Introduction

Firms develop and deploy resources and capabilities, skillsets developed and embodied in a company’s processes to over perform competition, to operate and create value for their customers and themselves (Feng, Morgan & Rego, 2017). Microcredit institutions are value creators through commercial interactions at the BOP, focusing on low income consumers. These commercial interactions are dyad-based between the credit analyst (seller) and a poor micro-entrepreneur (customer) (Casidy and Fafchamps, 2017). Little research has been done in order to understand how organizations organize their resources and capabilities in specific contexts in order to create value for customers (Sirmon, Hitt & Ireland, 2007), especially for those at the BOP in developing countries (Seelos & Mair, 2007); (Seelos & Mair, 2017), where commercial interactions are based on individual human relationships instead of institutional or group relations.

There is a broad accepted assumption that solidarity groups substitute traditional collaterals due to the peer pressure that exists within a group´s members. According to the traditional view, that characteristic, together with a client´s appreciation of having access to credit opportunities, have been some of the main arguments to explain the past low default rates in the microcredit industry, especially in Asiatic countries. However, some organizations have also had above average performances using individual methodologies (dyad based human relationships) where collaterals don´t operate with peer pressure. Thus, how to approach and interact with individual customers (not groups) is a relevant issue for the microcredit industry that also could explain a firm’s performance.

The microcredit industry has a high relevance within the financial services landscape. It began in the middle 70s with Muhammed Yunus´ social entrepreneurship, known as Grameen Bank, in Bangladesh and it has now evolved to become a giant industry worldwide and in Colombia (Villamizar & Ducon, 2018). Microcredit consists of lending money without traditional collaterals to informal (or formal) low-income people (in our analysis specifically a micro-entrepreneur). It has been done through a methodology that can be either individual or in solidarity groups, but a specific characteristic, among others, is that credit analysts co-construct with customers the financial statements. This is a key issue because micro-entrepreneurs don’t deploy accounting practices due to their informality, but this information about the small businesses is a condition for loans.

Microcredit practices have been researched from the financial and economic point of view, giving place to both fans and detractors, while some praise this practice, others are very critical about it (Guerin, Labie, & Morvant-Roux, 2018). An impressive amount of academic literature has been written based on financial models for firms and measures of the impact of microcredit in economic development. Research about emerging markets have also triggered a new academic field that had its turning point in 2004 with Prahalad´s book, The fortune at the bottom of the pyramid (Prahalad, 2004). However, there is little research in the field of strategic and marketing perspectives of microcredit, from the point of view of resources and capabilities.

Our main research question is: How do Colombian microcredit social enterprises organize themselves to configure their commercialization capability? Besides the main research question, we are also interested in the meaning of this commercialization activity for internal actors (employees), given their protagonist role in the human relationship of the commercial interaction. We consider this analysis particularly time relevant since Colombia’s political undergoing requires financial inclusion (which might proliferate through microcredit) in order to achieve sustainability of the recently negotiated peace agreement (Thoene & Turriago, 2017; Grau, 2017).

Due to the lack of research on the strategic and marketing perspectives of microcredit practices, in order to addresses our research question, we use a qualitative investigation of multiple case-based research. We have tackled the phenomenon from the perspective of the internal actors in the organization (employees), which means that interviews are our main source of data. However, we have triangulated these interviews with internal company documents and observations, both on corporate grounds and with customer-seller interaction on site.

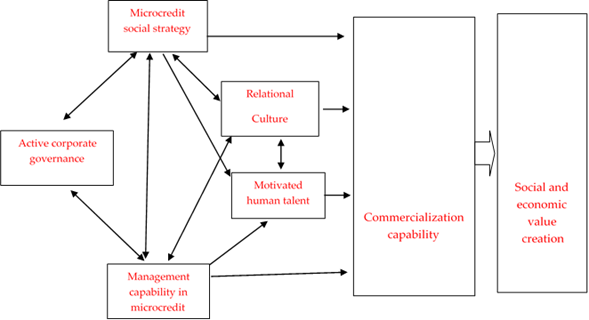

The conceptual domain relied on the resource based-view of the firm theory (RBV), the relationship marking theory (RM), and contributive motivation conceptualization. They were the lens approach to the research questions and our cases. We use these three theories blended together to create a conceptual framework to iterate with the empirical domain. We derivate an emergent contextualized model to explain how microcredit social enterprises organize themselves in order to develop a commercialization capability that creates social and economic value.

Understanding strategy as a set of resources and capabilities that allow for the exploitation of opportunities and help the firm to obtain a superior performance (Grant, 1991), our proposition is that microcredit organizations must configure their resources and capabilities in order to structure a value creating commercialization capability based on the human interaction between the seller (credit analyst) and the customer (micro-entrepreneur): this relationship explains a firm’s performance and how these social enterprises create social and economic value.

Literature review

A firm’s superior performance can be addressed from its specific resources (Wernerfelt, 1984). A firm’s strategy and performance, when orientated to create value through competitive advantages, can be framed through its specific resources (Barney, 1991).

Resources could be classified as tangible and intangible (Wernerfelt, 1984; Barney, 1991; Hall, 1993). Some examples of tangible resources are equipment, cash, vehicles and buildings, among others. On the other hand, intangibles resources are goodwill, copyrights, know-how, organizational culture, and data bases (Hall, 1993). Otherwise, resources that lead to a competitive advantage are valuable, rare, inimitable and durable (Barney, 1991, Alexy, West, Klapper & Reitzig, 2017). Capabilities are routines or skills that combine and coordinate resources (Grant, 1991; Helfat & Peteraf, 2003); for example, service delivery.

Resources and capabilities can be owned by organizations, but they could also have access to them through partners, alliances and suppliers (Helfat & Peteraf, 2003). Under this conceptualization (RBV), strategy is understood as a set of resources and capabilities that allow for the exploitation of opportunities which allow the firm to have a superior performance (Grant, 1991) and value creation (Luján, 2017). However, resources and capabilities should be adapted to different contexts for creating value to customers (Sirmon et al., 2007; Wibowo & Handika, 2017).

In terms of the BOP in developing countries, not much research has been done through the RBV perspective (Seelos & Mair, 2007; Seelos & Mair, 2017 ). In this paper, the RBV and the BOP markets concepts are brought together to comprehend how social enterprises organize their commercialization capability for value creation in deep poverty environments.

According to Prahalad & Ramasvamy (2004), firms should orient their business models, structures, systems and processes towards customer needs. Value is created through interactions with customers and consumers. Thus, the organizational configuration, in this case, understood as resources and capabilities combinations, should be oriented to create value to customers (Sirmon et al., 2007 ) and to co-create it with them (Prahalad & Ramasvamy, 2004 ). So, organizational conformation must be built under a customer-oriented framework.

The RM is a perspective that, even different approaches (Rasul, 2017), sheds light on how companies attract, develop and manage commercial relations with customers (Berry, 1995; Morgan & Hunt, 1994). Those relationships have been considered resources (“relational resources”) from which competitive advantages emerge (Hunt, 1997 ). Under this framework of high employee-customer contact services (Berry, 1995), customer relationship management has a special interest.

The RM has developed several constructs that have impact when approached by microcredit services, where the human interaction between the credit analyst and the micro-entrepreneur is face-to-face, outside the bank´s branches. In other words, microcredit is a business deployed “on the street”, at the micro-entrepreneurs’ homes, the place where micro-businesses also take place.

The first RM relevant construct in this research is the “relational benefit” (Gwinner, Gremler & Bitner, 1998). This concept implies that commercial relations go beyond the transaction and incorporates value created from long lasting customer relationships (Gwinner et al., 1998). In the case of microcredit, this means that organizations give some additional benefits to clients, beyond “selling a credit”.

This approach incorporates into the business model the benefits that the customer (micro-entrepreneur) derives from the personalized relationships. Between human beings that interact with each other (employees and customers) emerges some sort of friendship that has been called “commercial friendship” in the academic literature (Price & Arnould, 1999)

Organizations deploy specific resources and capabilities when competing at the bottom of the pyramid markets in developing countries (Seelos & Mair, 2007). They configure their organizational components in a specific way that helps them interact with individual customers (commercialization capability) in their contexts.

Social enterprises (SE) create social and economic value (Dees, 1998; Stevens, Moray, Brunells, 2015). A business model with high social impact is deployed though these organizations (Dees, 1998). It is a business model where both economic and social value interact, and this is why some authors call them “hybrid organizations” (Mair & Noboa, 2003). They develop a strong identity among employees because of the social mission, but also keep the strong meaning of work, through human resource practices like hiring, internal promotion and socialization (Battilana & Dorado, 2010).

Resources and capabilities in the context of deep poverty in developing countries is a field with a gap in the academic literature (Sirmon et al., 2007; Seelos & Mair, 2007; Seelos & Mair, 2017, Wibowo & Handika, 2017 ), as well as the relationships developed by social enterprises with their individual customers in order to create value. “Relational benefits” and “commercial friendship” play an important role when it comes to understanding this topic. The mission or organizational purpose, if it is tangible, perceived by the internal actors (employees), develops a contributive motivation that activates a higher level of commitment (Pérez López, 2014 ).

Methodology

This qualitative research aims to develop a model derived from a grounded theory approach (Strauss & Corbin, 1990) and a multiple-case design. Through literal replication logic in several cases (Eisenhardt, 1989); (Yin, 2017), saturation is accomplished 1. This means that each case is treated as an experiment to confirm or not the observations found in the previous cases (Eisenhardt, 1989; Yin, 2017). The unit of analysis is: Commercialization capability in the organization. Thus, this research fits in Yin’s type 3 -multiple-case design with a unit of analysis (Yin, 2017).

This qualitative approach is due to the nature of the research question -“how” for events within contextual conditions- (Yin, 2017) and to the lack of academic literature (incompleteness) on this specific topic (Eisenhardt, 1989; Golden-Biddle & Locke, 2007). Little research has been done using the resource-based view of the firm (RBV) framework within the bottom of the pyramid academic field, especially in deep poverty contexts (Seelos & Mair, 2007; Seelos & Mair, 2017), and even less has been done when it comes to integrating the RBV with the relationships marketing theory (RM) in order to comprehend the performance of different firms in the developing countries environments, where contexts matter for the configuration and reconfiguration of an organization’s resources and capabilities for creating social and economic value through interaction with customers.

Sampling

A purposeful sampling (Miles & Huberman, 1994; Patton, 2014) was conducted, considering the fit between organizations and the research question. Moreover, this is being combined with the possibility of gathering rich information from the settings and to accomplish the replication logic through multiple experiments, with similar results (literal replication) (Yin, 2017). A priori informants’ willingness to collaborate has also been an important matter (site availability2. Each CEO was contacted through a Colombian non-profit organization within the industry that plays the role of a lender for micro-financial institutions. This fact has allowed having the opinion of an expert regarding how well the cases fitted the research objectives, including a reputational case selection (Miles & Huberman, 1994). What’s more, this person has helped the researchers obtain access to key informants and get the green light from the chosen social enterprises.

Four criteria were used to choose these cases in the Colombian context: 1) social impact (outreach and growth), 2) auto-sustainability (financial viability), 3) longevity (at least 10 years), 4) recommendations from an expert in the industry. Likewise, three chosen organizations were ranked by Forbes3 magazine within the world’s top 10 performance micro-financial institutions.

Data sources and collection

The data was collected from three main sources of evidence: 1) interviews as the primary data, 2) archival data (documents), and 3) non-participant observations. Interviews were conducted in a top-down approach with semi-structured templates (protocol guide) with open-ended questions. The researcher began the interviews at the top management level and went down through the hierarchical structure, customizing the interview to the informants’ levels and functions.

This implies collecting data from different perspectives and levels within the organization (Leonard-Barton, 1990). Documents were given to the researchers by each of the informants during the interviews: PowerPoint slides, statistics, financial statements, publicity material, company memories, codes, manuals, magazines, newspaper articles, etc. Organizations Websites were also visited. During the interviews (being within the organizational setting) field notes were taken with details of the interactions and the researcher’s impressions and observations.

Descriptive narratives (histories) were written by the researcher, including and selecting quotes from the informants and triangulating different sources (Eisenhardt, 1989). Three descriptive case reports (narrated neutrally), reviewed and approved by the informant organizations, give the research a broader validity in terms of reducing the researcher’s subjectivity (Yin, 2017) and looking for saturation (Patton, 2014).

Data analysis and conceptualization

As mentioned above, the general chosen strategy integrates the grounded theory, the multiple case studies for analyzing data, and narrative and visual strategy to present the findings. For validity, this research also used different sources of data and triangulated them (different informants, documents and non-participant observations). Moreover, the organizations and the key interviewees reviewed the case reports; an activity that increases validity (Yin, 2017) and credibility (Lincoln & Guba, 1985).

In order to identify the emergent categories, an open codification (coding) process (Strauss & Corbin, 1990) was conducted, having the interviews as a primary source. This source of data was also triangulated with documents and observations (Eisenhardt, 1989; Patton, 2014; Yin, 2017).

The aim was to obtain convergent evidence that could support the emergent categories. At this first analysis stage, main resources and capabilities for structuring the commercialization capability were identified. A counting rule (frequency counts) was followed during this phase. An organizational component was considered a code if it was mentioned by three informants within each organization and across three cases.

Simultaneously to the cross-case comparisons, iterations with the conceptual and theoretical frameworks were conducted (Eisenhardt, 1989; Patton, 2014). This allowed the researcher to develop the categories’ definitions and its dimensions (constructs development). Second, validity emerged from the evidence during the cross-case analysis, and was built through literal replication logic (Eisenhardt, 1989; Yin, 2017) after saturating (Patton, 2014) the emergent categories that constructed the emergent model.

However, this research cannot be extended to an external generalization. Rather, it has been designed, under the replication logic and qualitative data interaction with the conceptual framework, accomplishing an analytic generalization (Miles & Huberman, 1994; Yin, 2017) or internal generalization (Maxwell, 2013).

A figure was used to present and summarize the model (Eisenhardt, 1989; Miles & Huberman, 1994, Langley, 1999). This is common practice among qualitative researchers.

Finally, for enhancing reliability, a case study protocol was written and a case study database was kept in order to allow other researches and evaluators’ reviews (Yin, 2017). The researcher has protected the integrity and rights of the persons involved in this research. Interviews were conducted in Spanish and were translated in order to incorporate them in this paper.

The emergent model

A performance model emerged from the qualitative data. This model explains how microcredit social enterprises organized the main organizational components (in terms of resources and capabilities) in order to deploy the commercialization capability that creates social and economic value. This model is depicted by Figure 1, and each component will be explained with its dimensions in this section.

Microcredit social strategy

The social strategy has a general intention: the incorporation of micro-entrepreneurs in the financial formal system as worthy borrowers. This is done through a business model that creates simultaneously economic and social value.

The strategy is oriented to take care of those micro-entrepreneurs rejected by traditional commercial banks, and doing this in a profitable way. It is about implementing a tool to address poverty in underdeveloped countries and empowering the poor micro-entrepreneurs.

The social strategy is about creating social and economic value at the same time (hybrid organizations). For example, a microcredit social enterprise CEO said:

At the beginning, I saw there was a lot to do. I wanted to do something for women. I believed that it was important for women to learn how to manage their own lives. This was the reason why I decided to work here and not in other banks. With time and after all these years in this organization, we have realized, after we have given the status of borrower to the micro-entrepreneurs, that women have improved as human beings and they have been given more power at home; so there is an empowerment effect in microcredit.

Another microcredit social enterprise CEO said:

The rural microcredit has a special charm since its main objective is to avoid peasants from migrating to the cities. People from the countryside have understood that our mission is to give them opportunities, to accompany them and to support their improvement. Woman farmers work too much… they manage their family’s food, sell products in the village, buy provisions and help their husbands by generating some additional income. In this respect, women help their family´s life conditions, and microcredit gives them some kind of power; it increases their self-esteem and reassures their rights. Microcredit has an important social impact in the countryside.

Another microcredit social enterprise CEO said:

Our main goal has been to give credit access to the low-income micro-entrepreneurs, with a special focus on women. We are struggling to incorporate low-income people into the economic and productive activity of this country. We want to elevate their life quality, their income, and their assets. This is what we call “social profitability”. We are not a charity. We also work for financial profit. We are in a self-sustaining financial business in the financial industry, but with an additional component: social impact, through including the poor into the market system.

The strategy has been oriented towards the positive impact on micro-businesses, but also in the micro-entrepreneur’s life quality, or in other words, it is about a strategy that contributes directly to economic development and human capacities. These microcredit organizations have a social strategy, because the aim is to improve the customer’s quality of life, and also because they are looking for human empowerment in the midst of profound poverty.

These microcredit organizations offer solutions for their customers’ specific needs. They aim to solve social needs with profit. Their social strategy is client-oriented and relies on five differentiating attributes: easy access, agility (quickness), simplicity (in requirements and procedures), flexibility (in collaterals) and customized service. Under this evidence, and using Porter’s (1996) framework for competitive strategies, this microcredit social strategy fits into “focus with differentiation”.

Management capability in microcredit social organizations

This category refers specifically to CEOs, senior management, and implies, in first place, a people-oriented style. There is an “open door” policy in order to listen to and discuss things with employees. Senior management takes care of human competences and skills improvement in the whole organization. Second, it is about “management by wandering around”. For these managers, the physical presence, not only in the headquarters but also throughout the branches, and interacting with customers is important. This latter element is very important: it allows the CEO to know directly the micro-entrepreneurs’ conditions and needs.

A third finding was a “team-work-orientation”, allowing active participation from employees. CEOs have a participative style, crystallized, for example, in steering committees with frequent meetings and training people from within, looking for high performance teams. CEOs appreciate different points of view, even if they are contrary to their own. In these teams, people can think out of the box, out of the mental models, without negative consequences. This triggers innovation, an important element to compete at the bottom of the pyramid.

Finally, specific experience in the industry ended up to be a key issue, so it implies the importance of hiring people from within the industry, and much better if you have an internal promotion policy. For example, a vice president said about his CEO:

The long-lasting experience of our CEO has been a key factor for our success. She likes listening to different points of view, discussing them, and she loves having complementary people, different from the way she thinks. She has helped to create a differential culture, oriented towards empowering people, but also towards supporting customer service, growth, and assets management.

A financial director said about his CEO:

The management style has been an important key success factor in this organization´s performance. Throughout the years, she has led through example and supporting employee active participation. She always listens to those who are in continuous interaction with our customers. She is very rigorous, but treats others with respect. She promotes and allows an equilibrated life for our employees. The senior management has managed the complex things in a simple way. She knows how to manage the tension between results and social impact. She customizes her interaction with employees and treats them with respect. This is important because it is also replicated in the way we treat our customers; in other words, in the way we commercialized our products.

Interpreting these citations, we consider that contributive motivation (Pérez, 2014) operates for microcredit management capability. This approach goes beyond the frontiers of the traditional intrinsic-extrinsic motivation model. It is about a management capability that deploys its skills and talents in order to accomplish, with its work, a social mission expressed in the firm’s social strategy: empowering the micro-entrepreneurs by giving them access to credit. This purpose (meaning) gives a specific identity to an organization and ignites commitment in its employees.

Senior management has a strong conviction about the social impact and develops an emotional bond with its customers. It is not only about making “customers fall in love with the company”, but also the other way round. There is an identification between the personal project (personal mission) and the company’s social strategy. It is a leadership focused on the organization’s mission (Cardona & Rey, 2008). A CEO’s work and exemplary behavior become a framework to follow in the whole organization.

Relational Culture

This category also emerged from the qualitative data. Culture is the norms, values, behaviors, symbols, and artifacts that members in the organization practice (Schein, 1985, Rasul, 2018 ). It is clear that the combination of the social strategy and the management capability have help to build a customer-oriented culture which focuses on developing service relationships with clients. A CEO said about the culture in her organization:

Our excellent performance in the microcredit industry can be explained through the quality of interaction with our customers. It is not only about the credit methodology, it is more about how our culture is configured in terms of the customer. It is customer-oriented. We understand this, not only as a good service during the interaction with simple procedures and requirements, but also in terms of how we rescue human dignity in these micro-entrepreneurs.

A senior manager from the same organization said:

If we require excellent customer service from our employees, as senior managers, we must give high-quality service to our collaborators. The organizational values must be reflected within our organizational culture and in our relationships with our customers. The first is a condition for the second.

The social strategy has been implemented through a customer-oriented culture. This culture is focused on the micro-entrepreneur’s well-being and on the value proposition customized with attributes for this specific segment. This is why we can call it a relational culture. Because its norms, behaviors, values, and symbols are configured to develop social value, creating service relationships with customers that triggers a contributive motivation (meaning) for work. However, results also matter in a social enterprise, so it’s important also to be goal-oriented though extrinsic incentives and look for profitability and economic value creation.

Active corporate governance

The board of directors is another important component for organizing commercialization capability. They mobilize resources within the company, make decisions about strategic projects, and approve the strategy. In this case, for microcredit social enterprises, a first element within this category is their compromise with the social mission: to improve the customer’s (micro-entrepreneurs) quality of life (organizational purpose and meaning).

Second, the board of directors closely controls and monitors the social strategy and the CEO’s performance. In a document written by Microrate, an important rating agency in this industry, the following was expressed about the board of directors -in a case-:

The Foundation has an experienced and stable board of directors. This is a true strength. This board has followed a consistent strategy in order to keep the organization in its competitive position in the market.

An important component has been “control”. The board of directors has implemented professional oversight tools (e.g. balanced scorecard). This control, however, is not only about operational or financial excellence, but also includes accomplishing the social mission, and actively participating in board of directors’ thematic committees.

Motivated human talent

Human resource practices (hiring, promoting and socializing) are key success factors for performance and for organizing the commercialization capabilities. These practices, including extrinsic incentives and rewards, create employees who are committed to the social mission. A human resources manager said:

The collaborators’ motivation has different sources: a stable work contract, the institution’s brand, an adequate wage, permanent on the job training, and internal promotion. We think the language managers use to communicate is important. That’s why we refer to our employees as “collaborators”; this implies that they are important for the company. However, beyond all these human resource practices, the main motivation is this company’s activity and its mission: to improve the quality of life at the base of the pyramid.

A financial director said:

What motivates me the most is that I am creating wealth for the community, and not only for the shareholders. We perform a social activity with profitability. We compete against the usurer’s illegal activity, and we do it to empower and protect the micro-entrepreneur.

Besides the extrinsic and intrinsic motivation, employees developed a contributive motivation, like senior managers. This means that they work for a specific purpose: to improve the quality of life of their customers. This is what makes sense in their daily lives at work and what makes them act in a pro-social way. This triggers the contributive motivation and creates an environment for employee commitment.

Commercialization capability

The main element for commercializing microcredit is the “human interaction” between the credit analyst and the micro-entrepreneur. This relationship is deployed “on the street”, which means it takes place at the customer’s home or at their work, not in a bank. The microcredit organization goes to the customer and this means doing things in an innovative way, in a different way from traditional banks. A CEO said:

Since the 80s, we learned how to lend and recover money from the micro-entrepreneurs. We did many things in a way that contradicted the traditional practices in the financial industry. Banks lent money to those who had money; we lent money to those who didn´t have money. We replaced collaterals with information about the micro-entrepreneur payment capacity. However, micro-entrepreneurs didn´t have the information; we had to co-build it with them.

A credit manager said:

Microcredit is a world of close relationships with customers. The credit analyst is a psychologist, a financial advisor, a business consultant, and even a friend. The analyst enters the customers’ houses, talks to them, and even gets to know their husbands. This is important for us as a firm, because we get information from this frequent and close interaction. An emotional relationship is developed that locks-in the customer and influences them to punctually pay back the loans. This relationship educates the micro-entrepreneur to be a good borrower.

The commercial capability, through the creation of a “commercial friendship” between the credit analysts and the micro-entrepreneurs, gives the customer “relational benefits” that lock-them up. This means emotional switching costs, but also some sort of a reciprocity from the client to the analyst and the microcredit organization.

A micro-entrepreneur could say something like this: “this organization has given me access to credit, the analyst advises me in how to manage my micro-business, and has supported me in developing my human capacities”. These organizations believe in poor people, in their potential, in their ability to be part of the economic system. These social enterprises empower their customers through the “commercial human interaction” and empower them to be autonomous, while offering them the opportunity to live the most valuable life they can, and not the one they had to live.

Conclusion

Commercialization capability in microcredit institutions is built through several organizational components oriented towards configuring a human commercial interaction. These organizational components, organized for social and economic value creation, according to the emergent model presented in the paper, are (I) social strategy, (II) management capability, (III) active corporate governance, (IV) relational culture, and (V) motivated human talent. They are combined to deploy a service relationship with customers. This effect is perceived by employees as an organizational purpose that impacts them as a contributive motivation (meaning) for work and activates high levels of commitment. This commitment in a dyad relationship framed sell means value creation for the customer. In the case of microcredit, value is created through human interaction because it is a process where collaterals can be substituted for information and deep knowledge of individual customers, allowing their inclusion into the economic system, and empowering micro-entrepreneurs in profound poverty contexts.

Contributive motivation, derived from an organization’s social mission and the value created in the commercial human interactions, is throughout the microcredit organization. This means that senior managers and collaborators make sense of their work in terms of its impact on customers. This propels a pro-social behavior: serving and empowering the low-end segments.

Some limitations must be mentioned. This research has been carried in a specific context: Colombia. Findings are limited to microcredit social enterprises. We refer to microcredit and not to microfinance. Microcredit is about loans, whereas microfinance is about loans, savings and insurance.

For future investigation, this research could be replicated, first, in other industries in Colombia where the relationship between buyers and sellers represents a translatable dynamic, and second, in other Latin American countries, in order to build a regional model for the development of commercialization capability.