Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

AD-minister

Print version ISSN 1692-0279

AD-minister no.25 Medellín July/Dec. 2014

ARTÍCULO

Internationalization strategies of a Multilatina in the service sector: Avianca-Taca holdings S.A. case study

Estrategias de Internacionalización de una Multilatina en el sector servicios. Caso: Avianca-Taca Holding S.A.

Carolina Franco-Arroyave1

Alexis Martins-Cheze2

Eyal Siegel3

Juan Carlos Díaz Vásquez4

1 MIB (c), Universidad EAFIT, Medellín, Colombia, Mail: cfranco3@eafit.edu.co

2Master student, Strasbourg, Francia. Mail: almartinscheze@gmail.com

3Master in International Business, Amsterdam, Países Bajos. Mail: eyal_siegel@hotmail.com

4 Dr. phil, Universidad EAFIT, Medellín, Colombia. Mail: jdiazva@eafit.edu.co

Recibido: 01/09/2014 Modificado: 14/10/2014 Aceptado: 04/11/2014

Abstract

This paper explores how existing internationalization theories can be applied to a Multilatina in the service sector, using the case of Avianca-Taca Holdings S.A. as an example. This paper introduces the company by analyzing the context in which it grew, starting with the service sector in Colombia, which is its country of origin. This paper also analyzes the international and domestic air transportation industry alongside the history of Avianca-Taca Holdings S.A. It describes in detail the internationalization program undertaken by the company and analyzes it based on three existing theories that may explain why such choices were made instead of others available. This paper explores different applications of these traditional theories. By this token, it concludes that, rather than using a brand new theory and aspiring to cover a large array of services, it is wiser to make decisions with a more comprehensive scope and use existing theories to adapt an efficient internationalization strategy to a particular context, region or country.

Keywords:Multilatina; internationalization theories; services; emerging markets.

JEL Classification: F230, M160.

Resumen

Este artículo explora como las teorías de internacionalización existentes pueden ser aplicadas a una Multilatina del sector servicios, tomando como ejemplo el caso de Avianca-Taca Holdings S.A. El artículo presenta a la compañía analizando el contexto en el cual se desarrolló, empezando con el sector servicios en Colombia, su país de origen; la industria del transporte aéreo tanto a nivel nacional como internacional; y la historia de la compañía misma. El artículo describe en detalle el proceso de internacionalización llevado a cabo por la compañía y lo analiza bajo la luz de tres teorías existentes, las cuales pueden explicar porque dichos procesos fueron elegidos entre todos los disponibles. El artículo concluye que en lugar de buscar nuevas teorías que aspiren a explicar el amplio espectro de los servicios, es conveniente usar las teorías existentes para adaptar una estrategia de internacionalización eficiente a cada contexto particular de industria, región o país.

Palabras clave:Multilatina; teorías de internacionalización; servicios; mercados emergentes.

Clasificación JEL: F230, M160.

Introduction

This paper aims to describe and analyze the internationalization process of one of the most representative air transportation companies in Colombia, as a case study for the service sector as well as for Multinationals in emerging markets. Avianca is still the national icon for this industry(Semana, 2007). It is also ranked 21st among the most global companies in the region, ranking 2nd amongst Colombian firms (América Economía, 2012). Due to its importance for the country's development and its unique internationalization process, it's an interesting representative of the internationalization of the country's service sector.

The context within which Avianca-Taca Holdings S.A. (from here on Avianca-Taca) developed is highly relevant for understanding of its evolution, and therefore this paper offers its readers a brief description of its macro and micro contexts, describing the service sector in Colombia, the air transportation industry and a brief history of the company.

By using three internationalization theories this document sheds light on the firm's internationalization. The first theory mentioned in this report is Hymer's (1960, 1976), which explains the objective of the firm to expand its business in foreign countries. Secondly, this report examines the stage at which Avianca-Taca is operating, explaining their need to go abroad using the Vernon's Product Life Cycle (1966). Lastly, this research describes the air transportation market in Colombia and how it induced the firm's internationalization (Knickerbocker, 1973).

Finally, this paper provides a detailed description of the company's internationalization process along with an analysis of why such strategies were chosen over others available. Finally, the previously explained theories are applied to the Avianca-Taca's internationalization in the concluding remarks.

Literature Review

Numerous internationalization theories have been explored by diverse academics and created a foundation for this topic: Dunning and Lundan (2008), Coase (1937), Cuervo-Cazurra (2011), Vernon (1966), Knickerbocker (1973), Hymer (1960, 1976), etc. Most of these theories have been extracted from an analysis of manufacturing firms in developed economies. The development of theories for service companies and firms in emerging markets has not been as proliferous as the former, but attention and interest are growing. In the debate proposed by this issue over whether or not new theories are required to explain the motivations and modes of entry for service firms from emerging markets, we ourselves fall in the grey area between the two positions. In this sense, we believe that existing theories might be extended and adapted to explain service firms' behavior, but we also think that complementing the former with new or partially new theories is indeed useful for fully explaining the internationalization of the service sector.

However, we have identified a serious constraint for the development of a theory that can be generalized and expanded to cover services as a whole, due to the heterogeneity intrinsic to their nature. This will be explained in further sections.

In this line of thought, theories are required for different types of services and organizational structures. Therefore, we will present in this section, three existing theories of corporate internationalization applicable to the air transportation industry. Further on a brief review of literature on internationalization of services will also be presented as background for structuring additional explanations and theories. Moreover, a contextual analysis of the service sector as a whole will be presented, looking especially at the specificities of the air transportation industry.

Firm-specific advantages

Hymer (1960/1976) in his doctoral dissertation, proposed a theory of internationalization that states that firms develop, in their domestic market, certain advantages that are specific to the firm. Such advantages are not easily imitated but are exploitable in foreign markets and are powerful enough to overcome a “foreigness liability”. This concept, also introduced by Hymer, refers to the difficulties that a foreign firm faces in a host country when competing with local firms, such as communication barriers, a lack of a proper flow of information, and unfavorable treatment from local governments. The author also innovated by proposing a differentiation between portfolio investments and foreign direct investments. In the neoclassical approach, the former implies the pursuit of income from differences in interest rates and provides no control to the investor as criticized by Hymer. The latter gives control to the investor but does not necessarily involve the movement of capital across borders. Furthermore, countries can be sources as well as receipients of this capital at the same time.

Product Life Cycle

Vernon (1966), proposes that a firm's internationalization is determined by the life cycle of its products as follows: Product innovations are likely to occur in developed home markets (Vernon's case study is the US market), nearby high income consumers, where the product can be adapted to their specific needs and where it benefits from an initial monopolistic advantage wherein high production costs can be transferred to customers. Vernon identifies this as the initial stage.

The next is the growth stage, where demand for the product has grown and new competitors are on the scene. Now pricing is more relevant than product flexibility and adaptation. It is in this stage where internationalization begins, motivated by a search for new high-income markets. According to Vernon, the first mode of entry the firm will use is exports. Nonetheless, the high-cost of trade (tariffs and transportation), and the threat of imitators in the new market will prompt the firm to engage in foreign production.

As the company acquires experience, the product becomes standardized and imitation is easier, therefore price-based competition is fierce. In order to reduce costs, production is likely to be moved to developing countries where labor costs are comparatively lower. Home market and other developed markets are then likely to be served by exports from developing countries. This is presented by Vernon as the maturity stage.

Oligopolistic Structures

Derived from the previous theory we have Knickerbocker (1973), who argues that an oligopolistic market structure is a determinant of foreign direct investment. This type of market structure is characterized by a few sellers, close substitute products and interdependence between competing firms. Under these characteristics, harsh competition in the domestic market is likely to be destructive, and firms prefer to preserve domestic market distribution as-is and look for new markets abroad. The author also distinguishes between two types of foreign direct investment. An initial incursion into a foreign market by a firm is labeled an “aggressive move” and the reaction to this enterprise by competitors is labeled a “defensive move”.

Internationalization of services

As was stated earlier in the paper, the internationalization of manufacturing firms has received more attention in academic publications than that of services. However some regulations, theories and strategies have been proposed and a select few will be summarized in this section.

The General Agreement on Trade in Services (GATS) defines four modes of entry into international markets:

1. Cross-border trade: From one territory to another one through telecommunication networks or embodied in goods.

2. Consumption abroad: Consumers moving to the supplier's territory

3. Commercial presence: Establishment of subsidiaries, affiliates, etc. in a foreign territory.

4. Presence of natural persons: independent suppliers moving to a foreign territory temporarily (World Trade Organization, 2013).

The main factor influencing this choice is the type of service, as supported by Vandermerwe & Chadwick (1989), who believe that the degree of tangibility, pure service or embodiment in a product, is the first determinant for the best choice to serve a new market.

In the case of Avianca-Taca, due to the type of service embodied by its aircraft, the offer of international flights will suit the first mode of entry described above. However, as will be outlined in the findings section, this mode must be complemented by an additional strategy.

Different theorists have determined different macro and micro level issues that will be key for such a choice. Philippe & Léo (2011) state that the main issue, besides the type of service, is the firm's financial capacity. Vandermerwe & Chadwick (1989) state that levels of risk and control are the main issues.

Then we must take into account that services tend to be more quality dependant than goods. Therefore, control is an issue of great concern when internationalizing a service company. Quality control of processes and final output is a key issue for customer satisfaction. This need for control might be a driver for choosing foreign direct investment (FDI) over other modes of entry. Also due to the intangibility and, in some cases, heterogeneity and the impossibility of getting a product sample before full completion, the “foreign liability” identified by Hymer (1960, 1976) is sometimes a barrier for successful penetration of a foreign market. This is why some language and cultural-related perceptions of risk should receive special consideration (Javalgi & Martin, 2007) when entering foreign markets.

Despite the different determinants explored above, it's important to note that the dynamics of modern transnational activities may require simultaneous use of several modes of entry, either in the same foreign market or one for each of them.

Also, the choice of strategy is not permanent or definitive. A firm should be able to adapt to any given circumstance and in this particular matter the same principle applies. Firms may adapt their chosen mode of entry based on market response, competitors, and their internal situation (Petersen & Welch, 2002).

The service sector

Services are an economic activity that has been gaining ground over recent decades. In 2010, they accounted for 72% of Global GDP (World Bank, 2012). The service sector is not just perceived as an independent sector but also as a support for the others. Many industries and commercial activities are now supported by the offer of additional services along with a physical product. Javalgi & Martin (2007) identify the development and coverage of Information and Communication Technologies as a key factor in the increasing importance of services.

Particularly in Colombia, the home country of the company look at by this paper, trade has been mainly dominated by the extraction sector. According to data from UNCTAD and the World Bank (2013), 65.72% of Colombia's exports come from this industry with a dominance of oil and coal. Services, due to their intangible nature, heterogeneity and current legislation regarding trade in services, pose a great accountability-related challenge.

However, and surprisingly, the situation within its borders is quite different. Fedesarrollo (2011), the Colombian economic and social research institution, states that the service sector has experienced its biggest growth since the 1970s (10.5%). Additionally, the National Industry Association (ANDI, 2012) reported that, by 2012, 60% of all employment came from the service sector, grouped under the following activities: commerce, hotels and restaurants, transportation, storage and communications, community, social and personal services, and real estate and business services.

Nonetheless, this should not be misinterpreted. These numbers can be tricky to analyze as they might cover a very different situation of informal employment. In Colombia, as in other Latin American countries, the relocation of the rural population to urban areas has created in the latter an increase of the supply of labor and therefore in unemployment (Cameiro, 1994; Mazumdar, 2010; Mitra, 2010; Roggero, 1976, quoted by Barreiro de Souza, de Andrade Bastos, & Salgueiro Perobelli, 2012) leading them to work in improvised and informal activities, many times categorized as services (specially commerce).

Services usually demand highly skilled labor and high levels of innovation (Mondiano and Ni-chionna, 1986 quoted by Larsen, Tonge, & Lewis, 2007); therefore education plays a key role in the development of this sector. The Ministry of Education forecasts an increase of up to 50% in higher education coverage by 2019 (Vélez White, 2006),which might represent an opportunity for the development of the service sector in the country.

Air transportation industry

The air transportation industry is a very dynamic market. In the last twenty years, many changes, including technological and political ones, have enabled the internationalization of companies within this market. “Deregulation and liberalization of air transport markets and renegotiation of existing bilateral agreements” (Delfmann, Baum, Auerbach & Albers, 2005: 1) were the main causes for a stronger internationalization.

Based on research done by the International Air Transport Association (IATA) in 2011, another important recent phenomenon within the global air transportation industry is cooperation between international airlines. Joint ventures between firms offer greater global advantages such as economies of scale, quality improvements and customer satisfaction. Many companies are compelled to internationalize to sustain their international and domestic market share (Doernhoefer, 2011).

As the perception of Colombia (especially in terms of security) improves, so also does the flow of travelers for both tourism and business. This has a positive impact on the air transportation industry, which between January and August 2011 grew 18.5% compared with the same period of the previous year (Asociación del Transporte Aéreo en Colombia [ATAC], 2013)

As mentioned by Cruz and Puerta (2012), air transportation is an industry that supports the dynamics of the economy as a whole, since it is mostly through its operation that Colombia connects to the world and it also supports the internationalization process of many other Colombian companies, through both cargo and passenger movement.

In terms of market share, we could say that the air transportation industry is a rather closed market, taking into account that a relatively low number of companies co-exist in the Colombian domestic market: seven airlines control the entire domestic passenger transportation market (CAPA, 2013). However, markets with few sellers, as mentioned by Vernon (1966) when studying oligopolies, can be threatened by the entrance of new innovative competitors. In 2012, a new and innovative concept broke into the market: VivaColombia, a low-cost airline intended to serve the domestic market with investors from Colombia, Mexico and Europe (VivaColombia, 2013).

Its entry has forced many of the companies to reduce their prices in order to keep up with the fierce price-competition and has created a new division of market share, since VivaColombia is betting on the lower-income market, which increases the number of possible consumers. By 2011 the number of passengers reported by Aeronáutica Civil for the period between January and August was of 10,657,203 (2011), after the entrance of VivaColombia, the number during that same period for 2013 increased to 14,163,116 (2013). However, this is not a controlled variable and other factors may have influenced such an increase, and therefore this statement has to be viewed as a mere assumption.

Nonetheless, this has not reduced the market importance of Avianca, which in the period between January and August 2013 accounted for 58.7% of passengers transported, followed by LAN with 18.6%, VivaColombia with 8.4%, Copa Airlines with 6%, Satena 3.7%, Easy Fly 3.4% and ADA 1.3% (Aeronáutica Civil, 2013).

It is important to note that Avianca and Taca, after their merger, agreed to maintain separate operations in 4 specific markets: Colombia, Peru, Costa Rica and El Salvador (Cruz & Puerta, 2012). Therefore, in Colombia Avianca services national and international routes while Taca mainly focuses on international routes to and from Colombia.

Research Methodology

Given the qualitative and theoretical approach of the research and the availability of existing data explicit enough to help us answer our research question, we collected data from secondary sources such as academic papers, corporate reports and national and international institutions' statistics. Our data collection methodology is explained below.

Data collection has been addressed using three different approaches since the paper focuses on three different aspects (the service sector, the air transportation sector and the firm itself). A different perspective was used for each section. First, data collection for the service sector is based on publications from the main authorities for both the international and the Colombian situation. Sources such as ANDI5, UNCTAD and the World Bank provide data that helps understand this specific case, including the development of the sector throughout the years and its participation in the global economy. Complementarily, academics such as Cameiro (1994), Javalgi & Martin (2007), Mazumdar (2010) and Mitra (2010) provide an overall framework for the way the service sector has been developed in the last decades. The data in this section was useful for explaining the sector's growing importance and the challenges it poses for internationalization studies.

The second section discussed relates to the air transportation industry. For this purpose, data is collected from independent associations concerned with the industry as well as aerospace regulations such as the International Air Transport Association (IATA), Asociación del Transporte Aéreo en Colombia (ATAC) and Aeronáutica Civil (2013). The main research conducted by these associations refers to global, continental and domestic developments within the sector. According to the aforementioned organizations, subjects such as liberalization of trade and multilateral agreements regarding aerospace, globalization, and collaboration are frequently in their core interests, which is in line with the aim of this paper. This paper focuses on the business activities of Avianca-Taca - as they specifically relate to Latin-American, and in particular Colombian, industries. There is not much prior research done in this regard (Delfmann et al., 2005; Doernhoefer, 2011; Cruz & Puerta, 2012), and the data collected does not include an academic background to complement the independent organizations referenced above. Consequently, limited information validation and comparison took place.

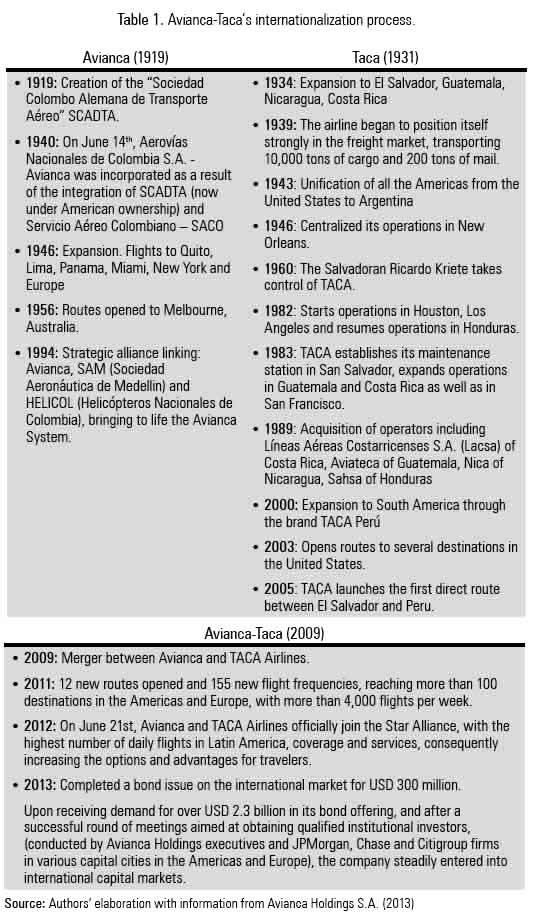

With respect to data collection in the third section that relates to the company Avianca-Taca itself, the same limitations are found. Not much prior previous academic research has been done regarding this firm. The evolution of the internationalization process was initially analyzed using a time scale describing the development of the company throughout previous decades. To identify the internationalization strategy, the collection of data is based on internal corporate information presented in the 2012 Annual Report and 2012 financial statements. Complementary to that, firm specific data has been explored within their foreign expansion process.

We have implemented the theories in this research paper based on the above segmented data, and related it specifically to the case of Avianca-Taca. This research also follows a descriptive - analytical approach, meaning that we intend to summarize and organize as much of the existent data on this topic as possible, in order to provide a clear understanding of the internationalization process followed by Avianca-Taca. Besides this, we also intend to analyze the data in terms of why such a process was conducted the way it was in light of existing internationalization theories such as Hymer's (1960/1976) firms-specific advantages, Vernon's (1966) product life cycle and the oligipoly theory from Knickerbocker (1973). We intend to understand why such strategies were chosen over the alternatives available, and subsequently we will relate this to the macro and microenvironment faced by the company.

Findings

Avianca-Taca Holdings S.A. Results

Avianca has been one of the major representatives of the Colombian Air Transportation Industry for several generations. Avianca was founded by domestic and international capital as a German-Colombian airline, although it only served the Colombian local market at the very beginning. Avianca-Taca's internationalization process has followed a very strategic path through alliances, mergers and acquisitions.

In 1919, the first Latin American commercial airline was born in Barranquilla, Colombia. It incorporated Colombian and German capital under the name: SCADTA. By 1940 this airline was owned by American capital and merged with SACO - Servicio Aéreo Colombiano - to create Avianca - Aerovías Nacionales de Colombia S.A. (Avianca, 2012).

After several alliances with national competitors, Avianca faced a crisis mainly due to the liquidation of one of its partners, increasing fuel prices, decreasing demand and the devaluation of the Colombian peso. This situation led the company to declare bankruptcy and It was auctioned off publicly. (Cruz & Puerta, 2012).

In 2004, the company was acquired by the Brazilian group Synergy. After 20 months of receivership and around 15 years of negative financial balances, Synergy managed to turn a profit of 20 million dollars in 2006 (Semana, 2007).

Finally, in 2009, Avianca merged with the Salvadorian airline TACA. Creating Avianca-Taca Holdings S.A., which has the largest network of routes in Latin America (Cruz & Puerta, 2012).

Avianca initially began operations for transporting mail and eventually diversified to include passenger transportation as well. Nowadays, the company offers both services as well as cargo transportation (Avianca, 2012).

In 2012 the company had over 18,000 employees in 25 countries with operating income revenue of 7.6 trillion COP. Compared to 2011, its revenue grew 8.3%. In 2012 it had a net profit of over 500,000 billion COP. Regarding ownership of Avianca's shares, there are two main shareholders: Synergy Aerospace Corp (58.6%) and Kingsland Holdings (27.7%). The remaining 13.7% is divided between smaller shareholders (Avianca, 2012).

The current state of AVIANCA-TACA Holdings is the result of a transitional process resulting from mergers, acquisitions and partnerships with companies from Colombia and around the world.

Here we present a timetable for Avianca-Taca's internationalization process:.

Although, the United Nations Conference on Trade and Development (UNCTAD, 2007) states that the export mode is the most common mode of entry for airlines from developing countries, we believe exports are not enough to explain the internationalization strategy followed by Avianca-Taca. The provision of international flights also requires a local presence either through direct investments or alliances, as some kind of local representation is needed for managing operations including personnel and sales. Therefore, airlines can either establish a direct commercial presence (Greenfield investment), make use of existing capabilities by acquiring a local airline, or contract representation under an alliance.

As stated by Delfmann et al. (2005) and Ramón-Rodríguez, Moreno-Izquierdo, & Perles-Ribes (2011), due to the liberalization of trade and aerospace policies, alliances have been the major driver for airline internationalization.

As mentioned before, given the strategies chosen by Avianca-Taca, its internationalization process will be analyzed in light of three important theories: Hymer's (1960/1976) firm-specific advantages, Vernon's (1966) product life cycle and the oligopoly theory from Knickerbocker (1973):

We can classify Avianca-Taca under two of Dunning & Lundan's (2008) motivations for foreign production: Market seekers and Strategic asset seekers. Adapting this theory to the service sector, Avianca-Taca expanded its operations to relatively nearby markets in North and Latin America, which were the first demanded by the local customers. Then, mergers became a way to benefit from the established resources and capabilities of foreign competitors, both as a way to expand its markets and to weaken its competitors in Latin America. The Star Alliance network brings a more co-operative approach to the strategic asset seeker motivation because it provides a mutually beneficial and coordinated way of working with a less competitive approach aimed more towards customer satisfaction.

Avianca-Taca, during its domestic operations in both home countries was able to create firm-specific advantages as described by Hymer (1960, 1976) which allowed them to be leaders in their regions of influence. For instance, in Colombia it was initially able to operate in an imperfect market where it had a monopolistic advantage as the first airline in the country and the second airline in the world. Besides the economies of scale that kept them as the number one airline in the country for several generations, they had great brand positioning and a diversified portafolio. Under Hymer's theory, such advantages, which could not be easily equaled by competitors, can be assessed as drivers for internationalization, since having such advantages in the local market allowed the company to exploit them in markets abroad.

Also, regarding firm-specific capabilities, and as explained by Cuervo-Cazurra (2011), the country environment gives the company the experience to create special capabilitiesfor operating in that specific context. So, in addition to its physical proximity to other Latin American countries, the geography, the culture and the created capabilities within its home market gave Avianca-Taca a special advantage when dealing with competitors from outside the region.

Additionally, by adapting Vernon's (1966) Product Life Cycle theory to services, we could say Avianca-Taca is now in the maturity stage. The company has acquired vast experience and its service has been imitated by its competitors. As previously mentioned, it exists now in an oligopolystic environment and is under threat from price-based competition. As a result, there is more interest now than ever before in maintaining low operational costs. In the initial stage when they were the only air transportation company, learning about the industry and developing it in the country, they only provided services within the local market and enjoyed a monopolistic advantage where no price-based competition existed. However, several decades later and with the entry of new competitors, price as well as customer satisfaction became an important differentiator from its competitors.

Without saying that the air transportation industry in Colombia is a strict oligopoly, there are certain characteristics of such a structure that can be identified in the industry:

According to Knickerbocker (1973), an oligopoly has three main characteristics: 1) Few sellers: in Colombia the market share is distributed amongst 7 companies, where only 4 have a significant share of over 5%. However, it can't be definitively framed as an oligopoly as the number of suppliers increases significantly along international routes. 2) Products are close substitutes: Despite some airlines having exclusive routes, the most important ones are covered by several. Therefore, product substitution in such cases can occur easily. Also, road transportation represents a cheap (although inefficient) alternative for traveling inside the country. And 3) there is market interdependence: due to the aforementioned two characteristics, competition in this market is very closed, and even though there is now fierce price-based competition due to the entrance of a low cost airline and collusion does not seem sustainable, there's a visible pattern of action and reaction, so an aggressive strategy by one company in the market is usually followed by a defensive one from its competitors.

In other words, the mono-oligopolistic advantages acquired during the initial stages of its life cycle are strong enough to overcome the difficulties of doing business abroad, making them feasible for exploitation in new markets. Now that the industry is mature, these opportunities must be used first as aggressive stratregies (first mover advantage) before competitors do so.

Finally we would like to highlight the importance of merger and acquisitions strategies. These modes of entry allowed the company to profit from the existing capabilities of local companies such as brand recognition, locations, aircraft, communication channels, qualified personnel, knowledge of market and regulations, etc. This reduces the risks of a greenfield investment as well as the time lag for starting operations.

Discussion

The main goal of this research is to explore whether existing internationalization theories are also applicable within the framework of services firms. In this case, a closer look into the Multilatina Avianca-Taca, since several academics have argued the need for new theories for these specific cases. This paper proves that in this particular Latin-American case the development of new internationalization theories isn't necessary. Existing traditional theories are generally applicable. However, as presented in the findings section, there are some implications of these theories that need slight adaptations. This paper suggests extensions of several aspects of the theories and encourages further research in this regard.

First of all, Hymer's theory focuses mainly on market characteristics and its influence upon the firm's operations. It's not product-centered so it can be applied to both manufacturing and services. This means that adaptations of this theory in this specific case would be based on the differences between developed and developing markets.

Services carry an important component of customer service and knowledge that isn't easily transferred. Therefore, companies will seek to exploit such characteristics in foreign markets by themselves. Firm-specific advantages, although not gained through production capacities, are obtained from market knowledge, quality standards, processes and customer satisfaction.

Vernon's theory on product life cycles exactly matches the case of Multilatinas as they develop a firm advantage in their home region. This theory states that firms start to develop in their home market, developed countries, in order to take advantage of wealthy customers in that market and then expand to developing countries in order to reduce costs and standardize their products.

Avianca's internationalization process began in a developing country, created its firm-specific advantage at home and grew within the Latin American region to gain market share. At this stage they were able to achieve a monopolistic position in the region thanks to the first mover advantage. In a later stage, two decades later, both Avianca and TACA were able to expand into developed countries. Service evolution motivates firm's internationalization. Origin and destination according to level of development does not apply in this specific case. Coming from an emerging economy, Multilatinas do not seek to lower production costs in less developed markets, on the contrary, they seek to exploit those already low costs to expand their customer base. This is just an assumption that requires further research in order to understand other reasons why Multilatinas enter developed countries.

Vernon's therory applies to services in the sense that they also have a life cycle. However, due to the increased importantance of Information and Communication Technologies, a physical presence is not a necessary part of the cycle and each stage could occur independently of location. Services have an initial stage where the service is created and requires flexibility and adaptation which might be financed through high prices. Once services have been developed and new competitors appear, service providers explore new markets abroad. Finally, when industry knowledge becomes consolidated, cost reduction strategies are implemented and sources of low-cost human assets are more valuable. Location loses importance when dealing with services since all stages could be performed from developed and developing countries and reach different markets at once. Although high-tech innovations are more likely to take place in high-income countries where access to research and resources is frequently more widely available.

Finally, as mentioned in the findings section, elements of an Oligopolistic Structure can be identified within the case study presented in this paper. Relevant market features such as few sellers, substitutes and interdependence were there to help Avianca-Taca grow and expand into foreign markets.

Along the same lines of Knickerbocker, when considering the importance of adaptation in terms of market response, competitors and internal situations, the Latin American market shows its particularities. One of them, which could be seen in other regions is the liberalisation of trade in services through regional trade agreements. This aspect may also be relevant with relation to the elements included when determining an accurate theory to be applied to a broader scenario. Regional trade agreements are a key factor for the liberalisation of local markets as shown by the number of agreements signed by Colombia with other countries in the region.

Conclusions

Due to international deregulations and liberalization in the air transportation industry, internationalization became more accessible for many firms. Specifically, joint ventures gave these companies many advantages including economies of scale, quality improvements and customer satisfaction. This, combined with Colombia's improving reputation, which increased tourism, made the country's air transportation industry more attractive on a global stage. Most Colombian air transportation firms felt the need to take action in this regard, since this industry is one of the key elements of the country's economic growth.

The sector demonstrates certain oligipolistic characteristics, with a structure that includes few sellers and interdependent firms. Nevertheless, beginning in 2012 the new threat of a low-cost airline VivaColombia started fierce price-based competition. This led to a big change in the market: existing firms had to change their strategy by appealing to new customers with lower incomes. As a whole, the consumer market benefited from this situation. Although this was an unexpected change within the industry, Avianca-Taca managed to remain the market leader. The company has been seen as one of the major representatives of the Colombian Air Industry.

Avianca(-Taca) has a diversified internationalization strategy. In the early stages of their existence they served only the Colombian domestic market. Through alliances, mergers and acquisitions they became a more strategically operated firm on an international level. In 2009, after the merger between Avianca and Taca, they now have the biggest network of routes in Latin America.

Based on the regulations of the General Agreement on Trade in Services, it's more likely that Avianca-Taca is a cross-border trade firm. This is due to the type of service embodied by its aircraft. However, this theory must be complemented with an additional approach since some kind of local representation is required for operations management, including personnel and sales. Therefore, airlines can either set up a greenfield investment, acquire a local airline or enter into an alliance contract for representation. The latter two options are the most used drivers for airline internationalization.

In this paper, the internationalization of Avianca-Taca is approached through three theories. From the point of view of Dunning & Lundan (2008) Avianca-Taca can be seen as a market seeker and a strategic asset seeker. This firm's drivers for moving across borders were to benefit from foreign markets and weaken its competitors in Latin-America. Avianca existed in a monopolistic environment in Colombia and this enabled it to create the firm-specific advantages discussed by Hymer (1960, 1976). This led to economies of scale, brand positioning and a diverse portafolio. These advantages in the domestic market gave them the opportunity to expand their activities into foreign markets.

Secondly Vernon's (1966) Product Life Cycle was taken into account. Although this theory is typically used for manufacturing firms, the overall approach is in this case is also suitable for Avianca-Taca. Initially the firm operated domestically, and focused on learning about the industry and benefiting from their monopolistic position. Later on, when more competitors entered the market, variables such as price and customer satisfaction became more important. Avianca-Taca is now located at the mature stage of the Product Life Cycle.

The last theory relates to an oligopoly (Knickerbocker, 1973). Based on this theory we can define the Colombian air industry as a oligipolistic market with three characteristics. First of all there are just a few sellers in this market, with only four companies that have more than a 5 percent market share. Besides that, their products -or in this case services- are close substitutes. And finally there is a strong interpendence in this market since there is fierce competition and, as mentioned before, the price war makes these companies depend on each other. This context provided the company with some specific advantages and strengths that could be exploited in foreign markets. At the same time, its market share at home permits more competition and the firm should look abroad to obtain new customers and increase profits.

In conclusion, some principles of existing internationalization theories are applicable in a context other than the ones they were originally created for. This paper has analyzed market-centered theories that, with some degree of adaptation, can be applied to services and goods. These adaptations are mostly issues of interpretation and flexibility. Further study is then needed using non-market-centered theories. Merger and acquisitions activities are very effective for companies in the service sector where quaility and control are key factors for foreign expansion. Taca and Avianca both followed this strategy as individual companies, and it proved to be even more successful when these two companies merged in 2009. This merger made them the market leader in Latin America.

Acknowledgements

We want to thank Kelvin McKoy for taking the time to read and provide feedback about this article

Notas al pie

5Asociación Nacional De Industriales (ANDI) also known as Asociación Nacional de Empresarios de Colombia, is the Colombian independent authority regarding economic progress and development within the country.

References

Aeronáutica Civil (2011). Cuadros Estadísticos Agosto 2011- Oferta y Demanda. Colombia. Retrieved from: http://goo.gl/Wtqxyp [ Links ]

Aeronáutica Civil (2013). Estadísticas de oferta y demanda - Transporte de pasajeros - Agosto 2013. Colombia. Retrieved from: http://goo.gl/yauQrN [ Links ]

Álvarez, J. M. (1998). La O.M.C. Comentarios Jurídicos para Colombia. Bogota, Colombia: Universidad Externado de Colombia. [ Links ]

América Economía (2012). Las empresas más globales de la región. Retrieved from: http://rankings.americaeconomia.com/2012/multilatinas/ranking.php [ Links ]

ANDI (2012). Colombia: Balance 2012 y perspectivas 2013. Bogota, Colombia. Retrieved from: http://www.andi.com.co/Archivos/file/CEE/ANDI-Balance2012-perspectivas2013.doc [ Links ]

Asociación del Transporte Aéreo en Colombia. (2013). Asociación del Transporte Aéreo en Colombia -ATAC. Retrieved from: http://www.atac.aero/ [ Links ]

ATAC (2011). El costo del combustible es uno de los factores que más impacta la competitividad del sector aéreo en Colombia. Bogota: Press release. [ Links ]

Avianca (2012). Avianca. Nace una história con alas. Retrieved from: http://www.avianca.com/AcercaAvianca/Nuestra+historia/es/Nace-Historia-con-Alas-Tradicion-Experiencia-Compromiso.htm [ Links ]

Avianca Holdings S.A. (2013). History. Retrieved from: http://www.aviancaholdings.com/en/history [ Links ]

CAPA (2013). Colombia's aviation market poised for more rapid growth in 2013, led by VivaColombia, Avianca & LAN. Retrieved from: http://centreforaviation.com/analysis/colombias-aviation-market-poised-for-more-rapid-growth-in-2013-led-by-vivacolombia-avianca--lan-101354 [ Links ]

Coase, R. H. (1937). The nature of the firm. Economica , 4 (16), 386-405. [ Links ]

Cruz, A., & Puerta, S. (2012). Internacionalización del sector aéreo colombiano. Bogotá: Universidad del Rosario. [ Links ]

Cuervo-Cazurra, A. (2011). Global strategy and global business environment: the direct and indirect influences of the home country on a firm's global strategy. Global Strategy Journal, 1(3-4), 382-386. doi:10.1002/gsj.35 [ Links ]

Delfmann W., Baum, H., Auerbach, S. and Albers, S. (2005). Strategic Management in the Aviation Industry. Aldershot: Ashgate. [ Links ]

Doernhoefer, G. (2011). The economic benefits generated by alliances and joint ventures. Retrieved from: http://www.iata.org/whatwedo/Documents/economics/Economics%20of%20JVs_Jan2012L.pdf [ Links ]

Dunning, J. H., & Lundan, S. M. (2008). The motives for foreign production. En J. H. Dunning, & S. M. Lundan, Multinational Enterprises and the Global Economy, (2nd ed. pp. 63-78). Cheltenham, UK: Edward Elgar. [ Links ]

Hymer, S. H. (1960/1976). The international operations of national firms: A study of direct foreign investment. Cambridge, MA, U.S.A: MIT Press. [ Links ]

Javalgi, R. G., & Martin, C. L. (2007). Internationalization of services: Identifying the building-blocks for future research. Journal of Services Marketing , 21(6), 391-397. doi: http://dx.doi.org/10.1108/08876040710818886 [ Links ]

Martinez-Gomez, V., Baviera-Puig, A., & Mas-Verdú, F. (2010). Innovation Policy, Services and Internationalisation: the Role of Technology Centres. The Service Industries Journal , 30(1), 43-54. [ Links ]

Petersen, B., & Welch, L. S. (2002). Foreign operation mode combinations and internationalization. Journal of Business Research , 55(2), 157-162. doi:10.1016/S0148-2963(00)00151-X

Philippe, [ Links ] J., & Léo, P.-Y. (2011). Influence of Entry Modes and Relationship Modes on Business Services Internationalisation. The Service Industries Journal , 31(4), 643-656. doi: 10.1080/02642069.2010.504826 [ Links ]

Pluta-Olearnik, M. (2011). Internationalization of the service sector- marketing approach. Folia Oeconomica Stetinensia , 10(1), 175-185. [ Links ]

Ramón-Rodríguez, A. B., Moreno-Izquierdo, L., & Perles-Ribes, J. F. (2011). Growth and internationalisation strategies in the airline industry. Journal of Air Transport Management , 17(2), 110-115. doi:10.1016/j.jairtraman.2010.11.002 [ Links ]

Romero Valbuena, I. E. (2003). Régimen de comercio exterior de servicios. Un enfoque práctico. Tesis de grado, Pontificia Universidad Javeriana, Facultad de Ciencias Jurídicas y Económicas, Bogota, Colombia. [ Links ]

Semana (2007). El milagro de Avianca. Semana. Recuperado el 5th de November de 2013, de: http://www.semana.com/economia/articulo/el-milagro-avianca/83650-3 [ Links ]

Tsai, H.-T., & Eisingerich, A. B. (2010). Internationalization Strategies of Emerging Market Firms. California Management Review , 53(1), 114-135. [ Links ]

UNCTAD & World Bank. (2013). WITS. Recuperado el 15 de September de 2013, de http://wits.worldbank.org/WITS/WITS/AdvanceQuery/RawTradeData/QueryDefinition.aspx?Page=RawTradeData [ Links ]

United Nations Conference on Trade and Development. (2007). FDI in tourism: The development dimension. New York and Geneva. [ Links ]

Vandermerwe, S., & Chadwick, M. (1989). The Internationalisation Of Services. The Service Industries Journal , 9 (1), 79-93. doi. 10.1080/02642068900000005 [ Links ]

Vernon, R. (1966). International investment and international trade in the product cycle. The Quarterly Journal of Economics , 80(2), 190-207. doi: 10.2307/1880689 [ Links ]

VivaColombia. (2013). Nuestra Aerolínea. Retrieved from: http://www.vivacolombia.co/co/nuestraaerolinea.htm [ Links ]

World Trade Organization. (2013). The General Agreement on Trade in Services. An introduction. WTO. Retrieved from: http://www.wto.org/english/tratop_e/serv_e/gsintr_e.pdf [ Links ]