1. Introduction

Organizations, in the context of their activities, generate direct and indirect impact on the surrounding environment. In the case of banks, the direct impact is the result of how they use resources to carry out their operations (e.g., pollution, energy consumption, water consumption, labor practices, human rights, etc.), while the indirect impact results from the use of their products or services (Jeucken and Bouma, 1999). The banking sector has faced less pressure in terms of sustainability as it generates a lower direct impact compared to other sectors such as industrial, agricultural, or mining (Branco and Rodrigues, 2008; Da Silva Inácio and Delai, 2022), which has led to a lag in the development of sustainability practices in this sector (Earhart, Van Ermen, Silver, and De Marcillac, 2009; Moufty, Al-Najjar, and Ibrahim, 2022) given its importance in the economy.

The banking sector is a key player in economic and social development (Jones, Hillier and Comfort, 2017; Scholtens and van't Klooster, 2019). Recently, it has been focused on the ability of these organizations to influence the behavior of their clients, as they can condition the granting of financing and its terms based on socio-environmental criteria (Aras, Tezcan, and Furtuna, 2018; Chatzitheodorou, Tsalis, Tsagarakis, Evangelos, and loannis, 2021; Moufty et al., 2022; Da Silva Inácio and Delai, 2022; Sobhani, Amran, and Zainuddin, 2012). For example, through initiatives like the Environmental and Social Risk Management System (ESRMS), banks apply models and tools to manage efficiently risks in their portfolios (Braly-Cartillier, Gavilanez, Calvo, and Cottle, 2021). Similarly, by adopting sustainability-promoting standards such as the Principles for Responsible Banking (PRB) or the Global Alliance for Banking on Values (GABV), banks have more knowledge and criteria to decide what type of activities they finance and prevent supporting activities associated negatively with sustainable development.

The pressure exerted by different stakeholders for sustainable behavior is increasing in all types of organizations, including the banking sector (Brooks and Oikonomou, 2018; Mohamed et al., 2023), where the incorporation and disclosure of sustainability practices have become necessary (Kumar and Prakash, 2020). Reporting on sustainability allows stakeholders to make informed decisions (Islam and Chowdhury, 2016), while also creating opportunities for organizations that can translate into benefits such as increased revenue, improved risk management, access to financing, and cost and efficiency improvements, among others (Abuamsha, 2021; Al Kurdi, 2021; Sobhani et al., 2012). However, despite its importance and potential benefits, there is limited evidence related to sustainability practices in the sector (Banhalmi-Zakar, 2016; Carnevale and Mazzuca, 2014; Moufty et al., 2022; Raut, Cheikhrouhou, and Kharat, 2017; Sethi, Martell, and Demir, 2017), a marked trend in emerging countries (Raut et al., 2017; Sobhani et al., 2012).

In Ecuador, banks play a significant role in the economy, injecting funds into various productive sectors (Granda, Zurita, and Alvarez, 2020). Given their importance, some studies have analyzed sustainability in the Ecuadorian banking sector. On one hand, it has been found that regulations related to microfinance, the use and access to financial products and services, green protocols, and social and environmental responsibility policies have promoted financial institutions to venture into social and green financial products, leading to an improvement in the use and accessibility to financial products and services (see, for example, Acosta, 2019; Mejia-Escobar et al., 2020; UNEP and CAF, 2016).The study by UNEP and CAF found that 41% of banks in Ecuador had an internal environmental, social, and corporate governance management system, while the rest had implemented some practices in that direction. On the other hand, the study by Mejia-Escobar et al. (2020) ranked Ecuador fifth among 16 Latin American countries in terms of sustainable financial products.

Furthermore, other studies have focused on determining if there is any relationship between sustainable behaviors with organizational performance (see, for example, Malla et al., 2021; Puente, 2023; Tulcanaza-Prieto et al., 2020). Specifically, Puente's (2023) work found a positive correlation between profitability and financial inclusion. A similar relationship was found by Tulcanaza-Prieto et al. (2020) when analyzing the effect of corporate social responsibility practices on different financial and non-financial indicators. However, Malla et al. (2021) found that, despite the commitment and socially responsible management of financial institutions in Ecuador, social responsibility does not have a significant impact on organizational performance.

Despite the existing studies, there is limited empirical evidence analyzing the current state of sustainability in the Ecuadorian banking sector. Therefore, the objective of this study was to provide evidence of the current status of sustainability disclosure in the Ecuadorian banking sector, an emerging country where banks are mostly private (with only four state-owned banks) and regulated by the Superintendence of Banks and Insurance (SBI). To seek the proposed objective, three research questions are addressed: (a) What are the most used reports by Ecuadorian banks to disclose sustainability information? (b) Are there factors that determine the willingness to disclose sustainability information in Ecuadorian banks? and (c) What type of sustainability information do Ecuadorian banks disclose? This study contributes to the literature with evidence on sustainability information in the banking sector within the context of an emerging country, Ecuador. Specifically, this study tries to identify the most used methods for disclosing information, factors that influence the decision to report or not, and the type of information disclosed. In general, the results show that there is room for improvement about sustainability disclosure by the banking sector of Ecuador to promote communication with their different stakeholders.

This document is structured as follows: The first section is the present introduction. The second section presents the literature review related to sustainability disclosure in the banking sector. The third section shows the methodology, while the fourth section presents the main results. The fifth section contains the discussion of the results. This document concludes with the sixth section, which summarizes and addresses the study's limitations and presents ideas for future research.

2. Sustainability in the Banking Sector: Evidence from the Literature

Increasing socio-environmental demands from stakeholders have led organizations in general to associate their brand with the concept of sustainability (Vieira, Rangel, Silva, and Martini, 2021), and the banking sector is no exception (Brooks and Oikonomou, 2018; Mohamed et al., 2023). To respond to these demands, banks face the decision of whether to incorporate sustainability into their operations. This promotes the questioning of two basic elements: What elements to incorporate into the sustainability strategy? and what methods have to be used to disclose the results of that strategy? The following discussion addresses these two elements.

2.1. Sustainability Strategy

In the field of organizations, sustainability refers to the ability to ensure their impact endures over time from a perspective that considers social, economic, and environmental criteria. Governance is an element that has recently complemented sustainability analysis through what is known as ESG criteria (Delgado-Ceballos, Ortiz-De-Mandojana, Antolín-López, and Montiel, 2023). Due to their potential to create environmental impacts, most sustainability studies have been conducted in extractive and manufacturing organizations (Vieira et al., 2021), resulting in greater advancement of the environmental dimension compared to other dimensions (Sharma and Ruud, 2003).

Initially, when talked about sustainability, it focused on the direct impact of organizations (primarily from an environmental perspective), and disregarding the indirect impacts on their operating environment. In the case of banks, the direct impact is the result of how they use resources to conduct their operations (e.g., pollution, energy consumption, water consumption, labor practices, human rights, etc.), while the indirect impact is the result of the use of their products or services (Jeucken and Bouma, 1999).

Sustainability has gained greater relevance in the banking sector due to multiple factors. Firstly, banks have the ability to condition the granting of financing and its conditions based on sustainability criteria from their clients (Chatzitheodorou et al., 2021; Da Silva Inácio and Delai, 2022),the banking sector has become a determining factor in incorporating sustainability practices in other industries (Brooks and Oikonomou, 2018; Da Silva Inácio and Delai, 2022; Sobhani et al., 2012). Secondly, the pressure from different stakeholders on banks has increased, leading them to consider the need to incorporate sustainability in their operations (Kumar and Prakash, 2020; Mohamed et al., 2023; Moufty et al., 2022).This new context, in addition to the challenges it demands, has also created business opportunities (Kumar and Prakash, 2020) that can translate into economic benefits for these types of organizations (Abuamsha, 2021 Al Kurdi, 2021).

Banks, like any organization considering the pressures generated by this new sustainability trend, must define the strategy with which they will address it. According to Jeucken and Bouma (1999), they can adopt one of four types of strategies: (a) defensive strategy: based on ignoring, and even opposing, sustainability advances, limited to risk management in sustainability within the strictly legal framework (known as defensive banking); (b) preventive strategy: incorporating sustainability into their operations more systematically, but only from an internal perspective; (c) offensive strategy: extending the internal sustainability focus to also systematically consider external aspects; and (d) sustainable strategy: aiming for the organization's long-term sustainability based on achieving the best performance in social, environmental, and economic aspects.

According to empirical evidence, despite using recognized standards for sustainability reporting (e.g., GRI), there is still a lot of variability in the topics disclosed by banks (see, for example, Almeida, Nascimento Júnior, and Costa (2017) and Vieira et al. (2021) for the case of Brazil). This variation makes it challenging to compare the level of progress among different banks, even for the same bank in different periods (Vieira et al., 2021). The literature has shown that organizations, in general, have mainly focused on disclosing their environmental impact (Sharma and Ruud, 2003), while in the case of banks, studies have indicated that they are more focused on communicating their social impact (Moufty et al., 2022).

2.2. Willingness and methods used to disclose information

The literature has identified some variables that influence the decision to disclose sustainability information. On one hand, it has been analyzed the relationship between organizational visibility and the willingness to disclose information. It is suggested that more visible organizations will face greater pressure from stakeholders, therefore will be more willing to report their sustainability performance. To highlight the visibility of the organization various variables have been used considering size as the most common variable. Empirical evidence has shown that larger organizations are more willing to disclose sustainability information (Farisyi, Musadieq, Utami, and Damayanti, 2022; Maama and Gani, 2022).

Another variable used to approximate organizational visibility is the age of the organization. It has been proposed that older organizations will have greater visibility, leading to higher pressures and a greater propensity to disclose, similar to the case of organizational size. Several studies have provided evidence confirming that older organizations have a higher willingness to disclose sustainability information (Correa-Garcia, Garcia-Benau, and Garcia-Meca, 2020; Maama, 2021) due to increased pressures from visibility and improved practices over the years, leading to a positive impact on the willingness to disclose sustainability information (Correa-Garcia et al., 2020).

Moreover, another aspect that has received significant interest regarding factors affecting sustainability disclosure is the ownership structure. In general, the literature suggests that ownership concentration can reduce transparency and the quality of information an organization is willing to disclose (Garcia-Meca and Sanchez-Ballesta, 2010). Specifically, some studies have found that family-owned organizations have a lower willingness to disclose sustainability information because they face fewer pressures compared to organizations with a more dispersed ownership structure (Gavana, Gottardo, and Moisello, 2016; Kilic, Kuzey and Uyar, 2015).

Another factor related to the ownership structure that can affect disclosure of information is the presence of foreign shareholders. It has been suggested that foreign shareholders may be more interested in transparency and quality relationships with stakeholders. Therefore, are more likely to adopt global practices that have a greater impact on stakeholders (Correa-Garcia et al., 2020). Some studies have found a positive relationship between sustainability disclosure and foreign ownership (Khan, 2010; Khan, Muttakin, and Siddiqui, 2013). Additionally, the involvement of the government as a shareholder can also affect the quantity and quality of information to be disclosed. In this regard, some studies have found that organizations with government participation as shareholders have low levels of disclosure and focus on specific topics such as philanthropy (Masoud and Vij, 2021; Ruiz-Lozano, De Vicente-Lama, Tirado- Valencia, and Cordobes-Madueno, 2022).

Regarding the availability sustainability information, organizations that decide to disclose sustainability information have different options to fulfill this purpose. One practical way to do this is to incorporate such information into annual reports, where the main focus is on financial information disclosure. Another way is to create a specialized report (e.g., sustainability report, sustainability memorandum, sustainability report, social balance sheet, among other designations) to communicate their contribution to sustainability. Some organizations may also disclose their information through the internet (e.g., websites, forums, etc.).

Although it is common for organizations to use several methods to disclose sustainability information, some studies have identified that banks prefer presenting a specialized report1 instead of alternatives such as internet disclosure or inclusion in the annual report (KPMG, 2008; Pérez and Rodríguez del Bosque, 2012).

There are several advantages of preparing a specialized report. It could indicate, for these organizations, disclosing sustainability information is as important as financial information disclosure (Holland and Foo, 2003). Also, the literature has found that organizations choosing to use a specialized report tend to concentrate their disclosure in it. This leads to a decreasing amount of sustainability information in the annual report (Moufty et al., 2022).

3. Methodology

3.1. Research Design

This study employed a mixed research methodology (quantitative and qualitative) with a descriptive-correlational approach to provide evidence of the sustainability disclosure in the banking sector of Ecuador. The descriptive approach focused on the systematic collection of data in order to describe particular behaviors (Hernández-Sampieri, Fernández, and Batista, 2010) of commonly disclosed strategies used by Ecuadorian banks to share sustainability information, as well as the type of information disclosed. Furthermore, the correlational approach sought to establish correlations between variables (Hernández-Sampieri et al., 2010) to identify factors that determine the willingness to disclose sustainability information in Ecuadorian banks.

3.2. Sample and Data

The banking sector in Ecuador has a total of 26 banks, of which only four are government-owned. For the descriptive analysis, the disclosure strategy about sustainability information were identified in the 26 banks, limiting the analysis to three disclosure strategies that organizations usually use to report on sustainability (annual report, web page and specialized report). The content analysis was applied only in those cases in which the existence of a specialized sustainability report was identified (for example, sustainability report, sustainability report, sustainability report, integrated report, social balance).

For the correlational analysis, the inclusion criteria required the bank to disclose available information in corporate governance reports and annual reports to identify: a) ownership: banks were classified into three variables according to ownership type: family-owned, state-owned, and local. This was done based on information about major shareholders provided in corporate governance reports and annual reports; b) size: three approximations were used for organization size such as total assets, number of employees, and operational income; c) age: the establishment date was used to determine the operating period of the organization; and d) stock exchange listing: it was identified whether the bank was listed on either of the two stock exchanges in Ecuador.

3.3. Data Analysis

To identify the disclosure strategy used for sustainability information, a dummy variable was used, taking a value of one (1) for each case in which the bank was found to use an annual report, website, or specialized report, respectively. Frequency tables were constructed based on this information.

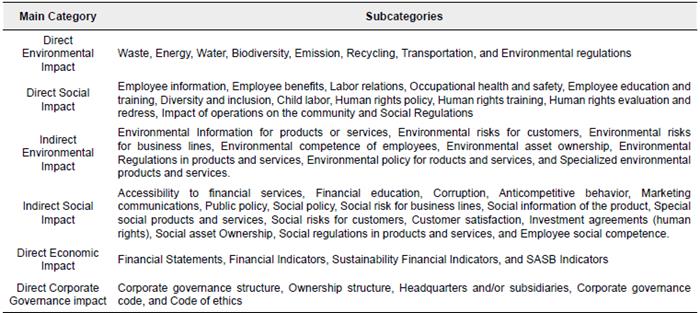

Subsequently, to identify the type of information disclosed, content analysis was applied as a research technique that allows inferences to be made for a dataset regarding its context (Krippendorff, 1997). For this purpose, only 17 banks were analyzed, in which a specialized sustainability report was identified2 (e.g., sustainability memorandum, sustainability report, integrated report, social balance sheet). The content analysis was conducted based on the presence (coded with a value of one) or absence (coded with a value of zero) of sustainability disclosure according to the index proposed by Moufty et al. (2022).This index classifies sustainability practices into two pillars: environmental and social, each of which is further broken down to distinguish between direct (operational) and indirect (products and services) impacts. Since reporting financial and corporate governance information is mandatory in the Ecuadorian banking sector, the analysis was complemented with two additional and more specific categories: disclosure of economic information (financial sustainability) and governance (see Annex 1). This aligns with the new sustainability trends, in which economic and governance aspects are also considered, alongside environmental and social topics (Delgado-Ceballos et al., 2023).

For the correlational analysis, Fisher's tests (for discrete variables) and mean difference tests (for continuous variables) were used. The willingness to disclose sustainability information was approximated as the use or non-use of any of the three disclosure strategies (annual report, website, and specialized report). Specifically, the relationship between the willingness to disclose sustainability information and additional variables identified in the literature as factors that may influence this decision was analyzed. These factors include ownership type (Correa-Garcia et al., 2020; Gavana et al., 2016 Kilic et al., 2015), measured as the predominant presence of family, state, or local shareholders; size (Farisyi et al., 2022; Maama and Gani, 2022); organization age (Correa-Garcia et al., 2020; Maama, 2021); and whether the company is listed on the stock exchange or not.

4. Results

4.1. Disclosure strategy used to share sustainability information

Among the most common methods used by organizations to communicate their approach to sustainability are specialized reports (commonly known as sustainability reports, information reports, or sustainability memoranda), the website, and the inclusion of such information in the annual management report. This study found that the majority of Ecuadorian banks (65.4%; 17 banks) disclose information related to their sustainability practices, with the specialized report being the most common disclosure strategy used (46.2%; 12 banks), followed by the website (42.3%; 11 banks), and lastly, the annual report (30.8%; 8 banks). These results are consistent with the evidence in the literature and reinforce the idea that specialized reports are becoming the most common means to communicate about sustainability (KPMG, 2008; Pérez and Rodríguez del Bosque. 2012). The widespread use of this type of report could suggest a greater commitment of organizations to sustainability, allowing different stakeholders to make more informed decisions (Islam and Chowdhury. 2016) based on their interests.

As 34.6% of Ecuadorian banks do not use any of the three analyzed means of disclosure (specialized report. website. annual management report). it is possible that these banks are still in a defensive strategy regarding the incorporation of sustainability, where their sustainability strategy is framed strictly within legal boundaries (Jeucken and Bouma. 1999). This suggests that there is significant room for improvement in terms of sustainability communication in the Ecuadorian banking sector.

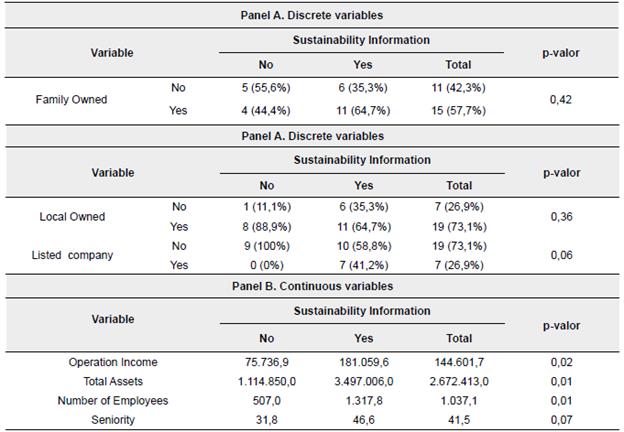

4.2. Willingness to disclose sustainability information

To identify whether there are factors influencing the willingness to disclose sustainability information in Ecuadorian banks, some variables identified in the literature as important and were analyzed. These variables include size, age, ownership structure of the organization. and whether the company is listed on the stock market. The analysis was performed using Fisher's test. The main results are summarized in Table 1. Panel A analyzes the variables related to ownership and whether the company is listed or not. Regarding ownership structure, three situations were analyzed: (a) participation of one or more families in ownership (family-owned); (b) participation of the government in ownership (state-owned); and (c) participation of foreign shareholders (local ownership). In the case of the family-owned variable. it was found that of the 17 banks that provided information on sustainability. 11 (64.7%) were family-owned companies. and 6 were non-family-owned companies (35.3%). Among the nine banks that did not have published information. 4 banks (44.4%) were family-owned companies. and 5 (55.6%) were non-family-owned companies. However. the differences found in the disclosure percentages are not statistically significant (family-owned, p-value = 0.42).

In the case of the state-owned variable, it was found that only one of the four state-owned banks had some type of sustainability information published; this corresponds to 5.9% of the reporting banks, while the remaining 94.1% correspond to 16 banks with private ownership. Among the nine banks that did not have information on sustainability, six (66.7%) were private banks. and three (33.3%) were state-owned banks. As with the previous case, the differences found in the willingness to disclose are not statistically significant (state-owned, p-value = 0.10).

Finally, regarding the local ownership variable, it was found that of the 17 banks that provided information on sustainability, 6 (35.3%) were banks with foreign investors, and 11 (64.7%) were banks with local investors. Among the banks that did not have information published, 1 bank (11.1%) had foreign investors. and 8 (88.9%) were banks with local investors. As with the previous cases, the differences found are not statistically significant (local ownership, p-value = 0.36). These results suggest that, in the case of Ecuadorian banks, there is no association between ownership type (family/non-family, state/private, local/ international) and the willingness to disclose sustainability information. This may suggest that there are other variables that may have a greater influence on the decision to disclose or not.

On the other hand, it was also analyzed whether banks listed on the stock exchanges of Quito and Guayaquil were more willing to disclose sustainability information. It was found that all listed banks provided information. Specifically, of the 17 banks that had information. 7 (41.2%) were listed. while 10 (58.8%) were unlisted. Among the banks that did not have information, 100% were unlisted banks. These differences are statistically significant (Listed company, p-value = 0.06) and show that there is an association between being listed on the stock exchange and the willingness to disclose sustainability information.

Tabla 1 Willingness to disclose sustainability information

Notes: In the case of discrete variables (Panel A), a Fisher's test was applied. For continuous variables (Panel B), a mean difference test was applied, where the calculations were performed using the natural logarithm of each variable. However, in the table, the average of the original variable is presented. The variables "Operating Revenues" and "Total Assets" are in thousands of US dollars. A p-value less than 0.10 indicates that there is a significant difference between the analyzed variable and the willingness to disclose sustainability information

Source: Own elaboration

In Panel B of Table 1, variables related to the size and age of the organization were analyzed. Size was approximated using three variables: operating revenues. total assets. and the total number of employees. The natural logarithm of each variable was used for this analysis. In this case, a mean difference test was used to determine if there was a relationship with the disclosure of sustainability information. Overall, it was found that larger organizations are more willing to present information about sustainability.

Regarding operating revenues, banks that published information had an average revenue of 181 million dollars, while those that did not publish had an average revenue of 75 million dollars. This difference is statistically significant (Operating Revenues, p-value = 0.02).

For total assets, a similar situation was found. Banks that published information had an average total asset of 3.497 million dollars, while those that did not publish had an average total asset of 1.114 million dollars. This difference is statistically significant (Total Assets, p-value = 0.01).

Regarding the number of employees, it was observed that banks with information were larger, with an average of 1.037 employees, while those without information had an average of 507 employees. This difference is statistically significant (Number of Employees, p-value = 0.01).

For the age of the company, the founding date was used. It was found that companies with greater age were more likely to provide information about sustainability. Banks that published information had an average age of 46.6 years, while those that did not publish had an average age of 31.8 years. This difference is statistically significant (Age, p-value = 0.07).

Thus, it is evident that the visibility of the organization (size, age, and listing on the stock market) is associated with the willingness to disclose sustainability information. These results are consistent with the literature, which has found a greater willingness to disclose sustainability information in larger companies (Farisyi et al., 2022; Maama and Gani, 2022), older companies (Correa-Garcia et al., 2020; Maama, 2021), and listed companies.

4.3. Content disclosed on sustainability

This section presents the results of the analysis of the specialized reports from the Ecuadorian banking sector. The banks in Ecuador used different denominations for their presentation: sustainability report (6), sustainability and social responsibility report (1), integrated report (1), sustainability report (1), Communication on Progress (1), institutional memory (1), and social and environmental performance report (1). It stands out that only 1 out of the 12 analyzed reports had external verification.

Regarding the standards used, a wide variety was found, with some reports combining different approaches. The most commonly used approaches are those developed within the framework of the United Nations (UN). The use of the Sustainable Development Goals (SDGs) (10; 83.3%), Global Reporting Initiative (GRI) (8; 66.7%), and Global Compact (GC) (6; 50%) stands out. Although it was not the focus of this study, it was evident that the level of depth and consistency with the standard used varies in each case. In many cases, the bank mentions the standard or approach used, but not all of them follow it rigorously. For example, it is striking that not all banks that are signatories to the Global Compact adhere to its reporting standards (only three out of six banks did so). A similar situation was observed with the GABV standard, where two banks (16.7%) are signatories but did not use it for reporting. In contrast, all seven signatory banks (58.3%) reported using the PBR standard extensively. To a lesser extent, other approaches were used for reporting, such as Materiality under SASB standards (3; 25%), stakeholder capitalism (1; 8.3%), and ISO 26000 (2; 16.7%). Finally, the inclusion of materiality analysis with its corresponding materiality matrix (7; 58.3%) is also highlighted. This indicates that some banks (3; 25%) report their materiality from the concept of double materiality, encompassing both financial and environmental and social materiality.

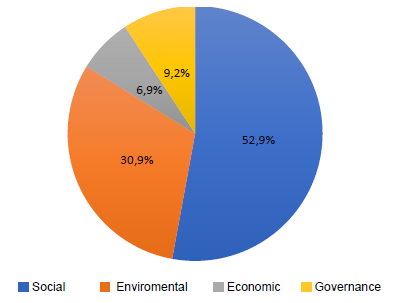

Regarding the specific actions reported by each of the 12 banks in their specialized reports, it was observed that the most disclosed dimension was the social dimension, accounting for 52.9% of the disclosures made by the banks, 30.9% were related to the environmental dimension, 9.2% to governance, and 6.9% to the economic dimension (see Figure 1). These results are consistent with other studies that have found that the majority of disclosures made by banks are related to social impact (Moufty et al., 2022).

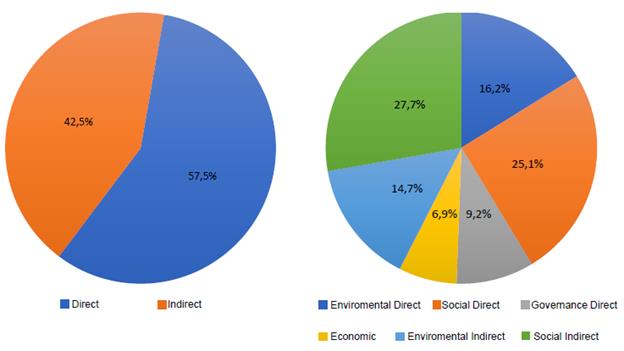

In Figure 2 (left side), the disclosure is presented according to the type of impact. 57.5% corresponds to practices with a direct impact, while 42.5% are practices with an indirect impact. Comparing the dimension and the type of impact (see right side of Figure 2), it was observed that the indirect social impact is the most disclosed aspect (27.7%), followed by the direct social impact (25.1%). The direct environmental impact accounted for 16.2% of the disclosures, and the indirect environmental impact accounted for 14.7%. Finally, the governance (9.2%) and economic (6.9%) dimensions were the least disclosed.

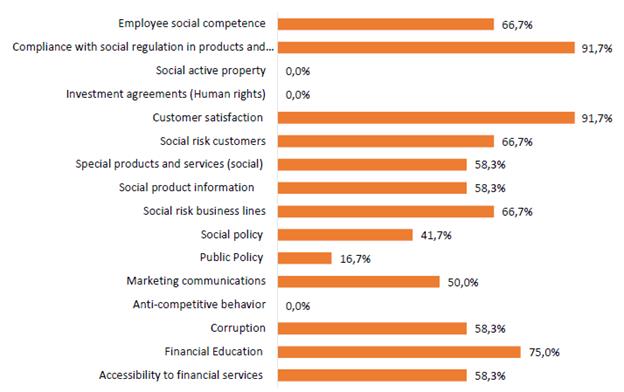

Next, an overview of the practices disclosed by the banks in Ecuador in their specialized reports is presented. In the category of indirect social impact (see Figure 3), practices related to regulatory compliance, customer satisfaction, and financial education were highlighted. There was no evidence to suggest shareholder participation from a social perspective, investment agreements based on human rights, or practices regulating behavior with competitor.

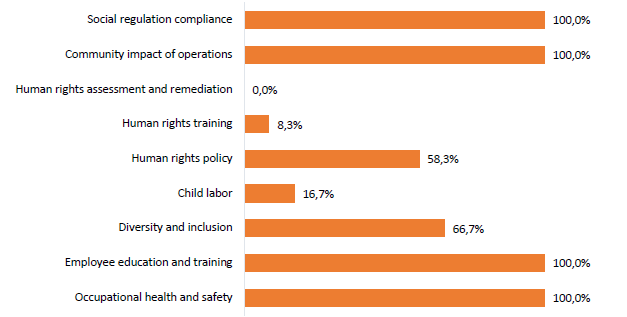

Regarding the direct social impact (see Figure 4), banks reported more extensively on regulatory compliance, the impact of their operations on the community, employee training and development processes, occupational health and safety, and detailed employee information. Practices with lower levels of disclosure were related to human rights assessment and remediation processes, labor relations (worker participation in unions or collective bargaining), and child labor.

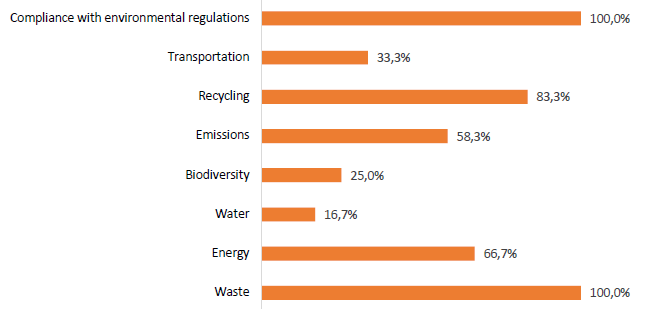

Regarding the direct environmental impact (see Figure 5), banks reported more extensively on environmental regulatory compliance, recycling practices, and efficient energy use. To a lesser extent, they reported on practices related to biodiversity conservation, waste management, and environmental care through transportation means.

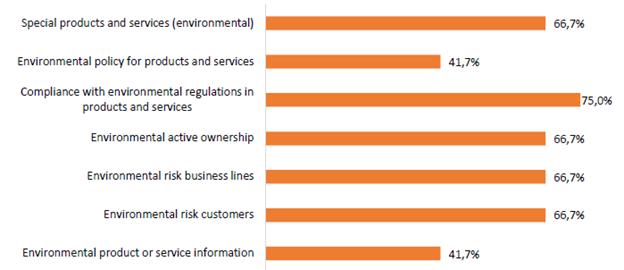

For the indirect environmental impact (see Figure 6), practices related to environmental regulatory compliance in product and service design, employee training and education on environmental care, inclusion of environmental risk in customer credit analysis, and business line design were highlighted. There was no evidence of direct shareholder involvement in environmental issues.

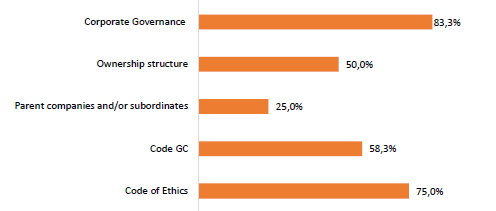

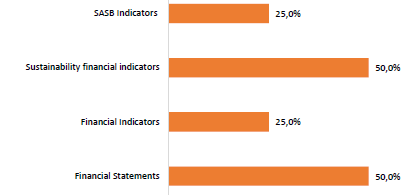

Regarding governance (see Figure 7), the disclosure of information about the different governing bodies directing these organizations, the existence and compliance with ethical and corporate governance codes, was emphasized. To a lesser extent, information was presented about ownership structure and relationships with parent and/or subsidiary companies. Finally, in the economic dimension (see Figure 8), banks reported more extensively on information related to key financial indicators. To a lesser extent, they presented financial indicators related to sustainability. Few banks attached financial statements to the specialized report and included SASB materiality indicators.

4. Discussion

The results showed that 65.4% of banks disclose information on sustainability, with specialized reports being the most commonly used strategy for this purpose (46.2%). These findings are consistent with previous studies (e.g., UNEP and CAF. 2016) that demonstrate the Ecuadorian banking sector's ongoing progress in sustainability, indicating an increasing understanding of the importance of disclosing organizational practices to the market. Likewise, the results suggest that regulations in this area are having an effect promoting sustainable practices that improve the conditions of financial product users, by incorporating social and green elements (e.g.. Acosta. 2019; Mejia-Escobar et al.. 2020; UNEP and CAF. 2016).

Even though, different standards or alternatives were used, including those originated within the UN (SDGs. GRI. Global Compact), the results showed that 34.6% of banks did not use any of the analyzed disclosure methods. This suggests that some banks may still adopt a defensive strategy regarding sustainability, primarily focusing on legal compliance. Additionally, among banks that do report, the depth and rigor in the application of these standards are varied. While this is not the primary focus of the study, this could indicate that organizations select a specific standard for reporting, based on the compatibility with their organizational characteristics.

The results indicate that Ecuadorian banking organizations still have significant room for improvement in enhancing their sustainability information and disclosure standards. Therefore, it is recommended to implement recognized standards in order to enhance transparency and accessibility of sustainability initiatives. This involves providing more comprehensive and transparent reports covering environmental, social, economic, and governance aspects. Considering this is an area in which regulatory entities could increase efforts to raise awareness of its importance and encourage the adoption of more rigorous standards.

Additionally, there was no significant relationship found between the willingness to disclose sustainability information and the type of ownership (family. state. local). However, a positive association was observed between disclosure and organizational visibility (size, age, and being listed). The lack of significant association between ownership type and sustainability disclosure suggests that ownership itself is not a determining factor for organizations to commit to sustainability, contrary to findings in previous studies (e.g.. Correa-Garcia et al.. 2020; Khan et al.. 2013; Khan. 2010; Masoud and Vij. 2021; Ruiz-Lozano et al., 2022).

On the other hand, the results are consistent with the more widespread view in the literature, indicating that more visible organizations. whether due to their size, age, or being listed on the stock market, face greater pressures from stakeholders. Therefore, they are motivated to improve transparency and accountability towards sustainability in order to strengthen their reputation and credibility in the market (e.g.. Farisyi et al.. 2022; Maama and Gani. 2022).

The previously mentioned results help better understand the Ecuadorian context by identifying aspects that may determine disclosure levels. For example. Smaller, younger, and unlisted banks may face resource and capacity constraints, which may hinder the adoption of more robust sustainability strategies, or also, they may consider sustainability adoption a lower priority in their current strategy.

In this context, policymakers and investors can play a key role in promoting sustainability disclosure strategies among non-listed, smaller, and younger banks, possibly through specific incentives or recognition programs.

Regarding the disclosed practices, most of them pertain to direct impacts, with the social dimension being the primary focus. It is recommended that banks explore and disclose practices that generate indirect impacts on society, as these often significantly contribute to sustainability. However, identifying indirect effects may require additional effort and resources.

Therefore, banks should consider evaluating practices in their supply chain, customer engagement, and investment decisions with long-term sustainable implications, among other indirect impacts.

In terms of dimensions, the social dimension accounts for the majority of the reported information. When characterized by dimension and type of impact, the most disclosed aspect is the indirect social impact, followed by the direct social impact, the direct environmental impact, the indirect environmental impact, governance, and finally, the economic dimension. However, the disclosure of information regarding environmental impacts, both direct and indirect, is relatively lower.

This indicates that there is room for improvement in the application and communication of practices related to other dimensions rather than the social one. In this regard, banks could focus on providing more detailed reports on actions to reduce their environmental footprint, waste management, recycling practices, energy efficiency, and commitment to biodiversity.

Overall, it is evident that there are areas for improvement in the Ecuadorian banking sector to incorporate standards that enable better communication with various stakeholders. Therefore, it is essential for organizations to strengthen communication with their stakeholders, including clients, Investors, regulators, and the community in general. This can be achieved through proactive disclosure of information about sustainable practices and the creation of channels for dialogue and feedback to address concerns and needs.

5. Conclusions

The aim of this study was to provide evidence of the status of sustainability disclosure in the Ecuadorian banking sector. The results showed that 65.4% of banks disclose information on sustainability, with specialized reports being the most common means of communication. These findings indicate that the country's banking sector is making progress in sustainability and recognizes the importance of communicating its practices to society. However. 34.6% of banks still do not use any disclosure method, suggesting that some institutions may be adopting a defensive strategy, focusing on legal compliance rather than proactively disclosing their sustainable practices.

In regard to the relationship between ownership type and disclosure, no significant association was found. However, it was evident that organizational visibility, measured by size, age, and stock market listing, positively influences the willingness to disclose information on sustainability. This suggests that pressures from stakeholders motivate more visible organizations to improve their transparency and accountability regarding sustainability. It is recommended that organizations adopt recognized standards to enhance the transparency and accessibility of their sustainable practices for stakeholders. Additionally, the importance of strengthening communication with different stakeholders, such as customers, investors, regulators, and the community in general, is emphasized.

Regarding the disclosed practices, it was observed that the majority focus on direct impact, primarily in the social dimension. Banks are encouraged to delve into the disclosure of practices that generate indirect impact on society.

Overall, the progress of the Ecuadorian banking sector in terms of sustainability has advanced, while acknowledging there are opportunities for improvement in broader and more effective practices for sustainable disclosures in the future.

Like any research, this study has some limitations that could be addressed in future work. Firstly, this study is limited to a specific type of organization: the Ecuadorian financial sector (commercial banks). Future research could include other organizations such as financial holdings, investment banks, financial cooperatives, brokerage firms, among others. These may be important for understanding the status of sustainability disclosure in the financial sector, possibly extending the analysis to more Latin American countries. Secondly, the content analysis is framed in a sustainability index that could be expanded to include other practices that provide a broader and more comprehensive overview of their application.

Thirdly, content analysis does not consider the quality of the information provided; it solely analyzes the presence or absence of certain practices. Future work could broaden the scope to investigate the quality of the reported information. In addition to the presence or absence of sustainability practices in the reports, it is essential for companies to pay attention to the quality of the disclosed information. This entails ensuring that the data is reliable, verifiable, and relevant to different stakeholders. External audits are also recommended to support the accuracy of the disclosed information.

Finally, the content analysis technique provides information on the aspects that banks wish to communicate. However, this may not reflect the actual practices within these organizations. In this regard, future work could compare the information reported in specialized reports with data from other sources, such as in-depth interviews with these organizations and their various stakeholders. Similarly, future research could address the existence of theoretical or content differences that may arise between different types of reports. Considering the selection of the type of report can be an indicator of an organization's sustainability strategy, an analysis in this regard could provide a better understanding of the topics that organizations consider important and, therefore, deserve to be disclosed.