1. Introduction

Firm growth, especially for small firms, has been widely studied over recent decades, and even now it remains a subject of great interest among academics, managers, and policy makers (Gilbert McDougall, & Audretsch, 2006; Henrekson & Johansson, 2010; McKelvie & Wiklund, 2010; Wiklund, Patzelt, & Shepherd, 2009). Since the publication of Theory of the Growth of the Firm in 1959 by Edith Penrose, most studies have been focused on predicting and describing differences in growth rates between firms by analyzing different variables and factors that affect growth, yet almost all empirical models of growth have low explanatory and predictive power (Baum, Locke, & Smith, 2001; Davidsson, Achtenhagen, & Naldi, 2006; McKelvie & Wiklund, 2010; Wright & Stigliani, 2012). Based on those studies, we noticed a substantial heterogeneity in both the theoretical framework and the amount of factors associated with firm growth (McKelvie & Wiklund, 2010), since research regarding SME growth focuses mainly on variability in terms of quantity, while ignoring the different patterns of growth (Davidsson et al., 2006; Delmar, Davidsson, & Gartner, 2003). As a result, we decided to focus on growth strategies and their relationship to a company’s resources and capabilities, using Resource-Based View (RBV) and Institutional Theory (IT) as base frameworks.

Substantial recent research on firm growth has widened the study of different growth patterns or strategies (Pasanen, 2007). An example would be work by Lockett, Wiklund, Davidsson, and Girma (2011), who analyzed the sequencing of growth strategies to discover the influence of organic and acquisitive growth rates over future growth. Other authors have identified the effect that an SME’s different internal characteristics, such as scale of operation, firm age, product and customer structures (Pasanen, 2007), or even size (Brenner & Schimke, 2015; Coad, Segarra, & Teruel, 2016) have on growth strategies.

Based on RBV (Barney, 1991), it is possible to state that specific resources and capabilities (R&C) are associated with different growth strategies (Chen, Zou, & Wang, 2009; Nason & Wiklund, 2018; Zou Chen, & Pervez, 2010). In turn, choosing a specific growth strategy presents different challenges to managers, allowing them to seize opportunities that allow the firm to grow (Delmar et al., 2003; Hamilton, 2012; Nason & Wiklund, 2018). Therefore, the allocation of A&C is associated with the growth strategies selected, but also with the opportunities and aspirations pursued by the firm. Research on different growth strategies, especially in emerging economies (in this case Mexico), remains limited, therefore it is necessary to investigate the effects these strategies have and the differences they entail. In this sense, we decided that analyzing R&C in relation to the growth strategies chosen by firms in Mexico can help us better understand growth in this region, as well as the connection between R&C and growth strategies.

Attending McKelvie and Winklund’s (2010) calling for more research along these lines, we decided to analyze the antecedents of growth strategies. We selected three growth strategies based on previous studies (McKelvie & Wiklund, 2010). We believe that each growth strategy requires and uses different R&C and allocates resources differently in order to fulfill specific aspirations and seize opportunities (Chandler & Hanks, 1994; Nason & Wiklund, 2018). Firms pursuing organic growth are likely to place emphasis on technological resources and internal technological knowledge to grow (De Kluyver, 1977; Kukko, 2013); firms pursuing acquisitive growth have strong finances enabling them to purchase other firms and access their resources (Agnihotri, 2014; Levie, 1997; McCann, 1991); and firms pursuing hybrid growth focus on strong networking capabilities and networking relationships (Velasco-Gutiérrez, Montoya, & Capelleras, 2019; Williamson, 1991; Zou et al., 2010).

The organic growth strategy is sometimes considered as the default for SMEs, but firms can opt for the acquisitive or hybrid growth strategy, with each having different goals and advantages (Brown, Mawson, & Mason, 2017). Another study concluded that firms adjusting to new markets maintain their positions through innovation and, once adjusted, they seek to diversify the businesses and grow by developing technology and opening subsidiaries (Đogić, 2017). Firms with resources, normally that have emerged from a previous firm, can choose to grow through acquisitions, although more research is needed (Brown et al., 2017). One study found that SMEs go through acquisitions strategically to grow, especially abroad, though financial and managerial resources are necessary for purchase and integration. Said resources tend to be lacking in new firms, but the study found that acquisitions are important for some firms, regardless of size and age (Mawson & Brown, 2017). Meanwhile, hybrid growth strategy is an option that allows firms to compensate for the resources they may lack, to obtain the firm’s specialized technology, or as a strategy that allows them to more easily enter a market (Brown et al., 2017). It has been found that managers use networking in order to gain access to knowledge and resources, while also getting external help when expanding globally (Thompson-Elliott, 2016).

It has been discussed in previous works that some institutional factors also affect a company’s growth; where a favorable environment improves performance, but an adverse one does not entail a negative, direct impact (Audretsch, Coad, & Segarra, 2014; Bamiatzi & Kirchmaier, 2012; Baumol, 1990; Pasanen, 2007; Williams & Vorley, 2015). In this sense, some emerging economies with weak institutions are particularly characterized by having unstable environments and more unexpected changes of general circumstances than developed economies do (Bruton, Ahlstrom, & Li, 2010; Diaz & Vassolo, 2010; North, 1990). Some studies of Latin American economies show that external, institutional factors, such as macroeconomic conditions and public policies, may affect a firm’s growth (Capelleras & Rabentino, 2008).

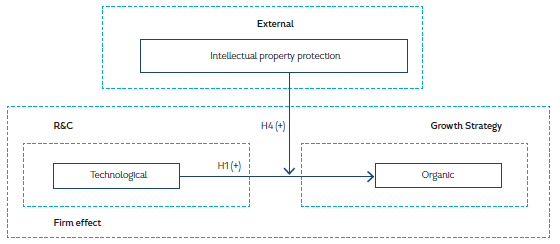

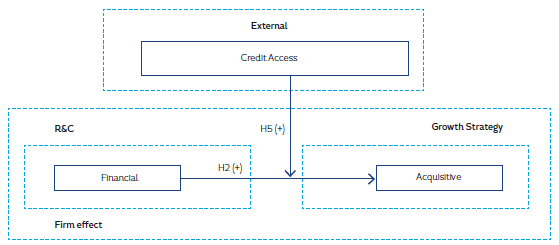

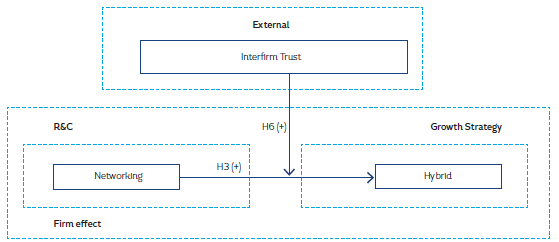

After establishing the relationship between R&C and growth strategies, and by using IT, we based our research on previous studies to analyze the moderating effects of institutional factors on firm growth. Specifically, we selected the intellectual property protection (IPP) regime (Candelin-Palmqvist, Sandberg, & Mylly, 2012) as a moderating factor in the relationship between technological resources and organic growth. A study on China analyzed how IPP is positively related to innovation, a form of internal development for organic growth, in both state-owned and privatized firms (Fang & Lerner, 2016). Similarly, we consider that access to credit (Carpenter & Petersen, 2002) is an institutional factor that moderates the relationship between financial resources and acquisitive growth. In another study, it was concluded that access to credit is an important element for success and sustainability, since it has a direct impact on the financial resources of the firm and gives it a competitive advantage (Godwin-Opara, 2016). In addition, we argue that inter-firm trust (Franco & Haase, 2010) moderates the relationship between networking capabilities and hybrid growth. There is a qualitative study that analyzed how a manager’s trust and support from colleagues can help in achieving global expansion by making consulting available to them (Thompson-Elliott, 2016). In a meta-analysis (Meier, Lütkewitte, Mellewigt, & Decker 2016), it was confirmed that trust between firms has a positive effect on an alliance’s performance, with previous experience between the partners and the constant communication between them being important factors.

There are few studies that analyze both internal and institutional factors and the effect they have on the decision-making process for growth strategies (Pasanen, 2007). In our model, growth strategies are influenced by institutional factors associated with a firm’s resource endowment: the greater the allocation of certain types of resources into the firm, the greater its growth will be according to the growth strategy chosen. We used the RBV approach and IT as an analytical framework. The aim of the study is to analyze R&C and growth strategies in firms from a developing economy, and hypothesize how institutional factors affect the relationship between both factors. We intend to fill a gap in research regarding these connections and provide useful information for decision-making among managers and owners in terms of resource allocation, growth strategies, and institutional, contextual elements affecting their firms.

This paper focuses on SMEs in the ETICS in Mexico, which we consider a relevant subject due to the lack of studies analyzing growth strategies in Latin American economies and the continuous growth of the sector despite recurrent crises. We used a self-developed database with 450 observations, which were the result of face-to-face surveys with the CEOs of SMEs in 2014. We expect this study to improve our understanding of the antecedents of growth strategies followed by Latin American SMEs.

This article is organized as follows: first, the literature review examines the previous theoretical and empirical literature on the topic and the hypotheses are stated. Then, we describe the data and variables, and present the results. Finally, we discuss our results and highlight the conclusions, future avenues of research, and limitations of our work.

2. Theory and literature review and development of hypotheses

2.1 Literature regarding Latin America

Firm growth and its multiple related variables have been analyzed through a wide variety of approaches. One study, for example, analyzed the characteristics of high-growth entrepreneurs and their firms in Latin America, since entrepreneurs are considered a significant variable for economic and job growth overall (Lecuna, Cohen, & Chavez 2016). Entrepreneurship has an important role in economic growth, but the way this relationship works can be difficult to understand. ValenzuelaKlagges, Valenzuela-Klagges, and Irarrazaval (2018) analyzed the literature regarding the relationship between entrepreneurial development and economic growth in Latin America, identifying some important individual aspects of the entrepreneurs and institutional factors affecting growth. They discovered a tendency among scholars to consider college education and previous work experience as fundamental aspects to analyze, but they also concluded that it is their networking capabilities which help them identify and seize opportunities and, in turn, provide a better chance for their firms to grow and prosper. In addition to individual characteristics, the environmental factors which they concluded to be relevant are access to financing (including credit access), the information available, lack of investment in R&D that hinders innovation, and lack of proper governmental programs and support. In this sense, they identified an important way that SMEs deal with their obstacles; by using their networking capabilities to collaborate with others, developing new products or developing an international presence through these associations (Valenzuela-Klagges et al., 2018).

Nichter and Goldmark (2009) also analyzed the characteristics of entrepreneurs, among other factors, to analyze small firm growth in Latin America. Some relevant key factors they analyzed were access to finance, social networks, firm age, interfirm cooperation, and contextual factors. This research presents multiple aspects to be considered with significant implications for small firms trying to grow in Latin America, but it also concluded that it is necessary to study and analyze these factors thoroughly, alongside whether they are causes for firm growth or only associated with it (Nichter & Goldmark, 2009). The present study directly responds to this calling, researching quantitatively the effects and relationships between different factors identified in Nichter and Goldmark’s (2009) work.

SMEs contribute significantly to the global economy, but they face multiple challenges due to their size or age. To overcome these difficulties, SMEs share both risk and profits (co-opetition) (Blázquez, Dorta, & Verona, 2006). Blázquez et al. (2006) presented an analysis of the factors associated with firm growth. Some internal factors include the firm’s size and age, the CEO’s attitude and motivation, close relations with clients, and investment in R&D and technological changes, among other intangible assets. Environmental and institutional factors also affect the way firms behave. When firms want to deter competitors, vertical integration or investment in new facilities can be useful strategies to follow. These different factors affect SMEs differently than older, larger firms, therefore it is necessary for SMEs to establish clear growth strategies and plans to follow (Blázquez et al., 2006). The present study analyzes factors related to the establishment of these growth strategies that can help SMEs grow and develop.

Another study in Latin America suggested that the intellectual capital of small firms, with three components of the people, the structure of the organization, and the relationship to the environment, is related to the development and usage of different capabilities, as well as with firm growth (Jardon & Martos, 2012). Some conclusions drawn from said study help us to better understand how human capital and structural capital help to “promote culture and technology to enter in (sic) new markets and improve their relationships with customers and suppliers”Jardon & Martos, 2012, p. 475). However, for firms seeking to cooperate it is more important to have good relational capital, in other words, a well-managed relationship between the firm and the environment (Jardon & Martos, 2012). These ideas support our main focus of analyzing the different R&C associated with specific growth strategies, but the present study analyzes a different sector and other variables related to it.

2.2 Growth strategies

Firm growth in general refers to an increase in size and, in recent decades, different approaches to studying growth have been developed. As a result, several ways of studying it have been created. There is no single theory that can explain firm growth (Dobbs & Hamilton, 2007; Macpherson & Holt, 2007; Weinzimmer, 2000), with most growth studies being related to one or more theoretical perspectives to derive hypotheses for empirical testing. An example of this was a study by Wiklund et al. (2009), in which they analyzed a series of factors that affect a firm’s growth from five different perspectives; entrepreneurial orientation, environment, strategic fit, resources, and attitude. There are a considerable number of empirical studies and the majority of them use independent variables to predict differences in growth rates across firms and to examine the aspects that increase or limit growth (Achtenhagen, Naldi, & Melin, 2010; Davidsson & Delmar, 1997; Weinzimmer, 1997; Zahra, 1996). Even though there have been attempts to develop an integrative model of small firm growth, the results show that there is low concurrent validity for a number of growth measures and high variability among them over time (Wiklund et al., 2009). The findings of previous studies concur that models are typically only able to explain a limited portion of the differences in growth among firms, as shown in research by McKelvie and Wiklund (2010), in which they identified the potential empirical and theoretical explanations for why these limitations occur, such as unit of analysis, differences in modes of growth, variation in growth rates over time, indicators of growth, and differences in the willingness to grow.

Using a different approach from generating new predictive models for growth, the most recent studies on firm growth have focused on analyzing it based on different growth patterns, also known as growth strategies (Davidsson et al., 2006; McKelvie & Wiklund, 2010; Pasanen, 2007). There are several definitions of strategy, among which we found:

A strategy is the pattern or plan that integrates an organization’s major goals, policies and action sequences into a cohesive whole. A well-formulated strategy helps marshal and allocate an organization’s resources into a unique and variable posture based upon its relative internal competencies and shortcomings, anticipated changes in the environment, and contingent moves by intelligent opponents.” (Grant, 2008, p. 17)

In other words, this definition emphasizes the alignment of a firm’s resources relative to external factors. Accordingly, we believe the selection of a strategy should be related to the endowment of specific resources within the firm, which is itself affected by different institutional factors. An example of this is how a firm tries to respond to the adequate allocation of its R&C when detecting a business opportunity (Pasanen, 2007). Previous studies, such as Weinzimmer (2000), found out that a competitive-level strategy is a determinant of a firm’s growth.

Several growth strategies have been presented in the literature on entrepreneurship (Pasanen, 2007), and we selected three. Edith Penrose (1959) established a clear distinction between two of them. The first is internal (or organic) growth, which refers to the strategic focus on internal research and development from within the firm, applied to product development, enhancements, knowledge, patents, extensions, and long-term business through technological resources (Bell & Pavitt, 1995; McCann, 1991; Medina, Sánchez-Tabernero, & Larrainzar, 2020). It is usually associated with genuine job creation (Pasanen, 2007), developing products and controlling their operations with the resources available (Agnihotri, 2014; Zahra, 1991). The second is external (or acquisitive) growth, which refers to forward or backward integration. It is more common in older, more mature and highgrowth firms that use acquisitions or mergers to grow (Henrekson & Johansson, 2010; Levie, 1997; Lockett et al., 2011; Medina et al., 2020). Acquisitive growth is often known as a shift of jobs from one firm to another (Pasanen, 2007). The third growth strategy combines elements from both organic and acquisitive growth, but is neither and falls in between them (Chen et al., 2009; McKelvie & Wiklund, 2010; Williamson, 1991; Zou et al., 2010) and is called hybrid growth. It can be defined as “contractual relationships that bind external actors to the firm at the same time as the firm maintains a certain amount of ownership and control over how any assets are used” (McKelvie & Wiklund, 2010, p. 274). It can take a number of forms including franchising, licensing, alliances, or joint ventures (Levie, 1997; McCann, 1991; McKelvie & Wiklund, 2010). The three growth strategies can differ systematically (Davidsson & Delmar, 1997) and are determined by the intentions and goals of the firm (McKelvie & Wiklund, 2010). In this aspect, Penrose concludes that the choice between organic and acquisitive (extensive to hybrid) growth is a strategic one and that the three processes are fundamentally different in many respects; each growth strategy requires a specific endowment of different R&C.

2.3 Firms’ resources and capabilities

A firm’s resources are all the assets controlled by the firm itself (Wernerfelt, 1984) and a firm’s capabilities are defined as the way the resources are used by the firm to improve performance. The RBV assumes that each organization is a collection of unique R&C; firms acquire different resources and develop unique capabilities based on how they combine, and use those resources by following a defined strategy to develop products and services (Grant, 1991; Nason & Wiklund, 2018). Not all of the firm’s R&C have the potential to be the foundation of the firm’s growth. There are three types of resources: tangible, such as equipment, land, and finance; intangible, such as technology, trade secrets, and reputation; and human, such as know-how, capacity for communication and collaboration, and motivation (Grant, 2008). One of the main challenges for SME managers is to properly allocate their resources, especially those which are valuable, rare, and inimitable, to develop a competitive advantage (Barney, 1991; Nason & Wiklund, 2018).

There are a considerable number of studies that analyze the relationship between the R&C of the firm and their effect on the firm’s growth (Churchill & Mullins, 2001; Correa, Acosta, Gonzalez, & Medina 2003; Davidsson et al., 2006; Gibb & Davies, 1990; Keogh & Evans, 1999; O’Gorman, 2001; Smallbone Leig, & North, 1995). As stated previously, the organic growth strategy in particular focuses on internal research and development applied to product development. Therefore, this strategy requires strong technological R&C, such as patents, algorithms, and trade secrets, in order to achieve product breakthroughs and maintain control of operations (Agnihotri, 2014; Bell & Pavitt, 1995; Medina et al., 2020; Zahra, 1996). Similarly, the acquisitive growth strategy focuses on integration, both vertical and horizontal. Therefore, it requires extensive financial resources, although it may also result in cultural integration issues (Agnihotri, 2014). Finally, the hybrid growth strategy focuses on establishing partnerships and other forms of association, allowing SMEs to participate in markets that would otherwise be inaccessible to them, due to a lack of knowledge or technology (Velasco-Gutiérrez et al., 2019). Because of this, it is considered essential for firms to develop social relationships in order to grow (Kogut & Zander, 1992); the ability to build alliances has become an important growth factor (Kale & Singh, 2009).

2.4 Resources and growth strategies

As we have mentioned before, growth strategies are different processes, requiring different managerial resources and capabilities. We consider technological resources and capabilities (TR&C) as a subcategory of R&C that allows a firm to make effective use of technical knowledge and skills, including absorptive capacity. TR&C are among the fundamental determinants of success in hightechnology industries (Kogut & Zander, 1992; Liao, Welsch, & Stoica, 2003). TR&C indicate the firm’s ability to either develop or improve products or services, or optimize its production processes (Kuivalainen & Megdad, 2005). TR&C are the result of the absorption of the firm’s research and development outcomes by the company (Bell & Pavitt, 1995). TR&C are neither mobile nor easy to transfer, therefore, they are more closely related to organic growth (since they stay within the firm and encourage it to grow internally) than to acquisitive or hybrid growth, which entail a transfer in location, control, or management. Due to the above, the firms that assign resources to their processes and technological products, and are able to make them productive, will tend to grow in an organic way (Lockett et al., 2011). Previous studies have found that firms in emerging economies invest in TR&C when pursuing internal growth (Zou et al., 2010). When allocating resources for the acquisition of TR&C, the availability of funds is reduced for other acquisitions (Bamiatzi & Kirchmaier, 2014). Therefore, we hypothesize:

H1 Firms with strong technological capabilities are positively related to an organic growth strategy.

Financial capital has been considered essential for firm growth (Barney, 1991; Grant, 1991). Access to financial capital is arguably the most widely recognized factor as a driver of business growth (Levie & Autio, 2008). Financial resources have been studied at length by numerous scholars due to their ease of being transformed into other kinds of resources (Autio & Acs, 2010; Correa et al., 2003; Davidsson et al., 2006; Delmar et al., 2003). We define financial resources as all the firm’s resources that enable or constrain the strategic growth decisions of the firm (Gilbert et al., 2006). Most young SMEs may not have the financial resources to buy other businesses, while the older and wealthier firms can grow through acquisitions (Levie, 1997; Pasanen, 2007). Usually, the SMEs that grow through acquisitions are larger and older than firms growing organically (Delmar et al., 2003; Wiklund, Davidsson, & Delmar, 2003), since their consolidated processes and strong financial resources help them purchase existing businesses (Becchetti & Trovato, 2002; Beck, Demirguc-Kunt, & Maksimovic, 2005; Carpenter & Petersen, 2002). Still, acquisitive growth can also be a mechanism to attract external advanced technology (Jones, Lanctot, & Teegen 2001). Penrose considered acquisitive growth’s antecedents to be organic growth’s limits: “The significance of merger [and acquisition] can best be appraised in the light of its effect on and limits to internal growth” (Penrose, 1959, p. 5). Financial resources can be transformed with relative ease (Autio & Acs, 2010; Correa et al., 2003; Davidsson et al., 2006; Delmar et al., 2003) and, therefore, be related to other growth strategies, but purchasing a business can allow a firm to acquire external technology advances without having to develop them internally (Jones et al., 2001) or share control, as in the case of hybrid growth (Agnihotri, 2014).

Previous empirical research has found that firms with sufficient financial capital can choose aggressive external growth directions (Zou et al., 2010), therefore we can hypothesize:

H2 Firms with strong financial resources are positively related to an acquisitive growth strategy.

The evolution of information systems has facilitated communication between firms, which has increased the number of temporary alliances, which is a hybrid growth strategy. With this form, firms work together and share assets and profits to accomplish mutual growth. To facilitate these relations, the firm must have strong networking capabilities that allow it to manage alliances and networking ties (Kogut & Zander, 1992; Velasco-Gutiérrez et al., 2019). Performing some form of association allows the firm to participate in markets which it would not be able to enter on its own (Kale & Singh, 2009). Moreover, firms share not only profits, but risks as well. Potentially, association may ease the flow of resources between organizations (Dickson, Weaver, & Hoy 2006). The relationship between networking capabilities and success has been intensively studied in small business literature; higher levels of networking activities are associated with greater firm performance (Aldrich, Rosen, & Woodward, 1987; Dowling, 2003), and are positively related to the speed of venture creation (Capelleras, Greene, Kantis, & Rabetino, 2010). Other researchers have also noted that successful knowledge transfer and learning through networks require specific social skills (Macpherson & Holt, 2007). Previous studies have shown that Chinese firms with various networking relationships will tend to prefer a partnership growth strategy to organic growth and acquisitive growth (Zou et al., 2010), which could be based on the role hybrid growth has in allowing firms to participate in markets they lack the knowledge or financial resources to access through organic or acquisitive growth (Velasco-Gutiérrez et al., 2019). Because of this, we argue that firms that develop networking capabilities follow a hybrid growth strategy and we can hypothesize that:

H3 Firms with strong networking capabilities are positively related to a hybrid growth strategy.

In recent years, the relationships between specific factors and growth strategies have been analyzed in research by Chen et al. (2009) and Zou et al., (2010). Nevertheless, we consider that said relationships are affected by institutional factors from the firm’s environment. Accordingly, we widened the scope of previous studies by analyzing the moderating effect of institutional factors with the help of IT.

2.4 Institutional factors

According to IT, institutions regulate political, social, and economic interactions, either through formal factors, such as laws and property rights, or through informal factors, such as traditions, customs, and codes of conduct (North, 1991). Applying this to a firm, the firm’s growth is influenced by institutional conditions, as has been studied in the past (Bruton et al., 2010; Gnyawali & Fogel, 1994; Scott, 2014).

Some of previous studies have analyzed firm growth and its relationship with institutional factors, such as rights and IPP (Beck et al., 2005), access to credit (Carpenter & Petersen, 2002), interfirm trust in SMEs’ development (Rus & Iglic, 2005), government support programs (Becchetti & Trovato, 2002; Delmar et al., 2003; Fuller-Love, 2006; Keogh & Evans, 1999), national cultural factors (Anderson, 2003), and adverse regional conditions, like unemployment, that can be barriers to growth (Capelleras, Contin-Pilart, Larraza-Kintana, & Martin-Sanchez, 2016). Most of the authors studying this issue agree that institutional factors affect business operations (Aidis, 2005; Dickson et al., 2006; Franco & Haase, 2010; Gilman & Edwards, 2008; Hessels & Terjesen, 2008; Rus & Iglic, 2005).

For the analysis of the relationship between R&C and growth strategies, we hypothesized that organic growth is related to the endowment of technological R&C, which has been analyzed in the literature as well (Zou et al., 2010). In high-tech industries in particular, the development and the acquisition of technological resources are expensive processes. Additionally, knowledge protection is of great importance (Candelin-Palmqvist et al., 2012). If the environment offers a credible commitment to guaranteeing property rights over time, the cost of protection decreases. Regarding the acquisitive growth strategy, we propose that it is related to the financial R&C of the firm (Zou et al., 2010). An environment with multiple sources of financing provides firms with more options that contribute to the reduction of capital costs in acquisitions (Levie & Autio, 2008). We also believe that hybrid growth is related to networking capabilities. The cost of protecting oneself from the opportunistic behavior (Gulati, 1998) is related to the level of trust between firms, since interfirm trust entails a firm’s willingness to be in a vulnerable position with a positive expectation of the other party (Anderson, Chang, Cheng, & Phua, 2017; Gulati, 1998; Kitching & Blackburn, 1999).

The evolution of institutions has been diverse, depending on the geographic and cultural context of each country or region. In the case of Latin America, processes and institutions are controlled centrally, which is a hallmark of other Western economies (North, 1991). We selected IPP, credit access, and interfirm trust as factors that have a positive effect on the regulation of the relationship between R&C and growth strategies.

2.5 Institutional factors as moderators

Institutional factors affect a firm’s growth and performance in different ways; similar firms, in fact, behave differently, due to directors’ differing perceptions of the institutional environment (Fu, Tsui, & Dess, 2006; Gilman & Edwards, 2008; Tonoyan, Strohmeyer, Habib, & Perlitz, 2010). In knowledge intensive sectors (KIS), intangible assets are today’s value drivers (Bollen, Vergauwen, & Schnieders, 2005). Nevertheless, one of the barriers to investing in R&D for existing firms is the lack of a solid IPP regime (Franco & Haase, 2010). Institutional forces play an important role in the degree of investment in different internal resources (Balbinot & Bignetti, 2007). Particularly in the technology industry, knowledge management in business is a crucial aspect of revenue creation, defending the firm’s competitive position, and surviving (Candelin-Palmqvist et al., 2012). The development, sale, and licensing of knowledge takes place within an institutional environment, where a solid IPP regime acts as a catalyst in the pursuit of growth through investment in technology (Herrera & Lora, 2005). Authors like La Porta, Lopez-de-Silanes, and Shleifer (1999) have demonstrated that the efficiency and the integrity of the institutional environment affect business performance, and that those countries with superior institutional development tend to have larger firms (Beck et al., 2005; Kumar, Rajan, & Zingales, 1999). Particularly in Mexico, the IPP regime is still under development. The legal system does not operate at the necessary speed to avoid affecting businesses growth. Therefore, even though most SMEs recognize the importance of registering and protecting their intangible assets, few of them actually do. The attitudes, motivations, and perceptions of CEOs regarding the commercialization of technological resources, like protection against patents and theft of industrial secrets, moderate investment in a firm’s TR&C (Herrera & Lora, 2005). These motivations and perceptions have been found to be related to firm growth, especially among small firms (Blázquez et al., 2006). In summary, IPP influences decisions regarding organic growth and the allocation of technological resources, while also taking into consideration managers’ perspectives. Therefore:

H4 IPP positively moderates the relationship between technological capabilities and the organic growth strategy; so that the stronger the IPP regime, the stronger this relationship is.

For acquisitions to occur, there must be both a seller and a buyer, both of whom expect to gain from the transaction (Penrose, 1959, p. 122). In most cases, business acquisitions are made using a mix of resources, compounded by their own financial resources and debt; low costs for debt encourages debt-financed acquisitions (Lockett et al., 2011). SMEs are financially more constrained than large firms and are less likely to have access to formal financing (Beck et al., 2005). In emerging economies such as Mexico, one of the most important problems for an SME is related to the quality and immediacy of financial resources (Aidis, 2005; De Clercq, Danis, & Dakhli, 2010; Franco & Haase, 2010). Access to credit is particularly restricted due to the lack of guarantees in obtaining financial resources (Aidis, 2005; Rus & Iglic, 2005). The perception of the manager regarding the ease of obtaining good-quality financial resources will depend, aside from bank loans, on the existence of external financial capital. This includes informal investors, business angels, and venture capital (Franco & Haase, 2010), and will allow him to perform acquisitions. In recent years, some empirical studies have demonstrated that loan rejection rates have increased sharply, and so has discouragement (Wright, Roper, Hart, & Carter, 2015). Yusuf (1995) argued that access to credit and the firm’s financial resources are critical factors for an SMEs’ success; in some countries, access to credit requires the firm to have networking capabilities (Witt 2004). Sometimes firms need to employ political strategies to get access to credit: “In some countries the capacity to obtain finance may depend on family connections rather than on the willingness to pay a certain interest rate” (Leibenstein 1968, pp. 73-74). On the other hand, McCann (1991) argues that in mature firms capital has been gained through a combination of public equity offerings and credit; this is particularly for acquisitions. An additional factor affecting access to credit in SMEs is that alternative forms of financing (such as crowd-funding) may be useful, but are used by few SMEs due to lack of guarantees and credit history (Wright et al., 2015). In the environment where this study was conducted, there are very few alternative sources of financing, such as angel investors or venture capital. Moreover, high commissions and interest rates characterize Mexican banks and commercial loans, making this financing source unattractive for SMEs.

H5 Credit access positively moderates the relationship between financial resources and the acquisition growth strategy; so that the stronger credit access is, the stronger this relationship is.

Regarding hybrid growth, firms need to be in harmony with institutional conditions in order to develop an association (Pasanen, 2007). Societies with a high level of trust enable actors to base their business relationships on trust rather than contract; in addition, when actors rely on trust, it is usually interfirm trust, rather than interpersonal trust (Rus & Iglic, 2005). When a company seeks an ally, either for a short or long-term relationship, to acquire a resource that it lacks, it often opens the firm up to the potential for opportunistic behavior (Dickson et al., 2006). To protect itself, the firm can elaborate long and complex contracts, or trust that its partner will not take advantage of it. If both parts get the same benefits, the latter is cheaper and it will promote continued hybrid growth. Thus, interfirm trust influences strategic growth decisions. In societies where interfirm trust is low, the cost of writing and executing complex contracts necessary to control the potential for opportunistic behavior is very high, but interfirm trust between parties can help reduce transaction costs and has a positive effect on cooperation (Liao & Long, 2018; Teece, 1986). Inversely, in societies where trust promotes long-term coexistence, competitors from one sector can overcome the limitations of their individual capacities by sharing (Dickson et al., 2006). In order to build associations, firms require the creation of a business environment that is growth-enabling (Wright et al., 2015). Interfirm trust, particularly between firms that can form alliances, helps them strengthen their competitive position. Having an environment with lower costs for alliances’ transactions, by substituting them with higher trust levels, motivates firms to choose hybrid growth (Kale & Singh, 2009). Interfirm trust refers to the confidence and positive expectation that a partner will not exploit the vulnerabilities of the other (Anderson et al., 2017; Gulati, 1998), avoiding the potential for opportunistic behavior from the alliance’s partners. In Mexico, an important factor is the speed with which the legal system works, since it is an additional cost to create complex contracts. Firms that have high interfirm trust will have a cheaper way to look after their interests through hybrid growth than those which do not . Because of this, we hypothesize:

H6 Interfirm trust positively moderates the relationship between networking capabilities and the hybrid growth strategy, so that the stronger interfirm trust is, the stronger this relationship is.

3. Methodology

3.1 Data and sample

We followed recommendations made by Davidsson et al. (2006) “…the use of homogeneous samples allows one to use operationalization that is maximally relevant for the particular type of firm or industry” (p. 387). The study sample consists of SMEs operating in the ETICS industrial sector in Mexico. The ETICS industry has been one of the fastest growing sectors in Mexico in recent years; over the last 10 years it has received $4,56 billion USD of direct investment. It has generated $47,59 billion USD in exports and has created around 50 000 jobs. The analysis focused on SMEs, using the classification of the Secretary of Economy that considers as SMEs those firms that have 250 employees and annual sales of up to $250 million Mexican pesos, or $15 million USD. The questionnaire was designed to be administered face-to-face with the CEOs from sampled firms. The questionnaire was written in Spanish, and multiple item constructs were used. In addition, experts from the sector were consulted to validate the instrument and to avoid misunderstandings in the questionnaire’s wording. Most of the answers were expressed on a Likert scale, where 1=strongly disagree; 5=strongly agree. The rest were ordinal or quantitative variables. We conducted a pilot project in the city of Guadalajara, where we realized the difficulty of collecting primary data. To ensure the attainment of data, we hired the firm BERUMEN S.A., which is one of the most prestigious companies in Mexico for collecting and processing information. To collect the full sample we signed two cooperation agreements; the first one was made with the National Association of Computer Technology and Communications Distributors (ANADIC) and the second one with the National Chamber of Electronic, Telecommunications and Technology Industry (CANIETI); which together account for 99% of the firms in this sector in Mexico. From all of the responses obtained, an once duplicates and unreachables were removed, was 2095 firms across the country, of which 1092 (52,1%) are located in Mexico City, 556 (26,5%) in Guadalajara, 393 (18,7%) in Monterrey and 54 (2,6%) in other states around the country. From the total of firms, 90% have fewer than 30 employees, 65% of the total are less than 10 years old. The pilot sample included 25 firms and the results helped us correct the wording of some items. Later, we sent e-mails to the CEOs requesting their participation in this research. From the positive answers, face-to-face appointments were made with CEOs in Mexico City, Guadalajara, and Monterrey; in the remaining cities contacts and surveys were carried out via telephone. A team of 11 professionals was trained to conduct the surveys, which they carried out over 12 weeks. In the total sample, there were 450 valid responses, of which 40% were firms located in Mexico City, 28% in Guadalajara, 23% in Monterrey, and 9% throughout the rest of the country, ensuring representativeness of the sample, regarding all the responses obtained. The characteristics of the CEOs were identified (see table 1). Most of the CEOs (99,1%) were Mexican, 78,2% were men, 2,1% had studied only up to high school, 52,9% had a bachelor’s degree, and only 9,1% had a master’s or Doctorate degree. Additionally, 29,6% of the CEOs had attended postgraduate business courses in addition to their professional studies. 58,4% were between 20 and 40 years old. In relation to the firms themselves, 55,3% were family businesses and 95,9% were in Mexico City, Monterrey, and Guadalajara; most of them (40,2%) in Mexico City. 61,6% had been doing business for less than ten years and 89,3% had fewer than 30 employees, which also shows the representativeness of the sample. According to the CEOs, 53,3% were in the consolidation stage, 44,7% had registered annual sales between $100 000 and $1,5 million dollars, and 44% reported a profit margin between 20% and 40%.

Table 1 Sample profile

| Frequency | % | Frequency | % | |||||

| CEO Nationality | Business Cycle | |||||||

| Mexican | 446 | 99,1 | Early Stage | 26 | 5,8 | |||

| Not Mexican | 4 | 0,9 | Initial Growth Stage | 126 | 28 | |||

| CEO Sex | Growth Stage | 240 | 53,3 | |||||

| Male | 352 | 78,2 | Mature Stage | 55 | 12,2 | |||

| Female | 98 | 21,8 | Unanswered | 3 | 0,7 | |||

| CEO Highest educational degree | Company age until 2014 | |||||||

| Elementary school | 1 | 0,2 | Between 1 and 5 | 153 | 34 | |||

| High school | 95 | 21,1 | Between 5 and 10 | 124 | 27,6 | |||

| Technical | 73 | 16,2 | Between 10 and 15 | 76 | 16,9 | |||

| College | 238 | 52,9 | More than 15 | 97 | 21,6 | |||

| Master/PhD | 41 | 9,1 | Number of employees during 2014 | |||||

| None | 2 | 0,4 | Fewer than 30 | 402 | 89,3 | |||

| CEO Additional Management Courses | Between 30 and 60 | 22 | 4,9 | |||||

| Yes | 133 | 29,6 | Between 60 and 100 | 10 | 2,2 | |||

| No | 314 | 69,8 | Between 100 and 200 | 12 | 2,7 | |||

| Unanswered | 3 | 0,7 | More than 200 | 4 | 0,9 | |||

| CEO Age | Business Sales during 2014 (millions of pesos) | |||||||

| Under 20 | 1 | 0,2 | Less than 1 | 177 | 39,3 | |||

| Between 20 and 30 | 127 | 28,2 | Between 1 and 20 | 201 | 44,7 | |||

| Between 30 and 40 | 136 | 30,2 | Between 20 and 40 | 14 | 3,1 | |||

| Between 40 and 50 | 113 | 25,1 | Between 40 and 60 | 2 | 0,4 | |||

| Between 50 and 60 | 58 | 12,9 | Between 60 and 80 | 3 | 0,7 | |||

| Between 60 and 70 | 11 | 2,4 | Between 80 and 100 | 5 | 1,1 | |||

| Over 70 | 4 | 0,9 | Between 100 and 120 | 3 | 0,7 | |||

| Family Business | Between 120 and 140 | 1 | 0,2 | |||||

| Yes | 249 | 55,3 | Between 140 and 160 | 2 | 0,4 | |||

| No | 201 | 44,7 | More than 160 | 2 | 0,4 | |||

| Company Location | Unanswered | 41 | 9,1 | |||||

| México | 181 | 40,2 | ||||||

| Monterrey | 103 | 22,9 | ||||||

| Guadalajara | 125 | 27,8 | ||||||

| Other | 41 | 9,1 | ||||||

Source: Self elaboration using SPSS.

4. Variables

The selection of variables included in the study was made taking into account previous studies. All the questions used were translated to Spanish. We presented the questionnaire to both academics from the business area and directors of the business chambers in which the survey was applied. We also ran a pilot test to ensure understanding of the questions and the measures’ validity and accuracy. Each variable is represented in the survey through specific questions with a Likhert scale grading system or ordinal selection of elements. The variables measured are presented below, starting with the description of the dependent variables.

Growth strategies: The growth forms proposed by McKelvie and Wiklund (2010) were used in the survey. The organic growth strategy was represented by two items. The first one related to the firm’s growth and internal development, both physical and human. The second item attended to the firm’s growth based on research and development of new products, looking for continuous innovation. The acquisitive growth strategy was also represented by two items and was measured by the firms’ acquisition of other firms or business units, both in related and unrelated businesses. Similarly, the hybrid growth strategy contained two items. The first related to a firm’s growth with licensing (buying or selling) technology to other firms. The second related growth to the establishment of any kind of partnership contract, such as franchising, licensing, and joint ventures.

Technological capabilities: These include assets and the ability to make effective use of technological knowledge, in addition to the resources invested in research and development for both product improvement and new product development (McCann, 1991). Some questions regarding the amount and importance the firm assigns to investment in R&D and new product development were included. Additionally, a question about patent development and property rights was included, as well as the level of importance that personnel’s recommendations have in the future (Zou et al., 2010). Financial statements regarding TR&C were not included due to a discrepancy identified during the focus group of the pilot study between the orally reported data and on that which was written on paper.

Financial resources: To measure the effect of financial resources on growth, we relied on Gilbert’s et al. (2006) approach, in which this factor was related to how financial capital influences strategic decisions in the firm. The survey addressed two issues: a) Internally retained earnings and debt, and b) resources obtained from public equity offerings and financial intermediaries.

Networking capabilities: These include all the firm’s partner relationships, including internal and external links and personal networks. The items asked about interpersonal (friends, family members, colleagues) and intra-firm (government agencies, professional associations, relation with investors) relationships based on strong ties (Fu et al.,2006).

IPP: This included four questions. The first was related to the perception of the correctness of IPP in the Mexican legal system. The second was if it was thought that IPP had increased over the last decade. The third was about whether the IPP regime has an influence on the decision to acquire intangible assets. The fourth asked if the strategic role of property rights had increased in the firm (Bontis, 1998).

Credit Access: This section included general questions on the adequacy of the financial system, as well as specific questions about credit access and the ease with which the required paperwork to apply for credit can be gathered (Rus & Iglic, 2005).

Interfirm trust: Since this is a broad concept, for this paper, we narrowed it down to trust between firms, trust provided by the legal environment when doing business with other firms, and the trust that firms have in their business partners and, similarly, in their clients (Rus & Iglic, 2005).

Control variables: Prior studies have utilized firm age and firm size (measured by the number of employees) as control variables (Coad et al., 2016; Davidsson & Delmar, 1997; McCann, 1991; Wiklund et al., 2003). We also considered the type of firm, (i.e. whether it is family-run or not) as a control variable. These elements were analyzed with rounded-up numbers to allow comparisons.

To eliminate any possible multicollinearity effects, three EFA were carried out, one per each construct of R&C, growth strategies, and institutional factors. This is the source of the zeros present in the correlation matrix between R&C, environmental factors, and growth strategies respectively (see correlation matrix in Appendix I).

5. Results

Reliability tests were carried out to ensure that the scales in the questionnaire produced consistent results for the variables. Cronbach’s alpha of all constructs was above 0,70, which shows there is a satisfactory reliability of the scales.

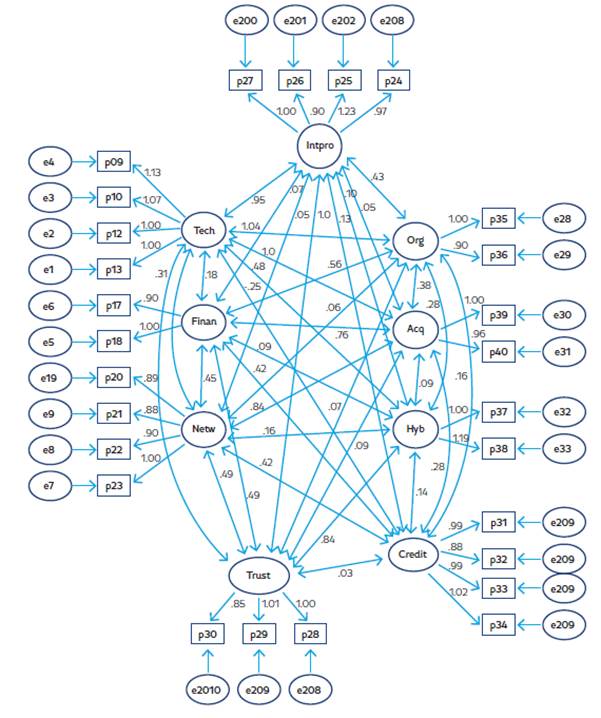

In order to control Common Method Variance and possible bias, we followed the proposal put forward by Simmering, Fuller, Richardson, Ocal, and Atinc (2015) by running the measurement model and introducing all constructs of the three models simultaneously (see the measurement model figure in Appendix II). By doing so, the constructs foreign to the stated hypotheses on a given model work as marker variables. Then, a confirmatory factor analysis (CFA) was conducted using AMOS 22, which resulted in a satisfactory model. All the results obtained for the coefficients of factor loadings are sufficiently large; χ2227=858 755, incremental fit index (IFI) = 0,918, normal fit index (NFI) = 0,895, and comparative fit index (CFI) = 0,916 (see Appendix III).

To verify discriminant validity, we applied the criterion described by Anderson and Gerbing (1988). This indicates that constructs can be considered to have discriminant validity if the trust interval of the correlation between each pair of constructs does not include the value 1. The result was that null hypotheses were rejected in all tests, indicating that the constructs present an adequate discriminant validity.

All previously stated results verify that the measured constructs fulfill both convergent validity and discriminant validity, as well as showing there is not a significant Common Method Variance bias that could affect the study’s conclusions.

The hypotheses were tested using OLS Regressions, since it is a common technique used to analyze correlations with the influence of external factors (Sheffet, 2017). To analyze both R&C and the effect of institutional factors on growth strategies, we used three regressions for each growth strategy. The first only considers control variables; the second includes independent variables regarding R&C; the third analyzes both institutional factors’ and interactions’ effects. The objective is to observe changes in the predictors’ relationship to the dependent variable. Thus, the following three models were tested:

To test the hypotheses established in Model 1 (H1 and H4):

Y 1 = β0 + β1 control variables n + ε n

Y 1 = β0 + β1 control variables n + β2 technological capabilities + ε 1

Y 1 = β0 + β1 control variablesn + β2 technological capabilities + β3 intellectual property protection + β4 technological capabilities*intellectual property protection + ε n

Where:

Y 1 is organic growth strategy

To test the hypotheses established in the Model 2 (H2 and H5):

Y 2 = β0 + β1 control variables n + ε n

Y 2 = β0 + β1 control variables n + β2 financial capabilities + ε 1

Y 2 = β0 + β1 control variables n + β2 financial capabilities + β3 credit access + β4 financial capabilities*credit access + ε n

Where:

Y 2 is acquisitive growth strategy

To test the hypotheses established in the Model 3 (H3 and H6):

Y 3 = β0 + β1 control variables n + ε n

Y 3 = β0 + β1 control variables n + β2 networking capabilities + ε 1

Y 3 = β0 + β1 control variablesn + β2 networking capabilities + β3 interfirm trust + β4 networking capabilities*interfirm trust + ε n

Where:

Y 3 is hybrid growth strategy

The results for each model are presented below, through Tables 2 to 4. The implications for the hypotheses and the relationships stated are presented underneath each table.

Table 2 Technological capability and organic growth strategy of the SMEs

| Variables | Regression 1 | Regression 2 | Regression 3 |

| Control | |||

| Firm’s age | -0,005 (0,007) | -0,004 (0,005) | -0,006 (0,005) |

| Firm`s size | 0,001 (0,002) | 0,000 (0,001) | 0,000 (0,001) |

| Family business | 0,007 (0,049) | 0,021 (0,035) | 0,006 (0,036) |

| Resources and capabilities | |||

| Technological | 0,705 (0,034)*** | 0,347 (0,059)*** | |

| Institutional effect | |||

| IPP | 0,440 (0,058)*** | ||

| Interaction | |||

| Technological*IPP | 0,043 (0,036) | ||

| R square | 0,002 | 0,498 | 0,559 |

| F | 0,234 | 110,647*** | 93,717*** |

*p < 0,10; **p<0,05; ***p<0,001

(Non-standardized β coefficients. Standard errors are in parentheses)

Source: Self elaboration using SPSS.

The results in Table 2 reveal that firms with strong technological capabilities are positively related to an organic growth strategy (β=0,705, ρ<0,001), therefore hypothesis 1 is supported. Regarding the moderating effect of institutional factors, we analyzed the interactions between SMEs’ R&C and institutional factors. Contrary to our expectations, the moderating effect of IPP was not statistically significant (β=0,043, ρ>0,10), so hypothesis 4 is not supported.

Table 3 Resources and capabilities and acquisitive growth strategy of the smes

| Variables | Regression 1 | Regression 2 | Regression 3 |

| Control | |||

| Firm’s age | 0,009 (0,007) | 0,011 (0,006) | -0,003 (0,005) |

| Firm’s size | -0,002 (0,002) | -0,002 (0,001) | -0,002 (0,001) * |

| Family business | -0,028 (0,049) | -0,043 (0,046) | 0,025 (0,038) |

| Resources and capabilities | |||

| Financial | 0,383 (0,044)*** | 0,163 (0,038)*** | |

| Institutional effect | |||

| Credit access | 0,573 (0,039) *** | ||

| Interaction | |||

| Financial* Credit access | 0,084 (0,032) ** | ||

| R square | 0,007 | 0,153 | 0,445 |

| F | 0,992 | 20,111*** | 59,419*** |

*p < 0,10; **p<0,05; ***p<0,001

(Non-standardized β coefficients. Standard errors are in parentheses)

Source: Self elaboration using SPSS.

Table 3 shows that firms with strong financial resources are positively related to an acquisitive growth strategy (β=0,383, ρ<0,001), thus hypothesis 2 is supported. Similarly, the results show a statistically relevant moderating effect of credit access on the relationship between financial R&C and acquisitive growth (β=0,084, ρ<0,05), therefore hypothesis 5 is supported.

Table 4 Resources and capabilities and hybrid growth strategy of the smes

| Variables | Regression 1 | Regression 2 | Regression 3 |

| Control | |||

| Firm’s age | 0,003 (0,007) | -0,003 (0,005) | -0,003 (0,005) |

| Firm’s size | 0,002 (0,002) | 0,000 (0,001) | -0,001 (0,001) |

| Family business | -0,030 (0,049) | 0,017 (0,039) | 0,015 (0,038) |

| Resources and capabilities | |||

| Networking capabilities | 0,631 (0,037) *** | 0,616 (0,037) *** | |

| Institutional effect | |||

| Interfirm trust | 0,104 (0,037) ** | ||

| Interaction | |||

| Networking capabilities*Interfirm trust | 0,084 (0,035) ** | ||

| R square | 0,002 | 0,396 | 0,413 |

| F | 0,366 | 73,117*** | 52,053*** |

*p < 0,10; **p<0,05; ***p<0,001

(Non-standardized β coefficients. Standard errors are in parentheses)

Source: Self elaboration using SPSS.

We found that hypothesis 3 is also supported, as firms with strong networking capabilities are positively related to a hybrid growth strategy (β=0,631, ρ<0,001). The results also show a statistically significant moderating effect of interfirm trust on the relationship between networking capabilities and a hybrid growth strategy (β=0,084, ρ<0,05), therefore hypothesis 6 is also supported. Additionally, robustness tests were carried out by analyzing the subsamples, particularly validating them by size and age with a median split.

6. Discussion

The present study contributes to the literature on firm growth from its least-studied dimension, by analyzing the antecedents of strategic growth decisions. Even though the selection of growth strategies is a dynamic process that can change over time, we have confirmed that there is a differential impact of resources on growth strategies, which has been proposed by researchers in the past (Gilbert et al., 2006; McKelvie & Wiklund, 2010). The results presented here are noteworthy in providing empirical evidence that demonstrates the connection between R&C and the growth strategies chosen by SMEs.

We confirm that firms allocating resources to invest in product R&D or to develop their own patents and intangible assets in-house, while having the capacity to use technical resources (Jin & von Zedtwitz, 2008), tend to prefer an organic growth strategy as seen in previously studied firms internationally (Chen et al., 2009; Zahra, Sapienza, & Davidsson, 2006). This is considered true as well for firms adapting to new markets, which tend to develop new technology (Đogić, 2017), though a common misconception is that this growth strategy is the default (Brown et al., 2017). We also confirm a weaker, but statistically significant, relationship between firms with solid financial resources and an organic growth strategy. This can be explained by the ease with which financial resources can translate into other types of assets, such as intangible assets.

On the other hand, we recognize that financial resources are vital for firm growth, especially for high profit attainment (Agnihotri, 2014; Barney, 1991; Grant, 1991). We confirm that firms prefer an acquisitive growth strategy when they have stable retained earnings, alternative sources of funding, and access to credit. We also found statistically significant evidence that shows that firms growing through an acquisitive growth strategy are larger, because older firms have consolidated processes that allow them to build retained earnings, a finding consistent with previous studies (Delmar et al., 2003; Wiklund et al., 2003). This happens because firms need to have financial and managerial resources to perform acquisitions and subsequent integration, and these resources tend to be lacking in younger firms (Brown et al., 2017; Mawson & Brown, 2017).

Firms which establish business connections through their existing relationships with friends, family, schoolmates, and social organizations prefer a hybrid growth strategy. A hybrid growth strategy includes partnership relations with other firms, including licensing, buying or selling technology from them. It is based on consensual, professional relationships that are operationalized by contracts (McKelvie & Wiklund, 2010), so firms need strong networking capabilities to negotiate and manage their networking ties (Velasco-Gutiérrez et al., 2019). Using networking to acquire knowledge and resources and establishing alliances allows firms to compensate for the resources and technology they lack, and enter markets more easily (Brown et al., 2017; Thompson-Elliott, 2016). We confirm that those firms which privilege hybrid growth reported having strong networking capabilities, which is consistent with previous studies carried out in different cultural contexts (Zou et al., 2010). We also found a weaker, but statistically significant, relationship between firms with solid technological resources and hybrid growth, which can be explained as previously mentioned, since hybrid growth borrows from the other growth strategies. In particular, ETICS is a KIS, in which investment in technological resources increases the attractiveness of firms looking to associate.

The results regarding R&C and growth strategies are consistent with previous studies that recognize the importance of understanding the motivation behind the selection of a specific strategy (Gilbert et al., 2006; McKelvie & Wiklund, 2010). Our study confirms the relationship between R&C and growth strategies, which complements the existing literature by expanding the knowledge there is regarding firm growth. With this, it is possible for CEOs and decision-makers in firms to have additional, statistical information that helps them choose the growth strategy best suited for the current allocation of R&C in their firms, or to reallocate said resources to align them with the new mindset or goals they have.

Our study contributes evidence of the effect of institutional factors on the aforementioned relationships. As we have argued, institutions influence economic behavior and performance (Bruton et al., 2010; Gnyawali & Fogel, 1994; Veciana & Urbano, 2008). Institutional conditions partially explain why firms with similar R&C exhibit varying business performance in developed and emerging economies (De Clercq et al., 2010). Most of the previous empirical studies agree that institutional factors influence SME growth (Becchetti & Trovato, 2002; Capelleras & Hoxha, 2010; Delmar et al., 2003; Fuller-Love, 2006; Keogh & Evans, 1999); however, some authors have found that in emerging economies institutional barriers are not a major influence on the growth (Capelleras & Hoxha, 2010). We confirm that credit access and interfirm trust moderate the relationship between R&C and growth strategies in Mexican ETICS. The results are relevant, because they allow us to better understand strategic growth decisions selected by SMEs.

Institutional forces play important roles in the development of both technological capability and absorptive capacity (Balbinot & Bignetti, 2007). Previous studies have demonstrated that one of the barriers to R&D investment in existing firms was a lack of trust in rights and IPP (Franco & Haase, 2010). In our study we have confirmed that there is a direct and statistically significant effect between IPP and an organic growth strategy. Despite this and contrary to our expectations, we have not found statistically significant evidence that supports the idea that IPP positively moderates the relationship between TR&C and an organic growth strategy. This is probably because intellectual property law is not robust in Mexico and the SME directors trust it only in theory, but not in the business decisions they make. IPP has a relationship with growth strategies, i.e. with the plans and decisions taken for the future, but it does not affect the allocation of resources. As mentioned previously, it could be that IPP is only trusted in principle. An explanation could be that the proper registration and IPP regime do not have a direct impact on firms’ internal functioning and, by extension, on the R&D departments and TR&C. In a study on the pharmaceutical industry in China, the authors concluded that IPP is not conducive to technological innovation or global competitiveness, since firms relying on imitative innovation are hindered by IPP (Cai, Zhao, & Coyte, 2018). Comparing this to the results from Fang and Lerner (2016), it could be possible that there is a key difference between firms attempting to innovate through imitation and those innovating through new ideas, as well as between privatized or state-owned firms and those independent from the beginning.

With regards to the moderating effect of credit access, in Mexico access is particularly restricted, due to the lack of guarantees of obtaining financial resources; only 20% of SMEs meet the requirements requested by banks to obtain credit, which causes elevated and unwanted financial costs , inhibiting growth (Aidis, 2005; De Clercq et al., 2010; Franco & Haase, 2010). We confirm that credit access positively moderates the relationship between financial resources and an acquisitive growth strategy. The importance of access to credit is supported by previous studies that have analyzed its effect on financial resources and a firm’s competitive advantage (Godwin-Opara, 2016).

We found a positive and statistically significant effect between interfirm trust and a hybrid growth strategy. We also found that interfirm trust positively moderates the relationship between networking capabilities and a hybrid growth strategy, which is consistent with previous studies (Scarbrough, Swan, Amaeshi, & Briggs, 2013). This trust, according to previous research, is key to an alliance’s performance and opens the possibility of consulting, which is mainly based on previous experiences and constant communication, and reliant upon superior networking capabilities (Meier et al., 2016; Thompson-Elliott, 2016).

In conclusion, we confirm the existence of a relationship between the allocation of certain R&C and the growth strategy chosen by an SME. There is a direct connection between TR&C and an organic growth strategy, between financial R&C and an acquisitive growth strategy, and between networking capabilities and a hybrid growth strategy. Additionally, we have complemented previous studies by analyzing the moderating effect of institutional factors. We confirm that credit access positively moderates the relationship between financial R&C and an acquisitive growth strategy, and that interfirm trust positively moderates the relationship between networking capabilities and a hybrid growth strategy. Contrary to our expectations we did not find any statistically significant evidence to prove that IPP moderates the relationship between TR&C and an organic growth strategy. Overall, our findings improve our understanding of the internal and institutional antecedents that influence the strategic decision making of SMEs.

7. Practical implications and future research

The present study was developed as a response to calls for further research made by scholars such as Davidsson (2006) and McKelvie and Wiklund (2010), who underscored the need for additional studies analyzing firm growth as a process. This research extends the knowledge about relationships between resources and capabilities with three growth strategies of the SME´s, moderated by environmental factors.

This study adds to the empirical research previously developed in this area, by incorporating IT into the analysis as a theoretical framework and identifying institutional factors related to growth strategies.

The study shows that there are three different growth strategies for firms in the sector, and that these modes are related to internal characteristics of the firm, as well as external institutional factors. In other words, the required competencies for each growth mode will be different. Through this insight, it is possible for decision makers to have more input in order to choose the course of action for their firms, both for selecting a strategy and for allocating resources. It also helps firms to analyze the effect the environment can have, and tends to have, on their growth and the decisions they make.

In relation to governmental public policies, contrary to what is proposed by most governmental support programs, two of the three growth modes do not necessarily result in increased levels of hiring or employment. Thus, adjustments to current policies are suggested so that these programs better meet their stated objectives of job creation.

One of the main challenges that the managers and CEOs of SMEs face is undoubtedly the assignation of resources within firms; at the same time, the role of external, institutional factors also affects the growth strategies pursued by the firm. We confirm that the endowment of R&C within a firm determines the firms’ growth mode. Thus, different growth modes will give rise to different firm performances. Because of this, managers will have to be consistent in the allocation of resources, in order to achieve their performance goals.

Firms that are unaware that their R&C are related to their selected growth strategy or of the effect that institutional factors have on the firm, will be at a disadvantage with respect to those who are conscious of it in order to achieve their growth goals. The sector under analysis is one of the fastest growing in Mexico, in which credit access and interfirm trust have a moderating effect on different firms’ R&C that is directly related to specific growth strategies. As previously stated, we did not find statistically relevant evidence of the moderation of IPP on the relationship between TR&C and an organic growth strategy. The reason is probably that IPP in Mexico is not robust, therefore CEOs rely more on informal mechanisms, which are also cheaper and common among SMEs in other developing countries. These informal mechanisms have also been found effective in capturing a return on development efforts (Holgersson, 2013; Kitching & Blackburn, 1999; Zulkifli, Kamal, Rushdan, & Zakiah, 2010). It could also be that IPP has an impact on strategic growth decisions strategies, but it does not have an impact on the internal development of R&C.

As a socioeconomic entity, firms are constantly evolving through time. Managers must adapt the assignment of R&C and identify the relevant institutional factors associated with the strategic growth mode of the company.

7.1 Limitations

Although the present study provides some interesting findings, several limitations should be noted. This study analyzed relations between antecedents and growth strategies in a single environment, and in a single sector. The study was designed in a relatively homogeneous sector of the economy, making the results valid for this sector exclusively. Another limitation was that we used a single informant approach in our data collection, therefore a bias problem can occur. The results expressed here were obtained from a unique observation in time; the lack of longitudinal data is a limitation to this study. In the case of the moderating role of IPP in the relationship between TR&C and an organic growth strategy, it would be necessary to analyze the reason why this role was not statistically meaningful.

7.2 Future research directions

Future studies could replicate this research in other KIS of the economy, such as pharmaceuticals or life sciences, and compare the findings. On the other hand, growth is dynamic and organic growth cycles may precede acquisitive growth cycles, therefore it would be interesting to perform a study with longitudinal observations.