Introduction

The BRIC (Brazil Russia, India, and China) countries occupy important positions in the global business process outsourcing (BPO) and information technology outsourcing (ITO) markets (Feakins, 2009). Brazil is a Latin American leader in outsourcing and its attractiveness on this front is improving. Unlike Latin American economies such as Mexico and Argentina, the Brazilian economy, and the call center market, grew despite the global financial crisis (GFC) (Network Business Weekly, 2010; Tomás, 2010).

Brazil has made it clear that it wants to compete with India in offshoring (Ruiz, 2007). Some recent indicators point out that the country may be en route to achieving this goal. In a survey of U.S.-based firms conducted by Aberdeen Group, Brazil ranked third, only behind China and India, in terms of the attractiveness as a global outsourcing destination (The Journal of Commerce, 2005). According to a survey conducted by A.T. Kearney for BRASSCOM, from 2005 to 2007, Brazil moved from tenth to fifth location in the ranking of offshore destinations (brasscom.org.br, 2010). A related point is that companies are moving to a range of attractive alternatives to the traditional ‘hot spots’ such as India and China (Farrell, 2006).

The purpose of this paper is to provide an in-depth analysis of the Brazilian offshoring industry and to describe possible measures to improve the attractiveness of the country as an offshoring destination. An understanding of how the offshoring industry develops in emerging economies matters not only for theoretical reasons but also for practical ones. For one thing, this industry’s development will improve national welfare. For instance, Indian BPO workers earn nearly twice the average wages in other sectors and in the Philippines, BPO employees’ wages are 53% higher than workers of the same age in other industries (Ribeiro, 2010). The development of the offshoring industry has been of paramount importance to the interests of labor, local communities, and the public. From the standpoint of industrialized world-based firms, offshore outsourcing decisions related to destinations are accomplished using common sense, accumulated experience, and rough judgment (Kshetri & Williamson, 2004). The analysis of this paper would prove helpful in guiding such decisions.

In the remainder of the paper, we first briefly review the Brazilian outsourcing industry. Next, we propose a framework for analyzing the evolution of the outsourcing industry in Brazil. The final section provides conclusion and implications.

The Brazilian outsourcing industry: a brief survey

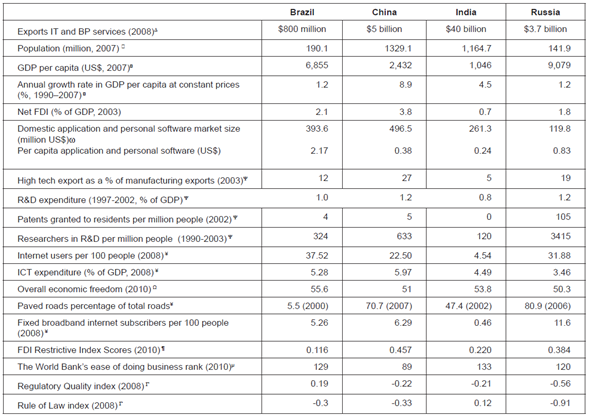

The indicators presented in Table 1 relate to the development of the offshoring industry, which compare the four BRIC economies. Being a relative late comer in the offshore outsourcing arena (Farrell, 2006), Brazil’s outsourcing industry is relatively small compared to other BRIC economies (Table 1). For instance, Brazilian call centers employed 153,900 people in 2009 (Tomás, 2010) compared to over 1 million in India.

Table 1: A comparison of BRIC economies on indicators related to the outsourcing industry

Data sources: Y UNDP (2005); “ UNDP 2009; Dlevi9.com 2009;μ doingbusiness.org (2010).

*The World Bank’s ease of doing business ranks measures the conduciveness of the regulatory environment to business operations. Economies are ranked from 1 - 183, a lower number being better; Kalinova et al. (2010). FDI Index (FDI Restrictiveness Index) Scores measure openness to FDI (closed = 1, open = 0). The index covers four types of measures: (i) foreign equity restrictions, (ii) screening and prior approval requirements, (iii) rules for key personnel, and (iv) other restrictions on the operation of foreign enterprises. 22 sectors are covered. The highest score for any measure in a sector is 1 (full restriction of foreign investment) and the lowest is 0 (no regulatory barrier to FDI). The average for the 22 sectors is a country score; heritage.org (2010); ¥ The World Bank Group (2010); The World Bank Group (2009a). Regulatory Quality measures “the ability of the government to provide sound policies and regulations that enable and promote private sector development” (The World Bank Group 2009b). Rule of Law measures “the extent to which agents have confidence in and abide by the rules of society, including the quality of property rights, the police, and the courts, as well as the risk of crime” (The World Bank Group 2009b). The score has a mean of zero, a standard deviation of one, and ranges from -2.5 to 2.5. A higher or positive value indicates a stronger rule of law.

Brazil’s outsourcing industry is, however, growing rapidly. Brazil exported about US$400 million in software and IT services in 2004 (Benson, 2005), US$ 604 million in 2006, $800 million in 2007 and $3 billion in 2009. The country aims to increase the exports of software and IT services to $5 billion in 2010 (Mari, 2010). Demand for Brazilian-based customer care services from U.S. based companies is expected to grow at a compound annual growth rate (CAGR) of 27% between 2005 and 2010 compared to 21% from other regions (MarketWatch, 2006). Brazil has more in-house contact center agent positions than any other country in Latin America (MarketWatch, 2006). According to IDC, Brazilian call center revenues grew 16.7% in 2009 to US$7.8 billion (Tomás, 2010). In 2010, call center revenues are expected to increase by 11% and call center workforce is expected to expand by 13.3% (Tomás, 2010).

A growing number of developed country-based firms have a notable presence in the Brazil. Brazilian firms have secured such clients as Whirlpool, Gap, and GE for BPO and ITO (Ruiz, 2007). Brazil represents 50% of BT’s Latin American business (Mari, 2010). Likewise, GE’s offshoring share in India is expected to fall from around 70% in 2010 to 50% by 2015 (Mishra, 2010). A significant proportion of the cut is expected to go to Brazil. GE has already started a pilot projects with Brazil’s CPM Braxis. Many U.S. companies are combining call and IT centers in Brazil with those in India and other locations (Fielding, 2006). For instance, in 2004, IBM revealed plans to send many high-skilled programming jobs to Brazil (Bulkeley, 2004). In June 2010, IBM opened its ninth R&D center in Brazil, which is its first in Latin America (Ioannou, 2010).

Lilly is expanding clinical trials on human patients in Brazil (Engardio et al., 2006). Other firms with significant presence in Brazil include Affiliated Computer Services (ACS), Sakonnet and Fidelity National Information Services. Farrell (2006) provides the case of a North American airline company that favored Brazil over India for its new location for customer-support function. Although India and China ranked ahead of Brazil on cost dimension, a Brazilian vendor got the highest rating when the airline company considered all of its six criteria. These represent just a handful of the hundreds of outsourcing projects going to Brazil.

Broader economic, technological, and political contexts

It is important to see the Brazilian offshoring industry in backdrop of broader economic, technological, and political contexts rather than as a self-contained phenomenon. In this regard, the EIU has predicted that Brazil will be the third fastest-growing economy between 2010 and 2020 (Mari, 2010). IT accounts for about 7% of Brazil’s GDP (Kobayashi-Hillary, 2010). As of the mid-2010, Brazil had an estimated 4,000 indigenous IT companies (Mari, 2010).

The Brazilian Federal Government’s Productive Development Policy (PDP) launched in May 2008 considered software and IT services industry as strategic. There are various financial incentives to encourage the development of the offshoring sector. Companies established in technology parks do not need to pay property taxes and receive discounts on service taxes. The Brazilian Development Bank has special credits lines to technology projects (Gil& Sowinski 2010). In addition to 50% reduction in the excise tax to purchase R&D equipment or 100% deduction to import software development materials, spending on staff training and R&D are eligible for an income tax deduction of 200% (Gil & Sowinski, 2010). Brasscom is providing IT-specific English proficiency courses to sector professionals (Mari, 2010).

Software and IT services industry in Brazil generated over US$ 29.4 billion (software sector: US$ 3.2 billion, services: US$ 10 billion, and hardware: US$ 16.2 billion) in 2008, making the country eighth largest in the world. Comparing with the Latin American market, which is estimated at US$ 61 billion, Brazil had a 48% share in 2008 (brasscom.org.br, 2010). In 2008, the country’s domestic IT-BPO market generated $59.1 and the total ICT market crossed $139.1 billion (Gil & Sowinski, 2010).

The Brazilian call center industry has made heavy investments in infrastructure as well as skill (Tomás, 2010). Gil and Sowinski (2010, p. 42) note: “After years of investment Brazil is better poised than China or India to address the full spectrum of IT outsourcing needs”.

Major local players

Brazil’s main IT services companies such as Politec, CPM Braxis and Stefanini, are world renowned in areas such as financial services, manufacturing, retail, and public sector (Heeks, 2010). In 2004, Politec began providing offshore outsourcing for application maintenance, legacy transformation, distributed monitoring, and software development to U.S. financial institutions (Bank Technology News, 2005). In 2005, Stefanini provided outsourcing services for 15 U.S. companies such as Johnson & Johnson, Kimberly-Clark, and Lucent Technologies (Benson, 2005). In 2009, Stefanini invested US$218,700 to boost cloud offering. IBM has established a cloud computing center in Brazil.

International marketing and brand building

Brazilian firms are taking measures to improve export orientation and global brand performances. A group of Brazilian companies created Brazil IT, a brand name for the U.S. market. Among other things, these companies sponsored trade shows in the U.S. In 2005, another group of companies created the BRASSCOM, which hired McKinsey/ AT Kearney consulting to devise international strategies. Likewise, Softex, a group of over 100 companies, launched an ambitious 3-year global marketing program.

An observation, however, is that Brazilian IT companies are less aggressive than their Russian counterparts on export orientation. For instance, every third Russian company has sales/representative offices in North America and over one third of software developers have sales offices in Western Europe (Dranitsyna, 2006). Moreover, Latin American firms in general lack brands that are globally recognizable. Brand-building efforts are mostly focused on home markets rather than on creating a world-wide image (Barham, 2005).

Infrastructure

A study conducted with multinationals’ executives by McKinsey Global Institute showed that they value a stronger infrastructure such as ports, roads and reliable telecommunications and network services more than government incentives (Baily et al., 2006). Infrastructures such as highways, ports, railroads, and power generation and storage facilities are not adequately developed in Brazil (Elstrodt et al., 2006). As indicated in Table 1, the proportion of total roads that are paved is the lowest in Brazil compared to other three BRIC economies. Nonetheless, compared to India (Rai, 2005), Brazil has better developed infrastructures. Brazil’s well-developed infrastructure was a major factor for a North American airline’s bend toward a vendor in the country (Farrell, 2006). As of 2010, Brazil had 18 fully operational technology parks and additional 12 were in final stages of implementation (Gil and Sowinski, 2010).

Industry structure

In terms of size distribution, Brazil’s 14 large companies and 9 subsidiaries of multinationals account for 88 % and 30 companies account for 90 % of software export (Mendonça, 2005; Brasil, 2005). Brazil’s structural composition in terms of size is similar to that of Russia2 (Cusumano, 2006) and China (Kshetri, 2005). That is, most Brazilian companies are much smaller than their Indian counterparts thus limiting their capability to handle large outsourcing projects (Benson, 2005; Cusumano, 2006). For instance, in 2009, Brazil’s biggest IT provider, Politec had just over 7,000 employees, 15 technology centers and 15 branch offices (Foreign Affairs, 2009) compared to the Indian company Tata Consultancy Services’ (TCS) employment size of over 160,000 in March 2010.

A framework for analyzing the outsourcing industry in Brazil

At the broadest level, the concept of “social coevolving ecosystem” (Mitleton-Kelly, 2003) can be extended to analyze the offshoring ecosystem. The offshoring ecosystem is composed of organizations, entrepreneurs, consumers, as well as economic, geographic, and institutional factors. These components are related to factors such as availability, quality and costs of inputs, infrastructures, regulatory regimes and domestic demand, trade policy, the export orientation of the industry, which would affect the development of the offshoring industry (Beise, 2001, Lehrer, 2004, Linder, 1961; Vernon, 1966, Tilton, 1971). Another way to view this is that various ingredients of the offshoring ecosystem would affect the elements in the economic models of outsourcing such as transaction costs, asset specificity and incomplete contracts (Grossman & Hart, 1986).

Externalities and linkages

The growth of the offshoring industry hinges critically upon the forward and backward linkages in the local economy (Markusen and Venables, 1999). A related point is that economic actors with interdependent relations jointly produce externalities (Frischmann & Lemley, 2007). Firms in the offshoring sector or between those that engage in industries related to this sector can create key externalities. The externalities, which originate from other firms in the same industry, are also called MAR externalities (Marshall, 1890 1920; Arrow, 1962; Romer, 1986). MAR externalities represent the positive role of specialization on growth through knowledge spillovers (Bun & Makhloufi, 2007). There are also potential “inter industry knowledge spillovers”. Such spillovers are referred as Jacobs (1969) externalities. Banks and companies in the electronic voting sector, for instance, generate Jacobs (1969) externalities.

Linkages and externalities in the Brazilian offshoring sector

Prior researchers have suggested that key industries and activities generate externalities that may benefit other industries and firms (Holtz-Eakin, 2000). In this regard, it is worth noting that, while India developed strong export-oriented software sector, Brazilian software sector, like China’s, grew primarily to meet the needs of domestic firms (Arora and Gambardella, 2005). Brazilian IT forms have focused on serving the well-developed and sophisticated domestic market for over 50 years, which has created forward linkages and externalities for the offshoring sector. Of the four economies, Brazil has the biggest per capita domestic spending in application and personal software (Table 1). Experts note that “local companies are the ace card for Brazil” (Kobayashi-Hillary, 2010).

Of the four countries, Brazilian IT sector most resembles economically developed nations, which typically generates a high degree of externalities for the offshoring sector. An important consideration is the proportion of IT budget that is spent on services. Brazilian firms spend 38 % of IT budget on services (the global average 4041%), compared to about 20% for Russia, India, and China (Summerfield, 2006). Brazil’s IT services market is expected to grow by 8-9% in 2010 (Arnold, 2010). The non-Brazil BRIC economies spend 65-70% of their IT budget in hardware (Summerfield, 2006).

Brazil’s banks are arguably among the world’s most automated (Tigre & Dedrick, 2004). Brazilian technology vendors are experienced in providing sophisticated IT solutions to local financial institutions. In the early 1990s, Brazilian banks developed sophisticated, efficient, and reliable fund-management software to deal with hyperinflation (Benson, 2005; Gil & Sowinski, 2010).

In the early 2000s, the country switched to electronic voting machines in all elections. Brazil was one of the world’s first to adopt electronic voting (Mari, 2010). Similarly, tens of millions of Brazilians file tax returns online (Benson, 2005). Likewise, manufacturing firms in chemicals, pharmaceuticals and cosmetics, plastics, paper, and textiles are also driving substantial IT spending growth (Summerfield, 2006). These activities have generated a high degree of externalities.

Foreign multinationals activities are an additional source of externalities in the Brazilian offshoring industry. Multinationals such as IBM, Accenture, HP, Electronic Data Systems, Intel, Microsoft, Cisco, HSBC, BT, Motorola, Dell, Siemens, Unisys, Exxon Mobil, and Johnson & Johnson have operations in Brazil (Gil & Sowinski, 2010; Ruiz, 2007).

Many Indian outsourcing firms have started operations in Brazil. In October 2004, India’s Satyam Computer announced its plans to start operations in São Paulo (satyam.com, 2004) mainly to serve as a near-shore location for the company’s U.S. customers (InformationWeek, 2004). Another Indian outsourcer, TCS entered Brazil in 2002. It had 485 people at its Brazilian unit in 2006. As of 2010, TCS had 1,300 professionals working in two Brazilian development centers located in Barueri (São Paulo) and Brasilia. TCS is also the first Brazilian IT company to obtain CMMi (Capability Maturity Model Integration) level 5 certifications as well as PCMM (People Capability Maturity Model). Tata engineers in Brazil work with teams in locations such as Uruguay, India, Hungary, China, Chile, Mexico, and Argentina (Friedman, 2006). TCS has teamed up with local institutions of technical and higher education. As of 2010, TCS provided trainings and employment to over 400 Brazilian students (TCS, 2010). Likewise, in December 2009, Infosys Technologies Limited opened a wholly owned Brazilian subsidiary - Infosys Tecnologia Do Brasil Ltda in Belo Horizonte, Brazil.

Export orientation of industries has also been an important source of externality. Like China, Brazil has emerged as a manufacturing hub for consumer durables such as televisions, cars, and computers. These products are exported to the U.S., Japan, and Europe. Brazilian companies are thus relatively well versed with the export business.

A final source of externality concerns knowledge about quality and value perceptions of consumers. A study found that Brazil has caught up with, or surpassed, Italy in ‘reliable product quality’ and ‘speed of response’, ‘punctual delivery’ and ‘flexibility in coping with changes in large orders’ (Schmitz & Knorringa, 2000). Looking at the backdrop of increasingly important role of quality in outsourcing (Franz et al., 2006), Brazil’s experience and expertise in delivering high quality product would produce potentially important externalities.

Closeness of experience, expertise, culture, and geographic reach to clients’ needs

Closeness of the supplier’s expertise to the clients’ needs (Grossman & Helpman, 2005) is affected by many factors:

Offshoring skills

An important component of asset specificity is human asset specificity, which is related to specialized skills, knowledge, and experience of an outsourcing firm’s personnel specific to the offshoring industry (Williamson 1983). In this regard, availability and quality of IT workforce play key roles in the development of the offshore outsourcing industry. Brazil has an IT expertise pool of about 1.7 million people. The country’s 1,714 ICT-related technical and graduate courses produce 100,000 graduates annually (Mari, 2010; Gil & Sowinski, 2010). In 2008, universities in the country produced more than 220,000 graduates (Gil & Sowinski, 2010). Brazil has 123 national institutes of science and 400 incubators. (Ioannou 2010). Brazil’s local IT staff turnover is estimated at 20% compared to India’s 40% (Mari, 2010).

While some observe that Indians perform better in “academic understanding of products” (Fielding, 2006), Brazilian firms’ have superior advantages in some industries. In aerospace, for instance, Brazilian firms’ expertise far exceeds those of other developing economies (Anselmo, 2005). The Brazilian firm, Embraer, is the world’s largest maker of regional jets and has become a serious challenger to the low-end of Boeing 737s and the Airbus A318 models (Bhatnagar, 2006). Brazilian firms are also ahead of Indians on delivering product quality.

The exact nature of expertise, however, varies across offshoring domains. Brazil suffers from a lack of manpower to perform highly sophisticated technical work relative to other BRIC economies (See Table 1 for indicators related to IT and human capital). For instance, Russia’s competitive advantage lies in its ability to perform sophisticated technical works at relatively low cost (Cusumano, 2006). Multinationals are mostly undertaking adaptive R&D projects in Brazil compared to several innovative R&D works in India and China (UNCTAD, 2005). Number of researchers in R&D per million people is higher than India’s but Brazil underperforms Russia and China on this indicator (Table 1).

Cultural compatibility

There are two reasons why cultural compatibility between an outsourcing provider and the client firm matters. First, language similarity is a function of the closeness of the supplier’s expertise to the needs of the client firm (Grossman & Helpman, 2005). In this regard, the reason perhaps most often cited behind India’s success in attracting outsourcing jobs is that the country has a huge English-speaking workforce. Brazil, however, has the second-largest number of English speakers (10.2 million) behind only India (Gil & Sowinski, 2010). As the Hispanic market is growing rapidly, U.S. firms need Spanish speaking call agents (Fielding, 2006). It is also worth emphasizing that Brazilians can provide services in English, Spanish, German, Italian and even Japanese, thanks mainly to the migrations in the 20th century. To take one example, ACS has service center in Brazil to provide support to Goodyear’s Latin America Region services in Spanish and Portuguese (Davidson, 2006). Compared to Russians and Chinese, which use alphabets that are different from used in most Western languages (Pries-Heje et al., 2005), Brazilians can communicate better with most Western countries. Brazilian contact centers are also better able to serve Spanish-speaking U.S. regions (MarketWatch, 2006). Some, however, observe that despite Brazilians’ English proficiency, many Brazilian firms face difficulty in doing business in English (Mari, 2010).

It is too simplistic to view language similarity as the only, and even primarily, important factor, however.

The second explanation rests upon isomorphism, which is a “constraining process that forces one unit in a population to resemble other units that face the same set of environmental conditions” (DiMaggio and Powell 1983). Organizational isomorphism is positively related with legitimacy (Deephouse, 1996). The importance of isomorphism is apparent in Indian outsourcing firms’ shift of parts of their operations in Eastern Europe to respond to client firms’ pressure for isomorphism. For instance, Indian outsourcing firm, Infosys, has opened an outsourcing center in the Czech Republic with 100 people working in 13 languages. Multilingual workers and cultural affinity with Western Europe were among major factors in the decision to relocate its outsourcing operations in the Eastern European country (The Economist, 2005a). Indian companies also provide training on the Western approach to time and other concepts related to culture. They also teach their employees attitudes to deal with U.S. customers (Sparks, 2006).

Prior researchers have shown many examples of cultural difficulties, not related to language, encountered by Indian call centers (Kshetri, 2007). Even those with good command of English may not understand cultural contexts and business practices of the client firm. In this regard, it is important to note that, for Indian outsourcing operations, some U.S. companies send employees of Indian descent who understand both the corporate and local culture (Bank Technology News, 2004). In this regard, one of Brazil’s strengths concerns culture. Indeed, Latin America’s culture is closer to that of the U.S. compared to India’s (Fielding, 2006). Brazil’s potential as an outsourcing venue lies in a culture that is similar to that of the west in terms of race, religion, and family lifestyle. In addition, Brazilian companies emphasize on teamwork in software development projects. Brazilians arguably also understand western business rules and environment better than other BRIC economies. In sum, Brazil has a better “commercial affinity” thanks mainly to its cultural similarity with the U.S. (Fielding, 2006). Speaking of cultural similarity between the U.S.

and Brazil, Carlos Diaz, vice president of PanAmerica and global accounts officer for Meta4 and an expert of HR issues in Latin America noted: “The countries share many cultural references-music, movies, television shows, etc. …You wouldn’t have to explain who Mickey Mouse is to a Brazilian, but that may not necessarily the case when it comes to somebody from India” (Ruiz, 2007).

Physical proximity to major markets and nearshoring trend

Brazil is relatively weak on price due primarily to high taxes and a strong currency (Mari, 2010). One estimate suggested that Brazil has a 30% cost advantage over the U.S. compared to India’s 50 % (Horowitz, 2003). Price has been the principal reason for buyers to source to India and China.

While Brazil performs poorly on cost dimension, part of the fascinating character of the Brazilian offshoring industry stems from the trend towards nearshore outsourcing, especially for projects that require physical supervision. Note that the world’s major offshoring clients are in North America. For instance, North American companies are the primary engineering outsourcers, accounting for 70% of the business (Sehgal et al., 2010). For North American outsourcers, when costs of travel and training and “soft” cost of managing people are considered, costs of hiring arguably tend to be lower for Brazil compared to India. One study found that the cost of employing one call center agent in 2005 was $13.05 in Brazil compared to $15.00 in India (Fielding, 2006).

Brazil’s transportation links with major clients, which are associated with transport costs and travel time, also favor the country. In 2010, there were 150 direct flights a week from the U.S. to Brazilian cities (Gil & Sowinski 2010). Brazil is practically in the same time zone as the U.S. Offshore outsourcing teams thus can operate as remote members of the same project group, which facilitates active and continuous collaboration (Rao, 2004).

The importance of regulation and regulatory institutions

For parties involved in an offshoring agreement, making their contract complete represents a high degree of complexity and cost (Hart & Moore, 1988; Williamson, 1971, 1979, Williamson et al., 1975, Teece, 1980). The law and its enforcement are thus central to filling in the gaps in the actual agreement of the parties involved in offshoring. There are problems associated with writing and the lack of verifiability of outsourcing related contracts in the court of law (Grossman & Helpman, 2002). There are visible problems related to enforcement of contracts in developing countries, where the prospect of civil and criminal prosecution is weaker when such breaches take place in a country with a weak rule of law (Lowes, 2004). A proper regulation and a strong rule of law would help ensure that outsourcing firms and employees will not be engaged in opportunistic behavior.

Brazil’s judicial system is arguably comparable to that of the U.S. (brazil-it.com, 2005). Brazil has the highest Regulatory Quality index of the four economies and its Rule of Law index is second only to India (Table 1). The lowest FDI Restrictive Index Scores indicates that Brazil is the most open economy for FDI. Brazil also has the highest overall economic freedom index.

That said, a country’s labor laws also affect the development of the outsourcing industry. Employment costs in Brazil tend to be high because of labor laws such as constraints on firing workers. Moreover, restrictions on hiring temporary workers prevent businesses from adjusting workforce to account for demand fluctuations (Elstrodt et al., 2006).

Discussion, implications, and conclusion

The theoretical contribution of this paper is to explain the ‘Hows’ and ‘Whys’ (Whetten, 1989) of offshore BPO and ITO. An in-depth understanding and comparative evaluation of major destinations are also necessary to effectively assess and enable the possible trade-offs in economic, political cultural and geographic benefits that are provided by the competing destinations.

Moving to the specific contexts of Brazil, factors related to offshoring skills, cultural compatibility and physical proximity to major markets are related to its closeness to the needs of clients in terms of experience, expertise, culture, and geographic reach. Brazil’s competitive advantage lies on noncost benefits. The single most important firm-level determinant of decisions regarding offshoring destination, however, concerns cost. In this regard, Brazilian firms need to improve their marketing and branding strategies for the global market. More to the point, Brazilian firms are attractive on asset specificity (because of cultural similarity, reputation on quality, etc.) and incomplete contracts (because of a strong rule of law) in terms of economic models of outsourcing discussed above. Communicating these benefits offered by Brazil to potential clients is thus important. However, since most Brazilian firms engaged in outsourcing are smaller compared to Indian firms, industry level efforts are likely to be more effective.

Brazil’s high-tech export as a proportion of manufacturing exports is lower than those of China and Russia, indicating lower quality of externalities (Table 1). Well-developed high-tech sector has allowed China to bundle software with hardware products and export them worldwide (Kshetri, 2005; Reinhardt et al., 2006).

Notwithstanding some challenges such as language problems, perception of macroeconomic stability (e.g., unstable currency) and a high crime rate (Elstrodt et al., 2006; MarketWatch, 2006), Brazil has become an increasingly attractive outsourcing destination. While some analysts were concerned with a lack of political stability (Elstrodt et al., 2006) and a lack of relative performance in overall education levels (Benson, 2005; Horowitz, 2003; pbs. org, 2007), these concerns have been adequately addressed in recent years (Mari, 2010).

The country’s advanced telecommunication and financial networks, well-developed domestic IT market, its manufacturing prowess and export orientation have generated interorganizational as well as intraorganizational externalities or spillovers for the offshoring sector. Such externalities take various forms such as knowledge spillovers, learning curves, brand loyalty, availability of tools and resources, knowledge about quality and value perceptions of consumers as well as production externalities. Foreign IT firms have also generated externalities in the firms of indirect economic impacts on local organizations.

Forecasters have argued that the phenomenon of the outsourcing of jobs from industrialized countries has just started. Offshoring growth is likely to lead to measures in polishing workers’ skills in languages and other areas to take more business functions (Cetron & Davies, 2010). Emerging economies are thus likely to face even more pressures to improve various ingredients of the offshoring ecosystem. Note that in recent years, other BRIC economies have taken a more aggressive approach to develop the offshoring industry. For instance, the Chinese government wants to create 1.2 million jobs by 2013 in this industry. To do so, it has announced a five-year plan to spend $1 billion in subsidies, incentives, and training. The government aims to develop 10 outsourcing hubs in the country and 1,000 vendors, and attract 100 multinational customers (Fannin, 2010). Without similar measures, Brazil may not be able to move to a higher gear of offshoring performance.

The discussion above indicates that Brazil’s critical advantages include a large and developed domestic IT market and geographical and cultural proximity with the U.S. the domestic market offers Brazil an unprecedented advantage over other BRIC economies, whereas in India, small domestic markets forced its IT firms to focus on developed markets. One reason behind Brazilian IT firms’ lower level of internationalization is that they have not been forced to pay attention to the international market. After conquering the domestic market, Brazilian IT firms now seem to be ready for frontal attack in the export market. Experiences in serving the domestic market have generated intra-organizational externalities for Brazilian IT companies.

There remains the question of how Brazil can further strengthen its position in the global outsourcing arena. First, labor laws such as constraints on firing workers and restrictions on hiring temporary workers (Elstrodt et al., 2006) have become roadblocks to the growth of the Brazilian outsourcing industry. Regulatory correction is thus important. While regulation is the domain of Brazilian government, trade associations such as BRASSCOM can play critical roles (Kshetri, 2007). In this regard, Brazil can borrow a page from the lesson book of India’s National Association of Software and Services Companies’ (NASSCOM) (Kshetri & Dholakia, 2009).

The share of a developing country such as Brazil in the global outsourcing pie is a function of the existence of outsourcing-friendly manpower in the country. Outsourcing readiness of a country’s workforce depends upon a proper combination of cultural, linguistic, and technological expertise. Educational system geared towards preparing the workforce with broad skills and knowledge needed for attracting outsourcing related jobs would help compete globally. A related point is that, due to the growth of the Indian economy, the demands for Indian graduates in areas such as finance, health care and tourism is growing rapidly (Fielding, 2006). An estimate suggests that Indian outsourcing industry would face a shortfall of 260,000 qualified personnel by 2009 (The Economist, 2005b). These changes in India may increase Brazil’s relative attractiveness.