Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Revista Finanzas y Política Económica

Print version ISSN 2248-6046

Finanz. polit. econ. vol.7 no.2 Bogotá July/Dec. 2015

https://doi.org/10.14718/revfinanzpolitecon.2015.7.2.6

ARTÍCULO DE INVESTIGACIÓN

DOI: http://dx.doi.org/10.14718/revfinanzpolitecon.2015.7.2.8

WHY DOES COLOMBIA LACK AGRICULTURAL COMMODITY FUTURES?*

¿POR QUÉ COLOMBIA NO TIENE CONTRATOS DE FUTUROS PARA BIENES AGRÍCOLAS?

POR QUE A COLÔMBIA NÃO TEM CONTRATOS FUTUROS PARA BENS AGRÍCOLAS?

PABLO MORENO-ALEMAYa, CATHERINE PEREIRA-VILLAb

Universidad de la Sabana, Chía, Colombia.

a M.Sc. in International Management, BA in Finance and International Relations, Head of the area of Finance at Universidad de La Sabana, Chia, Colombia. Address: Kilómetro 7 Autopista Norte, Campus Universitario Puente del Común. Edificio E2, Oficina 216. Chía, Colombia. Email: pablo.moreno@unisabana.edu.co

b M. Phil. in International Finance, MSc. in Economics, M. A. in Economics and international Relations. Assistant Professor at Escuela Internacional de Ciencias Económicas y Administrativas, Universidad de La Sabana, Chía, Colombia. Address: Kilómetro 7 Autopista Norte, Campus Universitario Puente del Común. Edificio E2, Oficina 204. Chía, Colombia. Email: catherine.pereira@unisabana.edu.co

* This article is a product of the research project "Hedging Price Risk In The Colombian Agricultural Sector", financed through a research fellowship awarded to Pablo Moreno by UNCTAD's Virtual Institute in Geneva, Switzerland and by Universidad de La Sabana, Colombia.

Recibido: 21 de octubre de 2014. Concepto de evaluación: 28 de mayo de 2015. Aprobado: 04 de junio de 2015

ABSTRACT

This article explores the reasons why futures contracts are not traded as an alternative to price hedging for agricultural goods in Colombia. Based on surveys, interviews and statistical analysis, this study identified that conceptual gaps in contract negotiation, lack of consensus in the agricultural sector regarding the use of financial mechanisms and the sector's infrequent contact with Colombia's financial institutions, are the main reasons why a futures contracts market has not emerged.

Keywords: Agricultural commodities, futures market, derivatives, risk hedging.

JEL: Q02, Q14, G13, G32

RESUMEN

Este artículo explora los motivos por los que no se negocian contratos de futuros en Colombia como alternativa de cobertura de riesgo de precio para bienes agrícolas. A partir del análisis estadístico de entrevistas y encuestas a operadores del mercado de derivados, se logró identificar que los vacíos conceptuales en la negociación de estos contratos, la desunión de las instituciones y actores del sector, y el relativo aislamiento del sector agrícola de la estructura financiera del país, constituyen los principales motivos por los cuales este mercado no se ha hecho realidad en Colombia.

Palabras clave: Materias primas agrícolas, mercado de futuros, derivados, cobertura de riesgo.

RESUMO

Este artigo explora os motivos pelos quais não são negociados contratos futuros na Colômbia como alternativas para cobertura de risco de preço para bens agrícolas. A partir da análise estatística de entrevistas e pesquisas de opinião a operadores do mercado derivativo, pôde-se identificar que os vazios conceituais na negociação desses contratos, na desunião das instituições e atores do setor, e o relativo isolamento do setor agrícola da estrutura financeira do país constituem os principais motivos pelos quais esse mercado não é uma realidade na Colômbia.

Palavras-chave: matérias-primas agrícolas, contrato de mercado futuro, derivativos, cobertura de risco.

INTRODUCTION

The volatility of commodity prices and in particular of food products has been significant between 2003 and 2012 compared to the previous decade. Based on statistics by the commodity division of the United Nations Conference on Trade and Development (UNCTAD), we have estimated that price volatility in that period was 268 %. Recent studies on the determinants of volatility of commodity prices have identified that markets face a greater degree of uncertainty (Power & Robinson, 2013). In part, this helps explain the fact that between 2003 and 2012, trade in derivatives grew by 161% and trade in commodity based derivatives grew every single year (Futures Industry, 2012), despite the financial crisis of 2008.

Although increased volatility has encouraged the negotiation of standardized derivative products on agricultural commodities in both developed and emerging country markets, futures contracts have not taken hold in Colombia. This is paradoxical since Colombia is a commodity producer and derivatives could contribute to the processes of price discovery and risk management in the agricultural sector.

One of the reasons why it is important to study derivative markets is that empirical evidence suggests that financial markets in a given country may be associated with long-term economic growth. Among others who analyse the links between financial development and economic growth, King & Levine (1993) and Beck, Demirgüç-Kunt & Levine (2009), have found a positive correlation between the two, as was originally suggested by Schumpeter in 1911. These findings have also been confirmed by Şendeniz-Yüncü, Akdeniz and Aydoğan (2007), who used time-series analysis to test whether futures markets have a significant impact on economic growth.

Furthermore, and in relation to agricultural products specifically, UNCTAD's Secretariat on Emerging Commodity Exchanges (2009), assessed the positive impacts on development generated by commodity futures exchanges in Brazil, China, India, Malaysia and South Africa. The study's findings included the fact that price discovery, price-risk management, and access to financing in the agricultural sector, play an important role in financial development.

More recently and with regards to Latin American and Caribbean commodity markets, Arias, Lamas and Kpaka (2011) analysed agricultural commodity exchanges and suggested that Latin-American markets should imitate the strategies of Brazil, Argentina and Mexico with regards to: the creation of incentives for private sector and farmers' participation in the exchanges, information sharing, and promoting education in terms of the exchanges' contribution to risk management.

In Colombia, the stock exchange or Bolsa de Valores de Colombia (BVC) has been offering futures on financial assets since 2008, and futures on energy since 20101. In addition, the Colombian Mercantile Exchange (Bolsa Mercantil de Colombia - BMC), known until 2010 as Bolsa Nacional Agropecuaria (BNA), promotes derivatives on agricultural commodities.

The term mercantile has been used by several of the main commodities futures exchanges around the world such as the Chicago Mercantile Exchange (CME), the New York Mercantile Exchange (NYMEX) and the Brazilian Mercantile and Futures Exchange, to name a few. This is one of the reasons why in Colombia, former heads of the BNA, expected that a new name for the agricultural exchange would promote the supply of a more complete portfolio of financial instruments, which might include derivatives on agricultural commodities such as futures contracts.

In fact, former CEOs at BNA such as Mr. Estefan (1995) and Mr. Arias (1998) were quoted as saying that "The formation of prices... the standardization of contracts... mechanisms that allow users to hedge2 price risk, would be, undoubtedly, the most valuable contribution to overcome many of the difficulties suffered by the sector", and "The exchange works on a futures desk which will meet the hedging needs of producers, processors and traders for commodities whose the prices are fundamentally set on the world's principal futures exchanges". Nevertheless, even if some hedging products are offered to date in Colombia, they are far from being considered "futures" because they are basically forward contracts that only establish a determined quantity of the underlying asset to be delivered at a future date, without including a price agreement3.

The statement made by the current CEO of the BMC, Mr. Arroyave (2011), can be seen as evidence of the contract's limitation. Mr. Arroyave claimed that an essential role of a commodity exchange is to offer standardized products that allow users to hedge price risk, otherwise there is no sense in having a commodity exchange at all.

The fact remains that opportunities for hedging in the current commodity price context have not encouraged futures on agricultural commodities in some developing countries with high levels of GDP growth. This is the case of Colombia, where GDP growth has averaged 4.5% in the last decade, 37% of the total area is devoted to agricultural production, 76% of exports are commodities, and 21% of these are agricultural raw materials and food (UNCTAD, 2012).

This article explores the reasons why a commodities futures exchange has not emerged in Colombia. The first section describes the methodology used in the research; the second, summarizes the international context of derivatives on agricultural products; the third section presents the results of the research and finally, some conclusions are drawn.

METHODOLOGY

In order to determine the main reasons why a commodities futures exchange has not emerged in Colombia, this study took into account the criteria used in a large number of studies that analyse futures exchanges. In particular, we used studies by Shim (2006), UNCTAD's commodity division (2007, 2009), reports from the Futures Industry Agency (2010, 2012) and several working papers by World Bank researchers (2011). These studies were considered relevant to the research question as they originate from different sources -academia, multilateral organizations and the financial world- and therefore contemplate a variety of answers.

Furthermore, studies such as Dana & Gilbert's (2008) advocate that liquidity is essential to manage price risk and that the use of commodity futures can be useful to supply chain actors in emerging countries. In addition, Gilbert (2001) also illustrates how regulatory aspects and inadequate access to financial markets expose farmers in developing countries to greater risks associated with price volatility.

As a result, this paper identified six recurring aspects that might constitute the bottleneck to the design of trade futures contracts at BMC, namely, education, legislation, liquidity, government participation, technology and risk involved in future contracts.

According to the BVC, there are 30 institutions that trade in the derivatives market in Colombia. This study surveyed a representative sample of thirty-eight CEOs and executives of these institutions including banks, brokerage firms, agricultural commodity firms, public entities, financial consultants and the BMC. The survey was carried out in 2011 and in order to promote the reliability of the results, all participants surveyed were real players in the market.

The survey conducted was complemented with personal interviews. The questionnaire included the six factors described above, and the participating experts operate in commodities and futures markets and have practical experience or are involved in national hedging projects. In this sense, the study uses descriptive statistics in order to analyse the results.

Respondents were asked to rate with percentages the reasons that may explain why the domestic negotiation of futures contracts on agricultural commodities has not occurred in Colombia. Furthermore, they were asked to indicate which agricultural product(s) could be used as underlying asset(s) in a hypothetical negotiation of a futures contract offered at BMC. Respondents were also asked to rate on a percentage basis, the influence of each factor on the lack of development of a futures market: 0% (not important at all), 20% (low importance), 40% (partially important), 60% (important), 80% (quite important) and 100% (extremely important).

Supplementary insights into the research question of this paper were collected during the First Conference on Derivatives Market for Agricultural Goods in Colombia held in 2011. CEO's and CFO's of major influence on the Colombian commodity market were speakers at this event. Each expert answered open questions regarding the six criteria explored in the survey, and this qualitative data was contrasted with the quantitative results.

Based on the six factors, we carried out a survey in which respondents were asked to explain how relevant they considered each criteria to be, as well as illustrate which commodities could be used at present in standardized futures contracts in Colombia.

This study took on the research question based on the six criteria mentioned above as follows:

Education: To monitor a sophisticated market such as the derivatives market, the potential users and market makers must understand how it operates and the advantages and disadvantages associated with its use. Although some Colombian companies and investors have already traded futures on agricultural goods abroad, the first futures contract ever offered in the domestic financial market was launched in 2008 and was based on the national treasury bond (TES).

Legislation: A derivatives market, just as any other financial market, demands a specific regulation. Although the financial crisis of 2008 in the United States has sparked debate on the effectiveness of legislation for these instruments and how much financial liberalization there should be, the fact is that trade in futures contracts requires a regulatory framework.

Liquidity: As several case studies have concluded (UNCTAD, 2009), the liquidity4 of a contract is a key element for the success of a futures exchange because it guarantees a large number of both buyers and sellers who want to negotiate these instruments. In the case of China, for example, liquidity promoted extraordinary rates of growth since the market started in the nineties (UNCTAD, 2009).

Government Intervention: A perfect hedge is when both physical and futures markets move in the same direction. Therefore, it is worthwhile to consider how far government intervention in pricing some agricultural goods -through subsidies, tax incentives or supply control- affects the market.

Technology: Highly sophisticated software is needed to run a futures market: opening and closing out positions on a daily basis requires technology to trace and guarantee operations, and to control the margins and other requirements supervised by the clearing house.

Risk: Famous bankruptcies, such as that of Barings Bank, have occurred as a result of big losses from trading derivative instruments. In fact, derivative operations were criticized worldwide during the financial crisis that hit the global economy in 2008, among other reasons, because of the role played by speculators, who gambled on future prices for commodities, taking advantage of the rally that peaked that year. Specifically and both for spot and futures quotes for commodities, the 2009 UNCTAD Trade and Development Report shows how commodities had been treated as an "asset class". As a result, prices went up due to the influence of large investor positions, instead of fundamental supply and demand relationships. In fact, Gilbert (2010), found that index-based investment in agricultural futures markets was more important than supply to generate the 2007-2008 rise in food prices.

INTERNATIONAL CONTEXT OF DERIVATIVES ON AGRICULTURAL PRODUCTS

The Chicago Board of Trade (CBOT5) was founded in 1848 and has been considered one of the main commodity futures exchanges in the world, although, in recent years, countries such as Korea, China and India have improved their commodity trade statistics. Table 1 shows the ascent of countries such as China in terms of the number of contracts traded on agricultural goods. The first commodity futures exchange in China appeared as late as 1993, with the creation of the Zhengzhou Commodity Exchange (ZCE). The rise of China in the agricultural derivatives market outshines any previous similar experience and can easily be associated with China's rapid and sustained GDP growth over the last decade.

In fact, China implemented a number of structural agricultural reforms during the nineties (De Brauw, Huang and Rozelle, 2004) that included price liberalization and contributed to the growth of trade in commodities and derivatives based on them (UNCTAD, 2009). Table 1 illustrates the world's largest types of futures contracts on agricultural commodities.

Besides China, countries such as Brazil, India, Russia and South Africa have also experienced important growth in the trade of derivatives. According to the Futures Industry agency for 2012, the exchanges in these countries are ranked among the top 30 in the world by number of contracts.

Regarding the Latin American region, we find Brazil's BM&FBovespa which offers a wide portfolio of futures -not only on commodities but also on financial assets- and traded more than 1,600 million contracts in 2012. In addition, the Rosario Futures Exchange (ROFEX) in Argentina also offers the possibility of hedging agricultural price risk through futures. Mexico has also led some successful hedging projects, albeit using the contracts offered at the CME Group. No other countries in Latin America have consolidated a futures domestic market for agricultural commodities, although it should be noted that Chile has been successful at developing a market for derivatives on financial instruments.

RESULTS

Commodity futures exchanges have been created in both developed and developing countries. Hence, the goal of this study was to establish what has prevented commodity futures from being negotiated in Colombia. The survey evaluated six different reasons why commodity futures are not traded, and collected opinions on which commodities could be used in standardized futures contracts. Based on the strength of the perception of respondents regarding each factor's impact on the lack of negotiation of commodity derivatives, the results of the survey are described below.

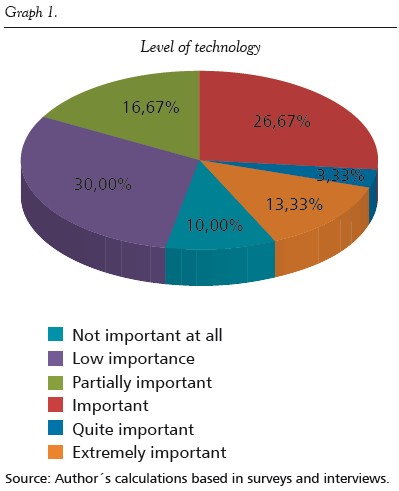

Technology

Graph 1 illustrates that only 16.7% of respondents considered that the current level of technology in BMC is either quite important or extremely important in explaining why futures on agricultural commodities are not traded on the Colombian domestic market.

Most of the respondents recognized the efforts to improve the technology used to trade financial instruments in Colombia. Nonetheless, it is worth noting that not all those surveyed were particularly aware of what kind of software the BMC uses. Furthermore, some participants expressed different opinions with regards to the moment in which investing in technology is appropriate. For example, a CEO of a brokerage firm pointed out, during his interview, that "First, there must be a market; as it grows or develops, there should be investment in technology. In Colombia, investing in technology was the first step". Similarly, a partner and senior advisor of a consultancy firm on risk management concluded during the survey that, in the case of Colombia's mercantile exchange, "Technological barriers are being overcome".

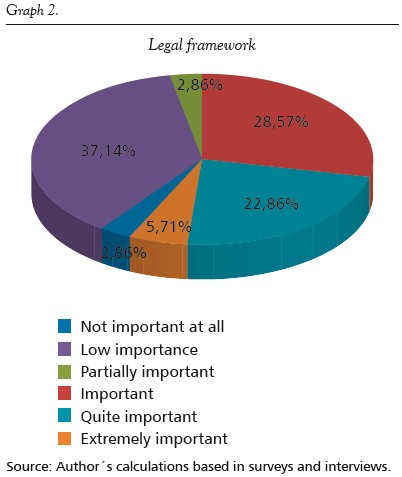

Legal Framework

Figure 2 shows that 29% of respondents considered that the legal framework helps to explain why futures on agricultural commodities are not traded in Colombia's domestic market. The perception collected with regards to this factor is that local norms did not consider the negotiation of commodities as part of the financial market. In fact, several respondents mentioned that a big weakness of the system cantered on the prohibition for banks to trade derivative instruments on agricultural commodities in Colombia.

It must be recognized that this limitation not only affected the expectation of liquidity for an eventual negotiation of futures contracts in Colombia, but that it also increased the perception that derivatives are mainly used for speculative purposes. However, we should mention that foreign banks in Colombia, such as CITIBANK and BBVA, offer their Colombian customers the possibility to trade these contracts in the international markets throughout their offices abroad.

Notwithstanding, legislation does not seem to justify the lack of a market for futures on commodities, and this may be due to the fact that financial legislation was initially adjusted in 2008 when the BVC launched the derivatives markets on financial assets. In fact, an officer of the Colombian clearing house, Cámara de Riesgo Central de Contraparte de Colombia S.A., noted that "The current legal framework is very comprehensive; and only some tax and foreign investment adjustments -already in progress- are required". In contrast, a Director of Floor Trading at an international bank claimed, "The market is restricted by high entry barriers".

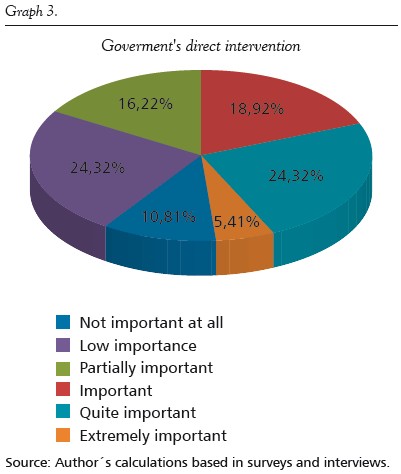

Government intervention

Graph 4 shows that 30% of respondents considered that the Government's direct intervention in the establishment of prices in the physical market, explains why futures on agricultural commodities are not traded in the Colombian domestic market. In this regard, two products were constantly mentioned during the survey and interviews, namely palm oil and rice.

With regards to palm oil, FEDEPALMA -the association that controls all matters involved in the production, consumption and commercialization of palm oil- applies a formula that combines the international price with the exchange rate and the domestic price in such a way that a palm grower may receive the same profit from exporting palm oil or selling it in Colombia. As for rice, the government does participate in the setting of prices by subsidizing the commodity.

Even though the two mechanisms mentioned above can be criticized because they contradict a free-market, the fact remains that many developed and developing countries with commodity futures exchanges, have been using similar policy measures. As a risk expert from the Ministry of Agriculture of Colombia suggested: "In the European Union, products are subsidized and it does not prevent the operation of futures market on commodities". From a different angle altogether, the CEO of a powerful commodities export company claimed that these mechanisms do not contribute to the competition with foreign companies and therefore do not encourage Colombian producers to use hedge instruments.

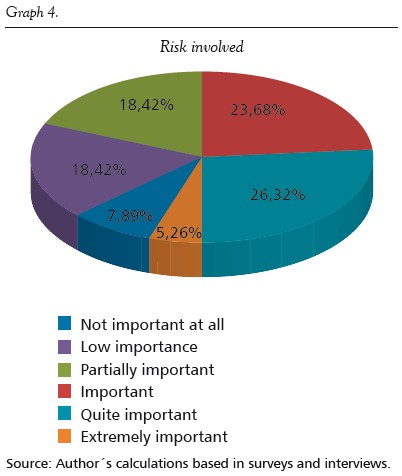

Risk

Graph 4 shows that 32% of respondents considered that the risk involved in derivative operations explains why futures on agricultural commodities are not traded in the Colombian domestic market.

Undoubtedly, the negotiation of futures contracts on any underlying asset involves risks such as those associated with basis6 and margins7.

Considering the basis risk for example, operators must analyse the correlation between spot and futures quotes. This relation is normally positive, as the general rule of derivatives' valuation suggests, since the future price is derived from the spot price of the asset or vice versa (Hernandez and Torero, 2010). Likewise, with the estimation of betas, the number of contracts that should be negotiated to approach a perfect hedge can be determined; the same is the case for the number of contracts needed to make a cross-hedging operation8.

In relation to margin risk, it is necessary to have a clearing house that guarantees that both parties will satisfactorily pursue their obligations under any circumstance. To date, the capacity of the BMC's clearing house to provide this reliability is uncertain, since it is not at present handling margins and operations of derivative contracts. However, there is another clearing house in Colombia with successful experience trading derivatives on financial assets.

One of the survey respondents contributed another perspective on the meaning of risk and claimed "... the failure to hedge also means speculating. Ignorance of this market makes you think that using these products is speculating. This factor has a high incidence". In addition, the CEO of a risk management company -widely regarded for his expertise on futures contracts- pointed out that "In particular, the risk of working capital required to meet the margin calls must be considered. This is the most important risk".

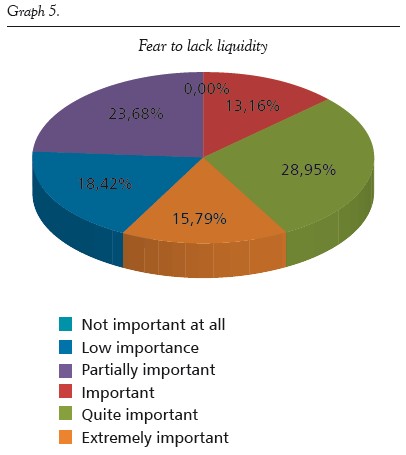

Liquidity

Graph 5 shows that 45% of respondents considered that the fear of a lack of liquidity explains why futures on agricultural commodities are not traded in the Colombian domestic market. During the interviews, this study identified that the expectation of a possible lack of liquidity in the market for commodity based derivatives generates both fear and rejection to these kinds of operations.

The following observations obtained through interviews illustrate the importance of liquidity as a factor that has prevented trade in derivative products associated with agricultural commodities. A head of Division at BMC mentioned that "Fear is typical in an emerging market; I do not think that this is the difficulty. It must be that hedgers have to learn about derivatives and their usefulness for market development". Furthermore, a CEO of a risk management consulting firm highlighted that "On many occasions I have heard from stakeholders interested on a market, but they do not want to operate first or second, until there is depth".

Education

This factor received the highest affirmative response rates in the survey. In fact, 71% of respondents considered that the lack of education on issues regarding hedging risk explains why futures on agricultural commodities are not traded on the Colombian domestic market.

As an illustration, while the total number of contracts traded on derivative exchanges worldwide in 2012 reached 21.2 billion (FIA, 2012) -of which 1.3 billion are based on agricultural commodities- and there was an overall decline in most regions of the world, Latin American volumes grew by 7.9%, explained mainly by an excellent year in Brazilian markets. Nevertheless, derivative trading markets remain fairly unknown in most Latin American countries, including Colombia. In fact, the survey showed that individuals in the Colombian agricultural sector tend to be risk adverse but not prone to learning about derivative products, and this helps to explain the absence in the market of standardized products to hedge.

Commodities that could be used in standardized futures contracts

Regarding the choice of products that respondents would be willing to trade as futures, Graph 7 shows that coffee led the survey. The reasons for this choice seem to be based on three facts: it is a traditional crop of the Colombian economy, the National Coffee Growers Federation has a recognized tradition and expertise in all aspects of the crop, and the international experience in price risk hedging operations for this underlying asset that exists in the country. A similar result was obtained for palm oil. Namely, the growth in national production of the good in recent years, and an equally strong guild interested in the negotiation of hedging instruments and its experience in international markets.

According to a recent study by Estupiñán (2011), the products on which futures contracts could be offered in Colombia are corn, soybean, soybean oil, palm oil, coffee, cocoa and cotton, as all of these goods have a price correlation with international markets higher than 85%. It is important to mention that in Graph 7, the products described as "others" are the sum of different agricultural commodities, infrequently mentioned in the survey such as cocoa, beans, soybeans, and potatoes, among others.

In addition to the survey's results described above, this study derived insights into the research question during the First Conference on Derivatives Market for Agricultural Goods in Colombia held in 2013. The main insights obtained at the conference are summarized below.

The first insight was that there is no need to have two clearing houses in the country. The development of a derivatives market for financial assets in Colombia in 2008 was accompanied by the creation of Cámara de Riesgo Central de Contraparte de Colombia S.A, designed to ensure compliance with the operations of futures contracts in the country. This entity is independent from the BVC, and therefore has no impediment to guarantee operations for other futures contracts offered in the domestic market, regardless of the nature of the asset. Additionally, this institution has invested heavily in technology, which explains the survey's results in this factor. Furthermore, opinions expressed during the conference confirmed the information collected in the survey in relation to the fact that the BMC clearing house has failed to create a climate of trust and sufficient guarantees. This seems to be because the clearing house has performed functions -that are not among its normal functions- by not managing margins and operations of derivative contracts.

While speculation on agricultural commodity prices can turn them into common financial assets, it is also true that for a derivatives market to develop an adequate level of liquidity for trading is necessary. This means that if there is a high participation in the market, it will be easier to open and close positions i.e., hedgers will minimize their price risk through futures and optimally manage their basis risk. A recent change in the legal framework of derivatives, contained in Act 1450 of 2011, reversed the prevailing restriction on banks and established the legal grounds for offering and trading derivatives aimed at the Colombian agricultural sector. However, it seems that banks and other financial intermediaries have focused on financial assets rather than instruments in which the underlying asset is a commodity.

In 2011, a price-hedging program was launched for the sale of corn through futures options9 offered and traded on CME Group. The strategy envisaged a Government subsidy of up to 80% payment of the premium, and although the financial instrument was negotiated in international markets, BMC acted as the operator that could bridge the gap between the Colombian producer and the U.S. derivatives market. This was certainly the first major step towards the creation of a commodity futures exchange in Colombia. This project was based on two things: previous experience in put options premium subsidies for currency hedging by exporters of agricultural products, and the recommendations of the World Bank (Arias, 2011), with which the Ministry of Agriculture has been reviewing risk management policies. In addition to the hedging strategy on corn prices, a National Risk Office is currently being designed as part of the Ministry, in order to promote both insurance and hedging programs within the agricultural sector in Colombia.

From the data and the opinions expressed at the Conference, it is clear that all different would-be actors in an eventual futures market are interested in a mechanism for hedging risk. In contrast, it is not clear if any are willing to assume a leadership role in the market. Therefore, it appears that all agents involved with derivative contracts on agricultural commodities are working separately or waiting for others to jump-start the market. The general opinion expressed at the conference was that BMC should gather all institutions aimed at hedging risk with standardized contracts and assume a leading role. For example, BVC has trained brokers, bankers, academics and practitioners not only to trade derivatives but also to understand the particularities, advantages and even the risks involved in these operations. Thus, participants claimed that BMC should replicate BVC's strategy but focusing on the particularities of the agricultural sector.

There is little local research in the field of derivatives for agricultural goods and this has to change. Experiences such as Mexico's with CBOT, and those analysed by UNCTAD for five different emerging economies could be assimilated to Colombia. Although the BMC and the Ministry of Agriculture have begun to study the topic further, guilds and academia should also contribute.

Shim (2006) suggests that conditions such as macroeconomic stability, government regulations, a well-designed contract and structured financial intermediaries tend to lead to the successful trade of futures contracts for agricultural goods in developing countries. Case studies by UNCTAD (2009) reinforce Shim's conclusions. In the case of Colombia, both macroeconomic indicators and regulation are ideal and in place. Although the agricultural sector is not the leading sector in terms of GDP, the portfolio of products of BMC may be limited and therefore, the level of financial sophistication may be perceived as still low. Similarly, the commonly known agricultural sector banks such as Banco Agrario and FINAGRO should be interested in financial instruments for agriculture. Having a derivatives market eases the transferring of resources from savings to investment through an increased financial system portfolio for hedgers and individuals interested in leveraging agricultural projects.

CONCLUSIONS

The need to have a futures exchange on agricultural goods in Colombia has been expressed frequently for over a decade. However, the commodity exchange in Colombia does not behave as such because it offers some hedging products that cannot be considered futures as they only contemplate the delivery at a future date of a determined quantity of the underlying asset, but do not involve a price agreement. This research contributes answers as to why the implementation of this market has been hindered. Indeed, studies by Shim (2006), UNCTAD (2007, 2009) and Arias et al. (2011) suggest that the results of this paper are consistent with the experience of other emerging futures markets.

In the case of Colombia and until recently, investment in technology for the trade of derivatives on agriculture was either insufficient or pre-empted other conditions for the development of a futures market on agricultural products. However, this does not seem to be an important factor in explaining the lack of development of such a market.

The design of legal guidelines that give rise to an underlying market for financial derivatives was introduced in 2008 but excluded agricultural commodities; therefore, they behaved as a barrier to entry for banks. Recently, Act 1450 of 2011 has down-played this restriction and one would expect an improvement in banks' participation in the market. Therefore, even if regulation played its part in the lack of development of a futures' market on agricultural products, this study concludes that it was not an important hindrance.

In Colombia, both the government and guilds are involved in setting the prices for several commodities. This circumstance is not different from what happens in other countries with large derivative markets for agricultural products. Hence, this is not the main reason why such a market has not developed.

This study found that the risks associated with derivative operations, the fear that a low trading volume will affect liquidity and the lack of education are the main difficulties that the Colombian financial market and regulators must overcome. This research suggests that the three factors could be addressed through training. This is the case because: a) the perception of risk by hedgers could be diminished by learning that "basis risk" is usually less than price risk, b) users could learn to handle variations in the supply of physical and futures markets, and c) differences between the use of futures for speculation and hedging would be clearer. Furthermore, training should add to the skills of brokerage firms, which has been found in international studies to be a necessary condition for a successful derivative market on agricultural commodities.

Although this study does not tell us exactly why commodity producers in Colombia do not look-up to the financial market for products to hedge their risk, there are indications that this kind of product is perceived as contradicting their tendency to be risk adverse. However, more research is necessary in Colombia to fully understand why the agricultural sector does not play an active role in promoting a derivative market for agricultural products.

Finally, the greater barrier that has to be overcome in order to have a futures market on agricultural products is deciding who exercises a leadership role to jump-start the market. The corn hedging subsidy program implemented by the government with the participation of BMC is a positive first step towards the design of contracts that may be negotiated at a domestic level. Corn growers have successfully used this subsidy since 2011, so much so, that the CEO of the National Federation for Cereal Growers (FENALCE) has asked the Ministry of Agriculture of Colombia for additional financial alternatives to reduce the risk exposure of this guild in terms of both price and currency adverse movements.

The study is an initial effort to explain why there is a lack of standardized instruments on agricultural futures in Colombia, but it is by no means exhaustive. Future research should focus on how viable it is to create tailor-made contracts in Colombia for commodities such as corn or palm oil, based on the data available.

NOTES

1 Energy contracts are traded through an alliance between BVC and the Colombian energy exchange, DERIVEX Volver

2To reduce the risk of adverse price variations in an asset. Volver

3 More information available at http://www.bna.com.co/CategoryDetail/31/1/Instrumentos%20Financieros Volver

4 Liquidity is understood in financial markets as volume of transactions. Specifically for futures, the liquidity refers to the number of contracts to be traded (or that have already been traded). Volver

5 In 2007, CBOT and CME exchanges were merged to create the CME Group. Later, COPEX and NYMEX joined this group. Despite the integration, each one of these exchanges maintains its independence. Volver

6 Basis risk refers to the variable spread between the future Price and the spot (or present) price. Volver

7 According to Hull (2009), "when the balance in a trader's margin account falls below the maintenance margin level, the trader receives a margin call requiring the account to be topped up to the initial margin level". Volver

8 Cross-hedging means to hedge the price of an asset with a future contract on a different but price-correlated asset. Volver

9 An 'option' is another derivative contract. This gives the holder the right, but not the obligation, to buy (call options) or to sell (put options) the asset, e.g. an agricultural commodity, by a certain date for a certain price. As opposed to futures, options holders have to pay a premium in order to acquire this contract. Volver

REFERENCES

1. Act 1450 (2011). Congreso de la República de Colombia [ Links ]

2. Arias, D., Lamas, A. & Kpaka, M. (2011). Agricultural Commodity Exchanges in Latin America and the Caribbean. Washington D.C.: World Bank. Latin America and the Caribbean Region. LCSSD Occasional Paper Series on Food Prices [ Links ]

3. Arias, D. (2011). Tendencias de mercados agrícolas globales y manejo de riesgos. 5 Recomendaciones para Colombia. Agricultural and Rural Development Team, World Bank. Document presented in Agroexpo, 2011. Bogotá, Colombia [ Links ]

4. Arias, J. (1998). Colombia's National Agricultural Exchange, New strategies for a changing commodity economy: the use of modern financial instruments. UNCTAD. Geneva, Switzerland [ Links ]

5. Arroyave, I. (2011). Nuevas perspectivas de la Bolsa Mercantil de Colombia. Document presented at the Seminar: Oportunidad de Desarrollo para las bolsas de productos agropecuarios, agroindustriales o de otros commodities. Bogota, Colombia [ Links ]

6. Beck, Demirgüç-Kunt, Levine (2009). Financial institutions and markets across countries and over time - data and analysis. World Bank Policy Research, Working Paper No. 4943. Available at: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1414705 [ Links ]

7. Beck, Demirguc-Kunt, Levine (2010) Financial Institutions and Markets across Countries and over Time: The Updated Financial Development and Structure Database. World Bank Economic Review, 24(1), 77-92 [ Links ]

8. Dana, J. & Gilbert, C. L. (2008), Discussion Paper No. 19, Managing Agricultural Price Risk in Developing Countries. Dipartimento di Economia, Università degli Studi di Trento [ Links ]

9. De Brauw, A., Huang, J. and Rozelle, S. (2004). The sequencing of reform policies in China's agricultural transition. Economics on Transition, 12(3), 427-465 [ Links ]

10. Estefan, C. (1995). Por un modelo de comercialización. Mercado de Futuros Agrícolas en Colombia. Bogotá: Bolsa Nacional Agropecuaria [ Links ]

11. Estupiñán, F. (2011). Posibilidades de desarrollo de la Bolsa con el apoyo del Banco Agrario de Colombia. Document presented at the seminar: Oportunidad de Desarrollo para las bolsas de productos agropecuarios, agroindustriales o de otros commodities. Bogotá, Colombia [ Links ]

12. Futures Industry Association (2012). Annual Volume Survey. Washington D.C.: Futures Industry Association, 10 p. Available at: http://www.futuresindustry.org/downloads/Volume-Mar_FI(R).pdf [ Links ]

13. Futures Industry Association (2012). Annual Volume Survey. Washington D.C.: Futures Industry Association, 26 p. Available: http://www.futuresindustry.org/site-search.asp=annual%20volume%20survey [ Links ]

14. Gilbert, C. L. (2001), The International Task Force on Commodity Risk management: Background and Preliminary Lessons, Washington DC, World Bank [ Links ]

15. Gilbert, C.L. (2010). How to understand high food prices. Journal of Agricultural Economics, 61(2), 398-425 [ Links ]

16. Hernandez, A. & Torero, M. (2010). Examining the dynamic relation between spot and futures prices of agricultural commodities. Washington D.C.: International Food Policy Research Institute, p. 39 Available at: http://www.ifpri.org/sites/default/files/publications/ifpridp00988.pdf [ Links ]

17. Hull, J. (2009). Options, Futures and Other Derivatives. New Jersey. Pearson, Prentice Hall, 7th edition. [ Links ]

18. Interagency report to G20, (2011). Price volatility in food and agricultural markets: Policy responses. FAO, IFAD, IMF, OECD, UNCTAD, WFT, the World Bank, the WTO, IFPRI and the UN HLTF. Available at: http://www.oecd.org/dataoecd/40/34/48152638.pdf [ Links ]

19. King, R.; Levine, R. (1993). Finance and Growth: Schumpeter Might be Right. The Quarterly Journal of Economics, 108(3), 717-737 [ Links ]

20. Oliver, O. (2001). Chapter V: El riesgo en las negociaciones de bolsa y la Cámara de Compensación de la BNA. Las Bolsas de Productos. Bogotá: Bolsa Nacional Agropecuaria [ Links ]

21. Power,G.J.a. ; Robinson, J.R.C.b, (2013). Commodity futures price volatility, convenience yield and economic fundamentals. Applied Economics Letters, 20(11),1089-1095 [ Links ]

22. Shim, E. (2006): Success factors of agricultural futures markets in developing countries and their implication on existing and new local exchanges in developing countries. Thesis submitted to The Fletcher School, Tufts University, USA. 26 April 2006, available: http://fletcher.tufts.edu/research/2006/Shim.pdf [ Links ]

23. Sendeniz-Yüncü, I. ,Akdeniz, L. & Aydogan, K. (2007). Futures Market Development and Economic Growth. Working paper Series, Bilkent University, Ankara, Turkey. Available at:http://akdeniz.bilkent.edu.tr/vita/sendeniz_akdeniz_aydogan2.pdf [ Links ]

24. UNCTAD (2009). Chapter II. The financialization of commodity markets. Trade and Development Report. Geneva: UNCTAD, 53-84 [ Links ]

25. UNCTAD secretariat on Emerging Commodity Exchanges (2009). Development Impacts of Commodity Exchanges in Emerging Markets. Geneva: UNCTAD, p. 219 [ Links ]

26. UNCTAD (2007). Overview of the world's commodity exchanges 2007. Geneva: UNCTAD, p.39 [ Links ]