INTRODUCTION

During the first decade of the millennium, the world economy experienced a systemic financial crisis, which resulted from an unprecedented period of excessive borrowing and lending (Arner, 2009) and for some, it was widely regarded as the worst crisis since the great depression of the 1930´s. The crisis reduced consumer lending, caused sharp decline in stock prices, led to the bailout of several financial institutions and decreased bank loans (Dell’Ariccia, Igan, & Laeven, 2012). Consequently, financial institutions became the center of debate and massive criticism with respect to their poor lending practices as they reduced their screening and monitoring standards (Purnanandam, 2011).

According to Allen, Carletti & Gu (2015) banks play a specific role in the economy, it represents the means and methods that funds are obtained, controlled, allotted and used; improves the information problems between investors and borrowers, and contributes to economic development. They are believed to be the primary financier of the national economy, especially for small and large companies, thus the efficiency of the banking credit loan decision making process is a key determinant of sustainable growth.

In this manner, given the importance of bank credit for small and large companies, credit evaluation is a complex activity and requires large amounts of data and different evaluation process (Fuglseth & Gronhaug, 1997). This complexity may increase according to the different characteristics of borrowers and to environmental factors, and interactions and relationships amongst factors need to be considered. Therefore, the main purpose of this paper is to examine the credit decision-making process and the information requirements by banks, in order to assess the eligibility of loans for small and large firms, and the problems of finance that expanding companies, especially small one´s face.

Hence, the first part of the paper consists of outlining the main sources of funds available to small and large firms and the major problems and difficulties associated with them. Small firms face difficulties in each field in which it attempts to raise funds and it is on this topic which emphasis is given. The second part analyses the loan evaluation techniques banks use in order to assess the eligibility of a loan, and thus, reduce default probability. Subsequently, the methodology and results of the present investigation are described. Finally, the main points are drawn together, and an attempt in recommending a reduction in the asymmetric information between the banks and the small and large firms is given.

THEORETICAL FRAMEWORK

The main sources of finance for large and small companies

Large companies tend to dominate many sectors of the economy and few would argue about its ability to produce low-cost unit, obtain specialized workforce and equipment, and cheaper access to capital (Cowling & Sugden, 1995). On the other hand, small firms are vital to the economy and special emphasis has been given to the important stimulus they provide to competition in markets (Lean & Tucker, 2001); their role in the early development and exploitation of new technologies; and their job-creating effects (Haltiwanger, Jarmin & Miranda, 2013; Brownrigg, 1987). However, despite their differences, the principles on how to raise finance are similar for both large and small companies and there is no limit to the variety of financing instruments available to them.

In this manner, equity finance is an alternative to raise capital as firms can fund their expansion thorough retained earnings (internal funds); by selling shares to investors in the capital market; through venture capitalists (institutional providers) and business angels (high-risk investors) (Gombola & Marciukaityte, 2007). According to Ennew & Binks (1995), the availability of internal funds is determined by several factors such as profitability, growth rate and terms of repayment. Whilst large firms can finance part of their expansion through their own cash flow, this does not apply to expanding small firms. In order to maintain its competitiveness and to the large capital expenditure required in most of the cases, they are often unable to realize high levels of profitability.

On the other hand, participating in the stock exchange market opens access to different kinds of capital as it provides new equity funds mostly for large companies and a market for their shares (Robertson, 2017). However, small companies find it difficult to obtain funds to finance their growth, as the capital markets will have more confidence in a firm with a known record than new entrants. The reason for this is that the capital market does not have the same level of information for both companies; therefore, the market is thrown back on its experience of the companies involved (Cowling & Sugden, 1995). In addition, they are unlikely to be as diversified as the large firms are and they find it harder to protect themselves from external fluctuation due to the lack of market power. Other issues they face are the high fixed costs of participating in the capital market and the unwillingness of the institutional investors to take smallholdings (Ennew & Binks, 1995).

Alternatively, small companies can raise capital form venture capitalists and business angels, however, the problem with these types of finance is that the first one requires high rates of return and the second one invests small amounts when compared to venture capitalists (Chemmanur, 2010). As a result, small businesses tend to rely more heavily on bank borrowings than large companies (Istemi & Goddard, 1995).

An equally significant source of funding is debt finance, which involves a payback of the funds plus a fee (interest) and comes in many forms such as bank borrowing, and together with internal funds is an important financial instrument for small companies (Chittenden, Hall & Hutchinson, 1996).

Banks are in the business to fulfil its intermediation role by channeling money deposited and transferring it to those with cash need (Allen, Carletti & Gu, 2015). The provision of finance by a bank to a firm can be regarded as a contract between two parties. In the agency theory principal, the bank is regarded as the principal and the firm as the agent, and in effect, it is requiring the firm to undertake an investment and generate a return on behalf of the bank (Chantal, Namusonge & Shukla, 2018; Lean & Tucker, 2001; Dell’Ariccia, 2001). However, the decision to supply loans will depend on the companies capacity to fulfil all the requirements of the banks such as liquidity (be able to recall the loan in any occasion); safety (the need of security); and profitability (the loan will only occur if the borrower will make profitable use of it and repayment difficulties will not occur). Binks & Ennew (1997) argue that the decision will be governed by the financial and managerial strengths of the business, the suitability of the project and the prospects of the industry.

The banks will want to know a great deal about the firm, its history, structure of assets and liabilities and profit record when assessing its eligibility for a loan. In a world of perfect and available information, with no economic certainties, the information need of banks should not represent a problem. However, in practice, these conditions do not hold, and banks and firms operate in a world where information is not perfect and is often too expensive to obtain (Nyoni, 2018). Binks & Ennew (1996) claim that the restricted access to finance is not attributed to size but reflects the problems of asymmetric information. They are not unique to small firms’ sector but are considerably more prevalent due to higher costs of information collection.

There are basically two problems regarding the information asymmetry for the provision of debt finance. The first main issue is the fact that banks cannot observe beforehand certain information that is relevant to the credit loan decision. Due to this, banks may end up granting loans to low quality projects with high risks, whereas high quality projects end up being denied funding (Chantal, Namusonge & Shukla, 2018). The second issue is the risk that the firms will not perform consistently to what was established in the loan contract, therefore, there is the need of monitoring ex-post. In order to reduce information costs and risks associated with debt finance, banks resort to a capital-gearing approach when granting credit loans, which requires a 100% plus asset backed security. With this approach, a debt gap tends to be more frequent in the case of small firms since asset backed collateral must be valued as “carcass value” to ensure the loan is covered in the case of default payment (Binks & Ennew, 1997). In addition, small firms may not have enough business collateral, and may only be able to gain a loan by providing personal collateral in the form of guarantee or house deeds.

On the other hand, large corporate firms, due to its market power and financial sophistication, are able to demand from banks services tailored for their business needs and tend to grant them loans without the need of collateral, as they tend to use the income gearing approach. Whereas smaller firms, due to their high risk of non-performance end up having to ensure that the loan is covered by providing collateral.

Credit Assessment

As previously mentioned, the bank’s primary function consists of an intermediary role between investors and borrowers and in fulfilling this it inevitably undertakes credit risk. In a world of imperfect capital market, investors do not have exact information of the company’s prospect of which borrowers possess more information about its trading position than is available to the investors.

This information gap presents a risk to the lender and increases in proportion to the riskiness of the project and to its duration, which can lead to wrong credit decision making and thus problem loans (Cowling, & Sugden, 1995). If the bank does not have knowledge about the company´s management, business cycle and the industry, the default risk can be very high consequently leading to misjudgements of its repayment capacity (Vojtech, 2012). Therefore, in order to guarantee a good loan quality, the bank must reduce the information gap as well as analyse and understand borrowers default risk.

As a result, banks need trained loan officers as to investigate applicants, understand their business and interpret their financial statements. The credit investigation is primarily a credit information gathering which can vary from a one-page report to large files. One must remember that this information is very important as it will influence the credit decision-making process and wrong information can lead to bad credit loans and consequently losses.

When assessing the creditworthiness of a potential customer there is a variety of information sources available to the decision maker (Genriha, & Voronova, 2012). The actual decision environment, and the information available will differ from the various users. Thus, there are different methods of assessing creditworthiness of borrowers that include the 5C’s, CAMPARI, LAPP method, 5P’s and the Financial Analysis and Previous Experience Method.

According to Apostolik, Donohue & Went (2016) the 5C´s of credit is an approach of assessing credit worthiness using different factors categorized as: Capacity, which refers to borrower’s ability to generate enough funds to repay debts as scheduled. Capital is the company’s net worth (assets minus liabilities) which provides a cushion to absorb operating and asset losses that might affect repayment of debt. Conditions refer to the economic and political conditions of the country that are beyond the company’s control and can affect the industry and thus repayment. Character is the desire of the borrower to repay its debt. Collateral refers to the security provided by the borrower to support repayment of loan. The collateral may be an existing asset of the borrowing firm such as equipment, real estate, accounts receivable or inventories.

The CAMPARI model (Apostolik, Donohue & Went, 2016) on the other hand, comprises of seven variables that are used in the credit decision-making process and includes; Character refers to the obligation of the borrower to repay; Ability to borrow and repay; Margin to profit, Purpose of the loan; Amount of the loan; Repayment terms and Insurance against non-repayment such as security. Whereas the 5P’s, developed by the Federal Reserve Centre, comprises of People (the borrower’s commitment to repay the debt), Purpose (reasons for the loan), Payment (the structure of the repayment loans), Protection (collateral) and Prospective (loan supervision).

In addition, the Financial Analysis and Previous Experience Methods analyses the financial records of the applicants such as balance sheets, income statement and the source and application of funds (Allen & Powell, 2011). The purpose is to refine and translate the reported financial data and convert it into measures such as ratios that can be used to construct a profile of the company, which in turn can be compared with other companies in the same line of business to determine any trends. Examples of the most used ratios are shown in Table 1.

Table 1 Ratio Analysis Tools

| Ratio | Calculated From | What it Shows |

| Liquidity | ||

| Current Ratio | Current Assets Current Liabilities | Ability of the company to pay current debt |

| Quick ratio | Cash + Marketable Securities + debtors Current liabilities | Ability to pay current debt with cash or easily made cash |

| Activity | ||

| Stock Turnover | Sales Stock | No. of times stock replaced in year |

| Debtor days | Debtors Average sales per day | Average number of days customers take to pay bills |

| Leverage | ||

| Debt ratio | Total debt Total equity | Relative amount of debt and equity used to finance company |

| Interest cover | Profit before interest Interest paid | Interest paid Ability to service medium-long term debt |

| Profitability | ||

| Profit margin | Profit before interest Sales | How much profit generated from each sale? |

| Return on capital employed | Profit before interest Capital employed | How much profit generated from each dollar is invested in the company. |

Source: Authors´ elaboration based on Tugas (2012)

It is however important to note that, according to Tugas (2012), when assessing a company using ratio techniques, it is essential that the financial information and the resultant ratios be measured on the same basis for purposes of comparison at one point of time or over time. For the numbers to become comparable, there is a need for consistency in the accounting treatment of the company analyzed. In addition, when comparing it with other companies there is also the need of consistency between companies in the same trade or industry. In addition, published ratios reflect only cash flow and their effect upon the financial statements ex-post. If the company fails to meet its financial obligations analysts can study the cause and understand, what happened only after the event has occurred therefore, it does not have the ability to identify beforehand the possibility of default payment. Finally, ratios are limited to a comparative static analysis and cannot be described as a dynamic system.

In this way, financial analysts have moved towards statistical methods including discriminant analysis, linear regression, probit analysis (Vojtech & Koaenda 2006; Altman, 1994) that are relatively easy to implement and produce straightforward results. However, in the last decades due to the advance of technology alternative techniques have been applied to determine credit worthiness which involve decision trees (Lee, Chiu, Lu, & Chen, 2002), artificial neural networks (Akkoc, 2012, Bekhet & Eletter, 2012; Malhotra & Malhotra, 2003), and genetic programming (Chorng-Shyong, Jih-Jeng & Gwo-Hshiung, 2005).

METHODOLOGY

Research design was based on a survey methodology using a sample of twenty-two credit establishments registered with the Brazilian Federation Bank (FEBRABAN). Main data collection was by means of a self-completion questionnaire that was filled by credit assessment officers that involved closed and open-ended questions. Secondary data was obtained from reports published by government such as the Brazilian Central Bank, financial institutions and organizational records. A pilot study was conducted, and most of the questions were extracted from that used by Berry, Citron, & Jarvis (1987) when examining the information requirements banks use when dealing with small and large companies in order to understand their credit loan decision-making process. The answers to the questions were coded by grouping them into categories and analyzed using the statistical package for social scientists.

RESULTS AND DISCUSSION

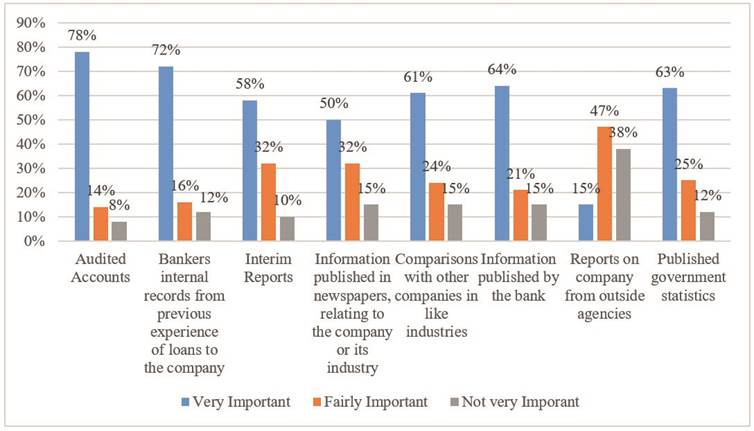

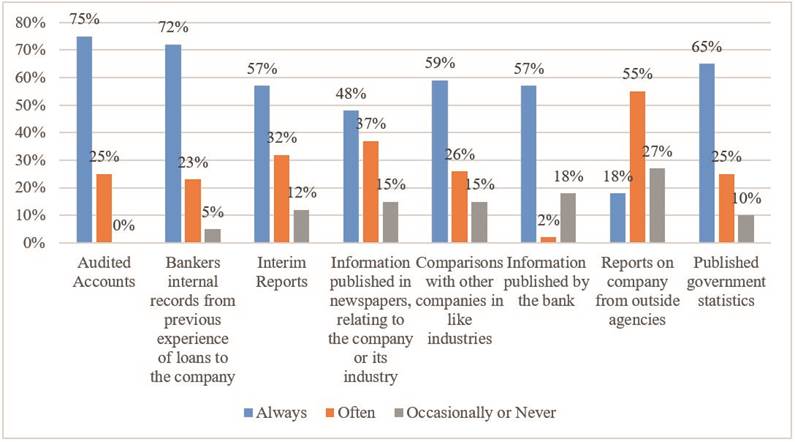

The survey results provide an interesting insight into the information requirements of bankers. As usual, there is skepticism towards it, and there is always the tendency that the participants may have answered the questionnaire the way they thought more appropriate rather than the way things occur. Despite this, the findings showed that the overall trend of the perceived importance and the actual frequency of use of the sources available were similar (Figure 1, figure 2) Thus, an average 78% of the respondents perceived that information from audited accounts as very important whereas the actual frequency of use was of 75%. In addition, an equal amount of respondent’s value banker’s internal records from previous experience of loans to the company also as very important.

Source: Authors´ elaboration based on Berry, Citron & Jarvis (1987)

Figure 1 Perceived importance of the use of sources of information available

Source: Authors elaboration based on Berry, Citron & Jarvis (1987)

Figure 2 Actual frequency of use of the importance of sources of information available

As far as the results were concerned, there was no difference in the rating of the audited accounts between bankers dealing with large and small companies. However, although the small company´s audited accounts are of great importance, it is argued that they are generally unreliable because they lack a system of internal control, which usually means that an independent confirmation of the figures presented in the accounts is impossible (Berry, Citron, & Jarvis, 1987). In addition, small company’s accounts are often delayed in their drawing-up, which means that the information is out of date (Binks & Ennew, 1996). In respect, it can be said that due to the inadequate accounts control and to information lag there is a high-risk factor when lending to small companies leading to a higher probability of default losses.

On the other hand, large firms due to their financial sophistication and multiple banking relationship are usually granted loans in an income-gearing approach. This means that repayment of loans will be based on the prospects of the business and its cash flow rather than the assets accumulated in the past (Charitou, Neophytou & Charalambous, 2004).

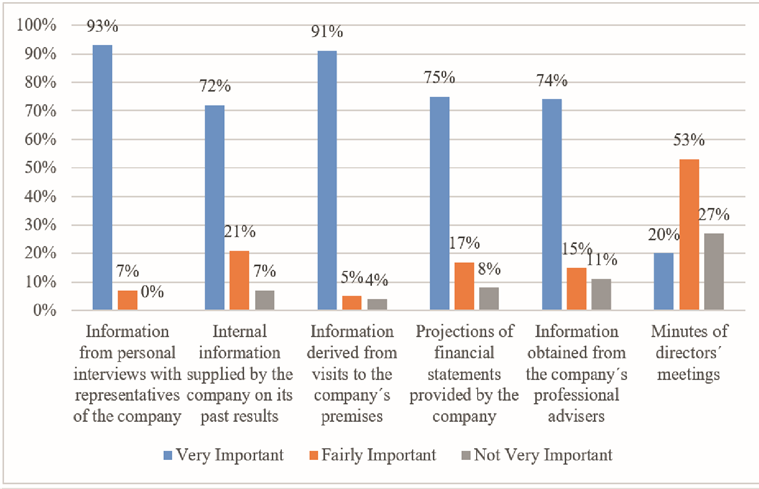

In the category of Information not Available to the Public (Figure 3), the information from personal interviews with representatives of the company (93%) was perceived as the most important source. The study showed that the level of importance was the same for both large and small companies and the main reason for these interviews was to assess the quality of management and to obtain more details of the company’s financial affairs, complementing the accounting information.

Source: Authors´ elaboration based on Berry, Citron & Jarvis (1987)

Figure 3 Perceived importance of the use of sources of information available

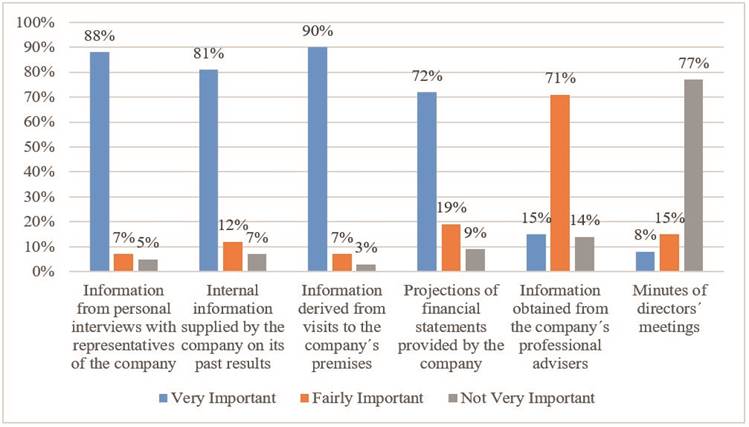

Concerning the information derived from visits to the company´s premises 90% of the respondents used it most frequently (Figure 4). However, the frequency of use was higher for small businesses and the reason according to bankers is that not so much is gained from visiting plants of large companies as their structure are more complex and they often have multiple banking relationships.

Source: Authors´ elaboration based on Berry, Citron & Jarvis (1987)

Figure 4 Perceived importance of the use of sources of information available

In the category of Information not Available to the Public (Figure 3), the information from personal interviews with representatives of the company (93%) was perceived as the most important source. The study showed that the level of importance was the same for both large and small companies and the main reason for these interviews was to assess the quality of management and to obtain more details of the company’s financial affairs, complementing the accounting information (Table 2).

Table 2 Importance of characteristics in company´s Accounts

| Rank | |||

| Large | Small | ||

| Profitability | 1 | 1 | |

| Financial Stability | 2 | 2 | |

| Liquidity | 3 | 3 | |

| Security | 6 | 4 | |

| Consistency of Trends | 4 | 6 | |

| Cash Requirements | 5 | 5 |

Source: Authors elaboration based on Berry, Citron & Jarvis (1987)

Security is probably the most contentious issue in the small firm/banker relationship (Cowling & Sugden, 1995). Bankers need at least one and in most cases two alternatives sources of repaying the loan, in case of default payment, other than the company’ s cash flow. It is argued that not only it guarantees repayment of the loan but also collateral as it will make the owners of the small company work harder to ensure the loan is repaid.

According to Binks & Ennew, (1997) in the absence of an accurate information system banks rely on tangible assets as security. In case of default payment, company´s would be faced to sell the assets and receive their market value. However, secondhand plant and equipment have relatively low price, therefore there would be the need to increase the volume of assets required to secure the loan. Where the volume of assets is not enough, personal guarantees and collateral such as house deeds are often required. This erosion of limited liability would, however, discourage investments in many cases. In this sense, small firms with little or no track record or with insufficient collateral are the ones who suffer from finance gap. Bankers will not be willing to consider them for a loan and they will encounter great difficulties in their expansion process.

CONCLUSIONS

Credit loans are made to all kinds of borrowers over a wide range of maturity. It spurs business development and supports a growing economy (Haltiwanger, Jarmin & Miranda, 2013; Brownrigg, 1987). However, the on lending of resources is a risky business as there is the possibility of default payment. The traditional procedures that banks adopt to evaluate a borrower´s creditworthiness are based on the company’s financial statements, industry performance and ratio analysis. In addition, it is guided by the famous rule about the 5C’s of credit, mathematical models and with advanced technology alternative techniques (Genriha, & Voronova, 2012).

Small firms, due to equity finance gap, tend to rely heavily on bank borrowing in order to finance their expansion. On the other hand, large firms tend to raise finance through the capital market and through internal funds; therefore, bank borrowing is not so commonly used (Chittenden, Hall & Hutchinson, 1996). In order to assess the eligibility for a loan, banks want to know a great deal about the company. The problems of asymmetric information arise despite the size of the company; however, it is more prevalent in small firms due to their higher costs of information collection. The collection of accurate information will depend upon the close relationship between both borrower and lender. According to Ennew & Binks (1995), a closer relationship between banks and small firms will give greater emphasis on the income-gearing approach. Banks instead of securing the loan with tangible assets, (which is the case for small firms), would rely on the prospects of the business and its potential cash flow. It is argued that by focusing on the firms prospects the banks would be able to provide a more flexible financial product.

Another factor that highlights the difference in attitude when dealing with credit loans between small and large firms and their bankers is the lack of a competitive banking environment for small companies. Small firms suffer from the lack of competition and according to Binks & Ennew (1997), a competitive environment would motivate banks to monitor the changing needs of small firms closely. This, on the other hand, does not occur with large firms, as they are financially sophisticated and have a multiple banking relationship; therefore, there is a fierce competition among banks. In addition, as a general worldwide trend large firms are using less bank borrowing.

Although the basic loan evaluation method, which banks use for small and large firms, is the same, there is little doubt on the bank’s dependency of security in the case of small firms. Therefore, in order to reduce the default possibility and the risks inherent to the small company sector it is recommended that banks should have a hands-on approach by providing advice to the business. A closer relationship would reduce the information asymmetry between borrowers and lenders and thus, improve the problems of finance for small firms.