Introduction

With new technological advances that seem to shrink the world, national economies around the globe have become more intertwined -like a cobweb. The neo-classical export-led development strategy, advocated by the Bretton Woods Institutions, and the recent birth of the World Trade Organization have caused the international trade volume to increase exponentially. This, along with unprecedented mobility of capital due to advances in communication technologies and new international investment opportunities, has been an impetus for nations around the world to develop their economies and to drastically improve the social welfare of their population. Paradoxically, increases in international capital mobility with its fluid nature are often the cause of financial crises of international dimensions. This often causes large sudden reductions in the volume of the international trade flows and disrupts the economic activities causing monetary crises in many nations. Moreover, in the current economic climate, not all economic relationships between two nations are alike. These bilateral relationships depend on the degree of development, endowments of natural resources, and infrastructures of the countries involved and so on. Usually the industrialized economies with fully developed infrastructures can weather certain crises or sustain contagions of crises from other countries better than others, while less developed countries usually suffer severely from crises.

Efforts to bolster the trade and capital flows between the US and Colombia include the Andean Trade Preferences Act/Andean Trade Promotion and Drug Eradication Act (ATPA/ATPDEA) and the yet to be enforced US Colombia Trade Promotion Agreement (CTPA). Historically, the US and Colombia engaged in negotiations for the latter since early 2004. The initiative included initially Colombia, Ecuador, Peru and Bolivia. Both Bolivia and Ecuador eventually stepped aside. On November 22, 2006, Deputy US Trade Representative John Veroneau signed the Agreement on behalf of the United States. However, under pressure from congressional Democrats, the Bush administration renegotiated the agreement to include more stringent environmental and labor standards. It was signed again in 2007. When enforced, This Preferential Trade Agreement will link the Colombian economy closer to the US economy as NAFTA did to the US, Canadian, and Mexican economies.

Naturally in the age of internationalization, a financial crisis of international dimension would be negatively contagious to other economies to certain degree. While the expatriate Colombians in the US may not be an important source of financial capital inflow to Colombia, the Andean Trade Agreement has definitely closely linked the US and the Colombian economies together. Also, the international trade between Colombia and the US is of non-ultra. Therefore, when the subprime mortgage crisis pushed the US economy into its most severe recession since the great depression of the 1930’s, the US demand for Colombian products decreased. The resulting altered trade flows and reductions in even small repatriated funds-magnified by the foreign trade multiplier- would negatively affect the Colombian economy.

The task of isolating and measuring the total impact of the US subprime crisis on the Colombian economy may seem to be hopelessly impossible. Fortunately, long-horizon event study methodologies have been developed which may be utilized to analyze the effects of these economic events. This model measures the impact of an event on the economy as a whole by first calculating and then analyzing the “abnormal returns” on the indices of market portfolios (i.e. the financial instrument price indices.) The usefulness of such a study using financial market data is based on the assumption that markets are rational and efficient; thus, the effects of any newsworthy event will be reflected immediately in security prices and hence in indexes of a market portfolios. Thus a measure of an event’s economic impact can be constructed using financial market data observed over a relatively short time period. In contrast, measurement by direct productivity may require many months or even years of observation, before the effects can be measured, (Mackinlay, 1997, p. 13).

Event studies using financial market data have a rich history in economic and financial analysis. The first published study was Dolley (1933), which studied nominal price changes at the time of stock splits. From the early 1930s until the late 1960s, the level of sophistication of event studies increased through the work, for example, of Myers and Bakay (1948), Barker (1956, 1957, 1958), and Ashley (1962). In the late 1960s, seminal studies by Ball and Brown (1968) and Fama, et al. (1969) introduced variations in the methodology. These modifications relate to complications arising from violations of the statistical assumptions used in the early work and relate to adjustments in the design to accommodate more specific hypotheses. The issues relating the practical importance of many of the complications and adjustments are addressed in papers by Brown and Warner published in 1980 and 1985. The 1980 paper considers implementation issues for data sampled at a monthly interval and the 1985 paper deals with issues for daily data.

In light of the above discussion, this study uses the long horizon event study methodology to assess the impact of the US subprime mortgage crisis on the Colombian economy. The remainder of this study is organized as follows: the next section briefly describes the methodology used in the investigation; the following section identifies event dates and describes the data for the study; the section that follows reports the empirical results; the next section discusses the empirical findings; and the final section provides concluding remarks.

Methodology

Event study has been so widely accepted theoretically and in practice that “the Security and Exchange Commission (SEC) regularly uses event studies to measure illicit gains captured by traders who may have violated insider trading or other securities laws. Event studies are also used in fraud cases, where the court must assess damages caused by a fraudulent activity (Bodie, Kane & Marcus 2009, p. 356.)” Interestingly, afterrigorous analyses and comparisons of the power of the constant returns model to other models using monthly data, Brown and Warner concluded that “This result is striking: It suggests that the simple model, the Mean Adjusted Returns method, is no less likely than either of the other two to detect abnormal performance when it is present, (Brown & Warner 1980, p. 216)”. This study uses the constant mean returns model of the event study methodologies to investigate theimpact of the US subprime mortgage shock on the Colombian economy. Returns will be indexed in event time, (. Following MacKinlay (1997 pp. 19-20), this study defines T = 0 as the event date, T = T1 + 1 to T = T2 represents the event window, and T = T0 + 1 to T = T1 constitutes the estimation window. Let L1 = T1 T0 and L2 = T2 T1 -1 be the lengths of the estimation window and the event window respectively. Given the above defined notations, the statistically motivated constant mean returns model, applied to the index on the market portfolio of country i, can be expressed as follows:

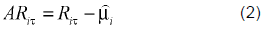

Where Rit is the period-t return on the market portfolio of country i, Ti is the constant mean of returns on the market portfolio of country i, T it is the period-t disturbance term of the return on the market portfolio for country i, and T it ~ i.i.d.(0,T ). With the parameter estimate of equation (1), one can measure and analyze the abnormal returns. Let ARiT, T = T1 + 1, T2, be the L2 abnormal returns for country i in the event window. Using the constant mean returns model to measure the normal return, the sample abnormal return in the event window is:

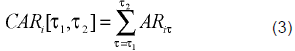

The abnormal return is really the disturbance term of the constant mean returns model calculated on an “out-of -sample basis”. Methodologically, the calculated abnormal returns are accumulated through time to draw an overall comparison. As articulated by MacKinlay (1997, p. 21): “The concept of cumulative abnormal return is necessary to accommodate a multiple period event window”. Define CARi (T1 , T2) as the cumulative abnormal returns of the market portfolio of country i, (CARi) from T1 to T2 where T1 < T1 << T2 < T2. The individual country market portfolio’s abnormal returns can be aggregated using ARi( from (2). The CARi from T to T is the sum of the included abnormal returns.

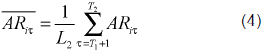

Naturally, the average abnormal return on the market portfolio of country i can be calculated using AR from (2) for the event period, T = T + 1 T2; i.e. L2 periods as follows:

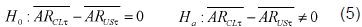

An important question is; as the subprime mortgage crisis pushed the US stock prices on an oscillating downward path, how did the Colombian stock prices behave? The calculated average abnormal returns for both the US and the Colombian stock price indices, and their variances in the event window can be used to test the hypothesis that the reduction in average abnormal return on the Colombian market portfolio is statistically the same as that for the US. The set of null and alternate hypothesis can be stated in equation (5). The testable hypothesis for this question can be set up by the following null hypothesis, (H0), and the alternative hypothesis, (Ha). As shown by Anderson, et al. (2006 pp. 399-389) the above descriptive statistics can be used to calculate the two tailed t-statistic and its degree of freedom to test the set of hypotheses (5). Although testing the set of null and alternative hypotheses, stated in equation (5) may not be an absolute answer to the question, it may scientifically lend credence or repudiate qualitative observations.

Event dates and data

This study uses monthly Colombian stock price index and the US S&P 500 index to calculate the abnormal and cumulative abnormal returns on the market portfolios for these countries. While the US housing market bubbles had been speculated as early as 2006, the portending crisis was not initially taken seriously by either Wall Street or Main Street. The seriousness of the crisis took some time to be recognized by both Wall Street and Main Street. According to the time line of the crisis reported by the Federal Reserve Bank of St. Louis, the first official indication of the US subprime mortgage crisis was the announcement on February 27, 2007, by the Federal Mortgage Corporation (Freddie Mac) that it would no longer buy the riskiest subprime mortgages and mortgage-related securities. Additional recognition of the crisis followed as leading subprime mortgage lender-New Century Financial Corporation- filed for Chapter 11 on April 2, 2007.

The first sign of the international dimension of the US subprime mortgage crisis was the authorization on September 14, 2007 by the UK Chancellor of the Exchequer for the Bank of England to provide liquidity support for Northern Rock, the fifth largest mortgage lender in the U.K. Standard and Poor’s and Moody’s Investor Services downgraded over 100 bonds backed by second-lien subprime mortgages on June 1, 2007. This action was quickly followed by Bear Stearns’ informing investors that it was suspending redemptions from its High-Grade Structured Credit Strategies Enhanced Fund on June 7, 2007. This action shook US financial markets and precipitated the beginning of downward spirals of equity markets in both the US and Colombia. Thus, across this spectrum of events, it can be arguably posited that May 2007 was the event month of the subprime crisis for the US and Colombia.

In most of the long-horizon event studies, the challenging question is the appropriate beginning and the length for the event window. After carefully analyzing the data, considering the aforementioned Federal Reserve Bank of St. Louis’s time-line of the crisis, this study chooses the event window to begin in June 2006 and to end on January 2009. The estimation period is between August 2001 and May 2006 inclusively. These selections provide 58 monthly observations for the estimation period and 32 monthly observations for the estimation of the abnormal returns.

Empirical results

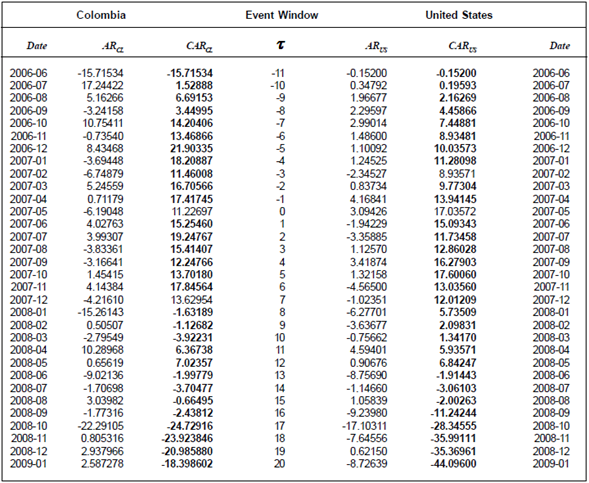

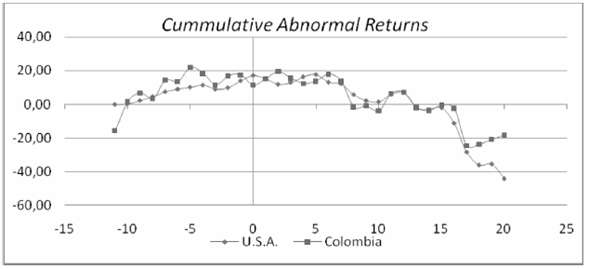

The point estimates of the model show that Ucl and Uas , the estimated constant mean of returns on the market portfolios of the Colombian and the US, are 4.232974 and 0.160668 respectively. The abnormal returns for Colombia ARcl and for the US ARus are calculated, using these parameter estimates and the constant mean returns model (2). Similarly, the sample cumulative abnormal returns on the market portfolios of Colombia and US CARCL (-11,20) and CARUS (-11,20) respectively are calculated using equation (3). The calculation results are reported in Table 1. Figure 1 displays the behavior of the respective cumulative abnormal returns on the US market portfolio CARUS (- 1,20), and the Colombian market portfolio in the above defined event window CARCL (-11,20). The descriptive statistics reveal that the mean of the abnormal returns on the Colombian market portfolio, AR in the event window is0.5750, ranging from -22.2911 to 17.2442, with the sample variance being 47.2040. The descriptive statistics also show that the corresponding figures for the US, ARus, is -1.3780 ranging from -17.1031 to 4.9400, with the sample variance of 23.0436.

As Figure 1 shows, the cumulative abnormal returns on both the Colombian and the US market portfolios increase significantly for twelve months prior to the selected event month (May 2007) of the event window with the Colombia’s index having higher variance, indicating bull financial markets in both countries. The patterns of the Colombian and the US monthly abnormal returns on their market portfolios tracked each other very closely in the ensuing eighteen months, beginning at the selected event month. However, the Colombian equity market oscillated more widely, as compared to the US’s, around a steep downward trend, In the last three months of the event window, while the US abnormal returns continued to move downward, the Colombian stock prices took a sharp upward turn.

The natural question is whether there is statistical support for the qualitative observation that the abnormal returns on the Colombian and the US stock price indices tacked each other closely during the event window. As aforementioned, while testing the two sets of null and alternative hypotheses, stated in equation (5) may not be an absolute answer to the question; it may lend statistical credence or repudiate qualitative observations. From the above descriptive statistic, the calculated two tailed t-statistic for testing the set of hypotheses (5) is 0.5420 with 25 degrees of freedom. The critical values for such statistics are ± 2.060 at the 5 percent level of significance, indicating that the null hypothesis of the average abnormal returns on the Colombian stock market is statistically the same as that one of the US’s cannot be rejected during the selected event window. This failure supports the qualitative observation that the average of the monthly abnormal returns of the stock prices of the Colombian and the US stock prices suffered from the same magnitude of reduction.

Historically, most of the new laws added to the books were enacted to deal with or to rectify past situations; rarely were they enacted pro-actively to resolve the future predictions and unknown situations. By definition, unknowns are unknown; thus no authority can, at any point in time, enact laws or formulate regulations to rectify a currently unknown situation in the future. However, the currently unknown and currently permissible activities that may have seriously unintended consequences which may not be known at the time the laws permit such activities do exist; but no laws or regulations may be enacted to preempt them. Clearly, the nature of the laws and regulations coupled with any of the behaviors of legal economic entities such as irrational exuberance, animal spirit, herding behavior, rational speculative bubble, or plain panicking will definitely create future crises. Even though macroeconomic policymakers have learned how to mitigate the magnitude of the up-down swings of business cycles, they cannot completely outlaw them, i.e., business cycles will continue as will crises of international dimension and their contagions! History has proved this to be true in the current age of globalization.

Taken together, the testing process indicates that the US subprime mortgage crisis affected the Colombian equity market the same as it did the US stock market in percentage measures. Interestingly, this impact took place at the same time that the crisis was manifested in the US and before the first sign of international contagion as evidenced by the authorization of the UK Chancellor of the Exchequer for the Bank of England to provide liquidity support for Northern Rock on September 14, 2007. Now that their economy is closely linked to the US economy, the Colombian policymakers should be aware of the contagious patterns in designing their national economic policy to incorporated measures to counter future external shocks originated from the US.

Concluding remarks

This study uses the event study methodology to assess the impact of the US subprime mortgage crisis on the Colombian equity market. The empirical results suggest that the Colombian equity market suffered the same consequences in term of percentage reduction in the index and timing as the US market. This qualitative observation is supported by simple statistical comparisons the means of the abnormal returns of the US and the Colombian stock price indices. The subprime mortgage crisis may reduce the US demand for Colombian products and to lesser degree a reduction in the repatriated funds are plausible explanations for the observed contagion. As long as the business cycles in the developed countries are not outlawed, the downturns originated in these countries will always be the source of economic difficulty for the international community, especially, the developing and transitional economies. Clearly, the more closely connected the developing economies are to the industrialized economies, the more opportunities the developing economies can develop in the prosperous time. The problems would however be more severe for them in the downturns. Thus, Colombian policymakers should be aware of the contagious patterns in designing their national economic policy to incorporated measures to counter future external shocks especially if the CTPA is enforced and closely ties the Colombian economy to the US economy.