INTRODUCTION

The relationship between the government expenditure and national production is important for issues related towards policy making. For example, in a recession, the authorities try to save the economy by increasing the share of public expenditure to GDP. The issue of public sector intervention towards controlling short-term fluctuations in economic activities has always been discussed among economists. However, classical economists disagree with such measures of government, while they propose Keynesian fiscal policy to improve the economy in periods of recession. Classical economists believe that market forces are able to guide economy to a long- term equilibrium through moderations in the labor market. But Keynesians believe that self-regulation mechanism is unable to improve the economy due to labor market inflexibilities. To avoid long-term recessions, Keynesian economists propose expansionary fiscal policies. As a result, there are two alternative situations for these two directions of opposed causality. One situation is presents a trajectory from expenditures to income (for the case of Keynesians) and the other situation presents a trajectory from the income to public expenditures (for Wagner theory) (Magazzino, 2012). Examining the reasons for increased government expenditures is one of the key issues in the economy for the public sector. Many theories have been proposed in this regard. They can be divided into two general categories of economic theories situated at the micro and macro levels. Wagner’s law is one of the macroeconomic theories in the field. Wagner’s law is the first and most famous model to determine public expenditures (Akitoby et al.,2006). The famous German economist Adolph Wagner (1835-1917) proposed his theory in 1883 with regard todevelopinggovernment expenditure. According to Wagner, there is a linear relationship between the growth of government activities and economic growth. Additionally, the rate of public sector growth is higher than economic growth. At the same time, market ineftciencies especially in the case of externalities or that of superior goods make government interventions necessary towards supplying optimal value in the supply of the goods and services by facilitating subsidies and direct supply. Wagner also states that the goods supplied by the public sector have higher income elasticity. According to the way of Keynesian thinking, the public sector expenditure is an important tool in developing and increasing economic activity. In the Wagner hypothesis, the direction of a causality emanates from economic growth and development to government expenditures. He examined the growth of the public sector in a number of European countries, America and Japan in the nineteenth century. Wagner defines the factors determining the impact of relative growth of the public sector on GDP in terms of political and economic factors. Wagner’s law or Wagner’s theory, especially since 1960s, has attracted much attention. This hypothesis has been tested in many countries using time-series and cross sectional data. Examples of academics that have tested this theory are Goffman (1968), Gandhi (1971), Ram (1987), Chang (2002), Halicioglu (2003), Narayan et al (2008), Huang (2006). Extensive empirical analysis of Wagner’s law has achieved mixed results in literature. The development of a nation depends on the development of its people. If talents are not identified and fostered, material, economic, political, and cultural development will not be possible. The main problem in many underdeveloped countries is not lack of natural resources but lack of human capital. Therefore, the first duty of such countries is to prepare and develop their human capital. Government expenditure on education can be an effective factor towards encouraging and gaining knowledge, improving education and strengthening the spirit of innovation and originality in a community. On the other hand, promoting the level of education of people in the society represents increased human capital of that country, leading to improved eftciency and strengthened production capacity. As a result, it might have a positive impact on economic growth. Therefore, the present study sought to examine the impact of the government’s educational expenditure on economic growth of Iran

THEORETICAL PRINCIPLES AND LITERATURE REVIEW

The relationship between government expenditure and economic growth has attracted the attention of many economists over the past few decades (Kolluri et al, 2000; Govindaraju et al, 2011). For a long time, there was no model to determine public expenditure. While some classical economists, such as Adam Smith, studied the long-term trend in public expenditure, no attempt was made to turn such observations into a general model. In fact, one of the fundamental aspects of the public sector and the size of government is the issue of public sector expenditure. These expenditures in some areas represent policy-making in the public sector. The changes within the public sector justifies the size of government. The only theoretical discussion that presents a relationship between the size of the public sector and economic growth is Wagner’s law. The law explains that economic growth leads to the increase in the government expenditure. Wagner is the first researcher who realized a positive relationship between the level of economic development and the size of the public sector (Ranjan & Chintu, 2013). Wagner introduced factors such as urbanization and work division along with industrialization, real income growth, the need to manage natural monopolies as well as areas where the private sector is not able to finance (for example railroad) as reasons for the growth of public expenditures in the economy (Durevall & Henrekson, 2011, pp. 709). According to Wagner’s law, government services such as judicial system, education, health and infrastructures lead to economic growth. In other words, the government expenditure of an elastic government is an income, in the sense that the public sector will grow in line with economic development. Experimental studies that have tested the validity of the law, in many cases led to conflicting results. Wagner’s law shows the long- term equilibrium relationship between public expenditures and GDP. According to this law, the causality is from GDP to public expenditures. Wagner determines the growth of public expenditures for education, culture, health and well-being in terms of the income elasticity of demand. In his view, the income elasticity of such services is high. Thus, by increasing the real income in the economy, public expenditures for these services increase. Wagner identified three main reasons for government expenditures as follows:

1) When the social relations are complicated, the need for increased public support and regulatory activities increases. In addition, urbanization, more division of work, and industrialization require higher expenditure for the execution of the contract, law enforcement, and ensure economic performance. 2) Real income growth leads to a relative increase of the income in cultural and welfare expenditures. Wagner stressed that the public sector in the field of education and culture are much more eftcient than the private sector. 3) To develop the economy and technological changes, the government should take the responsibility to manage natural monopolies to improve economic performance. The investment required in some areas is so high (for example railways) that the private sector is not able to finance in that areas (Durevall & Henrekson, 2011, pp. 709). According to Wagner reasoning (Y  G), meaning that economic growth is the cause of the growth of the public sector), by increasing the country’s per capita income in the process of industrialization, the share of public expenditures in the total expenditures increases. On the other hand, Keynes argued that public expenditure is an exogenous factor. Thus, the direction of causality in the relationship between public expenditures and national income is from expenditures to income (G

G), meaning that economic growth is the cause of the growth of the public sector), by increasing the country’s per capita income in the process of industrialization, the share of public expenditures in the total expenditures increases. On the other hand, Keynes argued that public expenditure is an exogenous factor. Thus, the direction of causality in the relationship between public expenditures and national income is from expenditures to income (G  Y) (Babatunde, 2011). In addition, according to the Keynesian thinking, public sector expenditures are real means of boosting and increasing economic activities and a means to stabilize short-term fluctuations in the total expenditures. The role of a financial policy in the increase of an economic growth rate and - in agreement with part of literature on the issue of endogenous growth is that government expenditures directly affect the production functions of the private sector. In contrast, Wagner’s approach is that the public sector expenditure is a natural result of economic growth (Dritsaki & Dritsaki, 2010). In the Keynesian approach, government expenditures, in the first place, increases the total demand. Then, it will have greater impact on economy through an increasing coeftcient. Therefore, government expenditures affect economic growth and reduce unemployment. In this view, the public sector plays a significant role in the provision of public goods and services - solving problems related to externalities, and achieving the optimal level of investment. The task of government is complementary to the activities of the private sector as they stabilizing institutions necessary for a useful performance of the market. In fact, contrary to the Wagner’s law, the Keynesian view believes that public expenditures are an exogenous policy instruments that affect GDP growth. Both hypotheses have been tested experimentally in developed and developing countries and they led to mixed results. For example, in studies conducted by Chow et al (2002), Thornton (1999) and Ansari et al. (1997) Wagner’s law was confirmed experimentally. While in the study conducted by Ram (1986), Afxentiou and Serletis (1996) and Wahab (2004), Wagner’s law could not be confirmed experimentally.

Y) (Babatunde, 2011). In addition, according to the Keynesian thinking, public sector expenditures are real means of boosting and increasing economic activities and a means to stabilize short-term fluctuations in the total expenditures. The role of a financial policy in the increase of an economic growth rate and - in agreement with part of literature on the issue of endogenous growth is that government expenditures directly affect the production functions of the private sector. In contrast, Wagner’s approach is that the public sector expenditure is a natural result of economic growth (Dritsaki & Dritsaki, 2010). In the Keynesian approach, government expenditures, in the first place, increases the total demand. Then, it will have greater impact on economy through an increasing coeftcient. Therefore, government expenditures affect economic growth and reduce unemployment. In this view, the public sector plays a significant role in the provision of public goods and services - solving problems related to externalities, and achieving the optimal level of investment. The task of government is complementary to the activities of the private sector as they stabilizing institutions necessary for a useful performance of the market. In fact, contrary to the Wagner’s law, the Keynesian view believes that public expenditures are an exogenous policy instruments that affect GDP growth. Both hypotheses have been tested experimentally in developed and developing countries and they led to mixed results. For example, in studies conducted by Chow et al (2002), Thornton (1999) and Ansari et al. (1997) Wagner’s law was confirmed experimentally. While in the study conducted by Ram (1986), Afxentiou and Serletis (1996) and Wahab (2004), Wagner’s law could not be confirmed experimentally.

In some studies, there are evidences suggesting the experimental confirmation of both hypotheses postulated by Wagner and Keynesian respectively. For example, in experimental study conducted by Devlin and Hansen (2001) and Biswal et al. (1999), a bidirectional causality was confirmed between real GDP and real public expenditures. However, in the study by Huang (2006), in comparison with other studies, none of the hypotheses was experimentally confirmed. Therefore, it is clear that issues related to Wagner’s law and the Keynesian theory still hold. It is noteworthy that in a large number of studies, only the test for Wagner’s law and the Keynesian hypothesis is done using estimations based on a simple regression equation and that includes only one independent variable. However, as it is clear that a great number of factors also affects GDP growth. Government expenditures, including expenditure on education also affect GDP growth. As a result, a simple regression including GDP and government expenditures led to specification error (Chow et al. 2002). The main objective of this study was to test the Wagner’s law and the Keynesian hypothesis in the Iranian economy using data from 1991 to 2012. The focus is in the relationship between government expenditures and GDP. In addition, Samudram et al (2000) and Kolluri et al (2009) examined the relationship between GDP and the components of government expenditures¨.

Qi (2016) investigated the impacts of government education expenditure on economic growth in China taking into account the spatial third-party spillover effects. The result revealed that (1) as a whole, government education expenditure in China has significantly positive impact on economic growth, but expenditure in different educational level shows different results. Government education expenditure in below high-education is positive related to local economic growth, whereas the effect of education expenditure in high-education is insignificant. (2) Neighboring government education expenditure shows spatial spillover effects on local economic growth, and spatial spillover effects in two education level is different. (3) Other input factors of third-government also have spatial effects. Some policies about education and economic development are proposed. Meanwhile this study recommends that corporation relationship among regions is very important.

Dissou et al. (2016) estimated the growth implications of alternative methods of financing public spending on education in a small open economy. They developed a multisector endogenous growth model with human capital accumulation and consider several fiscal instruments to finance the increase in government spending: transfers to households, output, capital and labor taxes. They found a significant difference in the growth impact generated by the choice of the financing method. Their simulation results also suggest that even though all methods of financing considered in this paper are growth-inducing in the long-run, their transitional impacts differ.

Using data on educational spending for 31 OECD countries over the years 1988- 2008 by level and type of expenditure, Wolff (2015) first re-examined the so-called cost disease model on the basis of a new formulation of the model and, in so doing, provide a new implicit price deflator for educational expenditures. The cost disease effect in education is estimated to be one to two percentage points per year relative to constant prices based on the GDP deflator. Next, unlike many previous studies, he found a positive and significant effect of secondary educational spending deflated using the traditional GDP deflator on both PISA math scores and literacy scores (both significant at the one percent level).

Abington and Blankenau (2013) considered the consequences of a reallocation using an overlapping generations’ model - with private and public spending on early and late childhood education. By the assumption that the early childhood investment has higher return, their survey showed that the current allocation may nonetheless be appropriate. With a homogeneous population, this can hold for moderate levels of government spending. But with a heterogeneous population, this can hold for middle income workers. Lower income workers, by contrast, may benefit from a reallocation. Prasetyo & Zuhdi (2013) investigated the efficiency level of government expenditure per capita in health and education sectors and transfers and subsidies in 81 countries. The investigation was towards human development in the respective countries, using the Data Envelopment Analysis (DEA) approach from 2006-2010. They found that there are countries that will always be positioned in the efficient frontier during the sample period. By studying the expenditure in education, human capital and growth in Canada using OLS analysis, Annabi et al (2011) have shown that budget policies do have a powerful effect. Education increases the rate of capital accumulation and reduces the negative effects of the reduction of growth in labor force. Nevertheless, this depends on the efficiency of government investments in education. Jung and Thorbeck (2003) have studied the effect of general expenditures in education on human capital, growth and poverty in Tanzania. They utilized the method of Computable general equilibrium (CGE). Their research findings indicate that the expenditure in education increase economic growth. Gupta et al (2001) have studied the impact of government expenditures on education and health in developing economies using the panel data collected from 50 countries based on OLS and 2SLS. The research results demonstrated that with the increase in government expenditure in education and health, there was a decrease in the number of child deaths. And the impact from education is more powerful than that of health. Levy and Clements (1996) have studied the government expenditure on education and private investment in developing countries using the panel data. The empirical test of the model was performed using data from the Caribbean peninsula. The data shows that education has a significant effect on private investment.

There are important reasons for Government expenditures in education. These reasons include: First of all, education is considered as important by governments. Therefore, an increase in expenditure towards education is remarkable. Education is one of the key variables that are effective in reducing poverty (Grubb and Michelson 1974). Meanwhile, growing global competition has caused policymakers to pay much attention towards expenditure spent on education in Iran. As Secondly as previously stated in several studies conducted, governmental expenditure in education have been used as means of producing human capital (Romer 1990; Jurges and Schneider 2004). In developing countries, economic growth is preferred over education expenditures, due to budgetary limitations (Al-Yousif, 2008). Though the effects and implications of government expenditure and other fiscal instruments are important, understanding the causal relationship between education expenditures and GDP growth is important for political reasons. Thirdly the relationship between education and growth is like a double-edged sword, regardless of causal direction of the relationship. Inmanystudies (forexample Rehme, 2007), the econometric models were proposed based on the assumption that the expenditure in education expenditures have direct impact on economic growth. Bidirectional causality can be estimated using appropriate statistical methods that have not been considered. The implication of the issue implies to the studies has used the public educational expenditures as an indicator for human capital (Blankenau and Simpson 2004). Therefore, the investigation of the causality in relation to Iran’s economy would probably increase our understanding of the complex relationship between educational expenditures and economic growth. In investigating the relationship between public expenditure and the total educational expenditures and GDP growth, the two schools of thought -of Wagner and Keynesian - can be considered. Unlike existing studies, in order to minimize the error of estimation, some control variables are included.

In addition, a long-term relationship between economic variables were examined using a suitable estimate technique.

MODEL, METHODOLOGY AND DATA

In most of the current studies, there has been an attempt to test Wagner’s law using the following methodologies. The methodologies are as follows:

Peacock and Wiseman (1961) used government expenditure to GDP

Gupta (1967) used the government expenditure and per capita GDP

Goffman (1968) used the government expenditure as a share of GDP and per capita GDP.

Since this study is conducted in one country, the three methods mentioned will not produce significantly different results. The Wagner hypothesis can be tested using the share of public expenditure in GDP and per capita income. However, in many studies, the Wagner hypothesis is evaluated using government expenditure and GDP. The use of government expenditure and GDP is preferable because the long-term elasticity of government expenditures compared to GDP can be estimated. In this study, the Peacock and Wiseman’s methodology is used leading to adoption of a two-way model in the literature as follows:

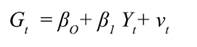

Where, G and Y are respectively natural logarithm of real government expenditure, real GDP and Vt is error term. In addition to examining the relationship between real GDP and real government expenditure, the between real educational expenditure of the government (Et) and real GDP were also investigated. In order to reduce the severity of bias, omitted variables of equation (1) were considered after considering the capital stock and labor force as control variables:

In equation (2) K and L respectively are natural logarithms of real capital stock

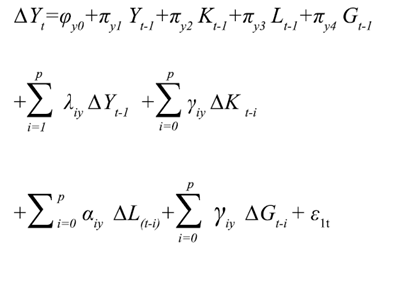

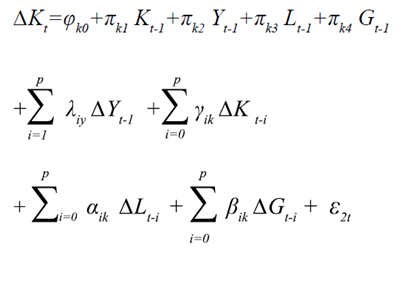

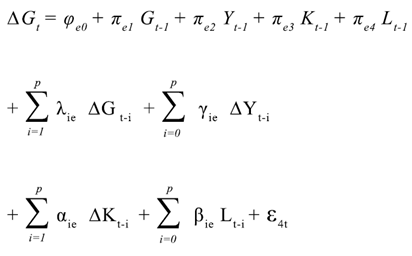

and labor force and μt is error term. Equation (2) can be interpreted as a function of total production and it can be rewritten as G ENT#091;Y = f (K, L, G)ENT#093;. Total production (i.e. Y) depends on capital, labor force and real government expenditures. Real GDP can be considered as combined public goods/input or infrastructure that is effective in increasing productivity. In addition, one special part of government expenditure, educational real expenditure, is human capital. The endogenous growth theory emphasizes on the importance of human capital and government expenditure in the long-term economic development of a country (Barro 1990, 1991 and Romer 1990). Equation 2 can be estimated using the ARDL method that is based on a system of equations. As a result, the co-linearity of government expenditures (or educational expenditures), capital stock, and labor force can be reduced. The ARDL approach used in this study also provides long-term estimates of compatibility even when right-sided variables are endogenous (Inder, 1993). Pesaran and Shin (1999) showed that by using the proper order of the ARDL model, simultaneous correction for serial correlation in the residuals is possible. However, in order to control the power of the model and to consider the omitted variable bias, a bivariate model is also estimated. The experimental analysis in this study is conducted based on data collected from the Central Bank Website. All nominal variables such as GDP, total government expenditures, educational expenditures, and capital stock have been converted to real values. Peacock and Scott (2000) have suggested that the co-integration approach alone is suftcient to describe the Wagner’s view with long-term relationship test. In the present study, this model was tested by using the autoregressive distributed lag (ARDL) method. This test based on ARDL method for Equation (2) is as follows:

Where, j = y, k, l, e and Δ is the first-order difference operator; φj0 is constant value; πs shows long-term coeftcients, λ, γ, α, β are short-term dynamics, and εt is the randomized variable assumed to be white noise. Accordingly, bivariate model can be tested using the same method without K and L.

RESEARCH METHODOLOGY

When an estimation method is about to be utilized, it is important to note that using the OLS method in the long-term relationship estimation would not provide necessarily estimation without bias. This is because the short-term dynamic interactions between the variables is ignored.

Therefore, it is necessary to consider the models - including the short-term dynamics - that leads to a more accurate estimation of the coeftcients of the model to be estimated. The ARDL method is a dynamic method that enables us to test co-integration between the variables. It also enables us to estimate the long-term coeftcients of the model. The results obtained by estimation of the considered models will be provided later in brief. The model was estimated using Microfit4 software and Schwartz-Bayesian Information Creterion (SBC) were considered in this regard. The advantage of this criterion on the Hannan-Quinn information criterion (HQC), Akaike information criterion (AIC) and R2 is that it saves in the number of lags and consequently it is less damaging to the model’s degrees of freedom. The proposed model was estimated based on autoregressive distributed lag (ARDL) models and error correction during the considered period. First, it is necessary to examine the stationarity tests before the above-mentioned tests.

EXAMINING THE STATIONARITY OF DATA

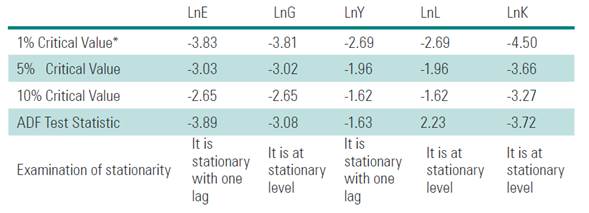

Before using the data, to prevent spurious regression analysis, augmented Dicky Fuller regression was used. Using Eviews6 software, time series were examined. If the absolute value of the test statistic is larger than absolute value of critical quantity, null hypothesis is rejected.

Based onthe results presented in the table 1, except for the real GDP and government educational expenditure which are stationary at the first order difference level, other variables are at the stationary level. It is worth noting that one of the advantages of autoregressive distributed lag over other methods is the lack of concern about the I(0) or I(1) of the variables. Therefore, without considering the reliability of the variables, adjustment estimates of long-term coeftcients can be achieved. In the next stage, the short-term dynamic model was estimated to assess the presence or absence of co-integration relationship. The estimation results using Microfit4 software are as follows:

Estimation of Wagner’s theory:

In the following estimation, the model presented by Wagner is estimated using ARDL method, with an emphasis on factors affecting government public expenditures.

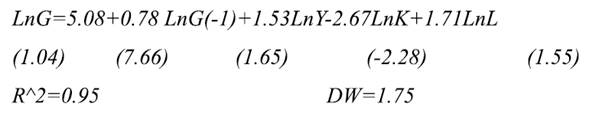

Based on the coeftcients obtained in the short-term relationship, the logarithm of both the real GDP and labor force stock had significant and positive impact on government expenditures and a 1 percent increase in each of the coeftcients increases public expenditures of the government by (1.53) and (1.71) percent, respectively. This result indicates that as the country produces more and growth of labor force is higher, the government expenditure would be also greater. On the other hand, the variable, capital stock, has a negative and significant effect on government expenditures. On the other hand, the reduction in the capital stock is more than the increase in any of the previous two variables. In addition, when the dependent variable coeftcient LNG (-1) is smaller than 1, the dynamic pattern will tend towards a long-term pattern. The explanatory power of the model is equal to 95%, which implies a relatively good explanatory model. Before extracting the long-term relationship, it is necessary to examine the presence or absence of a long-term relationship. One of the tests commonly used for this investigation is Banerjee, Dolado and Mastre test. To perform this test, the sum of the lagged coeftcients of dependent variable must be deducted from 1 and divided by its standard deviation that is calculated as follows:

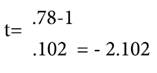

Since in the estimated model for the real expenditures of the government, the dependent variable has been obtained with one lag, its t-statistic is as follows:

Due to the critical value provided by Banerjee, Dolado and Mastre at 95% confidence level (-2.10), it can be seen that the absolute quantity of statistic calculated from the absolute value of the presented critical quantity is greater. Therefore, it can be concluded that the hypothesis of lack of co-integration between the variables of the model is rejected. As a result, there is an equilibrium relationship between the variables of the Wagner’s model according to the dependent variable of real expenditures of the government as follow:

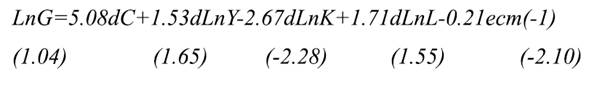

The coeftcient of real GDP variable shows that a one percent increase in the production and labor force stock increases the real government expenditure by 7.13% and 7.96%, respectively. And the obtained coeftcient for capital stock changes is negative. It also indicates that a one percent increase would reduce the real expenditures of the government by 12.43 percent in the long-term. The obtained results are similar to the short-term equation, but with larger coeftcients, which suggests that variables will show their strong effects in the longer period. Then, we will estimate the error correction model of Wagner’s equation. Error correction models are mainly used in the experimental studies since they link the variables to their long-term equilibrium values. The results of Error Correction Model (ECM) are as follows:

As you can see, all coeftcients of the labor force, capital stock, real GDP, and error correction term are significant. On the other hand, the coeftcient of error correction is (-0.21), which indicates that about 21 percent of the disequilibrium error in the each period is adjusted at the next period. Additionally, these coeftcients suggest the adjusted rate from short-term period to long-term equilibrium. Accordingly, changes in the mentioned variables of the formula lead to the reduction of error term in the short-term relation compared to long-term relation. Generally, the similarity that is present in the Wagner’s model in the short-term and long-term period is justified by the fact that variables of capital stock, real GDP, and labor force stock have always had positive, positive, and negative effects, respectively.

ESTIMATION OF KEYNES’S THEORY: WITH THE IMPACT OF TOTAL EXPENDITURES OF THE GOVERNMENT

At this stage, Keynes model is estimated based on the mentioned factors affecting the real GDP.

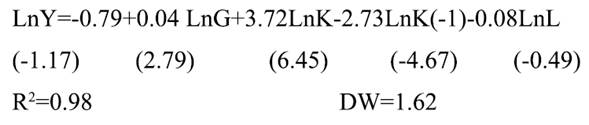

Based on the coeftcients obtained in the short-term equation, the logarithm of real government expenditure has a positive effect on the logarithm of real GDP. It means that by increasing one percent in government expenditures, GDP will increase by 0.04 percent. On the other hand, the variable of capital stock has a significant positive effect on the logarithm of real GDP, but this variable would have a negative and a significant effect on real GDP logarithm with a lag. In addition, the labor force variable has a negative and an insignificant impact on the real GDP logarithm. This result indicates that human capital has increased slightly in Iran and not in a significant way , and it is not in line with labor force market. Therefore, its labor force cannot cause an increase in real GDP. Additionally, as there is no coeftcient of dependent variable in the estimation, hence the dynamic pattern will not tend toward a long-term pattern. In general, the explanatory power of the model 98%, which implies that the model has relatively good explanatory power.

ESTIMATION OF KEYNES’S THEORY: WITH THE IMPACT OF GOVERNMENT EDUCATIONAL EXPENDITURES

For the effectiveness, the value of public expenditures of the government and educational expenditures of the government on real GDP, the Keynesian model is estimated this time with an emphasis on educational expenditures.

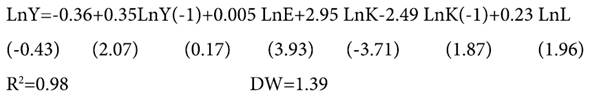

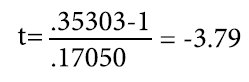

Based on the coeftcients obtained in the short-term equation, the logarithm of the educational expenditure by the government has a positive effect on the logarithm of real GDP. It means that if there is a one percent increase in educational expenditures of the government, GDP will increase by 0.005 percent. In addition, the variable of the labor force stock has a negative effect on the real GDP logarithm. Additionally, the dependent variable coeftcient LNY (-1) is smaller than 1, so the dynamic pattern will tend towards a long-term pattern. The explanatory power of the model is 98 percent, which suggests that the model has relatively good explanatory power. Before extracting the long-term equation, it is necessary to examine the presence or absence of the long-term equation calculated, using the Banerjee, Dolado and Mastre test. As the dependent variable has been obtained with one lag in the pattern estimated for real GDP, its t-statistic is as follows:

Due to the critical value provided by Banerjee, Dolado and Mastre at 95% confidence level that is equal to (-3.79), it is seen that calculated absolute value of statistic is greater than the absolute value of the critical value. Therefore, it can be concluded that the hypothesis of lack of co-integration between the variables of the model is rejected. As a result, there is a long-term equilibrium relationship between the variables of Wagner’s model presented - based on dependent variable of real expenditures of government as follows:

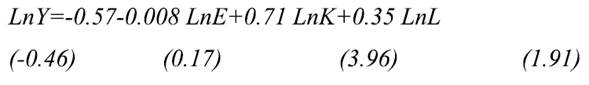

The GDP variable coeftcient indicates that an increase in capital stock and labor force stock leads to an increase in real the GDP real by (0.71) and (0.35) percent. And the obtained coeftcient is negative for government educational expenditure changes. This outcome suggests that a one percent increase in the educational expenditure of the government reduced the GDP by 0.008 in the long run. It can be due the fact that investment in education is a long-term activity and the effects of the costs accumulated in this sector cannot show its returns in the short-term. We will estimate the error correction model of Wagner’s model. Error correction models are mainly used in experimental works since they link the short-term fluctuations of the variables to their long-term equilibrium values. The results of ECM model are shown below:

As it is seen in the equation above, all of the coeftcients of labor force stock, capital stock, and educational expenditures of governments have a positive effect. However, among the set of variables, the effect of educational expenditure by the government is not significant. On the other hand, the coeftcient of error term is equal to -0.65. This value is a suggestion that about 0.65 percent of the error of disequilibrium in each period is adjusted in the next period. In addition, this coeftcient represents the adjusted rate from short-term period to long-term equilibrium, when the adjusted rate in the Keynesian model is higher than that in long-term model of Wagner. Generally, unlike the previous Keynes equation in this model, the coeftcient of the capital stock variable has positive impact on real GDP. The index represents the speed of adjustment in the short term to the long-run equilibrium period - although compared to the long-term adjustment in the Wagner model. The labor force stock also has a positive impact in this regard. On the other hand, the educational expenditures variable has a positive impact in the short-term, while its impact is negative on the long-term. It is perhaps due to the fact that increasing expenditures in the short-term leads to a quantitative growth in human capital and an increased production. But if the long term effect is a positive/ negative effect; maybe it’s because of the increase in expenditure in education on the short term growth of the quantitative human capital and increase production. But much qualitative growth is not seen in the long- term. Therefore, an increase in these set of expenditure leads to a waste of material resources.

COMPARING THE ESTIMATED KEYNESIAN MODEL

In concluding the Keynesian model estimations, it can be generally said that educational expenditure unlike real expenditure of the government, has a long-term relationship. And this indicates that this variable has a greater effect compared to the total expenditure and it will lead to increased GDP in the future. The variable, capital stock, in both models has a similar effect on real GDP. It can be analyzed on the basis that the educational expenditures and total real expenditures do not change the role of capital stock in the short-term model. Additionally, it leads to a change in the labor force coeftcients of these two models. So by changing the labor force variable in the presence of the total expenditure and educational expenditure, the coeftcient is negative and positive respectively. It means that educational expenditure will influence the labor force to play a more effective role in the real GDP.

CONCLUSION

Using annual data of Iran’s economy during 1981-2012, this study examined Wagner’s law and the Keynesian hypothesis about the relationship between government real expenditure and real GDP. In this paper, we have used bivariate and multivariate models. In this regard, the relationship between total government expenditures and GDP and the relationship between government educational expenditure and GDP were studied. Using a multivariate model to reduce the specified error issues that have not been considered in many studies, the co-integration was examined using auto regressive distributive lag method (ARDL) of long-term and short-term relationships. In Wagner’s view, the variables of real GDP, capital stock, and labor force stock having a positive, negative, and positive impact on the total expenditure of the government, respectively, on a long-term relationship is true in this regard. In addition, capital stock in both models, with its lagged variable, have similar effects on real GDP. And the variable of labor force, in the presence of total expenditures and educational expenditures, the coeftcient is negative and positive respectively. Generally, the similarity in the Wagner’s model, during the long-term and short-term period, is that the variables of capital stock, real GDP, and labor force stock have always had positive, positive, and negative impacts. In the Keynesian model, unlike the equation that emphasizes on public expenditures of the government in the educational expenditure model, the coeftcient of capital stock variable has positive impact on real GDP. In addition, labor force stock also had a positive impact. On the other hand, the variable educational expenditures have a positive impact in the short-term, while its impact is negative in the long-term.