Introduction

We could consider that a stock market provides liquidity whenever trading shares or titles in cash quickly is enabled, and vice versa, without any type of cost or impact on the closure price. The liquidity risk consists of the impossibility of undoing a position or investment under the price of a competitive market, and with enough speed, once the choice has been made (Zorrilla Salgador, 2005).

The liquidity risk is highly studied in developed markets, especially in North America and Europe, where the stock markets have an important depth. However, the situation is different for emerging economies, since measuring the liquidity risk is a challenge for a small stock market as is the case in Chile, so this work attempts to contribute to said direction.

As Amihud and Mendelson, (1986a) published in their weekly article, researchers have followed several research lines; the most classic one is the relationship between stock profitability and liquidity risk, which means whether the investors obtain profitability from this. There have also been attempts to determine whether the most liquid markets influence economic development, for instance, Naula Sigua et al. (2019) explore this relationship in eleven Latin American economies finding that liquidity does indeed have an effect on economic growth.

Liquidity risk studies have used different methodologies, the most frequently used being econometric models, in these models a series of variables and liquidity risk indices have been used, which can be divided into two groups; estimates based on information from the offer book or price range and ii) on negotiating activity. This work seeks to contribute to this second group.

The research guidelines have been diverse, and these have focused on the relationship between stock profitability and liquidity risk, stock market liquidity, the relationship between the liquidity risk and capital structure of companies, and recently on cryptocurrency liquidity (Koutmos, 2023; Lee & Milunovich, 2023; Theiri et al., 2023; Zhang & Li, 2023). Academia and specialised sectors have already studied liquidity risk for several decades, from the pioneering work of Black (1971), Amihud and Mendelson (1986a) and Amihud and Mendelson (1986b) to more recent studies that seek to explain the effect of liquidity risk on financial crises (Dang & Nguyen, 2020). These studies began in developed economies in North America and Europe and in recent decades in Asia, Latin America and Africa, examples of these latest works are studies carried out in Indonesia (Surjandari et al., 2020), Latin America (de Carvalho et al., 2022) and South Africa (Marozva, 2019), among others.

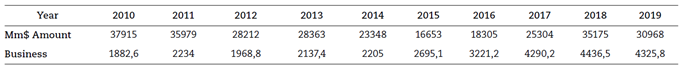

In Chile, the stock market has had an important development in recent years. Even though at the beginning of the last decade there was a decline in the amounts traded, from a maximum of MM$ 37,915 in 2010 to MM$16,653 in 2015, with a fall of 56%, in the following years an important recovery began. On the other hand, the number of businesses has also had significant growth from 1.8 million businesses in 2010 to more than 4.4 million in 2018 (Table 1).

Table 1 Amounts traded in shares and number of businesses

Source: Synthesis and Annual Statistics 2019 of the Santiago de Chile Stock Exchange.

The free float corresponds to those shares that are not owned by the controller shareholders, so these are usually available to be traded in the stock markets. Therefore, we can expect that this variable -when incorporated into the measures- captures the liquidity risk in a better way, as well as its relationship with the stock profitability. This variable has been recently incorporated into liquidity risk (Ding et al., 2016; El-Nader, 2018; Le & Gregoriou, 2022; Sterenczak, 2022).

This research aims to cover the gap regarding the view of new risk rates by incorporating the free float, a factor not considered in previous studies in Chile, as a contribution to the research of indicators that may capture the liquidity risk in small stock markets or emerging economies.

The present work has three specific objectives. First, to determine whether there is a liquidity risk award in the Chilean stock market. Second, to establish whether the liquidity risk is different or has undergone modifications in recent years. Third, to determine whether the liquidity risk is captured based on two groups of liquidity risk measures, some highly used and some recently proposed based on free float. Thus, the research questions are: Is there a liquidity risk award in the Chilean stock market for the last decade 2010-2019? Is there a significant relationship between the performance of stocks and different liquidity indices for the periods 2010-2015 and 2015-2019 in the Chilean stock market? Is the floating capital traded on the stock exchange significant in the liquidity and profitability risk of the shares?

Literary review

Recently, the liquidity risk study has been undertaken in new markets, such as the one carried out in South Africa; where evidence was found that liquidity risk is an important factor in shareholder returns on the Johannesburg Stock Exchange (Marozva, 2019). In the Indonesian market, a study found a negative ratio between free float and liquidity (Ibrahim & Hanggraeni, 2021). Regarding liquidity of the stock market, in a recent study in the emergent market of Fiji, this did not show any correlation with the development of the stock market, leading to the conclusion that the current regulatory conditions are not conducive for the stock market to be dynamic (Saliya, 2022). The work of Mehak and Singla (2022) in the Indian stock exchange used the five factors model of Fama and French (2015). They found evidence that the liquidity risk helps to explain the asset valuation. And in a more particular application, Waitherero et al. (2021) analyse the liquidity risk and the value of Kenya´s SACCO Company, aiming to underscore the importance the impact the management of the administration as well as of the government authorities has on them.

The impact of liquidity risk has also been studied based on the vantage point of the creation of the market makers and the conclusions of Jarrow (2020) are consistent with the relevant literature; no evidence is found of a balance that broadly supports several creators of the market, that obtain strictly positive profits.

Non-traditional studies on liquidity risk conducted in the last several years are the work of Guijarro et al. (2021) regarding the effect of microblogging data, as a tool of non-financial information, and whether these have a fair price together with the scopes of market liquidity. The liquidity risk has also been studied during the pandemic period (Covid), when using three measures, a negative and significant ratio was found between illiquidity and Covid in emerging and developed markets (Marozva, 2021). Yang’s study, using the three factor Fama-French model, the five factor Fama-French model, the LCAPM model, and the Pastor and Stambaugh (2003) model, finds no relationship between the transaction cost and the liquidity risk.

Liquidity risk is priced high during down markets and turbulent periods, while in general, the other factors exhibit negligible risk when market volatility is high, the evidence found indicates that liquidity risk is important, especially for periods of low quotation (Ma et al., 2021). On the other hand, there is no evidence of liquidity risk in the Warsaw exchange market (Sterenczak, 2021), particularly the liquidity premium does not rise during falling markets, since the investors enlarge the investment horizon when the market liquidity decreases.

The liquidity risk award has been an interest of researchers, especially for markets in emerging economies such as Latin America. A study along this line is the one carried out in the Latin American Integrated Market, initially composed of Chile, Colombia and Peru, later incorporated in 2014 in Mexico. This study found evidence of a liquidity risk award (Fuenzalida et al., 2017). There are many other studies on the relationship between shareholder returns and liquidity risk that found some direct and significant relationship (Lamothe-Fernández & Vásquez-Tejos, 2011; Vasquez-Tejos, Ireta-Sanchez et al., 2019; Vasquez-Tejos, Pape-Larre et al., 2019; Vasquez-Tejos & Lamothe-Fernandez, 2020).

The incorporation of several new indices or measures to assess liquidity risk is an area that has captured the attention of researchers. The work with multiple indices (Kim & Lee, 2014), which uses 8 indicators and finds a positive relationship between profitability and liquidity risk follows this line of thought. Doostian (2022) uses five measures of liquidity risk, among them, the free-floating ratio that this study uses as a factor to build the risk measures.

A good literary review is found in the work of Naik and Reddy (2021), who collect the main research following the worldwide financial crisis of 2008, describing the main indicators and factors that explain liquidity risk.

Data and methodology methods

The selection criteria were based on the stock presence of the shares and the free-float percentage. We use these criteria because intuitively the shares with low stock presence coincide with liquid shares, and therefore, with a high liquidity risk; we consider that this group of shares is not very attractive for the investors that are interested in having enough liquidity level for disinvestment decisions. A similar situation to those companies that have low free float percentages since this may result in difficulties or slowness for the investors when making offers to the market.

This research evaluates a non-probabilistic sample of 46 Chilean companies with a total of 5,509 monthly observations for the period comprising January 2010 to December 2019. The criteria used were the shares of companies in the non-financial sector, an average stock market presence greater than 50% and at least 10% of floating capital.

We use six measures of liquidity risk, all estimated based on statistics of trading activity or traded businesses. The measurements and their respective models are set out below:

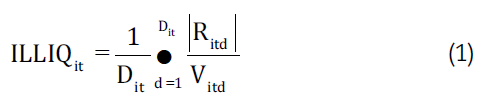

The most commonly used measure of liquidity risk in various studies corresponds to the Amihud index (Amihud, 2002) (equation 1):

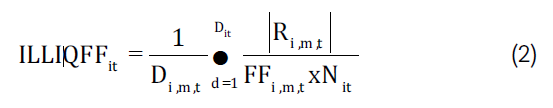

Following the contribution of Amihud (2002), is the proposal of Vásquez-Tejos et al. (2020) which modifies the denominator of the volume traded by the floating capital (equation 2):

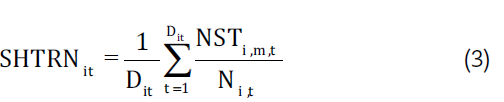

The Share turnover measure (ElBannan, 2017) whose calculation is (equation 3):

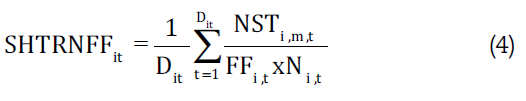

Following the rotation of shares, the proposal of (Vásquez-Tejos et al., 2020) modifies the denominator of the number of shares by the number of shares available in the market (floating capital) (equation 4):

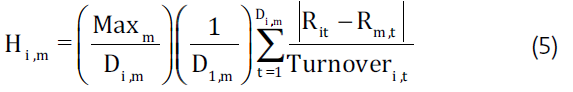

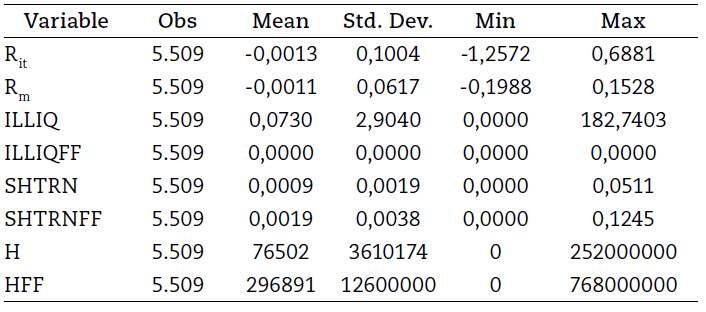

The Hybrid index is proposed in 2019 by Pontiff and Singla (2019), whose calculation is (equation 5):

As in the previous proposals, Vásquez-Tejos et al. (2020) modifies the denominator of turnover by the SHTRNFF (equation 6):

For the estimation of these measures, we use the following variables and nomenclatures:

We use the logarithmic return of asset i on the d-day of month t (Ritd). The volume corresponds to the traded total of asset i on day d of month t (Vitd). As transaction days (Dit), we consider the number of days the share is traded within month t. The number of transaction days in a month i is denoted as (Maxit), as the number of shares traded in the period (NSTI,M,T), (NI,T) is the number of shares available (outstanding). The floating capital consists of the percentage of shares that can be traded in the financial market and that are not stably held by shareholders, in English it is known as the Free-Float, we denote it as (FFi,t).

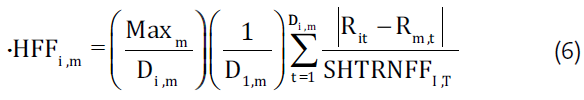

The objective of this study is to determine whether there is a liquidity risk award in the Chilean stock market. We follow the regression model with panel data used by Leirvik et al. (2017) in the Norwegian market. The model contains a dependent variable which is the return of the stock and two independent variables: the monthly return of the market portfolio and the liquidity indicator (equation 7).

Where the dependent variable is Rit, which is the monthly profitability of the month t of the share i; there are two independent variables: Rm,t which corresponds to the market profitability in the month t, and LIQ, of the month t which corresponds to the risk measure used. β1 and β1 correspond to the betas of the variables of the market return, and the liquidity risk rate, respectively. The model error is represented by ɛT. In order to estimate market profitability, we use IPSA, which is the most representative stock rate of the Stock Exchange of Santiago, Chile.

We assessed six models, where the dependent variable (Rit) and the independent variable (Rmt) remain, and the interdependent variable goes iterating regardless of the liquidity risk measure (LIQ) per each one of the risk rates detailed at the beginning of this section (ILLIQ, ILLIQFF, SHTRN,SHTRNFF, H, and HFF). These models are assessed in three periods of time, the total period between 20102019, an initial period between 2010-2014, and a final period between 2015-2019, in order to evaluate whether there are differences between the periods. To avoid problems of heterogeneity, contemporary correlation, heteroscedasticity and autocorrelation, we will use estimators “Feasible Generalised Least Squares or FGLS” or with “Panel Corrected Standard Errors or PCSE”. The authors Beck and Katz (1995) demonstrated that standard PCSE errors are more accurate than FGLS errors. Because of this reason, many jobs in the fields of economics and finance have used PCSE in their estimates for panel data.

Results

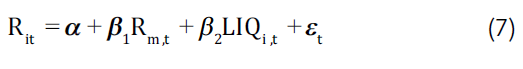

The descriptive statistics are shown on Table 2. A higher standard deviation of the return of the shares is observed compared to the standard deviation of the market return (IPSA).

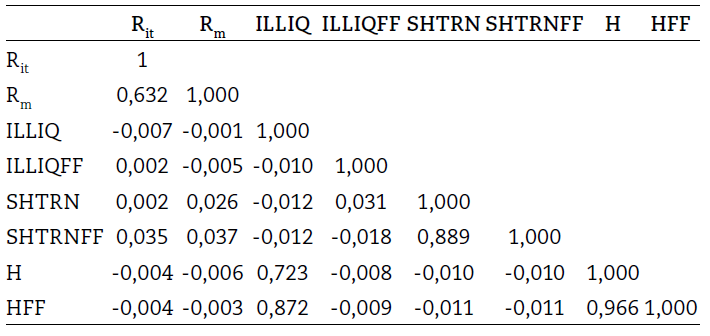

When analysing the correlations (Table 3) a low correlation between the variables is obtained except for the returns of the shares with the market return.

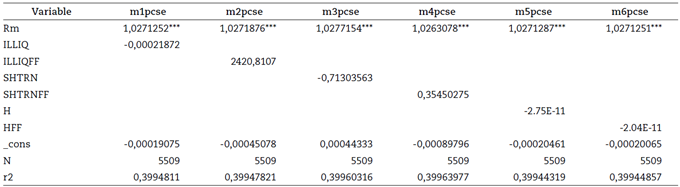

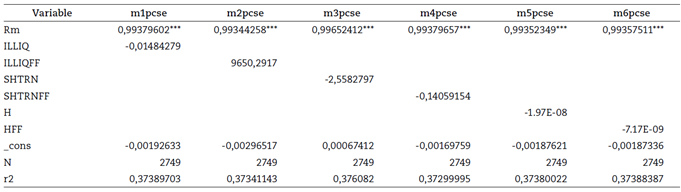

Tables 4 and 5 show the results of the regressions for the periods 2010-2019 and 2010-2014. The variable of market profitability is significant in all models, but in them no significant variables of liquidity risk indices are observed, which is an indication that the Chilean stock market does not present a prize for liquidity risk.

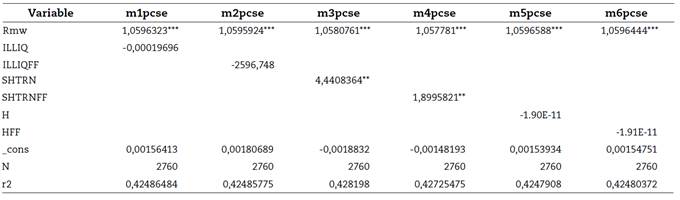

Table 6 shows the results of the regressions for the period of 2015-2019, which highlights the significance of the betas of the variables of the SHTRN and SHTRNFF indices, which indicates that for this period the stock market delivered a prize for liquidity risk, this is in accord with the work done by Vasquez-Tejos, Pape-Larre et al. (2019) that finds evidence of a liquidity risk award on the return of shares in the Chilean stock market.

The results are contrary to those found by F. J. Vasquez Tejos and Lamothe-Fernandez, (2020) for the Chilean market, where the Amihud ratio was negative and significant, this work used another study period and another methodology.

Although in the work of Leirvik et al. (2017) the betas of the liquidity risk variables are significant, it is concluded that there is no economic significance of the liquidity risk in the profitability of the shares in the Norwegian market due to the low R2 (0.0037). This differs from the R2 found for the Chilean market (0.42), however, only the beta associated with the share turnover variable (SHTRN and SHTRNFF) are significant.

Discussion

The Chilean stock market is small and has a small impact, compared to stock markets of developed countries, and even to other Latin American markets such as the Mexican or the Brazilian ones. In these developed markets, particularly the American and European ones, it is usual to find studies of liquidity risk using rates based on information from the book of supply and demand; since it is the price range (BisAsk), such information is hard to find in the Chilean stock market, so it becomes an important limitation. For this reason, this report works with data on negotiations already done regarding closure prices, maximum price, minimum price, and trading volume, among other variables.

We point out the similarity between the average profitability of the different stocks and the average profitability of the market portfolio, which may be a sign of profitability homogeneity of the investments between the different stocks. On the other hand, it is observed that the standard deviation between these variables is different being less for the market portfolio, as a result of the diversification opportunity given by the Chilean stock market.

On the other hand, it is generally observed that the correlations among the different variables are low, and some of them with a negative sign, which indicate an inverse relationship among them. In addition, a low correlation is a better predictor, and more relevant for the model used in this research.

We expected results in line with the Ding et al. (2016) study carried out with data from companies in 55 countries and the research of El-Nader (2018), undertaken in the United Kingdom. These works found that the shares with a bigger free-float level had a bigger level of liquidity. However, we did not find any evidence of such direction in our study.

The results found in this work do not show any strong evidence of a price per liquidity risk, which differs from the ones found by de Carvalho et al. (2022), who found a price per liquidity in the emerging Latin American stock markets (Chile included), during the 2000-2017 period. However, these authors used a different methodology, the three and five factor Fama-French models.

When incorporating the free-float variables into the different liquidity risk measures, significant results were not found; however, there is evidence of impact when incorporating this variable in the work of Le and Gregoriou (2022).

On the other hand, Sterenczak (2022), in the Polish market, did not find any significant difference in the liquidity premium among the shares held by long-term investors (free float) and short-term investors. This is in line with the results obtained by this research.

Conclusions

There is evidence in both developed and emerging economies of a price per liquidity risk, so we suggest continuing with this research in the Chilean stock market, as well as in other stock centres of the region. One of the future challenges is finding appropriate risk measures and methodologies, in order to measure the impact of liquidity risk on the stock profitability.

A shallow and illiquid stock market may be attractive for investors, with a short-term view, searching for opportunities for extraordinary profits, and assuming a high risk. However, government policies should promote investments with a long-term view, in order to provide a greater depth and liquidity to the market. This would bring more financial stability to the institutions and smaller investors, together with benefits that may be transferred to the people. For instance, access to mortgage credits with low-interest rates for the acquisition of houses or other tangible property.

Since investors make choices of purchase or stock sale on a daily basis, an important limitation of this work was the work with profitability and liquidity risk measures analysed on a monthly basis. Therefore, we would not be necessarily in line with the time factor used by the investors when making choices, many of them daily. The time misalignment is because the liquidity risk rates based on transactions made are estimated by monthly periods and not daily ones.

Despite the growth in business numbers experienced by the Santiago de Chile stock exchange, which may affect the impact of liquidity risk in this market, this risk is not captured by all the measures used in this work. However, there is a prize for liquidity risk for the Chilean market, which is captured by the stock turnover index.

Financial risks are difficult to be categorised into a specific model and liquidity risk is no exception. Thus, this can be measured and captured by different indices and models.

As research lines for the future, we suggest on the one hand, incorporating the free-float variable in the three and five factor Fama-French models and, on the other hand, studying the impact caused by the liquidity risk on the profitability of the different investment funds of the Chilean pension system, the Pension Fund Administrators (A.F.P.). Finally, another research line is the comparison of liquidity risk per economic sector on a Latin American level 1 2.