Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Citado por Google

Citado por Google -

Similares en

SciELO

Similares en

SciELO -

Similares en Google

Similares en Google

Compartir

Ecos de Economía

versión impresa ISSN 1657-4206

ecos.econ. vol.18 no.39 Medellín jul./dic. 2014

ARTÍCULO DE INVESTIGACIÓN

The Rational Expectations Hypothesis: An assessment on its real world application*

La Hipótesis de Expectativas Racionales: Una evaluación de su aplicación en el mundo real

Santiago Tobón*

* Facultad de Economía, Universidad de los Andes, Colombia. Calle 19A No. 1-37 Este Bloque W, Bogotá, Colombia. [s.tobon11@uniandes.edu.co].

Recibido: 22/07/2014 Aprobado: 11/11/2014

Abstract.

The Rational Expectations Hypothesis was first developed as a theoretical technique aimed at explaining agents' behavior in a given environment. In particular, it describes how the outcome of a given economic phenomenon depends to a certain degree on what agents expect to happen. Subsequently, it was introduced into macroeconomic models as a way to explain the ineffectiveness of monetary policy. Since then, most of these models have been based on the rational expectations assumption. This paper assesses the real life application of this feature based on two arguments: the determination of an objective reality through beliefs and subjective expectations; and the exclusion of the evolution of human knowledge and innovation in macroeconomic models.

Keywords. Rational Expectations; Macroeconomic Models; Reality in Economic Models; Innovation and Human Knowledge

JEL Classification: B41, B50, D84

Resumen.

La Hipótesis de Expectativas Racionales fue desarrollada en principio, como una herramienta teórica cuyo objetivo era explicar el comportamiento de los agentes en un escenario dado. En particular, procuraba describir cómo el resultado de un fenómeno económico depende en cierto grado de lo que los agentes esperan que ocurra. Posteriormente, el concepto fue introducido en los modelos macroeconómicos como un medio para explicar la ineficiencia de la política monetaria. Desde ese momento, la mayoría de estos modelos han encontrado su fundamento en el supuesto de expectativas racionales. Este artículo evalúa la aplicación que tiene el concepto de expectativas racionales en el mundo real con base en dos argumentos: la determinación de una realidad objetiva a través de creencias y expectativas subjetivas; y la exclusión de la evolución del conocimiento humano y la innovación en los modelos macroeconómicos.

Palabras clave. Expectativas Racionales; Modelos Macroeconómicos; Realidad en Modelos Económicos; Innovación y Conocimiento Humano

1. Introduction

The rational expectations hypothesis was originally suggested by John (Jack) Muth 1 (1961) to explain how the outcome of a given economic phenomena depends to a certain degree on what agents expect to happen. This conceptual feature was popularized by several following economists, notably Robert Lucas through the Expectations and the Neutrality of Money model (1972) and the so called Lucas Critique (1976), which constituted a milestone on the assumption of rational instead of adaptive expectations into macroeconomic models and whose original ideas remain in most of recently produced economic literature. This paper aims to provide a consideration on two arguments that may challenge the real world application of this feature, namely: i) the determination of an objective reality through aggregating subjective beliefs and expectations, and ii) the exclusion of the evolution of knowledge and innovation into macroeconomic models.

The paper is structured as follows. Section 1 draws a general context on which the Rational Expectations Hypothesis was formulated and generalized. Section 2 develops an assessment of the Rational Expectations Hypothesis under two different arguments: it first analyzes the relationship between the actual behavior of the economy and the expectations' formation process, then it turns to the consequences of limiting the scope of macroeconomic models because of the exclusion of the evolution of knowledge and innovation. Section 3 concludes.

2. The Rational Expectations Hypothesis

The formal specification of the rational expectations hypothesis was developed by John Muth in his Rational Expectations and the Theory of Price Movements (1961). Further works on the subject were published by Sargent and Wallace (1971) and Sargent (1972), however, it was until Lucas (1972, 1976) that the concept was widely spread among economists. In a recent discussion panel, Robert Lucas described the fact that turned rational expectations into what it is nowadays:2

I can tell you about me and Tom [Sargent] and Neil [Wallace]. Muth's idea was that if you take a policy that changes the time series characteristics and some of the variables that you were trying to forecast, people are going to be changing in their forecast rule, and you better have a model that explains exactly how that change occurs...

Now, then came the macro stuff: When Tom and Neil and I started plugging the same principles that Jack [John Muth] had advised into Keynesian models... Jack didn't care about Keynesian economics, and it wouldn't have occurred to him to use that as an illustration, but it occurred to us. Neil and Tom took an IS-LM model and just changed the expectations and nothing else, and just showed how that seemingly modest change completely, radically alters the operating characteristics of the system... It was helping to answer some real questions about macro policy, and his, Muth's, ideas start to really matter. There's no question that we got some undue credit for the basic concept, where what we had, I would say, was a more sexy implementation of an idea that Muth had offering a boring implementation of. [sic]

These events occurred since the beginning of the 60's up to the early 70s when monetary policy was partly driven by the Neoclassical Phillips curve. It was generally accepted that low levels of unemployment could be attained by sustained high levels of inflation. Furthermore, a ''sacrifice ratio''3 was defined as the points of GDP that needed to be waived in order to reduce inflation by one percent, implying a direct correlation of output and inflation levels due to monetary policy. By the time, the effectiveness of monetary policy was in the center of the debate (Friedman, 1968) and Lucas (1972) provided a model on which only unexpected monetary shocks could have real effects arguing that because of agents' rational expectations anticipated shocks would only alter prices. Two consequences of his conclusions were the further abandonment of the assumption of adaptive expectations, which was understood to carry out systematic forecasting errors and a reorientation of macroeconomic theory. Strong debates were developed between neoclassical economists and those that followed Lucas theory.

Lucas' seminal islands model

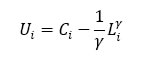

Lucas model is based on different individuals (i) distributed in the same number of islands. Each of them producing output (Qi) which is sold at price (Pi). The general price level of the economy is defined by and individual prices are built up from the general price and specific idiosyncratic shocks ri, where Pí = P + ri . Adjustments on Pi are generated either by or and precise information on the source is unknown by the agent. Individual employment generates the respective output . A budget constraint states that total income equals total consumption , where consumption goods are paid at the general price. Since individuals like consumption and dislike labor their utility is defined as:

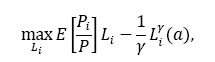

where y > 1 stands for convex disutility of labor. Provided Ci = PiQi/P and Qi, the maximization problem for the individual is stated as:

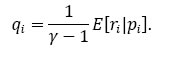

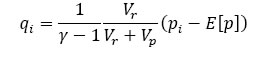

the solution yields:4

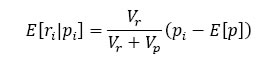

Under the assumptions of independence and normal distribution of  = α and βpi, and the estimation of through an OLS regression with α, β constants,

= α and βpi, and the estimation of through an OLS regression with α, β constants,  can be expressed as:

can be expressed as:

thus, the change in individual output is:

where Vr and Vp stand for the historical volatility (variance) of r and p respectively. Hence, aggregate supply and demand are:

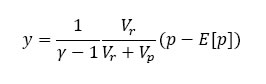

Supply:

Demand:

y = m - p

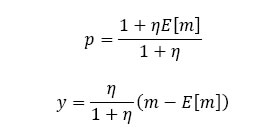

and equilibrium prices and output are:

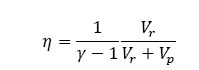

where:

It is straightforward to visualize Lucas' conclusions. Note first that money supply is positively correlated with both prices and output, therefore if prices are intended to be reduced through monetary shocks, output decreases too. Moreover, it can be observed that real effects can only be attained through monetary shocks when the change in money supply (m) is different than the expected shock (E[m]). Furthermore, in a time dependent model the effect of the shock would be expected to last for one period, this is, the event would be incorporated into the information set on which agents base their expectations and this will directly determine the following behavior of the economy. If a Central Bank was to follow a systematic rule to introduce monetary shocks, agents' rational expectations imply they forecast the shocks (m = E[m])and thus no real effect can be attained.

Hence, an important element to highlight on the Rational Expectations Hypothesis is that the original formulation by John Muth was not necessarily intended to be introduced intro Keynesian models. The central work on this respect was developed by Robert Lucas, who used this theoretical feature in order to provide a more formal framework for the ineffectiveness of monetary policy. Lucas work had a massive effect on economic theory and therefore the Rational Expectations Hypothesis was generalized into most of the subsequent macroeconomic models.

3. Empirical challenges

Subjective beliefs and objective reality

The conceptual apparatus of the rational expectations hypothesis relies on two main elements. On the one hand there is the objective future: what, limited to the scope of a given macroeconomic model, is really going to happen. On the other hand there is the individual expectations' formation process, where the formal claim is that those expectations should coincide with forecasts built up from economic theory. The central argument on this respect is that if indeed forecasts from economic theory were more precise than those of the agents, there would be a profit opportunity for the ''insiders'' who knew the information. Therefore, those profit opportunities would no longer be present on the event that agents' expectations coincide with economic theory (Muth, 1961).

Furthermore, the Rational Expectations Hypothesis links these two elements by stating that in fact, what happens in reality is a consequence of agents' expectations. As a practical example, the final price of a given agricultural commodity, let's say coffee, directly depends on the total plantation area in producing economies, which also depends on the prices at which farmers in those countries expect to sell the coffee beans.

Hence, reality in macroeconomic models on rational expectations is actually derived directly from the expectations' specification. A strong consequence is therefore that reality becomes irrelevant once the expectations are formed, and thus there are macroeconomic models with completely opposite conclusions founded on the rational expectations assumption. An example borrowed from Gertchev (2007) can be the most representative: RBC and New Keynesian models which incorporate the rational expectations assumption lead to completely opposite conclusions, while the former states that monetary policy is irrelevant (following Lucas' conclusions), the latter claims otherwise. The irrelevance of reality, while need not to be taken into account in every macroeconomic model, may stand as a limitation for further applications leading to interesting economic conclusions.

Back to Lucas' model, it is clear that the conclusions derived from it are directly related to the assumptions made. The final output equation could perhaps be open to the possibility that expected monetary shocks could have real effects if there were endogenous factors in the expectations' formation process that allowed for mistakes made by the agents, in which case the link between the expectations and the actual behavior of the economy could be interrupted. As it is conceived now, the way E[m] is formed directly determines m.

Evolution of human knowledge

Popper (1957) developed an argumentation in order to prove a theory in which the evolution of human knowledge cannot be foreseen. As conceived, it is originally focused on criticizing historicism, however, its application can be extended to different social sciences providing a strong epistemological background to them:

The course of human history is strongly influenced by the growth of human knowledge. We cannot predict, by rational or scientific methods, the future growth of our scientific knowledge.

By themselves, these claims raise interesting questions to the Rational Expectations Hypothesis and its use in economics, especially when thinking about how, in reality, agents' expectations evolve. Subsequently, he makes direct reference to economics invoking some particular exceptions that may be present when testing social theories:

The argument does not, of course, refute the possibility of every kind of social prediction; on the contrary, it is perfectly compatible with the possibility of testing social theories --for example, economic theories-- by way of predicting that certain developments will take place under certain conditions. It only refutes the possibility of predicting historical developments to the extent to which they may be influenced by the growth of our knowledge.

This additional explanation has two ideas that can be of help in understanding how rational expectations are applied to macroeconomic theory. First, Popper clarifies that his arguments does not necessarily comes against testing economic theories under a specific framework, namely predicting certain developments under certain circumstances. This approximation can be taken in favor of the Rational Expectations Hypothesis, and this is so because since its introduction into economics the central aim has been to develop models which answer specific questions under artificial, unreal conditions (Lucas, 1980).

Secondly, he rejects the attempts to forecast historical developments when there may be a direct influence of the evolution of human knowledge. Contrary to the previous approach, this extension sets an immediate challenge to the application of rational expectations in economics when broader aims are intended by using macroeconomic models. Although it need not exclude the possibility of using it in specific cases as stated above, it is clear that innovation and human knowledge dramatically influence economic events (Rosenberg, 2004). Furthermore, the precise element in which models created under the Rational Expectations Hypothesis fail to overcome to this idea is the need for a complete pre-specification of agents' behavior and expectations, leaving aside the possibility of non-routine changes and innovation (Frydman and Goldberg, 2007).

It is definite that innovation cannot be foreseen and this is not a particular shortcoming to the Rational Expectations Hypothesis, however, different approaches may provide more powerful frameworks that help better in understanding economic phenomena. 5

4. Conclusions

As a relevant fact in the origins of the Rational Expectations Hypothesis, it is important to notice that it was first developed as a theoretical technique to explain agents' behavior in a given environment. Subsequently, it was introduced into macroeconomic models in order to provide a formal, explicit proof to the ineffectiveness of monetary policy. The success was such that this feature was widely popularized in economic theory and most of macroeconomic models developed ever since are founded in the rational expectations assumption.

This assessment describes two possible challenges for the further applicability of rational expectations in macroeconomics:

- The fact that agents' expectations determine the actual behavior of the economy stands for the irrelevance of reality in macroeconomic models. This characteristic may limit the scope of economic events that can be explained by economic sciences whenever reality depends on external factors that agents cannot always assimilate. Important results could be obtained by means of different behavioral models where the link between agents' expectations and reality would for instance work in the opposite direction at given moments of time (i.e. sometimes reality determines agents' expectations).

- When developing a macroeconomic model based upon the assumption of rational expectations, agents' behavior needs to be completely pre-specified in the model. In a time when innovation plays such an important role in economics and human evolution, new conceptualizations of agents' expectations are needed in order to take into account endogenous characteristics in individuals' decision process and behavior.

By attempting to identify weaknesses in one of the most important assumptions in macroeconomics, this paper invites to permanently review relevant theoretical features in economics. Elements such as the representative agent, perfect competition and rational expectations need to be tested again in order to improve the scope of macroeconomic models providing a better understanding of economic phenomena. This stands for the need to have economic sciences as an essential aspect in human evolution.

* I am grateful to Michel De Vroey at the Catholic University of Louvain for his most important insights into the history of economic thought as well as for providing feedback for this assessment.

1 Herbert Simon (1956) introduced a similar concept in his certainty equivalence article, although he didn't directly named it rational expectations. See Hoover and Young (2011).

2 See Hoover and Young (2011), Rational Expectations: Retrospect and Prospect, a panel discussion with Michael Lovell, Robert Lucas, Dale Mortensen, Robert Shiller and Neil Wallace, moderated by Kevin Hoover and Warren Young

3 Formally, the sacrifice ratio is , with being the sum of output loses, and the change in trend inflation over time. See Mankiw (1994)

4 It can be attained through the development of first order conditions with respect to Li and defining pi =logPi, p=logP and qi = logQi so the lowercase letters denote the change in each variable.

5 An interesting work in progress has been developed by Frydman and Goldberg (2007) under the name of Imperfect Knowledge Economics.

References

Friedman, Milton. (1968). The Role of Monetary Policy. American Economic Review, 58, 1-17. [ Links ]

Frydman, Roman and Michael D. Goldberg. (2007). Imperfect Knowledge Economics: Exchange Rates and Risk. Princeton University Press. [ Links ]

Frydman, Roman and Michael D. Goldberg. (2008). Macroeconomic Theory for a World of Imperfect Knowledge. Capitalism and Society, 3(1) 1-76. [ Links ]

Frydman, Roman. (2010). Life after Rational Expectations? Institute for New Economic Thinking Conference, King's College, Cambridge. April 8-11, Conference. [ Links ]

Gertchev, Nikolay. (2007). A Critique of Adaptive and Rational Expectations,'' Quarterly Journal of Austrian Economics, 10, 313-329. [ Links ]

Hoover, Kevin and Warren Young. (2011). Rational Expectations: Retrospect and Prospect. A panel discussion with Michael Lovell, Robert Lucas, Dale Mortensen, Robert Shiller and Neil Wallace. Center for the History of Political Economy at Duke University, CHOPE Working Paper No. 2011-10. [ Links ]

Lucas, Robert E., Jr. (1972). Expectations and the Neutrality of Money. Journal of Economic Theory, 4(2), 103-124. [ Links ]

Lucas, Robert E., Jr. (1976). Econometric Policy Evaluation: a Critique. Carnegie-Rochester Conference Series on Public Policy, 1, 19-46. [ Links ]

Lucas, Robert E., Jr. (1980). Methods and Problems in Business Cycle Theory. Journal of Money, Credit and Banking, 12(4, Part 2), 696-715. [ Links ]

Mankiw, N. Gregory. (1994). Monetary Policy. The University of Chicago Press. Chicago. [ Links ]

Muth, John F. (1961). Rational Expectations and the Theory of Price Movements. Econometrica, 29(3), 315-335. [ Links ]

Rosenberg, Nathan. (2004). Innovation and Economic Growth. OECD, Paris. [ Links ]

Sargent, Thomas J. (1972). Rational Expectations and the Term Structure of Interest Rate,'' Journal of Money, Credit and Banking, 4(1), 74-97. [ Links ]

Sargent, Thomas J. and Neil Wallace. (1971). Market Transaction Costs, Asset Demand Functions, and the Relative Potency of Monetary and Fiscal Policy,'' Journal of Money, Credit and Banking, 3(2, Part 2), 469-505. [ Links ]

Sargent, Thomas J. and Neil Wallace. (1975). Rational Expectations, the Optimal Monetary Instrument, and the Optimal Money Supply Rule. Journal of Political Economy, 83, 241-254. [ Links ]

Simon, Herbert. (1956). A Comparison of Game Theory and Learning Theory. Psychometrika, 21(3), 267-272. [ Links ]

Stiglitz, Joseph. (2010). An Agenda for Reforming Economic Theory. Institute for New Economic Thinking Conference. King's College, Cambridge. April 8-11. Conference. [ Links ]