Introduction

With imminent future membership in the European Union and integration into the Euro-Atlantic security space, Ukraine faced armed aggression from the Russian Federation (hereinafter - the Russian Federation) and terrorist activities of a hybrid nature, suffering heavy losses among the civilian population. Since then, terrorism in all its forms and manifestations has become one of the main threats to Ukraine’s national security, as evidenced by the guiding documents of strategic planning in the security and defense sector. Recently, it has become open, comprehensive and massive, combined with special information operations, cyberattacks and cyber incidents, as well as encroaching against critical infrastructure.

Terrorist activity involves the need for financial support. Case in point, the source of Russia’s financing of its war against Ukraine at all stages of preparation and conduct was and remains a direct budget allocation of funds from its State Budget, obtained mainly from the export of energy carriers, primarily oil and gas.

The intensification of terrorism and separatism in Ukraine formulates the task of combating their financing in a new way and requires the adoption of strict measures to control financial flows. Therefore, the activity of identifying and effectively blocking the channels of financial support for terrorist and separatist organisations should be one of the key directions of the long-term strategy of state institutions. The foregoing determines the relevance of the study and the need to clarify issues of a legislative and administrative nature in counteraction to the financing of terrorism in modern conditions.

Materials and methods

In accordance with the purpose, tasks, object and subject of the research, general scientific and special methods of cognition were used. An active methodological approach is used to assimilate the sum and substance of financing terrorism, as well as the mechanism of counteraction to the specified criminal activity. In addition, the scientific article uses historical, logical-dogmatic, systemic- structural, comparative-legal statistical, concrete- sociological (study of documents, expert evaluations, etc.) methods. The information basis of the study was comprised of legislative and sub-legal regulatory acts (laws, strategies, concepts, etc.) of the Republic of Ukraine as well as international legal acts that regulate issues related to ensuring anti-terrorist security and the results of surveys and investigations of criminal offenses regarding the financing of terrorism.

Analysis of recent research

A number of works by scientists and practitioners are devoted to the study of the financing of terrorism and terrorist activities. In particular, M. Tierney investigated the peculiarities of terrorists’ use of online financing channels (Tierney, 2018, рр. 1-11), R. Wall attempted to ascertain the degree of readiness of national financial institutions to effectively counter the financing of terrorism (Wall, 2020, рр. 181-191), J. Edgar Hoover Morse identifies tools to counter the financing of terrorism at the international level (Morse, 2019, рр. 511-545), V. Malyy identified the financing sources of terrorism and financial monitoring tools used to prevent this phenomenon (Malyy, 2016, р. 143-147).

A sharp increase in terrorist acts related to the armed aggression of the Russian Federation, including cases of terrorist financing, a certain obsolescence of strategic planning guidelines, and the imperfection in the functioning of the national system of struggle against terrorism, all led to the choice of this research topic.

The purpose of the scientific article is to develop scientifically based recommendations regarding the directions and measures for counteracting the financing of terrorist activities at the national and international levels, and the goal led to the determination of the following tasks: to ascertain the legal nature of terrorist financing and to characterise the determining complex of such activities in Ukraine; to analyse foreign experience in combating the financing of terrorism; to propose priority measures to counteract the financing of terrorist activities in Ukraine.

Results

General understanding of the financing of terrorism

The concept of terrorism, due to its multifaceted nature, is the subject of much research by many scientists and is interpreted by them in different ways. Thusly, for example, U. Laqueur believes that terrorism is an illegitimate use of force to realise a political goal by threatening innocent people (Laqueur, 1987, p. 72). A. Schmidt understands terrorism as a violent method or the threat of violence, used by non-governmental conspiratorial individuals, groups or organisations in peacetime, carried out with the help of discrete actions aimed at various objects with certain goals or effects (Schmidt, 1983, p. 54).

At the legislative level, terrorism is defined as a socially dangerous activity, which consists of the conscious, purposeful use of violence by means of taking hostages, arson, murder, torture, intimidation of the population and authorities, or the commission of other encroachments on the life or health of innocent people or the threat of committing criminal acts in order to achieve criminal goals (On the fight against terrorism. Law of Ukraine, 2005).

Hence, as we can see, the researched scientific and legislative definitions have common key features that determine the essence of the analysed phenomenon. These are: the use of violence (or the threat of its use) as a means of intimidation, pressure or threats; the political, religious, social or ideological basis of terrorist goals and illegitimate forms of achieving the corresponding goal; the creation of an atmosphere of terror, an atmosphere of fear and hopelessness; the achievement of wide publicity and social resonance; the integration of terrorism and organised criminal activity. It is worth noting that the specifics of terrorist activity have certain similar characteristics with another form of violence - war. In this regard, L. Bonanate justifiably notes that terrorism is one of the possible alternatives to conventional forms of war, limited not so much by the desire of countries to cooperate, but by the threat of thermonuclear war, on the one hand, and the growth of interstate control, on the other (Bonanate, 1979, p. 53). Thus, terrorism should be considered through the prism of aggressive actions that are directed at the civilian population of a separate country and are an element for conducting hybrid military operations. In this aspect, it is possible to say that terrorism is also a form of modern war.

The practice of countering the financing of terrorism by the world community underscores the fact that terrorist organisations seek to use the simplest, most accessible and understandable methods for transferring funds. A specific feature of the formation of financial resources by terrorist organisations is that the sources of funding can have both legal and illegal origin - criminal activity, drug trafficking, human trafficking, smuggling, corruption. Therefore, the concepts of “money laundering” and “terrorist financing” are often interconnected because individuals and organisations that finance terrorism carefully mask the real origin and direction of funds, which gives rise to the difficulty of identifying them. However, unlike “money laundering», which is aimed mainly at hiding the source of income, the main goal of persons involved in the financing of terrorism is primarily to hide the nature of the funded activities (Combating the Financing of Terrorism: Investopedia, 2020). Sources of funds that move through the financial sector, while they can be quite legal. Typically, the financing of terrorism includes not only financing terrorist acts as such, but also supporting a criminal infrastructure. Thus, the financing of terrorism involves not only the preparation and implementation of terrorist acts, but also support of their organisations to provide, promote ideology, recruit, train and train new members of the organisation, pay bribes, move between cities or countries, etc. In addition, part of the funds can be used to create the appearance of legitimate activities, in particular controlled structures engaged in commercial or credit financial activities (Financing of terrorism, 2020).

According to the study of criminal proceedings to investigate the facts of terrorist financing, the sources of terrorist financing activities in Ukraine are: funds from the aggressor state (72 %), funds from illegal business in Ukraine (19 %), funds from individual political forces (6 %), secret funds from international terrorist organisations (3 %). In the current situation, the threat of terrorist acts in public places, the destruction and damage of critical infrastructure, the commission of cybercrimes for terrorist purposes, and the capture of hostages for this purpose are increasing.

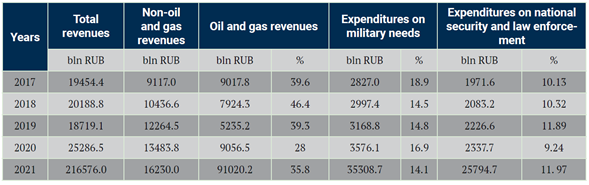

Another confirmation that Russia currently finances terrorism at the national level is that at the centre of all its mobilisation efforts, this country had the maximum possible accumulation of financial resources due to increasing energy exports to the EU member states and it further deprived these states of dependence on Russian oil and gas supplies. The quintessence of these efforts of the Russian Federation was to increase its spending on the defense and security sectors (see Table 1).

Table 1 Implementation of the State Budget of the Russian Federation by years and functional purposes in billions. Rubles (Ministry of Finance of the Russian Federation, 2022)

Financial support for terrorist and separatist activities can take place both through the direct transfer of assets, funds and weapons, and remotely, that is, using the services of the financial system (State financial monitoring, 2014, р. 13). It is possible that terrorist organisations and separatist movements independently ensure their existence in places where they have a particularly active presence through the exploitation of the local population, mining, processing and production assets in the region of presence. For example, in the temporarily occupied regions of Ukraine, enterprises are captured and operated, in particular, for coal mining. Other enterprises and the population are forced to pay so-called “taxes” collected by representatives of the occupiers, terrorist organisations and separatist movements.

In order to cover up the financing of terrorism, criminals can use a number of methods involving the use of financial infrastructure. Banks, non-banking institutions, charitable organisations, non-profit organisations and alternative systems of money transfer can be involved in financing terrorist activities. The movement of funds can be carried out both through international money transfer systems and through small regional payment systems. The development of new payment technologies, the ease and speed of financial transactions on a global scale, combined with a large number of unofficial (or semi-official) money transfer systems, create preconditions for the growing risks of using the financial system for financing terrorist purposes (Combatting the Financing of Terrorism: Investopedia, 2020).

Bank transfers from abroad deserve special attention. Cases identified by the subjects of primary financial monitoring and law enforcement agencies testify to the indisputable fact that international transfers aimed at financing terrorist and separatist activities in Ukraine originate in the territory of the Russian Federation. These transfers are carried out by both individuals and legal entities, private and even government agencies. There were also cases of international transfers by residents of the Russian Federation with crediting to the accounts of non-profit organisations registered and operating in the territory of Ukraine, funds classified as assistance, which were later to be used to carry out propaganda work in the territory of Ukraine to discredit the current government, provoke armed conflicts between different segments of the population of Ukraine and incite national hatred (State financial monitoring, 2014, р. 33).

The development of new payment systems increasingly attracts the attention of individuals and legal entities who wish to use cryptocurrency for financial transactions. Ukraine also became a participant in the use of virtual money. The legislative authorities of Ukraine should develop regulations for an effective system of control over the functioning of cryptocurrencies, which would make it possible to identify persons, control calculations, and combat the money laundering of the proceeds of crime and the financing of terrorism. Indeed, the above-mentioned problem is relevant for most countries of the modern world.

It should also be emphasised that the ways of financing terrorist organisations are evolving in parallel with the development of financial sector opportunities in the field of money movement, therefore, along with typical, well-established instruments, they may well be using those that involve complex cross-border multi-way schemes, the identification of which can be a difficult task for financial institutions. Often, financial institutions, primarily banks, act as the main intermediaries for financial transactions.

It is natural that in the case where such a significant share of the financial flows in the country moves through banks, the risk of financing terrorist activities using the banking sector should be considered as quite high. Important for effective counteraction to the financing of terrorism is the synergy of efforts and interaction of banks and non-banking financial institutions, the State Financial Monitoring Service, as well as law enforcement agencies. Ensuring the prompt exchange of information between the public and private sectors, between the financial sector and law enforcement agencies should become an integral element in building a strategy to combat the financing of terrorism (Thony, 2001).

We share V. Rysin’s position, that special emphasis should be placed in such cases on the procedure for investigating criminal offenses related to the financing of terrorist activities and the effectiveness of law enforcement agencies, because informing banks about suspicious financial transactions and stopping such transactions is insufficient if their initiators or beneficiaries are not prosecuted in the future (Rysin, 2020, p. 84). Particular attention should be paid, among other things, to identifying those persons within the composition of terrorist organisations that are engaged in the collection of financial resources. To do this, law enforcement agencies need, among other things, to concentrate their efforts on conducting investigations into the final recipients of funds as part of terrorist organisations, not only on discovering the sources of funds.

Thus, for Ukraine, the urgency of challenges and potential threats caused by international terrorism is growing, which is caused by the terrorist activities of mostly Russian-terrorist mercenaries and sabotage and reconnaissance groups, less often - by the expansion of Ukraine’s political, economic, humanitarian and cultural ties with the countries of the world where armed conflicts continue, the participation of the Ukrainian military contingent in peacekeeping operations. The foregoing encourages the further development of a system for ensuring anti-terrorist security, which would meet the standards of developed countries, in order to create an effective mechanism for preventing, responding to and countering terrorist threats.

At the end of this subsection, we note that, numerous war crimes committed by the Russian occupiers in Ukraine, as well as Russian missile attacks against the civilian energy infrastructure of Ukraine, illustrated the terrorist nature of the actions of the Russian Federation and prompted the European Parliament to adopt Resolution No. 2022/2896(RSP) dated November 23, 2022, according to which the Russian Federation is recognized as a state that sponsors terrorism and a state that uses the means of terrorism (European Parliament Recognized Russia as a state sponsor of terrorism, 2022). About €300 billion belonging to the Russian Central Bank has been frozen and may be transferred to Ukraine to stabilise its economy and cover war damages (Poleshko, 2022).

We consider such steps taken by the EU to be consistent with the resolution of the UN General Assembly regarding the payment of reparations by Russia in favour of Ukraine, adopted the previous day. The resolution calls for the development of a universal regime in the legal systems of the EU and its member states, which will allow recognising states as sponsors of terrorism and applying a wide range of restrictions to them, which may include at least: a ban on persons from the EU cooperating with state bodies and enterprises of the Russian Federation; strengthening control over supplies and transactions between persons from the EU and Russian counterparties; expansion of sanctions lists, as well as the possibility of introducing secondary sanctions.

Foreign experience in countering the financing of terrorism

The study of foreign experience in combating the financing of terrorism is a necessary condition for improving the national system of countering terrorism, reducing the level of terrorist threat in the territory of Ukraine, minimising the consequences of terrorist acts. Some foreign powers have made significant progress in the fight against terrorism and have developed highly effective anti-terrorist systems. The analysis of the principles and mechanisms of action of these systems will make it possible to identify certain recommendations on the prevention of terrorism in Ukraine.

One of the countries in the world that informally leads the fight against international terrorism is the United States of America (hereinafter - the United States). Therefore, it would be logical to start an analysis of the legislation of foreign countries with the legislation of the United States, of which the regulatory framework for the fight against terrorism is characterised by the presence of legislative acts on two levels: which operate throughout the country (federal) and in the territory of a particular state as an independent system. At the same time, the legal regulation of counteraction to the financing of terrorism is carried out exclusively at the federal level.

Regarding the types of material support and resources for crimes related to the financing of terrorism, the U.S. legislation includes the provision of any property or the provision of any services, including money or monetary instruments, securities and financial services, the provision of housing, professional advice, including training, the provision of forged documents, means of communication and maintenance, weapons, explosives, personnel and vehicles, with the exception of medicinal drugs and religious materials.

If we talk about the administrative aspect of countering the financing of terrorism, then in the United States there are Designated Foreign Terrorist Organisations, as well as Delisted Foreign Terrorist Organisations. The legislation of this country provides for a special extrajudicial procedure for recognising an organisation as a terrorist organisation, as well as strict control of financial transactions that may be associated with the financing and supply of material resources to such organisations. The following criteria have been identified by which an organisation can be Recognized as terrorist: the organisation is foreign; the organisation participates in terrorist activities or has the opportunity and intention to engage in such activities; The organisation’s activities threaten the safety of American citizens and the national security of the country. In accordance with US law, an organisation recognized as terrorist can appeal this decision within 30 days from the date of publication in the Federal Register.

Taking into account the positive experience of the United States and taking into account the need to take measures to systematise the materials for studying foreign experience in the fight against terrorism, proposals for the introduction of an article in the Law of Ukraine “On Combating Terrorism” should be recognized as appropriate, which should emphasise that “the degree of terrorist threat is determined in accordance with the five-point scale, and actions aimed at countering terrorism should correspond to the degree of terrorist threat” (Zharovska, 2019, p. 459).

The Anti-Terrorist Centre carries out a coordinating function in the activities of the subjects in the fight against terrorism, its financing, the prevention of terrorist acts against statesmen, critical objects of life support of the population, objects of increased danger, acts that threaten the life and health of a significant number of people, and their termination in Ukraine. Therefore, strengthening the role of this body is a necessary measure in the fight against any provocations of terrorism. The solution of this issue became especially relevant under the conditions of martial law introduced in Ukraine.

In order to strengthen the fight against the financing of terrorism, in December 2016, the European Commission presented a corresponding set of measures to strengthen border control, improve the Schengen information system (hereinafter - SIS), which provides for increasing control over the transportation of cash and gold when crossing borders. To increase the effectiveness of control over cash and bank cards sent by mail, customs authorities will receive more powers, it is proposed to introduce general rules to combat money laundering and eliminate funding sources for extremist organisations. In particular, it is proposed to include in the specified database information regarding persons suspected of involvement in terrorist activities and persons who are prohibited from entering the European Union. The EU also invites member states to provide Europol with unrestricted access to the SIS.

In view of the growing terrorist threat, some countries have changed their national legislation on counterterrorism, in particular, additional powers have been given to law enforcement agencies and special services in terms of counteracting the legalisation of funds obtained illegally, financing terrorism (Foreign experience in countering terrorism: conclusions for Ukraine, 2017).

More recently, France adopted the Law “On Combatting Terrorism», the provisions of which expand the powers of law enforcement agencies, in particular, regarding conducting searches at night, technical equipment for electronic surveillance, surveillance on the Internet of sites and publications that contain calls for terrorist attacks (The French National Assembly passed a law on the fight against terrorism, 2017). This legal document provides, among other things, for strengthening the fight against money laundering and the financing of terrorism, in particular, by banning the replenishment or use of bank cards that cannot be associated with an identified user (Foreign experience in countering terrorism: conclusions for Ukraine, 2017). 89 % of the surveyed respondents who are involved in combating the financing of terrorism recognise the prospects of using such a mechanism in Ukraine.

The new anti-terrorist law adopted in Poland in 2016 gives special services additional powers to counter terrorist threats, including the financing of terrorist acts (Foreign Experience in Countering Terrorism: Conclusions for Ukraine, 2017). The Law also provides for simplified access of special services to databases, as well as mandatory registration of prepaid telephone cards and quick access to personal data of persons suspected of money laundering and terrorist financing. (Antiterrorism law in Poland, 2022).

The Counter-Terrorism and Security Act, which came into force in the UK in 2015, provides for the power of law enforcement agencies to temporarily request documents if a suspect intends to travel to another country for terrorist purposes, including money laundering (Foreign Experience in Countering Terrorism: Conclusions for Ukraine, 2017).

Evaluation of legislative initiatives and practical measures in the context of the implementation of the EU’s best world practices in the field of combating terrorism shows that the fight against the financing of terrorism is characterised by the adoption of regulations that take into account the need to criminalise all socially dangerous manifestations of terrorist activity, strengthening international and interdepartmental cooperation between special services and law enforcement agencies, strengthening control over crossing state borders and countering the financing of terrorism. A comprehensive approach to counter-terrorism is one of the determining factors for successfully confronting the terrorist threat in general and financing terrorist activities in particular.

The fight against money laundering obtained by criminal means became the cornerstone of efforts to combat serious crimes at the world level at the end of the last century. One of the effective means of combatting these negative manifestations is primary financial monitoring, the purpose of which is to identify, prevent and prevent possible violations in the financial activities of business entities in accordance with the standards established by the acts of financial law.

A necessary step towards solving this urgent problem is the formation, both in the world as a whole and at the national level, of coordinated approaches and regulation of interstate relations in the field of combating money laundering. In such circumstances, it is extremely important to use advanced foreign methods in the field of law and economics in order to develop such mechanisms for implementing legislation in the field of prevention and counteraction to the legalisation of proceeds from crime and the financing of terrorism.

Let us focus on the general analysis of the developments of the post-Soviet countries, which, taking into account the spread of the facts of using the imperfection of the credit and banking system for the purpose of money laundering and terrorist financing, have developed separate anti-legalisation tools to counteract this negative phenomenon. First of all, we are talking about financial intelligence units, which are usually entrusted with three main functions - the formation and implementation of state policy in the field of prevention and counteraction to the legalisation (laundering) of proceeds from crime and the financing of terrorism; collection, procession and analysis of information on financial transactions subject to financial monitoring; creation and ensuring the functioning of the state information system in this area (that is, information support of the anti-legalisation system).

The mechanism for organising financial intelligence units can be submitted within the general categories: administrative, law enforcement, judicial/prosecutorial and mixed types (Zelenetskyi & Yemelyanov, 2007, рр. 509-510). Such a division is conditional and does not claim categoricality.

Administrative-type financial intelligence units are part of an administrative body that does not belong to the system of law enforcement or judicial bodies, or operate under its supervision and, as a rule, operate within either a separate department or an agency whose significant issues of activity are under the control of the executive body. The main reason for using such a mechanism is the creation of a “buffer” between the financial sector and law enforcement agencies responsible for investigating financial crimes of a terrorist nature.

In some countries, the emphasis on law enforcement aspects of the activities of financial intelligence units led to the organisation of these units within the structure of the law enforcement agency, since it was the easiest way to form a body with appropriate law enforcement powers without the need to create a new institution. In operational terms, with such an organisation scheme, such subdivisions should interact with other law enforcement agencies and will be able to use the sources of information they have. In such circumstances, the information obtained by the financial intelligence unit will become more accessible to law enforcement agencies and can be used for investigation, which increases its value. The exchange of information can also facilitate the use of existing national and international networks for the exchange of relevant information. Also, financial intelligence units of this type do not need to be endowed with special powers by law, since they implement the function of an independent law enforcement agency, including the right to block operations and seize assets, which is dictated by the need to facilitate the timely exercise of law enforcement powers.

Some scholars rightly highlight the shortcomings of law enforcement-type financial intelligence units: the tendency to pay more attention to investigations rather than preventive measures; law enforcement agencies are not natural partners of financial institutions; the need to establish mutual trust, which may take some time. In addition, law enforcement agencies may not have sufficient qualifications in finance necessary to conduct such a dialogue; financial intelligence units usually do not receive data on cash currency transactions in excess of a specified fixed amount; to gain access to the data of financial organisations (except for operations for which information was provided), it is necessary to conduct a formal investigation; reporting agencies may be reluctant to share information with law enforcement agencies if they are aware that this information can be used in the investigation of any crime (and not just money laundering and terrorist financing). Reporting agencies may also be reluctant to share information about transactions that are nothing more than “suspicious” to law enforcement agencies (Zelenetskyi & Yemelyanov, 2007, рр. 515, 516).

Judicial or prosecutorial-type financial intelligence units are usually created by the prosecutor’s office, less often by the judicial branch of government. Examples of such an organisation are found in countries with a European continental legal tradition, in which public prosecutors are part of the judicial system, and their powers also extend to investigative bodies, which allows them to manage and supervise criminal investigations. Mixed-type financial intelligence units cover units that combine the different schemes of the organisation described above and are an attempt to take advantage of the simultaneous use of all its elements. Some units combine the characteristics of financial intelligence units of administrative and law enforcement types, others at the same time have the powers of both the customs authority and the police. In some countries, this is the result of the merger of two different anti-money laundering agencies (Zelenetskyi & Yemelyanov, 2007, р. 518). We share the position of 79 % of the respondents we surveyed regarding the advisability of creating in Ukraine, as a country with a continental legal system, similar units of mixed-type financial intelligence, the effectiveness of which can be invaluable in the conditions of martial law introduced in Ukraine.

Thus, the use of advanced foreign experience, the introduction of thorough scientific research in the practice of national law enforcement agencies, as well as other state structures involved in the process of combatting money laundering and financing terrorist activities, can become the key to an effective system of prevention of and counteraction to terrorism in Ukraine, including its financing and the legalisation (laundering) of proceeds from crime.

National mechanisms to counter the financing of terrorism

The Law of Ukraine “On Combatting Terrorism” establishes that the main body in the national system of combating terrorist activities is the Security Service of Ukraine. Other entities that, within their competence, carry out the fight against terrorism are: the Ministry of Internal Affairs of Ukraine, the National Police, the Ministry of Defense of Ukraine, central executive bodies that ensure the formation and implementation of state policy in the field of civil protection, the central executive body that implements the state policy in the field of protection of the state border, the central executive body that implements the state policy in the field of criminal execution punishments, the Department of State Protection of Ukraine, as well as the central executive body that implements the state tax policy, state policy in the field of state customs affairs. Central and local executive authorities, local governments, enterprises, institutions, organisations, regardless of subordination and form of ownership, their officials, as well as citizens with their consent, may be involved in the implementation of measures related to the prevention, detection and termination of terrorist activities (On the fight against terrorism. Law of Ukraine, 2005).

Among the normative legal acts regulating relations in the field of counterterrorism, one of the leading places is occupied by the Law of Ukraine “On Prevention and Counteraction to Legalisation (Laundering) of Proceeds from Crime, Financing of Terrorism and Financing the Proliferation of Weapons of Mass Destruction», which was adopted to ensure the protection of the rights and legitimate interests of citizens, society and the state, ensuring national security by determining the legal mechanism for counteracting legalisation (laundering) of proceeds from crime, terrorist financing and financing of proliferation of weapons of mass destruction, as well as the formation of a national multi-source analytical database to provide the law enforcement agencies of Ukraine and foreign countries with the opportunity to detect, verify and investigate crimes related to money laundering and other illegal financial transactions (On prevention and counteraction to legalisation (laundering) of proceeds from crime, terrorist financing and financing of proliferation of weapons of mass destruction. Law of Ukraine, 2014). The law provides for the conditions and procedure for “freezing” the assets of international terrorist groups and persons associated with terrorist activities, as well as the confiscation of such assets, which, in our opinion, makes it possible to include these measures on the list of the most effective means of combating international terrorism (On prevention and counteraction to legalisation (laundering) of proceeds from crime, terrorist financing and financing of proliferation of weapons of mass destruction. Law of Ukraine, 2014).

At the same time, in our opinion and in the opinion of 69 % of the surveyed authorised entities involved in counteracting the financing of terrorism, the provisions of this Law require clarification regarding the possibility of suspending the financial transactions of organisations recognized as terrorist in Ukraine. This problem arose in view of the transformation of the nature of the terrorist threat in Ukraine, as well as due to the unsettled nature of the relevant procedure. It seems extremely important that the National Security Strategy of Ukraine, approved by the President of Ukraine on September 14, 2020, states that for the systematic protection of Ukraine from threats to national security, it is necessary to develop the security and defense sector. In particular, to prevent, detect in a timely manner external and internal threats to the country’s security and prevent them, stop intelligence, terrorist and other unlawful encroachments of special services of foreign states, as well as organisations, individual groups and persons for the state security of Ukraine and eliminate the conditions that contribute to them and the reasons for their occurrence (Decree of the President of Ukraine № 392/2020, 2020). One of such threats is the financing of terrorism, for the commission of which criminal liability is provided, as defined by Article 2585 of the Criminal Code of Ukraine (Criminal Code of Ukraine. Law of Ukraine, 2001).

Today, part one of Article 24 of the Law of Ukraine “On Combatting Terrorism” establishes that an organisation responsible for committing a terrorist act and recognized as terrorist by a court decision is subject to liquidation, and its property is confiscated (On the fight against terrorism. Law of Ukraine, 2005). The basis for making such a decision, as follows from the law, is the need for a court decision to recognise the organisation as terrorist. At the same time, the legislation does not define the conditions under which an organisation is recognized as terrorist and does not provide for the synthesis and disclosure of data on organisations recognized as terrorist.

An organisation should be recognized as a terrorist organisation regardless of the presence or absence of the organisational and legal form provided by law, the status of a legal entity, its registration by authorised bodies of Ukraine or other states.

It should be noted that one of the Draft Laws proposes to introduce a list of organisations recognized as terrorist, and to impose an obligation on their formation and conduct to the Security Service of Ukraine, to establish the powers of the Cabinet of Ministers of Ukraine to determine the procedure for their conduct. In turn, it is proposed to establish thatthe activities of an organisation recognized as terrorist in the territory of Ukraine are prohibited. Inclusion of an organisation on the list of terrorist organisations is the basis for the confiscation of the property and assets of such an organisation by authorised bodies (Draft Law № 5872, 2021). However, until now, the corresponding changes to the current legislation have not been made.

In our opinion and in accord with the conviction of 75 % of the surveyed subjects of combatting the financing of terrorism, maintaining and publishing lists of organisations recognized as terrorist in accordance with the procedure established by law will be not only a powerful means of countering terrorist activities and their financing, but it is also an important tool for communication between the state and society, as it will provide an opportunity to publicly certify the connection of an organisation with illegal activities.

We also propose to amend the paragraph to Article 1 of the Law of Ukraine “On Combatting Terrorism», defining in its paragraph 21 that “an organisation is recognized as terrorist if at least one person who is a member or has a connection with this organisation carries out terrorist activities, if this activity is covered by the intent of at least one of the organisers or leaders (governing bodies), or the ultimate beneficial owner». In addition, Art. 24 of the afore-mentioned Law should determine that “an organisation is recognized as terrorist by a court decision on the pleading of a person guilty of criminal offenses provided for in Articles 258-2585 of the Criminal Code of Ukraine, which has entered into force, provided that the signs of a terrorist organisation are established in accordance with paragraph 21 of Article 1 of this Law». The introduction of such changes to the legislation was positively received by 81 % of the surveyed subjects of combating the financing of terrorism.

Ukrainian legislation stipulates that in order to recognise an organisation as a terrorist organisation, an appropriate court decision must be made. However, the relevant legal mechanism is not defined either by the Law of Ukraine “On Combatting Terrorism” or by any other regulatory document. The unresolved nature of this issue does not make it possible to implement certain provisions of the legislation on counteracting the financing of terrorism, detecting, arresting and seizing financial and other assets of organisations and persons associated with terrorist activities. The recognition in accordance with the established procedure of illegal armed groups of the so-called “DPR/LPR” as terrorist organisations will create understandable grounds to the international community for freezing the accounts and assets of such organisations and persons involved in their activities, establishing a ban on contacts with their leaders and other sanctions. In addition, it will strengthen Ukraine’s position in the International Court of Justice, as well as in negotiations with other states and international organisations on Russia’s violation of the requirements of the International Convention for the Suppression of the Financing of Terrorism of 1999 (Reznikova et al., 2017, p. 54).

In the current period of development of the national system of counteraction to the legalisation of proceeds from crime, the financing of terrorism is characterised primarily by certain qualitative changes in the regulatory framework governing this area. The new Law of Ukraine “On Prevention and Counteraction to Legalisation (Laundering) of Proceeds from Crime or Financing of Proliferation of Weapons of Mass Destruction”, agreed with the updated Financial Action Task Force on Money Laundering standards in 2014 and allowed Ukraine to completely fulfil its obligations to the world community at the present stage of development.

First of all, it should be noted that the Verkhovna Rada of Ukraine approved as a whole Draft Law No. 8008 regarding the protection of the financial system of Ukraine from the actions of the state that carries out armed aggression against Ukraine (Draft Law № 8008, 2018). In particular, transactions involving companies registered in the Russian Federation, regardless of the amount of the transaction, will be subject to financial monitoring. Also, in accordance with the adopted law, citizens of the Russian Federation are prohibited from heading Ukrainian banks, and lawyers and law firms are obliged to establish a high risk of business relations for clients associated with the Russian Federation (Mamchenko, 2022).

At the same time, we have to state that institutional support for the process of combating the legalisation of funds and the financing of terrorism in Ukraine remains a weak link in the national countermeasures system and has some drawbacks. The most significant should be attributed to lack of effective control by state regulators over the implementation by the subjects of primary financial monitoring of the provisions of national legislation; frequent disregard of established procedures in the banking system and, as a result, large-scale use of banks in criminal money laundering schemes; lack of established interdepartmental cooperation between the state financial monitoring service and law enforcement agencies; lack of cooperation between law enforcement agencies and the judiciary; lack of a procedure for the return of proceeds from crime due to the legalisation of funds or the financing of terrorism exported abroad. It is worth noting that to date, the use of electronic payment systems for monetary transactions has become widespread, one of which is the Bitcoin payment system, which is formed by complex chains of interactions between a huge network of computers around the world, and is not backed by a government or a central bank, unlike traditional currencies (Ten arrested in Netherlands over bitcoin money-laundering allegations, 2016). The presence of problems with the non-regulation of cryptocurrency payments can cause a significant blow to the economic security of states.

According to the clarification of the National Bank of Ukraine regarding the legality of the use of the Bitcoin cryptocurrency in Ukraine, the NBU considers it a monetary surrogate that does not have real value and cannot be used by individuals and legal entities in the territory of Ukraine as a means of payment, as this contradicts the norms of Ukrainian legislation. The use of Bitcoin cryptocurrency involves a high risk associated with the service, transaction or supply channel, including the anonymity of the transaction (which may involve cash) (Clarification regarding the legality of the use of the “virtual currency/cryptocurrency” Bitcoin in Ukraine, 2014). It is obvious that the rapid spread of such payments and failure to take timely countermeasures may have negative consequences, namely: tax evasion; non-controllability of the execution of financial transactions by the government by the subjects of this payment system; the use of the Bitcoin cryptocurrency for laundering the proceeds of crime and financing terrorism, etc.

Ukraine also became a participant in the use of virtual money. The legislator of Ukraine should develop regulations for an effective system of control over the functioning of cryptocurrencies, which will make it possible to identify persons, control calculations, and combat the money laundering of proceeds of crime and the financing of terrorism. Such conclusions are correlated with the point of view of 83 % of the persons we interviewed, involved in activities in the field of combatting the financing of terrorism.

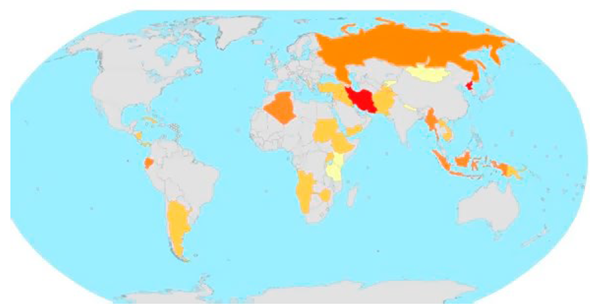

Particular attention in counteracting the financing of terrorism at the global level requires the use of international influence on this negative phenomenon. In countries that have gaps in financial regulation and where adequate anti-money laundering measures are not taken, the Financial Action Task Force to Combat Money Laundering (hereinafter referred to as the FATF) is included on the so-called “black list», to remain on this list leads to an extremely low level of trust from foreign investors. Today, the list of such countries includes North Korea (Democratic People’s Republic of Korea) and Iran (See Figure 1, Babenko, 2022).

Figure 1 The map shows the countries from the FATF blacklist in red, the countries that can be included on it in orange (Babenko, 2022; information as of December 25, 2022)

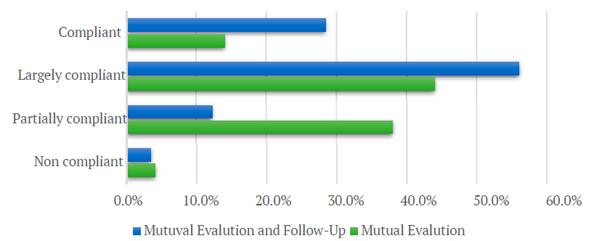

It should be noted that the FATF is the most influential international organisation in the field of countering the financing of terrorism and the proliferation of weapons of mass destruction. The FATF closely monitors countries’ progress in improving compliance with the FATF 40 Recommendations using the follow-up process. As part of that process, FATF members regularly report their progress toward addressing identified deficiencies. Countries can request a re-rating of their technical compliance with any recommendation rated noncompliant (NC) or partially compliant (PC) in the mutual evaluation (figure 2). FATF considers these requests and whether the country has made sufficient progress to merit a re-rating (FATF. ANNUAL REPORT 20202021).

Figure 2 2020-2021 Technical compliance ratings after re-assessment compared to mutual evaluation report

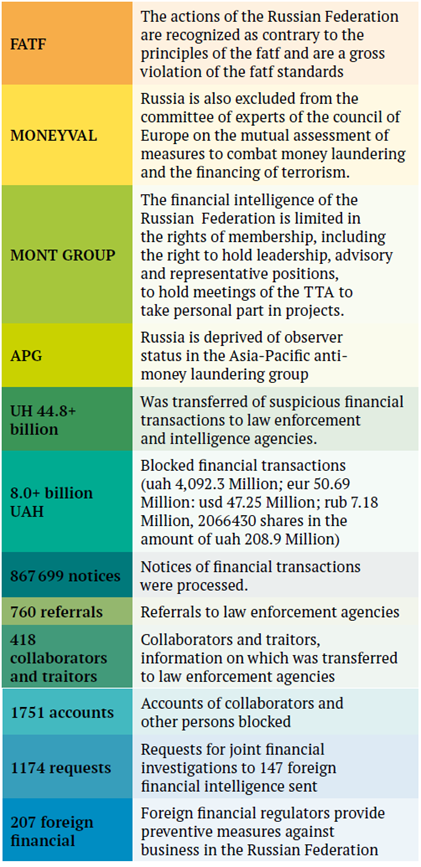

At the end of 2022, the State Financial Monitoring Service of Ukraine sent the FATF and the Egmont Group of Financial Intelligence Units new facts regarding the Russian Federation’s terrorist acts and the use of weapons of mass destruction during the war, demanding that Russia be included on the sanctions list as a terrorist state. The measures taken by the FATF, which Ukraine insists on (for example, closing all correspondent accounts and placing limits on all transactions with all Russian banks, and not only the sanctioned ones), can increase economic pressure on the aggressor country and how this will affect Russia’s ability to pay its military expenses. Particularly useful here are the FATF’s efforts to counter attempts to circumvent the sanctions imposed, as well as to track the mechanisms and sources of terrorist financing, taking into account future trials to establish the involvement of Russian individuals and organisations in the war in Ukraine. Proof of such involvement would mean the possibility of arrest and confiscation of their assets to pay reparations.

Currently, the EGMONT GROUP has imposed unprecedented sanctions on the Russian Financial Intelligence Unit - Rosfinmonitoring. In particular, the following sanctions were agreed upon Rosfinmonitoring’s participation in cooperation with EGMONT GROUP: to deprive the right to hold meetings; deprive of the opportunity to occupy formal leadership, advisory and representative positions, as well as the privilege to physically attend meetings and the opportunity to participate in projects; terminate the contract for the provision of material support, suspend the fulfilment of corporate obligations on the basis that payments will resume after the end of the current crisis (See Figure 3; Russia’s financial intelligence was cut off from the civilised world, 2022).

Figure 3 Measures taken by the state service of financial monitoring of Ukraine at the international level in wartime conditions regarding the counterfall of Russian aggression (Paziy, 2022; information as of December 16, 2022)

In general, we affirm that Ukraine’s use of the scientific material and practical experience accumulated by the world community in the course of further improvement of the national system of counteraction to the legalisation of proceeds from crime and the financing of terrorism is crucial, since it significantly accelerates the integration process of the state into the international system of cooperation and mutual assistance in the fight against this negative, one of the types of transnational criminal activity. In this context, the analysis of the Ukrainian system of counteraction to the legalisation of proceeds from crime, the financing of terrorism made it possible to identify and evaluate the main trends and directions in its development, indicate the existing shortcomings and develop mechanisms for improving the analysed system at the legislative and administrative levels.

Conclusions

Russia’s military invasion of Ukraine, which transformed into a full-scale war, became a catalyst for the functioning of terrorist organisations, which reformulates the task of combatting their financing and requires effective preventive measures to control financial flows.In the context of complying with the requirements of the legislation, financial institutions should focus their activities on applying a risk- oriented approach in the process of identifying and verifying clients, monitoring their transactions, timely identifying and blocking financial transactions that are suspected to be related to the financing of terrorism. Important for establishing obstacles to the movement of funds to terrorist organisations is the establishment of financing schemes for terrorist organisations, the financial instruments they use, the establishment of an operational exchange of information between the financial sector and law enforcement agencies, as well as cooperation with the authorities responsible for the fight against terrorism in other countries.

An important component of the toolkit for combatting terrorist financing is the regulatory framework, which should determine an exhaustive list of cases of recognition of an organisation as terrorist and the procedure for such recognition as well as the procedure for maintaining and publishing lists of organisations recognized as terrorist organisations in accordance with the procedure established by law.

At the international level, it is necessary to recognize the current political regime in the Russian Federation as terrorist, strengthen the work of the FATF in the fight against the financing of terrorism and the parallel efforts of the International Monetary Fund, the World Bank, the European Union and the United Nations as well as ensure a comprehensive system of responsibility of the Russian Federation from the point of view of its violation of the requirements and norms of international law, in particular by creating a special tribunal and the creation of a comprehensive system of compensation related to the act of aggression against Ukraine.

The basis of state policy in the field of combatting terrorism during the period of martial law and in the post-war period in Ukraine should be the development of the Strategy for Combatting Terrorism in Ukraine, which should take into account both the best world practices and the modern realities of waging war in the conditions of supporting terrorism with financial infusions. This proposal was supported by the absolute majority (94 %) of respondents involved in activities in the field of counter-terrorism. Among the urgent tasks in the field of improving the state system of combatting the financing of terrorism in Ukraine, which should be reflected in the afore-mentioned Strategy, the following should be noted, in particular:

Activation of international cooperation in the field of combatting terrorism and preventing its financing (Mutual recognition of lists of individuals and legal entities recognized at the national level as involved in the financing of terrorist activities and the freezing of their assets in the territories of all states; conducted by states of mutual assessments, consultations and mutual provision of technical assistance in the fight against the financing of terrorism, etc.);

Simplification of the procedure of implementation into national legislation of international legal norms in the fight against the financing of terrorism and ensuring at the national level a mandatory reaction to the resolutions of the Security Council of the United Nations;

Establishment of cooperation between subjects of the fight against the financing of terrorism at the international and national levels;

Definition and improvement of the directions of interaction between the state and society in the course of the implementation of the main tasks of state policy in the relevant field (ensuring public awareness of the sources of terrorism financing; the procedure for detecting suspicious transactions with financial resources; developing the latest ways of involving citizens to participate in countering the financing of terrorism etc);

Improvement of information and scientific support for the activities of state bodies involved in the fight against terrorism and its financing.

In order to provide adequate financial support for the implementation of measures, the Anti-Terrorism Strategy requires the adoption of the State target programme for combatting terrorism, which must determine the state customer, the amount of financial and logistical support for the implementation of specific measures.

We emphasise that the proposed directions concern only the organisational and legal aspect of the fight against the financing of terrorism and they are not exhaustive. Along with measures in the legal sphere, states should cooperate in both the economic and political spheres and apply appropriate measures for this to best ensure the fight against terrorism and its financing at the international and national levels.1