Introduction

Currently, the auditor's role is to express an opinion that provides reasonable assurance to users of financial information (FI) about whether the financial statements present, in all materially relevant aspects, a true and appropriate image of the company's performance and financial position, in accordance with an applicable financial reporting framework and related legislation, as stated in the International Audit Standards (ISA) 200 issued by the International Auditing and Assurance Standards Board (IAASB, 2009). In fulfilling this role, auditors must act in order to be independent and be perceived as such. Only in this way can the financial statements be considered credible from the perspective of the stakeholders (Porter et al., 2008) and, therefore, achieve the objective of the financial audit. However, in the scope of their performance, auditors see their independence threatened by a set of relationships and circumstances (Gelter, & Gurrea-Martínez, 2020).

Thus, in order to not allow their independence to be affected and, consequently, the quality and usefulness of the service provided by them to be compromised, it is essential that they comply with a set of fundamental principles foreseen in the codes of ethics existing in the different countries and apply the necessary safeguards to eliminate or mitigate those threats. The scandals that occurred at the beginning of the 21st century along with the 2008 global financial crisis led to the question of the usefulness of auditing and the role played by auditors and their independence being criticized (Cooper & Neu, 2015; Kandemir, 2013; Sikka, 2009).

In this context, and with the aim of restoring confidence in and markets, the European audit reform (EAR) was implemented (Schönberger, 2019; Štaher, 2019). This reform includes a set of measures that aim to respond to several objectives, of which the concern with the role and independence of the auditor is highlighted. Hence, it is in this context of reflection and change that the motivation for carrying out the present paper arises, which is linked to the possibility of contributing to the debate inherent to the impacts of EAR in Portugal, namely regarding the role and independence of auditors.

In view of the above, the investigation conducted is focused on the EAR, and aims to draw conclusions regarding its impact on the role and independence of the auditors, the professionals most directly affected by its introduction. Consequently, this will be the perspective to be explored in conducting the proposed study. It should be noted that, unless expressly stated otherwise, the terms "audit", "financial audit" and "external audit", as well as the terms "auditors", "financial auditors" and “external auditors”, must be understood as synonymous designations throughout this investigation.

The perspective to be explored, as well as the conclusions that are intended to be drawn, are also justified by the lack of consensus among financial audit professionals regarding some EAR measures. In this sense, the starting question for this study is defined in the following terms: "Does the EAR contribute, from the view of the auditors, to a better perception of the role and independence of these professionals?" The data collected for this study were obtained from a questionnaire addressed to auditors who are members of the Portuguese Institute of Statutory Auditors (Ordem dos Revisores Oficiais de Contas or OROC, the Portuguese Acronym).

In Portugal, a few researches related to the implementation of EAR are known (Abreu, 2019; Mestre, 2016; Pereira, 2016; Rua, 2019). However, except for the research carried out by Abreu (2019) and Rua (2019), the rest were conducted at a stage that was prior to the concrete effects of the implementation of EAR in Portugal. On the other hand, the recent research carried out by Abreu (2019) and Rua (2019) were dedicated to different topics other than the impacts of EAR related to the role and independence of auditors. Abreu (2019) focused on the audit quality through discretionary accruals in the empirical research, but the findings were inconclusive. The analysis proposed by Rua (2019), on the other hand, was dedicated to a comparison between the measures adopted in their national legislations by Portugal and France, with no empirical component added.

Internationally, there is a broader set of studies. Notwithstanding, and with a few exceptions, they are dedicated to envisioning the effects of the implementation of the EAR and not to presenting the concrete effects of that reform. In this sense, this research differs from the others in that it seeks concrete effects of the reform instead of looking at them.

The next chapter presents the theoretical framework that supported this paper.

Theoretical Framework

The auditors have the role of expressing an independent opinion about whether the financial statements that allows reasonable assurance to stakeholders that the FI fully and truthfully reflects the performance and financial position of a given entity (Antle, 1982 apudAziz & Omoteso1, 2014, p. 4; Sikka, 2009).

In performing this role, the auditors are subject to a set of fundamental principles, with which compliance is essential so that their independence and the consequent quality and usefulness of the service provided by them is ensured. However, due to non-compliance with these fundamental principles, the role of the auditors was not always performed effectively.

In fact, the beginning of the millennium was marked by the occurrence of several successive large-scale financial scandals that reflects the above. In the United States of America (USA), the cases of Enron and WorldCom were the most publicized, the former for having led to the disappearance of the market of one of the largest auditing companies in the world, Arthur Andersen, and the latter for the assumed size in financial terms. In Europe, the most emblematic case was that of Parmalat in 2003 (Dibra, 2016).

The occurrence of these scandals, namely that of Enron in 2001, led to the usefulness of the audit being called into question and the role played by the auditors to be strongly criticized (Cooper & Neu, 2015; Mocanu & Ionescu, 2020). Several authors, including Wilson and Key (2013), consider that there was unethical behaviour on the part of the auditors responsible for the audit of Enron, coupled with the lack of independence of the audit firm itself. According to them, this resulted from the provision of services other than auditing simultaneously with audit services and from an economic dependence caused by the high amounts of fees received from Enron in relation to its total billing.

In view of the occurrence of these financial scandals, which resulted in a crisis of confidence by investors and society in general regarding the work performed by auditors (Mocanu & Ionescu, 2020), the need of creating capable mechanisms in order to respond to and reverse the situation caused by them arose. Thus, to minimize conflicts of interest and guarantee the independence of auditors, the Sarbanes-Oxley Act was passed in the USA in July 2002 with the ultimate purpose of protecting investors' interests and increasing confidence in the markets (Mayoral & Sánchez-Segura, 2008 apudSantos et al., 2015, p. 154). Later, but for the same purpose, Directive 2006/43/EC of the European Parliament and Council was published in the European Union (EU) in May 2006, which was mandatory for transposition by Member States until 28 June 2008.

While the transposition of the Directive was in course, the 2008 global financial crisis occurred. It seemed that the implementation of these measures was not enough to render the audit and the auditor immune to this crisis. In fact, with its occurrence, several questions were raised regarding the value of external audits (Sikka, 2009), and so the role played by auditors was, again, strongly criticized (Kandemir, 2013).

Against this backdrop, the need for debating and taking measures to stabilize financial markets emerged. A reform process started at the European level on 13 October 2010, with the issuance of the Green Paper “Audit policy: lessons from the crisis”.

The purpose of the Green Paper was to stimulate public and global discussion on certain issues, such as the role of the auditor, the governance and independence of audit firms, the supervision of auditors, the concentration and structure of the market, the creation of a European market, simplification of rules for small and medium-sized enterprises and international cooperation for the supervision of audit firms (European Commission, 2010; Humphrey et al., 2011).

The Green Paper culminated in the issuance on 16 April 2014 of the Directive 2014/56/EU of the European Parliament and Council and the Regulation (EU) 537/2014 of the European Parliament and Council, the former (latter) mandatory for transposition (application) until 17 June 2016, which resulted in the EAR. According to the European Commission (EC), this legislation materialised the EAR and arose with the following specific objectives (OROC, 2014, p. 1):

Clarify and better define the auditors’ role.

Reinforce the auditor's independence and professional scepticism.

Make the audit market more dynamic.

Increase the auditors' supervision.

Facilitate the provision of cross-border audit services.

Reduce unnecessary burdens for small and medium-sized businesses.

The aggregate of these specific objectives is intended to restore the markets confidence (Štaher, 2019), contributing to the protection of investors and the reduction of the cost of capital. In other words, they intend to achieve the main objective of the EAR: the stabilization of the financial system (EC, 2010; Schönberger, 2019).

As highlighted by Cordoș et al., (2020), the new regulation in the EU coincided with the introduction of new ISA 701 by the IAASB, which became effective for financial statements in and after December 2016 and focused on the responsibility of auditors to disclose key audit matters (KAM) in the auditor’s report. This overlap can be seen, according to these authors, as evidence of “collaborative efforts of different regulatory bodies in their quest to improve audit reporting by increasing disclosure of KAMs related to significant risks and judgements”2.

From the Portuguese legislation perspective, the transposition of the directive and the application of the regulation took place through two different diplomas, namely the Law No. 140/2015, of 7 September, which approved the new OROC statutes (Estatuto da OROC or EOROC, the Portuguese acronym), and the Law No. 148/2015, of 9 September, which approved the new Legal Audit Supervision Regime (LASR). They came into force on 1 January 2016. It is worth noting that, according to Willekens et al., (2019), Portugal can be included in the group of the 12 out of 28 Member States that, at the beginning of June 2016, had already implemented all the rules proposed by the EU into their national legislation.

Given that the purpose of this paper is directly related to the specific objectives of the EAR to clarify and better define the role of the auditor, reinforce the auditors’ professional independence and scepticism, and increase the supervision of the auditors, the following measures indicated in Table 1 were selected for analysis.

The following chapter presents the hypotheses formulated for this research and the methodology used, which includes the description of the instrument and the period of data collection, the population and sample, and the statistical techniques proposed.

Hypothesis and methodology

The collection of data for this study was carried out using a questionnaire. The choice of this instrument was due, on the one hand, to the type of data intended to be obtained (with quantitative characteristics) and, on the other hand, to the fact that it allows «…to quantify a multiplicity of data and therefore carry out numerous correlation analyses» (Quivy & Campenhoudt, 1998, p. 189).

The final version of the questionnaire was created on the platform “Google Docs - Forms of Google”, after carrying out a pre-test sent to a small number of professionals, namely statutory auditors (Revisores Oficiais de Contas or ROC, the Portuguese Acronym) who are simultaneously teaching staff at the Lisbon Accounting and Business School (ISCAL, the Portuguese Acronym). This document is structured as follows:

- Sample characteristics (Part 0, with 4 questions: 1 to 4).

- Independence (Part I, with 2 questions: 5 and 6); questions 5 and 6 are subdivided in 5 (5.1 to 5.5) and 8 items (6.1. to 6.8), respectively.

- The auditor's role in society and confidence in the quality of his work (Part II - 14 questions: 7 to 20).

- General questions (Part III - 2 questions: 21 and 22).

Scale used: Likert scale, whose selected format consists of five levels, from “1 - I totally disagree” to “5 - I totally agree”, passing through the intermediate level "3 - I neither agree nor disagree", representing a neutral opinion.

The final version of the questionnaire was initially sent to the population selected for this study by email, in the period between February 21, 2019 and February 25, 2019. In order to increase the number of responses, we proceeded to a second submission in the period from March 19, 2019 to March 21, 2019. The last data collection took place on March 31, 2019. The population of this study are auditors who simultaneously meet two requirements: active or suspended registration with OROC and the existence of a publicly available email address. These professionals were selected because they are the professionals most directly affected by the changes that the EAR has introduced. Based on the information obtained from the institution's website, the email addresses of 1447 professionals were obtained. Finally, 89 out of the total number of potential respondents’ responses were obtained, which is equivalent to a response rate of 6.15%. This number is close to the responses recently gathered by Polychronidou et al., (2020) when performing research based on the perspective of members of the Institute of Certified Public Accountants of Greece. Van Liempd et al., (2019), in research covering different stakeholders in Denmark, gathered 132 responses, indicating this element as a relevant constraint.

The next step was to verify the adequacy of this sample, that is, the reasonableness of extrapolating, with a relative degree of confidence, the conclusions of the sample to the population under analysis. For this purpose, the minimum required sample was calculated based on Arkin (1982) for a 95% confidence level and an accuracy equivalent to 10%, resulting in a number equivalent to 90 observations, which corresponds to a value close to that obtained in this study.

This precision, it should be noted, is understood by Triola (1999, apudDaciê et al., 2017, p. 345) and by Levine et al., (2000, apudDaciê et al., 2017, p 345) as the maximum margin of error. Likewise, this is used in some studies of this nature, particularly when questionnaires were used as a source (for instance, Bahaddad et al., 2012; Daciê et al., 2017; Domínguez et al., 2014; Moussavou et al., 2016). In addition, national studies that used the same professionals and whose collection instrument was the questionnaire presented equivalent or lower numbers (Aires, 2016; Cunha, 2018; Ramos, 2016; Rocha, 2017). It should also be noted that, although the sample corresponds almost exclusively to professionals in activity, the exclusion of professionals with suspended activity in the calculation of the minimum sample does not significantly alter the results, considering that the formula used is a little sensitive to significant variations in the population. In the present case, the change would correspond to the reduction of the minimum sample from 90 to 87 observations. Table 2 presents a summary of the sample characterization elements obtained from the responses to part 0 (initial) of the questionnaire (sample characterization).

The hypothesis proposed for this study aims to identify whether the auditors' perception of the relevance of the EAR is influenced by certain concepts, identifiable from the grouping (synthesis) of the different questions proposed in the questionnaire. The hypothesis presented below intends to verify if the groupings identified through the factor analysis used influence, or not, the auditors' perception regarding the relevance of the EAR. It should be remembered, in this context, that the groupings are potentially related to each of the specific parts of the questionnaire mentioned above. This hypothesis will initially be tested using factor analysis, since this statistical technique allows us to group the variables underlying each of the questions that are statistically correlated with each other. The smallest set of variables resulting from this process, called latent variables or components, consists of the theoretical representation of a common concept. Then, logistic regression will be used, as this technique allows us to verify how a given dichotomous dependent variable is influenced by a set of independent variables (in this case the concepts that result from the factor analysis). Following the information presented in this point, the next one will dedicate itself to the presentation of the results obtained in the scope of this study.

Findings

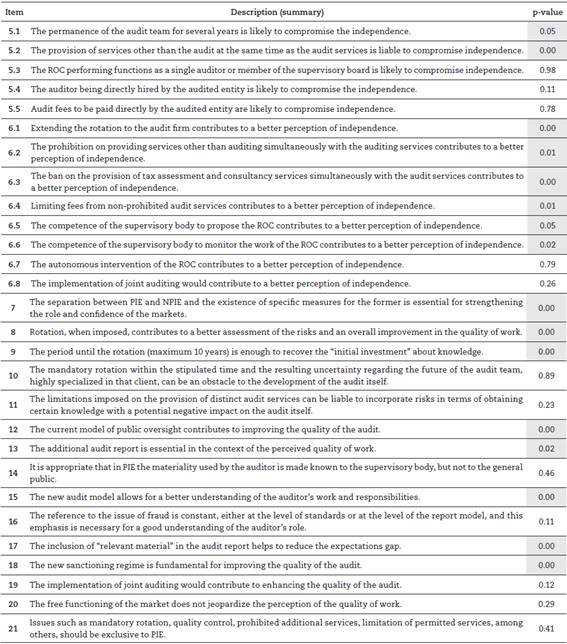

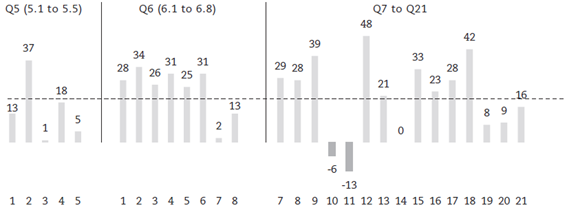

Table 3 summarizes the results of the Mann-Whitney-U test based on the groups or subsamples of auditors who considered the introduction of the EAR fundamental, or not, as proposed in question 22 (last) of the questionnaire. Furthermore, Figure 1 presents the differences in percentage points (Dif. pp) between those two groups, which were obtained after summarizing, for each item, the responses for the agreement (A) positions, that is, levels 4 and 5 (agree and strongly agree) of the proposed scale.

Table 3 Results of the Mann-Whitney test and differences in percentage points

Source: Own elaboration.

Source: Own elaboration

Figure 1 Differences in percentage points for the agreement level between the two groups

The results of the Mann-Whitney (U) test in Table 3 confirm the existence of significant differences between the two groups for most of the proposed questions (p-value <0.05 for 16 questions or 57% of the total). In addition, Figure 1 shows that the agreement levels for the group of auditors who attribute relevance to the EAR for these cases generally exceed the opposite group by more than 20 pp, reaching a maximum of 48 pp. Furthermore, and for the remaining positive cases (9 questions), the differences are between 10 pp and 20 pp for 4 cases. On the other hand, negative values can be observed as an exception for only two questions, where the difference does not exceed 13 pp (questions 10 and 11). Finally, it is worth highlighting a single case where there is a null difference (question 14).

Overall, it is possible to conclude that, despite the remaining debate on the need of increasing, or not, the independence rules, highlighted for example by Jenkins and Stanley (2019), auditors in Portugal consider that, in general, the EAR contributes to a better perception of independence. Particularly, the ban on the provision of services other than the audit is the measure that most contributes to this.

Regarding the role of the auditor, these professionals understand that the EAR has significantly contributed to a better definition and clarification of this concept as well as to a consequent reduction in the expectations gap.

More specifically, the EAR presents a more comprehensive definition of the concept of IPE which, according to the literature review carried out, appears to have been too extensive and, as such, should be subject to review, which may explain a higher level of agreement between the two groups in the answer to question 21. PwC (2015) states that this enlargement has led, namely, to the inclusion of entities that have no public relevance, to the increase in costs for IPE, to the dispersion of the supervision focus by competent entities, specifically, the Securities Market Commission (Comissão de Mercado de Valores Mobiliários or CMVM, the Portuguese Acronym) and the increased work by the auditors, as well as the unjustified dispersion of resources. Metka (2016) suggests, in turn, that the EC should have adjusted the legislation considering the size of the countries and the development of their capital markets.

The mandatory rotation of the audit firm is another issue in which the results were not consistent, with question 10 diverging from the others. In this regard, the EAR gives Member States the option of establishing a minimum (1 year) and maximum (10 years) rotation period for the audit firm, with the possibility of an extension in the following terms: to 20 years, if applicable, a public tender process was carried out; or for 24 years, in the case of a joint audit, a possibility that was rejected by most countries. The implementation of this measure, according to what is expressed in the Green Paper (EC, 2010), will contribute to increasing independence and tends to reinforce the rotation mechanism of the partner responsible for the audit, which, by itself, does not contribute to eliminate threats from familiarity. Although the convictions were contained in the Green Paper (EC, 2010), opinions are not convergent. The studies carried out by Pereira (2016) and Ruud et al., (2018) corroborate the understanding printed in the Green Paper (EC, 2010). More specifically, the research by Polychronidou et al., (2020), for example, concluded from the perspective of the auditors that the mandatory rotation “will increase both auditor independence and resistance to the management of the audited firms”, despite the fact that it will also increase the overall costs of the audit process, which is also corroborated by Chutchev (2019). The increase in costs was also mentioned by Myntti (2019), who also indicated that the effects on the audit quality are inconclusive. These findings partially corroborate what was found by Kim et al., (2019) from the view of investors, namely that the mandatory rotation of the audit firm “provides an environment for qualified audits by enhancing auditor independence and scepticism”. However, Mestre (2016), Schönberger (2019) and Velte and Eulerich (2014) indicate that this measure will not contribute to increasing independence. Moreover, Garcia-Blandon et al., (2020), in a cross-European study and using three different sets of proxies for audit quality, did not find any evidence that companies with more than ten years with their auditors had a lower level of audit quality than other firms.

The EAR also extended and consolidated the prohibition on services other than auditing, as well as limiting fees from these types of services, as the total fees related to these services cannot exceed 70% of the average fees paid in the same period for the audit service. It should also be noted that some countries, such as Portugal, have opted for more conservative percentages compared to those defined in the regulation. These measures are justified in the Green Paper (EC, 2010) because they allow us to reinforce the independence which is threatened with the provision of these types of services. According to Pereira (2016), these measures enhance the auditor's independence and the quality of the audit overall. On the other hand, Mestre (2016), Schönberger (2019) and Velte and Eulerich (2014) consider that these measures will not contribute to increase the independence and, additionally, will have a negative impact on the quality of the audit, while some Danish stakeholders, according to the research carried out by Van Liempd et al., (2019), considered that the threshold is “too high” (Quick & Warming‐Rasmussen, 2019). The reason behind this conclusion is that the auditors can potentially lose the accumulated knowledge of the entity, which was acquired when providing these types of services. On the other hand, Lien and Bhattarai (2020) found some evidences that the audit (accruals) quality increased when non-audit services are limited to 70% in the last three years, suggesting, however, the need for conducting further tests to improve this analysis. These findings could partially explain the results obtained for question 11. In this sense, Ruud et al., (2018) also state that this prohibition should be reconsidered, since some of these services do not affect independence and increase the knowledge of the entity to be audited. Furthermore, Schönberger (2019) indicates, based on research that included three Member-States (France, Germany and United Kingdom), that “it is not clear whether the non-audit fee cap of 70 percent is effectively enhancing auditor independence”, given that even before the implementation of the EAR the companies from these countries had limited the non-audit services to a level below that of the threshold.

The EAR also brought about changes in the supervision of the audit activity by giving life to one of the options provided for in the Green Paper (EC, 2010), through the creation of the Committee of European Audit Oversight Bodies (CEAOB), which replaces the European Group of Auditors Oversight Bodies (EGAOB). This new body is composed of one member from each Member State, a high-level representative of each competent authority, and a member appointed by the European Securities and Markets Authority (ESMA), whose function is to supervise cooperation between competent authorities and assume all functions that, until now, have been performed by EGAO. Despite the creation of this body, each Member State remains responsible for supervision at a national level.

The EAR has also reinforced the role of the EIP supervisory body by increasing its responsibilities, as well as changing, through an increase in requirements, the CLC and requiring the delivery to the supervisory body of a report called “additional report inspection body”. These measures respond to the concern presented in the Green Paper (EC, 2010), which is related to the need to clearly define what information should be provided by the auditor to interested parties. It seems consensual among the various researchers, of which we highlight Pereira (2016), Mestre (2016) and Ruud et al., (2018), that these measures are considered adequate and advantageous, and even contribute to a reduction in the expectations gap. The results obtained for questions 7 and 12, which point to a high level of agreement on these matters by the auditors who consider the introduction of the EAR to be fundamental, corroborate this understanding.

Finally, the EAR introduced several changes in terms of sanctions and penalties, namely with regard to the increase in the monetary values due for non-compliance. According to Mališ and Brozović (2017), the objective of the verified increases is to guarantee the application of the measures imposed by the EAR and these are generally adjusted to the audit market of each country. In Portugal, OROC and several audit professionals consider that they are out of place with the reality of the entities, given that the fines are substantially higher than the gross fees of the ROCs of several years (OROC, 2015; OROC, 2017). Despite this, the results obtained for question 18 show more categorically the agreement of the Portuguese auditors regarding the relevance of this measure, in line with such authors. Subsequently, the multivariate analysis started with the factorial analysis based on the principal component method with varimax rotation. This analysis was carried out in order to identify the components that explain the correlations between the different items of the questionnaire, in order to identify the underlying concepts (latent variables) of the different groupings.

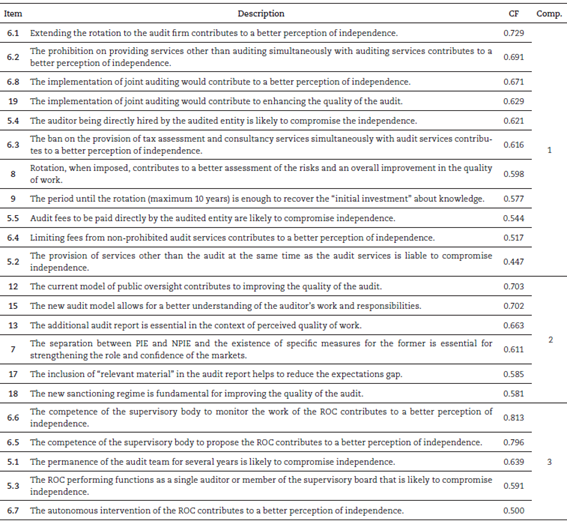

Thus, and in order to identify the components that explain the correlations between the variables from the available items (questions proposed in the questionnaire), the initial rotation of questions 5.1 to 21 proceeded. The final results of the factor analysis, however, were produced following several outputs produced, and which were based on the assumption of some assumptions typically used in this process, in order to obtain, in each component, a minimum number of four items with a factor load greater than 0.4. These assumptions led to the final solution present in the eighth rotation, limited to three components with factorial loads equal to or greater than 0.4 (exercise assumption).

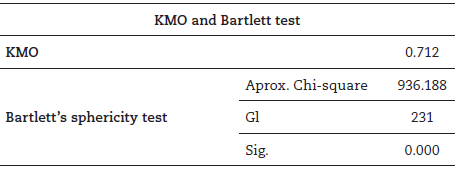

As can be seen in Table 4, the final solution has a KMO value of 0.712 and a significance level of the Bartlett test below 0.05. These results indicate, according to Kaiser and Rice (1974, cited in Hill and Hill, 2002, p. 275) and Sharma (1996, cited in Marôco, 2003, p. 368), an “acceptable” level of correlation between the variables (items/questions), demonstrating, as such, the adequacy of the factor analysis performed.

The proportions of the total variance for each item explained by the components, called “communalities”, can be seen in Table 5. The values of these vary between 0.322 and 0.676 and, as such, are adequate to proceed with the factor analysis. The total variance explained for the three components where the 22 items subject to factor analysis were grouped in the last rotation performed has a value close to 49%, with 21% explained by the first component, with the remaining components assuming values between 13% and 15%. Note that this percentage is very close to that shown in other studies (Cohen & Sayag, 2010; Grote & Kunzler, 2000; Khuong & Hoang, 2015).

Considering the items identified in each of the components, it was sought to understand the nature of the underlying latent variable from the various questions or items that synthesize them. Thus, it was possible to identify the components as follows: 1. “the independence and the possible changes that the measures implemented to increase its cause in quality”; 2. “the confidence of FI users in the role played by the auditor”; 3. "the importance of the supervisory body as an intermediary in the relationship between the auditor and the company subject to the audit and supervisor of independence". Table 5. groups the items identified in each component (comp.) with the respective factorial loads (CF).

The justification for the name of the first component is due to some elements that underlie it, identified from the items that integrate it. Thus, three of the items (5.2, 5.4 and 5.5) allow us to see if certain relationships and circumstances are likely to compromise independence. Additionally, for the remaining eight items of this component, which in turn are related to the measures implemented by EAR with the purpose of strengthening independence, five items (6.1, 6.2, 6.3, 6.4 and 6.8) are identified that offer indications regarding the measures that effectively contributed to reinforce independence, and three others (8, 9 and 19) that allow us to understand whether such measures caused variations, positive or negative, in terms of quality.

Regarding the second component, its name is due to the fact that it includes, on the one hand, four items (7,12, 13 and 18) that allow us to understand if certain measures contribute to increased confidence, by the users of the FI, in the role played by the auditor and, on the other hand, by identifying two items (15 and 17) that offer indications about the impact of certain measures regarding the understanding of the role of the auditor.

In regards the third component, its designation is due to the fact that it includes a set of items (5.1, 5.3, 6.5, 6.6 and 6.7) that allow us to understand if the separation between the supervisory body and the auditor, together with the attribution of competencies to the former regarding the “supervision” of the relations between the auditor and the audited entity, contributes to an improvement in the perception of the auditor's independence.

In order to verify the reliability of the correlation of the items that integrate each of the components, a reliability analysis was carried out using Cronbach's alpha (α) internal reliability estimation.

The value of α is, according to Hill and Hill (2002), identified as “good” for the first component (0.855) and as “reasonable” for the second and third components (0.740 and 0.764, respectively). It should be noted that these values do not change significantly with the exclusion of any item included in each component.

Finally, the proposed logistic regression was performed, using the three components that resulted from the previous factor analysis as independent variables. The dichotomous dependent variable is a result of a transformation proposed for the question, which aims to capture the overall relevance of the EAR from the perspective of the auditors.

For this purpose, the auditors who responded up to level 3 of the scale proposed for this question were classified with the code “0” (“partially disagree”, “strongly disagree” or “neither agree nor disagree”), while auditors who responded with levels 4 or 5 on the same scale (“partially agree” and “strongly agree”) were classified with code “1”.

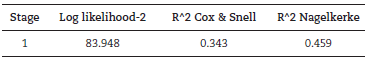

Looking at table 6, it is possible to verify that 34.3% of the variations that occurred in the logarithm of the odds ratio are explained by the set of proposed independent variables and that the model explains 45.9% of the variations recorded in the dependent variable, values that are relatively expressive. Note that this percentage is higher or close to studies that used the same technique (Chau & Leung, 2006; Nez &Cunha, 2018; Salehi & Alinya, 2017; Sharma & Siduh, 2001).

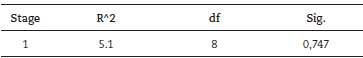

Table 7 shows a significance value greater than 5% for the Hosmer and Lemeshow test. This result, combined with the results of the Cox & Snell and Nagelkerke tests, point to the adequacy of the proposed model.

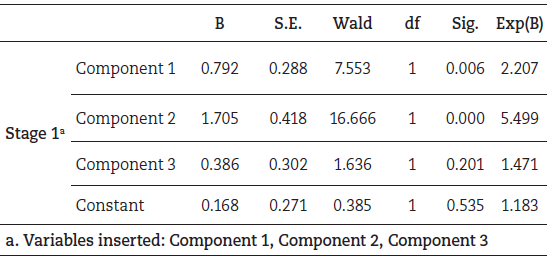

Table 8 shows, finally, the results of the logistic regression performed. From the analysis of the aforementioned table, it is possible to verify that the first and second components, respectively, “the independence and the possible changes that the measures implemented to increase its cause in quality” and “the confidence of the users of the FI in the role played by the external auditor” have significance levels below 5% and, as such, are significantly related to the way in which the importance of the EAR is perceived by auditors.

The same is not true, however, in relation to component 3, described as “the importance of the supervisory body as an intermediary in the relationship between the external auditor and the company subject to the audit and the independence 'supervisor', which leads partial confirmation (not rejection) of the hypothesis. The next point presents, among other elements, a summary of the main conclusions obtained during the development of this investigation.

Conclusions

The findings of this paper identified that it is the auditors who considered the introduction of the EAR to be fundamental and who agreed, at higher levels, with most of the questions proposed for the different aspects analysed. This is aligned with the research performed by Myntti (2019), who interviewed three big-4 auditors from different firms, concluding that “the overall attitude towards the reform was mostly positive”. Additionally, the findings pointed out that, of the concepts identifiable through factor analysis, not all influence the auditors' perception of the relevance of the EAR, so the proposed hypothesis is considered only partially validated (not rejected).

The conclusions of this research, in a certain sense, contradict the perspectives identified by Mestre (2016) with regard to the achievement of the objectives of the EC, namely with regard to the objectives of “clarifying and better defining the role of the auditor” and “reinforcing the auditor's independence and professional scepticism”. On the other hand, it reinforces the positive contribution of EAR to the strengthening of the sector also identified by the author.

Additionally, this research also supports the findings presented by Pereira (2016), Ruud et al., (2018) and Mališ and Brozović (2017), since the measures implemented by the EAR proved to be globally advantageous, despite the fact that it created concerns about particular topics to be considered, some of which were already considered within the recent preliminary draft review of the legal audit regime under the national CMVM No. 8/2018.

In fact, the effective impacts of the European audit reform need to be further investigated, as the implementation of some measures proposed by the EAR are still at an early stage of implementation. Accordingly, recent papers have mentioned a non-consensual positive perception about their effectiveness overall. Mertens (2019), for instance, indicates that “despite the Commission's high ambitions, the European Union (EU) audit market legislation of 2014 left most observers unsatisfied”.

This investigation has some limitations that cannot be left out. The first restriction to be mentioned, also indicated by Van Liempd et al., (2019), is essentially related with the difficulty in obtaining answers, which is a recurrent situation in studies that use the questionnaire as an instrument for data collection. This results in the consideration of a higher margin of error in the analysis than the conclusions presented in the present study. An increase in the number of responses would enable the development of richer and more diversified analyses, considering, namely, the characterization or demographic elements of the population under analysis.

At the end of the present research, some perspectives can be suggested in terms of their exploration in future research projects. The first considers the possibility of overcoming the limitation on the number of responses obtained and concerns the extension of this study to the supervisory bodies. The comparison of the results between different subsamples is a topic of interest in the analysis of this theme. For instance, Cordoş et al., (2020), based on a systematic literature review, found that distinct stakeholder groups can have a different understanding on the auditor’s responsibility, independence, and level of assurance they provide, which is aligned with the findings by Van Liempd et al., (2019).

The extension of the analysis performed to other EU countries, as the EAR is applicable to all Member States, could also be adopted in future research. Moreover, and given that the present investigation does not aim to answer all the specific objectives of the EAR, it is suggested that a study be carried out that covers elements other than the topics proposed in this study, either at a national or at a multinational level.

In fact, some studies covering different topics were performed after the EAR was implemented. For instance, Willekens et al., (2019) performed a cross-European study on costs, concentration and competition, while Saksonova and Rozgina (2019) covered some of these topics in a domestic perspective (in Latvia). In Portugal, Abreu (2019) assessed the audit quality. The researchers, however, indicate more consensually that the changes are still moderate or can be understood as provisional or inconclusive at this stage. Also, they generally propose the revision of some topics implemented under the EAR. In this sense, it is worth mentioning the research carried out by Clacher et al., (2019), who suggest that “the definition and scope of a PIE needs revisiting both within the UK and across all EU Member States”, also identifying lobbying strategies. In turn, Gelter and Gurrea-Martínez (2020) mention the failure of all the mechanisms recently proposed to improve the auditor's independence. Finally, Van Liempd et al., (2019) mentioned some criticisms by Danish stakeholders on the criteria regarding the threshold for non-audit services proposed by the EC, which “seems unnecessarily strict”.

Finally, further investigations may relate some of the measures implemented by the EAR with the expectations for the future of audits from the perspective of several entities. For instance, by considering the characteristics proposed by the International Organization of Supreme Audit Institutions (INTOSAI) as regards the future relevant and value-adding auditor (INTOSAI, 2020).