Introduction

Latin America has constantly reassessed the role of public spending in the economic growth of nations. The role of public expenditure became one of the cornerstones of regional development, especially with the application of economic policies structured by the Economic Commission for Latin America and the Caribbean (ECLAC), particularly during the import substitution industrialization (ISI) stage. For some scholars, such as Bértola1 and Ocampo2, the role of the state, as a goal-setting agent, creator of instruments and regulations, and as a direct agent in production processes, was relevant to the industrialization of nations such Argentina, Chile and Uruguay. Nonetheless, according to Jeffry Frieden3, although some countries, such as Brazil and Argentina, experienced industrialization processes, the model was not sustainable for two reasons: first, because of the increasing instability in the trade balance caused by new industries, which required inputs such as raw materials, machinery or material for repairs; and second, the growing public debt that supported the infrastructure programs required by the new industrialization plans of the nations.

A model similar to the ISI was established by the government of Rafael Correa, through the political movement «Revolución Ciudadana». The government established a process similar to the ISI through an increase in public spending and through a plan called the change of the productive matrix. The results of the regime resemble the results of the ISI, that is, instability in the balance of payments; and, a growing public debt. However, the instability in the balance of payments was not caused by the growing number of industries that required inputs, but by the increase in public spending; the new pressure of monetary income found its outlet in imports.

The primary objectives of this investigation are to comparatively review the outcomes of the «cepalino» and «correato» processes, and to analyze the Ecuadorian model, taking into account the relationship between the dollar and the money supply. These two objectives are developed within two hypotheses: first, in both cases, the increment in public spending brought along problems in the public debt and in the balance of payments; second, in the case of the Ecuadorian 21st-century socialist government, the industrialization process was more a rhetorical discourse than a real phenomenon. An alternative premise is suggested, that the problem with the ECLAC model of the 1950s, 1960s and 1970s are some of the main features that ought to be considered in order to understand the debt crisis of the 1980s, as the increasing public debt was one of the results of this period. In the same line of argument, it is suggested that Ecuador's growing public debt will continue for some years after the government of Rafael Correa.

1. Import substitution industrialization

The ECLAC model includes the response to dependence on the external market, as a shield against the vicissitudes of international economic cycles. According to Furtado4, Pinto5 and Prebisch6, integration with the world market allowed for the problems of the external market to affect the economies of developing countries. In this context, Tavares7, quoted by Vallejo8, points out that exports were, until 1929, the central axis of the growth of the Latin American region, while imports served for the acquisition of consumer goods, and a small percentage of intermediate goods and capital goods. The economic policy was developed upon two principles9: first, a closed economy, with high tariff barriers, quotas and exchange controls; and second, a strong role for the state, with government expenditure as the main element of the economy, and with extensive regulations and state-owned industries.

The central problem focused on the terms of trade, that is, over time, the prices of manufactured goods would grow at a higher rate than the prices of raw materials and agricultural products, which would mean, in the long term, that the gap between developed countries and developing countries would expand over time. Prebisch10, cited by Martinez Casas & Guzman11, presents the hypothesis that from 1876 to 1947 there was a tendency of the terms of trade to deteriorate, leaving primary products increasingly behind the manufactured products. «The price relationship has therefore moved adversely to the periphery; contrary to what would have happened, if prices had declined according to the decrease in cost caused by the increase in productivity))12. This first hypothesis was later corroborated by Ocampo and Parra13, who perform a statistical analysis of 24 commodities between 1900 and 2000. In their research, the authors conclude that there was a deterioration in the terms of trade, a drop of around 1% per year.

The solution to the problem of the difference of the terms of exchange was visualized in growth inwards. The ISI then concentrated on industrialization through industrial growth from within, whose production could be consumed internally or externally. This idea governed much of Latin America from 1930 until the end of 197014. The ISI was not implemented in the entire region at the same time, but, on the contrary, the large urban centers were the first to implement the policies of the ISI, such as in Brazil, Argentina, Chile and, Mexico. The first stage of the ISI corresponded to a system of strong restrictions on imports, in addition to supporting the substitution process through the management of the exchange rate and income restriction policies15. The following sections will analyze the most important achievements and problems of the implementation of the ISI program in some Latin American countries.

After the 1970s, ECLAC's development model went through at least four stages16. During the 1970s, it focused on the productive and distributive structure and industrialization processes that combined the domestic market and the export sector. Beginning in the 1980s, the region had to face the debt crisis, due to previous models. At this stage, ECLAC concentrated on adjustment with growth, avoiding social shocks. In the 1990s, the ECLAC focused on productive transformation with equity given the vulnerability to capital movements. Finally, from the first decade of the second millennium, the focus shifted to macroeconomic instability, low economic dynamism and adverse social effects; thus, it proposed the correction of international macroeconomic and financial asymmetries, institutional strengthening through regulatory agencies and efficient social pacts, a broad vision of macroeconomic stability, and strategies for productive development.

2. Industrialization programs

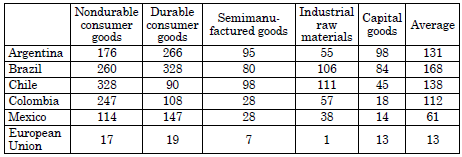

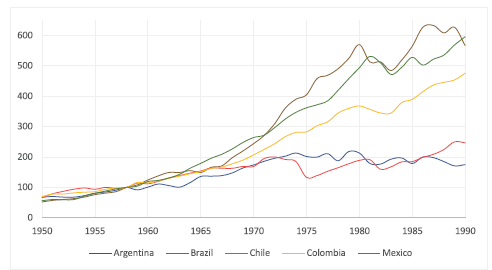

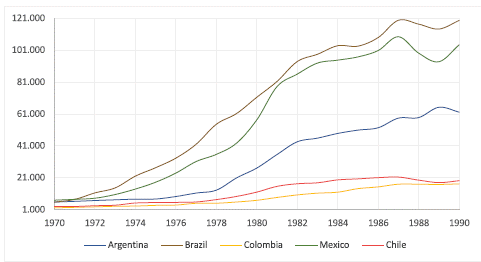

The industrialization programs in Latin America had several stages17. The first stage was characterized by the strong protection of national production. This stage brought with it an increase in domestic consumption. A second stage, contextualized in the decade of the fifties until the seventies, was visualized as a massive development of industrial production, especially of manufacturing (figure 1). However, at the end of the 1960s, the industrial sector began to show signs of weakness, which led the nations to greater protection of domestic supply. In this period, transnational companies would transfer decision-making abroad. The third stage extended through the decade of the seventies, until the beginning of the eighties, depending on the country analyzed. In this stage, the structural failures were profoundly accentuated. The new industry would produce capital goods briefly, which exacerbated the problem of the balance of payments.

Although several countries in Latin America tried to implement certain industrialization plans through import substitution, the countries with the greatest industrial development were Brazil, Mexico, Colombia, Argentina, and Chile. Among them, the most developed were Brazil, Mexico, and Colombia (figure 1). Bulmer-Thomas18, points out that, while some countries rose on the wave of industrialization by import substitution, other countries, as in the case of Peru, remained stagnant due to political limitations. In the case of Venezuela, it saw the emergence of some modern manufacturing that was made possible through the growth of oil revenues.

Source: elaborated by the author, based on Mitchell19.

Figure 1 Indices of industrial production in the manufacturing sector for Argentina, Mexico, Brazil, Colombia and Chile, 1950-1990, 1958 = 100

Although some countries in the region experienced industrialization processes, the protection that had been built around local industries was inconsistent, often taking the form of the protection of the balance of payments and not in the protection of the needs of the region. In addition to import taxes, economic policies converged on multiple exchange rates, import quotas, and licenses were also provided to new industries. Latin America was moving in a direction contrary to that of developed nations; after long negotiations among developed countries in the General Agreement on Tariffs and Trade, (GATT), import taxes were reduced considerably, while tariffs in Latin America remained high, or increased over time.

After the negotiations, the developing countries received pressure to reduce tariffs. In the case of Brazil, it did not reduce its tariff levels, but, at the same time, to determine the costs of imports, it introduced an international exchange auction system20. The countries with the highest nominal rates during the 1960s were Brazil, Argentina, Chile and Colombia. In the case of Mexico, tariffs remained low, however, imported products were managed using quota systems.

Despite the industrial development of some Latin American nations, the GDP growth of the countries mentioned was, with the exception of Brazil and Mexico, on average, less than 5%. From 1950 to 1980, Argentina grew by 3.5%, Chile by 3.2%, and Colombia by 5%. On the other hand, Mexico grew by 6.5% and Brazil by 7%. When per capita growth is revised, growth averages are reduced: Argentina by 1.8%; Chile by 1.3%; Colombia by 4.5%, Mexico by 3.4% and Brazil by 4.3%22. The data show that industrialization translated into economic growth only in Colombia, Mexico, and Brazil.

Problems of the ECLAC Model

In addition to the problems of economic growth, countries that embarked on the new development trend faced problems with the balance of payments and public debt. In the balance of payments, this was because the new industry would generate new needs for capital goods, which would push the growth of imports. On the other hand, public spending, which would become the main driver of the economy, faced the dilemma of constant increases from the generation of debt.

Balance of payments

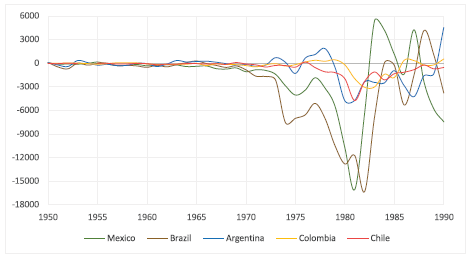

During the first stage of the ISI, the increase in protection for domestic consumption brought with it an increase in the foreign currency deficit, resulting in constant negative balance of payments records. As can be seen in figure 2, from 1950 to 1970, there were no important positive records; however, as of 1970 negative balance of payments records increased considerably. According to Frieden23, this phenomenon is the result of a new industrial sector that required greater importation of inputs for continued growth. The growth of the new industry created a paradox: the growth of the industry came along with the disequilibrium of the balance of payments. Bértola and Ocampo24 pointed out that the shortage of foreign exchange continued to be one of its determining elements, and despite the initial abundance of international reserves, balance of payments crises became a recurring problem. The evaporation of the dollar reserves, against the repressed demand for imports, gave rise to the first balance of payments crises, generating a feeling that the restriction on the balance of payments (the so-called «shortage of dollars») was both a Latin American and a European reality.

Source: elaborated by the author, based on Mitchell25.

Figure 2 Balance of payments in Mexico, Argentina, Brazil, Colombia, and Chile, 1950-1990, in millions of USD

In the Colombian case, Vallejo26 mentions that the dynamism of the industry presented the first problems of growth at the end of the 1960s. However, the industries that maintained steady growth were those of processed products, vehicles, and chemical products. The problems of the inward development model were mainly caused by the decrease in productive investment, which influenced global demand. The model was exhausted and, in the seventies, Colombia promoted the diversification of exports for the external market for the manufacture of industrial products.

For Aldo Ferrer27, Argentina's problem was the liberalization of imports with a strong revaluation of the exchange rate. In this sense, Bonfanti28 points out that the long-term development of Argentina would be impossible because of the dismantling of the industry, together with growing public and private debt. In addition, an element that also had a significant impact on the change of the model was the overvaluation of the national currency because it was considered an anti-inflationary instrument. Despite the release of imports, taking into account the figures of percentages of imports published by MOxLAD29 it is evident that imports of intermediate goods were growing steadily, from 30% of total imports in 1947 to 76% in 1975.

In the case of Mexico, according to the data presented by Godínez Montoya, Barrios, Pérez and Figueroa30, the evolution of the current and capital accounts is diametrically different; on the one hand, the current account declined steadily from 1970 until 1990, while capital accounts increased substantially, from less than one billion dollars in 1970 to more than 20 billion dollars in 1980. These data show that, in the case of Mexico, capital accounts destabilized the balance of payments. In addition, the current account records constant deficits generated in the trade balance, in the balance of factorial and non-factorial services, and by the excess in transfers31.

Brazil shows a deep imbalance of the balance of payments between 1970 and 1980, in fact, the negative records are only comparable with those of Mexico (figure 2). Until 1970, the Brazilian case was exemplified as miraculous. This was made possible through the SALTE Plan (health, food, transportation and energy) in 1948, and the Metas Plan in 195632. The two plans were comprised of industrial policies and commercial activities to promote the economic development of the nation. The main adverse results of this policy were inflation and the imbalance of the balance of payments. According to Márquez33, the decision to promote exports and reset imports, in favor of intermediate and capital goods, produced high inflationary indices that, together with the limited domestic supply to satisfy the demand for consumer goods, led to this domestic demand being covered by imports.

Public debt

After registering problems with the balance of payments, the region was led into periods of debt, the money coming in was not enough to cover expenses an as a result enormous deficits were produced. These fiscal holes had to be covered by the external debt. The increase in the external debt pushed Latin America to the essential reduction of public spending, which caused stagnation in economic growth. Beginning in 1950, the growing activity of Latin American governments in the economy brought with it fiscal pressure, which found new sources of revenue in foreign debt. However, the debate about the origin of the debt crisis in the eighties is still unresolved. The import substitution model began to receive strong criticism from the economic orthodoxy as well from the political left34.

According to Ocampo35, the economic orthodoxy criticized the model for having little macroeconomic discipline and the problems caused in foreign trade because of tariff and para-tariff protection, while the left criticized the inability to overcome external dependence. Ocampo also mentions that the size of the central government doubled between 1950 and 1982, from 12% to 22% of GDP. In principle, this growth was financed by a constant increase in taxes; however, starting in the 1970s, these deficits were financed by external debt.

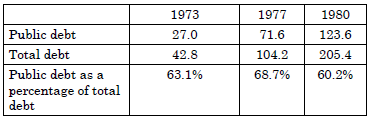

The phenomenon of foreign debt is not seen until the final stage of the import substitution model as the huge demand for resources brought with it the overuse of external loans. Thus, the problems causing the fiscal imbalance were only visible in the external debt as from the seventies. Table 2 and figure 3 show the huge increase in external debt and public debt until 1990. The change of model from the ISI to the neoliberal model, close to the export model before the crisis of The Great Depression, increased the indebtedness for an important reason; It was a tool to get out of the crisis caused by the ISI. The abrupt reduction of the debt would have produced a social commission that, in turn, would have caused deep political instability.

Table 2 Public and total debt in Latin America, billions of USD

Source: elaborated by the author, based on Ffrench-Davis Muñoz36

Source: elaborated by the author, based on MOxLAD, total external debt37.

Figure 3 Total external debt in Mexico, Argentina, Brazil Colombia and Chile, 1970-1990, in current millions of USD.

As shown by Ocampo38, the fiscal balance of the countries in Latin America was negative as from 1950, with percentages lower than 2% of the Gross Domestic Product. However, these percentages increase gradually from 1970 to 1982, from 1% to 5%. Afterwards, the negative records of fiscal balances were reduced until 1991. The enormous need for resources led to constant deficits which, in principle, were covered by the tax increase and, later, were covered by public debt. Furthermore, Senpelli39 points out that the ECLAC model had an impact on the growth of an inefficient industrial sector, whose products had prices that were higher than global prices, lowering purchasing power, within the tendency of creating oligopolistic markets. Finally, according to Hira40, the economic policies did nothing to improve international and national class polarization based on the mode of production, but rather, it exacerbated the differences, and by the late 1970s, the region had the most unequal income distribution in the world.

3. Presidency of Rafael Correa: Change in the productive matrix and substitution of imports

Rafael Correa began his term as president of the Republic of Ecuador in January 2007 with a discourse against the banks, the press, big business owners, and that of regional integration, which had the approval of the main socialist countries of Latin America, institutions such as Unión de Naciones Suramericanas (UNASUR), Comunidad de Estados Latinoamericanos y Caribeños (CELAC), and Alianza Bolivariana para los Pueblos de Nuestra América (ALBA)41. These institutions presented a clear political agenda that focused on the restructuring of the constitutions and, from that point, the restructuring of the political and economic scenario. The main intention was to explicitly recover the role of the state as the protagonist of the process of industrialization, accumulation and income distribution in the new constitutional text42. Within this context, in a period of ten years (20072017), during which there was a continuous emphasis on the intentionality of revisiting ideas of the ECLAC period, Correa pretended to involve Ecuador in a process of industrialization through the substitution of imports. This process would be called the change of the productive matrix through the directing of public planning.

According to Jácome Estrada43, who was part of the government as Superintendent of Popular and Solidarity Economy, the economic policy of the Rafael Correa government sought five objectives: first, to develop national production and productivity in a sustainable way, orienting this process to the satisfaction of the fundamental needs of the population; second, to generate decent employment and stimulate social recognition of productive and reproductive work as the basis of the economy and the well-being of the population; third, to promote regional integration; fourth, to achieve productive inclusion and the redistribution of income and wealth by modifying concentrating tendencies, repairing injustices and reducing current economic and social inequalities; finally, to create confidence in government policies through social cohesion, citizen participation and transparency. These economic objectives were celebrated by many as the consolidation of the heterodox management of the economy to strengthen the state's capacity to plan and promote development, in order to reduce inequality, with an emphasis on supporting the small and medium-scale productive sector.

Thus, public planning changed rapidly. Public planning had been in the hands of different institutions, such as the National Planning and Economic Coordination Board (JUNAPLA, by its acronym in Spanish) from 1954 to 1978. In 1979, it was replaced by the National Development Council (CONADE, by its acronym in Spanish). In 1998, the CONADE was replaced by the Planning Office (ODEPLAN, by its acronym in Spanish), and in 2004, the National Secretariat of Planning and Development (SENPLADES, by its acronym in Spanish) was created. Finally, in 2007, SENPLADES would merge with the National Council for the Modernization of the State (CONAM, by its acronym in Spanish), and with the National Secretariat for the Millennium Development Goals44. Thus, SENPLADES would become the only central national planning agency through which it would attempt to program the change of the productive matrix.

Change of the productive matrix

Through national planning, the National Development Plan 2007-2010 would be built, and after the generation of a new charter in 2008, the National Plan for Good Living 2009-2013 would be created, and finally, the National Plan for Good Living 2013-2017. Of the national development plans, the last two provide a detail of the change in the productive matrix. The 2009-2013 plan, objective 11, on establishing a social, solidary and sustainable economic system, mentions the need to recreate an endogenous economy for good living, investment and public purchases aimed at creating productive conditions that can stimulate the development of disadvantaged sectors45.

On the other hand, the 2013-2017 plan clearly expresses the transformation of the productive matrix. Objective three establishes the economic-productive transformation from the change of the productive matrix. In this sense, the plan mentions productive diversification based on added value, a boost to exports, and import substitution46. This plan mentions the objective of increasing industrial participation in GDP, in addition to the increase in industrialized exports.

Although the National Plan for Good Living 2013-2017 mentions that the manufacturing sector in Ecuador had grown at a rate of 2.9 from 2002 to 2006, the information from the Central Bank of Ecuador47 shows that the growth rate of the manufacturing industry, excluding oil refining, in the same period, was 5.6, while from 2000 to 2006 (2000 = 100), it was 3.7. The only year with a decrease was 2000, with -6.8. This is understandable since in this year the economy of Ecuador would have an abrupt adaptation to the change of currency: on January 9, 2000, the change of currency was established, from sucres to US dollars.

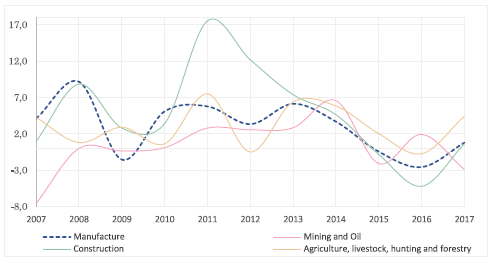

On the other hand, at the time of the presidency of Rafael Correa, as can be seen in figure 6, the growth rate of manufacturing from 2007 to 2017 (2007 = 100) was 3.0, while the growth rate of the construction sector was 4.7, agriculture was 0.3, and the oil and mining sector was 0.3. These data show (figure 4) that the sector with the highest growth was that of construction, with a turning point in 2011, a year whose growth record was 17.6. Construction received an important boost from the growth in public spending. The growth rate of public spending, as will be seen below, remained positive until 2014, when commodity prices fell considerably.

Source: elaborated by the author, based on data from the Central Bank of Ecuador48

Figure 4 Growth rate of manufacturing, oil and construction in Ecuador, 20072017, 2007 = 100

With the data presented, it can be concluded that the change of the productive matrix in the manufacturing sector would become a crutch for political discourse, but, in reality, it did not happen. The manufacturing sector presented higher growth rates in the period 2000-2006 than during the presidency of Rafael Correa. The only sector with high growth rates was the construction sector. However, as of 2014, all sectors of the economy would register minimum or negative growth rates. WTI oil prices would fall from 111 USD in 2014 to 36 USD in February 201649, which exemplifies that the economy as a whole was highly dependent on the raw materials sector.

Problems of the economic model during the presidency of Rafael Correa

The economic model of the presidency of Rafael Correa had problems similar to those presented during the ECLAC period, namely, problems with the balance of payments and the increase in government spending, which would result in an eventual increase in public debt. These common elements appear in the cases studied within the presidency of Rafael Correa, however, there was a unique element, the dollarization system applied by the Ecuadorian government in 2000. Dollarization would be a monetary model that restricted the increase in working capital, at the same time that it led to greater public spending and rising inflation rates. Monetary rigidity would restrict inflationary rates and the imminent devaluation of the national currency.

Balance of payments

The National Development Plan50 mentions the deepening of the transformation of the industrial sector through the substitution of imports, with the idea of obtaining a non-oil trade balance at equilibrium levels. These policies had the objective of contributing to the export of services and products with added value. The applied weighted average tariff went from 4.2 in 2011 to 7.0 in 201751. Although tariff rates rise significantly, tariff rates in the 1990s were higher, on average; from 1993 to 2000, the tariff was 10.42. Thus, it is evident that the levels of protectionism increased in the decade from 2007 to 2018; however, the levels were higher in the nineties.

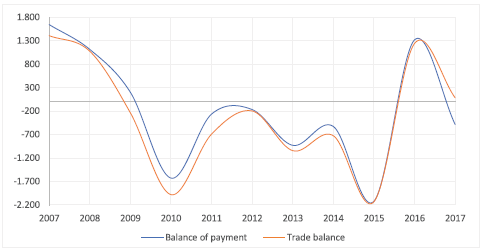

On the other hand, the increase in public spending (figure 6) created an unusual monetary pressure, which it found the possibility to vent in imports. As of 2007, the balance of payments, as well as the trade balance (figure 5), registered a decreasing trend until 2016. In this case, the imbalance is not caused by a growing industry that needed to import capital goods. or intermediate goods, but it was caused by the increase of spending on consumer goods, raw materials and fuels in the international market.

Source: elaborated by the author, based on the data from the Central Bank of Ecuador 52

Figure 5 Balance of payments and trade balance in Ecuador, millions of USD, 20072017

The impact caused by the imbalance of the balance of payments would have caused, with a national currency, an increase in money printing which, in turn, would have caused worrying inflation levels. However, in the Ecuadorian case, the imbalance of the balance of payments endangered the monetary system based on the US dollar. The sustainability of the monetary system depends on external monetary flows, such as exports, remittances, foreign investment and public debt53. In this way, the imbalance of the balance of payments put the stability of the monetary system in Ecuador at risk.

Growth and government spending

Bose (2007)54, after examining the effects on the growth of government spending in a group of 30 countries during the 70s and 80s, reaches two approaches. First, it is mentioned that the share of government capital spending in GDP correlates positively and significantly with economic growth, while current spending is insignificant in GDP growth. Second, government investment in education and total education expenditures are the only disbursements that are significantly associated with growth. In the same sense, Lupu, Petrisor, Bercu and Tofa55, conclude that spending on education and health have a positive impact on the economy, while spending on defense, economic affairs, general public services and social welfare have a negative impact.

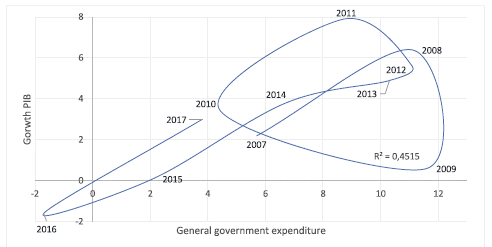

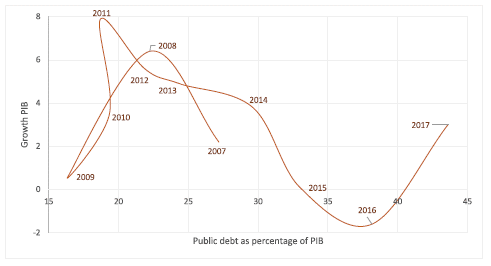

In the case of Ecuador, the total expenditure on education, in relation to GDP, increased from 4.34% to 5.26%, from 2009 to 201556. From then on, the ratio decreased steadily until 2017. On the other hand, health spending, in relation to GDP, increased from 5.8% to 8.4%, from 2007 to 201257. From then on, health spending stagnated until 2017. Although the correlation between total government spending and GDP growth is not high (R2 = 0.451), as can be seen in figure 6, the growth of the government's total spending coincided in several years with GDP growth through to 2012. From this year, government spending and GDP growth steadily declined. The decrease in public spending, generated by the decrease in the prices of raw materials, would lead the government of Ecuador to try to sustain total spending through public debt.

Source: elaborated by the author, based on data from the Central Bank of Ecuador58

Figure 6 Growth rate of government spending and GDP in Ecuador, 2007-2017, 2007 = 100

The public debt became a major problem of the economic model. Although the increase in spending on health and education coincided with the growth of GDP, the increase in public spending, from the decrease in the prices of raw materials, was being financed by public debt. To try to give a solution to the problems that emerged because of the decrease in oil prices, the Ecuadorian government found unexpected levels of public debt, which was used as a protective bubble in order to wait for the recovery of international raw material prices.

In 2008, the Comprehensive Audit Committee for Public Credit was created. The commission presented reports questioning the legality and legitimacy of certain sections of the foreign debt. With this report, the government created a very controversial plan; after announcing the suspension of payments of the Global 2012 and 2030 bonds, the bonds were repurchased at 25% of the nominal value, generating a saving of around 2 billion dollars. This maneuver generated uncertainty in international markets which was visible in the country risk index, which shot up from 582 points in June 2008, to 5,000 points in December of the same year59. The risk index remained high during the first half of 2009, between 4000 and 1000 points. As of 2009, the public debt increased progressively until exceeding the limit legally established by the National Assembly.

As of 2016, the total public debt exceeded the legal barrier stipulated in the Organic Code of Planning and Public Finance60. This phenomenon occurred despite the fact that article 124 of the code establishes that the total amount of public debt, composed of all the entities and agencies of the public sector, may in no case exceed forty percent (40%) of GDP. The same article proposes a way to exit the public debt limit, by the approval of the National Assembly with an absolute majority; that is to say with three-quarters of the total number of assembly members. However, during the last years of the decade studied, the National Assembly did not receive any request from the Presidency of the Republic asking for permission to acquire y finanzas Públicas/T.5458-SNJ-10-1558 more debt, nor was there any formal demand from the National Assembly.

Source: elaborated by the author, based on the data from the Central Bank of Ecuador 61.

Figure 7 Public debt as a percentage of GDP and GDP growth rate in Ecuador, 2007-2017, 2007=100

The government found an escape route; the decision to not declare certain obligations as part of the public debt. Among the items that were not considered were the debt contracted with the International Monetary Fund, the debt with the Central Bank of Ecuador and the Ministry of Finance, the anticipated sale of oil, and the social security system debt 62. In total, the undeclared debt amounted to around 10 billion dollars, which meant 15 extra points to the external debt / GDP ratio. Since 2018, the official figures of the Central Bank of Ecuador and the Ministry of Finance have registered these items as part of the public debt.

Monetary offer and dollarization

The change of the productive matrix, through the substitution of imports, would encounter a particularity, the national currency was the US dollar, which would restrict devaluation processes as part of the monetary policies and present a real problem, the disequilibrium of the balance of payments would put the monetary system at risk. During the decade studied, dollarization would become a fragile delineation of prosperity if its main input of vitality, the flow of money that came from abroad, was not addressed. On the one hand, the monetary restriction would limit the inflationary fluctuations, and on the other hand, the only visible money flow during the decade studied would be public debt.

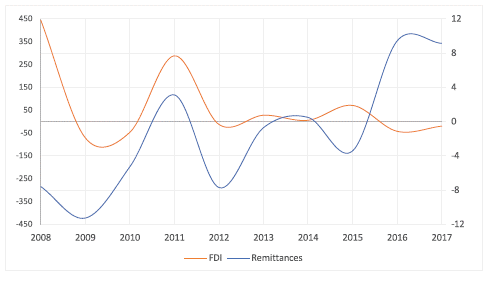

Inflation would remain low as from 2002, with an annual average of 5%63. Nevertheless, the monetary system of dollarization counteracted two eminent risks: first, the income of new dollars would depend on the trade balance, public debt, remittances and foreign investment64; second, the most used money inflow was public debt. Taking into account this panorama, as we have seen, the main problems of the economic model during this government brought with it problems in the form of negative balance of payments that, combined with growing public debt, put the medium-sized monetary system at risk. As can be seen in figure 8, in relation to remittances, from 2007 to 2017, the average growth was negative until 2015. Thereafter, the growth rate was negligible. On the other hand, foreign investment showed high growth rates until 2011, especially due to the huge items from the construction sector65.

Source: elaborated by the author, based on data from the Central Bank of Ecuador66, for remittances; and, BCE-SIGADE67, for foreign direct investment Note: Remittances are plotted on the secondary axis.

Figure 8 Growth rates of FDI and remittances, 2007-2017

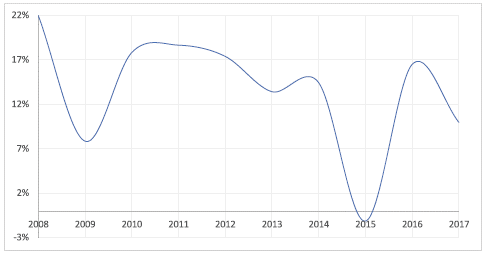

The vitality of the dollarization system depends on the money supply, and the money supply depends on the inflow of dollars. In this way, the vitality of the monetary system depends on the attraction of foreign investments, remittances, foreign trade, and foreign debt. Of these factors, the government was characterized by the increase in public debt, leaving aside other monetary sources. Foreign investment reduced its annual growth rates dramatically, the growth percentages of remittances were very small, while the trade balance presented negative records in most of the decade from 2007 to 2017. The monetary system was being sustained by public debt, which tripled from 2009 to 2017 (figure 7).

Source: elaborated by the author, based on data from the Central Bank of Ecuador68.

Figure 9 M2 growth rates, 2007-2017.

The consequences of the monetary system are visible in the evolution of the money supply. The M2 growth rate was between 7 and 18 points until 2014. As shown in figure 9, the growth rate dropped sharply in 2015 and in 2017. In 2016, the last year of the government, which sought the election to the presidency of a close friend of the government, Lenin Moreno, public activity was pushed; public spending was activated through public debt. In 2016, public spending and public debt increased by 5 points. Thus, it can be understood that the rate of the growth of the money supply recovered in 2016, and then fell again.

Conclusions

The influence of the ECLAC model, based on import substitution industrialization, has influenced the region for more than half a century. The model had a profound impact on Latin America during the 1950s and 1960s, and had an unimagined impact on the movement of socialism of the 21st Century. In both cases, the strengthening of economic growth and industrialization was in the role of public spending. The role of public expenditure became one of the cornerstones of regional development, however, the model brought several problems, such as the increasing instability in the trade balance, taking into account that new industries required growing inputs such as raw materials or machinery, and the growing debt required for the infrastructure programs needed by the new industrialization plans of the Latin American nations.

A model similar to import substitution industrialization was established by the government of Rafael Correa, through the political movement «Revolución Ciudadana». The presidency established a process similar to the ISI through an increase in public spending and through a plan called change of the productive matrix. The results of the Ecuadorian regime resemble the results of the ISI, that is, an imbalance in the balance of payments; and, a growing public debt. However, the imbalance in the balance of payments was not caused by the growing number of industries that required inputs, but by the increase in public spending; monetary pressure found its outlet in imports.

It can be argued that the Ecuadorian government's spending between 2007 and 2017 allowed for the generation of mega works69 such as highways (268 stretches of roads), hydroelectric plants (8 plants), the construction of new hospitals (21 hospitals and 21 health centers) and fostered education (4 new universities). However, in 2019 a thorough review showed that the majority of these mega-works resulted in huge amounts of overpriced buildings, which led to the trial known as «bribes 2012-2016»70, in which 18 people were sentenced to 8 years of imprisonment, including the former President Rafael Correa and former Vice President Jorge Glas.

Although the models are similar in an important way, the article shows that there are two elements that are unique to that time. First, Ecuador did not have its own currency, but, since January 2000, its national currency has been the US dollar. Second, the money supply depended directly on the stability of the currency, that is, the inflow of dollars into the economy. These two elements, closely related, make the Ecuadorian situation a case of study that is different to the other cases of 21st-century socialism. The article concludes that the ECLAC model and the Ecuadorian economic model produced similar results, with two variants, that in the Ecuadorian case there were no problems with inflationary fluctuations and that Ecuador's monetary system depended on the flow of money from abroad.