Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Revista de Economía del Caribe

Print version ISSN 2011-2106

rev. econ. Caribe no.6 Barranquilla July/Dec. 2010

HOW DO AGGLOMERATION ECONOMIES AFFECT THE DEVELOPMENT OF CITIES?

COMO INFLUYEN LAS ECONOMIAS DE AGLOMERACION EN EL DESARROLLO DE LAS CIUDADES?

Jasson Cruz Villamil

jassoncruz@gmaiI.com

Economist, M.Sc. in Urban Economics and Development, DPU - University College, London, M.A. in Economics, Universidad Nacional de Colombia. Bogotá-Colombia.

Fecha de recepcion: agosto de 2009

Fecha de aceptacion: octubre de 2009

ABSTRACT

This paper tries to shed some light on the role of agglomeration economies in the development of cities, offering a literature review of types of agglomeration economies and their sources, and how those economies can affect both economic growth and urban growth in the cities. Likewise, it aims to document how the agglomeration economies can influence the level of specialization and diversification of the cities.

Keywords: Agglomeration economies, Specialisation and diversification of the cities.

RESUMEN

Este articulo identifica el papel de las economias de aglomeracion en el desarrollo de las ciudades, ofreciendo una revision de la literatura de los tipos de economias de aglomeracion y sus fuentes, y como las economias pueden afectar tanto el crecimiento economico y el crecimiento urbano en las ciudades. Del mismo modo, se pretende documentar como las economias de aglomeracion pueden influir en el nivel de especializacion y la diversification de las ciudades.

Palabras clave: Aglomeracion economica, Especializacion y la diversificacion de las ciudades.

1. INTRODUCTION

The concentration of economic and social activities over the world has been increasing dramatically in recent years. According to United Nations (2007) it is the first time in history that the urban population in the world is equal to the rural one and by 2050 it expects urban population to represent 70% of the total population in the world. The spatial concentration is also observed within countries, in fact population tends to locate in the largest cities and hence the migration from rural areas or small cities to big cities is currently a common phenomenon. For instance, in the United States 75% of inhabitants live in the cities, this concentrates 83% of total employment in metropolitan areas, which in turn represents 24% of the total area (US Census Bureau, 2008).

Concentration gives advantages to firms when they cluster1 as a consequence of the presence of externalities, among others, with spillover of knowledge or labour. These externalities are a source of larger productivity in the firms and therefore greater profit. The externalities are called agglomeration economies or diseconomies, and they refer to either attraction forces leading to agents clustering, or to forces that reject this agglomeration. According to Rosenthal and Strange (2006, p. 9) these agglomeration economies exist when "long-run average cost falls in response to an increase in the size of a city or the size of an industry in a city."Thus these economies refer to benefits or cost savings that industries have when they are located close to each other.

In spite of the study of the agglomeration economies as part of economics in the nineteenth century, empirical results have not been entirely successful because of problems in the assessment of effects of agglomeration economies on development of cities as consequence of difficulty of implement this theoretical concept in quantitative models and lack in information to allow model estimation without omitting variables.

Faced with the problems pointed out above, there is a broad list that establishes a connection between the effects of agglomeration economies on development of cities. Some regularities found in these studies show a positive relationship between agglomeration economies and economic and urban growth as well as economic specialisation of cities. In this context this essay mainly aims to explain how the agglomeration economies affect the development of cities particularly with accumulation of capital. Furthermore, it explains the sources of agglomeration, sorts of agglomeration economies and the current problems in the empirical studies in estimating these impacts.

Thus this essay is divided in the following six parts: the second part will give a definition of agglomeration types, agglomeration economies and diseconomies. In the third part it will show the four different sources identified by the literature. In the fourth section, it will provide a description and analysis of the main effect of agglomeration economies on development of cities such as enhancement of economic and urban growth and level of specialisation of cities' economic basis. The fifth part describes problems in the current approach to the study of agglomeration economies. Finally some conclusions and suggestions are provided.

2. AGGLOMERATION ECONOMIES AND DISECONOMIES

2.1. Agglomeration economies

The study of agglomeration economies goes back to Marshall (1890), who introduced the concept of the agglomeration economies specifying the external advantages that firms have when they locate together, thus the agglomeration economies are beyond the control of the individual firm and typically result from the existence interaction among firms. Likewise Marshall identified two types of agglomeration economies; localisation and urbanization economies.

2.2. Types of agglomeration economies

According to Marshall (1890) localisation economies correspond to cost savings by the firms, depending on the size of the industry to which they belong therefore the localisation economies are external to the firm and internal to the industry. Thus the localisation economies are benefits because of close localisation of firms belonging to the same industry in a given area leading to savings on the basis of greater cooperation in research, lower transportation rates as well as consumption of special inputs or services.

Urbanisation economies are based on the size or presence of firms of other industries and/or the city's size and diversity which allows them to share specialised inputs but also to share public utilities, transportation services and infrastructure. In fact, the city can offer access to big markets of both products and labour and provide to the firms located in big cities the advantage of provision of public utilities and public infrastructure suggesting that there are increasing returns to scale, according to the city's size.

2.3. Agglomeration diseconomies

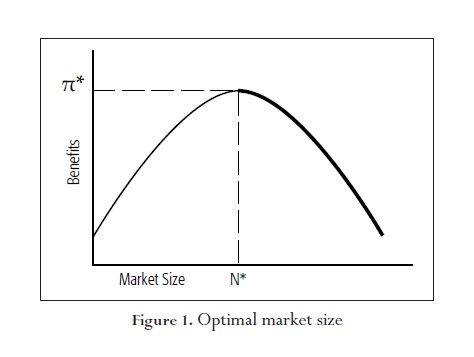

So far this chapter has concentrated on descriptions of positive effects of agglomeration or clustering. Nevertheless, there are also negative aspects insofar as density influences costs such as land value, pollution, congestion and crime, phenomena that frequently are related to overcrowding. As described in figure 1 the profit function in a given space shows an inverse U-shape, regarding the number of firms located versus profit. Therefore the firms' profitability is increased until the utility is on its maxima. A certain number of firms maximise the agglomeration externalities in which the location of additional firms produces a decrease in the utility. This area of the curve is known as net agglomeration diseconomies and it is produced because of negative effects of agglomeration economies being larger than positive effects.

The above analyses used to describe the diseconomies of localisation economies can also be used to describe the diseconomies of urbanisation economies. As a matter of fact factors such as high prices of land as a consequence of scarcity, congestion, pollution and an insufficient amount of urban utilities impact negatively on productivity of cities.

3. SOURCE OF AGGLOMERATION ECONOMIES

The urban economics identified four main causes why the firms cluster; sharing intermediate inputs, sharing labour pool, labour matching and knowledge spillover. The first one is related to advantages that represent the interaction between suppliers and manufacturers in order to obtain suitable inputs as is the case of industries that require no standardized inputs or that the inputs have a higher change rate of innovation. Thus clustering can provide cost savings to manufacturers such as find suppliers specialized with lower price due to exploitation of scale economies by suppliers (OSullivan, 2008). For instance high technology firms are near to their suppliers in order to respond quickly to demand changes as is the case of Stanford Industrial Park located in Palo Alto where cutting edge firms share the same suppliers of electronic components making for matching these intermediate inputs

4. EFFECTS OF AGGLOMERATION ECONOMIES ON THE CITIES

Cities are economic engines in every country because they concentrate the social and economic activities that allow existence of economies of scale plus economies of agglomeration. Cities favour productivity and facilitate the provision and exchange of goods, reducing transaction costs. Likewise agglomeration economies have an impact on urban development; as mentioned above the agglomeration economies constitute advantages to firms as a result of clustering. The main advantage of agglomeration economies is the enhancement of productivity. Firm birth leads to higher demand of employees which play a central role in economic and urban development of cities.

Henderson (2000) identified two main effects of the agglomeration economies on cities. On the one hand they result in an accumulation of capital, reflected in economic growth and city size; on the other hand they influence the level of economic specialisation, or economic profile, of each city.

4.1. Effect on capital accumulation

Broadly speaking, capital accumulation is the process of increasing production or creation of wealth. In terms of a city we can distinguish two classes of capital accumulation caused by agglomeration economies: the first refers to an increase in the production of goods in a city (economic growth) and the second corresponds to the increase in the production of real estate as a consequence of a rising population, also known as urban growth.

4.2. Economic growth

Henderson (2000) studied and developed models to explain the relation between agglomeration economies and economic growth. These models are based on the theory of endogenous growth (Krugman 1991) and according to them there are increased returns to scale which are connected to the functional and spatial context of knowledge production. "Regions including dynamic industrial systems with scale economies in knowledge production would grow faster than regions not in command of such elements." (Diaz-Bautista, 2005, p. 59).

Such a competitive advantage of clustering enhances the local economic performance by taking advantage of supply of skilled labour, broader access to markets, business services and technological expertise. In this way an increasing concentration of industry in a city encourages free exchange of information among firms and at the same time helps to increase productivity and capital accumulation.

The estimation of the effect of agglomeration economies on economic growth is not easy because it is a theoretical concept including many variables, difficult to transfer to practical experience. Therefore the results depend on measuring the instrumental variables used for each research as well as the variables taken into account. Nevertheless there are some generalities on this relation such as the level of urbanisation being positively related to GDP. Indeed Henderson (1996) estimates the correlation coefficient between GDP and urbanisation for 80 countries being about 0.85.

Furthermore Henderson (2000) carried out an econometric study using a panel between 80 to 100 countries from 1960 to 1995 and discovered that growth of concentration has a positive impact on economic growth until a certain peak. From this peak further increase on the concentration could cause losses. In this sense the cities that suffer of urban over-concentration could be affected in their economic growth rates as a result of agglomeration diseconomies, confirming the fact that there is an optimal size of cities that provides most benefits.

Glaeser and Mare (2001) state that there is a positive correlation between productivity, and through wages with cities sizes that increases in market potential (domestic) that shows the strongest impact on city growth. Likewise Rigby and Es-seltzbichler (2002) carried out an econometric modelation with longitudinal database for metropolitan areas of the USA, finding out a positive relationship between productivity and city-size.

Another important topic of study of agglomeration economies and economic growth is the link between foreign direct investment -FDI- and its externalities on the enhancement of economic growth. For example, Hilber and Voicu (2007) discovered in the case of Romania that agglomeration economies are relevant to the location decisions of FDI, leading to an accelerated economic growth in the locations where the investments were made. Additionally Henderson (1986) found out that in Brazil agglomeration economies represent a relevant variable explaining FDI in each Brazilian region.

Finally it is clear that the interactions encourage the creation of new ideas and innovation which allow companies to improve their productivity and the cities' economic growth. Nevertheless this correlation does not imply causal correlation between production and urbanisation. This point is very important as issues of local policy, due to some local authorities with the purpose to improve their economic growth, spend considerable amount of their budget in building up industrial or services parks attempting to attract new companies. The results of policies have been diverse, in some countries successful but in others they have been a failure.

4.1.2 Urban growth

Agglomeration through more productivity fosters urban or physical growth. In fact firms' larger productivity entails a faster urban growth; accordingly the demand of employees increase production which encourages the migration of new population as well as firm birth that profit from these spatial advantages. This phenomenon is due to economic development and increases in capital intensity. The more capital intensity escalates fixed costs compared to variables costs, scale intensity increases expand cities. As argued above, efficient city size increases with economic development until some sort of capital saturation sets in, because of limited effect of scale economies.

Pioneering studies as Henderson (1972) and Arnott (1976) addressed the connections between urban growth and agglomeration economies, focusing on how the optimal size of cities can produce maximum agglomeration economies, nevertheless this area of research has not had conclusive results yet.

Currently the researchers are mainly interested in understanding how changes in the concentration and dispersion of social and economic activities correlate and affect physical growth of cities. In this sense studies from Mano and Otsuka (2000), Rigby and Essletzbichler (2002) and Nakamura (1985) have attempted to discover the interaction between economies, diseconomies and cities. For example, Nakamura (1985) stated a positive and statistically significant relation between city-size and productivity. In this study a doubling of industry leads to a 4.5% increase in productivity in the Japanese cities while doubling of population leads to a 3.5% percent increase in productivity. In this case the causality is originated by size of industry or population. On the other hand Wheaton (2002) discovered that urban agglomeration benefits influence per capita income that denominate a clear rise in salary with an increase in city size.

4.3. Specialisation and diversification2 in the cities

According to New Economic Geography the differences among industrial productivities of different regions will produce interregional specialisation. With time the cities have been developing their economic strength. Nevertheless there are cities with different levels of specialisation or megaci-ties whose economic base is completely diverse. What is the cause of this phenomenon? There is not a unique answer to this question because it can be explained from three different perspectives, the historical, the geographical and the economic perspective. In general the specialisation level of cities corresponds to the interaction of all factors together which play and weigh differently depending on each context. For some countries the urban supremacy can be better explained by historical events, natural endowments or agglomeration economies.

From the urban economic perspective, the productivity has direct impact on the city's size and its diversity.The localisation and urbanisation economies have different impacts on firms depending on factors such as size, sort and industry of firms. This variety in the effects generates cities which contain a big variety of industries and services that support their size. For example, NewYork and Los Angeles do not provide a predominant sector; on the contrary, Silicon Valley is highly specialised (Rosenthal & Strange, 2006, p. 13).

Some empirical studies have found localisation as well as urbanisation economies are associated with the level of economic specialisation of urban centres. For instance, Holmes (1999) ascertains that the urbanisation economies are more important to small industries or new firms in The United States.Therefore the new small companies have a preference to locate in big cities while the big companies are more willing to move to small cities or towns. On the other hand, Henderson, Kuncoro, and Turner (1995) pointed out that the innovation industries settle mainly in diverse cities while the mature industries prefer specialised areas. From the point of view of Rosenthal and Strange (2003) the higher diversity of cities enhances firm birth. In regard to these results the small cities attract big or mature companies because these companies are independent of the benefits of a high diversity in bigger cities.

5. TROUBLES IN ASSESSMENT OF THE EFFECT OF AGGLOMERATION ECONOMIES

In spite of the advances in empirical studies aimed to understanding the effects of agglomeration economies on firms, industries and cities, there is still a lack of development of suitable instruments to assess the results and create theoretical models on urban economic geography. The used proxies to measure the agglomeration economies in the researches have been inappropriate to find general results exacerbating an advance in the study of this phenomenon. In fact, there is no consensus about the most adequate variable to measure agglomeration economies. Some researchers use criteria such as population, industrial employment or share of industrial employment out of total employment. Changes in the use of these variables can produce biases in the estimations due to significant influence of omitted variables.

In addition, some researchers assume that agglomeration economies are independent or unique. Nevertheless one firm can take advantage of more than one agglomeration economy and these can be related with others, this supposes misspecifica-tion of the model. As described above the diseconomies play a central role in spatial configuration of industries and therefore it is necessary to take into account in the applied studies the concept of net agglomeration economies.

Finally, as described above, the diseconomies play a central role in spatial configuration of industries.Therefore it is necessary to take the concept of net agglomeration economies into account in the applied studies. The researchers' attempts to assess the agglomeration economies should discount cost savings derived of these advantages versus the costs produced by spatial concentration, as higher transportation and congestion among others.

6. CONCLUSIONS

Agglomeration economies enhance the exchange of ideas generating innovation and improvements in the production systems of firms, increasing productivity and therefore the capital accumulation of a city. The agglomeration economies enhance the productivity which allows a faster growth of firms and physical and economic growth of the cities. From this perspective the externalities are stronger in the cities than in rural areas due to better mingling of people in the cities; hence the cities are able to generate more capital accumulation than rural areas.

The relation between economic growth and agglomeration economies is comprehensible though; there is a struggle in theoretical definitions with the identification of the causality of agglomeration economies as affected in applied studies. In detail, is more productivity influencing the attraction of employees and as consequence causing economic growth to encourage higher consumption, or vice versa? Unfortunately so far there is not a conclusive answer to this question.

On the other hand agglomeration economies do not show identical impact in every industry and, in this sense the firms aim to locate in the city that provides benefits according to specific characteristics of each company. Thus the agglomeration economies influence on level of diversification or specialisation of the cities.

Pie de página

1"Clusters are geographic concentrations of interconnected companies and institutions in a particular field." (Porter, 1998, p. 78).

2Specialisation is the degree to which a location specialises in one industry and diversification the range of different industries in a location.

REFERENCES

Arnot, R., (1976). A Spatial, General Equilibrium Analysis of Optimal City Size. Queen's Economics Working Papers 222. [ Links ]

Marshall, A. (1890). Principles of Economics, (8th edit). London: Macmillan. [ Links ]

Nakamura, R. (1985). Agglomeration economies in urban manufacturing industries: A case of Japanese cities. Journal of Urban Economics, 17(1):108-124. [ Links ]

Pigou, A. (1907). Review of the Fifth Edition of Marshall's Principles of Economics. The Economic Journal, 17: 532-535. [ Links ]

Porter M. (1998). On competition. The Harvard business review booh series, Boston MA. [ Links ]

O'Sullivan, A. (2008). Urban Economics (6th ed.) McGraw-Hill College. [ Links ]

Rigby, D. & Essletzbichler, J. (2002). Agglomeration economies and productivity differences in US cities. Journal of Economic Geography 2, 407-432. [ Links ]

Rosenthal, S. & Strange W. (2003). Geography, Industrial Organization, and Agglomeration, Review of Economics and Statistics, 85 (2). 377-393. [ Links ] [ Links ]

Saxenian A., (1994). Regional Advantage: culture and competition in Silicon. Valley and Route 128. Boston: Harvard University Press. [ Links ]

United Nations 2007 world urbanization prospects: the 2007 revision, New York USA http://www.un.org/esa/population/publications/wup2007/2007_urban_agglomerations_chart.pdf [ Links ]

Wheaton, W. (2002). Urban Wages and Labor Market Agglomeration. Journal of Urban Economics 51(3): 542-562. [ Links ]