1. INTRODUCTION

The collaboration between firms in the same sector has become increasingly popular in recent years, where companies are encouraged to collaborate with suppliers, research organizations and competitors (Gesing et al., 2015; Gnyawali and Park, 2009; Pinasti and Adawiyah, 2016). This has even greater relevance for SMEs, since most of them have limited resources, market presence, or capabilities (Galdeano-Gómez et al., 2016; Pinasti and Adawiyah, 2016). There has been considerable interest in linking them through a variety of networks and associations to share knowledge and encourage innovation (Balestrin et al., 2008; Butler et al., 2007). The ability to make cooperative agreements is fundamental for activities, such as development of new products (Hansen, 1999; Li et al., 2016), transfer of better practices (Szulanski, 1996), training, learning, and gaining knowledge (Argote et al., 1990; Dadfar et al., 2014; Gesing et al., 2015). Collaboration is considered an effective and efficient way of success (Cavusgil et al., 2003) and represents a situation where relationships between partners consist of more collaboration than competition, seeking mutual benefits by pooling complementary resources, skills, and capabilities, and delivering value to customers, which helps achieve a competitive advantage (Dadfar et al., 2014; Quintana Garcia and Benavides Velasco, 2002). Although there are different perspectives to analyze the formation of alliances, such as reducing costs or gain new resources (Dadfar et al., 2014), we decided to focus on two motives for collaborations. The first is formed by firms collaborating with others in the same sector with new product development as the motive. The second type is formed by those collaborating with others in the same sector with outsourcing as the motive (Todeva and Knoke, 2005).

A firm’s social connections provide access to share and transfer knowledge, resources, markets, and technology (Inkpen and Tsang, 2005; Li et al., 2016). Entrepreneurship networks have been previously studied, due to their role in encouraging and supporting knowledge-based SMEs (Hayter, 2013; Koryak et al., 2015). The value of a network’s specific characteristics can be analyzed through the ties that conform it, including its link to new product development (Hayter, 2013; Jifeng, 2011). We conceptualize the networking capabilities as interpersonal relationships, based on family members, classmates, and friends, and intra-firm relationships, as being based on industrial associations and governmental agencies (Chen et al., 2009). Based on this, we consider that there is a relationship between an SME’s networking capabilities and its decision to take part in collaborative activities with firms from the same sector, both to develop new products and to outsource.

In general, the allocation of resources and capabilities is related to the growth strategy the firm follows, since growth strategies have different antecedents and goals, where the differences in performance between firms can be explained due to the resource endowment (Nason and Wiklund, 2018; Penrose, 1959). Even though they are not mutually exclusive, the choice of a specific growth strategy and the usage of certain resources generate specific challenges for the management of the firm (Delmar et al., 2003; Nason and Wiklund, 2018). Recent studies have shown that SMEs with various network relationships will tend to prefer Hybrid growth strategy over Organic and Acquisitive growth strategies (Zou et al., 2010), which is the reason why we argue that Hybrid growth strategy mediates the relationship between networking capabilities and the decision to carry out collaborative actions.

This study responds to the call made by scholars to conduct studies examining factors that drive firms to collaborate. We analyzed the relationship of networking capabilities with different motives to collaborate (Gnyawali and Park, 2009) to better understand the mechanism through which the networking capabilities affect the collaborative motives and the potential success of alliances (Dadfar et al., 2014). We also analyzed the Hybrid growth’s role as the mediating variable in these relationships, as the Hybrid growth strategy is frequently used by firms to avoid a number of problems regarding managerial capacity and lack of resources (McKelvie and Wiklund, 2010).

The primary objective is to examine the relationship between a firm’s networking capabilities and the two motives for inter-firm collaboration. The second objective is to analyze the mediating effect of the Hybrid growth strategy related to these relationships. It is hoped that this study will better help to understand the interaction between networking capabilities and inter-firm collaboration and the Hybrid growth strategy’s role.

After the introduction, we present a literature review about inter-firm collaboration, networking capabilities, and Hybrid growth strategy, and establish the hypotheses. We tested the objectives previously named by using a self-developed database with 450 observations, the result of surveying SMEs’ directors in the Electronic, Technology, Information, and Communications sector (ETICS) in Mexico. This is followed by the methodology used, the findings, and the implications of the study.

2.LITERATURE REVIEW AND HYPOTHESES

2.1 Inter-Firm Collaboration

Compared to large-sized firms, SMEs are more vulnerable to environmental forces (Becchetti and Trovato, 2002; Galdeano-Gómez et al., 2016). To face this, and since they have less resources, inter-firm collaboration may represent a viable strategy to contribute to their survival and growth and deliver value to customers (Dadfar et al., 2014; Morris et al., 2007). Inter-firm collaboration is a means of leveraging resources, and can be a useful method to protect a firm's market position (Dyer and Singh, 1998; Galdeano-Gómez et al., 2016). When two firms from the same sector collaborate, a paradoxical relationship may emerge. On one hand, there is a resistance to share resources and capabilities with others; on the other hand, they know it is necessary to develop trust and mutual commitment to achieve common goals (Galdeano-Gómez et al., 2016; Quintana Garcia and Benavides Velasco, 2002).

From the Resource-Based View’s (RBV’s) perspective, the competitive advantage is met through the acquisition of unique, inimitable, and valuable resources and capabilities (Barney, 1991; Nason and Wiklund, 2018). Therefore, the difference in performance among firms may be attributed to said resources and capabilities. Still, most SMEs are small and have few resources, so they will need networking capabilities to renew competencies and achieve congruence with the changing business environment (Dadfar et al., 2014; Quintana Garcia and Benavides Velasco, 2002).

SMEs need a balance between pursuing a competitive advantage and inter-firm collaboration. Firms undertake inter-firm collaboration for many reasons: summarizing, the generic needs of firms seeking alliance include cash, scale, skills, access, or a combination (Bleeke and Ernst, 1995), but also aiming to share the risks and costs with others (Dadfar et al., 2014). The commitment degree linked to the motive for the firms to collaborate is not always the same. Different collaborative forms represent different approaches that firms adopt to control their dependence from their partners, requiring different levels of trust and dependency that are related to the outcome of competitive alliances (Hameed and Naveed, 2019). Also, they are associated with different legal forms, enabling firms to control the resources’ allocation and the distribution of benefits among partners (Todeva and Knoke, 2005). In other words, it does not require the same level of commitment between two firms to collaborate to fulfill a core business objective (like developing a new product) than the level of commitment between firms that collaborate in a peripheral activity, like outsourcing services.

The strategic motives for organizations to engage in an inter-firm collaboration vary according to firm-specific characteristics and multiple environmental factors (Todeva and Knoke, 2005). We selected two motives to engage in inter-firm collaboration; developing new products (Ettlie and Pavlou, 2006; Wessel, 2004) and reducing costs through outsourcing (Agarwal and Ergun, 2008; Vitasek and Manrodt, 2012).

Previous studies have analyzed the importance of inter-firm collaborations for development and improvement of new products (Corallo et al., 2012; Huang et al., 2010). The high cost and risk associated can be especially problematic for smaller firms with limited resources and that are especially vulnerable to environmental discontinuities (Galdeano-Gómez et al., 2016; Parker, 2000). Because of this, the partners with whom a firm must collaborate may play a critical role, since they represent an important source of ideas and commercialization (Afuah, 2000; Matt et al., 2012). For many SMEs, their ability to compete may be tied to their ability to collaborate and, by extension, to innovate and grow, which shows the complexity in those relationships (Konsti-Laakso et al., 2012; Morris et al., 2007).

This problem has been studied by Ettlie & Pavlou (2006), who analyzed the dynamic capabilities that result from inter-firm partnerships during new product development; Wessel (2004), explored how new product development performance is affected by the information available between firms with formal collaboration agreements. Other authors have analyzed how knowledge from multiple partners is effectively integrated in inter-organizational new product development (Corallo et al., 2012). These relationships involve certain openness and vulnerability and require high levels of trust among firms (Morris et al., 2007). Collaboration with competitors is an important way to acquire new technological knowledge and skills and to create and access other capabilities based on an intensive exploitation of existing resources and capabilities (Galdeano-Gómez et al., 2016; Quintana Garcia and Benavides Velasco, 2002). In general, we can say that the inter-firm relationships seeking new product development and innovation are complex and require formal arrangements (Colombo, 2003; Corallo et al., 2012), trust, commitment (Morris et al., 2007; Ul Hameed and Naveed, 2019), and solid networking capabilities from both firms (Konsti-Laakso et al., 2012; Wessel, 2004).

Outsourcing can be defined as the act of subcontracting out all or parts of the functions of a firm to an external party (Gilley et al., 2004). Even though it can refer to all activities, we focused on those activities that are not the core of the business and in which the SMEs operate below minimum efficient size, and therefore have a cost disadvantage compared to large firms (Sarkar et al., 2001). Because of this, becoming associated with other firms allows them to achieve economies of scale and reduce costs: “if the focal activity is not a source of sustainable competitive advantage - in other words, others are performing this activity at a lower cost and/or with lower quality - then it makes sense to outsource it” (Mudambi & Venzin, 2010, p. 1528).

Previous studies discovered that outsourcing services for logistics is effective in reducing costs (Heshmati, 2003), retailing (Fisher and Raman, 1996), and managing revenue (Talluri and Van Ryzin, 2004). “For many companies, outsourcing partnerships are being used to achieve rapid, sustainable improvement in enterprise level performance. More specifically, in addition to the baseline value of reducing costs and offloading unimportant activities, partnership with an outsourcing vendor can be used to gain access to competitive skills, improve service levels, and increase the company’s ability to respond to changing business needs” (Linder et al., 2002, p. 23). Much of the discussion about outsourcing in the literature has focused on the potential cost savings associated with non-core activities (Gilley et al., 2004). In general, SMEs tend to outsource operations where the created value is low (Mudambi and Venzin, 2010). An important antecedent for success in outsourcing is to build network exchange structures with outsiders, requiring good organization within the firm (Lacity and Willcocks, 2012; Zeffane, 1995).

2.2 Networking Capabilities

The coexistence relationships and the interactions among different work groups can be analyzed through networks and its impact on the alliance’s outcome (Jifeng, 2011; Rosenthal, 1997). Monge (1998) identified ten theoretical mechanisms to explain the emergence, maintenance, and dissolution of networks in organizational research. A firm’s social connections give it the opportunity to identify the subjacent interests before it decides to cooperate with others and its networking capabilities allow a firm to manage its alliances and network ties (Gulati, 1998; Jifeng, 2011). Particularly, the network approach to entrepreneurship is associated with the mechanism by which different entities make interchanges. Networks allow access to resources the firms lack and firms must establish connections to find resources and explore business opportunities, where their variations on resources and network resources influence their ability to exploit useful information and innovate (Jifeng, 2011; McEvily and Zaheer, 1999; Zimmer and Aldrich, 1987).

Networking capabilities are the capabilities a firm develops to identify, cultivate, and manage its networks with strategic partners and to develop its networking skills to utilize, maintain, and extend its relationships (Hayter, 2013). Networking capabilities provide novel ideas and promote innovations and R&D ideas, by giving SMEs greater access to a broader base of information and resources and enabling the transfer of knowledge between individuals or teams (Konsti-Laakso et al., 2012; Uzzi, 1997). In both cases, when looking to develop new products and to outsource services, the firms’ aspect of collaboration is rooted in the social network perspective (Hayter, 2013). Then, we can hypothesize:

H1: The level of the networking capabilities increase the likelihood of taking part in inter-firm collaboration relations to develop new products.

H2: The level of the networking capabilities increase the likelihood of taking part in inter-firm collaborative relationships in order to outsource services.

2.3 Mediating of Hybrid Growth Strategy

Several growth strategies have been presented in the entrepreneurship literature (Pasanen, 2007). From the growth management approach, it is possible to classify the growth strategies into three categories, each with different characteristics. Edith Penrose (1959) established a clear distinction between two. The first is internal, or Organic, growth, which refers to the strategic focus on internal research and development, applied to product development, enhancements, and extensions (McCann, 1991), allocating resources in specific areas the firm chooses in order to grow steadily (Moatti et al., 2015). The second is external, or Acquisitive, growth, which refers to forward or backward integration. It is more common in older firms (Levie, 1997) and in mature industries (Henrekson and Johansson, 2010), especially when looking for market knowledge during an international expansion (Agnihotri, 2014). The third growth strategy combines elements from both Organic and Acquisitive growth to share or borrow resources (Agnihotri, 2014; Williamson, 1991) and is called Hybrid growth. It can be defined as “contractual relationships that bind external actors to the firm at the same time as the firm maintains a certain amount of ownership and control over how any assets are used” (McKelvie & Wiklund, 2010, p.274). It can take different forms, including franchising, licensing, alliances, and joint ventures (Levie, 1997; McCann, 1991).

Some forms are more common depending on the sector. For example, in the hospitality sector, franchising is an important form of growth (Combs and Ketchen, 2003); in manufacturing and distribution, licensing is a common strategy, mainly for the young firms that need complementary assets (Arora et al., 2001). In contrast, when two firms decide to collaborate in technological developments, these relationships are formal and complex, since they involve a high degree of commitment from both firms and sharing the risks. “Technological or research-based alliances essentially bring together the specific and oftentimes tacit skills to collaborate on developing new technologies. This saves other firms from investing time and resources into risky technology development.” (McKelvie & Wiklund, 2010, p. 275). On the other hand, outsourcing also involves creating formal, contractual structures, even when the motive is related to subcontracting peripheral activities: “Firms tend zealously to protect their core businesses and, are thus more willing to enter involving peripheral activities which offer wider scope for organizational learning and less vulnerability from sharing confidential information” (Todeva & Knoke, 2005, p. 7).

Previous studies have shown this strategy’s usefulness in overcoming a lack of specific technological (Hagedoorn and Schakenraad, 1994) or international/local knowledge (Lu and Beamish, 2006), as well as to defend or consolidate a firm’s market position (Agnihotri, 2014). The Hybrid growth strategy is based on formal cooperative mechanisms to license technology and share knowledge from other firms to jump-start their own internal innovation process (McCann, 1991; Hameed and Naveed, 2019). The mediating function of a third variable represents the generative mechanism through which the focal independent variable is able to influence the dependent variable of interest (Baron and Kenny, 1986). Some authors have shown the existence of a relationship between networking capabilities and the Hybrid growth strategy (Zou et al., 2010). Networking with various strategic partners contributes in sharing the risk in innovative processes (Dadfar et al., 2014; Ramachandran and Ramnarayan, 1993), exchanging information (Larson, 1991; Hameed and Naveed, 2019), and increasing the speed of technology transfer (Kotabe et al., 2003).

Therefore we can hypothesize that:

H1a: The Hybrid growth strategy is a mediating variable between the level of the networking capabilities and the likelihood of taking part in inter-firm collaborative relationships in order to develop new products.

H2a: The Hybrid growth strategy does not have a mediating effect between the level of the networking capabilities and the likelihood to outsource.

3. METHODOLOGY

3.1 Data and Sample

Following recommendations by Davidsson et al. (2006, p.387) “…the use of homogeneous samples allows one to use operationalization that is maximally relevant for the particular type of firm or industry.” The sampling method used was, initially, snowball sampling, being a non-probability method. This type of sampling helps analyze and understand phenomenon occurring with individuals or groups (Onwuegbuzie and Collins, 2007), in this case, SMEs operating in the ETICS industrial sector in Mexico. This method was selected, since non-probability sampling is often used in business-related researches. Snowball sampling refers to recruiting informants through networks, where the contact with an individual or group helps the researcher connect with others; it is useful to get information from a specific area (Etikan and Bala, 2017). The snowball effect was met through two agreements with institutions in the ETICS industry. The second sampling method, once the first contacts were made, was through purposive sampling, where the subjects are selected according to parameters established by the researchers and focused on those who will provide the best information for the established objectives (Etikan and Bala, 2017).

The ETICS industry has been one of the fastest growing sectors in Mexico in recent years, receiving 4.560 billion USD of direct investment in the last 10 years and generating 47.590 billion USD in exports and about 50,000 jobs. The analysis focused on SMEs using the classification of the Secretary of Economy that considers as SME those firms with 250 employees and annual sales of up to 250 million of Mexican pesos. The questionnaire was designed to be administered face to face to the CEOs of the sample’s firms. The questionnaire was designed in Spanish, and multiple item constructs were used. In addition, experts from the sector were consulted to validate the instrument and avoid wording misunderstandings. Most of the answers were expressed on a Likert scale, where 1=strongly disagree; 5=strongly agree. The rest are ordinal or quantitative variables.

We conducted a pilot project in the city of Guadalajara and we realized the difficulty of collecting primary data. To ensure the attainment of data, we hired BERUMEN S.A., one of the most prestigious companies in Mexico for information collection and processing. To collect the full sample, we signed two collaboration agreements, the first one was with the National Association of Computer Technology and Communications Distributors (ANADIC) and the second one, with the National Chamber of Electronic, Telecommunications and Technology Industry (CANIETI); together they meet 99% of the firms in this sector. The universe, once the duplicates and unreachable were removed, had 2,095 firms over the country, where 1,092 (52.1%) are located in Mexico City, 556 (26.5%) in Guadalajara, 393 (18.7%) in Monterrey and 54 (2.6%) in other states around the country. From the total of firms, 90% have less than 30 employees and 65% are less than 10 years old. The analysis focused on SME using the classification of the Secretary of Economy that considers SMEs as firms with up to 250 employees and annual sales of up to 15 million dollars yearly.

The pilot sample included 25 firms; the results helped us correct the wording of some items. Then, we sent e-mails to the CEOs requesting their participation in this research. From the positive answers, face-to-face appointments were held with CEOs in Mexico City, Guadalajara and Monterrey; in the rest of the cities, the contact and surveys were done by telephone. A team of 11 professionals was trained to conduct the surveys, developing the surveys in 12 weeks. In the total sample, there were 450 valid responses, from which 40% were firms located in México City, 28% in Guadalajara, 23% in Monterrey, and 9% through the rest of the states, ensuring representativeness. Out of the 450 responses, 296 firms took part in inter-firm collaboration activities in the last three years, thus they were chosen to prove the hypotheses previously mentioned.

From this subgroup, we found the following information. Most of the CEOs (99%) are Mexican; 79.1% are men; 64.1% are between 21 and 40 years old; 26% studied up to high school, 42.9% have a bachelor’s degree, and 9.5% have a master’s or doctoral degree. Additionally, 30.7% of the CEOs have attended postgraduate business courses additional to their professional studies. In regards to firms, 57.8% are family businesses and 88.5% are located in Mexico City, Monterrey, and Guadalajara; most of them, 38.5%, in Mexico City. 70.6% are under ten years old and 88.2% have less than 30 employees, also showing representativeness. According to the CEOs, 56.1% are in the consolidation stage and 50.9% registered annual sales of less than a million dollars. Additional information is presented in Table 1.

Table 1 Sample Profile

| Frecuency | % | Frecuency | % | ||

| CEO Nationality | Business Cycle | ||||

| Mexican | 293 | 99 | Early Stage | 18 | 6.1 |

| Non Mexican | 3 | 1 | Initial Growth Stage | 75 | 25.3 |

| Growth Stage | 166 | 56.1 | |||

| CEO Sex | Mature Stage | 53 | 11.8 | ||

| Male | 234 | 79.1 | Unanswered | 2 | 0.7 |

| Famale | 62 | 20.9 | |||

| Company Age until 2014 | |||||

| CEO Highest Educational Degree | Between 1 and 5 | 134 | 45.3 | ||

| Elementary school | 17 | 5.7 | Between 6 and 10 | 75 | 25.3 |

| High school | 77 | 26 | Between 11 and 15 | 47 | 15.9 |

| Technical | 45 | 15.2 | More than 15 | 40 | 13.4 |

| College | 127 | 42.9 | |||

| Master/PhD | 28 | 9.5 | Number of Employees During 2014 | ||

| None | 2 | 0.6 | Less and 30 | 262 | 88.2 |

| Between 30 and 60 | 18 | 6.1 | |||

| CEO Additional Management Courses | Between 61 and 100 | 6 | 1.9 | ||

| Yes | 91 | 30.7 | Between 101 and 200 | ||

| No | 202 | 68.2 | Between 201 and 220 | ||

| Unanswered | 3 | 1 | |||

| Business Sales during 2014 (millions pesos) | |||||

| CEO Age | Less than 1 | 153 | 50.9 | ||

| Less than 20 | 1 | 0.3 | Between 1 and 20 | 117 | 38.9 |

| Between 20 and 30 | 97 | 32.8 | Between 21 and 40 | 14 | 4.5 |

| Between 31 and 40 | 93 | 31.3 | Between 41 and 60 | 4 | 1.2 |

| Between 41 and 50 | 62 | 21.1 | Between 61 and 80 | 7 | 2.2 |

| Between 51 and 60 | 33 | 11 | Between 81 and 100 | 0 | 0 |

| Between 61 and 70 | 7 | 2.3 | Between 101 and 120 | 1 | 0.3 |

| More and 70 años | 3 | 0.9 | Between 121 and 140 | 0 | 0 |

| Between 141 and 160 | 0 | 0 | |||

| Family Business | More than 160 | 0 | 0 | ||

| Yes | 171 | 57.8 | Unanswered | 0 | 0 |

| No | 125 | 42.2 | |||

| Company Location | |||||

| Mexico City | 114 | 38.5 | |||

| Monterrey | 75 | 25.3 | |||

| Guadalajara | 73 | 24.7 | |||

| Other | 34 | 11.5 |

4. VARIABLES

The unit of analysis for this study is the motive to establish a collaborative relationship, and we selected two different motives. The first motive is to develop and/or improve new products. New product development studies have highlighted many industries, but they have primarily focused on high technology industries (Wessel, 2004). This paper had the dependent variable motive of the collaboration. Based on the ETICS industry perspective, the first motive is new product development, therefore we asked the CEOs whether they had participated in alliances with another company within the sector during the past three years. The second motive was cost reduction through outsourcing (Lacity and Willcocks, 2012; Todeva and Knoke, 2005). Similarly to the first motive, respondents were asked to indicate whether they outsourced services to another company within the sector during the past three years.

The independent variable is the networking capabilities. They include all of the partnership relationships of the firm: internal and external links, including personal networks. The items ask about interpersonal (friends, family members, colleagues) and intra-firm (government agencies, professional associations, relationships with investors) relationships (Fu et al.,2006).

The mediating variable is the Hybrid growth strategy, which contains two items. The first relates to a firm’s growth with licensing (buying or selling) technology to other firms. The second relates to growth with the establishment of partnership contracts, such as franchising, licensing, and joint ventures (Zou et al., 2010).

We included two control variables, firm age and firm size, that have been previously used in the literature as controls and as indicators of possible performance of inter-firm collaborations (Chen et al., 2009; Zhang et al., 2013; Zou et al., 2010), in order to control relevant effects that could tamper with the independent variable’s effect.

5. ANALYSIS METHODS

Logit regressions were made for each motive for inter-firm collaborations. To perform the appropriate analysis for testing mediational hypotheses, we followed the previous work by Baron and Kenny (1986) and reinforced by Rijnhart et al. (2019). At first, a logit regression was made regarding the networking capabilities (causal variable) and the motive of the collaboration (dichotomic dependent variable). Afterwards, it was proven that the networking capabilities are related to Hybrid growth (mediating variable) through a linear regression. This step essentially involves treating the mediator as if it were an outcome variable. Then, we did a logit regression, considering as the dependent variable the motive to collaborate and as predictors both the networking capabilities and Hybrid growth strategy. We did so, because it is not enough to only relate the Hybrid growth strategy with the dependent variable, because the mediating variable and the dependent variable can be related, since both are caused by the networking capabilities. Therefore, the networking capabilities must be controlled when establishing the mediator over the dependent variable.

6. RESULTS

Two exploratory factor analyses (EFA) were developed using SPSS; both used the maximum likelihood extraction method and VARIMAX rotation, which allows analyzing the shared variance with clear patterns due to the oblique rotation (Osborne, 2015). The first corresponds to the items related to networking capabilities of the firms; the second one relates all the items about Hybrid growth strategy, clearing the pattern to be more easily understood and compared with the shared variance. The results of the first EFA showed the existence of one factor we name, networking capabilities, which is consistent with the expected solutions. Likewise, the results of the second EFA showed the existence of one factor, we name Hybrid growth. Both the Kaiser-Meyer-Olkin statistic and the Bartlett's Test of Sphericity yielded satisfactory results. All communalities were above 0.5 and the cumulative variance represented by all the sets of factors was over 73% (Appendix A).

Table 2 presents the logit models’ estimations related to collaborations to develop new products, which were constructed by three different models. The first model included the control variables, firm age and firm size. The second showed the results obtained by using the networking capabilities as the independent variable. The third included both the networking capabilities and the mediating effect of the Hybrid growth strategy. Specifically, this table shows the coefficients, the standard errors (values in parentheses), and an indication of the significance level per model. Additionally, the chi-squared for each model is reported. The models were structured this way to demonstrate the different stages of the analysis and the difference in significance level by the inclusion of variables, thus indicating the strength of their effect. Regarding the H1, there is evidence showing that the networking capabilities affect significantly the probability of collaborating with another firm within the sector to develop new products (coefficient = 0.391, p < 0.01). Regarding the H1a, we identified that there is a total mediating effect of the Hybrid growth strategy, because, by applying the mediating variable to the model, the direct effect between the networking capabilities and collaborating to develop new products resulted irrelevant (coefficient = 0.124), while the effect of the Hybrid growth strategy over collaborating to develop new products was significant (coefficient = 0.448, p < 0.002). Therefore, the hypothesis is supported. Figure 1 displays the relationship between these variables and the results.

Table 2 Logit models’ estimation to create alliances to develop new products.

| Variables | Model 1 | Model 2 | Model 3 |

| Networking capabilities | 0.391** (0.120) | 0.124 (0.149) | |

| Hybrid growth strategy | 0.448** (0.148) | ||

| Firm age | 0.007 (0.017) | 0.005 (0.017) | 0.004 (0.017) |

| Firm size | 0.002 (0.003) | 0.002 (0.003) | 0.002 (0.003) |

| Chi-squared | 0.615 | 11. 071** | 20. 713*** |

| -2 of verisimilitude | 614.084 | 596.475 | 604.286 |

| Cases classif. Correct. | 58% | 62% | 58% |

| No. of observations | 296 | 296 | 296 |

*p<0.1; **p<0.01;***p<0.001

Figure 1 Relationships between networking capabilities and new product development, mediating effect of Hybrid growth strategy

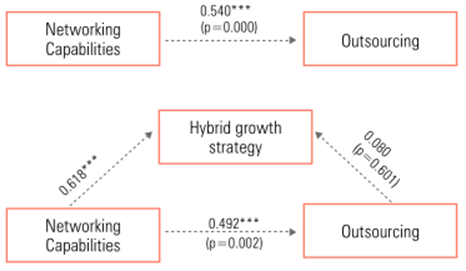

Similarly, the Table 3 shows the logit models’ estimations related to outsourcing with firms within the same sector. Three models are presented. The first included the control variables, firm size and firm age. The second model presented the results obtained by using the networking capabilities as the independent variable. The third included both the networking capabilities and the mediating effect of the Hybrid growth strategy. The table shows the coefficient value, the standard errors (values in parentheses), and an indication of the significance level per model. Additionally, the chi-squared values for all the models are shown. Related to the H2, there is evidence showing that the networking capabilities affect significantly the probability of collaborating with another firm within the same sector to outsource (coefficient = 0.540, p <0.000). Regarding H2a, we identified that the effect of the Hybrid growth strategy over collaborating to outsource services is not statistically significant (coefficient = 0.080). Therefore, it is not considered as a mediating variable in the relationship between the networking capabilities and the probability of outsourcing, thus the hypothesis is supported. The Figure 2 shows the results presented in the table.

Table 3 Logit models’ estimation to create alliances to outsource

| Variables | Model 1 | Model 2 | Model 3 |

| Networking capabilities | 0.540** (0.134) | 0.492 (0.162) | |

| Hybrid growth strategy | 0.080** (0.154) | ||

| Firm age | 0.002 (0.017) | -0.001 (0.017) | 0.004 (0.016) |

| Firm size | 0.002 (0.003) | 0.001 (0.003) | 0.001 (0.003) |

| Chi-squared | 0.425 | 17.572** | 17.945*** |

| -2 of verisimilitude | 573.814 | 360.966 | 360.963 |

| Cases classif. Correct. | 66.4% | 66.9% | 67.9% |

| No. of observations | 296 | 296 | 296 |

*p<0.1; **p<0.01;***p<0.001

7. DISCUSSION

The collaboration mechanisms allow firms to get positive outcomes, due to the identification of partnering opportunities (Todeva and Knoke, 2005), cost reduction, and combination of resources (Dadfar et al., 2014). Particularly, since most SMEs are small and have limited resources, they try to create value through association with the discovery and exploitation of business opportunities (Dadfar et al., 2014; Lumpkin and Dess, 1996; Shane and Venkataraman, 2000). Previous studies have shown the importance of SMEs establishing connections to resources and niches in an opportunity structure. Said process is motivated by a firm’s resources and capabilities (Aldrich and Zimmer, 1986; Dubini and Aldrich, 1991). The networking capabilities allow firms to identify both business opportunities and resources and manage their business network and ties (Aldrich and Zimmer, 1986; Jifeng, 2011).

Even though, there are different motives for SMEs within the same sector to collaborate (Todeva and Knoke, 2005), we decided to analyze two particular cases. The first is related to those that look for SMEs within the same sector to collaborate to develop new products. The second is related to those SMEs within the same sector that collaborate to outsource services.

The obtained results show that the intensity of the networking capabilities’ allocation increases the likelihood of firms deciding to collaborate with firms within the same sector to both develop new products (Haeussler et al., 2012; Jifeng, 2011; Quintana Garcia and Benavides Velasco, 2002) and to outsource services.

Our results match those from previous studies. Sherer (2003) found that networks are the means to involve interdependent firms involved in similar activities into participating in collaborative development of new products. Ettlie & Pavlou (2006) showed that partnership dynamic capabilities significantly influence the development of new products.

Regarding the likelihood to outsource services, our results show that the intensity in the networking capabilities increases the likelihood of outsourcing with other firms within the same sector. This is consistent with the study by Sherer (2003), who discovered soft or explorative networks that allow firms to share resources and engage in collaborative cost reducing strategies. Our findings agree with Agarwal & Ergun (2008), since they found that collaborative service networks provide the capacity to reduce costs through outsourcing in communication and transport services.

We consider our most relevant contribution to be the results obtained regarding the Hybrid growth strategy’s mediating effect, since different authors consider it an area with little empirical research (Gilbert et al., 2006; McKelvie and Wiklund, 2010). When firms decide to follow the Hybrid growth strategy, they base their growth on licensing technology to/from other firms, sharing technology and partnering with other firms in core objectives.

Our results show that the Hybrid growth strategy is a mediating variable between the networking capabilities and the likelihood of a firm to collaborate to develop new products. We did not identify prior studies proving said relationship specifically, but there is literature showing that co-opetition is a used strategy to develop new products (Haeussler et al., 2012; Tomlinson and Fai, 2013). Gnyawali & Park (2009) discovered that firms need to establish strategies to pursue ways to simultaneously engage in collaboration and competition with other firms in the industry, since their competitors’ resources are more useful than those that come from other sectors and can be used directly to develop new products. “Hybrid modes consist of contractual relationships that bind external actors to the firm at the same time as the firm maintains a certain amount of ownership and control over how any assets are used” (McKelvie & Wiklund, 2010, p. 274). New product development alliances is an important research issue that represents the forefront of the changing dynamics of competition and cooperation (Hameed and Naveed, 2019; Wind and Mahajan, 1997). Previous studies have shown that the networking capabilities have a direct, positive relationship with the Hybrid growth strategy (Zou et al., 2010), which is consistent with the results obtained in this study.

Additionally, our results showed that the Hybrid growth strategy does not have a mediating effect in the relationship between the networking capabilities and the likelihood of outsourcing between companies within the same sector. This can be because some firms consider outsourcing exclusively as a cost-reducing process and not as a strategy to develop performance-based partnerships and, in general, they do not involve licensing or technology transfer processes: “[There] are excellent examples of collaborative, flexible and innovative approaches to project and outsourcing contracts. Unfortunately the state of the art in this area has long been grounded, for the most part, in non-flexible task-oriented contracts that focus primarily on risk avoidance, liability limitation and lowest possible cost” (Vitasek & Manrodt, 2012, p. 5).

CONCLUSION

Our study has demonstrated that the likelihood to do collaborative activities between companies in the same sector, both to develop new products and outsourcing, increases according to the endowment in the networking capabilities of SMEs. We also discovered that the Hybrid growth strategy is a mediating variable between the networking capabilities and the likelihood to collaborate to develop new products. The Hybrid growth strategy does not have a mediating effect when the motive is to collaborate to outsource. This is due to the fact that the Hybrid growth strategy is based on licensing and knowledge transfer, which are common processes in new product development, but not in the traditional conception of outsourcing.

8.1 Limitations and Future Research Directions

This study analyzed relationships between networking capabilities and collaborative motives in a single environment and in a single sector. The study was designed to be developed in a relatively homogeneous sector of the economy, making the results valid for this sector exclusively. Another limitation was that we used a single informant approach, therefore a bias problem can occur. The results expressed were obtained from a unique observation in time; the lack of longitudinal data is also a limitation.

We show the results obtained from a sample of the ETICS sector, however it is advisable to analyze other sectors within the same environment. The results of the study implicitly consider the external effects of the environment in Mexico; so another line of research could analyze the firms’ growth strategies and performance in different countries, to identify the effect of the institutions on the firms’ performance. The decision of “how to grow” is a complex process, responding to several factors that can vary over time. We show the results obtained in a single observation in time, therefore, future research could analyze the same sector in other points of time. We hope that our study will inspire further investigations on the relationship between growth strategies and SMEs’ performance.