of companies to relate to stakeholders of their environment.

Table 1: Logisticsregression Results

Note: Standard error in parentheses. Significance level: p<0.10*, p<0.05**, p<0.01*** Source: the authors.

This estimate allows us to observe two things; 1) there is a positive and significant influence of 5% of the money coming from public entities for R&D over the companies' innovative results; that is, this variable increases the probability of occurrence of the event.2) This probability is moderate and influenced by variables such as human capital and relationships with other companies.

According to the results, the probability of achieving innovative outcomes increases when qualified human capital and interaction with some entities within their environment are included in the model, showing a significant influence (between 1% and 10%).

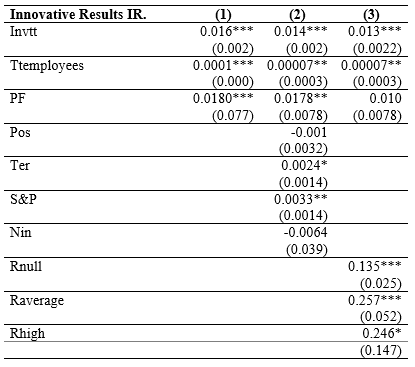

When calculating the marginal effects, presented in Table 2, it is also evident that human resource that has tertiary education (Ter) and secondary and primary (S&P) completed have a strong influence on the probability of firms in obtaining innovative results. It firms hiring employees with tertiary education, it increases by 0.24% the probability of obtaining new or improved goods or services. As far as employees with primary or secondary education, it increases in 0.33% the probability of getting an innovation by firms' side.

Table 2: MarginalEffects

Note: Standard error in parentheses. Significance level: p<0.10*, p<0.05**, p<0.01*** Source: the authors.

Also, it is found that the significance level of the variables in column 1 of Table 2 to Table 1 does not vary, except for the variable PF that goes from having a positive and significant effect of 5% to 1%. For its part, in column 2 is observing that all the variables retained their level of significance; while in column 3, the variable "Rhigh" went from being not statistically significant to have a significance of 10%.

Discussion

The results obtained by using the Logit probabilistic model allow hypothesis 1 to be accepted to indicate that companies with access to more public resources to invest in scientific, technological, and innovation activities are more likely to obtain innovative results (Column 1, Table 2). These results are congruent with previous studies realized in Singapore, some European countries, China, and Germany, where the positive and significant effects of public funding for R&D on innovation activities are evident. These studies verified that companies are more likely to innovate when they receive R&D subsidies (Wong & He, 2001; Zhang & Liu, 2010; Hanel, 2003; Albors-Garrigos, & Rodríguez, 2011). The marginal effects in this model suggest that for every 1% that increases investment with public resources, companies' probability of obtaining innovative results will increase by 2%. These results are consistent with the findings of Benavente (2005), who indicates that the presence of public funding in companies means taking into account innovation as a catalyst for productivity. Additionally, the results suggest that a subsidy in R&D activities enables innovation in companies, therefore increasing their productivity in terms of public policies.

On the other hand, about hypothesis 2, it is evident that the inclusion of human capital moderates the relationship between public funding and obtaining innovative results, maintaining its significance level as observed in column 2 of Table 2. The results indicate that the qualification of workers represent a key element to increase the probability of achieving innovations when public resources are used for this purpose, given that the personnel skills and knowledge are essential to take proper advantage of resources and generate innovations (González & Hurtado, 2012; Castellanos, 2003; Nelson & Phelps, 1966). In this way, hypothesis two is accepted.

Human capital, in turn, has a significant effect on the dependent variable. The findings indicate that, faced with an increase of an employee with undergraduate or primary and secondary education, the probability of obtaining innovative results increases by 0.24% or 0.33%, respectively. On the other hand, an increase of an employee without any educational level reduces companies' probability to achieve innovations by 0.64%, which means that the shortage of qualified personnel affects the innovative processes (González & Hurtado, 2012; Nelson & Phelps, 1966). It is important to note that out of the total number of skilled workers in Colombian industrial companies, only 4% perform scientific, technological, and innovation activities, and 0.58% of the overall total are doctors. Additionally, on average, the work teams in these processes are comprised of 10 people, which allows establishing a relationship between the low employability of people with postgraduate degrees, the reduced number of workers in "STIA” and its non-significant effect to achieve innovative results in the industrial sector. There is a negative effect on the variable related to the Ph.D. level of qualification. This is probably due to the type of innovations that this model measures. They include innovations much more related to close-to-market products and services, while doctors may be related to other types of results as patents or utility models.

On the other hand, concerning hypothesis 3 (Column 3, Table 2), the findings indicate that the ability of companies to interact with actors of the National Science and Technology Department moderates the relationship between public resources and innovative results, where a reduction of the effect and the significance of public resources in the dependent variable can be observed.

Additionally, when a company has a low relationship with actors of the National Science, Technology and Innovation System, the probability of having innovative results is 13.5%, when this relationship is of an “average” size, the probability increases to 25.7%, and when it is high, it reaches 24.6%, while those companies that do not relate to any of these actors, their probability of obtaining innovations is zero. Therefore, when companies relate to National Science and Technology Department actors, their probability of innovating increases in significant amounts.

These results are consistent with what is stated by Bernal-Torres & Blanco-Valbuena (2017), who indicate that the relationships of companies with the diverse environment actors make product innovation possible. Additionally, they contrast with the studies carried out by Verganti & Öberg (2013) y González & Hurtado (2012), who also express those external actors play an important role since they add new perspectives, knowledge, skills, technology, resources, and capabilities in the search for profitable and innovative activities.

Conclusion

This research studies the effect that the investment of public resources has on private R&D activities, more precisely, its effects on companies' innovative results. Also, two moderating de variables of this relationship were considered: human resource qualifications and the organization's ability to relate to its environment. From the analysis, it is highlighted that the Colombian industry has a reduced number of innovations: 5.7% of the companies studied managed to include new or significantly improved goods or services in the national market during 2014, and the outlook is more discouraging when noting that only 0.5% of the organizations managed to develop innovations in the international market.

The analysis results show that public funding affects, although low, statistically significant on companies' innovative results. Therefore, it can be affirmed that the greater the public resources allocated to companies to invest in technology, science, and innovation, the greater are the probability that they will achieve innovative results; this aspect has also been verified by the researches of Wong & He (2001), Zhang & Liu (2010), Hanel (2003), Albors-Garrigos & Rodríguez (2011) , although they are carried out in other countries, they indicate the influence of public resources in R&D on innovative results.

Furthermore, it can be observed that the level of education of employees exerts a positive moderating effect on the relationship between the investment of public resources and obtaining innovative results. Additionally, this level of schooling, which is understood as a specialized resource that companies have available, has a positive and significant effect on the dependent variable, that is, on the innovative results themselves. It should be noted that, for the Colombian case, in particular, only 0.058% of the personnel hired at "STIA" are doctors and 3.65% have master's degrees, which reflects the weakness of the industry concerning the academia in this sense, since the majority of hiring of this type of people is taking place in the academic field, which may contribute to explain the effect of these variables on the innovative results of the industrial sector, together with the type of variable selected as “innovative results” which could be more linked to results close to the industry. This statement is reinforced by the fact that, of the total number of workers in the Colombian industry, only 4% are dedicated to science, technology, and innovation.

These results reaffirm what has been mentioned by various investigations that the scarcity of resources (financial and human) imposes limits for innovation strategies (González & Hurtado, 2012; Nelson & Phelps, 1966; Pereiras & Huergo, 2006).

In this way, this work validates the moderating effect of the ability to relate to National Science and Technology Department actors in the relationship between the investment of public resources and the achievement of innovative results and their positive influence on the dependent variable studied. This is in line with what has been pointed out by researchers such as Bernal-Torres & Blanco-Valbuena (2017), who indicate that the relationship with external actors makes the development of innovations possible.

This contribution can be of great importance for the formulation of policies that favor the interrelation between the industry and National Science and Technology Department members, as well as for CEOs and business managers insofar as it will allow the establishment of business strategies that seek to increase the innovation results of their companies.

This study's contribution to the literature is the proposal of an alternative measure for the innovations achieved by companies, its statistical estimation, which goes beyond patents, utility models, or industrial secrets, as it appears recurrently in literature. This is because company innovations respond to the dynamics of countries that still exhibit incipient levels in terms of innovations in the industrial sector, as is the case of Colombia and in most Latin American countries and the Caribbean. Additionally, it is shown that the resources and capabilities of a company influence the number of innovations achieved, given that the sample data indicate that the greater the investment in R & D processes, the greater the probability for the achievement of such innovations; this also influenced by other variables such as human capital qualifications and the relational ability.

It is then recognized that innovation is a complex process involving hundreds of variables, both internal and external, so it is recommended that future studies should provide more in-depth knowledge of other variables that influence innovative processes in the industry.