Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Dimensión Empresarial

Print version ISSN 1692-8563

Dimens.empres. vol.13 no.2 Barranquilla July/Dec. 2015

https://doi.org/10.15665/rde.v13i2.536

DOI: http://dx.doi.org/10.15665/rde.v13i2.536

International reserves and governance: A comparative study for colombia1

Reservas internacionales y gobernanza: Un estudio comparativo para colomba

Reservas internacionais e governança: Um estudo comparativo para colômbia

Jorge Mario Ortega de la Rosa2

1 Artículo de investigación requisito de grado en la maestría investigativa en Economía de la Universidad del Norte, Barranquilla, www.uninorte.edu.co fecha de elaboración del artículo junio 2014, fecha de conclusión febrero de 2015.

2 Profesional en Finanzas, Universidad San Martín, magister en economía, Universidad del Norte, docente investigador Universidad Autónoma del Caribe, Barranquilla, Colombia. http://www.uac.edu.co, correo: jorge.ortega80@uac.edu.co.

Fecha de recepción 10/03/2015 fecha de aceptación: 15/07/2015.

Citation

Ortega, J.M. (2015). International reserves and governance: a comparative study for Colombia. Dimensión Empresarial, 13(2), p. 11-31, JEL: G15, G34, DOI: http://dx.doi.org/10.15665/rde.v13i2.536

Abstract

This paper examines the relationship between the governance and the demand for international reserves in Emerging Economies (EE). The Database World Governance Indicators Project (Project WGI) available for the period 2002-2013 is employed. The main goal in this research is to examine the possible relationship between risk indicators and political stability, the strength of democratic institutions and legal regime to the accumulation of reserves in the EE in order to discern the matter to the Colombian case. Using panel data for 14 Emerging economies, it became clear how these variables of governance, the traditional determinants of the demand for international reserves and their level interrelate. The panel cointegration tests show the relationship between the behavior of political stability, strengthening of the institutions with the accumulation of international reserves of Colombia and other Emerging economies. The institutional characteristics such as corruption, political stability and violence can affect accumulation of reserves through the perception of uncertainty. The results suggest that in order to reduce the need to accumulate higher levels of reserves, Colombia could continue institutional strengthening so as to demand lower levels of reserves for precautionary reasons.

Keyword: international reserves, governance, political stability and institutions.

Content: 1. Introduction 2. Review of literature, 3. Methodology, 4. Stylized facts, 5. Results, 6. Conclusions of the panel.

Resumen

En este trabajo se examina la relación entre la gobernanza y la demanda de reservas internacionales en Economías Emergentes (EE). Se utiliza la base de datos del Proyecto Mundial de Indicadores de Gobernanza (WGI Project) disponible para el periodo 2002-2013. El objetivo principal de esta investigación es examinar la posible relación entre los indicadores de riesgo y la estabilidad política, la fortaleza de las instituciones democráticas y el régimen jurídico de la acumulación de reservas en los EE. Mediante datos de panel para 14 economías emergentes, se evidenció cómo estas variables de gobernanza, los determinantes tradicionales de la demanda de reservas internacionales y su nivel se interrelacionan. Las pruebas de panel de cointegración muestran la relación entre el comportamiento de la estabilidad política, el fortalecimiento de las instituciones con la acumulación de reservas internacionales de Colombia y las otras economías emergentes. Las características institucionales como la corrupción, la estabilidad política y la violencia pueden afectar la acumulación de reservas a través de la percepción de incertidumbre. Los resultados sugieren que para reducir la necesidad de acumular mayores niveles de reservas Colombia podría continuar el fortalecimiento institucional a fin de poder demandar menores niveles de reservas por motivos de precaución.

Palabras clave: reservas internacionales, gobernanza, estabilidad política e instituciones.

Resumo

Neste trabalho a relação entre governança e a demanda por reservas internacionais nas economias emergentes é examinado. Banco de Dados de Indicadores de Governança Mundial de Projetos (Project WGI) disponível para o período 2002-2013 é usado. Usando dados em painel para 14 economias emergentes, tornou-se claro como estas variáveis de governança, os determinantes tradicionais da demanda por reservas internacionais e seu nível inter-relacionam. Os testes de co-integração painel mostrar a relação entre o comportamento de estabilidade política, o reforço das instituições com a acumulação de reservas internacionais da Colômbia e outras economias emergentes. As características institucionais, tais como a corrupção, a estabilidade política ea violência pode afetar o acúmulo de reservas através da percepção de incerteza. Os resultados sugerem que a redução da necessidade de acumular níveis mais elevados de reservas Colômbia poderia continuar o fortalecimento institucional, a fim de exigir níveis mais baixos de reservas por motivos de precaução.

Palavras chave: as reservas internacionais, governança, estabilidade e instituições políticas.

1. Introduction

Current levels of international reserves (IR) in the case of the main Emerging Economies have exceeded the appropriate level metrics. Moreover, in the last financial crisis of 2008, the central banks were reluctant to draw on reserves to meet international payments in times of illiquidity; substitutes reserves as sovereign wealth funds and flexible credit lines were preferred to respond to external shocks. Countries like Colombia, Mexico and Poland made use of this possibility contingent financing to strengthen market sentiment.

This has risen questions about whether current levels of IR can be justified as optimal to tackle potential risks in times of crisis and, in particular, the marginal benefit of higher levels of IR in economies where acceptable levels in key metrics and models of optimal levels presented in the current literature are met. The concern is that domestic interest rates paid for sovereign debt are higher than international rates gain in IR investments, and the question is whether it is correct to accumulate more reserves if Colombia, like other Emerging countries, didn´t used those in the recent financial crisis or whether they should invest in other socio-economic aspects.

IR accumulation in Emerging Economies like Colombia also has various benefits related to international recognition and risk perception. High levels of IR symbolize the strength of the economy and indicate the support of the currency (as a result the confidence of international investors attracted to the country), while low levels of IR may cause uncertainty and increase the perception of country risk. The IR also allow the government to smooth over the outflow of capital in a crisis, Countries have them as a mean to meet external payments, thereby they reduce uncertainty and risk perception, which ultimately strengthens market confidence and it promotes financial and economic stability.

Although the central bank of Colombia performs efficient management of reserves3, the country incurs in costs associated with a higher level of reserve accumulation. The rate gap, or spread between the rates paid by government debt and the rate of return on reserves, causes a heated debate about why Emerging countries should have such high levels of reserves. As mentioned by Aizenman & Marion (2003), the main point of discussion is whether these resources could use more productively for economic development in areas such as infrastructure way, the fight against poverty, education among many other. Then the greatest accumulation of IR for Colombia have not only financial cost differential interest rates, also an opportunity cost in economic development.

The last financial crisis revealed the importance of expectations; political credibility and institutional structures have in determining the appropriate level of IR and its use in crisis, a situation that raises the need to understand the relationship between institutional variables and IR to Colombia.

During the financial crisis of 2008, Colombia did not use their reserves but it chose credit lines granted by the International Monetary Fund. Undoubtedly, the country wasn´t affected by international flows during the recent crisis; among the arguments behind it, it´s the strength of its financial system, the improvement of their political and monetary stability, EE investment flows during the period and the prices of raw materials.

Therefore, this work away from the discussion of the determinants and appropriate level and concentrate on trying to clarify the relationship between the variables of governance such as corruption, political stability and the rule of law with the accumulation of IR. Rationally you can understand that countries accumulate reserves serve not only for payment to face crises, also to serve as a backup image and international credit quality that ultimately enhances the perception of country risk. However, it has not yet studied the relationship between the variables of government risk significantly influence the perception of the international community with the accumulation of IR for Colombia.

The hypothesis of this study is that improving governance characteristics of a country increases the amount of reserve accumulation (partly caused by the improvement in risk perception) likewise it reduces the need to accumulate IR to a higher rate of growth; as Emerging Economies strengthened institutionally the reserve levels rise, but at a decreasing rate. This is understandable when it is considering that during periods of external shocks high level of risk and weakness may accelerate capital outflows in some economies. Therefore, we sense that the strengthening of the institutions of an Emerging country like Colombia could reduce costs by requiring lower levels accumulation of IR to face external shocks.

However, there are several problems involved in studying the relationship between governance and economic variables. The first problem is that the different measures of governance are highly correlated. It stands that a government with greater political stability and absence of violence can be more effective and control corruption more efficient; in this scenario the respect for the laws and institutions would help, that is, the variables that measure these institutional aspects tend to be highly correlated behavior.

Because of this, it is difficult to identify that aspect of good governance that would be responsible for the performance of a particular economic variable, in this case, the accumulation of IR. This problem becomes more important if one tries to make policy suggestions from such empirical analysis product.

Another difficulty due to the heterogeneity of the studied economies. Considering the Emerging panel used here, the difficulty is that for some political stability economies may be more determinant of the accumulation of IR while another may be for regulatory quality.

In short, governance variables are subject to three types of estimation problems: high correlation between indicators that measure the quality of institutions of a country, endogeneity between these variables and possible errors in measuring governance. This document intends to solve these problems by using different econometric specifications and by panel cointegration methodology try to demonstrate the interrelationship between the study variables.

The document divides into four parts; the first is a review of the recent literature on traditional determinants of the demand for reserve and the reasons leading to the realization of this study. in the second part the theoretical link between governance and the accumulation of reserves for Emerging Economies stands out; in the third part it develops a descriptive analysis and the results of regressions OLS and fixed effects in line with the empirical literature are discussed; Finally, the panel cointegration methodology used and present the findings and recommendations.

2. Review of literature

The empirical literature on the accumulation of IR in the EE is wide and focuses on critical variables. The IMF conducts periodic reports and methodological suggestions that contribute significantly to the standardization in IR analysis. The presence of variables determining the demand for common IR in the literature is indisputable; these include; trade openness, short-term external debt, the (M2) and other external exposure variables than any empirical research must consider as determinants of the demand for reserves regardless of the approach addressed.

The last financial crisis of 2008 showed the benefits of reserves as a means of protection against external shocks. Although in 2008 and 2009 the total amounts of reserves for Emerging Economies increased annually, in the quarters of crisis severity, the IR reduces in general, some countries actively used the reserves to reduce volatility in the currency markets and to provide liquidity to the banking sector (IMF, 2011).

It is clear that the EE maintain reserves to soften the external shocks product momentary imbalances in international payments. Monetary authorities try to determine the optimal level of reserves necessary to deal with the shocks with the opportunity cost of holding reserves (Heller, 1966). This implies that countries raise their level of reserves to the extent deemed most vulnerable or risk averse volatility in the exchange rate and massive flows out in times of financial crisis.

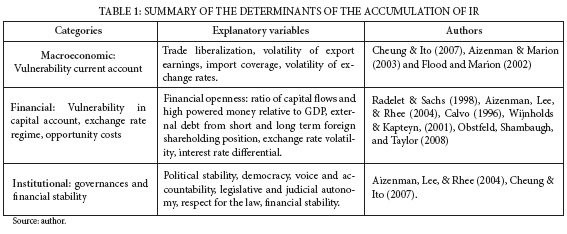

Through a review of the empirical literature on the demand for IR reveled a set of determining variables common as is the case in Heller & Khan (1978), S. Edwards (1985), Lizondo & Mathieson (1987), Landell Mills (1989) and Lane & Burke (2001) among others. These variables grouped into three categories: traditional macroeconomic variables, financial variables and institutional variables.

Traditional macroeconomic variables representing current account vulnerabilities include coverage of imports and exports as a percentage of production, trade liberalization and exchange rate volatility. Since the beginning of research in IR, accumulation reason attributed to the need to cover possible current account imbalances. Among the investigations that have found that trade relations are positively correlated with the accumulation of reserves are Cheung & Ito (2007); Aizenman & Marion (2003) and Flood and Marion (2002).

The second group of variables includes the capital account vulnerabilities, such is the level of external debt, particularly short-term, and capital flows. This set of variables considers the risk of domestic capital outflows abroad in times of financial crisis, and is in authors like Radelet & Sachs (1998) and Aizenman, Lee, & Rhee (2004). Money supply (M2) commonly used to capture potential drains of bank funds in times of crisis. An increase of the monetary variable would be associated with an increased risk of departure of national funds and consequently increase the level of reserves required for precautionary reasons; authors such as Calvo (1996); Wijnholds & Kapteyn (2001) and Obstfeld, Shambaugh, and Taylor (2008) included these variables in their studies of demand for IR.

The exchange rate regime is also a determinant of reserve accumulation; in a system of fixed regime, central banks need large reserves to intervene and control the exchange rate, as affirmed by Frenkel (1974); Edwards (1983) and more recently in IMF (2011). Exchange rate flexibility should negatively correlated with the demand for reserves, and central banks are not obliged to have large reserves to intervene and maintain a fixed exchange rate.

A final type of financial variable is the opportunity cost of holding reserves; which occurs when an Emerging economy debt acquired at a high fixed rate and invests its reserves in financial assets with lower rates. Thus, rationally demand for IR should negatively relates to the interest rate differential; however, this variable is often insignificant in the empirical literature in part because of the difficulty of estimating the differential, since there are many investment rate and borrowing to each Emerging country, as is highlighted by Edwards (1983 and 1985) and Frenkel (1974).

In the third group governance variables in this fall and it includes: the strength of institutions, political stability, among other be revealing of the levels of corruption, respect and compliance with legal standards. Aizenman, Lee, & Rhee (2004) showed that countries with weak institutions may need higher levels of reserves for confidence, but also lower reserve levels may be associated with inappropriate use of them by corrupt governments.

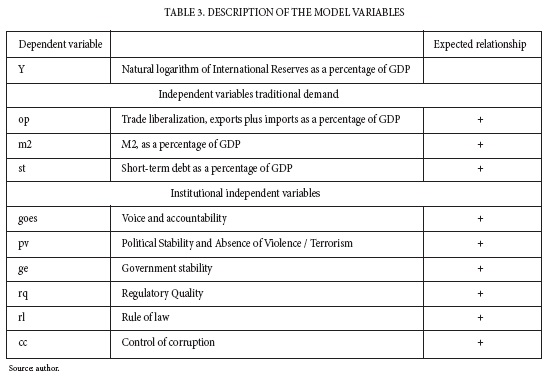

3. Methodology

The empirical analysis of IR in Emerging Economies begins with the selection of a panel of 14 countries which discrimination due to the presence of complete for these annual data during the period from 2002 to 2013. The sample is limited to middle income economies for having such a more homogeneous behavior in the accumulation of reserves.

In line with the empirical literature it was estimatedri,t= Ri,t/PIBi,t, which represents the stocks of the economyi and PIBi,t is the gross domestic product of the economy i both in the period t . Both measured in US dollars.

The model includes fixed effects estimate is:

Where ri,t is the dependent variable xi,t contains the explanatory variables, K is the number of regressors, i indicator of the country, t the number of periods, and y ei,t is the term steady error.

To consider the effects of heterogeneity between countries in a panel model of fixed effects as appropriate regression model is estimated to perform the Hausman test the hypothesis of random effects with a probability less than 1% significance is rejected.

4 Stylized Facts

4.1 Evolution of reserves

The International Monetary Fund report on adequate level of reserves in 2011 conveyed that gross reserves in Emerging markets increased by more than 6 times in the last decade, surpassing traditional metrics appropriate level of global and regional level. Global reserves in early 2000 were a little more than 2 trillion in 2013 and have become more than $ 12 trillion. The accelerated pace of reserve accumulation, which fell during the crisis, recovery speed since. Most countries, regardless of their region, have accumulated reserves above the suggested standards. The average coverage ratios in Emerging markets are more than 6 months of imports, 200% of short-term debt and 30% of M2. The phenomenon of acceleration in the accumulation of reserves is a subject of controversy today between managers and central banks there is no clear consensus on the reasons.

According to the IR administration policies, central banks invest in low-risk and high liquidity, mostly US Treasuries. Colombia gross reserves reached 46.8 billion dollars in 2013, representing about 12% of annual GDP; these reserves are at about 93%, represented an investment portfolio mainly consists of US government securities.

The last financial crisis urged advanced economies to stimulate recovery through monetary policy; this has caused historically low levels of interest rates paid by these countries. This has resulted in Colombia's reserves have rented annually between 150 and 250 million dollars between 2010 and 2012, however, interest paid on sovereign external debt has on average been 2.3 billion annually during the same period, although the balance in international reserves and the accumulated amount of foreign debt are of similar size.

These figures are evidence of justified concern to find ways of requiring lower levels of reserves relative to the debt of the country and for Latin American countries is particularly important as these have significant needs for investment in projects to reduce poverty, improve infrastructure, education, among many other socio-economic.

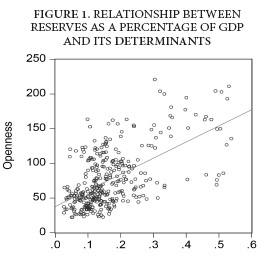

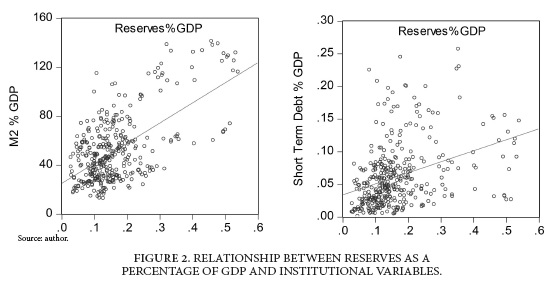

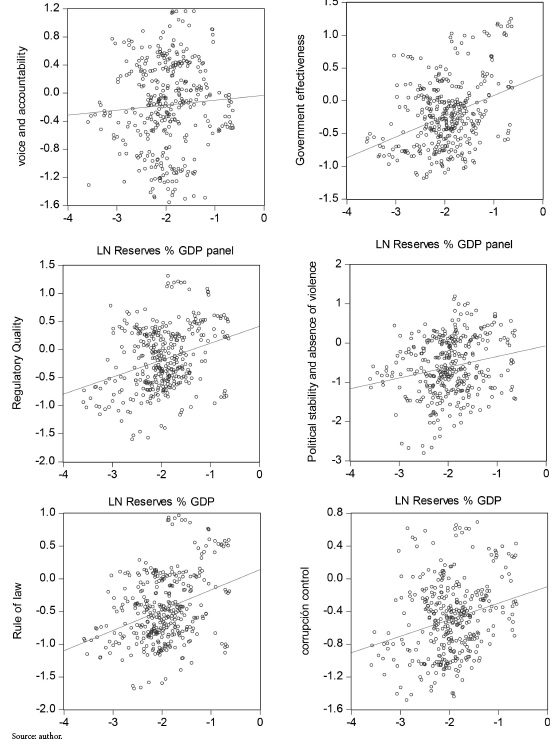

As mentioned above, the aim is not to discuss the effect of the traditional determinants of reserve accumulation; however, the literature suggests inclusion in any empirical study. As shown in figure dispersion 1 and 2, there is a positive relationship between higher levels of reserve accumulation and a higher level of trade exhibition, high-powered money economies and short-term debt for the selected Emerging countries. The accumulation of reserves has a positive behavior in relation to the institutional variables; this confirms what intuition suggests: strengthening institutions may positively relate to increased levels of international reserves.

4.2 Governance and the Role of the Reserves

Governance defined as

The traditions and institutions by which authority in a country is exercised “(Kaufman, Kraay, & Zoid-Lobatón, 1999). Good governance (improved governance) involves” transparent independent judicial and legislative power, and just laws its impartial application, reliable public financial and high public trust information (Li, 2005).

The consensus is that countries with good governance tend to receive more financial inflows, which favors the accumulation of reserves in the EE via supply (World Bank, 2002). Understandably external financial inflows are reduced to a bad government and, in turn, this increases the sensitivity of the outflow of capital in events of external shocks, then the economy becomes more vulnerable and require higher levels of reserves to smooth external pressures.

In the literature on the relationship between institutional variables and economic Johnson, Boone, Breach, and Friedman (2000) it stands out; they estimated the depth of the Asian crisis during the years 1997-1998 using the currency depreciation and stock market contractions in the US. They found that the law and order and the protection of shareholder rights were more explanatory variables during the crisis of the volatility in exchange rates and the performance of stock markets than traditional macro-economic variables. Countries with strong institutions such as Singapore and Hong Kong experienced the crisis more smoothly, while countries with weak institutions, such as the Philippines and Russia, suffered most severely negative effects of the crisis.

Wei (2001) establishes a link between the structure of capital flows of a country and its degree of corruption. He argues that a country with more severe problems of capitalist corruption is more likely to have a distorted structure of capital flows, which makes the country more vulnerable to a sudden reversal of international capital flows and therefore require more reserves to respond to external pressures.

Politics and institutions play an important role in the performance of the economy considering that the efficiency of markets requires solid governmental structures and laws that promote stability and control. According to Kaufman, Kraay & Zoid-Lobatón (1999), the main role of government institutions should be to improve market conditions.

Globalized countries face to an increase in its exposure to external shocks as their domestic markets are developed and are increasingly dependent on the conditions of international markets. As noted by Rodrick, Subramanian & Trebbi (2004), the quality of institutions can affect the level of income in at least three main channels: reduces the problems of asymmetric information, helping to reduce different types of risks because it defines and enforces property rights and poses greater restrictions on political and special interest associations so that they are accountable to citizens.

Then the link between the quality of institutions, good governance and economic performance worked in the literature; its link to the accumulation of reserves is associated with increased exposure to external shocks. Countries with high levels of information asymmetry could face acute reactions of risk aversion in the market participants to be at these higher levels of uncertainty. Direct and portfolio investments are an important source of external funding especially for EE; if uncertainty about property rights, the country may face sudden outflows of funds abroad in a scenario of external pressure rises. These statements show the relationship between good governance performance and reducing the adverse effects of external crises; then it is understandable that if the institutional framework is strengthened governmental authorities could care less about accumulating higher levels of reserves precautionary reasons.

Unlike the EE, the Advanced Economies have had little concern for accumulating reserves, and most are assumed to have little precautionary reasons for holding reserves, due to its strong access to financial markets (even in adverse conditions), strength in its legal and institutional framework, highly developed financial markets and flexible exchange rate regime. In addition, some of the Advanced Economies are reserve currency issuers or can borrow in its own currency, the IMF (2011).

The features that allow Advanced Economies to accumulate lower levels of reserves that emerging ones are highly related to the strengthening of its institutions and depth of its financial markets. The study of these characteristics in an Emerging economy like Colombia, would discern better on aspects of economic policy that could developed to require less onerous levels of reserves.

The relationship is clearly not direct, institutional variables are not represented on measurements of the balance of payments of any country explicitly, as if they are exports, financial flows, debt and other external vulnerability. However, it is reasonably clear and understandable that governance affects the sentiment of investors and consumers about the strength of the economy, this reduces the harmful effects of uncertainty in times of crisis, during which individuals, and domestic and foreign companies could, by risk aversion, draining the country of funds in search of havens of financial risk.

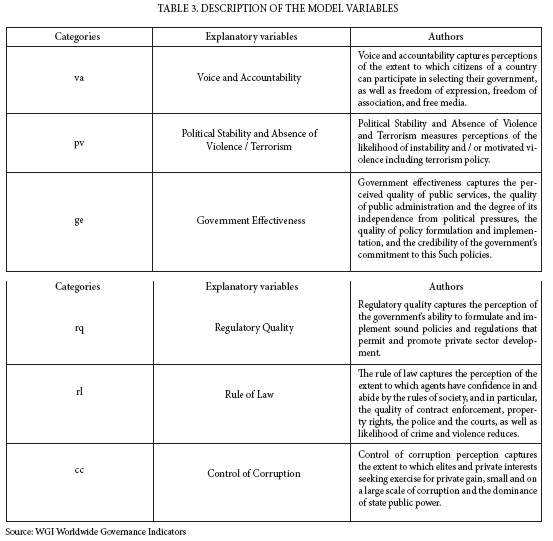

In order to establish the relationship between these variables, the database of Global Governance Indicators (WGI Worldwide Governance Indicators) developed by Kaufman is used, Kraay & Mastruzzi. Global Governance Indicators are a research project to develop longstanding estimates of governance in over 200 countries since 1996. These indicators report on six dimensions of governances, these variables scaled to have zero mean, a deviation Standard unit in each period, the data range is 2.5 to 2.5, with higher values corresponding to better governance, and it presents in the following table:

5. RESULTS

5.1 Regression Results OLS and Fixed Effects

In this section, the traditional variables of governances and are tested in the defined model, the panel includes 14 Emerging countries as defined above and the period is 2002-2013.

- The current account vulnerability, captured by trade liberalization, showed to be a significant determinant of reserve accumulation. A one percent increase in trade openness is associated to an increase of between 0.7 and 0.8% in reserves. These results is in line with other studies (Aizenman & Marion, 2003).

- The vulnerability in capital account estimated by changes in the M2 to GDP ratio also proved to be a positive determinant. An increase of one percent in this variable associates with an increase in the same proportion in reserves, indicating that these Emerging Economies increase their reserves to the extent that deepen its financial system, the development of financial markets in these economies promotes attraction of foreign funds, these results are similar to those Found in Mwase, (2012).

- Finally, short-term debt as a percentage of GDP has a significant positive effect but it´s not statistically significant to reserves the accumulation in the used panel. The results obtained by OLS and fixed effects indicate that an increase in short-term debt of one percent could be associated with an increase of about 0.8% in the relative level of RI, similar to that found in Mwase (2012).

5.2 Results with institutional variables

- The OLS model showed that government or effectiveness (ge), regulatory quality (rq) and control of corruption or n proved significant 99%, but the address or n of relations was mixed in the variables.

- The obtained mixed coefficients relate positively and negatively to the governance variables reserve. This is consistent to the fact that the proxies of governance have different effects in each economy. The dependent variable expressed in natural logarithm and this estimates the sensitivity of the accumulation reserve to changes in governance, a negative coefficient could construed as an improvement in governance variables it could relate to a deceleration in the rate of accumulation, even if levels of total reserves are greater.

- The negative coefficients could be an indication of improving governance in Emerging Economies as it could reduce the need to accumulate higher levels of reserves; they cause a deceleration in the accumulation. Similar to Advanced Economies as having institutional strength and accumulate these reserves at very low rates, run them down or require very low levels of reserves in relation to the size of its economy.

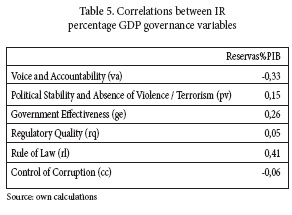

- Furthermore, governance variables show that such association increases to exception of the voice and accountability and control of corruption, it shows in Table 5, correlations, as stated before, between governance variables and accumulation of IR show a mixed relationship that could be explained by the difference in perception of institutional variables in each country.

5.3 Cointegration analysis

It is understandable that institutional strengthening reflected in the improvement of governance variables have an impact on the macroeconomic performance of a country and therefore the accumulation of international reserves. The results above show that there is a significant relationship between the variables and determinants governances traditional with the accumulation of IR y EE in the panel by OLS and fixed effects. The reduction of violence and terrorism, improving regulatory quality, strengthening government effectiveness and rule of law in an Emerging country would have a positive effect on attracting foreign capital. _It favors the deepening of the expanding the market and financial system in general and improve productivity among other effects that may contribute to the accumulation of higher levels of international reserves either surpluses or external flows precautionary reasons.

However, empirical evidence on the relationship between the variables of governance and the accumulation of reserves has characteristics similar to random walk in the short term. Similar to those described by Murray (1994), governance's variables in short-term periods show changes in correlation with reserve accumulation. Governance's variables behave differently in relation to the accumulation of international reserves in different countries, exemplified, In Colombia and Mexico Political Stability and Absence of Violence and Terrorism could favor the accumulation of reserves but would not be the case for Chile or Uruguay where perhaps regulatory quality could be a factor more determinant of the accumulation of international reserves.

However, in the long term, errors in the list of the variables could correct and the randomness of the variables disappears, then prevail theoretical relationship of the variables over the short-term cyclical divergences, like the drunken ride Murray and his dog.

This paper makes a first attempt to test empirically the role of governance variables in relation to the accumulation of international reserves in Emerging Economies. The study of this relationship using OLS and fixed effects is a step forward but neglects the stationary aspect of the data, as is well known, the macroeconomic time series could be non-stationary and as a result, estimates for MCO performed on the data could lead to false results. Therefore, cointegration analysis provides the ability to discern deeper into this phenomenon considering the nature trend figures studied and safer prove the relationship between the variables studied.

5.4 Unit root test

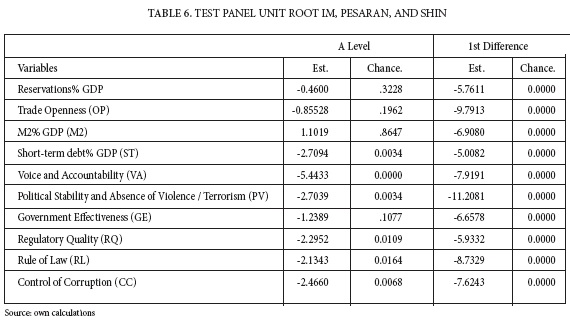

The unit root test could determine the existence of stationary data series in the order of integration of each series. The condition for cointegration is that the variables integrates into the first order, are level nonstationary and become stationary in the first difference.

Levin, Lin and Chu (2002) for estimating unit root test is widely used in the literature, however, this is based on the assumption of independence of the cross section, which is one of the problems described earlier in this job. Im, Pesaran, and Shin (2003) propose a unit root test based on the average statistics of Dickey-Fuller test and this allows the presence of serial correlation panel.

The condition for panel cointegration is that the level variables are non-stationary and stationary in the first difference value less than 5%, therefore only excluded from the panel cointegrating reserves as a percentage of GDP, trade openness, M2 and percentage of GDP, and government effectiveness. The remaining variables indicate provide a non-stationary process therefore can be used test panel cointegration.

5.5 Panel Cointegration

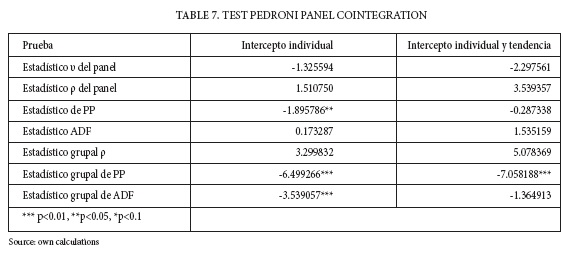

The cointegration methodology proposed by Pedroni (1999.2004) is used to determinant the existence of cointegration in this methodology. Seven different statistical cointegrating four of which are based on common panel inside dimensions (panel and Phillips-Perron are derived (PP), and augmented Dickey-Fuller (ADF)) and three are based in common between dimensions panel (panel, PP and group ADF) and the null hypothesis of these tests is no cointegration.

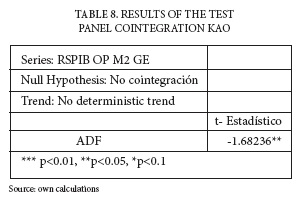

Pedroni test in the panel cointegration tries to investigate whether there is a stable long-term relationship or cointegration between variables. The test at level and constant coefficient results in 4 out of 11 statistical reject the null hypothesis of no cointegrating 1% and one weakly to 5%, by the above, it is not possible to determine conclusively the existence of cointegration between the variables. Furthermore, the results of estimation by cointegration panel test Kao (1999), previous studies, Gutierrez (2003), show that the test is most effective Kao paneled short periods as presented here. But this test only weakly reject the null hypothesis of no cointegration, therefore, with the previous results it is not possible to conclusively conclude that there is a cointegration between reserve accumulation, traditional variables and determinants of governance.

6. Conclusions of the panel

This study examines the relationship between the variables of governance and accumulation of international reserves using panel data for 14 Emerging Economies. Cointegration analysis show relationship between institutional variables and the accumulation of international reserves weak cointegration in the long-term. Despite the heterogeneity of the group of countries, the results indicate the existence of an influence of government effectiveness countries reserve accumulation along the empirical analysis.

Therefore, one can conclude that to reduce the need to build expensive reserve levels and reduce the cost of accumulation; EE could take a complementary approach, which is to improve and strengthen institutionally due to the existence of the relationship between these variables.

Recent research has provided sufficient empirical evidence on the positive impact of improved governance on development, the quality of institutions and the investment climate. Kaufmann, Kraay and Mastruzzi (2009) suggest that improving governance is relevant for sustained growth and development and, generally, in the Emerging Economies implementing reforms to strengthen governance and the increase was not prioritized the fight against corruption.

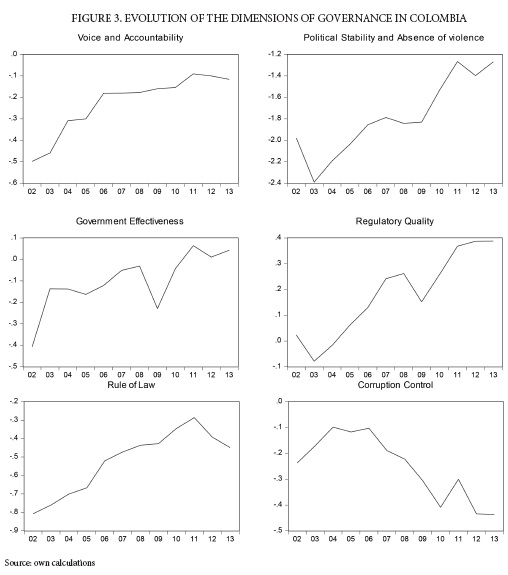

Despite the popular perception of the behavior of governance, it has shown positive development if in general terms for Colombia, estimates of the six basic dimensions of governance of the database studied here show it this way:

The dimensions of governance, voice and Accountability and the rule of law showed a continuous and highly correlated with the increase in reserves in the period of analysis improvement. Political stability and absence of violence and regulatory quality showed deterioration in 2003 in which the accumulation of reserves was also the lowest in the period with almost zero growth (0.7% compared to 2002).

On the other hand, the perception of corruption has worsened in the last decade to Colombia; the agency for international transparency ranked this country in its corruption index at 57 in 2002 put 94 passing for 2012 of 176 countries being in the first place the most transparent countries in terms of corruption. Furthermore, according to the survey results of the Global Corruption Barometer (2013) citizens also perceive that corruption is widespread in the country. According to the survey, 43% of respondents perceive the level of corruption in Colombia in the past two years had increased significantly. Institutions identified as the most corrupt in this study were political parties and parliament, with an average score of 80% as extremely corrupt.

Similarly to Colombia, other Emerging countries such as Bolivia, India, Thailand, Romania, South Africa, Pakistan, Romania and Ukraine also had impaired control of corruption indicators estimated global governances for the period 2008-2012, a period in which the accrual rate reduces. Intuition originally raised in this document states that the deterioration of variables governances should lead to a greater accumulation of international reserves precautionary reasons because of increased risk and possible reductions in external influences. These Emerging Economies increased their levels of reserves during this period, however, reduced the rate of accumulation. Notably, during this period of reference these Emerging Economies were favored with inflows of foreign investment caused by the dynamics of international investments mobilized developed with low interest rates to these Emerging Economies.

The relationship of governance and stockpiling of Colombia goes beyond the descriptive in terms of numbers. As mentioned, governance and performance of macroeconomic numbers have been studied with inconclusive results, linking the behavior of these numbers of institutions with the stockpiling of Colombia is not directly or determinant as if it is the International trade, the depth of the financial market, the exchange rate regime, and the levels of short-term debt and other factors external exposure.

Linking governance and accumulation of reserves can also be understood by considering the general objectives of accumulation of reserves by the Central Bank of Colombia, The Central Bank holds foreign reserves in amounts it considers sufficient to intervene in the exchange market and to facilitate access of the government and the private sector to international capital markets. On the stage of accelerated depreciation of the peso in the Central Bank may use reserves to sell currencies and mitigate exchange pressures on the performance of the economy and reserves serve as credit enhancement that strengthens the profile of country risk and reduce external borrowing costs and facilitates their acquisition.

Finally, you can add the results contribute to strengthen the explanatory framework of reserve accumulation; based on the findings it suggests to consider public policy decisions aimed at improving the stability of institutions and reducing the presence of violence and / or terrorism. With this, the perception of country risk and therefore could improve reduced the reserve requirement to strengthen market sentiment. The optimal design of public policies that promote market efficiency and stimulate the dynamics of international flows are also ways to attack the problem of international exposure if require higher levels of reserves and, although this represents an increase of vulnerabilities into account current and capital, also suggest a facilitation to foreign credit in times of crisis.

Referencias

Aizenman, J. & Marion, N. (2003). The high demand for international reserves in the Far East: What is going on? Journal of The Japanese and International Economies, 2003, 17 (3), 370-400. [ Links ]

Aizenman, J., Lee, Y. & Rhee, Y. (2004). International Reserves Management and Capital Mobility in a Volatile World: Policy Considerations and A Case Study of Korea. Cambridge, Massachusetts: National Bureau of Economic Research, Nº 10534. [ Links ]

Anghel, B. (2005). Do Institutions Affect Foreign Direct Investment? International Doctorate in Economic Analysis, Universidad Autónoma de Barcelona. En http://www.webmeets.com/files/papers/SAE/2005/217/paperFDI.pdf, 15/04/2015. [ Links ]

Banco de la República. (2014, 10 26). Administración de las Reservas Internacionales. Retrieved from: Banco de la República: http://www.banrep.org/listado-publicaciones-periodicas/2455 15/04/2015. [ Links ]

Calvo, G. (1996). Capital Flows and Macroeconomic Management: Tequila Lessons. International Journal of Finance and Economics, 1998, 1 (3), 207- 223. [ Links ]

Cheung, Y.-W. & Ito, H. (2007). A Cross-Country Empirical Analysis of International Reserves. CESifo Working Paper Series No. 2654. Retrieved from http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1410569 15/03/2015. [ Links ]

Edwards, S. (1983). The Demand for International Reserves and Exchange Rate Adjustments: The Case of LDCs. NBER Working Paper No. 1063 (Also Reprint No. r0453) Issued in 1983. [ Links ]

Edwards, S. (1985). On the Interest-Rate Elasticity of the Demand for International Reserves: Some Evidence from Developing Countries. Journal of International Money and Finance,4 (3), 287-295. [ Links ]

Flood, R., & Marion, N. (2002). Holding International Reserves in an Era of High Capital Mobility. IMF Working Paper WP02/62. Retrieved from https://www.imf.org/external/pubs/ft/wp/2002/wp0262.pdf 11/12/2015. [ Links ]

Frenkel, J. (1974). The Demand for International Reserves by Developed and Less Developed Countries. Economica, 1974, Vol. 41, No. 161, 14-24. [ Links ]

Gutierrez, L. (2003). On the Power of Panel Cointegration Tests: A Monte Carlo Comparison. Economics Letters, 2003, 80, 105 - 111. [ Links ]

Heller, H. R. (1966). Optimal International Reserves. The Economic Journal, 76, Nº 302, 296-311. [ Links ]

Heller, H. R., & Khan, M. S. (1978). The Demand for International Reserves Under Fixed and Floating Exchange Rates. Palgrave Macmillan Journals. Staff Papers - International Monetary Fund, Vol. 25, No. 4 (Dec., 1978),623-649. [ Links ]

IMF. (2011). Assessing Reserve Adequacy. INTERNATIONAL MONETARY FUND, 32. Retrieved from http://www.imf.org/external/np/pp/eng/2013/111313d.pdf 10/12/2014. [ Links ]

Johnson, S., Boone, P., Breach, A., & Friedman, E. (2000). Corporate Governance in the Asian Financial Crisis. Journal of Financial Economics, 2000, 58, 141 - 186. [ Links ]

Kaufman, D., Kraay, A., & Zoid-Lobatón, P. (1999). Aggregation Governance Indicators. World Bank Policy Research Working Paper. N 4978. Retrieved from https://openknowledge.worldbank.org/bitstream/handle/10986/4170/WPS4978.pdf?sequence=1 12/12/2014. [ Links ]

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. (1999). The Quality of Government. Journal of Law, Economics and Organization, Oxford, 15 (1). 222-279. [ Links ]

Landell-Mills, J. (1989). The Demand for International Reserves and their Opportunity Cost. International Monetary Fund Staff Papers, 1989, 36 (3), 708-732. [ Links ]

Lane, P., & Burke, D. (2001). The Empirics of Foreign Reserves. Open Economy Review, 2001, 12 (4), 423-434. [ Links ]

Li, S. (2005). "Why a poor governance environment does not deter foreign direct investment: The case of China and its implications for investment protection. Business Horizons, 2005; 48(4):297-302. [ Links ]

Lizondo, J., & Mathieson, D. (1987). The Stability of the Demand for International Reserves. Journal of International Money and Finance, 1987, 6, (3), 251-282. [ Links ]

Mejía, L. F. (2012). ¿Se encuentran las reservas internacionales en un nivel óptimo? Notas Fiscales. N 18. Retrieved from http://www.minhacienda.gov.co/portal/page/portal/HomeMinhacienda/politicafiscal/reportesmacroeconomicos/NotasFiscales/Boletin%2018%20Se%20encuentran%20las%20reservas%20internacionales%20en%20un%20nivel%20optimo.pdf 20/12/2014. [ Links ]

Morahan, A., & Mulder, C. (2013). Survey of reserve managers: lessons from the crisis. IMF Working Paper. Retrieved from https://www.imf.org/external/pubs/ft/wp/2013/wp1399.pdf 11/01/2015. [ Links ]

Murray, M. P. (1994). A Drunk and Her Dog: An Illustration of Cointegration and Error Correction. American Statistical Association, 1994, 48 (I), 37 - 39. [ Links ]

Mwase, N. (2012). How much should I hold? Reserve Adequacy in Emerging Markets and Small Islands. IMF Working Paper. Retrieved from https://www.imf.org/external/pubs/ft/wp/2012/wp12205.pdf 11/01/2015. [ Links ]

Obstfeld, M., Shambaugh, J., & Taylor, A. (2008). Financial Stability, The Trilemma, and International Reserves. Cambridge, Massachusetts: National Bureau of Economic Research, NBER Working Paper No. 14217. Retrieved from http://www.nber.org/papers/w14217.pdf 12/01/2015. [ Links ]

Radelet, S., & Sachs, J. (1998). The Onset of the East Asian Financial Crisis, NBER Working Paper. Cambridge, Massachusetts: National Bureau of Economic Research, Nº 6680. Retrieved from http://www.nber.org/papers/w6680 15/02/2015. [ Links ]

Rodrik, D., Subramanian, A., & Trebbi, F. (2004). Institutions Rule: The Primacy of Institutions over Geography and Integration in Economic Development. Journal of Economic Growth, 2004, 9(2,Jun), 131-165. [ Links ]

Wei, S.-J. (2001). Domestic Crony Capitalism and International Fickle Capital: Is There a Connection. International Finance, Spring 2001,4 (1), 15-45. [ Links ]

Wijnholds, O. B., & Kapteyn, A. (2001). Reserve Adequacy in Emerging Market Economies. Washington: International Monetary Fund, IMF Working Paper 01/143. Retrieved from http://www.imf.org/external/pubs/ft/wp/2001/wp01143.pdf 17/02/2015. [ Links ]

World Bank. (2002). Global development finance 2002. Washington, D.C. World Bank. Retrieved from http://siteresources.worldbank.org/GDFINT/Resources/334952-1257197834412/FullText-Volume1.pdf 17/02/2015. [ Links ]