Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Citado por Google

Citado por Google -

Similares en

SciELO

Similares en

SciELO -

Similares en Google

Similares en Google

Compartir

Producción + Limpia

versión impresa ISSN 1909-0455

Rev. P+L vol.11 no.1 Caldas ene./jun. 2016

Financial analysis of ethanol as primary fuel in two sugar mills in Colombia*

Análisis financiero del etanol como combustible principal en dos ingenios azucareros en Colombia

Análise financeiro do etanol como combustível principal em dois engenhos açucareiros na Colômbia

José Daniel Mosquera-Artamonov**, Julio Cesar Mosquera***, Irina Artamonova****

* Artículo derivado de la investigación: "Fluctuación en el mercado de los Biocombustibles en Latinoamérica" desarrollado en el año 2014, financiado por CONACYT, Universidad del Quindío.

** Ingeniero Industrial, Ingeniero en calidad, magister en ingeniería de sistemas. Estudiante del postgrado en Ingeniería de sistemas.

*** Físico, Magister en Física, Doctorado en Física.

**** Física, Maestría en Física, Maestría en Matemáticas, Doctorado en Ciencias Físicas

Autor correspondencia: José Daniel Mosquera-Artamonov, E-mail: jose.mosqueraar@uanl.edu.mx.

Artículo recibido: 15/05/2014; Artículo aprobado: 20/05/2016

Abstract

Introduction. On this paper, the results of studying the economic benefit obtained by using vehicles -fueled with different ethanol concentrations- for the transportation of the operative, technical, and administrative personnel in two sugar mills, are presented. Data from the production costs of two sugar mills in Colombia were used in the study. Objective. To determine the economic benefit of using a gasoline-methanol mixture in the vehicles used in two sugar mills for the transportation of operational, technical, and administrative personnel. Materials and methods. By the use of a mathematical equation, the variation in the price of the fuel in each mixture of ethanol and gasoline was determined in order to analyze the best price scenario to make the conversion of the cars to the flex fuel system feasible. Such a scenario will have to be tested in the years to come, using the results presented on this paper as a base. Results. The research work demonstrated that the use of ethanol in lower concentrations up to 40 % in the mixture (E40) in modified vehicles with the fuel flex kit installed is financially feasible in Colombia. However, such a conversion can be less or more feasible depending on the ethanol concentration in the mixture. Conclusions. Fuel prices for the producers (sugar mills) are different from those for the final consumers. Therefore, it can be said that the conversion to the flex-fuel is very profitable for the industry, but it is not for transporters and for the people in general. Such a finding means that, under the current production system, the use of mixtures above E40 are not feasible in the Colombian market.

Key words: internal rate of return, sugar mill, ethanol, gasoline, Colombia.

Resumen

Introducción. En este trabajo se presentan los resultados del estudio del beneficio económico obtenido en los vehículos utilizados en dos ingenios azucareros para el transporte de personal operativo, técnico y administrativo, mediante el uso de diferentes concentraciones de etanol. El estudio utilizó datos de los costos de producción de dos ingenios azucareros en Colombia. Objetivo. Determinar el beneficio económico del uso de una mezcla de etanol-gasolina en los vehículos utilizados en dos ingenios azucareros para el transporte de personal operativo, técnico y administrativo. Materiales y métodos. Usando un modelo matemático se determinó la variación de la precio del combustible en cada mezcla etanol-gasolina, a fin de analizar el escenario de precios que permite que la conversión de autos al sistema flex fuel sea viable. Dicho escenario deberá ser probado los años siguientes con base en los resultados presentados en este documento. Resultados. La investigación demostró que el uso de etanol en concentraciones inferiores de hasta el 40 % en la mezcla (E40) en vehículos modificados en el kit flex fuel es económicamente inviable en Colombia. Sin embargo, tal conversión resulta más viable dependiendo de la concentración de etanol en la mezcla. Conclusiones. Los precios del combustible son diferentes para el productor (los ingenios azucareros), y para los consumidores finales, lo cual conlleva a afirmar que en tanto que la conversión al sistema flex - fuel es altamente rentable para la industria, no lo es para los transportistas ni para el público en general. Tal hallazgo permite predecir que con el sistema actual de producción, el consumo de mezclas mayores a E40 no es viable en el mercado colombiano.

Palabras clave: tasa interna de retorno, ingenio azucarero, etanol, gasolina, Colombia.

Resumo

Introdução. Neste trabalho se apresentam os resultados do estudo do benefício económico obtido nos veículos utilizados em dos engenhos açucareiros para o transporte de pessoal operativo, técnico e administrativo, mediante o uso de diferentes concentrações de etanol. O estudo utilizou dados dos custos de produção de dois engenhos açucareiros na Colômbia. Objetivo. Determinar o benefício económico do uso de uma mistura de etanol-gasolina nos veículos utilizados em dois engenhos açucareiros para o transporte de pessoal operativo, técnico e administrativo. Materials e métodos. Usando um modelo matemático se determinou a variação do preço do combustível em cada mistura etanol-gasolina, a fim de analisar o cenário de preços que permite que a conversão de autos ao sistema flex fuel seja viável. Dito cenário deverá ser provado nos anos seguintes com base nos resultados apresentados neste documento. Resultados. A investigação demostrou que o uso de etanol em concentrações inferiores de até 40 % na mistura (E40) em veículos modificados no kit flex fuel é economicamente inviável na Colômbia. Mas, tal conversão resulta mais viável dependendo da concentração de etanol na mistura. Conclusões. Os preços do combustível são diferentes para o produtor (os engenhos açucareiros), e para os consumidores finais, o qual implica a afirmar que a conversão ao sistema flex - fuel é altamente rentável para a indústria, não sendo para os transportadores nem para o público em geral. Tal descoberta permite prever que com o sistema atual de produção, o consumo de misturas maiores a E40 não é viável no mercado colombiano.

Palavras chaves: taxa interna de retorno, engenho açucareiro, etanol, gasolina, Colômbia.

Introduction

The last two decades have been characterized by a deep concern about environmental pollution, due to the indiscriminate use of fossil fuels and hydrocarbons in transport systems (Lozada, Islas & Grande, 2010).

Nowadays, the U.S. derives 85 percent of its energy from fossil fuels, compared to the 7 percent acquired from renewable sources (The National Academies of Sciencies Engineering Medicine, 2016). Solutions to environmental pollution caused by transport emissions are required. Pressured by many groups, governments worldwide have agreed to decrease CO2 emission rates and those from other gases that produce the greenhouse effect (Paris - Paris climate change agreement, 2015), as a step forward to the United Nations meeting in Copenhagen (2009), where the main subject was climate change, and the agreements proposed under Kyoto Protocol were discussed.

Biofuels have become a good alternative, not just as an environmental pollution solution, but as a relative cheap fuel alternative that could replace oil-fuel being depleted day by day (Schmit, Luo & Tauer, 2009) (Mukhopadhyay & Thomassin, 2001). Moreover, constant military and market wars spurred by the hydrocarbon have highlighted the need for each country to strive for energy independence (Walls, Rusco & Kendix, 2011). This is further motivation for biofuel science to seek out alternative energy for transportation. In Colombia, Act 2629 of 2007 establishes that by 2012 all cars manufactured or imported into the country had to run on an E20 (ethanol 20 % -80 % gasoline) blend. On the other hand, a flex fuel kit (Kamimura & Sauer, 2008), should had been installed in cars built before 2000.

In Act 693 of 2001 the Colombian government proposed to boost the production of biofuels, forcing the market to use a mixture of 10 % ethanol in gasoline as of 2005, in order to reduce fossil fuel dependence.

The implementation of this program was screened at various stages, beginning from central Colombia for the first years and gradually spreading to the entire country. All Colombian cars are able to run on an ethanol-gasoline fuel blend without modifying the engines as long as the ethanol proportion is 10 % (Serna, Barrera & Montiel, 2011). However, any program involving the use of blends containing over 10 % ethanol would involve changes in combustion systems and parts of engines that must be considered before its implementation (Agüero, Pisa & Andina, 2006; SENER, 2007).

It is evident that the environment conservation is still subjected to economic decisions. That is why the question about economic benefit of using biofuels emerges. Two sugar mills (SMs) have been selected as research samples, due to their high consumption of fossil fuels and the ease with which they can produce ethanol (García, et al., 2011). The main objective of the research is determining the economic benefit in the vehicles used in two sugar mills for the transportation of operational, technical, and administrative personnel. An economic and environmental benefit is expected as a result of this research (Garcia, Manzini & Islas, 2010; Hoekman, 2009; Andress, Nguyen & Das, 2011; Demirbas, 2008; Agudelo, Muñoz & Trujillo, 2000).

Materials and methods

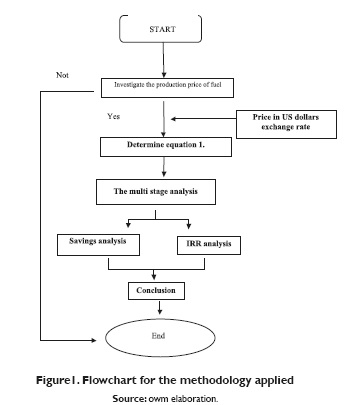

The methodology used in this research is described in the flowchart below (figure 1). The study used data from the production costs of two sugar mills in Colombia. The administration of the sugar mill provided the ethanol production data costs.

In addition to securing the fluctuating prices for ethanol production, a mathematical model involving the price of fuel, the percentages used for the blend and the daily consumption of fuels is required.

The mathematical model represents a relationship between blends and prices. According to the fuel quantity consumed in gallons, it is presented in equation 1.

P is the price of the blend according to the initial conditions, G is the daily consumption in liters, % ethanol is the blend percentage of the fuel used (E20, E40, E60, E80, E85)1 and Pgasoline and Pethanol are the gasoline and the ethanol prices per liter, respectively.

All fuel prices used in the analysis for ethanol, gasoline and the price of the flex fuel kit, were converted into USD according to the representative market rate (RMR) for March 2015.

Three parameters were used in equation (1). In this mathematical calculation, it was assumed that vehicles consume a daily average of 30.4 liters in a 5-day workweek. The gasoline price per liter was set at $ 1.0553 (average fuel price for May 2015). For the Riopaila mill, the ethanol price was set at $ 0.5184.The cars must be equipped with a flex fuel kit, which has an average cost of $ 417.53.

A multi-stage analysis of different percentages of ethanol-gasoline blends was performed using an Excel spread sheet.The following stage of the analysis involved the addition of ethanol price variations.

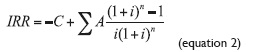

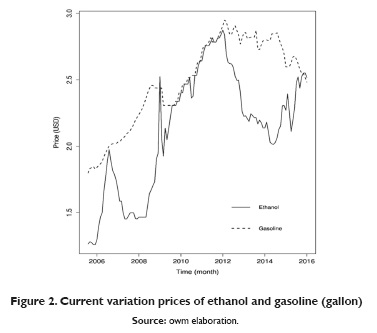

Using the Internal Rate Return (IRR) indicator, which is explained below, it is possible to determine if the project is economically Feasibility.

Internal Rate Return (IRR)

The internal rate return on an investment or project is the "annualized effective compounded return rate" or the discount rate that makes the net present value (NPV) of all cash flows (both positive and negative) from a particular investment, equal to zero (Sarnat & Haim, 1969; Percoco & Borgonovo, 2012).

In more specific terms, the IRR of an investment is the discount rate at which the net present value of costs (negative cash flows) of the investment equals the net present value of the benefits (positive cash flows) of the investment (Dorfman, 1981). The calculation of the IRR is given by equation 2:

Where C is the cost of the investment project, A is the payment amount, i- is the interest and n - is the number of periods.

Results

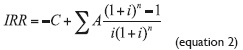

Comparative analysis of ethanol and gasoline costs

The economic study begins with a research work about the behavior of the gasoline and ethanol market prices, which are taken in average values per month in Colombia. The gasoline and ethanol prices were obtained from the Colombian governmental website and the ASOCAÑA website, respectively (figure 2).

Figure 2 shows gasoline and ethanol price trends over time. It is noted that the margin of difference decreases as time increases. Therefore, a comparison between ethanol and gasoline showed a small margin of price difference. This behavior causes ethanol to be economically unfeasible for the transportation sector. However, it is nonetheless worthwhile -with the appropriate legislation- when taking into account the benefits of emission reduction2

Financial analysis for mills

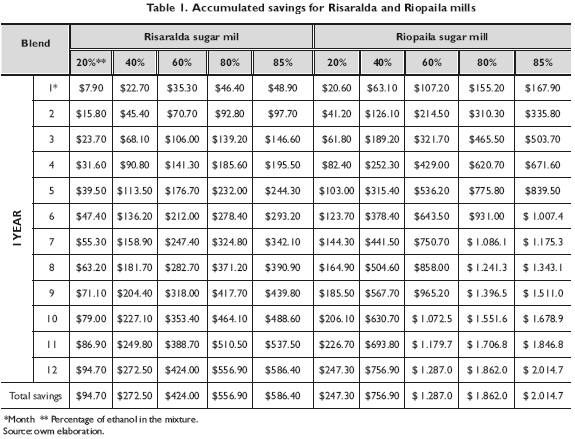

Table 1 presents the calculations made using equation (1) for the two sugar mills. The table presents each sugar mill´s different percentages of mixtures, analyzed over a period of one year.

The same table is used for the Risaralda mill by varying the price of ethanol, as the cost of production there is $0.70351 per liter. It is evident that fuel cost and the cost of the investment to adapt the car to flex fuel can be amortized in less than 12 months if blends at or above the E40 are used. If E60 fuel is used, the investment will pay off in just four months.

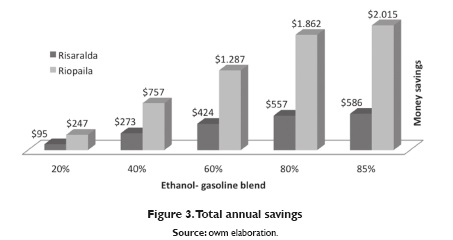

Analyzing the accumulated savings for the Riopaila and Risaralda sugar mills, Riopaila mill data indicates that it would take an average of 5 months to recover the investment made in the kit, while, compared to the Riopaila mill, the Risaralda mill presents a significant difference in the price of ethanol production and thus has a slower recovery of the cost of the kit if the fuel mix used has less than E60 (Figure 3).

Figure 3 reports the total savings accumulated by the two mills in a year. The Riopaila mill generates greater savings in comparison with the Risaralda one, due to the varying internal costs in each company.

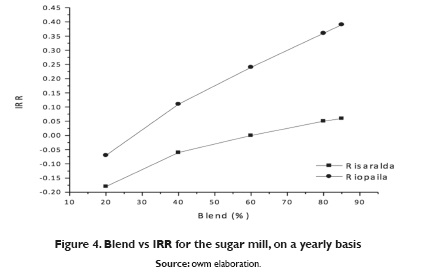

Figure 4 shows that the internal rate of return for each sugar mill varies with the price of fuel, especially in terms of the relationship between producer prices for ethanol and the consumer cost of gasoline.

Conservative estimations are presented in figure 2, where conclusions are similar to those mentioned in the amortization (Table 1) for each mill. Since the ethanol-gasoline cost difference is more significant for the Riopaila mill, the IRR performs better for this mill. In both mills the one-year IRR is negative for the E20 blend.

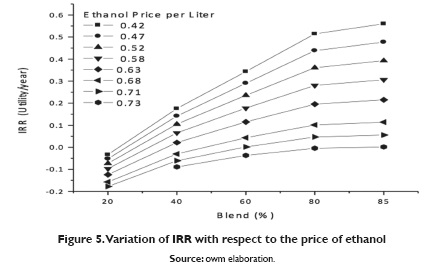

Figure 5 shows how the IRR varies according to the blend and gradual ($ 0.05) price increases per liter of ethanol, starting at $ 0.42 and reaching up to $ 0.63.The last increase was $ 0.08 to reach a price of $ 0.71 per liter, which corresponds to the maximum price allowed for the investment in the full flex kit to be fully amortized within the first year of use.

This demonstrates that for other types of population the use of ethanol in high concentrations in vehicles with not full flex kit installed is financially unviable (Mosquera, Ortiz, Fernández & Mosquera, 2011). This situation is mainly due to the small price difference between gasoline and ethanol, which does not affect the mills where research was made as they pay the production price of ethanol, not the selling price.

Conclusions

This is an attractive proposition for sugar mills in Colombia and abroad. One limitation of this research work is the accuracy of the information provided by sugar mill officials. A multi-stage analysis varying the price of ethanol depending on the mixture used was performed to avoid using unverified data, where the cost of production per liter of ethanol is higher than the one mentioned.

If the State sets the ethanol production or sale price above 2.77 USD, this would be financially unviable, for annual amortization purposes, for blends of less than E60.

Acknowledgments

The authors thank faculty members Pedro Daniel Medina and Sergio Augusto Fernandez, as well as the engineer Christian Ortiz, for the information supplied for the realization of this research. J. Mosquera-Artamonov thanks the CONACYT for scholarship.

Notas

1 E20 is 20 percent ethanol and 80 percent of fossil fuel.

2 The RMR for the dollar of 22 March 2016 was used to convert the time series.

Bibliographic references

Agudelo, J.; Muñoz, J. & Trujillo, L. (2000). Análisis de viabilidad técnico-económica de la conversión de vehículos a sistemas biocombustible gasolina-gas natural para el caso colombiano. Revista Facultad de Ingeniería de la Universidad de Antioquia, 35-42. [ Links ]

Agüero, C., Pisa, J. & Andina, R. (2006). Consideraciones Sobre el Aprovechamiento Racional del Bagazo de Caña como Combustible. Investigación y Desarrollo, 27, 1-8. [ Links ]

Andress, D., Nguyen, D.& Das, S. (2011). Reducing GHG emissions in the United States' transportation sector. Energy for Sustainable Development, 15, 117-136. [ Links ]

Demirbas, A. (2008). Biofuels sources, biofuel policy, biofuel economy and global biofuel projections. Energy Conversion and Management, 49,106-2116. [ Links ]

Dorfman, R. (1981). The Meaning of Internal Rates of Return. The Journal of Finance, 36, 1011-1021. [ Links ]

García, C.; Fuentes, A.; Hennecke, A.; Riegelhaupt, E.; Manzini, F. & Masera, O. (2011). Life-cycle greenhouse gas emissions and energy balances of sugarcane ethanol production in Mexico. Applied Energy, 88, 2088-2097. [ Links ]

Garcia, C., Manzini, F., & Islas, J. (2010). Air emissions scenarios from ethanol as a gasoline oxygenate in Mexico City Metropolitan Area. Renewable and Sustainable Energy Reviews. Renewable and Sustainable Energy, 14, 3032-3040. [ Links ]

Hoekman, K. (2009). Biofuels in the U.S. - Challenges and Opportunities. Renewable energy, 34, 14-22. [ Links ]

Kamimura, A. & Sauer, L. (2008). The effect of flex fuel vehicles in the Brazilian light road transportation. Energy Policy, 36, 1574-1576. [ Links ]

Lacasaña-Navarro, M., Aguilar-Garduño, C., & Romieu, I. (1999). Evolución de la contaminación del aire e impacto de los programas de control en tres mega ciudades de América Latina. Salud pública de México, 41, 203-215. [ Links ]

Lozada, I.; Islas, J. & Grande, G. (2010). Environmental and economic feasibility of palm oil biodiesel in the Mexican transportation sector. Renewable and Sustainable Energy Reviews, 14, 486-492. [ Links ]

Mosquera, J.; Fernández, S. & Mosquera, J. (2010). Análisis de emisiones de CO2 para diferentes combustibles en la población de taxis en Pereira y Dosquebradas. Scientia Et Technica, 45, 141-146. [ Links ]

Mosquera, J., Ortiz, C., Fernández, S. & Mosquera, J. (2011). Viabilidad económica y mecánica para la conversión de motores de combustión interna a sistemas flex fuel. Producción + Limpia, 6, 85-95. [ Links ]

Mukhopadhyay, K. & Thomassin, P. J. (2001). Macroeconomic effects of the Ethanol Biofuel Sector in Canada. Biomass and bioenergy, 35, 2822-2838. [ Links ]

Percoco, M., & Borgonovo, E. (2012). A note on the sensitivity analysis of the internal rate of return. Int. J. Production Economics, 135, 526-529. [ Links ]

Sarnat, M., & Haim, L. H. (1969). The Relationship of Rules of Thumb to the Internal Rate of Return: A Restatement and Generalization. The Journal of Finance, 24, 479-490. [ Links ]

Schmit, T., Luo, J., & Tauer, L. (2009). Ethanol plant investment using net present value and real options analyses. Biomass and bioenergy, 33, 1442-1451. [ Links ]

SENER. (2007). Potenciales y Viabilidad del Uso de Bioetanol y Biodiesel para el Transporte en México. México: Secretaria de Energía. [ Links ]

Serna, F., Barrera, L. & Montiel, H. (2011). Impacto Social y Económico en el Uso de Biocombustibles. Technology Management & Innovation, 6, 100-114. [ Links ]

The National Academies of Sciencies Engineering Medicine. (2016). Retrieved from Energy, What you need to know about: http://needtoknow.nas.edu/energy/energy-sources/. [ Links ]

Walls, W., Rusco, F., & Kendix, M. (2011). Biofuels policy and the US market for motor fuels: Empirical analysis of ethanol splashing. Energy Policy, 39, 3999-4006. [ Links ]