1. INTRODUCTION

One of the main reasons for studying the multiproduct firm is that the empiricism suggests that there are no mono product firms, and second, that the technological characteristics of these firms tend to produce more than one product (Willig, 1979). On the other hand, the multiproduct firms are omnipresent in the modern world economy, especially in technologically advanced countries (Eckel & Neary, 2010). But despite this empirical importance, the multiproduct firm has received relatively little attention in the theory of firm internationalization (Goldberg et al., 2010), and also in the literature of technological change.

In this sense, "The focus on multiproduct firms' product mix decisions is relevant to the extent that the changes in the product mix account for a significant portion of changes in firms' output over time' (Goldberg et al., 2010: 1042), which means that diversifying product portfolio gives place to new productive capabilities over time, or in other words, gives place to a technological change by means of innovation.

Additionally, studying the multiproduct firm in emerging countries is relevant for several reasons, an emerging country defined as "a country where the process of basic institution building is not complete' (Heyman, 2011: 31), where the markets are important in terms of sales (Wood et al., 2011), but are not completely developed (as is the case of Mexico), give place to some lags in their technological performance, since these countries generally have economic and institutional problems for developing technologies, and this produces a lag in the development of new products. This is important in terms of describing the limitations that emerging economies have to succeed in developing new products and technologies, but also to venture into international markets.

Thus the objective of this manuscript is to explain how these factors determine the transition from a single product to a multiproduct company, by means of a panel regression using a database of the World Bank. The article is organized in six sections, the first is presenting a background of this research, putting into context the literature about multiproduct firms. The second section presents a literature review in which the relations between the internationalization and the multiproduct firm are described, and also explains the main hypothesis of this research. The third section describes the multiproduct context in Mexico, with the statistics given by the surveys for both periods (2006 & 2010), where the research problem is put in context. Fourth and fifth sections describe the model which is going to help to contrast not only the hypothesis, but also the main results. The last section presents the concluding comments with a deeper discussion of the results in section five.

2. LITERATURE REVIEW

2.1. Background of multiproduct firms

Most organizations, are formed originally to engage in one activity, such as producing a particular product, and then when the organization grows, they seek to diversify (the product portfolio) to sustain that growth (Hos-kisson et al., 1993). Since 1980 Teece (1982 & 2000) argued the importance of the multiproduct firm, which is a firm capable to diversify the product portfolio, understanding this portfolio as a related and non related product diversification (Teece, 1982), explaining in part that the economies of scope and the unused resources settle the multiproduct organization. The main argument for neglecting the neoclassical model to explain the multiproduct firm existence was the need for a market failure, since the rational choice of the firm should lead to a better mono product organization. From another perspective, it is pointed out the lack of convincement of the management discipline, since it explained that the manager is looking for a corporative growth in favor of its own interests1, the argument is that the corporative growth will lead to a prestigious position for both the manager and the firm, the main problem with this hypothesis is that it also came with a reduction of the returns over capital, which in the long term needs the irrational behavior of the stockholders.

Regarding the previous arguments, two things are clear, the first is that the neoclassical theory first settles the resources needed for manufacturing a product, and second that the organizational theory first settles a product that is consistent with the resources available in the firm2. From this perspective, Teece (2000) states that the excess of resources (management and technology) and their fungible character are critical for the diversification of the firm, allowing the existence of the multiproduct firm, which is true only if the cost of producing the goods 1 and 2 jointly are cheaper than the cost of producing only one of them (Willig, 1979). These arguments may cause economies of scope and entry barriers, since the entry into an oligopolistic industry is more difficult and riskier, the greater the number of products that the entrant must develop.

It gives a special attention to the first category proposed by Teece3 (2000), since this problem was not new even in his time. He states that time before Penrose (1959) argued that the final product of any firm at any time is just one of the several ways in which the firm could use their own resources. According to Penrose (1959), the firm growth is not just the indivisible and fungible character of their unused resources, since the opportunities of growth must be taken through learning, which is a normal process in any business. From another perspective, some years later, Willig (1979) argued that the multiproduct firm arises from inputs that are shared, or utilized jointly without complete congestion, where the shared factor may be imperfectly divisible, so that the manufacture of a subset of goods leaves the excess capacity in some stage of production.

Since these explanations of the existence of the multiproduct firm, there have been three main streams, the first adding in the indivisible, but non-specialized physical capital, indivisible specialized physical capital, and the human capital as common inputs to two or more products (Levy, 1989; Vannoni, 1998; Granstrand, 1998; Grossmann, 2007; Lin & Zhou, 2013), the second line is added on the external economies (Botasso et al., 2011; Qiu & Zhou, 2013), and the third line pointing market structure as an explanation for the multiproduct firm (Tauman, Urbano & Watanabe, 1997; Constantatos & Perrakis, 1997; Barcena & Paz, 1999; Garcia & Geargan-tzis, 2001; Symeonidis, 2002; Allanson & Montagna, 2005; Livanis & Moss, 2006; Minniti & Turino, 2013; Seale, Vorotnikova & Asci, 2014).

Despite the contribution on the multiproduct firm, it has been little the contribution of the internationalization theories and their effect on the multiproduct organization, since one of the main aspects of the internationalization is the diversification strategy (Peng, 2001). In addition, the previous categories imply a role played by technology and the intangible resources (Eckel & Neary, 2010), which have not been studied until nowadays. Even it has been little the contribution on the role played by the small and medium sized firms in the process of becoming a mul-tiproduct, but also on becoming an international firm (Alarcón, 2014; Ocampo, Alarcón & Fong 2014).

Among the main empirical facts Iacovone & Javorcik (2010) found that since the NAFTA (North America Free Trade Agreement) was signed in 1995, the Mexican firms generate new products, diversifying the gamma of products and becoming multiproduct firms. Minniti & Turino (2013) found that 39% of the US firms are multiproduct firms and they generate over 87% of the manufacturing production. Qiu & Zhou (2013) found that in the US, 41% of the manufacturing firms are multiproduct, and they contribute to 94% of the US exports. Bhattarai & Schoenle (2014) found also that 98.55% of the prices are settled down by multiproduct firms, and they have in average 4 products offering.

From these facts, it cannot be neglected the existence of a relationship between the multiproduct firm and internationalization. Nevertheless, the mechanism by which this relation occurs is explained, as well as the role of technology and intangible resources have been unattended in the actual context of internationalization theories. In this sense, the purpose of this research, is to explain how these factors determine the transition from a single product to a multiproduct company.

2.2. The internationalization and the multiproduct firm

Perhaps the first relation internationalization-multiproduct is located in the diversification logic, but the diversification in the internationalization strategy is understood in a first instance, as the diversification on the allocation of products, but not as diversification on the products themselves (Welch & Luostarinen, 1988). As a matter of fact, the mainstream of internationalization is seen as the process of increasing commitments of a company outside its origin country and transferring services, products or resources beyond the borders of their home country.

In a broader sense, an internationalized company is one that conducts any operation of its value chain in a country that is not local (Welch & Luos-tarinen, 1988). This explains this condition, since the internationalization phenomena imply any operation of a firm in another country, but not exclusively the diversification of products. In fact, many academics (Valenzuela, 2000; Peng 2001; Servais, Zucchella, & Palamara, 2007; Fong & Ocampo, 2010; Roxas & Chadee, 2011; Jiang, Yang, Li & Wang, 2011) point out that, export activity could be seen as a firm strategy to achieve better financial and economic performance. Where they are taking only the export activities which is the allocation of production in other countries, maybe this is the first explanation of why the internationalization isn't used used to explain how the firm is becoming a multiproduct.

One of the first mechanisms for diversifying the product portfolio through the internationalization is found in Granstrand (1998). In his research, the author points out that firms diversify the product portfolio by means of the internationalization, since it is a method to expose the firm to knowledge and technologies of foreign markets (Kylaheiko et al., 2011), thereby providing opportunities for developing new skills and capabilities, and contributing to the path dependent technology and innovation. In this perspective, the company combines its tangible and intangible resources to form organizational capabilities, which preserve the strategy, considering the factors that have led to the success to other companies of the sector. Thus, exporting performance can be conceptualized like a strategic factor contributing to the diversification of the product portfolio, conditioned by internal elements which the company possesses (Valenzuela, 2000; Servais et al., 2007).

Instead of the importance of the internationalization term, there is a lack of consensus on the most important characteristics for explaining the internationalization (Welch & Luostarinen, 1988), where the most important variable for interpreting the internationalization is the exporting performance of the firm (Luostarinen & Gabrielsson, 2004; Fong & Ocampo, 2010). This approximation to the internationalization performance has two main approaches:

The Born-global approach, which arises because of the existence of an increasing number of companies, mainly SMEs (Small and Medium Enterprises)4, which begin international activities not in a gradual way, as to suggest traditional models, but risking an important amount of resources since the foundation of the company (Luostarinen & Gabrielsson, 2004; Rialp, Rialp & Knight, 2005; Cavusgil & Knight, 2009; Torres, Rialp, Rialp & Stoian, 2015).

The Uppsala approach, as the main sequential model presents internationalization like a gradual and evolutionary process that follows the next stages5: not to export, export sporadically, export regularly by agents, organize a commercial network to export and settle down abroad.

The Born-global companies, being by definition of recent creation, do not count on an extensive grant of financial or human resources, at the same time they can also lack properties, equipment and other physical resources. This is important because these resources, mainly tangible, are those that traditional companies have used to be successful in foreign markets. However, the born-global company uses a set of intangible resources to get and to preserve international competitive advantage (Rialp et al., 2005). Also in the multiproduct theory (Grossmann, 2007), it is said that the diversification of products is a result of exploiting a specific asset in the company, and if the asset is substitutable it is said that the firm becomes a mono product firm.

According to Prahalad & Hamel (1990), this kind of intangible resources called in their article "core competencies" settle the opportunity for the firm to diversify the product portfolio. Here the task of the manager is to identify, cultivate, and exploit the core competencies that make firm growth possible, since the core competence is the one that: a) gives access to a variety of markets, b) makes the customer perceive the benefits of the product, and also c) is configured in such a way that is difficult to imitate. This argument of core competence is closely related with the concept of intangible resources given in the RBV (Resources Based View) by Hall6 (2003) Hazlett et al. (2005) and Newbert (2007).

Therefore, the intangible resources are the key factor of the firm competitive behavior, with this kind of resources the firm can access or generate innovation, and in turn that innovation can be expressed as a competitive advantage (Fong & Alarcón, 2010). In addition, due to the speed in which the erosion of intangible value is reflected, the firm must effectively generate, get and allocate these resources in order to reach rents and above-normal returns (Baldwin, 1996; Hall, 2003; Zhao, 2006). Some of these intangible resources are the R&D activities that according to Hitt et al. (1997), have different effects on the firm performance, since in the beginning has positive effects, but then become negative as the firm gets more internationalized.

H1: Resources, mainly intangible, determine the transition capability of the single-product firm to become a multiproduct firm.

The last argument takes us to point that one of the possibilities that a firm has to take advantage of the intangible resources is, on the one hand, the appropriate institutional infrastructure to generate property rights protection (Jiang et al., 2011), nevertheless this possibility is out of the firm's control. Thus, the second option is to establish a model in which the firm can immediately appropriate rents from the markets. Some of the models for appropriating rents in the international markets through the intangible assets are the internationalization model called Born-global and the Uppsala model.

H1a: Resources, mainly intangible, determine the transition capability of the single-product firm to become a multiproduct firm, with greater force in an internationalized firm.

Instead of the beneficial effects of internationalization mentioned above, there are certain risks of becoming a mono product firm through this strategy, since the internationalization strategy means the incremental commitment of resources to increase the resources placed in other countries, which in turn means the incremental sunk cost for the firm, these sunk costs are characteristics of the single product firm (Levy, 1989). Moreover, the incremental commitment of resources leads the firm to reduce the production of other products because of the external economies of being substituted products (Hitt et al., 1997; Lin & Zhou, 2013).

On the other hand, contingent factors such as investment in licenses and royalty payments to acquire new technology influence the configuration of a multiproduct company. Dabic et al. (2012) proposes that the investment of the company plays a key role, since the investment allows to acquire and develop new technology or technological resources, and this is what allows the improvement of the company's products. Thus, investment in technology is a key factor for both internationalization and for the transition to a multiproduct company, since companies based on this sort of improvements can enter new foreign markets (Granstrand, 1998; Alarcón, 2014).

H2: Investment in licenses or royalties negatively impacts in the transition to a multiproduct firm, as it compromises the existing technology to a single product.

In addition, investment in technology becomes a factor for innovation, as companies can now acquire or develop technology that represents greater tangible and intangible resources (Fong & Ocampo, 2010; Alarcón, 2014), and thus it also contributes to commit resources to a path of technological dependence which compromises the existing technology towards specialization in production.

H2a: Investment in licenses or royalties negative impacts in the transition to a multiproduct- firm, as it compromises the existing technology to a single product, with greater force in an internationalized firm.

This paper proposes that the multiproduct company is based on intangible and tangible resources (human resources and fixed assets, respectively), contingent factors (payment of royalties and licenses), company size, the level of internationalization (export or not exports) and control factors (total sales). As proposed in the sequential model of internationalization, contingent factors have a positive impact on the performance of internationalization and for becoming a multiproduct firm, the accelerated model proposes that the most important resources for internationalization are the intangible ones. Last, the multiproduct firm theory in Teece (1982 & 2000) proposes that unused resources are important tangibles to become a multiproduct company.

3. DESCRIPTIVE STATISTICS AND METHODOLOGY

3.1. The multiproduct firm in Mexico

The data for testing the hypothesis proposed in the last section is taken from the World Bank Group, specifically from the enterprise surveys taken from Mexico during the periods of 2006 and 2010. The Enterprise Survey is a firm-level survey of a representative sample of an economy's private sector. The surveys cover a broad range of business environment topics including access to finance, corruption, infrastructure, crime, competition, and performance measures. Since 2002, the World Bank has collected this data from face-to-face interviews with top managers and business owners in over 130,000 companies in 135 economies (for more information contact http://www.enterprisesurveys.org/ Accessed 09/01/2016).

The survey taken from Mexico in both periods has 1400 observations in each survey, and it was constructed as a panel data with the firms that are in both periods (210 firms). With this panel data, it is captured the idiosyncratic error term in the data that cannot be measured in a direct way in both periods taken in a separate way. In addition, by taking into account all the data from both periods, it gives an explanation of the main features that describe exporters and multiproduct companies. Since this is one of the main objectives of this research, starting with the possession of the company by foreigners in Table 1.

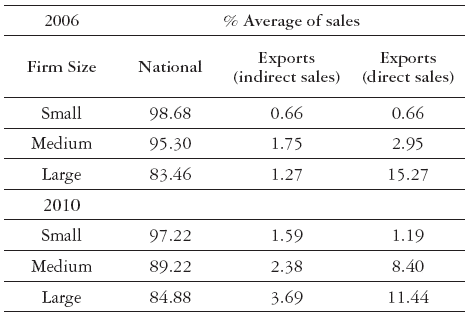

Table 1 shows the process of internationalization that is seen in terms of exports of the firms, where the company's small size has entered the dynamics of internationalization, doubling its sales abroad either through direct or indirect export. The median company increased significantly its direct pass from 2.95% to 8.40% of direct exports in four years internationalization. An important aspect that should be highlighted is that the large firm kept its export performance. However, it has chosen to maintain a less direct internationalization, since it reduced its direct exports and increased its indirect exports, which indicates that these businesses have been able to establish a strong network of international collaboration. On the other hand, the main markets of the companies are shown in Table 2.

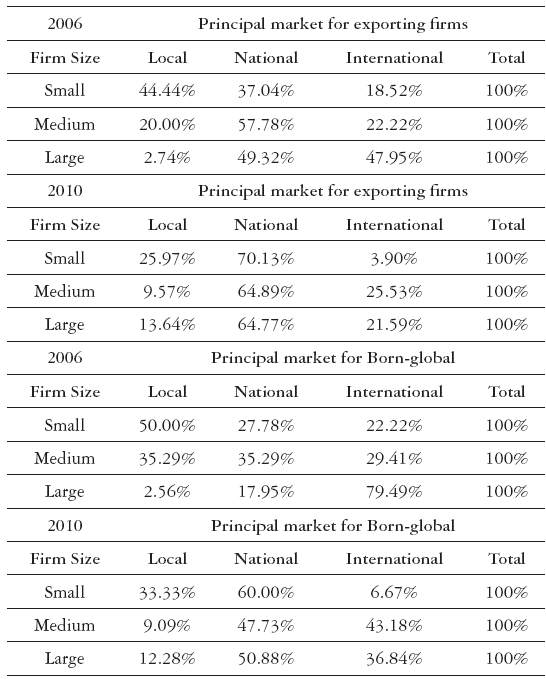

The Table 2, shows that the international markets for the exporting firms has decreased its participation, mainly in the large sized firm from 47.95% to 21.59%, the same happened with the born-global large firm, but not with the born-global medium firm that has increased its participation in the international market in more than 10% and also consolidated the sales in the national market from 35% to 47%. Which is an indicator of the performance in the accelerated model of the internationalization of the firms that also could lead to a more multiproduct firm. The relationship established, between the internationalized firm and the multiproduct firm are described in Table 3.

Table 3 The multiproduct firm in the internationalization context

Source: Own elaboration with data from WEBS

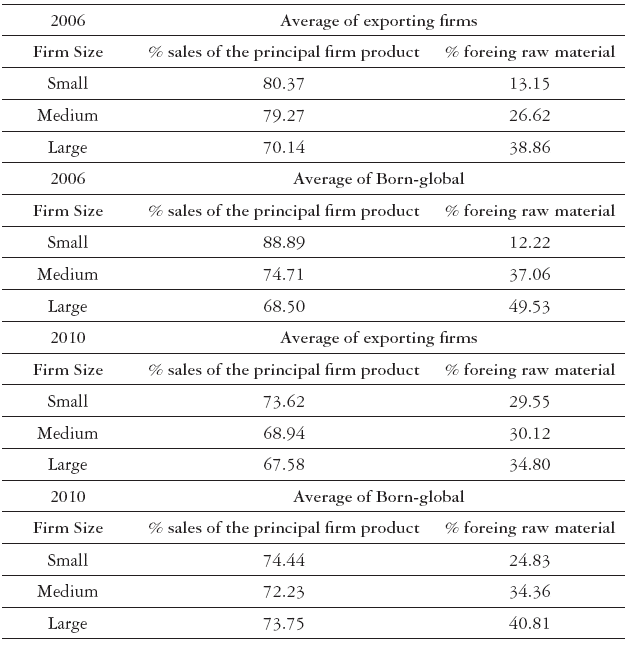

In the Table 3 it is shown that the exporting firms have diversified the product portfolio with 7%, 10% and 3% for the small, medium and large firm respectively, and the born-global have diversified the portfolio in 14%, 2% and 5%, respectively, this means that the large born-global firm have tended to become a mono product firm, while the small born-global firm have tended to become a multiproduct firm in the same period.

Moreover, in Table 4, and in relation to companies that pay royalties and / or licenses, there is also a significant relationship with internationalization, as companies that export are increasingly flocking to pay technology licensing and/or royalties to compete in international markets, which is consistent with models of sequential internationalization.

Table 4 Exporting firms that pay royalties and/or lincenses

Source: Own elaboration with data from WEBS

In all the tables above, it is seen a process of internationalization of the small firm, where the higher internationalization is given in the small born global firm, which is also paying a higher amount of royalties and licenses as a strategy of technological change. But, on the other hand, the large firm is the most diversified company in terms of sales of the principal product, which in turn is pointing to a multiproduct company. This phenomenon of the process to start a transition from a single product to a multiproduct company is better explained in the next section.

3.2. The method

Given the nature of the data, the model is a cross section regression analysis for firms in two survey periods (2006 and 2010), since an option to use panel data is to identify the unobservable effects, which in turn impact the dependent variable in two ways: with constant effects and with time changing effects (Wooldridge, 2010). Considering that "i" is the cross section and "t" the time, two estimation models are represented as follows (constant and time changing). In addition, the model will add a dummy to differentiate between companies exporting and non-exporting companies, where you can find the differential effect of both the internationalization of the company, as new technology the firm acquires.

The enterprise survey is taken in two years, 2006 and 2010, but the survey is taken in different firms in each year, so it is not a panel data for both periods, nevertheless the panel data in this research are constructed taking the firms that are present during both periods, in fact the World Bank, also builds the data panel and has made it available on its website. These panel data have 420 observations. With this treatment, only companies that can show their evolution in these two periods are analyzed. Another important factor to take into account in this database is that this survey shows the number of products offered at company level.

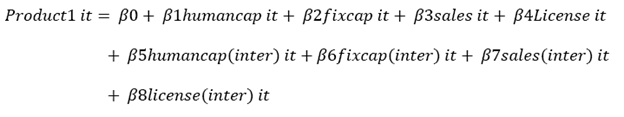

In essence, in the model we estimate the determinants of the multipro-duct company in the context of internationalization, so the effects of intangible assets such as human capital, tangible assets such as fixed capital, technological change given royalties and licenses, and the differentiated impact of these factors on internationalized firms. In the way shown in the following equation:

Where productl represents the percentage of sales of the main product, which represents the multiproduct or the single product firm, since the World Bank Enterprice Survey is considering different kind of products, but variations of the same product, with this in consideration, a multipro-duct firm must be near to 1% if it is very diversified in the portfolio of products, and near to 100% if it is a single product firm.

On the other hand, Humancap represents full-time employees, fixcap represents the percentage of use of fixed assets, a dummy variable indicating whether the company pays royalties and licensing, sales as a control variable for firm size by line of business, inter as a dichotomous variable indicating whether or not the company exports.

According to the theory established by Teece (1982 & 2000), the mul-tiproduct company is largely due to the existence of unused resources, which have a fungibility in the company, according to this theory, it is expected that the company has more volume of tangible and intangible resources, you can use these resources in production processes other kind of goods. Thus, to the extent that resources are accumulated over the company it tends to diversify its product portfolio, however, learning and the accumulation of knowledge acquired by the internationalization should emphasize this behavior and generate more multiproduct firms.

However, the above idea, in the model of sequential internationalization, innovation and acquisition of new technologies, such as some royalties and licenses, should also compromise the production process to specialize in one type of product, so this model is tried in order to observe what is the influence of internationalization and technological change on the conversion of a multiproduct company.

4. RESULTS AND DISCUSSION

The results of the regression equation are implemented in three different ways, the first model was panel data with unfixed effects over time or in the enterprises; the second model was run with panel data and fixing the temporary effects of the years 2006 and 2010; finally, the third model was run with fixed effects both in time and in companies (which is simply known as fixed effects), discarding the execution of random effects because not all cross observations had complete information on both periods, it either could run a Haussman test for random effects , so we chose a test called Likelihood ratio, which shows whether fixed effects are significantly different from the fixed effects just in time. All these models are shown in Table 5.

Table 5 Results of the regression model

The symbol *** means that the statistic is significant at 1%, ** 5% and 10% *.

Source: Own elaboration with data from WEBS

Given the results shown in Table 5, the first two models show that the effects are nearly identical, so we can conclude that there are no significant differences arising from the effects in time periods between 2006 and 2010, this means in terms of transition to a multiproduct firm, the effects of the variables did not change significantly in these two periods, and are based on the criteria of Akaike, the second model has more explanatory power than the first.

Regarding the third model, the total fixed effects showed that they must be discarded, since the likelihood ratio test suggests that not reject total fixed effects are best explanation only fixed time effects, thus the effects of the variables are emphasized in the internationalized companies to generate a multiproduct company, since the effects of human capital and licensing are higher in this model than shown by companies not internationalized.

On the other hand, this model also shows that human capital surplus unused has smaller effects to become a single-product company, which are shown in models one and two, while the human capital and licenses have greater effects considering total fixed effects, without having considered models one and two, nevertheless, it is worth noting that the criterion of Akaike is lower than in the first models, which means that the results must be taken with caution.

Individually, by observing the coefficients of the variables separately, it can be distinguished the transition to a multiproduct company, it is given more for the surplus human capital (intangible resource) than from fixed assets (tangible resource), which corroborates the hypothesis of Tee-ce (1982 & 2000), which states that the greater the volume of unused equity, the greater the propensity for the creation of a multiproduct company; however, it may be noted here that in the Mexican case, there is only intangible human capital surplus which create incentives to produce a larger product portfolio, confirming the hypothesis H1. Adding further explanation to the above, in the internationalized companies, the differential effect of human capital is even greater than in non- internationalized, as well as showing the variable "Log(humancap)(inter)", which corroborates the hypothesis H1a.

Finally, it should be noted that the effects of technological change, given for payment of royalties and licenses, are the same in all three models, so it cannot be said that there is a differential effect with the passage of time, nor is there a differential effect between undertakings. It is concluded that this license payments compromise technology towards specialization in production and therefore not move to a multiproduct firm, which corroborates the hypothesis H2. However, you can make a distinction between internationalized and not internationalized firms, as the effects of the variable "License (inter)", it is said that an internationalized company has more incentives to become a single-product company, without changes over time, but if among businesses since the total fixed effects show that the greater the effect of free licenses and internationalized companies, to become a single-product company, this finally confirms the hypothesis H2a.

With respect to data processing, we have calculated the factor weights with the principal component analysis, ordering the coefficients by absolute values and estimating the communality coefficients in Table 6.

The communalities are very high, which means that all variables are well represented in the space factor (Communality represents the multiple linear correlation coefficient with each variable factor). This calculation is shown with the intention of justifying the inclusion of the variables in the panel regression model.

5. CONCLUDING COMMENTS

In the literature review, it was noted that the multiproduct enterprises are due to a significant amount of unused tangible and intangible resources, which provide incentives for companies to use in various production processes, leading the company to become the called multiproduct company. Evidence of the contribution these firms internationally in cou ntries like the US and further showed that these businesses are closely linked to the process of internationalization, where greater internationalization evidence of greater diversification of the product portfolio will be detailed shown, leading the transition from a single-product company to a multiproduct company.

It was made the distinction between forms of internationalized firms, with sequential and accelerated (called Uppsala and Born-Global) models, which is similar evidence about their relationship between internationalization and diversification of product portfolio, so the internationalization model taken into account equally affects the transition to a multiproduct firm. Likewise, these models of internationalization involving technological change, which was described by royalty payments and licensing of foreign technology, undertake the production system towards specialization, and thus stop or moderate the transition to a multiproduct firm.

With respect to the regression models, there is evidence that it is not the accumulation of tangible assets such as fixed assets or technological change (licenses and royalties) which determines the transition to a mul-tiproduct firm. It is shown the accumulation of intangible assets such as human capital is the one which determines the expansion of the product portfolio, which is a significant theory Teece (1982 & 2000) about the existence of multiproduct firm contribution. But in addition to these results, if one takes into account the phenomenon of internationalization, the effects of human capital on product diversification is even greater, as there are also higher dampening effects of this transition payment of royalties and licenses, as this transition stop significantly.

Some limitations of this research have to do with the lack of variables that make it possible to measure the effect of the cultural, functional, positional and regulatory capabilities, over the multiproduct firm internationalized and not internationalized. Moreover, further analysis is needed on what are the capabilities to be developed in the various models of internationalization (Uppsala and Born- Global), to achieve a better transition to a multiproduct company. Future research could focus on case studies detailing such variables and capacity.