Introduction

Historically, the offer of foreign programming in the US audiovisual market has been extremely restricted. Except for a few programs imported from Canada and the United Kingdom, American mainstream television networks have tended to exclusively schedule locally produced productions. The reasons for this historical trend are many but those of an economic and cultural nature stand out.

On the economic side, the main explanation for the lack of audiovisual imports in the North American context is the power of the giant American television networks and film studios (Croteau & Hoynes, 2001; Gitlin, 1985; Gomery, 1992). These conglomerates, capable of exporting high volumes of films and television programs since the beginning of cinema and later of television (Maltby & Stokes, 2004) were able to saturate American television networks and stations as well as cinema venues with their domestic products, hardly leaving any slots for foreign content. Fu's (2010) assertion that the larger and more mature an internal audiovisual market the smaller the number of imports of films and television programs seems adequate for the US case. With a market value of 720 billion dollars expected by 2020, the entertainment sector in the United States is undoubtedly one of the largest and most lucrative in the world (Statista, 2019a).

On the cultural side, it could be argued that any foreign production coming from non-English-speaking countries to the United States suffers a significant cultural discount (Hoskins et al., 1989), given the differences in language, narrative structures, and values (pp. 66). The hypothesis of cultural proximity developed by Straubhaar (1991) that television audiences in any country will prefer their domestic audiovisual productions (if available) over regional and foreign ones for reasons of cultural proximity, is fulfilled in the case of the United States and could constitute an additional reason for the historical shortage of television and film imports.

Netflix and other video-on-demand platforms, however, seem to be significantly increasing the availability in the US of fiction produced in different regions of the world, potentially exposing their subscribers to new narrative styles, scenarios, ethnicities, nationalities, languages, and cultural features. As Aguiar & Waldfogel (2018) have pointed out, with the development and growth of these digital platforms "it is possible that consumers, even internationally, would get access to a much wider variety of foreign fare" (pp. 420). This study looks at the geographical origin and production type of new Netflix scripted television releases in the United States from January 2017 to June 2018 and the potential for the ones coming from other countries to broaden the degree of geographical diversity among American subscribers to the platform. By discussing whether the imported content was financed and produced directly by Netflix or not, the paper also explores the possibility of this platform influencing local production values and formats making them more appealing to American audiences.

The paper first provides an overview of the different video-on-demand (VOD) platforms available in the United States and of the growth of Subscription-based VOD like Netflix. Next, the paper discusses the concept of diversity in the literature on public policies for audiovisual media and the usefulness of including both the geographical origin of audiovisual productions and the genre and program-type as sources of diversity. The results section provides an analysis of the 18 months of new TV scripted releases (January 2018-June 2019) according to their geographical origin and type of financing or licensing.

Video on Demand Platforms

Due to reasons like the ones discussed above, the average American public lacked systematic access to television programs and films from other countries for decades, except for some limited content produced in Canada or the United Kingdom broadcasted on paid television channels or public television (PBS). This situation improved somewhat with the boom of cable and satellite television during the 1980s and 1990s when paid-TV companies started to include foreign channels in their original language (with very little dubbing or subtitles provided). These channels helped linguistic minorities in the US to have access to their country-of-origin's programming but did little to expand access to international audiovisual content among mainstream American audiences.

The growth and popularity of the internet, however, have facilitated the development of digital services for the distribution of audiovisual content that directly brings television programs and movies to consumers, skipping traditional media (open television, cable, and satellite channels) that previously had control over them. These services, referred to in English as "over-the-top" (precisely because they bypass the traditional suppliers), have also led to the proliferation of platforms that offer Video-On-Demand (VOD) in three modalities: 1) Video-On-Demand with advertising sponsorship, such as Youtube; 2) Transactional VOD (sale or rental of programs or movies) such as iTunes; and 3) VOD based on subscriptions, such as the Netflix and Amazon Prime cases (Doyle, 2016, pp. 631). The different business models of the later SVOD services, and more precisely, Netflix's particular business model and multinational expansion (including its systematic dubbing and subtitling of non-English contents), seem to have significantly increased the availability of foreign productions for the average American viewer.

The Netflix case, without a doubt, is the most relevant among the SVOD modality. Launched in 1998 as an online movie and TV series rental company (thus competing with Blockbuster stores), Netflix revolutionized the way of viewing audiovisual content in 2007 by becoming a platform for digital video on demand, offering access to digital subscribers to all movies and television shows in its catalog for a fixed monthly subscription. In 2010, Netflix started offering its service in Canada. The following year, the platform expanded to Latin America and the Caribbean, and immediately after too many other countries and regions in the world (BBC, 2018). In 2013, Netflix launched its first original production, House of Cards, which would be followed by many more originals. By 2020 Netflix had around 193 million subscribers worldwide, of which 63 million were from the US (Moody, 2020).

During the first years of Netflix as an SVOD service, the big American television networks had no problem selling their rights for the transmission of reruns, thus enriching the catalog of this digital platform. Despite the exponential growth of Netflix, media conglomerates took a long time to fully enter the VOD market and it was not until 2019 that some of the main companies decided to launch their platforms: ABC and NBC Universal, as well as telecommunications companies such as AT&T and Apple, launched their new VOD platforms at the end of 2019 or early 2020 (Lynch, 2019). An exception was Hulu, launched in 2008 by ABC, Fox, NBC/Comcast in strategic alliance and based on playing popular television series from the big networks a day or a week later from their original release. By 2018, Hulu had reached 25 million subscribers in the United States (Prang, 2019). With its purchase of 21st Century Fox in 2019, ABC ended up controlling 66 % of Hulu's shares, making it part of its two-pronged strategy to compete in the SVOD market, after the launch at the end of 2019 of the new ABC VOD platform Disney + (Press, 2020).

Another of the main VOD platforms in the United States is Prime Video, owned by the powerful online shopping company Amazon. This service started in the United States in 2006 as Amazon Unbox. At the end of 2013, the platform began offering original programs such as Alpha House and Betas and in 2015 it released the first original production of a VOD platform that won an award at the Golden Globe Awards: Transparent. Although Amazon refuses to disclose information about the number of subscribers of its Prime service, Reuter calculated for 2017 about 26 million within the United States (Jarvey, 2018) while the Observer suggested it had around 150 million global subscribers by 2020 (Katz, 2020). The main difference between most of these VOD platforms with Netflix, however, is the fact that they "use video in the service of another, more primary revenue stream" while Netflix is a "pure-play" video service (Lotz & Lobato, 2019).

In addition to the previously mentioned VOD services, the American audiovisual market has many more options, either through apps or through new streaming services of the big channels or television networks. HBO Max is one of the most popular, with approximately 67 million in the United States and a similar amount in the rest of the world (Statista, 2019b). Other chains such as CBS, CW, Fox, TNT, etc., also offer their original programs through apps, increasing the volume of content available on-demand. Peacock, a new service by Comcast Universal launched in July 2020 had by September of that year around 15 million subscribers (Nunan, 2020). Unlike Netflix and Prime Video, however, all, or almost all, of these platforms, apps, and chains' catalogs consist of their own or national productions, with very little content originating outside the US.

Diversity in audiovisual content

In the literature on public policies for the media, one of the most discussed and sought-after principles is to ensure that the press, radio, television, film, and new digital media are plural and promote diversity in their different manifestations (van Cuilenburg, 2007). For pluralists, liberal scholars' diversity understood as heterogeneity in media content is a fundamental requirement to ensure the competition of ideas and proposals from which the social consensus necessary for the proper functioning of democratic systems emanates. For critical political economists, on the other hand, diversity in media ownership and content is the antidote to the concentration of power and ideological dominance (Becerra & Mastrini, 2007; Trejo Delarbre, 2010). For cultural studies, diversity in media content is necessary to promote a greater number of alternative meanings able to confront and counterbalance the preferred ones, and to give voice to groups and proposals that would otherwise be marginalized from the social debate (Lembo & Tucker, 1990).

Public policy proposals on media diversity have tended to focus on issues of ownership and media control, assuming that the greater the number and diversity of owners and organizations, the greater the plurality and diversity of content (Napoli, 1999, p. 10). The diversity in the supply of available media content, in contrast, has received much less attention, although some references and mentions of its importance can be found in the literature. Becerra and Mastrini (2007), for example, have argued that the way to guarantee pluralism in a social system should not be confined to non-oligopolistic property structures but should also strive for a "multiplicity of contents in the media" (pp. 18-19).

For Napoli (1999), the diversity of content depends on the range of different types of programs, genres, and formats available at a given time in the television schedule from which a receiver can choose what he wants to see. For this programmatic diversity to work properly, Napoli argues, it must respond to "genuine distinctions in audience preferences and, consequently, to behavioral distinctions in exposure patterns" (p. 18). In general, different types of people have different television preferences according to variables and mediations such as gender, age, social class, education, ethnicity, etc. A diverse television offer, then, will respond in as balanced terms as possible to the range of preferences of a multiplicity of audiences and does not focus exclusively on satisfying that of a few (typically those with greater purchasing power, such as young adults of the middle and upper classes; Hellman, 2001).

A related problem in the US and Latin American literature on diversity in media content is that it frequently fails to include as a source of diversity the geographical origin of audiovisual productions. Normally, the discussions focus on how varied the genres and formats are as well as the contents within them, but their origin is neglected, despite the high degree of diversity one could assume may come from the audience's exposure to contents coming from different parts of the world. Productions coming from other countries, arguably, may reflect narrative styles, perspectives, values, and visions of the world qualitatively different from each other, even if all are based on certain formulas and genre conventions.

The geographical origin of audiovisual productions, however, has been an integral part of theoretical and empirical studies and reports in the European Union, where public policies promote the circulation of audiovisual productions among the different member countries. Van Cuilenburg (2007, p. 24) mentions four dimensions used in Europe to empirically assess media diversity: 1) Diversity of formats and themes; 2) Diversity of content; 3) Diversity of people and groups represented in the media content; and 4) Diversity of contents in terms of geographic coverage and relevance (local, regional, national, and international content). This last dimension is the one investigated in this paper. A distinction must be made, however, between the diversity of content and the variety of content. The latter refers to the specific number of programs and genres available, while diversity focuses on both the number of options and the qualitative differences in their content (Napoli, 1999). If a police drama produced in Spain is very similar to one produced in the United States in terms of the representations of race, gender, age, and amount of violence, a variety of geographical origins may exist, but not authentic diversity. Garcia Leiva & Albornoz (2021) argue that the degree of diversity of any audiovisual system depends on, among other factors, whether the productions show "differences of variety, balance, and disparity about values communicated, identities represented, and aesthetics showed." They add that audiovisual contents should reflect the multiplicity of groups that coexist in a given society (internal diversity) as well as the cosmogonies and expressions of foreign cultures (external diversity) (pp. 268).

Program-type diversity scholars, thus, assume that the greater the diversity of genres and types of programs, the greater the satisfaction of various types of audience's information, entertainment, or education needs and preferences. An additional assumption is that the more genres a single user watches, the more enriching his or her media experience will be. Audiences are a complex and diverse conglomerate of groups and subgroups with diverse and contrasting characteristics and interests (Morley, 2006; Straubhaar, 2003) that are impossible to be served by a limited type of audiovisual productions. In the case of American TV audiences (and now SVOD subscribers), having access to foreign audiovisual productions, particularly from non-English language foreign countries, may significantly increase the diversity of characters, topics, representations, and worldviews they have traditionally been exposed to.

Research Questions

Based on the discussion above, this paper set to explore answers to the following research questions:

RQ1. How diverse was the offer of television fiction series on Netflix USA in terms of the geographical origin of the productions? Were American productions dominant over all other international content?

RQ2. What percentage of foreign productions was presented as "Netflix Originals"? And of this percentage, how many series were produced partially or entirely by Netflix?

Method

Levels of diversity in media content

Within the literature on media content diversity, four levels of study are recognized (van Cuilenburg, 2007, pp. 21): 1) Individual content units (a TV program, a journalistic note); 2) Content "packages" (a television channel, a specific news medium); 3) Type of medium within a given local market (radio stations, television stations, daily newspapers); 4) National media system as a whole (total available media in a country).

The present content analysis, set at the first level of study, defined its unit of analysis as the television series announced in The Hollywood Reporter to be released by Netflix in the United States from January 2017 to June 2018. Thus, the type of diversity discussed here is the "intra-medium" diversity (McQuail, 1992, pp. 145-147), that is, how much geographic diversity of fictional television content was offered within Netflix, without comparing it to the one in other digital platforms in the same country. The final interpretation of the findings, however, engages level 4: The degree, if any, in which Netflix has increased the number of foreign television series available in the US audiovisual market, historically short on imports from other countries, especially non-English language ones.

Focus on monthly releases

Previous content analyses on program-type diversity like the one presented here were based on traditional TV channels' schedules. This is not relevant for Netflix, a curated database allowing viewers to watch any content at any time and date (as long as the platform keeps license rights or ownership of the content for any given market). This posed a particular methodological challenge for this study, namely, how to select a representative sample of content useful to "delimit...the likely range of textual experiences available to audiences through that system" (Lobato, 2018, p. 243). Other researchers have used scraping tools and comparator websites, Unofficial Netflix Online Global Search like Allflicks or Netflixable (Lobato, 20, p. 245) to look at the totality of the Netflix catalog at one point in time. The current study decided to focus exclusively on the new monthly releases announced in The Hollywood Reporter for Netflix's US platform during 2017-2018. While monthly releases are not representative of the whole catalog available to American viewers at any given time, they are the productions most likely to be watched in any given period by more subscribers (as evidenced in analytical streaming services on the web like Flixpatrol.com and What's-on-Netflix. com). Also, monthly new releases are representative of the newest types of TV series (local and international) Netflix adds to its US catalog, as well as the new seasons of pre-existing shows). Information on the monthly premieres of these television series during 2017-2018 was obtained from the official website of The Hollywood Reporter (https://www.hollywoodreporter.com), one of the most respected film and television industry magazines in that country. Given the emphasis of the study on scripted television series, film productions, and non-scripted television programs such as documentaries, reality series, and stand-ups were omitted from the sampling design despite being part of the premieres within that period. Instead of drawing a sample, this study included as units of analysis a census of all TV scripted series announced on The Hollywood Reporter between January 2017 and June 2018 for Netflix's US platform.

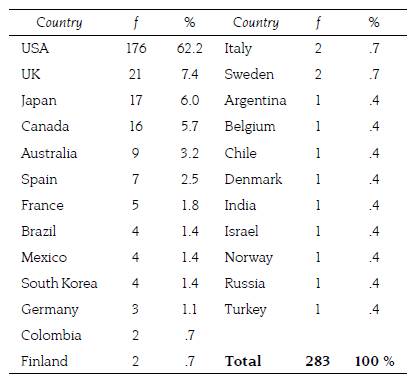

Identification of geographical origin, genre, years of production, and production companies

To complement the information available on the website of The Hollywood Reporter, the International Movie Database (IMDb) was used to identify the geographical origin, the original year of production, and the production companies of each series. This information was entered into a database in Excel and subsequently analyzed with SPSS. In total, 283 television series from a total of 24 different countries, released during the 18 months, were identified. The main coders were Mathew Balderas, Amy Cortina, Marcos Villanueva, and Cynthia T. Martinez (Texas A&M International University).

Netflix Originals

Many of the series released on this platform during 2017-2018 carried prominently the legend "Netflix Original." Due to Netflix's lack of transparency, that label may refer to one of four possibilities: 1) Netflix commissioned and produced the show; 2) Netflix has exclusive international streaming rights to the show; 3) Netflix has co-produced the show with another network; 4) Netflix financed the continuation of a previously canceled show (Robinson, 2018). Thus, the label Netflix original does not necessarily mean these contents have been directly financed and/or produced by Netflix, nor that they have been purchased definitively (Beer, 2020). On many occasions, what that denomination means is that the series' rights have been purchased by Netflix from independent studios (or TV or film networks) to exhibit them exclusively in a country or region (Rodriguez, 2019). The "Netflix Original" label, however, is also used in Netflix's productions (like Stranger Things or The Irishman), making it difficult to identify the degree of participation of the platform in its financing or production (Iordache, 2021). To have further information on the specific type of Netflix's involvement, we used the IMDb to identify whether there was direct financing or not from the platform in each of the series included in our analysis. While this information from IMDb may not be completely reliable and does not come from Netflix itself, it is a good proxy for the actual involvement of the platform in the financing and production of foreign content,

Results

Diversity in geographical origin

How diverse was the offer of television scripted television shows on Netflix USA from January 2017 to June 2018 in terms of geographical origin? As discussed in the literature review, Netflix seems to have increased the availability of foreign television series in the United States, a historically restricted audiovisual market. The continuous promotion of the service's made-outside-the-United-States "original productions" and the long list of foreign movies and television series in its catalog generates the perception of Netflix offering a large number of imports.

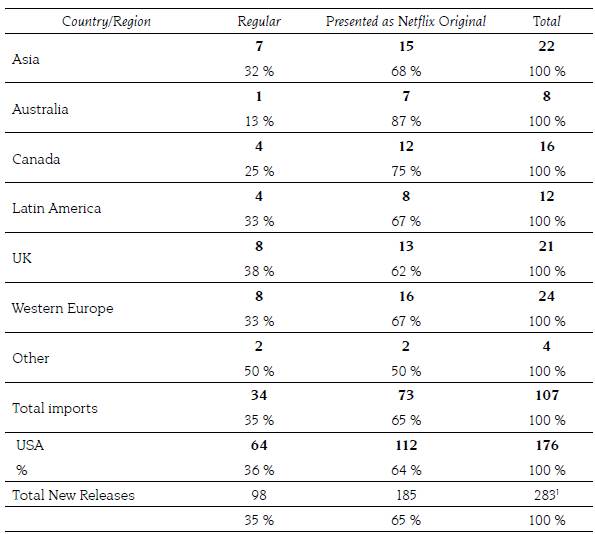

Table 1 shows that while foreign productions accounted for 38 % of the new releases of scripted TV shows (new titles and new seasons of existing series) during the sampled months on Netflix USA, most of them came from English-speaking countries. In Hoskins et al. (1989) terms, imports from English-speaking countries may reflect a smaller degree of "cultural discount" than the ones coming from other regions of the world. If we add the contents originating in the United Kingdom (21 series), Canada (16), and Australia (9), to the 62 % taken by local US productions (176), it turns out that almost 80 % of Netflix releases originated in its own country or countries linguistically and culturally close to it. Only 2 out of every 10 programs in the supply of new releases, consequently, came from regions of the world more likely to introduce higher degrees of diversity into the options available to American audiences due to their significant cultural and linguistic differences with the United States. These findings coincide with Iordache's (2021) analysis of four European Netflix catalogs (Romania, Belgium, Spain, and Sweden). Not only was "the representation of US content overwhelming" in the four catalogs, but it was "complemented by additional strong presences from the English-speaking 'global North,' such as UK, Canada, and Australia" (pp. 8). Findings for Netflix's Brazilian service also show that content from American and anglophone countries like the UK, Canada, and Australia overwhelmingly dominated its catalog over content from other linguistic regions (Penner and Straubhaar, 2020, pp. 138)

Table 1 New scripted series released in Netflix USA by country of origin: January 2017-June 2018

Source: own elaboration.

The country with the highest number of monthly releases in the 1.5 years of the sample, after the United States and the United Kingdom, was Japan (see table 1). Most of these productions belonged to the category of anime and cartoons (Glitter Force Doki Doki, The Many Faces of Ito, and The Seven Deadly Sins), although some comedies, dramas, and thrillers were also included. After Japan, Canada, and Australia, the country with more productions during the monthly premieres of Netflix USA was Spain, with seven fiction series, mostly dramas and crime series such as Cable Girls and Money Heist.

Releases from Latin America

Despite the potentially high number of Mexican-American subscribers, Netflix USA released only four series produced in the neighboring country during the months included in the sample (Club de Cuervos, Ingobernable, Señora Acero, and Legend Quest). The same happened with the releases from the rest of Latin America. Only Brazil (4 series), Colombia (1), Argentina (1), and Chile (1) were represented in the scripted TV shows releases from this year and a half (see table 2). The opening of Netflix's Mexican office in 2019 may change this, increasing the production of more series from this country: the service announced the production of 50 Mexican originals by the end of that year and its VP Originals for Spain and Mexico Francisco Ramos announced the service would launch nine Mexican original series (and three movies) during 2020 (Bertran, 2020).

Releases from Europe

Series from Europe (with the British and Spanish exceptions already mentioned) were equally scarce during 2017-2018. Table 2 shows that five series were from France (Marseille, A Very Secret Service, PJ Masks, Ten Percent, The Chalet), and three were from Germany (Babylon Berlin and Dark, S1 and S2). Very few series were from the rest of Europe: two from Italy (Gamorrah season 2 and Suburra), two from Finland (Angry Birds and Bordertown Season 1), two from Sweden (Bonus Family, seasons 1 and 2), and only one from countries like Belgium (Beau Sejour), Denmark (The Rain), and Norway (Borderlines). As in the case of Mexican and Latin American productions financed by Netflix, by 2020 Originals from Europe seemed to be growing, with German series like Barbarian reaching the five most-watched series on Netflix for several weeks during the second half of 2020.

In summary, it could be said that during 2017 and 2018 Netflix USA offered a certain degree of geographic diversity to its then 60 million American subscribers. While there is no breakdown of these subscribers by ethnic group, a survey done in 2017 by Statista (Watson, 2018) among more than 4,000 respondents in the US found that 21 % of whites reported using Netflix several times a day, and an additional 11 % once a day, for a total of 32 %. In the case of African Americans, the equivalent percentage was 40 %, and in the case of Hispanics 56 %. These three different groups, potentially, could be increasing their vertical geographical exposure diversity (the amount of series from different countries each viewer tends to watch) in a significant manner via the new releases from regions outside the US. According to some scholars (Evans et al.; Limov, 2020) factors like "accessibility (that content is available, discoverable, and appealing in some way) and cultural affinity (that audiences are no longer turned off by a foreign language, culture, or subtitling) emerge as audiences become users and engage with the features of VOD platforms" (Limov, 2020, pp. 6305). Whether viewers of foreign content in Netflix USA are white or members of ethnic and national minorities, or whether US viewers watching foreign productions are already predisposed to watching them due to previous personal experience in terms of travel abroad, are questions which have not yet been answered satisfactorily. In a survey of 288 Netflix USA subscribers who reported having watched foreign series or films on the platform, Limov found that 72 % of them were White/Caucasian, but that a substantial portion of all of the survey respondents had been abroad (61 %), lived abroad (16 %), were second-generation (19 %) or third-generation citizens (19 %), suggesting that subscribers watching foreign contents usually had some sort of previous experience or contact with other countries.

Number of releases by country or region

Table 3 shows that of the total 283 television series released in our sampled period, 107 were from foreign countries and 176 from the United States. While the number of foreign productions discussed in this section represents a clear breakthrough compared to the number of imports available in the United States before Netflix, as explained above, it was not that geographically diverse. This latter fact, however, may be changing. A recent report on the "What's on Netflix" website found that in the US Netflix's catalog, 45 % of the 5,806 movies and TV series available in mid-2020 were foreign-language titles (Moore, 2020). In contrast with our findings (based exclusively on recent releases), the general catalog available in the United States in 2020 seemed to offer a higher proportion of foreign-language content. It seems clear that the significant differences in the business model of Netflix (subscriber funded, internet-based) in contrast with traditional US mainstream media (reliant on selling audiences to advertisers) allow this service to include in its American catalog an unprecedented number of foreign and foreign-language contents without worrying too much about ratings and the immediate commercial success of each production in this country.

Foreign series purchased or financed by Netflix

Despite the increasing number of original productions, Netflix has still been investing heavily in license agreements to obtain rights to stream American or foreign TV shows or movies through its service in some or all of its markets. In late 2019, Netflix spent $14,7 billion on licensed content versus $9,8 billion in produced content (Beers, 2020). However, many of the new releases of foreign scripted shows carried the legend of "Netflix Original," analyzing this type of content relevant.

How many of the Netflix Originals released in the United States market were non-US productions? According to Variety, out of around 700 original TV shows available during 2018 in its catalog worldwide, only 80 were non-English language Originals from outside the U.S (Spangler, 2018). In our analysis, focused exclusively on new scripted TV series releases and not on the total catalog, 41 of the 73 foreign series were from non-anglophone countries (see table 3), perhaps signaling an upward trend in these imports to the US market. In terms of "counter-flows" from the rest of the world to the United States, these numbers were not that insignificant, considering that the US audiovisual market, historically, tended to be highly restricted in terms of imports from non-English-speaking countries.

Many of the series released on this platform during 2017-2018 carried prominently the legend "Netflix Original." Table 3 shows that 65 % of the total series released in the sampled months were presented as "Netflix Originals." The magnitude of this percentage reflects a strategy to attract subscribers and keep them satisfied with exclusive content. Netflix has already signed contracts with some producers in other countries, like "Dark" creators Jante Friese and Baran bo Odar, and "Money Heist" creator Alex Pina (Schneider, 2018). According to other scholars, however, despite these contracts and the production of new originals, Netflix seems to still be dependent on licensed content: As of 2018, 63 % of all viewing hours on Netflix were devoted by subscribers to watch licensed content (Trainer, 2019). Out of 671 series available on Netflix USA in 2015, 512 were non-exclusive among US streaming platforms (Aguiar and Waldfogel, 2018). For commissions, Netflix "largely relies on contracting other production companies to make its series and films, requesting exclusive global rights and to hold those rights in perpetuity or at least a period of 10 to 15 years" (Lotz, 2020, p. 7). Co-commissions (splitting the rights and the costs of production with another entity) are another way of getting content without having to produce it in-house. Usually, Netflix pays more than 50 % of budget costs and gets exclusive distribution rights in all countries except the partner's country, at least for the first year or so (p. 7). Out of the total number of new releases labeled "Netflix Original" in our study, only 13 % were listed in the IMDb as having been produced exclusively by Netflix; 28 % were listed as having been co-produced by Netflix with other companies, and 59 % were licensed productions with streaming rights in the US market without any direct financing from Netflix, at least as reported by the IMDb.

This Netflix policy of obtaining licenses for existing productions (acquisitions) or splitting the costs with other entities (co-commissions) in other countries, if maintained, could have an important effect on the consolidation and growth of quality audiovisual works in those nations, indirectly strengthening local and regional audiovisual markets. However, we must not lose sight of potential restrictions coming from Netflix in the creative control and decision-making on foreign production companies due to the enormous investments by the digital platform. Given Netflix's biases for certain types of genres, formats, and narrative structures, in addition to the need for acquired productions to be understandable and attractive to all types of audiences in the rest of the world, national companies may be tempted to abandon local or experimental formats and structures in favor of increasingly standard and generic formats that meet Netflix's expectations and requirements. Thus, the fact that this SVOD platform pays large sums to the original producers in exchange for the exclusive control of the reproduction rights over long periods and in multiple territories, could radically alter the uniqueness in the perspectives, production values , and narrative structures of foreign series and films, developing increasingly standardized and homogenized formats with few differences with the rest of the offerings on Netflix. However, empirical research based on content analysis is required to prove or disprove the latter.

Americanization of formats and contents?

Netflix could also be exerting an important influence in certain regions of the world where it has decided to directly finance and produce series and films. By hiring and/or paying the salaries of directors, producers, screenwriters, actors, technicians, and local extras directly or indirectly, the platform may be contributing to the growth of the production capacity in these countries while at the same time taking over the creative control from the local personnel, "modeling" (Kivikuru, 1988) and/or standardizing the narrative and aesthetic structures as in American series and films. At least in the discourse of Netflix's executives and creative talent, the latter seems not to be the case. According to them, Netflix International Originals are completely committed to respecting and promoting the "authenticity" (a reflection of the local culture in which a series' narrative is situated) of the content (Wayne and Sandoval, 2021). Netflix's executives and creatives seem to be convinced that for a show to "travel" well around the world, it first has to resonate in its market and be "authentically local" (p. 7). According to some scholars (Rios & Scarlata, 2018), this may not mean that these international productions, due to their local authenticity, may help Netflix to compete successfully with the national SVOD platforms in regions like Latin America or Asia. Local SVOD platforms in countries like Australia and Mexico, they point out, "have been able to capitalize on the global behemoth's inability to ever become truly local, even as it has started to develop original slates" in those countries (Rios and Scarlata, 2018, p. 485). This assertion, however, refers mostly to the total number of local productions available in the catalog of a given SVOD platform, and not to the degree of "authenticity" of specific shows.

While most new releases from Australia, Canada, Japan, and South Korea were not originally financed by Netflix, around half of the new releases from Latin America, the United Kingdom, and Western Europe were. It is very likely that, in the case of Latin America, the high proportion of series financed by Netflix is due to at least three reasons: a) a commercial strategy to compete in the region with its productions due to the significant number of Latin American subscribers, and b) the reticence of local media conglomerates like Televisa in Mexico, Globo in Brazil, Venevision in Venezuela, and Clarin in Argentina, to sell transmission rights to its powerful and popular SVOD competitor, and c) the lack of independent production companies in this region due to the historical monopoly and in-house production tendencies of the Latin American media conglomerates (Lozano, 2006). In addition to feeding the catalog of its millions of Latin American subscribers with original productions that have a "local" appeal, Netflix also incorporates them into its US catalog, satisfying first the preferences of its significant number of Hispanic subscribers and, secondly, the rest of its viewers.

If production costs abroad keep being significantly lower than in the United States, especially in regions that are not linguistically and culturally close to this country, the series financed by this platform will surely continue to grow in the coming years. Netflix has already opened offices in Amsterdam, Paris, Madrid, and Mumbai, and has production teams in Mumbai, Singapore, Tokyo, and Sao Paulo.

Conclusions

As Lotz (2020) has argued, multinational video services like Netflix are not unprecedented but pose new and relevant theoretical questions about how deliberately multinational streaming services "challenge the nation-based frames of theorizing audiovisual content and industries" (p. 2). This paper has discussed the degree of geographical diversity in the new scripted television series releases of Netflix USA from January 2017 to June 2018 and whether this digital platform meets expectancies about a significant and permanent increase in the choices available in the American audiovisual supply.

Traditionally, media flow studies have focused their attention on the presence and degree of domination of American audiovisual imports in foreign markets (De Bens & De Smaele, 2001; Fontaine & Grece, 2016; Lozano & Hernández, 2020; Martínez, 2005; Nordenstreng & Varis, 1974; Schement, 1984; Varis & Nordenstreng, 1985). The assumption has been that the more audiovisual flows in one particular country or region are dominated by American movies and TV shows, the less diversity in origin and type of media content the local audiences will get and the more they will be influenced by American values and visions of the world. This study has somewhat reversed this question while keeping in mind the relevance of program diversity (in particular geographical diversity) in increasing the knowledge, viewpoints, and respect for national and cultural differences among the traditionally ethnocentric American audiences.

The fact that 4 out of 10 premieres of fiction television series on Netflix USA came from other countries undoubtedly represents a significant change in the American television supply, compared to the meager percentages represented by previous imports. More than 60 million American Netflix subscribers have, perhaps for the first time as media consumers, the possibility of systematically selecting and watching a wide array of foreign productions. The fact that two out of these four foreign monthly premieres come from English-speaking countries reduces somewhat the significance of this high percentage of imports, but the remaining number of imports still represents a clear improvement. Australia, the United Kingdom, and Canada, despite sharing a common language with the US, maintain certain cultural differences that may contribute to a wider spectrum of ideas and meanings in the US supply. If we add to this English-language imports the remaining new released series produced in Asia, Europe, and Latin America, Netflix's contribution to the increase of geographical diversity in the US audiovisual market becomes even more significant1.

The presence and popularity of Netflix in most countries of the world, together with a drastic reduction in the number of rights for US series available to Netflix, will undoubtedly encourage this platform to intensify the licensing or direct financing of foreign content. The latter, as argued above, could break the monopoly of large regional conglomerates such as Televisa, Globo, Venevision, and Clarin in the case of Latin America, diversifying and expanding audiovisual production in these countries, something needed given these companies' tendency to produce 100 % of their contents "in-house" and their disinterest in buying content from independent studios and companies. However, Netflix's incursion into international markets could also have negative effects on these independent companies by restricting the financed television genres to those favored by the platform and by imposing production criteria, rules, and standards to make them attractive in other geo-linguistic markets, diminishing their originality and cultural uniqueness.

It is necessary, also, to problematize the assumption that the geographical origin of the fiction series necessarily entails diversity in content. Quantitative and qualitative content analyses of the series' ideological meanings and visions of the world are required in programs of the same genre but different geographical origins, as well as of the ethnic and socio-demographic composition of their fictional characters according to their role. Although it seems feasible to expect significant differences between them, only empirical explorations can determine if the increasing number of imports will result in a greater diversity of meanings and ideas, rather than only increasing the variety of productions available according to their origin. The encoding of TV shows' ideas, concepts, and experiences by actors and producers from other countries, it could be argued, may very well end up incorporating some degree of diversity in the content due to cultural differences and production experiences and traditions. As Castro and Cascajosa (2020) explain in the case of Spanish Netflix Originals (Cable Girls, Elite, Ministry of Time), productions from this country follow the local storytelling norms and "fit well with Spanish viewers' tastes, shaped for decades by Spanish broadcasters" (pp. 159).

If conventional studies on the horizontal and vertical diversity available in the United States are scarce (Napoli, 1999), research on the types of programs available in the US audiovisual supply by geographical origin is even more limited, with some remarkable and recent exemptions (Limov, 2020). Future studies should investigate both through qualitative and quantitative methodologies the vertical exposure diversity of different types of audiences, given the supply available on the media and platforms to which they have access. By doing this, we will be able to understand the degree to which the content diversity available in the audiovisual supply is accompanied by diversity in its reception and appropriation by specific audience groups. In the case of Netflix USA, audience studies would determine to what extent the foreign programs offered by the platform are watched by all types of US subscribers or if most members of ethnic communities related to the places of origin of such imports tend to watch them. The scarce empirical studies focused on the consumption of foreign content among subscribers of the platform in the US difficults the determination of the degree to which mainstream and minority subscribers watch foreign content. If future studies on Netflix USA subscribers keep finding that the most likely viewers of foreign content on the platform are Americans who have already been abroad or who belong to ethnic or national minorities (Latinos watching series produced in Latin America, Asian-Americans watching series produced in Asia, etc.), the optimism generated by the substantial increase in geographic diversity in the supply of television series in the US market would have to be considerably reduced.