1. INTRODUCTION

According to the Centre for Research on the Epidemiology of Disasters (CRED) at the Université Catholique de Louvain, in the period 1998-2017 disaster events (climate-related and geophysical) killed 1.3 million people and left 4.4 billion affected. These events generated direct economic losses valued at US$ 2,908 billion, of which climate-related disasters caused US$ 2,245 billion or 77% of the total. All this is even more troubling given that only 37% of the reports received by CRED contain economic data (CRED, 2018). The direct economic costs of disasters have been systematically under-reported. After two decades of intense work mainstreaming disaster risk reduction (DRR) into the public agenda, this field is not a sole responsibility of governments. Without undervaluing the central and non-delegable responsibility of the government, the co-responsibilities of individual members of society, civil society, and the private sector should also be recognized. The private sector plays a twofold role, both as a risk generator and as a subject exposed to risks.

Three terms frequently used in this paper are: disaster, risk, and resilience. Disaster is defined as “a serious disruption of the functioning of a community or a society at any scale due to hazardous events interacting with conditions of exposure, vulnerability and capacity, leading to one or more of the following: human, material, economic and environmental losses and impacts” (United Nations, 2016: 13). Disaster risk is understood as “the potential loss of life, injury, or destroyed or damaged assets which could occur to a system, society or a community in a specific period of time, determined probabilistically as a function of hazard, exposure, vulnerability and capacity” (United Nations, 2016: 14). In the business context “resilience is the ability to survive, adapt and grow regardless of the shocks or stresses businesses experience. This includes being prepared for disasters, knowing how to respond to disasters, and understanding how to be connected both before and after a disaster” (AECOM, 2016, p. 55).

The impact of disasters in the private sector has been recorded relatively well by large firms, but the impact on small and medium enterprises (SMEs) has been an area insufficiently studied. Isolated reports indicate that SMEs are disproportionately affected by disasters, both in wealthier countries and most especially, in poorer ones (UNDP, 2013). A 2017 report from the U.S. Federal Reserve notes: “…little is known about the natural disasters on small businesses, which are a critical engine of the American economy and are responsible for creating two out of three new private-sector jobs” (FRBSF, 2018). The relevance of SMEs is even greater in emerging economies where SMEs represent the highest percentage of companies and provide the main source of employment (WB, 2019).

There are competing narratives in the literature regarding the relationship between business’ disaster experience and disaster risk reduction (DRR). While some studies indicate that SMEs that have experienced disaster impacts seek to improve their readiness capabilities to face future events, others indicate that there are other conditions besides disaster experience that condition preparedness capabilities.

The objective of this study is to determine if being exposed/affected by a disaster predicts DRR, considering business size.

This article is organized into five sections that follow the introduction: 1) Review of the literature on the social and economic importance of SMEs, the frailty observed in the SMEs, and the relationship between business’ disaster experience and DRR; 2) Materials and methods that include the study data, outcome variable, predictor variables, and statistical analyses; 3) Results, descriptive statistics and results of the multivariable linear regression; 4) Discussion; and 5) Conclusions.

2. LITERATURE REVIEW

Once the objective and the hypothesis of the study were defined, a literature review in three particular areas was carried out: 1) the social and economic importance of SMEs as generators of employment; 2) the susceptibility or frailty observed in the SMEs compared to the large firms; and 3) the competing narratives in the literature regarding the relationship between business’ disaster experience and DRR.

Electronic platforms such as Google Scholar, PreventionWeb, and Scielo were used for this review. The search initially included the terms SME, SMEs importance, SMEs fragility, SMEs disaster impact, and DRR and SMEs. The search was based initially on titles and abstracts, as a result of which 365 articles in the English language were chosen. After reviewing methodology and results, 31 articles were finally selected for review.

1.1. Social and economic importance of SMEs

SMEs are one of the greatest sources of innovation and job creation in industrialized and developing countries (Calice, 2016). In industrialized countries, SMEs provide more than 60% of employment and about 50% of GDP, while in developing countries, SMEs account for over 50% of employment and 40% of GDP (Calice, 2016).

Despite the acknowledgement of the existence of small businesses as relevant actors for several decades now, there is no agreement on the terminology or definition for such initiatives at the global level. In terms of terminology, some consider them as small businesses, others refer to them as small and medium enterprises (SMEs), and still others call them micro, small, and medium enterprises (MSMEs). The main trend is to simply identify them as a type of business that does not match large business features (Berisha & Pula, 2015). Common criteria used to define small businesses include number of employees, sales, net profits, assets, and loan sizes. However, the range within these categories varies significantly depending on the industry and country, making it difficult to compare them objectively.

The World Bank considers three quantitative criteria for defining SMEs: number of employees, total assets (U.S. dollars), and annual sales in U.S. dollars (IEG, 2008) (see Table 1).

Table 1 Definition of small and medium enterprises by World Bank standards * .

| Number of employees | Total assets | Annual sales | |

| Medium | > 50; < 300 | >$3,000,000; <$15,000,000 | >$3,000,000;< $15,000,000 |

| Small | > 10; < 50 | >$100,000; <$3,000,000 | >$100,000;< $3,000,000 |

| Micro | < 10 | <$100,000 | < $100,000 |

The U.S. Small Business Administration (SBA) agency defines small business as: “… one that is independently owned and operated, is organized for profit, and is not dominant in its field” (Greene, 2011, p. 34) and follows the condition of size defined in terms of number of employees and/or sales over a specific period of time. In the U.S., the maximum number of employees in a small business may range from 100 (in wholesaling) to 1500 (in manufacturing), but fewer than 250 employees are generally considered to constitute a small business. In Canada, 0 to 99 employees are considered small businesses, 100 to 499 employees, medium businesses, and 500 or more employees, large businesses. In Australia, small business size varies from fewer than 15 to fewer than 50, based on the institution and the purpose.

The European Union (EU) defines small and medium-sized businesses according to the number of employees and/either turnover or total balance sheet. Based on number of employees, the EU considers a micro business as having fewer than 10 employees, a small business as having fewer than 50 employees, and a medium business fewer than 250 employees (EC, 2016). In Latin America and the Caribbean, small businesses are defined by number of employees as well as the annual sales of the company. Table 2 summarizes the criteria used in the six countries considered in the current study.

Table 2 Official definition of SME.

| Country | Employees | Time Period | Source |

| Canada | 500* | 1990-93, 1996, 1998 | Presentation to Standing Committee on Industry, Science & Technology, APEC Globalization & SME (OECD, 2013) |

| Chile | 200* | 1996 | Inter -American Development Bank-SME Observatory |

| Colombia | 200 | 1990 | Inter-American Development Bank-SME Observatory |

| Costa Rica | 100 | 1990, 92-95 | Inter-American Development Bank-SME Observatory |

| Jamaica | 50 | 2013 | Ministry of Industry, Investment and Commerce |

| United States | 500 | 1990-1998 | Statistics of US Businesses: Microdata and Tables |

* The country has no official definition of SME or we do not have data for the country’s official cut off for SME. Adapted from Ayyagari et al. (2005, pp. 33-35).

According to Ayyagari et al. (2003), the importance of the small business sector differs significantly across countries. For example, small and medium-sized businesses represent less than 5% of the formal workplace in the Eastern Partnership Countries (Azerbaijan, Belarus, and Ukraine), but over 80% in countries like Chile and Thailand. The ratio between the share of small and medium-sized businesses in total employment and the GDP varies from 9% in Switzerland to 71% in Thailand (Ayyagari et al., 2003).

Kok et al. (2013) refer to a study conducted by the International Labour Organization (ILO) and the German Agency for International Cooperation, which examined almost 50 research studies on the topic. They concluded that SMEs provide two-thirds of all formal jobs in developing countries in Africa, Asia, and Latin America, and 80% in low income countries, mainly in Sub-Saharan Africa. The role of SMEs in generating jobs has been questioned by their short lifespan (Urwin, Karuk, Buscha, & Siara, 2008). Nevertheless, Kok et al. (2013) affirm that 50% of total employment creation comes from enterprises with less than 100 employees, particularly from companies that grow very fast in the first years of activity, whether existing companies or newly-created firms.

Table 3 shows the contribution of small and medium-sized businesses to job creation and GDP in countries included in the current study. It was not possible to obtain data for Jamaica (as seen in Table 1) as it was not until 2013 that Jamaica sought a unification of criteria for SMEs.

Table 3 Firm size and employment/GDP Share

| Country | GDP/Capita | SME 250 | SME OFF | SME GDP | INFORMAL | INFO GDP |

| Canada | 19,946.50 | - | 58.58 | 57.2 | - | 11.75 |

| Chile | 4,476.31 | 86 | 86.5 | - | 40 | 27.6 |

| Colombia | 2,289.73 | 67.2 | 67.2 | 38.66 | 53.89 | 30.05 |

| Costa Rica | 3,405.37 | - | 54.3 | - | - | 28.65 |

| Jamaica | - | - | - | - | - | - |

| United States | 28,232.07 | - | 52.54 | 48 | - | 12.2 |

Note. GDP/Capita is the real GDP per capita in US$. SME 250 is the SME sector’s share of formal employ-ment when 250 employees are used as the cut-off for the definition of SME. SME OFF is the SME sector’s share of formal employment when the official country definition of SME is used. SME GDP is the SME sector’s contribution to GDP (The official country definition of SME is used). INFORMAL is the share of the shadow economy participants as a percentage of the formal sector labor force. INFO GDP is the share of the shadow economy participants as a percentage of GDP. Values are 1990-99 averages for all the variables. Adapted from Ayyagari et al. (2005, pp. 25-25).

1.2. Susceptibility or frailty observed in SMEs

Despite the growing recognition of the role that small and medium-sized businesses play in sustained development at global, regional, national, and local levels, there are several constraints that should be considered. These include managerial skills, market information, enabling environment, and access to finance. These constraints lead to a vulnerable position for small and medium-sized businesses, limiting their chances of survival over time, and restricting their achievement in employment generation and GDP contributions.

Managerial skills are considered one of the most important and common limitations for small and medium-sized businesses. In June 2011, the U.S. Census Bureau released results from its 2007 Survey of Business Owners, stating that only 50.8% of owners of respondent firms had a college degree. The demand for management skills (i.e., marketing, production, sales, and finance) grows proportionally to the extent in which small and medium-sized businesses grow.

Market information is critical to small and medium-sized businesses. Knowing about market composition, understanding market opportunities, working within a supply chain, and adapting to a demand fluctuation constitute a real challenge. While market openings arise on a permanent basis in industrialized countries, a real demand and consequent market opportunity is a limiting factor for small business development in developing countries. The problem is more evident in poor countries where despite the needs, the low average income compromises the purchasing capacity as well as the market. Other aspects to consider are the fragmentation of markets because of physical aspects such as access, and cultural conditions where race, ethnic, language, religious and social differences generate barriers for trade. Finally, and particularly in developing countries, small businesses need to compete with large enterprises, often subsidiaries of international businesses, that benefit from economies of scale (Makerere University Business School, 2014).

An enabling environment is understood as the set of political, institutional, regulatory, infrastructural, and cultural conditions that govern formal and informal business activities (DCED, 2008). The term enabling environment, embraces a complex, diverse and abstract matrix or interacting forces that facilitate the development and support the long-term viability of small businesses. Among the topics included are: history, culture, societal norms, electricity provision, roads, transportation, legal and regulatory systems (i.e., business regulations, labor rights, real state, competition laws, and commercial dispute resolution) civil service, local governments, financial mechanisms, and access to appropriate, affordable, and reliable technology.

The International Labour Organization (ILO, 2011) when referring to the enabling environment for sustainable enterprises, gives special emphasis to social aspects such as social inclusion, social protection, education, and training opportunities, as well as environmental considerations focusing on equitable consumption of natural resources.

The final constraint is related to the lack of access to finance, inflation, and rising interest rates which limit small enterprise growth. Issues of collateral, feasibility studies, and unexplained bank charges affect the already fragile managerial and financial capabilities. Small and medium-sized businesses usually require particular financial markets and instruments that can suit their needs and capacities. Therefore, an educational component on financial mechanisms is needed for this sector. The limited availability of financial instruments imposes additional constraints.

According to the OECD (2013) small and medium-sized businesses faced higher interest rates in 2011 compared to 2009-2010, and credit conditions were tougher for small and medium-sized businesses than for large businesses. Calice (2016) indicates that International Finance Corporation’s Enterprise Finance Gap Database recorded that between 55%-68% of formal SMEs are either unserved or underserved by financial institutions in developing countries, estimating the credit gap in US$0.9 - 1.1 trillion. Moreover, financial institutions imposed shortened maturities and increased demands for collateral on this sector, combined by an important level of risk aversion among lenders. These measures are seen as a result of the lending institutions’ perception of higher risk associated with small businesses. The issue of SMEs financing is not limited to developing economies, industrialized countries experience that constraint, aggravated by the 2008 financial and economic crisis. In regard to this particular economic environment, the situation in the Americas region varies from country to country, but maintains the same trends, SMEs have less access to bank loans as compared to large businesses, higher transaction costs and higher risk premiums.

Despite efforts made by some countries to encourage and support the development of small and medium-sized businesses, it is clear that the figures presented in our study confirm there is still a long way to go. The path is increasingly moving away from the trend of protectionism toward competitiveness.

1.3. Disasters and Their Socio-economic Toll on SMEs

Evidence of impact and interruption of operations on SMEs after major events is limited and varies significantly from case to case. The causes of business disruptions include:

Physical: Direct impact on facilities, equipment, machinery, loss of inventory, and business records (Asgary, Anjum, & Azimi, 2012).

Functional: Disruptions in the provision of public services such as electricity, water supply and sewage, fuel (e.g., petrol and natural gas), transportations and telecommunications (Zhang, Lindell, & Prater, 2004). Problems with the supply chain resilience (Vargas-Florez et al. 2019).

Market: Disruption of service/product delivery. Demand constraints due to issues such as population dislocation and transport disruptions (Murta, Gero, Kuruppu, & Mukheibir, 2012). High dependency on community recovery (Battisti & Deakins, 2012).

Financial: Lack of cash flow. Longer closure periods and more resources allotted for repairs, particularly in the case of uninsured firms (Corey & Deitch, 2011).

Some statements have permeated the institutional literature, indicating the impact of disasters on businesses. Some of them are well supported, others have been transmitted without knowing its veracity. Statements based on evidence include:

Howe (2011): after one year of Hurricane Katrina (August 2005), close to 7,900 businesses remained closed in southeast Louisiana.

Asgary et al. (2012): a survey conducted after the 2010 Pakistan floods, showed that 9 percent of Pakistani MSMEs did not reopen.

FEMA (2016): in the US, 40% of SME do not reopen after disasters.

Blythe (Saleem et al., 2008): 75% of MSMEs without business continuity (BC) plans experience business failure within three years after disasters.

Two competing narratives exist in the literature on the relationship between disaster experience and readiness capabilities. Webb et al. (2000) present evidence that disaster experience contributes to an improved level of preparedness at the household and community levels, and further suggests that this applies to businesses too, as shown in studies conducted after the Loma Prieta earthquake (1989) and Hurricane Andrew (1992). According to Hernandez Montes de Oca (n/a), the more MSMEs have faced losses due to disasters, the more likely they are to implement adaptive measures after the event. In New Zealand’s earthquake-prone area, MSMEs showed an inclination to adopt proactive risk management strategies during the recovery phase including recovery priorities in their planning processes (Battisti & Deakins, 2012).

On the other hand, prominent authors, Wenger and Quarantelli (1992, p. 8) maintain that, “…repeated experiences per se of a disaster agent does not automatically generate a disaster subculture among the population of an area; other facilitating conditions are also necessary.” The same authors acknowledge that experience could increase hazard perception, but that there is also a possibility that populations develop a sense of future invulnerability. A more recent study carried out by Noth and Rehbein (2019), studying the effects of the 2013 floods in Germany, found consistency with Wenger and Quarantelli that experiencing a disaster does not generate a learning effect. However, a positive effect was evident on the financial performance of many businesses post-disaster, due not to prior learning but financial assistance in the form of insurance payments and government support following disaster events.

According to Asgary (2016), disaster risk reduction (DRR) and business continuity (BC) management aim to mainstream themselves into management systems (e.g., corporate, strategic, tactical, and operational). DRR is defined by the UNISDR as “… preventing new and reducing existing disaster risk and managing residual risk, all of which contribute to strengthening resilience and therefore to the achievement of sustainable development.” (United Nations, 2016, p. 16). Sarmiento refers to BC as “the processes, protocols, assets, and benchmarks required for an organization to develop plans that ensure the safety of its employees, its community and the continuity of time-sensitive operations” (Sarmiento, 2016, p. 11). It is clear that there is an overlap between the two concepts, particularly when applied to SMEs. Specifically, a combination of DRR and BC plans can contribute to reducing the impact of adverse events on damages and revenue losses, and to resuming normal operations. This is key for the survival of the company, community welfare, and the recovery of the region in which the business operates.

There is an indispensable need for the private sector to participate in prospective risk management, dealing with future development to avoid risk construction; to work on corrective risk management, facing the already built environment and the existing risks; and to take action on compensatory risk management, through risk financing and transfer. DRR and BC should be sought not only for the business’s own protection but to also act within a clear concept of social commitment.

The topic of social commitment broaches another approach that also intersects the DRR and BC overlap: Corporate Social Responsibility (CSR). CSR is understood as “the continuing commitment by business to behave ethically and contribute to economic development while improving the quality of life of the workforce and their families as well as of the local community and society at large…” (Dahlsrud, 2008, p. 7).

An analysis of CRS reports from 84 ‘Fortune 100 companies’ reveals that disaster related initiatives rank third among all corporate social responsibility related activities, behind environmental health and safety, and community (Johnson, Connolly, & Carter, 2011). The analysis finds that these corporations’ response to disasters is usually post-event, financial in nature, and geared toward short-term relief and recovery. Long-term disaster related initiatives exist but are fewer in number; companies restrict their efforts to predictable risks (e.g., diseases) that demand simplistic mitigation processes rather than complex mitigation plans that natural hazards require. Beneficiaries of such actions largely include current and potential stakeholders that strengthen the profit base of the business company, ensuring business continuity (Johnson et al., 2011).

The reliance on the significant role of advocacy in risk reduction that the private sector has to play contrasts with the results obtained in an earlier study by Sarmiento et al. (2012) which served as a background paper for the Global Assessment Report (GAR) on Disaster Risk Reduction (DRR) in 2013. In the study, a survey was conducted across six cities in the Americas (Bogotá, Miami, Kingston, San José, Santiago, and Vancouver) to determine private sector participation in disaster risk reduction. The study found a significant lag in addressing the issue of risk by the private sector, especially SMEs. The larger the company, the more the possibility that the business would take active steps to implement and sustain disaster risk plans. These tendencies seem to be influenced by the size of the companies, and the characteristics and limitations associated, rather than by their location and the level of exposure to different threats.

One interesting finding is an initiative fostered by the German Government, United Nations, the U.S. Agency for International Development, and led by Florida International University, to discuss the role of business schools in the theme of DRR. This endeavor made a call for White Papers on state-of-the-art approaches to mainstream disaster and risk management content into academic offerings, based on seven axes: (1) Strategic Investment and Financial Decisions; (2) Generating Business Value; (3) Sustainable Management; (4) Business Ethics and Social Responsibility; (5) Business Continuity Planning; (6) Disaster Risk Metrics; and (7) Risk Transfer (Sarmiento, 2016). In March 2016, an international workshop was held in Toronto, Canada, to present and discuss the White Papers prepared by the business schools. SMEs was one of the topics discussed throughout the different studies, agreeing on the fragility of the SMEs and their weak resilience capacity, concluding on the need to achieve a better collaboration between business schools and SMEs, and other stakeholders, such as chambers of commerce and small business associations (Muñoz-Gomez 2016, Minto-Coy 2016, Sarmiento et al. 2016).

2. MATERIALS AND METHODS

The objective of this study is to determine if being exposed/affected by a disaster predicts DRR, considering business size. The literature reviewed (Battisti & Deakins, 2012; Hernández Montes de Oca, n/a; Webb et al., 2000), with the exception of the study by Dynes and Quarantelli (1992), suggests that disaster experience increases readiness capabilities in businesses. Based on these studies, the null hypothesis and alternative hypothesis are expressed as follows:

H0. Disaster experience does not have an effect on readiness capabilities.

H1. Disaster experience has a positive effect on readiness capabilities.

2.1. Study Data

The current study utilized survey data from a larger project on private sector participation in DRR conducted in six Western Hemisphere cities: Bogotá, Colombia; Kingston, Jamaica; Miami, USA; San José, Costa Rica; Santiago, Chile; and Vancouver, British Columbia, Canada (Sarmiento et al., 2012) (N=1197).

The subjects targeted for interviews were senior managers, personnel, or directors of private sector companies in three main sectors: (a) food and agriculture, (b) tourism, and (c) construction in the countries under study. The survey contained 40 questions that assessed characteristics of the respondent, features of the business, perceived disaster risk, perceived business continuity, and perceived social corporate responsibility. This was complemented with an analysis of governmental measures necessary to create an enabling environment for the private sector to participate in disaster risk reduction.

The survey was conducted from June to November of 2012 and was carried out by personnel trained and contracted by Florida International University (USA); York University (Canada); INCAE Business School (Costa Rica); and University of Chile (Chile). The database is part of an international effort and cannot be transferred or deposited in an open-access repository.

The current study focused on business features, disaster experience or business disruptions, and DRR (i.e., preparation and mitigation, referred here as readiness). Complete data on these variables was missing for 35 respondents who were, thus, excluded from the current study (N=1162).

The study design went through the Institutional Review Board (IRB) review and registration, under the “exempt” category.

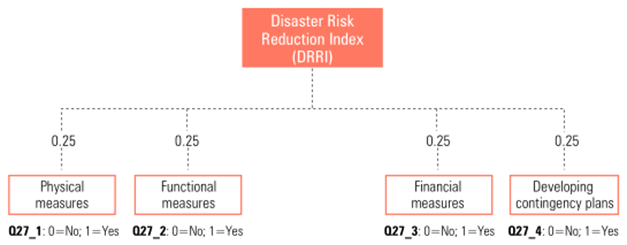

2.2. Outcome Variable

A DRR index (DRRI) was developed to capture the measures taken to control risks and reduce potential damage and losses as the result of an adverse event occurrence. Four variables with equal weight (0.25 each) were used to compute the index: physical measures, functional measures, financial measures, and developing contingency plans. The index has a scale of 0-1, where 0 indicates absence of capabilities to deal with situations of stress, crises, or disasters, and 1 indicates maximum level of risk management and emergency readiness. Figure 1 illustrates the composition of the DRRI.

Has your company implemented interventions to prevent / mitigate disaster risk in its operationes

2.3. Predictor Variables

Disaster experience: Sixteen disruptions experienced (DE) by businesses due to disaster events were explored in the survey. A previous study (Sarmiento et al., 2015) identified the DEs with the highest incidence: (a) supply chain disruption, (b) loss of telecommunications, (c) power outage, (d) water outage, and (e) damaged facilities/ equipment/inventories. These were included as categorical predictors in the model. Categorical predictors can be entered in linear regression models using dummy-coded dummy variables; k-1 variables are required (k=number of groups (Sarmiento et al., 2015)). The 5 DEs were considered independent predictors where k=2 for each variable. As such, each DE required 1 dummy-coded dummy variable (1=supply chain disruption and reference category=no supply chain disruption; 1=loss of telecommunications and reference category=no loss of telecommunications; 1=power outage and reference category=no power outage; 1=water outage and reference category=no water outage; 1=damaged facilities/ equipment/ inventories and reference category=no damaged facilities/equipment/inventories (Warner, 2013)).

Business size: The number of employees in a business was inquired in the survey. This was used to categorize business size as follows: small (<100 employees), medium (100-499 employees), and large (≥ 500 employees). Business size was included as a categorical predictor in the model. Specifically, business size was entered as a dummy-coded dummy variable where k=3. As such, business size required 2 dummy-coded dummy variables (1=large business and 0=not large business size; 1=medium business and 0=not medium business size; small business size not included to serve as reference category (Warner, 2013)).

2.4. Statistical Analyses

Statistical analyses were conducted in SPSS (Version 24) for Windows (SPSS, Inc., Chicago, IL, USA). Multivariable linear regression was used to determine whether the DE variables predict the DRRI, accounting for business size. Stepwise variable selection method was utilized. Fit statistics (i.e., F, R square, and adjusted R square) and predictor coefficients (i.e., unstandardized, standardized, 95% confidence intervals, and part correlations) are reported.

3. RESULTS.

3.1. Descriptive Statistics

Table 4 summarizes the descriptive statistics for the predictors and outcome variables. Overall, power outages were the most common and supply chain disruptions were the least common DEs, and small businesses were predominant in the sample.

Table 4 Descriptive statistics for st

| Predictors | n (%) or M (SD) |

| Supply chain disruptions | 137 (11.8%) |

| Loss of telecommunications | 282 (24.3%) |

| Power outages | 581 (50.0%) |

| Water outages | 238 (20.5%) |

| Damaged facilities/equipment/inventories | 197 (17.0%) |

| Business size | |

| Small | 915 (78.7%) |

| Medium | 201 (17.3%) |

| Large | 46 (4.0%) |

| Outcome | |

| DRRI | 0.41 (0.27) |

Table 5 presents the point-biserial correlations between the DEs and the DRRI. The correlations were all positive and statistically significant, but in the small range.

3.2. Results of the Multivariable Linear Regression

The overall regression model was statistically significant F(6.1155) = 24.47, p<0.001. The coefficient of determination (R square = 0.113) indicated that 11.3% of the variance in DRRI was predicted by the model (adjusted R square = 0.108).

The stepwise variable selection method retained five of the six predictors. Table 6 presents the regression coefficients and associated statistics. Results indicated that having experienced supply chain disruptions, loss of telecommunications, power outages, and damaged facilities/ equipment/ inventories, and being a medium or large business (versus small business) predicted higher DRRI values. The squared part correlations (sr2) indicate that the variables that uniquely predict (i.e., statistically controlling for the other variables) the most variance in DRRI are: medium business size (versus small business size; 4.4%), large business size (versus small business size; 1.6%), and loss of telecommunications (1.2%).

Table 6 Multivariable linear regression of the DEs and business size predicting the DRRI.

| B | 95% CI | SE | β | sr | sr2 | |

| (Constant) | 0.32 | 0.29 - 0.34 | 0.01 | |||

| Supply chain disruption | 0.06 | 0.01 - 0.11 | 0.02 | 0.07* | 0.06 | 0.004 |

| Loss of telecommunications | 0.08 | 0.04 - 0.11 | 0.02 | 0.12** | 0.11 | 0.012 |

| Power outage | 0.05 | 0.02 - 0.08 | 0.02 | 0.09** | 0.08 | 0.006 |

| Damaged facilities/equip./inventory | 0.05 | 0.01 - 0.09 | 0.02 | 0.07* | 0.07 | 0.005 |

| Business size† | ||||||

| Medium business | 0.15 | 0.11 - 0.19 | 0.02 | 0.21** | 0.21 | 0.044 |

| Large business | 0.18 | 0.11 - 0.26 | 0.04 | 0.13** | 0.13 | 0.016 |

† Small business size is the reference category.

*p<.05, **p<.01

4. DISCUSSION

The multivariable linear regression confirmed that business size matters-small businesses had lower level of disaster readiness when compared to medium and large businesses. Disaster experience in the form of supply chain disruption, loss of telecommunications, power outage, and damaged facilities/equipment/inventory predicted disaster readiness. The model was statistically significant and accounted for 11.3% of the variance in the DRRI.

Overall, the results support the hypothesis that disaster experience has a positive effect on business readiness capabilities. This is in accordance with assertions by Battisti and Deakins (2012), Hernandez Montes de Oca (n/a), and Webb et al. (2000) that disaster experience increases the capacity of preparation. The results also underscore the complexity of the relationship as it explains only a portion of the variance in the DRRI. This nuance concurs with claims by Dynes and Quarantelli (1992) and Noth and Rehbein (2019) that several other conditions besides disaster experience affect readiness capabilities.

It is important to highlight the contribution of Noth and Rehbein (2019), in relation to the benefit of providing support after disaster (insurance payments and government aid), initiatives that, in order to reach a greater impact, must necessarily be designed and implemented before the disaster occurrence.

There are limitations to the current study that should be noted. First, the analyses were constrained to variables collected in the principal study. There may be other factors that explain DRRI, including: intensity of the event and its impact, resilience of the community where the business is located, pre-event business capabilities to deal with adverse events, age of the owner and employees, level of education of the owner and employees, business regulations and DRR incentives, legal framework, availability of risk transfer mechanisms, technical assistance programs for businesses in the post-event, financing programs for business recovery, and cultural, attitudinal and behavioral factors. Second, the analyses relied on self-reported data. It is possible that business practices differ from what was reported. Third, the survey examined past experiences and current practices measured at a single time point, thus offering limited perspective. Lastly, the survey sample is not representative of all business sectors, it was focused on three sectors: food and agriculture, tourism, and construction. Nevertheless, these three sectors have an important weight in the global economy and have a special sensitivity to disaster risks.

5. CONCLUSION

The current study aimed to review the literature to define and characterize businesses in the Americas, focusing on small and medium enterprises, and to examine whether disaster experience predicts DRR, considering business size.

The literature review highlighted the importance of SMEs in their role in employment and GDP, and at the same time the existence of several constraints (i.e., managerial skills, market information, enabling environment, and access to finance) that grant them particular conditions of fragility, circumstances that compromise their disaster resilience. This situation is of vital importance for emerging economies where SMEs represent the highest percentage of companies and where employment generation is concentrated.

Overall, the results support the hypothesis that disaster experience has a positive effect on business readiness capabilities, and highlight the complexity of the relationship, as there are several other conditions besides disaster experience that affect those capabilities.

The results from this study contribute to the existing literature on SMEs, particularly on its relationship with disasters. In the area of management sciences, the study poses important challenges, ranging from the evaluation of the usefulness and effectiveness of topics such as risk management and business continuity to strategies that extend the benefit of undergraduate and graduate programs in association with public, private and civil society organizations to sectors of the community unable to access such academic offerings.

This study underscores the importance of fostering, advising, and financing small and medium enterprises, so they can proactively develop capabilities in the line of risk and emergency management, and early resumption of operations post disasters. For those SMEs who have experienced disasters, this support can be critical to overcome the impasse in operations and avoid future damages and losses. And for those SMEs who have not experienced an impact yet, this assistance implies a proactive way to avoid severe effects of adverse events on their businesses, thus strengthening their resilience.

Future research is needed such as longitudinal studies to assess how past experiences and practices dynamically change and influence each other over time, and how other factors can positively influence readiness capabilities, including: intensity of the event and its impact, resilience of the community where the business is located, pre-event business capabilities to deal with adverse events, age of the owner and employees, level of education of the owner and employees, business regulations, DRR incentives, legal framework, availability of risk transfer mechanisms, technical assistance programs for businesses post-event, financing programs for business recovery, and cultural, attitudinal and behavioral factors, among others.