Introduction

This research investigates how the relationship of a small financial institution affects the credit access conditions by the small and medium-size enterprises (SMEs), appraising the association between the client´s credit rating, the level of banking relationship and the credit contract models with regards to the credit offer profile, concerning the cost, average credit maturity and the available credit line.

SMEs usually have greater limitations of financing sources, when compared to large companies. While large companies can access financing through capital markets, international credit lines and the issuance of equity shares, a great number of SMEs are restricted to commercial banks (Beck & Demirguc-Kunt, 2006). The lack of reliable accounting data and the difficulty in obtaining information on the reputation and competence of SME managers are some of the reasons for the difficulties in accessing credit (de la Torre et al., 2010; Petersen & Rajan, 1995; Ryan et al., 2014; Zambaldi et al., 2011).

In this context, small-size regional banks are germane in providing credit access to SMEs, as the size of the bank is inversely correlated with the offer and conditions of credit access for this group of companies (Berger & Udell, 2002; Hasan et al., 2017; Mkhaiber & Werner, 2021; Uchida et al., 2012). Small-size financial institutions exceed in serving SMEs due to their comparative advantages in the use of relationship-based credit. These advantages derive, mainly, from their proximity to clients, the greater use of soft information gathered from the personal relationships and the flow of such information, within a small institution with fewer hierarchical levels (Berger & Udell, 2002).

This research aims to examine the impact of the relationship between a small financial institution on the credit access conditions for SMEs. We study the association between the level of banking relationship, credit risk rating, credit instruments, and the indebtedness profile of SMEs with the financial institution.

The study utilises a theoretical model proposed by Berger and Udell (2006) to analyse a dataset comprising 194 credit transactions from 43 SMEs. The data includes financial information and the level of banking relationship obtained from a client database of a small financial institution located in the southeastern region of Brazil between 2015 and 2019.

In addition, the significance of this research becomes evident as credit risk in financial institutions has been the subject of recent studies with various approaches applied across different countries. Several studies have contributed to the understanding of credit risk in financial settings. Delis et al. (2022) examined the gender-credit-firm outcomes relationship. Ganzela et al. (2023) focused on credit management in cooperative financial institutions. Ibrahim (2023) explored financial risk and profitability in the UAE banking sector. Additionally, Noura Metawa et al. (2023) investigated the impact of digitalisation on credit risk, with financial inclusion as a mediator, using the National Bank of Egypt (NBE) as a case study. These studies underscore the importance of comprehending credit risk in diverse contexts, shedding light on its implications for financial institutions and the broader economy.

The analysis employs the Ordinary Least Squares (OLS) multiple linear regression method and has three objectives. The first is to apply the theoretical model set forth by Berger and Udell (2006) in the Brazilian context, which is characterised by the significance of small businesses in the economy and high banking concentration (Banco Central do Brasil, 2017). The second is to contribute to the literature concerning relationship lending, specifically the information hypothesis and its economic outcomes. The third objective is to comprehend how the relationships that SMEs have with small financial institutions impact their credit conditions.

The method approached in this research stands out from the previous literature, due to the database used. While the previous literature has used data on local banking structure, qualitative perception research and public financial information of financial institutions to assess the impact of small-size financial institutions on the credit conditions of SMEs, this research explored this effect, making use of a credit transaction database contracted by SMEs, in a small-size bank.

Theoretical benchmark

The literature on the factors influencing credit for SMEs focuses on specific aspects, within the context of the credit market, either on the demand or the offer side. The availability of credit for SMEs is determined by a chain of factors which are segregated among the credit technologies (lending technologies), the regulatory framework and the public policies (lending infrastructure) and by the financial market structure (financial institution structure) (Berger & Udell, 2006).

For Berger and Udell (2006), the lending infrastructure includes the information environment for credit analysis, the regulations, bankruptcy laws, and social environment, as well as the tax issues related to credit. The financial institution structure refers to the structural characteristics of these institutions and their effects regarding the feasibility of using credit instruments. The structural characteristics of financial institutions, such as scale, branch network, participation of foreign or state-owned institutions and the banking relationship model, also influence the availability of credit instruments (lending technologies).

Large banks vs. small banks

The availability of funding alternatives in the market can impact credit conditions for SMEs, while large companies have several sources of capital, SMEs are more reliant on commercial banks for capital (Beck & Demirguc-Kunt, 2006). In this context, the small-size regional banks gain relevance in the credit access of SMEs, as previous research has highlighted differences in credit conditions and access based on the size of the financial institution (Berger & Udell, 2002).

Large banks have advantages in providing loans to large companies due to greater financial information disclosure and high transaction volumes. Conversely, small-size banks have comparative advantages in relationship-based lending, which is a lending technology common for smaller and less-established companies. These advantages stem primarily from their proximity to clients, the greater use of soft information gathered from personal relationships and the flow of such information, within a small institution with fewer hierarchical levels (Berger & Udell, 2002).

As approached by Uchida et al. (2012), the ability of proprietary information production, derived from relationships, is not exclusive of small-size banks, since the production of this kind of information does not depend upon the size of the financial institution. Especially in the SME segment, credit managers are responsible for conducting the due diligence process, structuring and monitoring the operation after disbursement, resulting in the production of said property information (Berger & Udell, 2006).

The research of Berger et al. (2017), Hasan et al. (2017) and Mkhaiber and Werner (2021) analysed this relationship and determined that small-size financial institutions have comparative advantages in meeting the credit needs of SMES, since these advantages tend to be greater during times of adverse economic crisis. Moreover, the results demonstrated that the propensity of the banks to lend to SMEs decreases as the size of the bank increases.

Even during the period of the COVID-19 pandemic, the relationship-based business models of small banks proved to be relevant in serving SMEs. James et al. (2021), evidenced that small banks were more agile than larger banks in disbursing emergency loans, part of the Paycheck Protection Program (PPP), to SMEs during the COVID-19 pandemic in the United States. This research also revealed that a greater number of SMEs received PPP loans in regions with a higher concentration of these community banks.

Lending infrastructure

According to Berger and Udell (2006), the concept of lending infrastructure refers to the rules and market conditions under which financial institutions operate. Within this context, the researchers highlight three elements related to infrastructure: the information environment, the social environment, and the regulatory, legal and tax framework. These elements influence competitive conditions of the financial market, such as the market concentration of large financial institutions compared to smaller banks, the participation of foreign and state-owned institutions in the market, and the feasibility of different lending technologies employed by financial institutions to finance SMEs.

The research of Beck et al. (2008) and Mc Namara et al. (2017) considered the structure model of the credit environment (lending infrastructure) in order to assess the impacts of the characteristic of the banking system on the credit restrictions to SMEs, as proposed by Berger and Udell (2006).

Beck et al. (2008) investigated how institutional and financial environments affect the credit usage patterns of large and small companies in 48 countries. Their results indicated that smaller companies use less proportion of debt to capital than larger companies. Nevertheless, when the institutional environment favours the creditors’ protection, these companies are more, disproportionally, benefited than the larger ones. Another relevant result of this research was the determination that the SMEs end up using less resources from development banks or other public sources, when compared to larger companies.

The research of McNamara et al. (2017) was based on the credit structure context (lending infrastructure) to examine the impacts of the credit environment structure on the capital of European SMEs. They discovered that the indebtedness of SMEs is greater, and with longer term, in countries with a more efficient bankruptcy environment regarding loan recovery and with regulatory environments with less restriction to the requirement of bank capital. Therefore, solely the mitigation of problems related to information asymmetry is not enough to ease the access to credit for SMEs, the regulatory and legal environments are also important to favour the flow of the system.

The evolution of digital financial inclusion in the bank system is a factor that can impact the competition between large and small banks in serving SMEs. Lu et al. (2022), found that local banks and digital financial inclusion are relevant in reducing SME financing constraints, indicating that the existence of regional bank branches and digital financial inclusion significantly influenced the reduction of financial restrictions for SMEs. This suggests that, under the advancement of digital financial inclusion, large banks can effectively compete with local banks in serving SMEs.

Relationship lending

Although the effect of competition is frequently considered advantageous in various sectors, the greater credit market competition may not yield straightforward benefits due to the important role information access plays on credit dynamics (Fungácˇová et al., 2017). The seminal study of Petersen and Rajan (1995) identified the effect of competition on the relationship between companies and banks, currently known as information hypothesis. They observed that, in more concentrated credit markets, banks have a greater probability of financing companies with credit restrictions or with information opacity, aiming to build a long-term relationship with the client.

Fungácˇová et al. (2017) provide support for information hypothesis by revealing an inverse relationship between banking competition and spread. That study was based on a 20 European-country sample from 2001 to 2011, and it found an inverse and significant relationship between credit cost and concentration indices, especially in the case of SMEs. The results are in accordance with the theory proposed by Petersen and Rajan (1995), in which the lack of competition encourages banks to invest in gathering client information with some restriction and credit costs that increase with more competition.

At variance with the research that provided support for the information hypothesis, other researchers have found an inverse relationship between banking competition and credit restrictions. They determined that the market power hypothesis predicts that the greater market power of banks leads to higher spreads and reduced credit supply.

To test the effect of banking competition on credit restrictions for companies, Carbó-Valverde et al. (2009) used the Lerner index as a proxy of the market power of banks. The study considered a sample of more than 30 thousand Spanish SMEs, from 1994 to 2002, and it verified that less banking competition was associated with greater credit restrictions for these companies. Afterwards, Ryan et al. (2014) studied the effects of the market power of the banks on the financial restrictions of SMEs. More than 118 thousand SMEs from 20 European countries were analysed from 2005 to 2008. The study substantiated that the greater market power of the banks enhances the financial restrictions of SMEs.

The impact of the banking relationship also presents diverging positions among researchers. Some studies defend the positive effect created by stronger relationships, affirming that they benefit both borrowers and lenders. This view is supported by the seminal study of Boot and Thakor (1994) that simulated a credit market considering factors such as the longevity of banking relationships, differences in the loan costs and the guarantees offered by the borrowers.

This work concluded that a successful credit transaction is sufficient to ensure borrowers a new loan without the need for guarantees, during the remainder of their planning horizon (infinite). Thus, long-term relationships reduce guarantee requirements, reducing costs for borrowers. Empirically, Álvarez-Botas and González (2023) also provided support for the hypothesis that relationship lending favours credit conditions for borrowers, requiring lower spreads and fewer collateral requirements compared to other credit models. Moreover, this effect was more distinct in countries with a regulatory environment that favours creditor protection. Nevertheless, other researchers advocate for the negative effects of strong banking relationships, contending that they primarily benefit the creditor at the expense of the client (Bonini et al., 2016).

Soft information vs. hard information

From the viewpoint of credit risk, SMEs are very different from large corporations. BCB data point to higher default rates for SMEs than for larger companies (Banco Central do Brasil, 2017). Hence, several studies approached the credit risk analysis of SMEs and how creditors seek its mitigation.

The lack of reliable accounting data and the difficulty in obtaining information on the reputation and competence of SME managers are among the reasons for the difficulty in accessing credit. Building a banking relationship can help overcome these difficulties; however, this approach is not easily scalable for banks due to its reliance on specialised personnel for credit analysis and subjective approval processes. Thus, banks aiming for scale utilise automatised processes of analysis and credit approval via credit scoring, and contracts backed by real guarantees and securitisation of receivables (Zambaldi et al., 2011).

The issue of information opacity regarding SMEs was also highlighted by Hyytinen and Pajarinen (2008) as an important factor for credit limitation, due to problems related to information asymmetry. They analysed data from nearly 4000 Finnish SMEs from 1999 to 2002, from two credit bureaus. The study intended to identify factors contributing to SME information opacity by examining the differences in credit ratings assigned to the same SME by these bureaus. The results showed that the age of the SME, not the size of the company, is the main factor for explaining the credit rating differences, as foreseen. The researchers suggest that the newest SMEs tend to suffer more credit restriction because of their shorter credit and operating history.

Altman and Sabato (2007) developed a credit risk model specifically for SMEs, comparing its effectiveness to other common models for corporate credit risk analysis. The selected financial indicators aimed to describe key aspects of a SME’s financial profile, including liquidity, profitability, indebtedness, credit coverage, and operating indices. The researchers determined that this model has 30% higher predictability than a common model for corporate credit risk. Later, Gama and Geraldes (2012) elaborated a credit scoring model analysing the quantitative and qualitative factors of a sample of 1260 Portuguese SMEs in the beverage and food sector, from 1988 to 2006. The model revealed that the probability of default was inversely related to liquidity, profit ability, interest coverage, and asset turnover indices, while it was directly related to leverage indicators.

The use of soft information in credit risk models for SMEs has demonstrated to be effective. Modina et al. (2023) presented empirical evidence highlighting the advantages of incorporating relationship lending variables into default prediction models for SMEs. By incorporating information related to the checking account activity of SMEs and the historical performance of their credit operations, the predictability of credit risk models is significantly enhanced. The study conducted by Del Gaudio et al. (2022) observed that the SMEs which engaged in trade credit transactions experience fewer credit constraints from banks. This suggests that trade credit serves as a positive signaling mechanism for banks, reducing information asymmetry and contributing to a more favourable credit assessment for these SMEs.

Hypothesis

Based on literature evidences and in order to reach the objectives of this research, the hypotheses to be tested will address how the relationship of a small-size financial institution affects the conditions of credit access for SMEs, correlating the association of the client´s financial risk assessment, the level of banking relationship and the models of contracts with the profile of credit offer, regarding the cost, average term and the limit of credit available.

Granting credit to SMEs differs from that of large corporations due to information opacity and the limited availability of audited financial statements. The relationship loan can be adopted to overcome these difficulties since the bank can gather proprietary soft information through long-term contact with the executives and partners of the company and use it to support the credit offering (Duqi et al., 2018).

When considering that a greater level of relationship with the financial institution brings benefits to the client, it is expected that the length and intensity of this relationship result in lower financial cost for the SMEs, suggesting that the banks and companies share the cost savings which result from the reduction of the information asymmetries (Bonini et al., 2016). Thus, the 1st. hypothesis is established:

H1: There is a negative association between the SMEs which have a greater relationship level with the small-size financial institution and the cost of credit and, also a positive association with credit availability.

As approached by Altman and Sabato (2007), SMEs have distinct characteristics, so the analysis of their credit risk cannot be carried out by generic models. Therefore, the choice of some specific financial indices, related to liquidity, profitability, indebtedness, credit coverage and operating indices, is more efficient for describing the main aspects of a SME financial profile. Nevertheless, this kind of hard information ends up being less used by small-size banks in credit structuring for SMEs.

The large-size financial institutions have comparative advantages in the use of “lending technology” based on this raw information (i.e., analysis of audited financial statements, credit ratings issued by risk agencies). On the other hand, the small-size banks have comparative advantages in the use of credit based on relationships (Berger et al., 2017; Berger & Udell, 2006; de la Torre et al., 2010; Uchida et al., 2012). Thus, it is expected that the use of hard information, based on financial indicators, by a small-size financial institution is not relevant to determine the credit conditions for SMEs. That said, the 2nd hypothesis is postulated:

H2: The small-size financial institution does not offer differentiated credit conditions to the SMEs which have a better credit risk indicator (rating).

Despite the legal environment establishing the extension to which the contracts are carried out in cases of default and the determination of the reliability of lenders (Berger & Udell, 2006), it is expected that the guarantees provided do not influence the credit conditions offered to SMEs by small banks. Due to the competitive advantage in the use of the credit modality based on relationship of these institutions, it is expected that the number and quality of the guarantees offered are not relevant for determining the term conditions contracted for this group of companies. Hence, the 3rd. hypothesis:

H3: For the small-size financial institution, the quality and number of guarantees offered do not provide differentiation in the credit conditions for SMEs.

Methodology

The initial database used for this study consisted of 631 non-standardised credit transactions contracted by SMEs, granted from 2015 to 2019. Non-standardised transactions are those which do not have contracts with predetermined commercial conditions of maturity, cost or constitution of guarantees, that is, the contracting of the credit transaction underwent a negotiation process between the parties. The transactions of the same modality granted to the same client within a month were excluded from the sample since the same transaction can be fractionated into several similar contracts and, therefore, the final database for the study consisted of 194 credit contracts granted to 43 SMEs.

To measure the lender´s risk profile and the aspects of the credit offer, the database also encompasses the financial information stated in the yearly financial statements of the SMEs, their cadastral information regarding the risk rating determined by the bank and the different aspects of the commercial relationship with the financial institution.

The bank chosen is located in the southeastern region of Brazil and rated as small financial institution, under the S4 segment, according to Resolution # 4,553 dated January 30, 2017 of the Banco Central do Brasil (Central Bank of Brazil). This segment represents financial institutions whose total assets amount to less than 0.1% of Brazil’s Gross Domestic Product (GDP). During the analysed period, the total assets of this institution varied between R$700 million and R$1 billion. The bank’s location and its business model can have a significant influence on its clients’ profile. The client sample is concentrated in the agribusiness sector (farmers, cooperatives, and agriculture input and equipment manufacturers) and the construction industry (real estate developers and urban developers).

The variables employed in this study include financial reports, the relationship with the financial institution and the credit transactions, during the period from 2015 to 2019. They seek to explain the financial aspects, the level of relationship with the bank and the credit risk mitigators utilised. These factors are relevant in explaining the profile to credit access by SMEs, regarding cost, conditions and the need of guarantee offers.

The Rating variable was calculated on a scale from 1 to 5, in which 1 refers to lower credit risk. It is a proxy variable for the credit risk index, and it is part of the group of variables of financial indicators. Its methodology uses financial and qualitative indicators considered important in foreseeing the bankruptcy of companies (Altman & Sabato, 2007; Berger et al., 2017; Berger & Udell, 2006; Bonini et al., 2016; de la Torre et al., 2010; Lehmann & Neuberger, 2001; Uchida et al., 2012).

The Length of Relationship, Approved Credit Limit/Gross Indebtedness and Number of Services Contracted variables compose the group of variables related to relationship information. The Length of Relationship variable, classified in this paper as t_relacionamento, is a component which measures the intensity of the relationship with the financial institution (Berger et al., 2017+; Berger & Udell, 2006; Bonini et al., 2016; de la Torre et al., 2010; Lehmann & Neuberger, 2001; Uchida et al., 2012; Voordeckers & Steijvers, 2006).

The Approved Credit Limit variable, represented as lim_ aprov, is the value in thousands of reais (R$) of the credit limit approved for the client and it measures the credit line offered to the client (Berger & Udell, 2006). The Approved Credit Limit/Gross Indebtedness Variable, represented by lim_aprovado/div_bruta, was calculated by the participation percentage of the credit limit available in relation to the total indebtedness of the client. It demonstrates the concentration of the credit limit to the client (Bonini et al., 2016; Carbó-Valverde et al., 2009; Fungácˇová et al., 2017; Petersen & Rajan, 1995; Ryan et al., 2014). The Number of Services Contracted Variable, represented by q_serv, can favour the reduction of information asymmetry besides being able to create new credit structures secured by the receivables (Bonini et al., 2016; Klapper, 2006).

On the other hand, variables referring to the characteristics of the credit instrument were gathered. Among them, are listed: Transaction Average Term, Total Cost, Pre-fixed Rate, BNDES Onlending Operations, FUNCAFE Onlending Operations, Number of Guarantees Offered and Guarantees with Fiduciary Lien.

The Transaction Average Term Variable was calculated with the average maturity of the credit transactions, and it is a variable which assesses the credit conditions offered to the client (Berger & Udell, 2006; Bonini et al., 2016). The Total Cost variable was calculated by the total yearly interest rate of the credit transaction, and it also aims to assess the credit conditions offered to the client (Berger & Udell, 2006; Hernández-Cánovas & Martínez-Solano, 2010). The Pre-fixed Rate Variable, represented by pre_fix, was built as a dummy variable which takes on 1 if the transaction is pre-fixed, and 0, if otherwise.

The BNDES Onlending Operations Variable, represented as bndes, and the FUNCAFE Onlending Operations, represented in this paper as funcafe, were also built as dummy variables, taking on 1 if the contract is onlending of the institutions, and 0, if otherwise. These kinds of transactions are state subsidised instruments and can have credit benefits that are different from other contracts (Berger & Udell, 2006). The Number of Guarantees Offered was represented in the study as q_garantia and was calculated by the sum of the number of guarantees. Despite the guarantees for reducing the impacts of failure to pay, it is not expected that the small-size banks offer distinct credit conditions (Berger & Udell, 2006; Bonini et al., 2016; Voordeckers & Steijvers, 2006).

Finally, the Guarantees with Fiduciary Lien variable, represented in this paper as af, was built as a dummy variable. The literature does not expect that small-size banks make any differentiation based on these types of guarantees (Banco Central do Brasil, 2019; Berger & Udell, 2006).

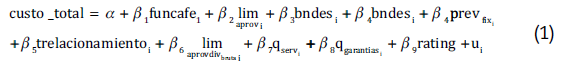

To assess how the relationship of a small-size financial institution affects SME credit conditions, the ordinary least square multiple regression method was chosen. In order to test hypotheses H1 and H2, two regression models were created, and are detailed below in equations (1) and (2):

H1

In order to test the association between SMEs with a stronger relationship with the small financial institution and the cost of credit, the statistical significance of coefficients β5, β6, and β7 in Model 1 will be tested. The first hypothesis suggests that a more intensive relationship with the financial institution will lead to a reduction in financial costs for the client, as the resulting economies from reduced information asymmetries are shared between the parties (Bonini et al., 2016). Therefore, these parameters are expected to be statistically significant and exhibit negative assignation, indicating that a longer relationship duration, higher credit concentration, and more contracted services with the institution are associated with lower credit costs for the borrower.

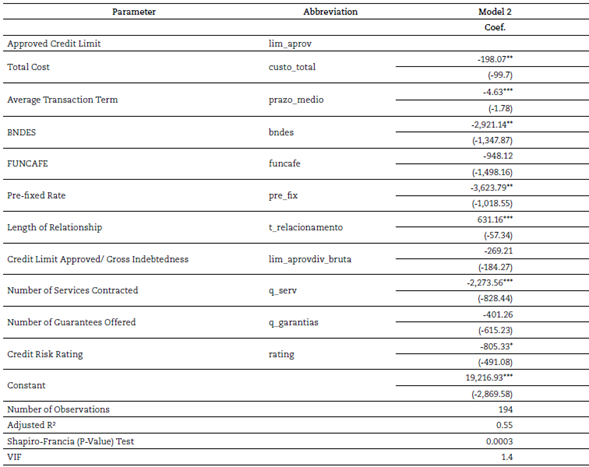

In order to test the association between the level of relationship with the availability of credit, the statistical significance of the coefficients β6, β7, and β8 will be tested in Model 2. As established in the 1st. Hypothesis, the “relationship loan” modality is commonly adopted by the small-size bank to overcome problems related to information asymmetry, gathering proprietary information through the contact with the executives and partners of the company throughout time and using it to justify the credit to the company (Berger & Udell, 2002; Duqi et al., 2018). Thus, it is expected that these parameters be statistically significant and present positive assignation. It is also expected that the longer the relationship length, the greater the credit concentration, and the greater the number of services contracted with the institution are associated with a greater credit limit made available by the small-size financial institution.

H2

In order to test whether the small-size financial institution offers differentiated credit conditions to the SMEs which have a better credit risk rating, the statistical significance of the coefficients β9 in Model 1 and β10 in Model 2 will be reviewed. As stated in the 2nd. Hypothesis, small-size financial institutions have comparative advantages in the use of credit based on relationship (Berger et al., 2017; Berger & Udell, 2006; de la Torre et al., 2010; Uchida et al., 2012). Therefore, the use of hard information, based on financial indicators by a small-size financial institution, is expected not to be relevant in determining the credit conditions for SMEs.

Thus, these parameters are expected not to be statistically different from zero, that is, that the assessment of credit risk is not associated with the credit cost and the volume of credit limit made available by the small-size financial institution.

H3

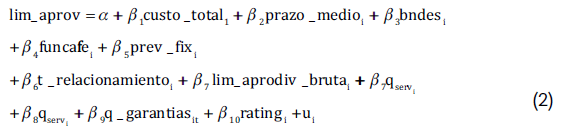

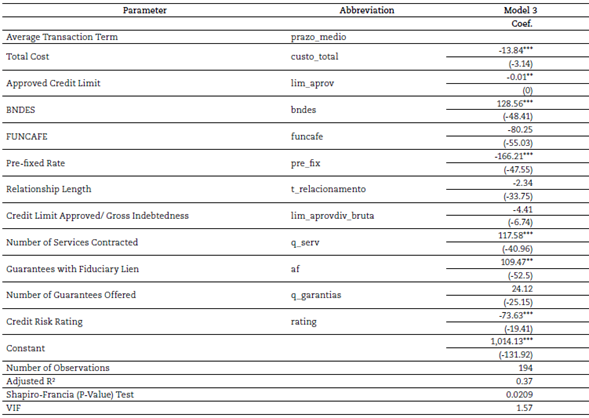

In order to test the H3 hypothesis, the regression model was created, as shown below in equation (3):

Model 3:

In order to test whether the quality and number of guarantees provided affect the credit conditions offered to SMEs by small-size financial institutions, the statistical significance of the coefficients β9 and β10 in Model 3 will be revised. In accordance with the 3rd. hypothesis, it is expected that the number of guarantees provided not be relevant in the determination of the credit conditions contracted for SMEs, due to the competitive advantage of the use of the credit modality based on the relationship with the small-size banks (Berger et al., 2017; Berger & Udell, 2006; de la Torre et al., 2010; Uchida et al., 2012). Therefore, the existence of the association between the number and the presence of guarantees under the fiduciary lien modality with the average maturity of the credit transactions will be verified. Thus, these parameters are not expected to be statistically different from zero in Model 3.

Result analysis

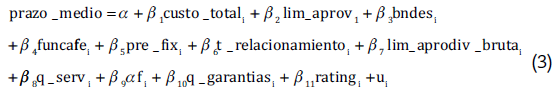

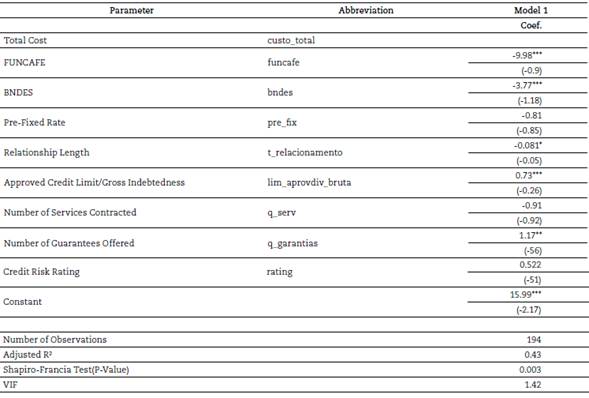

The results of the estimated parameter of the models proposed are shown below in the STATA® software, with the use of heteroscedasticity and autocorrelation tests. The Tables (1, 2 and 3) below show the results of the estimated parameters of Model 1, Model 2 and Model 3, the determinants of Credit Total Cost, Approved Credit Limit and Average Term of Credit Transaction respectively.

Table 1 Results of the parameter estimates: model 1

(1)* Significance level of 10%, ** Significance level of 5%, ***Significance level of 1%

(2)Values in parentheses represent the standard deviation of estimated coefficients.

Source: own elaboration.

Table 2 Result of parameters estimates: model 2

(1)* Significance Level of 10%, ** Significance Level of 5%, *** Significance Level of 1%

(2)Values in parenthesis represent the standard deviation of the coefficients estimated.

Source: own elaboration.

Table 3 Result of parameters estimates: model 3

(1)* Significance Level of 10%, ** Significance Level of 5%, *** Significance Level of 1%

(2)Values in parenthesis represent the standard deviation of the coefficients estimated.

Source: own elaboration.

The adjusted R-squared values in this study are determined to be less than 60%, highlighting certain limitations associated with the utilised database. Consequently, it suggests the need for future research endeavours in this domain, incorporating new determinative variables into the models. Nonetheless, it is imperative to emphasise that despite the relatively lower adjusted R-squared values, a statistically significant relationship persists between the variables in the models. This crucial finding reinforces the significance and implications of the obtained results.

H1 Results

With regard to the first hypothesis, the results demonstrated that the relationship length with the financial institution and the number of banking services contracted did not present negative relationship with credit cost. On the other hand, the credit concentration in the financial institution presented direct association with credit cost. Such result reinforces the “negative side” of the relationship between the bank and the SME, corroborating findings from other studies that suggest that the higher relationship level benefits the lender primarily, rather than the client (Bonini et al., 2016; Hernández-Cánovas & Martínez-Solano, 2010). This result also reinforces the hypothesis that the greater concentration of exposure in just one client leads to greater spread to remunerate the risk taken by the bank.

Regarding the volume of credit line available, the relationship length with the financial institution was relevant and it reinforces the thesis that the proprietary information gathered from the client throughout time is important for the bank to stipulate the credit line available for the client (Duqi et al., 2018). This result supports the studies which defend the importance of the credit model based on relationship for this kind of financial institution.

H2 Results

Regarding the second hypothesis, the association between the SMEs which have the best credit risk rating indicators with the credit cost and the volume of credit line available was not statistically significant. Moreover, a positive association with the transaction average term was observed. This result suggests that the small-size bank does not use hard data information (e.g.: analysis of financial statements, credit score) to determine the credit cost and volume. Nevertheless, such information is relevant for the bank to estimate the future capacity of the client´s payment, as well as to estipulate the maturity of the transaction.

H3 Results

The third hypothesis tested sought to analyse the associations between the average term of credit transactions and the value of the credit contract security. The results indicated that the variables related to the guarantees and the presence of guarantees under the fiduciary lien regime were not statistically significant to explain the transaction average term. Nevertheless, the results indicated a negative association between the credit risk rating and the average transaction term. This result suggests that the guarantees and their legal protection are not enough to justify the concession of long-term transactions. However, the bank makes use of its credit risk rating evaluation to estimate the future capacity of payment of the SME, offering better maturity conditions for those clients with less default risk perception.

Conclusions

This research adopts the theoretical framework proposed by Berger and Udell (2006) to investigate the impact of the relationship with a small-size financial institution on the credit access conditions for SMEs. The study examined the association between the degree of banking relationship, the credit risk rating, and the credit instruments with the characteristic of the contracted credit, regarding the total cost, average maturity, and the credit limit available.

The results of this study allowed to assess how SME relationships with a small-size financial institution affects the credit contracting conditions. Three groups of variables were chosen: Relationship Information, Credit Contracting Modality, and Credit Risk Indicators, and they were used to explain the total credit cost, the transaction average maturity and the volume of credit limit offered to SMEs. The results obtained for the Relationship variables stand out, supporting both the information hypothesis (Petersen & Rajan, 1995) and the Market Power hypothesis.

The main highlight of this study compared to previous research lies in its methodology. While prior studies relied on local banking structure data, qualitative perception research, and public information of financial institutions to measure the impact of small-size financial institutions on credit conditions for SMEs, this research used a different approach. We utilised a database of credit transactions contracted by SMEs in a small-size bank to examine this effect. By doing so, the study intended to comprehend the association between the banking relationship and factors such as cost, term, and volume of credit available, considering the characteristics of the borrower and the aspects of the contracting model, besides the commercial relationship with the bank.

The database used and the period analysed involve some limitations for this research which have potential to affect its results. The period analysed was characterised by years of weak economic performance and the fall of the basic interest rate in Brazil, which can affect the financial health and the credit demand of companies, aside from the perception of credit risk of the financial institution. For future research, enlarging the sample base, including the credit contracts and relationship data of the different financial institutions with distinct commercial strategies and different sizes, is suggested.

Additionally, as a potential avenue for future research, it is suggested to assess the impact of the COVID-19 pandemic on the credit policies of financial institutions. The study conducted by Salehi (2022) examined the performance of the banking sector in Canada during the COVID-19 pandemic. Expanding this analysis to encompass other geographical regions or specific financial sectors could yield valuable insights into the broader implications of the pandemic on credit policies adopted by financial institutions and their subsequent effects on credit access conditions for businesses and individuals. Such research would offer a comprehensive and comparative understanding of the COVID-19 pandemic’s impacts on the financial sector and its implications for economic stability in various contexts1 2.