1. Introduction

In recent decades, and with increased financial liberalization worldwide, the banking industry has experienced significant changes. This financial liberalization has had a significant impact on banks’ performance, attracting the attention of specialists in economic and financial policy.

Regarding market structure, several studies have shown that market concentration improves banks’ performance since it allows them to have greater control over industry prices (Shepherd, 1983; Molyneux & Thornton, 1992). In this scenario, larger banks obtain greater advantages as they are able to scale the provision of financial services (Berger, 1995). However, other studies have provided contrary findings, opening again the debate surrounding market structure and banking performance. These studies argue that when the banking sector is excessively concentrated, their resulting pursuit of the “quiet life” reduces their efforts to maximize profits (Smirlock, 1985; Demirgüç-Kunt & Huizinga, 1999; Staikouras & Wood, 2004).

This debate has also been extended to the effects of income diversification on banking performance. Widespread financial liberalization has also facilitated the development of non-traditional activities such as securities trading, investments and insurance, among others. Common production technology for various financial products has meant that economies of scope generate greater benefits than economies of scale. This has transformed income diversification into a source of improved banking performance (Deng & Elyasiani, 2008; Demirgüç-Kunt & Huizinga, 2010; Sanya & Wolfe, 2011; Meslier, Tacneng, & Tarazi, 2012). However, there are also studies that support the idea that income diversification generates greater risk for banks, especially when the costs of these strategies can not be covered (Stiroh, 2006; Stiroh & Rumble, 2006).

This lack of consensus leads us to believe that the effects of market concentration and income diversification on banking performance are not persistent. Moreover, the subprime crisis in the United States, where banks took advantage of regulatory loopholes and other institutional weaknesses to develop riskier and more diversified activities, revealed the fragility of a concentrated and diversified banking industry. In this sense, we believe that the reversal of the positive effect of both factors is due to a non-linear relationship with banking performance. This is relevant because it would imply the existence of threshold values for the effects of market concentration and income diversification on banking performance, which is useful for the design of financial and banking stability policies. It is relevant for banks as it allows them to precisely design their diversification strategies and action incentives within the industry.

Our objective is to analyze the effect of market concentration and income diversification on banking performance. Our contributions to the empirical evidence can be summarized in two points. First, we evaluate the potential non-linear effect of market concentration on banking performance as a way to evaluate the trade-off between banks’ monopolistic behavior and their efforts to maximize profits. Second, we also analyze a possible non-linear effect of income diversification on banking performance. We believe that there is a trade-off between the benefits of economies of scope and economies of scale for firm profitability.

We used a sample of 134 countries extracted from World Bank databases between 1994 and 2011. Our results support that market concentration and income diversification have positive and non-linear effects on banking performance. The non-linear relationship of these factors reveals that their effects are not persistent and are reverted for high levels of market concentration and income diversification. Income diversification even reduces banking performance in periods of economic crisis. These results are relevant for banks because they allow them to evaluate the design of income diversification strategies and limit the incentives to concentrate the banking industry. For regulators and policymakers, they are also relevant for financial policy design aimed at regulating the structure and activities of the banking sector. It is possible to infer the effect of market structure and income diversification on bank performance from the qualities of the banking markets of each country.

This article is structured as follows. After this introduction, section 2 provides a literature review of the relationship between market concentration, income diversification, and banking performance. This section also states our research hypotheses. Section 3 presents the data and methodology, while section 4 shows the results obtained. Finally, section 5 indicates the conclusions and implications of this study.

2. Theoretical framework and hypothesis

2.1 Effect of market concentration on banking performance.

According to various studies, banking industry structure is a relevant factor influencing banks’ performance. The seminal works of Klein (1971) and Monti (1972) formulated the theoretical relationships that associate improved banking performance with a more concentrated banking industry.

There are several studies and arguments that support the positive relationship between banking performance and market concentration. Some studies based on structure-conduct-performance hypothesis (SCP) indicate that when banks develop monopolistic behavior they obtain advantages that allow them to control interest rates and industry prices. These conditions lead to improved performance. As a result, several researchers have supported this approach for developed markets such as the United States and Europe (Bourke, 1989; Molyneux & Thornton, 1992) as well as in emerging markets (Garza-García, 2012; Guillén, Rengifo, & Ozsoz, 2014). Other studies suggest that the positive relationship between market concentration and banking profitability is due to the banks can reduce their production costs by distributing them through higher production of financial services (Shepherd, 1983). Berger (1995) adds that larger banks take advantage of scale factors that allow them to obtain greater advantages and returns. This is the “efficient structure” hypothesis, also known as the “relative-market-power hypothesis” (RMP). Chortareas, Garza-Garcia, and Girardone (2011(, in an empirical study based on Latin American banks between 1997 and 2005, found evidence in favor of this hypothesis. Their results show that market concentration is associated with a broader financial product portfolio that allows banks to reduce their operational activity costs.

Through empirical analyses of both hypotheses, some scholars have concluded that market concentration increases banking performance, since banks benefit from developing monopolistic behaviors (Martínez-Peria & Mody, 2004; Athanasoglou, Brissimis, & Delis, 2008; Gelos, 2009; Jara, Arias, & Rodriguez, 2014). This phenomenon can be observed in a banking industry with few banks (Tregenna, 2009), and where the large banks obtain the greatest profits in the sector due to a broader financial products portfolio (Maudos & Fernandez de Guevara, 2004).

However, there are those who remain skeptical, arguing that the aforementioned effect on banking performance is marginally reversed when market concentration is high. This negatively impacts on banking performance and has collateral effects on financial stability and the creation of non-banking institutions. Goddard, Molyneux, and Wilson (2004) have shown through a dynamic panel data model applied to European banks that the effect of market share on banking performance is not significant. They suggest that, in comparison to banks with greater market power, banks with small market share can achieve greater returns because they operate within specific and riskier niches. Similar results have emerged from other studies (Smirlock, 1985; Demirgüç-Kunt & Huizinga, 1999; Staikouras & Wood, 2004; Carbó & Rodríguez, 2007; Mirzaei, Moore, & Liu, 2013). Chortareas et al. (2011) and Behname (2012) warn that if the banking market tends towards a monopoly, profitability can decrease as institutions become less efficient. Other scholars add that this negative relationship could be due to banks with greater market power becoming inefficient as they neglect the goal of maximizing profits (Berger & Hannan, 1998). Zhang, Jiang, Baozhi, and Wang (2013) in their work on BRICS countries indicate that the negative effect of market concentration on banking performance is explained by a pursuit of a “quiet life” whereby banks tend to diminish their efforts to maximize profits.

Finally, a possible non-linear relationship between market concentration and banking performance is not an illogical idea. Although there is no concrete evidence, some studies may help to support this hypothesis. Boyd and De Nicoló (2005) conclude in their research that higher interest rates (as a result of greater concentration in the credit market) increase the debt burden for borrowers, the incentive to participate in riskier projects and the probability of defaults. These aspects negatively affect banks’ returns. In this way, the positive effect of market concentration on banking performance is not persistent, due to this adverse selection problem and the creation of an environment conducive to a “quiet life”. According to these arguments we propose the following hypothesis:

H1: Market concentration has a non-linear effect on banking performance.

2.2 Effect of income diversification on banking performance.

Income diversification is another relevant determinant for banking performance. Although some empirical evidence has shown that income diversification is beneficial for banking performance, there is no consensus.

Banking products have similar productive technology. Banks can take advantage of economies of scope to distribute their production costs across various financial products (Gregoire & Mendoza, 1990). For this reason, several empirical studies have argued that income diversification increases profitability. Elsas, Hackethal, and Holzhäuser (2010) analyzed 380 banks from Australia, Canada, France, Germany, Italy, the UK, the US, Spain and Switzerland between 1996 and 2008. Their results corroborated the positive effect of income diversification on banking performance. The authors add that this impact generates a greater market value for banks. Lee, Hsieh, and Yang (2014) analyzed 2372 banks from 29 countries in the Asia-Pacific region between 1995 and 2009, and found similar results. These empirical findings have been corroborated by other studies for both developed and emerging economies (Deng & Elyasiani, 2008; Demirgüç-Kunt & Huizinga, 2010; Fang, Hasan, & Marton, 2011; Sanya & Wolfe, 2011; Meslier et al., 2012; Amediku, 2012; Jara et al., 2014). Even the positive effects of income diversification are consistent with the RMP hypothesis as banking efficiency is achieved by distributing production costs across a diversified financial services portfolio and concentrated banking industry.

Other studies provide a different vision and results. For instance, they indicate that income diversification also has collateral effects, such as performance instability and higher bank risk (Stiroh, 2004a, 2004b, 2006; Stiroh & Rumble, 2006; Demirgüç-Kunt & Huizinga, 2010). Accordingly, Chiorazzo, Milani, and Salvini (2008) analyzed Italian banks and showed that income diversification generated a trade-off between risk and return, which conditioned its impact on performance. In fact, the higher risk from income diversification strategies reduced performance. Berger, Hasan, and Zhou (2010), in a study of Chinese banks, showed that income diversification effectively reduces banking performance and increases costs. Ben and Plihon (2011) analyzed 714 banks from East Asia and Latin America and found evidence that corroborates these findings. Such conclusions can also be found in the work of other researchers (DeYoung & Rice, 2004; Acharya, Hasan, & Saunders, 2006; Baele, De Jonghe, & Vander-Vennet, 2007; Lepetit, Nys, Rous, & Tarazi, 2008; De Jonghe, 2010; Fiordelisi, Marques-Ibanez, & Molyneux, 2011). It would seem that greater income diversification is a source of adverse selection that increases risk and reduces performance. We believe that the impact of income diversification is non-linear, and although there may initially be a positive relationship between diversification and performance, this relationship is reversed at high levels of diversification as a result of higher risk. Accordingly, we propose the following hypothesis:

H2: Income diversification has a non-linear effect on banking performance.

3. Data and methods

3.1. Data

The data used in this research was extracted from Global Financial Development (GFDD) and World Development Indicators (WDI), both World Bank databases. The data covers the period between 1994 and 2011. Based on this information, we constructed panel data for 134 countries.

Table 1 presents the geographical distribution of those countries. As shown, 30.60% (41 countries) of the sample are developed countries, while emerging countries represent 69.40% (93 countries). Europe concentrates the highest proportion of developed countries (80.49%), while Latin America and the Asia-Pacific region are the main emerging markets. The geographical distribution of the sample reveals a somewhat more equitable distribution, except for counties in Sub-Saharan Africa and North America.

Table 1 Sample distribution, percentage (countries)

| Region | Developed | Emerging | Total |

| Sub-Saharan Africa | - | 4,30 (4) | 2,98 (4) |

| Latin America | - | 35,48 (33) | 24,62 (33) |

| Asia-Pacific | 7,31 (3) | 36,56 (34) | 27,61 (37) |

| Europe | 80,49 (33) | 5,37 (5) | 28,35 (38) |

| Middle East | 4,87 (2) | 18,27 (17) | 14,17 (19) |

| North America | 7,31 (3) | - | 2,23 (3) |

| Total | 30,60 (41) | 69,40 (93) | 100,00 (134) |

Source: Own elaboration.

Table 2 provides a description of the variables. The dependent variable is banking performance (BPER), measured by return on assets (ROA). According to several studies, this ratio compares the net profit generated by banks of a particular country to their total assets. Therefore, this measure is a global performance indicator for these institutions (Bourke, 1989; Mercieca, Schaeck, & Wolfe, 2007; Athanasoglou et al., 2008; Goddard, McKillop, & Wilson, 2008; Jara et al., 2014; Yahya, Akhtar, & Tabash, 2017). We also use net interest margin (NIM) as an alternative measure for banking performance in the robustness analysis.

Some variables were also used as measures of market concentration. First, we used the five largest banks’ asset concentration in each country. Williams (2003) and Chen and Liao (2011) suggest that the concentration ratio indicates the possible barrier to entry for other financial intermediaries. Therefore, a higher concentration ratio is related to a less-competitive banking industry and improved performance for banks (Molyneux & Thornton, 1992; Beck, Demirgüç-Kunt, & Levine, 2006; Athanasoglou et al., 2008; Jara et al., 2014). Second, we used the Lerner and Boone indices as competition measures. According to Berger, Klapper, and Rima (2009) and Chen and Liao (2011) an increase in the Lerner index indicates a higher degree of monopoly in the banking industry, and therefore a deterioration of the competitive conduct of financial intermediaries. Any value within this range indicates a noncompetitive market structure for a country’s banking sector (Klein, 1971; Monti, 1972). Similar arguments correspond to the Boone Index. Both the Lerner and Boone Indices are used as market power measures associated with less-competitive banking markets and a potentially greater degree of industry concentration. The empirical data of this research reveals that the correlation between the asset concentration ratio and the Lerner Index was 0.12, while between the concentration ratio and the Boone Index it was 0.11. In both cases, the correlations were statistically significant.

We measured income diversification through the percentage of nontraditional or non-operating activity income to total income (Baele et al., 2007; Stiroh, 2004a, 2004b; Stiroh & Rumble, 2006; Chiorazzo et al., 2008; Deng & Elyasiani, 2008; Fang et al., 2011; Meslier et al., 2012; Jara et al., 2014).

Table 2 Variables

| Variable | Definition |

| A. Dependent variable | |

| Bank performance-ROA | Return on assets ratio |

| Bank performance-NIM | Net interest margin |

| B. Banking industry-level variables | |

| Bank concentration | Assets of five largest commercial banks as a share of total commercial banking assets |

| Lerner Index | Market power index. It varies between 0 (competitive market) and 1 (concentrated market). |

| Boone Index | Elasticity of bank profits to marginal costs. |

| Bank diversification | Bank noninterest income to total income ratio |

| Non-performing loans | Non-performing loans on gross bank loans |

| Financial stability | Financial stability indicator |

| Bank liquidity | Bank credit provided to private sector total deposits |

| Bank capital | Bank capital and reserves to total assets ratio |

| Financial Development | Domestic credit provided by banking sector to GDP |

| Operating efficiency | Gross margin ratio |

| C. Macroeconomic-level variables | |

| Economic crisis | Dummy takes value 1 in Asian and Subprime crisis periods and 0 otherwise |

| Economic growth | Annual GDP growth |

| Inflation | Annual inflation rate |

| D. Institutional-level variables | |

| Political stability | Political stability index that varies between -2,58 and 2,58 |

| Rule of law | Rule of Law index that varies between -2,58 and 2,58 |

Source: Own elaboration.

The analysis also incorporates other control variables suggested by empirical studies. At the banking industry level, we used the capitalization ratio to quantify the impact of banks’ financing on performance (Goddard et al., 2008; Gul, Irshad, & Zaman, 2011); the credits to deposits ratio as a proxy for liquidity and growth opportunities (Maudos & Solis, 2009; Gul et al., 2011; Yahya et al., 2017); the non-performing loans to total bank loans ratio as a measure of operational risk exposure faced by banks and the quality of their assets (Jara et al., 2014); and the bank credits to GDP ratio as a proxy for banks’ degree of penetration (King & Levine, 1993). We also used the gross margin ratio to quantify the role of operational efficiency (Martínez-Peria & Mody, 2004; Gelos, 2009) and the Z-Score indicator as a proxy for banking system stability.

At the macroeconomic level, we used economic growth, annual inflation rates and the dummy variable denoted by crisis as control variables. These variables were suggested by Demirgüç-Kunt, Laeven, and Levine (2004), Gul et al. (2011) and Yahya et al. (2017) amongst other authors. At the institutional level, we used the political stability and rule of law indices. These indices vary between -2.58 and 2.58, where positive (negative) values indicate higher (lower) political stability and respect for investors’ rights (Girma & Shortland, 2008; Roe & Siegel, 2011; Marcelin & Mathur, 2014; Montes, Mendonça, & Oliveira 2016).

3.2. Econometric methodology

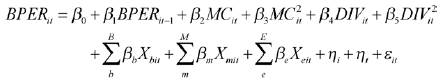

To determine the effect of market concentration and income diversification on banking performance we estimated a dynamic panel data regression using the GMM estimator proposed by Arellano and Bover (1995). The empirical model is:

Where BPER it is the dependent variable that measures the banking performance of the country i in the period t. The variable MC it measures banking market concentration, which was measured through the five largest banks’ asset concentration, Lerner index and Boone Index. Income diversification (DIV it ) was measured through non-traditional income to total bank income ratio. Note that model (1) incorporates the variables MC 2 it and DIV 2 it to control the possible non-linear effects of market concentration and income diversification on banking performance. Model (1) incorporates other control variables, at industry, macroeconomic and institutional system levels, grouped in the matrices X bit , X mit and X eit respectively. Finally, Ʃ it is the remaining random disturbance.

Model (1) includes individual fixed-effects ƞ i related to country i and temporary effects ƞ t linked to year t. The model also includes dummy variables to measure unobservable heterogeneity across geographic zones and countries’ income levels. The dynamic panel data model proposed by Arellano and Bover (1995) is widely used to control the endogeneity problem. In this case, endogeneity lies in the lag of banking performance (BPER it-1 ) and banks’ operational risk (NPL it ). According to Stiglitz and Weiss (1981), bank performance and operational risk are endogenous variables. When banks seek higher returns, interest rates will increase and therefore their assets portfolio becomes more risky. The risk increase is consistent with the adverse selection problem. Therefore, if banks reduce their risk, a reduction in performance would be expected. These variables were instrumentalized through the t-2 and t-3 lags. For the model to be correctly specified, Arellano and Bover (1995) point out that these estimators must be consistent and the model must be instrumentally overidentified. To ensure the consistency of GMM estimators the presence of first-order autocorrelation was required (but not of a higher order); while the instrumental overidentification of the model was verified through the Sargan Test. Model (1) was estimated with robust variance to control heteroskedasticity patterns.

4. Empirical results

4.1 Descriptive analysis

Table 3 shows the descriptive and correlational statistics. At an international level, banking industry performance shows an average return on assets of 1.37%. Within this figure there is a contrast between the inferior performance of banks in developed countries (0.54%) and the higher return of banking in emerging countries (1.65%). The NIM has a similar pattern. This disparity is significant, showing that the structural characteristics of emerging markets offer the conditions for superior performance.

Banking markets are not competitive. The five largest banks have 79.58% of banking assets on average, while the Lerner index has an average value of 0.24. The results also show significant differences between developed and emerging markets. Emerging economies have a more concentrated banking structure, even above the world average. In any case, it is observed that both market concentration measures correlate positively and significantly with banking performance. Similar results are shown in the Boone index.

Income diversification indicates that 38.40% of bank income comes from non-operational (nontraditional) activities, a figure that rises to 39.82% in developed countries and falls to 37.92% in emerging markets. The difference between these markets is significant. It is observed that income diversification is positively related to banking performance, an idea that supports the view that banks obtain higher benefits from economies of scope than economies of scale.

Table 3 Descriptive statistics and correlations

| Variable | Total | Developed | Emerging | ||||||

| Mean | S.D | Correlation | Mean | S.D | Mean | S.D | tstatistics | ||

| A. Dependent variable | |||||||||

| Bank performanceROA | 1,37 | 3,11 | 1,00 | 0,54 | 5,04 | 1,65 | 2,03 | (-4,85)*** | |

| Bank performanceNIM | 3,96 | 2,62 | 0,16*** | 2,39 | 1,60 | 4,76 | 2,67 | (-21,62)*** | |

| B. Banking industry-level variables | |||||||||

| Bank concentration | 79,58 | 19,78 | 0,094*** | 73,27 | 21,41 | 84,39 | 1916 | (-5,28)*** | |

| Lerner Index | 0,24 | 0,15 | 0,208*** | 0,18 | 0,11 | 0,26 | 0,15 | (-12,37)*** | |

| Boone Index | 0,09 | 0,20 | 0,252*** | -0,05 | 0,16 | 0,17 | 0,23 | (-9,71)*** | |

| Bank diversification | 38,40 | 14,91 | 0,054*** | 39,82 | 13,02 | 37,92 | 15,47 | (2,84)*** | |

| Non-performing loans | 6,57 | 7,09 | -0,346*** | 4,46 | 5,49 | 8,38 | 7,79 | (-9,29)*** | |

| Financial stability | 15,33 | 10,07 | 0,130*** | 14,60 | 9,17 | 15,58 | 10,35 | (-2,02)** | |

| Bank liquidity | 97,86 | 62,15 | -0,037*** | 115,43 | 49,35 | 90,38 | 65,45 | (9,45)*** | |

| Bank capital | 8,48 | 3,15 | 0,283*** | 6,99 | 2,58 | 9,81 | 3,01 | (-15,86)*** | |

| Bank development | 59,84 | 55,02 | -0,153*** | 112,88 | 65,46 | 44,58 | 40,31 | (25,15)*** | |

| Operating efficiency | 43,32 | 17,63 | 0,086*** | 41,31 | 16,48 | 43,99 | 17,95 | (-3,23)*** | |

| C. Macroeconomic-level variables | |||||||||

| Economic growth | 3,99 | 5,65 | 0,115*** | 3,05 | 3,36 | 4,27 | 6,14 | (-6,48)*** | |

| Inflation | 22,57 | 462,28 | -0,053*** | 6,71 | 42,44 | 27,61 | 529,98 | (-3,79)*** | |

| D. Institutional-level variables | |||||||||

| Political stability | 0,148 | 0,951 | -0,083*** | 0,819 | 0,545 | -0,155 | 0,941 | (26,48)*** | |

| Rule of law | 0,265 | 0,971 | -0,118*** | 1,199 | 0,602 | -0,156 | 0,795 | (38,42)*** | |

Superscripts ***, **, * indicate statistical significance at 1, 5, and 10 percent, respectively.

Source: Own elaboration.

At the banking industry level, the variables also show interesting results. The Z-Score index indicates an average of 15.33, which demonstrates the high financial stability of banking worldwide. On average, 8.48% of bank assets are financed with capital, which indicates a heavy dependence on external financing, while banks obtain an average gross margin of 43.32%. Regarding these figures, we observe that emerging markets have a more stable banking system, with higher capital requirements and greater costs control efficiency. It should be noted that financial stability, bank capital requirements and operational efficiency correlate positively and significantly with banking performance.

Other banking system characteristics, such as operational risk, bank liquidity and the degree of banking development, are negatively correlated with performance. On average, 6.57% of bank loans are delinquent, 97.86% of bank deposits are converted into credits, and bank credit penetration amounts to 59.84% of GDP. It should be noted that developed countries show the lowest levels of non-performing loans (4.46%), as well as more advanced bank development (112.88%) and greater liquidity (115.43%) than emerging countries.

Regarding macroeconomic characteristics, an annual growth of 3.99% is observed. The low growth of the developed countries stands out, with a figure of 3.05%, contrasts with the greater activity of emerging countries, which is above average. The variables that measure political stability and rule of law show obvious differences between developed and emerging countries. Descriptive results show that institutional development in developed countries is significantly higher than in emerging ones. Furthermore, it appears that institutional characteristics are both negatively and significantly correlated with bank performance. Preliminarily, this result would indicate that greater bank performance is related to national institutional weaknesses.

4.2 Effect of market concentration and income diversification on banking performance

Table 4 shows the results of model (1). According to Arellano and Bover (1995), the GMM estimators are consistent because the z-test denoted as AR1 reveals the presence of first-order autocorrelation, but the AR2 test discards the second order autocorrelation. In addition, the Sargan test indicates that the model is instrumentally overidentified, while the Wald test supports global significance for all models.

Some control variables report the expected results according to empirical evidence. At the banking industry level, factors such as capital requirements, operational efficiency and financial stability have a positive and significant effect on banking performance. These results suggest that banks’ returns increase due to greater external financing autonomy (Jara et al., 2014), greater control of costs (Martínez-Peria & Mody, 2004; Gelos, 2009) and operating in a financially sound banking system (Yahya et al., 2017). Contrary to these results, non-performing loans and banking development have a negative and significant impact on performance. This indicates that an increase in operational risk reduces profitability, while financial development leads to stricter regulations that could limit banks’ behavior and their returns (Athanasoglou et al., 2008; Yahya et al., 2017). At the macroeconomic level, GDP growth has a positive and significant impact, which shows that banking performance is directly linked to economic activity (Revell, 1979; Demirgüç-Kunt & Huizinga, 2000; Bikker & Hu, 2002). Finally, inflation and periods of economic crisis have the expected negative effect (Jara et al., 2014).

Table 4 GMM regression for bank performance

| Variables | Dependent variable as measured by Banks’ ROA | |||||

| Banking market structure: | ||||||

| (a) Assets concentration | (b) Lerner index | (c) Boone index | ||||

| Constant | 0,1462** | 0,0905*** | 0,0237 | 0,0339 | 0,0022 | 0,0079 |

| (2,56) | (2,69) | (0,82) | (0,97) | (1,16) | (0,83) | |

| Bank performancet-1 | 0,2485*** | 0,2603*** | 0,2852*** | 0,2718*** | 0,3081*** | 0,2894*** |

| (4,01) | (3,29) | (3,73) | (2,89) | (3,17) | (3,63) | |

| Bank diversification and market structure | ||||||

| Bank concentration | 0,1028*** | 0,1163*** | 0,0293*** | 0,0302*** | 0,2169** | 0,2385*** |

| (3,93) | (5,25) | (4,63) | (5,01) | (2,55) | (3,14) | |

| Bank concentration square | -0,0689*** | -0,0766*** | -0,0317*** | -0,0338** | -0,7248*** | -0,7425*** |

| (-3,58) | (-6,21) | (-2,73) | (-2,52) | (-3,37) | (-4,11) | |

| Bank concentration critical value | 74,60% | 75,91% | 0,46 | 0,45 | 0,15 | 0,16 |

| Bank diversification | 0,0561*** | 0,0493*** | 0,0517*** | 0,0572*** | 0,3585*** | 0,3562*** |

| (3,12) | (4,77) | (2,59) | (2,74) | (3,28) | (3,53) | |

| Bank diversification square | -0,0595*** | -0,0564*** | -0,0611** | -0,0624*** | -0,4312*** | -0,3968*** |

| (-2,76) | (-3,91) | (-2,44) | (-3,08) | (-3,72) | (-4,01) | |

| Bank diversification critical value | 47,23% | 43,71% | 42,32% | 45,75% | 41,57% | 44,88% |

| Diversification × Crisis | -3,1725*** (-5,33) | -2,8626*** (-2,73) | -2,0125*** (-3,13) | |||

| Diversification × Crisis× Emerging | -2,5371*** (-6,18) | -1,8462** (-2,41) | -1,1941*** (-2,74) | |||

| Industrial-level control variables | ||||||

| Non-performing loans | -0,1794*** | -0,1825*** | -0,1835*** | -0,1381*** | -0,2014*** | -0,1951*** |

| (-10,59) | (-12,06) | (-9,65) | (-9,77) | (-5,57) | (-4,98) | |

| Financial stability | 0,0006*** | 0,0006*** | 0,0007*** | 0,0005*** | 0,0006*** | 0,0005*** |

| (4,93) | (5,68) | (3,87) | (4,29) | (4,14) | (3,82) | |

| Bank liquidity | 0,0019 | 0,0011 | 0,0024 | 0,0028* | 0,0008 | 0,0014 |

| (0,97) | (0,72) | (1,57) | (1,71) | (0,86) | (1,18) | |

| Bank capital | 0,0637*** | 0,0958*** | 0,1317*** | 0,1053*** | 0,1128*** | 0,1305*** |

| (3,59) | (5,17) | (3,02) | (2,95) | (4,72) | (3,67) | |

| Bank development | -0,0133*** | -0,0156*** | -0,0102*** | -0,0116*** | -0,0111*** | -0,0125*** |

| (-4,25) | (-4,10) | (-2,63) | (-3,21) | (-2,90) | (-3,39) | |

| Operating efficiency | 0,0203*** | 0,0199*** | 0,0161*** | 0,0144*** | 0,0219*** | 0,0205*** |

| (5,25) | (5,73) | (3,77) | (3,90) | (3,18) | (3,64) | |

| Macroeconomic-level control variables | ||||||

| Economic growth | 0,0158** | 0,0173*** | 0,0231*** | 0,0197*** | 0,0148*** | 0,0182*** |

| (2,47) | (2,98) | (2,86) | (2,62) | (3,21) | (3,02) | |

| Inflation | -0,0275** | -0,0291*** | -0,0537*** | -0,0368*** | -0,0309*** | -0,0352*** |

| (-2,37) | (-3,29) | (-4,28) | (-2,69) | (-3,10) | (-3,84) | |

| Crisis | -0,6935*** | -1,2852*** | -0,7365*** | -0,9672*** | -0,9916*** | -0,8241*** |

| (-3,18) | (-4,59) | (-3,31) | (-4,12) | (-3,57) | (-3,26) | |

| Institutional-level variables | ||||||

| Political stability | -0,0173*** (-2,75) | -0,0149** (-2,51) | -0,0182*** (-3,02) | -0,0165*** (-2,61) | -0,0155*** (-2,74) | -0,0193*** -3,28) |

| Rule of law | -0,0117*** (-2,65) | -0,0105** (-2,27) | -0,0124*** (-2,73) | -0,0109** (-2,41) | -0,0121*** (-2,80) | -0,0128*** (-2,96) |

| AR1 | (-3,19)*** | (-3,03)*** | (-3,66)*** | (-3,42)*** | (-2,97)*** | (-3,21)*** |

| AR2 | (-1,08) | (-0,75) | (-0,86) | (-0,91) | (-1,02) | (-1,29) |

| Sargan test | (42,38) | (45,83) | (39,02) | (40,27) | (39,28) | (41,17) |

| Wald | (606,13)*** | (559,38)*** | (634,22)*** | (583,93)*** | (621,06)*** | (610,35)*** |

| Dummy year | Yes | Yes | Yes | Yes | Yes | Yes |

| Dummy income | Yes | Yes | Yes | Yes | Yes | Yes |

| Dummy zone | Yes | Yes | Yes | Yes | Yes | Yes |

z-statistics in bracket. Superscripts ***, **, * indicate statistical significance at 1, 5, and 10 percent, respectively. Source: Own elaboration.

Market structure is a relevant factor. Our results indicate that the five largest banks’ asset concentration, Lerner index and Boone index have a positive and significant effect on performance. This result is not a novelty, since an extensive research literature has demonstrated that market concentration increases returns (Bourke, 1989; Molyneux & Thornton, 1992; Demirgüç-Kunt et al., 2004; Martínez-Peria & Mody, 2004; Athanasoglou et al., 2008; Jara et al., 2014). However, the effect of market concentration is nonlinear, validating hypothesis H1. The positive effect of market concentration on performance is observed at low concentration levels (Goddard et al., 2004). However, when the five largest banks’ asset concentration exceeds a threshold of 75.26% (the average of critical values indicated in Table 4), the Lerner index exceeds the critical value of 0.46 (the average of critical values indicated in Table 4 and the Boone index exceeds the critical value of 0.16, the effect reverses and becomes negative. Thus, above these threshold values, the phenomenon of banks seeking a “quiet life” impacts on performance and reduces profitability (Carbó & Rodríguez, 2007; Zhang et al., 2013).

Income diversification strategies are another relevant factor acting on performance. It is noted that the diversification variable has a positive and significant effect on banks’ ROA. Income diversification generates higher returns as a result of economies of scope, which promote a multi-product banking industry, being more profitable than economies of scale. This result is in line with several studies (Deng & Elyasiani, 2008; Elsas et al., 2010; Demirgüç-Kunt & Huizinga, 2010; Fang et al., 2011; Sanya & Wolfe, 2011; Meslier et al., 2012; Jara et al., 2014; Lee et al., 2014). However, the effect of income diversification on banking performance is not linear, a result that validates hypothesis H2. When the non-traditional income to total bank income ratio exceeds the average threshold value of 44.24%, the positive effect of diversification is diluted and becomes negative. This second effect of income diversification shows that risk predominates over risk-return trade-off (Berger et al., 2010; DeYoung & Rice, 2004; Acharya et al., 2006; Lepetit et al., 2008; De Jonghe, 2010; Fiordelisi et al., 2011). Therefore, economies of scope are less predominant in comparison to economies of scale. The interactive variable (DIV × CRISIS) is negative and significant for all models. Periods of economic crisis and contraction impose higher costs on banks which offer a more diverse portfolio of services. This leads banks to cut back on nontraditional activities, and therefore, to become more specialized. This result contradicts the findings of Jara et al. (2014).

4.3 Robustness analysis.

In this section we analyze the robustness of our estimations. To do this, we used the net interest margin as an alternative measure of bank performance. Model (1) was estimated through the GMM estimator proposed by Arellano and Bover (1995). This regression satisfies the necessary conditions for consistency and specification according to the autocorrelation and overidentification tests, respectively. To correct the endogeneity problem caused by non-performing loans and bank performance in t-1, these regressors were instrumentalized through the t-2 and t-3 lags

Table 5 GMM regression for bank performance

| Variables | Dependent variable as measured by Banks’ NIM | |||||

| Banking market structure: | ||||||

| (a) Assets concentration | (b) Lerner index | (c) Boone index | ||||

| Constant | 0,0396 | 0,0411* | 0,0451*** | 0,0517*** | 0,0179** | 0,0217*** |

| (1,28) | (1,76) | (4,37) | (5,08) | (2,02) | (2,71) | |

| Bank performancet-1 | 0,2051*** | 0,1975*** | 0,2461*** | 0,2418*** | 0,2593*** | 0,2344*** |

| (2,63) | (2,89) | (3,66) | (3,12) | (3,95) | (4,02) | |

| Bank diversification and market structure | ||||||

| Bank concentration | 0,0177*** (2,79) | 0,0192*** (3,01) | 0,0194*** (3,12) | 0,0165*** (2,88) | 0,0252*** (3,37) | 0,0293*** (3,52) |

| Bank concentration square | -0,0122*** (-3,25) | -0,0129*** (-3,53) | -0,0218*** (-2,83) | -0,0201*** (-2,66) | -0,0697*** (-2,96) | -0,0753*** (-3,36) |

| Bank concentration critical value | 72,54% | 74,42% | 0,44 | 0,41 | 0,18 | 0,19 |

| Bank diversification | -0,0203*** (-2,61) | -0,0192*** (-2,77) | -0,0288*** (-2,83) | -0,0238*** (-3,19) | -0,0745*** (-4,15) | -0,0825*** (-3,91) |

| Bank diversification square | 0,0219*** (3,02) | 0,0203** (2,55) | 0,0309*** (2,91) | 0,0276*** (2,59) | 0,0832*** (3,67) | 0,0897*** (3,88) |

| Bank diversification critical value | 46,35% | 47,29% | 46,60% | 43,12% | 44,77% | 45,98% |

| Diversification × Crisis | 0,0348*** (3,01) | 0,0296*** (2,65) | 0,0187** (2,46) | |||

| Diversification × Crisis × Emerging | 0,0211*** (2,73) | 0,0187** (2,32) | 0,0172*** (2,60) | |||

| Industrial-level control variables | ||||||

| Non-performing loans | -0,0542*** | -0,0597*** | -0,0489*** | -0,0407*** | -0,0631*** | -0,0578*** |

| (-4,15) | (-3,94) | (-2,59) | (-3,03) | (-4,44) | (-4,13) | |

| Financial stability | 0,0002 | 0,0001 | 0,0001 | 0,0002 | 0,0002* | 0,0002* |

| (1,17) | (0,96) | (1,02) | (1,42) | (1,69) | (1,73) | |

| Bank liquidity | -0,0129** | -0,0157** | -0,0148*** | -0,0137*** | -0,0112*** | -0,0125*** |

| (-2,36) | (-2,55) | (-2,78) | (-2,59) | (-2,63) | (-3,00) | |

| Bank capital | 0,1228** | 0,1486*** | 0,1151** | 0,1394*** | 0,1015** | 0,1191*** |

| (2,45) | (3,02) | (1,97) | (2,64) | (2,51) | (2,79) | |

| Bank development | -0,0101*** (-3,10) | -0,0123*** (-3,57) | -0,0089*** (-2,92) | -0,0071** (-2,44) | -0,0095*** (-2,67) | -0,0107*** (-3,12) |

| Operating efficiency | 0,0171*** (2,65) | 0,0205*** (3,16) | 0,0187*** (2,86) | 0,0193*** (3,02) | 0,0178** (2,55) | 0,0159** (2,21) |

| Macroeconomic-level control variables | ||||||

| Economic growth | 0,0275*** | 0,0304*** | 0,0147*** | 0,0136*** | 0,0221*** | 0,0259*** |

| (3,25) | (3,47) | (2,88) | (3,01) | (2,89) | (3,38) | |

| Inflation | -0,0501*** | -0,0493*** | -0,0545*** | -0,0612*** | -0,0558*** | -0,0531*** |

| (-4,58) | (-3,85) | (-5,11) | (-4,27) | (-3,63) | (-3,55) | |

| Crisis | -0,2773*** | -0,2185** | -0,2182** | -0,2749*** | -0,3651*** | -0,3092*** |

| (-3,02) | (-2,19) | (-2,15) | (-2,75) | (-3,17) | (-3,43) | |

| Institutional-level variables | ||||||

| Political stability | -0,0266*** (-3,11) | -0,0208** (-2,39) | -0,0254*** (-2,97) | -0,0212** (-2,10) | -0,0237*** (-2,61) | -0,0281*** (-3,02) |

| Rule of law | -0,0202*** (-2,77) | -0,0225*** (-2,96) | -0,0199*** (-2,61) | -0,0153** (-2,23) | -0,0239*** (-3,12) | -0,0187** (-2,35) |

| AR1 | (-2,73)*** | (-2,85)*** | (-3,17)*** | (-3,35)*** | (-3,15)*** | (-2,94)*** |

| AR2 | (-0,99) | (-0,90) | (-0,73) | (-0,85) | (-1,16) | (-1,41) |

| Sargan test | (38,75) | (39,01) | (40,16) | (43,36) | (42,10) | (43,36) |

| Wald | (113,85)*** | (131,03)*** | (112,09)*** | (121,35)*** | (141,37)*** | (133,95)*** |

| Dummy year | Yes | Yes | Yes | Yes | Yes | Yes |

| Dummy income | Yes | Yes | Yes | Yes | Yes | Yes |

| Dummy zone | Yes | Yes | Yes | Yes | Yes | Yes |

z-statistics in brackets. Superscripts ***, **, * indicate statistical significance at 1, 5, and 10 percent, respectively.

Source: Own elaboration.

Table 5 shows the results. As in the case of the results described in Table 4, the control variables have the same effects on banking performance, with the exception of the negative and significant effect of liquidity.

Regarding interest variables, similar results are observed that support the robustness of the estimation. On the one hand, market structure has a positive and non-linear effect on banking performance. The five largest banks’ asset concentration, the Lerner index and Boone index have threshold values of 73.48%, 0.43 and 0.19, respectively. These figures are similar to those obtained previously which separate the effects of market concentration on bank performance.

On the other hand, income diversification also has a negative and non-linear effect on net interest margin. This result is consistent with the previous positive effect of income diversification on ROA. The net interest margin is an specialized banking performance measure related to purely operational activity. Therefore, an increase in income diversification reduces the proportion of operating income in relation to total bank income, but increases global performance (Jara et al., 2014). A similar argument applies to the impact of income diversification on net interest margin in periods of economic crisis.

5. Conclusions and discussion

The banking system is relevant to the macroeconomic and financial functioning of a country. Due to its systemic relevance, several studies have examined the factors that explain bank performance, finding different determining factors both at a macroeconomic and industrial level.

In recent decades, the impact of globalization in international markets, the increase in foreign investment and financial liberalization, have allowed banks to diversify their product and income portfolios, and concentrate the banking market. These phenomena have also had an impact on bank performance. Although there is not a complete consensus in the scholarly literature, several empirical studies have shown that banking performance increases with income diversification and market concentration. In this matter, the data worldwide show relevant differences between economies. Banks from emerging countries exhibit superior performance, receive higher income from non-traditional activities and exist within market structures which are more concentrated in relation to the banking industry of developed countries. Such differences are relevant to the elaboration of financial policy and banking strategies.

Our research further explores these questions and analyzes the effects of market concentration and income diversification on banking performance. The main findings and implications of this research can be summarized in two points. First, market structure is a relevant factor acting on performance. Our results suggest that a more concentrated market promotes superior performance. However, this effect is not persistent and it reverses at high levels of concentration. These results are robust in terms of market concentration and banking performance measures. These findings have important implications for banks and regulators. For banks, our results provide evidence that limits their incentives to concentrate the banking industry by indicating that high market concentration is related to reduced efforts to maximize efficiency. For regulators our findings establish quantifiable parameters for the design of financial policy aimed at 1) limiting market concentration and 2) reducing the consequent negative effects on industry stability.

Secondly, income diversification improves banking performance. This result shows that banks obtain greater advantages from economies of scope than economies of scale, benefiting from a multi-product industry. The non-linear relationship observed suggests that this type of strategy imposes a trade-off between profitability and adverse selection from a diversified financial products portfolio, where for high levels of diversification the adverse selection effect generates a reversal of the initial positive impact. Diversification strategies additionally reduce performance during crises as it is more challenging to cover the production costs of non-traditional activities. Our results establish relevant implications for banks and banking regulators, since they allow them to establish policy parameters on non-traditional activities. Our results also suggest that banks adapt their strategies between diversification and specialization according to levels of economic activity, reducing the degree of diversification to sustain performance in periods of economic contraction. This also has implications for public policy. Our research provides a key result for regulatory standards from the Basel Committee on Banking Supervision (BCBS). Previously critical values might be the basis for quantifying new requirements necessary to financial stability.

From these results, avenues for future research can be established. We believe that the institutional environment and degree of financial development can affect the impact of market concentration and income diversification on banking performance. These possible relationships could differentiate financial policy design worldwide, even more if one considers that countries promote institutional and financial development as a pillar of foreign investment.