Introduction

The covid-19 disease has had devastating consequences worldwide for economy and public health. The disease has created negative demand and supply shocks that differ from those of previous global crises (Ilzetzki et al., 2020). Besides, restrictions on mobility and economic activities have severely affected global economic dynamics (Ding et al., 2020). For example, in the second quarter of 2020, the United States recorded an annual GDP growth of -9.5%, while the United Kingdom showed the largest annual decline of its economy (21.7%) and the European Union fell by 12.1%. According to World Bank estimates, the global economy shrank by 5.2% in 2020, creating a recession much worse than the global financial crisis of 2008 (Cuesta & Pico, 2020).

According to Cuesta and Pico (2020), the impact of the crisis could be greater in developing countries since their health systems have fewer resources, marginal financial markets, limited fiscal capacity, and weaker institutional management. El Salvador, Honduras, Guatemala, and Nicaragua, located in Central America, are at a disadvantage compared to other countries in the region due to the serious socio-political crisis they are experiencing, which has implications for human rights and their economies. Added to that, part of public recovery funds created to address the pandemic has been allocated to support big businesses instead of social protection programs, according to a study published on April 2021 by the organization Financial Transparency Coalition (FTC), which also reports that these countries are among the poorest in Latin America. These economies have also been affected by anti-covid-19 measures such as restrictions imposed on mobility and temporary closings of non-essential economic activities. As a result, in the second quarter of 2020, El Salvador and Honduras GDP fell 20%, while Guatemala and Nicaragua reported a decrease of 9.6 and 8%, respectively; for comparison reasons, in 2019 these countries had an average GDP of USD 3,000 per capita. As a consequence, household and firms are facing economic recession due to the pandemic, with effects through all the supply chain. Hence, the covid-19 outbreak presents a unique opportunity to study how markets contract in the face of an abrupt shock.

This global phenomenon is likely to cause many firms to go bankrupt as consumers stay home and economies close down (Tucker, 2020). According to Bricongne et al. (2012), the effects of the 2008 crisis on large firms have been mainly on the intensive margin, affecting less the products offered to export destinations. Therefore, the impact of the current pandemic in developing countries would be greater for SMEs, where the flow of working capital and capital resources are lower, which adds to their reduced capacity to access the credit market.

In the literature, several analysis had been working on corporate governance and its influence on the performance of companies during the crisis (Chaston, 2012; Erkens et al., 2012; Mitton, 2002). The results confirm that, regardless of whether the company is family or non-family owned, improved cost management and market efficiency during the crisis favors firms’ performance. Asgharian (2002) finds through a linear model that highly leveraged Swedish industrial firms face relatively lower returns and a higher probability of bankruptcy risk. The same results were obtained for a sample of Indian companies by Jandik and Makhija (2005).

The main interest of this research is to study how firms’ performance in developing countries from Central America was affected by the covid-19 pandemic. The purpose is to advise policymakers on the strategies needed for economic recovery. This work also arises within a context where no surveys or statistics on the reality of business in these countries are available at the moment. To do that, longitudinal microdata from the World Bank enterprises survey for 2017 and 2020 was studied. With this information, the author was able to track the economic activities of companies in the baseline from February 2020, making a follow-up until May 2020, when government actions in response to covid-19 were already in place. Using a first difference estimation method, 34,040 microenterprises were selected for evaluation in the stated period.

The main findings of this research show that all enterprises experienced a sudden drop in their economic activity due to the official outbreak of the pandemic. Two percent of firms closed permanently because of the pandemic and 60 % of businesses closed temporarily. Measured indicators also fell, with sales showing a negative change of 31 %, sales per worker a 10% decrease, and employment a 3 % drop. For enterprises that closed temporarily during this period, there was an additional 31% reduction in sales, a 13% contraction in employment, and a 24% decrease in sales per worker. Besides, despite all sectors being affected, manufacturing and services industries stand out over retail. Results also depict that the economic decline was greater among small businesses, while medium and large-sized firms have been resilient in their employment and sales indicators.

This paper makes two main empirical contributions. First, it exploits a sudden impact, such as covid-19, over supply chains in order to estimate its effect on firms’ performance indicators based on a longitudinal survey. Secondly, the source of information is composed of microdata from formal firms in Central American countries, which is a valuable asset, considering that this type of input is not commonly known for these countries. In this sense, the findings could help inform about the potential impact of the pandemic for the business sector. The approach followed is relevant for governments to better focus public policy actions.

After this introduction, the paper is organized as follows. The next section describes mitigation policies implemented by the studied countries in response to covid-19 and their related effects on businesses, according to the literature. Then, the data and the model to be estimated will be presented. The section afterwards introduces the results obtained. Finally, the conclusions of the study will be reported in the last section.

Firms and the covid-19 pandemic

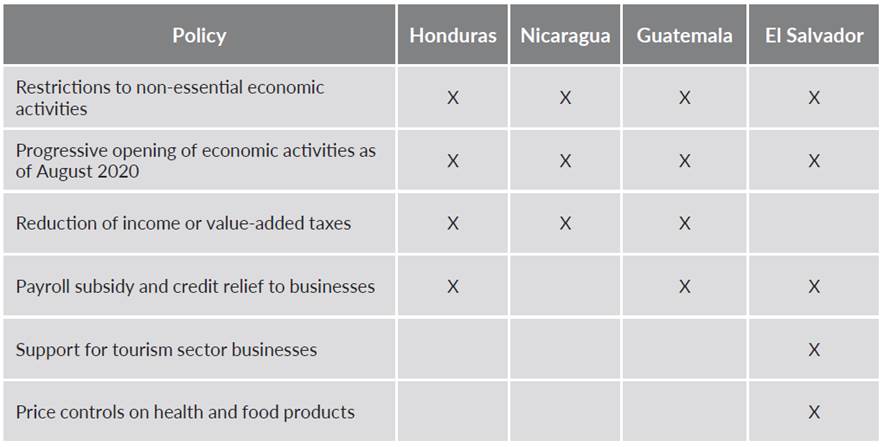

Industries produce, consume raw materials and distribute their products and services. But now countries have imposed restrictions on social gatherings or people’s proximity. In this setting, non-essential activities have had to minimize operations, temporarily cease or close indefinitely, which is especially true for labor-intensive companies (Tucker, 2020), while the manufacturing of products considered as essential (food, health, financial services) was allowed in most countries (Seetharaman, 2020). Table 1 shows the measures implemented by the countries analyzed in this paper between March and May 2020.

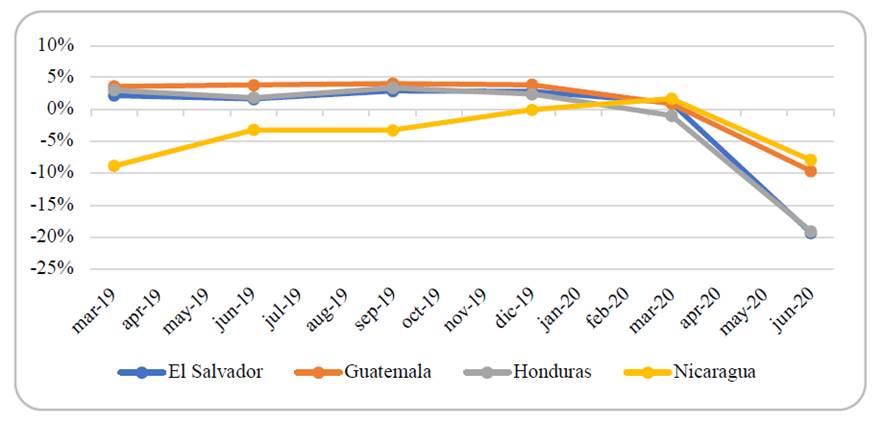

In general, Central American countries shut down part of their non-essential activities. To alleviate the consequences of closures, governments implemented payroll support programs and credit relieves. Despite this, economies reported declines in production. Figure 1 shows the quarterly changes in GDP between 2019 and 2020. All countries, except Nicaragua, were growing at a rate of 1 to 5% before 2020. However, the first and second quarters of 2020 show declines of more than 10%, with El Salvador and Honduras reporting a nearly 20% contraction.

The existing literature provides evidence that pandemics have a significant short-term impact on the economy (Apergis & Apergis, 2020; Fan et al., 2016) and credit market constraints due to increased uncertainty (Halling et al., 2020; Narayan, 2020). Articles focusing on the macroeconomic aspect are recently abundant (Gil-Alana & Monge 2020; Haroon & Rizvi 2020; Qiu et al., 2020) and their objective has been to analyze —through stochastic and general equilibrium models— the impact of the covid-19 pandemic and aggregate economic outcomes. For example, it has been assessed that the potential cost of modern pandemics will represent a net loss of global GDP of 0.5-2% (Guerrieri et al., 2020; Verikios et al., 2010). When studying the impact of the current pandemic by sector, results vary across industries. Sectors such as restaurants, parks, transportation and tourism are affected by demand, while labor-intensive industries (manufacturing, mining) face large supply shocks (Hepburn et al., 2020).

Despite the existing literature, few quantitative efforts have been made to analyze how Latin American enterprises are responding to the covid-19 pandemic. In developed countries this had been an actual task. As an example, Hassan et al. (2020) found through structured interviews with nearly 2,000 U.S. enterprises that companies expressed concerns related to the supply and access to credit markets. Moreover, Donthu and Gustafsson (2020) detail that U.S. companies with quite a few years of foundation, such as Sears, JCPenney, Hertz and J. Crew, are under enormous financial pressure. In the same vein, the travel industry is deeply affected, since 80% of hotel rooms are vacant and firms such as American Airlines cut their workforce by 90% and will unlikely make any profit in 2020 (Asmelash & Cooper, 2020). In addition, exhibitions, conferences, sporting events, other large gatherings and cultural establishments, such as galleries and museums, have been abruptly cancelled (Asmelash & Cooper, 2020). Alonso et al. (2020), studying an international sample of 45 Spanish hotel companies through a descriptive analysis, confirmed that firms are considering new ways of generating revenue through new forms of industrial organization and logistics distribution.

For their part, Gu et al. (2020) examined daily electricity consumption data from 34,040 industrial firms in Suzhou (China) before December 2019 and after mitigation measures to covid-19 were adopted. Employing a difference-in-differences estimation model, these authors found that the manufacturing industry suffered the largest negative effect, while the IT, health care and social work services sector were positively influenced, particularly by the implementation of telework and covid-19 care measures. By ownership type, private firms suffered more than state-owned and foreign-owned firms. By firm size, SMEs reported a 30% drop in sales, while large companies presented less negative variations.

Bearing the above in mind, this research contributes to the literature in several ways. First, the results complement studies investigating the economic impact of covid-19 by supplying quantitative evidence on the pandemic situation in four Central American countries. Second, longitudinal data provide a unique perspective on how firms have been reacting to the pandemic, as they make possible to control a number of variables that may alter the analysis in other types of structures. Third, this work delves into how the impact of the pandemic on businesses by country varies by economic sector and other domestic characteristics. Together, these results provide valuable information for understanding broader economic implications of the covid-19 pandemic and thus contribute to the design of strategies for economic recovery.

Methodology

Data

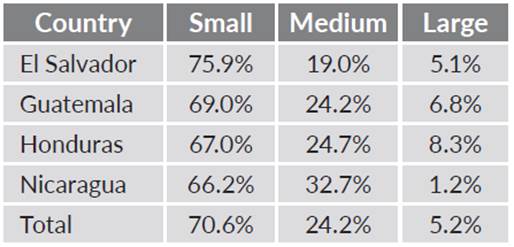

The data used was obtained from the Enterprises Survey conducted by the World Bank (2020) between 2017 and 2020, which is open access and is available at the World Bank (WB) web page. This survey gathers data from formal firms in all sectors of the economy. Firms in the industrial sector include apparel manufacturing, food, metals and machinery, electronics, chemicals and pharmaceuticals, furniture, non-metallic products, plastics, automobiles, and other manufacturing industries. The survey covers topics such as firms’ characteristics, employee distribution, access to finance, annual sales, input and labor costs, workforce composition, corruption, licensing, infrastructure, trade, innovation, technology, crime, competition, capacity utilization, land and permits, taxation, informality, and government relations, among other variables. To define firm size, there are three sets that could be used: 1-19 employees (small firms), 20-200 employees (medium firms), and more than 200 employees (large firms).

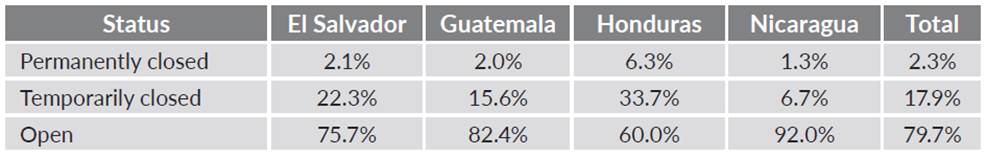

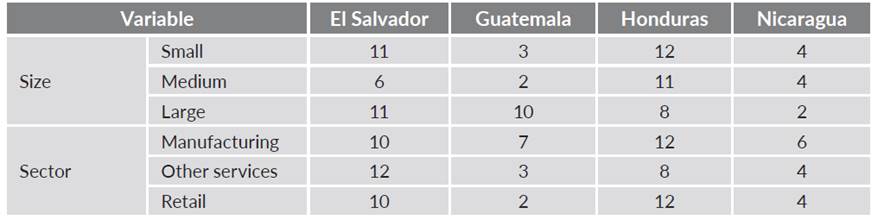

This research used data from the 2017 and 2020 surveys. The most recent survey (2020) includes a February 2020 baseline and a follow-up in May 2020. Only those companies that answered all questions inside the survey in the two periods were chosen, resulting in a final sample of 13,466 firms to be monitored. Estimates were made with the expansion factors. Table 2 shows the current situation of examined firms and table 3 the distribution of companies by size.

Table 2 Status of studied enterprises according to the World Bank Enterprise Survey

Source: World Bank (2020).

The variables of interest (dependent variables) to be examined were chosen from the WB database, making up two groups of variables. The first group corresponds to quantitative continuous variables, which account for the performance of companies in the market in a measurable and comparable way for all types of firms: number of permanent employees, sales, and sales per worker. These values are expressed in the national currency of each country, so they were homologated to constant 2010 USD to make the data comparable. On the other hand, the second set of variables is made of the dichotomous qualitative dependent variables, which comprise liquidity and attention to commitments with financial entities and derived from closed questions on the performance of an enterprise during the pandemic. After evaluating the database and validating survey responses, 13,400 firms were selected for analysis.

Model

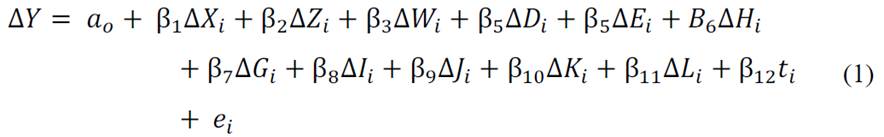

This paper combines a descriptive exploration of the results of the WB Enterprise Survey with linear and probabilistic models to determine the impact of covid-19 on the financial performance of firms. Equation 1 shows the organization of the estimation function, where the dependent variables will be: (i) variations in sales, (ii) employees, and (iii) sales per employee. Therefore, three ordinary least squares (OLS) estimations of equation 1 are executed, having the firm’s characteristics as independent variables. A dichotomous variable (t) that is 1 if the firm was temporarily closed during the pandemic (between March and May 2020) and zero otherwise was included. For independent variables, internal and external factors that may have had an influence on firms’ performance was also included. Evidence from developing countries examined through the WB Survey (Botello & Guerrero, 2014; Hudson et al., 2012; Wang, 2016) shows that it is necessary to include the following variables: firm’s age, economic sector, size, whether it exports, location, gender of the manager, and number of weeks the firm was closed. Consequently, we have:

where ∆ is the difference operator. Therefore, ∆Y corresponds to the growth rates of dependent variables and is a constant. Firm size is represented by X, region by Z, economic sector is W, access to credit is D, whether the establishment has its own website is represented by E, sales level by G, whether it is a branch of a larger firm is H, firm’s age is I, whether the firm exports J, international quality certificate of the firm is K, and the absolute sales level in February 2020 is represented by L. The error with zero mean and constant variance is represented by e i .

In terms of interpretation, the constant will estimate the mean impact of the dependent variables during the period analyzed. Coefficients (β) in the linear models are interpreted as the percentage increase or decrease in the dependents variables exerted by the presence of each characteristic of the firm. For categorical variables, the coefficient measures the relative variation as a comparison of a base characteristic, while for continuous variables it measures the change in units of the dependent variables versus a change in units in the independent variables.

Once the models have been established, the assumptions of normality, homoscedasticity and non-collinearity are tested. In case any of these are not met, they are corrected and re-estimated based on econometric techniques such as robust error for heteroscedasticity problem. The effectiveness of this model is measured through the variance of the dependent variable captured by independent variables. This indicator is called R2, the higher, the more effective the model is in determining the behavior of the dependent variable.

With this determination we can proceed to present the hypotheses of this work:

H1. The economic sectors in which companies are located determine the impact of covid-19.

H2. Smaller firms will have a higher bankruptcy rate and a lower capacity to face the crisis.

H3. Competitive advantages such as strategic asset holdings, foreign sales and access to financing favor firm performance during the crisis.

Results

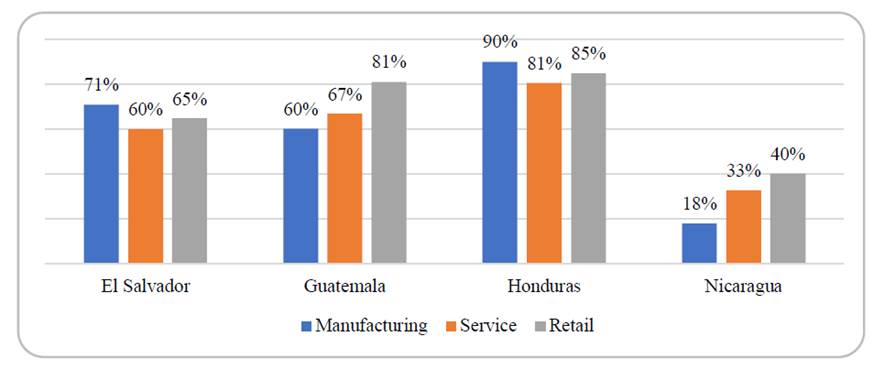

The results of the WB survey show that, on average, 61 % of firms closed due to covid-19 mitigation measures. By country, Nicaragua showed the lowest rate of temporary closures (33 %), while Honduras reported the highest rate (84 %). By industry, the retail sector was the most affected, followed by services and manufacturing (figure 2).

Source: author with data from the World Bank (2020).

Figure 2 Share of firms temporary closed because of covid-19 by sector and country

Up to May 2020, businesses were temporary closed for an average of 10 days, with Nicaraguan companies closing for the least number of days (3), followed by Guatemalan companies (5). In these two countries, large firms remained closed for two days less, on average (table 4).

Table 4 Days that companies were forced to close temporarily

Source: author with data from the WB Enterprise Survey (World Bank, 2020).

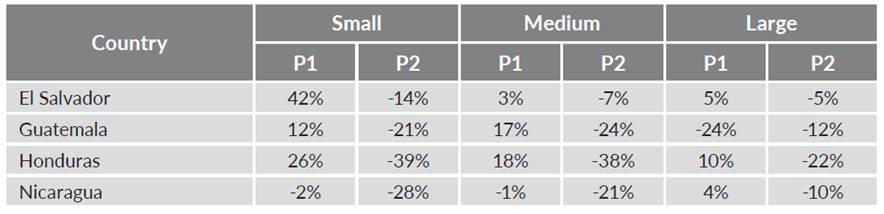

Mitigation policies described in table 1 and the reduction on economic activities (figure 1) have negatively impacted the employment generated by firms. Table 5 presents two periods in employment growth: between August 2016 and February 2020 (P1) and from February 2020 to May 2020 (P2). In the first period, net job creation is observed for all countries and firms sizes. Between February 2020 and May 2020, job loss is close to 20 %. The countries showing the greatest job loss are Honduras and Nicaragua, with large companies showing the smallest negative variations.

Table 5 Annual growth of permanent employees by country and firm size

Source: author with data from the WB Enterprise Survey (World Bank, 2020).

Regarding the estimation models, in terms of overall fit the model is acceptable considering that the value of the chi2 statistic is highly significant. In turn, all the variables introduced presented statistical significance levels of 5 %. According to the R2, the model manages to explain about 38 % of the variances of the dependent variables. After evaluating the database and validating the survey responses, 13,400 firms were selected for analysis.

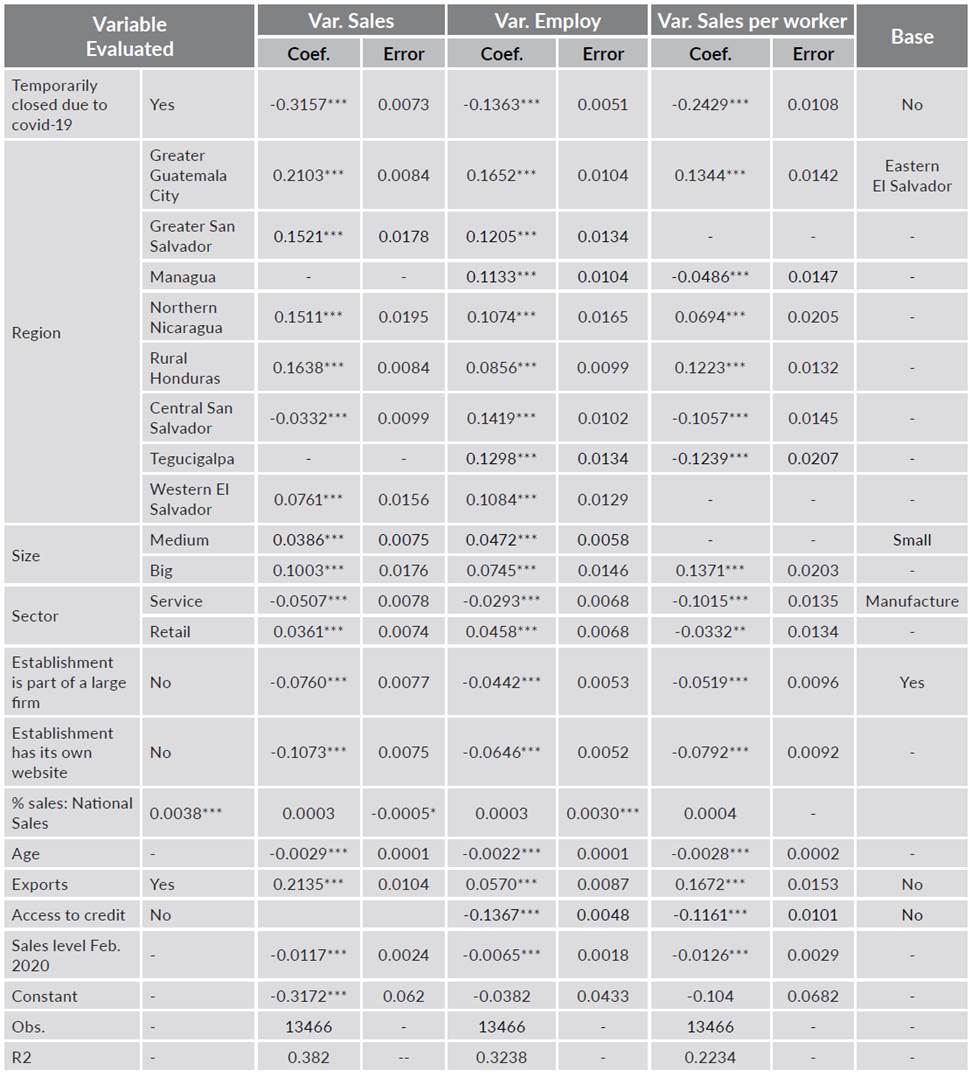

In relation to the main hypothesis, the constant obtained in the model show an average drop in sales of 31 %, employment decreased 3 %, and sales per worker dropped 10 % for all firms. For the companies that temporarily closed their establishment the decrease was worse: 31, 13 and 24 % in the same variables.

Table 6 Results of the estimations of the linear models

Source: author’s estimations based on the World Bank (2020) database.

Among other findings, some differences can be found by regions. For example, in relation to the Eastern region of El Salvador, Guatemala City presented a 21 % higher growth rate in sales, 16 % in employment, and 13 % in productivity. The geographic location variable could affect the costs faced by the company such as logistics and transportation of goods. Being located in large cities brings benefits due to agglomeration economies, as a result of larger service and infrastructure providers, thus lowering costs and increasing the likelihood that the company can distribute its products more easily (Botello, 2014).

By size, firms with more than 100 employees had a 10 % higher sales growth than small companies. This effect may be due to the economies of scale that large companies can obtain, as well as better distribution and logistics chains (Botello, 2020). In relation to employment, the difference was 7 % and 13 % with productivity. By sector, retail firms had a 10 % higher sales growth than manufacturing companies. In relation to employment, the difference was 7 % and 13 % with productivity. This effect is due to the fact that essential companies (food, pharmacies) were not forced to close during the pandemic (table 1).

Similarly, the highest rates of variation of the dependent variables were presented by firms that are part of an industrial conglomerate, have their own website, have access to credit, and export their products. The base effect of initial sales was also analyzed using February 2020 sales reports. This indicates that firms starting with lower sales have the potential to grow more than companies with higher sales rates.

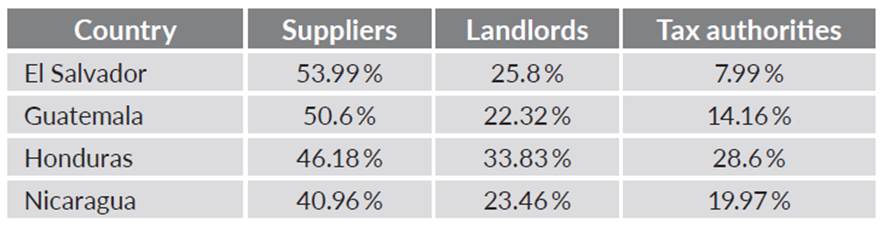

The decline in revenue streams has affected companies’ ability to meet their short-term expenses. In this regard, table 7 shows the percentage of companies that defaulted on their commitments with their suppliers, lessors or tax authorities within the observation period. Results show that nearly half of companies experienced liquidity problems with suppliers, 30 % with landlords, and 15 % with tax authorities.

Table 7 Share of companies that defaulted on their commitments in the studied period

Source: author with data from the WB Enterprise Survey (World Bank, 2020).

Conclusions

The objective of this paper was to show a first review of the effects of covid-19 and mitigation policies in the Central American countries of El Salvador, Honduras, Guatemala and Nicaragua from February to May 2020. This work presented an estimate of the impact of restrictions due to the pandemic on sales, employment and sales per worker in a panel of 13,466 firms from these countries. The economic reduction of over 10 % in the studied countries’ GDP has affected companies significantly. According to the WB Enterprises Survey, as of May 2020, 2.3 % of the companies in these nations had closed.

This research showed a significant drop in all indicators, especially sales (-31 %) and productivity (-10 %). For those firms that temporarily closed during this period, there was an additional reduction of 31 % in sales, 13 % in employment, and 24 % in sales per worker. All branches of economic activities were affected, although manufacturing and services faced stronger effects that the retail sector. These results are in line with the scarce related literature available, such as the work by Bandrés-Goldáraz et al. (2021). Furthermore, the decline caused by the pandemic in commercial activities was greater in small companies, while medium and large enterprises proved being resilient in their employment and sales indicators. Companies with these characteristics also showed the best survival according to Masacón et al. (2020).

The results of this work suggest different policy actions. First, it is important to provide emergency funding policies. These resources should be allocated to a greater extent by the most affected companies. Secondly, fiscal relief policies must also be granted, given the strong liquidity problems of companies. Third, governments should consider how to allocate resources over time. In addition, the rapid drop in company production in this period shows the economic uncertainty created by this decline, so governments will need to assess the long-term economic impact of the pandemic.

The limitations of this study are associated to the length of time that firms were evaluated, their answers to the survey, and the composition of the sample. The length of the period analyzed does not allow us to infer the full impact of the pandemic, hence future developments should be targeted at filling this gap. Similarly, the WB Enterprise Survey only focuses on formal enterprises, posing the need to later examine the impact on informal enterprises, given the significant participation of this sector in Central American economies.