Introduction

Historically, Africa’s trade with the rest of the world has experienced three different phases. Before many African countries attained independence in the early 1960s, African trade policy was determined by the colonial powers. Trade was to a large extent a two-way phenomenon whereby primary commodities were exported to their metropolis and manufactured goods were imported to African countries. During this period, the trade structure of African countries was influenced by the interests of the colonial powers. Between the 1960s and 1980s, the doctrine of import-substitution industrialization informed the trade policies of many countries in Africa. For instance, Nigeria, Burundi, Madagascar, Ethiopia, Sudan, Zambia, Senegal, and Tanzania all implemented internal oriented policies with decisive trade restrictions. This encouraged the protection of the domestic market from foreign competition so as to improve the domestic industrial production. In the period from the 1960s to 1970s, import-substitution industrialization was widely considered as a feasible policy intervention to attain structural transformation in the developing countries in order to minimize their reliance on primary products United Nations Conference on Trade and Development (UNCTAD, 2008).

As a result, most African trade policies during this era were characterized by extensive government involvement in the economy. Moreover, several policy interventions were put in place to shield the domestic market in these countries from foreign competition. Non-tariff measures in the form of government licenses and quantitative import restrictions were applied copiously to curb imports. Whilst exports were often constrained by different export taxes coupled with strict rules and regulations. During this period, the exchange rates of countries outside the Communauté Financière Africaine (CFA) franc zone often experienced high depreciation together with rationed access to foreign exchange (Abdillahi and Manini, 2017).

After Ghana attained independence in 1957, the country implemented the import-substitution industrialization strategy, coupled with a number of restrictive trade policies such as an increase in import tariffs, non-tariff measures, and exchange rate controls, which lasted until the liberalization period in 1986. The exchange rate was fixed, whereas the quantities of import were stringently restrained through the allocations of foreign exchange by the Bank of Ghana (Armah, 1993). During the period 1970-1982, both the import quantities and the importation of goods and service as a percentage of GDP diminished continuously, while the volume of exports and export share of GDP all exhibited downward trends. Exports as a percentage of GDP decreased from 20.7% in 1970 to 3.6% in 1982, and imports as a percentage of GDP declined from 18.5% in 1970 to 3.3% in 1982 (World Bank, 1995). Besides, Ghana’s economy witnessed negative growth rates of 12.9% in 1975, 3.5% in 1976, 7.8% in 1979, and 4.6% in 1983 (Institute of Statistical, Social and Economic Research (ISSER), 2000). Conversely, over the successive years, a positive growth rate was experienced at a diminishing rate (Asiedu, 2013).

Steady improvement in economic growth is an important target of most governments in developing countries, especially in Ghana. Over the years, many developing countries have followed several policies aimed at improving the growth and development of their respective economies. However, to achieve and maintain a higher growth rate, policymakers need to understand the determinants of growth as well as how policies affect growth. This has brought to light the concept of trade liberalization which has become a highly debated topic in economics (Hoque and Yusop, 2010).

Trade liberalization has been prominently considered as an important “engine of growth” (Nurkse, 1961) and later referred to as a “handmaiden of growth” (Kravis, 1970), particularly among developing and transition economies over the past three decades. Trade liberalization is purported to have a catalytic effect on economic growth; however, the nexus between them has remained debatable among economists for many years. A copious number of empirical studies have been conducted to ascertain whether indeed economic openness results in economic growth. Several empirical studies have indicated that a significant positive relationship between trade liberalization and economic growth exists (Ahmed and Anoruo, 2000; Jin, 2000; Wacziarg, 2001; Nugent, 2002; Greenaway, Morgan & Wright, 2002; Yanikkaya, 2003; Siddiqui and Iqbal, 2005; Chang, Kaltani, & Loayza, 2009; Kim, 2011; Jouini, 2015). Trade liberalization not only widens the domestic market and the country’s access to knowledge and more efficient technologies, but it also stimulates the growth of economic activities with comparative advantages and increases foreign exchange earnings. Also, increased economic openness attracts private and foreign capital, promotes entrepreneurship in the private sector, creates employment, and reduces distortions in price relatives (Wacziarg and Welch, 2008). These putative factors finally result in a faster rate of economic growth. However, contrary to the numerous empirical studies supporting the relationship that economic openness enhances economic growth, other studies have asserted that increased economic openness could curtail economic growth (Rodriguez and Rodrik, 2000; Clemens and Williamson, 2002; and Vamvakidis, 2002). Moreover, opponents of trade liberalization have argued that there is no persuasive evidence that shows that trade liberalization is always related to economic growth.

In 1986, Ghana implemented trade policy reforms as part of the Structural Adjustment Program of the Bretton Wood Institutions in order to open-up its economy. Despite the fact that, trade liberalization in Ghana resulted in economic growth, the effect was not substantial due to the slow growth of the manufacturing sector of the economy. Ghana’s growth record was 5.20% in 1986 and it increased to 5.63% in 1988, but decreased to 3.33% in 1990. Again, the response of the economy to the paradigm shift of economic management from state control to a liberalized state increased to 5.28% in 1991, but declined to 3.30% in 1994. During the liberalization period, the imports and exports as ratios of GDP in 1986 began to increase again from 12.43% and 13.49% to 28.51% in 1993 and 22.63% in 1994 respectively, as a result of an increase in per capita income (Institute of Statistical, Social and Economic Research (ISSER), 2002). Inflation has been a major macroeconomic challenge in the country over the years, until 2011 when a single digit annual average inflation rate of 8.73% was recorded and remained until 2012. The rate of inflation has hovered between 8.73% and 59.5% resulting in an average year-on-year rate of 21.68% over a thirty-one-year period between 1986 and 2016. The upsurge in the inflation rate was attributed to the effects of the sharp depreciation in the Ghana cedi against the major currencies, especially the United States (US) dollar. The cedi depreciated by 48.9% following the adoption of a floating exchange rate in 1986. The domestic currency depreciation also rose from 11.54% in 1991 to 21.76% in 1994 and 22.66% in 1997. In 2000, the Ghana cedi depreciated by 96.8%; the highest ever, and it declined drastically to 1.1% in 2006. The cedi depreciation later soared to 24.1% in 2008, 27.3% in 2011, but fell to 14.6% in 2012 (Bank of Ghana, 2015). The steep depreciation of the local currency in an open economy such as Ghana’s has resulted in an increased cost of doing business and an increased cost of living (Bawumia, 2014).

Although the implementation of trade liberalization was a laudable decision (Asiedu, 2013), the issue of whether an increased economic openness can be considered as a prime source of convergence to growth in Ghana has not been properly settled yet. The reaction of growth to trade liberalization has varied considerably across countries, with most countries gaining, but others being adversely affected by trade liberalization. Most countries in Africa have not benefited from trade liberalization; a situation which is attributed to the fact that trade policy reforms are inclined to generate both winners and losers within a country, and Ghana is no exception. Identifying and understanding the impacts of trade liberalization on economic growth will better inform the policymakers on how to tackle the problems emanating from the country partaking in international trade. In light of trade liberalization, this study provided answers to the following questions: What are the impacts of trade liberalization and other macroeconomic variables like investment, exchange rate, inflation, and population growth on the performance of the Ghanaian economy? Based on the above research questions, the study specifically investigated the implication of trade liberalization for the Ghanaian economy.

The rest of this paper is structured as follows: Section 2 discusses the econometric methodology as well as the data used for the study. Section 3 provides the empirical results with detailed interpretations. Section 4 finally captures all the conclusions deduced from the empirical results coupled with policy implications.

Model Specification, Data and Analytical Techniques

Model Specification

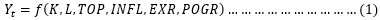

The study employed the endogenous growth model in the form of an augmented production function to model economic growth in order to capture the impact of trade openness (proxied for trade liberalization) as expressed in the following equation.

where Y denotes real GDP, K is the aggregate capital stock which is proxied for investment (INV), L denotes labour force, TOP indicates trade openness, INFL is the rate of inflation, EXR represents the exchange rate of the country, and POGR denotes the population growth of the country.

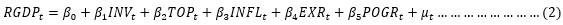

However, due to non-availability of data on the active employed labour force (Asiedu, 2013), labour, L is therefore excluded from the model. Also, by including the stochastic element of GDP to equation (1), the growth equation can be expressed as:

is the error term. All the other variables have already been defined.

is the error term. All the other variables have already been defined.

By applying a natural logarithm to equation (2), a log-linear model is given as:

represents the elasticity coefficients. The following are expected

represents the elasticity coefficients. The following are expected

Data Source

The study used yearly time series data from 1970 to 2016. The data on real GDP, investment, trade openness (which is used as a proxy for trade liberalization), inflation, exchange rate, and population growth were sourced from the World Development Indicators (2017) published by the World Bank.

Measurement of Variables and Their Expected Signs

The growth in real GDP is one of the numerous ways of gauging the growth rate of an economy, and it is considered as the dependent variable in this study. Therefore, real GDP was regressed on the following macroeconomic variables to assess their respective effects on the growth rate of the Ghanaian economy.

Investment is also an independent variable and it is measured by gross fixed capital formation as a percentage of GDP. As indicated by Sundrum (1993), capital accumulation stimulates the growth of income in an economy when an increase in the consumption of goods usually moves in tandem with the growth of income. The Neo-classical and Marxist economic theory postulates investment as one of the two essential parameters in explaining the growth rate of an economy (Felipe and Fisher, 2003). In accordance with economic theory, investment is predicted to relate directly to economic growth in the model specified

Trade openness was incorporated into the model as an explanatory variable in order to catch the effect of trade liberalization on economic growth. Trade liberalization as contended prompts an adjustment in the relative prices of traded and non-traded commodities. It is established that the changes in relative prices will trigger changes in the provision of resources to various activities and consequently changes in both sub-sectoral and total levels of production. These changes have the potential both to lessen destitution and raise income levels. In this manner, trade liberalization improves economic growth (Zakari, 2012). In this study, trade openness was used as a measure to gauge trade liberalization. This is because trade openness captures relatively every aspect of trade liberalization (Sinha and Sinha, 2002; Siddiqui and Igbal, 2005). Moreover, it is established that trade liberalization positively relates to economic growth, and hence, the expected sign is positive

Inflation is an independent variable and it is represented by the consumer price index. Inflation is a measure of macroeconomic instability. High inflation leads to a high cost of borrowing, which lowers the level of investment, and thereafter results in a decline in economic growth. However, this study expects inflation to have a negative impact on economic growth

The exchange rate, which is one of the critical independent variables in the model specified, influences the growth rate of an economy given that it impacts the number of products that are imported and exported in an economy. The Marshall-Lerner condition states that the depreciation of the Ghana cedi results in a decline in imports, but leads to an upsurge in exports. The net effect of the depreciation of the Ghana cedi is, therefore, a rise in net exports (Zakari, 2012). This situation improves national output, hence enhancing the growth rate of the economy. As a result of this scenario, the exchange rate is expected to have a positive relationship with economic growth

Population growth is the exponential rate of growth of the mid-year population. Empirical evidence on the association between population growth and economic growth does not point to any uniform conclusion. High population growth has been found to exert pressure on the available limited natural resources, and as such reduces domestic investment and economic growth. However, Asiedu (2013) found a positive relationship between population growth and economic growth. Hence, in this study, population growth is anticipated to have a direct influence on economic growth

.

.

Analytical Techniques

Pre-tests for Stationarity

Recent econometric analyses that involve time series data suggest that the variables in the model have to be tested for stationarity by using a unit root test before any meaningful inference is drawn from the results. The reason is that the estimations based on time series data require special attention; an application of standard estimation techniques on non-stationary time series data can cause spurious results. This will lead to wrong policy implications and incorrect forecasting. Using time series data set in regression analyses require some care due to the trending. In order to avoid reporting spurious regression outcomes, the study employed the augmented Dickey and Fuller (1979), and Phillips and Perron (1988) tests to determine whether the variables have no unit roots and are in fact integrated of the order one or zero to suggest the application of the autoregressive distributed lag (ARDL) modeling approach to cointegration, which was proposed by Pesaran and Shin (1999) and Pesaran, Shin & Smith (2001).

ARDL Cointegration Test

A cointegration test is carried out to examine whether long-run relationships exist between the variables. Two or more series are said to be cointegrated if they exhibit a well-established long-term equilibrium relationship between each other. This normally implies that the variables must have a long-term co-movement. However, for time series, variables that exhibit cointegration, even though they may be non-stationary in levels, the regression relationships of these variables do have a long-run relationship. Therefore, testing the cointegration becomes very important when dealing with time series data. Since the underlying variables were integrated of order zero and one (i.e. I(0) and I(1)), the study proceeded to employ the autoregressive distributed lag (ARDL) bounds testing approach to cointegration.

The utilization of the autoregressive distributed lag (ARDL) bounds testing approach to cointegration by Pesaran and Shin (1999) and Pesaran et al. (2001) has been evolving. The ARDL bounds test provides a less tedious process in ascertaining the long-run and short-run dynamics between the variables under investigation, relative to multivariate cointegration techniques. The method is particularly dynamic and is able to provide a simple univariate framework with regressors that are either I (0) and/or I (1). In addition, the ARDL modeling technique is popularly used to examine the cointegrating association in small samples, which allows different optimal lags of variables.

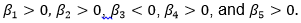

The cointegrating relationship for the economic growth model expressed in equation (3) was computed using the ARDL bounds test, which was based on the ensuing unrestricted error correction model (UECM):

represent the lag length and the first difference of the variables respectively.

represent the lag length and the first difference of the variables respectively.

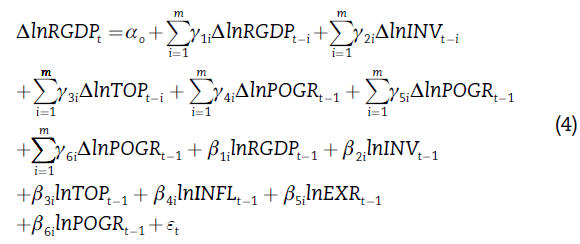

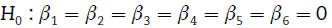

Practically, testing the hypothesis of a cointegrating relationship between the underlying variables in the unrestricted error correction model in equation (4) leads to the exclusion of the lagged variables from the model. Thus, the hypothesis that the coefficients of the lagged variables equal zero is tested as follows:

(i.e. non-existence of long-run relationship among the variables).

(i.e. non-existence of long-run relationship among the variables).

(i.e. existence of long-run relationship among the variables).

(i.e. existence of long-run relationship among the variables).

The hypothesis is tested using the F-statistic. The asymptotic distribution of the F-statistic is non-standard, regardless of whether the variables are I(0) or I(1). Narayan (2005) provided two critical values for determining the presence of a long-run relationship among variables; particularly, for small sample sizes spanning 30-80 observations. The lower bound critical value assumes that all the series are I(0), indicating that there is no cointegration among the variables, whereas upper bound critical value assumes that all the series are I(1), suggesting that the evidence of a cointegrating relationship between concerned variables exists. Supposing the estimated F-statistic is less than the lower bound critical value, it implies that the null hypothesis of no evidence of cointegration among the variables cannot be rejected. When the estimated F-statistic is found to be greater than the upper bound critical value, then the null hypothesis of no cointegration among the variables is rejected, thereby accepting the alternative hypothesis that cointegration among the variables exists. Finally, an inconclusive inference is made if the estimated F-statistic falls between the lower and upper bounds.

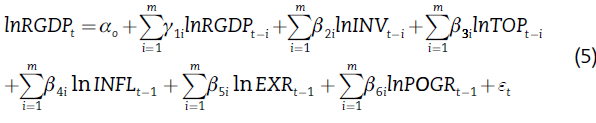

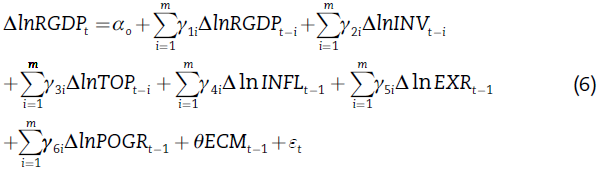

The long-run ARDL model is expressed as:

Since the

is considered as the gap (the error factor) between the

is considered as the gap (the error factor) between the

and its long-run equilibrium level, the short-run dynamics are captured by the error correction model as follows:

and its long-run equilibrium level, the short-run dynamics are captured by the error correction model as follows:

indicates the coefficients of the short-run dynamics of the model in converging to the long-run equilibrium.

indicates the coefficients of the short-run dynamics of the model in converging to the long-run equilibrium.

is the error correction term. The error correction term as the feedback effect shows the extent to which disequilibrium in the short-run converges to the long-run equilibrium.

is the error correction term. The error correction term as the feedback effect shows the extent to which disequilibrium in the short-run converges to the long-run equilibrium.

refers to the coefficient of the error correction term. In the aforementioned equation system,

refers to the coefficient of the error correction term. In the aforementioned equation system,

means that there is a tendency for economic growth to converge to the long-run equilibrium path.

means that there is a tendency for economic growth to converge to the long-run equilibrium path.

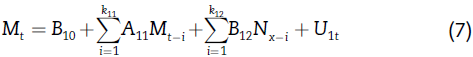

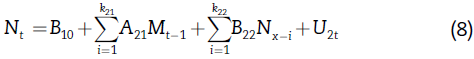

Granger Causality Test

This study sought to determine the dynamic relationship between trade openness and economic growth in Ghana. As part of its general objective, this study focused on the causality between the two variables, using the method developed by Granger (1969). The Granger causality test is an econometric tool that looks at identifying causality between a set of variables. The idea of causality does not imply causation, but that one variable helps to better explain another variable. Thus, if M and N are two variables of interest, we say N Granger causes M if M is not better explained by the lag values of M, but that considering a variable N and its lags will better predict the behaviour of variable M. Generally, the expression of the Granger causality test in a bivariate situation is given by the following equations:

Empirical Results and Analyses

Tests for Stationarity

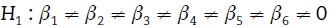

The study employed the augmented Dickey-Fuller (ADF) and Phillips-Perron (PP) tests to determine the stationarity of the underlying variables in accordance with the dictates of the methodology. These stationarity tests were carried out to avoid spurious regression estimates resulting from the use of non-stationary variables. Table 1 presents the results of the stationarity tests.

Table 1: Results of the Stationarity Tests

Source: Authors’ own creation.

Note: *** and ** indicate statistical significance at 1% and 5% levels respectively

From the results in Table 1, real GDP, and inflation were found to be stationary at their levels, hence being integrated of order zero (i.e. I(0)). Whereas investment, population growth, exchange rate, and trade openness exhibited a stochastic trend at their levels. The study then confirmed the stationarity of these variables at their first difference, hence being integrated of first order (i.e. I(1)). Thus, the study considered it appropriate to apply the ARDL approach to compute the empirical model due to the mixed results (i.e. I (0) or I(1)) of the stationarity tests.

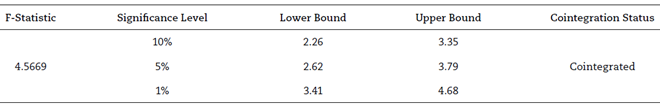

Test for Cointegration

The ARDL bounds test was employed to examine the existence of a cointegrating relationship between the underlying variables. The results of the ARDL bounds test are presented in Table 2.

The existence of a long-run equilibrium relationship between economic growth and its explanatory variables is established when the computed F-statistic is greater than the upper critical values at a certain level of significance. The results presented in Table 2 showed that the F-statistic (4.5669) is apparently greater than the upper bound critical value of 3.79; therefore, suggesting that there is a cointegrating relationship between the underlying variables used in this study.

Long-Run Relationship Results

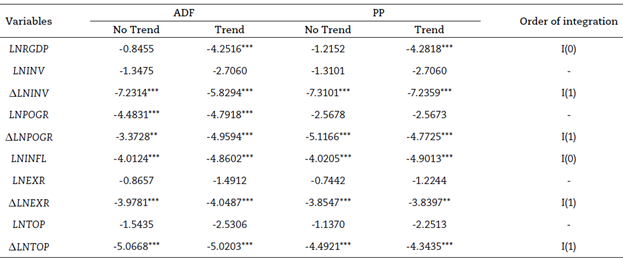

The results displayed in Table 3 present the long-run relationship between economic growth and its determinants estimated by ARDL modeling technique.

Table 3: Estimated ARDL Long-run Results

Source: Authors’ own creation.

Note: *** indicates 1% level of significance

The study found inflation to have a negative and significant impact on economic growth in the long-run as displayed in Table 3. By implication, the rate of inflation tends to negatively relate to the growth rate of the economy. This means that a 1% increase in the rate of inflation causes economic growth to decrease by 1.19% in Ghana. The result attained is consistent with the economic theory which states that an increase in inflation lessens the rate of capital investment since it raises the cost of borrowing and hence lowers output growth. However, the study opposes the Structuralists’ opinion that inflation is a significant prerequisite for economic growth. The result suggests that inflation is harmful to economic growth as there is no threshold beyond which inflation enhances growth, and therefore it contradicts Khan and Senhadji (2001) who contended that inflation per se is not detrimental to economic growth. The result also refutes Mbulawa (2015), and Siaw, Enning & Pickson (2017) who found a long-run positive correlation between inflation and economic growth in Botswana and Ghana respectively.

From the results in Table 3, population growth was inversely related to the growth rate of the economy and it was found to be significant at 1% level of error margin. This implies that population growth tends to negatively affect the growth rate of the economy. An increase in population growth by a percentage results in a decline in economic growth by approximately 2.95% in the long-run. This result opposes Siddique and Iqbal (2005), and Asiedu (2013) who found that “a rise in population adds to the labour force and also increases the market size and raises aggregate demand, which in turn enhances investment, and hence, output growth” in the case of Pakistan and Ghana respectively.

The study used trade openness as a proxy for trade liberalization. It was obvious from the results in Table 3 that in the long-run, trade openness has a significant negative impact on the growth rate of the Ghanaian economy. This means that a proportionate allowance of trade openness results in a 1.84% decline in economic growth. The hostile effect of trade openness on Ghana’s economy is also a result of the fact that other trading partners of the country have been engaging in unfair trade practices like subsidies and dumping which are causing serious injury to domestic manufacturers. Also, according to UNCTAD (2005), Ghana is confronted with deindustrialization which has made the country vulnerable to trade liberalization. The study supports the conventional views that trade openness leads to faster growth of imports than exports and has a serious implication on the balance of trade and economic growth. This result corroborates the findings of Karras (2006), and Simorangkir (2006). However, the result contradicts the previous studies conducted by Mwaba (2000), Wacziarg (2001), Yanikkaya (2003), Asiedu (2013), Olaifa, Subair, & Biala (2013), Shaheen, Ali, Kauser, & Ahmed (2013), and Siaw et al. (2017).

The exchange rate exerted a positive and significant impact on economic growth. This implies that a 1% increase in the exchange rate increases economic growth by 0.35%. The study thus confirms the expected positive sign informed by an economic theory which states that an upsurge in the exchange rate makes domestic goods and services competitive in international trade, and thereby enhancing economic growth. The finding contrasts the results of Ahmad, Ahmad, & Ali (2013), and Oyakhilomen and Zibah (2014).

Investment was found to have a positive influence on economic growth in the long-run, yet this was not significant at any of the conventional levels of significance. A coefficient of 0.5688 implies that a 1% increase in investment would cause economic growth to increase by 0.57%. This is not surprising due to the high rate of inflation in Ghana which has led to a high cost of borrowing; a creeping rise in investment does not result in a significant increase in the output growth. This is incongruous with the findings of Aryeetey and Fosu (2005), Asiedu (2013), and Ofori-Abebrese, Pickson, & Diabah (2017).

Short-Run Relationship Results

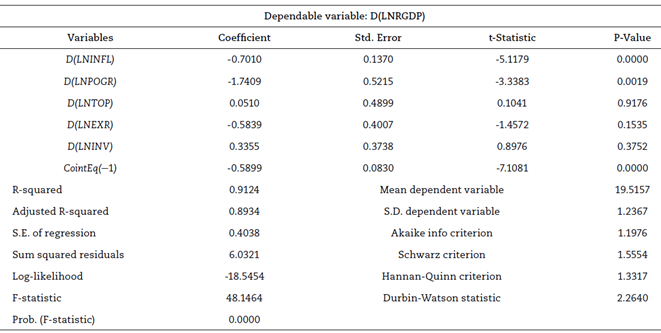

Table 4 shows the results for the short-run relationship between economic growth and its regressors.

Table 4: Estimated ARDL Short-Run Results

Source: Authors’ own creation

Note: *, ** and *** indicate statistical significance at 10%, 5%, and 1% levels respectively

The estimation of the short-run dynamics of the model indicated that the R-squared value of 0.9124 suggests that about 91.24% of the variations in economic growth are determined by changes in the explanatory variables. The adjusted R-squared value is 0.8934. This shows the high goodness of fit, implying that the variables used for this study are very strong in determining the growth rate of the Ghanaian economy. The F-statistic affirmed the common importance of all the explanatory variables selected at the 1% level of significance. The Durbin-Watson statistic was 2.2640, which is high enough to ignore the evidence of serial correlation in the model. The error correction term was negative, which is the appropriate sign, and it was found to be significant at 1%. This means that the model is stable and returns to equilibrium when unexpected shocks occur to independent variables. The error correction coefficient of -0.5899 shows that the model is adjusted to achieve a faster than expected equilibrium, as displayed in Table 4.

Similarly, inflation was found to maintain its negative and significant impact on economic growth in the short-run. This implies that a 1% increase in inflation triggers economic growth to fall by 0.70%. This result is in contrast with Asiedu (2013) who found that inflation has no short-run effect on economic growth in Ghana.

The study also indicated that population growth was negatively related to economic growth and it was statistically significant, suggesting that population growth has a significant and negative influence on economic growth in the short-run period. With the coefficient of -1.7409, it suggests that a 1% rise in population growth causes economic growth to decline by 1.74% in the short-run, all things being equal. A similar result was attained by Ofori-Abebrese et al. (2017), but it opposes the result of Asiedu (2013) which suggests a positive relationship between population growth and economic growth.

In conjunction with the theoretical relationship between trade openness and economic growth, the results indicated that trade openness impacts positively on economic growth in the short-run. Thus, a proportionate allowance in trade openness results in a 0.05% increment in economic growth, but this was not found to be significant. Worded differently, though trade openness reported a positive sign, it has no significant influence on economic growth in the short-run. This is at odds with the result of Ofori-Abebrese et al. (2017), but it confirms the outcome of Asiedu (2013).

The exchange rate has an inverse impact on economic growth, but it was insignificant. The coefficient of the exchange rate (-0.5839) implies that a 1% increase in the exchange rate triggers a 0.58% increase in economic growth, though this impact of the exchange rate on economic growth was not found to be significant in the short-run. This implies that the exchange rate does not deteriorate the value of Ghana cedi; hence, creating macroeconomic stability and certainty in the economy in the short-run. The result is in contrast with the outcomes of Oyakhilomen & Zibah (2014), and Verter & Bečvářová (2016) which indicated that in the short-run, the exchange rate positively and significantly influences economic growth in Nigeria.

Additionally, the short-run results showed that investment has a positive, but insignificant impact on economic growth. All other things being equal, with the coefficient of 0.3355, a 1% rise in investment would increase economic growth by 0.34% in the short-run, though the upsurge rate of investment has not significantly triggered output growth yet. This confirms the fact that in the short-run, investment is not essential in explaining the growth of the Ghanaian economy (Ofori-Abebrese et al., 2017).

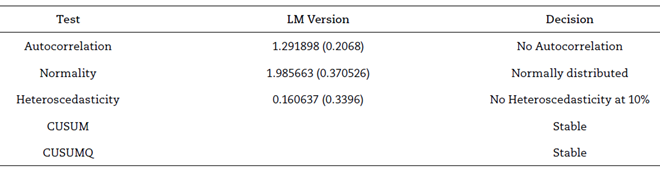

Diagnostic and Stability Tests of the ARDL Model

The suitability of the ARDL model is observable by its statistical properties. The results of the different diagnostic and stability tests affirmed the statistical adequacy of the estimated model. The results of the diagnostic test showed that there were no problems with heteroscedasticity. The test showed no evidence of autocorrelation and the residuals are distributed normally; such that no normality problem was evident. The study further determined the stability of the coefficients of the ARDL model using the cumulative sum (CUSUM) and cumulative sum of squares (CUSUMQ) tests. The regression coefficients did not indicate any problem with stability. Table 5 shows the report of various diagnostic and stability tests.

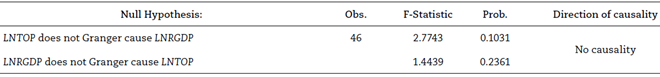

Granger Causality Test Results

The intention of this section was to determine whether the relationship between trade openness and economic growth is unidirectional, bi-directional or uncorrelated to each other. Table 6 shows the tabular representation of the results of the Granger causality test.

Table 6 presents the Granger causality test results for the variables of interest. The null hypothesis that trade openness does not Granger cause economic growth was not rejected given the probability of 0.1031. Thus, changes in economic growth are not explained by variations in trade openness. There is consistency in terms of the results of the causality test for the trade openness variable with causality from economic growth. Similarly, no causality was observed running from either the two main variables (trade openness and economic growth). The implication of these results is that no complementary relationship between trade openness and economic growth exists in the short-run in Ghana.

Conclusion and Policy Implications

This study attempted to examine the implication of trade liberalization for the Ghanaian economy. The empirical results indicated that trade openness (proxied for trade liberalization), inflation, and population growth negatively affected the growth rate of the Ghanaian economy in the long-run, whilst the exchange rate has a significant and long-run positive effect on economic growth. Also, investment has no impact on economic growth in the long-run. The study further indicated that only inflation and population growth have significant impacts on economic growth in the short-run. The results of the Granger causality test showed that no complementary relationship between trade openness and economic growth exists in the short-run in Ghana.

Premised on the aforementioned findings, the following recommendations are made:

In view of no significant relationship between investment and economic growth in both short-run and long-run periods, the government has to invest more in physical infrastructure and human capital. This supports Pickson and Ofori-Abebrese (2016) who suggested that government investment expenditure would crowd in private investment in Ghana. This investment to a certain extent will enhance the growth rate of the economy.

Since there is a negative and significant relationship between inflation and economic growth, the government and policymakers must come up with programs and remedial measures to revive and accelerate the growth of the Ghanaian economy in an attempt to reduce the inflationary rate to a single digit in order to ensure macroeconomic stability and certainty in the economy.

Finally, the Ghanaian exports should be diversified in terms of adding value to the present ones, as well as seeking new foreign market destinations in order to reverse the negative effect of trade openness on the economic growth. Also, in a bid to ensure a favourable balance of trade, leading to high economic growth, trade fairs and exhibitions should be organized at the district level to encourage the citizenry in order to patronize Ghanaian made goods and services, as this possibly will lessen domestic expenditure on imported goods and services.

Limitation of the Study and Suggestion for Future Research

This study only examined the implication of trade liberalization for the Ghanaian economy, and it is therefore suggested that future studies could use cross-country studies, including other African countries like Burundi, Ethiopia, Nigeria, Kenya, Madagascar, Sudan, Senegal, Tanzania, and Zambia, which have also undertaken similar trade reforms. Such a study may provide useful information about cross-country comparisons of the implication of trade liberalization for other African economies with the Ghanaian economy.