1. INTRODUCTION AND BACKGROUND

Collaborative Carousel between the Negocio Cárnico 1 from the Nutresa Group 2 and Almacenes La 14 S.A., is an alliance to improve the delivery time, reception and the product portfolio in the supply network.

In November 2004, the head of Distribution Logistics at Rica Rondo Industria Nacional de Alimentos S.A., Eberto Zúñiga, and the director of Logistics Management at La 14 S.A., Abel Cardona, met in the city of Santiago de Cali, with the purpose of finding alternatives to improve the logistics connectivity of the companies to achieve efficiency in the delivery times, the reception and the meat product portfolio at the supermarket chain outlets.

This meeting was held after Inveralimenticias Noel S.A. acquired the company Rica Rondo, Industria Nacional de Alimentos, in July 2002.

Later, in September 2004 they both participated in the International Congress of Logistics Managers, organized by the National Association of Entrepreneurs, ANDI, Valle del Cauca branch 3. On this occasion, the participating companies presented successful cases of collaboration as generation of competitive advantages in the relationship between customer and supplier in the supply chain.

With the conferences, Zúñiga and Cardona were able to understand that the topics were similar to the problems that had them in their companies and that they could therefore, work together and take advantage of the reality they were living. Motivated by the changes in connectivity issues that the market had been experiencing, through electronic data interchange, EDI 4, and the CEN (Centro Electrónico de Negocios) 5, the research, development and handbooks from the Institute of Automation and Commercial Coding, IAC - LOGYCA, 6 on good logistics practices, were mandatory to be at the forefront, since similar customer-supplier relationships in the sector were showing significant advances in this field.

The ties between the representatives of the companies became stronger and through a pilot carried out in January 2005 in one of the Almacenes La 14 S.A., confidence was strengthened and an improvement in the delivery times, reception and meat product portfolio was obtained. The final evaluation of each of the common activities was very important for the companies that progressively facilitated new pilots up to formalize the concept of the Collaborative Carousel, 7 supported by the certified delivery program of GS1, Colombian Bar Codes, administered via Logyca.

However, and with all the tangible progress achieved and presented to the corporate boards, there were restrictions on the internal audit areas of the organizations to formalize the agreement. For them, this new practice did not point out to the strategy proposed for each of the businesses.

Almacenes La 14 S.A. was a leading supermarket chain in Valle del Cauca. 8. The Cardona family began their business history with a grocery store in Aguadas, Caldas, which was attended by Abel Cardona and his son Jaime, who at the age of 14 became interested in the business.

In 1952, the Cardona family settled in the city of Santiago de Cali, where Abel Cardona and Antonio Villegas, founded a small store, which opened to the public on 14th Street with Carrera 8. During the first year, the business lost money and Antonio Villegas sold his share to Cardona, who with the help of his children, Jaime and Gustavo took over the business and managed it to generate profits.

Soon after, a merchant by the name of Benicio Mejia offered the Cardona family his china shop 9 called La 14, from where the name came. The business operated as a trading establishment until 1963, when it was transformed into a limited company.

Several years passed and the small business was transformed into Almacenes La 14 S.A., an important chain of supermarkets, leader in the southwestern area of the country and with national projection, having 16 points of sale in Cali, five more in the municipalities of Jamundí, Palmira, Buenaventura, Tuluá and Yumbo in a regional area. At the national level, it extended its operation to the cities of Bogota, Pereira, Armenia and Manizales, with a total of 26 supermarkets throughout the country. Its administrative headquarters were located in the Calima Commercial Center, in the city of Cali.

Their constant growth allowed them to offer an excellent service to more customers nationwide; under this premise they inaugurated their first supermarket in the city of Bogotá in 2011. Its expansion plan was oriented to the design of new supermarkets for the cities of Armenia and Neiva, while other possibilities were analysed in Bogotá, Ibagué, Girardot, Cali and Palmira, where they projected others "Calima Shopping Center" with one La 14 store.

What they organized in these years turned, by year 2013, into one of the great generators of employment at a national level, with 4.954 direct collaborators and more than 9.000 allies, which constituted their main strength.

Rica Rondo, Industria Nacional de Alimentos S.A., meanwhile, was a leading company in the cold meat business of the Colombian Southwest and the second largest brand in the country. 10

In 1968 was born in Santiago de Cali the company Rica Rondo, Industria Nacional de Alimentos S.A., product of the union of four partners who, with the vision and enthusiasm of their president, William B. Murray, obtained in a short time, prestige as an innovative company, based on the quality of its products and the good service to its customers. Its image was consolidated in 1971 when Ricarondo obtained from the Organizing Committee of the VI Pan American Games the contract to supply 40,000 pounds of sausage products to feed the athletes participating in the event.

Since the beginning, the company stood out for its solidity in the quality of its employees and its good internal working environment. This basic heritage, together with an excellent brand management and the gradual integration of a large distribution network, generated a business culture of work, dedication and commitment that the market recognized. It also served as an example for the entire Colombian industry. This condition allowed it permanently to be placed in the list of the most important companies in Colombia.

The company was also distinguished by its customer orientation from its marketing strategies and by having an open and participatory work environment, which evolved to total quality control.

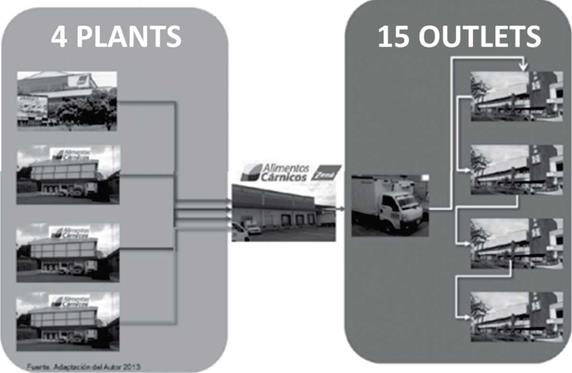

Since its inception, it has developed and distributed more than 100 product references and covered the entire Colombian territory, through seven regional sales units called districts, which had specialized sales management heads for each distribution channel, key account executives and with the support of the respective distribution centers, CEDIS. See Annex No.1, Negocio Cárnico Distribution Network. In 1995 the Planning Area of the company projected that it would require new facilities in the year 2000, due to the expected growth in the market. This was how the need arose to build a new production plant with all the technical specifications where the productive and environmental activities were developed harmoniously. At that time, Law 218 of 1995, known as the Páez Law, was enacted with very good fiscal benefits.

In December 1996, a lot was purchased at Parque Industrial y Comercial del Cauca, Caloto and with the legal name Frígorifico del Sur S.A. The construction of the new plant began in July 1998 and raw construction materials and manpower from that region were used.

One of the most difficult moments in the company's history occurred in 1998, due to the implementation of an enterprise resource planning system (ERP) 11 which in its initial stage did not work properly and generated distribution inefficiencies, as well as in the finance and manufacturing modules. The system did not allow for adequate compliance with the order billing and presented a total deficiency in the generation of information on such topics as inventory control, production planning, and accounts receivable and payable. This led to a 4% drop in market share in the period April-May 1998.

Only until the fourth quarter of the same year the ERP began to produce benefits by allowing control over management indicators and offering initial advantages such as: computer terminal for the sales force to take customer orders, online and updated data for devolutions, missing products, financial and volume discounts and production planning. By October 1998, a cost and expense reduction program was implemented.

Between 1999 and 2001, Rica Rondo, Industria Nacional de Alimentos S.A. began with the operating process of cold rooms and blend preparations. The canning area was moved to the facilities of Frígorifico del Sur S.A., which allowed an increase in the utilization of the installed capacity of the latter. The company advanced contacts with investors interested in acquiring 100% of the shares of Frígorifico del Sur S.A., which, at the end of the year, signed a sales contract with Inveralimenticias Noel S.A.

Between 2002 and 2008, the company became part of the Inveralimenticias S.A. Group, later to the food sector of the Nacional de Chocolates S.A Group . and finally from 2013, to the Nutresa Group,

In 2008 the plant of Frígorífico del Sur S.A. was merged with the companies Rica Rondo S.A., Suizo S.A., Frígorifico Continental S.A., Tecniagro S.A., Proveg Ltda., and Mil Delicias, thus, consolidating the company Alimentos Cárnicos S.A., leading operation in the cold meat market in Colombia, which sought to boost its resources and to homologate processes aimed at the central objective of the business, which was the growing generation of value.

By 2013, the plant of Alimentos Cárnicos S.A.S., located in the municipality of Caloto, department of Cauca, generated more than 230 direct and indirect jobs and had a capacity of more than 900 tons per month of products.

Zenú, brand name with 50 years of history.(12

Zenú was founded in Medellín in 1957, when the meat process was limited to cutting and dispensing; when there were only small artisan factories producing 'chorizos' that were transformed into the production of sausages.

Eduardo Ospina was an entrepreneur and visionary, who under the encouragement of his father, Pedro Nel Ospina, designed a modern plant to produce processed meats with equipment imported from the United States and under the advice of a German technician called Matías Brass.

In 1957, with 50 employees, the Zenú product company dedicated itself to the production of canned meat, such as Vienna sausages, Frankfurt sausages, liver paste, devil meat and ham. For this first year, production reached 12,000 cans a day. In 1959, and with great acceptance from its customers, a system was presented to the market to open cans more easily and safely as an innovation.

In the decade of the sixties, Zenú was acquired by the company Industrías Alimenticias Noel S.A., which generated a modernization of the equipment, an increase in the number of operators and a greater demand for quality controls, attributes characterizing the company's processes. In the same period, Zenú inaugurated in Medellín the first tasting center open to the public, with which they presented to consumers all the variety of their products, when they announced their new presentations. They also educated consumers about nutrition

By the 70s, the company was granted a sanitary operating license to sell its sausage and canned products throughout the national territory and also to export. The automation of the key processes of the production plant began in 1974; it became the first Colombian company to use vacuum packaging for its end products, which facilitated marketing and conservation. It also improved its presentation to consumers and points of sale. Then, in the year of 1975, the production of the company allowed it to cover the national territory and attended exports to Peru, The Antilles and Curaçao.

By the 80s, the production volume was estimated at 50 tons per day, with more than 80 references between cold meats and canned products, including peas, beans and asparagus, among others. In this same period, the company became an example for the management of human talent, by successfully forming integration groups in the work philosophy that invited the staff of the same area to identify, analyse, investigate and solve issues of your daily work. In 1988, by decree of the National Government, Zenú was awarded the National Quality Award, a stimulus that exalted the organization in its technological and industrial development.

Industria de Alimentos Zenú S.A.S., Sociedad por Acciones Simplificada, with indefinite duration and principal domicile in Medellín, Antioquia. Its social purpose was to exploit the food industry in general and substances used as ingredients in food, especially meat, including the processing and use of by-products from other sectors.

In addition, the social purpose of the company included the investment and application of resources or availabilities under any of the associative forms authorized by law, and the performance of any other lawful economic activity.

Suizo arrived in Colombia in the early thirties. 13

José Krucker, a Swiss immigrant, arrived in Colombia at the beginning of the 30s, and began the assembly of a delicatessen named Salsamentaría Suiza, located in the city of Bogotá. This company specialized in hamburger sales. In 1970, it was incorporated as a public limited company of a commercial nature, named Frígorifico Suizo S.A., an entity with 100% Colombian capital. By this time, the Krucker family shifted all their economic interests to the new shareholders and laid the groundwork for developing a large industry.

Between 1970 and 1992, Frígorifico Suizo S.A. began a process of growth, diversification and technological improvement, until it became one of the most important cold meat processing companies in the country. From 1993 onwards, its corporate name was changed to Suizo S.A. From this date, its sales volume, commercial coverage, patrimonial situation and volume of employed labor, allowed it to become one of the largest and most important meat sector companies in Colombia.

Looking for a consolidation process that would allow Suizo SA to achieve better levels of competitiveness in the sector, in 2008 joined six more companies of the Negocio Cárnico 14 of the Grupo Nacional de Chocolates to form the new company, Alimentos Cárnicos S.A.

Alimentos Cárnicos S.A.S.

As of January 2008, the history of Alimentos Cárnicos S.A.S. was interpreted and summarized within the organization as a "sum of successes, tenacity, dedication and business development, which made the company a benchmark for growth for the food industry in Colombia" 15.

The organization was constituted by the integration of a series of companies that were acquired by the Inversiones Nacional de Chocolates Group in a certain period of time, as a result of its strategy to grow not only through the successful execution of its routine tasks, but also through its policy of acquisitions of established businesses but having some affinity in their production and distribution processes.

At the beginning of 2008, the creation of Alimentos Cárnicos S.A.S., which integrated the companies Rica Rondo S.A., Suizo S.A., Frigorífico Continental S.A., Frigorífico del Sur S.A., Tecniagro S.A., Proveg S.A. and Productos Mil Delicias S.A.

In 2009, as a result of some governmental changes and market dynamics, Alimentos Cárnicos S.A. was transformed on the 17th March 2009 by the unanimous decision of the Shareholders' Meeting into a Simplified Share Company, (S.A.S.), with indefinite duration and principal domicile in the city of Yumbo, Valle del Cauca.

During 2010 all this patrimony, along with the skills of the Inversiones Nacional de Chocolates Group in the brand management, and the consolidation of a powerful distribution network, allowed Alimentos Cárnicos S.A. to work with an on-line production processes in its different plants, with high technology in its logistic processes and operationally integrated with the other company of the Negocio Cárnico known as Industria de Alimentos Zenú S.A.

By 2011, by decision of the shareholders' meeting, the parent company changed its corporate name from Grupo Nacional de Chocolates S.A., to Grupo Nutresa S.A. The new company continued to develop its corporate purpose under the new name; since then, also Alimentos Cárnicos S.A.S. became part of the Negocio Cárnico of Grupo Nutresa

Between 2011 and 2012, they continued working in production processes online, specialized plants and with the best technology for the logistic process seeking the satisfaction of consumers, development of human talent, strengthening innovation, better corporate performance and leading brands, with the aim of fortifying the Negocio Cárnico and tripling its profitability by 2015.

Negocio Cárnico, a strategic alliance.

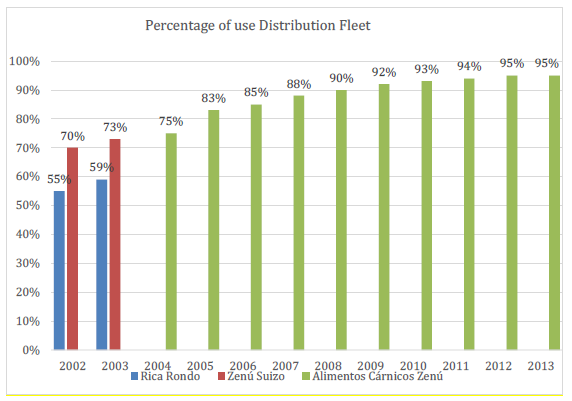

The Nacional de Chocolates Group, which later became the Nutresa Group, visualized the reorganization of its companies dedicated to the Negocio Cárnico through a consolidation process that allowed it to have better levels of competitiveness and helped it consolidate as the most important organization in production, distribution and marketing of cold meats in Colombia. Everything was achieved as a result of the different synergies they made between the companies, thus strengthening their business, financial, productive and logistic processes but above all they were able to protect their national trademarks from the possible entry of international trademarks and companies. Below are the main facts of Negocio Cárnico's historical development between the years 1999 and 2013. Please see Chart 1 at the end of the article Before the strategic alliance was started between the companies that formed the Negocio Cárnico of the Nutresa Group, the companies acted independently in the same market, competing with very high operating costs, in distribution, administration and marketing. The production was done by brand, depending on the geographic location of the parent factory and from there distributed to the whole country with a very expensive reverse logistics 16. When joined operationally, the percentage of utilization of the fleet of vehicles went from 60% to 95%. (See Annex No.3, % Utilization of vehicles in the Meat Business fleet. Years 2002-2013).

Chart 1: Negocio Cárnico’s historical development between the years 1999 and 2013.

Source: Internal sources Nutresa obtained by MBA E. Zuñiga

The Negocio Cárnico had a mission to grow profitably with leading brands, superior service and an excellent national and international distribution. Its products were known for having high standards of quality, innovation and customer service 17. Its main customers were chain outlets 18, independent supermarkets 19, distributors 20, wholesalers21 and neighbourhoods' shops 22.

Within the distribution of the Negocio Cárnico the integration of logistic operators stood out and yielded economic benefits to the company in terms of cost reduction. Additionally, a software was implemented for demand management, tracking and customer care and management programs that managed to improve the supply coverage and presence of products in the Colombian market.

The advertising investment facilitated the strengthening of new brands such as Ranchera, Pietrán, Zenú, Americana, Rica Pollo and Cunit. The performance of the brands was characterized by the innovations of their products.

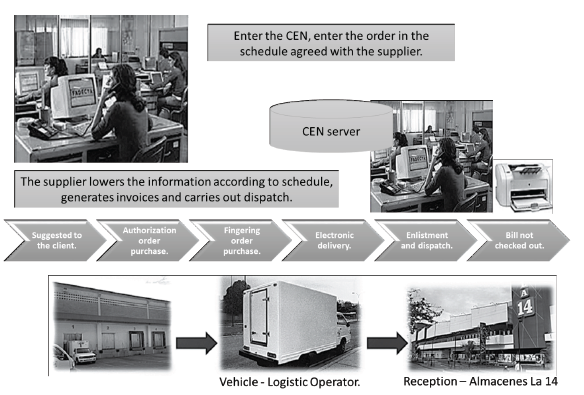

The integration process made it possible to place orders through EDI (Electronic Data Interchange), under the CEN (Electronic Data Centre) 23 platform, which facilitated the alliance more effectively (See Annex No.4, Diagram Information Systems in the supply chain operation, between the Meat Business and La 14). The companies integrated the entire logistics operation, this was translated into benefits for the company and customers, who from that moment could carry out purchases in a centralized fashion. However, the companies were conceived independently by their customers, thereby affecting distribution costs. In view of the above, the Negocio Cárnico saw the need to seek partners to develop a strategy to solve the problems in an efficient manner; then, they sought to approach the largest and most representative customer of the department of Valle del Cauca, Almacenes La 14 S.A.

Strategic alliance between the Negocio Cárnico and Almacenes La 14 S.A.

During 2004, fallacies in the logistical process were identified that were affecting the level of service in the customer. To achieve strategic alignment, companies had to adjust the following processes. Please see on Chart #2 at the end of the article.

A key factor in this adjustment process was the electronic exchange of data, due to the fact that negotiations for the Negocio Cárnico and La 14 S.A., made it possible to increase revenues by making the collection process through electronic invoices more efficient, costs were also reduced by improving supply chain coordination and forecasting the interrelationship between supply and demand.

"Purchase orders were placed manually and billing was completed at 9:00 p.m": Victor Hugo Molina Charry, Logistics Coordinator for Meat Business Distribution.

Prior to and during 2005, the sponsors of the companies Negocio Cárnico and La 14 S.A., as a result of joint action and acting as an open book (knowledge of needs, management of opportunities and proposals for joint solutions for companies) and as an exercise in the results obtained from the pilot tests carried out, they had to choose to look at the consumer on the same side of the table, thus, it was necessary to speak the same language and look for working as the team the best alternatives to satisfy it. They had to agree on common measurement elements, as the parties initially calculated their indicators differently and this led to some degree of discomfort, because positions persisted, and not common interests were experienced. The company functional areas: Administrative, Marketing, Auditing, some of the Commercial, Logistics and third parties, had not initially participated did not agree and at times, the activities had to be suspended until they were reviewed, validated and solved.

The figures related to stock-out and returns were diagnosed and evaluated to improve customer service, in terms of product availability in the shelves. With regard to human talent, the training needs of both parties were identified, and new skills developed to improve profiles and finally, logistics processes were standardized.

This strategic alliance between La 14 S.A. and Negocio Cárnico allowed the companies to optimize the logistical process between them and generated collaboration and trust links as a result of the alignment between their databases, facilitating the development of joint business activities. In addition, it improved the technological infrastructure, some operating costs, delivery times, and reduced the environmental impact due to the sensible reduction of distribution vehicles in the retail logistics.

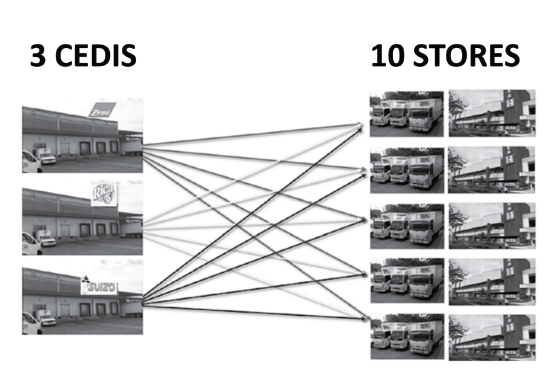

In 2005, La 14 S.A. accounted for 35% of sales on the self-service channel for Negocio Cárnico in the southwestern Colombian region (Valle del Cauca, Cauca and Nariño). On the other hand, La 14 S.A. had ten points of sale distributed in the cities of Cali and Jamundí, which were the geographic space in which the alliance was developed. (See Annex No. 5. Initial route Cali Negocio Cárnico-La 14. See Annex No. 6. Initial route - Cali Colaborattive Carousel Almacenes la 14).

2. THEORETICAL FRAMEWORK

Below there is an explanation of the topics selected to determine the application of the distribution model:

2.1 Competitive and supply chain strategy 24

The competitive strategy of a company defines, in relation to its competitors, the group of customer's needs seeking to be satisfied with its products and services, likewise, it can address one or more segments of customers. A supply chain strategy determines the nature of the sourcing of raw materials, the transport of materials to and from the company, the manufacture of the product or operation to provide the service and distribution of the product to the customer, together with any tracking services and a specification indicating whether these processes will be carried out in-house or subcontracted.

Strategic adjustment means that both companies must have their goals aligned, refers to the congruence between the customer's priorities that the competitive strategy expects to satisfy and the supply chain capabilities that the supply chain strategy wants to build -Chopra Sunil.

Supply chains must achieve dynamic aligning, so, they can keep up with customers and consumers and evolve over time.

"A value chain emphasizes the close relationship between functional strategies within the company, each function is crucial for the company to meet the customer's needs in a cost-effective manner, therefore, the various functional strategies cannot be formulated in isolation, must be adjusted and supported each other for the company to succeed"25

2.2 Supply chain network design 26

When designing a distribution network, the needs to be met by the customer and the cost to meet them must be considered, some key needs are: response time, the variety and availability of the product, visibility of the order and reverse logistics, other costs to consider are inventories, transportation and information management.

"The Collaborative Carousel is giving a special service to a special customer, is segmenting the service, is efficient in delivery that benefits the customer and supplier, is a win - win situation for both, as we offer an improved frequency and at the same time optimize the distribution center resources." Ernesto Diaz, -Manager Zenú Cali.

2.3 Satisfaction of customer and supplier needs 27

A model like the Collaborative Carousel focuses on:

Response time. Shorter times in the receipt of goods through the certified delivery system.

Availability of the product. Guarantee the best level of service (decrease the rate of spent products at point of sale).

Customer experience. Automation to place and receive the order.

Time to reach the market. Increases customer service frequency.

Visibility of the order. Information of the order in real time, through effective communication: customer-supplier.

Returnability, Reverse Logistics. Ensure that returns of goods are certified when they do not generate customer satisfaction.

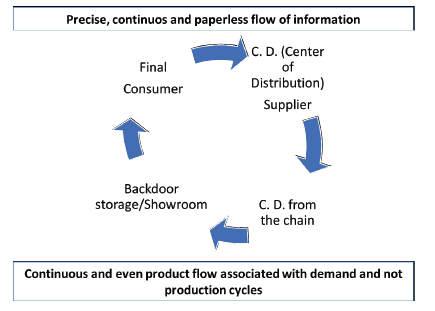

The strategic focus of the design of the COLLABORATIVE CAROUSEL model is, on one hand, to satisfy the needs of the client (better level of service) and, on the other, to increase the efficiency of the chain, through lower costs. Under this operating model, the product is sent directly from the manufacturer to the final consumer, avoiding the retailer, its great advantage is the ability to centralize inventories at the manufacturer. It can add demand throughout the retailers it provides, as a result, the supply chain is capable to provide a high level of product availability with low levels of inventory, also offers the manufacturer the opportunity to product with low levels of stocks, as well as offers the manufacturer the opportunity to postpone customization until the customer places the order, save on the fixed cost of facilities by using direct shipping. In addition, this type of shipment provides a good customer experience by delivering to your location, if the deliveries are not partial. 28

The performance of direct shipping, with respect to several dimensions applied to the case, can be seen in Table 1: Performance characteristics of Collaborative Carousel, based on storage in the manufacturer with direct shipping.

2.4 Definition of the Collaborative Logistics Model 29

The joint analysis between the customer and the supplier allows to improve the logistic efficiency in each of the activities, through the application of a collaborative model in which trust is the basis for the sustainability of it. Let us see what is involved in this:

Logistical aspects. Continuous resupply, timely assortment and efficient receipt.

Commercial aspects. Efficient order, attention to the consumer and growth of sales.

Strategic support: Differentiated service based on logistics assistants with training from the being and doing.

Consumer satisfaction: Companies acting together, control of baskets, improvements in the cold chain and decrease in the level of spent references in the gondola.

2.5 Supply Chain Continuous Resupplying CPR. 30

They are distinguished by the customer's loyalty and in return expect a high level of dedication and service; all their members try to meet the demand in the most effective way, the parties, including the outsourced ones, work together to lower costs, meet demand and improve their delivery times and services constantly. The most distinctive feature of this type of chain is that customers have a real collaboration purchasing behaviour and processes are participatory, standard and replicable; in other words, "one happy end customer is a happy customer for everyone".

Members of such chains enter into joint investment societies and projects; planning and management of supply facilitates balance with demand, share freely in both directions demand forecasting information that will help improve performance, which is a common cause; reliability and credibility are also essential ingredients for the success of such chains.

2.6 Efficient Consumer Response (ECR) 31

Strategy of the mass consumption industry in which industrials and merchants work together to offer greater added value to the consumer, responding to real demand, maximizing satisfaction and reducing total operating costs.

The strategies followed by an ECR Model are as follows:

Continuous replenishment. Modification of the current supply chain, changing from a push system to a pull one to respond to real costumer's demand.

Efficient assortment. Optimize the use of the space at the point of sale, gondolas, offering the consumer the products that he really needs.

Efficient Promotion. Define new promotion schemes ensuring a greater impact on the consumer without generating additional costs for the product management.

Efficient introduction of products. To optimize investments made in the development and launch of new products, reducing the percentage of failed market entries.

2.7 Collaborative planning, forecasting and resupply CPFR 33

Standard, global and neutral business process in which supply chain partners coordinate plans to reduce the gap between supply and demand, sharing the benefits of a more efficient and effective operation; CPFR is a collaborative approach to increase product availability, while reducing inventory through the supply chain, its objective is to increase product's availability and decrease the inventory level; it also involves an interaction between the participants of the production chain and the retail, based on a collaborative management in the planning processes and the information exchange. A successful CPFR requires partners with business strategies to operate in an integrated manner.

The CPFR has its origin in the strategy of efficient response to the consumer ECR, a management concept based on vertical collaboration in production and distribution processes, with the aim of achieving an efficient satisfaction of consumer needs, with supply chain management (SCM) and category management (CM), as its main components.

'The goal of CPFR is to achieve the collaboration of the entire supply chain, around the commercial partners who have contact or have effect on the value of the product going to the final consumer' - Supply Chain Management.

3. EFFECTIVE COLLABORATION IN THE SUPPLY NETWORK' CONCLUSIONS

In 2005 the logistic operation of the Collaborative Carousel 34 model began, once Eberto Zúñiga and Abel Cardona agreed to carry out a pilot test at one of the points of sale of La 14 S.A., in the city of Cali. The result of this experience was a collective learning that allowed the parties to identify opportunities for improvement in the logistics operations that shared with their work teams was the basis for the implementation of the model in all the customer's sales points.

Collaborative Carousel was a program designed for the effective collaboration between the Meat Business and La 14 S.A. (see Annex No. 7 Information Flow: Products, Materials and Cash Negocio Cárnico NUTRESA GROUP). Its main objective was to improve the orders delivery times, reception and product supply of Zenú, Rica Rondo and Suizo brands in the ten stores of La 14 S.A., in order to offer a better level of service to the final consumer (See Annex No. 8, Receiving times) and reduce logistical costs associated with the logistics operation with the client (See Annex No 9, Cost reduction. Implementation of the Collaborative Carousel). This process was the result of the integration of three elements into the logistics chain: Certified Delivery Program, Basic Carousel and Multibrand Dispenser.

Each of these is explained below (See Annex No. 10). Collaborative Carousel Scheme.

3.1. Certified Delivery Program

In 2005, Eberto Zúñiga proposed to Abel Cardona to operate the Collaborative Carousel model, based on a certified delivery scheme. With the process of certified deliveries 35, the Meat Business and La 14 S.A. managed to minimize the costs associated with verification, delivery time, merchandise handling, accounting notes, returns and repetition of operations through the logistics process. This was how the Negocio Cárnico used in this model a logistic service provider, Cargacoop 36. considered as an integral part of the program.

During the second quarter of 2005, based on experiences with other customers, Eberto Zúñiga proposed that companies should align themselves in orders placement, supply schedules and real-time communications between the points of dispatch and receipt. As a result of this need, a training space was started to contribute to the improvement of the logistical process between the parties. This process was carried out in different phases, as follows: through a sampling plan that facilitated the monitoring of the inspection level in the Certified Delivery Program (See annex No. 11, Certified Delivery Program: sampling plan), a specific duration of each step for the certification process was also agreed, taking into account the frequency of delivery (see Annex No. 12, Certified Delivery Program: Phase Duration). In the phases there were tolerance levels, safety conditions and corrective actions within which decertification was considered. (See Annex 13, Certified Delivery Program: Corrective Action Procedure).

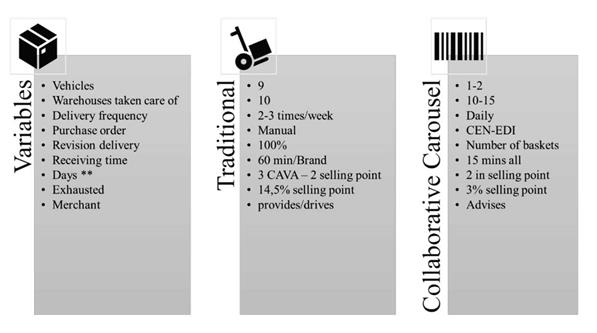

At the points of sale of La 14 S.A. the contents of each basket of the delivered order were checked, so the delivery time took more than 90 minutes per brand; with the new model only the number of baskets was counted, and the delivery time was reduced to only 15 minutes in the delivery of the three brands.

"The Collaborative Carousel provided a streamlined service and better organization of internal processes such as the chain itself, generated greater customer reliability in our processes". Maria Teresa Restrepo - Suizo Manager Cali.

This is how the certification was achieved during the last quarter of 2005. This generated a greater degree of confidence among the parties, as fewer items were checked per invoice to the point where only the total number of baskets delivered were verified and not the detailed order. By the end of 2005, the parties achieved the following benefits in terms of time reduction: attention, waiting, unloading, verification, as well as product handling and administrative 'wear and tear' in dispute resolution; the quantity of products in the delivery was assured and a relationship of strategic allies was consolidated between the La 14 S.A.

3.2. Basic Carousel

It consisted of specializing a single vehicle to deliver the new brands at each of the sales points of La 14 S.A. Before implementing this model, there were two previous phases:

Phase 1 - Year 2003: nine vehicles were required (three for each of the companies, Industria de Alimentos Zenú S.A., Rica Rondo Industria Nacional de Alimentos S.A, and Suizo S.A.), deliveries were made at different times and frequencies.

Phase 2 - Year 2004: three vehicles were required (a single vehicle fleet for all companies), this meant moving to a single delivery schedule, unifying its frequency.

In 2005, with the operation of the model, a vehicle was required, a unified delivery schedule and the frequency of deliveries increased from 2 to 6 times per week.

3.3. Multibrand Dispenser

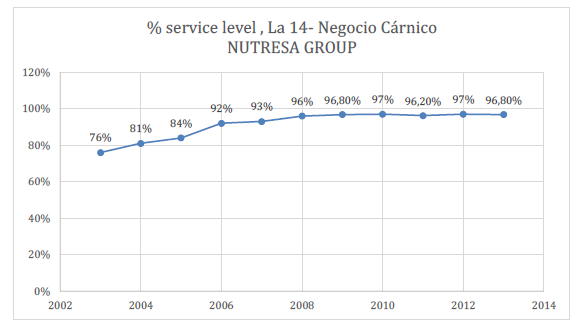

During 2005, Mr Giovanni Vico, manager of Rica Rondo Industria Nacional de Alimentos S.A., proposed to Abel Cardona and Eberto Zúñiga to complement the model with the figure of a person trained by the parts, so that, once the order was delivered, it was supplied in real time. This was widely accepted by the parties as it ensured the decrease of depleted products at the point of sale, also eliminated storage in cold rooms and reduced excessive handling of products before reaching the gondola. This allowed us to increase the efficiency in the service level of La 14 S.A. (See annex No. 14, Service Level Traditional vs Collaborative Carousel NUTRESA GROUP).

'The collaborative carousel resulted in the understanding and comprehension of a process providing significant time savings in daily tasks that had a direct impact on the end customer, the great beneficiary andfor which we continued to look for continuous improvement in our processes', Vladimir Arenas Logistic Coordinator of La 14 S.A.

During 2006, trust between the parties reached such a high level that processes flowed naturally, this fact improved operational efficiency, every time new sales points were opened for La 14 S.A., the model was implemented immediately.

It was thus the integration of the three elements: Certified Delivery Program, Basic Carousel and Multibrand Dispenser, meant the basis that over time became the operational efficiency of the entire model (See Annex No.15, Benchmarking between systems: Traditional vs Collaborative carousel).

The Collaborative Carousel supply chain strategy required most of the Negocio Cárnico distribution to be outsourced, so it had to be both inward and outward oriented. It identified not only what Negocio Cárnico y La 14 S.A. should do, but also the role of the third parties to whom it subcontracted for the accomplishment of the tasks. This strategy defined which transport, operation and service functions should be developed in the future, including greater control over the overall supply chain structure, and this ended up being a logistics operations strategy.

4. SOME LESSONS LEARNED IN THE IMPLEMENTATION OF THE MODEL

To have the acceptance and participation of senior management in both companies.

Unify the form of measurement based on the definition of GS1 Colombia.

Adjustment of databases as a transactional facilitator between companies.

For companies to look at the needs of the consumer on the same side of the table

Flexibility of the parties to meet consumer needs

Knowledge and participation of all areas of companies and third parties for common definitions.

Understand the reality of the parties and, if necessary, modify by agreement the defined processes.

Start pilot testing at a customer sales point to ensure the basic operation of the model

Timely, accurate and real-time communication.

Act as open books to seek the timely solution of news

Joint solution of non-conformities and socializing the opportunities found

Definition of business sponsors, with autonomy, for the implementation of improvements and decision-making.

Respect for process and model, as defined and agreed by the parties

Use of technology as model facilitator.

Formalize the protocol to the agreement (basic format GS1 Colombia).

Joint socialization of the model in all parts (customer-supplier and logistics service provider).

Ensure that the execution of the model does not depend on the duty officer.

Periodic evaluations (recommended monthly) and process adjustments.

Recognition and permanent feedback to the direct executors of the model.

Resignations of participants if they facilitate and provide quantitative benefits to the model as a whole.

Certify the model, once the number of deliveries defined in the phases of the model (model GS1 Colombia) is exceeded.

4.1. The Future of the Collaborative Carousel Alliance

As part of the dynamics presented by the market, the market invited the participating companies of the Collaborative Carousel model to review what was happening in their sectors, in order to visualize opportunities that would allow them to anticipate and prepare for these new scenarios, we shared some cutting-edge decisions that companies had to make.

Almacenes La 14 S.A.

In 2009, La 14 S.A. decided to change its strategy, seeking to be recognized as a Latin and world-class chain. They defined in their initial expansion plan to Bogota as the most important region of the country, there, they expected to inaugurate two more sales points in the next five years (2014-2018). To strengthen its IT structure, since 2012 its board of directors approved the SAP project as an integrative ERP and connectivity with its customers and suppliers. They hope to go live with this implementation (retail and financial) at the end of the second half of 2014. In the short and medium term, managers of La 14 rules out a possible sale and alliances with third parties. As part of its strengthening in the medium range, they have considered the construction of a distribution centre in Cali, to take care of everything related to mass consumption. They say that customer service is and will continue to be their main factor in differentiation from their competitors and they are leveraging their new strategic dynamic to dynamize new openings in other regions of Colombia.

Negocio Cárnico of the Nutresa Group

Since 2008, Negocio Cárnico provided to their processes a comprehensive management model, based on strategic readings of the commercial environment. They declared the consumer as their focus and defined his century-old strategy that pursued to double sales by 2020, reaching them in 2013. They made statements on leadership to leverage new challenges, promulgated their core and enabling capacities; emphasized the desirability of continuing to strengthen the required culture, as part of adjusting their processes, to be more competitive and to ensure the flow of information between the work teams. Starting in 2014, they redefined its enabling process structure, giving way to the beginning of structuring a supply chain management fully mature.

4.2. Future of the Collaborative Carousel model

For Abel Cardona, developing the model inside the company La 14 S.A., did not constitute a strategic turn of the operation, so he invited other suppliers to know and implement the model advanced with the Negocio Cárnico.

Instead, for Eberto Zúñiga, it became an opportunity to visualize the Negocio Cárnico at a higher stage, to enable it to develop Collaborative Carousel and strengthen it as a program to offer logistics services to other national and international supply chains; socializing it with other companies in the region, both industrial suppliers and commerce in general, so, this practice could lead to improve other supply chains.

With the exercise carried out with La 14 S.A. and the possibilities offered by the market, through the different distribution channels, the invitation to consider alternatives such as diversification into collaborative processes that would support the model by presenting this relationship where customers, suppliers, channels, materials to be distributed compatible and the wide range of frequency attention could be used and applied to be built in into other possible product categories.

The strength and proper construction of the model presented total consistency, since between 2008 and 2013, La 14 S.A., in Cali, increased its sales points by five, and this new market condition involved the inclusion of an additional vehicle by the Negocio Cárnico, which allowed them to ensure the delivery schedules (according with the number of new sales points to attend) and the new equivalent volume of products.

This did not affect the level of service, distribution costs, receipt times and other associated indicators, as can be seen from the annexes. To explain the service model at the end of 2013, you can see annexes No. 16 and 17. Routes Carousel Collaborative Negocio Cárnico and La 14, year 2013. Likewise, for greater understanding we share annexes 18, which show the behavior of the cost per kilo transported between the years 2003 and 2013.

Will this model allow logistics service providers and/or suppliers to serve other supply chains than the meat sector? Strategies such as Efficient Consumer Response (ECR) 37 and Planning, Demand Forecasting Collaborative resupply (CPFR) 38 of which there are recognized global practices and applied to mass consumption can be successfully applied in this model? Can this logistic model, from its versatility, be used to serve new channels or ensure multi-channel attention in the new distribution schemes?