1. Introduction

Recently, small and medium-sized enterprises (SMEs) have managed to position themselves as the answer to the problem of low economic growth in developing countries (Classen, Carree,Van Gils & Peters, 2014); this thanks to its great potential as generators of employment, drivers of progress in the local environment, and its flexibility to become an important complement to the work of large companies, which is why it has been considered a dynamic business sector with greater potential for productive development (Cardona, Rada & Hernández, 2017). In this sense, the characteristics of SMEs provoke in them a necessary role to achieve accelerated growth of the Colombian economy, a situation that has contributed to the fact that, at present, SMEs are constituted as indispensable when it comes to projecting themselves as one of the best options to achieve the full reactivation of the country's economic development, even with the shortcomings that still persist (Niebles, Niebles & Barrios, 2019).

By virtue of the foregoing, Colombian SMEs develop their productive activity in the midst of a paradox (Escandón & Hurtado, 2014); since, their contribution to the economy is unquestionable, however, they constantly face conditions and environments that diminish their competitiveness and do not allow them to be the engine that dictates their potential, especially in times of economic downturn (Aya Pastrana & Sriramesh, 2014) (De La Ossa Guerra Niebles, Hernández, Santamaria, & Niebles, 2019). In this regard, the National Administrative Department of Statistics (DANE, 2016) reported that this segment of companies, which represents more than 90% of the national productive sector, is responsible for 35% of the Gross Domestic Product (GDP), in addition to generating 80% of national employment; however, its production capacity is restricted by various internal and external factors.

In this sense, the Great SME Survey (ANIF, 2018), conducted by the Cámara de Comercio de Bogotá, revealed several of the shortcomings suffered by SMEs in the country, consequently establishes, in the first place, the use of a very short term vision of their owners and managers, evidenced from the very little planning of their business in horizons greater than six months or a year, which ends up reducing their chances of growth. Additionally, it was noted that in this type of companies, the priority is to address the issues of day to day, leaving aside issues that can make a difference in the markets, such as the generation of added value. A third factor that affects SMEs is the low level of market diversification, partly derived from the two previous aspects, since without the opportunity to self-evaluate and draw up adequate strategic guidelines, the task of market penetration and sustainability becomes even more difficult (ANIF, 2018).

On the other hand, the non-internationalization of SMEs is another factor that affects their development (ANIF, 2018); in this sense, the lack of investment, the non-compliance with quality standards, the lack of knowledge of the market, the absence of qualified personnel in the area of trade, and the fear of looking at different markets, continues to affect these organizations considerably (Hurtado and Escandón, 2016). In this regard, Segura and Manzanilla (2015) state that SMEs lack the necessary financial means and knowledge, which makes them prone to non-compliance with regulatory requirements. In line with the foregoing, another latent threat is the lack of knowledge of the financial area on the part of the owners, since not everyone has sufficient training or knowledge in the subject and incur involuntary errors that affect different levels of the organization, such as price fixing, deficiencies in administrative procedures, or erroneous calculations of profitability, and consequently, increases the difficulty to achieve the sustainability of the company in time (ANIF, 2018).

On the other hand, there is a problem regarding information systems, since it was observed that without information it is difficult to know what the real and current situation of the company is, nor to define where the company's business strategy should be directed (Franco, De Fátima, Ramalho & Nunes, 2014) (Marulanda, López & López, 2016). The SMEs cannot be indifferent to this reality, since when being constituted as legal person, they are obliged to maintain an adequate accounting, reason why it is essential to count on the safeguard of the information with the purpose of generating reliable, understandable, real reports that contribute in the taking of correct decisions (Saavedra, Tapia & Aguilar, 2016). In this sense, it was observed that SMEs often, in the face of difficulties, leave information systems aside without considering that an organized and timely accounting information would allow them to be better managed, would facilitate their access to credits, and would help them to calculate taxes correctly (ANIF, 2018).

As observed, these challenges reflect an ostensible reality related to the difficulty of formalizing a new SME and its multiple threats to survival (Hernández, Marulanda & López, 2014). Faced with this scenario, the challenges for these companies are diverse, especially those related to survival and growth in a market that is increasingly demanding in terms of productivity and competitiveness, to the extent that they must bear significant tax burdens, labor costs and lack of labor flexibility; and consequently it is necessary for the country to generate the necessary tools to achieve the strengthening of the institutional framework for productive development and promote the consolidation of the processes of SMEs themselves (Jiménez et al., 2018).

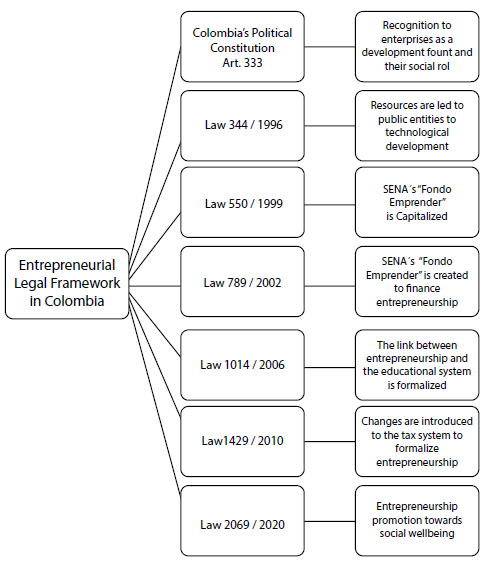

Although, in a country like Colombia, the emergence and consolidation of companies is not a priority for the national government, it is essential to develop strategies that contribute to the strengthening of this type of projects, for example by designing a business plan that allows them to expand the short-term perspective inherent to the majority of SME entrepreneurs, who start their activity with expectations that are not entirely viable, and who end up becoming disillusioned as time goes by (Mora-Riapira, Vera-Colina & Melgarejo-Molina, 2015). Even though the complicated context of the country around entrepreneurship, it is remarkable the articulation of two laws: the "2069 de 31 de diciembre de 2020" law and the "1014 de 2006" law which support the entrepreneurship culture in Colombia, but it is important from the government entities to encourage these economical activities more often with the legislative power. In this sense, Figure 2 provides a clearer view of the most important legal implementations along the last 25 years which were the basis to the entrepreneurship culture of nowadays' Colombia.

To understand the legal framework that underpins entrepreneurial activity in Colombia, it is essential to address in the first instance Article 333 of the Political Constitution of Colombia, where the importance of the productive sector for the development of the nation is established, recognizing business as a basis for development and well-being; Then the "Ley 344 de 2996" stipulates the directing of 20% of the resources of the national learning service (SENA), which allowed an inter-institutional relationship towards the development of the business sector in the country. Similarly, the "550 de 2999" and the "ley 789 de 2002", are the laws which address the capitalization of the "Fondo Emprender" from SENA and its creation respectively; this fund is currently one of the main sources of financing for enterprises in the country which is accompanied by a program of accompaniment of experts in business incubation.

Then, in 2006, Law 2024 appeared, which stipulates the linking of entrepreneurship subjects at the various levels of the educational system in order to create an entrepreneurial culture from education. In this way, the "Ley 1429 de 2010" proposed tax changes seeking to promote entrepreneurial activity in the country. Finally, in recent years the "Ley 2069 de 2020" is highlighted for presenting the promotion of an entrepreneurial culture in Colombia.

In view of the foregoing, the preparation of this document seeks to break down the regulatory frameworks that allow for the operational development of SMEs in Colombia; to this end, the operational, environmental, labor, and economic-financial frameworks are presented, with the purpose of generating a methodological tool that contributes to the promotion of the success of Colombian small and medium-sized enterprises.

2. Scenario of Entrepreneurship in Colombia

According to figures from Comfecámaras (2019b), 328,237 production units were created in 2018, of which 69,283 were companies and 258,954 consisted of natural persons, representing a growth of 0.8% with respect to 2027; on the other hand, the incorporation of companies fell by 2.4%, from 70,247 to 69,283, while the enrollment of natural persons increased by 2.4%, from 255,280 to 258,954. The above represents, for the president of that entity, a strengthening of the conditions for the development of business activity that motivates the effort of the Chambers of Commerce of the country to support entrepreneurship and business formalization, because of its benefits to the productive sector. To be constituted as a company in Colombia is a quite simple and economic process, thanks to the simplification of procedures established for the creation of new organizations, so that it is possible to carry out the procedures directly without the need of intermediaries, even so elaborating a previous analysis of the different ways of organizing internally a company and its particular normative (Pena, Bravo, Alvarez & Pineda, 2011). It is important to highlight that the data presented in the investigation are not completely reliable, due the fact that the number of businesses varies from organization to organization and their own database.

One of the initiatives that has managed to facilitate and promote the processes of creation and constitution of companies, by simplifying procedures, has been the implementation, by the Chambers of Commerce of the country, of the Business Attention Centers (CAES); this new system has generated a more efficient relationship between new companies, public administration and private entities that are part of the process of creation of companies, benefiting the new entrepreneur with the reduction of the need to address different instances, thus achieving reduction of time and costs in the formalization of their business (Comfecamaras, 2019a).

The decision to constitute a company represents a very important step, since, in general, the new organization becomes an option of an integral life, where it is important to know which are the strengths and weaknesses with which one counts, the motivation that leads to the entrepreneurship, and its missionary objective, considering the areas of interest of the entrepreneur and the resources with which it counts. The constitution of companies, from business ideas, also has support entities for different aspects related to promotion, promotion and development, and integral support for the creation and financing process; this is how some of these entities are the Chambers of Commerce; Fondo Emprender del Servicio Nacional de Aprendizaje (SENA); Innpulsa, from the Ministry of Commerce; technological development centers; business incubators; universities; foundations and groups of private investors. By virtue of the above, the main steps to follow in order to constitute a company in Colombia are outlined.

Step 1: Define the legal form of the company to be incorporated

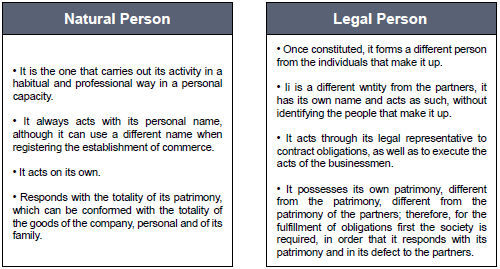

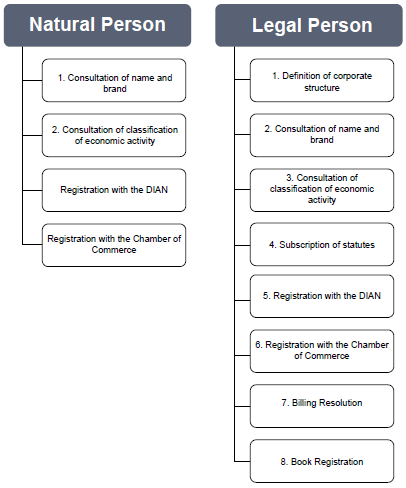

An organization can be made up of two types, such as a natural person or a legal person, and their choice depends on the characteristics of the partners and the level of responsibility they wish to assume in the face of obligations; Therefore, the main characteristics of each legal figure are listed (Figure 2) (ANIF, 2018).

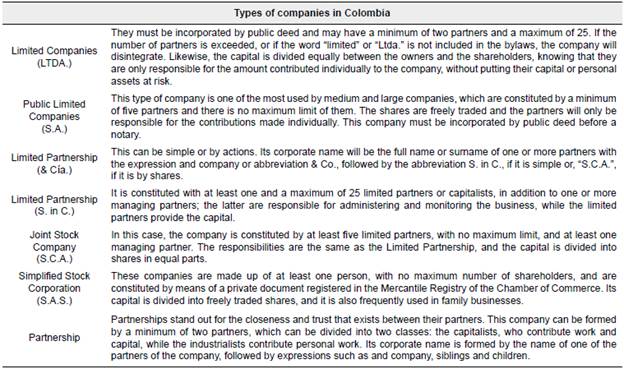

In agreement with what is expressed in the previous graph, it is important to highlight that for companies of natural persons, the total responsibility for the fulfillment of the obligation's rests with the owner; while in companies of legal persons, responsibilities are assumed according to the type of company chosen. In this sense, legal entities must define their corporate structure or type of company, in addition to the number of people with whom they will be involved in the project, since they can be formed by a single owner or by several partners. This type of company is regulated by the Colombian Commercial Code, in addition to special laws, such as the one that gives rise to Simplified Public Limited Companies (SAS), which provide the legal basis to achieve effectiveness in the process of incorporation of societies. without incurring in legal problems that complicate the process (AGT Abogados, 2017); As a consequence of this and in order to provide greater clarity in the selection of the type of company, the following table is presented (Escuela para Emprendedores, 2018).

Table 1 then presents important information in relation to the main characteristics of the different types of companies, around criteria such as name, number of partners, distribution of shares and responsibility of their owners.

Step 2: Consult name and brand

Once the previous step has been assorted, the availability of the company's name must be verified before the Chamber of Commerce, in order to ensure that it is not previously registered. According to the portal encolombia.com (2018), this check ensures the conservation of the principle of homonymy, defined by the premise of a single establishment with a single name, so they recommend doing this verification also in the Unique Business Register (RUE), which has control of the registries at the national level. Also, in a complementary manner, it is recommended to carry out the consultation of trademarks and patents.

Step 3: Identify the classification of economic activity

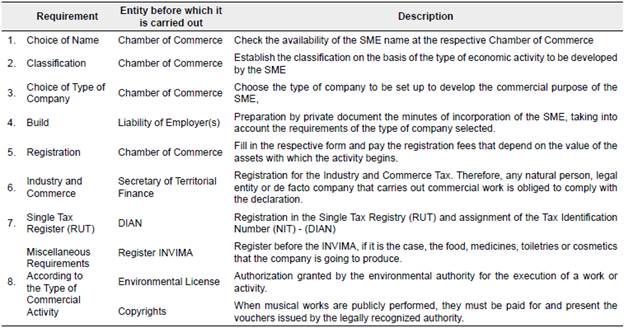

The economic activities in the country are classified according to the ISIC code, elaborated by the United Nations (UN), revised by the DANE, which governs the Chambers of Commerce from the year 2000 (Cámara de Comercio de Bogotá, 2012). In accordance with this, Table 2 presents the requirements for the establishment of company statutes (Corporación Cres, 2018).

Table 2 Requirements for the establishment of statutes

| Natural Person | Legal Person |

|---|---|

| Not applicable | Prepare, draft and subscribe the company's bylaws in public deed or private document depending on the type of company. This is the contract that will regulate the relationship between the partners; and between them and the company. |

Source: Own elaboration, 2019

The establishment of the statutes is very important for the incorporation of companies as they determine the rules of the game of the partners, so special attention must be paid to their proper definition.

Step 4: Register with the DIAN

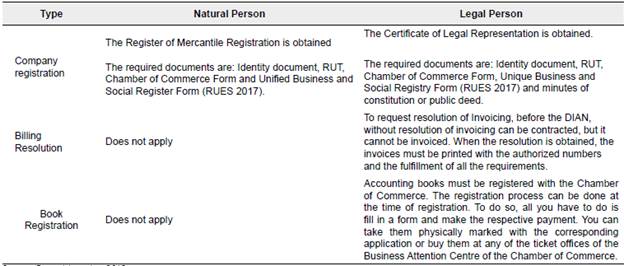

This step consists of processing the Single Tax Registry (RUT), which consists of the national database maintained by the Tax Administration of taxpayers, which includes their basic information for statistical and control purposes. With the RUT, each taxpayer is assigned a Tax Identification Number (NIT), with which he or she will be identified before the Directorate of National Taxes and Customs (DIAN) and other entities; this procedure may be carried out in the entity's offices or, virtually, through the DIAN website, www.dian.gov.co. Finally, a copy of this registration must be submitted to the corresponding Chamber of Commerce in order to complete the registration and registration procedures (encolombia.com, 2018); the steps for this and other additional registrations are presented in Table 3 (ANIF, 2018).

The registration of the company, the billing resolution and the registration of books are necessary requirements for the conservation of the operational data of each organization and contribute to the evolutionary analysis of Colombian SMEs, hence the importance of carrying out not only the appropriate procedures but also providing accurate information. Apparently, clear differences can be observed between the procedures corresponding to the formation of a company with a natural person and one with a legal person, since the very nature of the organization frames some responsibilities that must be considered at the time of its constitution. This is how Figure 3 presents a summary of the main activities to be carried out.

However, there are other additional procedures that depend on the economic activity of the organization, such as registration with the National Institute of Drug Surveillance (INVIMA), in cases related to the production, storage and distribution of food, medicines, toiletries or cosmetics; the environmental license, for companies that carry out activities that affect some natural resource; or simply the recognition of copyright when using musical or artistic works that do not come from the company itself; the important thing is to take the necessary time to investigate carefully the legal requirements to which the organization is subject to operate without inconvenience. In accordance with the foregoing, a compendium of these requirements is presented in Table 4, in such a way that it serves as a guide in the start-up of new companies.

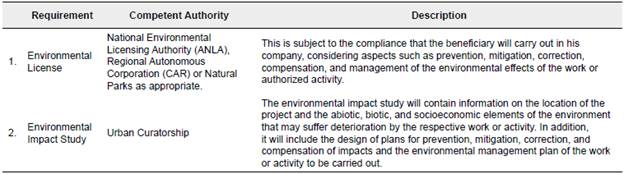

In addition, the contents of the table above may be altered by the autonomous provisions that each Governor's or Mayor's Office may assume for the search for better development in its region; it is therefore important to add the consultation in the Territorial Development Plans (POT) in order to ensure that the economic activity of the company can be carried out on the land claimed; or, likewise, to note the existence of some benefits that may be obtained in response to economic stimuli that have been stipulated to promote the creation of certain types of companies. The following tables set out the requirements to be considered with respect to the environmental, labor, and economic-financial components, bearing in mind that each of them represents a fundamental aspect for the development of future organizations. In the first instance, Table 5 shows the requirements in the environmental framework.

An environmental license is understood to be the authorization granted by the environmental authority for the execution of a work or activity; and it may happen that the execution of some works, the establishment of industries, or the development of any activity require a special permit, if according to the law and regulations, they can produce serious deterioration to renewable natural resources or the environment, or also introduce considerable modifications to the landscape (Cardoza, Fornes, Farber, Duarte & Gutierrez, 2016).

Description

This is subject to the compliance that the beneficiary will carry out in his company, considering aspects such as prevention, mitigation, correction, compensation, and management of the environmental effects of the work or authorized activity.

The environmental impact study will contain information on the location of the project and the abiotic, biotic, and socioeconomic elements of the environment that may suffer deterioration by the respective work or activity. In addition, it will include the design of plans for prevention, mitigation, correction, and compensation of impacts and the environmental management plan of the work or activity to be carried out.

This goes hand in hand with the environmental impact study, which is understood as the set of information that the person applying for an environmental license must present to the competent environmental authority (Acuna, Figueroa & Wilches, 2017). The important thing is to carefully know the scope of each project, it's possible impacts, and the mitigation mechanisms that will be proposed for a sustainable development of the activity. Once the environmental aspect has been considered, the labor requirements are continued (Table 6) which, if not attended to with care, could generate serious inconveniences for new companies.

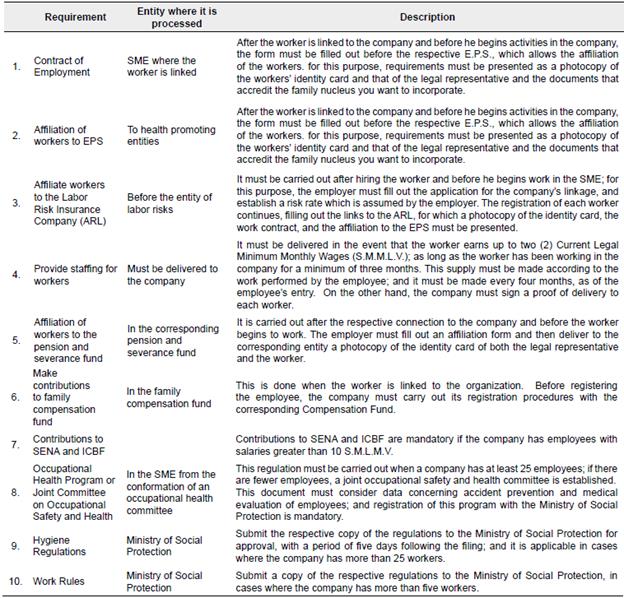

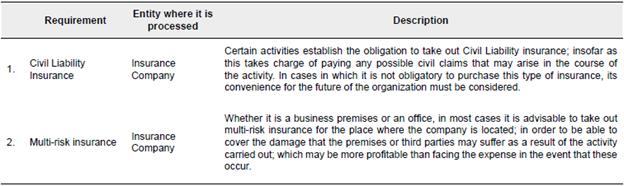

As can be seen, compliance with legal requirements represents a great task for the new company; in many cases, enthusiasm, the eagerness to set up an organization, or simple ignorance, lead to neglect of basic labor aspects that may generate serious inconveniences in the future, ranging from small fines for extemporaneous registration, to total coverage of illnesses or deaths of workers due to deficiencies in their social security coverage. However, once these requirements have been met, those related to the economic-financial aspect of SMEs are examined in greater depth (Table 7).

In order to avoid this, a responsible manager stops to estimate the risks of his operation, to define their possible consequences, and on this basis, to proceed to take out a civil liability or multi-risk insurance or not; however, it should be clarified that the mandatory compliance requirements must be verified first.

3. Conclusion

SMEs represent a fundamental component for the economic development of the country, insofar as they have become a solution for Colombians to seek to generate their own income, and thus reduce national unemployment rates. However, starting from this fundamental need, it is possible to establish that many new entrepreneurs are not adequately prepared for this new purpose, which is why they end up incurring serious mistakes that can lead to major economic crises, or even the closure of their companies.

Starting a new company is not easy, so the best way to achieve success is discipline and the commitment to review and take care of every detail necessary for its operation; Know and project the environments where sustainable development is sought, knowing that in the business world there are many more organizations that seek the same end, and from which examples can be taken, alliances established, or simply be careful not to invade their field of action; In this sense, part of these companies is the State, which has its own obligations and interests to ensure the good economic development of the country.

From the theoretical development presented, it can be concluded that SMEs should focus and develop various competitive factors in order to achieve sustained development. In this sense, the keys for this type of organizations to achieve greater competitiveness are related to compliance with each of the regulatory requirements established in the current legislation, in order to avoid long-term failure arising from the risks of non-compliance with the frameworks presented above. Additionally, other key elements to be more competitive are the implementation of innovations in their products or services, keeping up to date with trends, thinking globally and acting locally because information technologies are linking the world, and in turn, creating market niches.

It should be pointed out that the State plays a fundamental role in promoting the business competitiveness of SMEs, which requires the development of public policies that contribute to promoting uniform actions that make it possible to promote and protect this type of entities, differentiating what their needs really are.